Services on Demand

Journal

Article

Indicators

Related links

Share

Problemas del desarrollo

Print version ISSN 0301-7036

Prob. Des vol.47 n.186 Ciudad de México Jul./Aug. 2016

Articles

Intangible Capabilities for Micro-Enterprise Competitiveness in Mexico

1Colegio de la Frontera Norte, and the Autonomous University of Baja California, Mexico. E-mail addresses: afuentes@colef.mx, gosorio@uabc.edu.mx, and mungaray@uabc.edu.mx, respectively

Business competitiveness has long been a subject of study and debate in the economic literature, which has pointed to various drivers of business development. Drawing on the Industrial Economics, the New Industrial Economics, and theory of Resources and Capabilities approaches, this paper sets forth a panel data econometric model with 2,671 Mexican micro-enterprises over four time periods, detailing the relationship between the competitive advantages of micro-enterprises and external and internal factors, such as the sectoral structure and the tangible and intangible assets of the economic unit. The principal results obtained suggest that the synergies needed for the development of the small-scale productive sector are primarily generated by way of intangible capabilities.

Key Words: micro-enterprises; business development; competitiveness; econometric model

La competitividad empresarial ha sido objeto de estudio y debate dentro de la literatura económica, estableciendo diferentes factores determinantes para el desarrollo empresarial. En este trabajo, desde el enfoque de la Economía Industrial, la Nueva Economía Industrial y la Teoría de Recursos y Capacidades, se elabora un modelo econométrico de panel con 2 671 microempresas mexicanas a lo largo de cuatro periodos, que detalla la relación de ventajas competitivas de la microempresa con factores externos e internos como la estructura sectorial y los activos tangibles e intangibles de la unidad económica. Los principales resultados encontrados sugieren que la generación de las sinergias adecuadas para el desenvolvimiento del sector productivo de pequeña escala se logra principalmente a partir de las capacidades intangibles.

Palabras clave: microempresas; desarrollo empresarial; competitividad; modelo econométrico

La compétitivité des entreprises a été un sujet d’étude et de débat dans la littérature économique, et il a été établi différents facteurs déterminants pour le développement de l’entreprenariat. Dans ce travail, à partir de la perspective de l’économie industrielle, de la nouvelle économie industrielle et de la théorie des ressources et compétences, est élaboré un modèle économétrique de panel avec 2 671 micro-entreprises mexicaines au long de quatre périodes, qui détaille le rapport entre les avantages compétitifs de la micro-entreprise et des facteurs externes et internes comme la structure sectorielle et les actifs tangibles et intangibles de l’unité économique. Les principaux résultats obtenus donnent à penser que la génération de synergies adéquates pour l’essor du secteur de la production à petite échelle est atteinte principalement à partir des compétences intangibles.

Mots clés: micro-entreprises; développement de l’entreprenariat; compétitivité; modèle économétrique

A competitividade empresarial foi objeto de estudo e debate dentro da literatura econômica, estabelecendo diferentes fatores determinantes para o desenvolvimento empresarial. Neste trabalho, desde o enfoque da Economia Industrial, a Nueva Economia Industrial e a Teoria do Recursos e Capacidades, se elabora um modelo econométrico de panel com 2 671 microempresas mexicanas durante quatro períodos, que detalha a relação de vantagens competitivas da microempresa com fatores externos e internos, como a estrutura setorial e os ativos tangíveis e intangíveis da unidade econômica. Os principais resultados encontrados sugerem que a geração das sinergias adequadas para o desenvolvimento do setor produtivo de pequena escala se logra principalmente a partir das capacidades intangíveis.

Palavras-chave: microempresas; desenvolvimento empresarial; competitividade; modelo econométrico

企业竞争力向来是经济类文献的探讨及辩论重点, 各类研究都会给出决定企业发展的不同因素。在文本中, 我们从产业经济学、新兴产业经济及资源能力理论出发, 建立了包含四个时期、2671家墨西哥微型企业的计量经济学面板数据模型, 把微型企业的竞争优势与外部及内部因素的关系作为经济单位的产业结构及有形及无形资产。研究的主要结果表明, 适用于小规模生产部门发展的协同效应主要产生于无形能力。

关键词 微型企业; 企业发展; 竞争力; 计量经济模型

1. Introduction

This paper studies the relationship between competitive business advantages and factors both external and internal to companies, such as the sectoral structure, size of the economic unit, and tangible and intangible assets of micro-enterprises in Mexico.

The economic literature has played host to debate about various external and internal factors that have an impact on the competitiveness of enterprises in productive sectors. This research discusses the factors that determine competitive business advantages for micro-enterprises in developing regions. To do so, we look at the productive sector of the state of Colima, Mexico, to demonstrate that using the economic sector of activity and the size of the economic unit as the evaluation criteria, it is intangible assets which drive competitive advantages for micro-enterprises in Mexico.

This paper is divided into six sections. Following the first section, the Introduction, the second presents theoretical and empirical debate about the intangible factors related to business competitiveness. The third explains the issues small enterprises face in achieving competitive advantages. The fourth details the methodology used with the data source and analysis of variables. The fifth describes the analysis of the results of estimating the economic model and, finally, the sixth section presents some conclusions.

2. The Theoretical And Empirical Debate On Intangible Factors In Business Competitiveness

In the economic literature, there have been various proposals as to how to define business competitiveness. Despite widespread use of the term, it is still being shaped, and lacks precise limits or a unified definition, which means there are ambiguities when it comes to defining it (Hernández, Mendoza et al., 2008). However, there is some consensus as to attributing business competitiveness to causes to create sustainable advantages, to produce goods and services with added value, and to generate profitability or raise productivity and growth (Castañón, 2005: 56). In this way, business competitiveness can be conceptualized as the capacity to, in competition with other companies, achieve a comparatively favorable position, which allows for the attainment of performance superior to that of rivals (Aragón and Rubio, 2005).

Industrial Economics (IE), understood as the application of microeconomic theory in analyzing the workings of companies, markets, and industries (Stigler, 1968), studies business competitiveness. The classic approach is centered on the external characteristics of companies, that is, the broader industry and market conditions, maintaining that within economic sectors there are no significant differences in the behavior and results of companies, which allows researchers to focus their attention on the market structure of the industry to determine profits, profitability, value creation, and business growth (Ramsey, 2001: 39).

Pursuant to this perspective, competitive business advantages should be reflected in the short term with an increase in profits. In the long term, they should be represented in growth and market power. In the words of Tirole (1990), business growth is derived from structural change brought on by production factors in fluctuating proportions, which makes a company different from its prior state and implies a rise in market power, as a mechanism to ensure the attainment of future and better benefits.

In Tirole’s interpretation, added to works by Schmalensee (1985), Grant (1991), and Rumelt (1991), among others published at the end of the 1980s and the early 1990s, spurred the New Industrial Economics Approach (NEI), which questions the original IE formulation, establishing that the economic sector does have minor relevance as a determinant of business profits and, moreover, that there is significant business heterogeneity within each industry explained by the availability of internal business factors.

Originally, the neoclassical school contributed that tangible factors are the principal drivers of internal differentiation in companies, especially capital and labor (Cañibano, García-Ayuso et al., 1999). Understanding tangible factors as those assets necessary for the production and sustainability of a company that has a material identity, either physical or financial (Fernández, Montes et al., 1998: 86), then, capital and labor are added to factors such as materials, tools, cash flow, etc.

Intangible factors are defined as those assets basically consisting of knowledge and information, with no material identity, which are therefore not susceptible to being touched or perceived in a precise fashion (Fernández, Montes et al., 1998). In principle, the incorporation of this type of factor into economic analysis lacked agreements to define their economic nature, their classification, the way in which they would affect the value of the company, or other criteria that should be adopted for their recognition and measurement (Cañibano, García-Ayuso et al., 1999).

However, the economic literature has come to a consensus as to the increasingly important role of intangible capital in explaining competitive advantages, associating it with the growth of technology innovation, improved productivity, cost reduction, product differentiation, rising quality, etc. This has spurred a transition from IE to the knowledge economy (Díaz and Torrent, 2010: 02).

Parallel to this economic vision is the Theory of Resources and Capabilities, which classifies tangible and intangible assets to determine competitive business advantages. Proponents of this school of thought include: Itami and Roehl (1987), Dierickx and Cool (1989), Barney (1991), Mahoney and Pandian (1992), Amit and Schoemaker (1993), and more. While resources are considered to be any physical asset available at the company for developing competitive activities, capabilities are those resources associated with the knowledge and skills that emerge from collective learning at the company (Suárez and Ibarra, 2002). The former include both assets and financial and technology resources, while the latter contribute intangible assets to the theoretical debate, such as: commercial capital (reputation, prestige, brand), human capabilities (skills, experience, knowledge, innovation), and organizational capital (business culture) (García, Mareo et al., 1999).

This has given rise to a series of models that have sought to come up with and categorize instruments to measure the various capabilities or intangible assets a company has. The most emblematic include those published by Kaplan and Norton (1996), Roos and Roos (1997), Bontis (1998), Bueno (1998), Sveiby (2000), and Edvinsson and Malone (2003). With some modifications, they have come to a consensus in grouping intangible capabilities into three categories: human capital, structural capital, and relational capital. Human capital refers to the knowledge a person possesses, both to run the company as well as to generate new skills. Structural capital obeys the capacity to systematize organizational processes within the company, so this includes an organizational component (systems, supply channels, organization and distribution of knowledge), innovation (protected commercial rights, patents, new products), and processes (certifications, production efficiency). Relational capital refers to the set of relationships the company maintains with market agents that produce dividends for it (Edvinsson and Malone, 2003).

Now, at the level of applied work, such as works published by Rumelt (1991), Vargas (2000), Barcenilla and Lozano (2001), the international empirical evidence has corroborated the validity of theories that sustain business heterogeneity based on external and internal factors relevant to competitiveness, in diverse industries in various developed countries. In principle, these works prove that intersectoral differences have a lesser impact on company results than intrasectoral differences. In some cases, it has been estimated that as little as 25% of the variability observed in business profitability is due to the sectoral effect (Vargas, 2000).

Lafuente and Yagüe (1989) maintain that business competitiveness is primarily grounded in he size of the economic units based on the accumulation of tangible internal factors, because the larger the company, the better position it is in to access capital, mass production, and cost-cutting practices. However, empirically, there has also been a positive relationship between technology innovation and organizational culture with business competitiveness demonstrated, in addition to the linkages between intangible assets and competitive advantages for companies in developed countries (Díaz and Torrent, 2010: 07).

3. The Challenges Small-Scale Enterprises Face In Achieving Business Competitiveness

Although it has been proven that both tangible and intangible factors are relevant to aggregate business sectors in developed countries, this paper aims to bolster the theoretical and empirical debate by highlighting the importance of intangible factors to achieving competitive advantages for micro-enterprises in specific economic sectors and in developing regions.

It has been estimated that in Mexico, micro, small, and medium-sized enterprises (MSMEs) constitute 99% of all economic units in the country, generate over 50% of the gross domestic product (GDP), and create seven out of every ten formal jobs in the country. Of all of the economic units in Mexico, micro-enterprises alone account for 95.2% of companies, small enterprises represent 4.3%, and medium-sized 0.3%. Micro-enterprises are also the top business sector in job creation, employing 45.6% of employees, while small enterprises account for 23.8%, and medium-sized 9.1% (INEGI, 2009).

In this sense, various empirical papers (Mungaray, Osuna et al., 2015; Flores, Flores et al., 2012; Ramírez, Mungaray et al., 2010; Moreno, Espíruto et al., 2009; Sánchez, 2007) have discussed the structural and contextual problems facing micro-enterprises, asserting that the principal difficulties they encounter include, among others, the acquisition of tangible assets, especially fixed assets, as the result of a credit market that makes it very difficult to meet the terms of credit, reduced demand due to low wages that are paid to support the economic stabilization policy, and a large number of competitors sidelined from the labor market, a situation that depresses sales, cash flows, and profits.

An additional problem ailing the Mexican business sector is derived from the deterioration of a segment of medium-sized and large enterprises that have faced difficulties in adapting to strong foreign competition following trade liberalization. The closure of many small companies and job cuts undertaken by all types of companies as a strategy to raise competitiveness have entailed a drop in formal employment, encouraging the creation of family enterprises. Even so, the macroeconomic and institutional context, which does not offer an environment conducive to developing this type of family business, has turned them into subsistence companies that do not offer any chance for social mobility to their owners (Ocegueda, Mungaray et al., 2002).

Although measures to increase the competitiveness of micro-enterprises have been implemented both at the national and regional level, it should be noted that these companies must be singled out as the object of priority attention, as there is a need to foster business competitiveness in a context characterized by growing international competition, the rise of the knowledge economy, and the sufficient capacities held by large enterprises.

As such, in light of the problems facing micro-enterprises in developing regions, the hypothesis of this paper is that this business sector can find in the NIE and the Theory of Resources and Capabilities, specifically in intangible capabilities, the determinants of competitive advantages, using the economic sector and size of the enterprise measured by number of employees as the evaluation criteria.

4. Methodology

a) Data Sources

To prove the hypothesis described above, we conducted an econometric analysis for the case of Mexico, focused specifically on micro-enterprises in the state of Colima, which is a state that, according to the 2009 Economic Census, had 30,306 economic units, of which 99% were MSMEs, creating around 80% of formal jobs, in other words, an economy tremendously dependent on the MSME productive sector (INEGI, 2009).

The main source of information is the National Micro-Business Survey (ENAMIN) database, which was compiled by the joint work of the Secretary of Labor and Social Planning (STPS) and the National Statistics and Geography Institute (INEGI). It aims to provide statistical information about the main economic characteristics of micro-businesses and the labor conditions of the population involved in them (INEGI, 2013).

ENAMIN includes both employers and freelance workers who report being freelance in either their primary or secondary occupation. The structure of the survey allows the agencies to capture such information as related to productive resources, sectors, activity types, labor force employed and conditions of employment, trainings, and business support received. All of this has been collected in the years 2002, 2008, 2010, and 2012.

The sample selected contains 2,671 micro-enterprises surveyed in all four years by ENAMIN in the state of Colima. Using a typology similar to that presented in Hernández (2012), each enterprise was sorted into either Micro-1, Micro-2, or Micro-3, depending on whether it was a sole proprietorship, employed two to four people, or five or more people, respectively.

b) Analysis of Variables and the Database

The theory is that competitiveness and efficiency in the synergies of tangible and intangible assets belonging to each company should be reflected, in the short term, in profitability or profits earned, and in the long term, in the market share attained (Fernández, Montes et al., 1998). As such, in the econometric model applied, the dependent variable is the average monthly profit of each economic unit, which is a continuous variable expressed in nominal monetary values.

Fifteen independent variables were used (see Table 1), grouped into physical resources and intangible capabilities, pursuant to the Theory of Resources and Capabilities methodology to catalogue and measure the tangible and intangible assets of companies. Despite the limitations of the data sources when it came to gathering information from the micro-enterprise sector, five variables were confirmed to evaluate tangible factors and ten for intangible factors.

Table 1. Variables to Use in the Econometric Model

| Name of the Variable | Acronym | Form of Measurement | Unit of Measure | Source of Information ENAMIN 02, 08, 10, 12* |

| Dependent Variable | ||||

| Business profit | gan | Income minus expenses | Monetary | Question 74 |

| Independent Variable | ||||

| Tangible Resources | ||||

| Tool | herr | Does it have? Did it invest in in the past year? | (0, 1) no, yes. If affirmative, monetary value. | Question 56 |

| Furnishings and equipment | mob | |||

| Vehicle | Vehi | |||

| Store | Local | Does it have a store location, either own or rented? | (0, 1) no, yes. | Question 42 |

| Access to financing | fin | Has it applied for credit? Was it granted credit? | Question 84 | |

| Intangible Capabilities | ||||

| Human Capital | ||||

| Training | ||||

| Use of tools | Cap_herr | Has received training? Was it useful? | (0, 1) no, yes. | Questions 90-91 |

| Administration | Cap_admon | |||

| Quality of product or service | Cap_calidad | |||

| Computing | Cap_compu | |||

| Safety and hygiene | Cap_segur | |||

| Other | Cap_otro | |||

| Experience of owner | Expe | Has experience from previous jobs helped in the current business? | Questions 13, 24, and 25 | |

| Schooling of owner | escolaridad | What level of schooling has been completed? | Index from 0 to 1. No schooling 0, graduate level 1. | Question 55 |

| Structural Capital | ||||

| Organizational nature | Org | Keeps records of money and/or merchandise inflows and outflows? | (0, 1) no, yes. | Question 37 |

| Relational Capital | ||||

| Business network associations | Asoc | Member of a trade association? | (0, 1) no, yes. | Question 39 |

*The number of questions varies depending on the year in which ENAMIN was conducted. For purposes of this table, we used the number of questions from ENAMIN 2010.

Source: Created by the authors based on ENAMIN 2002, 2008, 2010, and 2012.

The variables measuring tangible resources were obtained by asking each company if in the past year it had made an investment in tools, furnishings, or vehicles; whether or not they have a store, and whether or not they have had access to financing. Although investment in tools, furnishings, and vehicles is given in monetary value, for purposes of the estimate, we only considered whether or not an investment had been made, making this variable dichotomous.

The intangible capabilities were divided into human capital, structural capital, and relational capital. The first category considered whether or not the owners and/or employees had received training in the usage of tools, administration, product and/or service quality, computing, security and hygiene, and more. We also included experience of and degree of schooling attained by the owner.

For structural capital, although it includes both organizational aspects and innovation-and process-related factors (Edvinsson and Malone, 2003), the data source only provided information to look at the organizational nature of the micro-enterprise, asking whether or not it keeps track of money and/or merchandise inflows and outflows. Finally, relational capital was defined as whether or not the micro-enterprise had some sort of trade union association.

The independent variables were dichotomous with the exception of schooling, calculated on a scale of 0 to 1, with continuous values, where 0 is no instruction and 1 is graduate-level schooling, with intermediate values ranging from primary school to doctoral degrees.

Initially, the database consisted of 2,733 micro-enterprises. After conducting an exploratory analysis for the dependent variable to determine which atypical data points affected its distribution, box and whisker charts were used to find 62 outliers and clean up the sample, reducing it to 2,671.

The economic units were sorted by activity sector and size depending on the number of employees (see Table 2), coming up with four economic sectors: manufacturing, trade, construction, and services, and three enterprise sizes: Micro-1, with the only employee being the owner; Micro-2, with two to four employees including the owner; and Micro-3, with five or more employees, including the owner.

Table 2. Distribution of the Database by Economic Sector and Size of the Micro-Enterprise

| Year | St1 (Manu) | St2 (Trade) | St3 (Const) | St4 (Serv) | Total | Micro-1 | Micro-2 | Micro-3 | Total |

| 2002 | 62 | 108 | 72 | 207 | 449 | 321 | 117 | 11 | 449 |

| 2008 | 105 | 259 | 64 | 317 | 745 | 430 | 281 | 34 | 745 |

| 2010 | 100 | 248 | 47 | 319 | 714 | 408 | 277 | 29 | 714 |

| 2012 | 119 | 269 | 72 | 303 | 763 | 408 | 323 | 32 | 763 |

| Total | 386 | 884 | 255 | 1146 | 2671 | 1567 | 998 | 106 | 2671 |

Source: Created by the authors.

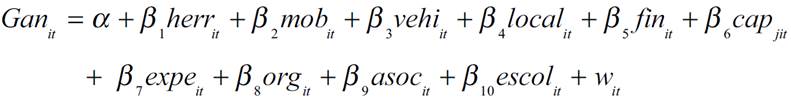

To conduct the analysis, we formulated the following econometric model:

Where the competitive business advantage in the short term represented by the business profit (Gan it ) is a function of the constant (⍺) of investment in tangible resources, such as tools (herr it ), furnishings and equipment (fin it ), and vehicles (vehi it ), whether there is a store (local it ), and access to financing (fin it ); as well as intangible assets, such as training (cap it ), where “j” represents training in tools, administration, product quality or service, safety and hygiene, or something else; experience of the owner (expe it ), organizational nature (org it ), trade union membership (asoc it ), and schooling (escol it ). The symbol (w it ) represented the error term.

In the wide format of panel data, where the number of cross-section data points is higher than the number of time periods, a random effects approach is appropriate when the cross-section units of the sample are randomly drawn from a larger population (Judge, Carter et al., 1985). That is why the random effects panel data technique was used and, as such the constants for each observation are considered as a specific error of each unit and are randomly distributed. That is why the model does not present a constant for each enterprise, as would be the case for a fixed effects approach (⍺i), but rather just one for the entire sample (⍺). As such, the error term (w it ) also includes the random error of the ith observation, which is constant over time and can be interpreted as the set of factors not included in the regression that are specific to each unit.

As the disturbances in the model (w it ) are not spherical, because they present issues related to autocorrelation and heteroscedasticity, we cannot directly apply the Ordinary Least Squares (OLS) method directly, because the estimators calculated would not display the desired properties. The Generalized Least Squares (GLS) method offers the best and most unbiased linear estimators in these cases (Greene, 2008). However, it is useful to note that GLS is OLS applied to variables that have been transformed to meet the traditional assumptions of least squares. The customary transformation consists of dividing the target study variables by the square root of the variances that do not meet the basic assumptions. After this transformation, the new error terms become homoscedastic and do not exhibit autocorrelation. Although the model has dichotomous independent variables, this does not have an impact on using GLS to estimate the panel data model for the statistics package.

5. Results

A total of eight panel data models with random effects were run for each of the four economic sectors considered (manufacturing, trade, construction, and services), and the three sizes of micro-enterprises considered by number of employees (Micro-1, Micro-2, Micro-3), as well as a general model estimated with all of the data and no division by evaluation criteria.

Each model was compared with the Breusch-Pagan test pursuant to the null hypothesis that the random effects structure is irrelevant and, therefore, it should follow a grouped data structure, versus the alternative hypothesis that the random effects are indeed relevant. We also conducted the Hausman test under the null hypothesis that the GLS estimators are consist and the random effects structure is relevant, versus the alternative hypothesis that the GLS estimators are inconsistent and therefore the fixed effects structure is relevant. Both tests follow an asymptotic chi-square distribution (Greene, 2008).

Table 3 displays a summary of the eight models with the values of significant coefficients and expected signs. It details the two tests comparing with the P value, as well as the number of observations for the cross section and the time series that comprise the panel structure.

Table 3. Models Estimated Using GLS, by Economic Sector and Size of Micro-Enterprise

| Variables | General | Sectors | Size | |||||

| Manufacturing | Trade | Construction | Services | Micro-1 | Micro-2 | Micro-3 | ||

| Constant | 1076*** | 1035** | 833** | 2927*** | 672** | 1046*** | 1960*** | 6231*** |

| (189.3) | (414.6) | (361.7) | (473.7) | (287.8) | (208.1) | (381.4) | (2068.7) | |

| TANGIBLE (Past-year tangible investments) | ||||||||

| Tools | ||||||||

| (181.2) | (430.5) | (265.1) | (220.2) | (302.6) | ||||

| Furnishings and equipment | ||||||||

| Vehicles | 2469*** | 2368** | 2799*** | 1837** | 2863*** | |||

| (498.2) | (1060.4) | (716.7) | (780.6) | (767.6) | ||||

| Store | 633*** | 1931*** | 1376*** | |||||

| (199.2) | (496.7) | (339.7) | ||||||

| Access to financing | 783*** | 1400*** | 583* | 726** | ||||

| (207.06) | (326) | (330.1) | (316.7) | |||||

| INTANGIBLES | ||||||||

| Training in use of tools | 4257** | |||||||

| (1784.02) | ||||||||

| Administration | 1903* | |||||||

| (1065..9) | ||||||||

| Product or service quality | 2701** | 15095*** | ||||||

| (1267.9) | (4280.6) | |||||||

| Computing | ||||||||

| Safety and hygiene | ||||||||

| Other | ||||||||

| Experience of owner | 793*** | 709* | 830*** | 656** | 767*** | 543* | ||

| (168.2) | (366.5) | (290.7) | (258.1) | (191.9) | (300.2) | |||

| Organizational nature | 1400*** | 2381*** | 998*** | 1749*** | 855*** | 1796*** | ||

| (194.1) | (493.7) | (340.7) | (293.2) | (221.4) | (348.02) | |||

| Membership in business networks | 1360*** | 2593*** | 1954*** | 778** | 1476*** | |||

| (267.7) | (865.8) | (370.7) | (376.2) | (397.8) | ||||

| Schooling of owner | 2458*** | 1438** | 6401*** | 3842*** | 2447*** | 1797*** | ||

| (351.2) | (625.4) | (1206.4) | (508.8) | (414.9) | (608.9) | |||

| P statistic | ||||||||

| Breusch-Pagan test | 0.5443 | 0.553 | 0.1243 | 0.1808 | 0.5728 | 0.799685 | 0.0601 | 0.4596 |

| Hausman test | 0.8453 | 0.6452 | 0.3455 | 0.9372 | 0.6032 | 0.680286 | 0.5247 | 0.137 |

| Number of observations | ||||||||

| Cross-section (balanced) | 763 | 119 | 269 | 72 | 319 | 430 | 323 | 34 |

| Time series | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

Notes: (***) Significant at 99%. (**) Significant at 95%. (*)Significant at 90*.

Source: Created by the authors.

It should be mentioned that, as observed in Table 2, the number of cross section observations is not the same in the four time periods for the database used. For purposes of estimating the model with the panel data technique, the models were balanced out with the highest number of observations of each cross section for each evaluation criteria. This prevented elimination of observations and respected the objectivity o the study. The estimates were made using piled cross sections.

The Hausman test value indicated that in no model was the null hypothesis that the random effects structure is relevant rejected, so therefore the GLS estimators are consistent. However, the Breusch-Pagan test indicated that in all models, the null hypothesis was not rejected, so although the grouped data structure is relevant, so is that of the random effects. Due to said contradiction, the eight models were estimated using the grouped data structure with combined OLS and contrasted with the F statistic to evaluate overall significance, pursuant to the null hypothesis that the coefficients are statistically equal to zero and irrelevant versus the alternative hypothesis that the model is well specified (see Table 4).

Table 4. Models Estimated Using Combined OLS, by Economic Sector and Size of Micro-Enterprise

| Variables | General | Sectors | Size | |||||

| Manufacturing | Trade | Construction | Services | Micro-1 | Micro-2 | Micro-3 | ||

| Constant | 1076*** | 1035** | 807** | 2927*** | 672** | 1042*** | 1958*** | 6143*** |

| (189.3) | (414.7) | (359) | (473.7) | (287.8) | (207.8) | (381.2) | (2059.1) | |

| TANGIBLES (Tangible investment past year) | ||||||||

| Tools | 1080*** | 1240*** | 537** | 918*** | 931*** | |||

| (181.2) | (433.1) | (265.2) | (220.1) | (302.7) | ||||

| Furnishing and equipment | ||||||||

| Vehicle | 2469*** | 2393** | 2799*** | 1834** | 2873*** | |||

| (498.2) | (1070) | (716.7) | (780.7) | (767.8) | ||||

| Store | 633*** | 1931*** | 1379*** | |||||

| (199.2) | (496.7) | (340.3) | ||||||

| Access to financing | 783*** | 1383*** | 583* | 729** | ||||

| (207.06) | (328.2) | (330.1) | (316.8) | |||||

| INTANGIBLES | ||||||||

| Training in use of tools | 4257** | |||||||

| (1784.02) | ||||||||

| Administration | 1887* | |||||||

| (1066.2) | ||||||||

| Quality of product or service | 2512** | 15095*** | ||||||

| (1274.8) | (1274.8) | |||||||

| Computing | ||||||||

| Safety and hygiene | ||||||||

| Other | ||||||||

| Experience of owner | 793*** | 793*** | 793*** | 793*** | 793*** | 793*** | ||

| (168.2) | (168.2) | (168.2) | (168.2) | (168.2) | (168.2) | |||

| Organizational nature | 1400*** | 2381*** | 1018*** | 1749*** | 850*** | 1795*** | ||

| (194.1) | (493.7) | (340.9) | (293.2) | (221.4) | (348.3) | |||

| Membership in business network | 1360*** | 2593*** | 1954*** | 776** | 1478*** | |||

| (267.7) | (865.8) | (370.7) | (376.2) | (398.1) | ||||

| Schooling of owner | 2458*** | 1459** | 6401*** | 3842*** | 2456*** | 1798*** | ||

| (351.2) | (627.4) | (1206.4) | (508.7) | (415) | (608.9) | |||

| P statistic | ||||||||

| F statistic | 0.000 | 0.000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4941 |

| Number of cross section observations (balanced) | 763 | 119 | 269 | 72 | 319 | 430 | 323 | 34 |

| Time series | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

Notes: (***) Significant at 99%. (**) Significant at 95%. (*) Significant at 90%.

Source: Created by the authors.

Comparing the coefficients obtained with the OLS and GLS combined, there are considerable differences in the parameters that are significant for the two estimation models, so we only analyze the models pursuant to the panel data technique with random effects structure.

The coefficients of the eight GLS models prove that initially, there are considerable differences in both factors and magnitudes of the significant factors for business competitiveness by activity sector and enterprise size (see Table 3).

Considering all micro-enterprises as equal, the most important tangible resources are investing in vehicles and work tools, followed to a lesser degree by owning a store and access to financing. All presented significance at 99%.

For intangible assets, schooling of the owner, organizational nature, and belonging to a trade association were more important than the majority of the aforementioned tangible assets. Owners’ experience had less importance pursuant to its coefficient, but was still statistically significant at 99%.

Comparing the general model and the models estimated by economic activity sector, in the manufacturing sector, only store ownership was statistically significant when it came to tangible resources; by contrast, belonging to a business network, organizational nature, and owner experience were all statistically significant intangible capabilities.

For micro-enterprises working in trade activities, assets were another driver of competitiveness, as compared to other economic sectors, as assets such as investing in vehicles, access to financing, store ownership, and tools were all significant tangible factors to achieving competitive advantages for micro-businesses. When it came to intangible capabilities, both human capital and structural capital variables such as school and experience of the owner, as well as organizational nature, were statistically significant factors. In this sector, the most significant factor over the rest was the intangible factor of human capital, referring to training in product or service quality.

For micro-enterprises specialized in the construction sector, only the intangible capabilities related to human capital were statistically significant, between 95% and 99%. Training in product or service quality did display considerably high importance, as well, followed by owner schooling and training in the use of tools.

The drivers of competitiveness in the service sector included investing in work vehicles and tools, as well as access to financing, for physical resources, while for intangible capabilities, owner schooling, belonging to a business network, organizational nature, and owner experience were significant, in that order.

When micro-enterprises were grouped by size according to the number of employees, considerable differences also emerged. First, the most statistically significant coefficient in the category of Micro-1 was the intangible asset of owner schooling, while for Micro-2, it was the tangible asset of investing in a work vehicle. Another major difference was that in Micro-1, training in business administration was statistically significant, with the second-highest coefficient value of all of the factors studied for Micro-1. Another difference was that in Micro-2, access to financing was important, while it was not for Micro-1.

The two categories (Micro-1 and Micro-2) had some drivers of competitive advantages in common, such as investing in tools, for physical resources, and owner experience, organizational nature, and membership in business networks, for the intangibles.

Meanwhile, the model that evaluated the drivers of business competitive advantage in the category Micro-3 did not present any statistically significant coefficients, meaning it was not possible to analyze those coefficients using the panel structure. One cause for this may be the low number of observations in this category, as the sample had just 32 enterprises in 2012.

In general, the study conducted for the eight estimated models proves the hypothesis that there are significant differences among micro-enterprises pursuant to various evaluation criteria, such as the economic sector of specialization and size measured by number of employees. Secondly, we proved the importance of intangible capabilities in driving competitiveness for this business sector.

6. Conclusions

Economic theory has evolved, although not yet reached a consensus, to better understand the complex concept of competitiveness and competitive advantages, for both individual enterprises and specific business groups or sectors, respectively. The theoretical framework that has emerged has shifted from holding that competitive advantages originate from external factors, derived from an industry’s market structure, to considering, overwhelmingly, that it is internal factors within a company, derived from its resources and capabilities, that make the difference for an economic unit.

This would mean that the theoretical study of business competitiveness has moved from a classical approach that believed that within each activity there were no significant differences in the behavior and results of companies, thereby focusing on the market structure of the industry as the main determinant of competitiveness, to a new approach that accepts that there is indeed significant business heterogeneity within each industry, explained by the degree to which businesses create and harness imperfect assets (which cannot be transferred and are difficult to create), such as the intangible resources a company has and the space or region in which a company is located, which determine the competitiveness of the economic unit.

Although the foregoing has been demonstrated in general terms for companies with no evaluation criteria in developed countries, this econometric study empirically shows that there the factors that produce competitive advantages do indeed vary depending on a company’s activity sector and size, for companies in developing regions. These results reveal the intangible capabilities involved in human capital, such as training and the level of schooling attained by the business owner, which are significant factors in engendering competitive advantages in the short term. This allows us to infer that efficient synergies that spur greater business competitiveness can be formed through targeted policies to support human capital, primarily by increasing monetary profits and secondarily by increasing market share.

The econometric models estimated in this paper also prove the importance of physical resources, such as investing in tools, work vehicles, and access to financing. However, it is evident that intangible capabilities must be developed to generate the right complementarities within an economic unit and achieve profits. In this sense, any business support policy must complement the intrinsic qualities of a business owner, such as experience and schooling, with business training and a boost to financing and investment, as well as support the organizational culture and business networks.

Finally, some areas of opportunity for future studies would include an econometric model that estimates the intangible factors underlying business competitiveness in the long term, as a function of the market share of small-scale enterprises.

Bibliografía

Amit, Raphael y Paul Schoemaker (1993), “Strategic Assets and Organizational Rent”, en Strategic Management Journal, vol. 14, pp. 33-46. [ Links ]

Aragón Sánchez, Antonio y Alicia Rubio Bañón (2005), “Factores explicativos del éxito competitivo: el caso de las PyMEs del estado de Veracruz”, Revistas de la UNAM, México, UNAM, núm. 216, mayo-agosto (consultado en noviembre de 2012), disponible en < 216, mayo-agosto (consultado en noviembre de 2012), disponible en http://www.ejournal.unam.mx/rca/216/RCA21603.pdf > [ Links ]

Barcenilla Sara y Pablo Lozano (2001), “Competitividad y comportamiento tecnológico de la empresa multinacional en España”, en Economía Industrial, núm. 338, pp. 169-178. [ Links ]

Barney, Jay (1991), “Firm Resources and Sustained Competitive Advantage”, en Journal of Management, vol. 17, núm. 1, pp. 99-120. [ Links ]

Bontis, Nick (1998), “An Exploratory Study that Develops Measures and Models”, en Management Decision, vol. 36, núm. 2, pp. 63-76. [ Links ]

Bueno Campos, Eduardo (1998), “El capital intangible como clave estratégica en la competencia actual”, en Boletín de Estudios Económicos, núm. 164, pp. 207-229. [ Links ]

Cañibano, Leandro, Manuel García-Ayuso Covarsi y Paloma Sánchez M. (1999), “La relevancia de los intangibles para la valoración y la gestión de empresas: revisión de la literatura”, en Revista Española de Financiación y Contabilidad, Artículos doctrinales, núm. 100, España, Universidad Autónoma de Madrid, pp. 17-88. [ Links ]

Castañón Ibarra, Rosario (2005), La Política Industrial como eje conductor de la competitividad en las PyME, México, Centro de Investigación y Docencia Económica, CIDE, Fondo de Cultura Económica, pp. 213. [ Links ]

Díaz Chao, Ángel y Joan Torrent Sellens (2010), “¿Pueden el uso de las TIC y los activos intangibles mejorar la competitividad? Un análisis empírico para la empresa catalana”, en Estudios de Economía Aplicada, vol. 28, núm. 2, España, pp. 1-24. [ Links ]

Dierickx, Ingemar y Karel Cool (1989), “Assets Stock Accumulation and Sustainability of Competitive Advantage”, Management Science, vol. 35, núm. 12, Estados Unidos, pp. 1504-1513. [ Links ]

Edvinsson, Leif y Michael Malone (2003), El capital intelectual. Cómo identificar y calcular el valor de los recursos intangibles de su empresa, Barcelona, Gestión 2000. [ Links ]

Fernández Sánchez, Esteban, José Manuel Montes Peón y Camilo José Vázquez Ordas (1998), “Los recursos intangibles como factores de competitividad de la empresa”, en Dirección y Organización, núm. 20, España, pp. 83-98. [ Links ]

Flores Preciado, Juan, Rogelio Flores Félix y Teodoro Reyes Fong (2012), “Estrategias Financieras en las Empresas Familiares en Colima”, en Memorias, Red Internacional de Investigadores en Competitividad (consultado en abril de 2013), disponible en <Flores Preciado, Juan, Rogelio Flores Félix y Teodoro Reyes Fong (2012), “Estrategias Financieras en las Empresas Familiares en Colima”, en Memorias, Red Internacional de Investigadores en Competitividad (consultado en abril de 2013), disponible en http://www.riico.org/memoria/sexto/RIICO-21708.pdf > [ Links ]

García, Francisco, Bartolomé Mareo, José Francisco Molina y Ramón Diego Quer (1999), “La capacidad de innovación como intangible empresarial: una aproximación a través de la gestión del conocimiento”, en Revista Espacios, vol. 20, núm. 3, Venezuela. [ Links ]

Grant, Robert Morris (1991), “The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation”, en California Management Review, vol. 33, pp. 114-135. [ Links ]

Greene, William (2008), Econometric Analysis, 6a. ed., Prentice Hall, Englewood Cliffs, New Jersey, pp. 1216. [ Links ]

Hernández Calzada, Martín Aubert, Jessica Mendoza Moheno y Luis González Fernández (2008), “Construcción y validez del instrumento de cultura organizacional y competitividad”, en Julio Pindado García y Gregory Payne (coord.), Estableciendo puentes en una Economía Global, Salamanca, Universidad de Salamanca, pp. 292. [ Links ]

Hernández, Daniel (2012), Identificación y tipología de sistemas productivos locales: el caso del sector microempresarial en la frontera de Baja California México, 1992-2002, Baja California, México, Universidad Autónoma de Baja California. [ Links ]

Instituto Nacional de Estadística Geografía (INEGI) (2009), “Censo Económico 2009”, Sistema Automatizado de Información Censal, INEGI, México (consultado en octubre de 2012), disponible en <Instituto Nacional de Estadística Geografía (INEGI) (2009), “Censo Económico 2009”, Sistema Automatizado de Información Censal, INEGI, México (consultado en octubre de 2012), disponible en http://www.inegi.org.mx/est/contenidos/espanol/proyectos/censos/ce2009/saic/default.asp?s=est&c=17166 > [ Links ]

______ (2013), Encuesta Nacional de Micronegocios 2002, 2008, 2010, 2012. Encuestas en Hogares, Módulos, Micronegocios enamin, Microdatos (consultado en enero de 2013), disponible en <http://www3.inegi.org.mx/sistemas/microdatos/defaultanio.aspx?c=29729&s=est> [ Links ]

Itami, Hiroyuki y Thomas Roehl (1987), Mobilizing Invisible Assets, Cambridge, Harvard University Press, pp. 186. [ Links ]

Judge, George, Carter Hill, William Griffiths, Helmut Lütkepohl y Tsung-Chao Lee (1985), Theory and Practice of Econometrics, New York, John Wiley and Sons. [ Links ]

Kaplan, Robert y David Norton (1996), “Using the Balanced Scorecard as a Strategic Management System”, en Harvard Business Review, enero-febrero. [ Links ]

Lafuente, Alberto José María y María José Yagüe (1989), “Ventajas competitivas y tamaño de las empresas: Las Pyme”, en Papeles de Economía Española, núm. 39, pp. 165-184. [ Links ]

Mahoney, Joseph y Rajendran Pandian (1992), “The Resource-based View within the Conversation of Strategic Management”, en Strategic Management Journal, vol. 13, pp. 363-380. [ Links ]

Moreno, Hugo Martín, Roberto Espíritu Olmos, Víctor Aparicio Rosas y Alfredo Salvador Cárdenas (2009), “Capacitación en las micro y pequeñas empresas de la ciudad de Tecomán, Colima, México”, en Multiciencias, vol. 9, núm. 1, Venezuela, Universidad de Zulia, enero-abril, pp. 38-45. [ Links ]

Mungaray Lagarda, Alejandro, José Osuna Millán, Martín Ramírez Urquidy, Natanael Ramírez Angulo y Antonio Escamilla Díaz (2015), “Emprendimiento de micro y pequeñas empresas mexicanas en un escenario local de crisis económica: El caso de Baja California, 2008-2011”, en Frontera Norte, vol. 27, núm. 53, pp. 115-146. [ Links ]

Ocegueda Hernández, Juan Manuel, Alejandro Mungaray Lagarda y Rubén Roa (2002), “Estabilización Macroeconómica y Microempresas pobres en México”, en El Mercado de Valores, vol. 62, núm. 11, México, Nacional Financiera, noviembre, pp. 5-11. [ Links ]

Ramírez Angulo, Natanael, Alejandro Mungaray Lagarda, Martín Ramírez Urquidy y Michel Texis Flores (2010), “Economías de escala y rendimientos crecientes: Una aplicación en microempresas mexicanas”, en Economía Mexicana, nueva época, vol. 19, núm. 2, pp. 213-230. [ Links ]

Ramsey, John (2001), “The Resource Based Perspective, Rents, and Purchasing’s Contribution to Sustainable Competitive Advantage”, en Journal of Supply Chain Management, vol. 37, pp 38-47. [ Links ]

Roos, Goran y Johan Roos (1997), “Measuring your Company´s Intellectual Performance”, en Long Range Planning, vol. 30, núm. 3, pp. 413-426. [ Links ]

Rumelt, Richard (1991), “How much does Industry Matter?”, en Strategic Management Journal, vol. 12, pp. 167-185. [ Links ]

Sánchez, Barajas Génaro (2007), Perspectivas de las Micro y Pequeñas Empresas como factores del desarrollo económico de México, México, UNAM (consultado en abril de 2013), disponible en <Sánchez, Barajas Génaro (2007), Perspectivas de las Micro y Pequeñas Empresas como factores del desarrollo económico de México, México, UNAM (consultado en abril de 2013), disponible en http://www.economia.unam.mx/profesor/barajas/perspec.pdf > [ Links ]

Schmalensee, Richard (1985), “Do Markets differ much?”, en The American Economic Review, vol. 75, núm. 3, pp. 341-351. [ Links ]

Stigler, George Joseph (1968), The Organization of Industry, Chicago University Press, pp. 328. [ Links ]

Suárez Hernández, Jesús y Santiago Ibarra Mirón (2002), “La teoría de los recursos y las capacidades: un enfoque actual en la estrategia empresarial”, en Anales de estudios económicos y empresariales, núm. 15, pp. 63-89. [ Links ]

Sveiby, Karl Erik (2000), La nueva riqueza de las empresas: cómo medir y gestionar los activos intangibles para crear valor, Barcelona, Gestión 2000. [ Links ]

Tirole, Jean (1990), La Teoría de la Organización Industrial, España, Ariel Economía, pp. 736. [ Links ]

Vargas, Pilar (2000), “Características de los activos intangibles”, en Gestión del Conocimiento, Fundación Iberoamericana del Conocimiento (consultado el 02 de octubre de 2015), disponible en <Vargas, Pilar (2000), “Características de los activos intangibles”, en Gestión del Conocimiento, Fundación Iberoamericana del Conocimiento (consultado el 02 de octubre de 2015), disponible en http://www.unipamplona.edu.co/unipamplona/portalIG/home_10/recursos/general/documentos/pdf/14072011/1caracteristicas.pdf > [ Links ]

Received: November 06, 2015; Accepted: March 29, 2016

text in

text in