1. INTRODUCTION

According to Gregory (2010), the expansion of corporate business in the first decades of the twentieth century (post-Industrial Revolution), has promoted the need for corporate spaces. In the 1960s, many organizations focused their real estate1 activities on the construction of new buildings for their own use. As the focus of corporations was to promote their growth, the acquisition and construction of new buildings had become part of their main activities, and so, receiving a greater quantity of resources. Thus, the demand for rented spaces has had a great growth, boostingthe professionalism of the real estate markets.

Prior to any decision regarding the sale, purchase or asset demobilization property of a corporation, corporations need to know the importance of the real estate for the transaction, since it isan asset with important impacts for their financial aspects, market and organization (O'Mara, 2000). As Pottinger et al. (2002) said, the level of flexibility and kinds of spaces for the same corporation are not uniform. Thus, the strategic and operational needs of each space used in the operation, interfere on the decision by immobilization, or not, of the real estate enterprise.

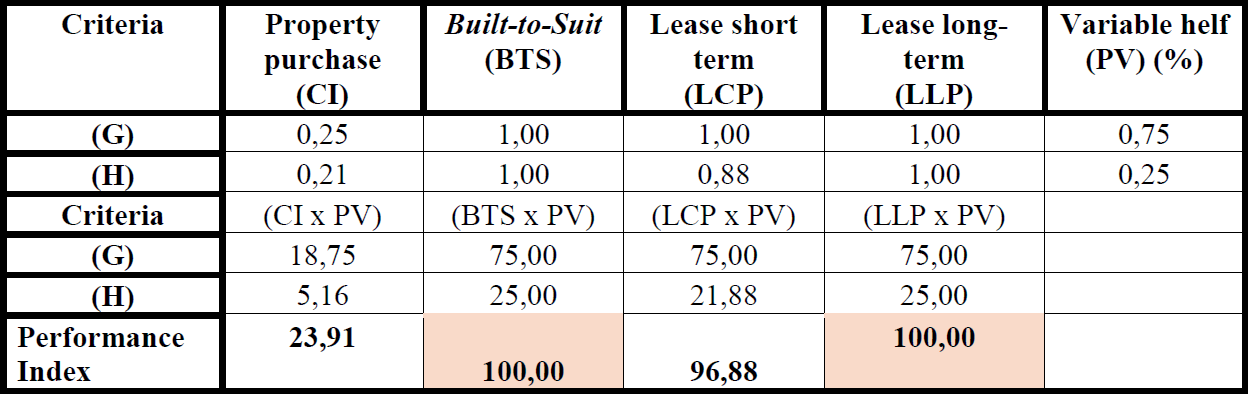

In research conducted by Jones Lang La Salle2, it were contacted relevant information about the trend toward investment in corporate real estate. In the year thissurvey was published (2005), only 15% of respondents were corporations that owned more than 50% of the space used in their operations and 43% did not own any real estate assets. It wass also observed that companies that had between 10% to 50% of corporate spaces indicated interest in reducing their real estate assets, as shown in Figure 1.

Source: Jones Lang La Salle, 2005.

Figure 1 Percentages of corporations in relation to ownership percentages of corporate spaces.

Another survey, developed in 2013 by the same author, indicates that 66% of executives in charge of the surveyed management companies in Brazil were focused on expanding their portfolios in the next three years. At the same time, 15% of international companies were outsourcing all the activities related to their real estate portfolios, while only 6% of brazilian companies were doing the same.

Currently, Brazilian companies are reorganizing their capital structure, changing from the owners’ position to tenants of physical spaces, in order to prevent corporations of immobilizing their capital in real estate assets, and so promoting the investment only in their business activity (GREGÓRIO, 2010). Brazilian corporations tend to demobilize real estate assets and a to have a higher resistance to the immobilization of assets in the acquisition of new properties. This increases the importance of developing a research on this topic. It is worth mentioning that Brazil has some peculiarities concerning the implied forms of contract transaction, as well as necessary guarantees, posible risks, and other factors. These particularities have impacts on qualitative and quantitative aspects of the alternatives between mobilize or not in the real estate corporate.

The purpose of this paper is to analyse the possibilites of immobilisation and demobilization of the corporate real estate, considering the expectations of corporations that make user of it. For this, we have chosen to study the case of a micro-enterprise whose focus was on applying information technology to construction, and which was incubated at the Federal University of Paraná. The reason for choosing this enterprise was that it had great potential for expansion of it’s business. Their active immobilizing opportunities were then assessed, and amongst these, the following ones have been considered: buying the property (SP) or not, as well as the options of not immobilizing it: the simple lease short-term (LCP), the simple lease long term (LLP) and the built-to- suit (BTS).

2. METHODOLOGY

The decision-making method used in this paper is the hierarchical analysis, which includes relevant qualitative and quantitative decision criteria for the choice between options that operate in very different ways in order to achieve the necessary attributes and criteria to be considered the most suitable one. And it is what ensures the alignment of real estate resource to the operational needs and strategic objectives of corporations.

According to Medeiros (2014) the hierarchical analysis process converts the evaluated criteria in numerical values that can be processed and compared considering the entire extent of the problem. This method is more useful to teams that are involved in complex problems that need the comparasion of different alternatives and whose resolution will imply on long-term impacts (Bhushan & Rai, 2004). While the unmeasurable qualitative criteria focus mainly at meeting the operational requirements for the use of commercial spaces, the quantitative result indicators support the decision from the economic and financial points of view, which are important to meet the corporation's investment strategies and policies.

This technique assesses the most suitable alternative of accommodation for the operational activities of each studied corporation, considering the different corporate spaces needed, and being in accordance to the operational and strategic needs of each corporation.

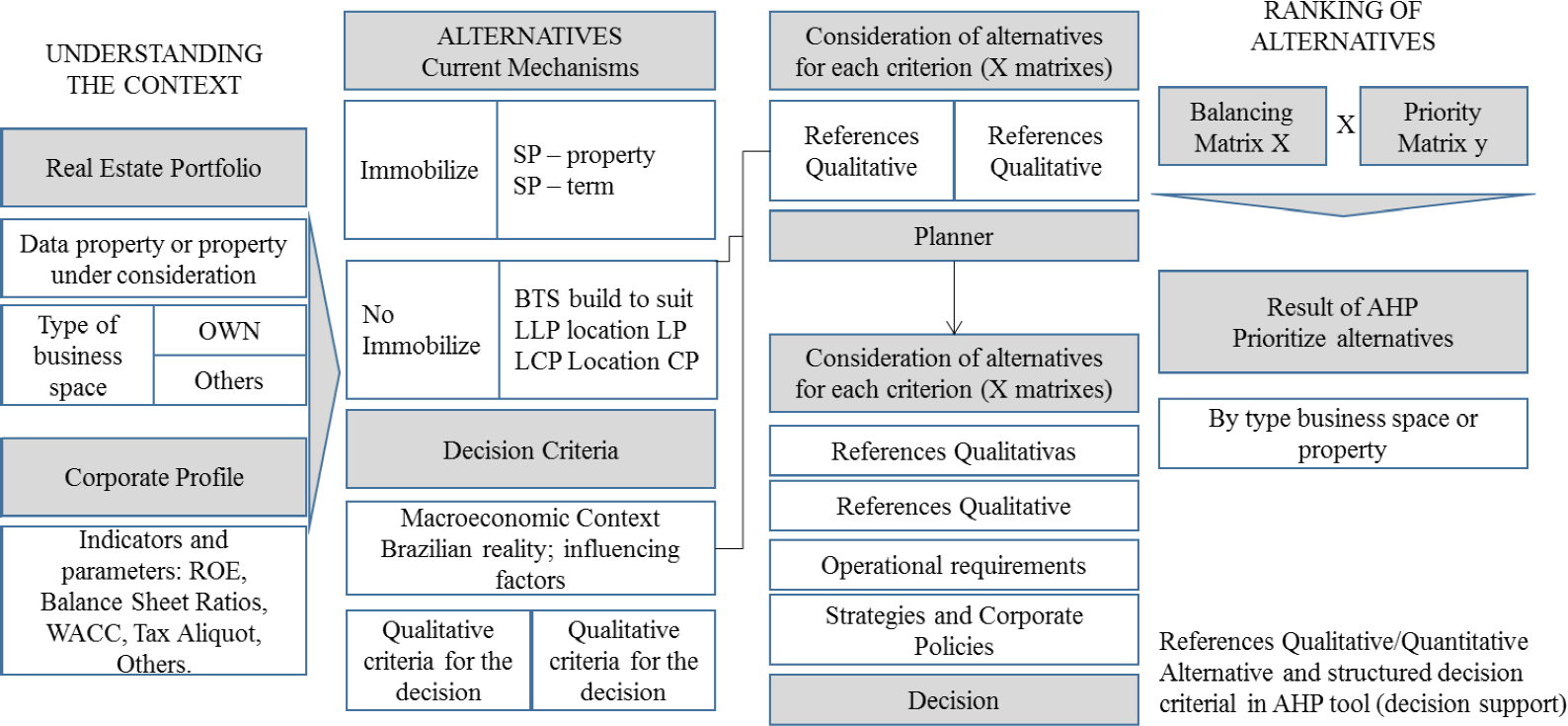

The final result of this analysis is the recommendation of a hierarchy between the different options, starting from the one that best meets the criteria prioritized by the stakeholders, as shown in Figure 2.

2.1 Methodology for the method configuration

Gregório (2010) states that qualitative references along with the quantitative references structured in a decision support tool configure the MAOI (Method for Analysis of Fixed Assets Corporate Real Estate Opportunity), as shown in Figure 3.

Source: Adapted by the author (Gregório, 2010).

Figure 3 Method Routines for Immobilization Opportunity Analysis in Corporate Real Estate (MAOI).

This method allows the balance between both qualitative criteria, which is related to the use of space, and quantitative data, which concerns investment strategies and policies of corporations when choosing the most appropriate solution for achieving strategic objectives and attending operational needs.

The decision between immobilize, or not, the real estate enterprise, is taken based on a multi-criteria analysis process. This article has used the decision support tool known as Analytic Hierarchy Process, which provides different alternatives for each criterion, allowing the best choice according to the strategies of each company.

2.2 Quantitative analysis - measurable decision criteria

The quantitative analysis provides indicators that are relevant to the decision between immobilizate in the real estate enterprise or not. Each corporation has it’s own strategy to immobilize financial resources. According to Gregório (2010), the following tests must be performed:

2.3 Qualitative analysis - prioritization of criteria by stakeholders

The tool used to structure the qualitative and quantitative references of MAOI was the Analytic Hierarchy Process (AHP - Analytic Hierarchy Process). This method has been developed by Saaty (1980) with the function of structuring decisions hierarchically. The models must include all important measurable factors (both quantitative and qualitative), which may be tangible or intangible and able to be compared and considered.

The main function of hierarchical analysis is to increase objectivity and reduce the subjectivity of the decision process. By the division of the decision into smaller parts, and through the comparison and correlation between criteria, it is possible to take a better choice according to the prioritization of criteria given by each corporation.

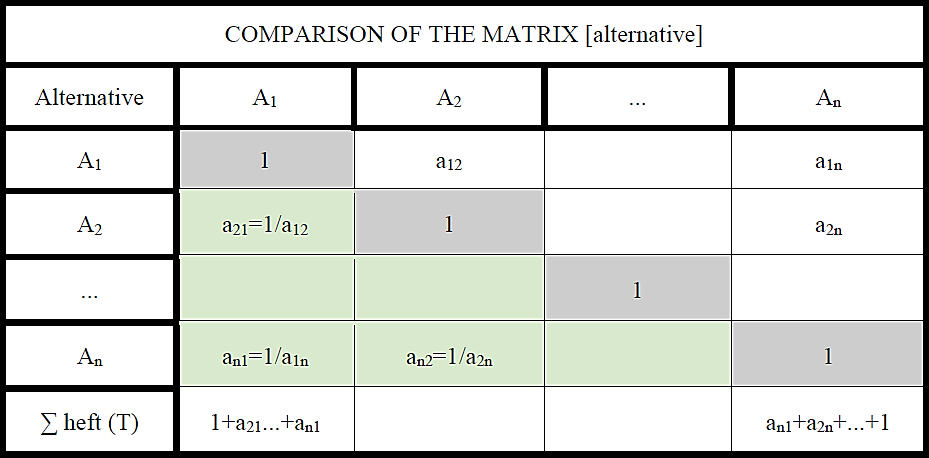

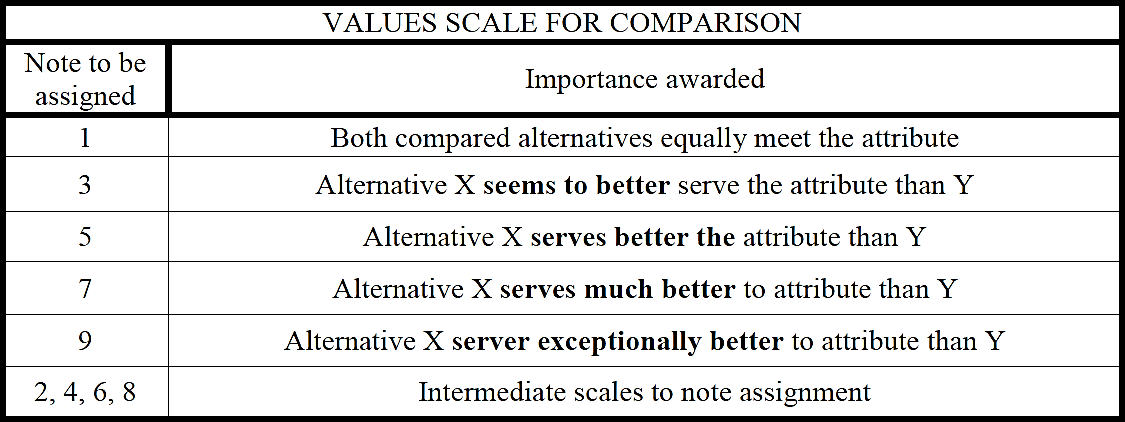

The advantage of each tool is to enable stakeholders to assign relative weights to the criteria and compare them with each other by following the scale developed by Saaty. An array of comparison for n elements is shown as follows: A = [aij] where aij = 1 / aji. Thus, it is possible to develop a comparison matrix, as shown in Table 1. All the criteria are compared and correlated following the Saaty scale, shown in Table 2. This scale can also be seen in ASTM 1765 -2011 - Standard Practice for Applying Analytical Hierarchy Process (AHP) to Multiattribute Decision Analysis of Investments Related to Buildings and Building Systems.

According to Saaty (2008), if all results are perfect in all of the comparisons, it is stablished the following condition: Aik = aij, ajk, for all i, j, k. The high number of comparisons may lead stakeholders to give an specific alternative importance gradients in a different way from as the others. The same author has also presented a consistency index (CI) for the evaluation of the comparison matrix between the different factors. The consistency index is represented in Equation 1:

Where:

λmax = eigenvector obtained from the multiplication of two matrices - the first one being formed from the eigenvector (relative weight) and the second by sum of the assigned values in the comparison matrix.

𝑛 = order of a square matrix

Saaty has also introduced randomness index, which consists of a random consistency index (RI) generated for random arrays of different dimensions, as described in Table 3.

Table 3 Random consistency index values (depending on the array order)

Source: National Laboratory Oakridge

With the random consistency index (RI) and the consistency index (CI) obtained by Equation 2 reason of consistency (RC):

According to Saaty (2008), a lower consistency reason or equal to 0.1 may be acceptable for analysis.

2.4 Case study

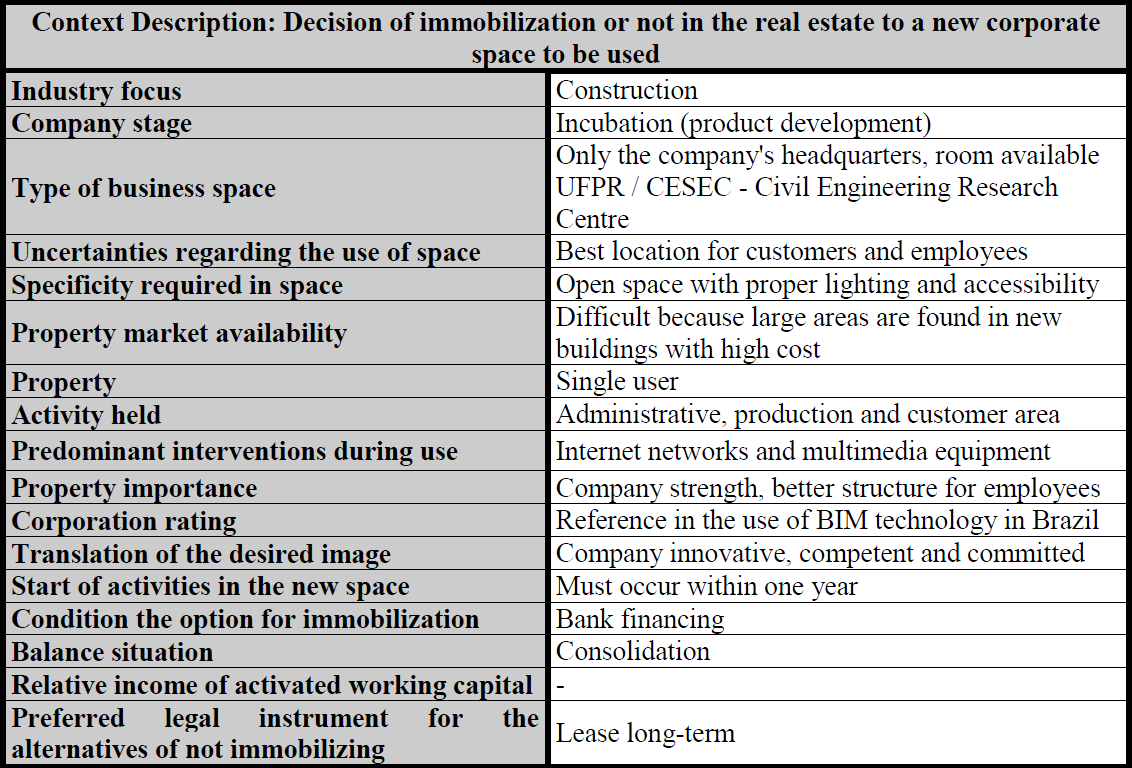

The selected case for study was an information technology applied to construction company, which was incubated within the Federal University of Parana. This company has an innovative profile in the information technology area, being nationally highlighted as a reference in the area BIM - Building Information Modeling.

According to the rules of ANPROTEC (National Association of Promoting Entities of Innovative Enterprises), a company can stay in the incubator for the maximum period of six months, if it is at the Pre-Incubation Program, and three years if it is in incubation. The studied company started its operation within the university in 2013, having two more years to continue their activities within the university. Thus, its facilities could not be sold, so that the hypothesis Sale Leaseback, which consists of the sale of the corporation's property, followed by a longterm contract with the investor, was dismissed for the study.

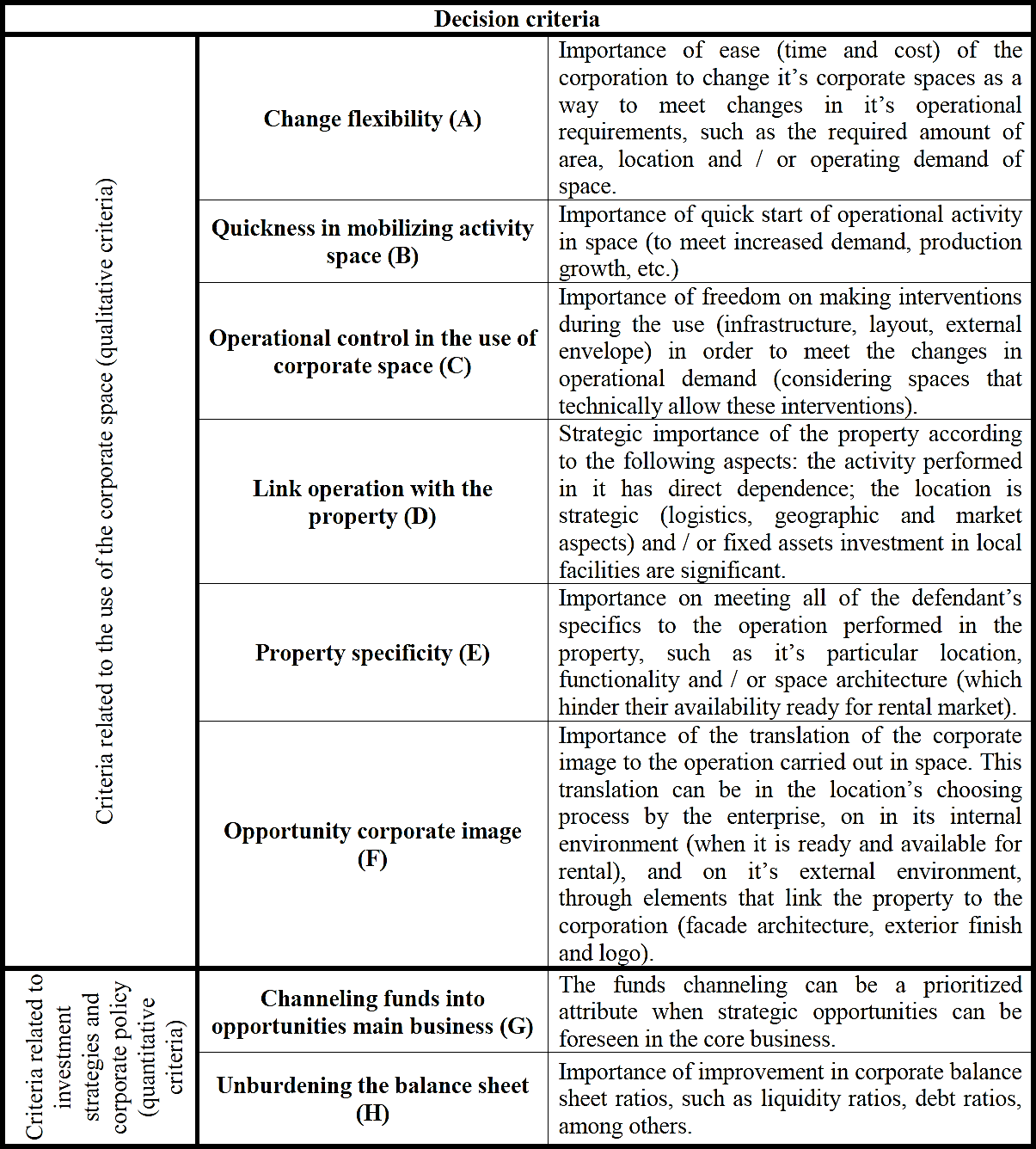

Figure 4 shows the structure of hierarchical analysis and alternative criteria based on the thesis written by Gregório (2010). The structure has an hierarchical level which consists of eight criteria organized in four qualitative and four quantitative aspects.

Table 4 shows a brief comment on each of the selected criteria, in order to help the understanding of the criteria that was used by the incubated enterprise’s owner when completing the questionnaire.

In this paper, we used the data collection protocol presented by Gregório (2010), which enabled the corporation's data collection by the means of an interview, whose results are summarized in Table 5, as well as a questionnaire in which the planner has compared several preestablished criteria, assigning them grades according to values presented by Saaty in Table 2.

From the description of the context and the results obtained from the questionnaire, it was possible to stablish degrees of importance for every decision criterion, which were later compared and weighted by the comparing array of both quantitative and qualitative alternatives.

3. ANALYSIS OF RESULTS

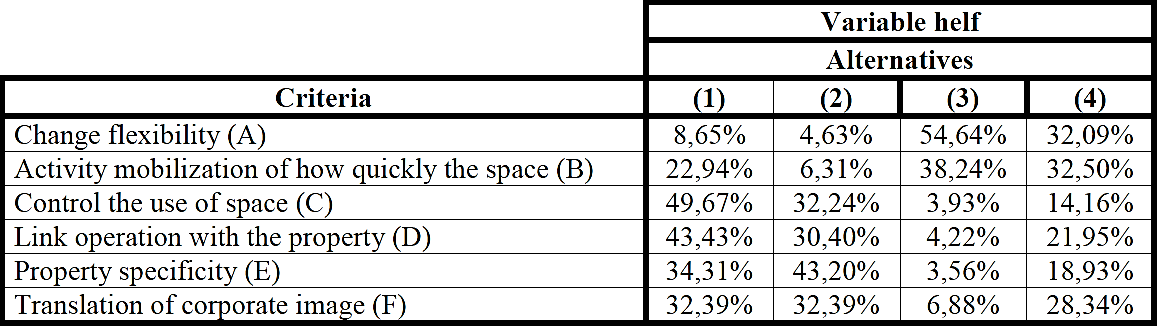

From the answers obtained in interviews with professionals from the real estate sector, as described by Gregório (2010), it was possible to calculate their weights, based on the relevance of each alternative for every decision criterion, as shown in Table 6.

Table 6 Comparison matrix for decision criteria - Change flexibility.

Source: Adapted by the author (Gregório, 2010).

However, given that the presentation of all decision criteria individually would result in an excess of information, in this paper we have chosen to summarize these answers in form of a table (Table 7), which shows, from the values that were obtained according to the procedures exemplified in Table 6, a summary of the weight of the studied variables and also the individual weight of each decision criterion.

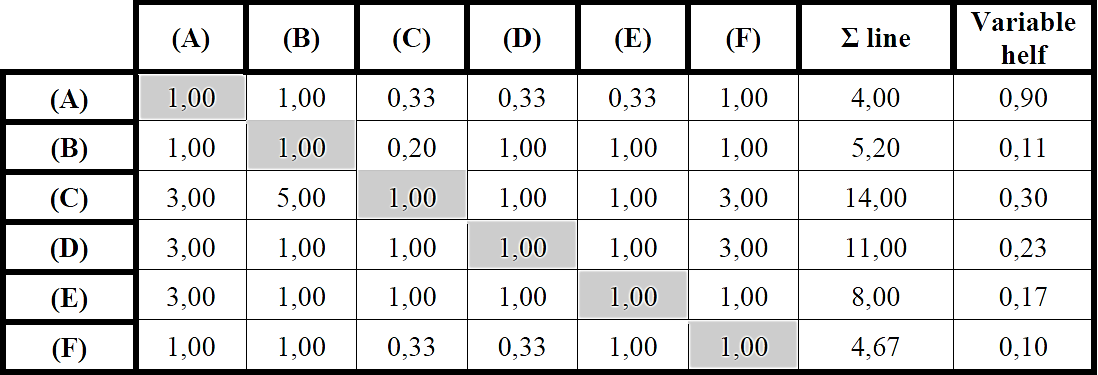

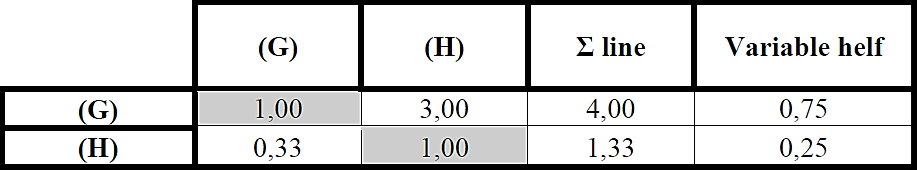

The importance of each of the decision criteria is shown in in Table 8, while in Table 9 it is shown the comparison matrix between the quality criteria. In Table 10 the quantitative criteria are compared. All of them are scored according to the rating scale developed by Saaty.

Table 8 Importance of decision criteria developed by the parties in accordance with the values established by Saaty (1991)

It is worth to emphasize that the criteria adopted as quantitative refer to economic performance, while the qualitative criteria address the technical performance of the building.

These data were collected and tested following the techniques reported by Saaty (2008). After the calculation of the decision matrix eigenvalue (𝜆𝑚á𝑥) we have calculated the consistency index of the decision matrix using Equation 1.

Costa (2006) proposes the use of a random consistency index (IR), as seen in Table 3, for a reciprocal matrix of order of n, without negative nor randomly generated elements.

By using the data obtained from the consistency index and the random consistency index in equation 2, we have obtained the consistency ratio (RC).

According to Saaty (2008), the value of consistency reason lies within the recommended amount, i.e., RC <0.1. When comparing the results between the calculated consistency of reason, and the reason of consistency established by Saaty, it can be observed that the values that were provided by the owner of the enterprise incubated within the Federal University of Paraná have enough consistency.

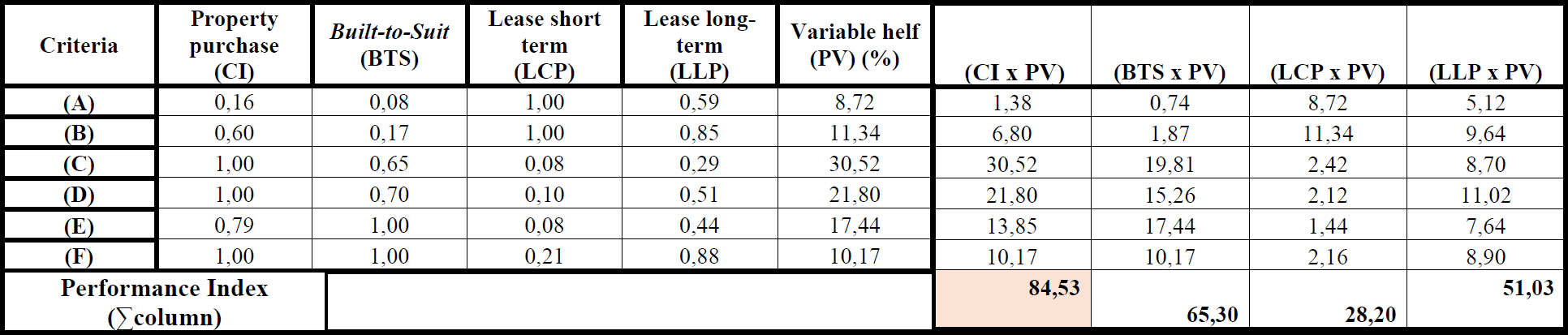

To check the alternative that best meets the company studied, we have correlated the set out criteria with possible alternatives. Next, the criteria’s weights were applied to each of the correlated values, in order to find the alternative that best suited the company's needs, that is, the one with the highest score. Table 11 shows their relative performance as the qualitative criteria.

While Table 12 shows the relative performance relating to the quantitative criteria.

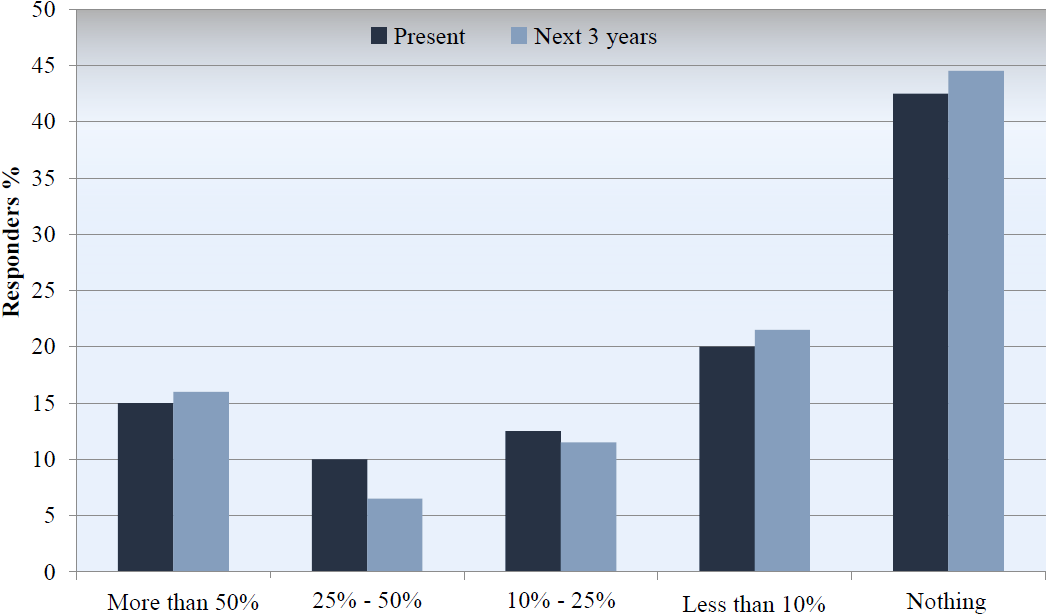

Thus, for better viewing, Table 13 shows in decreasing order, the results of economic attractiveness obtained for each of the evaluated alternatives in the case study.

As we could verify by using the method of hierarchical analysis, the most viable alternative to the selected case is the Built-to-Suit. However, during the interview for contextualization of the company, it has been said that the preferred alternative would be the long term lease. This alternative obtained the third highest rate in view, as it would sucessfully fulfill many of the aspirations of the incubated company.

4. CONCLUSION

This article was written based on the use of hierarchical analysis method for the decision on imobilize or not their assets in real estate. The chosen method provides parameters for better assessment of alternatives, as it is based on quantitative and unmeasurable qualitative criteria. The qualitative process correlates all the criteria, giving them grades according to the scale previously proposed by Saaty.

The final result of this analysis provided numerical indices that allow to define, in a systematic way, the best alternative for the case study, given that the company incubated within the Federal University of Paraná has, according to ANPROTEC three more years to remain installed at the University.

For this case, it was seen that the alternative with the best performance was th Buit-to-suit, which serves more broadly the company's needs, although in the interview it was said that that the preferred option was the lease long term. This option obtained the third highest rate in view, attending many of the aspirations of the incubated company, only not more effectively.

Despite the company’s preference, chosing Built-to-suit (BTS), may not be, tough, the best alternative, since the BTS operation implies the construction of a custom property for the specific use by the company, being linked to a long term lease. It is for the company to find investors to assume the construction of this property. Usually, this operation is used as part of the investment portfolio only for large leased areas (a property with large or several smaller properties) for the same client.

Nonetheless, both alternatives - best option (Buit-to-suit) and preference of the company (long-term lease) - are similar on what regards the decision not to immobilize the capital in the purchase of a property.

It should be noticed that the used method was intrinsically based on interviews with the company’s representants, so that the achieved results are essentially constitued on subjective data, as the interview tends to be a subjective method. Thus, extrinsic changes, such as the respondent's stress level during the evaluation of responses, may influence directly on the consistency of the results.

It is also noteworthy that this work had the purpose of evaluating the best solution for a single company, so that the result obtained does not necessarily represent a statistical universe of the same size companies, practice area, etc. The used method, however, can be applied to any related study.

text in

text in