Services on Demand

Journal

Article

Indicators

Related links

Share

Economía mexicana. Nueva época

Print version ISSN 1665-2045

Econ. mex. Nueva época vol.22 n.2 Ciudad de México Jan. 2013

Artículos

Trust, Information Acquisition and Financial Decisions: A Field Experiment

Confianza, adquisición de información y decisiones financieras: Un experimento de campo

Sonia Di Giannatale1, Alexander Elbittar2, Patricia López Rodríguez3 and María José Roa4*

1Associate professor of Economics, Department of Economics, CIDE; sonia.digiannatale@cide.edu

2Aassociate professor of Economics, Department of Economics, CIDE. elbittar@gmail.com

3Professor, Department of Economics, Universidad Iberoamericana. patyloro@hotmail.com

4Researcher, Economic Research Department, CEMLA (Center for Latin American Monetary Studies). Mexico City. roa@cemla.org

Fecha de recepción: 17 de enero de 2011;

Fecha de aceptación: 16 de agosto de 2011.

Abstract

We study the relationship between information acquisition and trust in financial decision making. A field experiment with a variation of the trust game was conducted with the partners of a financial cooperative located in a Mexican rural area. Individuals who frequently visit friends are more trustful, those who visit their families regularly reciprocate less, and active cooperative partners reciprocate more. Individuals show interest in acquiring information on the financial status and participation in social networks of other people with whom they may establish financial transactions. However, information does not appear to affect transfers; trust seems to overshadow information acquisition in financial decision making.

Keywords: social networks, information, social preferences, field experiments, trust, reciprocity, financial development.

Resumen

Estudiamos la relación entre la adquisición de información y la confianza en la toma de decisiones financieras. Se implementa un experimento de campo con los socios de una cooperativa financiera en México. Los individuos que visitan frecuentemente a sus amistades son más confiados, aquellos que visitan regularmente a sus familiares son menos recíprocos, y los socios más activos son más recíprocos. Los individuos mostraron interés en adquirir información sobre la situación financiera y participación en redes sociales de otros individuos con los cuales llevan a cabo transacciones financieras. No obstante, la información no parece afectar las transferencias; la confianza podría reducir el papel de la información.

Palabras clave: redes sociales, información, preferencias sociales, experimentos de campo, confianza, reciprocidad, desarrollo financiero.

JEL classification: O12, O16, C93, Z13.

Introduction

In this paper we analyze individuals' willingness to pay to acquire information about another individual before making a financial decision. To achieve this goal we conducted a field experiment using the trust game (Berg, Dickhaut and McCabe, 1995) with the members of a financial cooperative located in rural Mexico.

The motivation for this analysis comes from the role of information acquisition costs in determining the structure of financial markets, along with transaction costs and contract enforcement costs (Levine, 2005). In particular, information acquisition costs are relevant in credit markets because asymmetric information between the borrower and the lender can lead to adverse selection problems, in which the lender is unable to distinguish between types of borrowers, and moral hazard problems, in which there is a probability that the borrower does not pay the money back to the lender. These types of informational problems arise in credit markets of both developed and developing economies, being the latter more adversely affected by those problems. The role of financial markets in the process of economic development has been largely discussed by some authors; see, for example, Ray (1998). In general, the financial systems of developing countries are characterized by high levels of the three types of costs mentioned above. Moreover, there is empirical evidence that their financial institutions are less efficient than those of the developed countries in fulfilling the objectives of the financial system, such as risk diversification, information production, and allocation and supervision of investment resources (Demirguc-Kunt and Levine, 2001).

On the other hand, there is ample evidence in the literature that social networks and trust play a role in reducing problems of asymmetric information, more so in developing countries, by complementing or substituting formal financial markets and institutions (Townsend, 1994; Foster and Rosenzweig, 1995; Easterly and Levine, 1997; Zak and Knack, 2001; Guiso et al., 2001; Adato et al., 2006; Chantarat and Barret, 2007). The central idea is that social networks develop direct monitoring mechanisms that produce information about the financial behavior of the individuals that belong to such networks. Also, social networks tend to use social sanctions to improve the enforcement of contracts. Hence, social networks might play a role in reducing the informational costs inherent to the financial sector. Furthermore, this literature sustains that the operation of financial institutions is always —regardless of the degree of development— based on trust. Trust and social networks can improve the efficiency of a society by facilitating the coordination of actions (Putnam, 1993). Furthermore, according to Guiso et al. (2001) and Ferrary (2003), the existence of social networks and trust translates into greater degrees of development and institutionalization of the financial sector.

However, some articles (Uzzi, 1996; La Porta et al., 1997a, b; Guiso et al., 2001), based on Fukuyama (1995), state that in societies where family networks prevail, the emergence of large companies and impersonal organizations, frequently observed in developed societies, might show delays. They maintain that family businesses reduce transparency in view of external investors or partners, and that the prevalence of this type of networks is one of the reasons behind the existence of a strong, inefficient informal financial sector in developing countries.

In addition, Lussardi and Mitchell (2009) state that the individuals' educational level and the availability of financial information are partially relevant to assure a suitable handling of personal finances. However, these two elements have not been sufficient to explain the high rates of indebtedness and its possible consequences of non-payment, as well as the low levels of financial forecast for retirement. Intertemporal, social, and risk preferences, participation in networks, and cognitive abilities seem to be more relevant (De Meza et al., 2008; Meier and Sprenger, 2010; Barr et al., 2009).

In this paper we analyze the interaction and relationship between financial decisions, information acquisition and trust. In particular, we work with the hypothesis that financial transactions depend not only on economic variables, but also on variables such as the level of trust, reciprocity and association among individuals. Also, individuals' willingness to acquire and process information relevant to perform financial transactions is related not only to their cognitive abilities, but also to the level of trust they have in the individuals with whom they perform those transactions.

The experimental protocol known in the literature as the trust or investment game (Berg, Dickhaut and McCabe, 1995) has been used to measure the degree of trust and reciprocity between the players. This game has been implemented in laboratories as well as in the field. Karlan (2005) conducted a field experiment in Peru in which individuals played the trust or investment game, and found that the strategies of one type of players correlate with some measures of social capital identified as trust. A similar methodology was used by Johansson-Stenman et al. (2009).

In order to simultaneously study the role of trust and information acquisition behavior when individuals perform financial transactions, we conducted a field experiment using the trust or investment game with two important variations, as well as a survey with the objective of gathering prior information about the potential participants in the field experiment. Our unit of analysis is Caja Mixtlán, a credit and savings cooperative located in the mountains of the state of Jalisco, Mexico. This cooperative has been functioning for over 50 years and serves a rural population in situation of poverty. We expect the information acquisition behavior to be the highlight of our analysis on financial decision making of this population, which is a fairly closed community with supposedly strong ties among family members and cooperative partners. That is, given the characteristics of this community, our hypothesis is that trust is an important component in the process of the individuals' financial decision making, while information acquisition, being an activity that for our experimental subjects is costly and in which they are very likely to be inexperienced, is performed more tentatively and with little sophistication. It is possible that, for those individuals, trust overshadows the role of information acquisition in financial decision making.

The paper is organized as follows: in section I, we present a brief description of our unit of analysis; in section II, we describe our methodology; in section III, we present some of our results; and, in section IV, we offer some concluding remarks.

I. Description of the unit of analysis: Caja Mixtlán

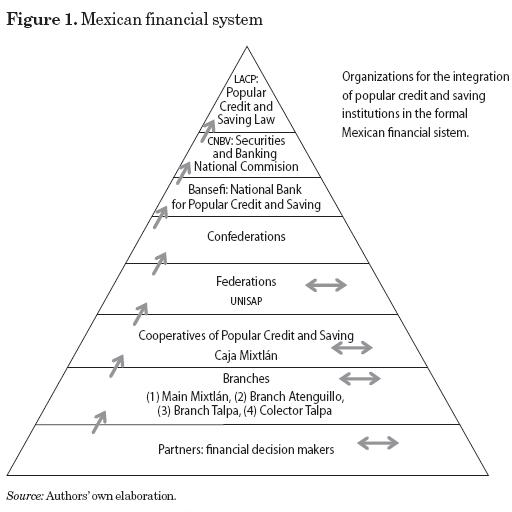

We undertook our study based on Caja Mixtlán, a credit and savings cooperative belonging to the UNISAP Federation located in the Mexican state of Jalisco. We decided to work within the Mexican financial hierarchy, depicted in figure 1, in order to analyze the financial decisions of individuals in a framework that includes the possibility of horizontal and vertical social networks. We chose the UNISAP Federation because it is one of the federations with greatest financial development and heterogeneity. We specifically selected Caja Mixtlán because it is one of the cooperatives with greatest diversity in terms of the population it serves, and because it has been operating for more than 50 years. Caja Mixtlán is located in a rural area and offers financial services to a population in a situation of poverty.

We use the cluster sampling methodology and select the sampling units taking into account their levels of access to the financial services of Caja Mixtlán. We consider four clusters: Caja Mixtlán's main office (Mixtlán), two branches (Talpa and Atenguillo) and a mobile branch (La Laja). We have to highlight that these four communities are heterogeneous. Talpa is the most developed community because it has the highest level of commercial activity generated by the Sanctuary of the Virgin of Talpa, and a factory of guava products. La Laja is a very remote community located in the mountains, and does not have any commercial activity.

The Talpa and Atenguillo branches are located approximately 21 and 23 kms. from the main office in Mixtlán, and have some 35 and 197 partners respectively. La Laja mobile branch is a meeting point at a distant town, about 145 km. from Mixtlán, where the partners (approximately 154) perform their financial transactions with Caja Mixtlán through a representative of the institution, who travels to La Laja once a week.

The unit of selection and observation consists of the partners of each of the clusters. We take as our primary unit of analysis the partners who are heads of a household. We define the head of a household as the individual who makes the financial decisions within the household. If the head of the household was absent at the sampling moment, we consider the spouse or the second adult (18 years or older) in charge of the household. From a universe of around 1,066 active partners belonging to Caja Mixtlán, we selected a sample of 418 partners. By cluster, the sample is of approximately 195 partners in Mixtlán, 104 in Talpa, 108 in La Laja, and 11 in Atenguillo.

The clusters are located in rural communities in which most of the partners are engaged in activities related to agriculture, livestock, services and small retail businesses. This population is characterized by high levels of migration to the United States or to nearby cities (Guadalajara or Puerto Vallarta), so there are cases where partners are registered in Caja Mixtlán but do not live in the locality. To ensure the presence of partners in the locality at the moment of sampling, the sample size was reduced to registered partners who live in the locality and that were present at the time of applying the methodology.

II. Methodology

Our field work started with a survey that was applied to 108 members of Caja Mixtlán from October the 6th through October the 10th, 2008. The sampling dates were selected to ensure the presence of a higher number of migrants in the locality. Although they are not present in their communities throughout the year, we considered it important to capture information from migrant partners because the level of their financial transactions with Caja Mixtlán is high due to the remittances they send when they are away. Moreover, the reception of remittances is an important source of financial transactions in Caja Mixtlán.

The survey consists of 80 questions divided in two sections. In the first section we collect data on the personal, financial and socio-economic characteristics of the individuals. This section also collects information about their levels of participation in social networks and of trust in other individuals, in Caja Mixtlán and in some governmental institutions; these questions were based on those of the General Social Survey. In the second section we ask each respondent to specify the amounts of money that he would return to a potential sender (Type A individual), conditional on the several possible monetary amounts this individual could send in return. Respondents were notified that their responses could be taken into consideration at the moment of assigning payments to them in case of their being selected for the field experiment a posteriori. Both the survey and the experimental activity were carried on dates of local holidays in which the migrants tend to go back to their communities of origin.

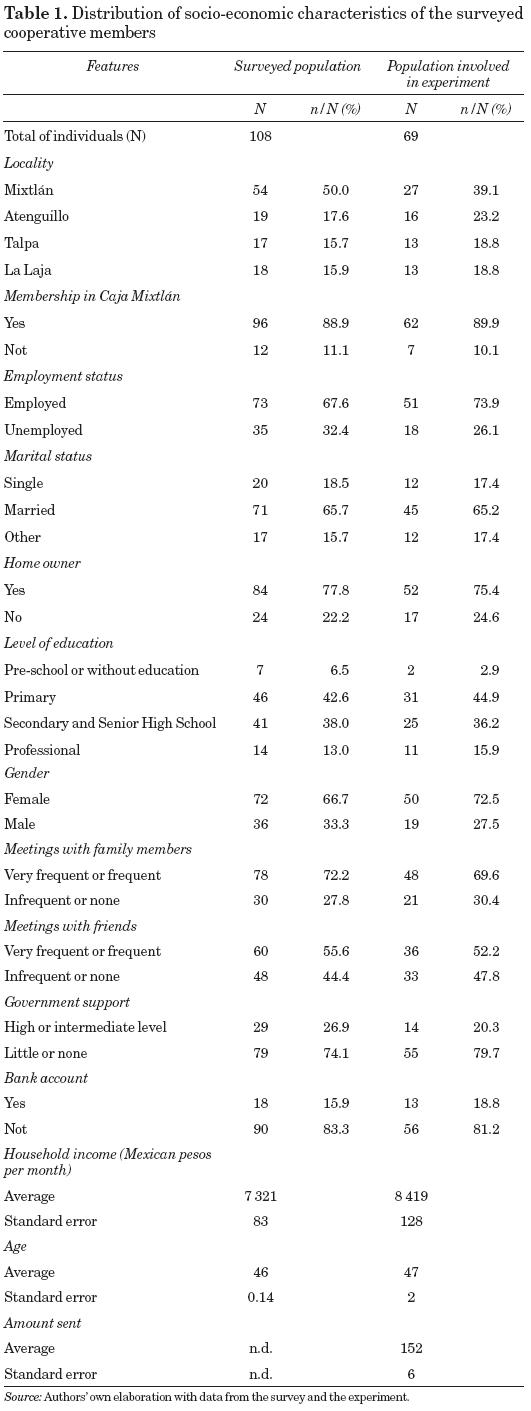

Table 1 shows a distribution of the general characteristics of the population reported in the survey. From the survey results, we can infer that the degree of acquaintanceship and trust are important in financial decision-making. Closed social networks (relatives and friends) prevail in these communities. On the other hand, we observe that there is limited use of a variety of financial services on the part of Caja Mixtlán's partners. Most of the individuals reported that they save in Caja Mixtlán, and only a very low percentage reported having accounts in other formal financial institutions. The percentage of partners that reported saving in informal financial institutions is also very low. Thus, partners are characterized by low levels of financial diversification and sophistication. The answers to the questions associated with membership and participation in activities of Caja Mixtlán show that this institution has a fundamental role in the creation of social networks among the partners and with its authorities. When asked directly, most of the partners reported that they would not participate in another credit and savings cooperative for trust-related reasons. In percentage terms, 18.12 per cent of the surveyed partners save in a bank, 1.18 per cent of them have investment funds, and 13.97 per cent of them participate in informal savings institutions. Finally, almost all partners indicated that they feel Caja Mixtlán has benefited the community.

Once the information collected in the survey had been processed, our second step was to undertake the field experiment from January the 12th to January the 16th, 2009. The experiment was applied to 69 members of the population initially surveyed.

The field experiment implemented for this study (the Script of this experiment is in Appendix A) consists of a variant of the protocol known in the literature as the trust game (Berg, Dickhaut and McCabe, 1995). In this game, a type A individual has the task of deciding how much money to send to a type B individual, who is anonymous, and how much of an initial capital to keep. The type B individual receives the amount sent by the type A individual multiplied by three. Then, the type B individual decides how much money he wants to return to the type A individual and how much money he wants to retain. The amount of money which may be received and retained by any of the two types of individuals is a decision that is exclusive to the subjects of the experiment. That is, they do not receive suggestions or pre-established rules that might lead them to behave in a specific way.

The results of this experiment have been interpreted in the literature as a measure of the degree of trust and reciprocity that can exist between types A and B individuals. To observe these types of behavior among individuals, it is necessary that the type A individual transfers resources to the type B individual trusting to receive some future return, and that the type B individual acts reciprocally by transferring resources back to the type A individual (Camerer, 2003). Thus, the quantity sent by the type A individual is considered to be a measure of trust, and the amount returned by the type B individual is considered to be a measure of reciprocity.

With the objective of studying the effect of knowing certain information about the type B individual on the monetary quantities sent initially by the type A individual, we introduced two important variants to the original game. First, the type A individual has the opportunity to send money to three different type B individuals. Second, the type A individual has the opportunity to acquire information about some relevant features of each type B individual. The acquisition of information about these features has a cost. The type A individual receives an initial amount of money which he may or may not use for the purchase of information.

To implement this activity we designed an activity book in which each of the 69 participants was given the possibility of acting as a type A individual and deciding the different amounts he could send to three possible type B individuals. In addition, participants were shown a set of pieces of information about type B individuals, which the type A individuals could acquire (up to a maximum of five pieces) before making their decisions about monetary quantities to be sent to the type B individuals. Once the type A individuals decided the amounts to be sent to the three possible type B individuals, just one type B individual (out of the three type B individuals considered) was chosen at random and we looked at how he had answered the question on the initial survey as to the amount of money he would send back to the type A individual in case of receiving that specific monetary quantity.

The amount of money given to the type A individuals was 300 Mexican pesos. Those individuals could send multiples of 50, from 0 to 300 Mexican pesos. They also received a payment of 50 Mexican pesos that they could use, if they wished, to buy information about type B individuals.1 The cost of each piece of information was 10 Mexican pesos.

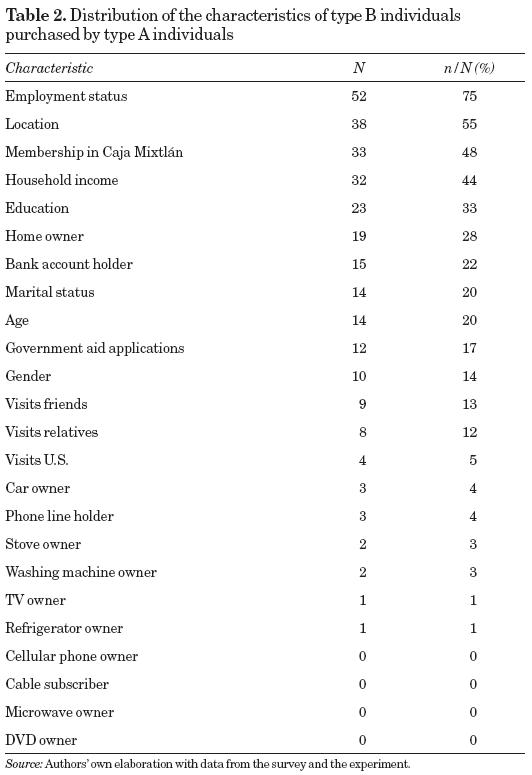

Table 2 shows the list of features about type B individuals that type A individuals could buy. We considered demographic, financial and social network participation characteristics. Including those variables enables us to analyze the hypothesis that social variables are relevant when individuals make financial decisions. To construct the list of pieces of information we took as a starting point a series of questions included in the survey in which partners of Caja Mixtlán were asked about factors that were relevant for them when lending or borrowing money. Those factors which appeared most often, along with some control variables, were included in the list of pieces of information that the type A individuals could purchase.2

III. Results

In this section we present and discuss our principal results.

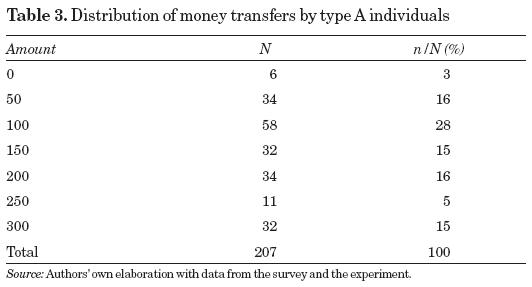

Transfers Made by Type A Individuals

Table 3 reports the distribution of payments sent by type A individuals. Even though the mode of the payments was 100 Mexican pesos, the average and median were approximately 152 Mexican pesos, with a standard error of 6 Mexican pesos. This heterogeneity in the decisions as to the amount of the original payments contrasts with the results observed in laboratories with students as experimental subjects, in which cases payments are relatively constant at approximately half of the capital available (Camerer, 2003). To estimate the characteristics that are relevant for the type A individuals when deciding the amount of money to be sent to type B individuals, we use the ordinary-least-squares model with random effects.

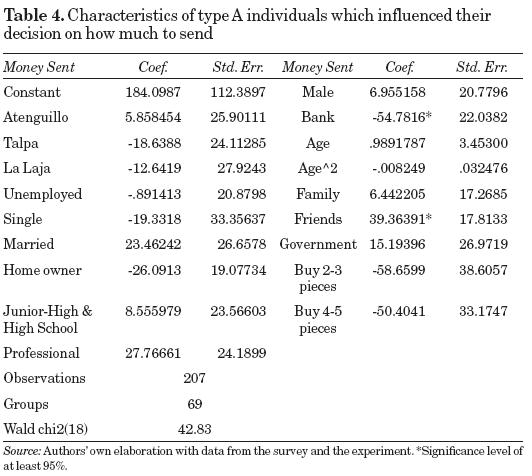

As can be observed in table 4, among the personal features of type A individuals that seemed to affect the amounts they transferred was whether they had bank accounts and with what frequency they visited friends. Specifically, individuals who reported having a bank account tended to send 55 Mexican pesos more than those who reported not having a bank account. This result is consistent with the idea that those individuals more familiar with financial interaction are more trusting. Barr (2004) reports results of a field experiment conducted in Zimbabwe, in which individuals less familiar with the economic and social rules of the environment where they are settled tend to be less trusting. On the other hand, those individuals who reported visiting their friends regularly tended to send 39 Mexican pesos more than those who reported visiting their friends rarely or never.

Even though home owners tended to send more, and those who bought from two to five pieces of information tended to send smaller amounts of money, the coefficients are not significant.

III.2 Information Purchased by Type A Individuals

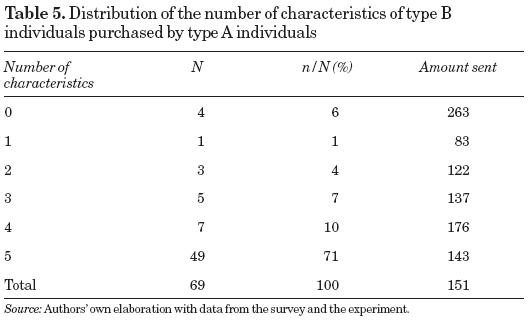

Table 5 reports the distribution of the number of characteristics of type B individuals purchased by type A individuals. As can be observed, more than 2/3 of the individuals in the sample decided to buy the five pieces of information and only 6 per cent of them decided not to find out anything about the type B individuals.

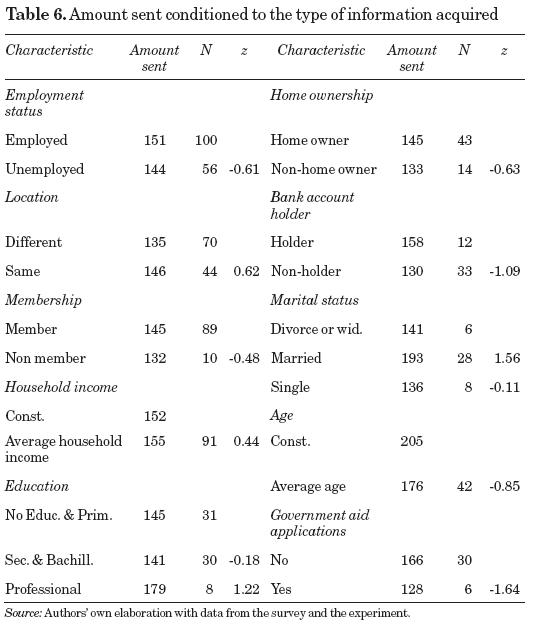

In Table 2 we show the distribution of features of type B individuals that could be purchased by type A individuals. The first five features include: the employment status of the individual (75%), location (55%), membership in Caja Mixtlán (48%), household income (45%) and educational level (33%). Thus, individuals were not only interested in financial variables. Participation in Caja Mixtlán and the proximity to their community were also relevant variables. However, as seen in table 6, t-tests for differences between populations show that there is no significant relation between these variables and the amounts of money sent. As noted in the previous section, the number of pieces of information purchased does not prove to be significant in the decisions of type A individuals as to how much money they sent to type B individuals.

III.3 Conditional Amounts Type B Individuals Return, Given the Transfers of Type A Individuals

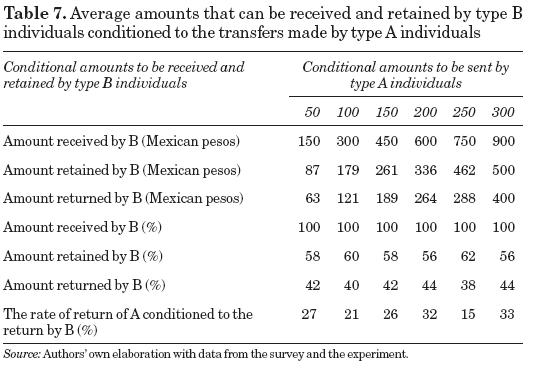

Table 7 reports the average monetary amounts type B individuals received from and returned to type A individuals; the amounts returned being conditional on the amounts received. As shown in this table, type B individuals tended to return monetary amounts that increased in accordance with the amounts they received from type A individuals. However, the average retention for each of the possible transfers from type A individuals is quite stable, at an average of 58 per cent of the amount received. The monetary amounts that type B individuals returned to type A individuals was greater than the amounts that type A individuals had originally sent. This result contrasts with experiments in developed countries where type B individuals tend to return less money than the transfer sent by type A individuals; that amount has been tripled. In our study the average rate of return for type A individuals is approximately 27 per cent of the amount originally sent.

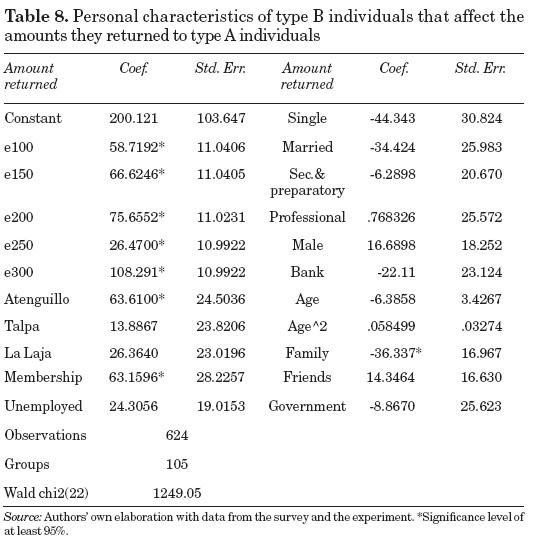

Table 8 shows the personal characteristics reported by type B individuals that affect the conditional amounts they returned to type A individuals. The specification includes dummy variables (e100, e150, e200, e250, e300) that were equal to one whenever they received an amount higher than 50 pesos. All these coefficients were significant and positive, indicating an increasing function on the contributions.

The estimation also considers other variables that include living location, active membership in Caja Mixtlán, bank account holding, level of education, civil status, age, frequency of visiting family and friends, and requiring assistance from government. Active partners of Caja Mixtlán3 and individuals who live in Atenguillo returned higher amounts (63 Mexican pesos more). The individuals that reported visiting their relatives frequently returned 36 Mexican pesos less. Older people returned less up until a minimum, after which the amount of money returned increased.4

IV. Discussion and Future Research

Our experimental results highlight the interest that individuals show in acquiring specific information on the financial status and participation in social networks of other people with whom they may establish financial transactions. Just over 2/3 of the participants purchased the maximum number of five pieces of information. Only 6 per cent of the subjects decided not to buy any information. However, we have found no evidence that the information acquired had any impact on the amounts type A individuals sent to type B individuals. This result allows us to conclude that the acquisition of the pieces of information offered to the participants has little impact on their financial decision making process; a process that is based on pre-existent levels of trust among the individuals who are immersed in vertical and horizontal social networks.

The broad support of the distribution of the transfers type A individuals send to type B individuals highlights the heterogeneity of individuals' preferences with respect to the agreements based on trust they wish to reach. At the same time, the degree of concentration around the range between 100 and 150 Mexican pesos provides us with a basis for further research. With respect to the behavior of type B individuals, we find a high degree of reciprocity compared with that found in studies of a similar nature conducted in developed countries. Preferences for reciprocity are fairly homogeneous. We also find that those individuals who meet with friends more often show greater trust. However, the individuals that frequently visit their relatives show a lower level of reciprocity. The active members of Caja Mixtlán show a greater level of reciprocity, which reinforces the perception that the cooperative plays a role in the formation of social networks in this community.

We can thus conclude that in locations where closed social networks prevail, financial transactions depend not only on economic variables but also on other variables such as the individual's level of trust, reciprocity and association. Another point is that, in communities like those involved in this study, the level of sophistication of the use of information when making financial decisions and of the diversity of financial instruments they use and, concomitantly, the degree of financial development, tends to be low. In general, the level of trust seems to be high, although preferences over trust are quite heterogeneous. Moreover, for the case of our experimental subjects, trust seems to overshadow the role of information acquisition while making financial decisions, because they seem interested in acquiring information but they do not use the information they purchase in their financial decision making, relying on pre-existent levels of trust they have in the individuals of their social group.

To have a better map of individuals' preferences on trust and reciprocity and of the impact of new information on their financial decisions and economic cooperation agreements, it is necessary to study other populations. For this reason, and given the differences in the level of development between rural and urban areas, we intend to apply this methodology in different regions within Mexico to capture the dynamic element in our idea about the relationship between financial development, trust and information acquisition.

References

Adato, M., M. R. Carter and J. May (2006), "Exploring Poverty Traps and Social Exclusion in South Africa Using Qualitative and Quantitative Data", Journal of Development Studies, 42 (2), pp. 226-247. [ Links ]

Barr, A. (2004), "Kinship, Familiarity and Trust: An Experimental Investigation", in J. Henrich, R. Boyd, S. Bowles, C. Camerer and H. Gintis (eds.), Foundation of Human Sociality, Oxford, Oxford University Press. [ Links ]

Barr, A., M. Dekker and M. Fafchamps (2009), "Who Shares Risk with Whom under Different Enforcement Mechanisms?", Centre for The Study of African Economies, Oxford University, mimeo. [ Links ]

Berg, J., J. Dickhaut and K. McCabe (1995), "Trust, Reciprocity and Social History", Games and Economic Behavior, 10 (1), pp. 122-142. [ Links ]

Camerer, C. (2003), Behavioral Game Theory: Experiments on Strategic Interaction, Princeton, Princeton University Press. [ Links ]

Chantarat, S. and C. B. Barrett (2007), "Social Network Capital", Economic Mobility and Poverty Traps, MRA Paper 1947, pp. 1-56. [ Links ]

De Meza, F., B. Irlenbusch and D. Reyniers (2008), "Financial Capability: A Behavioural Economics Perspective", prepared for the Financial Services Authority, London School of Economics. [ Links ]

Demirguc-Kunt, A. and R. Levine (2001), "Bank-Based and Market-Based Financial Institutions: Cross Country Comparisons", in A. Demirguc-Kunt and R. Levine (eds.), Financial Structure and Economic Growth: A Cross Country Comparison of Banks, Markets and Development, MIT Press. [ Links ]

Easterly, W. and R. Levine (1997), "Africa's Growth Tragedy: Politics and Ethnic Divisions", Quarterly Journal of Economics, 112 (4), pp. 1203-1250. [ Links ]

Ferrary, M. (2003), "Trust and Social Capital in the Regulation of Lending Activities", Journal of Socio-Economics, 31 (6), pp. 673-699. [ Links ]

Foster, A. and M. Rosenzweig (1995), "Learning by Doing and Learning from Others: Human Capital and Technical Change in Agriculture", Journal of Political Economy 103 (6), pp. 1176-1209. [ Links ]

Fukuyama, F. (1995), Trust: The Social Virtues and the Creation of Prosperity, New York, The Free Press. [ Links ]

Guiso, L., P. Sapienza and L. Zingales (2001), "The Role of Social Capital in Financial Development", The American Economic Review, 94 (3), pp. 526-556. [ Links ]

Johansson-Stenman, O., M. Mahmud and P. Martinsson (2009), "Trust and Religion: Experimental Evidence from Bangladesh", Economica, 76 (303), pp. 462-485. [ Links ]

Karlan, D. (2005), "Using Experimental Economics to Measure Social Capital and to Predict Financial Decisions", The American Economic Review, 95 (5), pp. 1688-16899. [ Links ]

La Porta, R., F. López de Silanes, A. Shleifer and R. Vishny (1997a), "Trust in Large Organizations", The American Economic Review, 87 (2), pp. 333-338. [ Links ]

---------- (1997b), "Legal Determinants of External Finance", The Journal of Finance, 52 (3), pp. 1131-1150. [ Links ]

Levine, R. (2005), "Finance and Growth: Theory and Evidence", in P. Aghion and S. Durlauf (eds.), Handbook of Economic Growth, Elsevier Science. [ Links ]

Lussardi, A. and O. S. Mitchell (2009), "How Ordinary Consumers Make Complex Economic Decisions: Financial Literacy and Retirement Readiness", National Bureau of Economic Research, Working Paper No. 15350. [ Links ]

Meier, S. and C. Sprenger (2010), "Present-Biased Preferences and Credit Card Borrowing", American Economic Journal: Applied Economics, 2 (1), pp. 193-210. [ Links ]

Putnam, R. (1993), Making Democracy Work: Civic Traditions in Modern Italy, Princeton, Princeton University Press. Ray, D. (1998), Development Economics, Princeton, Princeton University Press. [ Links ]

Townsend, R. (1994), "Risk and Insurance in Village India", Econometrica, 62 (3), pp. 539-591. [ Links ]

Uzzi, B. (1996), "The Sources and Consequences of Embeddedness for the Economic Performance of Organizations: The Network Effect", American Sociological Review, 61 (4), pp. 674-698. [ Links ]

Zak, P.J. and S. Knack (2001), "Trust and Growth", The Economic Journal, 111 (470), pp. 295-321. [ Links ]

*The authors thank two anonymous referees for many valuable comments, which greatly improved the quality and exposition of the paper. We also have benefited from comments and suggestions by Blanca Aldasoro, Ferrán Martínez, Pablo Brañas Garza, Ricardo Smith, Alfredo Ramírez, and participants at the cide seminar and the 2008 Meeting of Cooperation Through the Ages: The Social and Psychological Dynamics of Cooperation and Punishment, Barcelona Meeting of TECT Groups. We also wish to thank Rodrigo Aranda, Ika Sarait Cárdenas, Martín Lima, Alejandro Montesinos, Iván Osnaya, Wendy Sánchez, Oscar Santiago y Ana Priscila Torres for their work as research assistants. We express our enormous gratitude to the members and authorities of Caja Mixtlán for their cooperation and patience. Finally, we thank AFIEMA-USAID/Mexico and the Instituto de Investigaciones Económicas y Sociales "Francisco de Vitoria", Madrid, for the financial aid they granted to this project.

1 The simultaneous implementation of this protocol without the possibility of acquiring information about type B individuals would allow us to study the relationship between anonymity and the degree of cooperation between types A and B individuals.

2 Monetary amounts returned by type B individuals are obtained from the answers to the questions included in the second part of the survey.

3 We consider that active partners of Caja Mixtlán are those partners who attend the meetings organized by the authorities of Caja Mixtlán and make frequent use of the financial services offered by Caja Mixtlán.

4 The level of significance of this variable is 10 per cent.