1 Introduction

Development of societies since decision-making fundamentally influences individuals by improving in any area of their daily life. However, when analyzing decision-making in individuals and problem-solving activities [1], multiple factors involved have been determined that are derived from various aspects that influence throughout their lives. The problem with these aspects is that they change over time.

Some of them are the factors that are as different as the psychological sentimentality of spiritual rituals etc. In addition to this, individuals are considered as people who over time change their behavior depending on the situation they present in their lives and depending on the physiological issues they present.

This situation causes individuals to be considered as a complex system in which there are different derivations of behavior throughout their lives and their evolution [2]. For this reason, few authors are dedicated to the study of human behavior, because when trying to analyze a complex system, millions of combinations are contemplated to find an absolute answer to your behavior when making decisions.

There are even possibilities where the combinations between men and women are very diverse since women are more capable of making decisions in a shorter time than men make for the evolutionary development of the human being [2].

However, men are able to decide more sincerely and clearly why they do not consider certain aspects that could alter the conception of their behavior. These behavior’s influence societies, because individuals seek a way to make concrete decisions for economic activities.

This aspect is very important since the development of their life depends on this and this greatly impacts the vast majority of current societies.

The economic aspects are very valuable in any society since several individuals can contribute to the economic development of a society within cities and countries [3]. In recent years it has been observed that the economic contribution is an inherent part of society since it has not functioned properly without it for more than 500 years.

To analyze the decision-making of individuals, it is necessary to look for alternatives with which the aspects that influence the decision-making of people can be grouped and represented through models, with the help of the models you will not waste time resources for your analysis.

Derived from current technologies, computer modeling can be done which does not waste time resources when looking for a certainty of data analysis. An example of them is the modeling of these problems, using data mining [4].

Since data mining is a very appropriate area to analyze large volumes of data and thus determine patterns or similarities between economic decision-making in individuals.

This article develops a computational mobile model supported with decision tables techniques to determine the economic decision-making of individuals, represented as a complex system, with which it is successful in their lives.

This modeling is proposed because the analysis of the data manually is very complicated and complex due to the number of variables that exist and the number of possibilities that an individual present when making decisions. In this modelling, each of the phases or stages of data mining is used to extract the knowledge that provides us with a comparative of the aspects that improve the economic decisions of peers.

The following describes the way in which the modeling was determined through the analysis and representation of the receipt of more complexes, subsequently finishing the modeling as they are.

2 The Individual Choice

One key area for social sciences and economics is centered on how individuals make decisions in their daily lives. As a result of Adam Smith’s ideas that men are selfish and looking for self-interest above all other considerations, the term Economic Man was coined by neoclassical economics, as defined by [5], to describe individuals working in the market, and always trying to reach their personal interests.

According to this conception, individual actions and choices are guided by profit maximization. Thus, in the words of [5], human behavior complexity was simplified to a rationalist model condemning individuals to an economic man condition.

Such a model has been used in the conception and implementation of public policies and business strategies which, in the words of [6], refer to a narrow understanding of human nature (the economic man) limited to see human beings as employees.

In addition, employees are seen as limited and small-minded individuals, prejudiced and slothful, guilty of business waste; individuals who should be controlled through rationalization of work and time.

More recent contributions about the complex process involving decision making are due to [7] who shows that it is important to take into consideration emotions and human predispositions for economic chooses, for which a series of states called unmistakable feelings is given, among which we find: anger, hatred, guilt, shame, pride, taste, sorrow, happiness, grief, envy, malice, outrage, jealousy, contempt, annoyance, fear, and love.

In all the states above, visceral feelings such as pain, hunger, and sleep must be distinguished, which are physiological and frequently accompanied by psychological activity states like fear. Besides selfishness there are other activities ruled by animal spirits, and those stimuli which motivate people are not always economic, nor rational is their behavior when looking for that type of interest, as stated by [8].

The corruption and bad faith; human beings have a dark side too lead us to antisocial behavior and difficulties economics.

To the above must be added that capitalism does not automatically produce what people really need, but what they think they need and are willing to pay. Both aspects increase propensity to antisocial behavior.

The money illusion is when decisions are influenced by nominal quantity. Standard economy states that economic decisions must be focused from a point of view, which has a rational behavior as its foundation. Such rational behavior does not allow money illusion.

Experimental evidence also shows that an important type of social preferences is spiteful and envious [9]. A person motivated this way always values other people´s positive payments negatively, and tries to thwart them if possible, even if it means assuming the same cost for doing it. [10] Ostrom states that human beings are characterized by bounded rationality, unable to find a solution based on an exhaustive representation of the situation and choose an optimal overall solution.

Individuals try to find only one satisfying solution given their resources and objectives. Instead of thinking that some individuals are incompetent, bad and irrational, and others are omniscient, Ostrom assumes that individuals have limited capacities to reason and understand the structure of complex environments.

To make rational decisions individuals build mental models of the situation. Such models have two sources: experience interacting with the world, and culture (shared mental models). But these mental models are not a mirror or a copy of reality, but fallible human constructions.

Therefore, Ostrom says that even when individuals have limited capacities, they are capable of making decisions and select actions within a range of possibilities. They have the cognitive capacity to evaluate their beliefs and distinguish alternatives or courses of action based on proper reasons. In their efforts to come up with better rules, human beings frequently try to use reason and persuasion. They have the capacity for self-reflection. Human beings use, without much awareness, a mental account which allows them to relate to those who acted cooperatively.

This kind of unconscious thinking turns out to be a social habit. For the author, we live in two worlds: personal exchange, governed by conscious and intentional rules; and impersonal exchange, governed by emerging rules, which have not been designed by anybody in particular.

Says that selfishness has played a critical role in the process of natural selection in both human and natural history. To survive, an individual needs selfish characteristic, which contribute to survival, breeding, and welfare; but, counting with social characteristics of cooperation is also critical.

The effort to cooperate is partly based on selfish basis: “our evolving heritage has programmed us to be selfish, as well as capable to learn heuristics and rules, such as reciprocity which helps us reach a successful collective action” [10].

In order to capture the complexity of the decision-making process, a model of the individual chasing multiple objectives instead of a single objective is given.

For Ostrom “human beings are not omniscient saints neither devilish scoundrels.” Individuals are diverse in different levels because they have different mental models, different internal and external assessments, and different preferences depending on the situation they are in.

Finally, Alpuche and Bernal [11] state that an individual, who participates in an organization (and in a society), is immersed in a culture and imbued with symbolic elements through which their surrounding reality is seen.

An individual approach takes place when making a compilation of characteristics associated to them in the decision-making process, allowing a comprehensive analysis, in other words, as a subjective being: feelings, emotions, beliefs, etc., which coexist with their rationality.

Furthermore, the concept of bounded rationality [12] is essential, since an individual –far from optimizing resources–, as the neoclassical economics theory says, makes sure their choices are satisfying.

The information available to individuals is not complete, neither the capacity to process it, plus emphasis is placed on the importance of plans, not only strategies; and brings to the table the existence of a certain margin of freedom for decision making [13].

It should also be added certain significant features of individuals, such as greed, envy, selfishness, hedonism, impulse [14], fear, panic, indifference, precaution, selflessness, hesitation and suspicion, trust, enthusiasm, drive and euphoria [15], etc.; however, it is also important to point out that individuals make satisfying choices [16], not optimal or for the maximum benefit, but regularly through an imitation effect; in other words, they follow what market leaders, industry leaders, sector leaders, etc., have done, and without overlooking the symbolic framework of relations (ceremonial and ritual).

Additionally, a desire to transcend and leave a mark as well as being able to act within the margins of freedom and take control over the grey areas in the organization [17].

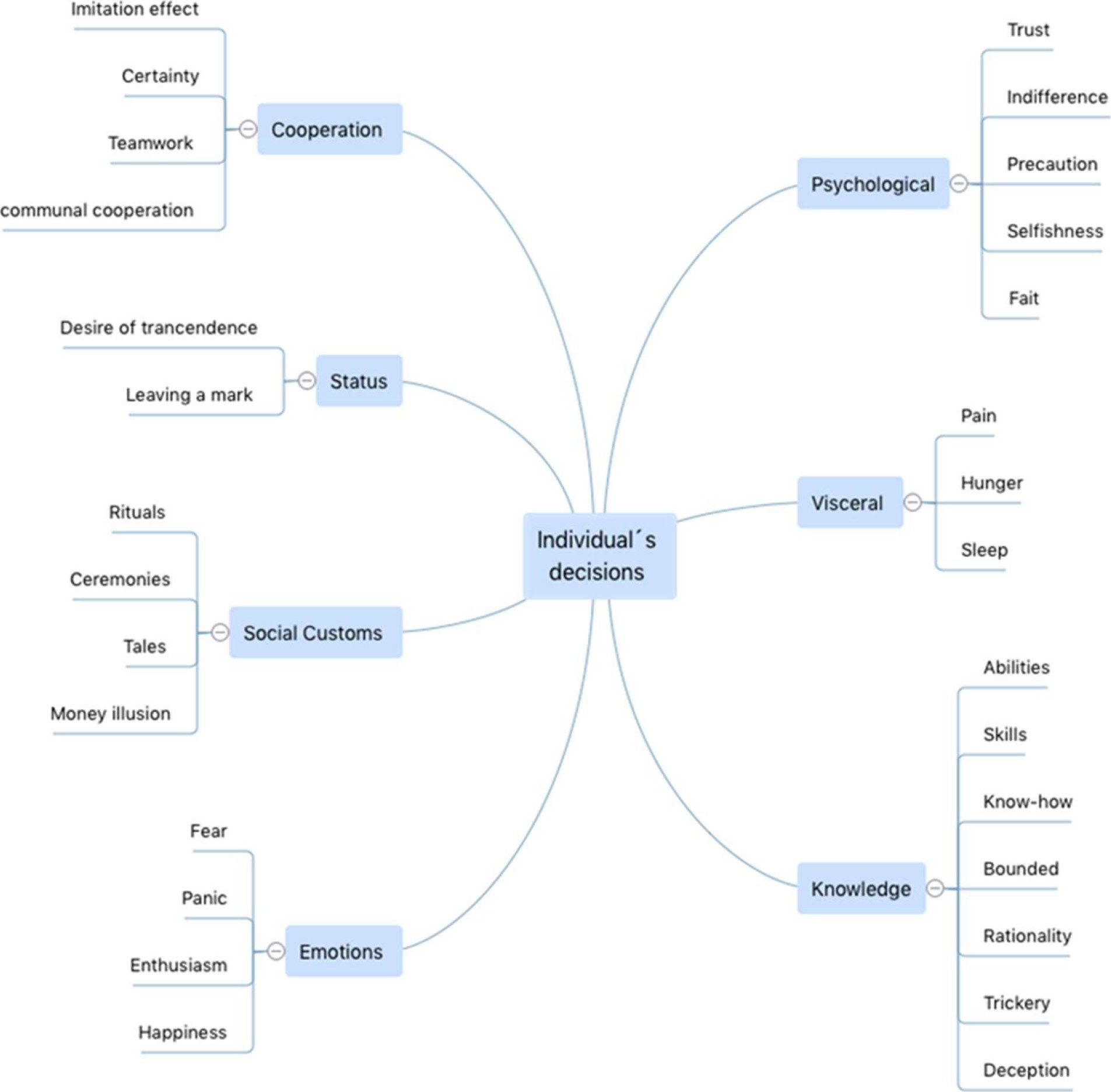

In this way, the factors considered to be essential in this paper (by no means exhaustively) and involved in the individual decision making are listed in figure 1, derived from the theoretical contributions above and with which a computational model is made.

3 Complex Systems

Complex systems are characterized by the fact that relationships shown between their elements turn out to be selective and not linear.

To understand the meaning of a complex system, first we should postulate a brief but clarifying concept of it. In an anthropology context, the concept of system is relevant because:

“The system concept has two possible interpretations. The first corresponds to a synonym of theory, while the second refers to a systems theory. According to Marc-Lipiansky, the concept of system is characterized by the following properties:

A group of interdependent significant elements.

There is a priority for the whole rather than its divisible parts.

The elements taken at random have no meaning and do not acquire it if not for the group of relationships in which they are found.

A fourth not considered property to Marc-Lipiansky is needed, since relationships in a system are complex” [18]. In order to achieve further approximation to social and natural phenomena, this perspective for the whole makes use of multiple points of view to address –from different angles– its real dimensions.

The characteristics of complexity are listed below:

Nonlinearity. The principle of nonlinearity is one of the bases of classic science […] this principle is not fulfilled in complex systems.

Chaos. While the common concept of chaos means confusion, disorder, with no clear pattern […] it allows to identify certain patterns of a hidden order within irregular and unpredictable behavior.

Strange attractor. The concept of attractor becomes useful to describe those points or states which lead others towards a chaotic system or better said those points or states which lead each other into a chaotic dynamical system.

Self-organization. This term has evolved over time. In his book Critique of Pure Reason, German philosopher Immanuel Kant was the first author referring to it as the capacity to create order between the parts of a system. Structure emerges from the internal interactions of the system itself.

Coevolution. This term has been frequently used as a synonym of adaptation; however, this is a mistake since the idea of a complex system never ceases to grow and evolve. Therefore, a balance is never reached.

Emergency. This concept is related to surprise, increase of consequences, lack of proportion, and devastating effect. Emergency is what happens in a local phenomenon with limited consequences, based on self-organization and the effects of the external environment.

Networks. The term network describes a group of interconnected nodes through physical or virtual mechanisms; even there is room for speculation about mental associations based on deep intuition for which little is known so far.

Hierarchy. Hierarchy within networks is relevant, even though it has nuances that are frequently defused.

Autopioesis: “Derived from the Greek and whose most immediate meaning would be “self-maintaining” [19].

The level of complexity is present in the social organization and the levels of analysis must be recognized.Thus, the individual possesses bounded rationality [20] for the understanding of environmental complexity and organizational environment.

This must be considered in daily activity, routines and procedures [21] it can also be seen in habit formation [22], organizational knowledge creation [23], the influence of technology on organizational structure in levels of performance in a company [24], control over grey areas in a company [25]; complexity can also be seen at firm level once the organizational conventions have been developed [26], as well as in a behavioral theory of the firm.

When a system undergoes a transformation the number of elements comprised grows exponentially and therefore relationships between them are intensified, giving rise to the idea of a complex system and selectivity becomes a central element.

Complex systems rise not only from complementarity, but also from the integration of various disciplines which aim to achieve a better understanding of human behavior from different perspectives–social and natural–regarding decision making within micro and macro social organization.

3.1 Adaptive Complex Systems

Adaptive Complex Systems (ACS) comprise a wide variety of areas expressed in systems, subsystems, meta-systems, structures, etc.

Emphasized at macro-analysis level, ACS are present in the way information is gathered and networks are formed in financial markets [27] technological imperative expressed through the sciences of the artificial, integration of systemic and cybernetic approaches including information management which processing pretends to reduce the levels of complexity in the company [28], the revolution in technologies of information and its capacity to penetrate and understand economy, society and culture today. processes involving slow and fast thinking regarding decision making.

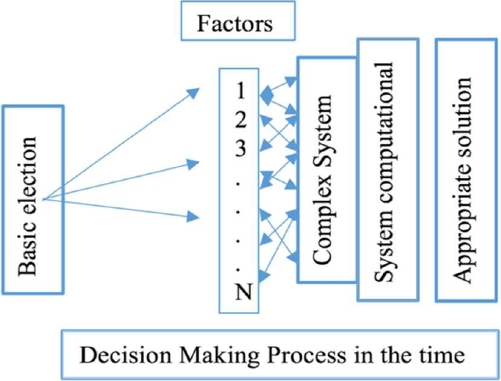

In the words of a theorist of the institutional school. Figure 2 outlines the decision-making process: an integration of the complexity in the organization, in other words, decision making in the organization seen as a complex process.

The decision-maker selects, from a group of alternatives, those considered satisfactory for the project and objectives of the company.

The distance between the chosen alternative and each one of those temporarily discarded is the opportunity cost: the results of choosing a determined alternative cannot be argued a priori, but it can be verified posteriori and, a fortiori, the decision-maker counts on stock information to make a better decision.

To develop the representation of this decision-making model on the complex system that is constantly changing, data collection is carried out through the use of technology.

By obtaining multiple data, the way in which they can be analyzed in a short time so that the results are valid are used by computer systems. For data collection and analysis, a mobile application will be developed described in the following section.

4 Computational Mobile Model of Decision Making

Figure 2 shows that the basic choice of an individual depends on the alternatives generated by the decision-making that occurs daily.

These decisions are governed mainly in the economic area by the cost involved in each of the products, services, and businesses present. The complicated problem is to determine which are the factors that are considered most difficult to analyze in your daily life.

Figure 1 determines all factors collected over time that facilitate the search for decisions that influence people. In this work, data collection is generated in different places to obtain relationships between the reported factors and determine the influence on the economic decisions of the individual with the help of computer systems.

The data is collected through a mobile application, with a survey of all the reported patterns of Figure 1. The data is collected through four possible responses based on the Likert scale. The first important result is to obtain the data on ages, genders, and place of residence that will be used later in the study.

4.1 Generation of the Questions of the Economic Decision-Making Model

To generate the questionnaire, all the factors that are represented in figure 1 were analyzed and a question was sought to represent a situation in the economic environment. precise questions are developed without impositions so that the question is answered objectively.

The questions are formulated through everyday actions that most people understand to avoid conceptual complications in the questions.

However, there are aspects for individual decisions that go from social customs to psychological aspects, which does not make a standardization of the questions for the study subjects.

Each factor is related to economic aspects to be certain that the people in the study understand. In the case of some aspects such as the visceral, it is sought that the present economic situations are very every day.

Below is the questionnaire of the questions that were generated for the study individuals in the case of decision-making with economic aspects:

Factor Involved Social Customs:

◻ When making an economic decision of purchase, sale, business, the opinions of my family, friends, partner, or neighbors are very important to me. (Model building).

◻ My religious beliefs dictate what I should choose when making a financial investment or purchase (Rituals).

◻ The stories that have been told to me throughout my life tell me that they help me decide if what I buy and consume is okay (The Story).

◻ All people should have the same opportunities to make purchases or acquire a product or service or business with an associated cost (Equity).

◻ You always must think about financial retribution when we make a decision (Monetary illusion).

Factor Involved Status:

◻ I would love that the following generations remember me for the things that I consume or acquire with an associated cost (Desire to transcend).

◻ For me it is very important to invest money in what I like to do so that people remember me (Leave a mark).

Factor Involved Cooperation:

◻ When you must invest money in what to do to improve my environment, others trust me to make good proposals (Trust in others).

◻ I like others to imitate what I buy or what I buy as a service (Imitation effect).

◻ When others support what I buy, it means that I am very good at making decisions (Security).

Factor Involved Psychological:

◻ When choosing a product or service or business with cost, I only care about my benefit (Selfishness).

◻ I trust myself a lot when making financial decisions or investing money in products and services or businesses.

◻ When making an economic decision, I do not care what repercussions it may have on others (Indifference).

◻ I am always cautious with my monetary decisions mainly in those of some associated cost (Caution).

Factor Involved Visceral:

◻ It is very important not to make money decisions when I am hungry (Hungry).

◻ I am good at choosing products, services, or businesses with associated cost, even when I have not slept well (Sleep).

◻ Physical pain does not influence my important financial choices (Pain).

Factor Involved Emotions:

◻ When I am angry, I make economic decisions in articles, services or businesses that drive me to get ahead (Revenge).

◻ I always think about comfort and pleasure when purchasing products and services when choosing something (Enthusiasm).

◻ When I am happy, I tend to make good financial decisions (Happiness).

◻ When I choose something with an associated cost, I am always afraid that something will go wrong (Fear).

Factor Involved Knowledge:

◻ I believe that I have the necessary skills to choose the best options when purchasing products or services with associated cost (Skills).

◻ Life has made me an experienced person when doing business with money involved, so others can come to me for good advice (Know to do).

◻ The decision you make on a product, service or business does not matter, if you know how to modify the rules so that everything is in your favour (Trickery).

◻ Others see me as a person who analyzes the situation very well to make economic decisions (Rationality).

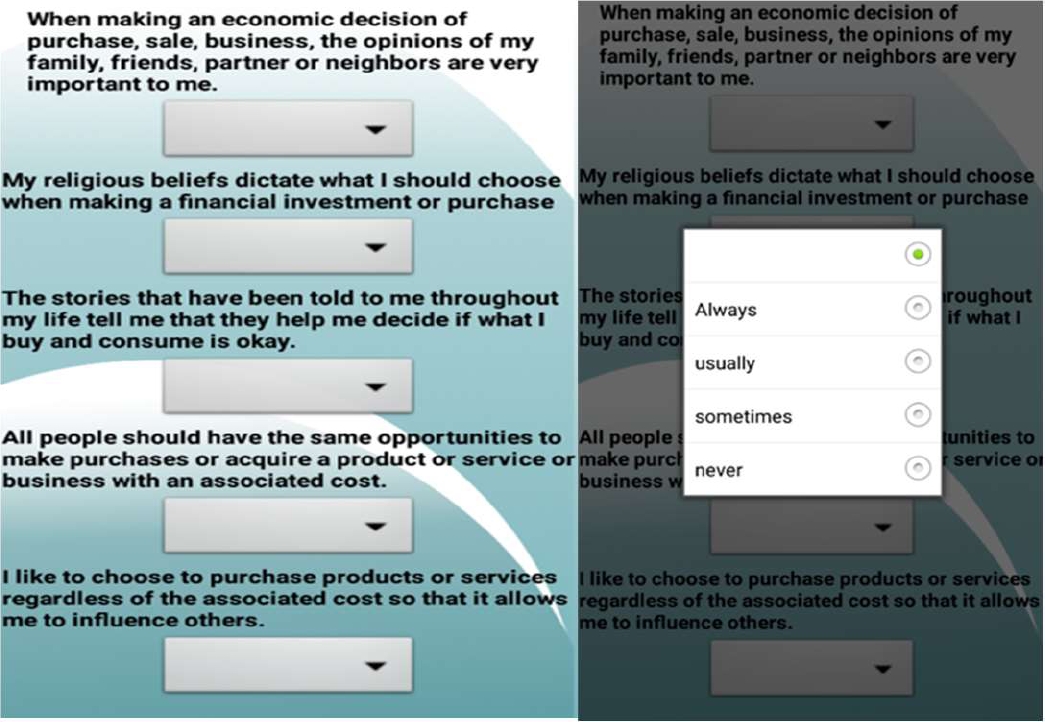

The generation of the model was developed based on data collection through a survey made using a Likert scale in which information is collected with four possible answers for each question.

The Likert scale is a tool with which you can obtain answers related to the success or failure of the issues you are working on.

In this case, four possible answers were made for each question, which are never (failure), almost never, sometimes (little success) and always (success) in such a way that people can choose between these four, depending on the factor associated with the question.

The Likert scale is also a way for people to answer without the stress associated with analyzing each question.

It can be answered directly depending on what they decide, and think related to their daily life. Below is the development of the mobile application, which is one of the main tools with which data can be analyzed because it can reach many people at the same time.

Derived from the current COVID-19 pandemic, it can also be used by having a large discussion between each of the users so that they can answer you appropriately.

4.2 Generation of the Mobile Application for Data Collection

Currently, the growth of mobile applications is extensive throughout the world, derived from the technological increase of the last 10 years. Mobile applications are considered an essential tool for the development of any type of product or service that you want to make available to everyone.

For this work I develop a mobile application because many people can use it simultaneously without the need to survey or visit them directly. The mobile application developed was generated in the inventor app, which is a very important tool because all kinds of applications are developed.

It is also viable because it produces executable APK files for installation on Android devices. This tool allows us to save and store data in different databases in the cloud, which is a very important part of the work to analyze the data.

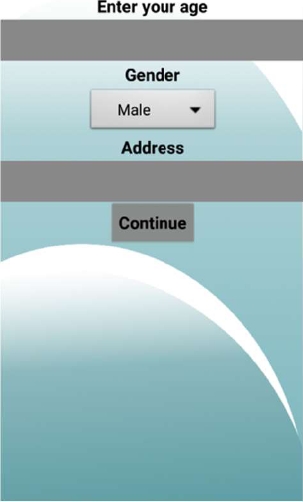

The initial interface was developed that requests essential elements for this work, they are age, gender and the place where the person lives.

Subsequently, a second interface is displayed as seen in figure 4, it shows the entire set of questions depending on the associated aspects. Each of the aspects studied is separated to generate different windows and that the user does not see too much information that is being requested.

Neutral designs and simple designs were used so that there were no distractions when answering the application questions. Figure 5 shows the configuration of the database that was stored on a Firebase server which is available for free in the cloud for Google users.

4.3. Algorithms to Determine Economic Decision Making

In the application, information about the decisions that individuals make in the economic part will be collected. The data set obtained is saved in a Firebase database that is in the cloud available for free.

The data begins to be ordered in such a way that there is a record for each of the individuals regarding the questions of the questionnaire.

4.3.1. Data Transformation

Available in the database, each of the records is filled with the responses of the people interviewed. A single record is generated per person where each question is coded numerically. a value is associated to it in such a way that it includes all the responses in a single register which the program interprets.

In this way, the entire set of the questions shown above was coded depending on their answer on the Likert scale.

This way, all the interviews were carried out, a total of 3,200 in different areas of the State of Mexico. Once the complete set was available, the analysis of the data obtained with the collection of the mobile application was carried out.

By obtaining the total set of data provided by people and coding it, similar patterns (with which people are making decisions) can be determined by using decision tables.

The decision tables are used to obtain a criterion with which clusters are formed depending on their similarities between each of the records. All records are checked one by one to determine what measure of similarity is found between the data collected by the responses obtained.

The measure of similarity is given by the responses between each of the individuals, it is determined by the following rules.

Answer user 1 = Answer user 2 -> value= 0.

Answer user 1 = never && Answer user 2 = almost never -> value= 1.

Answer user 1 = sometimes && Answer user 2 = always -> value= 1.

Answer user 1 = sometimes && Answer user 2 = never -> value= 3.

Answer user 1 = almost never && Answer user 2 = always -> value= 3.

Answer user 1 = never && Answer user 2 = always -> value= 4.

If the answers are totally opposite, a distance of 4 is considered, however, if the answers are between never and almost never, the distance is 1. If they are separated in the set of never and sometimes the distance is 3.

From the same way if they are between a few times and always the distance will be 1. Answers with the same answer are considered distance 0. Once this is achieved, the patterns associated with this decision-making are determined in terms of the shorter distance between the people interviewed.

A relationship of age and gender is sought to see if centroids influence people's economic decision-making. With this specification, it is possible to analyze all the responses together of all the individuals to determine the degree of similarity between the distances of each of the responses provided.

It is analyzed individual by individual and the degree of distance between each of the total questions that were asked to the individuals is drawn until a total set of the 3,200 surveys carried out is generated.

The data collected was made to people in a range of 26 to 45 years of age, two decades apart. The number of women is 1376 is 43% and of men is 1824 is 57% of respondents. the system did not continue if the surveys carried out were not completely filled out

5 Results

The result of the social customs factor in Table 2, shows that the highest percentages obtained in this study are reflected in the monetary illusion with 82%. In this case, people consider that they are successful in making economic decisions following this aspect.

Table 2 High percentages for factors of social customs

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Rituals | little success | 63 | 48/15 | 35-45 |

| Ceremonies | success | 62 | 27/35 | 32-42 |

| Tales | failure | 54 | 44/30 | 26-33 |

| Model building | little failure | 54 | 34/20 | 26-35 |

| Money illusion | success | 82 | 43/39 | 33-45 |

| Equity | failure | 85 | 42/43 | 30-42 |

The equivalence is equitable with 43% (1376) of men and 39% (1284) of women, who selected this condition. For this result, the ages ranged from 33 to 45 years, so 63% of the people in the study chose this option. The result shows that both men and women consider monetary illusion when making economic decisions.

The next important result in table 2 is that of Equity, which obtains 85% of the responses associated with failure.

In this case, the equivalence is not equitable because there are 42% (1344) of men and 43% (1376) of women, who selected this condition with a 1% greater difference. The age range for this result is 63% of people who chose this option from 30 to 42 years of age.

For the other important results of this table, it can be observed that the rituals and ceremonies that a person performs are considered successful in a percentage of 63 and 62% respectively.

For rituals ,there is a higher percentage of men with 1536 men who chose this option and several 480 women who chose this option.

The age range is a decade difference from 35 to 45 years of age. With this result, we can see that most of the men chose this response associated with the rituals.

In the case of ceremonies, people consider that it provides them with success in their economic decisions to a greater extent for women with a total of 1120 women who chose this trend. Only 844 men considered this condition for the ceremonies factor. The ages range in a decade from 32 to 42 years of age.

Table 3 shows the high percentages obtained from the factors related to status, in this case the factor related to leaving a mark obtains a percentage of 76% in the case of the failure response. In this case, the total number of women (43%) 1376 selected this option.

Table 3 High percentages for factors of Status

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Leaving a mark | failure | 76 | 33/43 | 26-38 |

| Desire of transcendence | little success | 68 | 38/30 | 35-44 |

The number of men who chose this option is 1056, which represents 33%. For this particular question the age range is 63% from 26 to 38 years old. It indicates that for economic decisions in this study the idea of leaving a mark is not very important for people, especially for women of those ages.

This table also shows that the desire to trace factor obtains a result of 68% matches for the little success response. In this case, 1,216 men agree with the associated answer, in the case of women, 960 of them consider that the answer is similar. The age range for this factor is less than a decade since it ranges from 35 to 44 years of age.

Table 4 shows the factors that obtained a high percentage in cooperation. In this case, it is observed that the imitation effect obtains 91% of the results in the case of success. 46% of men, which is equivalent to 1,472 of them, agreed on this answer.

Table 4 High percentages for factors Cooperation

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Imitation effect | success failure | 91 | 46/43 | 29-43 |

| Cooperation | 79 | 37/42 | 27-36 |

The number of women who agreed in this answer is 1376, occupying the total number of women who coincide. In this case, it can be observed that the imitation effect to make economic decisions is very high in terms of the percentage of coincidences of the people who carried out the study.

The ranges go from 29 to 43 years of age, which implies that there are 74% of the ages of people, who agree on this question in the age ranges. In this case, people think that with the imitation effect they are successful in making economic decisions, with most respondents agreeing.

In the case of the cooperation factor, 79% of the people agreed that making economic decisions causes failure. For this factor, it can be observed that 1184 men agreed with this answer and in the case of women, 1344 of them agreed.

Result is very important because for cooperation most people believe that it causes failure in making economic decisions and the age range goes from 27 to 36 years occupying a decade in the range.

Table 5 shows the high percentages for the visceral factor. This table is very important since each of the factors obtained a percentage greater than 80%. It can be observed that for all the factors the answers obtained are oriented towards failure when making economic decisions.

Table 5 High percentages for factors Visceral

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Pain | little failure | 80 | 38/42 | 29-42 |

| Hunger | little failure | 88 | 38/30 | 26-43 |

| Sleep | failure | 90 | 47/43 | 26-44 |

It is shown that for the fear factor there are a number of 1216 of men who think that by making an economic decision with fear it leads them to failure. It is observed that there are for women a number of 1,344 of them who consider that when making economic decisions with fear of results and failure.

The ages ranged from 29 to 42 years, occupying almost all the age ranges for this study. Which implies that most people think similarly when they try to make an economic decision with fear.

For the hunger factor, it is also very important to note that 88% of the respondents were matched for this study. It is observed that 1216 men also responded in the same way for this factor.

About women, only 960% of them said that it is difficult for them to make an economic decision when they are hungry. In this case, it is observed that if it has a range of ages ranging from 26 to 43 years, occupying a significant number in terms of the percentage of ages occupying 94% of them.

In the case of making an economic decision with sleep, it can be observed that it obtains a percentage of 90% of the respondents who agree that they present failure.

In this case, we have the total number of 1,376 women considered with this answer. In the case of men, there is also a very high number of 1504 of them who believe that sleep causes failure when making an important financial decision.

This factor is very important since the age range covers almost the entire study in terms of the coincidence of what sleep causes failure in making financial decisions. Table 6 shows that there are three factors that obtained more than 80% coincidences between each of the answers provided.

Table 6 High percentages for factors Psychological

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Trust | Little success failure | 80 | 38/42 | 27-40 |

| Indifference | Success | 68 | 25/43 | 27-38 |

| Precaution | little success | 91 | 48/43 | 26-43 |

| Selfishness | 87 | 45/42 | 26-44 |

Shows that for Trust there is a bit of success as there were a number of matches between the men out of 1216 of them who agreed that this factor provides them with some success. In the case of women, the total number of them is almost obtained by agreeing in the answers with a total of 1344 of them who agree that this factor provides them with some success. The age range is very important as it has a range of 27 to 40 years of age that match this factor to provide them with some success.

For the precautionary factor, the results showed that most people consider that it implies success. A 91% agreement was obtained in responses when making economic decisions in the precautionary factor. In this case, the number of men who got these answers is very high with 1536 of them who consider that precaution is very important to make an economic decision.

The number of women is the total number of respondents who consider that by taking precautions an economic decision is more viable with a total of 1,376 of them achieving in this case it can be observed that they occupy a very wide age range that goes from 26 to 43 years what they consider almost the total number of ages of the respondents.

In the case of the selfishness factor, there is some success, occupying 87% of the respondents who agree on this answer. In the case of men, 1,440 of them coincide with this factor. In the case of women, there are 1,344 of them that coincide with the success associated with this factor and the age range for this case is the broadest of the entire study, with the responses obtained from 26 to 44 years of age for this factor.

Another important aspect shown in this table is that under the indifference factor, most people agree that it implies failure, with 68% of people saying this.

Table 7 shows the percentages of the knowledge factors. In this case, for skills there are 82% of people who think that this factor provides failure. It is observed that 39% of men consider that this factor guides them to failure when making economic decisions and the total number of women, which is 1,376, consider that this factor guides them to failure.

Table 7 High percentages for factors of Knowledge

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Skills | failure | 82 | 39/43 | 29-38 |

| Know how | failure | 76 | 40/36 | 29-36 |

| Trickery | little failure | 87 | 52/35 | 29-41 |

| Rationality | little success | 68 | 36/32 | 26-37 |

The ages range in a decade from 29 to 38 years of age for this factor. It is observed that for the rationality factor there is little success with 68% of responses associated with this factor. Only 36% of men and 32% of women believe that it is feasible to make rational decisions when taking an economic action.

It is observed that in the case of knowledge factors related to tricks, it is observed that there is a percentage of 87% of coincidences for some failure. This factor shows that most men with a total of 1664 believe that when making economic decisions, tricks should not be used.

The number of women who think that tricks also provide failure when making economic decisions is 1120 of them. In this case it can also be observed that the age range goes from 29 years to 41 years, which implies that they have a good number of people who match this factor.

Table 8 shows the percentages for the factor of emotions. It is very interesting to observe that for the three factors shown in this table, a percentage greater than 88% is obtained, which results in the table with the highest percentage of coincidences index in the study.

Table 8 High percentages for factors of Emotions

| Factor | Values | % Obtain | %Gender M/F | Age (years) |

| Enthusiasm | success little success | 88 | 45/43 | 26-44 |

| Fear | success | 88 | 47/41 | 27-43 |

| Happiness | 89 | 46/43 | 26-44 |

For the first of the factors, which is enthusiasm, it is observed that some success is obtained since 45% of men think that they obtain some success when making economic decisions with this factor, the number of men is 1440 with this opinion.

In the case of women, it can be observed that all of them (1376) agree that enthusiasm is the factor with which they identify in the best way to make an economic decision.

It is very important to note that the age range covers almost all the people in the study for this factor, which indicates that the degree of coincidences is oriented towards enthusiasm when making financial decisions in life.

In the case of fear, it can be observed that this factor provides success when making an economic decision with 88% areas that corroborate it. 47% of men, equivalent to 1504 of them, think that when making decisions with fear, their economic decision is very successful.

It can also be observed that 41% of the women think the same, with a number of 1,312 of them corroborating it. The age range is also very wide, ranging from 27 to 43 years, which indicates that most people agree with this factor for making economic decisions.

Happiness can be seen that when a financial decision is made being happy, it is successful in all the activity that is carried out, it obtained a total percentage of 89% of coincidences for this factor. In the case of men, 46% of them have a similar opinion in this study, with a number of 1472 of them agreeing. In the case of women who have the total number of Less, that is, 1,376 of them who think that by making an economic decision in a happy way they achieve success in what they are doing.

It can be observed that for the three factors shown in emotions there is a high rate of coincidences in most ages and for men and women alike that it provides them with success.

6 Conclusions

The aspects that obtain a higher percentage in the study are those that are related to visceral factors. Sleep and hunger obtained very high percentages for all ages in the study. Which suggests that they are directly related to the economic decision-making of individuals and has a great impact.

It can also be concluded that psychological factors are very important in this decision-making regularly because they are those that are associated with human behavior.

The factors of social customs without change, does not show a high percentage in this study. due to economic decisions that are made individually between people. It is notable that the equity factor resulted in high percentages in terms of failure, for this study, as well as the cooperation aspect in individuals.

In economic decisions, the factors of knowledge and tricks also resulted in high percentages when they indicated failure in decision-making. Finally, the factors related to emotions were successful with good percentages, mainly for fear, joy and enthusiasm.

It can be concluded that decision-making for the monetary illusion factors obtain higher percentages above 80% at ages 30 to 40 years. This indicates that these people, being older, are focused on worrying about generating more resources and are more concerned about conserving their monetary resources.

In the equity factor there is a high percentage of 85% where people are not interested in having equity to meet their daily economic needs at ages 30 to 40 years. It is also observed that the imitation factor is very important to be successful in making economic decisions, where 91% were obtained in ages between 30 and 40, with a very similar gender equivalence in terms of people.

This indicates that most people are behaving similarly to others for economic gain during their lifetime when the cooperative factor is being dealt with. In the factors named in this article as visceral, it can be seen reported that fear, hunger and sleep cause bad economic decisions to be made from the ages of 26 to 44, regardless of gender.

This indicates that these types of factors are related to the poor accumulation or decision of economic elements, they are factors that if people are tired, sleepy or hungry they will not decide correctly in their economic decisions that they are working.

And apart from the economic factors, it can be concluded that economic decision-making by doing things correctly and telling the truth obtain rates greater than 80% for ages from 27 to 40, which indicates that people feel more confident in telling the truth when choosing or making an economic decision and it is reflected in an improvement in their economic decisions.

Like the precaution where a 91% success rate was obtained in their economic decision-making between the ages of 26 and 43, which implies that most of the people who were included in this study are cautious when making decisions. use financial resources for their daily lives.

It can also be seen that the percentages obtained in emotional factors, such as enthusiasm, happiness and fear, help to make good economic decisions in ages from 26 to 44 years, because if people are in a state of happiness

They can decide in a better way in economic decisions, as well as if they are very enthusiastic for their economic work. It is also important that fear is an important factor for making economic decisions, since it has an 88% percentage for success when making your economic decisions in the individuals who contributed to this study.

As a final contribution, it was possible to determine that there are multiple factors that help us make decisions on a daily basis and it was possible to demonstrate which factors that are related to human behavior and to some physiological elements of people are the most important for decision making. economic and they coincide between men and women of the sample population that was taken in this study.

It is worth mentioning that the study should be extended to generate a broader compendium of information and verify if the data is related to people from other places in Mexico and with ages similar to those of the study in order to improve and help make economic decisions for people.

text new page (beta)

text new page (beta)