Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Problemas del desarrollo

Print version ISSN 0301-7036

Prob. Des vol.48 n.191 Ciudad de México Oct./Dec. 2017

Articles

What Happened to Latin America's Empty Box Development Thirty Years Later?

1 Graduate students in Economics at the National Autonomous University of Mexico (UNAM). E-mail address: alelip92@gmail.com and matamorosromerog@gmail.com, respectively.

This paper revives Fernando Fajnzylber's methodology, used to characterize Latin America's development pattern from the nineteen-sixties to the nineteen-eighties, leading him to describe it as a non-equitable growth pattern, which he termed the empty box. This time around, we analyze the last thirty years, aiming to reveal how the development pattern in the region has fundamentally changed, if it has changed at all, and find evidence as to whether the empty box, pursuant to its original definition, persists or not. Implicitly, the task is to propose a critical analysis of Latin American economic development in line with a classic structuralist work, as Fajnzylber's research is.

Keywords: Empty box; economic development; equitable growth; distribution; Fernando Fajnzylber

El presente texto reaplica la metodología que utilizó Fernando Fajnzylber para caracterizar el patrón de desarrollo de América Latina desde la década de 1960 hasta mediados de 1980, lo que lo llevó a distinguirlo como un patrón carente de crecimiento con equidad, y al que llamó casillero vacío. En esta ocasión, se analizan los 30 años posteriores con el objeto de revelar los cambios fundamentales en el patrón de desarrollo de la región, si es que los ha habido, y evidenciar la permanencia o no del casillero vacío en sus términos originales. El cometido implícito es la propuesta de un análisis crítico del desarrollo económico latinoamericano en línea con el trabajo de un clásico del estructuralismo como lo es Fajnzylber.

Palabras clave: casillero vacío; desarrollo económico; crecimiento con equidad; distribución; Fernando Fajnzylber

Clasificación JEL: B31; B41; O11; O47; O54

Le texte actuel réapplique la méthodologie utilisée par Fernando Fajnzylber pour caractériser le modèle de développement de l’Amérique latine depuis les années 1960 jusqu’au milieu des années 1980, ce qui l’a conduit à le distinguer comme un modèle dépourvu de croissance équilibrée, aussi appelé comme « la boîte vide ». À cette occasion on analyse la trentaine d’années suivante afin de révéler les changements fondamentaux dans le modèle de développement de la région, le cas échéant, et de remettre en question la permanence de la boîte vide dans ses termes d’origine. La tâche implicite est la proposition d’une analyse critique du développement économique latino-américain en droite ligne avec le travail classique du structuralisme tel que celui de Fajnzylber.

Mots clés: boîte vide; développement économique; croissance équitable; distribution; Fernando Fajnzylber

Este trabalho aplica novamente a metodologia utilizada por Fernando Fajnzylber para caracterizar o padrão de desenvolvimento da América Latina desde os anos 1960 até meados dos anos 1980, que o levou a distingui-lo como um padrão desprovido de crescimento com equidade, e ao que ele chamou de “conjunto vazio”. Desta vez, se analisou 30 anos mais tarde, a fim de revelar as mudanças fundamentais no modelo de desenvolvimento na região, se é que houve mudanças, e demonstrar a permanência ou não “conjunto vazio” em seus termos originais. O objetivo implícito é a proposta de uma análise crítica do desenvolvimento econômico latino-americano, de acordo com o trabalho de um clássico do estruturalismo como é Fajnzylber.

Palavras-chave: “conjunto vazio”; desenvolvimento econômico; crescimento com equidade; Fernando Fajnzylber

根据费尔南多.法尹齐布尔的研究方法,拉美地区上个世纪60年代至80年代中期的发展过程,被定义为缺乏公平的增长模式,也就是所谓的空格。本文重新利用该理论,对拉美地区三十年之后的发展轨迹进行了分析,目的是展现该地区发展模式的主要变化;如果有变化的话,空格的原来意义是否继续存在。因此,本研究隐含的意思,是保持像费尔南多.法尹齐布尔一样的古典结构学者做法,对拉美经济发展提出一个批判性分析的方案。

关键词 空格; 经济发展; 公平增长; 分配; 费尔南多; 法尹齐布尔

Inequality is undeniably the spirit of the decade, not that it is anything new. Rather, a longstanding state of affairs is getting a new lease on life, opening the door to reexamine studies on income distribution from the past. Such is the case of empty box development in Latin America, first suggested by the Chilean economist Fernando Fajnzylber in 1990. The empty box cannot be ignored, as it was a powerful conclusion drawn from a simple method that revealed the failure of Latin America's varied development strategies to close the economic development gap with respect to advanced countries, as no Latin American country seemed, at the time, to have managed the dual objectives of growth and income equality.

This paper revives Fajnzylber's (1990) methodology to analyze economic development in the region in the next 30-year period (1985-2015), questioning whether the empty box is still applicable in its original terms. The reason for this work resides in the fact that the methodology considers two variables that, according to classic economics, ought not to be separated: income distribution and economic growth. Moreover, although a simple method, the advantage is that it analyzes development in relative terms. In other words, it compares Latin American development to that of another group of countries conventionally referred to as developed. Thus, this analysis could serve as the basis to challenge the success of Latin America's current development strategies.

ANOTHER EMPTY BOX?

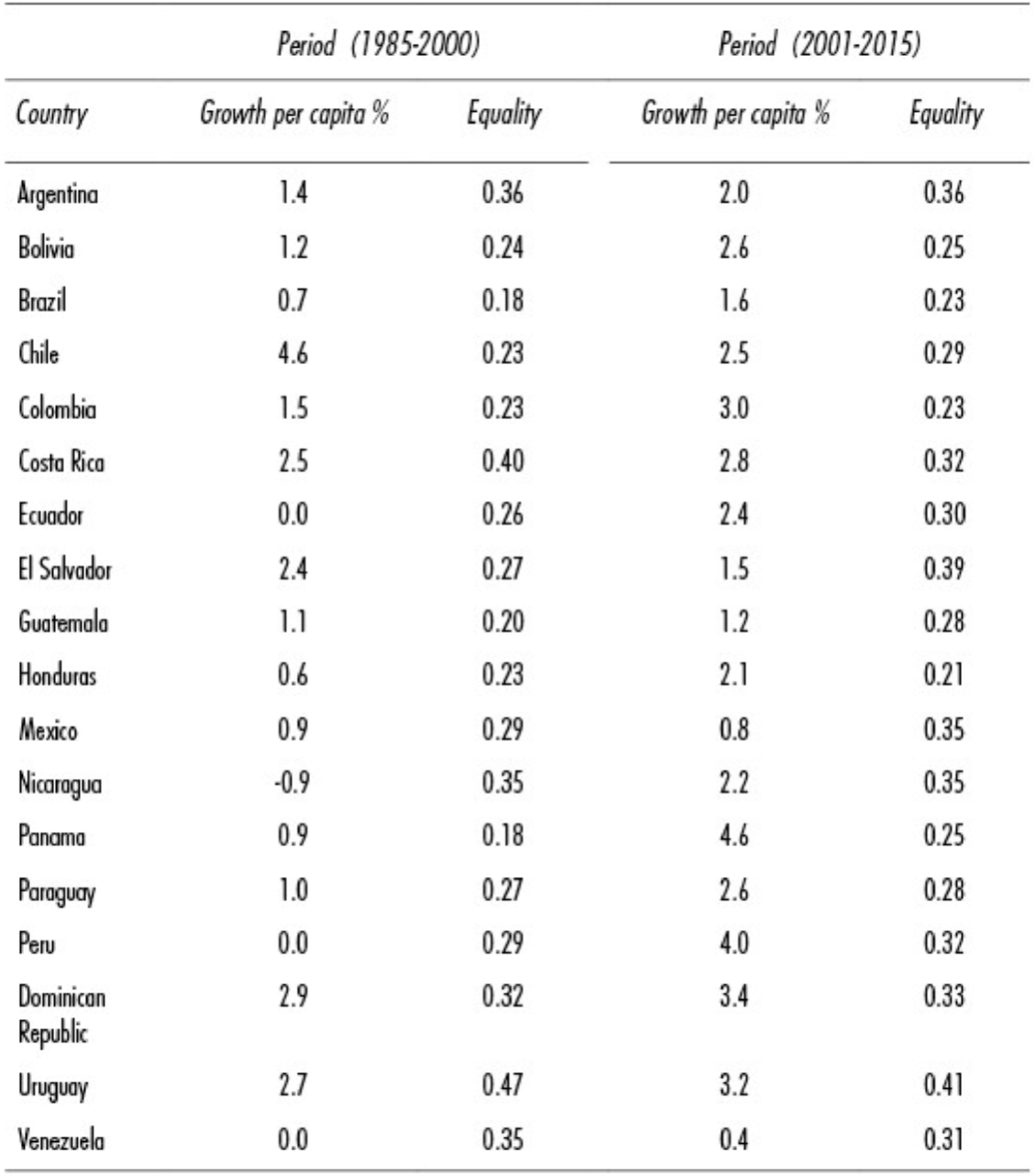

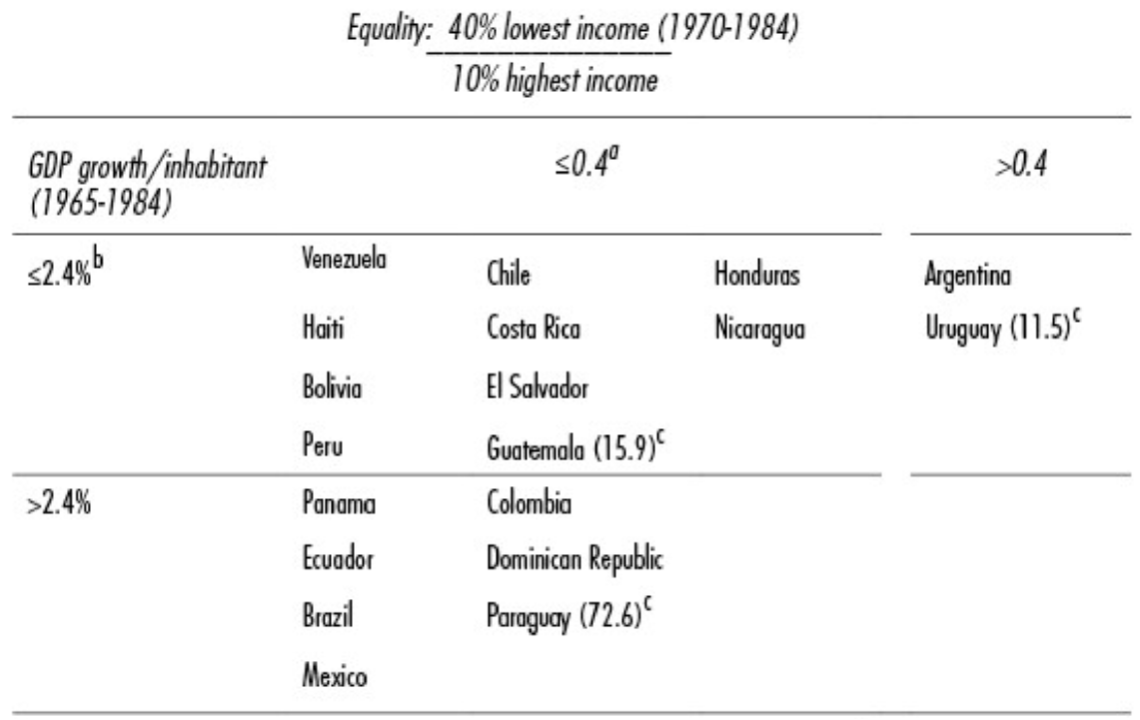

This study examines the timespan from 1985 to 2015, in turn divided into two sub-periods (1985-2000 and 2001-2015). Staying faithful to Fajnzylber's methodology, two criteria were used to evaluate economic development: equality and economic growth. The former consists of the ratio between income earned by the poorest 40% of the population and that earned by the wealthiest 10%, and the latter of the annual average gross domestic product (GDP) per capita growth rate. Economic development is compared between Latin American countries and advanced countries (Germany, United States, Japan). The dividing line for the equality criterion in Latin America is half of that in the advanced countries in the time period.

For the time period of 1985 to 2000, the equality ratio in the advanced countries amounted to an average of 0.84, such that the dividing line for equality in Latin America is 0.42. This ratio means that the income earned by the lowest-earning 40% of the population is equivalent to 42% of the income earned by the wealthiest 10%. The economic growth variable came to 2% average per capita annual growth in advanced countries Crossing the two criteria, we get a four-box matrix.

Quadrant 1 (see Table 1) contains the most stagnated and unequal countries; in other words, the countries whose economic growth was lower than that of the advanced countries and whose equality did not exceed half that of the advanced nations. Thirteen of the 18 Latin American countries analyzed in this study fall into Quadrant 1. In Quadrant 2, the upper right, we find stagnated, but more equal, countries that meet the equality criterion alone. On the bottom right is Quadrant 3, home to the dynamic and equal countries. In this time period, only Uruguay passes the equality-with-growth test. The fourth and final quadrant contains the dynamic and unequal countries, which grew faster than the developed countries but which failed to meet the equality threshold.

In this time period, we are talking about the years immediately after Fajnzylber's exercise (see Annex), which therefore give an account of the economic growth that he did not witness before his research. His characterization of Latin American development was the empty box, as at that point in time, not one country in the region fit into the equality-with-growth Quadrant 3. Subsequent economic history would see Uruguay moving into the box as the sole exception to Latin America's unequal development pattern. Nevertheless, inequality continues to be part and parcel of growth in Latin America, seeing as 90% of the regional product is thanks to countries in Quadrant 1, the inequitable stagnated group. Only Chile (4.6%), Costa Rica (2.5%), El Salvador (2.4%), and the Dominican Republic (2.9%) grew at rates above those of the developed countries.

Тable 1. Latin America. Growth: Equality, 1985-2000

a Half of the comparable ratio from tbe advanced countries (Germany, United States, Japan); bGDP growth/per capita in advanced countries (2010 dollars);c share in regional GDP in 2000. Prices from 2010.

Note: For the equality ratios of the United States and Japan, we used the OECD statistics and the Palma ratio (which is exactly the reciprocal of the Fajnzylber [ 1990] equality indicator).

Source: World Bank, World Development Indicators.

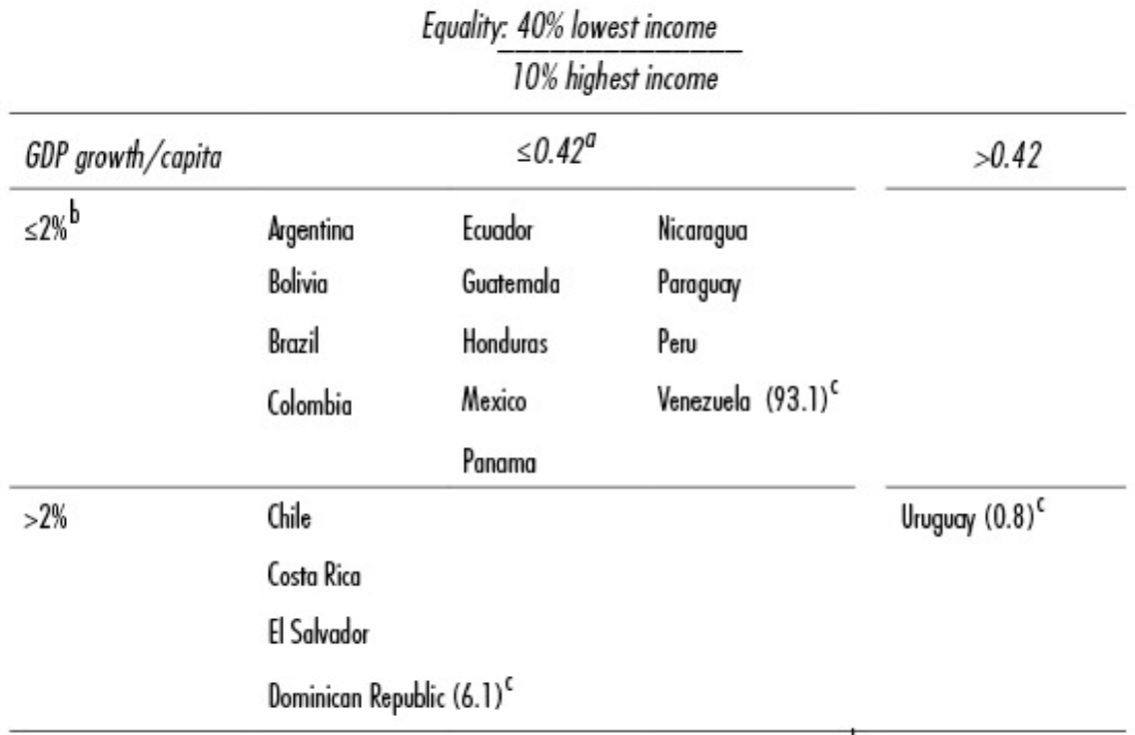

The second time period ranges from 2001 to 2015 (see Table 2). The criteria reveal economic development dynamics weaker than those in the advanced countries as compared to the period prior. Their growth rate on the whole fell to an annual average of 0.9%, and their equality index to 0.72, which places the dividing line for Latin America at 0.36. During this time period, Mexico and Venezuela were the only countries that remained in the stagnated and unequal box, while the rest shifted to Box 4. One might surmise that it is the new dividing line that caused this movement. However, even if we were to set the dividing line back at 2% growth, like in the time period prior, all of the countries that were in Box 1, except Argentina (2%), Brazil (1.6%), and Guatemala (1.2%), would still move.

Uruguay and El Salvador can be found in Box 3, growth with equality. Uruguay held onto its position, while El Salvador saw its equality indicator rise markedly from 0.27 to 0.39. Bear in mind that if we were to keep the dividing lines from the time period prior, neither of the two countries would be in this box. Accordingly, everything depends on what Fajnzylber coined the wafer line, which refers to how the reference criteria ebb and wane over time, because they are defined with respect to the development of the countries that he considered to be industrialized, which has shifted considerably over the time period of the study.

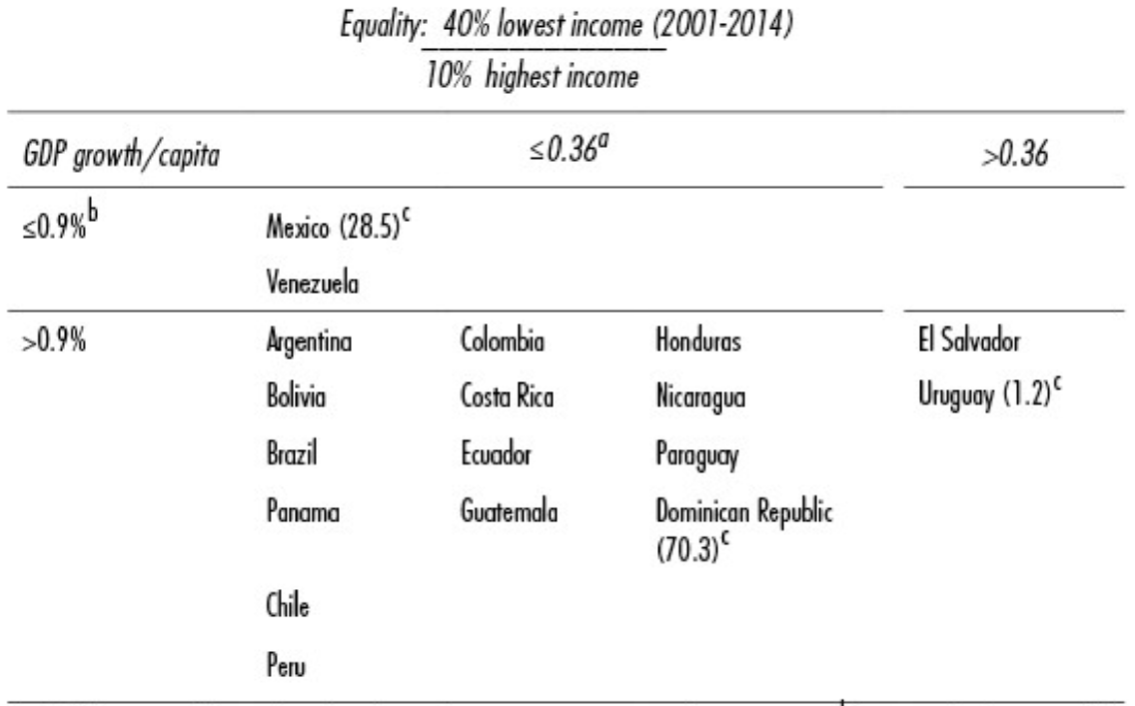

For example, if we were to compare with the original 1965-1984 exercise (see Annex), there would be three reference periods of approximately 15 years on average each, where the economic growth criterion per capita went from 2.4% in the first to just 0.9% in the last. This tells us that the advanced countries have declined notoriously over time, making it more likely for Latin American countries to move into the economic growth box. Something similar has happened with the equality criterion, too, which went from 0.4 in Fajnzylber's time period, rose slightly in the next (0.42), and then fell in the final period to a mere 0.36. It is fair to say that if the equality reference were to have remained as high as it was in the highest time period (0.42), the equality-with-growth box would have lost Uruguay (0.41) and El Salvador (0.39) in the most recent time period, meaning that Latin America's empty box would still be there.

Table 2 Larin America. Growth:Equality,1985-2000

a Half of the comparable ratio from the advanced countries (Germary, United States,, Japan); bbGDP growth/per capita of the advanced countries; cShare in regional GDP in 2015. Prices from 2010.

Source: World Bank, World Development Indicators.

Strictly speaking, there is still an empty box in Latin America, albeit true that it is no longer the equality-with-growth box, but rather Box 2, stagnation with equality. This insight raises more questions than answers. Why is it so hard to find equality in Latin America? What is the link between growth and equality? The sole exception in this study, Uruguay, was not always the exception. In Fajnzylber's eyes, Uruguay was equitable but stagnated. Is it possible that Uruguay had to redistribute income to grow? But in the rest of the cases, growth seems to be divorced from equality. To gain clarity as to these questions, we explore several nuances of development in the few exceptions, El Salvador and Uruguay, and compare them to the development patterns observed throughout the rest of Latin America in broad strokes.

NEW DEVELOPMENT CONCEPT, SAME OLD RESULTS

The above exercise provides a rough breakdown of three development phases in Latin America. The first, which Fajnzylber analyzed, ranges between the nineteen-seventies and the mid-eighties, characterized by high economic growth but inequitable distribution. In fact, the period itself contains two phases: the nineteen-seventies, distinguished by marked economic growth and high inflation, high raw materials prices, and severe indebtedness. In the early nineteen-eighties, raw materials prices plummet and international interest rates shoot up, spurring the Latin American debt crisis and what would come to be known as the lost decade due to economic stagnation, price instability, social policy adjustments, and the effects they all had on chipping away at welfare in the region (Ocampo and Ros, 2011).

The lost decade of the nineteen-eighties is a transition to a new economic development paradigm in the region. Generally speaking, the development strategy shifts from government-led to market-based. To do so, countries throughout the region enact a series of structural reforms-backed by the International Monetary Fund-originally to alleviate the debt crisis and later as a deliberate development strategy, aiming to diminish the government's direct role in the market, theretofore considered an obstacle to development: "In any case, this event (the debt crisis) led to a reversal of the previous consensus on the development strategy and to a new conventional wisdom which viewed government as an obstacle to development, the private sector as the leading actor, trade as the engine of growth, and foreign direct investment as a priority" (Ocampo and Ros, 2011 ; p. 16).

The reform agenda on the macroeconomic front consisted of a fiscal, monetary, and exchange rate policy agenda in pursuit of a balanced budget and price stability. The microeconomic side saw the dismantling of industrial, agricultural, and trade policy, and a move towards commercial and financial liberalization, as well as a massive package of privatizations (Ocampo and Ros, 2011).

With that said, the second time period (1985-2000) ushers in a new economic development pattern, market-oriented and underpinned primarily by external demand. The years from 1990 to 1997 were marked by an international environment favorable to growth and, domestically, the implementation of social policies designed to combat poverty. Another series of financial crises hit Latin America between 1998 and 2003 in countries such as: Argentina, Brazil, Mexico, Uruguay, and more, which came to be known as the lost half decade Results of this time period were, generally speaking, modest, which is reflected in a fact stated above: 93% of the regional product came from low-growth and unequal countries.

Finally, the most recent time period (2001-2015) bore witness to a sustained growth cycle abruptly interrupted by the global financial crisis unleashed in 2008. The so-called growth boom of 2003-2008 owed itself primarily to high raw materials prices that endowed the region with sufficient trade surpluses to finance poverty-mitigation and inequality-reduction programs, as well as macroeconomic policies different from those espoused by the prevailing paradigm, as countries were left with a bitter taste in their mouths in the wake of the lost half decade This is perhaps one of the explanations underlying why both inequality and poverty fell in Latin America in the early aughts.

The 2008 crisis and its aftermath slowed the wave of social policies throughout much of the region: incipient advances in income distribution were coopted by the demand shock of 2009 and slow global economic recovery. Considering that regional growth was essentially buoyed by primary exports, namely, by external demand (mainly coming from China), the so-called Great Recession revealed, for the umpteenth time, Latin America's economic dependency on the industrial center and the absence of an integrated regional market (Katz, 2016).

Now, any analysis would be incomplete without an explanation of the exceptions to the rule. Such is the case of the two countries that made their way into the empty box of equality with growth in Latin America: Uruguay in the 30 years following Fajnzylber's (1985-2015) study and El Salvador solely in the twenty-first century (2001-2015). It is worth underscoring that the fact that these two countries fit into the equality-with-growth box does not mean that their economic development in any way stacks up with that of the industrial countries. Outside of the fact that in terms of equality, the two countries barely fulfill the half-average of the developed nations requirement, the only assertion that can honestly be made-at best-is that both El Salvador and Uruguay have distanced themselves from the unequal growth patterns that have historically characterized Latin America, either by finding an effective development strategy, as is the case of Uruguay, or by dint of happenstance, as is the case of El Salvador.

The end of El Salvador's civil war (1992) prompted profound economic and social transformations. Economically, the end of the war entailed the reorganization of public finances with an eye to macroeconomic stabilization, on the one hand, and raising social spending, on the other (which had practically stagnated during the conflict), with a main focus on vulnerable groups (Tejerina and Muñoz, 2015). In the social realm, the most significant transformation was brought on by mass migration to the United states and the impact of remittances, which became even more extreme in the aughts. Social-economic dependency abroad changed from exporting prime materials (coffee, sugar cane, and cotton) to a reliance on remittances and the maquila industry. Domestically, the agriculture and livestock sector lost ground to the services, commerce, and construction sectors. For a little perspective, in 2004, when over 20% of Salvadorans had migrated to the United States, remittances accounted for 16.3% of the country's domestic product; a mere three years later, the figure grew to 18.1% (Damianovic et al., 2009).

In the time period when El Salvador made it into the growth-with-equality box, the country certainly does not have a strong showing in growth (1.5% annual average per capita), although the equality indicator rose considerably over the period prior. It would not be outlandish to say that much of El Salvador's progress is due to the nature of the remittances: one, their outsized magnitude with respect to the domestic economy and two, that they end up in the hands of the lowest-earners, the base of the distribution pyramid. As a result, it might be assumed that the reason why El Salvador made it into the enviable Box 3 is more due to the lack of an effective job and inclusive growth policy, which has sidelined a broad swath of the population and pushed them to find better opportunities by crossing the border.

One major limitation of this study is that at the end of the day, it does not manage to transcend the economisite bias in its analysis of development. By focusing solely on two indicators (growth and equality), other crucial aspects that influence material welfare are left out. One clear example is social violence, which is rampant in El Salvador, even now that the civil war is over. In particular, in the latest period of analysis, violence has both deepened and spread throughout the territory of El Salvador in multiple manifestations. Murder, theft, extortion, violent crime, etc.: all have multiplied to the extent that El Salvador has earned the moniker of "one of the world's most violent countries outside a war zone" (Damianovic et al., 2009, p. 11).

Bear in mind that although the data does show that inequality declined in El Salvador, the possibility that a strong perception of insecurity leads to people in the upper strata under-declaring their income cannot be ruled out, which would upend all the estimates and make inequality seem lower in a society that de facto is not equal. This reasoning makes sense because violence has spiraled out of control at the same time that inequality has fallen, in the midst of only modest economic growth, an analysis of which goes beyond the scope of this text.

In Uruguay, the story is very different. In 1985-2000, the Uruguayan economy initiated a series of important changes derived from the end of the military dictatorship that began in 1973. The return to democracy led to a suite of structural reforms designed to improve conditions for the broader population. The first five years of democracy were a transition to a new economic development model that was initially accompanied by wage recovery, rising domestic demand, and burgeoning exports to neighboring countries. All of this augured an economic recovery that was undermined between 1987 and 1990 by the disproportionate growth of the public deficit as a result of the elections and subsequent inflationary pressures (Bertola and Bittencourt, 2005).

By the 1990s, Uruguay was implementing familiar market reforms (deregulation and liberalization, principally), alongside a raft of macroeconomic stabilization programs predicated on the exchange rate. Nevertheless, this plan led to sharp currency appreciation with respect to the dollar, which stimulated spending on imports and exacerbated the trade deficit. Some of the transformative industries fell to the international competition" which could have further hurt unemployment (Bertola and Bittencourt, 2005).

With the twenty-first century in full swing, Uruguay began to respond to the Fajnzylber thesis that inequalities in productivity and wages may not be correlated; in other words, productivity gains in a given sector may not necessarily be reflected in wage increases in that sector. Whether or not there are improvements will be largely dependent on market conditions, in terms of wage negotiating power and job and wage policy. By the end of the nineteen-nineties, following a sustained period of growth, the Uruguayan economy (rooted in the devaluation of the Brazilian currency and imbalances in the Argentine economy) experienced a decline that culminated in the 2002 crisis (Amarante and Tenenbaum, 2016).

Recovery came relatively fast, reflected in production gains and improved social and economic indicators. Economic growth was sustained for 11 uninterrupted years starting in 2003, with annual growth rates exceeding the rates in the second half of the twentieth century (Amarante and Tenenbaum, 2016). This expansive cycle was characterized by rapid growth, external prosperity, and better income redistribution. Recovery was in principle unequal, because the productive and wage inequalities between the high- and low-productivity sectors widened between 2001 and 2007. However, it was starting in 2007 that productivity inequality continued to rise, but wage inequality started to ease (Amarante and Tenenbaum, 2016; Bertola, 2016).

This means that even when heterogeneity in the productive structure has put pressure on rising wage disparities between the low- and high-productivity sectors, the country has managed to correct them through social policies designed to prevent the wages of low-productivity sector workers from coming under fire. These policies have been effective to the extent that the social protection system recognizes that there are productivity and wage disparities and has therefore managed to redistribute the welfare of growth.

A bevy of institutional changes are meant to mitigate labor inequalities, including collective negotiations, minimum wage increases, employment formalization, and tax structure reform, all of which have led to a substantial change in the labor market, increasing the number of private-sector wage workers. It has also allowed low-productivity sector workers to move into higher-productivity sectors, and the informality rate fell from 36% to 24% between 2002 and 2014 (Rossel, 2016; Amarante and Tenenbaum, 2016).

THE CURRENCY OF THE MODEL AND CONCLUSIONS

This exercise fits into the series of studies that have confirmed a fact of yore: Latin America is the most unequal region in the world. What's more, the results do not leave much room for optimism, like the sort of optimism that came out of the growth boom before the Great Recession, with its promise of a stronger-growing and more equal Latin America. That illusion was short-lived, and history is ruthless. Latin America's empty box, although not on Fajnzylber's precise terms, is still biased in the wrong direction of regional development: inequality.

Accordingly, the explanatory power of Fajnzylber's analytical framework has not run out of steam: development in Latin America continues to be structurally unequal both across and within countries. In essence, the Chilean economist did identify the roots of structural inequality in the region, beginning with what he termed the pathology of inequality.

The pathology of inequality refers to chronic and noticeable income inequality resulting from "sharp productivity heterogeneity" across and within economic sectors, principally in the agricultural goods sector (Fajnzylber, 1990, p. 58).4 This pathology assumes that each sector's income is driven by its productivity; and because productivity is so unequal across activity sectors, income inequality is also likewise enormous. What this text has brought to light, in the case of Uruguay, is that redistributive policy can play a large role as a counterweight to structural deficiencies. Recent development strategy in Latin America, grounded in the market, has not reversed productive structure heterogeneity, shows poor signs of growth, and is marked by inequality. Nor has it considered any broad-scope redistributive piece except in a brief time lapse leading up to the Great Recession.

Thus, the pathology of inequality continues to be one reason why inequality is so high in Latin America, in addition to the paucity of effective redistributive policy. And the link between this pathology and the lack of growth is unbreakable, because both ailments are provoked, in essence, by sharp heterogeneity in the productive structure. Getting out of this vicious cycle or, the other side of the coin, achieving sustained growth, "demands an internally joined-up and equitable society, which creates the conditions conducive to a continuous effort to incorporate technical progress and raise productivity and, therefore, to growth" (Fajnzylber, 1990, p. 165).

Nevertheless, the above does not explain to what the enormous inter- and intra-sectoral productivity disparities are owed. In this regard, Fajnzylber underscores the importance of productive investment in lagging sectors (such as subsistence farming, in its time, as well as informal sectors, at the moment), to free up resources for more productive activities. The biggest problem resides in a generalized dearth of productive investment that would penetrate far and wide in the economic structure. After all, activities with very low productivity, meaning limited ability to accumulate capital, coexist in the region, and they will continue to coexist as long as the more productive sectors fail to grow enough to absorb underemployment, which will not happen without a generalized and sustained increase in investment.

In turn, following Fajnzylber, there is a restriction on investment given by the fact that the highest-earning groups spend in a way that imitates the lifestyle of more advanced countries! mainly the United states, characterized by outsized consumption of cheap goods (beverages, prepared food, clothing, and electronics); durable goods (automobiles and household appliances), and imported merchandise (which eats up foreign currency). This power-intensive, waste-generating spending pattern transposed on a reality with high population density, capital and foreign currency scarcity, and sharp inequality inhibits capital accumulation by way of consistently low investment over time. When the high-income groups overspend on cheap, durable, and imported goods, their propensity to save is abnormally curtailed. In lower-income groups, this propensity is even lower due to the distorted spread of the consumption pattern from the top down in the income pyramid:

"The rentier elite aspires to propagate the lifestyle of advanced countries and manages to do so, regardless of the private and social cost, not only in their direct consumption, but also by spreading values and physical investment choices congruent with the hypothetical and committed access to this way of life to the rest of society. This reference pattern spreads down into the base of the income pyramid and leads to ever-lower layers pursuant to the unit value of the goods and services at play (Fajnzylber, 1990, p. 63).

That is seemingly the reason why Fajnzylber decided to measure inequality using the extremes of the income pyramid, and thus his equality indicator proposal. Because it is there, perhaps more patently, that the possibilities of domestic market-targeted growth are evinced. All of the foregoing is consistent with the results of Fajnzylber's exercise, which is introduced in this text. The absence of growth with equality in the majority of Latin America is tied to domestic limitations on capital accumulation, which are in turn the outcome of an imitative consumption pattern reinforced by such an unequal income distribute, in a vacuum of effective redistributive policies. To explain why certain countries grow so much without achieving equality, it is simply because that growth is fundamentally due to the external market, whether via the export of primary goods or low-added-value manufactures, or thanks to capital inflows. Extreme cases of stagnation with inequality are a perverse combination of insufficient domestic capacity and an adverse external environment.

It is worth clarifying that this paper has focused on highlighting overall trends in recent development in Latin America in the style of Fajnzylber, rather than being centered on income inequality, much less on polemizing how it is measured and its nascent sophistication. The measure of equality described here, even as a simple ratio, is much more powerful than it seems. So much so that nowadays it constitutes the inequality indicator regularly published by the Organization for Cooperation and Economic Development (OECD), under the name the Palma ratio. It is precisely the reciprocal of the Fajnzylber equality ratio, and was proposed by yet another Chilean economist by the name of Gabriel Palma in the aughts, as an inequality measure alternative to the Gini coefficient, upon which he based the 50/50 rule, which says that inequality matters more at the ends of the income pyramid, because the five middle deciles (from 5 to 9) maintain a fairly stable share of income over time (see Palma, 2014).5

The above is merely an argument for the freshness of Fajnzylber's proposals from nearly three decades ago. Analyzing their implications and explanatory power in depth would require much more ink than what appears on these pages.

ACKNOWLEDGEMENTS

We would like to acknowledge the valuable suggestions made by the three anonymous readers. All responsibility for the ideas expressed herein pertains exclusively to the authors.

REFERENCES

Amarante, V. y Tenenbaum, V. (2016), “Mercado laboral y heterogeneidad productiva en el Uruguay”, en V. Amarante y R. Infante, Hacia un desarrollo inclusivo. El caso del Uruguay, Santiago, CEPAL-OIT. [ Links ]

Bértola, L. (2016), “Ciclo económico y heterogenidad estructural”, en V. Amarante y R. Infante, Hacia un desarrollo inclusivo. El caso de Uruguay, Santiago, CEPAL-OIT . [ Links ]

Bértola, L. y Bittencourt, G. (2005), “Veinte años de democracia sin desarrollo económico”, en G. Caetano, 20 años de democracia, Montevideo, Ediciones Santillana, S.A. [ Links ]

Damianovic, N. et al. (2009), Dinámicas de la desigualdad en El Salvador: hogares y pobreza en cifras en el periodo 1992-2007, Santiago de Chile, Rimisp. [ Links ]

Fajnzylber, F. (1990), Industrialización en América Latina: de la “caja negra” al “casillero vacío”, Santiago de Chile, Cuadernos de la Cepal. [ Links ]

Katz, C. (2016), “El viraje de Sudamérica”, Pensamiento al margen, núm. 4. Recuperado el 19 de diciembre de 2016, de <https://www.pensamientoalmargen.com/viraje/ > [ Links ]

Ocampo, J. A. y Ros, J. (2011), “Shifting Paradigms in Latin America’s Economic Development”, en J. A. Ocampo y J. Ros (eds.), The Oxford Handbook of Latin American Economics, Londres, Oxford University Press. [ Links ]

Palma, J. G. (2014), “Has the Income Share of the Middle and Upper-middle Been Stable around the ‘50/50 Rule’, or Has it Converged Towards that Level? The ‘Palma Ratio’ Revisited”, Development and Change, vol. 45, núm. 6. [ Links ]

Rossel, C. (2016), “De la heterogeneidad productiva a la estratificación de la protección social”, en V. Amarante y R. Infante, Hacia un desarrollo inclusivo. El caso del Uruguay , Santiago, Cepal-OIT. [ Links ]

Tejerina, L. y Muñoz, L. (2015), 20 años de reducción de pobreza y desigualdad en El Salvador, Banco Interamericano de Desarrollo. [ Links ]

2A preliminary version of this paper was presented on December 2, 2016 at the ILAS@40 Conference organized by the Institute of Latin American studies and La Trobe University in Melbourne, Australia.

3The authors would like to acknowledge the funding provided by the Program for Graduate studies Support (PAEP, in Spanish) from the National Autonomous University of Mexico (UNAM), which sponsored this presentation.

4To Fajnzylber, the productive homogenization both within the agricultural sector and between it and the other (presumably more advanced) sectors is the heart of the transformation of the agrarian structure, a precondition for overcoming underdevelopment. In line with the first arguments of Latin American structuralism, this transformation allows the workforce to reorganize towards more productive (and higher income) sectors and historically "has played the decisive role of helping farmers join modern society, changing the relations between agriculture and industry, and, specifically, increasing the degree of equality" (Fajnzylber, 1990, p. 56).

5The comparative advantage of the Palma ratio over the Gini coefficient, for example, depends on the empirical veracity of the 50/50 rule. If you accept it, while the Gini gives excessive weight to the income layers that experience practically no changes (from decile 5 to 9), underestimating inequality, the Palma ratio is a better reflection of changes in distribution where they are most likely to happen. Likewise, following Palma (014, p. 1419), this indicator is "intuitive, transparent, and useful for policy purposes, in other words, one can evade all of the unnecessary (and often counterproductive) algebraic sophistication of alternative inequality indicators."

ANNEX

Table 3 Fajnzylber's Table (1990) Latin America. Growth:Equality, 1965-1984

a Half of the comparable ratio from the advanced countries (Germany, United States, Japan); bGDP growth/per capita of the advanced countries; cShare in regional GDR

Source: World Bank, World Development Indicators.

Received: January 10, 2017; Accepted: April 20, 2017

text in

text in