Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Investigaciones geográficas

On-line version ISSN 2448-7279Print version ISSN 0188-4611

Invest. Geog n.110 Ciudad de México Apr. 2023 Epub June 26, 2023

https://doi.org/10.14350/rig.60636

Articles

Industrias Peñoles and the Monopoly of Mining Concessions in Mexico

*UNAM, Programa de Becas Posdoctorales en la UNAM, Becario del Instituto de Investigaciones Económicas, asesorado por la doctora Josefina Morales Ramírez. Email: isidrotr@gmail.com

**Instituto de Investigaciones Económicas, UNAM, México. Email: moramjos@gmail.com

This article explains the main causes, dynamics, and effects of the expansion of the concession area granted to mining companies in Mexico. To this end, the company Industrias Peñoles was used as a case study, limiting the period of analysis from 1982 to 2018. The selection of this mining corporation was not fortuitous. With more than a century of history, it deviates from the generalizations and types of cases addressed by the specialized literature: foreign-capital companies, especially Canadian ones, which own open-pit operations and mining projects that have caused risks or adverse environmental effects and social conflicts. By contrast, Industrias Peñoles is a Mexican company that, despite having records of serious environmental impacts, is the world’s largest producer of silver, one of the largest producers of bismuth, zinc, and lead, and the second-largest producer of gold in Mexico. These features provide an interesting perspective to consider, at the company level, the economic and territorial factors that define the layout and dynamics of mining concessions. In addition to reviewing the sources, we followed three methodological approaches: 1) identification of the concessions granted to the 14 mining corporations that were among the 500 most important companies in Mexico in 2018; 2) identification and review of the concessions granted to Industrias Peñoles and its subsidiary Fresnillo plc.; 3) analysis of the titles issued to this company in the municipality of Fresnillo through the compilation of 100 files. Key data are represented through tables, graphs, and maps.

Three main results are described: a) Industrias Peñoles is the second top company concentrating the largest concession area in Mexico, with a total of 3.1 million hectares distributed across 22 states; b) 77% of the mining concessions were obtained in the period 2001-2012; c) the municipality of Fresnillo manages seven out of every ten hectares under concession. It is highlighted that, along with financial speculation, the monopoly over large areas of the subsoil is one of the main causes of the territorial expansion of mining concessions because they represent a geographic barrier based on the uniqueness of the location and a temporal barrier supported in the centennial validity allowed by the current mining law. Altogether, both barriers represent a territorial strategy that creates or protects monopoly power, making it possible to appropriate a differential income. It is pointed out that the recording of the subsoil and the privatization of the soil has resulted in reduced remuneration to the public accounts; in addition, it has transformed the land in terms of its use and landscape, which has led to social conflict. It is concluded that, in addition to yielding huge profits, the monopolization of mining land enables the very existence of rentier mining capital.

The above information is presented in the following sequence. First, the methodological approaches used for obtaining and conducting the spatial data analysis are detailed. Second, the main legislative changes directly affecting mining concessions are outlined. The following sections highlight the key findings, starting with the spatial evolution of the mining titles at the national level and those granted to the main mining companies. Then, the temporal and spatial dynamics of the area granted to Industrias Peñoles are reviewed by six-year term and state, emphasizing the grabbing of titles. Finally, the factors explaining the expansion are discussed by analyzing the evolution of mining concessions in Fresnillo, a municipality where the company controls the world’s largest silver deposit. The conclusions are then outlined, mentioning the constraints of the research; additionally, some recommendations are made based on the findings.

Keywords: mining concession; precious metals; monopoly; geographical barriers; temporary barriers

El objetivo del presente artículo es explicar las principales causas, la dinámica y los efectos de la expansión de la superficie concesionada a las empresas mineras en México. Para ello se tomó como caso de estudio a la empresa Industrias Peñoles, limitando el horizonte temporal al periodo 1982-2018. La elección de esta corporación minera no fue fortuita. Con más de un siglo de historia, se desvía de las generalizaciones y los tipos de casos abordados por la literatura especializada: empresas de capital foráneo, en especial canadiense, propietarias de operaciones y proyectos de minado a cielo abierto que han ocasionado riesgos o efectos ambientales negativos y conflictividad social. En contraste, Industrias Peñoles es una empresa mexicana que, si bien cuenta con registros de afectaciones ambientales graves, también es el mayor productor de plata del mundo y uno de los mayores en bismuto, zinc y plomo, así como la segunda empresa productora de oro en México. Estos rasgos brindan una óptica interesante para considerar, a nivel de empresa, los factores económicos y territoriales que definen la conFiguración y dinámica del otorgamiento de las concesiones mineras. Además de la crítica de fuentes, se siguieron tres rutas metodológicas: 1) la identificación de las concesiones otorgadas a las 14 corporaciones mineras que Figuraron entre las 500 empresas más importantes de México en 2018; 2) la identificación y revisión de las concesiones otorgadas a Industrias Peñoles y su filial Fresnillo Plc; 3) el análisis de los títulos expedidos a esta empresa en el municipio de Fresnillo por medio de la compulsa de 100 expedientes. Los datos refinados se representaron a través de cuadros, gráficas y mapas.

Se plantean tres resultados principales: a) Industrias Peñoles es la segunda empresa que concentra la mayor superficie concesionada en México con un total de 3.1 millones de hectáreas distribuidas en 22 entidades federativas; b) 77% de las concesiones mineras las obtuvo en el periodo 2001-2012; c) en el municipio de Fresnillo controla 7 de cada 10 hectáreas en concesión. Se discute que, junto con la especulación financiera, el monopolio sobre grandes extensiones del subsuelo es una de las principales causas de la expansión territorial de las concesiones mineras debido a que estas representan una barreras geográfica basada en la unicidad de la localización, y otra temporal sustentada en la vigencia centenaria que permite la Ley minera vigente. Ambas barreras representan en conjunto una estrategia territorial que crea o protege el poder monopolista, lo que posibilita la apropiación de una renta diferencial. Se señala que el acaparamiento del subsuelo y la privatización del suelo han derivado en una reducida retribución al erario, además de implicar la transformación de la tierra de propiedad ejidal en términos de su uso y paisaje, lo cual ha dado lugar a conflictividad social. Se concluye que el monopolio de lotes mineros además de la apropiación de una ganancia extraordinaria, posibilita la propia existencia del capital minero rentista.

El orden de exposición del artículo es el siguiente. En primer lugar, se detallan las estrategias metodológicas empleadas para la obtención y análisis espacial de los datos. En el segundo apartado se hace un recuento de los principales cambios legislativos que afectan directamente a las concesiones mineras. En los siguientes apartados se muestran los resultados obtenidos, empezando por la evolución espacial de los títulos mineros a escala nacional y de los otorgados a las principales firmas mineras. Después se revisa la dinámica temporal y espacial de la superficie concesionada a Industrias Peñoles por sexenio y entidad federativa, con énfasis en el acaparamiento de títulos. Finalmente, se discuten los factores que explican la expansión por medio del análisis de la evolución de las concesiones mineras en Fresnillo, municipio donde la empresa controla el mayor yacimiento de plata del mundo. Finalmente, se presentan las conclusiones y se señalan los límites de la investigación, además de que se brindan algunas recomendaciones basadas en los hallazgos.

Palabras clave: conseciones mineras; metales preciosos; monopolio; barreras geográficas; barreras temporales

INTRODUCTION

During the first decade of the 21st century, the Mexican mining sector recorded a boom characterized by the emergence of new mines and projects, the increase in foreign investment, and the entry of foreign companies, especially Canadian ones (Azamar, 2021). This activity was also driven by the unprecedented expansion of private control over the national subsoil (Burnes, 2019; Téllez and Sánchez, 2022).

According to the Mining Chamber of Mexico (CAMIMEX, 2021), there were a total of 16.8 million hectares under concession for mining activities in Mexico in 2020. Of these, 201 996 hectares were occupied by pits, chimneys, wells, trial pits, trenches, tailings deposits, exploration surveys, camps, offices, and roads, among other infrastructure (GEOMIMET, 2020). This means that the area actually impacted by mining operations does not equal 10.6% of the national territory, much less 50%, as suggested by some sources (Burnes, 2019; Guzmán, 2013), but accounts for only 0.1% of Mexico's mainland surface area. Why have the companies requested mining concessions for lots they do not currently exploit?

Recent studies have attempted to respond to this concern by pointing out that the enormous extent of mining concessions in Mexico is the result of speculation with them by companies in the financial markets (Téllez and Sánchez, 2022; Núñez, 2022; Ferry, 2020). Other studies point to the permissiveness in the current legislation as the factor that has fostered the expansion of the number and extension of mining titles, mainly due to the reduced cost and lack of transparency in their issuance (Peláez and Merino, 2021; Transparencia Mexicana, 2020).

On the other hand, the works that address the relationship between the granting of mining concessions and the social rejection of peasant and native communities acknowledge the expansion of the mining frontier as a result of a state policy that favors private national and foreign investment regardless of the risks and social and environmental impacts (Montoya, Sieder, and Bravo-Espinosa, 2022; Bastidas et al., 2021).

Other studies have indicated that this advance of mining is part of a process of dispossession for the accumulation of capital, which needs to be expanded to the territories (Rodríguez, 2017). Along the same lines, works such as Wanderley (2017) indicate that this is the territorial expansion of extraction activities in Latin America motivated by the commodity boom recorded during the period 2003-2012.

Except for works clearly relevant such as Garza and Moreno (2021), Lamberti (2016), and the Union of Scientists Committed to Society (UCCS, 2016), which have advanced in the understanding of the structure of mining titles, the common denominator of this group of studies is that they conducted a review at the national level and, to a lesser extent, at the state level, but without approaching the spatial and temporal evolution of these concessions at the company level.

For this reason, the objective of this study is to analyze the main causes, dynamics, and effects of the territorial expansion of mining concessions granted to the Industrias Peñoles corporation. Our research covered the period 1982-2018 at the national, state, and municipal scales. This corporation was selected because it deviates from the generalizations and types of cases addressed by the specialized literature: Canadian foreign-capital companies that own open-pit operations and mining projects that have triggered social conflicts. By contrast, Industrias Peñoles is a Mexican company that, despite having records of mining conflicts. is the world’s largest producer of silver, one of the largest producers of bismuth, zinc, and lead, and the second-largest producer of gold (Industrias Peñoles, 2020). These features provide an interesting perspective to consider, at the company level, the economic and territorial factors that define the layout and dynamics of mining concessions in Mexico.

CONCEPTUAL FRAMEWORK AND METHODOLOGY

This research defines mining concessions as the permits granted by the Mexican State, through the Board of Economy (SE), to private companies to carry out, in a certain extension of the national subsoil, surveillance, exploration, exploitation, and beneficiation of metallic and non-metallic minerals.

Official data on mining concessions, although freely available, present several inconsistencies. For example, some are reported as valid despite having exceeded 50 years without being renewed. Others indicate that they were issued in 2028. In addition to these errors, since December 2018, the federal government announced the cancellation of new concessions and the revision of those already granted. This involved the closure of consultation sources such as the Public Mining Registry Card.

For these reasons, we conducted a cross-analysis of different sources. The starting point was the database called “Cartography of Mining Concessions in the National Territory" prepared by the Secretariat of Economy (SE, 2018). We also reviewed the data recorded in the database called "Current Mining Concessions in Mexico (2021)", obtained by Geocomunes (2021) after we submitted a request for information. The data preparation also involved the breakdown of titles by mineral type, holder type, and presidential term from 1982 until 2018. To this end, SQL queries were made of the database mentioned in the QGIS program, following three approaches: 1) identification of the concessions granted to the subsidiaries of the 14 Mexican and foreign mining corporations that were among the 500 most important companies in Mexico in 2018, according to a list published by the Expansiòn magazine (2019); 2) identification and review of the concessions granted to Industrias Peñoles and its subsidiary Fresnillo plc; 3) analysis of the titles issued to this company in the municipality of Fresnillo through the compilation of 100 files kept at Agency 93 of the Office of Mining Affairs of the State of Zacatecas. Finally, key data were summarized and displayed in tables, graphs, and maps.

THE “AURIFICATION” OF THE MINING FRONTIER IN MEXICO

Between 1991 and 1993, the legal framework that regulates mining activities in Mexico was amended. The key amendments with respect to the repealed legislation of 1975 include the removal of the geographic limits of mining concessions and the extension of their validity from 25 to 50 years, renewable for an additional 50 years, as well as the ratification of mining as a preferential activity over any other land use, except for the extraction and exploitation of hydrocarbons (Cámara de Diputados, 2012).

As several studies have shown (Cravioto, 2019; Burnes, 2019), this legislative framework allowed companies to freely choose the location and extension of mining lots. In this way, from 2003 onwards, there was a systematic increase in the area granted to mining companies but also included areas where this activity was minimal or nonexistent. As of February 2018, the area granted totaled 26.7 million hectares under concession through 26 762 current titles, covering 13.9% of the 1 960 018 square kilometers of Mexico’s mainland surface (SE, 2018).

The expansive trend of the mining frontier is not unique to Mexico. In Chile, the area granted for mineral extraction represented a little more than 10% of its territory in 2003. In 2018, this percentage had grown to 49.8% of the country. In Peru, mining titles went from comprising 3.1% of the country’s territory in 1992 to 15.5% in 2017. Canada, the second-largest country in the world, has 27% of its territory granted to mining, while in Brazil, the fifth-largest country, the mining frontier represents 19% of the national area (Global Forest Watch, 2019).

In Mexico, the geographic expansion of mining concessions was driven by the upward cycle of international quotations of different metals recorded between 2001 and 2012 (Wanderley, 2017). Gold was an emblematic case. As shown in Figure 1, in the first twelve years of the 21st century, the price of gold increased by 516%, a rise that was reflected in the “aurification” of the concession area.

Sources: SE (2018) and SGM (2019).

Figure 1 Concession area, mining titles, and gold price, 2000-2018.

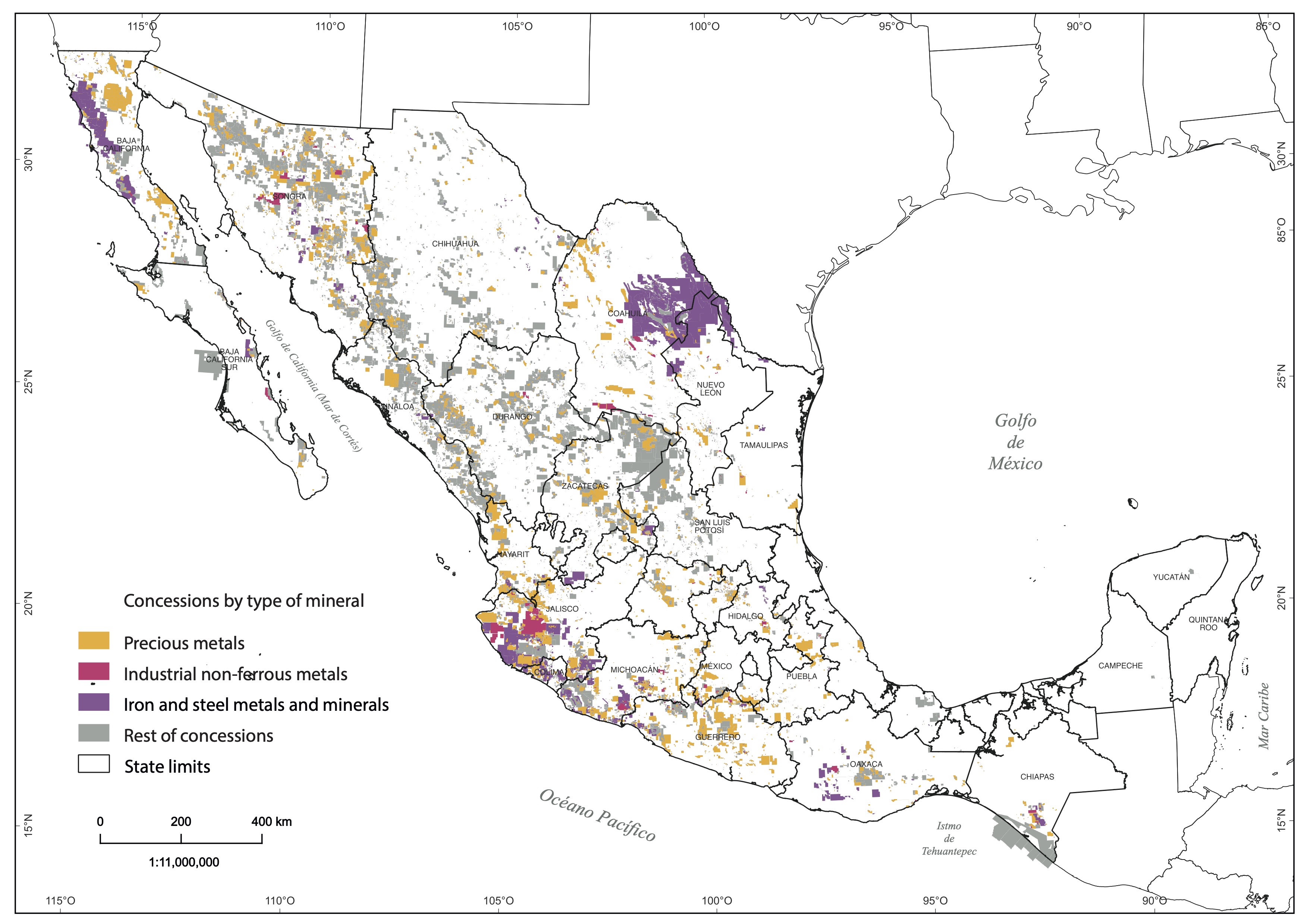

Figure 2 shows this geographic expansion of the concessions to search for and exploit precious metals across 28 of the 32 states. It also illustrates the concentration of the lots to extract non-ferrous industrial metals (copper, lead, zinc, and molybdenum) and steel metals and minerals (coal, coke, iron, and manganese) in the states of Coahuila, Nuevo Leon, Baja California, Jalisco, Colima, and Michoacan.

Source: Own elaboration based on SE (2018).

Figure 2 Mining concessions granted in Mexico by type of metal, 2018.

The more than 9 thousand holders of these concessions include companies that neither have mines in operation nor, for the most part, projects (SE, 2018). These are so-called junior companies, that is, small firms primarily dedicated to requesting concessions and identifying mining prospects, advancing their exploration, and, if they discover a profitable field, selling them for a higher price to a senior company. The latter type of company refers to corporations whose revenues derive from the operation of mines and large-scale beneficiation plants (Téllez and Sánchez, 2022).

The acquisition of mining concessions by junior companies for subsequent resale for an expected higher price in the financial markets has been described as speculation and placed as one of the primary causes of the geographic expansion of mining activities (Ferry, 2020; Téllez and Sánchez, 2022). This phenomenon was the result not only of the permissiveness of the current Mining Law but also of the availability of capital surpluses that, after the global economic crisis of 2008-2009, sought new spaces for valorization (Téllez, 2021).

MINING CONCESSIONS OF INDUSTRIAS PEÑOLES

After reviewing the ten mining holders with the largest concession area in Mexico, we found that only two are junior companies. The rest are subsidiaries of senior companies: two foreign companies and six Mexican corporations (Table 1). This means that financial speculation is not the only factor explaining the geographic expansion of mining concessions.

Table 1 The ten largest mining concessionaires in Mexico, 2018.

| Concessionaire | Concession area (hectares) |

Parent Company |

Country of origin |

Type of company |

| Exploraciones Mineras Parreña | 1 818 538 | Industrias Peñoles | Mexico | Senior |

| Minera Plata Real | 557 807 | Gatos Silver y Dowa Metals & Mining | United States / Japan | Senior |

| Minera María | 523 692 | Minera Frisco | Mexico | Senior |

| Minera Carbonífera Río Escondido | 412 415 | Altos Hornos de México | Mexico | Senior |

| Minera Penmont | 392 713 | Industrias Peñoles | Mexico | Senior |

| Minera Golondrina | 371 225 | West Timmins Mining | Canada | Junior |

| Minera Agua Tierra | 362 170 | Freeport McMoran | United States | Junior |

| Las Encinas | 353 724 | Ternium | Italy/Argentina | Senior |

| Industrial Minera México | 339 484 | Grupo México | Mexico | Senior |

| Minera del Norte | 324 169 | Altos Hornos de México | Mexico | Senior |

Source: Own elaboration based on SE (2018).

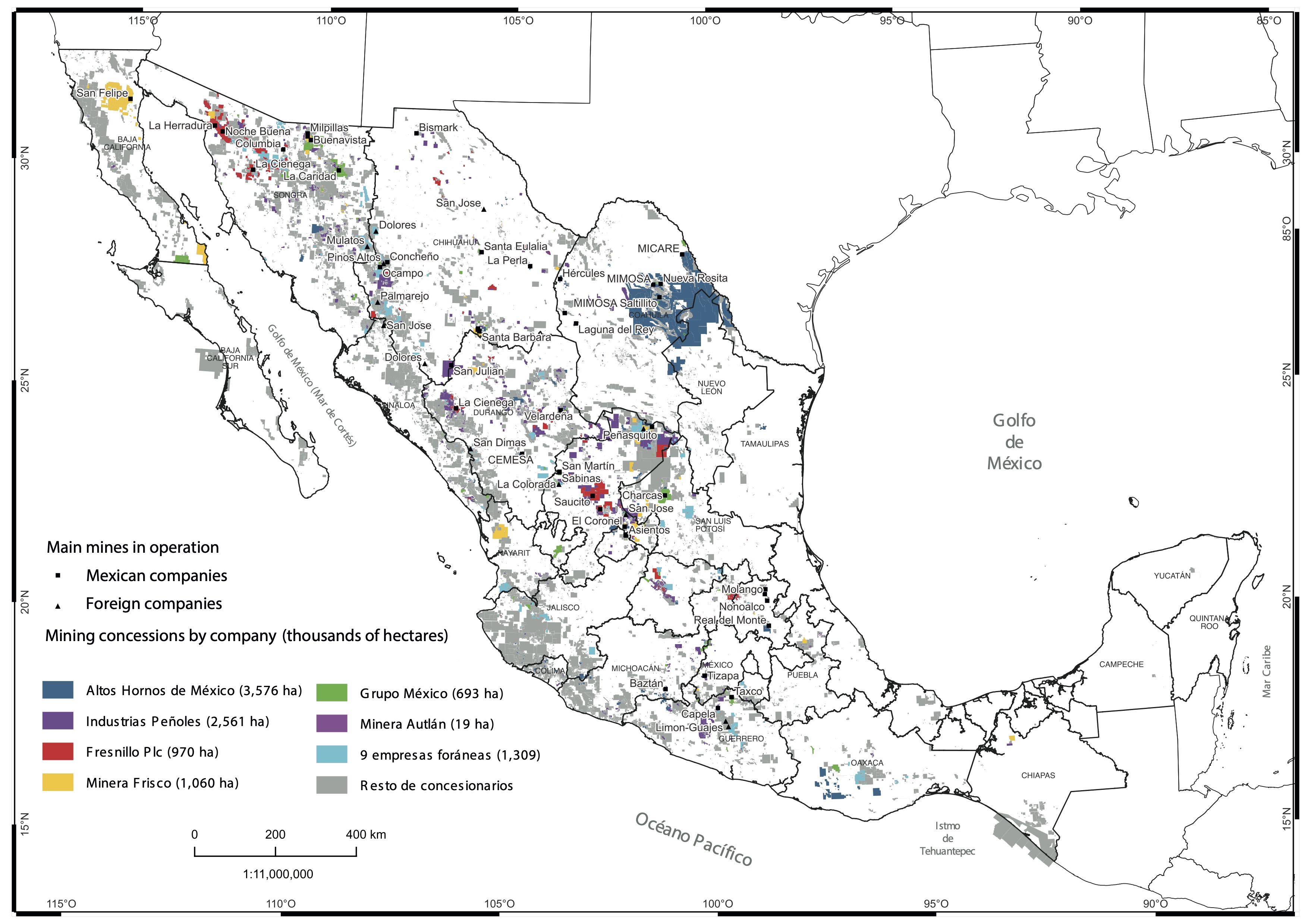

If the analysis is extended to the subsidiaries of the ten corporations listed among the 500 most important companies in Mexico,1 it shows that in 2018, six Mexican corporations jointly controlled about 30% of the total area granted in concession (Figure 3). Altos Hornos de México and Peñoles are the companies with the largest surface area, jointly concentrating nearly 2 out of every 10 hectares granted. On the other hand, the nine foreign corporations included in the list controlled 3.6% of the national concession area.

Source: Own elaboration based on SE (2018).

Figure 3 Main operations and area concessioned to mining groups in Mexico, 2018.

Although competition between these companies can be assumed (Garza and Moreno, 2021), the truth is that it does not occur in spatial terms. As shown in Figure 3, the geographic distribution of concessions and the main mines of these companies currently in operation confirm what Vargas and Martinez suggested (2019: 193), i.e., the existence of a sort of "tacit monopoly agreement" by type of mineral produced: Altos Hornos de México exploits iron and coal, essential minerals in the manufacture of steel; Grupo México, refined copper; Autlan Holding, manganese; Frisco, cathodic copper, and dore; Industrias Peñoles, lead and zinc; Fresnillo plc, silver; and foreign firms, gold.

Industrias Peñoles is the second most important mining-metallurgical company in the country and a subsidiary of the Mexican conglomerate Grupo Bal. Peñoles is the largest producer of refined silver worldwide, with 6% of total production, and the main producer of gold, lead, and zinc refined in Latin America and Mexico (Industrias Peñoles, 2020). The control of the subsoil through mining concessions has been one of the main strategies followed by this company.

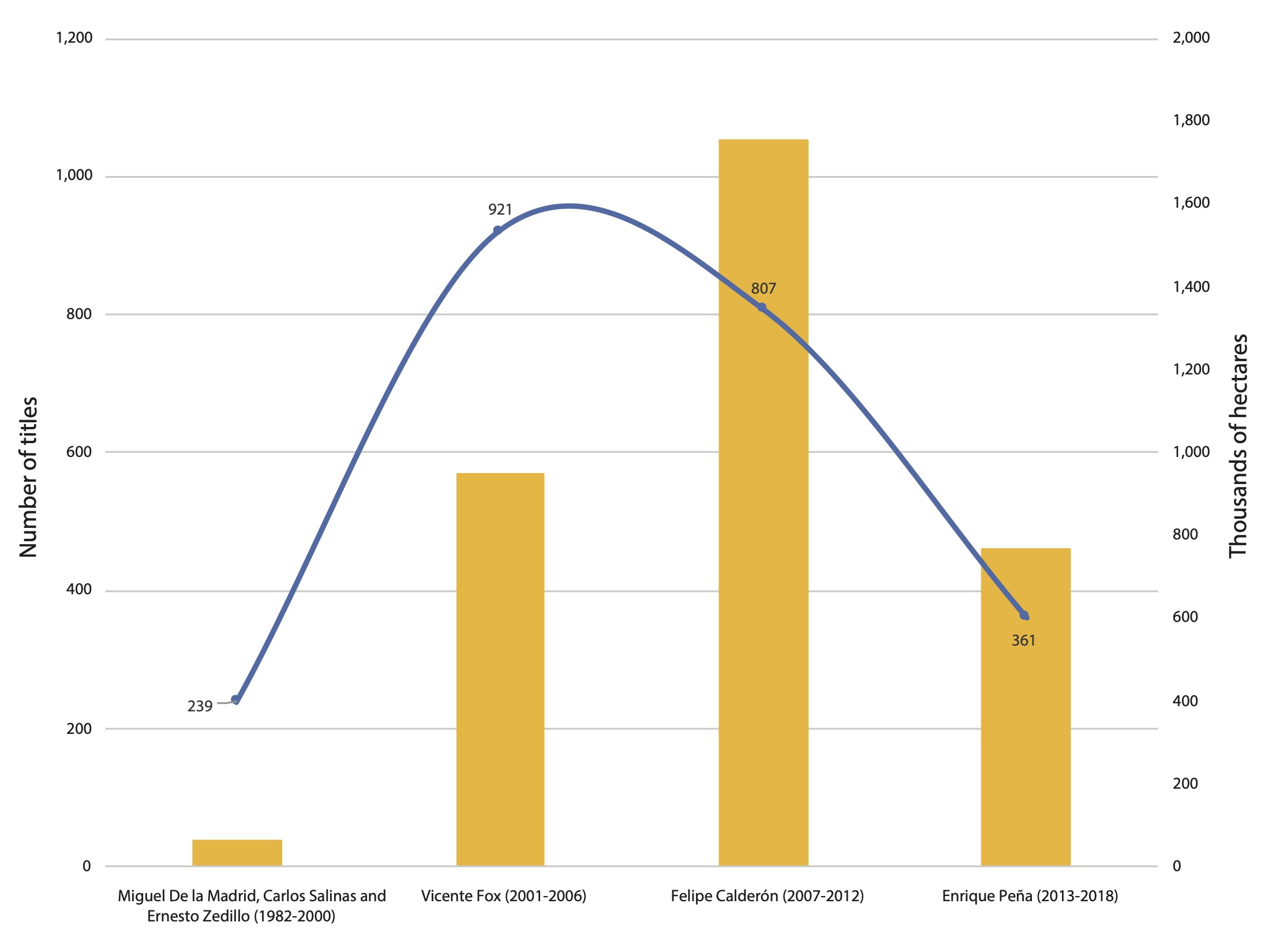

During the neoliberal period, the area granted in concession to Industrias Peñoles expanded to cover 22 states, driven by the geographic distribution of the metallogenic provinces of the metals exploited by this corporation: gold and silver, as well as the byproducts lead and zinc. Thus, as of 2018 and excluding the canceled titles, the company controlled a total of 3 185 082 hectares in concession through 2 167 valid titles, of which 77% were granted between 2001 and 2012 (Figure 4).

Source: Own elaboration based on SE (2018).

Figure 4 Mining concessions granted to Industrias Peñoles by presidential term, 1982-2018.

Between 2008 and 2018, the company added 84 300 hectares Chileof concession area granted in Peru and ten thousand hectares in Chile (Fresnillo Plc, 2018). These figures illustrate the expansive capacity of Industrias Peñoles beyond Mexico’s borders. What is the element explaining such a strategy of massive acquisition of mining concessions? This issue is explored through the case of the municipality of Fresnillo.

MONOPOLY OF THE SUBSOIL IN FRESNILLO

Fresnillo is a municipality located in the state of Zacatecas. The Fresnillo mine, formerly Proano, has been operating in this territory since 1551. The adjacent mines Saucito and Juanicipio started operations in 2009 and 2022, respectively. The three mines are owned by Industrias Peñoles, which controls them through its subsidiary Fresnillo plc. The main features of these underground mines are their veins, with a silver content from 350 to 2 000 grams per ton, and their reserves greater than 450 million ounces. These features positioned this area as the largest silver-producing center worldwide, with an annual production of 35 million ounces in 2018 (Fresnillo Plc, 2019).

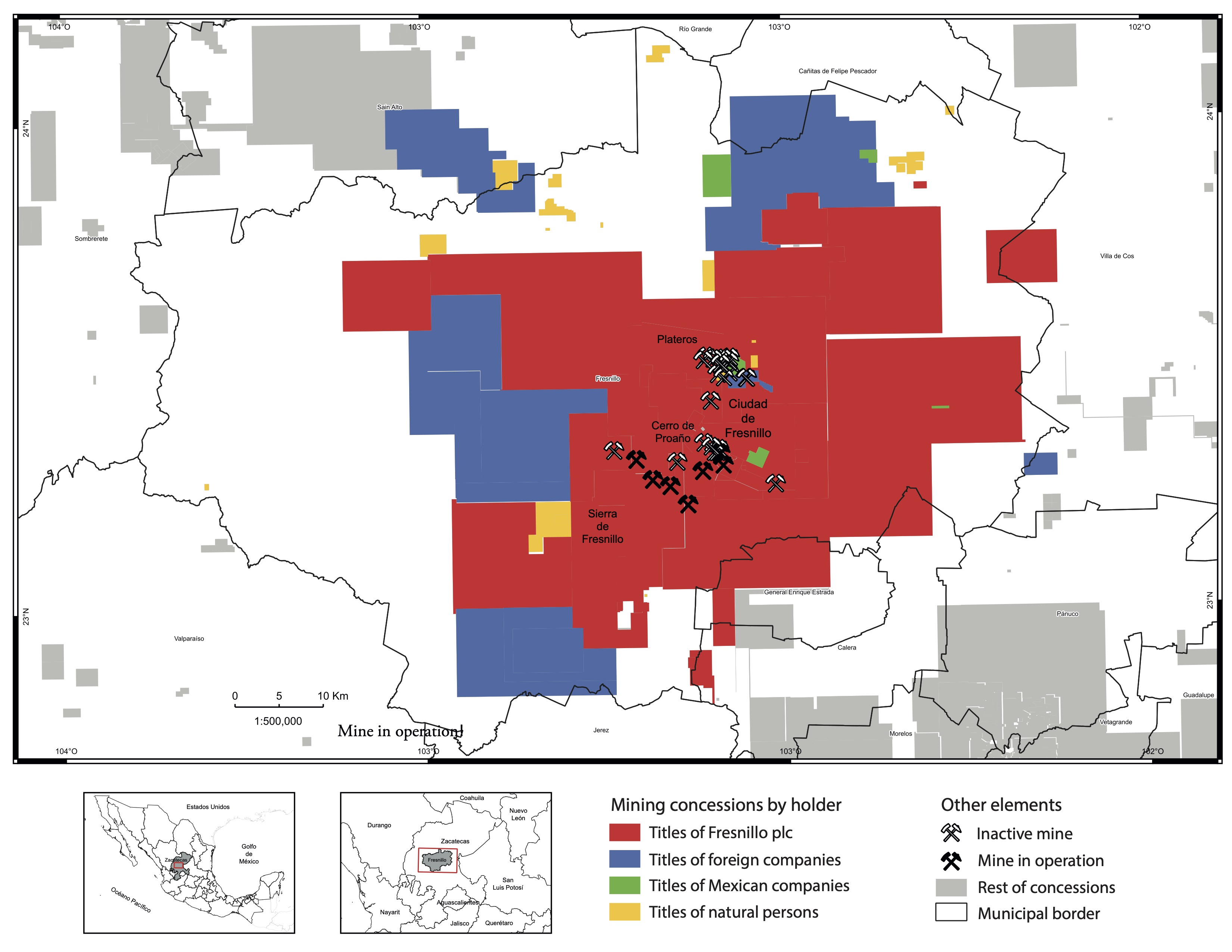

One of the core axes of mining production in this historic district was the growing control of the municipal subsoil through mining concessions. As shown in Figure 5, between the years 1991 and 2000, Fresnillo Plc was granted 10 009 hectares — three times the area granted between 1950 and 1990. Subsequently, during the first decade of the 21st century, the concession area granted to this company increased by 1 751% relative to the area obtained ten years earlier.

Source: Own elaboration based on SE (2018).

Figure 5 Evolution of the concessioned area in the municipality of Fresnillo, 1950- 2018.

During this same decade, the foreign firms Golden Minerals and MAG Silver were also granted mining titles in the municipality of Fresnillo. Although it should be noted that the latter obtained the Juanicipio 1 lot in partnership with Fresnillo Plc, 44% of the rights to it belong to MAG and 56% to this subsidiary of Industrias Peñoles (Téllez, 2021).

In the period 2011-2018, the concession area requested by Fresnillo Plc decreased considerably, adding up to 62 630 hectares. Thus, until 2018, Fresnillo had recorded a total of 128 mining concessions covering an area of 351 823 hectares, that is, 63% of the municipal territory. Fresnillo Plc has been granted 64 titles, equivalent to 261 170 hectares, which means that 7 out of every 10 hectares under concession in the municipality were obtained by this company (Figure 6).

Source: Own elaboration based on SE (2018).

Figure 6 Mining concessions in the municipality of Fresnillo by type of holder, 2018.

The four foreign firms that requested mining lots currently control a total of 78 909 hectares, that is, 22% of the municipal area granted. Minera Lagartos, a subsidiary of the Canadian company MAG Silver, stands out for managing 60 992 hectares (Table 2). In contrast, Mexican companies such as Minas de Santa Martha, a subsidiary of Minera Autlán, control 2 572 hectares, equivalent to only 1% of the municipal area under concession. There is also a total of 35 natural persons who control a concession area of 9 171 hectares (3% of the municipal total).

Table 2 Mining concession holders in the municipality of Fresnillo, 2018.

| Company name | Mining group | Source of capital |

Concession area (hectares) |

% of the municipal area |

| Compañía Fresnillo | Fresnillo Plc | Mexico | 117 556 | 23.08 |

| Compañía Minera La Parreña | Fresnillo Plc | Mexico | 82 246 | 16.15 |

| Minera Lagartos | MAG Silver | Canada | 60 992 | 11.98 |

| Desarrollos Mineros El Águila | Fresnillo Plc | Mexico | 52 350 | 10.28 |

| Minera Cordilleras | Golden Minerals | United States | 16 737 | 3.29 |

| Desarrollos Mineros Madero | Fresnillo Plc | Mexico | 4 800 | 0.94 |

| Minera Saucito | Fresnillo Plc | Mexico | 4 189 | 0.82 |

| Litio Mex | Piero Sutti | Mexico | 1 534 | 0.30 |

| Compañía Minera Terciario | United States | 598 | 0.12 | |

| Plata Panamericana | Pan American Silver | Canada | 582 | 0.11 |

| Minas de Bacís | Grupo Bacis | Mexico | 361 | 0.07 |

| Gómez Mineros | Mexico | 317 | 0.06 | |

| Minas de Santa Martha | Autlán Holding | Mexico | 250 | 0.05 |

| Logística de Construcción Minera y Metalúrgica | Mexico | 60 | 0.01 | |

| Metalúrgica Reyna | Fresnillo plc | Mexico | 30 | 0.01 |

| Desarrollo Monarca | Grupo Demosa | Mexico | 26 | 0.01 |

| Servicios Mineros | Mexico | 25 | 0.00 | |

| Natural persons | 9 171 | 1.80 |

Source: Own elaboration based on SE (2018).

The mapping by type of holder (Figure 7) shows that mining concessions were extended in two directions: a) around the subsoil of Cerro de Proaño and the inactive Plateros mines, b) to the northwest and southwest of the Sierra de Fresnillo. This geographic distribution formed a sort of border in favor of Fresnillo Plc that prevents other companies from operating in the same territory.

Source: Own elaboration based on SE (2018).

Figure 7 Mining concessions in the municipality of Fresnillo by type of holder, 2018.

Accumulation by dispossession is one of the most used concepts in the specialized literature to interpret this expansion of mining concessions (Sacher, 2015) because it involves the commodification and private use of the soil and subsoil. However, dispossession is only the first link in the capital accumulation/non-accumulation process (Rodriguez, 2017).

Hence, if the expansive trend of mining concessions is reviewed from the concepts of absolute (or monopolistic) and differential income (Delgado, 2019), it can be interpreted that for the accumulation of mining capital to exist and restart even more vigorously, dispossession should be associated with an exclusive right of ownership, as happens with the accumulation of mining concession titles by Industrias Peñoles. In other words, it should be linked to absolute income, which does not derive from dispossessed public or common goods,

but from the surplus profit earned by the company from the exclusive ownership of these goods (Foladori and Melazzi, 2016; Téllez, 2020).

From this theoretical perspective, the border set by Industrias Penoles in the municipality of Fresnillo mentioned above shows that mining concessions represent two aspects.

On the one hand, a geographic barrier since no one can locate their mine or perform exploration activities where Fresnillo has mining titles, i.e., it is an artificial entry barrier for having been created by the State.

On the other, a temporal barrier because if the exploration work in land under a mining concession to Fresnillo plc results in the discovery of a deposit, the possibility of exploiting it belongs only to the company when it best suits it during a period of 50 years, which can be further extended for the same period. This long time window functions as a subsoil reservation mechanism and allows the concessionaire to wait for high mineral quotes or favorable political conditions to exploit the lot as a producer, speculate on it as a reserve in the financial markets, or rent it to another company.

Both aspects imply the possibility (albeit only the possibility) that Fresnillo plc appropriates a surplus product fundamentally as differential income. Although, as a concessionaire, it does not own the subsoil, it is the only entity allowed to exploit its mineral richness. This is because mining deposits have four characteristics that make them heterogeneous goods susceptible to monopolization (Bartra, 2006):

A mineral deposit, like the rest of natural resources, is a good not produced by human labor.

Mineral deposits possess heterogeneous qualitative features: they have different mineralogy, ore concentration, abundance, depth, and topographic, hydrological, and climatic conditions.

They are not renewable resources and, therefore, neither is the availability of high-quality mineral areas, understanding that scarcity is relative to the social needs and technical capacities at the time.

They display an uneven geographic distribution relative to the processing sites (smelting and refining) and the centers that demand and consume the minerals, giving rise to divergent transportation costs.

Combined, these four elements make mineral deposits susceptible to monopolization under mining concessions. First, because no company can produce a deposit of silver or other metal in a factory or laboratory. Although a company can exploit deposits sharing similar physical features, these differ in access and, especially, geographic location, which is determined inevitably by the unique geological-tectonic evolution of each territory. Second, the obstacle for companies to exploit similar mining resources also arises from the artificial barrier just mentioned, which prevents one company from locating a mine or carrying out exploration activities in an area granted to another company under a mining concession. Therefore, a concession title confers a certain monopoly power to its holder based on the so-called “uniqueness of location” (Harvey, 2007, p. 85).

In this way, when the subsoil has exceptional geological and economic qualities, as happens in Fresnillo, the geographic and temporal barriers jointly represent a territorial strategy to create or maintain monopolistic powers that enable the appropriation of a differential income, of an extraordinary profit (i.e., a value not created but appropriated from other sectors of the economy), as well as the very existence of this rentier mining capital (Delgado, 2019).

In this sense, the monopoly on mining resources is another of the main reasons why Industrias Peñoles has requested an increasing number of hectares under concession in the municipality of Fresnillo, Zacatecas, Mexico, and even abroad. Thanks to this strategy, which does not exempt the financial speculation mentioned above, this mining company expanded its territorial control over exceptionally abundant deposits and their adjacent areas, as well as over areas with potential resources, described by Torres and Gasca (2006) as “on reserve spaces for subsequent accumulation of capital”. In this way, the company has excluded other mining corporations from sharing the benefits (current and possible) for a hundred years, thus obtaining an unparalleled advantage to compete in the national and global markets.

EFFECTS OF MONOPOLY CONTROL ON THE SUBSOIL

The monopoly of the subsoil through mining concessions has produced adverse effects. In the case of the municipality of Fresnillo, one of the main consequences is the meager transfer of resources to the government from mining exploitation under this concession-title scheme. Considering only the 19 titles corresponding to the Fresnillo, Saucito, and Juanicipio mines and assuming that the company paid a fee of US$7.8 per hectare under concession — a semi-annual payment corresponding to the maximum fee set for 2017 for titles more than 11 years old (SE, 2018) —, the result is that Fresnillo plc paid a total amount of US$548 323 that year for the exclusive exploitation of 34 997 hectares of municipal subsoil (Table 3).

Table 3 Active mining concession in the municipality of Fresnillo, 2017

| Title | Name | Area (hectares) | Annual payment (US dollars) |

| 218210 | Reyna IV | 17 866 | 279 920 |

| 226339 | Juanicipio I | 7 679 | 120 312 |

| 240468 | Reyna I Norte | 2 104 | 32 965 |

| 243814 | Reyna 1 Sur | 1 980 | 31 022 |

| 219389 | El Retaque | 1 680 | 26 322 |

| 205408 | Santa Cruz | 985 | 15 433 |

| 168272 | Unificación Proaño No. 1 | 488 | 7 646 |

| 168274 | Unificación Proaño No. 2 | 474 | 7 427 |

| 168277 | Apolo 9 | 350 | 5 484 |

| 188015 | Apolo 17 | 236 | 3 698 |

| 162960 | Santa Lucía | 225 | 3 525 |

| 168276 | Unificación Proaño No. 4 | 210 | 3 290 |

| 213239 | El Fierro | 191 | 2 993 |

| 216456 | Aránzazu | 140 | 2 193 |

| 243813 | Jarillas Oeste | 105 | 1 645 |

| 168275 | Unificación Proaño No. 3 | 103 | 1 614 |

| 188377 | Independencia | 91 | 1 426 |

| 168281 | El Manganeso | 65 | 1 018 |

| 163998 | La Milagrosa | 25 | 392 |

| Total | 34 997 | 548 323 | |

Source: Own elaboration based on SE (2018).

This figure represented 0.06% of the US$925.5 million in adjusted revenues reported for 2017 by Minera Fresnillo and Minera Saucito only (Minera Juanicipio started operations until 2022). Fresnillo plc defines these revenues, which are part of the differential income, as those “reported in the adjusted income statement to add the treatment and refining and coverage costs of gold, lead and zinc” (Fresnillo Plc, 2019: 16). This means that these two subsidiaries paid to the government an insignificant amount compared with the profits generated from subsoil exploitation. This finding is consistent with the report presented by the Superior Audit Office of the Federation (ASF, in Spanish) for the period 2008-2013, indicating that the amount paid by the mining companies for concessions represented 0.6% of the national mining production value (ASF, 2013).

As regards the resources allocated to the Fund for Sustainable Regional Development, the Secretariat of Agrarian, Territorial, and Urban Development indicates that the municipality of Fresnillo received US$6 306 295 in 2017 as part of the Special, Additional, and Extraordinary Rights payment (SEDATU, 2017). This amount paid by Fresnillo plc was again insignificant, accounting for 0.7% of the adjusted revenues that Minera Fresnillo and Minera Saucito reported together that same year.

Apart from other payments from mining companies to the government, the contributions of Fresnillo plc for the use of mining concessions only openly contradict the spirit of the Magna Carta: achieve rational exploitation and ensure an equitable distribution of the mining richness that, to date, continues under the direct rule of the Mexican State (Chamber of Deputies, 2012). The second effect of municipal subsoil control is the transformation of the use and landscape of the soil. The location of chimneys, ramps, beneficiation plants, workshops, tailings deposits, tepetateras, landfills, power stations, wastewater treatment plants, ecological parks, camps, and offices, which together cover an approximate area of 1 117 hectares,2 are facilities that require access to the land through purchase or rent.

In the case of Fresnillo, this land occupied by mining facilities geographically coincides with parts of the Saucito del Poleo-Belena and Valdecanas ejidos (Figure 8). The owners of the first ejido, after negotiations with the company following the discovery of the Saucito vein in the year 2000, transferred approximately 66 of the 2 985 hectares that make up their property, implying the disappearance of previous activities such as beans or peach cultivation. However, the entire subsoil in the ejido is concessioned to Fresnillo plc through the mining lots Reyna IV, Reyna 1 Sur, and Juanicipio 1. Likewise, the Valdecanas ejidatarios transferred the rights of at least 398 hectares of their agricultural land, first for the Minera Fresnillo expansion works and then for the construction of the facilities of the Saucito and Juanicipio mines. The 2 440 hectares that make up the Valdecañas ejido are also fully given in concession.

Source: Own elaboration based on SE (2018).

Figure 8 Social property and mining operations in the municipality of Fresnillo, 2019.

On the other hand, in the past decade, the landscape has been systematically modified, especially by the construction of mining waste deposits (tailings and tepetate). These facilities cover a total area of 419 hectares (30% of the 1 117 hectares occupied); 83% of this area has not been reforested or has no lining (Téllez, 2021).

In addition to the disappearance of agricultural land, these changes in the landscape generate a risk of physical and chemical instability, volatility of dam dusts, and undesirable waste runoff. This was evidenced on 6 December 2015, when the peasants of Saucito del Poleo-Belena confronted Minera Saucito for the spill of 386 tons of tailings containing hydrocyanic acid. This spill affected an agricultural area of 3 425 square meters of ejido land (Profepa, 2015). In other words, the mining occupation of the land has also caused social conflicts in Fresnillo, as in other parts of the country. Between 1996 and 2019, 173 mining conflicts were identified, of which 75% were related to land ownership and environmental issues (Sánchez, Casado, and Téllez, 2022).

CONCLUSIONS

This article identified the monopoly over large areas of the subsoil as one of the major causes of the territorial expansion associated with mining concessions granted to Industrias Peñoles. It showed that the increasing issuance of mining titles, not necessarily used for production currently, is a strategy followed by this company because it enables or protects the appropriation of an income based on the exclusive control of the subsoil.

Through this argument, it was first recognized that the expansion of the mining frontier would not have been possible without the legislative changes that took place in the 1990. It also showed that the geographic expansion of mining operations during the period 2000-2018 coincided with the availability of capital surpluses, which boosted its dynamics.

Secondly, the spatial analysis at the national scale exhibited the wide spatial distribution of gold and silver concessions and the geographic concentration of lots to extract iron and carboniferous minerals. The temporality and spatial evolution indicators at the company level revealed the hoarding of mining concessions by ten Mexican and foreign corporations. Altos Hornos de Mexico and Grupo Mexico stand out for concentrating 20% of the mining concession area in Mexico. Likewise, mapping lots and mines controlled by these companies showed the existence of a "tacit non-competition monopoly agreement".

Thirdly, this study showed that the territorial strategy followed by Industrias Peñoles is based on the monopoly control of the subsoil through the expansion of the concessioned area. In this way, as of 2018, the group controlled a total of 3.1 million hectares and even added mining concessions in South America.

Fourthly, the analysis at the municipal scale revealed that Industrias Peñoles controls 74% of the concessioned area in Fresnillo, while foreign companies control 22% of this area, although their lots are located far from the area currently operated by Fresnillo Plc.

The concepts of absolute and differential income were used to characterize the deposits as a good susceptible to monopolization through mining concessions. Based on this theoretical perspective, this study showed that one of the main forces that explain the expansive trend and dynamics of Industrias Peñoles is the fact that mining concessions represent a geographic barrier based on the uniqueness of the location and a temporal barrier based mainly on the centennial validity that characterizes the issuance of mining titles in Mexico.

A concession is no guarantee of discovering a deposit because it is only the first step in a process that requires years of fieldwork and exploration studies, as well as the development of access infrastructure, with no insurance of a return on investment. If concessions are issued in a massive way and without any regulation, it can lead to the monopoly of the subsoil. This is the case of Industrias Peñoles, a company that has used this territorial strategy to ensure the exclusive use of the mining reserves in the municipality of Fresnillo, either through direct exploitation or in the financial markets, and ensuring future access to mining resources by preventing the participation of potential competitors for a century. In other words, the corporation has strengthened the appropriation of a differential income, that is, of extraordinary profits that would not occur if the granting of the mining lots did not allow monopolization.

Finally, the multi-scale analysis of subsoil control by Industrias Peñoles allowed us to identify two major effects. On the one hand, the meager contribution of Fresnillo plc to the government as payment per hectare granted and as a contribution to the Fund for Sustainable Regional Development. This fact contradicts the constitutional principle of ensuring an equitable distribution of Mexico's richness. On the other hand, this study showed that the privatization of ejido land and the changes in the landscape (from agricultural to one characterized by huge deposits of mining wastes) have resulted in disputes over the territory.

A pending aspect for future research is to verify whether the monopoly on the subsoil is a recurrent practice by other Mexican or foreign companies or takes place irrespective of nationality. It also remains to be explored whether this phenomenon is unique to historic mines or also happens in the case of new mines or emerging mineral projects such as lithium, whose market is booming. Despite these constraints, the results exposed herein support recommending to amend the current mining law aiming to eliminate the monopolistic exploitation of mining resources and regulate the validity, extension, and location of mining concessions, as these elements directly impact the generation of social conflicts.

REFERENCES

Aquino Centeno, S. (2022). Experticias y juridificación comunitaria: defensa del subsuelo y tierras comunales en Oaxaca, México. Íconos. Revista de Ciencias Sociales, (72), 13-32. http://.doi.org/10.17141/iconos.72.2022.5022 [ Links ]

Auditoría Superior de la Federación (ASF) (2013). Informe del Resultado de la Fiscalización Superior de la Cuenta Pública 2014. Recuperado de https://www.asf.gob.mx/Trans/Informes/IR2013i/Documentos/Auditorias/2013_0370_a.pdf [ Links ]

Azamar, A. (2021). Perspectivas y análisis de la minería mexicana en el siglo XXI. En A. Azamar, L. Merino, C. Navarro y J. Peláez, Así se ve la minería en México (pp. 98-109). México: Universidad Nacional Autónoma de México, Secretaría de Desarrollo Institucional, Universidad Iberoamericana, Fundación Heinrich Böll. [ Links ]

Bartra, A. (2006). El capital en su laberinto: de la renta de la tierra a la renta de la vida. México: Universidad Autónoma de la Ciudad de México, Centro de Estudios para el Desarrollo Rural Sustentable y la Soberanía Alimentaria de la Cámara de Diputados, Editorial Ítaca. [ Links ]

Bastidas, L., Juárez, J., Ramírez, B. y Cesín, A. (2021). Percepción de los posibles efectos de la minería a cielo abierto y su impacto en la agricultura en Ixtacamaxtitlán, Puebla, México. Scripta Nova, 25(3), 33-53. http://.doi.org/10.1344/sn2021.25.32638 [ Links ]

Burnes, A. (2019). Zacatecas: más allá de Peñasquito. En M. Méndez, R. Olivares, J. Juárez y M. Pineda (Coords.), Tiempos y regiones. Historias de las sociedades rurales de México, siglos XVI al XXI (pp. 150-173). México: Universidad Autónoma de Tlaxcala, Facultad de Filosofía y Letras. [ Links ]

Cámara de Diputados (2012). Reglamento de la Ley Minera. México: Diario Oficial de la Federación. [ Links ]

Cámara Minera de México [CAMIMEX] (2021). Informe Anual 2020. México: LXXXIII Asamblea General Ordinaria. [ Links ]

Cravioto, F. (2019). La normatividad minera en México: problemas y propuestas de modificación. Nota informativa. México: Consejo Civil Mexicano para la Silvicultura Sostenible, A.C. [ Links ]

Delgado, R. (2019). Aterrizando el debate sobre la minería en América Latina. Observatorio del Desarrollo, 11(7), 58-61. [ Links ]

Ferry, E. (2020). ‘Deep in the earth a shining substance:’ sequestration and display in gold mining and central banks. Journal of Cultural Economy, 14(4), 416-434. http://.doi.org/10.1080/17530350.2020.1818603 [ Links ]

Foladori, G. y Melazzi, G. (2016). La economía de la Sociedad capitalista y sus crisis recurrentes. México: Universidad Autónoma de Zacatecas. [ Links ]

Fresnillo Plc (2019). Informe Anual. México: Fresnillo Plc. [ Links ]

Garza, M. y Moreno, J. (2021). La estructura de concesiones del sector minero en México: un estudio de concentración y competitividad. Innovaciones De Negocios, 18(35). http://.doi.org/10.29105/rinn18.35-3 [ Links ]

Geocomunes (2021). Concesiones mineras vigentes en México (2021). Recuperado de http://132.248.14.102/layers/CapaBase:concesiones_vigentes#more [ Links ]

GEOMIMET (2020). La entrevista. Ing. Fernando Alanís Ortega. Recuperado de https://www.revistageomimet.mx/2020/08/la-entrevista-4/ [ Links ]

Global Forest Watch (2019). Mining Concessions. Recuperado de https://www.globalforestwatch.org/ [ Links ]

Guzmán, F. (2013). Rostros del despojo en Zacatecas. Observatorio del Desarrollo , 2(6), 49-53. [ Links ]

Harvey, D. (2007). El Nuevo Imperialismo. Madrid: Akal. [ Links ]

Industrias Peñoles (2020). Reporte anual 2019. México: Bolsa Mexicana de Valores. [ Links ]

Lamberti, M. (2016). Almaden Minerals LTD. (TSX: AMM). Informe de investigación empresarial para evaluación de impacto en derechos humanos. México: Proyecto sobre Organización, Desarrollo, Educación e Investigación. [ Links ]

Montoya, A., Sieder, R. y Bravo-Espinosa, Y. (2021). Juridificación multiescalar frente a la industria minera: experiencias de Centroamérica y México. Íconos, 72, 57-78. http://.doi.org/10.17141/iconos.72.2022.5038 [ Links ]

Núñez, V. (2022). La batalla por el litio en México. México: Entretejas. [ Links ]

Peláez, J. y Merino, L. (2021). ¡Cambiar la Ley Minera ya! Hacia un nuevo marco regulatorio minero. En A. Azamar, L. Merino, C. Navarro y J. Peláez, Así se ve la minería en México (pp. 98-109). México: Universidad Nacional Autónoma de México, Secretaría de Desarrollo Institucional, Universidad Iberoamericana, Fundación Heinrich Böll . [ Links ]

Procuraduría Federal de Protección al Ambiente (Profepa) (2015). Minera Saucito reportó inicialmente 450 ton. de jales derramados y superficie afectada de 10 mil m2: Profepa. Recuperado de https://www.profepa.gob.mx/innovaportal/v/7844/1/mx/minera_saucito_reporto_inicialmente_450_ton_de_jales_derramados_y_superficie_afectada_de_10_mil_m2:_profepa.html [ Links ]

Revista Expansión (2019). Las 500 empresas más importantes de México, 2018. Expansión, 1(192), 250-271. [ Links ]

Rodríguez, C. (2017). Despojo para la acumulación. Un análisis de los procesos de acumulación y sus modelos de despojo. Bajo el Volcán, 17(26), 41-63. [ Links ]

Sánchez, M. T., Casado, J. y Téllez, I. (2022). Mapa 10.2.1 Conflictos entre empresas mineras y comunidades locales según tipo de conflicto y tipo de minado, 1996-2019. En M. T. Sánchez (Coord.), Atlas de la minería en México. México: Instituto de Geografía, UNAM. [ Links ]

Secretaría de Desarrollo Agrario, Territorial y Urbano (SEDATU) (2017). Fondo Minero. Distribución por Estados y Municipios 2017. Recuperado de https://www.gob.mx/sedatu/documentos/fondo-minero-distribucion-por-estados-y-municipios-2017 [ Links ]

Secretaría de Economía [SE] (2018). Base de datos de concesiones mineras. Recuperado de https://www.datos.gob.mx/busca/dataset/listado-de-titulos-de-concesiones-mineras [ Links ]

Servicio Geológico Mexicano [SGM] (2019). Anuario estadístico de la minería mexicana, 2018 (Edición 2019). México: Servicio Geológico Mexicano. [ Links ]

Téllez, I. (2020). La vigencia del concepto de acumulación originaria de capital en el siglo xxi. Aportaciones desde México. Pacarina del Sur, 11 (42). Recuperado de http://pacarinadelsur.com/home/abordajes-y-contiendas/1826-la-vigencia-del-concepto-de-acumulacion-originaria-de-capital-en-el-siglo-xxi-aportaciones-desde-mexico [ Links ]

Téllez, I. (2021). La gran minería y la reorganización espacial del Distrito Minero de Fresnillo, Zacatecas (1975-2018). Tesis Doctoral. Posgrado en Geografía, UNAM. [ Links ]

Téllez, I. y Sánchez, M. T. (2022). Financiarización y nueva geografía minera de oro en las inmediaciones de la Zona Arqueológica de Xochicalco, Morelos - México. Cuadernos de Geografía: Revista Colombiana de Geografía, 31(1), 146-163. https://doi.org/10.15446/rcdg.v31n1.85852 [ Links ]

Torres, F. y Gasca, J. (2006). Los espacios de reserva en la expansión global del capital: el sur-sureste mexicano de cara al Plan Puebla-Panamá. México: Universidad Autónoma de México, Instituto de Investigaciones Económicas, Facultad de Economía, Instituto de Geografía Plaza y Valdés. [ Links ]

Transparencia Mexicana (2020). Riesgos de corrupción en el otorgamiento de concesiones mineras en México. Recuperado de https://www.tm.org.mx/riesgosenconcesionesmineras/ [ Links ]

Unión de Científicos Comprometidos con la Sociedad [UCCS] (2016). Minería en Chiapas. (Boletín 1). Recuperado de https://www.biodiversidadla.org/content/download/128770/1006969/file/Bolet%C3%ADn+Miner%C3%ADa+en+Chiapas.pdf [ Links ]

Vargas, G. y Martínez, K. (2019). Formas de competencia e innovación en el mercado de cobre en México. El caso del Grupo México. En J. Basave (Coord.). Grandes empresas en México: reproducción de capital, internacionalización y poder (pp. 181-234). México: Instituto de Investigaciones Económicas, UNAM. [ Links ]

Wanderley, L. (2017). Do Boom ao Pós-Boom das commodities: o comportamento do setor mineral no Brasil. Versos-Textos para Discussão PoEMAS, 1(1), 1-7. [ Links ]

1The Mexican companies listed in 2018 were Grupo Mexico, Industrias Peñoles, Altos Hornos de Mexico, Fresnillo Plc, Minera Frisco, and Minera Autlán. The foreigners were Newmont Goldcorp, Agnico Gold, Pan American Silver, Coeur, First Majestic, Torex Gold, Agnico Eagle, Alamos Gold, and Fortuna Silver.

Received: October 11, 2022; Accepted: November 14, 2022; Published: February 10, 2023

text in

text in