Introduction

One of the barriers still faced by the International Accounting Standards Board (IASB) in its efforts to converge global accounting standards is the existence of alternative presentation, recognition, measurement and disclosure practices. While flexibility in accounting choice allows companies to represent events and transactions more faithfully, it also affects the comparability of the information disclosed.

IAS 7 (IASB, 2010) allows some items in the Statement of Cash Flows (SCF) to be classified under different subgroups. This subjectivity can result in adjustments to economic reality or simply the company preference. It also gives rise to the possibility of accounting choice with respect to these items. If the goal of IASB was to segregate the amounts paid or received by a company into operating, financing or investing categories, then this goal implies that segregation is important for user decisions. If not, input and output values would simply be listed, for example, in alphabetical order or by relevance, or even by whatever model a company deemed appropriate. Therefore, to be useful, it is assumed that cash flow values from operating activities must be comparable among companies.

According to IAS 7 (2010), Statement of Cash Flows help increase the comparability of business performance by decreasing the use of different accounting criteria for the same transactions and events. Furthermore, according to IAS 07, one of the main improvements provided by the SCF is increased comparability among different companies regarding the presentation of operating performance. Macedo, Machado, Murcia, and Machado (2011) states that the options allowed by IAS 7 (2010) hinder comparability among companies facilitate cash flows management and consequently affect the relevance of accounting information for decision-making.

The convergence of Brazilian accounting standards with International Financial Reporting Standards (IFRS) in 2010 was an important milestone in Brazilian accounting. IASB should examine the remaining choices in IFRS in order to make financial statements truly comparable. Accounting choice allows more faithful representations of accounting facts, but also allows greater discretion. One of the accounting choices still allowed in IFRS is the ability to classify items in the SCF.

Given these facts and a desire to contribute to this discussion, our objective is to identify the level of comparability in the accounting choices of Brazilian companies in their statements of cash flows and to identify the factors that might explain these choices. We selected a sample of 354 Brazilian public companies with shares traded on the BM&FBOVESPA from 2010 to 2015 and analyzed accounting choices related to the disclosure of the following SCF items: interest expense, interest income, income tax and social contribution on net income, dividends and interest on own capital (IOOC) received and dividends and IOOC paid. After identifying these choices, the Herfindahl index (H index) was calculated to determine the degree of comparability among the choices made by the companies in the sample. Statistical tests were used to determine whether company size, indebtedness, profitability, growth opportunities and negative operating cash flows affected the choices made by companies in the disclosure of the previously mentioned SCF items.

The importance of this study stems mainly from the desire to understand the decisions taken by managers regarding the classification of SCF items and the consequential impacts on comparability within our sample of Brazilian companies. These results may be useful for investors, managers, and in standardized analyses of the impacts of the choices allowed in the accounting regulations regarding the disclosure of SCF items. Silva, Martins, and Lima (2014) identified the factors that affect the accounting choices selected by 107 Brazilian companies listed in 2010 in one segment of the BM&FBovespa regarding the disclosure of interest expense, income, dividends and interest on own capital in the Statement of Cash Flows. The period (2010 a 2015) and sample (354 companies) were widened in this study to more robustly evaluate changes in accounting practices over six years.

After this introduction, the paper will present the theoretical reference for the study. The third section will then describe the methods used to carry out the study, the fourth section will present results and the fifth section will present final considerations.

Review of the literature

Statement of Cash Flows

According to Ernst and Young (2009), the SCF is important because it helps users identify the value of an entity through projections of its future cash flows and its ability to create and circulate cash and cash equivalents. The purpose of SCF is to provide important information about the cash receipts and payments of a company during a given period. This information in turn sheds light on the company’s capacity to generate cash and cash equivalents and its needs for the utilization of these cash flows. The idea of cash in this sense has been widened to include bank deposits and cash equivalents that are defined as short-term investments with low risk and high liquidity (Iudícibus, Martins, Gelbcke, and Santos, 2010).

According to IAS 7 (2010), the SCF should be divided into three sections: operating, investing and financing activities. Operating activities provide the main source of income for a company and are usually derived from operations that define profits or losses. Investing activities are related to the purchase and sale of long-term assets and other investments not included in cash equivalents. Financing activities result from changes in the equity composition, size and the indebtedness of a company.

IAS 7 (2010) states that cash flows related to interest, dividends and interest on own capital paid and dividends and interest on own capital received must be disclosed separately and presented consistently under investing, financing or operating activities. IAS 7 (2010) also states that cash flows related to income tax and social contribution on net income should be presented separately and classified within the operating group. Nevertheless, it is still also possible to associate these cash flows with other activities (investment or financing). Table 1 shows the classification possibilities (primary and alternative) for SCF items according to IAS 7. The IASB strongly encourages primary classification for these items, but if practicable, the alternative classification may be adopted as long as an explanatory note indicates it.

Table 1 Accounting Choices in SCF

| Item | Primary Classification | Alternative |

| Interest Income | Operating | Investing |

| Interest Expense | Operating | Financing |

| Income Tax and Social Contribution on Net Income | Operating | Investing/Financing |

| Dividends and Interest on Own Capital Received | Operating | Investing |

| Dividends and Interest on Own Capital Paid | Financing | Operating |

Source: Prepared for IAS 7 (2010)

IASB has made significant advances in global convergence to its standards over the last fifteen years. However, the choice within SCF is still a point that deserves further consideration. Cash flows from operating activities are an important indicator of business performance. Comparison with other companies is an important step in evaluating a business. Thus, specifically regarding the comparability of information generated by the SCF, and despite the concept underlying comparability that different things look different, the effort required to compare such different classifications needs to be evaluated. Identifying the extent that these classification possibilities are reflected in the cash flows management of a company is fundamental to the present study.

Thus, considering the IASB’s strong incentive for companies to classify the items presented in Table 1 according to primary classification, the first research hypothesis is:

H1- Brazilian public companies classify the accounting choices in SCF in the primary classifications suggested by the IASB.

Comparability and Accounting Choice

According to Niyama and Silva (2011), comparability refers to the ability of users to compare the financial reports of different companies and at different times. For Barth (2013), comparability is a qualitative characteristic that enables users to identify and understand the differences and similarities among items. This author asserts that comparability should permit that equal things appear equal and different things appear different.

IASB’s efforts to achieve comparability have been praised in the accounting literature. However, many authors consider that the ideal of comparability set by IASB will not be achieved because of barriers related to translation, partial amendment of rules by some countries for cultural and economic reasons and the existence of intrinsic choices, even when clear options are eliminated (Zhang & Andrew, 2010; Durocher & Gendron, 2011; Nobes, 2013).

The fundamental qualitative characteristics of Conceptual Framework of Financial Reporting (IASB, 2010) are relevance and faithful representation. Comparability is one of the four qualitative characteristics of improvements. The other characteristics are verifiability, timeliness and responsiveness. These features enhance the efficiency and reliable presentation of relevant information. The number of choices allowed by the IASB in IFRSs can increase the faithful representation of economic transactions, thus improving the quality of accounting information. On the other hand, accounting choices can reduce the comparability of financial statements.

According to Fields, Lys, and Vincent (2001), accounting choice refers to any decision in which the main objective is to generally influence the results of accounting, which consequently enables choice of accounting policies regarding measurement, recognition and disclosure criteria.

Cole, Branson, and Breesch (2011) state that there are three types of choices in IFRS: 1) Clear (Over options), 2) Disguised and vague criteria (Cover options) and 3) Estimates and judgments. Clear choices or Over options include the possibility of classifying interest income as operating cash flows or investment cash flows, presenting SCF by direct or indirect methods and classifying dividends and interest on own capital paid in financing cash flows or operating cash flows. The Disguised and Vague criteria or cover options include cases for determining functional currency based on various criteria, recording losses with impairment based on distinct criteria and recognition based on the likelihood of loss for provisions and contingent liabilities. The third group refers to estimates (e.g. useful life, depreciation rate and the recoverable amount of an asset).

Souza, Silva, and Costa (2013) determined whether the recognition and measurement of accounting choices in IAS 38 - Intangible Assets permitted comparability of the intangible assets of publicly traded companies. The research sample consisted of entities belonging to the oil and gas and electricity industry in Brazil from 2010 to 2012. The Herfindahl index (H index) was used to measure the comparability of these accounting choices. The results indicated that, in relation to intangible assets, financial statements had an average degree of comparability that was likely to decrease over the years.

Lemes, Costa, and Martins (2014) determined comparability in recognizing fixed assets before, during and after convergence to IFRS. The sample consisted of 63 Brazilian companies traded on Ibovespa in 2014. The analysis was based on the Herfindahl index (H index) and the results showed low comparability among the choices used by companies for initial and subsequent recognition of fixed assets.

Despite IASB efforts, the existence of accounting practices still significantly undermines the comparability of accounting information in certain areas (Lemes, Costa, & Martins, 2014). Thus, considering the efforts of the IASB to improve the comparability of accounting information and considering the IASB’s strong incentive for companies to classify the accounting choices in SCF according to primary classification (see Table 1), the second research hypothesis is:

H2- The index of comparability of the accounting choices related to the classification of items in the SCF of Brazilian public companies increases over time.

Silva, Martins, and Lima (2014, p. 2) consider that “the most important of the researches in accounting choices is the search for the understanding of its determining factors, that is, its motivations and economic consequences”. In this sense, this research seeks to identify the factors that explain the accounting choices in SCF.

Gordon, Henry, Jorgensen, and Linthicum (2017) analyzed companies from 13 European countries that adopted the IFRS from 2005 and indicated that three factors (financial situation, capital market incentives and indebtedness) were related to the cash flows classification of the sample companies (choice of classifications that increase operating cash flows). Profitability was not related to this classification. These authors conclude that companies with financial difficulties are motivated to report higher operating cash flow because this is an important measure in credit and risk assessment. Operating activities are the main revenue generating activities. The greater the capacity to generate operating cash flows, the greater the capacity to pay. In addition, more indebted companies with higher debt renegotiation costs also tend to report higher operating cash flows.

Baik, Cho, Choi, and Lee (2016) examined the determinants and economic consequences of the changes in the classification of interest paid in the Statement of Cash Flows and companies that have adopted IFRS in Korea. These authors found that firms with high leverage, large firms and those that are accompanied by a few analysts tend to shift interest payments from operating cash flows to funding streams, thus increasing total operating cash flows. They also considered growth opportunities, represented by the book-to-price index, as high growth companies require high investments and then have a strong incentive to maintain high cash flows to attract capital providers.

Lee (2012) warns that cash flow management can be managed by classifying flows between activities (operating, investing and financing) and timing, such as delaying payments to suppliers or anticipating customer receipts. This author identified four characteristics of companies related to incentives to increase operating cash flows: (1) financial difficulties, (2) long-term credit rating near the cut-off point of the investment / non-investment category, (3) existence of analysts’ cash flow forecasts, and (4) greater associations between stock returns and cash from operating activities.

Quagli and Avallone (2010) used logistic regression to test the ‘accounting choice theory’ in the measurement of investment properties under the scope of IAS 40, which allows the fair value or cost option to evaluate such assets. These authors have worked with companies from seven European countries and the most significant results they found are that size as a proxy for political costs reduces the probability of using fair value while the market-to-book relationship is negatively associated with the choice of fair value. On the other hand, leverage, a typical proxy for hiring costs, does not seem to influence choice.

Silva, Martins, and Lima (2014) investigated the accounting choices made by Brazilian companies in the SCF and the factors that could explain these choices. Their sample consisted of 107 companies listed in 2010 on the Novo Mercado of the BM&FBovespa. The results indicate that there are indications that the sample companies with more growth opportunities chose to classify interest paid on the cash flows of financing activities, maximizing the operating cash flows.

Martinez, Martinez, and Diazaraque (2011) examined, through logistic regressions, the annual reports of companies listed in Spain, which adopted IFRS in 2005, and related the choices of accounting practices to institutional characteristics such as sector, indebtedness, international markets, return on shareholders’ equity, size and big four. These authors found a relationship between the accounting practice choices and the sector, size, profitability and type of company audit.

In view of the foregoing, profitable and more indebted companies with negative operating cash flows opt for classifications that allow reporting greater cash flows from operations (Gordon et al., 2017). In addition, larger firms and those with more book-to-market opportunities also make choices that increase the cash flows from operating activities (Baik et al., 2016). Thus, five other hypotheses were tested in this research to identify the factors that affect SCF accounting choices:

H3 - Larger public companies are more likely to make choices that increase operating cash flows.

H4 - Public companies with greater indebtedness are more likely to make choices that increase operating cash flows.

H5 - Public companies with greater profitability are more likely to make choices that increase operating cash flows.

H6 - Public Companies that have more growth opportunities are more likely to make choices that increase operating cash flows.

H7 - Public companies with negative operating cash flow are more likely to make choices that increase operating cash flows.

Methodology and data

The research sample consisted of Brazilian public companies listed on BM&FBOVESPA from 2010 to 2015, except those in the finance and insurance industries and companies with missing dates of the operating cash flows (Table 2). Financial and insurance companies were excluded because their classification of interest is distinct from that of companies in other industries. Thus, the valid sample size was 354 Brazilian public companies. The financial statements of these companies were obtained from the Brazilian Securities Commission (CVM - Comissão de Valores Mobiliários) website.

Table 2 Sample Composition

| Description | Companies |

| Initial Sample | 593 |

| (-) Companies from finance and insurance industries | (110) |

| Missing dates of the operating cash flows | (129) |

| Final Sample | 354 |

Data collection involved the identification of the classification for the following five items in the Statement of Cash Flows of the sample companies: interest income (II), interest expense (IE), income tax and social contribution on net income, (ITC) dividends and interest on own capital received (DIR) and dividends and interest on own capital paid (DIP). Table 1 shows the choices analyzed in data collection. Each of these items could be classified in operating (O), investment (I) or financing (F) cash flows. In addition, three other classifications were included in the research: not mentioned (NM), mixed (M) and not applicable (NA). The option ‘not mentioned’ was recorded when an item was recognized in the balance sheet, income statement or notes, but was unrecognizable in the SCF. The option ‘not applicable’ was noted when one of the itens was not mentioned in the SCF, balance sheet, income statement or notes. The mixed option was used to group companies that chose more than one rating for the same accounting practice, which is not allowed by the nomenclature used or the notes disclosed by the company.

After collecting the classifications of the items in the SCF, the Herfindahl index (H index) was used to calculate comparability. The H index is an accumulated index that is calculated from the relative frequency of comparison between alternatives and the same alternatives (Tas, 1988). The H index was chosen because of its applicability to the five possible SCF accounting choices considered by the present study. Thus, the data collected from the financial reports was compared among all sample companies to determine the degree of comparability. Equation 1 shows the Van Der Tas (Tas, 1988) formula for the H index:

Here H represents the Herfindahl index, n is the number of alternative accounting methods and pi is the relative frequency of accounting method i. H varies from 0 (no harmony, with an infinite number of alternative methods having the same frequency) to 1 (all companies using the same method) (Tas, 1988).

The H index uses all the elements introduced in this equation to generate a value that represents the level of comparability of the practices evaluated. Lemes, Costa, and Martins (2014) state that researchers must use judgment to interpret this comparability value as high, moderate or low. Taplin (2011) highlights the difficulty of evaluating harmony due to the lack of benchmarks, but notes that this criticism extends to all indices and statistical summaries. The author cites the traditional benchmark for the p-value (0.05). This value is accepted by convention but not universally accepted as appropriate in all areas. Table 3 summarizes some of the parameters used to classify comparability.

Table 3 Degree of Comparability

| Study | High/ Considerable | Moderate/ Some | Low/ Little |

| Ali, Ahmed and Henry (2006) | Index>0.8 | 0.6 <Index< 0.8 | Index<0.6 |

| Parker and Morris (2001) | Index>0.9 | 0.75 <Index< 0.9 | Index<0.75 |

Source: Taplin (2011) cited by Lemes, Costa and Martins (2014)

As in the Taplin (2011) study, we adopted the Ali, Ahmed, and Henry (2006) classifications to determine the degree of comparability of the SCF accounting choices.

In addition, statistical analyses were performed to identify the factors that affect the classification choices of the items analyzed in this study. First, statistical analysis consisted of the mean differences test for two independent samples. Then, logistic regression was used to test the hypotheses of the study. Equation 2 shows the model used in this study that was first specified by Silva, Martins, and Lima (2014) and based on research by Lee (2012), Gordon et al. (2017) and Baik et al. (2016).

The CLAS variable represents the classification of items in SCF (1 when the company classified the items described in Table 1 according to the first classification suggested by the IASB; 0 otherwise). The first classification suggested by the IASB was also presented in Table 1. SIZE represents the size of a company measured by the logarithm of total assets in reais (BR$). IND is indebtedness measured by the ratio of total liabilities to total capital. ROE symbolizes return on equity as measured by net income divided by shareholder equity and is a proxy for the company’s profitability. NOPC is negative operating cash flows, dummy 1 if the company had negative operating cash flows and 0 otherwise. BP refers to book-to-price or growth opportunities, which is the calculated market price of the share divided by the book value per share.

It is expected that larger firms, companies with negative operating cash flows, greater indebtedness, greater profitability and more growth opportunities will tend to choose classifications that increase operating cash flows. Thus, the expectation is that companies with these characteristics prefer to classify interest and dividends paid from financing activities rather than operating activities and also prefer to classify interest and dividends received under operating activities and not investing activities. It is also expected that these companies would prefer to classify the payment of income tax and social contributions on net income from financing activities or investment rather than operating activities.

Thus, the expected signals for the variables of Equation 2 are presented in Table 4. When the variable CLASS is represented by the choices related to Interest Income (II), the expected signal for the five independent variables is positive. In other words, larger, more indebted, more profitable companies with higher book-to-market and negative operations cash flows choose to classify item II in the operations cash flows, increasing this flows. The positive sign is also expected for the five independent variables when the dependent variable is Dividends and Interest on Own Capital Received (DIR).

Table 4 Signals expected for the variables of Equation 2

| Coefficient | Dependent Variable | ||||

| II | IE | ITC | DIR | DIP | |

| β1 | + | - | - | + | + |

| β2 | + | - | - | + | + |

| β3 | + | - | - | + | + |

| β4 | + | - | - | + | + |

| β5 | + | - | - | + | + |

Notes: II = Interest Income; IE = Interest Expense; ITC = Income Tax and Social contribution on net income; DIR= Dividends and Interest on own Capital Received; DIP = Dividends and Interest on own Capital Paid.

When the dependent variables are Interest Expense (IE) and Income Tax and Social Contribution on Net Income (ITC), the expected signal for the five independent variables is negative. Considering that the classification of these items into the cash flows of operations would reduce this flows, companies are expected to classify these items into another flows (investment, financing, or otherwise).

The dependent variable Dividends and Interest on Own Capital Paid (DIP) has a value of 1 when the company classifies this item in the financing cash flows (primary classification) and 0 otherwise. Thus, the positive sign of the five independent variables indicates that companies are classifying the DIP item in financing activities, which increases the cash flows of operations.

Data analysis

Table 5 shows the choices made by the publicly traded sample companies regarding the classification related to SCF items. Most of the sample companies (282 companies or 80%) did ‘not mention’ (NM) in the notes or in the SCF the classification of interest income (II) in 2010. This behavior was repeated in every year of the study. Few Brazilian public companies (around 3%) have classified interest income in the cash flows of operations as suggested by the IASB as the primary classification.

Table 5 Accounting Choices Classification

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Total | |||||||||

| Interest Income(II) | |||||||||||||||

| O | 12 | 3% | 13 | 4% | 9 | 3% | 10 | 3% | 8 | 2% | 9 | 3% | 61 | 3% | |

| I | 3 | 1% | 3 | 1% | 5 | 1% | 3 | 1% | 2 | 1% | 3 | 1% | 19 | 1% | |

| F | 2 | 1% | 2 | 1% | 3 | 1% | 3 | 1% | 3 | 1% | 3 | 1% | 16 | 1% | |

| NM | 282 | 80% | 287 | 81% | 298 | 84% | 298 | 84% | 302 | 85% | 299 | 84% | 1,766 | 83% | |

| M | - | 0% | - | 0% | - | 0% | 1 | 0% | 1 | 0% | 1 | 0% | 3 | 0% | |

| NA | 55 | 16% | 49 | 14% | 39 | 11% | 39 | 11% | 38 | 11% | 39 | 11% | 259 | 12% | |

| Total | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 2,124 | 100% | |

| Interest Expense(IE) | |||||||||||||||

| O | 104 | 29% | 111 | 31% | 125 | 35% | 125 | 35% | 126 | 36% | 136 | 38% | 727 | 34% | |

| I | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | |

| F | 77 | 22% | 76 | 21% | 86 | 24% | 90 | 25% | 95 | 27% | 95 | 27% | 519 | 24% | |

| NM | 123 | 35% | 119 | 34% | 102 | 29% | 100 | 28% | 93 | 26% | 84 | 24% | 621 | 29% | |

| M | 5 | 1% | 4 | 1% | 2 | 1% | 2 | 1% | 3 | 1% | 1 | 0% | 17 | 1% | |

| NA | 45 | 13% | 44 | 12% | 39 | 11% | 37 | 10% | 37 | 10% | 38 | 11% | 240 | 11% | |

| Total | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 2,124 | 100% | |

| Income Taxand Social Contribution on Net Income(ITC) | |||||||||||||||

| O | 128 | 36% | 151 | 43% | 175 | 49% | 179 | 51% | 188 | 53% | 196 | 55% | 1,017 | 48% | |

| I | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | |

| F | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | - | 0% | |

| NM | 168 | 47% | 146 | 41% | 122 | 34% | 119 | 34% | 112 | 32% | 98 | 28% | 765 | 36% | |

| M | 3 | 1% | 3 | 1% | 2 | 1% | 3 | 1% | 1% | 0% | 1 | 0% | 13 | 1% | |

| NA | 55 | 16% | 54 | 15% | 55 | 16% | 53 | 15% | 53 | 15% | 59 | 17% | 329 | 15% | |

| Total | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 2,124 | 100% | |

| DividendsandInterestonOwnCapitalReceived(DIR) | |||||||||||||||

| O | 36 | 10% | 44 | 12% | 44 | 12% | 52 | 15% | 48 | 14% | 45 | 13% | 269 | 13% | |

| I | 76 | 21% | 82 | 23% | 94 | 27% | 102 | 29% | 95 | 27% | 101 | 29% | 550 | 26% | |

| F | 10 | 3% | 9 | 3% | 4 | 1% | 3 | 1% | 5 | 1% | 8 | 2% | 39 | 2% | |

| NM | 27 | 8% | 19 | 5% | 15 | 4% | 16 | 5% | 15 | 4% | 16 | 5% | 108 | 5% | |

| M | - | 0% | - | 0% | 1 | 0% | 1 | 0% | 1 | 0% | - | 0% | 3 | 0% | |

| NA | 205 | 58% | 200 | 56% | 196 | 55% | 180 | 51% | 190 | 54% | 184 | 52% | 1,155 | 54% | |

| Total | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 2,124 | 100% | |

| DividendsandInterestonOwnCapitalPaid(DIP) | |||||||||||||||

| O | 2 | 1% | 1 | 0% | 2 | 1% | 4 | 1% | 4 | 1% | 5 | 1% | 18 | 1% | |

| I | - | 0% | - | 0% | - | 0% | - | 0% | 1 | 0% | - | 0% | 1 | 0% | |

| F | 238 | 67% | 233 | 66% | 235 | 66% | 235 | 66% | 232 | 66% | 227 | 64% | 1,400 | 66% | |

| NM | 17 | 5% | 20 | 6% | 19 | 5% | 17 | 5% | 16 | 5% | 14 | 4% | 103 | 5% | |

| M | 4 | 1% | 3 | 1% | 4 | 1% | 2 | 1% | 3 | 1% | 2 | 1% | 18 | 1% | |

| NA | 93 | 26% | 97 | 27% | 94 | 27% | 96 | 27% | 98 | 28% | 106 | 30% | 584 | 27% | |

| Total | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 354 | 100% | 2,124 | 100% | |

| Overall | |||||||||||||||

| O | 282 | 16% | 320 | 18% | 355 | 20% | 370 | 21% | 374 | 21% | 391 | 22% | 2,092 | 20% | |

| I | 79 | 4% | 85 | 5% | 99 | 6% | 105 | 6% | 98 | 6% | 104 | 6% | 570 | 5% | |

| F | 327 | 18% | 320 | 18% | 328 | 19% | 331 | 19% | 335 | 19% | 333 | 19% | 1,974 | 19% | |

| NM | 617 | 35% | 591 | 33% | 556 | 31% | 550 | 31% | 538 | 30% | 511 | 29% | 3,363 | 32% | |

| M | 12 | 1% | 10 | 1% | 9 | 1% | 9 | 1% | 9 | 1% | 5 | 0% | 54 | 1% | |

| NA | 453 | 26% | 444 | 25% | 423 | 24% | 405 | 23% | 416 | 24% | 426 | 24% | 2,567 | 24% | |

| Total | 1,770 | 100% | 1,770 | 100% | 1,770 | 100% | 1,770 | 100% | 1,770 | 100% | 1,770 | 100% | 10,620 | 100% | |

Notes: O = Operating cash flows; I = Investing cash flows; F = Financing cash flows; NM = Not Mentioned; M = Mixed; NA = not applicableost companies chose to classify interest expense (IE) in 2010 under operating activities (104 companies - or 29%) and financing (77 companies - or 22%) (Table 5). This result differed from the findings of Silva, Martins, and Lima (2014) where most of the companies in the segment of BM&FBOVESPA entitled “Novo Mercado” (54%) classified interest expense under financing cash flows. Sample size may be the reason for the differen ce in results. The sample of Silva, Martins, and Lima (2014) is composed of only 107 companies. In addition, it is ob served that the percentage of companies that classified interest expense on operating and financing activities increased throughout the period, while the number of companies that did not mention (NM) the classification decreased during the same time (35% in 2010 and 24% in 2015).

The classification of Income Tax and Social Contribution on Net Income (ITC) was also reported under operating cash flows (36% in 2010 e 55% in 2015), as recommended in IAS 7 (2010) (Table 5). Next to it, despite a high number of companies that did not mention (NM) the classification of this item, this percentage has been reducing over the period (47% in 2010 e 28% in 2015),

Most companies chose to classify dividends and interest on own capital received (DIR) under investment cash flows (29% in 2015), contradicting IAS 7 (2010), which recommended operating cash flow for this classification (Table 5). Most statements classified dividends and interest on own capital paid (DIP) under financing cash flows (64% in 2015), similar to the findings of Silva, Martins, and Lima (2014) and as suggested by the IASB as the primary classification.

Of the total number of companies disclosing the classification of items in the SCF, most classified the items as income, interest expense, income tax and social contribution on net income in operating activities as suggested by the IASB as the primary classification. In addition, most companies classified the item dividends and interest on own capital paid as a financing activity, as also recommended by the IASB. Thus, the H1 hypothesis that Brazilian public companies classify the accounting choices in SCF in the primary classifications suggested by the IASB can be accepted for items II, IE, ITC and DIP.

On the other hand, most of the companies in the sample did not follow the IASB’s recommendation to classify dividends and interest on own capital received in the cash flows of operations, classifying this item in the investment cash flows. This did not allow the hypothesis H1.

It is important to note the significant number of companies that did not disclose (not mentioned) the classification of the items analyzed in this study of SCF. This fact may suggest poor quality of the information disclosed.

From the data in Table 5, it was possible to calculate the H index (Equation 1). These H indexes were then used to determine the degree of comparability of the choices of SCF (Table 6). For this calculation, the companies that did not mention the items analyzed in this research of the balance sheet, income statement, notes or the SCF (not applicable - NA - Table 5) were not considered.

Table 6 Comparability level calculated using the H index

| AC | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | GCI | |||||||||||||||

| n | RF | HI | n | RF | HI | n | RF | HI | n | RF | HI | n | RF | HI | n | RF | HI | n | RF | HI | ||

| II | ||||||||||||||||||||||

| O | 12 | 0.04 | 13 | 0.04 | 9 | 0.03 | 10 | 0.03 | 8 | 0.03 | 9 | 0.03 | 61 | 0.03 | ||||||||

| I | 3 | 0.01 | 3 | 0.01 | 5 | 0.02 | 3 | 0.01 | 2 | 0.01 | 3 | 0.01 | 19 | 0.01 | ||||||||

| F | 2 | 0.01 | 0.89 | 2 | 0.01 | 0.89 | 3 | 0.01 | 0.90 | 3 | 0.01 | 0.90 | 3 | 0.01 | 0.91 | 3 | 0.01 | 0.90 | 16 | 0.01 | 0.90 | |

| NM | 282 | 0.94 | 287 | 0.94 | 298 | 0.95 | 298 | 0.95 | 302 | 0.96 | 299 | 0.95 | 1,766 | 0.95 | ||||||||

| M | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 1 | 0.00 | 1 | 0.00 | 1 | 0.00 | 3 | 0.00 | ||||||||

| T | 299 | 1.00 | 305 | 1.00 | 315 | 1.00 | 315 | 1.00 | 316 | 1.00 | 315 | 1.00 | 1,865 | 1.00 | ||||||||

| IE | ||||||||||||||||||||||

| O | 104 | 0.34 | 111 | 0.36 | 125 | 0.40 | 125 | 0.39 | 126 | 0.40 | 136 | 0.43 | 727 | 0.39 | ||||||||

| I | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | - | 0.00 | ||||||||

| F | 77 | 0.25 | 0.33 | 76 | 0.25 | 0.34 | 86 | 0.27 | 0.34 | 90 | 0.28 | 0.34 | 95 | 0.30 | 0.33 | 95 | 0.30 | 0.35 | 519 | 0.28 | 0.33 | |

| NM | 123 | 0.40 | 119 | 0.38 | 102 | 0.32 | 100 | 0.32 | 93 | 0.29 | 84 | 0.27 | 621 | 0.33 | ||||||||

| M | 5 | 0.02 | 4 | 0.01 | 2 | 0.01 | 2 | 0.01 | 3 | 0.01 | 1 | 0.00 | 17 | 0.01 | ||||||||

| T | 309 | 1.00 | 310 | 1.00 | 315 | 1.00 | 317 | 1.00 | 317 | 1.00 | 316 | 1.00 | 1,884 | 1.00 | ||||||||

| ITC | ||||||||||||||||||||||

| O | 128 | 0.43 | 151 | 0.50 | 175 | 0.59 | 179 | 0.59 | 188 | 0.62 | 196 | 0.66 | 1,017 | 0.57 | ||||||||

| I | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | - | 0.00 | ||||||||

| F | 0 | 0.00 | 0.50 | 0 | 0.00 | 0.49 | 0 | 0.00 | 0.51 | 0 | 0.00 | 0.51 | 0 | 0.00 | 0.53 | 0 | 0.00 | 0.55 | - | 0.00 | 0.50 | |

| NM | 168 | 0.56 | 146 | 0.49 | 122 | 0.41 | 119 | 0.40 | 112 | 0.37 | 98 | 0.33 | 765 | 0.43 | ||||||||

| M | 3 | 0.01 | 3 | 0.01 | 2 | 0.01 | 3 | 0.01 | 1 | 0.00 | 1 | 0.00 | 13 | 0.01 | ||||||||

| T | 299 | 1.00 | 300 | 1.00 | 299 | 1.00 | 301 | 1.00 | 301 | 1.00 | 295 | 1.00 | 1,795 | 1.00 | ||||||||

| DIR | ||||||||||||||||||||||

| O | 36 | 0.24 | 44 | 0.29 | 44 | 0.28 | 52 | 0.30 | 48 | 0.29 | 45 | 0.26 | 269 | 0.28 | ||||||||

| I | 76 | 0.51 | 82 | 0.53 | 94 | 0.59 | 102 | 0.59 | 95 | 0.58 | 101 | 0.59 | 550 | 0.57 | ||||||||

| F | 10 | 0.07 | 0.36 | 9 | 0.06 | 0.38 | 4 | 0.03 | 0.44 | 3 | 0.02 | 0.44 | 5 | 0.03 | 0.43 | 8 | 0.05 | 0.43 | 39 | 0.04 | 0.41 | |

| NM | 27 | 0.18 | 19 | 0.12 | 15 | 0.09 | 16 | 0.09 | 15 | 0.09 | 16 | 0.09 | 108 | 0.11 | ||||||||

| M | 0 | 0.00 | 0 | 0.00 | 1 | 0.01 | 1 | 0.01 | 1 | 0.01 | 0 | 0.00 | 3 | 0.00 | ||||||||

| T | 149 | 1.00 | 154 | 1.00 | 158 | 1.00 | 174 | 1.00 | 164 | 1.00 | 170 | 1.00 | 969 | 1.00 | ||||||||

| DIP | ||||||||||||||||||||||

| O | 2 | 0.01 | 1 | 0.00 | 2 | 0.01 | 4 | 0.02 | 4 | 0.02 | 5 | 0.02 | 13 | 0.01 | ||||||||

| I | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 1 | 0.00 | 0 | 0.00 | 1 | 0.00 | ||||||||

| F | 238 | 0.91 | 0.84 | 233 | 0.91 | 0.83 | 235 | 0.90 | 0.82 | 235 | 0.91 | 0.83 | 232 | 0.91 | 0.83 | 227 | 0.92 | 0.84 | 1,173 | 0.91 | 0.83 | |

| NM | 17 | 0.07 | 20 | 0.08 | 19 | 0.07 | 17 | 0.07 | 16 | 0.06 | 14 | 0.06 | 89 | 0.07 | ||||||||

| M | 4 | 0.02 | 3 | 0.01 | 4 | 0.02 | 2 | 0.01 | 3 | 0.01 | 2 | 0.01 | 16 | 0.01 | ||||||||

| T | 261 | 1.00 | 257 | 1.00 | 260 | 1.00 | 258 | 1.00 | 256 | 1.00 | 248 | 1.00 | 1,292 | 1.00 | ||||||||

| GCI | 0.58 | 0.59 | 0.60 | 0.60 | 0.61 | 0.62 | 0.60 |

Notes: AC = accounting choices; n = number of companies; RF= relative frequency; HI = H index; II= interest inco-me; IE = interest expense; ITC = income tax and social contribution on net income; DIR= dividends and interest on own capital received; DIP = dividends and interest on own capital paid; GCI = general comparability index in SCF; O = operating; I = investments; F = financing; NM = not mentioned; M= mixed; T = company total.

The comparability index for interest income (II) in 2010 was 0.89 (Table 6). This level of comparability for this choice is high; however, the ratio is due to non-disclosure (not mentioned- NM) of interest income in SCF, although this item was disclosed in the balance sheet, in the DRE or in the explanatory notes. In the other periods, the comparability index was similar, ranging from 0.89 to 0.91 due to the high volume of companies that did not mention (NM) the classification of interest income in SCF. Although the general index of the comparability (GCI) of interest income (0.90) is high, this index represents a poor quality of the disclosure of the accounting choices since most companies (1,766, approximately 95%) did not mention (NM) the classification of interest income in SCF during the period from 2010 to 2015.

The comparability level of interest expense (IE) was lower in each of the years analyzed (0.33, 0.34, 0.34, 0.34, 0.33 e 0.35, respectively). Most of the companies classified interest expense under operating cash flows. Nevertheless, this classification is disperse. The index of comparability was also low for income tax and social contribution (ITC) from 2010 until 2015 (0.50, 0.49, 0.51, 0.51, 0.53 and 0.55, respectively). Most of the companies classified this item under operating activities, but many companies did not mention (NM) the classification of these items in the SCF.

The comparability level for dividends and interest on own capital received (DIR) was low throughout the entire period analyzed (between 0.36 and 0.43). Most companies chose to rate this item in investing cash flows. However, one possible explanation for these low comparability values could be that companies chose heterogeneous classifications for DIR.

The level of comparability for dividends and interest on own capital paid (DIP) was moderate throughout the study period (between 0.82 and 0.84). It can be inferred that this comparability index was maintained because the companies chose to classify DIP under financing activities, in accordance with IAS 7.

Table 6 shows that, in general, given the time horizon of the study, the comparability level was high for interest income (II = 90%), moderate for dividends and interest on own capital paid (DIP = 83%) and low for interest expense (IE = 33%), income tax and social contribution (ITC = 50%) and dividends and interest on own capital received (DIR = 41%).

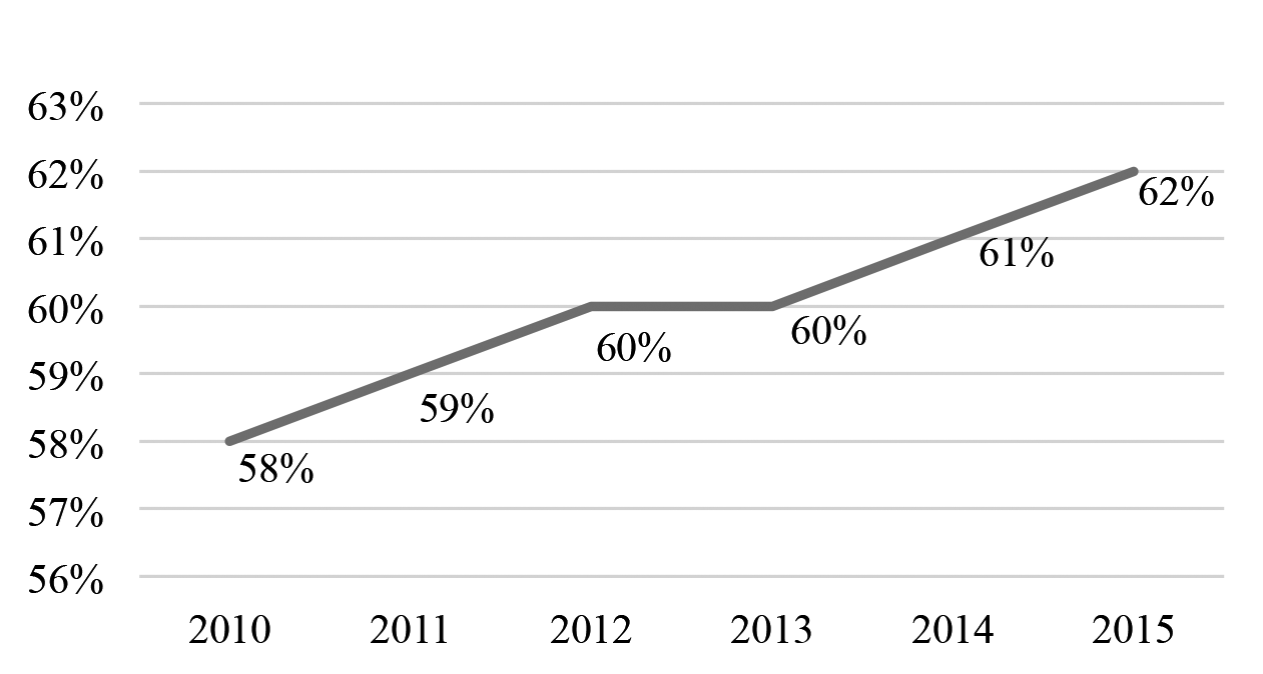

Figure 1 also shows that comparability was lowest in 2010 (roughly 58%). However, in subsequent years, comparability gradually increased to moderate levels (59% to 62%), which allows the hypothesis H2 (Figure 1) not to be rejected. Despite moderate indexes, this upward trend may indicate an improvement in comparability over time, which may in turn suggest that these Brazilian companies had garnered more experience with IFRS.

Table 7 shows the descriptive statistics for the variables that comprise the model specified in Equation 2. Table 8 shows the difference of means test for the variables that represent the group of companies that classified interest income (II), interest expense (IE), income tax and social contribution on net income (ITC) and dividends and interest on own capital received (DIR) under operating cash flows and the group that classified these items under other items or that did not mention the item. Add to this, Table 8 also shows the difference of means test for the variables that represent the group of companies that classified dividends and interest on own capital paid (DIP) under financing cash flows and the group that classified these items under other items or that did not mention the item.

Table 7 Descriptive Statistics (by group)

| CLAS | II | IE | ITC | DIR | DIP | ||||||||||||

| n | M | SD | n | M | SD | n | M | SD | n | M | SD | n | M | SD | |||

| SIZE | 1 | 61 | 15.7 | 1.3 | 727 | 14.9 | 1.6 | 1,017 | 14.6 | 1.8 | 269 | 15.2 | 1.8 | 1,400 | 14.6 | 1.8 | |

| 0 | 1,804 | 14.1 | 2.1 | 1,157 | 13.7 | 2.2 | 778 | 13.7 | 2.2 | 700 | 14.6 | 1.9 | 140 | 13.3 | 2.4 | ||

| IND | 1 | 61 | 0.5 | 0.2 | 727 | 0.6 | 0.2 | 1,017 | 0.6 | 0.2 | 269 | 0.5 | 0.3 | 1,400 | 0.5 | 0.2 | |

| 0 | 1,804 | 0.6 | 0.4 | 1,157 | 0.7 | 0.5 | 778 | 0.6 | 0.4 | 700 | 0.6 | 0.3 | 140 | 0.6 | 0.5 | ||

| ROE | 1 | 61 | 12.3 | 18.3 | 727 | 8.3 | 19.9 | 1,017 | 11.1 | 18.0 | 269 | 10.4 | 18.7 | 1,400 | 11.7 | 17.6 | |

| 0 | 1,804 | 7.1 | 19.7 | 1,157 | 5.8 | 19.1 | 778 | 6.8 | 18.8 | 700 | 8.2 | 17.0 | 140 | 3.4 | 17.7 | ||

| BP | 1 | 61 | 1.9 | 1.8 | 727 | 1.4 | 1.5 | 1,017 | 1.2 | 1.4 | 269 | 1.3 | 1.4 | 1,400 | 1.2 | 1.4 | |

| 0 | 1,804 | 1.0 | 1.4 | 1,157 | 0.8 | 1.2 | 778 | 0.9 | 1.3 | 700 | 1.3 | 1.4 | 140 | 0.9 | 1.2 |

Notes: CLAS = Classification; II= interest income; IE = interest expense; ITC = income tax and social contribution on net income; DIR= dividends and interest on own capital received; DIP = dividends and interest on own capital paid; SIZE = company size; IND = indebtedness; ROE= return on equity; BP = growth opportunities (book-to-price); n = number of observations; M = mean; SD = standard deviation.

Table 8 Differences in means for two independent samples

| CLAS | II | IE | ITC | DIR | DIP | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| z | Prob | z | Prob | z | Prob | z | Prob | z | Prob | |

| SIZE | -6.103 | 0.001 | -11.679 | 0.001 | -8.711 | 0.001 | -5.357 | 0.001 | -6.513 | 0.001 |

| IND | 1.840 | 0.066 | 1.606 | 0.108 | 1.785 | 0.074 | 1.942 | 0.052 | 0.213 | 0.831 |

| ROE | -1.827 | 0.068 | -3.867 | 0.001 | -5.484 | 0.001 | -3.086 | 0.002 | -6.273 | 0.001 |

| BP | -4.172 | 0.001 | -8.966 | 0.001 | -5.281 | 0.001 | -0.651 | 0.515 | -3.168 | 0.002 |

| NOPC | 0.409 | 0.682 | 5.896 | 0.001 | 6.640 | 0.001 | 0.692 | 0.489 | 5.275 | 0.001 |

Notes: CLAS = Classification; II= interest income; IE = interest expense; ITC = income tax and social contribution on net income; DIR= dividends and interest on own capital received; DIP = dividends and interest on own capital paid; SIZE = company size; IND = indebtedness; ROE= return on equity; BP = growth opportunities (book-to-price); NOPC = negative operating cash flows, dummy 1 if the company had negative operating cash flows and 0 otherwise.

Table 7 shows that the mean SIZE is higher for the group that chose to classify interest income (II), interest expense (IE), ITC and DIR in the operating activities (dummy = 1). The same occurred with DIP, the average SIZE is higher for those companies that chose to classify this item in financing activities (dummy = 1). The mean test in Table 8 confirms these results, which that the company size may affect the choice of classification of these items in the Statement of Cash Flows.

Besides that, the tests in Table 8 show that companies size (SIZE) and book-to-price (BP) can determine the option used to classify interest income in SCF (95% confidence level) and indebtedness (IND) and profitability (ROE) can determine this classification with a 90% confidence level.

Size (SIZE), profitability (ROE), book-to-price (BP) and negative cash flows from operating activities (NOPC) can determine the classification choice for interest expense in SCF (95% confidence level).

In the same way, size (SIZE), profitability (ROE), book-to-price (BP) and negative cash flows from operating activities (NOPC) may affect the classification choice for taxes on income tax and social contribution (95% confidence level), but indebtedness (IND) can only determine this classification with a 90% confidence level.

Size (SIZE) and profitability (ROE) may affect the classification choice for dividends and IOOC received (95% confidence level), but indebtedness (IND) can only determine this classification with a 90% confidence level. Whereas size (SIZE), profitability (ROE), growth opportunities (BP, book-to-price) and negative cash flows from operating activities (NOPC) can affect the classification of dividends and interest on own capital paid.

Table 9 - Panels A to E - shows the logistic regressions. The absence of significant multicollinearity in the data set is verified through VIF and tolerance statistical tests. It was possible to verify that it is not multicollinearity in the models, since the VIF test indicated that the highest colinearity in the models is equal to 1.37. The significant LR chi2 test results (5) at the 5% level in Panels A to E suggest that the variables should not be dropped. In other words, it seems appropriate.

Table 9 Logistic Regressions

| Expected signal | Coef. | Odds Ratio | z | p-value | Sensitivity analysis | ||

| PANEL A - Interest Income | |||||||

| SIZE | + | 0.62 | 1.87 | 5.94 | 0.001 | LR chi2(5) | 71.91*** |

| IND | + | -2.32 | 0.10 | -3.37 | 0.001 | Pseudo R2 | 0.134 |

| ROE | + | 0.01 | 1.01 | 0.90 | 0.369 | Log likelihood | -232.67 |

| BP | + | 0.27 | 1.31 | 2.93 | 0.003 | 1.803 observations classified correctly | |

| NOCP | + | 0.94 | 2.56 | 2.18 | 0.029 | 62 observations classified incorrectly | |

| X | -12.14 | 0.00 | -7.38 | 0.001 | Correctly Classified = 96.68% | ||

| PANEL B - Interest Expense | |||||||

| SIZE | - | 0.29 | 1.34 | 9.69 | 0.001 | LR chi2(5) | 202.77*** |

| IND | - | -0.34 | 0.71 | -2.02 | 0.044 | Pseudo R2 | 0.081 |

| ROE | - | 0.00 | 1.00 | -1.07 | 0.286 | Log likelihood | -1,155.00 |

| BP | - | 0.19 | 1.20 | 4.99 | 0.001 | 1.227 observations classified correctly | |

| NOCP | - | -0.24 | 0.78 | -1.49 | 0.137 | 657 observations classified incorrectly | |

| X | -4.60 | 0.01 | -10.06 | 0.001 | Correctly Classified = 65.13% | ||

| PANEL C - ITC | |||||||

| SIZE | - | 0.19 | 1.21 | 7.00 | 0.001 | LR chi2(5) | 121.23*** |

| IND | - | -0.57 | 0.56 | -3.38 | 0.001 | Pseudo R2 | 0.049 |

| ROE | - | 0.01 | 1.01 | 2.02 | 0.043 | Log likelihood | -1,167.62 |

| BP | - | 0.06 | 1.06 | 1.48 | 0.138 | 1.163 observations classified correctly | |

| NOCP | - | -0.45 | 0.64 | -2.80 | 0.005 | 632 observations classified incorrectly | |

| X | -2.13 | 0.12 | -5.60 | 0.001 | Correctly Classified = 64.79% | ||

| PANEL D - Dividends and IOOC Received | |||||||

| SIZE | + | 0.31 | 1.36 | 6.17 | 0.001 | LR chi2(5) | 56.66*** |

| IND | + | -1.57 | 0.21 | -4.52 | 0.001 | Pseudo R2 | 0.050 |

| ROE | + | 0.01 | 1.01 | 1.40 | 0.161 | Log likelihood | -544.04 |

| BP | + | -0.02 | 0.98 | -0.42 | 0.672 | 698 observations classified correctly | |

| NOCP | + | 0.42 | 1.52 | 1.61 | 0.107 | 271 observations classified incorrectly | |

| X | -4.79 | 0.01 | -6.62 | 0.001 | Correctly Classified = 72.03% | ||

| PANEL E - Dividends and IOOC Paid | |||||||

| SIZE | + | 0.36 | 1.43 | 6.97 | 0.001 | LR chi2(5) | 94.68*** |

| IND | + | -1.37 | 0.26 | -4.30 | 0.001 | Pseudo R2 | 0.101 |

| ROE | + | 0.02 | 1.02 | 3.12 | 0.002 | Log likelihood | -421.80 |

| BP | + | 0.01 | 1.01 | 0.14 | 0.885 | 1.404 observations classified correctly | |

| NOCP | + | -0.19 | 0.83 | -0.70 | 0.485 | 136 observations classified incorrectly | |

| X | -2.04 | 0.13 | -3.09 | 0.002 | Correctly Classified = 91.17% | ||

Observations: SIZE = Size; IND = Indebtedness; ROE = Return on Equity; NOPC (1) = Negative Operating Cash Flows; BP = book-to-price

Panel A - Table 9, where the dependent variable is a dummy with a value 1 when the company chose to classify Interest Income in the operating activities and 0 if other classifications were chosen. The results of Table 9 - Panel A suggests that companies with higher size (SIZE), lower indebtedness (IND), higher book-to-price (BP) and negative operating cash flows chose to classify interest income under operating cash flows, which allows us initially to accept the hypotheses H 3, H6 and H7. That is, public companies with negative operating cash flows (H7), larger public companies (H3) and more growth opportunities (H6) are more likely to make choices that increase operating cash flows, evidencing interest income in operating activities. Hypothesis H4 was not confirmed because companies with greater indebtedness seem not to classify interest income under operating cash flows. Similarly, the hypothesis H5 was not confirmed since the coefficient of the profitability (ROE) was not significant at the 5% level. The ‘Correctly Classified’ of 96.68% shows the overall efficiency of the model, that is, 96.68% of the observations were classified correctly (Table 9 - Panel A).

The “odds ratio” presented in Table 9 should be interpretd as follows: the coefficient 1.87, in Table 9 - Panel A, means that the probability of a larger (SIZE) company choosing to classify the item “Interest Income” in operating cash flows is 1.87 times more likely than the larger company to classify this item in another flow or not mention the rating. Similarly, the odds ratio 0.10, being less than 1, in Tabel 9 - Panel A, indicates that companies with higher indebtedness (END) is 0.10 times less likely to classify “Interest Income” in operating cash flows as compared to a company less indebted.

Table 9 - Panel B considers classification choices in SCF related to interest expense as a dependent variable. Here, the company size (SIZE), indebtedness (END) and book-to-price (BP) affected the option for the classification of interest expense in SCF (at the 95% confidence level). There are indications that larger Brazilian public companies, companies with lower indebtedness and companies with higher growth opportunities opted to classify interest expense as an operating activity. Considering that when the company classifies interest expense into the operating cash flows, the balance of that flows decreases, the hypotheses H3 and H6 was not confirmed because larger companies and companies with more growth opportunities classify interest expense into operating cash flows, reducing this flow. H4 can be confirmed because companies with higher indebtedness did not classify interest expense into operating cash flows, which increases this flow. The ROE and NOCP coefficient were not significant at the 5% level.

Regarding the dependent variable choices related to the classification of income tax and social contribution (ITC), Table 9 - Panel C, the results suggest that larger companies (SIZE), companies with lower indebtedness (IND), higher profitability (ROE) and when operating cash flows are not negative (NOCP) to register this item under operating cash flows. Considering that when the company classifies ITC into the operating cash flow these flows decrease, the hypotheses H4 and H7 were confirmed because companies with higher indebtedness (IND) and companies with negative operating cash flows (NOCP) do not seem to register ITC in operating cash flows. But H3, H5 and H6 were not confirmed. Larger companies (SIZE) and companies with higher profitability (ROE) allocated ITC in operating cash flows, which reduced these flows. The book-to-price (BP) coefficients were not significant at the 5% level.

Table 9 - Panel D - considers classification choices in SCF related to Dividends and IOOC Received (DIR) as a dependent variable. The SIZE and END coefficients are significant at the 5% level. These results suggest that larger companies (SIZE) and companies with lower indebtedness (IND) to register DIR under operating cash flows. Therefore, the hypothesis H3 was confirmed because larger companies make choices that increase operating cash flows.

Table 9 - Panel E - considers classification choices in SCF related to Dividends and IOOC Paid (DIP) as a dependent variable. The SIZE, END and ROE coefficients are significant at the 5% level. These results suggest that larger companies (SIZE), companies with lower indebtedness (IND) and higher profitability companies (ROE) to register DIR under financing cash flows. Therefore, the hypotheses H3 and H5 were confirmed because larger companies and profitable companies make choices that increase operating cash flows, allocating this item in the financing cash flows.

Table 10 is a summary of the rejected and non-rejected hypotheses based on the logistic regressions in Table 9.

Table 10 Summary of Hypotheses Results

| Dependent variable | Hypotheses Not Rejected | Hypotheses Rejected | |||

| II | H3 - SIZE; H6 - BP; H7 - NOCP | H4 - END; H5 | - ROE | ||

| IE | H4 | - END | H3 | - SIZE; H5 - ROE; H6 - BP; H7 - NOCP | |

| ITC | H4 | - END; H7 -NOCP | H3 | - SIZE; H5 - ROE; H6 - BP | |

| DIR | H3 | - SIZE | H4 | - END; H5 | - ROE; H6 - BP; H7 - NOCP |

| DIP | H3 | - SIZE; H5 - ROE | H4 | - END; H6 | - BP; H7 - NOCP |

Observations: II = Interest Income; IE = Interest expense; ITC = Income Tax and Social Contribution; DIR = Divi-dends Received; SIZE = Size; IND = Indebtedness; ROE = Return on Equity; NOPC = Negative Operating Cash Flows; BP = Growth Opportunities.

Thus, the results suggest that larger, more indebted, more profitable Brazilian public companies with larger book-to-market and negative cash flows from operating activities make choices that increase operating cash flows. Size, book-to-market, and negative operating cash flows affect the choice of allocating interest income to the operating cash flows. Meanwhile, indebtedness affects the choice of allocating interest expense in operating activities.

Indebtedness and negative operating cash flows mean that the company chooses to register ITC in its operating cash flows. Size influences the decision to allocate the DIR and the size and profitability influence the decision to allocate the DIP to the operating cash flows.

These results corroborate the study by Gordon et al. (2017) with regard to profitability and size of companies and the study of Baik et al (2016) in relation to the growth-opportunities (book-to-price). However, the results of this research contradict those of Gordon et al. (2017) as to profitability. These results may help complement the ‘accounting choice theory’, since it shows that in Brazil there are also significant evidences of the use of accounting choices to manage cash flows.

Conclusions

Our objective was to identify the comparability level of accounting choices selected by Brazilian public companies for their Statement of Cash Flows and the factors that might explain these choices. We evaluated accounting choices related to the disclosure of the following items in SCF: interest expense (IE), interest income (II), income tax and social contribution on net income (ITC), dividends and interest on own capital received (DIR) and dividends and interest on own capital paid (DIP). The Herfindahl index (H index) was used to calculate comparability and logistic regression was used to identify variables that might affect the classification of accounting choices in SCF for the 354 sample companies.

Our results suggest a high level of comparability (0.90 from 2010 to 2015) for the classification of interest income in the SCF. The level of comparability was moderate (0.83) for dividends and interest on own capital paid during the time horizon of the study. Conversely, the comparability index was low for the classification of interest expense, income tax and social contribution, and dividends and IOOC received (0.33, 0.50 and 0.41, respectively).

It should be noted that the high indexes of the comparability of the items interest income and interest expense are derived from the high number of companies that registered these ítems in the balance sheet, income statement or notes, but was unrecognizable in the SCF. Thus, these companies are comparable because they made the choice not to show the classification of these two items in the SCF, but this does not represent the quality of the accounting information.

The comparability index for the classification of accounting choices was low in 2010 (0.58), but it has gradually increased over time to a moderate level (0.62 in 2015), which might suggest improvements in the quality of information reported by Brazilian public companies. This trend also suggests a migration to similar choices, with lesser dispersion among the classifications in the SCF.

The results of our quantitative analysis suggest that the size of the Brazilian public company, indebtedness, profitability, book-to-market, and negative operating cash flows affect the choice of item classification in SCF. Larger, more indebted, more profitable Brazilian public companies with larger book-to-market and negative cash flows from operating activities make choices that increase operating cash flows. Size, book-to-market, and negative operating cash flows affect the choice of allocating interest income to the operating cash flows. Meanwhile, indebtedness affects the choice of allocating interest expense in operating activities. Indebtedness and negative operating cash flows mean that the company chooses to register ITC in its operating cash flows. Size influences the decision to allocate the DIR and the size and profitability influence the decision to allocate the DIP to the operating cash flows.

These results may be useful for accounting choice theory since they suggest that Brazilian listed companies use accounting choices to manage cash flows.

The fact that most of the companies in the sample did not mention the option used to classify, for example, interest income in the SCF is one limitation for the research. Nevertheless, this limitation does not invalidate the results of the study given that the results of the logistic regressions indicate variables that might affect the classification options chosen for the items in the SCF. Furthermore, Taplin (2003) points out that bias in the estimation of populations based on the index calculated for the sample are negligible and that the index based on the sample is, on average, close to the population index.

text new page (beta)

text new page (beta)