Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Contaduría y administración

Print version ISSN 0186-1042

Contad. Adm vol.62 n.2 Ciudad de México Apr./Jun. 2017

https://doi.org/10.1016/j.cya.2016.06.009

Articles

Effects of hiring former employees of multinationals in the absorptive capacity of local firms

aTecnológico de Costa Rica, Costa Rica

bUniversidad de Costa Rica, Costa Rica

Attracting Foreign Direct Investment seeks, among other goals, increase productivity of local firms through knowledge spillovers. Nevertheless the empirical evidence is contradictory. One influential factor is the absorptive capacity of local firms. This article analyzes the effect of the presence of ex-employees of multinational companies, as employees of local firms in the absorption capacity of these firms. The study was conducted in Costa Rica, a country recognized for its successful strategy in this area. The data come from a survey of 1,167 companies conducted by the Costa Rican Observatory of Small and Mediums Enterprises in 2011. It was found that hiring former employees of multinational companies by local firms has a positive effect on the rate of absorption capacity. In short, this engagement of former employees of multinationals increases by nine percentage points the rate of absorption capacity, with differences for sectors and firms sizes.

JEL classification: M21; O19; F23

Keywords: Absorption capacity; Multinationals companies; SME; Knowledge spillovers; Costa Rica

La atracción de inversión extranjera directa busca, entre otros objetivos, aumentar la productividad de las empresas locales vía derrames de conocimiento. Sin embargo, la evidencia empírica al respecto es contradictoria. Un factor influyente es la capacidad de absorción de las empresas locales. Este artículo analiza el efecto de la presencia de exempleados de empresas multinacionales, como empleados de empresas locales, en la capacidad de absorción de dichas empresas. El estudio se realizó en Costa Rica, país reconocido por su exitosa estrategia en la materia. Los datos provienen de una encuesta a 1,167 empresas efectuada por el Observatorio Costarricense de las Pymes en 2011. Se halló que la contratación de exempleados de empresas multinacionales por parte de las empresas locales tiene un efecto positivo sobre el índice de capacidad de absorción de conocimiento en las empresas de todos los sectores productivos. Específicamente, esta contratación de exempleados incrementa en nueve puntos porcentuales el índice de capacidad de absorción, con diferencias por sectores y tamaños de empresas.

Códigos JEL: M21; O19; F23

Palabras clave: Capacidad de absorción; Empresas multinacionales; Pymes; Derrames de conocimiento; Costa Rica

Introduction

The attraction of foreign direct investment through the establishment of multinational corporations (MNC) is a strategy that several countries have used, expecting to obtain, among other benefits, knowledge spillovers from the aforesaid MNC (who are closer to the state of the art in their field) to the local companies, thus increasing the productivity of the latter ( Görg & Strobl, 2005; Javorcik, 2004; Smeets, 2008 ). There are three channels through which knowledge spillovers may occur from the multinationals to the local companies: (i) demonstration effects, which include imitation, or reverse engineering of the products or practices of the MNC by the local companies; (ii) labor mobility, which enables those employees trained by the MNC to apply their knowledge in the local companies when they have stopped working for the former; and (iii) vertical forward and backward chains between the MNC and its local suppliers ( Saggi, 2002 ). In this article, our interest is focused on one of them: Labor mobility. This is due to how much it enables employees who have been trained by multinational companies to apply their knowledge in the local companies, where they begin working after they retire from the latter.

Nevertheless, up to this moment, empirical evidence on the results of this foreign direct investment attraction strategy in the business conglomerate of the host country remains ambiguous ( Zhang, Li, Li, & Zhou, 2010 ). In this situation, the study of the determining factors for the occurrence of these knowledge spillovers is relevant for academics, for practitioners, as well as for designers of public politics.

One of the factors that have emerged to understand the phenomenon previously described is the absorptive capacity of the local companies. Said absorptive capacity (AC) is defined as the set of routines and processes through which the organizations acquire, assimilate, transform, and exploit the knowledge of their environment to achieve a dynamic organizational capacity ( Zahra & George, 2002 ). Consequently, the capacity of the local companies to absorb a knowledge spillover by the MNC is our focus of interest.

It is important to mention that said AC has become a subject of study from different aspects. For example, it has been linked to differences in the performance of the companies according to different environments ( Liao, Welsch, & Stoica, 2003; Wales, Parida, & Patel, 2013 ); to the creation of companies from the knowledge generated by other companies ( Qian & Acs, 2013 ); and to the performance of local companies in areas where they co-exist with multinational corporations ( Girma & Görg, 2002; Zhang et al., 2010 ). In turn, there have been different approaches when trying to understand the factors that influence the AC, its components as such, and its interactions with other elements in the economic environment ( Camisón & Forés, 2010; Qian & Acs, 2013 ).

It is in this context that this article can be found. Our objective is to understand the effects that the hiring of former employees of multinational corporations has on the absorptive capacity of local companies. This is of interest from different perspectives. If the AC is important for the performance of the companies as is suggested by scientific literature ( Wales et al., 2013 ), then there are many reasons for trying to understand “how” this AC behaves, and what factors influence its composition. In that sense, it is important to improve the understanding of the role that a very concrete factor plays-the presence of former employees of multinational corporations in the AC of local companies of the host country where the MNC operate. This also allows assessing one of the benefits that can be expected by the attraction of foreign direct investment in several countries, which is the knowledge spillover toward the local companies.

The study was done in Costa Rica, a country that has been internationally known for its successful foreign direct investment attraction strategy ( Cordero & Paus, 2008; World Economic Forum, 2013 ), combined with an extensive foundation of local companies where micro, small and medium enterprises predominate (SMEs) ( Gómez, 2012). In this particular case, Monge-González and González-Alvarado (2007) illustrate the contribution of the high-technology multinational corporations in the development of the Costa Rican workers’ abilities, based on the experiences of Intel, Microsoft and Cisco. Furthermore, Monge-González, Leiva, and Rodríguez-Álvarez (2012) document the high labor mobility from the MNC to the Costa Rican companies during the period of 2001-2007, as well as the role of the same MNC as a source of “soft” skill acquisition for their employees.

In accordance with the objective proposed, the document has been organized into five sections, including the introduction. In the second section, the theoretical reference framework is presented; in the third section the methodological reference framework is addressed; in the fourth section the empirical results are discussed; and, finally, in the last section the main conclusions of the study are formulated.

Theoretical framework

Knowledge management is a conceptual approach that classifies knowledge as the most important resource, strategically speaking, that a company possesses ( Grant, 1996 ). More specifically, scholars have focused on elucidating how knowledge in organizations is created, shared and used ( Nonaka, 1994 ), so that it can become a sustainable competitive advantage for them ( Ragab & Arisha, 2013; Teece, Pisano, & Shuen, 1997 ). It is under this theoretical paradigm that our work lies, interspersing aspects of absorptive capacity and performance of the local companies, affected by the multinational corporations that operate in the host economy.

Concept and measurement of the absorptive capacity

In its original design, the AC is understood as the ability of an external company to recognize the value of new information to assimilate it and apply it for commercial purposes ( Cohen & Levinthal, 1990 ). Subsequent refinements have led to a concept of AC with four components: acquire, assimilate, transform, and use the knowledge to obtain a dynamic organizational capacity ( Zahra & George, 2002 ). In this sense, said authors define AC as a set of routines and processes. Furthermore, the four components are grouped into two big dimensions: potential capacity (acquisition and assimilation) and achieved capacity (transformation and use).

Regarding the way of measuring or quantifying the AC, scientific literature addresses several approaches. In some works, the AC has been measured through scales built ad hoc, through theoretical reviews, and statistical analyses. For example, scales have been created for the variables linked to the four theoretical dimensions: acquisition, assimilation, transformation and use ( Camisón & Forés, 2010; Jansen, van den Bosch, & Volberda, 2005; Jiménez, García, & Molina, 2011 ). Some works even propose new dimensions or constructs, and design the corresponding scale to measure it. An example of this is Lichtenthaler (2009) , who elaborates a scale to measure the AC from three dimensions (explore, transform, and use) as well as six constructs, two for each dimension accordingly (recognize and assimilate; maintain and reactivate; transform and apply). Similarly, Vega-Jurado, Gutiérrez-Gracia, and Fernández-de-Lucio (2008) propose a scale to quantify a set of determinants or precedents of the AC classified into three dimensions: organizational knowledge, formalization, and social integration mechanisms.

On the other hand, there is a series of proposals to measure the AC through simpler, one-dimensional character ( proxy ) indicators, such as research and development expenses (R&D) ( Rothaermel & Alexandre, 2009 ); expenses in R&D and experience of the employees ( Grimpe & Sofka, 2009 ); as well as the expense and intensity in R&D ( De Jong & Freel, 2010).

Another approach has been to measure the AC through a combination of variables searching for a kind of index, i.e., internal expense in R&D, the presence of permanent R&D, the training of the R&D personnel, and the percentage of scientists and researchers of the organization ( Escribano, Fosfuri, & Tribó, 2009 ). By the same token, Murovec and Prodan (2009) measured the AC through a bi-dimensional construct according to the source of information: scientific and market-based, used by the company. For their part, Monge-González, Rodríguez-Álvarez, and Leiva (2015) measure the AC for the micro, small and medium sized Costa Rican companies through an index created from variables that emerged from a survey, grouping said variables according to the determining groups proposed by Vega-Jurado et al. (2008) . In the methodological section, the index that was used for this article will be addressed in greater detail.

Performance and absorptive capacity of the companies

The AC has been linked to some differences in the performance of the companies, both directly and indirectly through other variables. This means that it operates as a mediator variable.

The main exponents of the AC have theoretically outlined a linear relation between it and the performance of the companies ( Cohen & Levinthal, 1990; Zahra & George, 2002 ). In the most recent empirical works, the AC is associated with business performance, but from a perspective that sees the AC as a mediator variable; more concretely, between: the internationalization activities and the financial performance ( Zahra & Hayton, 2008 ); the relationship learning and the innovative performance ( Chen, Lin, & Chang, 2009 ); the mix of technology sources (new vs known technology) and the financial performance ( Rothaermel & Alexandre, 2009 ); as well as between the strategic alliances and the innovative and financial performance ( George, Zahra, Wheatley, & Khan, 2001 ).

In an interesting piece of work, Wales et al. (2013) find a curvilinear relation (in an inverted U-shape) between the AC and the financial performance, reaching the maximum level of financial performance when the AC has an intermediate level. Furthermore, its effect was moderated by another variable denominated entrepreneurial orientation. To reach these results, said authors carried out an investigation between 285 small and medium sized Swedish enterprises (SMEs). In their reasoning, the authors assert that this curvilinear relation can be explained through the incremental growth of the costs associated with the increase of the AC in the enterprises. In other words, from a certain moment, the marginal cost is higher than the marginal benefit of increasing the AC.

Factors affecting the absorptive capacity

Seen from another perspective, the AC as such is influenced by different variables in the business sector. That is, the focus is not on the relation of the AC with the performance, but rather on what factors influence the AC of the organizations.

Within this approach, Vega-Jurado et al. (2008) propose that the AC is determined by three types of variables: organizational knowledge, formalization, and social integration mechanisms. In their proposal, said authors argue that these three factors combine with the relevant external knowledge, resulting in a specific level of AC. On the other hand, Flor, Oltra, and García (2011) find that the AC varies according to the type of strategy used by the enterprise. For this, the Miles and Snow typology (1978) is used, finding differences between the absorptive capacity (differentiated between potential and accomplished) and the types of strategy of the enterprises being studied (exploration, defender, analyzer, and reactive). For his part, Jansen et al. (2005) link the AC with the organizational coordination, systems, and socialization capacities; whereas Liao, Fei, and Chen (2007) link it to the interaction that the employees have with their own knowledge and with that of their colleagues in the company (knowledge sharing).

Multinational companies in the local economy and the absorptive capacity of local companies

A relatively unexplored line and in which the interest of our work lies, is whether the AC of the local companies can be positively affected by the hiring of former MNC employees.

As we know, when an MNC operates in a certain country it can become a source of knowledge for the local business community. This knowledge is transferred from the MNC to the local companies in two ways: through knowledge transfer mechanisms (commercial agreements, alliances, exchange of better practices, access to technology, etc.) as well as knowledge spillovers ( Spencer, 2008 ). The difference is that, the MNC does not receive any type of compensation for the knowledge spillovers, turning this into a positive external factor for the host economy ( Görg & Strobl, 2005; Javorcik, 2004; Smeets, 2008; Zhang et al., 2010 ).

This theoretical relation between the knowledge spillovers from the MNC to the local companies has been empirically studied with different results. Some works ( Blomström, 1986; Buckley, Clegg, & Wang, 2007 ; Tian, 2007; Wei & Liu, 2006 ) found positive results (for example, in terms of productivity growth in the companies of the host country) whereas others show negative results ( Aitken & Harrison, 1999; Feinberg & Majumdar, 2001 ).

Looking to understand this diversity of results, Smeets (2008) indicates the importance of fully understanding and modeling the way in which the channels through which said knowledge spillovers can occur operate. Citing Görg and Strobl (2005) , they indicate that in several cases the researchers only worry about finding a statistical relation (positive or negative) between the performance of the local companies and the existence of MNC in the host country, which implicitly supposes that the knowledge spillovers happen within a “black box”.

A recent study by Farole and Winkler (2014) presents an interesting conceptual framework based on a previous work by Paus and Gallagher (2008) to explain the dynamic of knowledge spillovers from the MNC to local companies. This framework identifies the factors that act as mediators for the existence of knowledge spillovers associated with the operation of MNC in a host country.

According to these authors, the determining elements for the appearance of knowledge spillovers can be grouped into three categories. In the first place, the characteristics of multinational corporations , such as the reasons for the establishment of operations in the host country, the production and global supply strategies, input models, as well as the time spent in the host country. Secondly, the capacity of national companies to absorb the knowledge and the technology from the multinational corporations ( absorptive capacity ) through the three channels described by Saggi (2002). Finally, the factors and the institutional framework of the host country, such as the regulation of the labor market, copyright, the access to financing, and the infrastructure for learning and innovation. An important aspect of this conceptual framework is that the set of factors that act as mediators for the spillover of knowledge from multinationals to local companies is dynamic and not stationary. Its composition may change with the passage of time.

In short, both the work by Farole and Winkler (2014) as well as other previous works ( Lim, 2001; Paus & Gallagher, 2008 ) indicate the importance of taking into consideration the fact that the learning relation between local companies and MNC depends, among other things, on the AC of the former. In other words, the AC influences the use that the local company gives to the knowledge obtained from the MNC. Our study considers this aspect, but it tries to answer a question that has yet to be answered: how does the hiring of former employees of multinational corporations influence the AC of local companies? The answer to this question is a fundamental element for the understanding of the dynamic of knowledge between the MNC and the local business conglomerate.

Methodology

Sample

The data used comes from the survey that originated the second national study of the MSMEs carried out by the Observatorio Costarricense de las Mipymes (Omipymes) (Gómez, 2012 ). In this study, 117 micro, small, and medium sized Costa Rican1 companies were interviewed via telephone through a probabilistic sample layered by the size and productive sector of the company (agriculture and fisheries; commerce; services; and industry). The maximum sampling error in the estimation of proportions, with a level of confidence of 95%, is of ±2.9 percentage points.

Sources of secondary and variable data

In this study, the variable of interest was the AC. For this, we used the absorptive capacity index (ACI) estimated by Monge-González et al. (2015) for micro, small and medium sized Costa Rican enterprises, such as the dependent variable. Said ACI was elaborated based on the approach of Vega-Jurado et al. (2008) , proposing an index comprised by three factors: organizational knowledge, formalization, and social integration mechanisms. The other variables included in the model are the following: (1) whether the local MSME has employees that have previously worked with a multinational company established in Costa Rica; and (2) the number of employees of the local MSME. Similarly, the sector in which the MSMEs operated was included in the modeling. The analysis of the variables was done through the model explained below.

Statistical analysis of data

To explain the behavior of the ACI, an equation that attempts to measure the effect of the hiring of former MNC employees by local companies on the absorptive capacity of the latter is created.

In the previous model: the i sub-index indicates the i th company and varies from 1 to 1167; exL i is a variable that takes the value of 1 if the i th has former MNC employees and a value of zero otherwise; L i is the number of employees of the ith company; and S ij are three variables that take the value of 1 if the company belongs to the j th sector and a value of zero otherwise. The j = 1 sub-index indicates the service sector, j = 2 commerce, j = 3 manufacturing industry and j = 4 the agriculture and fisheries sector, which, given that it is not taken into consideration in the model, indicates that it is the reference sector. Random disruption is represented by ε i , which is considered independently, identically, normally distributed, with a zero median and constant variance.

In Eq. (1) the interest coefficient is β 1 , which measures the effect on the AC of the local company when hiring former employees of MNC. In general terms, it measures how many percentage points the index of absorptive capacity of the local company increases or decreases by when hiring former employees of MNC. Where the premise is that the knowledge previously acquired by these workers while working at an MNC can be used in their new positions in the local company and, therefore, positively affecting the performance of the latter.

Eq. (1) is estimated through Ordinary Least Squares (OLS). It is worth mentioning that no more control variables were included, given that for the construction of the CI several characteristics of the local companies were taken into consideration, which, were they to be included in the model, would invalidate it as they would be present on both sides of the equation.

Several statistical tests were done to verify that the assumptions of the regression model with OLS were fulfilled.

For each one of the models estimated, the assumptions were verified graphically. Histograms of the residuals were obtained to verify the normality of the assumptions, as well as the graph of normal probability. The graph of residuals against assumptions was used to verify the independence of errors, the constant variance, and the zero median. This led us to conclude that the estimates of the parameters of the models, as well as their standard errors, have all the characteristics provided by the ordinary least squares.

Results

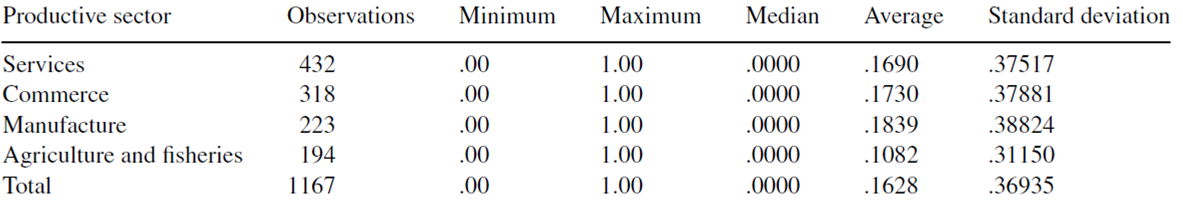

The first point to answer is how important the number of former employees of multinationals hired by local companies in Costa Rica is. Table 1 shows the results for this question for all the samples and by productive sector. As can be observed in column six, 16.28% of all local companies indicated having former MNC employees in 2011. This percentage is higher for the case of the manufacturing sector (18.39%) and much lower for the agriculture and fisheries sector (10.82%).

Table 1: Costa Rica: local companies that hire former employees of multinational corporations.

Source: Own elaboration based on the survey by the MSMEs Observatory ( Gómez, 2012).

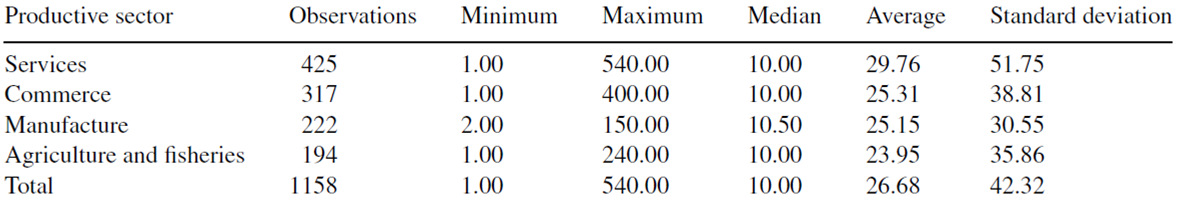

Regarding the composition of the sample according to the size of the enterprises and their distribution by productive sector, the figures in Table 2 make it possible to assert that half of the companies have a size equal or inferior to 10 employees, that the size of the companies goes from one employee to 540 employees, and that on average they have around 27 employees and a standard deviation close to 42 employees. The sectors with bigger enterprises are services and commerce (540 and 400 respectively).

Table 2: Costa Rica: distribution of local companies according to size and productive sector.

Source: Own elaboration based on the survey by the MSMEs Observatory ( Gómez, 2012).

It is important to stress that the sample distribution by sector is similar to the population distribution in 2011, and that to do the linear regression analysis by sector there are sufficiently large sample sizes.

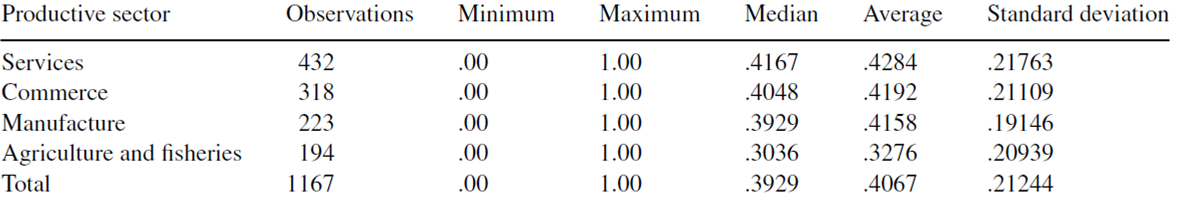

As previously indicated, the dependent variable in Eq. (1) is the absorptive capacity index, built by Monge-González et al. (2015) , for a group of 1167 micro, small, and medium sized Costa Rican enterprises, which groups together a series of variables in the categories proposed by Vega-Jurado et al. (2008). Table 3 shows some statistical measures and a summary of the ACI for all the samples, listing them by productive sector.

Table 3: Costa Rica: absorptive capacity index per productive sector.

Source: Own elaboration based on data by Monge-González et al. (2015) .

As can be observed in the table above, the ACI average is 0.4067 with a standard deviation of 0.2124. An important decrease can be seen in the average of the agriculture and fisheries sector (0.3276). The other three productive sectors show very similar average values. In all sectors, there are companies with very high (one) and very low (zero) ACI values. In other words, there is a significant variability in the ACI values throughout the entire sample.

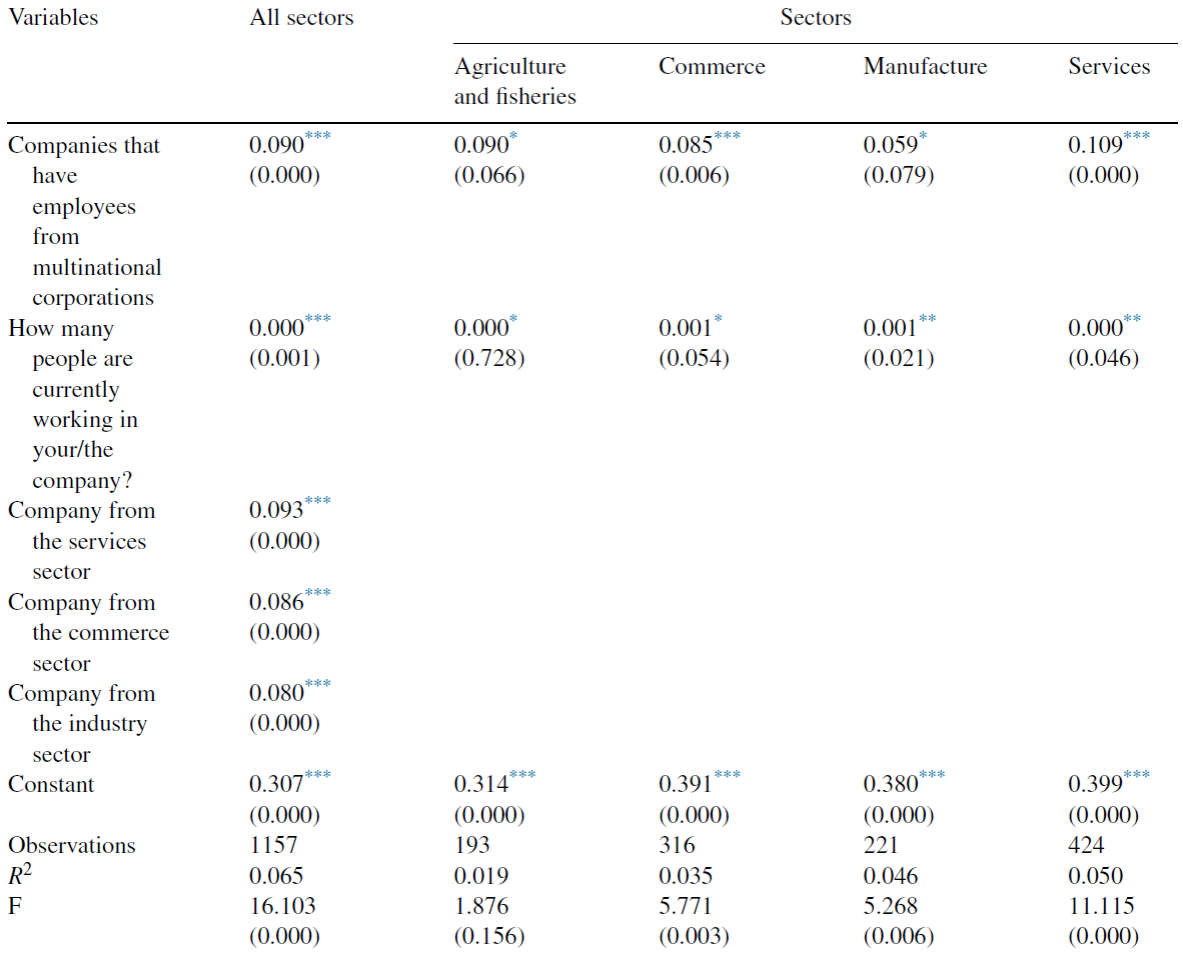

The results of the estimation of Eq. (1) for the entire sample are presented in Table 4 . In the second column of said table, it can be observed that the coefficient associated to the ACI variable is 0.09 positive and significantly different from zero ( p-value = 0.0000). This means that the hiring of former MNC employees by local companies increases the absorptive capacity index of knowledge in said companies by nine percentage points.

Table 4: Costa Rica: impact of the former employees of multinationals on the absorptive capacity of local companies.

Source: Own elaboration.

Note: The absence of asterisks means that the coefficient is not different from zero with statistical significance.

*Statistically significant coefficients at 10%.

**Statistically significant coefficients at 5%.

***Statistically significant coefficients at 1%.

Based on the result above, and given that one of the policies of the Costa Rican government authorities has been attracting foreign investment, it could be asserted that said policy has a positive externality in terms of knowledge spillovers toward local companies, by increasing their knowledge and technology absorptive capacity.

On the other hand, it is also observed that the coefficients associated with all the other variables in the equation (number of employees and the dummy variables of the productive sectors) are positive and statistically significant, which indicates the importance of dividing the analysis by sector.

Some interesting results were found when estimating Eq. (1) for each of the four productive sectors, which can be seen in columns 3, 4, 5, and 6 of Table 4 . From these, it can be concluded that the hiring of former MNC employees has a positive effect on the index of absorptive capacity of knowledge in the companies of all productive sectors, but with a greater impact for those of the service sector (0.109), followed by companies in the agriculture and fisheries sector (0.090) and the commerce sector (0.085), with the effect being smaller in the manufacturing sector (0.059). In all the cases the coefficients are positive and statistically different to zero, even if in the case of the commerce and service sectors the significance factor is greater.

These results contribute to the theory from different perspectives. On the one hand, they contribute information regarding the factors that influence the increase of AC in the companies. There is evidence that, aspects such as organizational knowledge, formalization, social integration mechanisms, strategic approach, organizational capacities, and shared knowledge, influence the AC ( Flor et al., 2011; Jansen et al., 2005; Liao et al., 2007; Vega-Jurado et al., 2008 ). Our work contributes with an additional concrete element to the factors that influence in the AC, such as the hiring of former employees of multinational companies. Similarly, the differences found in each sector make it possible to discern a possible research vein that is very interesting, as it would link the environment as a factor that also has some influence in the AC of the local SMEs, which would go hand in hand with the results of authors such as Farole and Winkler (2014).

On the other hand, our work addresses a thematic line that is relatively unexplored, as is the possible positive externalities of the MNC toward the local SMEs through knowledge spillovers. In this sense, it would link to works such as those by Blomström (1986), Buckley et al. (2007), Tian (2007) and Wei and Liu (2006) , who contributed with evidence regarding the positive externalities brought forth by the MNC for the business groups of the host country.

Conclusions

The available empirical evidence indicates that the AC influences the performance of the companies ( Wales et al., 2013 ). Therefore, knowing the factors that affect the AC of the companies is important. On the other hand, there are presently several nations that have applied a foreign direct investment attraction strategy through the installation of MNC, in which, in addition to certain tangible benefits (i.e., the creation of jobs), the transfer and spillover of knowledge from said MNCs to the local business sector is expected. It was in this thematic intersection that our study was placed. We aim to answer the question of how the AC of local companies is affected by the hiring of former employees of MNCs located in the same country. The former is done using a country such as Costa Rica, which has been acknowledged due to its foreign direct investment attraction strategy ( World Economic Forum, 2013).

The results make it possible to conclude that, in general terms, the hiring of former MNC employees by local companies increases the absorptive capacity index of local companies by nine percentage points, with some relevant differences depending on the sectors and the size of the companies. Therefore, the hiring of former MNC employees by local companies is an important element for the increase of absorptive capacity regarding the knowledge and technology of the latter and, consequently, their productivity and performance.

This result also represents hard evidence of a positive externality of the attraction of foreign direct investment that the Costa Rican authorities have promoted in recent decades.

The work has limitations as any of its type. It is important to mention that we used a measurement type that does not contemplate how much time the former employee of the MNC stayed in their position, and what type of knowledge they acquired. We only took the reference of whether the employee was hired by a MNC. Furthermore, we do not explore the way in which the employee applied the knowledge acquired in the MNC when transferring to the local company.

This article opens future lines of investigation. For example, more research is needed to better understand the learning process of local companies through the hiring of former MNC employees through promoting policies that favor the training of these former employees in certain areas, while they work in the multinational corporations. Moreover, it would be of significance to delve into the dynamics of the processes of the MSMEs, looking to better understand which factors have a greater effect on said companies to make use of the knowledge brought along by a former employee of an MNC that is now working in a local company.

REFERENCES

Aitken, B. J. y Harrison, A. E. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3), 605-618. [ Links ]

Blomström, M. (1986). Foreign investment and productive efficiency: The case of Mexico. Journal of Industrial Economics, 35(1), 97-110. [ Links ]

Buckley, P. J., Clegg, J. y Wang, C. (2007). Is the relationship between inward FDI and spillover effects linear? An empirical examination of the case of China. Journal of International Business Studies, 38(3), 447-459. [ Links ]

Camisón, C. y Forés, B. (2010). Knowledge absorptive capacity: New insights for its conceptualization and measurement. Journal of Business Research, 63, 707-715. http://dx.doi.org/10.1016/j.jbusres.2009.04.022 [ Links ]

Chen, Y. S., Lin, M. J. J. y Chang, C. H. (2009). The positive effects of relationship learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. Industrial Marketing Management, 38(2), 152-158. http://dx.doi.org/10.1016/j.indmarman.2008.12.003 [ Links ]

Cohen, W. M. y Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128-152. [ Links ]

Cordero, J. y Paus E. (2008). Foreign investment and economic development in Costa Rica: The unrealized potential. Discussion paper number 13, Working Group on Development and Environment in the Americas. [ Links ]

De Jong, J. P. J. y Freel, M. (2010). Absorptive capacity and the reach of collaboration in high technology small firms. Research Policy, 39, 47-54. http://dx.doi.org/10.1016/j.respol.2009.10.003 [ Links ]

Escribano, A., Fosfuri, A. y Tribó, J. A. (2009). Managing external knowledge flows: The moderating role of absorptive capacity. Research Policy, 38, 96-105. http://dx.doi.org/10.1016/j.respol.2008.10.022 [ Links ]

Farole, T. y Winkler, D. (2014). Making Foreign Direct Investment Work for Sub-Saharan Africa: Local Spillovers and Competitiveness in Global Value Chains. Washington DC: The World Bank. 668 [ Links ]

Feinberg, S. y Majumdar, S. (2001). Technology spillovers from FDI in the Indian pharmaceutical industry. Journal of International Business Studies, 32(3), 421-438. [ Links ]

Flor, M. L., Oltra, M. J. y García, C. (2011). La relación entre la capacidad de absorción del conocimiento externo y la estrategia empresarial: un análisis exploratorio. Revista Europea de Dirección y Economía de la Empresa, 20(1),69-88. [ Links ]

George, G., Zahra, S. A., Wheatley, K. K. y Khan, R. (2001). The effects of alliance portfolio characteristics and absorptive capacity on performance. A study of bio-technology firms. The Journal of High Technology Management Research, 12(2), 205-226. [ Links ]

Girma, S. y Görg, H. (2002). Foreign direct investment, spillovers and absorptive capacity: Evidence from quantile regressions. Research paper/Leverhulme Centre for Research on Globalisation and Economic Policy, No. 2002, 14. [ Links ]

Gómez, A. (2012). Informe técnico: Segundo diagnóstico nacional de MIPYMES. Documento de trabajo. Observatorio Costarricense de las Mipymes. [ Links ]

Görg, H. y Strobl, E. (2005). Spillovers from foreign firms through worker mobility: An empirical investigation. Scandinavian Journal of Economics, 107(4), 693-709. [ Links ]

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109-122. [ Links ]

Grimpe, C. y Sofka, W. (2009). Search patterns and absorptive capacity: Low- and high- technology sectors in European countries. Research Policy, 38, 495-506. http://dx.doi.org/10.1016/j.respol.2008.10.006 [ Links ]

Jansen, J. P., van den Bosch, F. A. y Volberda, H. W. (2005). Managing potential and realized absorptive capacity: How do organizational antecedents matter? Academy of Management Journal, 48(6), 999-1015. http://dx.doi.org/10.5465/AMJ.2005.19573106 [ Links ]

Javorcik, B. (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American Economic Review, 94(3), 605-627. [ Links ]

Jiménez, M. M., García, V. J. y Molina, L. M. (2011). Validation of an instrument to measure absorptive capacity. Technovation, 31, 190-202. [ Links ]

Liao, J., Welsch, H. y Stoica, M. (2003). Organizational absorptive capacity and responsiveness: An empirical investigation of growth-oriented SMEs. Entrepreneurship Theory and Practice, 28(1), 63-85. http://dx.doi.org/10.1111/1540-8520.00032 [ Links ]

Liao, S. h., Fei, W. C. y Chen, C. C. (2007). Knowledge sharing, absorptive capacity and innovation capability: An empirical study of Taiwan’s knowledge-intensive industries. Journal of Information Science, 33(3), 340-359. http://dx.doi.org/10.1177/0165551506070739 [ Links ]

Lichtenthaler, U. (2009). Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Academy of Management Journal, 52(4), 822-846. http://dx.doi.org/10.5465/AMJ.2009.43670902 [ Links ]

Lim, E.-G. (2001). Determinants of, and the Relation Between, Foreign Direct Investment and Growth: A Summary of the Recent Literature. IMF Working Paper WP/01/175. [ Links ]

Miles, R. E. y Snow, C. H. C. (1978). Organizational Strategy, Structure and Process. New York: McGraw-Hill. [ Links ]

Monge-González, R. y González-Alvarado C. (2007). The Role and Impact of MNCs in Costa Rica on Skills Development and Training: The Case of Intel Microsoft, and Cisco. Working paper. International Labor Organization, Geneva, Switzerland. [ Links ]

Monge-González, R., Leiva, J. C. y Rodríguez-Álvarez, J. A. (2012). Inversión extranjera directa, movilidad laboral y derrames de conocimiento en Costa Rica. Revista Tecnología en Marcha, 25(5), 103-115. http://dx.doi.org/10.18845/tm.v25i5.483 [ Links ]

Monge-González, R., Rodríguez-Álvarez, J. A. y Leiva, J. C. (2015). Propuesta de un índice para medir la capacidad de absorción de las mipymes costarricenses. TEC Empresarial, 9(1), 7-18. http://dx.doi.org/10.18845/te.v9i1.2204 [ Links ]

Murovec, N. y Prodan, I. (2009). Absorptive capacity, its determinants, and influence on innovation output: cross-cultural validation of the structural model. Technovation, 29(9), 859-872. http://dx.doi.org/10.1016/j.technovation.2009.05.010 [ Links ]

Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 5(1), 14-37. http://dx.doi.org/10.1287/orsc.5.1.14 [ Links ]

Paus, E. y Gallagher, K.P. (2008). Missing links: foreign investment and industrial development in Costa Rica and Mexico. Studies in Comparative International Development. Transaction Periodicals Consortium, Rutgers Univ., New Brunswick, N.J. [ Links ]

Qian, H. y Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40, 185-197. http://dx.doi.org/10.1007/s11187-011-9368-x [ Links ]

Ragab, M. y Arisha, A. (2013). Knowledge management and measurement: A critical review. Journal of Knowledge Management, 17(6), 873-901. [ Links ]

Rothaermel, F. T. y Alexandre, M. T. (2009). Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organization Science, 20(4), 759-780. http://dx.doi.org/10.1287/orsc.1080.0404 [ Links ]

Saggi, K. (2002). Trade, foreign direct investment and international technology transfer: A survey. The World Bank Research Observer, 17(2), 191-235. http://dx.doi.org/10.1093/wbro/17.2.191 [ Links ]

Smeets, R. (2008). Collecting the pieces of the FDI knowledge spillovers puzzle. The World Bank Research Observer, 19(3), 1-32. http://dx.doi.org/10.1093/wbro/lkn003 [ Links ]

Spencer, J. W. (2008). The impact of multinational enterprise strategy on indigenous enterprises: Horizontal spillovers and crowding out in developing countries. Academy of Management Review, 33, 341-361. http://dx.doi.org/10.5465/AMR.2008.31193230 [ Links ]

Teece, D. J., Pisano, G. y Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533, http://dx.doi.org/10.1002/(SICI)1097-0266(199708)18:7%3C509::AIDSMJ882%3E3.0.CO;2-Z. [ Links ]

Tian, X. (2007). Accounting for sources of FDI technology spillovers: Evidence from China. Journal of International Business Studies, 38, 147-159. http://dx.doi.org/10.1057/palgrave.jibs.8400245 [ Links ]

Vega-Jurado, J., Gutiérrez-Gracia, A. y Fernández-de-Lucio, I. (2008). Analyzing the determinants of firm’s absorptive capacity: beyond R&D. R&D Management, 38(4), 392-405. [ Links ]

Wales, W. J., Parida, V. y Patel, P. C. (2013). Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strategic Management Journal, 34, 622-633. http://dx.doi.org/10.1002/smj.2026 [ Links ]

Wei, Y. y Liu, X. (2006). Productivity spillovers from R&D, exports and FDI in China’s manufacturing sector. Journal of International Business Studies, 37(4), 544-557. [ Links ]

World Economic Forum (2013). Foreign Direct Investment as a Key Driver for Trade, Growth and Prosperity: The Case for a Multilateral Agreement on Investment [consultado el 30 Abr 2015]. Disponible en: Disponible en: http://www3.weforum.org/docs/GAC13/WEFGACGlobalTradeFDIFDIKeyDriverReport 2013.pdf . [ Links ]

Zahra, S. A. y George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185-203. http://dx.doi.org/10.5465/AMR.2002.6587995 [ Links ]

Zahra, S. A. y Hayton, J. C. (2008). The effect of international venturing on firm performance: The moderating influence of ACAP. Journal of Business Venturing, 23(2), 195-220. [ Links ]

Zhang, Y., Li, H., Li, H. y Zhou, H. L. (2010). FDI spillovers in emerging markets and absorptive capacity. Strategic Management Journal, 31, 969-989. [ Links ]

Received: September 19, 2015; Accepted: January 17, 2016

text in

text in