Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Investigación económica

Print version ISSN 0185-1667

Inv. Econ vol.67 n.263 Ciudad de México Jan./Mar. 2008

The Macroeconomics of Aggregate Demand and the Price Level

La macroeconomía de la demanda agregada y el nivel de precios

Thomas I. Palley*

* Economics for Democratic and Open Societies, <thomaspalley@starpower.net>.

Received June 2007

Accepted October 2007.

Abstract

The effect of prices on aggregate demand (AD) is one of the most important questions in macroeconomics. The conventional assumption is that a lower price level increases ad. However, there are good reasons to believe the opposite. The monetary base on which the Pigou effect operates is small; the interest rate channel may be weak, or even blocked entirely; and Fisher debt effects are likely strong in modern financial economies with extensive credit. Moreover, increased debt burdens can unleash bankruptcy effects that destroy the banking system. This suggests Keynes was right about the price system's inability to solve deficient demand unemployment. This conclusion has enormous implications for both teaching of macroeconomics and economic policy.

Keywords: prices, aggregate demand, interest rate, debt, credit, unemployment.

Clasificación JEL: E00

Resumen

El efecto de los precios sobre la demanda agregada (DA) es uno de los problemas más importantes en macroeconomía. La suposición convencional es que un nivel de precios más bajo incrementa la da. Sin embargo, hay buenas razones para creer lo contrario. La base monetaria sobre la cual funciona el efecto Pigou es pequeña; el canal de la tasa de interés puede ser débil o aun bloqueado enteramente; y los efectos de deuda Fisher son probablemente fuertes en las economías financieras modernas con crédito extenso. Además, la deuda creciente puede desencadenar efectos de bancarrota que destruyan el sistema bancario. Esto sugiere que Keynes estaba en lo correcto acerca de la incapacidad del sistema de precios para solucionar el desempleo por deficiencia de demanda. Esta conclusión tiene enormes implicaciones tanto para la enseñanza de la macroeconomía como para la política económica.

Palabras clave: precios, demanda agregada, tasa de interés, deuda, crédito, desempleo.

AGGREGATE DEMAND, THE PRICE LEVEL AND MACROECONOMICS

Microeconomics assumes that individual market demand functions are negatively sloped in output-price space, and that quantity demanded is a negative function of price. The implication is that a lower price will increase demand. Only in the rare cases of Giffen (strongly inferior) and Veblen (snob) goods does this not hold. Modern macroeconomics parallels this treatment by assuming that the aggregate demand (AD) function is negatively sloped, so that a lower general price level increases AD. Is this assumption justified?

The question itself is a simple one. However, engaging it is extremely difficult because of widespread and deep confusion between the concepts of the AD junction and the AD schedule. The AD function describes the quantity demanded as a function of the level of income, the price level, and other variables. The AD schedule is part of the aggregate supply/aggregate demand (AS/AD) model, and it imposes the additional condition that quantity demanded is equal to income. It is therefore an equilibrium schedule and not a demand function.

The aggregate demand function is the central building block of Keynesian macroeconomics, yet its price-theoretic properties are not well understood. This is because it is persistently conflated with the AD schedule owing to widespread adoption of the AS/AD model (which uses the AD schedule) in textbooks and the profession at large.

This conflation has encouraged the economics profession to assume that AD is a negative function of the price level, which has had momentous consequences for macroeconomic analysis. With regard to theory, neo-Keynesian economics used the assumption to reject Keynes' core contention about the inability of the market economies to automatically remedy demand-deficient unemployment. Instead, neo-Keynesians argued that Keynesian unemployment was attributable to downward price and nominal wage rigidity. With regard to policy, if unemployment is due to price and nominal wage rigidity, this recommends policies promoting flexibility —especially in the labor market.

The current paper analyzes the relationship between the price level and aggregate demand as embodied in the AD function, and identifies conditions under which the AD function can be positively sloped. This issue has been implicitly addressed in earlier papers by Tobin (1980), Dutt (1986/7), and Palley (1999). However, those papers fail to fully excavate the issue by not fully distinguishing between the different causes of price level change, which can have different economic effects.

The post-Keynesian critique of the effectiveness of price level adjustment (Davidson, 1994) has been developed using Keynes' Z-N model. However, like is/lm and AS/AD analyses, the treatment of price level effects in the Z-N model is opaque because it does not work directly with the AD function constructed in quantity demanded-price level space. Additionally, the Z-N model also fails to distinguish between different causes of price level change.

In many regards the debate over the AD effects of the price level constitutes something of a 'folk' theorem. The paper collects and formalizes these arguments in a tractable comprehensive model, and makes two innovations. First, it shows that it is not accurate to talk generically about the price level and ad. Instead, it is necessary to decompose the price level into its constituent elements as these elements operate differentially on AD. Second, the AD impact of these constituent elements depends on whether the economy is wage —or profit-led—. This adds a monetary dimension to the real wage analysis of Bhaduri and Marglin (1990) who introduced the wage-profit-led distinction.1

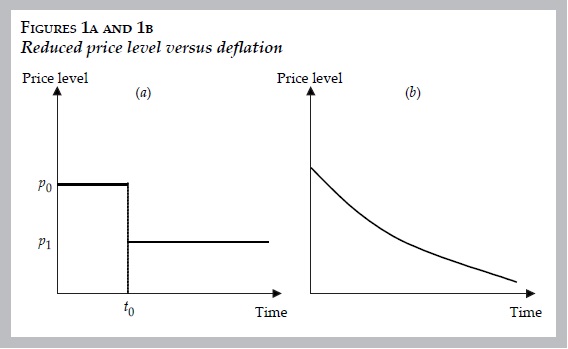

Finally, the paper is exclusively concerned with price 'level' effects, and does not address deflation. The distinction between price level and deflation effects is shown in figures 1a and 1b. Figure 1a shows the case of a price level reduction, which is the experiment analyzed in the paper. Figure 1b shows the case of steady deflation, which is not analyzed. The focus on a one-time price level reduction means that expectations of future price declines, which were another concern in Keynes' (1936) General Theory, are not addressed. Such deflationary expectations constitute an additional impediment to remedying deficient AD by price adjustment (Tobin, 1975, 1993).

HISTORY OF THOUGHT: AD AND THE PRICE LEVEL

Keynes' (1936) General Theory proposed a theory of persistent unemployment due to insufficient AD. Though not the central focus of the book, Keynes was clearly aware of the need to address the question of whether price level reduction could solve the problem, and chapter 19 is exp licitly devoted to this.

One channel Keynes identified, now widely referred to as the "Keynes effect," was through a lower price level increasing the real money supply, thereby lowering the real interest rate and increasing AD. However, this effect does not work if (1) there is a nominal interest rate floor (due to the liquidity trap, transaction costs, regressive interest rate expectations, or exogenously determined nominal interest rates) or (2) expenditure is interest insensitive. In this case, the interest rate channel is blocked.2

The Keynes effect is easily illustrated in Hicks' (1937) is/lm interpretation of the General Theory. Figure 2a shows the Keynes effect, whereby a lower price level increases the real money supply and shifts the lm schedule down. This lowers the real interest rate, spurring spending and a movement along the is schedule. Figure 2b shows the case when the Keynes effect fails due to a nominal interest rate floor. Figure 2c shows the case when it fails due to interest insensitivity of AD.

Pigou (1943) challenged this conclusion about the inability of price level reduction to cure unemployment. His argument, now known as the Pigou or real balance effect, was that a lower price level would increase the real value of money balances, thereby making agents feel wealthier and increasing spending. Once again, this argument can be illustrated in the is/lm framework. Figure 3a shows the conventional case in which a lower price level increases real balances, which expands AD and shifts the is up. Figure 3b shows that the expansionary impact of increased real balances holds even when the economy is stuck at a nominal interest rate floor. Indeed, the impact is even larger because interest rates remain unchanged. Lastly, Figure 3c shows that the expansionary impact of increased real balances also works when AD is interest insensitive. Pigou's real balance effect therefore countered early Keynesian arguments regarding the inefficacy of price level reductions.

Kalecki (1944) presented a critique of the Pigou effect centered on the bank nature of money. His argument was that bank deposits are matched by bank loans. Whereas decreases in the price level increase the real value of deposits, they also increase the real burden of loans. This latter effect would tend to cancel out the former. Kalecki's critique therefore reduced the size of the Pigou effect by restricting it to operate on the supply of monetary base (i.e. the issued liabilities of the central bank). However, though reduced in size, the Pigou effect remains operative in principle owing to the presence of outside money.

Whereas Pigou (1943) focused attention on pure price level effects, Modigliani (1944) shifted the focus away from the price level to downwardly rigid nominal wages. This was done by appending a neo-classical labor market to the is/lm model. The existence of downward nominal wage rigidity then causes price level rigidity, blocking off both the Keynes and Pigou effects.

Modigliani's paper established the foundation of the neo-Keynesian synthesis that became the dominant interpretation of Keynes after World War II. Within this framework, Keynes' was deemed theoretically wrong. A lower price level was in principle capable of solving the Keynesian problem of demand-deficient unemployment. However, neo-Keynesians argued that in the "real world" prices and nominal wages are downwardly rigid and adjust very slowly. That means Keynesian policies are still a good idea, being the best way to deal with Keynesian unemployment in an imperfect world.

The triumph of the neo-Keynesian synthesis in macroeconomics, in tandem with the triumph of Arrow-Debreu (1954) general equilibrium theory in microeconomics, shifted the development of macroeconomic toward general "disequilibrium" analysis. This line of inquiry took downward price and nominal wage rigidity as the starting point and then examined the general equilibrium consequences of preventing markets from clearing by price level adjustment. It also began the search for so-called "microeconomic foundations of macroeconomics."

The leading contributors to the general disequilibrium paradigm were Clower (1965), Barro and Grossman (1971) and Malinvaud (1977). The basic approach was to place fixed prices and nominal wages in an applied microeconomic general equilibrium model, and then examine the economic implications thereof. When prices are fixed, the result is quantity rationing, which in turn generates inter-market spillovers that amplify the Keynesian multiplier.

On the surface this finding strengthened the economic logic of Keynesianism, but in fact general disequilibrium analysis initiated a deep reconfiguration of Keynesian economics. The logical question emanating from fix-price general disequilibrium theory is why are prices and nominal wages downwardly rigid. This question provided the foundation stone for new Keynesianism, which views price and nominal wage rigidities as the product of profit —and utility— maximizing behaviors. The economic world is marked by frictions, including transaction costs and imperfect information. Consequently, it is not optimal to change prices and nominal wages in response to every economic disturbance.

This is the contemporary stance of macroeconomics, and it has huge implications for theory and policy. First, the implicit theoretical claim of contemporary mainstream economics is that if it were possible to adjust prices and nominal wages downward instantaneously (as shown in figure 1a), the economy would quickly go to full employment and there would be no Keynesian unemployment. Second, the policy implication is that policymakers should encourage price and nominal wage flexibility, and new Keynesianism therefore provides the theoretical justification for today's widely pursued labor market "flexibility" policy agenda.

A MODEL OF THE AD FUNCTION

The relationship between AD and the price level can be captured by the following model:

where E = aggregate spending, y = current income, M = nominal money supply, P = price level, I = investment spending, i = nominal interest rate, DF = corporate debt, DH = household debt, W = nominal wage, m = markup, e = exchange rate (domestic currency per unit of foreign currency), P*= foreign price level, and a = average productivity of labor. Equation [1] is the ad function. Equation [2] is the mark-up pricing equation. There is no inflation or deflation, which means the nominal interest rate is equal to the real rate. Signs above functional arguments represent assumed signs of partial derivatives.3

AD depends positively on the level of income, but AD is not equal to income. This is the key distinction between the ad function and AD schedule, something which is explored in more detail below. AD depends positively on real money balances reflecting the Pigou effect.4 It also depends positively on investment spending, which in turn depends negatively on the real interest rate, with the latter depending negatively on the real money supply. This captures the channel for the Keynes real money supply effect. Many post-Keynesians believe the real interest rate is independent of the real money supply level, in which case the Keynes effect is absent. If this is the case, it implies the partial derivative iM/P = 0.

AD is also negatively affected by the level of indebtedness, which consists of firm (DF) and household (DH) debt. The impact of firm sector debt works via investment spending, while the impact of household sector debt works via consumption spending. The generic argument about the negative impact of debt originates with Fisher (1933), who developed a debt-deflation theory of depressions.

The burden of business sector debt depends on the price level, and is therefore scaled by P. The logic of the negative impact is that increases in the real burden of firms' debts tighten balance sheet constraints, reducing access to finance and negatively impacting investment spending.5 The burden of household debt depends on the level of nominal wages, and is therefore scaled by W. The logic of its negative impact on AD is that creditor households are assumed to have a higher marginal propensity to consume than creditor households.6

AD also depends on the level mark-up, which influences the distribution of income between wages and profits. The sign of this effect is ambiguous and is discussed further below. Finally, AD depends on the relative price of foreign and domestic goods, which impacts imports and exports. A decline in the relative price of domestic goods increases AD. The exchange rate is assumed fixed to avoid getting into controversies about its determination, which would require a separate paper.

THE MARK-UP, THE PROFIT SHARE AND AD

An important issue is the impact of the mark-up on AD. The mark-up is positively related to the profit share, as can be seen from the following standard Kaleckian model:

where N = employment and V = real profits. Equation [3] defines real national income in terms of the wage bill and profits. Equation [4] restates the markup pricing rule, and equation [5] is a linear production function.

Appropriate substitution and manipulation of these three equations then yields expressions for the profit and wage share given by

The implication is that the profit share is a negative function of the markup, and the wage share is a positive function.

An increase in the mark-up will increase the profit share, and if output is unchanged it will also increase the profit rate and firms' cash flows. All of this will be good for investment spending. Conversely, an increase in the mark-up will decrease the wage share and real wage, which will be bad for consumption spending. If the investment effect dominates, AD will increase. Such an economy can be termed "profit-led". Alternatively, if the consumption effect dominates, AD will fall. Such an economy can be termed "wage-led."7 Not only does this distinction matter for an analysis of the AD effects of real income shares, it also matters for an analysis of the AD impacts of changes in nominal income as is shown below.

Keynes' General Theory paid little attention to the AD effects of income distribution, and that line of inquiry emerged out of the work of Polish economist Michael Kalecki. These income distribution effects enter through the mark-up, and post-Keynesians have tended to analyze mark-up effects in exclusively real terms. However, because the mark-up impacts the price level, it also has nominal effects. Mark-up analyses tend to overlook the price level effects, while price level analyses tend to overlook the mark-up effects. The current treatment covers both.

DISTINGUISHING BETWEEN THE AD FUNCTION AND AD SCHEDULE

Contemporary macroeconomic textbooks make widespread use of the aggregate supply-aggregate demand (AS/AD) framework, which has come to replace the is/lm model. The AS/AD model suffers from two pedagogical weaknesses.8 First, the AD schedule is not an AD function, yet textbooks gloss over this and encourage students to think of the AD schedule as the macroeconomic analogue of the microeconomic market demand function. Second, the AD schedule is not automatically downward sloping in output-price level space, which is also overlooked in textbooks.

The AD function shows the demand for output as the general price level varies, holding aggregate income constant. It is a Marshallian demand function in which income is held constant. Contrastingly, the AD schedule (used in textbooks) shows the general price level that ensures AD equals output. It is a goods market-clearing schedule, not a demand function.

The difference between the AD function and AD schedule can be easily illustrated as follows:

Ey is the marginal propensity to spend out of income, and it is assumed to lie between zero and unity. This is the standard expenditure multiplier stability assumption. Absent it, small increases/decreases in income would give rise to cumulative explosions/implosions of economic activity.

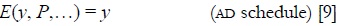

Equation [8] is a shorthand version of the AD function previously described by equation [1]. It shows the quantity demanded (E) as price varies and income (y) is held constant. Contrastingly, equation [9] is the AD schedule, and it shows the price level needed to ensure that the quantity demand (E) equals income (y).

Under what conditions is the textbook AD schedule a negative function of the price level? Differentiating equation [9] with respect to y and P, and rearranging, yields

The necessary condition for the AD schedule to be a negative function of the price level is therefore that the ad function be a negative function of the price level.

THE AD FUNCTION AND THE PRICE LEVEL

The neo-Keynesian synthesis and new Keynesianism both "assume" that the AD function is a negative function of the price level. This assumption is open to question. Recall the core model given by equations [1] and [2]:

The first important insight is that asking about the impact of the price level is an ill-formed question. Prices are formed by the constituent parts, m, W, and a, and these variables impact AD differentially. That means it is impossible to talk of a generic price level effect. Instead, the question must be framed in terms of the impact of changes in m, W, and a on AD. Substituting equation [2] into equation [1] yields.

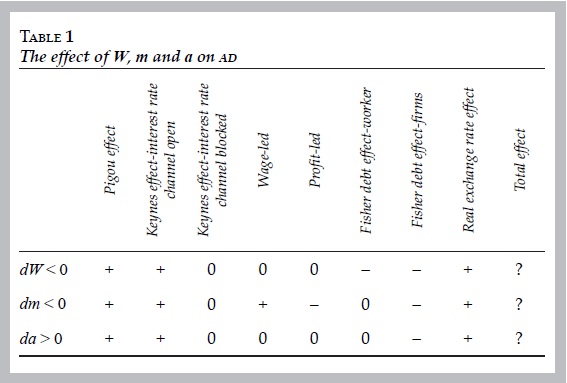

Differentiating with respect to W, m, and a yields the impact of changes in the constituent parts of the price level on AD, holding income constant. These impacts are shown in table 1.

Reading across the rows of table 1 to the far right-hand column, it can be seen that the effect of P, operating via W, m, and a, is theoretically ambiguous. The first two columns capture the conventional Pigou and Keynes effects. The third column applies if the Keynes effect is blocked by a nominal interest rate floor or interest rate insensitive AD.

The fourth and fifth columns show that when analyzing the effect of changes in the mark-up, it is necessary to distinguish whether the economy is wage —or profit-led—. This feature has been over-looked in previous analyses of macroeconomic impacts of price level changes, just as the price level impacts of the mark-up have been over-looked in macroeconomic analyses of changes in the mark-up. The mark-up has both income distribution effects and price level effects, and both effects must be attended to. Finally, the open-economy relative price effect is always positive.

If the economy is wage-led, the following conclusions hold:

a) A decrease in the nominal wage level (W) will increase AD if the combined Pigou, Keynes and international relative price effects exceed the combined household and firm Fisher debt effects.

b) A decrease in the mark-up (m) "will increase AD if the combined Pigou, Keynes and international relative price effects exceed the firm Fisher debt effect.

c) An increase in labor productivity (a) will increase AD if the combined Pigou, Keynes and international relative price effects exceed the firm Fisher debt effect.

d) If the economy is profit-led, the following conclusions hold:

e) A decrease in the nominal wage level (W) will increase AD if the combined Pigou, Keynes and international relative price effects exceed the combined household and firm Fisher debt effects.

f) A decrease in the mark-up (m) will increase AD if the combined Pigou, Keynes and international relative price effects exceed the firm Fisher debt effect plus the profit share effect.

g) An increase in labor productivity (a) will increase AD if the combined Pigou, Keynes and international relative price effects exceed the firm Fisher debt effect.

Lastly, an interesting feature is that an increase in labor productivity (a) may reduce employment even though it increases AD and output. Such an outcome is shown in figure 4. An increase in labor productivity rotates the production function counter-clockwise. Assuming AD is also increased (i.e. the Keynes and Pigou effects dominate), this shifts the AD function up. The new equilibrium is then characterized by higher AD and output, but lower employment. Such technological unemployment may be relevant today with computer-based technologies raising productivity and output but potentially reducing manpower needs.

CONCLUSION: IMPLICATIONS FOR MACROECONOMICS AND POLICY

The effect of changes in the price level on AD may be the most important question in macroeconomics. The standard assumption is that a lower price level (whatever the cause) increases AD. However, there are good reasons to believe the opposite. The monetary base on which the Pigou effect operates is small. The interest rate channel may be weak, or even blocked entirely. And Fisher debt effects are likely to be strong in modern financial economies in which credit is extensive. Moreover, increased debt burdens can unleash adverse dynamic effects associated with bankruptcy, destruction of credit worthiness, and defaults that destroy the banking system (Bernanke, 1983). These considerations suggest that Keynes was right in his conclusion about the inability of the price system to address deficient demand unemployment, and that the neo-Keynesians and new Keynesians are wrong in their claims otherwise.

This conclusion has major implications. Contemporary macroeconomic theory ignores these problems, so that textbooks need to be rewritten to take account of them. There are also major implications for policy, and today's policy agenda promoting microeconomic "flexibility" may end up creating macroeconomic "instability."

From a macroeconomic perspective, downward nominal flexibility can be undesirable because of adverse the AD impacts of a lower price level. Instead, what is needed is relative price flexibility at the microeconomic industry level combined with a gently rising general price level. In economic depressions, policy may actually want to increase the general price level to reduce debt burdens, rather than decrease the price level. However, market forces acting on prices are all on the downside. This helps understand the 1930s New Deal policies that created price floors and limited competition in an attempt to block off these adverse market forces.

Market economies work better when they have protections against declines in the aggregate price level, but they also need relative price flexibility to enable adjustment at the industry level. That means relative price adjustment must be done by upward price adjustment in markets where demand is robust, which explains why a little inflation improves macroeconomic performance. This is the economic logic behind the notion that inflation "greases the wheels of adjustment".

The debate over price level effects is central for distinguishing neo-Keynesianism and new Keynesianism from post-Keynesianism. All recommend macroeconomic monetary and fiscal policies that are broadly consistent with Keynesianism. However, the former recommend microeconomic price and wage flexibility policies that are inconsistent with Keynesian analysis, whereas post-Keynesians have a more complicated view about price flexibility as described above.

Finally, paradoxically, the current policy push for price flexibility (especially in labor markets) has its origins in macroeconomics rather than microeconomics. Neo-Keynesians and new Keynesians identify downward price and nominal wage rigidity as the cause of macroeconomic failure, and it is this reasoning that has pushed policymakers (particularly in Europe) to argue that price flexibility can restore full employment. Thus, the microeconomic policy agenda of price flexibility has its origins in the faulty macroeconomic reasoning of neo-Keynesians, new Keynesians, and new Classicals. That is a difficult point to communicate.

REFERENCES

Arrow, K. and G. Debreu, "Existence of an Equilibrium for a Competitive Economy", Econometrica, no. 22, 1954, pp. 265-290. [ Links ]

Barro, R.J. and H. Grossman, "A General Disequilibrium Model of Income and Employment", American Economic Review, no. 61, 1971, pp.82-93. [ Links ]

Bernanke, B., "Non-monetary Effects of the Financial Crisis in the Propagation of the Great Depression", American Economic Review, no. 73, 1983, pp. 257-276. [ Links ]

Bhaduri, A. and S. Marglin, "Unemployment and the Real Wage: the Economic Basis for Contesting Political Ideologies", Cambridge Journal of Economics, no. 14, December 1990, pp. 375-393. [ Links ]

Colander, D., "The Stories We Tell: A Reconsideration of AS/AD Analysis", Journal of Economic Perspectives, Summer 1995, pp. 169-188. [ Links ]

Coghlan, R., "A New View of Money", Lloyds Bank Review, no. 129, July 1978, pp. 12-28. [ Links ]

Clower, R.W, "The Keynesian Counter-revolution: A Theoretical Appraisal", in F.H. Hahn and F.P.R. Brechling (eds.), The Theory of Interest Rates, London, Macmillan, 1965. [ Links ]

Davidson, P., Post Keynesian Macroeconomic Theory: A Foundation for Successful Policy for the 21st Century, Hants, Edward Elgar, 1994. [ Links ]

Dutt A.K., "Wage Rigidity and Unemployment: The Simple Diagramatics of Two Views", Journal of Post Keynesian Economics, no. 9, 1986/7, pp. 279-290. [ Links ]

Fazzari, S., R.G. Hubbard and B.C. Petersen, "Financing Constraints and Corporate Investment Activity", Brookings Papers on Economic Activity, no. 1, 1988, pp. 141-195. [ Links ]

Fisher, I., "The Debt-Deflation Theory of Great Depressions", Econometrica, no. 1, October 1933, pp. 337-357. [ Links ]

Hicks, J., "Mr. Keynes and the Classics: A Suggested Interpretation", Econometrica, no. 5, 1937, pp. 146-159. [ Links ]

Keynes, J.M., The General Theory of Employment, Interest and Money, London, MacMillan, 1936. [ Links ]

Kalecki, M., "Professor Pigou on "The Stationary State"-A Comment", Economic Journal, no. 54, 1944. [ Links ]

Malinvaud, E., The Theory of Unemployment Reconsidered, Oxford, Basil Blackwell, 1977. [ Links ]

Modigliani, F., "Liquidity Preference and the Theory of Interest and Money", Econometrica, no. 12 1944, pp. 45-88. [ Links ]

Palley, T.I , "General Disequilibrium Analysis with Inside Debt", Journal of Macroeconomics, no. 21, Fall 1999, pp. 785 - 804. [ Links ]

----------, "Expectations, the Production Period, and Keynes' Aggregate Supply Schedule", The Manchester School of Economic and Social Studies, vol. LXV, June 1997, pp. 295-309. [ Links ]

Pigou, A.C., "The Classical Stationary State", Economic Journal, no. 53, December 1943, pp. 343-351. [ Links ]

Tobin, J., "Keynesian Models of Recession and Depression", American Economic Review, no. 65, May 1975, pp. 195-202. [ Links ]

----------, Asset Accumulation and Economic Activity, Chicago, Chicago University Press, 1980. [ Links ]

----------, "Price Flexibility and Output Stability: An Old Keynesian View", Journal of Economic Perspectives, no. 7, Winter 1993, pp. 45-66. [ Links ]

The author acknowledges valuable comments from two anonymous referees.

1 Formally, Bhaduri and Marglin (1990) term a wage-led economy stagnationist, and a profit-led economy exhilarationist.

2 This importance of interest rates for price level effects is another reason explaining why so much of the early debate surrounding the General Theory focused on the interest rate mechanism.

3 Equations [1] and [1] do not constitute a model of AD and AS because output (y) is assumed constant. Completing the supply side of the model requires adding a production decision framework for firms. In Keynesian models this is usually done by adding a condition that output equal expected aggregate demand (Palley, 1997).

4 To take account of Kalecki's (1944) argument that inside money is cancelled out by inside debt, the AD function could be re-specified to depend on real high-powered money (H/P) instead of the money supply (M/P). In a neo-Keynesian framework, high-powered money is then given by H = M/k where k is the money multiplier which is greater than unity. In a post-Keynesian endogenous credit money model, high-powered money is given by H = [DH + DF]/k where k is now the credit money multiplier (see Coghlan, 1978).

5 Such financing constraints are also emphasized by new Keynesians (Fazzari et al., 1988), which provides a shared point of analysis between new Keynesianism and the economics of Keynes. However, there remains a fundamental difference regarding the ability of the price level to restore full employment. This illustrates how easy it is for the debate to become distracted, and to lose sight of core differences.

6 A more complicated specification of debt burdens would take into account employment and output effects. It would also take account of interest rates, and whether debt is floating or fixed rate. Assuming floating rate debt, an alternative specification could be as follows: household debt burden = i(M/P)DH/WN and business sector debt burden = i(M/P)DF/[Py - WN], where N = employment and Y = nominal output. Now, the household sector's debt burden is scaled by the nominal wage bill, while the business sector's debt burden is scaled by nominal profits. As long as the interest rate is not very sensitive to the price level, then the Fisher debt effect will continue to hold.

7 These competing impacts are discussed in Bhaduri and Marglin (1990).

8 These critiques of the AS/AD model have been raised by Colander (1995).