Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.67 no.266 Ciudad de México oct./dic. 2008

Disinflation and real currency appreciation in Chile and Mexico: the role of monetary policy

Desinflación y apreciación cambiaría real en Chile y México: el papel de la política monetaria

Carlos A. Ibarra*

* Universidad de las Americas Puebla, <carlos.ibarra@udlap.mx>.

Received August 2007

Accepted May 2008.

Abstract

Chile and Mexico followed strategies of gradual disinflation during the 1990s, conducted their monetary policies in broadly similar ways, and experienced real currency appreciation. But the appreciation was larger in Mexico, which helps to explain its economic-growth underperformance. Motivated by these parallels and contrasts, the paper compares the conduct of monetary policy in the two countries through (a) a qualitative analysis of monetary policy episodes -episodes featuring a clear shift in the policy stance— and (b) the estimation of error-correction models for the interest rate, and identifies the specific traits of Mexico's monetary policy that contributed to the large appreciation of its currency.

Key words: disinflation, inflation, real currency appreciation, real exchange rate, monetary policy, interest rate, Chile, Mexico.

Clasificación JEL: E31, E43, E52, E58, E65, 054

Resumen

Chile y México siguieron estrategias de desinflación gradual durante los noventa, manejaron de manera similar sus políticas monetarias, y experimentaron una apreciación real de sus monedas. Pero la apreciación fue mayor en México, lo cual ayuda a explicar su pobre desempeño en términos de crecimiento económico. Basado en estas similitudes y diferencias, el artículo compara la conducción de la política monetaria en Chile y México a través de (a) un análisis cualitativo de los episodios de política monetaria —definidos por un cambio claro en la postura de dicha política— y (b) la estimación de modelos de corrección de error para la tasa de interés, e identifica las características específicas de la política monetaria en México que contribuyeron a la fuerte apreciación de su moneda.

Palabras clave: desinflación, inflación, apreciación cambiaría real, tipo de cambio real, política monetaria, tasa de interés, Chile, México.

INTRODUCTION

During the 1990s, Chile and Mexico's macroeconomic situations showed striking parallels and contrasts. The two countries had at the start of the decade similar inflation rates, both used monetary policy afterwards to support a strategy of gradual disinflation, and both experienced real currency appreciation. But the currency appreciation was larger in Mexico, which in addition —and presumably because of the large appreciation— recorded significantly slower economic growth. The parallels and contrasts support the comparative study carried out in this paper.

The paper studies comparatively the conduct of monetary policy in Chile and Mexico, in order to determine its role in the currency appreciation. The evidence for the study is gathered from two sources: a qualitative analysis of episodes featuring a clear shift in the stance of monetary policy, and the estimation of error-correction models for the interest rate. Both strands of evidence reveal a broadly similar orientation of monetary policy, but also some key differences. The differences help to explain the particularly strong appreciation of the Mexican currency.

A first difference is uncovered by the qualitative analysis of monetary episodes. The analysis shows that, during disinflation, monetary policy reacted restrictively to currency depreciations (arguably, because of their inflationary impact), a policy reaction that tended to stabilize the nominal exchange rate and appreciate the currency in real terms. The same reaction took place in both countries, but it was especially marked in Mexico.

A second difference appears in the estimation of the error-correction models, according to which changes in the inflation rate were fully transmitted to the nominal interest rate in Chile, but only partially so in Mexico. The partial transmission, in a context of disinflation, implied an upward bias for the real interest rate, and therefore an increasing return on Mexican assets and a stronger appreciation pressure on the currency.

The argument is developed as follows. The second section provides the macroeconomic background since the 1980s. The third section identifies and discusses the monetary episodes that developed in each country since the middle of the 1990s (when the series for the policy instruments that served to identify the episodes start). The fourth section presents the error correction models, which were estimated separately for the disinflation and post-disinflation periods in each country, and using monthly series that begin in 1990 in Chile and 1996 in Mexico. The fifth section summarizes the results.

DISINFLATION, ECONOMIC GROWTH, AND REAL CURRENCY APPRECIATION

Chile and Mexico converged, through different paths, on a similar inflation situation in the late 1980s. During most of that decade, inflation was high and rising in Mexico, and reached an annual rate of 177% in the first quarter of 1988; on the same period, the inflation rate was only 19% in Chile. The inflation rates converged quite rapidly, though, after Mexico introduced a new stabilization plan in 1988. By the third quarter of 1989 the inflation rates in the two countries, below 20%, were almost identical.

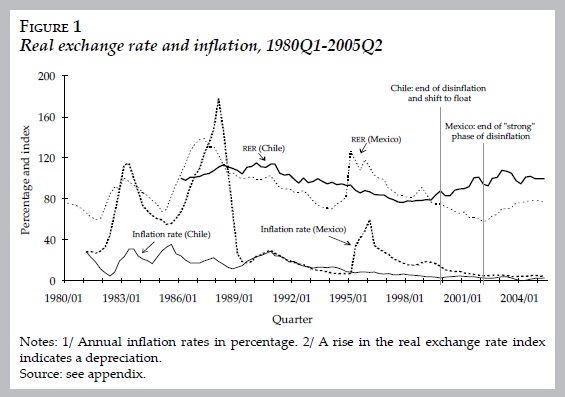

After their inflation rates converged, in 1991 the two countries began gradual disinflationary processes. Chile reached its medium-term inflation target of 3% in 1999, after which it adopted an explicit inflation-targeting regime, abandoned its long-standing exchange-rate band system, and let its currency float. Mexico displayed initially a more aggressive disinflationary stance, but lagged behind because of the economic crisis of 1995. The large currency depreciation that characterized the crisis temporarily derailed the disinflationary process, and the country did not reach a situation of low and stable inflation rates until 2002, one year after it had also adopted explicitly an inflation-targeting regime (see figure 1).1

In both countries, the currency appreciated in real terms as disinflation proceeded. The appreciation was linked, above all, to the pursuit of disinflation. The countries' specific type of exchange-rate system, for instance, was not decisive. As just mentioned, Chile relied all through the process on an exchange-rate band, while Mexico operated a system of semi-fixed exchange rate during the disinflation of the early 1990s and shifted to a float in 1995. What mattered was not the exchange-rate system but the disinflationary stance of monetary policy.

The importance of the policy stance can be realized by looking at the evolution of capital flows. The trend of capital flows to both countries turned negative in the late 1990s. In Chile this turn was accompanied, conforming to the results of previous studies,2 by real currency depreciation. In Mexico, however, the real value of the peso continued its upward trend (see figure 2). The observation, at first surprising, is consistent with the fact that Mexico's monetary policy was at the time in full disinflationary mode.3

Besides the parallels, there were also contrasts in the macroeconomic situations of Chile and Mexico. The disinflation-appreciation link, while shared, differed quantitatively between the two countries. In particular, similar reductions in inflation led to a larger appreciation in Mexico, as shown by the evolution of the respective real exchange rate indices in the early 1990s, or the very different levels of the indices at the end of disinflation in each country (see again figure 1).

The different degree of currency appreciation is important because it helps to explain a second contrast, one which concerns economic growth. As shown in table 1, economic growth has been on average slower and more volatile in Mexico. The contrast is not a mere reflection of the 1995 economic crisis in Mexico, but a persistent fact. Even in the relative financial calm of the early 2000s, Mexico's output growth rate was nearly 40% smaller than Chile's, and more than twice as volatile.4

MONETARY POLICY EPISODES

While Chile and Mexico followed similar disinflation strategies in the 1990s, Mexico experienced slower economic growth and a larger currency appreciation. The different degree of currency appreciation is examined from the standpoint of monetary policy in this and the next section. This section presents a qualitative analysis of monetary policy episodes —that is, episodes defined by a clear shift in the stance of monetary policy.

The analysis draws conclusions on the determinants of the real exchange rate in the two countries by stressing the parallels and contrasts in the conduct of monetary policy. Monetary policy is characterized here by its reaction to key macroeconomic variables: the inflation rate, the exchange rate, and two indicators of economic activity: the output growth rate and the output gap (plus the United States (US) interest rate in the next section; the appendix details the definition and source of the variables).

Chile

During disinflation, the main instrument of Chile's monetary policy was the so-called monetary policy rate, which was set by the central bank in real terms from May 1995 until July 2001, and in nominal terms afterwards. The evolution of the policy rate allows identifying four monetary policy episodes —two characterized by monetary tightening (episode 1: late 1995 and 1996; episode 3: 1998), and two by monetary loosening (episode 2: 1997; episode 4: 1999) (see figure 3).

What were the macroeconomic ingredients —the triggers— of the episodes? In those of monetary tightening there were two evident factors. One of them was a lack of progress in the disinflationary process. Thus, disinflation halted at the outset of episode 3, while it slightly reversed during episode 1 —with the inflation rate rising from 7.4% in May 1995 to 8.6% one year later.

The second factor was the evolution of the exchange rate. Policy leaned against currency depreciations. Depreciation accelerated before episode 1, moving the nominal exchange rate from about 373 pesos per dollar in June of 1995 to 411 pesos in November. The same phenomenon took place before episode 3, with the exchange rate rising from about 413 pesos in October of 1997 to 452 in January of 1998 (see figure 4).

Since the acceleration of currency depreciation and the stop or reversal of disinflation were roughly simultaneous events, there is the question of whether monetary policy was reacting to the exchange rate or to its possible inflationary impact. Two observations help to answer. First, during both episodes the currency remained in the strong part of the exchange-rate band (that is, below central parity) and, therefore, there was no risk that the depreciation would bring the exchange-rate regime down. Second, the currency was highly appreciated, in real terms, compared with the levels recorded at the beginning of disinflation (see again figure 4).

Both observations suggest that monetary policy was reacting to the exchange rate's possible impact on inflation, not to the exchange rate itself. But the distinction may be irrelevant: in either case the policy reaction would tend to stabilize the nominal exchange rate and —with inflation at home higher than abroad— to appreciate the currency's real exchange rate. It will be seen that a qualitatively similar, but more marked, pattern is discernible in Mexico.

The episodes exhibit elements of counter-cyclical policy. The decisions to tighten benefited from a favorable macroeconomic configuration that featured a rising output growth rate and a positive output gap (although the output growth rate was relatively small in episode 3). As could be expected, both indicators fell shortly after the tightening (see figure 5). Symmetrically, the two episodes of monetary loosening (in 1997 and 1999) took place under conditions of low economic activity, which rebounded after the policy shift.

Episode 4 illustrates a dilemma that may arise when monetary policy targets both the inflation rate and the exchange rate. On one hand, since late 1988 the exchange rate had been close to central parity, or even in the weak (upper) half of the band, which called for an interest-rate rise to defend it. On the other hand, after inflation reached the 3% target in late 1999, the central bank abandoned its disinflationary stance, which called for no further rises in the interest rate.

A possible defense of the exchange-rate band by higher interest rates conflicted, not only with the now-desired stability of the inflation rate, but with the need to raise a nearly-zero output growth rate. Facing this dilemma, the central bank gave up the exchange-rate band and adopted a looser monetary stance (see De Gregorio and Tokman, 2004). The currency depreciated steadily afterwards, and the rate of economic growth recovered.

Mexico

During the period under study, Mexico's monetary policy was conducted under a system of target balances for the commercial banks' current accounts at the central bank. Banks were required to satisfy a zero cumulative balance over a certain period, which was of 28 days until March 2003, and of one day afterwards (see Yacamán, 1999; Banco de México, undated, a and b).

Banco de México always supplied the banks with the reserves needed to meet the target balance, but did so under conditions that signaled its policy stance: if the conditions included a so-called short (corto) of some amount, then such amount of reserves were supplied at penalty rates. Because of the penalty, a rise in the short induced banks to compete for funds and raised the market interest rates (see Díaz de León and Greenham, 2000; Ibarra, 2004).5

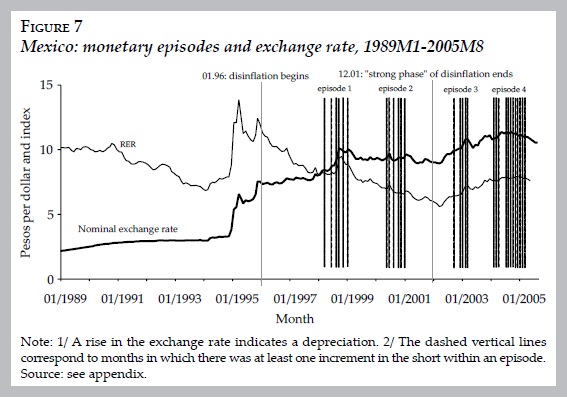

The cases of short increments far outnumbered those of short decrements, a gap that illustrates the disinflationary character of monetary policy in Mexico during the period under study (see Ramos and Torres 2005; Galindo and Ros, 2008). In fact, while no instance of sustained monetary loosening can be found, it is possible to identify four episodes of monetary tightening (see figure 6): March 1998 to January 1999 (episode 1), May 2000 to January 2001 (episode 2), September 2002 to March 2003 (episode 3), and February 2004 to March 2005 (episode 4). The episodes were defined by a series of consecutive (or nearly so) monthly changes in the short, rather than by isolated ones.

Mexico's episodes developed in a macroeconomic setting that was similar to that found in Chile. Monetary policy reacted to the state of disinflation. Thus, the episodes of monetary tightening took place after disinflation had decelerated or stopped (as in episodes 2 and 3) or after the inflation rate had started to rise (episodes 1 and 4). Monetary policy also reacted to the exchange rate. In particular, episodes 1, 3 and 4 developed in the middle of an acceleration in the rate of currency depreciation (see figure 7).

Mexico's central bank leaned against currency depreciations even though the real exchange rate had accumulated a substantial degree of appreciation. By February of 1998, at the outset of episode 1, the real exchange rate index had descended to the low levels observed in November of 1994 (82 versus 78.5) —only one month before the collapse of the exchange-rate band—. In August of 2002, before episode 2, the real exchange rate index had an incredibly low level of 63. Although less dramatic, the macroeconomic setting of episode 4 was similar.

As in Chile, the clearly appreciated currency suggests that Mexico's policy was reacting not to the currency depreciation itself but rather to its possible inflationary impact. In practice, however, it was as if policy were reacting to the real exchange rate. Figure 8 shows that Banco de México usually shifted to a more restrictive policy stance whenever the rates of real currency depreciation became positive. No similar picture can be drawn for Chile, despite its qualitatively-similar pattern of policy reaction.

The initial episodes of monetary tightening in Mexico took place under conditions of high economic activity. At the beginning of episode 1, the output growth rate neared 7% and the output gap was positive; of course, as a consequence of the tightening, growth fell and the output gap eventually became negative. The same sequence characterized episode 2 (see figure 9).

When faced with a dilemma, though, the central bank favored disinflation. Thus, although the output growth rate was practically zero and the output gap negative, monetary policy shifted to a more restrictive stance in late 2002. By the same token, the monetary tightening of episode 4 brought to a stop the shy growth recovery that had started in the first half of 2004.

INTEREST RATE EQUATIONS

The qualitative analysis of Chile and Mexico's monetary episodes revealed common elements in their conduct of monetary policy. Monetary policy reacted to the exchange rate —although the ultimate concern was the inflationary impact of currency depreciations— in a pattern that appeared most clearly in Mexico and which therefore helps to explain why the resulting real currency appreciation was especially large in that country. The qualitative evidence is complemented by the econometric analysis presented in this section, which again seeks to exploit the parallels and contrasts between the two countries.

The analysis rests on the estimation of error-correction models that quantify the reaction of the interest rate (in the short and the long run) to changes in key macroeconomic variables. The approach allows inferring the influence of monetary policy on the real exchange rate but without leaving the familiar framework of a policy reaction function. The function (also called, in this context, a monetary policy rule) can be derived, for instance, from the assumption that the government targets the inflation rate and the output gap. The function's coefficients describe the government's reaction as it seeks to keep the variables on target.6

The coefficients can be given also a normative interpretation. Consider, for instance, the inflation coefficient in an equation for the nominal interest rate. The coefficient, it is argued, should be larger than one if the central bank is to keep the inflation rate close to its target. If the coefficient meets the condition, a rise in inflation will induce a larger rise in the nominal interest rate. The real interest rate will move up, and its negative effect on aggregate demand will help to bring inflation down to the desired level. This interpretation assumes that the initial inflation rate equals the government's target. Under conditions of disinflation —that is, when the initial inflation rate is well above the target— care is needed to interpret the inflation coefficient, as will be discussed below.

The interpretation of other coefficients may not be straightforward, since it depends on the government's unobservable loss function. For instance, suppose the estimation yields a significant exchange-rate coefficient. Is this because the government has an exchange-rate target —in what is sometimes called a flexible inflation-targeting regime— or because it is reacting to the exchange rate's impact on inflation —as in a strict inflation-targeting regime?— Since the loss function cannot be observed, this question can be answered only by considering other relevant indicators —the extent of real currency appreciation, for example— as was done in the previous section.

The initial specification of the error-correction models took the form:

where nir is the percentage nominal interest rate, ri is the percentage inflation rate, rer is the log real exchange rate (where a rise means a depreciation), out is the output gap, and usr is the percentage us real interest rate. In equation [1], nirlr is the long-run value of the interest rate as determined by the following level relationship:

As is well known, equation [1] can be derived from a general unrestricted autoregressive-distributed lag model of order (M + 1, L + 1). Initially M and L were equal to 3. The lag structure was then simplified according to the statistical significance of the estimated coefficients. The final models retain only those coefficients with a p-value below 0.10, and they are accompanied by the results of Wald tests for the hypothesis that the coefficients on each variable and its lags are jointly equal to zero.

On the right side of equation [1], the term inside parenthesis equals the deviation of the actual interest rate from its long-run equilibrium; its coefficient, σ, measures the speed of adjustment toward equilibrium. o —also known as the error-correction coefficient— plays an important role in the analysis: it must be statistically different from zero to accept the existence of equation [2]; and it is expected to be negative, indicating that the interest rate adjusts over time to restore the equilibrium.

The analysis followed the approach proposed by Pesaran et al. (2001), which does not require pre-testing the variables for order of integration and focuses instead on the statistical significance of σ.7 When the approach was inconclusive, it was supplemented by the Engle-Granger procedure, which consists of testing for a unit root in the residuals of equation [2]. If the unit root hypothesis is rejected, the variables are taken to be cointegrated.

The two-step estimation procedure —first equation [2], and then equation [1]— yielded the results shown in table 2. The table also presents a set of diagnostic tests for the error-correction models. In addition to the Wald tests referred to, they include the Breusch-Godfrey test for the absence of up to sixth-order serial correlation, the Jarque-Bera test for normally-distributed residuals, and Ramsey's general specification reset test. Separate models were estimated for the disinflation and post-disinflation periods in each country, namely, 1990M1-1999M12 and 2000M1-2005M6 in Chile, and 1996M1-2001M12 and 2002M1-2005M7 in Mexico. All the test results are favorable, except for Ramsey's in the equation for the post-disinflation period in Mexico.

The disinflation period

As expected, the estimation yielded a large, negative coefficient on the error-correction term (—0.38 in Chile and —0.66 in Mexico). In both countries the Pesaran et al. test cannot reject the long-run equation [2] at 5% of statistical significance, regardless of the order of integration of the variables. The estimated long-run coefficients have the expected signs, making possible to causally interpret the equations as policy reaction functions. For instance, the positive coefficients on the real exchange rate and the inflation rate favor an interpretation of causality that runs from these variables to the interest rate, rather than the other way around.8

At the level of individual coefficients, there are similarities between the two countries. For instance, changes in the US interest rate were fully transmitted to the local interest rates: the point estimate for the US interest rate coefficient is 1.46 in Chile and 1.20 in Mexico; in both cases, the hypothesis that the coefficient is equal to one cannot be rejected at conventional levels (p-values of 0.35 and 0.61, respectively). Since local interest rates fully adjust to changes in the US rate, there is no evidence of monetary autonomy, at least from a long-run perspective, irrespective of the varying degrees of exchange-rate flexibility afforded by the band regime in Chile and the float in Mexico.

There is a similarity also in the estimated coefficients for the output gap: a 1% increment in this variable induced an interest rate change of 1.81 in Chile and 1.75 in Mexico.9 Thus, in both countries the interest rate tended to react counter-cyclically to relatively long-lasting changes in the output gap. The reaction to the output gap is significant also in the short run in Chile, but not in Mexico —echoing the weaker counter-cyclical pattern of Mexico's monetary policy found in the previous section (see figure 10).10

A first important difference between the two countries concerns the reaction to the real exchange rate. The estimated real-exchange-rate coefficient is positive in both countries but much greater in Mexico (74.5 against 19.4), which implies that a sustained change in the real exchange rate elicited a relatively large interest-rate reaction in Mexico. This conclusion is reinforced by the estimated short-run effects. In Mexico, the interest rate rises in 5.4 points in reaction to a 10% change in the real exchange rate, against 4 points in Chile (see figure 11).11

How to interpret the positive real-exchange-rate coefficient? Recall that during this phase the real exchange rate followed in both countries a downward trend. The positive coefficient indicates that, controlling for the effect of inflation and other relevant variables, a fall in the real exchange rate —a currency appreciation— led to a fall in the local interest rate. The reaction reflects a policy of leaning against the appreciation. It is surprising, therefore, to find that the reaction was stronger in Mexico, where the currency appreciation was larger. In other words: the difference in the estimated coefficients on the real exchange rate cannot explain the difference in the extent of currency appreciation between Mexico and Chile.

The key difference lies in the reaction to the inflation rate. The estimated inflation coefficient is positive in both countries, but smaller in Mexico (0.66 against 1.24); importantly, the hypothesis that the coefficient equals one can be rejected in Mexico (p-value of 0.009), but not in Chile (0.50).

The interpretation of the different size of inflation coefficients must consider the disinflationary context. In Chile the real interest rate did not change as inflation fell, because the nominal interest rate fully adjusted to the fall in the inflation rate. In Mexico, in contrast, there was an upward bias for the real interest rate, given the partial adjustment to disinflation. This has important consequences: in addition to its possible negative effect on economic growth, the rising real interest rate implicit in the policy rule implies an increasing return on Mexican assets and, therefore, a heavier appreciation pressure on the currency.

The point is reinforced by the short-run interest-rate reaction to inflation. In Chile the reaction is strong: a change of 1 point in the inflation rate is followed, after three periods, by a change of nearly 2.5 points in the nominal interest rate. In Mexico, the less-than-proportional reaction reaches a peak of only 0.5 points after one period (see figure 12).

The post-disinflation period

The Pesaran et al. (2001) procedure is not conclusive for the second part of the sample. In Chile the long-run relationship can be accepted regardless of the order of integration of the variables, but only at 10% of significance; in Mexico the relationship can be accepted only conditionally on the variables being stationary. The Engle-Granger procedure yields favorable results, though, since all the tests reject the hypothesis of a unit root in the residuals of equation [2].

The estimated coefficients for this part of the sample reveal important changes in the conduct of policy, in a manner that suggests an increase in monetary autonomy after the end of disinflation (or the strong phase of disinflation, in Mexico). The first suggestive result concerns the error-correction coefficient, which declined, in absolute value, from 0.66 to 0.46 in Mexico. This reflects a lower speed of adjustment of the interest rate —or, in other words, a decrement in the response of policy to variations in the selected macroeconomic variables.

A second related result is the reduced transmission of changes in the US interest rate to the local rate. The point estimate for the coefficient on the US real interest rate fell from 1.46 to 0.55 in Chile, and from 1.20 to 0.48 in Mexico; in both countries, the hypothesis that the coefficient equals one (full transmission) has a very low probability (0.08 and 0.02).

The final piece of evidence consists of the weaker response of the interest rate to the real exchange rate. In Mexico the corresponding long-run coefficient lost its significance, while the short-run reaction became much smaller (with a peak change of 2 points in the interest rate for a 10% change in the real exchange rate, rather than the 5.5 peak obtained in the disinflation period12). In Chile the coefficients became negative, no longer allowing interpreting the results as a policy reaction function (see again figure 11).

The completion of disinflation (rather than the different exchange-rate systems) appears then to have had significant implications for the conduct of monetary policy; the last two estimation results just mentioned, in particular, basically correspond to the textbook definition of monetary autonomy, i.e., the possibility of controlling the interest rate under conditions of high international mobility of capital. It is worth noting, therefore, that the increase in monetary autonomy was not reflected in a correspondingly larger reaction of policy to output. In Mexico, the output-gap coefficient in the long-run equation increased marginally, from 1.8 to 2.1 (for a one-point change in the output gap). In Chile both the long- and the short-run coefficients fell (see again figure 10).

CONCLUSIONS

From similar inflation situations, Chile and Mexico adopted at the start of the 1990s strategies of gradual disinflation that were supported by broadly similar monetary policies and entailed a real appreciation of the currency. But the appreciation was especially large in Mexico. The paper argued that this resulted from specific traits of Mexico's monetary policy.

The paper studied the cases of Chile and Mexico, seeking to draw conclusions from observed parallels and contrasts in their conduct of monetary policy, and relying on two strands of evidence. The first came from a qualitative examination of episodes featuring a clear shift in the monetary policy stance. The monetary episodes revealed that in both countries the policy stance became more restrictive in reaction to the joint occurrence of a stop or reversal in disinflation and a higher rate of currency depreciation. The reaction tended to stabilize the currency's nominal exchange rate and —with inflation at home higher than abroad— to appreciate the currency in real terms. Although shared by the two countries, the policy reaction was especially marked in Mexico.

The second strand of evidence came from the econometric estimation of error-correction models for the interest rate. Separate models were estimated for the disinflation and post-disinflation periods in each country. The separation proved useful: it revealed an increase in monetary autonomy after the completion of disinflation, but a failure of policy to react more decidedly to variations in the output gap.

Focusing on the disinflation period, the estimation results showed some similarities in the two countries —e.g., the full transmission of changes in the US interest rate to the domestic rate. A key difference, though, concerned the inflation coefficient, which was equal to one in Chile but significantly smaller in Mexico. In a context of disinflation, this difference implied a constant real interest rate in Chile, but an increasing one in Mexico.

The two results —the marked qualitative pattern of monetary tightening as a reaction to currency depreciations (which tended to stabilize the exchange rate) and the upward bias in the real interest rate (which increased the return on Mexican assets)— help to explain the large currency appreciation recorded in Mexico compared with Chile, and, therefore, the growth underperformance of the Mexican economy.

REFERENCES

Aninat, E. and C. Larrain, "Flujos de capitales: lecciones a partir de la experiencia chilena", Revista de la CEPAL, no. 60, 1996, pp. 39-48. [ Links ]

Banco de México, "La conducción de la política monetaria del Banco de México a través del régimen de saldos acumulados", available at <www.banxico.org.mx>, undated, a. [ Links ]

----------, "La conducción de la política monetaria del Banco de México a través del régimen de saldos diarios", available at <www.banxico.org.mx>, undated, b. [ Links ]

Blecker, R., "External shocks, structural change, and economic growth in Mexico, 1979-2006", Department of Economics, American University Working Paper, December 2007. [ Links ]

Caputo, R., "Exchange rates and monetary policy in open economies: the experience of Chile in the nineties", Central Bank of Chile Working Paper no. 272, 2004. [ Links ]

Corbo, V, "Monetary policy in Latin America in the 1990s", in N. Loayza and K. Schmidt-Hebbel (eds.), Monetary Policy: Rules and Transmission Mechanisms, Central Bank of Chile, 2002, pp. 117-165 [ Links ]

De Gregorio, J. and A. Tokman, "Overcoming fear of floating: exchange rate policies in Chile", Central Bank of Chile Working Paper no. 302, 2004. [ Links ]

Díaz de León, A. and L. Greenham, "Política monetaria y tasas de interés: experiencia reciente para el caso de México", Banco de México Working Paper no. 2000-8, 2000. [ Links ]

Frenkel, R. and L. Taylor, "Real exchange rate, monetary policy and employment", United Nations Department of Economic and Social Affairs (DESA) Working Paper no. 19, February 2006. [ Links ]

Galindo, L.M. and J. Ros, "Alternatives to inflation targeting in Mexico", International Review of Applied Economics, vol. 22, no. 2, 2008, pp. 201-214. [ Links ]

Gavin, M., R. Hausmann and L. Leiderman, "The macroeconomics of capital flows to Latin America: experience and policy issues", Inter-American Development Bank (IADB) Working Paper no. 310, 1995. [ Links ]

Hausmann, R., L. Pritchett and D. Rodrik, "Growth accelerations", Harvard University Working Paper, 2005. [ Links ]

Held, G. and R. Szalachman, "Flujos de capital externo en América Latina y el Caribe en los años noventa: experiencias y políticas", Revista de la CEPAL, no. 64, 1998, pp. 29-46. [ Links ]

Ho, C. and R.N. McCauley, "Living with flexible exchange rates: issues and recent experience in inflation targeting emerging market economies", Bank for International Settlements (BIS) Working Paper no. 130, 2003. [ Links ]

Ibarra, C.A., "Exporting without growing: investment, real currency appreciation, and export-led growth in Mexico", Department of Economics, Universidad de las Américas Puebla Working Paper, June 2008a. [ Links ]

----------, "Mexico's slow-growth paradox?", forthcoming in CEPAL Review, March 2008b. [ Links ]

----------, "Macroeconomic effects of capital flows: the case of Mexico", in S. Motamen-Samadian (ed.), Capital Flows and Foreign Direct Investments in Emerging Markets, New York, Palgrave Macmillan, 2005, pp. 29-59. [ Links ]

----------, "The interest rate-exchange rate link in the Mexican float", Economía Mexicana, vol. XIII, no. 1, 2004, pp. 5-28. [ Links ]

Le Fort, G., "Capital account liberalization and the real exchange rate in Chile", International Monetary Fund (IMF) Working Paper no. 132, 2005. [ Links ]

Martínez, L., O. Sánchez and A. Werner, "Consideraciones sobre la conducción de la política monetaria y el mecanismo de transmisión en México", Banco de México Working Paper no. 2001-02, 2001. [ Links ]

Mohanty, M. and M. Klau, "Monetary policy rules in emerging market economies: issues and evidence", BIS Working Paper no. 149, 2004. [ Links ]

Pesaran, M.H., Y Shin and R.J. Smith, "Bounds testing approaches to the analysis of level relationships", Journal of Applied Econometrics, no. 16, 2001, pp. 289-326. [ Links ]

Ramos, M. and A. Torres, "Reducing inflation through inflation targeting", Banco de Mexico Working Paper no. 2005-01, 2005. [ Links ]

Rodrik, D. "The real exchange rate and economic growth: theory and evidence", JFK School of Government, Harvard University Working Paper, August 2007. [ Links ]

Ros, J. and N. Lustig, "Trade and financial liberalization with volatile capital inflows: macroeconomic consequences and social impacts in Mexico during the 1990s", Center for Economic Policy Analysis (CEPA) Working Paper no. 18, New School University, 2000. [ Links ]

Schmidt-Hebbel, K. and A. Werner, "Inflation targeting in Brazil, Chile and Mexico: performance, credibility and the exchange rate", Central Bank of Chile Working Paper no. 171, 2002. [ Links ]

Taylor, J., Monetary Policy Rules, National Bureau of Economic Research (NBER)- University of Chicago Press, 1999. [ Links ]

Uthoff, A. and D. Titelman, "Afluencia de capitales externos y políticas macroeconómicas", Revista de la CEPAL, no. 53, 1994, pp.13-29. [ Links ]

Williamson, J., The Crawling Band as an Exchange Rate Regime. Lessons from Chile, Colombia, and Israel, Institute for International Economics, 1996. [ Links ]

Yacamán, J., "The implementation of monetary policy through the zero-average reserve requirement system: the Mexican case", in Monetary Policy Operating Procedures in Emerging Market Economies, BIS Policy Paper no. 5, 1999. [ Links ]

I would like to thank A. Calcagno and two anonymous referees for their valuable comments and suggestions. Any remaining errors are my responsibility. A previous version of this paper was carried out under the United Nations Conference on Trade and Development (UNCTAD) Project of Technical Assistance to the Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development with the aid of a grant from the International Development Research Centre of Canada (IDRC).

1 Mexico's central bank announced in 2002 a medium-term inflation target of 3%, implying that disinflation remained a policy goal in mid 2005 (the end of the period considered in the paper). The strong phase of disinflation, however, concluded in 2001, after which the process became markedly slower and marginal. For instance, the inflation rate was 4.75% in the first quarter of 2002 and a similar 4.51% in the second quarter of 2005 (the last observation included in figure 1).

2 See Uthoff and Titelman (1994) and Gavin et al. (1995) for early analyses of Latin America; Le Fort (2005) for Chile, and Ibarra (2005) for the Mexican case.

3 As a proportion of gdp, capital inflows are larger in Chile than in Mexico (see figure 2); thus, their relative size cannot explain the smaller degree of real currency appreciation recorded in Chile (see Held and Szalachman, 1998, for a similar observation). Some authors argue that the crawling-band system and the use of capital controls helped to ease the appreciation pressures in that country (see Williamson, 1996; Aninat and Larrain, 1996).

4 Recent studies of the effect of the real exchange rate on economic growth include Rodrik (2007), Frenkel and Taylor (2006), and Hausmann et al. (2005); for the Mexican case, see Ibarra (2008a, 2008b), Blecker (2007), and Ros and Lustig (2000).

5 The short was the main instrument of monetary policy in Mexico during the period under analysis. In 2004 Banco de México began the transition to a new framework, by announcing its policy stance through both the short and an inter-bank interest rate. In practice, the short ceased to be a relied-on policy instrument before it was officially abandoned in early 2008.

6 See the works collected in Taylor (1999); chapter 9, in particular, discusses in simple terms the alternative ways to derive analytically a monetary policy rule. The choice of regressors for the error-correction models was guided by this literature, which typically considers macroeconomic variables such as inflation and the output gap, but not, for instance, the country risk premium. The expected inflation rate, although of possible interest, was left out of the analysis because the survey series available from the two central banks, beginning in 1999, were too short.

7 Pesaran et al. (2001) provide separate critical values for the hypothesis that σ equals zero, conditional on whether the variables are integrated of order one or zero [I(1) or I(0)]. If the estimated t-statistic falls between the critical values for the I(0) and I(1) cases, then equation [2] can be accepted only under the assumption that the variables are stationary. In contrast, if the t-statistic is larger, in absolute value, than the critical values for the I(1) case, then equation [2] can be accepted irrespective of order of integration.

8 The models include a linear trend and a 0-1 dummy for the Russian crisis. The Chilean model also includes a dummy for December 1990, necessary to pass the normality test. Since it is possible that the variables are non-stationary, and therefore that the coefficient distributions are not standard, the p-values for this part of the model are only indicative.

9 Corbo (2002) found no significant reaction of the real interest rate to the output gap during the Chile's band period. But Caputo (2004), using a longer estimation period, got a positive result.

10 The reaction was calculated using the coefficients on the differenced variables in the short-run part of the model (recall equation [1]). Changes in the relevant variables were assumed transitory but "persistent", meaning that they lasted for three months.

11 A positive exchange-rate coefficient is a frequent estimation result for emerging market economies (see Ho and McCauley, 2003). Mohanty and Klau (2004) also found a larger exchange-rate coefficient in Mexico than in Chile.

12 Martinez et al. (2001), relying on a shorter estimation period, found no statistically significant effects. See also Schmidt-Hebbel and Werner (2002).