INTRODUCTION

Pension plans can be classified into two large groups: defined benefit and defined contribution. This classification is given from how contributions are made to the pension plan and the benefit that will be obtained at the time of retirement. The main difference between these plans is the amount of benefit that the individual receives; since, on one hand in defined benefit plans, the member of the plan knows the amount of benefit that he or she will receive from the beginning because it is stipulated in the pension plan rules.

While, on the other hand in defined contribution plans, the amount of benefit received will be based on the value of the fund that the individual has accumulated throughout his working life. Another important difference is about who assumes the risk since in defined benefit schemes it is mainly the sponsor; while in defined contribution schemes, it is mainly absorbed by the individual ( Gómez, 2015 ; Boelaars and Broeders, 2019 ; Van Meerten and Schmidt, 2018 ; Balter et al., 2018 ; Bennett and Van Meerten, 2019 ; Thurley and Davies, 2020 ).

It is important to point out that there is another type of plan called hybrid and that there is a transition from defined benefit plans to hybrid or defined contribution type; being the most frequent transition in the world, from defined benefit to defined contribution. This means that defined benefit plans are closing their funds to new members.

One of the reasons that have caused this change in pension systems is the increase in life expectancy since this complicates the sustainability of pension plans over time and has led to important reforms of pension systems in various countries. In this sense, the Organization for Economic Cooperation and Development (OECD) points out that pension systems must be balanced between the benefits offered and its financial sustainability. Thus, for different reasons, developed countries are the ones who have refined these pension plan systems, to face these different challenges ( Gómez, 2015 ; Martínez-Aldama, 2013 ; Valero et al., 2011 ; Martínez et al., 2014 ; Alonso, 2014 ; Van der Zwan et al., 2019 ; OECD, 2009 ; Boelaars and Broeders, 2019 ; Bams et al., 2016 ; Balter et al., 2018; Thurley and Davies, 2020 ).

Each of the three pension plans (defined benefit, defined contribution, and hybrid) has certain advantages either for the worker, the employer, or for both. For example, employees opt for employer-sponsored pension plans because these types of plans contribute to reducing the risk of individual savings for retirement since they are developed to provide adequate resources for retirement, complemented by social security. In this way, the financial risk arising from individual retirement savings is eliminated when employer-sponsored plans invest workers’ assets in a common fund, where administrative costs are also eliminated ( Gómez, 2015 ; OECD, 2009 ; Wiman, 2019 ; Thurley and Davies, 2020 ).

Traditional pension plans such as defined contribution and defined benefit plans face several challenges, the best known being the increase in life expectancy. Consequently, several pension plans have been raised to solve these problems, which are classified as hybrid. Some of these are individual-defined contribution, collective individual defined contribution, and collective defined contribution schemes.

It should be noted that it has been pointed out that the collectivization of pension schemes allows to better face the challenges identified for traditional plans, compared to individual schemes. In this line, collective defined contribution pension plans have been proposed by several authors ( Van Meerten and Schmidt, 2018 ; Wesbroom et al., 2013 ; Boelaars and Broeders, 2019 ; Gómez, 2015 ; Valero et al., 2011; Martínez-Aldama, 2013 ; Martínez et al., 2014 ; V an der Zwan et al., 2019 ; OECD, 2009 ; Boelaars and Broeders, 2019 ; Arends et al., 2020 ; Wiman, 2019; Bams et al., 2016 ; Balter et al., 2018 ; Bennett and Van Meerten, 2019; Thurley and Davies, 2020 ).

The objective of this research study is to explore the financial and actuarial viability of the collective defined contribution schemes as an alternative pension plan for public or private institutions, through the accumulation of a fund with specific characteristics that are taken from finance and actuarial literature. Section 2, shows a review of the literature on the characteristics of collective defined contribution pension plans, as well as a review of an implemented plan. Section 3, shows the methodology that was used in this work to achieve the stated objective, showing the quantitative methods that exist to determine the financial and actuarial viability of these plans. Section 4 shows the results and section 5 shows the conclusions of that study.

LITERATURE REVIEW

The collective defined contribution pension plans are institutional agreements, where the contribution made by the members of the plan is an amount agreed from the beginning of the plan, as in the defined contribution plans. However, these contributions are assigned to a single fund or collective bag, which is invested collective to finance a pension amount for retirement.

Thus, unlike defined contribution plans, the fund is allocated collectively, rather than individually for each worker. Also, members of the plan are granted a pension upon retirement; which is not guaranteed and may vary depending on the performance of the fund ( Wesbroom et al., 2013 ; Boelaars and Broeders, 2019 ; Royal Mail Group, 2020 ; Department for Work and Pensions, 2019; Royal Mail Group and Communication Workers Union, 2018 ; Arends et al ., 2020 ; Wiman, 2019; Bams et al., 2016 ; Bennett and Van Meerten, 2019; Thurley and Davies, 2020 ).

The main characteristics of collective defined contribution schemes are:

- The contributions of individuals are all brought together in a single collective fund

- The amount of the pension that the member of the plan receives at retirement is not guaranteed, long-term investments are allowed

- Several risks are shared, including longevity risk

- The plan member does not make investment decisions, which are left to the fund manager (who should be a professional)

- The pension that the subject receives will be mainly a function of the return obtained by the fund or the value of the assets

- The contributions made by the plan members and the sponsor are based on a fixed rate, which can be expressed as a fixed percentage of salary or a fixed amount.

It should be added that, although the benefits are not guaranteed, normally when they are going to decrease to meet the obligations (that is when a deficit occurs), they are adjusted based on rules which are stipulated in the contracts of the plan. Also, usually in CDC plans, the employer is not obliged to make contributions when there is a deficit in the pension plan, but it is financed collectively among its members ( Boelaars and Broeders, 2019 ; Royal Mail Group, 2020 ; Department for Work and Pensions, 2019 ; Royal Mail Group and Communication Workers Union, 201 8; Wesbroom et al., 2013 ; Arends et al., 2020 ; Wiman, 2019; Bams et al., 2016 ; Bennett and Van Meerten, 2018 , 2019; Thurley and Davies, 2020 ).

Some of the advantages of this type of plan, in general, are the following. These plans are simpler, since members of the plan are not involved in making investment decisions, but rather have a fund manager who is usually a professional. Due to the joint nature of the fund, it can opt in the last years of the workers' working life for investment strategies that are not so conservative, which allows it to potentially achieve higher returns. Longevity risk is shared, reducing the risk incurred by the plan sponsor.

Intergenerational risk is shared among plan members, thus allowing companies or plan sponsors to avoid significant liabilities. And, as there is a common fund, its size is greater; allowing to invest resources at a lower cost and in assets that generate higher returns. It is important to note that the fund, as it is managed by professionals, avoids the risk that unprepared individuals make investment decisions for the fund, as occurs in other types of pension schemes. In this way, incorrect decisions are avoided regarding how to save or invest the fund's assets. For these reasons, it has been noted that collective defined contribution (CDC) plans are more attractive to workers and sponsors ( Boelaars and Broeders, 2019 ; Royal Mail Group, 2020 ; Department for Work and Pensions, 2019; Wesbroom et al., 2013 ; Arends et al., 2020 ; Bams et al., 2016 ; Bennett and Van Meerten, 2019 ; Thurley and Davies, 2020 ).

Other advantages of CDC plans are that the benefits are not purchased through annuities in the insurance market, but rather the benefits received by the members of the plan are financed from the same fund. This allows the fund to keep the assets for longer, being able to achieve higher than expected returns and save costs, such as the commission of the insurer when buying the annuity. In this way, CDC plans can provide higher pension benefits compared to other types of group schemes. It should also be noted that the combination of risks of the CDC plans allows the investment returns to be optimized in the long term, thus preventing decision-making from responding to short-term problems ( Wesbroom et al., 2013 ; Thurley and Davies, 2020 ).

On the other hand, it has also been argued that CDC plans can provide greater benefits than an individual defined contribution plan. This is for several reasons which are mentioned below. The grouping of assets allows collective management that makes or even improves risk management. Moreover, there exists the possibility of making long-term investments at lower costs. Furthermore, CDC plans to promote less volatile benefits compared to individual defined-contribution plans ( Arends et al., 2020 ; Wesbroom et al., 2013 ; Bams et al., 2016 ; Thurley and Davies, 2020 ). The above, indicated by Wesbroom et al. ( 2013) and Arends et al. ( 2020 ); found that CDC pension plans obtain higher benefits, are fairer, and are more stable compared to an individual defined contribution plan. Bams et al. ( 2016 ) also reached the same conclusions that Wesbroom et al. (2013 ) and Arends et al. (2020) , but add that CDC plans are more stable and perform better in the long term than traditionally defined benefit schemes.

Also, it should be noted that longevity risk is better covered by the CDC plan than others, such as individual schemes. Since, for example, if the individual lives longer than projected, some schemes could not maintain the amount of the benefit or it would decrease; which in the CDC schemes does not occur ( Arends et al., 2020 ; Bams et al., 2016 ; Thurley and Davies, 2020 ).

It should be added that, in the CDC schemes, benefits for employers have been identified, among which are the following. The reduction of pension costs and possible liabilities. These attract and keep workers longer in their jobs. It reduces the possibility of working beyond their retirement date and allows companies to help their workers obtain a pension that improves their quality of life. Also, it has been pointed out that the CDC schemes can help the economies of the countries since the funds can make long-term and large investments (because of the collective fund); something that other types of plans do not allow. Due to the aforementioned advantages, even unions such as the Royal Mail Group consider that these CDC plans have a better design than individual defined contribution (CDI) plans ( Department for Work and Pensions, 2019 ; Royal Mail Group, 2020 ; Wesbroom et al., 2013 ; Arends et al., 2020 ; Wiman, 2019 ; Bams et al., 2016 ; Bennett and Van Meerten, 2019 , Thurley and Davies, 2020) .

One of the disadvantages of CDC plans that should be pointed out is that different designs of collective pension plans arise. This is because the CDC name is used to designate several types of schemes that share certain common characteristics, which are described below. On one hand, the risks are shared. Also, the contribution is defined, and the benefit is not guaranteed. Likewise, there may be several types of CDC plan designs, although these must share certain characteristics such as those already mentioned, which makes their study and regulation a difficult task. However, it has been pointed out that this may not be a disadvantage and is a strength, since it shows the ability to adapt to multiple scenarios and under different circumstances ( Arends et al., 2020 ; Wesbroom et al., 2013 ).

Notably, some concerns and other issues have also been attributed to CDC plans, including the following. There are doubts about its long-term sustainability and under different circumstances such as a decrease in the number of members. Intergenerational rate may not be desirable and therefore, be confusing; since plan members may not know or understand certain concepts such as that their pension is not guaranteed, although this also is found in other types of pension schemes ( Arends et al., 2020 ; Wesbroom et al., 2013 ; Thurley and Davies, 2020 ).

As already mentioned, it has been pointed out that one of the concerns of the CDC schemes is that they require a continuous flow of new members. Although, plans which share this disadvantage are normally badly designed. In this sense, the models that have been used to study the CDC plans have found that these well-designed plans produce stable and fair pension benefits, even for a not continuous number of members of the plan. Also, in these models, it has been shown that a CDC plan works well upon a phase-out fund for retirees, without the need to include younger members in the plan ( Arends et al., 2020 ; Wesbroom et al., 2013 ).

As previously noted, other concerns raised about these plans are that some concepts can be confusing to plan members; among them, that the pension is not guaranteed. Therefore, it has been said that it is important for the plan member to know that benefits are not guaranteed and that they may be less than expected. Faced with this type of risk, it has been suggested that, when designing a collective defined contribution plan, a mechanism can be implemented to help prevent high fluctuations in pensions.

This mechanism has been called a capital buffer or margin of prudence, which reduces the possibility that the pension plan will have to decrease the future pension benefit; but they could also limit the increase in the pension payment when this margin requires additional capital. It is important to note that this mechanism is already used in the Netherlands ( Thurley and Davies, 2020 ; Department for Work and Pensions, 2019 ; Royal Mail Group, 2020 ; Wesbroom et al., 2013 ; Bennett and Van Meerten, 2019 ).

The operation of this mechanism is as follows. This allows withdrawing a part of the additional benefits that would have to be granted, in such a way that once the indicated fund has been accumulated, there will no longer be a need to withdraw part of the additional benefits. Also, this may be appealing to some members, but others have noted that it can be difficult to handle. Another proposal to ensure the number of benefits of the pensioners is to buy a leveled annuity for the beneficiary with which a basic level is guaranteed; however, this comes with a fund reduction ( Thurley and Davies, 2020 ; Department for Work and Pensions, 2019 ; Royal Mail Group, 2020 ; Wesbroom et al., 2013; Bennett and Van Meerten, 2019 ).

METHODOLOGY

To achieve the objective of the present study, which is to explore the financial and actuarial viability of a type of hybrid scheme known as collective defined contribution (CDC), through the accumulation of a fund with specific characteristics that are taken from the literature; it is proposed in the first place, a methodology for the accumulation of a pension fund of the CDC type. However, as mentioned in section 2; few authors address this issue.

According to Nederlandsche Bank ( 2019 ), these types of CDC plans must meet some of the characteristics mentioned as follows. First, there must be a set of assets with a market value at a given moment in time. Second, that for each worker there must be a level of benefit so that when this worker reaches retirement age, he or she receives a continuous benefit or pension payment. Thus, when the worker dies, the benefit payment is terminated.

For a certain period, the accumulated fund is used to determine the regulatory present value (actuarial liabilities), which is calculated by discounting all pension payments that must be made in the future, assuming that the aforementioned benefit levels are constant, assuming a discount rate similar to the real rate for a certain time.

Finally, there must be an adjustment rule which will describe how the benefit levels and the value of pensions will vary over time, and it is defined normally as the Consumer Price Index. Considering the concepts mentioned above, it can be said that a collective defined contribution scheme (CDC) is fair for all participants if the choice of the discount rate and the process of adjusting the benefits over time, implies that the value of assets is equal to the value of liabilities.

For the simulation of this type of CDC pensions, it is used the accumulation fund formula of a defined contribution pension defined in Booth et al. ( 2005) and shown in equation ( 1 ).

Where:

- f(T) the accumulated real value of the fund at period

- c(t) the real contribution at period

- T the number of periods at retirement age

- i t he real rate of return for each period

- e i the percentage of commissions on the value of the contributions

At the end of the accumulation period of a CD pension fund, this is converted into a pension, which corresponds to an annuity that determines the pension benefit corresponding to the individual or employee ( Stewart and Gómez Hernández, 2008; Booth et al., 2005 ; OECD, 2017) . Equation ( 2) shows the formula that will be used in this work to calculate the amount of the projected real pension ( Booth et al., 2005 ).

Where:

- PRP is the amount of the projected real pension

- a R is the projected annuity value at age R

- e 2 the percentage of the commission paid to the insurance company

- g(s) a function that depends on the workers’ salary, used to calculate the pension

According to OECD ( 2017 ), the replacement rate is normally expressed as the ratio between the projected real pension and the last salary of the worker just before retirement. Furthermore, these replacement rates are like those calculated under the assumption of a salaried career, as considered in g(s), only if his or her wages are similar throughout his or her working life. On the contrary, if the worker's salary contains high variations during the working life, the person benefit will depend on the average of these variations and not on the last salary.

To allow that the accumulation of the fund to be of the CDC type, these formulae will be adapted by assuming the characteristics proposed in Aon ( 2020 ) and which are summarized below:

- The worker will obtain a pension after working for 30 consecutive years in the company, this pension is independent of the worker’s age.

- Plan contributions are 10% of the participant’s salary and are paid by the employer.

- The plan’s target benefit is based on 1% for each year worked and based on the participant’s average salary. That is, the target replacement rate for all workers is 30% of their last salary.

- Retiree benefits are not purchased by an annuity provider but are obtained from the same pension plan fund.

- An investment policy of 60% of the assets invested in equity instruments and the remaining 40% in government bonds.

Taking these characteristics into account, the accumulated fund for each worker over the 30 years of service are calculated using equation ( 1 ). For each period, the replacement rate is calculated for those workers who meet the conditions for their retirement with equation ( 2 ); while for the remaining workers, a deferred annuity is calculated. The value of the deferred annuity is obtained from equation ( 3 ), indicated in Bowers ( 1984 ).

Where:

k p x is the probability of death of an individual at age x and taken from the mortality table EMSSA 09

At the end of each period, the subsequent process is followed to determine the value of the replacement rates calculated for everyone:

- If the replacement rates obtained are greater than 30%, then the surplus is distributed equitably among the members of the plan who have an anticipated replacement rate lower than this value; and this is where the collectivity of the fund characterizes these CDC plans. The surplus is added directly to the value of the fund of each of the workers in a proportional way, that is, the surpluses are added to each worker so that they reach the 30% stipulated in the rules of the plan. If there is a case in which the surplus is not enough for the other workers to reach the target value of 30%, this is added so that they all reach the same percentage.

- If the replacement rates obtained are not greater than 30%, the surplus of workers who are not in retirement conditions is distributed to those who are so that they reach the stipulated percentage of 30%. If there is a case in which there is no surplus or the replacement rate does not reach 30%, then the workers will retire with their replacement rate obtained, even if it is lower than 30%.

- At the end of this process for each of the periods, the people who retire in that period stop accumulating funds, so they start their pay-off period and the process will be repeated until all participants in the plan retire.

Finally, the actuarial assumptions used to calculate the fund and the replacement rate are as follows:

- The initial value of the fund is $0, in other words, the worker begins to accumulate his fund with 0 Mexican Pesos.

- The total accumulation period of the fund is 30 years for all employees and this process is on an annual basis.

- The salary increase is determined through the value of inflation according to a forecast model based on a weighted moving average of three periods. The weighted moving average model is taken from Acosta López and Vega Castañeda ( 2021 ) and follows equation (4 ) shown by Wasserman ( 2006 ).

Where

Where W i r epresents the weight in percentage that is applied to each of the periods and the value of each period is represented by X i.

For the application of this model, historical values from 1977 to 2019 are used.

- An annual interest rate of 2.5% (actual inflation in Mexico) to calculate the value of the life annuity.

- A rate of return is used as a vector of historical values in fixed income and equities, and, for future years, the weighted moving average model described in equation (4) is used.

- Any type of commission is not considered.

The following section shows the results of the methodology presented here. The first section shows the results of the value of the fund for each of the workers in the sample, as well as the value of the replacement rate and the year of retirement. The second section shows an actuarial analysis of the relationship between the replacement rate and age, as well as the replacement rate with salary.

RESULTS

Simulations of the fund value and replacement rates

To determine the value of the fund in equation ( 1 ) and the value of the replacement rate in equation ( 2 ) with the characteristics of a CDC pension plan mentioned in section 3, a sample of 5 workers from a database of a hypothetical institution; which will be mentioned in this work as a Sample Institution to maintain its anonymity. The sample of these 5 workers has the characteristics shown in table 1 .

Table 1 Characteristics of the 5 workers on the sample

| Number of workers | Retirement year | Annual salary |

| 1 | 2023 | $1,239,570 |

| 2 | 2025 | $223,938 |

| 3 | 2029 | $688,908 |

| 4 | 2031 | $153,018 |

| 5 | 2033 | $298,209 |

Own elaboration.

Table 1 shows 5 plan members with very different salaries levels, as well as a 10-year difference for the first worker to retire in 2023, compared to the last one in 2033. This heterogeneity among plan members is desirable to obtain representative results. Annual salary data in the third column is shown in Mexican Pesos. As mentioned before, each year a value of the fund, replacement rate, and surpluses are calculated for each member of the plan. For each specific year, a member of the plan retires, and equation (2 ) is used. The difference between the value of PRP for a worker that retires that year and the worker who does not, relies on the value of a R , as explained previously.

The results of the calculation of the fund value, the replacement rate, and the surpluses for the year 2023, are shown in table 2 . Given that the first year in which there are retirements is 2023, the results show the replacement rate that is achieved by the worker who retires in that year. On the other hand, for the worker who does not retire in that year, the deferred replacement rate is shown. Thus, the first column shows the number of workers, ordered by year of retirement.

The second column shows the year in which each of them will retire, the third column shows the years of service that each of them has reached in 2023, the fourth column shows the replacement rate that each of them reaches in that specific year, the fifth column shows the surplus or deficit that each worker obtains in that year, the sixth column shows the value of the surplus in Mexican Pesos that is deducted from the worker who shows surplus (in this caseworker 1), and that it is equitably distributed to to the other workers in an equitable way according to the rules of the plan. The last column of Table 2 , shows the reevaluated replacement rate, considering the value of the reevaluated fund by adding the surplus to each of the worker’s funds who presents a deficit.

It should be noted that the difference between the replacement rates in column 4 refers to the fact that for worker 1, this is the actual replacement rate with which this worker will retire, while the other 4 replacement rates refer to deferred annuities because workers 2 to 5 have not yet reached the years of service to retire.

Thus, worker 1 who retires in 2023 achieved an initial replacement rate of 39.18%, while the other replacement rates are 27.82% for the person who retires in 2025, 23.74% for those who retire in 2029, 16.91 % for those who do so in 2031 and 13% for the worker who retires in 2033.

The amount of $152,311.96 for each of the four participants who have not yet retired, is the calculation of 9.18% surplus, converted in Mexican Pesos to add it directly to the value of the accumulated fund for each worker in that specific year 2023 and start with the next calculation year 2024, to continue with the process of calculating the pension fund, replacement rate, etc.

Table 2 Simulation of the pension fund for a CDC pension plan corresponding to the year 2023

| Number of workers | Retirement year | Years of service | Replacement rate | Surplus (%) | Surplus ($) | Reevaluated replacement rate |

| 1 | 2023 | 30 | 39.18% | 9.18% | - | 30% |

| 2 | 2025 | 28 | 27.82% | -2.18% | $152,311.96 | 30.12% |

| 3 | 2029 | 24 | 23.74% | -6.26% | $152,311.96 | 26.04% |

| 4 | 2031 | 22 | 16.91% | -13.09% | $152,311.96 | 19.21% |

| 5 | 2033 | 20 | 13% | -17% | $152,311.96 | 15.29% |

Own elaboration.

The results for the calculations corresponding to the years from 2024 to 2033, which is when the last worker retires, are shown in Table 3 . Only the results for the initial replacement rate and the surplus in Mexican Pesos from 2024 to 2026 are shown, from years 2027 to 2033 the reevaluated replacement rate is shown.

Table 3 Simulation of the pension fund for a CDC pension plan corresponding to the years from 2024 to 2033

| Number of workers | Retirement year | Years of service | Replacement rate | Surplus (%) | Surplus ($) | Reevaluated replacement rate |

| 2024 | ||||||

| 2 | 2025 | 29 | 38.71% | 8.71% | - | 30% |

| 3 | 2029 | 25 | 28.24% | -1.76% | $83,277.09 | 34.06% |

| 4 | 2031 | 23 | 32.94% | 2.94% | - | 30% |

| 5 | 2033 | 21 | 20.10% | -9.90% | $83,277.09 | 25.92% |

| 2025 | ||||||

| 2 | 2025 | 30 | 32.51% | 2.51% | - | 30% |

| 3 | 2029 | 26 | 29.60% | -0.40% | $55,337.22 | 36.30% |

| 4 | 2031 | 24 | 40.90% | 10.90% | - | 30% |

| 5 | 2033 | 22 | 24.60% | -5.36% | $55,337.22 | 31.34% |

| 2026 | ||||||

| 3 | 2029 | 27 | 33.17% | 3.17% | - | 30% |

| 4 | 2031 | 25 | 34.24% | 4.24% | - | 30% |

| 5 | 2033 | 23 | 28.23% | -1.77% | $184,219.67 | 35.63% |

| Number of workers | Retirement year | Years of service | Reevaluated replacement rate | |||

| 2027 | ||||||

| 3 | 2029 | 28 | 33.17% | |||

| 4 | 2031 | 26 | 32.02% | |||

| 5 | 2033 | 24 | 37.24% | |||

| 2028 | ||||||

| 3 | 2029 | 29 | 35.32% | |||

| 4 | 2031 | 27 | 34.21% | |||

| 5 | 2033 | 25 | 38.97% | |||

| 2029 | ||||||

| 3 | 2029 | 30 | 41.36% | |||

| 4 | 2031 | 28 | 36.60% | |||

| 5 | 2033 | 26 | 42.17% | |||

| 2030 | ||||||

| 4 | 2031 | 29 | 35.69% | |||

| 5 | 2033 | 27 | 42.89% | |||

| 2031 | ||||||

| 4 | 2031 | 30 | 42.29% | |||

| 5 | 2033 | 28 | 45.10% | |||

| 2032 | ||||||

| 5 | 2033 | 29 | 47.51% | |||

| 2033 | ||||||

| 5 | 2033 | 30 | 49.90% |

Own elaboration.

It can be seen from Table 3 that compared to 2023 in table 2 , every time more workers are reaching the target replacement rate of 30%. Another important aspect is that replacement rates eventually exceed their target value, resulting in workers obtaining a higher amount of pension. The highest replacement rate is found for worker 5, who retires with the highest amount of pension. This process seems to be logical, given that this worker is the one who receives the surpluses of the other workers and, as he or she is the last to retire in 2033, there are no more workers to distribute the surpluses left.

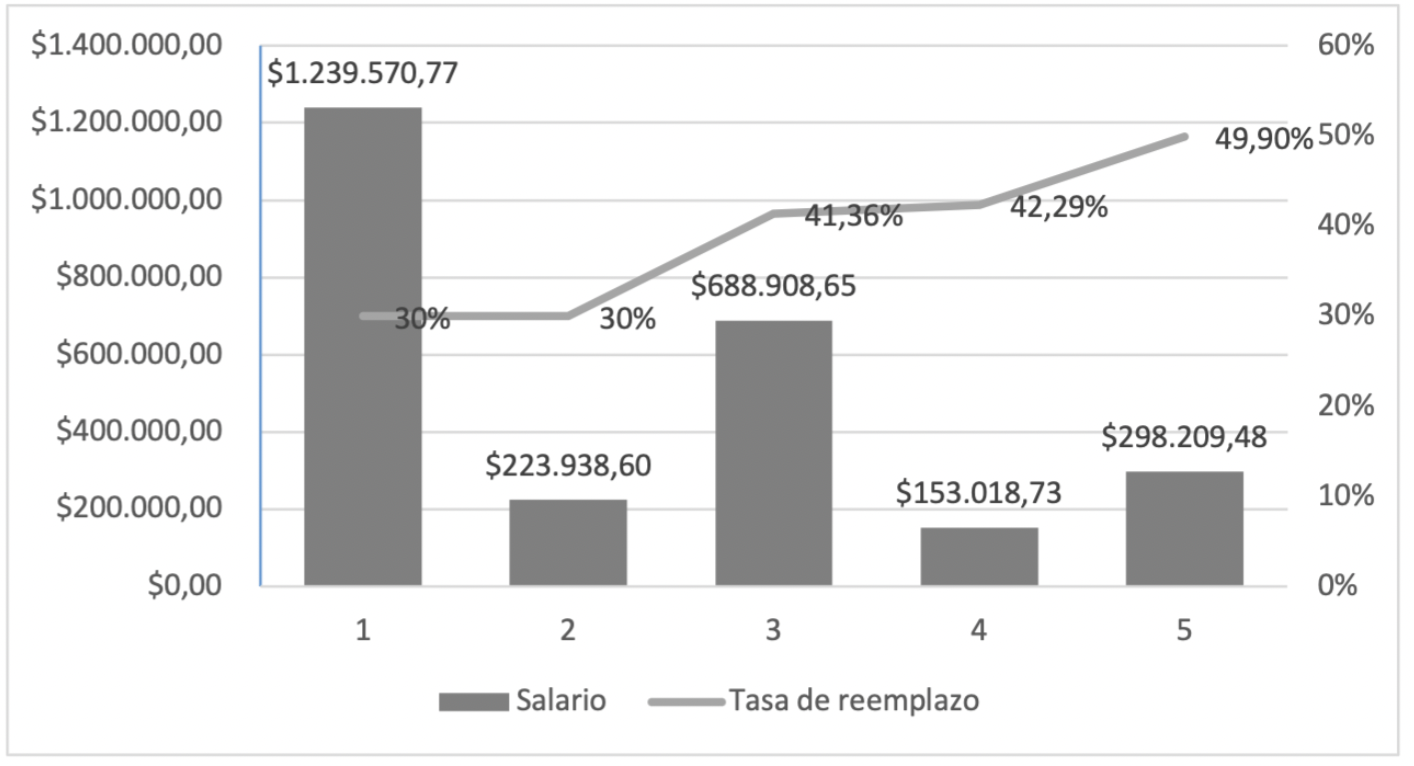

In the end, the 5 workers reach a replacement rate that is equal to or greater than 30%, which makes compliance with the rules of the plan and with the promise of a pension made to the workers. The replacement rates with which workers retire are 30%, 30%, 41.36%, 42.29%, and 49.90%; respectively, for workers 1 to 5. This result shows that the collectivity characteristic of CDC plans, is actuarially and financially sustainable; given that, with the same value of the fund without additional contributions, the target replacement rate is reached for all of them.

Actuarial analysis of the results of the replacement rate of the collective defined contribution plan (CDC)

When performing the analysis of the results obtained in the calculation of the replacement rate for a collective defined contribution pension, it can be observed that the replacement rates do not depend, at least linearly, on the age at which the worker enters the pension plan. Figure 1 shows that worker 5 who starts working at the age of 34, reached a replacement rate of 49.90%; while the two people who entered at age 40, reached replacement rates of 30% and 41.36%, respectively.

These results are obtained because the value of the fund depends entirely on the value of the rate of return assumed to simulate this value year after year. Furthermore, this is true since there are no commissions in this type of plan. That is why these replacement rates are so variable and do not depend on age. The main factor that affects the value of the replacement rate obtained is the performance of the rates of return for each year of service in which the worker contributes to the pension plan.

Figure 2 shows additionally the relationship between the worker’s salary and the replacement rate obtained by each of them. The results show that not necessarily the higher the salary, the higher the replacement rate. This is due, again, to the rates of return obtained by each of the worker’s funds during the years of contributions. Thus, worker 1 obtains lower rates of return than worker 4. In addition, worker 1 is the first to retire, so his or her earnings are distributed among the other workers; thus, the last worker is the one who obtains a higher replacement rate for having accumulated the earnings of the others and because there is no other worker to whom distribute surpluses. This model increases in the same line that the rates of return are also increasing. This makes that the simulation shown here is highly dependent on the model used to project rates of return over time.

With these results, those who have a higher replacement rate are the ones who will obtain a greater amount of money as a pension, and it would not be fair for the participants of the plan. However, the crucial element to determine this amount of money is the final salary of the workers since; for example, one of the workers who reached the lowest replacement rate (30%) gets a pension of $ 1,990,280 while the person who reached the highest replacement rate (49.90%) earns a pension of $ 1,097,826. This means that a difference of 19.9 percentage points translates into a difference of $892,453; this is by the salary difference and the difference between the ages.

CONCLUSIONS

Since traditional pension plans, such as defined contribution (CD) and defined benefit (BD), face several challenges; collective defined contribution pension plans (CDC) have been proposed as a hybrid or mixed pension plan that can function as an alternative to existing plans. However, these plans have not been fully explored, in some countries, these are already used as a novel plan design, but it has not been financially or actuarially proven. This is because in the countries where they are being explored, their plans are relatively new and it has not been possible to verify that plan members receive an adequate replacement rate.

Then, the present study explored the financial and actuarial viability of these schemes as an alternative pension plan for public or private institutions. It was analyzed whether these types of plans manage, through the collectivity that characterizes them, to solve the heterogeneity in the replacement rates received by the members of the plan at the time of their retirement. Therefore, we sought to build a methodology like the traditional methodology of accumulating defined contribution plans (CD), adapting it to the characteristics of collective defined contribution plans (CDC) found in the literature. This exposed methodology is considered novel, since no explicit quantitative formula, equation, or method was found in this literature to model this type of plan; so, this study built from scratch the methodology as a proposed to model CDC plans.

The results found, after performing the simulation exercise with 5 hypothetical workers, that the target replacement rates of 30% were achieved by all the members who participated in the sample. This result shows that the collectivity characteristic of the plan is actuarially and financially sustainable; given that, with the same value of the fund and no additional contributions, the target replacement rate is reached for all of them. This result is relevant, although it has its limitations, mainly due to the number of employees. This limitation will be explored in subsequent work to determine if, with a greater number of plan members, this continues to reach financial and actuarial sustainability.

Another conclusion found in the study was that, when performing the analysis of the results obtained in the calculation of the replacement rate, it can be observed that these rates do not depend linearly on the age at which the employee enters work or the salary of each member of the plan. This is because the replacement rate depends on the rates of return that everyone obtained in the value of the fund for the years in which they contributed (years of service), so the model largely depends on the behavior of the historical and future rates of return. This is a powerful conclusion because equity among the members is guaranteed, as well as the fulfillment of the objective of these plans, which is the collectivity, even in adverse situations in the prices of market instruments.

The simulations carried out in this study present, among others, the limitation that the exercise was carried out with a pension plan closed to new members, which we wish to explore in a later study; to determine if actuarial and financial viability remains in a group open to new members. For now, it can also be concluded that, as we have reviewed in the literature, the CDC plans are indeed a feasible alternative for many vulnerable groups of workers who now do not have a retirement savings plan and that, thanks to the collectivity of these plans, members of the plan can have access to a pension at retirement.

nueva página del texto (beta)

nueva página del texto (beta)