Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Migraciones internacionales

versión On-line ISSN 2594-0279versión impresa ISSN 1665-8906

Migr. Inter vol.5 no.3 Tijuana ene./jun. 2010

Artículos

A Spatial Approach to the Link between Remittances and Regional Growth in Mexico

Un enfoque espacial de la relación entre el envío de dinero y el crecimiento regional en México

Marcos Valdivia López* and Fernando Lozano Ascencio**

Universidad Nacional Autónoma de México. Dirección electrónica: *marcosv@correo.crim.unam.mx; **flozano@correo.crim.unam.mx.

Date of receipt: January 22, 2009.

Date of acceptance: April 3, 2009.

Abstract

This article studies the link between the inflow of remittances from international migrants and Mexico's regional growth in recent years. The results highlight the presence of a strong polarization in the regional behavior of the remittances/GDP ratio. The article also shows that this polarization is spatially associated with the economic growth of states. It specifically describes a recently observed process: a loss of dynamism in the growth of the remittances/GDP ratio within the region that has had a long history of migration and the presence of high growth rates in the remittances/GDP ratio in much of southern Mexico. This suggests that remittances might be playing an anti–cyclical role. However, once we use an econometric spatial model to explain the states' economic growth, there is a lack of solid evidence indicating that remittances are contributing significantly to growth at the state level.

Keywords: remittances, growth, polarization, spatial dependence, Mexico.

Resumen

En este artículo se estudia la relación entre el flujo de remesas de los migrantes internacionales y el crecimiento económico regional de México en años recientes. Los resultados del estudio muestran una intensa polarización del comportamiento regional de la razón remesas/PIB, asociada fuertemente al crecimiento económico de los estados. Así mismo se destaca que el crecimiento de la razón remesas/PIB ha perdido dinamismo en la región de tradición migratoria, pero por otra parte ha elevado sus tasas en gran parte de la región sur del país, lo que hace suponer que las remesas podrían estar jugando un papel anticíclico. Sin embargo, una vez considerados diversos modelos econométricos de tipo espacial, no se encuentra evidencia sólida que indique que las remesas estén contribuyendo significativamente en el crecimiento regional en el nivel estatal.

Palabras clave: remesas, crecimiento, polarización, dependencia espacial, México.

Introduction1

Studies analyzing the economic impact of remittances (and migration) can be classified into two extreme positions, one pessimistic, the other optimistic. The pessimistic position, known by some as Dutch Disease or "the migrant's syndrome" (Reichert, 1981) argues that migration constitutes a loss of capital and labor force from the communities of origin that adversely affects local productive activities. Conversely, in the optimistic position, remittances constitute a major source of investment and development for communities of origin. The main approach in this position is the New economics of labor migration (Stark, Taylor and Yitzhaki, 1986), which argues that remittances help reverse the imperfect conditions of the financial market (such as credit restriction) and the lack of local investment that prevails in poor communities in developing countries.

On the other hand, however, it is not difficult to imagine that the actual impact of remittances must be located somewhere between these two extremes (Taylor, 1999) and that the debate cannot be reduced to a simple discussion of "black and white," since the migratory circuit involving the sending and reception of remittances is complex and one in which the local conditions of each community play a key role (Durand and Massey, 2003; Lozano and Olivera, 2007). In this respect, going beyond an optimistic–pessimistic dichotomy of the effects of remittances can be a good analysis strategy and one which, from our perspective, is based on acknowledging the existence of a geographical dimension of the phenomenon. As it has been showed by Richard Jones (1998) in the case of Zacatecas, once the study of the impact of remittances incorporates a spatio–temporal dimension, it is impossible to arrive at a homogeneous diagnosis of the effects of remittances, since the type of impacts depends on the regional scale (households, communities, regions) and the phase of migration considered in the analysis. remittances are also received in regionally diverse contexts at the economic, social, political and institutional level, meaning that their regional impact on promoting local development is unlikely to be homogeneous. This essay coincides with this hypothesis and in particular, postulates that any study of the impact of remittances on the economy must consider an appropriate regional control before venturing a general conclusion.

Despite the enormous range of papers for the case of Mexico on the remittances–growth and remittances–inequality link and with very few exceptions (see Unger, 2005; Mendoza and Calderón, 2006), there are still not enough studies that have dealt specifically with the regional component of the phenomenon. The central purpose of this paper is therefore to analyze the intra–regional aspects of the link between remittances and growth and thereby contribute to regional research on remittances in the case of Mexico. The central objective of this essay is to show that there is a spatial component in the relationship between remittances and growth in Mexico that must be explored in detail.

This research uses information from Banco de México to undertake a regional exploration of the link between remittances and state GDP through spatial statistical techniques and the use of spatial econometric techniques to study economic growth models that incorporate the remittance variable.2 it therefore uses the state scale for convenience, while acknowledging the fact that analytically, this is not the most suitable regional analysis unit, since there are intrastate differences, particularly between countryside and city that significantly condition both the flows of remittances and local economic development in Mexico. Despite of these limitations on information, the results found in this research at the state level significantly reveal how the spatial dimension conditions the link between remittances and regional economic growth in Mexico.

This essay has another four sections. The second section contains a review of the literature on the link between remittances and growth. The third section employs non–parametric and spatial statistics techniques to explore the link between remittances and growth in Mexico at the state level over the past fifteen years. The fourth section uses conventional growth (and spatial) models to analyze the possible effects of remittances on regional economies.

Remittances and Growth: A Review of the Discussion

Our interest in this section is to comment on certain macroeconomic positions in the discussion between economic growth and migrants' remittances.3 The easiest way of understanding the impact of remittances on short–term growth is by considering a simple Keynesian model, in which the product of an economy (in other words, GDP) is determined by the level of effective demand. Under this scheme, any shock influencing demand (such as remittances) will have the potential to generate a multiplying effect on an economy's national product. In particular, remittances can be an important part of the propensity to consume in a traditional Keynesian model. This approach has been considered by Glytsos (2005) to study the aggregate effect of remittances in various countries, with strong multiplying effects being found in certain cases, such as Egypt, for example. Using a similar approach to the previous one are the works based on the social accounting matrix (SAM) approach that evaluate the direct and indirect effects on income caused by the injection of remittances (Adelman, Taylor and Vogel, 1988). This type of approach has been used for the Mexican case at both the regional (Adelman and Taylor, 1992; Corona 2007) and national level (Durand, Parrado and Massey, 1996; Zárate, 2005). All these studies have found significant multiplying effects of remittances on job creation and income. In contrast with the Keynesian and input–output model, the modern neoclassical macroeconomic approach is usually more skeptical of the effects that remittances may have on the output of an economy in the short term. Within this approach, in a hypothetical world where prices and salaries are fully flexible, an expenditure shock (caused by remittances) should not produce any effect on the output if the shock is anticipated by economic agents (Rapoport and Docquier, 2005).

With the arrival of the new economics of labor migration in the 1980s (Stark, Taylor and Yitzhaki, 1986), the discussion turned toward microeconomics with the aim of evaluating the effects of remittances on inequality rather than productivity.

This perspective opened up a window that emphasized the possible positive effects of remittances within the communities of origin or in those that received the remittances. And it is precisely within this framework that the new (endogeneous) growth theory have been used to built up models in which remittances play a role in encouraging investment in physical and human capital and thereby modifying the long–term balance of domestic economies (Rapoport and Docquier, 2005).

Regarding the elaboration of econometric models, it is only recently that researchers have begun to study the effect of remittances on economic growth among regional units, specifically among countries that receive remittances. These empirical exercises are based on econometric panel techniques widely used in recent years (Wooldridge, 2002) to apply economic growth models to the study of the economic impact of remittances. These groundbreaking studies include the work of Chami, Fullenkamp and Jahjah (2005) who, on the basis of the analysis of panel information from 113 countries, find that remittances have a negative effect on growth. Conversely, Giuliano and Ruiz–Arranz (2006) provide evidence of the positive effects of remittances on the growth of less developed countries. Likewise, Ziesemer (2006) holds that remittances may have an impact on growth by promoting investment in physical and human capital. Similarly, in a study with Latin American and Caribbean economies, Acosta et al. (2008) find evidence that remittances promote economic growth and reduce inequality and poverty in the region.

It is important to note that econometric studies based on economic growth models must be critically considered, since several problems of identification4 have been pointed out as unresolved (Durlauf, Johnson and Temple, 2005). Moreover, it is fair to say that although modern growth theories are invoked to justify the econometric exercises mentioned, the theoretical basis of the use of the remittances variable in a standard regression growth model continues to be ambiguous. In fact, very few theoretical studies have been carried out to analyze the effects of remittances on the economy (such as Djajic, 1986), meaning that until there is greater theoretical elaboration on how to consider the remittance variable in a growth model, typical growth regressions (à la Barro) will continue to be the few empirical options available for discussing general results regarding this issue.

With regard the regional scope of empirical studies on (economic) growth, they have mainly focused on analyzing countries or regions of countries, although very little of the literature has carried out this type of analysis within countries or regions. For the mexican case, there are various econometric studies at the household level that have analyzed the effect of remittances on inequality and poverty (McKenzie and Rapoport, 2007; Esquivel and Huerta–Pineda, 2007) that have found remittances to have a favorable effect on the reduction of inequality. There are also other microeconometric studies that hold that small entreprenueur activity, presumably with access to the inflow of remittances, is associated to a higher level of investment and business profits (Woodruff and Zenteno, 2007).

One of the few regional studies on the issue for the case of Mexico is unger's (2005). Through an indirect indicator of remittances, this author found that the process of regional convergence at the municipal level accelerates in regions with the greatest migratory intensity, suggesting the possibility of the existence of heterogeneous impacts of remittances on productivity. For his part, in a study at the municipal level without involving an economic growth model, López Córdova (2005) finds that remittances help reduce municipalities' conditions of inequality.

One of the few studies exploring the link between remittances and growth among the regions (states) of Mexico was undertaken by Mendoza and Calderón (2006), who analyze a regional growth model for Mexico involving trade liberalization variables foreign direct investment and remittances. Unlike the studies mentioned earlier, the authors fail to find significant effects of remittances on the regional economic dynamics, at least for the period from 1995 to 2003.

In general, it is striking that empirical research on growth and remittances among countries (or within countries) have failed to produce studies that place particular emphasis on the regional–spatial dimension. This is a relevant aspect because it might be questionable to assume (as most of the econometric studies cited earlier do) that there is no regional heterogeneity in the relationship between remittances and economic growth.

A last aspect worth commenting on is the role remittances can play regarding the economic cycle. It is usually held that the result of a particular economic decision (or activity) is countercyclical (or procyclical) when it correlates negatively (or positively) with the performance of economic activity as a whole (for example, with a country's GDP). In particular, researchers analyze the interaction between fiscal policy and the fluctuations in economic activity, and how public spending or taxes may counteract the effects of the economic cycle (Feldstein, 2002). It is important to note, however, that the interactions of economic agents in response to fluctuations in the economy are not only reduced to those from those responsible for economic policy but may also involve the rest of economic agents (individuals, firms, migrants, etcetera). In this respect, sending remittances may be motivated by helping to finance the consumer expenditures of receptor households in the country of origin (Russell, 1986). In this sense, it is common to find in the literature on remittances that they have a tendency to move countercyclicaly with respect to the GDP of receptor countries (Sayan, 2006). However, there is nothing to prevent remittances from being procyclical (in other words, having a positive correlation between the cyclical components of remittances and the growth of GDP) or acyclical (in other words, for there to be no correlation).5

One way of analyzing the countercyclical or procyclical aspect of the flow of remittances is by using growth regressions (such as those commented on in this section) and analyzing whether or not remittances contribute to the process of regional convergence.6 in this respect, if there were a process of regional convergence between the regions (i.e., equalizing GDP per capita) and remittances were positively contributing to this process, then remittances would be acting procyclically in the region. Conversely, if there is evidence of regional divergence and remittances were positively contributing to this process, then they would be acting anticyclically at the regional level. Some authors for the mexican case (Canales, 2006) have openly proposed the hypothesis that remittances in Mexico are anticyclical, but so far there has been no discussion from a regional perspective of whether there is heterogeneity in this phenomenon, in other words, whether remittances could simultaneously be pro–, anti– or acyclical in the same country. The following sections will empirically explore the central issues pointed out in this section.

Regional Behavior of Remittances

This section uses a regional perspective to explore the behavior of remittances and their link to the gross domestic product of mexican states (hereinafter referred to as GDP). The information used comes from Banco de México and includes state estimates of remittances for 1995, 2001, 2003 and 2006. It is important to note that Banco de México changed the methodology for measuring remittances in 2003, which should be taken into account when the comparisons with previous years are carried out.7

Remittances in Mexico totaled 23 742 million USD in 2006, making Mexico the third largest receiver of remittances after India and China. However, remittances only accounted for 3.2 per cent of the national GDP in 2006 (a percentage that fell to 2.7 per cent in 2007),8 a figure that is not very far from the two per cent for the entire Latin American region, which includes extreme cases such as Honduras and Guyana, where remittances account for 25 per cent of GDP (Fajnzylber and López, 2008; Lozano, 2009). Likewise, by comparing other flows of income from abroad to Mexico in 2006, we find that foreign direct investment (FDI) achieved a total of 19 128 million USD (2.5 per cent of GDP) while oil exports totaled 39 022 million USD (5.2 per cent of GDP) while non–oil exports totaled 210 903 million USD (28.1 per cent of GDP). An evaluation of this series of variables for the years considered in this study shows that remittances actually constitute a small proportion of what the mexican economy produces domestically and that in fact the income from non–oil exports (basically manufacturing) constitutes the central source of foreign currency entering the country. We mention this fact because it is common in the literature on this issue to find an exaggeration of the importance of remittances in an economy the size of Mexico's. On the other hand, however, it is fair to note that the amount of remittances does not substantially differ from other income flows such as FDI, which have even equaled it in recent years. In order to have an initial regional approach to the phenomenon studied, table 1 shows the data of the percentage of remittances of each state with respect to their GDP and an index of the intensity of the remittances that normalize the remittances/GDP ratio in each state regarding national figure.9

Table 1 highlights the cases of Michoacán, Zacatecas, Oaxaca and Guerrero to mention just some of the states where remittances accounted for over 10 per cent of the states' GDP in 2006. For its part, the data on intensity clearly show which states perform over the national figure and which have a remittances/GDP intensity below this average. Michoacán, for example, has an intensity factor five times higher than the national aggregate, Oaxaca and Guerrero have an average intensity that is three times higher while states such as Nuevo León, Baja California Sur, Campeche and the Federal District have an intensity five times lower than the national aggregate. These regional disparities show us the limitations of average data in describing the regional behavior of the remittances/GDP ratio.

In order to have a better idea of the regional nature of remittances, table 2 shows some statistics that describe the variation and distributions of the remittances/GDP variables and per capita remittances.

Table 2 shows that the proportion of remittances with respect to GDP and the per capita remittances of the 32 states have increased since 1995, at the cost of increasing the differences between state units (see the increase in the standard deviation). Standard deviation of the remittances/GDP log (by which we mean the natural logarithm of the proportion of remittances of a state with respect to its state GDP) has not registered an increase over time, nor has it decreased.10 This is symptomatic of the fact that the explosive growth of remittances in the country in recent years has not been accompanied by a more equitable growth in the remittances/GDP ratio. This element is related to the results of the remittance/GDP log normality tests shown in table 2 for the years studied, since they tend to reject the null hypothesis of normality of the variable. This result has important implications in terms of regional inequality, as we shall see below.

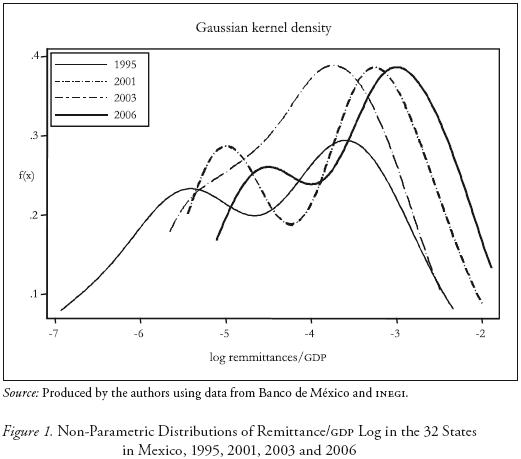

In order to have a first spatial approach to the behavior of remittances, we estimated the densities of the remittance/GDP log at the state level for each of the years for which information is available at Banco de Mexico, using the Kernel non–parametric method.11 Figure 1 shows the estimates for the Gaussian kernel densities given.

One advantage of the kernel density estimates such as those in figure 1 is that it allows one to visually assess the presence of multimodality in the remittances/GDP log of the state. In other words, it allows one to see whether there are groups of states that move away from the average behavior, since this would be a symptom of regional inequality. In this respect, figure 1 shows the bi–modal nature of the distributions. With the exception of the year 2001, in the remaining years, the variable clearly has a twin peaks performance, which is typical of the dynamics of polarization in the regional growth processes (Quah, 1997). The two groups of states (a group of states that are dependent on remittances that display a high proportion of remittances in relation to GDP and another group of non–dependent states that have a low proportion of remittances in relation to the GDP) have remained unchanged during the period from 1995 to 2006. The clubs or groups of convergence can be considered through the modes of distribution identified in table 2.12 For example, a set of states would appear to be converging at a level of two per cent of the remittances with respect to GDP (see years 2005 and 2006) which is not actually very far from the national aggregate (three per cent) although on the other hand, there is a large group of states that would be converging at a level near 15 per cent.13 in other words, there are elements that suggest a process of polarization of the phenomenon if we adhere to the definitions of polarization discussed in the literature on economic growth (Esteban and Ray, 1994).

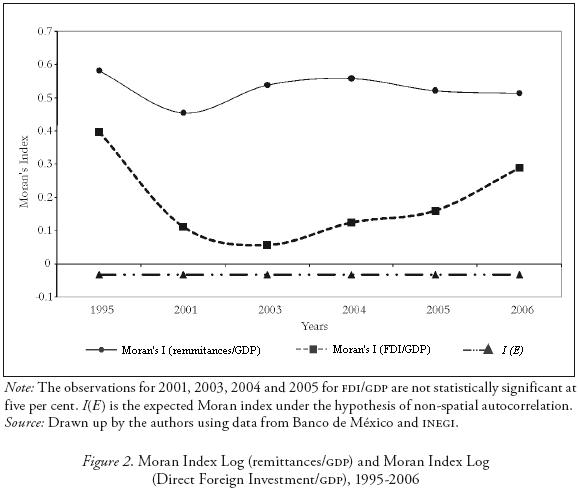

The next step is to analyze whether this process of polarization of the link between remittances and GDP has a regional bias. To this end, a statistic that reflects the presence (or absence) of spatial autocorrelation of the remittances/GDP log at the state level was calculated. Figure 2 shows the Moran index for each of the years for which information is available on the variable. Likewise and for comparative purposes, the Moran index series of the foreign direct investment (FDI) over GDP log was added to the figure. The Moran index simply evaluates whether the remittances/GDP log of a region (state) is or is not statistically correlated to the remittances/GDP log of the regions (states) that are physically close. If there was no spatial autocorrelation of the remittances/GDP log, one would expect the distribution of the variable to be random, if this distribution were deployed on a map of the country by states. Conversely, if there was a spatial autocorrelation of the remittances/GDP log, one would expect agglomerations of states with similar levels in their remittance/GDP log. In this respect, the Moran index can be seen as an approximation to the degree of spatial dependence the remittance/GDP log could have in the country.14

The results shown in figure 2 for the remittances/GDP series are all statistically significant (in other words, there is evidence of spatial autocorrelation of the variable) and, except for a fall in the index for the year 2001, the value of the index has virtually remained at a high, relatively stable level above 0.5 for the whole period. It is also interesting to note in figure 2 that the global autocorrelation of the remittances/GDP log is not only much greater than that recorded by the FDI/GDP log, but also has greater regional significance. In other words, the FDI/GDP series only has a statistically significant spatial autocorrelation (at 95 %) for 1995 and 2006, while remittances always maintain a significant spatial autocorrelation. This suggests a profound territorial connotation of remittances over the economic dynamics of states, even if they are compared with other income flows (such as FDI) that would hypothetically respond to territorial dynamics (Dussel et al., 2007; Calderón and Tykhonenko, 2007).

One can therefore conclude, from the results obtained from the measurement of global autocorrelation, that the bimodal distributions in figure 1 are closely linked to a dynamic of spatial dependence in the behavior of the remittances/GDP log being studied. In other words, the modes that stand out in the figure 1 distributions must have highly specific regional behavior. In order to evaluate this point, maps 1 and 2 show the regionalization of the remittances/GDP log based on local indicators of spatial autocorrelation.15

Both maps show the evolution of regions exhibiting the positive local spatial autocorrelation of the remittances/GDP log. States whose remittances/GDP log have a statistical significance above the national average and which are also surrounded by other states whose average remittances/GDP log is statistically above the national average (see high–high label on maps) are highlighted in dark gray. States whose remittances/GDP log have a statistical significance below the national average and which are also surrounded by other states whose average remittances/GDP log is statistically below the national average (see low–low label on maps) are highlighted in light gray. The main result derived from the maps is that the region with high levels of the remittances/GDP log (region high–high in dark gray) has shifted towards the southeast of the country. The region in dark gray in map 1 largely coincides with what is known as the region with a migratory tradition, which has been widely documented by researchers of the migratory phenomenon in Mexico (Durand and Massey, 2003). It is important to note that this region in dark gray (identified in this study by local spatial dependence criteria) has been losing importance in the remittances/GDP log while at the same time, a new region has emerged that combines certain states in the central and southeast region of the country.

Until now, we have shown that there is a sharp regional inequality in the variable being studied and that this inequality also has a strong spatial characterization in the country. From now on, we will explore whether this behavior is linked to the country's dynamics of regional growth.

It is important to insist that the analysis presented is sensitive to the changes Banco de México has made in the procedures for measuring remittances over the past ten years. This situation has been explored by various studies that have pointed out that there has been a structural break in the way remittances have been measured by Banco de México since 2001 (Pérez and Álvarez, 2007). We will therefore focus on the period from 2003 to 2006 to have an initial exploration of the recent territorial changes that have taken place in the growth of the remittances/GDP log and their link with the growth of the GDP per capita log.

Map 3 shows the regions of the country that depict local spatial autocorrelation of the growth of the remittances/GDP log during the 2003–2006 period. The main result of the map indicates that the migratory tradition region (in light gray) lost dynamism in the growth of the remittances/GDP log and nowadays (as a region) is far below the growth performance recorded throughout the whole country (see low–low labels on map 3).

One of the main purposes of this essay is to explore the meaning of these spatial patterns of remittances and what possible impact this dynamic has on the country's regional economic growth, a situation that will be dealt with in detail in the following section. But before we undertake this analysis, a simple measurement of the correlation between the GDP per capita growth and the growth of the remittances/GDP of states can provide some useful elements for interpreting the spatial changes detected in maps 1, 2 and 3. Figure 3 shows the scatterplot of GDP per capita (on the y axis) and remittances/GDP ratio (on the x axis) for the period from 2000 to 2006, as well as the linear regression that fits the data by ordinary least squares. The figure shows that there is a strong negative correlation between the variables, suggesting that the higher the proportion of remittances with respect to GDP , the lower the GDP per capita.

It is important to examine this negative correlation in light of the results of spatial agglomeration detected in maps 1, 2 and 3, since if remittances are effectively contributing to the growth of regional GDP (as we shall see in the following section) they will be doing so in an anticylical fashion. In this respect, the local spatial autocorrelation maps (1, 2 and 3) are indicating that the remittances/GDP log is growing more quickly in regions that have a lower growth rate of the GDP per capita log (particularly in the south of the country).

In order to spatially explore this possible anticyclical element in more detail, map 4 shows the bivariate local indicator of spatial autocorrrelation between the growth of the remittances/GDP log and the growth of the GDP per capita log for the period from 2003 to 2006. These bivariate indicators spatially compare the behavior of the growth of the remittances/GDP log in a state with the average growth of the GDP per capita log of adjacent states. If map 4 shows regions with negative local spatial autocorrelation, this may be indicative of regional anticyclical behavior of remittances while the presence of positive local spatial autocorrelation may denote procyclical behavior.

Map 4 shows anticyclical elements in the west–central region (see states with high–low label). In particular, one can see that the performance of states such as Querétaro, Colima, Aguascalientes and Nayarit (where the increase in the remittances/GDP log has been below the national average) contrasts regionally with the poor performance of the growth of the GDP per capita log of neighboring states. This last element suggests the existence of pro and anticylical dynamics that could be ocurring simultaneously in the region with a migratory tradition. Some micro–regional studies within this region have yielded elements that support this hypothesis (Zárate, 2005; Canales and Montiel, 2004). However, to advance towards a hypothesis of spatial heterogeneity (in other words, the simultaneous presence of procyclical and anticyclical regions) it is important to consider more disaggregated observation units (such as municipalities or groups of municipalities), which is beyond the scope of this paper.

In the next section, we will formalize the analysis of the link between remittances and economic growth on the basis of standard econometric models of regional economic growth.

Growth and Remittances

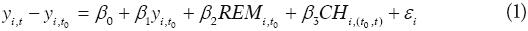

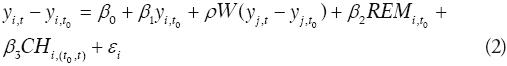

This section contains a first approach to the link between remittances and regional growth in Mexico by considering the following base model of conditional convergence at the state level:

where subindex i denotes the regional observation unit analyzed (i.e. states), y is the GDP per capita log, REM is the remittances/GDP log, CH are the average years of schooling of the population over 12 in the period and εi is an i.i.d. error term.16

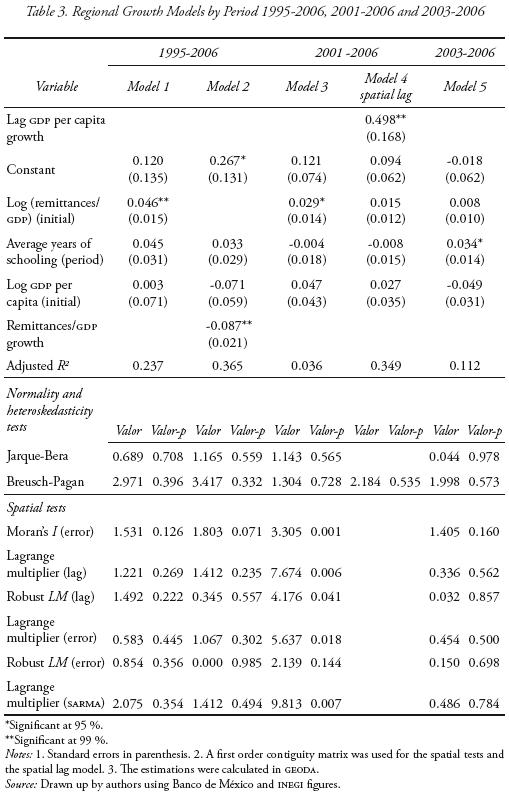

In table 3, the columns labeled model 1, model 3 and model 5 are OLS estimates of the equation (1) for the periods 1995–2005, 2001–2006 and 2003–2006 respectively.17

In the models mentioned, one can see that the initial level of REM only has a positive and significant effect on the GDP per capita if one considers the 1995–2006 and 2001–2006 periods. The fact that the REM variable in model 1 and 2 has a positive effect on growth does not necessarily mean that it is doing so favorably, since the estimates also indicate the presence of a dynamic of regional no–convergence among the states comprising the country (observe that the coefficient of the initial condition of the GDP per capita is not statistically negative in any of the models, β1> 0); in other words, REM grows at a faster rate in the states where GDP has grown least. This is revealed when equation (1) includes REM growth in the period instead of the initial REM level (a situation that may be analyzed in model 2 of table 3 for the period from 1995 to 2006). In model 2, the coefficient associated with the growth of REM has a statistically significant but negative effect on GDP per capita growth. In this sense, one could say that remittances have an anticyclical role in the country's dynamics of regional growth. It is important to note, however, that the significant effect of the REM variable on GDP per capita growth is not entirely clear. The REM effect prevails during the long period from 1995 to 2006 but the growth model analyzed has spatial autocorrelation of the regression errors when REM growth is involved instead of the initial REM condition (see Moran index in model 2). When this occurs, estimates are not correct, since the assumption of randomness of the error terms is violated.18 However, the spatial tests of model 2 do not suggest an alternative spatial model, and in this particular case, it is better instead to take into account omitted variables in the model, which in turn will probably make the effect of remittances insignificant in model 2. A propos of this, Mendoza and Calderón (2006) would appear to reach a similar result that indicated when the convergence model involves variables associated with trade liberalization.

The problem of the regression with autocorrelated errors becomes more evident for the period 2001–2006 (see model 3, table 2) where the estimate produces a positive and significant effect of the REM variable but with a strong spatial autocorrelation of the errors, indicated by the Moran's index. But unlike model 2, the spatial tests for model 3 clearly suggest a spatial lag model (or autoregressive spatial model) as an alternative. This last model has the following form:

where W is a standardized matrix of spatial interaction which, in this particular case, considers the GDP per capita growth of states adjacent to the region.

Equation (2) expresses a regional growth model that places particular emphasis on the spatial interaction among regional observation units (a situation that is absent from a traditional convergence model such as that expressed in the equation [1]). The estimates are shown in model 4 of table 3 (observe that rho in equation [2] corresponds to the coefficient associated with the "Lag in GDP per capita growth" or average GDP per capita of adjacent states). The main result in model 4 is the loss of statistical significance of the REM variable. This result shows that there are other regional factors (at the state level) and not necessarily remittances that contribute to the dynamics of the country's regional growth. Lastly, this result is also confirmed for the more recent period from 2003 to 2006 (see model 5) where the estimates of the traditional model (i.e. equation [1]) do not produce a significant effect of the coefficient associated to REM variable.19

It is important to note that due to the availability of the quarterly state series of remittances produced by Banco de México, panel growth models were also estimated for the periods from 2001 to 2006 and 2003 to 2006. The panel models used are not included in this essay since their results do not modify the central findings mentioned in this section. The panel models yielded no evidence that remittances are affecting the dynamics of regional growth in Mexico.20

Conclusions

This essay explores an issue that has rarely been examined in empirical studies on remittances in Mexico, which concerns the regional patterns that occur in the link between economic growth and remittances in the country's states. First of all, an exploration using non–parametric techniques and spatial statistics has found that the phenomenon of remittances and its links with the economic growth of states has a strong component of regional inequality and spatial dependence. This element is particularly important due to the fact that the country has also been characterized by displaying a dynamic of divergence and regional polarization in the growth of states since trade liberalization. The main spatial patterns detected in this study include the loss of dynamism in the growth of the remittances/GDP ratio in the traditional migration region, which has been accompanied by the emergence of a new region located in the south of the country with high growth rates of this indicator.

This fact may have significant implications for the country's dynamics of regional growth, since it is generally in the states in the south of the country that the lowest rates of GDP per capita growth are registered. Despite this, once econometric growth models are estimated, no significant effect of the remittance variable is detected and therefore no anticyclical function of the latter that might explain the shift in the rhythm of the rapid growth of remittances from the traditional migration region towards the south of the country. On this point, it is important to mention that the dynamic of remittances at the regional level also reflects changes in the country's migratory pattern, meaning that these elements alone might explain the greater dynamism of remittances in the south of the country in relation to the traditional region.

Lastly, the spatial analysis of remittances presented in this study suggests the importance of paying attention to the patterns of spatial dependence being developed by the phenomenon of remittances, particularly if they give signs of a significant polarization in the dynamics of the growth of the remittances/GDP ratio among the states. This element may be important for the orientation and deployment of regional development policies, since they may be more effective when there is a possibility of generating multiplying effects among regional units.

We conclude by saying that although the econometric techniques used in this study failed to detect significant effects of remittances on regional growth, this possibility should not be ruled out on the understanding that spatial dependence may be denoting spatial heterogeneity in the effects remittances may have on economic growth. In other words, in some areas, remittances may have an effect whereas in others they may not, and in some cases the effects among regions may be diametrically opposed. Some indications supporting this hypothesis found in this research include the sharp spatial instability between GDP per capita growth and the rate of growth of remittances/GDP within the region with a migratory tradition. This last hypothesis, however, forms part of a second and future research phase.

References

Acosta, Pablo et al. (2008), "What is the Impact of International Remittances on Poverty and Inequality in Latin America?," in World Development, vol. 36, num. 1, pp. 89–114. [ Links ]

Adelman, Irma, J. Edward Taylor and Stephen Vogel (1988), "Life in a Mexican Village: A SAM Perspective," The Journal of Development Studies, vol. 25, num. 1. [ Links ]

Adelman, Irma and J. Edward. Taylor (1992), "Is Structural Adjustment with a Human Face Possible? The Case of Mexico," Journal of Development Studies, num. 26, pp. 387–407. [ Links ]

Anselin, Luc (1995), "Local indicators of Spatial Association–LISA," Geographical Analysis, vol. 27, num. 2. [ Links ]

Banco de México (2007), Informe anual 2006, México, D. F., Banco de México, pp. 166. [ Links ]

Banco de México, "Ingresos por remesas familiares. Distribución por entidad federativa," Banco de México. Available at <http://www.banxico.org.mx/polmoneinflacion/estadisticas/balanzaPagos/balanzaPagos.html> (Last accessed on january 2009). [ Links ]

Calderón, Cuauhtémoc and Anna Tykhonenko (2007), "Convergencia regional e inversión extranjera directa en México en el contexto del TLCAN 1994–2002," Investigación económica, vol. 66, num. 259, pp. 15–41. [ Links ]

Canales, Alejandro (2006), "Remesas y desarrollo en México. Una visión crítica desde la macroeconomía", Papeles de población, num. 50, pp. 172–196. [ Links ]

Canales, Alejandro (2008), "Las cifras sobre remesas en México. ¿Son creíbles?," Migraciones internacionales, vol. 15, num. 4, pp. 5–35. [ Links ]

Canales, Alejandro and Israel Montiel (2004), "Remesas e inversión productiva en comunidades de alta migración a Estados Unidos. El caso de Teocaltiche, Jalisco," Migraciones internacionales, vol. 2, num. 3, p. 31. [ Links ]

Chami, Ralph, Connel Fullenkamp and Samir Jahjah (2005), "Are Immigrant Remmitance Flows a Source of Capital for Development?," IMF Staff papers, vol. 52, num. 1. [ Links ]

Consejo Nacional de Población (Conapo), "Indicadores demográficos básicos, 1990–2030," Consejo Nacional de Población. Available at <http://www.conapo.gob.mx/00cifras/00indicadores.htm> (Last accessed on july 2008). [ Links ]

Corona, Miguel (2007), "La economía de Tlapanalá," Migraciones internacionales, vol. 4, num. 2, pp. 93–120. [ Links ]

Djajic, Slobodan (1986), "International Migration, Remittances and Walfare in a Dependent Economy," Journal of Development Economics, vol. 21, pp. 229–234. [ Links ]

Durand, Jorge (2005), Nuevas regiones de origen y destino de la migración mexicana, New Jersey, University of Princeton/Center for Migration and Development (Documento de Trabajo 05–02 m). [ Links ]

Durand, Jorge and Douglas Massey (2003), Clandestinos. Migración México–Estados Unidos en los albores del siglo XXI, México, Universidad Autónoma de Zacatecas/Miguel Ángel Porrúa, pp. 179. [ Links ]

Durand, Jorge, Emilio Parrado and Douglas Massey (1996), "Migradollars and Development: A Reconsideration of the Mexican Case," The International Migration Review, vol. 30, num. 2, pp. 423–444. [ Links ]

Durlauf, Steven N., Paul A. Johnson and Jonathan R. W. Temple (2005), "Growth Econometrics," in Philippe Aghion and Steven Durlauf (eds.), Handbook of Economic Growth, vol. 1, num. 8, pp. 555–677. [ Links ]

Dussel, Enrique P. et al. (2007), Inversión extranjera directa en México: Desempeño y potencial, México, Siglo XXI editores/ Universidad Nacional Autónoma de México/Secretaría de economía. [ Links ]

Esquivel, Gerardo and Alejandra Huerta–Pineda (2007), "Las remesas y la pobreza en México: Un enfoque de pareo de puntuación de la propensión," in Integración y comercio, num. 27, pp. 47–74. [ Links ]

Esteban, Joan–María and Debraj Ray (1994), "On the Measurement of Polarization," in Econométrica, vol. 62, num. 4, pp. 819–851. [ Links ]

Fajnzylber, Pablo and Humberto López (eds.), (2008), Remittances and Development. Lessons from Latin America, Washington, D. C., World Bank. [ Links ]

Feldstein, Martin (2002), The Role for Discretionary Fiscal Policy in a Low Interest Rate Environment, Cambridge, Massachusetts, National Bureau of Economic Research (Working Paper Series, w9203). [ Links ]

Florax, Raymond, Henk Folmer and Rey Serge (2003), "Specification Searches in Spatial Econometrics: The Relevance of Hendry's Methodology," Regional Science and Urban Economic, vol. 33, pp. 557–579. [ Links ]

Giuliano, Paola and Marta Ruiz–Arranz (2006), Remittances, Financial Development and Growth, Bonn, Germany, Institute for the Study of Labor (IZA) (IZA Discussion Paper , 2160). [ Links ]

Glytsos, Nicholas (2005), "The Contribution of Remittances to Growth," The Journal of Economic Studies, vol. 32, num. 6, pp. 468–496. [ Links ]

INEGI (2000–2004), Encuesta nacional de empleo, Aguascalientes, Mexico, Instituto Nacional de Estadística, Geografía e Informática. [ Links ]

INEGI (2005–2006), Encuesta nacional de ocupación y empleo, Aguascalientes, Mexico, Instituto Nacional de Estadística, Geografía e Informática. [ Links ]

INEGI (2009), Producto interno bruto por entidad federativa, Aguascalientes, Mexico, Instituto Nacional de Estadística, Geografía e Informática. Available at <http://dgcnesyp.inegi.org.mx/cgiwin/bdieintsi.exe/NIVM1500020003000100100005#ARBOL> (Last accessed on january 2009). [ Links ]

Jones, Richard (1998), "Remittances and Inequality: A Question of Migration Stage and Geographic Scale," Economic Geography, vol. 74, num. 1, pp. 8–25. [ Links ]

López–Córdova, Ernesto (2005), "Globalization, Migration, and Development: The Role of Mexican Migrant Remittances," Economía, vol. 6, num. 1, pp. 217–256. [ Links ]

Lozano Ascencio, Fernando (2003), "Discurso oficial, remesas y desarrollo en México," Migración y desarrollo, vol. 1, pp. 23–31. [ Links ]

Lozano Ascencio, Fernando (2009), "Las remesas de los migrantes Latinoamericanos y caribeños en los Estados Unidos," Notas de población, num. 86, Centro Latinoamericano y Caribeño de Demografía (Celade)/División de Población de la CEPAL, pp. 39–62 [ Links ]

Lozano Ascencio, Fernando and Fidel Olivera (2007), "Impacto económico de las remesas en México: un balance necesario," in Marina Ariza and Alejandro Portes (coords.), El país transnacional migración mexicana y cambio social a través de la frontera, México, Universidad Nacional Autónoma de México/Instituto de Investigaciones Sociales, pp. 129–150. [ Links ]

Mankiw, N. Gregory, David Romer and David N. Weil (1992), "A Contribution to the Empirics of Economic Growth," Quarterly Journal of Economics, num. 107, pp. 407–437. [ Links ]

Mckenzie, David and Hillel Rapoport (2007), "Network Effects and the Dynamics of Migration and Inequality: Theory and Evidence from Mexico," The Journal of Development Economics, vol. 84, num. 1, pp. 1–24. [ Links ]

Mendoza, J. Eduardo and Cuauhtémoc Calderón (2006), "Impactos regionales de las remesas en el crecimiento económico de México," Papeles de población, num. 50, pp. 197–221. [ Links ]

Pérez, Pablo and Pedro Álvarez (2007), "Las remesas familiares en México y sus inconsistencias," Análisis económico, vol. 32, num. 51, pp. 223–252. [ Links ]

Quah, Danny T. (1997), "Empirics for Growth and Distribution: Stratification, Polarization and Convergence Clubs," Journal of Economic Growth, num. 2, pp. 27–59. [ Links ]

Rapoport, Hillel and Frederic Docquier (2005), The Economics of Migrants' Remittance, Institute of Labor Economics, (IZA), Bonn, Germany (IZA Discussion Paper, 1531). [ Links ]

Reichert, Joshua S. (1981), "The Migrant Syndrome: Seasonal U.S. Wage Labor and Rural Development in Central Mexico," Human Organization, num. 40, pp. 56–66. [ Links ]

Russell, Sharon Stanton (1986), "Remittances from International Migration: A review in Perspective," World Development, vol. 14, num. 6, pp. 677–696. [ Links ]

Sala–i–Martin, Xavier (1996), "The Classical Approach to Convergence Analysis," The Economic Journal, vol. 106, num. 437. [ Links ]

Salgado–Ugarte, Isaias, Makoto Shimizu and Toru Taniuchi (1995), "Practical Rules for Bandwidth Selection in Univariate Density Estimation," Stata Technical Bulletin, num. 27, pp. 5–19. [ Links ]

Sayan, Serdar (2006), Business Cycle and Workers' Remittances: How do Workers Respond to Cyclical Movements of GDP at Home?, Washington, D. C., International Monetary Fund (IMF Working Paper, 06/52). [ Links ]

Silverman, Bernard (1981), "Using Kernel Density Estimates to Investigate Multimodality," Journal of the Royal Statistical Society. Series B (Methodological), vol. 43, num. 1, pp. 97–99. [ Links ]

Stark, Oded, Edward Taylor and Shlomo Yitzhaki (1986), "Remittances and Inequality," Economic Journal, num. 28, pp. 309–322. [ Links ]

Unger, Kurt (2005), Regional Economic Development and Mexican Out–Migration, Cambridge, Massachusetts, National Bureau of Economic Research (Working Paper, 11432). [ Links ]

Taylor, Edward (1999), "The New Economics of Labour Migration and the Role of Remittances in the Migration Process," International Migration, vol. 37, num 1, pp. 63–88. [ Links ]

Tuirán, Rodolfo, Jorge Santibáñez and Rodolfo Corona (2006), "El monto de las remesas familiares en México. ¿Mito o realidad?", Papeles de población, num. 50, pp. 147–169. [ Links ]

Woodruff, Christopher y Rene Zenteno (2007), "Migration Networks and Microenterprises in Mexico," Journal of Development Economics, vol. 82, pp. 509–528. [ Links ]

Wooldridge, Jeffrey M. (2002), Econometric Analysis of Cross Section and Panel Data, Cambridge, Massachusetts, MIT Press. [ Links ]

Zárate–Hoyos, Germán. (2005), "El impacto de las remesas de los migrantes en el desarrollo de México," in Donald F. Terry and Steve R. Wilson (eds.), Moneda de cambio económico y social, Washington, D. C., Inter–American Development Bank, pp. 173–208. [ Links ]

Ziesemer, Thomas (2006), Worker Remittances and Growth: The Physical and Human Capital Channels, Maastricht, Netherlands, United Nations University/Maastricht Economic and Social Research and Training Centre on Innovation and Technology, pp. 1–47 (UNU–MERIT Working Paper Series, 20). [ Links ]

1 This article forms part of a broader research project entitled "Remittances, Convergence and Spatial Heterogeneity in Mexico" with the support of the BBVA Foundation. The authors are grateful for the support of Ariel Ramírez, Carlos Galindo and Rodrigo Aguilar.

2 The information from the central bank in Mexico (or Banco de México) has been sharply criticized by specialists, since the figures do not coincide with demographic thresholds (such as migration) that support the phenomenon of remittances; for example, various household surveys reduce substantially the estimation of remittances reported by Banco de México (Lozano, 2003; Tuirán, Santibáñez and Corona, 2006; Canales, 2008). Despite this and without avoiding this methodological problem of measurement, information from Banco de México is the only way to obtain a first spatio–temporal approach to the link between remittances and regional GDP.

3 Rapoport and Docquier (2005) provide an excellent summary of the various theoretical approaches that prevail in the macroeconomics of remittances. The following paragraphs take up some of these authors' positions.

4 These problems are due to the presence of simultaneity in the equations used, a situation that could arise when functional relations are proposed between remittances and GDP.

5 Another element that tends to be ignored is the fact that the cyclical component not only refers to the economic dynamics of the receiving country, but should also consider the dynamics of the country of origin of the remittances (Sayan, 2006). A propos of this, suffice it to say, in light of the current economic crisis (2009), the fact that the amount of remittances in Mexico is sensitive to the economic crisis in the United States.

6 The analysis with growth regressions differs from a macro analysis on the basis of a time series that focuses on the cyclical nature of remittances. Technically, the macro approach would eliminate the trend in the remittance and GDP series (of a region or country), meaning that the remaining cyclical components would be stationary with zero mean for each variable. One would then proceed to analyze the correlation between both variables and determine whether there is pro or anti–cyclical behavior (Sayan, 2006).

7 Banco de México made its latest methodological change when the observations of the reviewers of this article were being incorporated (2009), in which estimates of remittances have been revised upwards. Although the final version of these changes was not incorporated, an exploratory regional analysis with the new information indicates that this does not substantially alter the results found using the previous information.

8 The remittances/GDP estimates used in this essay were calculated by the authors on the basis of information from Banco de México and Instituto Nacional de Estadística, Geografía e Informática (INEGI) and do not necessarily agree with the other estimates found in other sources (see note to table 1).

9 The formula for the index is as follows: IRI = (Ri / GDPi ) / (Rn / GDPn ), where:

R = remittances from state i.

GDP = gross domestic product at constant prices.

n = national data.

10 The evolution of this standard deviation is similar to the measure of sigma convergence used in regional studies to evaluate processes of regional convergence–divergence. A reduction of the deviation would indicate convergence (in the variable) whereas an increase would indicate divergence among the regions.

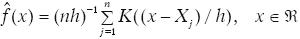

11 Drawing up a histogram is in fact an estimate of the probability density function of the phenomenon under study (such as the remittances/GDP log). But given the lack of a smoothed histogram, non–parametric methods have been developed to estimate probability densities. One of the most commonly used methods is kernel densities: given an X1, X2.. Xn sample of a population with an fdensity function, the expression for a kernel density estimator is:

where K is the kernel function (which in this study is assumed through a normal density function) and h is the smoothing parameter (window width) that has the same role as the interval length in a histogram.

12 The procedure was carried out in Stata using the wardpen command developed by Salgado–Ugarte, Makoto and Toru (1995) and 50 points per interval were considered for identifying the modes.

13 It is important to stress that the presence of multimodality in kernel density estimates is not a sufficient condition for making conclusions about the bimodal nature of the "true" density function of the remittance/GDP log of the country's states. To this end, it is necessary to consider a criterion of statistical inference, not presented in this essay, which will permit the evaluation of the multimodality of the functions estimated. There are several methods such as the one proposed by Silverman (1981) which, through bootstrapping methods, enables one to make probabilistic inferences about the bimodal nature of the estimates carried out in this research.

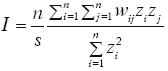

14 Formally, the Moran index is calculated through the following expression:

where n is the number of states in the country analyzed, wij are the elements of a binary contiguity matrix, s is the sum of all the elements in the W matrix and zi y zj are standardized values of the natural logarithm of the GDP per capita of state i and J. The Moran can be interpreted as a standardized measure of the autocovariance of a variable once a distance matrix is imposed. The Moran index has an expected value of non–autocorrelation given by the following expression:  Statistical inference tests based on assumptions of normality or experimental distributions can be used to accept or reject the null hypothesis of spatial non–autocorrelation.

Statistical inference tests based on assumptions of normality or experimental distributions can be used to accept or reject the null hypothesis of spatial non–autocorrelation.

15 A local Moran index was calculated using the criteria outlined by Anselin (1995). A first order contiguity matrix criterion was used and statistical significance tests were based on Monte Carlo experimental distributions. The states detected with local spatial autocorrelation indicate a pseudo p–value of 0.05 that the null randomness hypothesis will be true. Only states with positive local autocorrelation are highlighted in the maps.

16 This equation can be interpreted as a linear implementation of the neo–classical growth model that evaluates the conditional convergence hypothesis (Sala–i–Martin, 1996). In our specification, we include human capital and remittances as two variables conditioning the processes of convergence among the regions. The introduction of the CH variable into the conditional convergence moel can be justified in Mankiw, Romer and Weil (1992).

17 Once again, we stress that results based on data prior to 2003 must be viewed with caution, since Banco de México did not have a systematic mean of measuring remittances by state.

18 The literature of spatial econometrics (Florax, Folmer and Rey, 2003) has developed a series of statistical tests indicating that alternative (spatial) models can correct the spatial autocorrelation of the errors of the regressive model (see the spatial tests in table 3 for models 1, 2, 3 and 5).

19 A spatial lag model was not calculated for the period from 2003 to 2006 because the spatial tests do not provide evidence of spatial autocorrelation of errors.

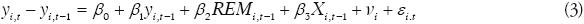

20 The following growth equation was estimated for the periods 2001–2006 and 2003–2006:

where y is the log of GDP per capita, REM is the log of remittances divided by GDP , X is a group of control variables, vi is a specific regional effect and e is an error term i.i.d. In the econometric procedures, first of all equation (3) was estimated by pooling together the information without the temporal and regional dimension of the data. That is, we assume that vi= 0 and eliminate the t subindex. OLS was used to estimatethis first model. The second stage focused on regional study units, and to this end, a fixed effect estimation was considered, where the differences between regional units can be considered through differences in the n constant of equation (3). Two different criteria of regional classification were used to estimate the equation with fixed effects. In the first case, a regional administrative criterion was considered, in other words, a state in the country represents a regional unit whereas in the second criterion, the Durand's regional classification (2005) was used, which deals with the different migratory dynamics in the country and in which the states are grouped into four migratory regions. Lastly, equation (3) was estimated using instrumental variables under the method of ordinary least squares in two stages. The results of these models are available from the authors on request.

Information about author(s)

MARCOS VALDIVIA LÓPEZ es doctor en economía por la New School for Social Research de Nueva York. Investigador de tiempo completo del Centro Regional de Investigaciones Multidisciplinarias de la Universidad Nacional Autónoma de México (UNAM). Entre sus publicaciones académicas recientes destacan "Social Interactions and Information Dynamics in Self–Employment in Mexico City" (Investigación económica, núm. 268, 2009) y "Desigualdad regional en el centro de México, una exploración espacial de la productividad en el nivel municipal durante el periodo 1988–2003" (Investigaciones Regionales, núm. 13, 2008). Sus líneas principales de investigación son: modelos computacionales de interacción social, geografía económica y mercados laborales.

FERNANDO LOZANO ASCENCIO es investigador del Centro regional de investigaciones multidisciplinarias (CRIM) de la Universidad Nacional Autónoma de México, campus Morelos. Es maestro en demografía por el Colegio de México y doctor en sociología por la Universidad de Texas, en Austin. Durante los últimos 15 años ha trabajado temas relacionados con la migración México–Estados Unidos, las remesas de migrantes y debates sobre el vínculo entre migración y desarrollo. Ha publicado más de 50 ensayos sobre estos temas. Su libro más reciente, en coautoría con Liliana Rivera Sánchez, Encuentros disciplinarios y debates metodológicos. La práctica de la investigación sobre migraciones y movilidades (2009), fue publicado por el CRIM, UNAM, en coedición con el Grupo Editorial Miguel Ángel Porrúa. En 2009 publicó también el trabajo La emigración de recursos humanos calificados desde países de América Latina y el Caribe: Tendencias contemporáneas y perspectivas, con apoyo del Sistema Económico Latinoamericano y del Caribe (SELA). Forma parte del Consejo Directivo de la Red Internacional de Migración y Desarrollo y pertenece al Sistema Nacional de Investigadores de México, nivel II.