Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Problemas del desarrollo

Print version ISSN 0301-7036

Prob. Des vol.48 n.190 Ciudad de México Jul./Sep. 2017

Articles

Software Companies in Mexico and their Ties to Local Development

1 Universidad Autónoma Metropolitana-Azcapotzalco, México. Correo electrónico: jordy.micheli@gmail.

2 Instituto Politécnico Nacional, México. Correos electrónicos: neburevilo@gmail.com.

This paper sets out to characterize the business dynamics of the software industries located in Mexico City, Monterrey, and Tijuana, beginning with a survey administered by the authors to 175 companies located in the aforementioned cities in 2014. The literature about this industry in Mexico has tended to favor theoretical approaches to innovation and learning and their subsequent application to local cases. This work relies on the logic of clusters (Porter, 1998) and therefore analyzes relationships with the local market in terms of sales and usage of human, financial, and informational resources, revealing regional differences in business dynamics. One important difference is the weight of local competition in Mexico City as compared with the other two cities.

Keywords: Software industry; local development; industrial clusters; Mexico City; Monterrey; Tijuana

El objetivo del presente artículo es caracterizar dinámicas empresariales de la industria de software ubicada en las ciudades de México, Monterrey y Tijuana, a partir de una encuesta realizada a 175 empresas ubicadas en las ciudades arriba mencionadas, durante el año de 2014. La literatura existente sobre esta industria en México privilegia enfoques teóricos sobre innovación y aprendizaje y su aplicación a casos locales. Este trabajo se enmarca en la lógica de los clústeres (Porter, 1998); por tanto, analiza las relaciones con el mercado local en materia de ventas y utilización de recursos humanos, financieros e información, lo que permite evidenciar diferencias regionales de las dinámicas empresariales. Entre ellas, una importante es el peso que tiene la competencia local en la Ciudad de México comparada con las otras dos ciudades.

Palabras clave: industria del software; desarrollo local; clusters industriales; Ciudad de México; Monterrey; Tijuana

Clasificación JEL: M15; O14; O18; R12

L’objectif de cet article est de caractériser les dynamiques entrepreneuriales de l’industrie de logiciels située à Mexico, Monterrey et Tijuana dans le cadre d’une enquête menée par les auteurs auprès 175 entreprises au cours de l’année 2014. Les travaux existants sur cette industrie au Mexique privilège les approches théoriques de l’innovation et l’apprentissage et leurs applications à des cas locaux. Ce travail s’inscrit dans la logique des clusters (Porter, 1998) ; en conséquence, on analyse les rapports avec le marché local en termes de ventes et de l’utilisation de ressources humaines, financières et de l’information, ce qui met en évidence les différences régionales des dynamiques d’entreprise. Une différence importante est le poids qui détient la concurrence locale à Mexico par rapport aux deux autres villes.

Mots clés: industrie de logiciels; développement locale; clusters industriels; Mexico; Monterrey; Tijuana

O objetivo deste trabalho é caracterizar a dinâmica de negócios da indústria de software localizada nas cidades do México, Monterrey e Tijuana, a partir de uma pesquisa realizada pelos autores em 175 empresas localizadas nas cidades acima mencionadas durante o ano de 2014. A literatura existente sobre esta indústria no México privilegia abordagens teóricas sobre a inovação e a aprendizagem e sua aplicação a casos locais. Este trabalho é parte da lógica dos clusters (Porter, 1998); portanto, analisa as relações com o mercado local em termos de vendas e utilização de recursos humanos, financeiros e de informação, permitindo explicitar diferenças regionais das dinâmicas empresariais. Entre elas, uma importante diferença é o peso que tem a concorrência local na Cidade do México em comparação com as outras duas cidades.

Palavras-chave: indústria de software; desenvolvimento local; clusters industriais; Cidade do México; Monterrey; Tijuana

基于2014年对175家位于墨西哥城、蒙特雷和蒂华纳三座城市的软件公司所做的问卷调查,本文旨在分析上述三座城市软件行业商务运行的特点。现存的相关文献主要聚焦于软件革新和学习及其在当地发展中的应用。本文以簇(波特,1998)的逻辑为理论框架,分析在销售和人力资源、金融资源和信息利用方面软件公司与当地市场的联系。通过这一分析我们可以证明商业运行中的区域差别。其中一个重要的区域差别是墨西哥城与另外两座城市相比当地竞争的权重。

关键词 软件行业、当地发展、工业簇拥、墨西哥城、蒙特雷、蒂华纳

INTRODUCTION

Academic studies published in recent decades about industrialization in Mexico have stressed productive articulation, innovation, scaling, learning, building social capital, and public policy against the backdrop of a regional framework that has looked at northern border states and the Bajío zone, with a notable interest in local agglomerations for automotive, aeronautics, and software production (Micheli, 2012). Mochi (2004) asserted the strategic role of the latter industry and the importance of developing innovative capabilities in order to specialize in supplying to specific markets and segments as a prerequisite to become sustainably competitive. Mochi and Hualde (2009) likewise pointed out that it is time to undertake a transformation to integrate the domestic electronics-software complex, strengthen human capital, and overhaul the institutional framework (PROSOFT) to boost industry development.

Other authors have studied industrialization through a regional lens, primarily in the cities of Guadalajara, Jalisco; and Tijuana and Mexicali, in Baja California. A non-exhaustive list includes papers by Casalet (2004); Casalet, González et al. (2008); Oliver (2009); Padilla (2008); Palacios (2008); Partida (2004); Rivera (2004); Gomis and López (2004); Hualde and Gomis (2007); Hualde (2010); Rivera, Ranfla, and Bátiz (2010), all of which underscore the relevance of local actors and ties in the realms of innovation, learning, and productive articulation as the primary explanatory factors underlying industry dynamics, documenting that the two regions, both of which have a track record in the maquiladora production of electronic consumer goods, have served as the breeding ground for the mobilization of stakeholders (companies, universities, and intermediary organizations), shaping clusters in the framework of public policy instruments (PROSOFT). Thus, these works have portrayed the rise of initiatives to link up networks to make business and sectoral activities more professional and help companies build better organizational and technological capacities.

Looking at Mexico City, Solleiro’s (2015) description reveals that the city’s importance as home to a software cluster, in terms of the PROSOFT definitions, is limited as compared to other sites (Guadalajara, Tijuana, and even Monterrey). Casalet, González et al. (2008) drew similar conclusions. Buenrostro (2013) compared the connectivity of clusters in Mexico City and Guadalajara pursuant to four dimensions: administration, articulation, capacity-building, and market access. Matus, Ramírez, and Buenrostro (2013) depicted articulation experiences in six software clusters, including that of Mexico City (Aguascalientes, Baja California, Guadalajara, Monterrey, and Querétaro).

What the academic literature has covered is just one piece of the regional mosaic of production capacities and the articulation of bodies and institutions, with an interest in a specific development model, but without delving into an analysis of the dynamics of cases that are more nationally relevant (in economic terms) in the software industry, like Mexico City and Monterrey.

This paper is interested in examining the software industry from the clusters viewpoint, namely, through the lens of the local in the sense of the industrial economy and the relevance of the resources that companies have and that local environments afford them in order to compete (Porter, 1998).

Given this territorial and sectoral context, the objective of this paper is to characterize local business dynamics in the industry in Mexico City, Monterrey, and Tijuana. The first is marked by a high concentration of activities that demand products and software services from the entire nation; the second by its industrial tradition; and the third is known as a dynamic territory, famed for its innovative attitude, proximity to the United States, and past experience in electronics manufacturing.

The idea is to shed light on the differences and similarities in the ways companies link up with the market, or companies link up with each other within the same industry when their headquarters are found in different urban territories. The assumption is made that a major factor driving the dynamics in the software industry falls to the local markets of companies, in light of their economic weight in the local and national productive structure of the software-consuming sectors.

This paper begins with an Introduction and then continues with a section explaining the theoretical underpinnings of this work, followed by some institutional context and background information about the software industry in Mexico. Then, it presents the field research findings and wraps up with conclusions that reveal the regional differences, mainly between Mexico City with respect to Monterrey and Tijuana.

CLUSTERS: THE RELATIONSHIP BETWEEN COMPANIES AND LOCAL MARKETS AND RESOURCES

A company’s efforts to develop productive capabilities are bound up in its economic and social relations against the backdrop of a territorial context. Various strains of theory have addressed the theme conceptually. Moulaert and Sekia (2003) catalogued several of them and grouped them under the term “territorial innovation models.” The suite of papers that have studied the software industry in Mexico from a regional stance tend to identify with these models, focusing on observing intra-sectoral relationships (bodies, institutions, and software vendors), giving greater weight to the density of players involved and their relationships and less to the local productive structure, the role of software consumers, and competition in the ways in which regional differences in the industry emerge.

This paper sets out to provide an explanation to complement the regional dynamics, departing from a Marshallian bent, pursuant to which territorial concentration generates external economies (Marshall, 1957). These are important to identify the feedback between productive agents and understand the economic weight of geographically-located activities.

A cluster refers to the conformation of a locally-situated critical mass of knowledge, relationships, and motivations that fortify the competitive advantages against external competitors, meaning that companies’ competitiveness is predicated on the vitality of this territorial productive configuration (Porter, 1998). It entails a space for competition and cooperation alike. Competition in the pursuit of profit margins and market share, to which is added a supply of services and goods that permit forward and backwards productive linkages with a wide range of public and private actors. Cooperation is inherent to business strategies to gain a better competitive position in terms of costs, because cooperating rationalizes vertical integration and supports differentiation and innovation.

In the industrial economy school, a cluster is a methodological resource that harnesses the conditions of the environment in which a company is performing and defines the resources with which to generate strategic behavior (Barney, 1991; Peteraf, 1993; Teece, Pisano & Shuen, 1997; Wernerfelt, 1984). The logic of resource identification tends to be associated with studies in the management sphere (Kraaijenbrink, Spender & Groen, 2010).

In this same vein, this paper examines the elements that comprise companies’ relationships with local markets and resources (human, financial, and informational), after determining the relative weight of regionally-located software industries in the national productive structure.

INSTITUTIONAL CONTEXT: PROSOFT

In light of the importance of PROSOFT as a local development tool in Mexican industry, it is worth a brief description. In 2002, Mexico enacted the first version of the Software Industry Development Program (PROSOFT 1.3) (Secretaría de Economía, 2004). Since the very beginning, it was conceived of as a program to expand the competitive foundation of the software industry in Mexico and position it worldwide, drawing on industrial development models observed in other countries, like India, Ireland, and Israel. The success of the program ensured its continuity and evolution to second and third versions (PROSOFT 2.0 and 3.0). It will be in place until at least 2024.

Two of the strategies set forth in this program are pertinent to the topic of this paper: 1) regional agglomeration of companies into clusters as a means of reinforcing and multiplying the program's resources and boosting company competitiveness and 2) the digital development of a local industry, capitalizing on the mainstreaming of software and its evolution from product to knowledge-based service.

In terms of the first strategy, the promotion of territorial agglomerations has prompted capacity-building and the emergence of infrastructure for companies in the respective cluster. It bears mentioning that the definition of a cluster is a way to make public policy actions tangible in the form of infrastructure and public and private organizations supporting companies.

By 2016, over 30 clusters had been identified in 20 entities, all accounted for in the National Council of Software and Information Technology Clusters, aiming to consolidate the industry and take full advantage of each cluster’s resources and competencies (CNCS, 2016). In terms of the digitalization strategy, the diagnostic study conducted to draft PROSOFT 2.0 (Secretaría de Economía, 2008) affirmed that the development of the domestic market was the least impactful aspect of PROSOFT 1.3, and that the new strategy (Secretaría de Economía, 2014, 2015) would recognize the software industry as an input to catalyze innovation in mature industrial sectors (metal-mechanics, textiles-apparel and leather-footwear, steel, wood and furniture, and food and beverage), dynamic sectors (automotive and auto parts, aerospace, power, electronics, and chemical), and emerging sectors (biotechnology, pharmaceutical, information technologies, creative industries, and medical equipment).

From that stance, public policy acknowledges, on the one hand, that it is important to promote territorial clusters in order to create a supply and, on the other hand, that it is equally important to take advantage of mainstreaming software to unleash new user sectors. Implicitly, the Innovative Development Program (PRODEINN) is meant to confront the challenge of new trends in software development and support infrastructure as the means to leverage the reshaping of the knowledge economy: cloud computing, big data, and the Internet of Things.

BACKGROUND OF THE DOMESTIC INDUSTRY

Productive activities involved in and revolving around software comprise an ever-wider spectrum of services. This is one of the features of the evolution and convergence of information and communication technologies, predicated on the digitalization of hardware and the spread of control languages and human-machine interfaces, embedded in a powerful and instantaneous means of communication: the Internet.

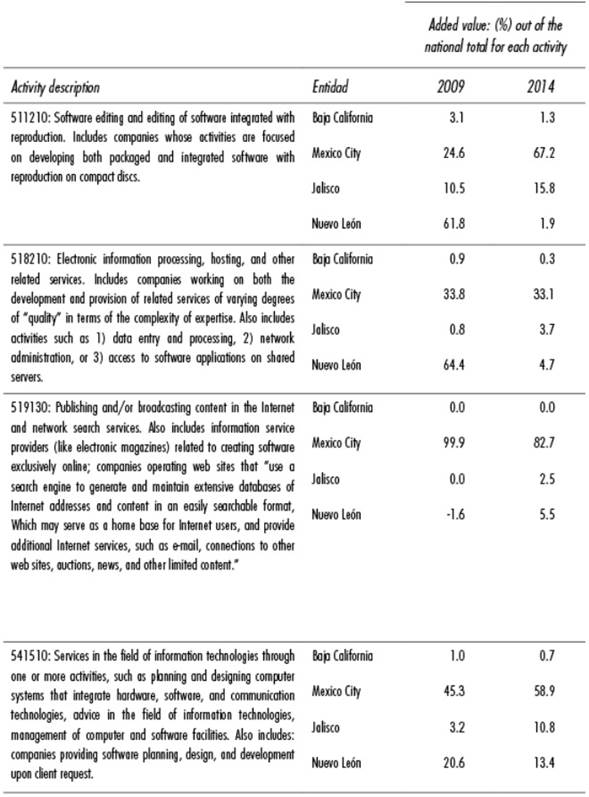

The wave of innovation reflected this century in the rise of the Internet, known as the cloud, has prompted the expansion of a new service entailing the innovative use of software, known as software as a service (SAAS) (Aramand, 2008; Lippoldt & Stryszowsky, 2009), which tends to blur the line between proprietary software (packaged) and bespoke software, the concepts traditionally used to define the industry. This new wave is breaking down entry barriers and creating new markets based on multiple uses of the Internet. Tracking software-producing activities reveals four main activities classified in the traditional industrial statistics in the North American Industrial Classification System (NAICS), namely, activities 511210, 518210, 519130, and 541510. Their definitions and geographic distributions throughout the states in the regions under study are summarized in Table 1.

Table 1 Distribution of added value in the software industry

Source: Created by the authors using the final results of the 2009 and 2014 Economic Censuses, INEGI, México

It should be noted that Mexico City’s share in each of the four subsectors of the software industry amounts to the majority nationwide. By 2014, Mexico City’s share in domestically-generated added value ranged from 33.1%, in subsector 518210, to 82.7% in subsector 519130. That same year, Jalisco’s share fluctuated between 2.5% (subsector 519130) and 15.8% (511210). Nuevo León's share was between 1.9% (511210) and 13.4% (541510). For its part, Baja California's share was very low with respect to the other states.

These figures statistically corroborate and update the evidence for a new economic geography: urbanization evolves alongside the expansion of the advanced tertiary sector. In Mexico, Mexico City is the key driver of the momentum for ICT services (Micheli, 2012). In the specific case of software, Corona and Paunero (2013, p. 200) wrote that:

it agglomerates principally in large urban hubs, due to various factors, including: 1) the basic infrastructure sufficient to guarantee certain facilities to the productive center (telecommunications, technology providers, 2) the presence of large corporations; 3) availability of highly qualified personnel; and 4) it is in the cities where demand is focused, primarily due to the presence of tertiary sectors.

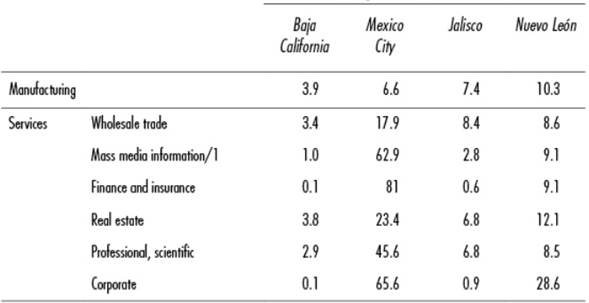

Data from the 2014 Economic Census (see Table 2) reveal the weight of Mexico City as a location where activities that are highly demanding of software are concentrated, which matches Corona and Paunero’s definition.

Table 2 The Share of States in National Added Value in Sectors with High Software Demand

/1 Mass media information encompasses, among others, the first three software activities in Table 1.

Source: Created by the authors based on the 2014 Economic Census, INEGI.

As can be observed, Mexico City’s share is higher than that of the other states in each one of the services, but not so in manufacturing.

LOCAL FACTORS IN THE SOFTWARE INDUSTRY

Methodology

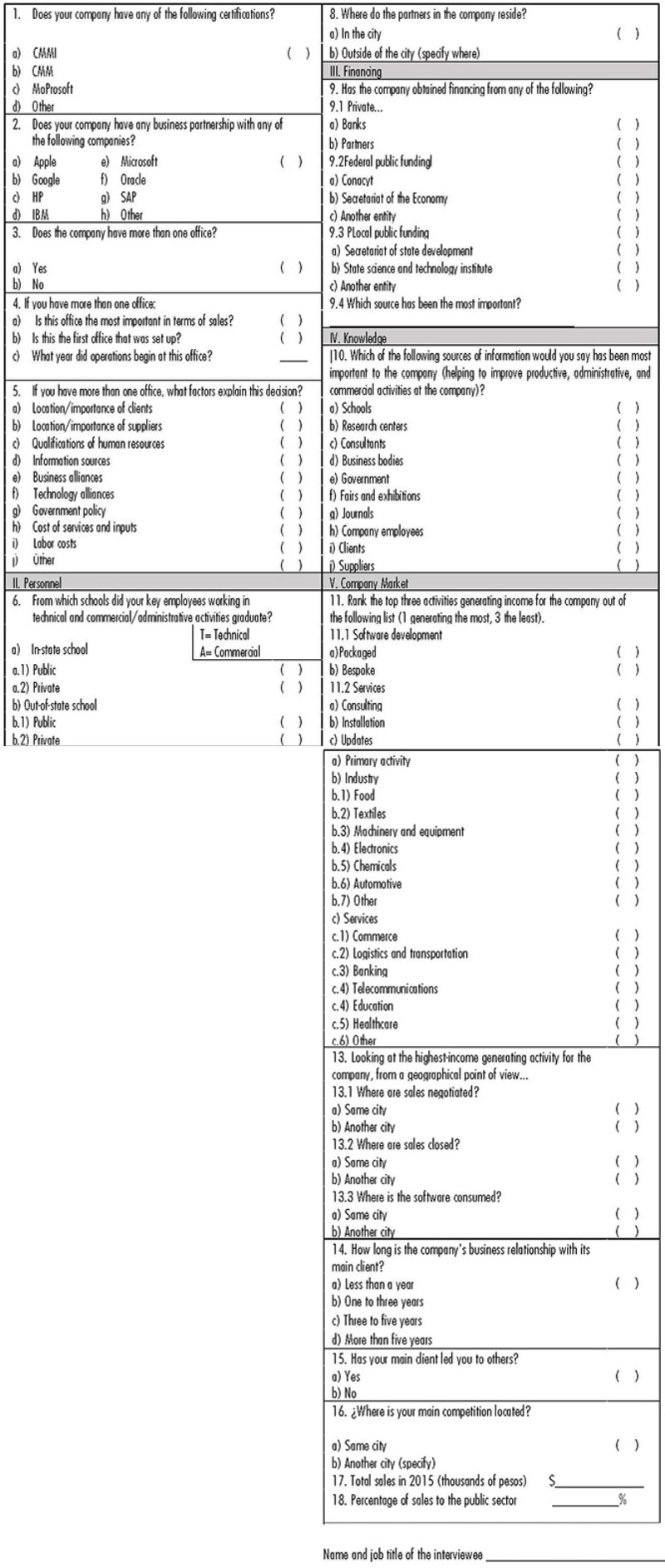

A survey was administered to 175 companies distributed throughout Mexico City (75), Monterrey (50), and Tijuana (50). The companies were identified as producers of proprietary software, open-source software, or software services (both consulting and the so-called “software as a service”), using information from chambers of commerce and business associations.

A directory of companies was assembled for the three cities. Companies were contacted by telephone, initially, up to three times. If they did not agree to take the survey, either explicitly or by evasion, they were ruled out as potential survey candidates.1 The NAICS was used as the operating definitions of the activities for companies working on software production, pursuant to the previously described classification.

The survey was designed to gather information about local factors that would help explain the structure and dynamics of the industry, using nominal and ordinal variables (geographic location and type of clients; geographical origin of the labor force; sources of financing, knowledge, and commercial relationships).

These data raise new questions to explain the territorial, social, and technical vision that has been so useful in understanding the behavior of the software industry in Mexico. Given the wide disparity between the scale of software production and consumption in Mexico City and the rest of the country, this research is more interested in determining which local features can elucidate the differences in business dynamics between Mexico City and other important poles of development, like Monterrey and Tijuana.

This method could be considered as applicable to studying software companies from a local markets perspective, and could be replicated (the Annex to this paper contains the survey administered). The major regions that have proven to be dynamic in the industry are located in Guadalajara, in the state of Jalisco, or in the metropolitan zones of the State of Mexico, Puebla, Guanajuato, Zacatecas, to name a few, and this tool could be used to garner more information about the local development of the software industry from the stance presented in this work.

Because the survey reveals the proportion of companies in each location with operations in the local market and using local resources, it paves the way to characterizing local relationships and, based on that, comparing locations with other cities. The exercise therefore entails identifying whether the local industry is characterized by companies that are plugged into the local market and local resources or not.

Accordingly, in terms of the market, the main features examined include who are the company’s main clients and what is the company’s geographic scope of sales and product consumption. In this way, if a company states that its main client is located in the same city, and that it is in this same city that it makes most of its sales, and its products are consumed locally, the company is characterized as being locally linked. Looking at resource use, if the company uses resources that come from the local environment, it is also characterized as a locally-linked company.

Market Structure

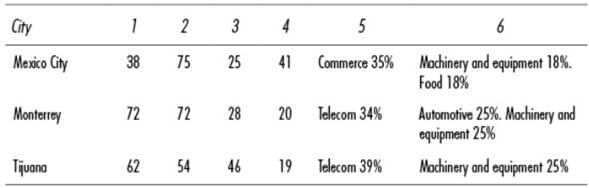

In characterizing the local market, a great deal of emphasis was placed on the surveyed company’s main client. The survey asked about the length of the company’s relationship with the client and the nature of the activities provided (in terms of the economic sector and branch and weight of the public sector in the company's main client base). Table 3 summarizes the results.

Table 3 Market Structure of Software Companies in the Three States

Notes to explain the market structure in this table:

1: With respect to the total number of companies, percentage whose relationship with the main customer has lasted five years or longer.

2: With respect to the main client, percentage of companies whose market is in services.

3: With respect to the main client, percentage of companies whose market is in manufacturing.

4: With respect to the total number of companies, percentage that sell to the government.

5: Main branch of clients in services.

6: Main branch of clients in manufacturing

Source: Created based on data from the survey attached in the Annex.

The data reveal clearly differentiated profiles: companies in Mexico City tend to have shorter relationships with their clients than those in other cities and, by contrast, the weight of public sector and services customers is greater. In Monterrey, the private sector accounts for a larger share than the public but, just as in Mexico City, there is a greater focus on services. In Tijuana, the private sector is predominant in the market, but there is better balance between services and manufacturing.

The main branches where the clients of the companies in the three cities work are very similar and are mainly in the area of highly software-demanding activities, although it is also worth noting that, as mentioned earlier, in Mexico City, complex software user services are predominant. In this same city, the proportion of companies with long-term client relationships is low.

Geographic Scope of the Market

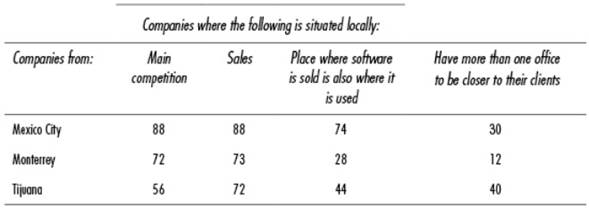

The study examined the geographic location of the market of the companies surveyed. Is the competition facing these companies local or not? Are sales made locally? Is the product sold for local consumption? Does the company have facilities elsewhere to be closer to the market? This set of questions elucidated the degree to which companies serve a local market or a market beyond the local realm. Results are summarized in Table 4.

Table 4 Geographic Scope of the Software Companies´Markets in the Three States (percentage)

Source: Created based on the survey attached in the Annex

These results led to the finding that it is companies in Mexico City that are most closely linked to the local market: competition, sales, and users located in the same city, mainly. By contrast, companies in Monterrey, and especially those in Tijuana, face more competition from other companies not located in the same city, making nearly one third of their sales outside of the local sphere. Their products are also primarily used outside of the city. The proportion of companies from Tijuana with more than one office confirms this greater emphasis on non-local work. Nevertheless, on this point, it is worth underscoring also that in all three cities, the local market does have a major weight: for 88% of the companies in Mexico City and 72-73% of the companies in the other two cities.

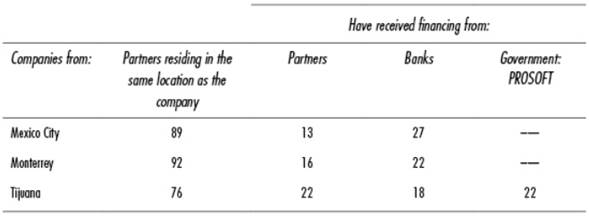

Financial Resources

To what degree do companies use local financing in their operations? To understand the dimension of the weight of local resources in financial capabilities, a question was asked about the place of residence of partners and the degree to which companies receive financing from them or from other sources, such as banks and the public sector. Results are summarized in Table 5.

Table 5 The Financial Resources of Software Companies in the Three States (porcentage)

Source: Created based on the survey attached in the Annex

It is striking that it is only in Tijuana where companies receive financing from the Secretariat of the Economy via the public program PROSOFT. Similarly, Tijuana stands out for having a lower degree of “local ownership” as compared to other cities. In Mexico City, companies tend to turn to bank financing.

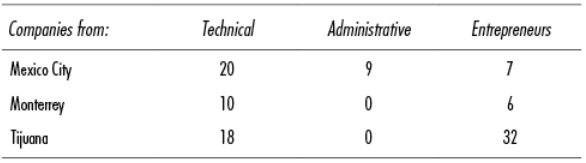

Human Resources

Human resources were another topic examined in the study, in the pursuit of finding out what percentage of personnel and owners received their professional education outside of the local environment (see Table 6).

Table 6 Software Company Personal Educated Professionally Outside of the Local Area, with Respect to total Personnel (percentage)

Source: Created based on the survey attached in the Annex

As can be seen, when it comes to software companies, Tijuana is an attractive city for entrepreneurs from outside the location, in a percentage nearly five times greater than that of the other cities. For their part, software companies in Mexico City and Tijuana tend to attract from other cities nearly twice the number of technical employees than Monterrey does. Speaking of other variables, Monterrey’s software companies overwhelmingly employ locally educated human resources.

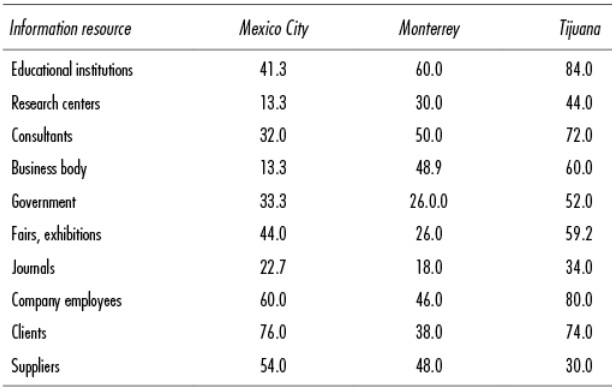

Information Resources

Because information is such a far-reaching factor as a competitive advantage, companies were asked to declare which information resources they used in developing their activities. Table 7 summarizes data on the main resources companies use in each location.

Table 7 The Information Resources Used by Software Companies in % in Each City

Source: Created based on the survey attached in the Annex

Significant differences emerge: software companies in Mexico City overwhelmingly use information resources from suppliers, clients, and company employees. For their part, Monterrey uses resources from educational institutions and consultants, primarily. Companies in Tijuana tend to use resources from educational institutions, clients, and consultants.

Broadly speaking, in Mexico City it is the market itself (the client-company-supplier axis) that is the most important source of information; in other cities, primarily in Tijuana, there is more widespread use of the regional system (consider that with the exception of clients and suppliers, the rest of the information sources revealed higher response rates than in the other two cities).

CONCLUSIONS

Using a structural and territorial approach based on the traditional cluster concept emanating from industrial economics, the objective of this paper was to characterize the local dynamics of the software industry in three cities in Mexico: two chosen due to their economic weight in the domestic economy (Mexico City and Monterrey), and the third thanks to its widely-recognized vigor in a territory marked by innovation and proximity to the United States (Tijuana). The paper set out to elucidate the differences and similarities in the ways companies link up with the market, and the similarities and differences between companies within the same industry but whose headquarters are located in different urban territories. It was assumed that a key factor in the dynamics of the software industry falls to companies’ local markets, pursuant to the nature of the geographic economy based on industrial agglomerations.

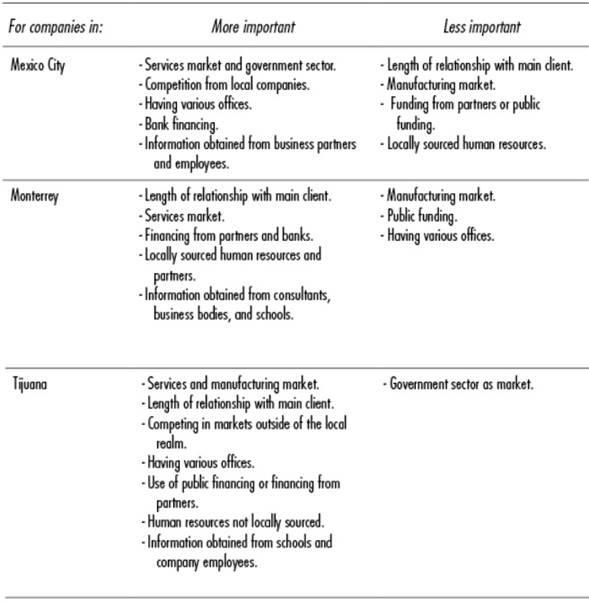

The responses to the survey point to the degree and ways in which companies are inserted in local markets and use resources from the local realm. This information led to the following summary characterization (see Table 8), by way of a general profile.

Connecting the general profile with the size and importance of local economies in the overall domestic economy, the following conclusions are reached:

Mexico City’s business dynamics differ considerably from those in the other two cities in terms of the number of factors that are not relevant to operations there. On the other extreme, the smallest economy practically employs more factors to compete. On this point, it is significant that companies surveyed in Mexico City and Monterrey did not report having received any PROSOFT financing, while those in Tijuana, by contrast, did.

Another aspect that sets Mexico City apart from the pack is the low proportion of companies that have long-term client relationships, because they are the most relevant source of information for business activities. Furthermore, of the three cities, Mexico City was found to receive the most direct information (clients and suppliers), which could speak to a more competitive market or more sophisticated clients or forms of consumption, which may be associated in turn with significant concentration, pursuant to data from the economic census, both for the national software offer, as well as for the productive sectors that consume software the most.

Each of the connectivity factors examined makes it possible to delve deeper into the way in which the software industry develops by region, looking at, for example: competition, relationships with different types of markets, public and private financing mechanisms, use of human resources, and use of the local information system, etc.

These differences are manifest not only in the strength of company ties to the local economy, but also in the economic weight of software supply and demand, factors that tend to concentrate where conditions that invigorate complex (or knowledge-intensive) services and advanced manufacturing emerge.

This is important, because although the role of the public policy emanating from PROSOFT (cluster-building) and PRODEINN (software mainstreaming) is important, there are still significant gaps in terms of the ability to make economic relations deeper and more complex (non-institutional and organizational) across regional actors. If on the one hand software-demanding productive activities in the three regions comprise a portion of the core of complex services and industries associated with the intensive use of information technologies, the relative importance of such activities in each region plays a role in the types of relationships companies report to be most pertinent in sourcing local resources.

As such, this phenomenon spurs reflection about the policy instruments to not only develop software production, but also to drive innovation: it is an industry whose evolution is subject to the articulation capacity presupposed by PROSOFT (as a sectoral program) hand in hand with PRODEINN, because it identifies the strategic role of software, given its cross-cutting scope. However, the central matter is that deeper use of software is reliant on the complexity of the productive structure and the relative weight of local economic activities.

In terms of research on the software industry in Mexico, the suggestion is that the approach used in this paper is useful in aggregating observations and data that in some sense have been heretofore obscured: the weight of Mexico City and its local business dynamics as a key explanatory driver underlying the software industry in Mexico.

ACKNOWLEDGEMENTS

The authors would like to acknowledge the comments and suggestions made by the two anonymous readers.

1 Initially, a total of 456 companies were identified in the three cities, but due to time constraints and research costs, 175 surveys were administered, given that sample representativeness was not sought.

REFERENCES

Aramand, M. (2008), “Software Products and Services are High Tech? New Product Development Strategy for Software Products and Services”, Technovation, vol. 28, núm. 3, Elsevier, 154-160, March. DOI:10.1016/j.technovation.2007.10.004. [ Links ]

Barney, J. (1991), “Firm Resources and Sustained Competitive Advantage”, Journal of Management, vol. 17, núm. 1, Souther Management Association, 99-120. [ Links ]

Breschi, S. & Camilla, L. (2016), “Co-invention Networks and Inventive Productivity in US Cities”, Journal of Urban Economics, vol. 92, Elsevier, 66-75, March, DOI: 10.1016/j.jue.2015.12.003. [ Links ]

Buenrostro, E. (2013), “Acuerdos para la producción al interior de clústers de software en México”, Experiencias y desafíos en la apropiación de las TICS por las PyMEs Mexicanas, Colección Memorias de Seminarios No. 2, México, Fondo de Información y Documentación para la Industria, 33-43. [ Links ]

Casalet, M. (2004), “La conformación de un sistema institucional territorial: el desarrollo de la maquila de exportación en dos regiones diferenciadas, Jalisco y Chihuahua”, en J. Carrillo y R. Partida (coords.), La industria maquiladora mexicana. Aprendizaje tecnológico, impacto regional y entornos institucionales, México, UdeG-Colef, 170-195. [ Links ]

Casalet, M., González, L., Buenrostro, E., Oliver, R. y Becerril, G. (2008), El Impacto de las políticas e instituciones locales y sectoriales en el desarrollo de ‘clusters’ en México: el caso del sector de software. México, Oficina Internacional del Trabajo (reporte no publicado). [ Links ]

Consejo Nacional de Clústeres (CNCS) (2016), “¿Qué es el Consejo Nacional de Clústeres CNCS?” (consultado el 15 de agosto de 2016), disponible en < Consejo Nacional de Clústeres (CNCS) (2016), “¿Qué es el Consejo Nacional de Clústeres CNCS?” (consultado el 15 de agosto de 2016), disponible en http://www.cncs.mx/j/index.php?option=com_content&view=article&id=22&Itemid=444&lang=es > [ Links ]

Corona, L. y Paunero, X. (2013), Ante la crisis: estrategias empresariales de innovación en México y España, México, Siglo XXI Editores, 287. [ Links ]

Gomis, R. y López, I. (2004), “La generación de ventajas competitivas a partir de la adopción y la aplicación de las tecnologías de la información: el sector de la electrónica de la industria maquiladora de exportación en Tijuana”, en J. Carrillo y R. Partida (coords.), La industria maquiladora mexicana. Aprendizaje tecnológico, impacto regional y entornos institucionales , UdeG-Colef, 37-67. [ Links ]

Hualde, A. (coord.) (2010), Pymes y sistemas regionales de innovación: un análisis de la industria del software en Baja California y Jalisco, Montevideo, Textual, 296. [ Links ]

Hualde, A. y Gomis, R. (2007), “Pymes de software en la frontera norte de México: desarrollo empresarial y construcción institucional de un clúster”, Problemas del Desarrollo, Revista Latinoamericana de Economía, vol. 38, núm. 150, México, UNAM-IIEC, 193-212, julio-septiembre. [ Links ]

Instituto Nacional de Estadística y Geografía (2016), Censo Económico 2009, Sistema Automatizado de Información Censal, INEGI, México, disponible en <http://www3.inegi.org.mx/sistemas/saic/> [ Links ]

______ (2016), Censo Económico 2014, Sistema Automatizado de Información Censal, INEGI, México, disponible en <http://www3.inegi.org.mx/sistemas/saic/> [ Links ]

Kraaijenbrink, J., Spender, J. C. & Groen, A. (2010), “The Resource-based View: A Review and Assessment of Its Critiques”, Journal of Management , vol. 36 núm. 1, Sage Publications, 349-372. [ Links ]

Lippoldt, D. & Stryzowski, P. (2009), Innovation in The Software Sector, Organization for Economic Cooperation and Development, 185. [ Links ]

Marshall, A. (1957) [1890], Principios de Economía, Madrid, Aguilar, 514. [ Links ]

Matus, M., Ramírez, R. y Buenrostro, E. (2013), “Capacidades adquiridas y por desarrollar en los clúster ti de México: Análisis comparativo centrado en el caso inteQsoft A.C.”, Cuaderno de Trabajo No. 4, México, Fondo de Información y Documentación para la Industria, julio. [ Links ]

Micheli, J. (2012), Telemetrópolis. Explorando la ciudad y su producción inmaterial, Barcelona, Gedisa, Universidad Autónoma Metropolitana Azcapotzalco, 140. [ Links ]

Mochi, P. (2004), “La industria de software en México”, Problemas del Desarrollo , Revista Latinoamericana de Economía, vol. 35, núm. 137, IIEC-UNAM, 41-58, abril-junio. [ Links ]

Mochi, P. y Hualde, A. (2009), “México: producción interna e integración mundial”, en P. Bastos y F. Silveira (eds.), Desafíos y oportunidades de la industria del software en América Latina, Colombia, Cepal en coedición con Mayol Ediciones, 171-203. [ Links ]

Moulaert, F. & Sekia, F. (2003), “Territorial Innovation Models: A Critical Survey”, Regional Studies, vol. 37, núm. 3, Taylor & Francis, 289-302. DOI: 10.1080/0034340032000065442 [ Links ]

Oliver, R. (2009), Innovación y eficiencia colectiva en el sector software de Guadalajara, tesis de Doctorado en Ciencias Sociales con mención en Sociología, México, Facultad Latinoamericana de Ciencias Sociales. [ Links ]

Padilla, R. (2008), “A Regional Approach to Study Technology Transfer through Foreign Direct Investment: The Electronics Industry in Two Mexican Regions”, Research Policy, vol. 37 núm-5, Elsevier, 849-860, june. DOI:10.1016/j.respol.2008.03.003. [ Links ]

Palacios, J. J. (2008), Alianzas público-privadas y escalamiento industrial. El caso del Complejo de alta tecnología de Jalisco, México, Comisión Económica para América Latina, Serie Estudios y Perspectivas núm. 98, 66. [ Links ]

Partida, R. (2004), “Instituciones empresariales, educativas y laborales en el clúster de la electrónica de Jalisco”, en Jorge Carrillo y Raquel Partida (coords.), La industria maquiladora mexicana. Aprendizaje tecnológico, impacto regional y entornos institucionales , México, UdeG-Colef, 196-218. [ Links ]

Peteraf, M. (1993), “The Cornerstones of Competitive Advantage: A Resource-Based View”, Strategic Management Journal, vol. 14, núm. 3., USA, John Wiley and Sons, 179-191. [ Links ]

Porter, M. (1998), Clusters and The New Economics of Competition, Harvard Business Review, vol. 76, núm. 6, USA, Harvard University, 77-90. [ Links ]

Rivera, I. (2004), “Transferencia y asimilación de tecnología en Jalisco: impactos y retos”, en Jorge Carrillo y Raquel Partida (coords.), La industria maquiladora mexicana. Aprendizaje tecnológico, impacto regional y entornos institucionales , México, UdeG-Colef, 68-94. [ Links ]

Rivera, M. Á., Ranfla, A. y Bátiz, J. L. (2010), “Aprendizaje tecnológico en empresas de software en México. Cuatro territorios locales: Guadalajara, Tijuana, Mexicali y Distrito Federal”, Economía Teoría y Práctica, núm. 33, México, UAM, 97-139, julio-diciembre. [ Links ]

Secretaría de Economía (2004), “Programa para el Desarrollo de la Industria del Software, Prosoft”, México, Poder Ejecutivo Federal. [ Links ]

______ (2008), “Programa para el Desarrollo de la Industria del Software, Prosoft 2.0”, México, Poder Ejecutivo Federal. [ Links ]

______ (2014), “Programa de Desarrollo Innovador 2013-2018, Prodeinn”, México, Poder Ejecutivo Federal. [ Links ]

______ (2015), “Programa para el Desarrollo de la Industria del Software, Prosoft 3.0”, México, Poder Ejecutivo Federal. [ Links ]

Solleiro, J. L. (2015), “Estado del arte de clusters de tecnologías de la información, Ciudad de México”, Cambio Tec, México, 205. [ Links ]

Teece, D., Pisano, G. & Shuen, A. (1997), “Dynamic Capabilities and Strategic Management”, Strategic Management Journal , vol. 18, núm. 7, John Wiley & Sons, 509-533. [ Links ]

Wernerfelt, B. (1984), “A Resource-Based View of the Firm”, Strategic Management Journal , vol. 5, núm. 2, USA, John Wiley & Sons, 171-180. [ Links ]

Received: October 17, 2016; Accepted: March 21, 2017

text in

text in