Introduction

Financial audits are born in a logical order to add credibility to the management of an organization’s resources, which must faithfully reflect the company’s position and how its departments are operating.

Interested parties on financial audit are, mainly, primary stakeholders or owners; however, there are other interested parties such as banks, fiscal authorities and even employees, among others (Normas de Información Financiera [NIF], 2018).

Audits are necessary not only to comply with legal guidelines but also to add value to companies by reducing the cost of information asymmetry and moral risk, which are detected by auditing procedures. Despite of generating the benefit of avoiding a direct revision from fiscal authorities, whether being under financial auditing or not is a tax-payer decision.

Since April 1959, auditing resolutions have been considered in Mexico as a fiscal element that gives security to companies’ financial registers. As a result, not only financial statements with fiscal effects emerged but also registries for public accounting assessors, known as external auditors (Hernández & Azuara, 2013).

In Mexico, tax reform exempts the obligation of fiscal auditing to a number of companies, forgetting to request this service; however, the same is not true with financial auditing.

In the past, companies that were not asked to be audited went to this service in order to prevent possible fines or to avoid administrative punishments. Thus, the demand for audits increased considerably (Santos, 2016); however, they have lessened interest in contracting the service, since according to the established in article 32-A of the Fiscal Code of the Mexican Federation, whether or not being audited is an option. The article states that:

"Individuals with business activities and legal entities, who in the immediately previous exercise have earned cumulative income of more than $ 109 990 000.00, and that the value of their determined assets in accordance with the general rules issued by the Tax Administration Service, exceeds $ 86 892 100.00 or at least three hundred of their employees had worked in the company in every month of the previous fiscal year, may opt to issue, in terms of Article 52 of the Federation Fiscal Code, its financial statements by an authorized public accountant. Federal Public Administration Enterprises cannot take advantage of the option that is referred in this article” (Código Fiscal de la Federación [CFF], 2018).

In the event that taxpayers chose to issue their financial statements, they must declare it at the moment of presenting their revenue-taxes statement corresponding to the fiscal year to which they are willing to apply the option and present it no later than July 15 of the following year to the referred fiscal year. In the case of existing differences on taxes to be paid, this must be notified in any authorized office, through an additional statement, within the next ten days after the presentation of the first report.

Awareness must be present when interpreting the article because the decree only issues an additional option for those who comply with the rules regarding compliance with fiscal obligations, but if they do not comply with them, they will still be required to present the report for fiscal purposes, additionally to those who, convinced of the benefits of being audited, voluntarily comply.

There are firms such as Grupo Modelo, Bimbo, Coppel, among others, that are required to be audited and that publish their assessed financial statements, complying with international standards on auditing (ISA), issued by the International Federation of Accountants (IFAC), which in Mexico are accepted by the National Banking and Securities Commission (CNBV, from its Spanish acronym) and by the Ministry of Finance and Public Credit. However, article 33 of the Mexican Commercial Code establishes that all companies with business activities are required to have an accounting system that is adequate to their business activities, which implies an accounting process that complies with the financial information norms, making them susceptible to be audited.

Financial statements auditing, as well as auditing in general, presents major challenges due to the fact that not fully satisfied clients are demanding for better services from the independent auditors who assess their financial statements, and audit procedures should be directed towards risk prevention (Sánchez, 2006).

Users of audits demand more integrated and open information about assessing criteria of auditors, they also want to know those aspects that are relevant for auditors to their conclusions and envisioning those financial risks that should be taken into account by the enterprise (Auditoría & Co., 2015; Martínez, 2012).

It is true that audits have not been fully transparent; thus, distrust about financial information is present, diminishing the corresponding credibility on such activities and making it necessary to conduct audits that demonstrate the financial reality of companies to contribute to the improvement of their processes and control of resources, by preventing financial risks.

The financial audit is proposed in small and medium enterprises (SME), which is a term used as a synonym for micro, small and medium enterprises (MSME) by agencies such as the Ministry of Finance and Public Credit, although according to the Official Journal of the Federation (DOF, from its Spanish acronym) of June 30, 2009, the Secretariat of Economy discloses the stratification of companies by differentiating them. The MSME in Mexico represent 98% of the total number of enterprises, and 99% of them are microenterprises, contributing to the Gross Domestic Product (GDP), which has decreased from 52% to 34% in the last decade (Secretaría de Economía, 2012). This is worrisome for governments and the national economy, in that 1% of enterprises are SME.

Another reason to focus this research on SME is that eight out of 10 emerging enterprises perish before arriving to the second year of operations (Secretaría de Economía, 2011), mainly because most of these businesses are not planned to be established and are managed by businessmen with no management training that, generally, also play the role as sales persons, technicians, among others, exacerbating and distracting the owners’ attention from the main activity they should be focused on. This leads to the losing of earnings and competitiveness (Lozano, 2014a). Additional causes that make companies fail are the lack of leadership and experienced team and strategic marketing, as well as inefficient management of resources and insufficient financial resources (Lozano, 2013).

There are several definitions of financial audit; however, it could be defined as the review and analysis of the information that is presented by a company in its financial statements. The audit might be performed by an auditor from the private sector by presenting a final report (Emprende PyME, 2018) as result of carried out activities.

In the same way, financial audit, or audit of financial statements, is defined as an examination of basic financial statements that are presented by the administration staff of the enterprise or any legally authorized person, with the goal of giving opinion to know whether information is organized according to applicable auditing norms based on the features of their transactions (Sánchez, 2006).

Financial audit can be practiced in any enterprise regardless its size. It istrue that the complexity changes depending on the features of the company and that the auditing process has to be adjusted; however, planning and procedures will be implemented in the same way. Thus, SME should be incentivized to be willing to practice financial audits on their will, considering that they will get some benefits such as: a) reliable financial information, b) higher competitiveness capacity, c) trust to get external financial support is increased, d) added value is gained from the improvement of their process, e) continuity in business, f) develop a stable financial culture, and g) contribution to reduce illegal activities and frauds in the enterprise. Lennox, (2011); Mire la solución (2016).

If financial audits are accepted as a tool that might contribute to the development and permanence of SME in business, they would approach auditing not just for compliance to legislation, but for the side benefits that may be obtained.

Several countries have adopted international regulations for financial information (INFI) for SME, but in Mexico the Issuing Council of the Mexican Council for Regulations on Financial Information (MCRFI, from its Spanish acronym) announces, in July 2011, that the INFI are not going to be adopted by SME, because in Mexico Large and SME use the same acknowledgement and assessing principles for issued financial statements, and that the MCRFI has already started a process to simplify the Mexican regulations for financial information (RFI) (Gaytán, 2012).

The main purpose of financial auditing is to issue an objective and professional opinion on the reasonableness of the financial statements that are prepared by the administrative personnel. Whether it is a public or private entity, the bases of the audits are found in the generally accepted auditing standards (GAAS) and international auditing standards (IAS).

GAAS are considered the fundamental principles, rules and procedures of auditing, and they should be considered by the auditor when any auditing process is implemented. Compliance with these standards guarantees the quality of the auditor’s professional work. Ten norms of auditing that are generally accepted have been approved, they are divided into three groups: a) general regulations, b) regulation for execution of activities, and c) regulations of information (Tu Guía Contable, 2016).

International auditing regulations (IAR) are rules, principles and procedures that have to be applied on financial statement audits, which must be interpreted taking into consideration the context and time when the audit was performed (Tu Guía Contable, 2016). Such regulations are easier to be adapted, based on the features of the financial audit and on the purpose stablished when auditing the financial statements.

IAR are integrated from several rules that have to be considered. One starts from global objectives of the independent auditor (IAR 200) to the information that is included in documents that contain audited financial statements (IAR 720) (AOB Auditores, 2018).

Globalization and advancements in technology compel companies wishing to stay in the market to be competitive and to get up-to-date on all fields of the business, otherwise they are at risk of perishing before the two years of operation.

In view of this situation, the purpose of this research is to analyze the SME’s perception about the significance of the financial audit’s applicability as a tool to prevent financial insolvency and to boost competitiveness.

This research is organized by introducing the method that was used for the survey. Then, relevant results are presented. These results serve as support for the discussion where relevant opinions on the subject given by other researchers are highlighted. Moreover, comparisons are made and those results that contribute to the proposed research objective are selected.

Methods

Financial audits are seen as a way to ensure the proper use of the resources available to the company, so all businesses should resort to this practice.

The study was conducted in the municipality of Celaya which is located between the geographical coordinates 20° 31' 24" north latitude and between 100° 48' 55" west longitude, with a surface of 553.18 square kilometers.

Celaya is an industrial city made up of 16 946 economic units (Instituto Nacional de Estadística y Geografía [INEGI], 2010, of which 98% are micro-enterprises, 1.8% are small and medium-sized enterprises (SME) and 0.2% are large enterprises. However, according to the Business System (SIEM, from its Spanish acronym) (Sistema de Información Empresarial Mexicano [SIEM], 2017), only 7295 companies (43%) are registered, indicating the informality of several businesses, mainly microenterprises. Considering a population of 305 SME for this research, a sample is 38 companies chosen from several industrial activities, with a sample error of ± 4.89% for a reliable level of 95%. Activities of participating companies in this research come from the service industry, food industry, National Chamber of Transformation Industry (CANACINTRA, from its Spanish acronym), commerce, construction, among others, being assisted by the SIEM and mainly the Business Coordinating Council of Celaya (CCEC, from its Spanish acronym), which in turn is made up of 12 business organizations.

By using an interpretative study with a transversal approach and using techniques such as a survey and a questionnaire and interviewing privileged informants, this research was conducted from September 2016 to May 2017, where 21 variables of business management, which contributed to the financial audit investigation, were evaluated.

The analysis allowed to identify those variables of greater relevance, as well as their significance and correlation between them obtaining remarkable results that might lead to other investigations.

This study was focused on SME, as they are the most likely enterprises to keep accounting records and financial statements, which are essential for conducting financial auditing.

Results

The obtained results are the product of the methodology used and will be the basis for the formulation of the research discussion.

Table 1 shows the relationship between the variables that were used in this research and their corresponding items in the documentary instrument.

Table 1 Relationship of the variables with the documentary instrument.

| Variable | Item | |

| Dependent | Financial Auditing Perspective | 10 |

| Independent | Company size | |

| Owner’s academic level | ||

| Company Age | ||

| Strengths | 8 | |

| Weakness | 9 | |

Source: Author’s own elaboration.

To verify the reliability of the documentary instrument, Cronbach’s Alpha coefficient statistical test was used for the ordinal qualitative items and the Kuder Richardson’s coefficient for the nominal qualitative items; in both cases the results obtained were 0.92 and 0.87, which are interpreted with high reliability. It is necessary to say that the Cronbach’s Alpha coefficient and the Kuder Richardson’s coefficient were determined with the support of the SPSS statistical and Excel software, respectively.

Results evidenced that the documentary instrument is reliable and that it is possible to continue with the analysis of the qualitative variables.

Through the use of descriptive statistics on items of ordinal nature, the mean is indicated to be the measure of central tendency, and the standard deviation is pointed out to be as a measure of dispersion, which are presented in Table 2, which shows that average age of the organizations ranges from 3.1 to 10 years. In addition to this, the average size of the organizations is within the range of 11 to 50 employees, which means that most enterprises are SME and that they are growing (Franco-Ángel & Urbano, 2016), they have succeeded the two-year survival stage; thus, they need to have reliable registers and an accounting-management control; moreover, they are dynamic (Kantis, 2004) because they have reached a size ranging from 15 to 300 employees.

Table 2 Mean and standard deviation of the items

| Descriptive statistics | Mean | Standard deviation |

| 2. The company age is: | 1.95 | 0.805 |

| 5. The company size considered (by the number of employees) | 1.86 | 0.793 |

| 6. The owner’s academic level: | 3.43 | 0.507 |

| 7.1 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) Financial Situation | 3 | 1.211 |

| 7.2 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) Efficient Administration | 3.35 | 1.057 |

| 7.3 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) Obtaining a Financing | 2.43 | 1.453 |

| 7.4 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) Inventory Control | 2.73 | 1.387 |

| 7.5 What are the main strengths of your company (consider 5 for the highest to 1 for the lowest) Efficient portfolio control | 2.8 | 1.265 |

| 7.6 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) | 2.94 | 1.181 |

| 7.7 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) Market Positioning | 3.07 | 1.223 |

| 7.8 What are the main strengths that your company presents (consider 5 for the highest to 1 for the lowest) Fiscal situation | 3.94 | 1.181 |

| 8.1 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Financial Situation | 3.27 | 1.438 |

| 8.2 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Administrative Efficiency | 3 | 1.414 |

| 8.3 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Obtaining Financing | 2.79 | 1.805 |

| 8.4 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Efficient Portfolio Control | 3.64 | 1.598 |

| 8.5 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Portfolio Overdue | 3 | 1.664 |

| 8.6 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Obsolete fixed assets | 2.79 | 1.369 |

| 8.7 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Technological Advancement | 3 | 1.317 |

| 8.8 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Market Positioning | 3.79 | 1.122 |

| 8.9 What are the main areas of opportunity facing your company (Consider 5 for the highest to 1 for the lowest) Fiscal situation | 2.71 | 1.773 |

| 12. When you hear the term audit, what impression does it cause? | 3.21 | 0.918 |

Source: Author’s own elaboration.

From the results, it is possible to know that bachelor’s is the average academic degree held by business owners, and those holding such degree were the ones that accepted to be willing to implement in their enterprises the financial auditing on a voluntary basis.

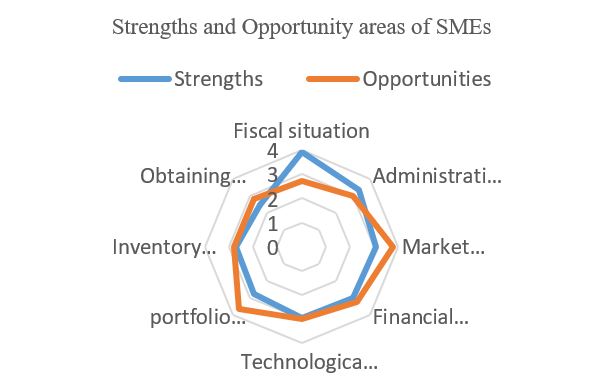

Finally, it is possible to observe that average values correspond to categories of items 7 and 8, associated with strengths and areas of opportunity perceived by companies. In item 7, the highest value (3.94) is found to correspond to the fiscal situation of the companies. The lowest obtained value (2.43) is related to obtaining financial levering, which confirms that companies are concerned about meeting their tax obligations, which is detected as a strength; they neglect the financial situation, which they would like to improve. This is understandable, since SME are aware of their fiscal obligations and of the sanctions to which they are imputable in case that noncompliance occurs, while they neglect what refers to obtaining financing and other activities, because they are internal and optional for the organization, without ceasing to be relevant.

Regarding item 8, and concerning areas of opportunity, while the highest value (3.79) shows a lack of positioning in the market, the lowest value (2.71) is related to a fiscal situation, coinciding with item 7 (Figure 1). Therefore, it is recognizable that their strength is compliance with their tax obligations, while they demand tools that drive them to reflect a position in the market, which will impact an increase in sales.

In summary, the SME research results modes can be concentrated, by highlighting those that influence the established objective:

90.48% of the companies are incorporated as legal entities.

58% of the companies are family businesses

36% of the companies have heard or know about the term of financial audit, and 89% do not know what that terms refers to; moreover, they are confused about the differences between fiscal auditing with financial auditing.

After explaining to the entrepreneurs what financial auditing is and after letting them know its benefits, 78% of companies’ owners are willing to go for a financial audit on a voluntary basis, as long as it is provided at an affordable cost.

More than 60% of the companies associate the term audit with fear of being reviewed, so they do not perceive it as a risk prevention and improvement process.

Regarding the interviews conducted with the auditors and privileged informants, they mentioned that they do audits of large companies and some medium-sized ones, because they are requesting the service, either due to legal compliance or to avoid future problems with the fiscal authority.

It is emphasized that audits can take from three to nine months or more, depending on the size of the company, the items or activities to be reviewed, and the period for which the audit is to be carried out. This turns to a high price which several organizations categorize as expensive; however, the benefits generated by these reviews are greater than the price of the service provided.

Another point to be noted is that businessmen stated that they do not understand the reports issued by auditors, due to the use of technical terms. This generates confusion and lack of interest and exacerbates the demand of additional services such as consulting or future reviews that imply an additional cost.

Regarding comparison of variables, by relating the dependent variable Perception about Financial Audit with other independent variables, results from non-parametric analyses usually are reported trough the statistical test of Wilconxon.

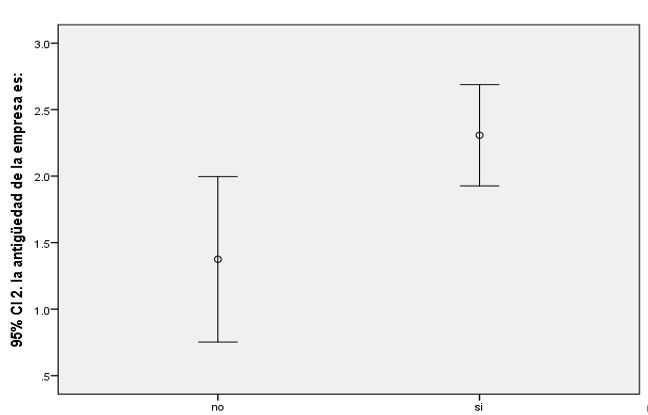

The first comparison performed was to test whether the perception about financial audit depends on the age of the companies. Table 3 shows that the asymptotic significance value is less than 0.05, and it can be concluded that the financial audit is different between the ages of the companies, showing in Figure 2 that the oldest companies are those that are more willing to participate in the financial audit, proving what is stated by Franco-Ángel & Urbano (2016).

Table 3 Statistical tests a financial audit with companies’ age

| 2. The age of the company is: - 10. Would you be willing to have a financial audit in your company? | |

| Z | -4.064b |

| Sig. Asymptotic (bilateral) | 0.000 |

| a. Wilcoxon test of sign ranges | |

| b. It is based on negative ranges. | |

Source: Author’s own elaboration.

Source: Author’s own elaboration.

Figure 2 Relationship between financial audit and the age of the companies.

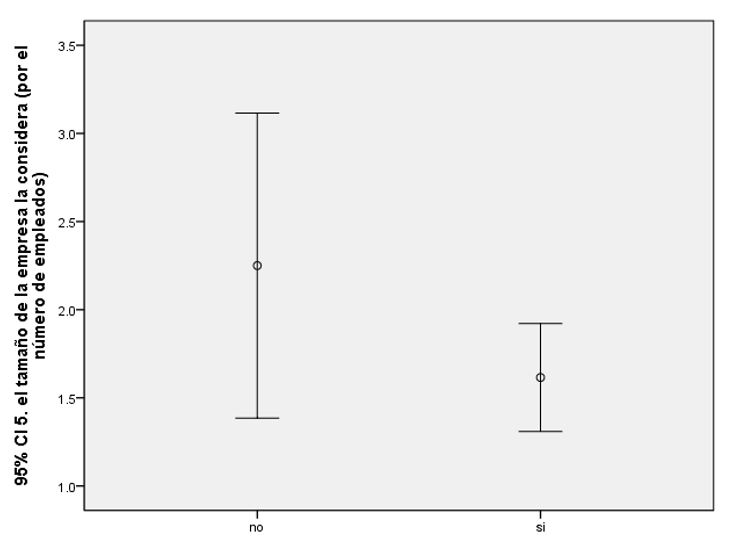

As for the second relation, it is desired to know whether the size of the company is indicative to get a financial audit, mainly on a voluntary basis, observing an asymptotic significance value lower than 0.05, from which it is concluded that financial audit is perceived in a different way depending on the size of the company. It is emphasized the will of small size companies to accept a financial audit, and that it is highly valued (Table 4 and Figure 3). However, it must be quoted that companies accept voluntarily the financial audit just after they have being explained about similarities and differences with fiscal audit as well as the benefits that the enterprise might obtain.

Table 4 Statistical test a financial audit and company size

| 5. The size of the company is considered (by the number of employees) - 10. Would you be willing to have a financial audit in your company? | |

| Z | -3.666b |

| Sig. Asymptotic (bilateral) | 0.000 |

a. Wilcoxon test of signed ranges b. based on negative ranges

Source: Author’s own elaboration.

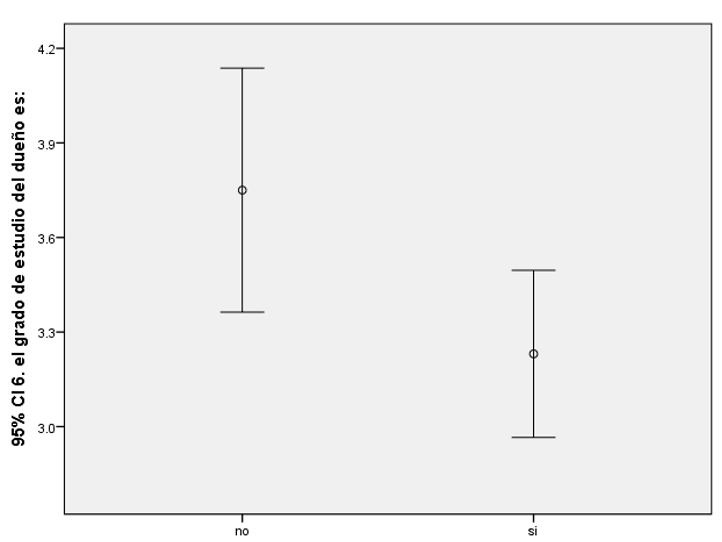

In the same way, it is desired to know the relationship between the degree of academic studies of the company’s owner and the perception of voluntarily attending the financial audit. It is observed that the value of asymptotic significance is less than 0.05, which influences the degree of studies in the audit; in addition, it is highlighted that the lower the academic degree of business owners is, the higher the will to have a financial audit, being aware of the benefits to be obtained either in the short or medium term (Table 5 and Figure 4).

Table 5 Statistical tests a studies of the businessman with the financial audit

| 6. The academic level of the owner is: - 10. Would you be willing to have a financial audit in your company? | |

| Z | -4.083b |

| Sig. Asymptotic (bilateral) | 0.000 |

a. Wilcoxon test of signed ranges b. Based on negative ranges

Source: Author’s own elaboration.

Source: Author’s own elaboration.

Figure 4 Relationship between the academic level of the businessman and the Financial Audit

Managers of a great percentage of SME (85%) are focused on meeting their fiscal and social security (external factor) obligations, leaving aside to implement control and efficiency systems in their enterprises (internal factors) that will be evidenced trough the substantial benefits gained.

Discussion

In Mexico, businessmen have the perception that audits are only applicable to large companies and that their purpose is to detect the inefficient administration of resources, although we remember that there are several types of audits and that the best known is the fiscal audit.

A large number of SME believes that audits are expensive, p = 86%, coinciding with Hellman (2006), who expresses that companies pay a high audit cost, waiting for some additional contribution. Sánchez (2015) agrees with Hellman (2006), stating that companies demand better services from the auditors who declare their financial statements, recommending that audits should be aimed at risk prevention. In addition, Johnson & Lys (1990) mention that the price of auditing is a determinant for companies to decide to contract the service, independently regarding the benefits that generates from it.

However, Collis, Jarvis & Skerratt (2004), Collis (2010) and Chung & Narasimhan (2001) mention that auditing brings benefits superior to the cost of it and is not perceived by the companies as an expensive service. Knechel, Niemi & Sundgren (2008) indicate that auditing procedures can help regulate companies, in addition to what is mentioned by Collis (2008) and Niemi, Kinnunen, Ojala & Troberg (2012), regarding the independent auditor providing advice based on his experience acquired in other companies.

Results of the research indicate that the age of the companies is positively related to voluntarily attending a financial audit; however, with the size of companies, the relation is negative, since smaller size SME are those that are willing to request a financial auditing service. This affirmation is contrary to what Collis et al. (2004), Collis (2012) and Niemi et al. (2012) mention, suggesting that the size of firms has a positive influence on the demand of the auditing service, with a higher probability of hiring as the company grows. Other authors do not agree with the previous statement, since it does not affect the size of the companies to obtain significant differences in the voluntary demand for auditing (Senkow, Rennie, Rennie & Wong, 2001).

SME are aware of the benefits to be gained from the practice of financial auditing, p = 78%, which would be reflected in their businesses, showing their willingness to go there voluntarily as well as the cost being affordable. The above is mentioned with the studies by Carey (2000), Minnis (2011), Pittman & Fortin (2004), Kim (2011) & Koren, Kosi & Valentincic (2014) who show the benefits of a voluntary audit, primarily in bank financing, even to obtain a lower interest rate, since it reduces the risk by information asymmetry and moral hazard.

When a quality financial audit is presented in SME, it increases the confidence in the control of the resources and the knowledge of the areas of opportunity detected; it would be possible to establish cognitive strategies of risk prevention such as corporate bankruptcy.

In the world of auditing and taxation, it is contemplated that the function of auditors is not to discover fraud but to issue a technical opinion on whether the financial statements are presented in a reasonable or truthful manner of the business financial reality. Although in 1999, Vicente Montesinos Juive, professor of financial economics and accounting at the University of Valencia, said:

"Traditionally, it has been said that auditing was not aimed at fraud detection, but in any case it showed them to the extent that they were detected within the normal development of the auditing process. This appreciation has been given significance in recent years as a result of the emergence of important cases of fraud and corruption in the public sector. " (Montesinos, 1999)

Distrust towards audits has been growing due to financial scandals presented in several companies and banks. Organizations and institutions that are responsible for the preparation of financial information are trying to show that they are working towards greater transparency and that they have advocated for a more regularized accounting model between the countries, in such a way that it allows the comparison of the financial information at a world-wide level.

Furthermore, Montesinos makes a decisive contribution to the modernization of public auditing in Spain (Montesinos, 2000), in which its contributions can be considered satisfactory, without being able to say the same at a local level, as it is not compulsory. However, it has contributed significantly to government accounting (Dasí, Montesinos & Vela, 2018; Montesinos, 1994; 2000; 2003) and its contributions are very valuable.

In an attempt to restore damaged trust, auditing standards and regulations are established at an international level, where it is shown that there can be crossed information as well as detecting irregular activities.

General perception of society is that auditors have been acting with extreme freedom, failing to examine the adequate control of resources becoming advocates for the interests of managers in auditing companies (García & Vico, 2003); as well, the auditors interviewed stated that some employers and employees comment that audits are to cover up the inadequate operations of employers, forgetting to audit for the purposes for which this tool was created.

When perceiving the audit as a way of detecting fraud, SME in this research associate auditing with the term fear, instead of trust, due to the use that is currently attributed to it; therefore, it is important to implement and instill auditing as a tool for financial prevention in SME, conducted to anticipate and reduce risks.

Conclusions

This research highlights the importance of financial auditing in SME and the benefits it brings in the management of resources, reflected externally in access to financing at affordable costs, detecting and reducing risks such as information asymmetry, moral hazard, liquidity risk, among others.

From the internal point of view, SME perceive that financial auditing would generate strategies in the improvement of their processes, contributing in the prevention of risks and in the efficient control of resources, which would be reflected in their competitiveness.

Results show that there are several aspects in which auditors should work on, such as reflecting transparency in audit work, making companies aware of the difference and complementarity between financial auditing and fiscal auditing and disclosing the benefits of voluntarily hiring a financial audit, trying to change the perception of audit fear by trusting them.

In México there exist a few studies focused on financial audits of SME, (Carey et al., 2000; Collis, 2012; Minnis, 2011; Pittman & Fortin, 2004; Senkow et al., 2001), thus, this study intents to highlight the importance and benefits that can be gained by those enterprises asking for financial audits, considering its cost like an investment which in return will bring substantial benefits to the company.

Results reflect that the academic level of the company’s owner and the age of the organization are positively correlated, influencing the desire to engage in a financial audit.

Likewise, it is observed that when relating the age and size of the organization with the degree of studies of the company’s owner, there is greater willingness to voluntarily access the financial audit in those companies that have more seniority in the market. This is because they know the difficulties that need to be faced in order to remain in the market and they wish to grow. They are the smallest and they recognize that, because of their limited degree of studies, they require advice and training to ensure business development.

The demand for this service on a voluntary basis reflects that companies are aware of the benefits that are obtained in a collateral manner, reflecting confidence for clients, suppliers, future investors, banking institutions, chambers, and councils, among others. SME in the municipality of Celaya should consider financial audits as a tool to prevent insolvency and accessibility to loans with lower financing costs, being able to establish strategies that contribute to their competitiveness.

Apparently, with the tax reform, companies are benefited by establishing that it is not mandatory for them to be audited; nevertheless, the reality is that they remain stagnant, with no probability of growth (Chung & Narasimhan, 2001; Collis, 2010; 2004), lacking preventive reviews that contribute to the efficient control of resources. Also, other qualities are lost such as the continuous efficiency, the generation of added value, the organizational learning and, consequently, the competitiveness of the companies. The lack of financial forecasting is very common in SME, which allocate their monetary resources to operational expenditures, neglecting investments that generate development in their companies (Lozano, 2014b), such as in the case of investment in a financial audit.

The perception of SME about audits is that they are expensive, so it must be interpreted considering the auditor and the client, coinciding between both points of view and being aware of the benefits generated. In order for a SME to request an audit to which it is not enforced, a more complete service must be offered to motivate the request of such service.

Results of this research will be useful for professional associations, chambers and regulatory agencies as an element of judgment to make decisions about actions to be considered for the benefit of companies, mainly SME and microenterprises.

It is pointed out that this research was carried out mainly on SME that have a permanence in the market, have accounting control system and great number of them prepare their financial statements by themselves, noting that microenterprises are not represented in a significative number because they are just born and constantly perish, and many of them do not have an accounting system, so they do not prepare their financial statements. This is an opportunity to motivate microenterprises to comply with regulations and take part in a financial audit program, obtaining the previously mentioned benefits.

nova página do texto(beta)

nova página do texto(beta)