Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Frontera norte

On-line version ISSN 2594-0260Print version ISSN 0187-7372

Frontera norte vol.26 n.52 México Jul./Dec. 2014

Artículos

The Wine Clusters of Mendoza and Serra Gaúcha: A Local Development Perspective

Los clústers vitivinícolas Mendocino y de Sierra Gaucha: Una visión desde el desarrollo local

María Verónica Alderete

Universidad Nacional del Sur mvealderete@gmail.com

Fecha de recepción: 1 de noviembre de 2012.

Fecha de aceptación: 6 de febrero de 2014.

ABSTRACT

This paper consists of a descriptive analysis that explains how the successful performance of the wine cluster is followed by improvements in local development indicators. To this end, certain local development indicators are proposed to describe and compare the wine clusters of Mendoza (Argentina) and Serra Gaúcha (Brazil). In Argentina, the Mendoza wine cluster has stimulated the local development of the region. For its part, Serra Gaúcha is the most successful wine center in Brazil and regards Mendoza as the benchmark in terms of local development.

Keywords: 1. cluster, 2. local development, 3. wine industry, 4. territory, 5. regional indicators.

RESUMEN

Este trabajo realiza un análisis descriptivo que explica cómo el desempeño exitoso del clúster vitivinícola es acompañado de mejoras en los indicadores que componen el desarrollo local. Con este fin, se proponen ciertos indicadores de desarrollo local que permiten describir y comparar los clústers vitivinícolas de Mendoza (Argentina) y de Sierra Gaucha (Brasil). En Argentina, el clúster vitivinícola de Mendoza ha estimulado el desarrollo local de la región. Por su parte, Sierra Gaucha es el polo vitivinícola más destacado de Brasil y encuentra en Mendoza una meta por alcanzar en términos de desarrollo local.

Palabras clave: 1. clúster, 2. desarrollo local, 3. industria vitivinícola, 4. territorio, 5. indicadores regionales.

INTRODUCTION

Local areas have recovered their role in view of the need to create their own structures to cope with the process of globalization and the new competitive environment. In this context, the recent literature emphasizes the phenomenon of networking and local/regional factors that contribute to the creation of areas for business cooperation.

Although there are different types of networks (manufacturing networks, industrial districts, agglomerations, etc.), the concept of cluster appears to dominate among the categories related to local and regional development. Regional clusters create jobs and wealth in the region and are therefore promoters of economic and social development (Corral et al., 2006).

Local economic development strategies have prioritized the development of territories with competitive capacity, with the following objectives: development and restructuring of the production system, increasing employment and improving the standard of living of the local population (Vázquez Barquero, 1986). The fundamental variable of this new paradigm is territory, understood as a group of social, cultural, productive, economic and political relations.

Sánchez Zepeda and Mungaray Lagarda (2010) analyze the productive organization of the industrial cluster of wineries in Valle de Guadalupe, Mexico, and its winegrowing and winemaking practices as an important factor for competing internationally and influencing endogenous development. The authors regard local and endogenous development as synonymous and define a process of growth and structural change that uses the potential of existing development in the area to improve the welfare of its population.

The wine market is currently experiencing continuous growth in both industrialized countries and emerging markets. In 2010, there were 60 wine producing countries worldwide. The 10 leading wine producing countries account for 80 percent of world production. According to estimates by the International Organisation of Wine and Vine (OIV), in terms of production, the United States ranks fourth in the global list headed by France, Italy and Spain.

For its part, Argentina ranks fifth, accounting for 5.2 percent of global wine production. Until 2010, Argentina's wine industry experienced an unprecedented boom. The sector exported 741.4 million U.S. dollars, in 2010, over 16.44 percent more than in 2009. Malbec in particular is considered a flagship product of the region, which has increased its share of the country's total red wine production since 2005. According to the National Wine Institute (Instituto Nacional del Vino, INV), in 2005, Malbec had a relative share of 26.89 percent, above other red wines. In particular, Argentinean Malbec exports in FOB dollars have increased from 23.1 million to 306 million U.S. dollars since 2002.

The Mendoza wine cluster has been selected due to the dynamism shown by the sector in the last decade. In pursuit of this dynamism, Argentina has established a Strategic Wine Plan (SPIL) with the primary objective of achieving a value of wine exports of approximately 2 billion U.S. dollars by 2029. Moreover, the Rural Development Plan of the Province of Mendoza (PDR) regards the wine sector as key to the region's sustainable economic development. The relative importance of Mendoza in the wine industry is as follows: 70 percent of the area planted with vines in Argentina, 63 percent of grape production for winemaking, 66 percent of wine production and 73 percent of currently operating wineries are located in the province. Moreover, the province created its own institutions to encourage the wine industry.

Argentina has not developed the conditions for the country to play a role in stimulating and creating externalities for industry and society as a whole (Boscherini and Poma, 2000). However, the cluster of Mendoza wine can be considered an exception. The province of Mendoza possesses approximately 70 percent of Argentina's fine vineyards.

Conversely, 90 percent of Brazil's wine production is concentrated in the state of Rio Grande do Sul, according to Empresa Brasileira de Pesquisa Agropecuaria (Embrapa Grape & Wine). At present, Brazil is not a major player in the international wine market and finds it hard to compete with other countries such as Chile and Argentina that produce similar quality at lower prices (Nierop, 2010). Rio Grande Do Sul is the only region to play a similar role to that of Mendoza and San Juan in Argentina. According to the Instituto Brasileiro do Vinho (Ibravin), winemaking in the Serra Gaúcha region covers an area of 27 000 ha and 620 wineries. The Brazilian agrifood system is a paradigm because of the co-existence of two closely related, competitive agrifood models. On the one hand, it has an emerging set of markets with specific qualities and on the other, a commodity market with a developing quality economy. Serra Gaúcha has a cluster of a significant number of companies acting in different production chains linked to wine production, with a significant share of the total number of jobs, revenues, growth potential and diversification, among other aspects (Gollo, 2006).

The aim of this paper is to analyze the importance of the wine cluster for local development in its region of influence. To this end, the wine clusters in the regions of Mendoza (Argentina) and Serra Gaúcha (Brazil) are described and compared from the perspective of local development. The paper is organized as follows. First, the theoretical framework of local development is posited and certain key indicators for measuring the phenomenon defined. On the basis of the acknowledgement of the cluster as one of the factors that promote local development, a brief description of selected wine clusters is provided. Subsequently, certain indicators of local development in both regions are analyzed and compared. The article ends with a conclusion section.

METHODOLOGY

First of all, in order to analyze the impact of the wine cluster on the local development of the regions of Mendoza and Serra Gaúcha, a theoretical review of the concept of local development is undertaken. Second, given the variety of definitions available, one for local development will be constructed to identify certain indicators. This definition will make it possible to measure the phenomenon and provide the basis for comparison between regions. Third, the wine regions of both clusters are described, since clusters are considered the backbone of regional development.

Fourth, the two regions are compared in terms of the indicators comprising local development, in order to assess whether the performance of the wine cluster accompanies the evolution of the latter.

THEORETICAL FRAMEWORK: LOCAL DEVELOPMENT

Local economic development posits a new paradigm in economic development research based mainly on the territory, which constitutes a strategic factor for development opportunities and one that defines the features it can assume. The promotion of local economic development requires the configuration of a production model through a network of companies that make up the backbone of local production systems (Vázquez Barquero, 1998). Collective strategies used by companies to cope with the globalization process from the local level have been given a variety of names: business clusters (Porter, 1990), local productive systems (Vázquez Barquero, 1998) and industrial districts (Becattini, 1979; Marshall, 1980, among others).

Maillat and Grosjean (1998) argue that considering the local as a unit of analysis means adopting a category that allows one to link social, economic, technological, environmental and cultural processes to practical policies and strategies to ensure the emergence of endogenous development capacities. Thus, regions have the potential to promote local dynamics based on the territorial accumulation of the specific collective resources required to develop their productive economic system and institutional environment.

For his part, Albuquerque (1997) considers that development in the local sphere can be understood as a process of transformation of the economy and local society designed to overcome current difficulties and challenges. It seeks to improve the population's living conditions through determined, concerted action among the different local socio-economic actors (both public and private) to ensure the most efficient, sustainable use of existing resources through the phenomenon of local entrepreneurship and the creation of an innovative environment in the area.

Local development is a process guided by the action of different agents and rarely emerges spontaneously (Barreiro, 2000). It requires a complex form of governance, involving stakeholders concerned about the development of the region and selected productive sectors. The existence of cooperation networks is a strategic resource for local development, albeit fairly scarce in areas with no tradition of forming partnerships and an uncoordinated social fabric (Méndez, 2001). Inter-firm cooperation networks permit the construction of competitive, innovative environments resulting from certain territorial externalities, while taking advantage of local business traditions (Narváez et al., 2008; Caravaca et al., 2005).

In referring to local development, the importance of the following four dimensions should be stressed (Gallicchio, 2004): Economic, concerning the creation, accumulation and distribution of wealth; Social and Cultural, involving quality of life, equity and social integration; Environmental: relating to natural resources and the sustainability of medium- and long-term models, and Political: territorial governance, independent, sustainable collective project.

Inter-firm networks are a necessary but not a sufficient condition for local development. Therefore, in order to determine the impact of clusters on local development, it is essential to know the characteristics or factors that affect local development, and to determine whether they are not simply production clusters. To this end, one must rely on the explanatory factors for local development and use certain measures or indicators of local development (Alderete and Bacic, 2012).

FACTORS THAT DEFINE LOCAL DEVELOPMENT

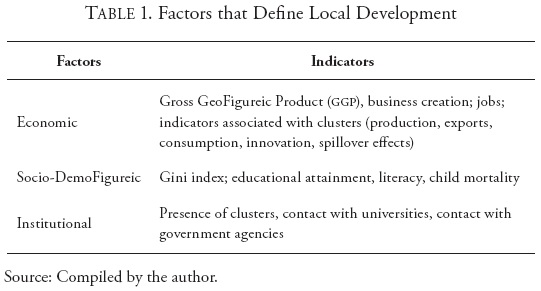

In order to analyze the impact of the wine cluster on local development, the analysis must be based on the explanatory factors of local development. Certain measurements or indicators of local development (Table 1) are therefore required.

The joint assessment of regional development indicators requires the consideration of several factors and using reliable indicators (Rambo and Ruppenthal, 2004). These factors result in a theoretical review of the previous section.

One of the items identified is the presence of a network of companies. According to Vázquez Barquero (1998), business networks are the backbone of local production systems for the promotion of local development. This paper analyzes the cluster as a particular case of a network of companies.

In referring to local and regional development, Gallicchio (2004) emphasizes the importance of the economic dimension in relation to wealth creation, accumulation and distribution. Some economic indicators specify the relative importance of the activity of the cluster, such as the percentage of sales, exports, investments, number of employees, etcetera. According to Barbosa (2006), economic indicators include the relative share of different economic activities (services, agriculture, industry) of each territory in their GGP.

It is possible to examine whether networks have a significant effect on wealth and jobs in their geoFigureic areas of influence. Direct economic effects are derived from the increase in final demand as a result of the productive activity of the network. Induced effects are those generated in the region as a result of the multiplying effect on income and employment in the regional economy.

Local development and the socio-economic effects of networks go beyond the scope of economic indicators. There is a need to include other types of measures. On the basis of Albuquerque's definition, (1997) entrepreneurship and business and job creation; the role of institutions and the presence of an innovative environment are also emphasized.

Likewise, when considering policies to promote local development, it is essential to create access to public goods such as education and health. In addition to creating jobs, firms in a cluster encourage a profile of education and skills, and may develop activities that contribute directly and indirectly to meeting the social objectives of local development. Some important issues must be considered, such as: whether the companies in the cluster increase employment, whether they improve income distribution by reducing social vulnerability and whether they meet environmental standards and achieve corporate social responsibility (Romis, 2008). Due to the lack of available information, environmental indicators will not be included as local development indicators.

Due to the multiplicity of dimensions comprising local development, it is possible to use composite indicators that summarize the dimensions analyzed. One case is IDESE, the Indicator of Socio-Economic Development, published by Fundación SEADE at the municipal level in Brazil, comprising four sections: Income, Sanitation and Housing Conditions, Education and Health.

DESCRIPTIVE, COMPARATIVE ANALYSIS

Institutional Factors: Characteristics of the Wine Cluster

Mendoza

The agroindustrial wine chain consists of a limited number of links whose origin is grape production, and which branches out, according to the use made of this production, into three main links: fresh consumption, raisin production and industrialization, the latter being the primary and most important recipient and consumer of grapes.

Following the industrial chain, there are two key sub-chains: first, the production of wines or musts, and second, the manufacture of grape juice (used as a sweetener or in fruit juice). Winemaking is the most important activity in the chain. According to official data, Mendoza currently possesses a vineyard area of 160 704 ha. Mendoza's vineyards account for 68 percent of Argentina's plantations. The main Mendoza varietals are: Malbec, Merlot, Cabernet Sauvignon, Torrontes, Chardonnay, Sauvignon Blanc and Viognier. In 2009 in Argentina, wine-making varieties predominated, accounting for 93.20 percent of the total planted. Table varieties constituted 5.03 percent of the total area while raisins accounted for 1.68 percent (INV, 2010).

Mendoza's wine industry is spatially arranged in the form of clusters. At the base of production are the vineyards that supply warehouses with the basic raw material and have a network of suppliers to provide the following inputs: fertilizers, harvesting machines and implements, irrigation equipment, among others. At the same time, there are wineries that benefit from the grapes provided for wine production. Winemaking requires inputs from industries supplying equipment, tanks, barrels, as well as marketing and software service providers. It is estimated that there are approximately 200 goods and service suppliers for wine clusters (IIRSA, 2006).

Historically, small family farmers played an important role in common table wine production.1 Since the start of winemaking, Mendoza benefited from the existence of trained human resources for its development. At first, the arrival of immigrants introduced the activity into the region and the experience was handed down within families. Subsequently, the state decided to train the local workforce. Human resource training by the state began through: a) the Escuela de Enología de la Quinta Agronómica; b) students being sent abroad by the government of Mendoza; c) hiring foreign winemakers.

At present, a number of universities are involved in training the local workforce. Various institutions support wine and grape productive activities such as research and development centers and universities. The province has nine universities, some of which are linked to the educational supply of undergraduate and graduate courses related to the wine industry: the Universidad Nacional de Cuyo, the regional campus of the Universidad Tecnológica Regional and the Universidad Agustín Maza, Guaymallén, Mendoza.

Business and trade associations, government support and regulatory institutions (Instituto Nacional de Vitivinicultura INV, Corporación Vitivinícola Argentina, Coviar, ProMendoza) and financial institutions also play a key role. There are several institutions linked to the promotion of wines such as Bodegas de Argentina, Wines of Argentine and ProMendoza. Alderete and Bacic (2012) analyze the role of both local and provincial and national institutions in the consolidation of the wine industry with a view to local development.

Serra Gaúcha

Serra Gaúcha is the main winemaking center in Brazil, located in the northeast of Rio Grande Do Sul. Grape and wine producers are drawing up a Local Productive Arrangement (APL), currently at an advanced stage of development. The 1990s saw the transformation of many grape growers into wine makers. Production and marketing is based on vertical integration. The cluster has guaranteed the viability and strengthening of the international integration of various RGS wine industries.

The center of the cluster comprises grape and wine producers, around which are suppliers of production inputs, machinery and equipment as well as local, regional and national institutions (government institutions, business associations, credit, education and research institutions), which trade grapes and wine directly or indirectly.

This winemaking industry involves small properties, with average of 15 ha, with 40 to 60 percent of useful area and 2.3 ha of vineyards, little mechanization due to the rugged terrain, where family labor prevails, each property having an average of four people. The primary red cultivars are Cabernet Sauvignon, Merlot, Cabernet Franc and Tannat. Wineries tend to adopt vertical integration to ensure the necessary raw material for the production of fine wines, due to the sometimes adverse weather conditions of Serra Gaúcha, which reduce the profitability of the vineyards, by restricting physical productivity and grape quality and increasing the intensive use of inputs. At a higher level are the government and professional and business institutions, partners in the control, regulation, coordination and promotion of activities in the sector. At a lower level are the educational and research organizations, including universities involved in vines and wine research (UCS, UFRGS, UFSM, Unisinos), the Escuela Tecnológica specializing in viticulture and enology (CEFET-BG), a federal vine and wine research institute (Embrapa) and two state agricultural institutions, one focused on research (Feprago), the other on technical assistance (EMAT).

In the Rio Grande do Sul region and the Northeast (Pernambuco and Bahia), it is possible to observe the tendency of existing institutions (Aprovale, Asprovinho, Valexport) as well as production leaders in the regions with the potential for a future partnership association (Campanha, Serra do Sudoeste, São Joaquim).

The mission of the Centro Nacional de Pesquisa de Uva e Vinho (CNPUV) of Embrapa, located in Bento Goncalves, is to generate and promote knowledge and technology for the sustainable development of the national agroindustrial wine complex. Universities such as Unisinos, UFRGS and others provide the cluster with the knowledge input. Embrapa also plays an important role through its research to overcome the obstacles of companies in the cluster, such as those associated with the climate and insects (Nierop, 2010).

This cluster interacts with three other clusters in the region: the agricultural, tourism and food and restaurants clusters, thereby increasing the importance of wine tourism. The cluster contains two types of networks of wine producers that are crucial to their future development: partnerships created with the aim of developing individual subregions within the cluster and an export consortium, called Wines of Brazil, located in Bento Goncalves, RS.

Economic Factors

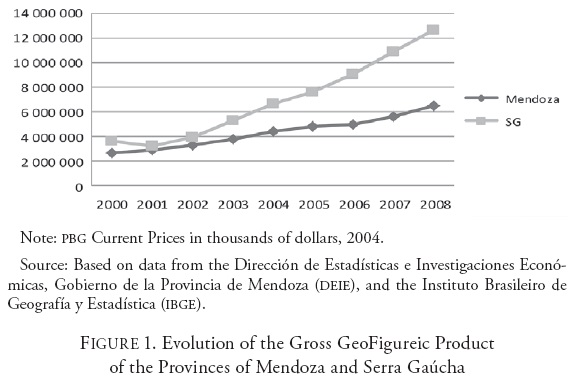

The Gross GeoFigureic Product of the region is composed of different sectors. The wine business is classified under both the agricultural sector, through winemaking activities (grape production) and the manufacturing industry (winemaking and manufacturing of must and other products). In both the Province of Mendoza and the Serra Gaúcha region (Figure 1), GGP has evolved positively in recent years, with Serra Gaúcha achieving a higher growth rate in the period from 2003 to 2008.

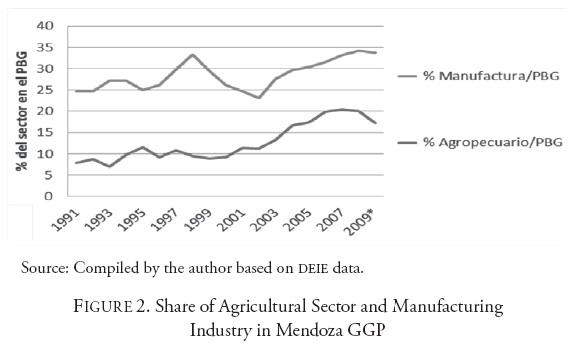

In disaggregated terms, 22.59 percent of the Mendoza provincial product is obtained from the trade, restaurants and hotels sector. This activity is followed, in order of importance, by community, social and personal services, with 16.89 percent and manufacturing industries, with 15.82 percent. The industrial activity with the greatest influence on the GGP of the provincial manufacturing industry is oil refining and petrochemicals. This is followed, in second place, by beverage production (mainly grape growing and wine production). Winemaking is one of the main economic activities in Mendoza, since during the period from 1991 to 2002, it produced approximately eight percent of the total gross added value of the PBG.

In the province of Mendoza, the relative share of the manufacturing industry is an average of 15 percent higher than the share of the agricultural sector of the GGP (Figure 2). According to Alderete and Bacic (2012a), the wine producing sector -Agricultural (Grape) plus Industrial (Wine and Must)- accounts for 18 percent of the total GGP.

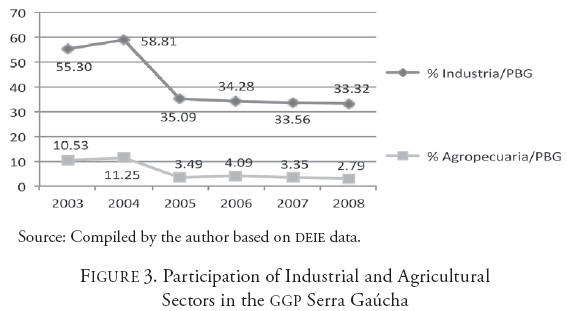

As for the composition of the product in the Serra Gaúcha region, the wine industry has accounted for 30 percent more of the GGP than the agricultural sector in recent years (Figure 3).

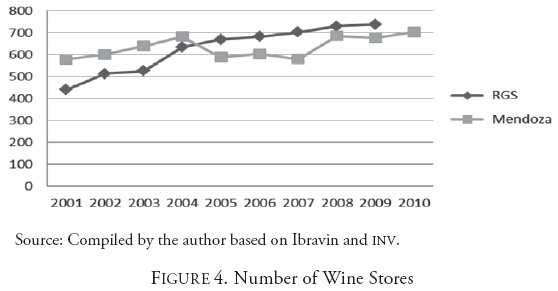

With regard to the promotion of entrepreneurship and business creation capacity in the sector, according to Ibravin (2010) the number of wineries in Rio Grande do Sul grew from 439 in 2001 to 738 in 2009 (Figure 4).

Most of the wineries are small family businesses although a small proportion, such as 625 firms.

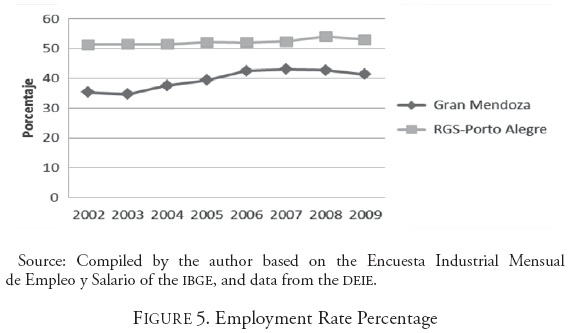

According to data from elsolonline.com accessed on August 9, 2010, Mendoza winemaking incorporated labor for its integration with SMEs, according to Bocco et al. (2007), whereas between 1996 and 2002, employment in the Argentine wine sector grew by a mere five percent and between 2003 and 2006, it increased by 31 percent. Despite the effects of the crisis, winemaking was able to expand and increase employment in the post-devaluation period. As one can see from Figure 5, employment in the sector accompanied the evolution of employment in the region.

Economic Indicators of the Wine Cluster

In Rio Grande Do Sul,2 the cultivation or production of wine grapes accounts for an average of 20 percent of total grape production. This relatively low percentage is emerging as a possible constraint on future expansion of Brazilian wine production.

Mendoza is characterized by the predominance of grapes for wine production compared to other uses (fresh grapes, raisins) with a share of approximately 99 percent during the period under study. In 2008, according to the Instituto Nacional de Vitivinicultura, the total amount of grapes for processing rose by 11.13 percent over 2007, while fresh grape production declined.

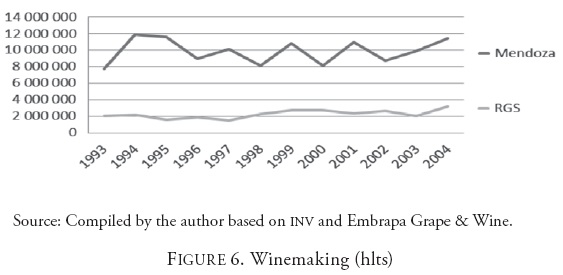

Brazil currently ranks 16th among the world's wine producers. According to a market study by the Corporación Vitivinícola de Argentina (Coviar) and the Instituto Brasileiro do Vinho (Ibravin), published by Argentinewine.com, in 2009, 77 percent of the total industrialized products comprised table wines and 9 percent grape juice, both made from grapes of American origin and other hybrid varieties. The evolution of wine production throughout the period in the regions compared is shown in Figure 6.

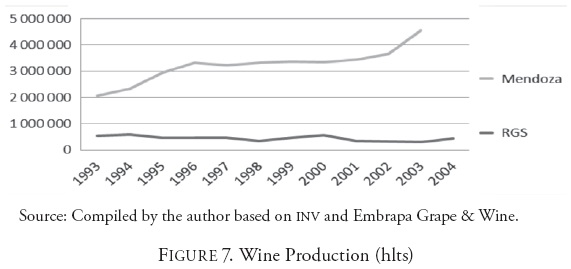

Production of wine and other wine products averages between 11 and 12 million hectoliters, accounting for approximately 68 percent to 70 percent of national production. Fine wine (Figure 7) produced in Mendoza has shown an increase over the period, with periods of expansion in the 1990s and from 2003 onwards.

From the mid 1990s to mid-2000, Rio Grande Do Sul, saw a decline in the production of fine wines and predominance of table wine production. It was not until 1999 that sparkling wines began to be produced. Sparkling wine production rose from 7 000 liters in 1999 to 970 000 liters in 2005. Ordinary wines are made mainly with American and hybrid grapes, whereas fine wines are produced from Vitis viniferas (nobler varieties).

Unlike the Mendoza market, where ist is estimated that an average of 30 liters of wine per capita are consumed annually, the Brazilian consumer has low per capita consumption of wine. According to a study by Ibravin (2009), wine consumption totaled 1.8 liters per capita per year.

Although Brazilian wines have been exported for nine years, current sales on the foreign market, primarily fine sparkling wine, fail to account for even 1 percent of total production. There are not only unfavorable global conditions, but also adverse domestic conditions such as: low per capita consumption (1.8 liters compared with an average of 30 liters in Argentina and Uruguay), lack of wine culture with meals, lack of an image as a wine producer, low importance of the sector to the national economy (albeit economically important for Rio Grande Do Sul, where production is concentrated) and a high tax incidence (taxes account for approximately 42 percent of the retail price, compared to about half that in Argentina and even less in Chile, currently the two main exporters of wine to Brazil) (Fensterseifer, 2006).

According to the International Organisation of Vine and Wine (OIV), Argentina is the largest wine producer in South America, the fifth largest wine producer in the world, accounting for about 6 percent of global production, and the ninth largest exporter worldwide (3.3 percent). However, Argentina has not yet managed to achieve a high share of world exports, mainly due to high domestic consumption, similar to that of European countries.

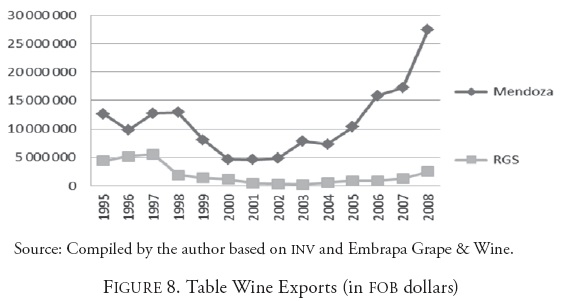

Mendoza currently exports products with a value of approximately 220 million U.S. dollars, the greatest percentage of which comes from fine wine exports. Argentina is recognized as a producer of refined Malbecs while those from Mendoza are considered the best in the world. Exports in containers with less than two liters have accounted for a larger share of the market than wines in containers with over two liters (usually table wines, Figure 8).

The share of larger containers is currently smaller than it was 10 years ago. The dynamism and sustained growth of the wine industry lies in bottled wine exports.

In Brazil, integration into international markets led to notable innovation in winemaking, primarily motivated by the need to adapt to the new requirements of import markets.

Spillover Effects

The wine industry is characterized by the presence of strong forward and backward linkages. Therefore, the growth of the wine industry has shifted to other sectors comprising the cluster, such as input supply firms. This is the case of Fecovita, which controls the production of Tetra Briks because of its machinery using advanced bottling and packaging technology.

In the 1990s, convertibility prompted several investments in the province of Mendoza, especially in imported machinery and lines for the production of fine wines. After devaluation, this situation was reversed, as a result of which a number of firms set up business in Mendoza to continue providing equipment. Nowadays, most of the machines and equipment are provided by local suppliers.

On the other hand, winemaking and vine growing activities have achieved virtuous integration with the business and tourism sector in the province of Mendoza. Several tourist routes have been created that integrate wine production with the hotel sectors, businesses and stores. Wine is more than an economic activity in the province, it is part of the culture and folklore of the people, observed through popular festivities such as the National Harvest Festival. This makes it a tourist attraction. Wine tourism's centerpiece is Valle de Uco, where the largest number of both national and foreign wineries are located.

The wine tourism sector contributes approximately 47 million U.S. dollars to Mendoza's production. According to a report by the Comisión Nacional de Turismo Vitivinícola de Bodegas de Argentina 2008, 70 percent of tourists buy wines in the cellars after they have completed the "wine routes." The increase in wine tourism creates positive externalities to promote public transport. Wine tourists use the following means of transport: taxis (28 percent); own car (27 percent); minibuses (20 percent); public transport (18 percent).

In the Serra Gaúcha region, Vale dos Vinhedos is considered one of the centers of wine tourism, attracting between 60 000 and 80 000 tourists a year. Comprising an area of 81 km2, it includes wineries, hotels, restaurants, and tourism related to the Associacão dos Vinhos Finos Produtores do Vale dos Vinhedos-Aprovale.

Innovation

For Mendoza, winemaking conversion began as vinegrowing conversion. Recent years have seen the advent of new vineyards with more advanced technologies and high quality wine grape varieties, replacing high yield vineyards, suitable for the mass production of table wine.

In the late 19th century, the technique of grafting a noble variety of Vitis vinifera onto an American rootstock or crosses of American with European varieties spread. The use of protective tubes for vineyards has also been implemented. With regard to productive balance and as part of the new vineyard management techniques, more scientific controls of pruning were introduced. In the global context of widespread mechanization of farming, there are harvesters and pruners for vine crops on high espaliers.

Innovation in the sector is also reflected in the area of marketing. The wineries promote wine tourism, as well as national and provincial institutions. In particular, Wines of Argentina established April 17 as World Malbec Day, in which Argentine wineries attempt to make the country be automatically identified with this variety.

Giuliani, Pietrobelli and Rabelloti (2005) concluded that the Serra Gaúcha wine cluster had high indicators of improvements in products and processes. 89 percent of companies introduced new techniques or improved existing ones in the past three years.

Socio-demoFigureic Indicators

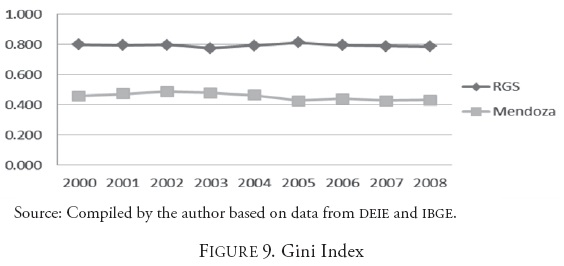

While there is a difference in the Gini index between the two regions (with a more equal distribution in the case of Mendoza), a decrease in income inequality has been observed in both regions during this period. This improvement is more visible in the case of Mendoza than in the RGS region (Figure 9).

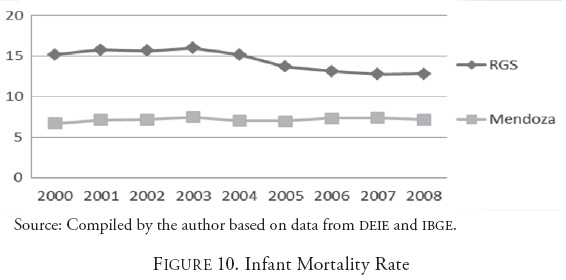

The infant mortality rate has shown a downward trend in both regions during the past decade (Figure 10). In the case of Mendoza, this trend has shown some fluctuations. In RGS, this social indicator has improved considerably in recent years.

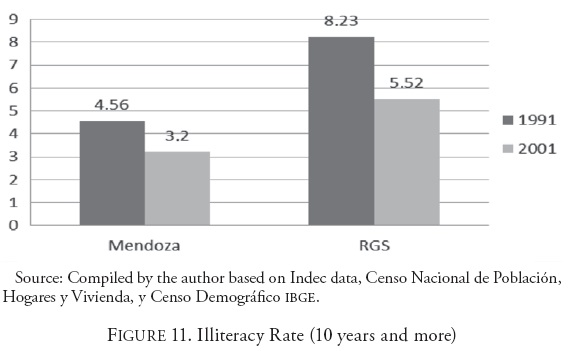

The illiteracy rate has decreased in both regions, and even more so in RGS (Figure 11).

Composite indicator of Socio-Economic Development

Alderete and Bacic (2012) analyze the wine cluster in Mendoza from a local development perspective, focusing on the economic and social dimensions. The authors use an analysis of the correlations between the indicators yielded by a factor analysis to show that there are statistically significant links between the wine industry and the socio-demoFigureic and economic indicators of the region. Although these correlations are not proof of the existence of causality,3 they anticipate a virtuous trend among the variables.

Based on this methodology, a similar analysis is suggested for the case of Serra Gaúcha in order to complement the previous analysis. The IDESE (Índice de Desenvolvimento Socioeconómico) published by the Fundação de Economía e Estatística Siegfried Emanuel Heuser-FEE was used as a proxy for an indicator of local development in the region of Serra Gaúcha. The IDESE enables municipalities to be classified into development groups. The index consists of four blocs: Education (primary education dropout rate, primary education failure rate, secondary education attendance rate, illiteracy rate of persons aged 15 years or over); Income (GDP per capita, ownership of income, per capita GVA trade, accommodation and food); Sanitation and housing conditions (percentage of households with running water: network, percentage of households with sewerage, average number of inhabitants per household); Health (percentage of children with low birth weight, mortality rate of children under five, and life expectancy at birth).

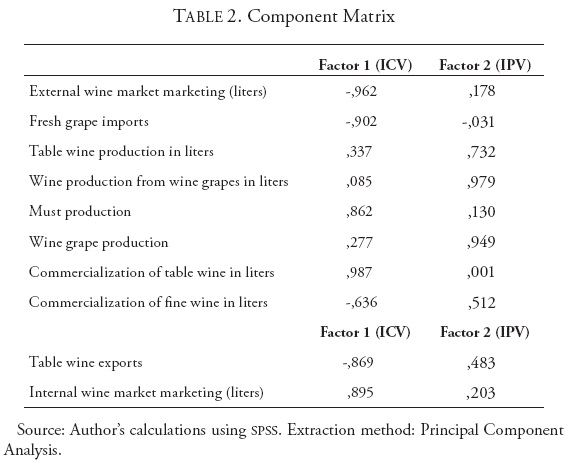

Since there are several economic indicators related to the wine industry for the region of Rio Grande Do Sul, a factor analysis was performed using the methodology of Alderete and Bacic (2012a) to obtain the smallest number of factors that explain the information provided by these variables. To this end, data from the wine industry indicators mentioned for the period from 2000 to 2008 published by Embrapa were used.

Using the method of extracting the main components through the factor analysis technique, of the 11 observable variables, two dummy variables were created that explain 91.32 percent of the total variance. On the basis of the information in Table 2, the variables obtained were called: ICV-wine marketing index, and IPV-wine production index.

Below is a correlation analysis between the Socioeconomic Performance Index (IDESE) and the ICV and IPV indicators.

This analysis demonstrates the presence of a significant correlation between the Index of Socio-Economic Development of the municipalities of Serra Gaúcha and the Wine Marketing Indicator (Table 3). This correlation does not imply that undertaking wine industry activity causes local development, but rather that one can expect a virtuous trend between variables.

The growth of the wine sector in Brazil, especially in Rio Grande Do Sul, is reflected in a small improvement in the marketing of fine wines in 2005 accompanied by increased share of the market compared with imported wines. An increase in exports, albeit small, has also been observed. This quantitative evidence, although weak, is important when combined with qualitative indicators such as the restructuring of the 1990s; strategic orientation towards growth, concerted efforts towards improving quality (with the promotion of geoFigureical indications), institutional support and export consortia. These factors explain the improved performance of economic indicators in the sector in recent years and accompany the trend toward improved local development.

FINAL CONSIDERATIONS

The aim of this paper is to analyze the importance of the wine cluster for local development in its region of influence. On the one hand, the Mendoza wine cluster, due to its outstanding performance in recent years reflected in the growing export trend; and on the other, the Serra Gaúcha, as the primary winemaking center in Brazil, which, together with Argentina, are the most important countries in Mercosur.

In Mendoza, restructuring has been an important process in the advancement of the wine industry. Wines produced in Mendoza have a higher external demand than those produced in Rio Grande do Sul. This is reflected in the greater participation of foreign companies in the industry and increased production and consumption of varietal wines, to the detriment of ordinary wines and a sharp rise in exports. For its part, the modernization of traditional vineyards is a primary objective of Rio Grande do Sul in response to market demands and opportunities.

Although the wine industry is a new area of activity in Serra Gaúcha, its growth prospects are important, given Mendoza's previous experience. This paper portrays the wine industry as an alternative for local development in both regions.

One of the constraints of the study is the lack of information available on winemaking at the municipal level in Brazil. Consequently, the definition of the geoFigureical area of wine indicators often refers to the region of Rio Grande Do Sul, and not specifically in the winemaking area of Serra Gaúcha. A similar situation occurs when economic and socio-demoFigureic indicators are analyzed. In the case of Mendoza, the information always refers to the province of Mendoza, with the exception of the employment rate, corresponding to Greater Mendoza region.

Admittedly, the evolution of indicators, especially socio-demoFigureic ones, responds to a multicausality of determinants, both social, economic and cultural. This makes it difficult to define the impact of the performance of the wine cluster on local development in its region of influence. For this reason, the aim of this paper is not to determine a direct causal link between the performance of wine clusters and local development. First, because given the multidimensional nature of the phenomenon of local development, the search for causality would be an elusive goal. However, it is possible to see from the descriptive analysis how the successful performance of the Mendoza wine cluster has been accompanied by improvements in the indicators that comprise local development. Given that the Serra Gaúcha cluster is a new sector of activity and having observed the results achieved in Mendoza, there is evidence that the wine region of Brazil has a goal to be achieved not only in terms of the performance of the cluster but also as regards its impact on local development in the region.

Acknowledgement of the multidimensional nature of the phenomenon of local development reveals an additional limitation of the study: only some indicators deemed important for the measurement of the phenomenon are included. In particular, this paper does not analyze the case of environmental factors, such as the problem of environmental sustainability. Furthermore, although it mentions the importance of government support for the development of clusters, it does not include political indicators such as government relations among local development indicators. In both cases, this is caused by the lack of information in the area.

REFERENCES

Alburquerque, Francisco, 1997, "Desarrollo económico local y distribución del progreso técnico. Una respuesta a las exigencias del ajuste estructural", Cuadernos ILPES, Santiago, Chile, ILPES, No. 43, pp 1-118. [ Links ]

Alderete, María Verónica, and Miguel Juan Bacic, 2012a, "The Impact of Inter-firm Networks on Regional Development: The Case of Mendoza's Wine Cluster", Lecturas de Economía, Medellín, Universidad de Antioquia, No. 76, pp. 177-213. [ Links ]

Alderete, María Verónica, and Miguel Juan Bacic, 2012b, "El clúster vitivinícola Mendocino: El rol de las instituciones para su desempeño productivo", 17th Annual Meeting of PyMEs Mercosur Network, September 26-28, 2012, San Pablo, Brazil.

Barbosa Pererira, Sudanês, 2006, "O cluster informal de cedro de São João." Revista da Fapese, Vol 2, No. 2, pp. 83-108. [ Links ]

Barreiro Cavestany, Fernando 2000, Desarrollo desde el territorio. A propósito del desarrollo local, Buenos Aires, Unidad de Fortalecimiento de los Gobiernos Locales de la Universidad Nacional de Quilmes y la Hanns Seidel Stiftung, available at Biblioteca Digital Municipal, biblioteca.municipios.unq.edu.ar/modules/mislibros/archivos/Barreiro.pdf, last accesed on August 8, 2013. [ Links ]

Becattini, Giacomo, 1979, "Dal settore industriale al distretto industriale", Rivista di Economia e Politica Industriale, Italy, Franco Angely, No. 1. [ Links ]

Bocco, Adriana; Marcelo Delfini, Daniela Dubbini, Sonia Roitter, and Diego Amorín, 2007 [paper], "Nuevas formas de organización del trabajo y calidad de empleo. Un estudio comparativo de las tramas automotriz y vitivinícola en Argentina", V Congreso Latinoamericano de Sociología del Trabajo. "Hacia una nueva civilización del trabajo", Montevideo.

Boscherini, Fabio, and Lucio Poma, 2000, Territorio, conocimiento y competitividad de las empresas: El rol de las instituciones en el espacio global, Buenos Aires, Miño y Dávila Editores. [ Links ]

Caravaca, Inmaculada; Gema González, and Rocío Silva, 2005, "Innovación, redes, recursos patrimoniales y desarrollo territorial", Revista Eure, Santiago, Chile, Pontifícia Universidad Católica de Chile, Vol. 31, No. 94, pp. 5-24. [ Links ]

Corral, Antonio et al., 2006, Contribuciones de las empresas al desarrollo en Latinoamérica, Washington, Ikei/Inter-American Development Bank. [ Links ]

Fensterseifer, Jaime, 2006, "The Emerging Brazilian Wine Industry: Challenges and Prospects for the Serra Gaúcha Wine Cluster", 3rd International Wine Business Research Conference, Montpellier, July 6-7.

Gallicchio, Enrique, 2004, "El desarrollo local en América Latina. Estrategia política basada en la construcción de capital social", Development with Inclusion and Equity: Its implications from the Local Level, Seminar, SEHAS, Córdoba, Argentina.

Giuliani, Elisa; Carlo Pietrobelli and Roberta Rabellotti, 2005, "Upgrading in Global Value Chains: Lessons from Latin America Clusters", World Development, Elsevier, Vol. 33, No. 4, pp. 549-573. [ Links ]

Gollo, Silvana Saionara, 2006, "Delineamento e aplicação de Framework para análise das inovações numa perspectiva de processo interativo: estudo de caso da indicação de procedência vale dos vinhedos-Serra Gaúcha/RS", Teoria e Evidência Econômica, Vol. 14. [ Links ]

Grosjean, Nicolás and Dennis Maillat, 1998, Territorial Production Systems and Endogenous Development, Neuchâtel, Switzerland, Institute for Regional and Economic Research, Neuchâtel University. [ Links ]

Iniciativa para la integración de la infraestructura regional suramericana (IIRSA), 2006, "Estudo de avaliação do potencial de integração produtiva dos eixos de integração e desenvolvimento da iniciativa Iirsa". Final Report. Part C. Chapter VII. Available until August 10, 2013 at www.iirsa.org/admin_iirsa_web/Uploads/Documents/plan_ip_parte_c7.pdf. [ Links ]

Marshall, Alfred, 1930 [1890], Principles of Economics, eighth edition, London, Macmillan. [ Links ]

Méndez, Ricardo, 2001, "Innovación y redes de cooperación para el desarrollo local", Interações, Brasil, Universidade Católica Dom Bosco, Vol. 2, No. 3, pp. 37-44. [ Links ]

Narváez, Mercy; Gladys Fernández and Alexa Senior, 2008, "El desarrollo local sobre la base de la asociatividad empresarial: una propuesta estratégica", Opción, Venezuela, Universidad de Zulia, Vol. 24, No. 57, pp. 74-92. [ Links ]

Nierop, Marnix [thesis], 2010, The Evolution of the Brazilian Wine Industry, Universiteit Utrecht and Universidade Do Vale Do Rio Dos Sinos. [ Links ]

Porter, Michael Eugene, 1990, Vantagem competitiva: criando e sustentando um desempenho superior, Rio de Janeiro, Campus. [ Links ]

Rambo, Jorge Antonio and Jains Elisa Ruppenthal [paper], 2004, "As redes de cooperação no contexto do desenvolvimento local e regional", XXIV Encontro Nac. de Eng. de Produção-Florianópolis, SC, Brazil, November 3-5.

Sánchez Zepeda, Leandro and Alejandro Mungaray Lagarda, 2010, "Vinos de calidad: base de desarrollo endógeno en el Valle de Guadalupe, Baja California", Frontera Norte, Tijuana, El Colef, Vol. 22, No. 44, pp. 109-132. [ Links ]

Vázquez Barquero, Antonio, 1998, "Desarrollo endógeno. Conceptualización de la dinámica de las economías urbanas y regionales" Cuadernos del Cendes, Venezuela, Universidad Central de Venezuela, No. 38, pp. 45-65. [ Links ]

Vázquez Barquero, Antonio, 1986 Política Económica Local, Madrid, Pirámide. [ Links ]

1 Until 2003, wine was classified as table, fine and others. The launch of new wines (INV Res No. 12/04) led to the decategorization of wines, which should only be classified as "wine."

2 The winemaking indicators correspond to Rio Grande Do Sul. Statistical information centers in Brazil do not have this information at the municipal level, in order to calculate the level of the Serra Gaúcha region. In any case, RGS represents 90 percent of domestic wine production.

3 On the other hand, the search for causality in a multivariate phenomenon is a difficult challenge to meet, particularly given the lack of information.