Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Estudios fronterizos

On-line version ISSN 2395-9134Print version ISSN 0187-6961

Estud. front vol.17 n.33 Mexicali Jan./Jun. 2016

Articles

Employment performance by sector in Hidalgo, County, Texas, 2007–2011

Rodrigo Vera Vázquez *

* El Colegio de Tamaulipas, Centro de Estudios Urbano Regionales. Address: Calzada General Luis Caballero, No.1540, Colonia Tamatán, C.P. 87060, Ciudad Victoria, Tamaulipas, Mexico. E-mail: ecovera2007@gmail.com

Received: March 28, 2014.

Approved: June 5, 2015.

Abstract

This article examines the sectoral performance of the economy of Hidalgo County, Texas, using as reference the 2007–2011 recession period of the U.S. economy. The results of the investigation show that Hidalgo County avoided the contraction of the U.S. employment rate of –4.4%, as evidenced by a positive local employment rate of 5.2%. This recession–proof profile is explained by its orientation toward a service economy, including the public administration sector as a strategic field for correcting market failures. The shift–share technique was applied to provide an account of sectoral performance, supplied with data from the U.S. Bureau of Labor Statistics. The data obtained are discussed in the framework of the theoretical discussion related to the implementation of Keynesian–style active policies.

Keywords: employment, shift–share, Hidalgo, McAllen and Reynosa.

Introduction

Cross–border economic geography is part of the research agenda of the northeast of Mexico and its relationship with Texas (Aguilar, 2007; Corrales, 2012; García and Trujeque, 2009; Palomares, 2009; Pérez, Ceballos and Cogco, 2014; Vásquez, Jurado and Castro, 2011). One aim is to investigate the sectoral economic behavior of the counties that comprise the international border with Tamaulipas. Although there are documents dedicated to distinguishing their productive roles, little is known regarding how they adjust during a recessionary phase in the economic cycle. Employment behavior by sector in Hidalgo County, Texas, warrants examination because, between 2007 and 2011, it held a positive rate of employment, which stands in contrast to what occurred to the overall U.S. rate.

Indeed, in that period, the employment rate in the U.S. moved by –4.4%, which is equivalent to the loss of 5.9 million jobs. The most controversial moment corresponded to the financial meltdown that afflicted the country in 2008. It was a phase that revealed the decisive intervention of the State through the implementation of Keynesian–style active policies aimed at overcoming the adverse effects of free–market forces. In southeastern Texas, Hidalgo County was stable during the crisis. In this region, the employment rate was positive: 5.2% for the aforementioned period.

This recession–proof profile draws particular attention because it was immersed in a context of decline for the manufacturing and construction sectors, which are part of the economic history of the county. The contraction of both —resulting from the broader adjustment of the sectoral structure in the U.S. economy— was not only observed in the county but also amplified outside its borders, such as in the case of Reynosa, Tamaulipas, one of the most dynamic manufacturing cities on the northern border of Mexico and a city that borders that county.1 This fact adds features that underpin the argument made by Corrales (2012, p. 137) by noting that, among the so–called border city "pairs", the Mexican cities are more prone to being affected by the U.S. economic cycle and not vice–versa.

In light of the fragility of these pro–cyclical sectors (manufacturing and construction), the fact is that other sectors served as a buffer and even helped stabilize the economy of the county through new jobs. The addition of more than 11 000 jobs is a competitive indicator that requires analysis. Taking into account the sectoral performance of local employment, the intention is to add elements to attempt to answer what the recession–proof profile is based on.

The aggregate demand hypothesis is one way of answering this question because it is part of a mechanism that arises in fiscal and monetary policy aimed at encouraging the circular flow of capital within the economic cycle; this intervention is evidenced through public expenditure and employment in the public administration sector. In other words, aggregate demand is viewed as a temporary stimulus generated by the State, whose multiplier effect helps to preserve the "health" of the economy. During recession periods, some services will regenerate even as production decreases: the health, education and public administration sectors are an example of this phenomenon. Everything indicates that the increase in jobs in these sectors explains the competitive component presented in Cameron County.

Therefore, the discussion of these outcomes occurs in the Keynesian camp, with the approaches of Samuelson (2008) and Samuelson and Nordhaus (2010) particularly emphasized, in addition to those of Stiglitz (2000; 2007; 2012), regarding the role of the State in seeking to mitigate recession through full employment. However, such calm or appearance of balance should be considered with caution, as Krugman and Obstfeld (1995) note.

Specifically, this article seeks to contribute to enriching the range of conducted studies that have analyzed the northeastern region of Mexico and its relationship with Texas. Moreover, its aim is to monitor the behavior of the main industries in the counties of South Texas that stimulate —but also withdraw— capital from the border cities of Tamaulipas during a recessionary phase. To that end, the shift–share technique was applied, with support from the Shields model (2003), fed with data from the U.S. Bureau of Labor Statistics.

Location of the county studied

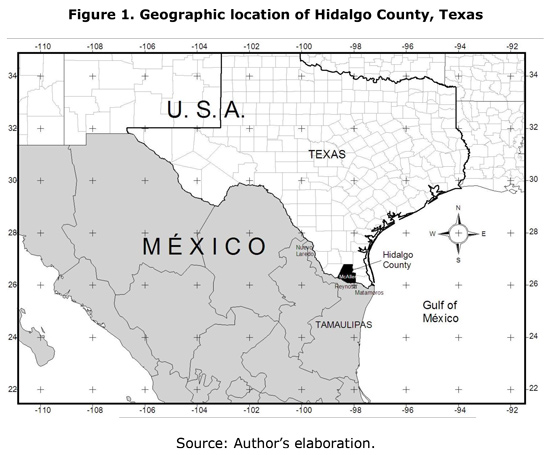

Hidalgo County is located in the vicinity of the mouth of the Rio Grande River2 in the southeastern portion of the state of Texas in the United States of America (see Figure 1). It is one of the 254 counties of this state, one of the 23 that border Mexico and one of the five that border Tamaulipas.

Its territorial boundaries are Cameron and Willacy counties to the east, Kenedy and Brooks counties to the north, Starr County to the West and the channel of the Rio Grande to the South, which also serves as the international border with Mexico. In 2012, the total population of the county was of 806 552 inhabitants. Its seat is Edinburg (81 029 inhabitants), which, although it is not its largest city, together with McAllen (134 719 inhabitants) and Mission (80 452 inhabitants), forms a metropolitan area of approximately 296 000 people, a number that represents 36% of the total county population. In Hidalgo County, slightly more than 91% of the population is Hispanic or Latino, with Mexicans being the largest representative group (U.S. Census Bureau, 2013). This territory has 6 international bridges.

Methodology for calculating the sectoral employment dynamics in the county

The shift–share method is used for the analysis of the behavior of the local economic structure.3 This method is used because of its ability to detect developments of an economic magnitude (such as employment) in a region and in a given sector, particularly in light of their expected growth derived from changes in the national economy. This differential growth, known as the competitive component, constitutes the fundamental purpose of this study.

Although this tool has been the object of various critiques, it is a fact that debate has minimized the instability of its outcomes; the method has evolved in terms of its procedure. Beginning in the 1980s, 3 basic limitations were indicated: 1) its tendency toward increasing measurement imprecision in parallel with the increase in the number of sectors or branches compared; 2) its methodological weakness when attempting prospective predictions (Bartels, William and Duijn, 1982); and 3) its inadequacy in comparing the value of an economic magnitude at 2 time points (initial and final) without considering any additional information within the period investigated (Mayor et al., 2005).

In an attempt to reduce such inferential limits, a smaller disaggregation has been agreed to; that is, the tool is applied only when taking large sectors into account or examining a single sector that is then divided into a particular number of branches (Arcelus, 1984; Casler, 1989; Mayor et al., 2005; Stevens and Moore, 1980). More recently, Shields (2003) and Kriesel (2014) from the U.S. have agreed on the appropriateness of applying the method to the 11 major sectors that structure the U.S. gross domestic product,4 and they also recommend applying the method for a period of no greater than five years. Their methodological outcomes lead to the conclusion that the technique is suitable for examining changes in retrospect because it provides a sufficiently accurate overview of the regional–sectorial shift and share in a given period of time.

What is the main feature of the method? It is based on the assumption that the performance of the local economy can be explained by the combination of 3 key components: 1) the share or participation in national total employment (national share); 2) the share attributed to the sectoral diversification of the national economy, also known as the comparative sectoral effect (industry mix); and 3) the capacity or competitive component attributed to the local structure (local share).

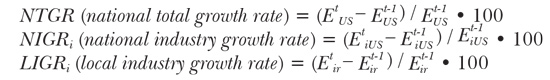

The prevailing annotation in the general formula is  or

or  , which refers to employment for industry i in region r or in country US at time t. If i is not noted, then the implication is that it is the total employment or the sum of all sectors. The general formula is as follows:

, which refers to employment for industry i in region r or in country US at time t. If i is not noted, then the implication is that it is the total employment or the sum of all sectors. The general formula is as follows:

SSi = NSi + IMSi + CLSi

SSi = shift-share.

NSi = national share.

IMSi = industry mix share.

CLSi = competitive local share.

The magnitudes for consideration in the application of the general formula are the following:

The results are the following equations for each component:

= number of jobs in the industry (i) in the locality (r) at the beginning of the period of analysis (t–1).

= number of jobs in the industry (i) in the locality (r) at the beginning of the period of analysis (t–1).

= number of jobs in the industry (i) in the locality (r) at the end of the period of analysis (t).

= number of jobs in the industry (i) in the locality (r) at the end of the period of analysis (t).

= total number of jobs in the country (US) at the beginning of the period of analysis (t–1).

= total number of jobs in the country (US) at the beginning of the period of analysis (t–1).

= total number of jobs in the country (US) at the end of the period of analysis (t).

= total number of jobs in the country (US) at the end of the period of analysis (t).

= number of jobs in the industry (i) in the country (US) at the beginning of the period of analysis (t–1).

= number of jobs in the industry (i) in the country (US) at the beginning of the period of analysis (t–1).

= number of jobs in the industry (i) in the country (US) at the end of the period of analysis (t).

= number of jobs in the industry (i) in the country (US) at the end of the period of analysis (t).

Retrospective of the total number of jobs in Hidalgo County, Texas

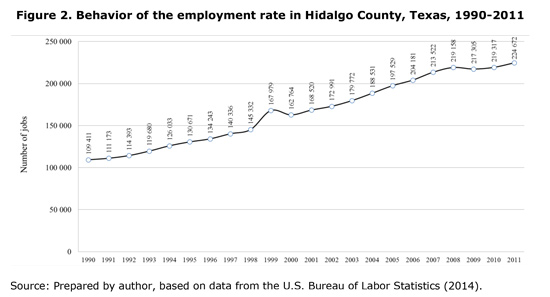

The historical behavior of the employment graph line is an essential component for viewing fluctuations over time. The information in Figure 2 shows a steady increase since the early 1990s without significant variations, except for two occasions in which the number of jobs in this territory shows positive rates.

The County began the 1990s with more than 100 000 jobs. From 1990 to 2011, approximately 115 000 jobs were added, which meant 224 672 total recorded jobs in 2011. In the region, this peculiarity conferred a certain primacy in terms of the labor supply because it surpassed other neighboring counties with international borders, such as Cameron County, which is adjacent to the municipality of Matamoros, Tamaulipas (Vera, 2015).

At the end of the first decade of the 21st century, a contraction was observed in the growth pattern, specifically since 2008. This decline has been the most abrupt that the county has had, at least since the last decade of the last century: these were the days of the financial collapse that engulfed the country.

Results

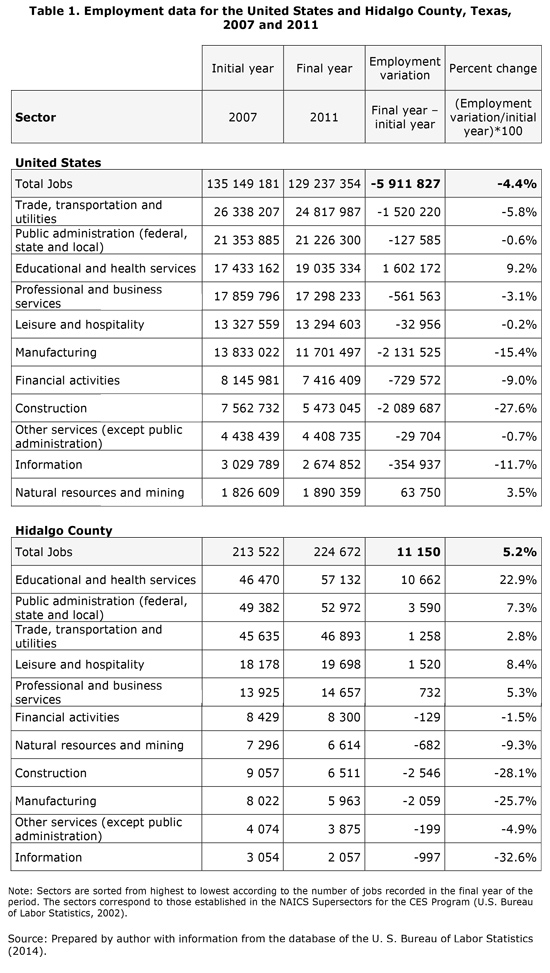

Table 1 shows the base input for the method. It presents the employment data for each of the 11 major sectors that structure the economic magnitude of the U.S.; the data are broken down at the country and county levels, identifying the percentage change in employment during the 2007–2011 period.

In the reference period, nearly 6 million jobs were lost nationwide, a change representing a rate of –4.4%. By contrast, vacancies increased by 5.2% in Hidalgo County. What was the effect of the national negative rate on local employment? How much did national economic diversification influence local employment? What was the competitive component of the county based on, that is, which sectors served as a buffer? To answer these questions, it is necessary to cross–reference sectoral data on national and local employment.

Jobs in Hidalgo County attributed to national dynamism (national share)

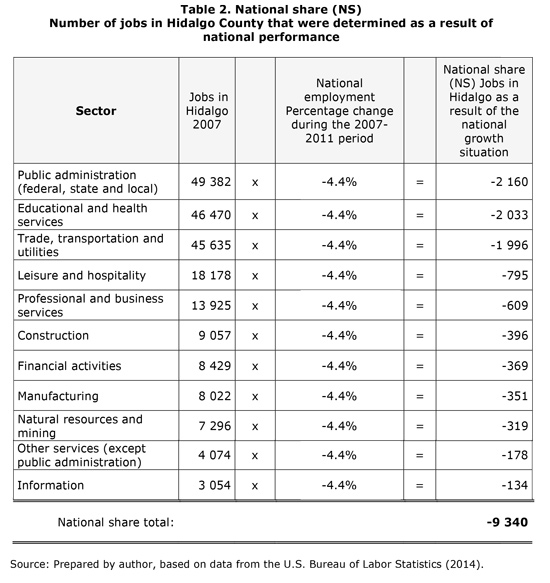

According to Shields (2003), recognizing the national influence (national share) is an aspect to be considered before testing the local competitive component because its behavior will affect local industry. It so happens that the effect of the national component is felt strongly during the peaks and declines of the economic cycle, that is, during boom times and recessions. A negative national employment rate results in the loss of opportunity locally, based on the generation of a certain number of jobs (see Table 2).

During the period under study, the national employment contraction of –4.4% was manifested in the local economy. As expected, in Hidalgo County, all sectors of employment were negatively impacted by the national component. The speed of change was so stunning that the national component was blamed for the lack of 9 340 jobs in the county (see Table 2). This figure suggests that the national component does not explain the 11 150 jobs that were added in the county (see Table 1). However, it is a fact that the State–implemented economic recovery policy led to reducing the time of recession within the cycle.

Notes on the 2007–2011 national recession cycle

After the 2001–2002 recessionary phase, the U.S. economic cycle entered recovery. Next, stability was perceived by society and corroborated by the number of jobs nationwide. However, as 2007 progressed, the U.S. economic model, supported by an oligopoly of large investment firms, showed signs of fragility.

On April 11, 2007, Citigroup, with headquarters in New York and ranked by assets as the third largest bank in the world, announced to the federal government that it would lay off 17 000 employees as a measure to withstand a phase of financial insolvency (U.S. Securities and Exchange Commission, 2007). The bank closed the year with the worst quarterly account after 196 years of financial history and announced that in only three months, it had lost almost 10 billion dollars due to exposure to subprime mortgages (Mar, 2008). The collapse of investment banking was an unavoidable fact. In November that year, Bear Stearns, the global investment bank and stock broker, also announced financial losses for the first time in 83 years (Basar and Ahuja, 2007). Five months later, the company could not be saved by the Federal Reserve Bank of New York and was sold to JP Morgan Chase.

Later in 2008, the financial insufficiency of global companies spread and deeply impacted nationwide employment. IndyMac Bancorp Inc., the second largest mortgage bank, reported the termination of 3 800 workers (Devcic, 2008) to the federal government. The turning point was the economic collapse of the financial services giant Lehman Brothers. Unable to support businesses with high–risk mortgage loans, that is, loans granted to debtors with a reduced ability to pay (a process known as subprime mortgage), the company filed for bankruptcy on September 15 after 158 years of existence. The announcement was made before the failure of negotiations with the two entities that initially emerged as potential buyers: Bank of America and the British group Barclays (PricewaterhouseCoopers, 2009). Lehman Brothers was the third company to disappear or change owners in a 6–month period.5

Other failures of insurance companies, banks and financial services firms were added to the insolvency of Lehman Brothers (which reported a debt of 613 billion dollars). For example, Merrill Lynch & Co. was sold to Bank of America; Morgan Stanley reported 80% losses in its stock valuation and entered into a Federal Reserve rescue plan, obtaining 107 billion dollars (Keoun, 2011); American International Group (AIG) was also saved by the Federal Reserve, being granted 85 billion dollars (Gethard, 2008); Wachovia Corp. announced losses of 9.6 billion dollars, culminating in its absorption, along with its subsidiaries, by Wells Fargo & Company (Álvarez, 2010); Washington Mutual was impacted by its customers, who withdrew 16.7 billion dollars in 10 days, prompting the government to place the bank under the control of the Federal Deposit Insurance Corporation (FDIC), which sold all the bank's assets to JPMorgan Chase for 1.9 billion dollars ("Empty Pockets", 2008); and IndyMac Bancorp Inc., the second largest mortgage bank in the country before the collapse, announced the layoff of 3 800 workers, a situation leading it to be included in the bailout list of the FDIC (Azul, 2008).

The role of the State resurfaced powerfully while immersed in the systemic crisis. This period stands as an example of State re–intervention aimed at the stabilization of the economic model: the rescue and nationalization of finance banking is an example of the implementation of Keynesian–style economic policies.

In effect, the government strategy to introduce resources into the financial system was based on the issuance of several laws. One of them, called the Emergency Economic Stabilization Act (EESA), approved on October 3, 2008, by the 110th Congress (U.S. Government Printing Office, 2008), resulted in the implementation of the Troubled Asset Relief Program (TARP), which was created to stabilize troubled assets and revive U.S. economic growth (U.S. Department of the Treasury, 2008).

The lead–up to these legislative instruments was the initiative of President George W. Bush, who defended the idea that this government intervention was necessary to prevent the crisis from spreading to all communities throughout the country. The legislation included an initial aid package of 700 billion dollars to recover the portfolio of several companies affected by the subprime mortgage crisis (Herszenhorn, 2008; Sahadi, 2008; Webel, 2013). This action served to stabilize the financial markets and guarantee an uninterrupted flow of credit to households and firms; it constituted an unexpected twist in U.S. free–market economic policies that hitherto had been anchored in the school of thought led by Friedrich von Hayek and Milton Friedman. Indeed, this program is perceived as the strongest cyclical intervention by the State in the economy of the country since the crisis of 1929.

During 2009, the implementation of the TARP produced signs of confidence among investors. In addition, the fact that Barack Obama signed the American Recovery and Reinvestment Act of 2009 (ARRA)6 2 months after having assumed the presidency of the United States of America made investors accept the State as a regulatory mechanism for confronting the recession. ARRA made explicit the need to save or create 3.5 million jobs in 2 years with an estimated total of 787 billion dollars. The State compensated for the decline in private spending with an unprecedented increase in public spending, specifically in areas of social welfare, education and healthcare. Furthermore, to reduce the uncertainty of the exogenous cycle, the State introduced capital into the energy industry (U.S. Government Printing Office, 2009).

The Hidalgo County immersed in the recession

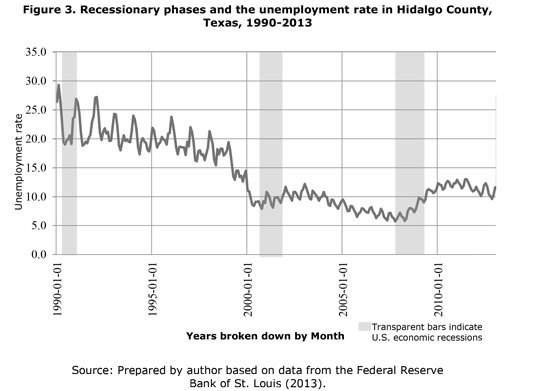

At the southern end of the country, on the southeastern border with Mexico, Hidalgo County, Texas, withstood the downturn with an unemployment rate of 7% at the peak of the financial crisis. It should be noted that this rate was lower than those during the 1991 and 2001 national recessions (see Figure 3). In this administrative territory, the unemployment rate remained positive at the time of the recession, a fact that suggests stability (see Figure 2).

So strong was its countercyclical profile that Forbes and The Wall Street Journal identified Hidalgo County in 2010 as one of the top 21 economies in terms of competitive profile in the United States of America (Hendricks, 2011). The constant addition of jobs was an indicator that supported such a position and that was reflected in the entire metropolitan area of McAllen–Edinburg–Mission.

However, this fact does not mean that all labor or full employment demand was covered because, according to data from the Texas Workforce Commission, from 2007 to 2011, the unemployment rate for the county remained above the state rate. The explanation for this situation is the growing labor force emanating from the flow of people attracted by the economic certainty of the county. Data from the U.S. Census Bureau (2013) indicate that from 2007 to 2011, the percentage of the resident population born outside the county increased from 29.2% to 37.6%, respectively, while at the state level, the same indicator went from 16.2% to 18.1%.

The resistance of the county to the decline in national employment also shows that its recession–proof profile was not observed in sectors that produce capital goods (materials) but rather in activities related to services. The hypothesis is based on the fact that there was an exponential increase in expenditures by the local government in the midst of the recession, that is, at the time of the adoption of the federal law known as the Emergency Economic Stabilization Act (EESA), which was issued in the last quarter of 2008.

Jobs in Hidalgo County attributed to the sectoral behavior of national employment (Industrial mix share)

For any economic model governing the economy of a nation, the behavior of its large sectors is uneven within the economic cycle. Although industrial diversification is essential for confronting recession, it is a fact that there are sectors that buffer and reduce uncertainty in the short term. Authors such as Ghosh (2007) refer to automatic stabilizers that ensure that, in some way, consumption does not decrease excessively during a recession, with the health and education sectors becoming the most widely used.

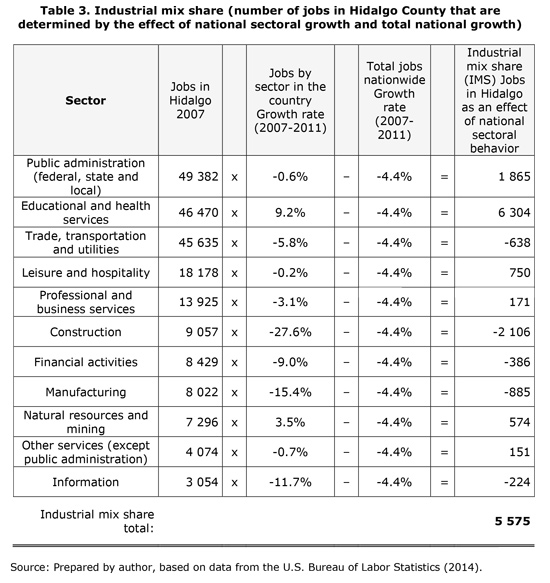

Regardless of that possibility, the fact is that there are two trends to consider in the analysis of local employment attributed to national sectoral behavior. The first trend is based on a sector's national behavior being reflected in a similar manner locally, meaning that if it is negative nationally, it will be negative locally (or vice versa). The second would show a dissimilar trend, that is, jobs may increase locally in a sector that shows a decline on a national level (or vice versa). After the analysis of both aspects, the component or factor based on sectoral diversification (industrial mix share) makes total sense because it makes it possible to clarify how many of the 11 150 jobs gained in Hidalgo County are explained by this component (see Table 3.)

Proportionally, it may be noted that 54% of the sectors that comprise the local economic structure were consistent during the recessionary phase due to the national sectoral diversification component, given that a counterweight of 5 575 jobs is attributed in favor of the county. This amount served to offset part of the impact of the contracting total national employment rate represented in –9 340 jobs not generated locally.

National percentage changes showed stability in sectors that do not produce capital goods such as the educational and healthcare services sectors and the public administration sector. The resistance of these sectors was essential for lessening the effects of the crisis. To illustrate the points above, data from the World Health Organization (WHO, 2014) indicate that during the recession period, public spending in the area of healthcare (federal, state and local) went from 45% in 2007 to 47.3% in 2011. This recurrent expenditure of capital increased the provision of preventive and curative healthcare services, family planning activities, nutrition activities and emergency assistance.

Conversely, the fragility of the national construction and manufacturing sectors was evidenced, and the same behavior occurred on the local level. The contraction of these sectors draws attention not only because they had an impact on the county but also because they were so strong in Reynosa, Tamaulipas, one of the most important maquiladora cities of northern Mexico and on the international border with Hidalgo, Texas.

In Reynosa, the decline in the U.S. manufacturing sector was crushing, to the extent that during the 2006–2009 period, the personnel employed in the exporting factories of the sector contracted by more than 30 000 workers, that is, when the U.S. economic recession was at its most turbulent moment. In this regard, the Instituto Nacional de Geografía e Informática (INEGI, 2014), through the Comprehensive Statistics of the Program for the Manufacturing, Maquiladora and Export Services Industries (Estadística Integral del Programa de la Industria Manufacturera, Maquiladora y de Servicios de Exportación), reported that in October 2007, the sector directly employed 101 598 people, whereas in the month of December 2009, this number was reduced to 70 903 employees. Automotive parts and electronics production lines were the most vulnerable to the U.S. economic cycle. The challenges in the labor climate were arduous. Relations between unions, employers and the government entered into a phase of distrust as they waited for a reorganization of the U.S. economy. In the last month of 2011, the manufacturing sector of Reynosa barely showed signs of recovery: it registered 81 037 jobs.

It is certain that at the border, particularly in metropolitan areas, the interdependence of economic sectors is a prerequisite for understanding the behavior of the labor market. However, although the asymmetry of the interdependence is known, the apparent contiguity of the border's cities is deceiving. Chavez (2007) and Corrales (2012) note that this phenomenon is mainly because demand depends on the behavior of the U.S. market and not vice versa. Counterpart sectors on both sides of the border have significant differences in terms of employment, causing unstable labor patterns, especially in Mexican border cities. From the perspective of Vásquez et al. (2011), this dependence, mainly during phases of contraction in the economic cycle, is reflected in higher rates of unemployment than in non–border regions and places transnational corporations, trade flows and even international tourism under greater vulnerability.

It must be clarified that economic asymmetry does not halt the existence of cross–border interdependence, and the legal–political differences between the two nations do not prevent cross–border cooperation, although they do hinder it and sometimes prevent it. In reality, cities that share international borders are currently the most visible places in the economic integration of international markets because they host large industries essential to the employment needs of the regional and immigrant populations.

Jobs in Hidalgo County attributed to the local competitive component (local share)

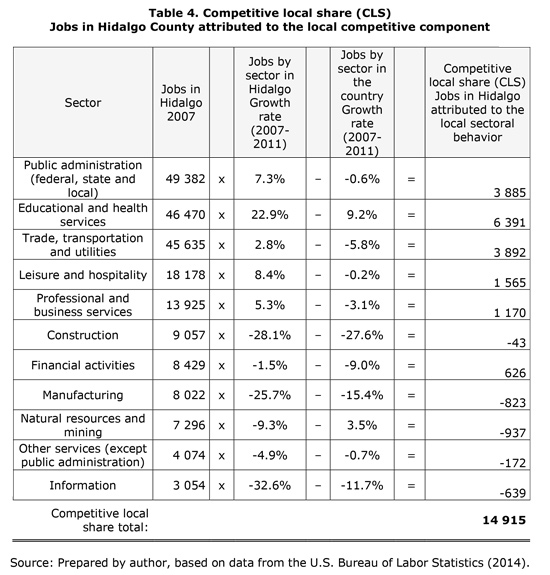

The sectoral behavior of local employment is key to explaining the countercyclical condition of the county. Internally, it is possible to detect different rates of growth but also of contraction; these two aspects are magnified in periods of both prosperity and crisis. It is certain that the local competitive component (local share) reveals the sectors that served to confront the national recession. According to Shields (2003, p. 2) it is, regardless, a question of comparing the stability or instability of a specific local sector, taking into account sectoral pace at a national scale.

Although the component of national sectoral diversification contributed to keeping various industries in Hidalgo calm during the recession, the economic strength sustained on the local economic structure was much more apparent. In Hidalgo, six out of its 11 economic sectors were consistent with the national recession, given that 14 915 jobs were added there. This amount served to counter the negative influence of the general employment rate nationwide represented by 9 340 jobs not generated locally.

The observed sectoral expansion and contraction indicate that the recruitment of employees at a local level was stimulated by not only the education and healthcare services sectors (22.9%) but also the public administration sector (7.3%) (see Table 4). These sectors were much more dynamic than others, for example, in comparison with the commercial and/or manufacturing sectors.

From 2007 to 2011, the area of healthcare was favored by the local government, which increased public spending by 9 million dollars; public healthcare spending went from 63 to 72 million dollars, respectively (County of Hidalgo, 2011). However, it is important to consider that although the county is home to 11 general hospitals, this fact does not mean that the demand is covered in terms of social welfare, so much so that the federal government identifies the area as one of the most expensive markets for healthcare services anywhere in the country. Hence, it is known as a medically marginalized area (Gawande, 2009).

This issue has led to the design of various investment and capital attraction projects. At the end of 2007, the 80th Texas Legislature, through the Department of State Health Services, began the distribution of public resources for the construction of preventive healthcare clinics. This mechanism was based on providing counties with the necessary conditions for inclusion in a future funding plan in which operating costs would be covered by the counties. For Hidalgo County, the legislature approved 3 million dollars for the construction of the Hidalgo County Primary Care and Substance Abuse Facility, which began offering services during the 2008 fiscal year.

This action is part of a strategy of strengthening the healthcare system of the county, where the structure of the biomedical–biotechnical cluster serves as a sectorial–regional leader. Hidalgo County is influenced by the Southwest Foundation for Biomedical Research, whose headquarters are located in San Antonio, Texas. The importance of this science cluster is that it has stimulated a value chain that pushes forward other local industries, such as in–home healthcare services, in addition to general and surgical healthcare in specialized hospitals. Internally, the education sector plays a crucial role not only in terms of research but also through the formation of human resources.

Indeed, in terms of the cluster, the increase in education spending by the government (federal, state and local) and provided to Hidalgo County must be taken into account, in addition to the local university supply represented mainly by the College of Health Sciences & Human Services at the University of Texas–Pan American and the Nursing and Allied Health Program of South Texas College.

According to data from the U.S. Department of Education, government expenditures reflected in contracts, benefits, grants and other types of financing to the education field doubled locally from 2008 to 2011; that is, they went from 80 514 586 to 166 432 334 dollars, respectively (USAspending.gov, 2015). Among these figures, the allocation of resources to the University of Texas–Pan American (Edinburg), South Texas College (McAllen), Education Service Center Region One and the McAllen, Mission and Donna independent school districts particularly stand out.

With regard to the large public administration sector, the outcomes in the period showed an employment increase on the order of 7%, which is equivalent to 3 885 jobs. The 2011 year–end payroll covered 52 972 workers in total. Similarly to what occurred in the education sector, in addition to the increase in jobs, a significant increase was detected in public expenditures; this outlay permitted the movement of capital in the county. From 2007 to 2009, total local government expenditures went from 285 million to 427 million dollars, respectively (county of Hidalgo, 2011). Spending on the rainwater runoff system alone increased from 5 million to 155 million dollars from 2007 to 2008, a radical difference that helps demonstrate the functionality of the sector during the phase of contraction in national employment and, moreover, the role of the State as a force that stimulates demand through spending and employment in times of economic recession.

The exponential increase in public spending observed during these years is part of a passage from history that is echoed in the logic of Stiglitz (2000), who notes that when the government spends, it is capable of injecting sovereign money into the economy; these resources reach the banking system and increase the amount of reserves, whereas taxation without expenditures acts inversely.

Theoretical discussion of the results

The economic recession that the U.S. experienced in the 2007–2011 period led to a rethinking of the classical logic of economic growth proposed by Friedrich von Hayek and Milton Friedman. The central point was that the free market did not have strong evidence to prevent the arrival of a new crisis. That superior mechanism of economic growth did not clarify how it would adjust or guarantee investment, employment and consumption in a highly speculative environment of uncertainty generated by financial institutions. Hayek's doctrine of libertarian capitalism, reflected in the annihilation of any planned form of economic activity, was questioned by the Council of Economic Advisers under the President of the United States, George W. Bush.

In his article "Houses of Cards", Stiglitz (2007), a supporter of Neo–Keynesianism, lashed out against bankers, calling them "rapacious lenders". He pointed to the need for greater regulation and transparency in the financial sector, primarily to protect the citizenry and the government against usurper credit. A year later, Paul Samuelson (2008), also a member of the Neo–Keynesian movement, published shortly before his death in 2009 an article entitled "Farewell to Friedman–Hayek Libertarian Capitalism"; in it, he stated that "unregulated market systems end up self–destructing" (par. 2). From his perspective, the lack of regulation allows bankers to implement irresponsible policies, such as the granting of credit to borrowers who are incapable of paying and also the manipulation of accounting numbers to hide problems that blow up as a result.

In essence, the rethinking of the free market model chosen by the government was to be a short–term compensation for the fluctuations or oscillations in the economic cycle. Indeed, the mistrust toward the general principles of liberalism at any cost has repeatedly involved the intervention of the State as a mechanism to mitigate or reduce the adverse effects of the recessionary phases in an attempt to avoid crises. Indeed, during recessions, the postulates of John Maynard Keynes regarding the general theory of employment are applied because they assume that the expansion of the functions of the government involves the task of maintaining consumption with the incentive of investing.

Viewed from another angle, if the government increases public spending, it automatically adds demand, which will have an impact on employment generation. The debate is that to increase public spending, taxes have to be increased; this situation reduces consumption and investment. The way out of this conundrum is found in the monetary authority (which, in the case of the U.S., is the Federal Reserve), which acts as a mechanism that attempts to stimulate the economy by two main routes: 1) minting large quantities of additional currency, supplying the government and avoiding the collection of more taxes but with a propensity to fall into what has been called "the liquidity trap". This situation is preferred by conventional monetary policy that seeks to lower interest rates to a limit of 0 but at the cost of losing the power to attract investment. The other route taken is 2) draining depreciation reserves7 under the principles of the multiplier–accelerator model for expenditures.

Keynes (1993/1936, p. 96) is cautious when he notes that printing money is the recommended route to reducing the length of a recessionary phase within the economic cycle; rather, he is inclined toward the path of "draining" the depreciation funds ―accumulated during either the previous phase or during growth phases― to avoid large–scale depreciation margins. To compensate for the loss of economic reserves, the State can rely on fiscal stimulus because it helps retain jobs. Simultaneously, automatic stabilizers are launched (such as healthcare and education policies that serve as a subsidy to unemployment).

The major postulate is that when monetary policy is unsuccessful and the private sector cannot be persuaded to spend more, the public sector has to take its place in supporting the economy. From Keynes' perspective, government intervention in the cycle is the only form of control or the only practical means to prevent the total destruction of existing economic modalities (1993/1936, p. 334).

In the U.S., the beginning of this interventionist policy based on full employment was in 1946, when the Full Employment and Balanced Growth Act was decreed through federal legislation. Immediately, Samuelson and Nordhaus (2010/1948), who focused primarily on the booms and busts of the capitalist economy and on the manner in which the policy of the State could influence the economic cycle, agreed with Keynes that the government has historically been a stabilizing mechanism for the cycle; that is, it has the economy in expansionary (and often inflationary) times and stimulates it during recessionary phases. However, they cautioned that the discretionary intervention of the State may trigger increasingly sharp economic recessions, or in other words, it can be a source of distortion in the efficient function of the market.

For Samuelson, it is not necessarily true that for every market imperfection, there is an optimal intervention by government authorities; in certain circumstances, especially political, he warns that it may be better not to attempt to correct the initial market imperfection. At certain points, he goes against early Keynesianism, for example in rejecting central planning due to its inevitable authoritarian component and the huge sacrifice it imposes on the population (Cue, 2003, p. 317–320). However, even Keynes (1993/1936, p. 100) commented that the discretionary use of public resources can affect the economy of a State over the long term; he noted that each time balance is achieved in the present —by increasing investment— it exacerbates the difficulty of ensuring the balance in the future.

It is noteworthy that it is not only this perspective that says that the free market may require a guide; this idea is also recognized and accepted by the neoclassical current to the point that Alfred Marshall, a key member of this group and one of the predecessors of welfare economics (he was once a teacher of Keynes), visualized how public spending and aggregate demand emerge cyclically, accompanied by the narrative of the welfare state (Reisman, 2011, p. 14).

In his analysis of the Neo–Keynesians postulates, Cue (2003, p. 321) notes that Samuelson agrees in considering the possibility that the optimal solution reached to minimize stability may not be acceptable from the perspective of citizens' preferences. In other words, the optimum solution in the allocation of resources may be a solution in which the income generated will be distributed in an extraordinarily unequal manner. To minimize the social perception and contain its concern with regard to using the reserves in favor of private stakeholders, the new Keynesianism of Samuelson opts for a balanced position that is capable of recognizing and responding to the formation of a mixed economy —a third way between statism and liberalism—.

This eclectic position considers that it is possible to establish social welfare measures without strictly limiting the free market. It seeks a balance based on incremental reforms and the use of public resources in countercyclical sectors, aspects that are used as methods to avoid social, economic and political cataclysm. Through the progressive regulatory intervention of the State and the expansion of resources in social welfare programs (primarily in healthcare and education), the most destructive inequalities are attenuated with regard to the distribution of income and employment.

At this point, it is important is to highlight that both Samuelson and Keynes consider the government regulation of capitalist activity, with each economist, of course, presenting his root concerns. However, they also show their distrust of the fact that liberal capitalism promotes the reduction to a minimum of the role played by government economic activity in the economy and, in general, in the lives of its citizens as well.

While under the full economic liberalism of the 1990s, Krugman and Obstfeld (1995, p. 550–552), critics of Keynesianism, noted how the apparent lack of full employment can be deceptively manipulated. Among the problems they noted was the fact that increased public spending can become a public deficit, a debt that sooner or later must be compensated by a new change in fiscal policy. They refuted the possibility that in the long term, the government can be more efficient and produce better results than private market initiatives.

Five years later, in his book Economics of the Public Sector, Stiglitz (2000) noted that State intervention is justified for market failures that include the loss of working conditions and guarantees in the stock market. However, he agreed with Samuelson and Nordhaus (2010/1948) that the powers of the State, in addition to those of the market, also suffer from problems or faults, especially taking into account that its actions serve to benefit certain powerful economic groups and/or because it cannot control or anticipate macroeconomic reactions promoted by the private sector.

Prior to the interventions of the federal government that occurred in 2008 and 2009, the debate was gaining strength. Stiglitz (2007) warned that the world was on the brink of the abyss. He questioned deregulation of the markets, saturated with incorrect incentives, at any cost, without any control whatsoever, leading to an unfair distribution of wealth.

By 2008, a hypothesis made in light of the onerous public spending allocated to rescuing the private investment banks —endorsed by the ad hoc passage of the Emergency Economic Stabilization Act of 2008 and the increase in public spending approved under the American Recovery and Reinvestment Act of 2009— suggested that the rapid expansion of capital in the previous 4 years had cumulatively led to an increase in deficit funds to such a large scale that an enormous volume of completely new investments was required to absorb these financial reserves.

The speculative bubble of the real estate sector caused by the large financial firms formed part of the drain on federal reserves. This formation is why the orthodox neoliberal business position, which advocates for 0 market interventions by governments, could be viewed as more rhetoric than reality. The large amount of public funds accumulated was hungered for.

Robert Lucas —known as one of the authors of the theory of rational expectations— was against the government maneuver. He noted that in the 2008–2011 period, the U.S. government had intervened so much in the economy that it was weakening the ability of the main global economic power to grow. He argued that the resolute intervention of the State would result in a prolonged GDP stagnation (Rodríguez, 2011). Stiglitz (2012) also noted that even with the financial system restored, the U.S. federal government would still need to reduce the national unemployment rate. To do so, it would have to create the conditions necessary to stimulate sustained growth in production and begin to reduce the burden on the public sector in terms of jobs.

Evidently, the debate remains in progress with respect to who is responsible for creating jobs or, moreover, who is responsible for stabilizing the economy. However, it is clear that the overall assessment points to public intervention. Presently, there is a worldwide wealth of empirical knowledge related to the existence of a "quiet revolution" favoring active economic policies of a Keynesian nature (Calderón, 2011, p. 275).

In sum, the shift from the classical model of growth is reflected in Hidalgo County; an example of this phenomenon includes counter–cyclical counterweights based on the increased number of jobs in the field of public administration (federal, state and local) and the increase in public expenditures on education and healthcare. The local competitive component is consistent with intervention by the federal government during a recessionary phase.

Conclusions

One aspect that characterized the U.S. economic cycle in its recessionary phase in the 2007–2011 period was the intervention of the State. The phase represented the implementation of Keynesian–style economic policies to counteract the adverse impact created by from the free force of the market. The most obvious examples were the public spending approved to rescue banks and financial firms from bankruptcy through the ad hoc issue of the Emergency Economic Stabilization Act of 2008 and the increase in public spending approved under the American Recovery and Reinvestment Act of 2009 (ARRA). There were signs of State intervention in Hidalgo County.

Within the period under study, when total national employment showed a negative rate of –4.4%, Hidalgo revealed a positive balance on the order of 5.2%, which is equivalent to the addition of slightly more than 11 000 jobs. Here, the large counter–cyclical sectors were those related to services, especially education and healthcare (22.9% growth), followed by public administration (7.3% growth). In these sectors, the addition of jobs was demonstrated, as was the substantial increase in government spending aimed at these sectors.

The results serve to demonstrate the shift of the free force of the market toward the intervention of the State to stabilize the system during times of recession. Moreover, they serve to clarify the basis of the local competitive component. It should be noted that trade, transportation and utilities were resilient but without real growth.

With regard to fragile local sectors during a recessionary phase, there is sufficient evidence to determine that those most exposed to the national trend were construction and manufacturing. In this county, both sectors contracted to a greater extent than the national rates, revealing their procyclical condition.

Regarding the implementation of the shift–share technique, it is concluded that it is suitable for the general behavior of employment by sector in this administrative region. It is recommended to continue with this sectoral–regional measurement scale but doing so by applying it during a recovery phase within the economic cycle. A contraction would be expected in the number of jobs in the public administration sector because sectors such as trade and construction would grow due to the recovery of the national component.

References

Aguilar, I. (2007). Frontera norte de México: Agenda de desarrollo e integración económica. Reflexiones sobre el Noreste de México–Texas. Revista Mexicana de Política Exterior, (81), 125–155. Recuperado de http://www.sre.gob.mx/revistadigital/index.php/numero–81 [ Links ]

Álvarez, S. (2010). The Acquisition of Wachovia Corporation by Wells Fargo & Company. Estados Unidos: General Counsel, Board of Governors of the Federal Reserve System before the Financial Crisis Inquiry Commission. Recuperado de http://www.federalreserve.gov/newsevents/testimony/alvarez 20100901a.pdf [ Links ]

Arcelus, F. J. (1984). An extension of shift–share analysis. Growth and Change, 15(1), 3–8. [ Links ]

Azul, R. (18 de Julio de 2008). Failed IndyMac Bank under investigation for lending fraud. Recuperado de World Socialist Web Site http://www.wsws.org/en/articles/2008/07/indy–j18.html [ Links ]

Bartels, C., William, N. y Duijn, J.J. van (1982). Estimating the impact of regional policy: A review of applied research methods. Regional Science and Urban Economics, 12(1), 3–41. [ Links ]

Basar, S. y Ahuja, V. (15 de noviembre de 2007). Bear downgraded in face of first loss in 83 years. Financial News. Recuperado de http://www.efinancialnews.com/story/2007–11–15/bear–downgraded–in–face–of–first–loss–in–83–years [ Links ]

Calderón, C. (2011). The Return to Keynes de B. W. Bateman, T. Hirai y M. C. Marcuzzo (Eds.) [Reseña]. Frontera Norte, 46(2), 275–279. [ Links ]

Casler, S. (1989). A Theoretical Context for Shift and Share. Regional Studies, 23(1), 43–48. [ Links ]

Chávez, J. A. (2007). Espacios preferenciales en la frontera de Tamaulipas: Nuevo Laredo, Reynosa y Matamoros (Tesis doctoral). Universidad Nacional Autónoma de México. [ Links ]

Corrales, S. (2012). Comercio al menudeo y cruces fronterizos: México–EUA. Análisis Económico, 65(2), 123–150. [ Links ]

County of Hidalgo. (2011). Annual financial reports. Statistical Section. Recuperado de http://www.co.hidalgo.tx.us/index.aspx?NID=448 [ Links ]

Cue, A. (2003). Samuelson y la enseñanza de la teoría económica. Análisis Económico, 38(2), 297–324. [ Links ]

Devcic, J. (30 de octubre de 2008). Too Good To Be True: The Fall Of IndyMac. Investopedia. Recuperado de http://www.investopedia.com/articles/economics/09/fall–of–indymac.asp [ Links ]

Dunn, E. (1960). A statistical and analytical technique for regional analysis. Papers of the Regional Science Association International, 6(1), 97–112. [ Links ]

Empty pockets, Washington Mutual Inc., Top 10 Bankruptcies. (2008). Time. Recuperado de http://content.time.com/time/specials/packages/article/0,28804, 1841334_1841431_1902071,00.html [ Links ]

Federal Reserve Bank of St. Louis. (2013). Unemployment Rate in Hidalgo County, TX, (TXHIDA5URN). Recuperado del sitio de Internet de Federal Reserve Bank of Sr. Louis: http://research.stlouisfed.org/fred2/series/TXHIDA5URN [ Links ]

García, R. y Trujeque, J. A. (Coords.). (2009). El noreste de México y Texas: Asimetrías y convergencias territoriales en las relaciones transfronterizas. México: El Colegio de la Frontera Norte, Miguel Ángel Porrúa. [ Links ]

Gawande, A. (2009). The cost conundrum: What a Texas town can teach us about health care. Recuperado de http://www.newyorker.com/reporting/2009/06/01/090601fa_fact_gawande?currentPage=all [ Links ]

Gethard, G. (17 de octubre de 2008). Falling giant: A case study of AIG. Investopedia. Recuperado de http://www.investopedia.com/articles/economics/09/american–investment–group–aig–bailout.asp [ Links ]

Ghosh, J. (2007). Macroeconomía y políticas de crecimiento. Nueva Delhi, India: Universidad Jawaharlal Nehru, Organización de las Naciones Unidas. [ Links ]

Hendricks, D. (14 de marzo de 2011). Hidalgo County ranked No. 1 nationwide for metro–area job growth. The Monitor. Recuperado de http://www.themonitor.com/news/local/hidalgo–county–ranked–no–nationwide–for–metro–area–job–growth/article_d9bc19a1–f21b–5344–aec4–914aaa8f9ea1.html?mode=jqm [ Links ]

Herszenhorn, D. M. (20 de septiembre de 2008). Administration is seeking $700 Billion for Wall Street. The New York Times. Recuperado de http://www.nytimes.com/2008/09/21/business/21cong.html?pagewanted=all&_r=0 [ Links ]

Instituto Nacional de Geografía e Informática. (2014). Banco de Información Económica. Estadística Mensual del Programa de la Industria Manufacturera, Maquiladora y de Servicios de Exportación. Recuperado de http://www.inegi.org.mx/sistemas/bie/?idserpadre=10400110#D10400110 [ Links ]

Keoun, B. (22 de agosto de 2011). Morgan Stanley at Brink of Collapse Got $107 Billion From Fed. BloombergBusines. Recuperado de http://www.bloomberg.com/news/articles/2011–08–22/morgan–stanley–at–brink–of–collapse–got–107b–from–fed [ Links ]

Keynes, J. M. (1993). Teoría general de la ocupación, el interés y el dinero (Trad. Fondo de Cultura Económica). Barcelona: Planeta–De Agostini. [ Links ]

Kriesel, W. (2014). Shift–Share Analysis of Regional Employment. Recuperado del sitio de Internet de The University of Georgia: http://www.georgiastats.uga.edu/sshare1.html [ Links ]

Krugman, P. R. y Obstfeld, M. (1995). Economía internacional. Teoría y política. Aravaca, Madrid: McGraw–Hill, Interamericana. [ Links ]

Mar, G. (1 de enero de 2008). La crisis hipotecaria sumerge a Citigroup en el peor trimestre de su historia. Economía Hoy. Recuperado de http://www.economiahoy.mx/empresas–finanzas/noticias/345581/01/08/La–crisis–hipotecaria–sumerge–a–Citigroup–en–el–peor–trimestre–de–su–historia.html#Kku8UMkEWds5OvKk [ Links ]

Mayor, M., López, A. J. y Pérez, R. (2005). Escenarios de empleo regional. Una propuesta basada en análisis shift–share. Estudios de Economía Aplicada, 23(3), 863–887. Recuperado de http://www.redalyc.org/articulo.oa?id=30123316 [ Links ]

Organización Mundial de la Salud. (OMS). (2014). Data Explorer. NHA Indicators. Recuperado de http://apps.who.int/nha/database/ViewData/Indicators/en [ Links ]

Palomares, H. (2009). Áreas de urbanización bilateral adyacente México–Estados Unidos. Hacia una reorientación y cambio en su naturaleza. En M. Ceballos (Ed.), Fenómenos sociales y urbanos transfronterizos entre México y Estados Unidos (pp. 83–125). Tijuana: El Colegio de la Frontera Norte, Dirección General Regional Noreste. [ Links ]

Pérez, J. A., Ceballos, G. I. y Cogco A. R. (2014). Los factores que explican la mayor aglomeración de la industria de alta tecnología en la frontera norte de México: el caso de Matamoros y Reynosa. Estudios Fronterizos, 29(1), 173–206. [ Links ]

PricewaterhouseCoopers. (2009). Lehman Brothers Bankruptcy: Lessons learned for the survivors. Informational presentation for our clients August 2009. USA: Financial Services Institute. Recuperado de http://www.pwc.com/en_JG/jg/events/Lessons–learned–for–the–survivors.pdf [ Links ]

Reisman, D. (2011). Alfred Marshall's Mission. New York: Routledge. [ Links ]

Rodríguez, M. (5 de junio de 2011). Robert Lucas: avanza el estado benefactor en EEUU y hay peligro de que se perpetúe su bajo crecimiento. La Tercera. Recuperado de http://papeldigital.info/negocios/2011/06/05/01/paginas/020.pdf [ Links ]

Sahadi, J. (4 de octubre de 2008). Bailout is law. President Bush signs historic $700 billion plan aimed at stemming credit crisis. Recuperado del sitio de Internet de Cable Netws Network. Turner Broadcasting System, Inc.: http://money.cnn.com/2008/10/03/news/economy/house_friday_bailout/ [ Links ]

Samuelson, P. A. (26 de octubre de 2008). Adiós al capitalismo de Friedman y Hayek. El país. Recuperado de http://elpais.com/diario/2008/10/26/negocio/1225026869_850215.html [ Links ]

Samuelson, P. A. y Nordhaus, W. D. (2010). Economics (19a ed.). Estados Unidos: McGraw–Hill Education. [ Links ]

Shields, M. (2003). Using employment data. Shift–Share Analysis. Helps Identify Local Growth Engines. Pennsylvania: College of Agricultural Sciences, The Pennsylvania State University. [ Links ]

Stevens, B. y Moore, C. (1980). A critical review of the literature on shift–share as a forecasting technique. Journal of Regional Science, 20(4), 419–437. [ Links ]

Stiglitz, J. (2000). La economía del sector público (4a ed.). Barcelona: Antoni Bosh Editor. [ Links ]

Stiglitz, J. (9 de octubre de 2007). Houses of cards. The Guardian. Recuperado de http://www.theguardian.com/commentisfree/2007/oct/09/housesofcards [ Links ]

Stiglitz, J. (12 de marzo de 2012). The US labour market is still a shambles. The Financial Times Ltd. Recuperado de http://www.ft.com/intl/cms/s/0/22e87a10–6c34–11e1–8c9d–00144feab49a.html#axzz3c26mMvlX [ Links ]

U.S. Department of the Treasury. (2008). Troubled Asset Relief Program: 5 year update 2008–2013, Financial Stability. Recuperado de http://www.treasury.gov/initiatives/financial–stability/about–tarp/Pages/default.aspx [ Links ]

U.S. Government Printing Office. (2008). Emergency Economic Stabilization Act of 2008. 110th Congress, Public Law 110–343. Recuperado de http://www.gpo.gov/fdsys/pkg/PLAW–110publ343/html/PLAW–110publ343.htm [ Links ]

U.S. Government Printing Office. (2009). American Recovery and Reinvestment Act of 2009. 111th Congress, Public Law 111–5. Recuperado de http://www.gpo.gov/fdsys/pkg/PLAW–111publ5/html/PLAW–111publ5.htm [ Links ]

U.S. Securities and Exchange Commission. (2007). Citigroup Inc., Form 8–K Current Report. Recuperado de http://edgar.secdatabase.com/1759/110465907027668/filing–main.htm [ Links ]

United States Census Bureau. (2013). State & County QuickFacts. Recuperado de http://quickfacts.census.gov/qfd/states/48/48215.html [ Links ]

U.S. Bureau of Labor Statistics. (2002). NAICS Supersectors for CES Program. Recuperado de http://www.bls.gov/sae/saesuper.htm [ Links ]

U.S. Bureau of Labor Statistics. (2014). Quarterly Census of Employment and Wages. QCEW NAICS–Based Data Files. Recuperado de http://www.bls.gov/cew/datatoc.htm [ Links ]

USAspending.gov. (2015). Spending map. Recuperado de https://www.usaspending.gov/transparency/Pages/SpendingMap.aspx [ Links ]

Vásquez, B. I., Jurado, M. A. y Castro, J. L. (Coords.). (2011). Procesos económicos, laborales y urbanos en la frontera noreste en el contexto de la apertura económica. México: El Colegio de la Frontera Norte, Universidad Autónoma de Chihuahua. [ Links ]

Vera, R. (2015). Comportamiento sectorial del empleo en el condado de Cameron, Texas: 2007–2011. Frontera Norte, 53(1), 147–176. [ Links ]

Webel, B. (2013). Troubled Asset Relief Program (TARP): Implementation and Status (Informe no. R41427). Recuperado del sitio de Internet de Congressional Research Service: http://fas.org/sgp/crs/misc/R41427.pdf [ Links ]

Footnotes

1 It is noteworthy that this paper is part of a larger study that includes the municipality of Reynosa, Tamaulipas. It is based on the premise that economic interdependence is asymmetric on the border; that is, the appearance of stability in a U.S. county does not mean that its Mexican counterpart will be in the same state. What is certain is that both territories comprise a region where 1.4 million inhabitants live.

2 In Mexico, it is known as the Río Bravo.

3 According to Mayor, López and Pérez (2005), Dunn (1960) is attributed with developing the shift–share technique as a method for determining the components that explain the variations in economic magnitudes, focusing initially on employment. For Dunn, the essential contribution of this technique is based on its contribution to quantifying economic developments in a fixed time and space.

4 The sectors correspond to those established in the North American Industry Classification System (NAICS) Supersectors for the CES Program (U.S. Bureau of Labor Statistics, 2002).

5 The demise of Lehman Brothers simultaneously represents the most significant bankruptcy in the U.S. since 1990, when the banking firm Drexel Burnham Lambert, a specialist in investment bonds, also filed for bankruptcy.

6 A federal public law approved February 17, 2009, by the 111th Congress of the United States of America.

7 The depreciation reserves exposed by Keynes are an example of institutional hoarding. They are a monetary accumulation fund that instead of being spent, is used to pay a debt in the future. The fact that it is not available for investing leads to an increase in interest rates.

text in

text in