1. INTRODUCTION: A RIGGED DEBATE

2019 marks the 25th anniversary of Mexico’s shift toward increased central bank independence. It is also the 20th anniversary of the founding of the European Central Bank (ECB), which is the most independent central bank in the world. Those anniversaries are part of a wave that reflects the triumph of the idea of central bank independence.

The idea of central bank independence was developed by economists and is now hegemonic. It has been implemented by central banks from the Arctic to the antipodes. It is supported by both conservative and social democratic politicians, as evidenced by the fact that the Bank of England’s shift to independence in 1997 was authorized by a Labor government. It is also absolutely dominant within mainstream economics, being wholly supported by both “saltwater (MIT)” and “freshwater (Chicago)” economists who define the spectrum of permissible thought. Its hegemony is illustrated in a Wall Street Journal op-ed (August 5, 2019) by former Federal Reserve Chairpersons Volcker, Greenspan, Bernanke, and Yellen defending the virtues of central bank independence.2 Between them, they span the contemporary spectrum of both establishment politics and economics.3

Central bank independence is an important public policy issue. In the wake of the 2008 financial crisis, there has been growing public concern about independence owing to massive discretionary unconventional central bank interventions that have significant distributional and fiscal implications. However, the hegemony of independence has resulted in a rigged debate. The overwhelming support of the economics establishment determines the stance of the establishment media. And when central banks discuss the issue, they inevitably turn to central bank insiders and the same establishment economists. The result is a drowning of critics who are dismissed as “populists” and “non-adults”.4

The case for central bank independence is built on an intellectual two-step. Step one is to argue there is a problem of inflation prone government. Step two is to argue independence is the solution to that problem. This paper challenges that case and shows it is based on false politics and economics.

Specifically, the paper argues central bank independence is a product of neoliberal economics and aims to advance and institutionalize neoliberal interests. As regards economics, independence rests on a controversial construction of macroeconomics and also fails according to its own microeconomic logic. That failure applies to both goal independence and operational independence. It is a myth to think a government can set goals for the central bank and then leave it to the bank to impartially and neutrally operationalize those goals.

The proliferation of central bank independence reflects the triumph of neoliberalism. Obviously, it alone is not responsible for the subsequent dysfunctions of the neoliberal economy (e.g. increased income inequality, proclivity to stagnation, and proclivity to financial instability), which are the product of the policy matrix that constitutes neoliberalism (Palley, 2012, Chapter 9). That said, independence is an important policy issue, which has become more important owing to policy developments since the crisis of 2008. However, the impulse to independence has become increasingly obscured as central banks have backtracked in the face of deflationary stagnation. That backtracking hides the original intent, which was to institutionalize monetary handcuffs, making it harder to make the case for reversing independence.

Lastly, the paper shows how economists are deeply implicated by the debate over independence. It is a grave misrepresentation to claim independence solves a fundamental public interest economic problem, and economists make themselves accomplices by claiming it does.

2. THE GLOBAL SHIFT TO CENTRAL BANK INDEPENDENCE

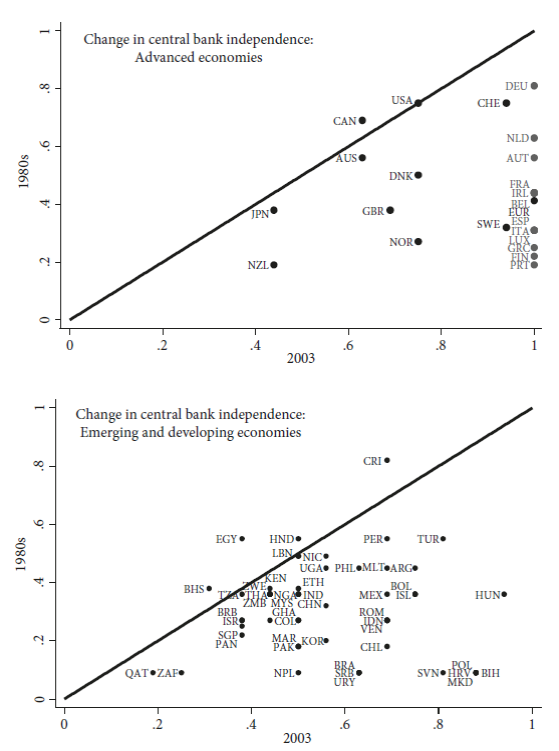

The 1980s and 1990s was a period of significant increase in the extent of central bank independence. That is captured in Figure 1 which shows the change in central bank independence in advanced and emerging economies from the 1980s compared to 2003. The 45o line marks unchanged independence. Countries situated below that line had an increase in independence, while countries situated above it had a decrease. The two graphs show a significant increase in central bank independence in both advanced economies and emerging and developing economies.

Source: Balls, Howat, and Stansbury (2018, p. 14) based on Cukierman (2008). The measure of central bank independence in the 1980s is constructed by Grilli, Masciandaro, and Tabellini (1991). The update 2003 measure of independence is from Arnone et al. (2009).

Figure 1 Change in central bank independence, 1980s-2003. Full dependence = 0, full independence = 1

In the upper figure for advanced economies only Canada moved against the trend. In the United States (US), the status of the Federal Reserve was unchanged, but it was already significantly independent with an index score of almost 0.8. The creation of the euro shifted all the central banks of euro zone countries to a position of more independence.

The lower figure shows the shift to central bank independence in emerging and developing economies. As regards the Banco de México, it became significantly more independent, with its independence score increasing from just under 0.4 to just under 0.7. By way of historical curiosity, New Zealand plays an especially important role in the recent history of central bank independence. The 1989 Reserve Bank of New Zealand Act, which established the legal framework whereby the central bank would deliver on policy targets agreed with the New Zealand Treasury, can be viewed as giving the green flag for the global shift to central bank independence.

3. AN IDEA OF NEOLIBERAL ECONOMISTS IN ADVANCED ECONOMIES

Figure 1 contains four important insights. First, the shift to increased independence was a global one. It swept across advanced, emerging, and developing economies, affecting a wide and varied swathe of countries.

Second, the shift occurred in the late 1980s and 1990s, a period which witnessed the cementing of neoliberal political and economic hegemony. Central bank independence is a neoliberal policy proposal and its justification is rooted in new classical macroeconomics which girds neoliberal macroeconomic policy. That should be an orange flag as neoliberalism has not performed well, as evidenced by the financial crisis of 2008 and the current era of stagnation. That poor performance is especially clear regarding the euro and the European Central Bank which was a greenfield project guided by new classical macroeconomic thinking. The result was a central bank designed to operate as a quasi-gold standard (Palley, 2010; 2017), with calamitous consequences for the euro zone. Forder (2001) suggests that the flawed construction of the European Monetary Union was significantly and specifically attributable to misunderstandings regarding the nature and benefits of central bank independence.

Third, the idea of central bank independence is an economist’s idea, and not one businessmen came up with. Its policy triumph shows the importance of economists in public policy and in shaping the economy. The claim that economists’ ideas are important for policy and politics is sometimes dismissively brushed aside on grounds that economics follows the lead of politics. Undoubtedly, politics plays a big role in opening the door for ideas, but the experiment with independent central banks clearly shows that economists supply the ideas when the door is opened. Additionally, as Milton Friedman showed, economists may also put their shoulder to the wheel and help create the big opening via their role as public intellectuals and advocates of grand economic theories.

Fourth, the extensive shift to central bank independence in emerging economies shows the powerful influence of advanced economy policy thinking over those economies. Central bank independence is an idea of economists in advanced economies and it was exported to emerging economies via such channels as elite universities, central bank policy forums, and the International Monetary Fund (IMF) [about which more below].

4. THE MEANING OF CENTRAL BANK INDEPENDENCE

A problem with discussion of central bank independence is that there has been a proliferation of meanings. The Wikipedia page on central banks identifies six forms of independence: institutional independence, goal independence, functional and operational independence, personal independence, financial independence, and legal independence. The economics literature focuses on goal and operational independence. However, those categories are overlapping because central banks have leeway in operationalizing their goals. For instance, the Federal Reserve is mandated with a goal of “price stability”, but the definition of price stability is left to it. That implies a lot discretion. Is price stability zero percent inflation? Two percent inflation? Or even three percent inflation?

That suggests distinguishing between “hard” and “soft” goals. Hard goals pin down the central bank’s target as an exact number, whereas soft goals give the central bank freedom to define its target. A soft goal grants more power and independence to the central bank in that the bank gets to decide the specific target. The formal theoretical literature, constructed on models, seems to have in mind a hard goal but the real world has both. That said, as shown below, hard goals, soft goals, and operational independence are all problematic since the underlying justification for independence rests on false politics and economics.

5. THE QUESTIONABLE ECONOMICS OF CENTRAL BANK INDEPENDENCE

The economic rationale for central bank independence derives from the Chicago School approach to political economy which emphasizes the concept of government failure. The Chicago argument is that government attempts to use policy to improve economic outcomes often fail because of either incompetence or self-interest on the part of politicians and bureaucrats. Government failure is then invoked to argue against government activism and in favor of neoliberal minimalist government. The argument for central bank independence draws on a similar line of reasoning, which is why independence is popular with neoliberals.

5.1. Economic models justifying central bank independence

As regards central bank independence, the fundamental claim is politicians engage in opportunistic inflationary monetary policy that imposes economic costs on society. An example of such opportunism is attempts to boost the economy prior to elections to improve electoral prospects.

That idea was formalized by Nordhaus (1975) in a model which generates a political business cycle. The logic of the model is as follows. The economy has a Keynesian Phillips curve so that policy can generate booms at the cost of higher inflation.5 Agents also have short-term amnesiac memories and forget about more distant economic outcomes. Consequently, politicians can spur the economy prior to an election, causing a temporary boom which voters like. After the election, politicians then cause a recession which agents quickly forget owing to their amnesia, wiping the slate clean and setting the stage for another pre-election boom prior to the next election. The economy cycles around the politically chosen unemployment rate owing to political forces, but that is sub-optimal as economic volatility reduces economic well-being. An independent central bank which prevents that pattern would therefore be welfare enhancing.6

Ironically, though making a potential case for an independent central bank, Nordhaus’ model was rejected by new classical macroeconomics (ncm) because it used non-rational expectations. Instead, Barro and Gordon (1983) provided an alternative justification with rational expectations. In their model, policymakers are represented as liking positive output shocks which push the economy below the natural rate of unemployment, giving them an incentive to impose surprise money shocks on the economy. The public recognizes that incentive and incorporates it into its inflation expectations. The result is an equilibrium at the natural rate of unemployment, but with a higher rate of inflation which is sub-optimal. The cause of the problem is policymakers’ desire to try and exploit surprise inflation. That leads to the recommendation of an independent central bank which, it is claimed, can eliminate that problem and thereby make society better-off.

5.2. Critique of the microeconomics behind independence

The above economic model provides the theoretical rationale for central bank independence, but it is subject to significant critique. The problem identified by the Barro and Gordon (1983) model rests on time inconsistency, whereby policymakers refuse or are unable to bind their hands and convince the public that they will not engage in surprise inflationary policy.

Central bank independence is supposed to solve that problem, but that is false. As detailed by Forder (2002), replacing a government policymaker with an independent central banker, who is picked by the government, leaves open the possibility the central banker will engage in time inconsistent policy. The independence argument collides with the fundamental problem of “who will guard the guardian?” Replacing one policymaker with another just kicks the can down the road, in the sense that the new policymaker faces exactly the same circumstances. For Forder (2002), the problematic of central bank independence connects with the theory of bureaucracy because problems of bureaucratic preferences and bureaucratic accountability repeatedly intrude (as discussed further in section 9) owing to the discretionary nature of monetary policy.

Imposing a hard target can bind the central bank, but the government must then act on failures to hit the target. Why would it if it is self-interested? If it does, that amounts to saying it is not selfish, which undermines the argument that independence is needed.7

The same argument can be used to deconstruct independence itself. Suppose independence is a solution to time inconsistency. Why would a selfish politician ever agree to independence in the first place? If they did, that would be tantamount to saying they are not selfish, in which case independence is not needed. In other words, only non-self-interested politicians choose independence, making independence redundant according to the logic of the Barro and Gordon (1983) model.

Rogoff (1985) has proposed the solution for the “guard the guardian” problem is to appoint a “conservative” central banker who dislikes inflation. That prevents inflation surprises, but it opens the door to deflation surprises which may be even worse in their impact (Palley, 1997). A conservative independent banker inevitably brings her own preferences, views, and prejudices to the policy table. In effect, the government will trade one bias for another.8

Furthermore, the era of stagnation has raised new time-inconsistency problems with the conservative central banker solution. According to conventional macroeconomics, one way to escape the zero lower bound nominal interest rate problem (ZLB) is to raise inflation expectations by promising higher future inflation. However, a conservative central banker will be reluctant to later deliver on that. The logical implication is that, when at the ZLB, one should appoint a reckless “populist” central banker who will deliver inflation later. However, the moment one escapes the ZLB one should fire that banker, so that the argument keeps recursively imploding on itself.9

And even if the banker is honest, there still remains the fundamental question of why would selfish politicians go against their own interests and appoint a conservative independent central banker? Doing so is tantamount to proving they are not selfish, in which case there is no need for an independent central bank.

Lastly, Forder (2000, p. 170) describes an even deeper critique of the microeconomics of independence based on rational voter behavior. The argument is simple. If voters dislike surprise inflation they will vote for politicians who are committed to low inflation and establish a reputation for delivering it. Moreover, since reputation is costly to acquire, politicians would have an interest in sticking with low inflation policies once they had acquired a good reputation (Backus and Drifill, 1985). Consequently, there is no political need for independence.

In sum, the above microeconomic arguments challenge the coherence of the independence doctrine. First, independence is not a solution to the self-interested policy maker problem. Second, the problem may be a concocted storm in a tea cup. That suggests something else is going on with the shift to central bank independence. By definition, selfish politicians cannot be authorizing it out of public interest. Instead, they are doing so out of self-interest, which is the clue to understanding the real reasons for the shift to central bank independence. As argued below, that implies central bank independence is not the socially benevolent phenomenon mainstream economists and central bankers claim it to be. Instead, somewhat obviously, it is a highly political development serving partisan interests.

5.3. Critique of the politics and macroeconomics behind independence

The above critiques concern the microeconomic consistency of justifications for independence. A second set of critiques concern assumptions about politics and the nature of the economy.

As regards politics, the Barro and Gordon (1983) model has a political structure that sets a self-interested government against a unified public. That reflects the Chicago school government failure perspective which tends to paint government as the enemy of the public. That is not the way real world politics is structured. Instead, government is a contested space and the public is divided, with the conventional division being between capital and labor.10

The absence of that division has enormous smuggled implications. It strips out the possibility that central bank independence is really part of political conflict and a means for capital to gain greater control over central banks. In effect, an entire way of understanding central bank independence is simply excluded by an unrealistic political assumption.

As regards the nature of the economy, the case for independence is constructed on the assumption of absence of a long-run negatively sloped Phillips curve and neutrality and super-neutrality of money. Those assumptions also serve to exclude politics. The reason why central banks are politically contested is they impact economic activity and growth, and political actors have different preferences regarding the level of economic activity (Palley, 1997; 2018a). In natural rate models there is nothing to argue over except inflation. However, in a Keynesian Phillips curve model labor’s bliss point is high employment, whereas capital prefers some slack to discipline labor and restrain the wage share. That conflict is excluded in natural rate models, but there is now growing evidence and reason for restoring the original negatively sloped long-run Phillips curve which was erroneously discarded following the economic turmoil of the 1970s (Eisner, 1997; Blanchard, 2018; Palley, 2018b).

6. AN ALTERNATIVE CLASS CONFLICT THEORY OF CENTRAL BANK INDEPENDENCE

Central bank independence involves politics. Mainstream economists implicitly interpret it through the political lens of the Chicago School which pits a self-interested opportunistic government against a unified public interest. In the Chicago framework independence is a way of increasing public well-being if it succeeds in restraining government’s proclivity to higher inflation.

Contrasting with that, this section argues central bank independence in high-income economies should be understood in terms of class conflict, with independence being a neoliberal policy innovation aimed at advancing neoliberal political and economic interests. In the proposed class conflict theory, independence advances neoliberal interests (i.e. industrial and financial capital) at the expense of others (i.e. labor).11

That raises the question of how and why does capital benefit from central bank independence? The fundamental economic argument is capital prefers the economy to operate lower down the Phillips curve than does labor, and central bank independence helps obtain capital’s preferred outcome. That preference for more economic slack is especially pronounced for financial capital owing to creditors’ dislike of inflation.

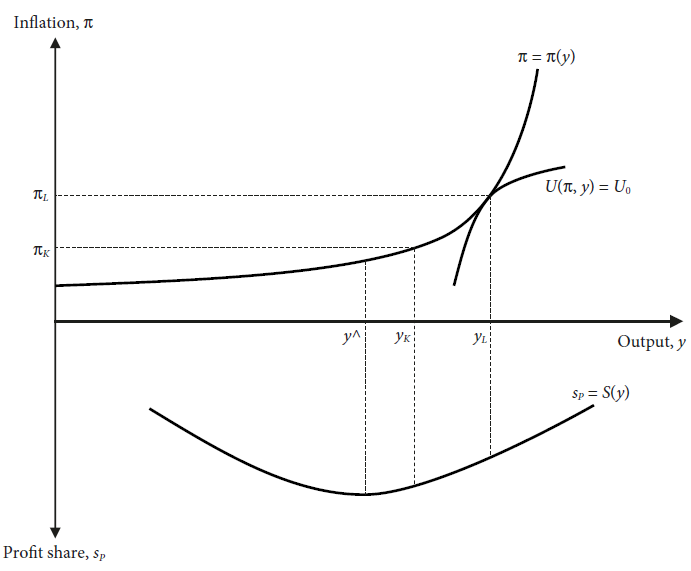

The logic of that argument is illustrated in the following simple stylized model (Palley, 1997; 2018a) describing the Phillips curve, the wage share, and labor’s and capital’s behaviors. The economy consists of two equations determining inflation and the wage share given by:

π = π(y) π y > 0 π yy > 0 [1]

s P = S(y) S y > < 0 if y < > y ^ [2]

π = inflation, y = output, s P = profit share. Equation [1] is the long-run Phillips curve in which inflation is a positive function of the output. As output rises (i.e. the output gap shrinks), inflation rises. Equation [2] determines the profit share which is a concave function of the output gap, with the profit share peaking when the output is y ^. Empirical evidence for the US profit share being concave is provided by Nikiforos and Foley (2012).

Capital values profits which are given by:

P = s P y [3]

P = profits. Capital’s macroeconomic bliss point is obtained by maximizing profits with respect to output which yields the following first-order condition:

dP/dy = [s P + ys py ]/y = 0

That implies profit is maximized by choosing the level of output at which the elasticity of the profit share function with respect to output is unity (E sP,y = 1).

Labor has a standard utility function that is positively impacted by output, which raises employment, and negatively impacted by inflation. The utility function is given by:

U = U(π, y) U π < 0, U ππ < 0, U y > 0, U yy < 0, U πy > 0 [4]

Labor’s macroeconomic bliss point is obtained by maximizing labor’s utility function subject to the constraint of the Phillips curve, which yields the condition:

dU/dy = [U ππ y + U y ]/y = 0

That implies labor’s utility is maximized by choosing the level of output at which labor’s indifference curve is tangent to the Phillips curve (-U y /U π = πy). Henceforth, it is assumed that labor’s bliss point output level is higher than that of capital (i.e. labor prefers a lower output gap). That is likely to the extent that labor derives significant utility from extra employment and modestly rising disutility from additional inflation.

The model is illustrated in Figure 2. y ^ corresponds to the level of output that maximizes the profit share. y K corresponds to the level of output that maximizes profits, and y L corresponds to the level of output that maximizes labor’s utility. Correspondingly, labor’s associated bliss inflation rate (π L ) is higher than capital’s bliss inflation rate (π K ).

In this framework central bank independence boils down to a conflict over macroeconomic policy and the determination of the inflation target and associated rate of unemployment. Two important things immediately follow from that characterization.

First, there is no such thing as optimal policy as usually defined by economists. Instead, there is optimal policy from a particular point of view, with capital and labor espousing different optimal policies. Second, debate about central bank independence is not about the efficiency benefits of independence for monetary policy. It is about control of monetary policy.

The above framing regarding capital’s preference for lower inflation is consistent with Posen’s (1995) argument that inflation is lower in countries with independent central banks because they have a lower political appetite for inflation. That lower appetite also drives central bank independence, making it look as if independence is what lowers inflation when, in fact, the real cause is political appetite. Central banks can lower inflation (even if they cannot necessarily raise it). Paul Volcker proved it. Independent central banks are more strongly inflation averse and go after inflation harder. Hence, the negative relation between independence and inflation. The relation is not because they are better and more efficient at monetary policy. They just go after inflation harder.

Arguing about whether independence is the cause of lower inflation loses the intellectual scent of the trail and erroneously shifts the debate to efficiency. The real issues are why do independent banks go after inflation harder, and what is the role of independence?

The reason they go after inflation harder is they are aligned with capital. That is because capital is politically in charge and sets the goals for central banks. It is also because central bankers and their economic advisers have bought into the Chicago School monetary policy framework which implicitly sides with capital (i.e. views the problem as being inflation prone government). That explains why there is central bank independence, but it still leaves open the question of the functional role of independence, which is addressed later.

7. REINTERPRETING THE EMPIRICAL EVIDENCE

Before turning to the details regarding the functional role of independence, a brief foray into the empirics of inflation and independence is warranted. Here, there is a firmly established and accepted empirical finding of a statistically significant negative relation between inflation and bank independence. Early highly influential papers reporting that relation was provided by Alesina (1988) and Grilli, Masciandaro, and Tabellini (1991), and it is viewed as confirming the mainstream claim regarding the benefits of independence.12 However, it is important to recognize that the finding is also fully consistent with the class conflict model of independence developed in the previous section. That model predicts inflation will be lower if capital gains control and make the central bank independent.

7.1. The empirical evidence from advanced economies

Figure 3, drawn from Balls, Howat, and Stansbury (2018), provides empirical evidence on the relation between independence and inflation in advanced economies. The upper panel shows the relation in the 1980s which is clearly negative. The 1980s were a period of neoliberal policy takeover, which initiated a sustained disinflation. That disinflation was launched by Paul Volcker’s Federal Reserve in 1979. Those countries in which the political shift to neoliberalism was stronger (like the US) tended to have independent central banks which pushed harder for disinflation. Ergo, the negative relation between inflation and independence. However, the cause was political alignment, not independence.

Source: Balls, Howat, and Stansbury (2018, p. 15).

Figure 3 Central bank independence and inflation in advanced economies in the 1980s and 2000-2008

The lower panel of Figure 3 shows the inflation -independence relation has disappeared in the 2000s. That challenges the mainstream argument that independence causes lower inflation, but it is not problematic for the class conflict theory of independence. Capital is interested in achieving its optimal inflation target, not in pushing inflation ever lower. Once inflation hits the target, capital holds that inflation rate regardless of independence. Figure 1 shows there was a generalized shift to increased independence as part of the wider neoliberal takeover of economic policy. Furthermore, central banking is a club in which bankers share a common perspective. Less independent banks have come on board for the same program and have also converged on the inflation target, thereby generating the data pattern in the lower panel of Figure 3.

7.2. The empirical evidence from emerging and developing economies

Balls, Howat, and Stansbury (2018, pp. 26-30 and pp. 77-78) also report on the relation between independence and inflation in emerging and developing economies, as classified by the IMF in 2003. They regress inflation against a vector of independent variables.13 For the full sample, there is no relationship between independence and inflation in the 1970s, 1980s, and 2000s. For just the 2000s, there is no relationship in emerging economies, but there is a negative relationship in developing economies. The main variables that mattered in the 1970s and 1980s were the degree of trade openness and the exchange rate regime. The variable that mattered in the 2000s was participation in an IMF program.

There are a number of striking features to the findings. First, central bank independence in emerging economies does not seem to matter for inflation, though there is weak evidence it may matter in developing economies. Second, participation in IMF programs is highly significant in explaining inflation. Third, as noted by Balls, Howat, and Stansbury (2018, p. 27) and shown in Figure 4, there is a strong correlation between increased operational independence and participating in an IMF program. Countries with IMF programs tend to lie below the 45-degree line and to the far right. That is fully consistent with the argument advanced earlier that independence is a neoliberal idea developed in advanced economies and exported globally, in part by the IMF. A bivariate regression of inflation on independence would yield a negative relation. However, the real driver is the IMF which imposes disinflation programs and simultaneously promotes the institution of central bank independence.

Source: Balls, Howat, and Stansbury (2018, p. 28).

Figure 4 Central bank operational independence over time in emerging and developing economies

Self-interest analysis then raises the question of why elites in emerging and developing economies accept this externally sponsored IMF change. There are a number of plausible reasons. First, the IMF helps elites in their domestic political contests by generously providing needed foreign exchange on favorable terms, and central bank independence is part of the quid pro quo. Additionally, IMF involvement creates a form of policy lock-in (Palley, 2017/18) as IMF loans are provided subject to conditions and creates official debt burdens that are difficult to shake. Elites are supportive of that since it locks-in a policy matrix they like. Second, independent central banks incline toward policies that benefit elites: namely higher interest rates, a stronger exchange rate, capital market openness, financial deregulation, and abandonment of financial repression. Those policies have direct wealth, income, and purchasing power benefits for emerging economy elites. Third, independence has now become the conventional wisdom advocated by economics technocrats, which makes it cognitively persuasive on its own terms. Additionally, it helps curry favor with international capital markets. In sum, elites in emerging and developing economies have multiple self-interested reasons for adopting central bank independence, some of which overlap with the rationale in high-income economies.

7.3. Putting the empirical evidence together

The above evidence is consistent with the notion that central bank independence originated in advanced economies as part of the neoliberal takeover and was then exported to the rest of the world. A goal of neoliberalism was lower inflation. Ergo, the initial negative relation between independence and inflation. However, independence no longer matters for inflation in advanced or emerging economies because the global economy is now dominated by neoliberal policy thinking, regardless of the degree of central bank independence. Ergo, the disappearance of the negative relation between independence and inflation.

Since independence no longer matters for inflation, does that mean it is a storm in a tea cup? The answer is unambiguously “No”. Independence is an important institutional development that assists in legitimizing and locking-in neoliberal policy, and it is also dangerously undemocratic. The challenge is to communicate that. Step 1 is to expose the false economic logic that has been used to justify independence. Step 2 is to propose an alternative explanation of what is driving support for independence. Step 3 is to expose the dangers of independence, which is what follows next.

8. HOW DOES CENTRAL BANK INDEPENDENCE HELP DELIVER CAPITAL’S GOAL?

The class conflict model explains capital’s goal. The next question is how does central bank independence help deliver capital’s goal? There are several mechanisms and they concern the political sociology of policy, which is glaringly absent in economic models and economists’ thinking.

First, central bank independence can be thought as a quasi-outsourcing of interest rate policy. A neoliberal (i.e. pro-capital) government would like that as it creates a degree of distance between the government and central bank. That facilitates a political shift away from prior policy commitments to full employment by creating a media optic and understandings that paints interest rate policy as a technical choice, rather than a political choice reflecting economic policy preferences. For instance, prior to the Bank of England being granted more independence, it was the Chancellor of the Exchequer who announced changes in the policy interest rate. That created an optic which directly tied the government to interest rate policy. Now, the Chancellor sets an annual inflation target, and the central bank announces interest rate policy and sends the Chancellor an annual letter explaining how it has done with regard to reaching the target. That institutional framework helps distance and insulate government from interest rate policy, and changes how monetary policy is reported in the media. In effect, it creates a form of political cordon sanitaire which gives more room to pursue pro-capital monetary policy.

Second, an independent central bank may facilitate institutional and cognitive capture by financial interests. An independent bank is likely to be easier to capture than one which is directly under and operationally answerable to the Treasury. In this regard, it is noteworthy that the era of increased independence has been one of financial deregulation and retreat from using regulatory and quantitative monetary policy. That change in policy mix likely reflects the cognitive and institutional capture of central banks, which has been causally facilitated by the independence doctrine.

In addition to changing the character of policy, capture via independence allows the resources of the central bank to be enlisted on the capturer’s side. Thus, central banks have a significant influence on the national policy conversation via their research efforts, their publication activities, and their public education efforts. Bank presidents and governors also have major media exposure and, as exemplified by former Federal Reserve Chairman Alan Greenspan, have used it to push a broad economic agenda.

Third, independence creates a form of focal point which financial markets can use to discipline monetary and financial policy. The notion of focal points was emphasized by Schelling (1960) in his game theoretic book, The Strategy of Conflict. Focal points provide a mechanism for decentralized coordination of action, and independence is a focus for financial interests. That is likely particularly true in emerging market economies where independence sends a signal of good housekeeping to capital markets, and deviations from or questioning of independence can be quickly punished.

Fourth, independence generates a form of policy lock-in that can help maintain a policy regime even when democratic elections produce change of government. The incoming government is dissuaded from tampering with independence for fear of upsetting financial markets. Consequently, the central bank’s existing personnel structure and ideological alignment remain significantly unchanged.

The above arguments resolve a fundamental problem in the mainstream explanation of independent central banks, which is why would a self-interested politician adopt an institutional form that restricts what that politician can do? The answer is self-interested neoliberal politicians like central bank independence because it rationalizes the neoliberal view of government as a problem, justifies the neoliberal construction of monetary policy, and helps lock-in a neoliberal policy perspective.

That explanation then raises a subsidiary question of why a social democratic politician (e.g. Labor Prime Minister Tony Blair in the United Kingdom) would also institute such a policy?14 The answer is cognitive capture. If social democrats come to believe and accept neoliberal thinking then they will be guided by its policy recommendations, which includes central bank independence.

The cognitive capture of social democrats by neoliberal economics can be viewed as one of the tragic hallmarks of the neoliberal era, during which political parties on both sides of the aisle have been guided by a common economic perspective (Palley, 2012, Chapter 3). It explains why social democrats have faithfully implemented neoliberal policies.

9. WHY INDEPENDENCE IS AN INAPPROPRIATE ORGANIZATIONAL FORM FOR CENTRAL BANKS

Previous sections have argued that the economic case for independence does not stack up, and independence is really a means for capital to capture central banks. That alone speaks against independence but, as illustrated in Figure 5, there are other organizational concerns which compound the flimsiness of the case for independence. Organizational concerns used to dominate the independence debate. One of the great tricks of the neoliberal era is how those concerns have been swapped out for a contrived concern with inflation.15

9.1. The work of central banks is intrinsically discretionary and political

The case for independence has been constructed on the basis of a new classical view of the macro economy plus a political economy that pits an inflation prone government against the general public. There is no inflation-unemployment trade-off, monetary policy has no impact on income distribution, there is no role for central banks regarding regulation and maintenance of financial stability, and no role for central banks regarding coordination with and financing of fiscal policy. All of those policy roles and effects are overlooked. Introducing them makes clear the extraordinary economic power and impact of central banks.

Most importantly, the design and implementation of central bank policies involves significant discretion and judgment. That links independence to the policy debate over “rules versus discretion”. Independence works best when central banks follow rules. However, there is now widespread agreement that discretion is superior, as has been illustrated repeatedly in recent US monetary policy. Discretionary policy saved the day in the heat of the financial crisis of 2008. It has also contributed to massive economic gains in the subsequent recovery (as it did in the 1990s) when the Federal Reserve has ignored model predictions that the economy was over-shooting the natural rate of unemployment and an acceleration of inflation was imminent.

Furthermore, the role of discretion has increased as central banks persistently undershoot their inflation targets. That has led to talk of “price level catch up”, so that a central bank which undershoots inflation today can overshoot inflation tomorrow at its discretion. That further highlights the significance of discretion and the intrinsically political nature of central banking.

The essential role of discretion in monetary policy further undercuts the microeconomic case for independence as it amplifies the intrinsic problem of how to guard the guardian. Consequently, the mainstream literature is driven into the contradictory position in which discretion is desirable as long as it is exercised by an independent central bank, yet discretion is the underlying source of the problem giving rise to need for independence in the first place (Forder, 2002, p. 62). Furthermore, discretion aggravates the anti-democratic disposition of independence (about which more below) as it de facto outsources decisions away from democratically elected government. Consequently, discretion renders monetary policy intrinsically political, undercuts the microeconomic case for independence, and also strengthens the democratic politics case against independence.

Central bank policies also have huge distributional consequences, which have follow-on collateral political consequences owing to the impact of money on politics. Even before the financial crisis of 2008 the logic of neoliberal monetary policy model was under attack. One critique was a tendency to push for too low inflation (Palley, 1998). A second critique was the exclusive focus on inflation targeting and neglect of the macroeconomic implications of asset price bubbles (Palley, 2003). Since then, the critiques have broadened and deepened. During the crisis central banks were called on to provide critical lender-of-last-resort services, which raises questions about who gets saved and who does not. Furthermore, access to such bail-out helps constitute an implicit subsidy that has enduring impacts as financial market participants know which firms do and do not have access. Subsequently, quantitative easing (QE) has had central banks buying massive quantities of private sector financial assets, thereby providing a price floor to those assets which has benefitted owners of such assets.

More generally, there has been a turn to elevating the place of asset prices. That turn began in the 1990s with the introduction of the “Greenspan put” whereby the Federal Reserve was viewed as promising to intervene to prevent a stock market melt-down. That notion continued under Chairman Bernanke, giving rise to talk of a “Bernanke put”. After the 2008 crisis, Federal Reserve policy explicitly focused on reflating asset prices and demand for risky assets. Now, there is talk of the Federal Reserve buying equities as part of its strategy for reviving the economy in the next downturn (Farmer, 2018).16

The bottom line is central banks have a heavy discretionary thumb that tilts the economic scales, with major distributional and political consequences. The combination of discretion, distributional impacts, and political impacts makes independence an inappropriate organizational form for central banks. That combination also explains why capital is interested in controlling central banks, and it is noteworthy that the above developments have occurred during the era of independence. It is consistent with the earlier argument that independence has served as a screen for capital to capture central banks and implement policies favored by capital.

Spartan macroeconomic models pay no heed to the institutional and transactional details of monetary policy, giving the impression that monetary stabilization policy is distributionally and politically neutral. That has never been the case, and non-neutrality has strengthened with the expansion of central bank policy interventions owing to increased financial instability and the emergence of stagnation. The combination of discretion and non-neutrality is why independence is an inappropriate organizational form. Moreover, the problem also applies to central bank “operational” independence since there are many ways to achieve a given goal. Consequently, creating a distinction between goal and operational independence does not escape the fundamental problem.

Lastly, independent central banks are an inefficient and sub-optimal organizational form for policy coordination. As Summers (2017) has emphasized, central banks are key players regarding coordination of fiscal and monetary policy, management of the public debt, and exchange rate policy. For the past thirty years, those policy interventions were significantly diminished within mainstream economics as new classical macroeconomics argued they were unnecessary. That view is now receding under the force of adverse economic circumstance, which is also diminishing the standing of new classical macroeconomics. However, the experience provides further evidence of how the case for independence was built on faulty macroeconomics.

9.2. Independence is anti-democratic

Not only is central bank independence intrinsically political, it is also anti-democratic. Forder (2002, pp. 62-64) frames that anti-democratic disposition through the lens of lack of accountability, which is acute in the case of the European Central Bank. The combination of extensive discretion and weak accountability renders independence anti-democratic.

Mainstream economics tends to neglect the accountability issue and disregard the anti-democratic implications of independence. The neglect of need for accountability is because recognizing that need also compels recognition that accountability is to the politicians who are the source of the claimed problem regarding policy discretion. Ergo, consideration of the need for accountability exposes the contradictory logic of the neoliberal case for independence, assessed on its own terms.

The disregard for democracy likely reflects twin forces. One is the technical nature of monetary policy which promotes the sentiment “Only experts need apply” (Buiter, 2017, p. 6). The second is a subterranean tension within neoliberal political economy between democracy and property, which promotes anti-democratic paternalism. Independence is an idea developed by US economists and US trained economists. Within the US, dating all the way back to the writing of the constitution, there has been a persistent ambivalence regarding democracy owing to fear of anti-property democratic sentiments. That fear is deep-seated in neoliberal political economy as developed by Buchanan (1975) and Buchanan and Tullock (1962), whose economic thinking is rooted in Chicago School political economy. Thus, a prime focus of Buchanan’s political economy is a constitutional order in which rights of property are sacrosanct. Central bank independence can be viewed as an idea, applicable to the monetary realm, that comes out of that political tradition.

Surfacing the anti-democratic dimension means democratic politics is implicated by central bank institutional design. Central banks have massive economic power and how they use it has economic consequences, distributional consequences, and political consequences. Historically, central banks were governed by a professional civil service that provided technical policy advice and carried out the policy instructions supplied by government. The government was democratically elected and subject to the checks and balances of the democratic system. For neoliberals, those protections are not strong enough, and the push for central bank independence can be viewed as an attempt to further strengthen them. Not only does independence protect against the threat of labor friendly monetary policy, it also locks-in an institutional form that favors capital.

As currently fashioned, central bank independence partakes of liberal paternalism, which is a cousin to authoritarianism. Paternalists claim democracy is unreliable and they know better. Independence puts an important piece of democratic decision making (the central bank) in trust, under technocratic hands. The claim is central bank is vulnerable to populist capture, the technocrats know better, and they will act as neutral benevolent public servants. Ironically, the claim relies on exactly the same behavioral assumptions that Chicago economists often single out in their criticisms of government.

The great rhetorical sleight of hand of new classical macroeconomics is to present independence as a solution to the problem of self-interested policymakers. However, given the microeconomic incoherence of that claimed solution, it is better understood as an institution favored by capital to guard against the danger that a democracy may choose economic policies capital dislikes.

From a democratic perspective central bank independence is perfectly permissible. However, if democracies chose that route they should do so truthfully informed, with eyes wide open. That means acknowledging independence is a politically tilted intervention in a policy arena rife with distributional and political consequences.

The above concerns raise the question of how central banks should be organized. The starting point is recognition that independence is a disingenuous screen and an inappropriate organizational form. It is a screen for institutionalization of neoliberal economic ideology, which has been disingenuously sold on the basis of the myth of inflation populism. It is also a profoundly anti-democratic organizational form. That suggests returning central banking to the earlier professional civil servant model.

Central banks can continue with policy innovations, such as inflation targeting, to the extent those innovations are deemed worthwhile. The head of the central bank could also be given cabinet status in government if greater separation from the Treasury is deemed beneficial.17 New legislation regarding central bank purchases of non-central government issued financial liabilities is called for given the fiscal nature of such purchases. That legislation should also address payment of interest on reserves, including negative interest rates, which is implicitly a fiscal action. Additionally, it should address any subsidies, explicit or implicit, provided by the central bank. The bottom line is less independence and more accountability should be the leitmotifs of future reform, which is the opposite of the direction taken over the past thirty years.18

9.3. Exiting the status quo

Independence is an inappropriate organizational form for central banks. That raises the question of how to exit the current status quo? The problem is independence now provides a focal point for market discipline. Consequently, a government that seeks to abandon independence will likely be penalized by financial markets.

Whether to exit “cold turkey” is a strategic political decision, but part of an exit strategy should be to expose the fallacious economics of central bank independence. As shown earlier, the argument for independence does not stack up in terms of its own logic. Exposing that fallacy will, of itself, corrode the case for independence and facilitate exiting the status quo.

Additionally, governments can change the economic staff and leadership of central banks so as to broaden the political economic perspectives within them. Ultimately, central banks’ behavior is shaped by their leadership, and the range of who is deemed acceptable has been sharply skewed. For instance, in the US, Republicans confidently nominate extreme partisans, whereas Democrats feel constrained to nominate conventional moderate neoliberals either because of their own cognitive capture or because that is all they deem politically feasible.19

10. ECONOMISTS AS ACCOMPLICES TO ANTI-DEMOCRATIC CLASS WAR?

The debate over central bank independence is revealing of the political biases which infect contemporary economics. Understanding that claim begins with the recognition that independence is a creation of economists. That creation rests on a false construction of politics, a controversial construction of macroeconomics, overlooks the broad range of discretionary non-neutral activities of central banks, and fails according to its own microeconomic logic.

Economists claim turning central banks over to independent bureaucrats (many of whom tend to be economists) will solve the problem. Implicit in their claim is the idea economists are true public interest bureaucrats and immune to the self-interest problems that afflict others. That denies the fundamental argument motivating the need for independence. In effect, mainstream economists apply caustic self-interest analysis to the rest of the world, but not to themselves. Whereas the rest of the world is self-interested, economists represent themselves as standing apart, objective and public-spirited.

Once that exemption is suspended, the independent central bank model falls apart on its own terms. First, the self-interested politician will have an interest in picking an economist/central banker that will carry out the politician’s wishes. Second, the economist/central banker will have an interest in looking after their own self-interest and will be guided by their own biases and prejudices, just like a regular bureaucrat. That is likely to show up in willingness to please the political principal who made the appointment, and also to curry favor with financial capital which promises to reward them later.20

Earlier, it was argued independence is a class-based proposition. Economists support for it therefore also shows the class aligned stance of contemporary economics. The class-based nature of independence derives from its Chicago School political economy, its new classical macroeconomics, and neglect of the distributional impacts of central bank. Together, those features foster an anti-government politics, a macroeconomic policy stance that emphasizes low inflation and disregards unemployment, and a policy mix favored by capital.

Additionally, independence is infused with a strong anti-democratic strain, reflected in the willingness to outsource monetary policy to an independent central banker. That anti-democratic strain derives from three inter-connecting beliefs, each of which is wrong. First, there is the belief that monetary policy is technical and should therefore be left in the hands of technocrats (i.e. economists) who know best. Second, there is the belief that economists can be trusted to be honest brokers (i.e. true public servants). Third, there is the belief that economists have the “true” understanding of the economy (i.e. true model).

All three beliefs are wrong. First, though monetary policy involves technicalities, it also involves much more and technical advice can be easily supplied by technical advisers. Second, economists have their own preferences and ideological prejudices, just like everyone else. Third, there is no known true model of the economy, but only competing interpretations, each of which has strengths and weaknesses. The mainstream claim of truth is a rhetorical club to suppress alternative views, and it is belied by the repeated inability of mainstream economics to anticipate imminent major economic developments (Palley, 2019; 2012, Chaper 11).21

For some economists there will be no clash with their personal values. However, the more interesting case is why liberal economists also buy into this program. The answer is surprisingly simple. As noted earlier, just as social democratic politicians can be subject to cognitive capture that leads them to support central bank independence, so too can economists. Like everyone, economists are subject to cognitive capture. Their training provides additional protections by making them aware of competing theoretical views and the role of alternative assumptions. However, that training can actually facilitate capture if it falls prey to its own ideological capture and suppresses openness -as can be argued to have happened in contemporary mainstream economics. Thus, having bought into new classical macroeconomics and belief in their own non-partisan technocratic superiority, it is a short step to supporting independence. That support is bolstered by acceptance of lay conservative political narratives about the dangers of inflationary populist government.22

11. CONCLUSION

This paper has argued central bank independence is a product of neoliberal economics which advances and institutionalizes neoliberal interests. As such, it sides with the economic interests of capital against those of labor, and it also has a significant anti-democratic strain. The paper showed independence rests on a faulty construction of politics and a controversial construction of macroeconomics. Moreover, it fails according to its own microeconomic logic. That failure applies to both goal independence and operational independence. It is a myth to think a government can set goals for the central bank and then leave it to the bank to impartially and neutrally operationalize those goals. Democratic countries may still decide to implement central bank independence, but that decision is a political one with non-neutral economic and political consequences. It is a grave misrepresentation to claim independence solves a fundamental public interest economic problem, and economists make themselves accomplices by claiming it does.

nueva página del texto (beta)

nueva página del texto (beta)