Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.74 no.292 Ciudad de México abr./jun. 2015

Artículos

Public-private sector wage differentials in Spain. An updated picture in the midst of the Great Recession

José-Ignacio Antón* and Rafael Muñoz de Bustillo**

* Department of Economics, Johannes Kepler University (Austria), <jose.anton@jku.at>.

** Department of Applied Economics, University of Salamanca (Spain), <bustillo@usal.es>.

Manuscript received on January 31, 2014;

Accepted on July 31, 2015.

Abstract

Using the recent Wage Structure Survey 2010, this article examines the public-private sector wage gaps in Spain along the whole earnings distribution and the incidence of the gender gap in both sectors of the economy. Firstly, we find that that there is positive wage premium to public sector employment that is not fully explained by employees' observable characteristics. Furthermore, this premium concentrates on low-skilled workers, while high-skilled individuals in the public sector suffer a pay penalty. Secondly, the gender gap is substantially larger in the private sector. Lastly, we analyse what happens in some specific activities, Education and Human health and social work, where both public and private sector coexist to a large extent. We discuss several explanations for these findings, which are coherent with the available international evidence, and the possible implications of the current process of downsizing of public sector employment associated with austerity measures.

Key words: wage gap, public sector, gender gap, quantile regression.

JEL Classification: C21, J16, J31, J45.

Resumen

El objetivo de este trabajo es examinar la brecha salarial entre los trabajadores del sector público y privado en España, así como la incidencia de las diferencias de remuneración entre hombres y mujeres en ambos sectores de la economía del país a través de la Encuesta de Estructura Salarial 2010. Entre los resultados obtenidos destacan los siguientes. En primer lugar, se encuentra que existe una prima salarial a favor de los empleados del sector público que no responde en su totalidad a las características observables de los trabajadores. Asimismo, este diferencial salarial positivo se concentra en los trabajadores de baj a cualificación, mientras que los empleados de mayor cualificación en el sector público perciben menores salarios que trabajadores similares en el sector privado. En segundo lugar, la brecha de género es sustancialmente inferior en el sector público. Finalmente, se exploran los diferenciales de remuneraciones en dos sectores —Educación y Salud— en los que la administración pública y el sector privado coexisten de manera relevante. Se discuten los principales resultados del trabajo a la luz de la evidencia internacional disponible y las posibles implicaciones del proceso de reducción del sector público que se lleva a cabo en la actualidad en España, asociado a las medidas de austeridad fiscal.

Palabras clave: brecha salarial, sector público, brecha de género, regresión por cuantiles.

INTRODUCTION

The existence of an eventual wage premium to employment by the public sector with respect to the private one is a topic that not only has received attention from economic research but also from the general public. With some qualifications, the existence of a wage premium to public sector employment, with exceptions, represents quite an empirical regularity in labour market studies.1 This topic has been under-researched in Spain mainly because data limitations, with most of available estimates dated between the late 80s and the middle 90s. The purpose of this article is to explore this issue in the Spanish case using a new source of earnings data, the Wage Structure Survey 2010 (WSS 2010), aiming to cover this gap in the literature and to provide an up-to-date picture of the earnings gap between public and private sector employees. This data source presents some advantages in terms of data quality and coverage that allows overcoming the limitations of older estimations. With that aim, we explore both the average differential between both types of workers and the gap along the earnings distribution, estimating the potential different gaps at different points of the distribution. Furthermore, we explore the incidence of the gender gap in both the public and private sector. In the light of these results, the implications of the measures fiscal consolidation carried out in Spain since May 2010, causing a reduction of both the volume of employment and the level of wages in the private and public sector, are discussed.

The rest of the article unfolds in four additional sections that follow this introduction. Section two briefly reviews the main reasons for the pervasive public-private sector wage differentials found in many developed countries and summarize the available literature for the Spanish case. The third section describes the characteristics, strengths and shortcomings of the database used in the analysis, while section four details the methodology of estimating such differences. Section five presents the main results and discuss their implications, while the last section, as usual, summarize the conclusions.

PUBLIC-PRIVATE WAGE DIFFERENTIALS IN HIGH-INCOME COUNTRIES

The surveys of Ehrenberg and Schwarz (1986), Bender (1998) and Gregory and Berland (1999) account for the main theoretical insights that explain the existence of a wage premium in the public sector. These works, jointly with the short literature review of recent progresses in the area presented by Giordano et al. (2011), summarize the main findings of empirical works disentangling the scope of the gap between public and private sector employees. According to these works there are several factors that might explain the existence of a positive wage premium enjoyed by public sector employees. Firstly, public sector usually does not have to compete with other providers in the production of public services. From this perspective, part of the monopoly power enjoyed by public administration might explain the economics rents enjoyed by public employees. In the second place, following the argument displayed by Public Choice theorists, bureaucrats might behave as rational agents with a utility function who maximize the budget under their control. In this respect, high wages contribute to the increase of the size of budgets. Thirdly, the pay premium would reflect the lack —or lower— level of gender discrimination in the public sector vis-à-vis the private sector. As female employees are overrepresented in public sector, the existence of lower discrimination would show directly into the existence of a wage premium. Fourthly, the public sector might have special interest in recruiting highly educated workers compared with the requirements of the private sector, as away to increase the prestige of public administration (Holmlund, 1993). In the fifth place, a wage premium might simple reflect the prevalence worse working conditions —in terms of other non-monetary characteristics— of public sector jobs. If that was the case, according to the theory of compensating differentials, pay would have to be higher to compensate the comparative higher (vis-à-vis the private sector) negative characteristics of the job. Sixthly, public employees, have a way of pressing their employers for higher wages that private sector workers do not have, with their role as voters. Moreover, the large volume of public employees (14% of total employment in the Organization for Economic Co-operation and Development, OECD, and more than 1/3 in countries such as Denmark or Sweden) increases the power of public employees as a pressure group. Linked to the previous argument, public sector usually has higher trade union affiliation rates than private sector, leading to greater bargaining power and better wages. For instance, according to the results of Visser (2006), who presents unionization rates for 15 developed countries in the public sector with respect to the private one, the rate of affiliation in the former is 2.15 times greater than in the latter (2.21 in Spain). In the seventh place, wage premiums of public employees might simple reflect a measurement problem: the existence of different pay structures between the two sectors (public and private) might make the wage gap at a specific point in time or age an inadequate index of working life or even lifetime differences. In many cases, the access to specific civil servant jobs requires long years of (unpaid) preparation; in others, pay scales might be shorter in public service. Lastly, but certainly not least, the Administration might consider different (political) elements compared to the private sector when setting wages. The introduction of non-market considerations at the moment of fixing wages -decent pay, fair or living wages, equal pay- might lead to the development of a public sector wage premium. There is no reason whatsoever for the Public Administration, a political body, to follow the types of rules that govern the market, an economic institution.

During the last three decades the estimation techniques used to calculate the public-private sector wage gap have progressively evolved towards complexity. Early works used Ordinary Least Squares (OLS) and a public-private sector dummy variable. This approach is refined, first, by the application of the Oaxaca-Blinder (OB) decomposition (Oaxaca, 1973; Blinder, 1973), which, modelling separately public and private sector earnings, allows splitting the average gap into a component associated with workers' characteristics and another one related to structural differences in pay (differences in the coefficients, which is usually interpreted as the pure gap). An additional improvement in the analysis comes from the consideration of the eventual endogenous nature of sorting process into the public sector. That is, the fact that one person works in the public or private sector is not random and might depend on factors correlated with the variables that determine wages, making thus the estimators inconsistent. In a nutshell, the strategy of estimation widely followed to solve this problem is searching for an instrumental variable related to the sector of employment (public or private) but a priori exogenous to wages. Usually these types of variables are used to estimate selection equations in models of endogenous switching.2 Furthermore, some authors, aiming to obtain estimates consistent for the whole population, control for self-selection into employment at the same time, as, for instance, Heitmueller (2006). Aiming to address the same kinds of problems, other studies are based on panel data and fixed-effects OLS (Disney and Gosling, 1998; Mueller, 2000) and the most recent ones combine fixed-effects and quantile regressions (Bargain and Melly, 2008; Campos and Centeno, 2012). Recent literature has tried to go beyond averages, focusing on exploring whether public-private sector pay differences are constant or change across the earnings distribution. For this kind of research, the most widely used tools are different types of econometric decompositions based in quantile regressions (mainly, the one proposed by Machado and Mata, mm, 2005) or propensity score matching (Ñopo, 2008) .3 Melly (2005a) for Germany and Lucífera y Meurs (2006) for the United Kingdom, Italy and France exemplify the use of this technique. In this same framework, some authors have been able to control for the endogeneity of the employment decision (Cai and Liu, 2011) or the sector choice (Depalo and Giordano, 2011). To our knowledge, no study simultaneously accounts for both sources of endogeneity when assessing the pay gap along the whole wage distribution.

Regarding Spanish literature, the scarcity of high-quality databases has limited the number of analyses of public-private sector wage differentials. The main findings of these works are summarized in Table 1. Most studies use data of the late 80s or the early 90s. Overall, all works point out to the existence of an average positive wage premium to public sector employment, larger among females than among men. In addition, the available evidence also suggests a larger gender gap, both raw and unexplained, in the private sector than in the public one. Regarding the source and causes of this gap, some studies point out to the role of observable characteristics, whereas others underline the role of the unexplained component of the gap, the "true" differential. Last, it is also worth mentioning that those works that study the gap by education or earnings level often find that the gap decreases at high levels of education or wage. A careful analysis of this literature allows concluding that the different results obtained are explained by the different databases used in the analyses, econometric specifications, the observable variables included in the equations, and the reference group when computing the unexplained gap.4 In the next two sections, we comment on the databases and techniques used in the most recent studies in more detail.

In order to fully understand the following analysis, it is convenient to provide the reader with several remarks about public employment in Spain. There are two types of employment relations in the Spanish public sector. The first category is civil servants, who access to public employment by open examinations and whose working conditions are regulated by administrative legislation. There is a second sort of workers employed by public authorities thatwe could call "standard public employees". These workers have their working conditions determined by the labour legislation applicable to their private counterparts. This means that they are affected by collective bargaining, can work under fixed-term contracts and can be dismissed following the same rules that operate in the private sector. They might belong to public administration at any level, just as civil servants, but they can also work for state-owned enterprises. Both types of public employees have been affected by the decentralization process carried out in Spain, started in the early 80s and intensified since the middle 90s that have involved core activities of activities the public sector such as education and health care. In this respect, both regional and local authorities enjoy certain autonomy for determining the working conditions —including pay— of public sector workers.5

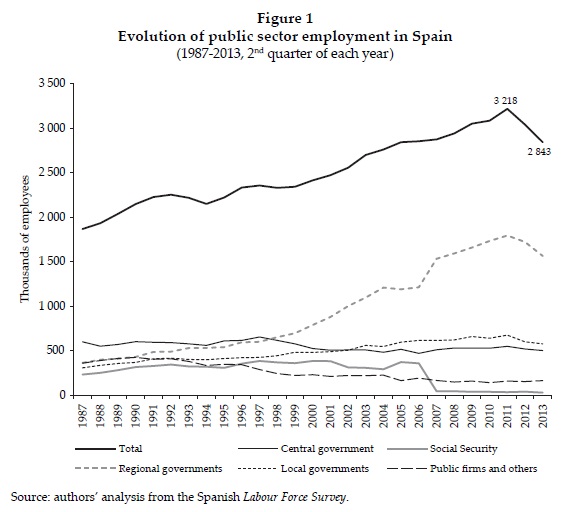

The need for a new look at this topic in Spain is justified for three reasons. First, most of works are outdated. In this respect, a look at the impressive growth of public employment in Spain during the last decades makes this point clear (see Figure 1): for example, since 1987 to 2011, the volume of public sector employees rose by more than 70%. Between 1994 —the first year of the European Community Household Panel, the base of some the last available estimates- and 2011, the increase was roughly 50%. The devolution process mentioned above might have had also implications on public-private sector gaps, which underlines the need for a recent portrait of earnings differentials. Furthermore, changes in the public sector wage policy (such as wage freezes in 1994 and 1997 and a lower nominal rate growth than in the private sector the rest of years) make advisable to re-estimate the public-private sector pay gap, now, with a more adequate and recent statistical database and a more ambitious methodology. Another interesting development of the last few years of the 20th century and the first decade of the new millennium, with potential impact on private sector wages, is the huge increase in labour supply related with an immigration wave of unprecedented proportions.6 In 1996, immigrants were a scant 1.4% of Spanish population; in 2010 the proportion reached 14%. Third, the most recent studies use databases that present quite serious problems when trying to estimate the public-private sector pay gap and, in any case, we provide an estimation with a new source that, as it is argued in the next section, present several advantages over other current alternatives. Lastly, it seems very relevant to have deep knowledge of the implications of public sector employment at the present turbulent times, characterized by serious cutbacks of both remunerations and labour force (Muñoz de Bustillo and Antón, 2013). Particularly, starting in 2011, the number of public sector workers has been reduced by almost 12% and they have experienced two nominal pay decreases of 5 and 7% (the former affecting, so far, only 2012) on average, respectively, since the beginning of the crisis. On top, many regions decreed further pay cuts in the wages of all or part of their employees. In this recessive context, the two main general-interest newspapers in the country referred to public employees as "privileged" in terms of pay at the end of 2012 (Gavino, 2012; Segovia, 2012) making specially interesting to study, scientifically, to what extent public employees are truly a privileged bunch.

Last, it is important to discuss one important aspect of the Public Administration and the economic geography of the country. Spain has a largely decentralized Public Administration, with the regional governments controlling roughly 35% of total public expenditure (with very large competences health and education). At the same time, regional differences in economic structure (and related to it in productivity) and employment levels are also large. In 2010, according to National Accounts, the Gross National Product (GNP) per capita of the poorest region, Extremadura, was 52% of the GNP per capita of the richest region, Madrid. This has implications for our analysis as different regions might have different compensation for the same types of workers. The strategy followed in the econometric exercise presented in this work includes both the variable region (aggregated in NUTS-1 regions) and sector of activity to control for such differences, as it is commonly done in this type of studies.7

DATA

As mentioned before, Spain has a long tradition of shortcomings in terms of earnings data. That has made quite difficult to present accurate and up-to-date information about public-private sector wage differentials. Recently, there has been some advancement in data collection that has opened new venues to address this issue. The first one is the introduction of wage information in the Labour Force Survey (LFS) by linking tax data with individual labour market data traditionally recorded by the LFS. Nevertheless, the wage data is made available only in a very aggregate fashion, giving information about the wage decile of the worker, making the information less than suitable for the purpose of this type of study.

The second is the Continuous Sample of Working Histories (CSWH), a sample of administrative records of the Spanish Social Security Administration linked to income tax data that allows identifying labour income and several basic job characteristics. This database, used by Muñoz de Bustillo and Antón (2012), Hospido and Moral-Benito (2013) and Fernández-Kranz (2014) includes those public sector employees affiliated to the general regime of the Spanish pension system (around 70% of total public sector employees). The circumstance of being comprised by this pension system does not depend on a voluntary choice, but it is roughly random, partly based on historical reasons. However, this data source presents three relevant shortcomings for the purpose of a research that tries to assess earnings gaps controlling for human capital characteristics. Firstly, occupational group is barely available through an obsolete variable developed in 1967, according to which many people in skilled jobs several decades ago that might very well be considered low-skilled employees nowadays are still considered high-skilled workers.8 The second problem refers to the codification of education: this information consists in the level of schooling recorded in Local Registers in 1996 (with, literally random updates since then), in which the registration is not compulsory. This means not only that information on education cannot be representative but also that it is not accurate for those who continued their studies after the middle nineties. The third problem has to do with the lack of information on working hours, although the database provides some information on whether employees hold part-time jobs.

The third source of improvement is the new wave of the Wage Structure Survey (WSS), of 2010. This survey is the main and most detailed source of information on labour earnings in Spain. Carried out by the National Statistics Institute on roughly a four-year basis and with a two-stage stratified sampling design, it contains information on monthly and annual wages earned by salaried employees in 2010 (INE, 2012).9 It is a survey of establishments and its sample exceeds 200 000 employees. The universe covered by this source includes both private and public sector workers —both civil servants and other types of public sector employees— in Industry, Construction and Services. Apart from the exclusion of Agriculture, Livestock and Fishing Activities and Domestic Services and extraterritorial bodies (not included in the survey), the only restriction regarding public sector workers has to do with the fact that, in the sector Public Administration, Defence and Compulsory Social Security, only those public sector employees affiliated to the general regime of the Social Security system are surveyed.10 In this respect, the problems of the data are minor compared to the ones present in the rest of alternatives mentioned here: excluding the Public Administration, Defence and Compulsory Social Security, coverage of public employees is complete and, including this sector, more than 8 out of 10 public sector workers are comprised by the data source.11 Furthermore, the database contains accurate information on education, occupation and working time as well as providing details on firm characteristics such as type of collective bargaining and firm's market target. The main disadvantage of using this database —a shortcoming which shares with the CSWH— has to do with the poor household and personal available information. Since it only includes details on employed people, it is not possible to control for selection associated with employment. Therefore, necessarily, results will be only representative for people in work. A second issue worth mentioning has to do with the impossibility of modelling the process by which an individual is employed by the public or the private sector. If the unobservable factors that affect sorting into public sector employment are correlated with non-observable characteristics determining earnings, then estimated coefficients in an econometric model of wages ignoring selection might be inconsistent. Nevertheless, a recent work of Melly and Puhani (2013), based on a natural experiments linked to European privatizations in the telecommunications sector, suggest that the main driver of public-private sector wage gap is structural rather than linked to self-selection. Furthermore, in order to model the sorting process, convincing instrumental variables (exclusion restrictions), affecting the probability of being employed in one or another sector but exogenous to wage determination, are needed.12 Unfortunately, this search can be cumbersome and most of the variables used in the Spanish literature are dubiously exogenous to earnings.13 In the worst case, a descriptive interpretation of the results is possible and it is useful as long as it allows exploring some implications of the role of public sector employment in the labour market, for instance, its implications in terms of the gender pay gap or earnings inequality.

Finally, it is worth mentioning a recent comparative paper of the European Central Bank (Giordano et al, 2011) on which we have commented above- that explores the public-private sector wage gap in 10 European countries that includes Spain using the European Union Statistics on Living Conditions (EU-SILC). This database does not contain information on the type of employer (public or private), but the authors skip this problem comparing employees in Public Administration, Defence and Compulsory Social Security, Education and Health and Social Work with the rest of salaried workers. All the former are considered as employed by the public sector as a whole, while the latter are seen as employed exclusively in the private economy. In spite of the useful comparative perspective this paper, we think that this approach is not appropriate for a national case when better alternatives are available.

In sum, we think that, according to the reasons explained above, the database used in the article incorporates remarkable advantages and improvements over previous attempts of measuring public-private sector pay gaps in Spain. Particularly, it seems more appropriate than the cswl and the EU-SILC.

METHODOLOGY

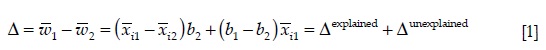

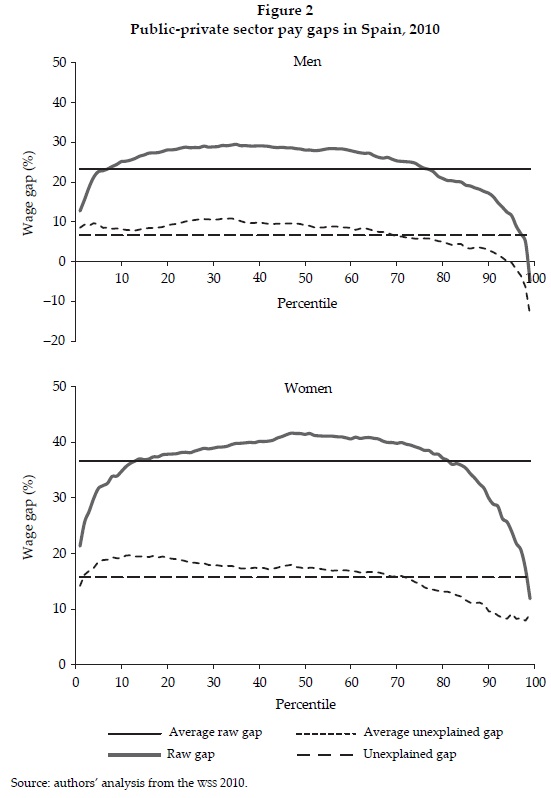

In order to study the existence and size of wage differences between public and private sector employees a double methodology is followed. In first place, the well-known Oaxaca-Blinder decomposition (Oaxaca, 1973; Blinder, 1973) is used to estimate which part of the average gap is explained by differences in workers' observable characteristics and which one is associated with the different remuneration of such characteristics in both sectors. This strategy requires selecting a reference group whose returns to observable endowments are considered as standard or a reference. From a theoretical perspective, it is more appropriate referring to the earnings gap as the existence of a public sector wage premium rather than "discrimination" against private workers. Therefore, public employees are chosen as the reference group.14 Formally, the difference (Δ) between average log-hourly gross earnings of public and private sector earnings ω1 and ω2) can be decomposed in the following way:

where x represents a set of worker and firm characteristics (including a constant), b is the vector of coefficients from an OLS regression of ω on x for each group, and overbars denote means. The total gap can be decomposed into a gap explained to characteristics (Δexplained) and another unexplained by such endowments, or due to differences in returns to them (Δunexplained). The first component refers to earnings differences observed if both types of workers had the same characteristics and public sector employees were paid as their private counterparts, whereas the second one has to do with the gap observed if workers employed by private firms had the same observable endowments as employees holding public jobs.

In addition, we explore, using the same strategy, in which sector male-female wage gaps not due to differences in productivity are narrower. In this case, it is reasonable to consider that the reference group, which defines the returns to observable characteristics considered as standard, are male workers.

In second place, we try to disentangle how the premium or penalty evolves across the earnings distribution. Several approaches have been proposed to address this issue and compute the gaps conditioned on observable characteristics across the whole wage distribution. We follow the approach firstly proposed by Machado and Mata (2005), though we apply their method following the slightly modified but equivalent version suggested by Albrecht, Björklund and Vroman (2003) and De la Rica, Dolado and Llorens (2008), adapted to this case.15 The basic idea is to construct the counterfactual public sector wage distribution that would exist in the hypothetical case that public sector employees' characteristics were remunerated exactly at the same rate private employees get for their endowments. In more detail, the procedure unfolds as follows:

1. Estimate quantile regressions for 99 percentiles separately using the public and private sector employees' dataset, obtaining b1(q) and b2(q), respectively.

2. For each quantile, take a draw from the public workers' sample and compute the predicted log-wage at each quantile q using the estimated coefficients b1(q), i.e., obtain x1b1(q). Repeat the process, but applying estimated coefficients for private sector workers, b2(q), and compute the predicted log-wage x1b2(q).

3. Repeat step two M times and, in this way, obtain a counterfactual distribution of public sector employees that reflects their remunerations as if they were paid as private ones and the predicted distribution of public sector employees retaining their characteristics and specific returns. Following Albrecht, van Vuuren and Vroman (2008), M is set to 100.

4. Profiting from the linearity of quantile regression, calculate the counterfactual gap, that is, the wage differential associated with coefficients, as x1b1(q) - x1b2(q).16

Regarding quantile regressions, following Koenker (2005), the model to be estimated can be expressed in the following way:

where ω denotes hourly gross wages (in logs), x includes a set of employee's observable characteristics, β is the parameter to be estimated, which captures the proportional wage change in the qth quantile conditional on x and εq is a disturbance satisfying E(u(q) | x) = 0. Therefore, one can write conditional population quantiles Quantq(ω | X = x) as:

β can be consistently estimated by minimizing the sum of weighted absolute deviations using q and 1—q as weighting factors for positive and negative errors, respectively.

After determining the scope of public-private sector wage differentials we carried out a comparative assessment of the extent of the gender gap in the public and the private sector. In order to do so, as it is common in this type of analysis, the structure of remunerations of males is considered the reference. Therefore, being ωm and ωf the log-wage of male and female employees, the average wage gap can be expressed as:

Analogously adapting the procedures described above, the unexplained difference between men and women at each quantile can be obtained as xfbm(q) — xfbf(q). Computing these formulae for each economic sector, we can make some guesses about how the current downsize of public sector employment might affect the gender pay gap in Spain.

After carrying out all the proposed analysis, we study in detail what happens in two important sectors of activity where both the public and the private sector play an active role as employers: Education and Human health and social work.17

RESULTS

Descriptive statistics

First of all, is convenient to make several comments on the control variables used. Although, as mentioned, the WSS 2010 does not contain information on household characteristics, we profit from reliable information on hourly gross wages (which is provided by the employers according to their registers) and a wide set of variables describing the work relationship and the activity of the firm and the context where it operates. In this respect, we use as much as information as possible taking into account the available variables and possible limitations in terms of observations when specifically assessing the situation in some sectors of activity like education and health. Particularly, the variables included in our analysis as controls in order to explore the earnings gaps are the following ones: age (three dummies), education (seven dummies), nationality (a dummy indicating if the person is Spanish or a foreigner), tenure (continuous), type of contract (indefinite or fixed-term, a dummy), part-time (a dummy), supervisory role at work (a dummy), firm size (two dummies), sector of activity (fourteen dummies), occupation (eight dummies), type of collective agreement (four dummies), firm's target market (three dummies) and region (six dummies). When diagnosing the situation in Education and Human health and social work, the variable occupation is recoded in four categories and the type of collective agreement and firm's target market are not included in the estimated equations because of problems of multi-collinearity.

As mentioned above, the coverage of the database in terms of public employment is remarkable, with only a fraction of public sector employees in Public Administration Defense and Compulsory Social Security excluded. The percentage of total employees in the public sector is 18.2% (15.2% among males and 21.7% among females). Particularly, in Education this proportion rises up to 38.5% (46.5 and 34.4 percent among men and women, respectively) and, in Human Health and Social Work activities, public sector amounts to 52.9% of employees (62% among men and 50.2% among females, respectively).18 The main descriptive statistics (means and standard deviations) of all the variables used in the econometric analysis are presented in Tables 2-4 (3). As usual in this kind of work, we restrict the empirical exercise to workers between 20 and 59 years old.

ECONOMETRIC ANALYSIS

In the econometric analyses carried out with the WSS 2010, we experiment with different specifications, considering different sets of variables. Since there are no substantial differences in the results, here, for reasons of simplicity and space, we only report the results from the most complete models, which include all the variables stated above.19

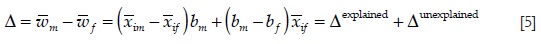

In the first place, we comment on the results of the analyses of the public-private sector pay gap in the economy as a whole (see Figure 2). In the case of men, public sector workers are paid 23% more than their private counterparts, but this premium decreases up to roughly 7% when observable characteristics are taken into account. The raw gap across the whole distribution is positive and inverse-U shaped, with lower values at the very bottom and the very top of earnings distribution. Nevertheless, the most interesting finding has to do with the unexplained gap: it is barely above 10% across most of the distribution but dramatically diminishes at the top, becoming even negative for the most qualified employees. The pattern is very similar in the case of females, being the main difference that the premiums are larger for them than for males and that the differential is not negative at any point of the distribution.

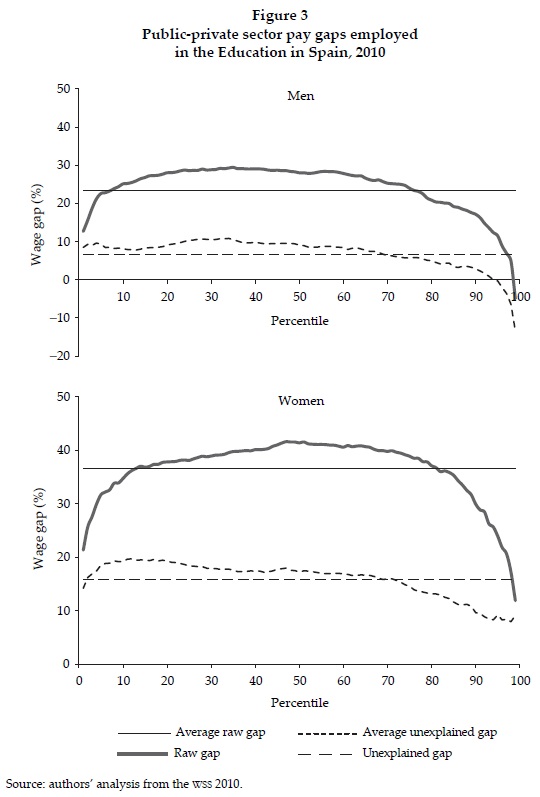

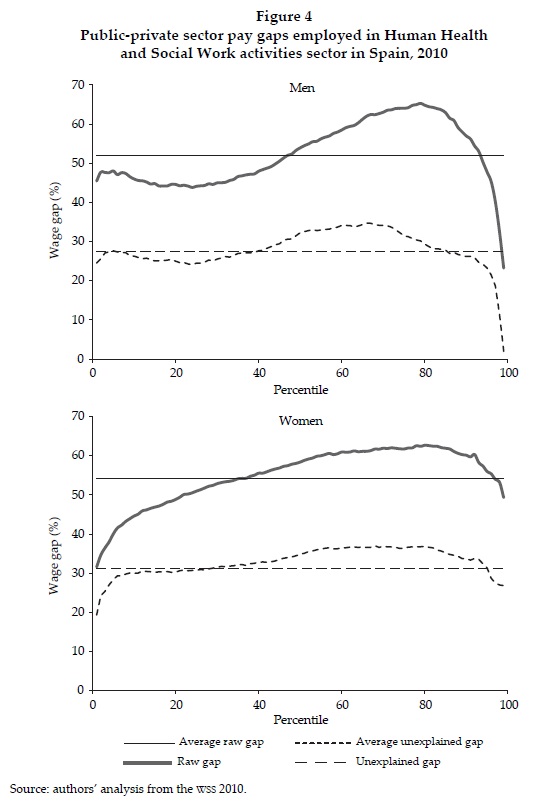

In the second place, we look at what happens at two areas of activity where the public and the private sectors coexist to a large extent, Education (see Figure 3) and Human Health and Social Work (see Figure 4). In the case of education, the first observation is that the average gap in favour of public sector employees is tiny, being even negative in raw terms among males. In the case of men, the largest penalty is suffered by the most skilled educational workers, whereas, among women, although the pattern follows a quite similar shape, it shows a positive premium at the bottom and a non-negligible penalty at the top. The results for workers employed in health-related activities differ. There is a substantial and positive public-private sector gap both among male and female employees, of roughly 50 and 30% in raw and net (associated with unexplained characteristics) terms, respectively. The main difference between both sexes is that the premium decreases very fast for the most skilled men.

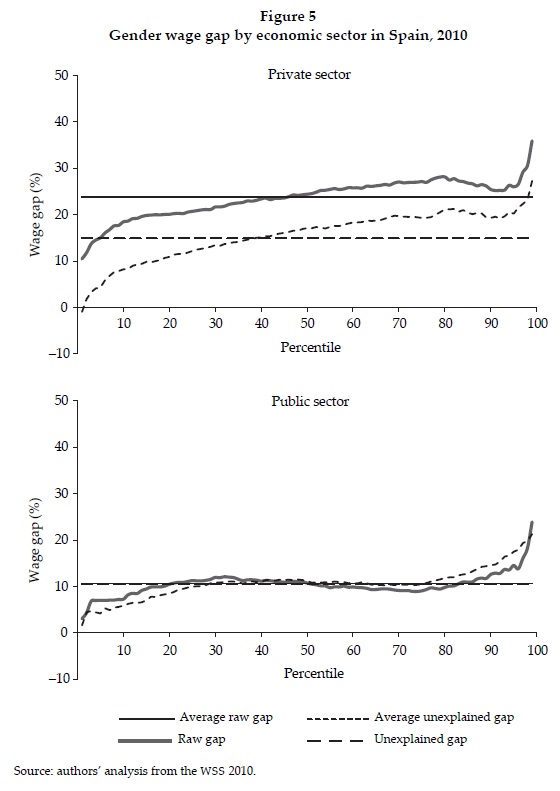

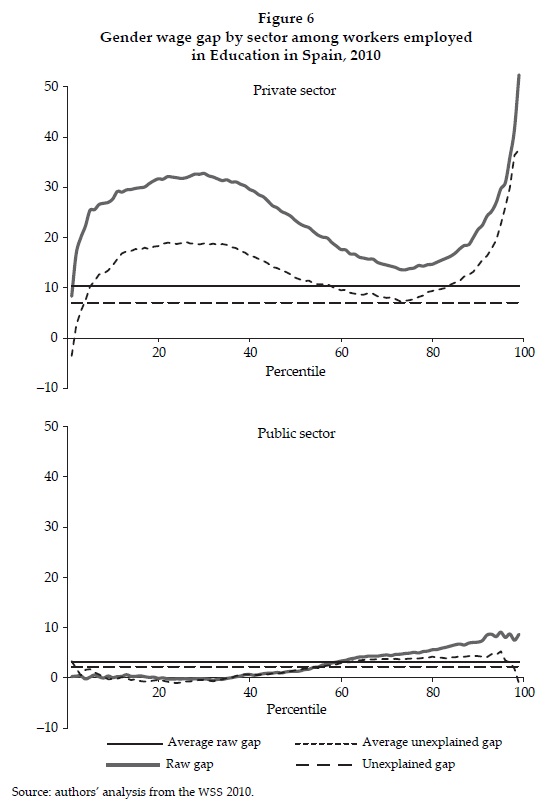

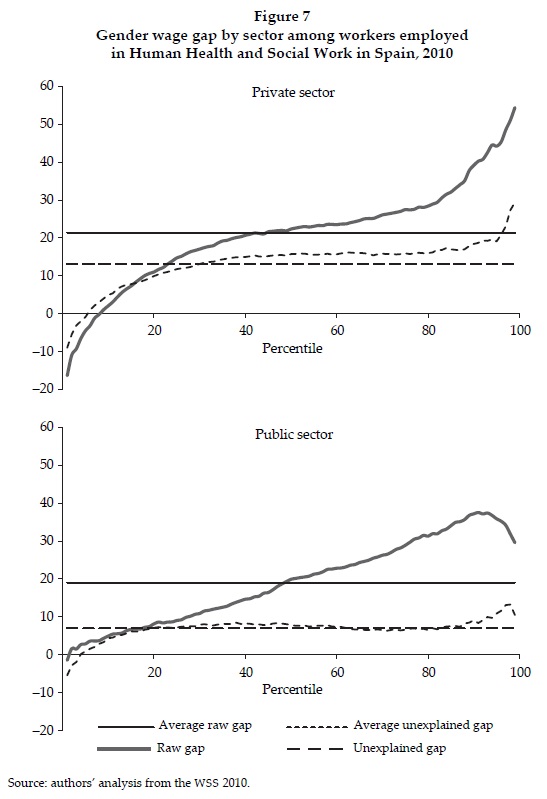

In the third place, we examine the scope and characteristics of the gender pay gap in both the private and the public sector. In the whole sample of employees (see Figure 5), we can confirm that, firstly, gender gaps are higher in the private sector, both in raw terms and after controlling for observable worker and firm's characteristics. In the second place, in both sectors, the unexplained component of the differential between men and women increases along the distribution, being the pattern much steeper in the private sector. It is particularly interesting to explore what happens in Education (see Figure 6). The first element worth mentioning in this sector is the negligible extent of the gender gap in the public sector. However, in the private one, there are substantial penalties for women. The raw and net mean gaps are around 10 and 7%, respectively, and the women more affected are those between the 10 and 40th percentiles and at the top of the distribution. The last set of results refers to Human Health and Social Work (see Figure 7). Again, penalties for women are higher in the private than in the public sector. Nevertheless, in this case, the increase in the unexplained gender gap is very clear in the private sector, whereas it is almost inexistent in the public one.

Although it is a task far from simple, it has been considered interesting to try to make some informed guesses about the causes underlying the results presented above on the basis of our knowledge of Spanish labour market and other economic institutions and the empirical evidence available from other countries. Firstly, the positive, and decreasing along wage distribution, public-private sector earnings gap is a common finding in most of recent literature (Melly, 2005a; Lucifora and Meurs, 2006; Cai and Liu, 2011; Depalo and Giordano, 2011; Mizala, Romaguera and Gallegos, 2011; Tepe, Kittel and Gottschall, 2015). This fact is very likely to be linked to the regulatory and institutional setting governing pay determination in the public sector, with higher unionization and wage floors and even larger specific commitments to implement policies that improve working conditions and wages. For instance, according to the Survey on Quality of Work Life, in 2010 the union affiliation rate among public employees was 31% compared to 15% among their private sector counterparts. The different is much higher than average for Human Health and Social Work activities (34.1 versus 11.6%) and much less narrow than average in Education (28.7% versus 20.7%). Such pattern closely follows the private-publie wage gap detected.

Furthermore, the public sector is usually a pioneer in the implementation of measures promoting gender equality and other non-discriminatory practices (Grimshaw, Rubery and Marino, 2012). Nevertheless, conversely to Muñoz de Bustillo and Antón (2013) and Hospido and Moral-Benito (2014), we find that the public employment wage premium workers become negative for high-skilled male. This finding is probably explained by our extensive use of controls and the more accurate definitions of the education and occupation variables allowed by the data base used in our study.20 In addition to this, it is also worth mentioning that the theory of compensating differentials might explain the penalty experienced by high-skilled men employed in the public sector, which could enjoy better non-monetary working conditions than in the private economy (in terms of job security, even under the same type of contract, or leaves). This pattern becomes even clearer for the case of Education, while among employees in Human Health and Social Work activities, the unexplained public wage premium is roughly constant along the distribution among women and decreases from the 80th percentile up among men.21 Secondly, the lower prevalence of the unexplained gender gap in the public sector, which is in line with the international evidence, suggests that the more rigid procedures and the so-mentioned institutional settings and specific measures governing pay determination in the public sector leave less room for wage differentials not based on productivity or, in general, on observable workers' characteristics (Ehrenberg and Schwarz, 1986; Bender, 1998; Gregory and Gerland, 1999). The anatomy of the estimated wage gap between males and females in the private sector is in line with the results obtained by previous studies for Spain: the gap increases across earnings distribution, much lower at the bottom than at the top of it. This profile is quite coherent with the compressing effect exerted by labour market institutions like minimum wages and collective agreements at the lower tail and the existence of a "glass ceiling" at the upper part of the spectrum, as alleged by previous works (Antón, Muñoz de Bustillo and Carrera, 2012). It should be mentioned that, although the profile of the gender gap is also increasing in the public sector, it is much less steep than in the private one, a circumstance probably associated with the larger effect of the mentioned labour market institutions and the procedures and settings of pay determination in the public sector. This tentative explanation is coherent with the tiny gap observed in Education activities in the public sector, where unions and collective bargaining has a remarkable presence. Further remarks can be made in order to try to explain the comparatively large premium in the public sector in Human Health and Social Work activities with respect to Education. Firstly, although we are able to control for large occupational groups and having a short and a long university degree —therefore, avoiding confounding nurses and doctors, for instance— and we have used maximum disaggregation by activity allowed by the database, this sector continues being considerably heterogeneous. For instance, it comprises not only human health care but other activities not necessarily similar like long-term care on animal health care. On top, even within the human health activities, we can have a remarkable heterogeneity not captured by the data. Particularly, we cannot distinguish between general practitioners and specialists and according to whether they have been resident physicians in a hospital (known as MIR) —which requires passing a public examination— or not. This last element is probably linked to higher abilities and, until the mid 90s, was required only for specialist physicians but not for general practitioners. Finally, it is also worth mentioning that in the health sector, many different forms of organizational forms are allowed within the public sector, allowing for productivity incentives and other pay complements. In addition, although there are both health interventions performed by private units and private health centres subcontracted by the different regional health services and funded by the public sector, the scale (and regulation) of such system of health service delivering is much less than in the case of publicly-funded schools.22

Apart from the elements mentioned above, there are other possible explanations for the premium and its pattern. For instance, Postel-Quinay and Turon (2007) argues that, in the long run, the public employment premium in Britain disappears and no significant gap is observed when considering lifetime incomes in both sectors. It is also worth mentioning, although we control for an extensive list of workers' and firms' characteristics, selection into public employment and unobserved heterogeneity might play a relevant explanatory role. In this respect, recent studies based on long panels finds that the large premium observed in cross-sectional studies becomes much lower when using fixed-effects techniques (Disney and Gosling, 1998; Bargain and Melly 2008; Campos and Centeno, 2012). Therefore, studies for Spain based availability on high-quality longitudinal data would be a remarkable contribution to future research.

Nevertheless, at worst, the results presented in this study will have an non-negligible descriptive value, as they provide us with some information about how the current process of downsizing of public sector employment, associated with austerity measures, might affect earnings and gender inequality.

The economic crisis suffered by Spain from 2009 to 2013 had a profound impact on the employment and wage levels of private and public sector employees. Regarding employment, from the 4th quarter of 2007, at the height of the employment boom, to the first quarter of 2013 —when the private employment destruction bottomed— the number of employees felt by 22% (three millions jobs lost in net terms). The reduction of public employment was more concentrated in time, from the 3rd quarter of 2011 to the 4th quarter of 2014, affecting almost four hundred thousand public employees (12% of total public employment). The reduction of public employment was the outcome of a radical change in economic policy from the application of anticyclical expansive policies in the first part of the crisis (2008-2010) to a resolute policy of fiscal consolidation from May 2010 onwards. Part of the austerity package consisted in two major labour market reforms in 2010 and 2012 aiming to reduce employment protection through the reduction of firing costs, decentralization of collective bargaining and the larger possibilities for firms for opting out from collective agreements.23

The dramatic increase of unemployment —reaching 26.9 % the 1st quarter of 2013— and the above-mentioned labour market reforms have had a downward impact on wages (with one-year lag) (OECD, 2012; Bank of Spain, 2015). Regarding public employees, since the beginning of the crisis in 2008, public sector workers have seen their wages eroded in nominal terms twice, in 2010 and 2012, while the rest of years the remunerations were frozen. The first reduction meant a permanent average cut of 5%, larger for higher wages, whereas the second one consisted in the temporary removal of the 14th month payment, one of the two extra annual payments of Spanish employees, which, on average, represented a proportional 7% wage cut.24 Although it is extremely difficult to know how this reduction of wages has affected the public-private wage gap (and, certainly, impossible with the database used here), the work of Fernández-Kranz (2014) provides some insights on this issue. This author explores the adjustment of wages in the Spanish economy for the period 2008-2014 among Spanish male workers using Social Security administrative data. His findings suggest a more intense pay reduction in the public sector, therefore, making very plausible a further erosion of wage premium to public sector employees. Regarding the gender gap, it is very likely that the reduction of volume of public employment, particularly in the sectors linked to Welfare State services (Muñoz de Bustillo and Antón, 2013), might result in a widening in the gender pay gap.

CONCLUSIONS

The aim of this article has been to provide a much-needed updated picture of the wage gap between public and private sector employees in Spain, as the public sector has experienced substantial transformations in both quantitative and qualitative terms since the early 90s, when most of previous studies are focused. Using the WSS 2010, which allows overcoming some of the problems presented by other current data sources, we have explored the premium to public employment for both males and females and the incidence of the gender gap among public and private employees. We have reached several conclusions. The first one refers to the existence of an average positive premium to public employment. Nevertheless, this gap concentrates on low-skilled workers, whereas very qualified employees in the public sector face a penalty with respect to similar individuals employed in the private economy. In the second place, we have found that the extent of the gender gap is smaller in the public sector and the incidence of a glass-ceiling effect is much more blurring than among private employees. Third, we have explored the particularities of the Education and the Human Health and Social Work sectors, where the public and the private economy largely coexist. The most remarkable result has been the much lower importance of the public sector premium in the former activity.

Finally, we have interpreted our findings in the light of the specificities —mainly, the labour market institutions— of the Spanish economy, arguing that the current process of downsizing of the public sector associated with the ongoing process of fiscal consolidation might have adverse effects on earnings inequality and widen the gender gap.

REFERENCES

Alba-Ramírez, A., and San Segundo, M.J., 1995. The Returns to Education in Spain. Economics of Education Review, 14(2), pp. 155-166. [ Links ]

Albert, C, and Moreno, G., 1998. Diferencias salariales entre el sector público y privado español: un modelo de switching. Estadística Española, 40(143), pp. 167-193. [ Links ]

Albrecht, J., Björklund, A., and Vroman, S., 2003. Is There a Glass Ceiling in Sweden? Journal of Labor Economics, 21(1), pp. 145-177. [ Links ]

Albrecht, J., van Vuuren, A., and Vroman, S., 2008. Counterfactual Distributions with Sample Selection Adjustments: Econometric theory and an application to the Netherlands. Eabour Economics, 16(4), pp. 383-396. [ Links ]

Angrist, J.D, and Pischke, J.-S., 2009. Mostly Harmless Econometrics. An empiricists companion. Princeton, New Jersey: Princeton University Press. [ Links ]

Antón, J.-L, Muñoz de Bustillo, R., and Carrera, M., 2012. Raining Stones? Female immigrants in the Spanish labor market. Estudios de Economía, 39(1), pp. 53-86. [ Links ]

Bank of Spain, 2015. Economic Bulletin 06/15. Madrid: Banco de España. [ Links ]

Bargain, Q, and Melly B., 2008. Public Sector Pay Gap in France: New evidence using panel data [IZADiscusion Paper Series no. 3427]. Institute for the Study Labor (IZA), Bonn Germany. [ Links ]

Bender, K.A., 1998. The Central Government-private Sector Wage Differential. Journal of Economic Surveys, 12(2), pp. 177-220. [ Links ]

Blinder, A.S., 1973. Wage Discrimination: Reduced form and structural estimates. Journal of Human Resources, 8(4), pp. 436-455. [ Links ]

Bound, J., Jaeger, DA., and Baker, R.M., 1995. Problems with Instrumental variables estimation when the correlation between the instruments and the endogenous explanatory variable is weak", Journal of the American Statistical Association, Vol. 90, No. 430, pp. 443-450. [ Links ]

Cai, L., Liu, A.Y.C, 2011. Public-private Sector Wage Gap in Australia: Variation along the distribution. British Journal of Industrial Relations, 49(2), pp. 362-390. [ Links ]

Campos, M.M., and Centeno, M., 2012. Public-private Wage Gaps in the Period Prior to the Adoption of the Euro: An application based on longitudinal data [Working Paper no. 1/2012]. Banco de Portugal, Lisbon, Portugal. [ Links ]

Carrasco, R., Jimeno, J.F., and Ortega, A.C, 2008. The Effect of Immigration on the Labor Market Performance of Native-born Workers: Some evidence for Spain. Journal of Population Economics, 21(3), pp. 627-648. [ Links ]

Chernozhukov, V, Fernández-Val, I., and Melly B., 2013. Inference on Counterfactual Distributions. Econometrica, 81(6), pp. 2205-2268. [ Links ]

De la Rica, S., Dolado, J.J., and Llorens, V, 2008. Ceiling or Floors? Genderwage gaps by education in Spain. Journal of Population Economics, 21(3), pp. 751-776. [ Links ]

Depalo, D, and Giordano, R., 2011. The Public-private Pay Gap: A robust quantile approach. Giornale degli Economisti, 70(1), pp. 25-64. [ Links ]

DiNardo, J., Fortin, N.M., and Lemieux, T, 1996. Labor Market Institutions and the Distribution of Wages, 1973-1992: A semiparametric approach. Econometrica, 64(5), pp. 1001-1044. [ Links ]

Disney, R., and Gosling, A., 1998. Does it Pay to Work in the Public Sector. Fiscal Studies, 19(4), pp. 347-374. [ Links ]

EACEA (Education, Audiovisual and Culture Executive Agency), 2012). Teachers' and School Heads' Salaries and Allowances in Europe, 2011 /12. Brussels: European Commission. [ Links ]

Ehrenberg, R.G, and Schwarz, J.L., 1986. Public-sector Labor Markets. In: O. Ashenfelter and R. Layard (eds.). Handbook of Eabor Economics [Vol. 2] (pp. 1219-1260). Amsterdam: North-Holland. [ Links ]

Fernández-Kranz, D, 2014. Ajuste salarial en España durante la crisis económica. Cuadernos de Información Económica, 240, pp. 47-57. [ Links ]

Firpo, S., Fortín, N.M., and Lemieux, T., 2009. Unconditional Quantile Regressions. Econometrica, 77(3), pp. 953-973. [ Links ]

Fortin, N.M., Lemieux, T., and Firpo, S., 2011. Decomposition Methods in Economics. In: O. Ashenfelter and D. Card (eds.). Handbook of Labor Economics [Vol. 4A] (pp. 1-102). Amsterdam: New Holland. [ Links ]

García, J., Hernández, P.J., and López, A., 1997. Diferencias salariales entre sector público y sector privado en España. Papeles de Economía Española, 72, pp. 261-274. [ Links ]

García, N.E., and Ruesga, S. (coords.), 2014. ¿Qué hapasado con la economía española? La gran Recesión 2.0 (2008-2013). Madrid: Editorial Pirámide. [ Links ]

García-Pérez, J.I., and Jimeno, J.F, 2007. Public Sector Wage Gaps in Spanish Regions. Manchester School, 75(4), pp. 501-531. [ Links ]

García-Serrano, C, 2011. Déjá vu? Crisis de empleo y reformas laborales en España. Revista de Economía Aplicada, 19(56), pp. 149-177. [ Links ]

Gardeazábal, J., and Ugidos, A., 2005. Gender Wage Discrimination at Quantiles. Journal of Population Economics, 18(1), pp. 165-179. [ Links ]

Gavino, A.R., 2012. El salario de los empleados públicos fue en 2010 un 30% mayor que la media. El País, [online] 24th October. Available at: <http://economia.elpais.com/economia/2012/10/24/actualidad/1351072633_131269.html>.

Giordano, R., Depalo, D, Coutinho, M., Eugene, B., Papapetrou, E., Pérez, J.J., Reiss, L., and Roter, M., 2011. The Public Sector Pay Gap in a Selection of Euro Area Countries [Working Paper Series no. 1406]. European Central Bank, Frankfurt am Main, Germany. [ Links ]

González, L, and Ortega, F, 2011. How do Very Open Economies Adjust to Large Immigration Flows? Evidence from Spanish regions. Labour Economics, 18(1), pp. 57-70. [ Links ]

Gregory, R.G, and Gerland, J., 1999. Recent Developments in Public Sector Labor Markets. In: OC. Ashenfelter and D. Card (eds.). Handbook of Labor Economics [Vol. 3C] (pp. 3573-3630). Amsterdam: North-Holland. [ Links ]

Grimshaw, D, Rubery, J. and Marino, S., 2012. Public Sector Pay and Procurement in Europe during the Crisis: The challenges facing local government and the prospects for segmentation, inequalities and social dialogue. European Commission project "Public Sector Pay and Social Dialogue during the Fiscal Crisis" (coordinated by EWERC, University of Manchester, no. VS/2011/0141). Manchester, UK: University of Manchester. Available at: <https://research.mbs.ac.uk/european-employ999999999999999999ment/Portals/0/docs/Comparative%20report%20final.pdf> [ Links ].

Hartog, J., and Oosterbeek, H., 1993. Public and Private Sector Wages in the Netherlands. European Economic Review, 37(1), pp. 97-114. [ Links ]

Heitmueller, A., 2006. Public-private Sector Pay Differentials in a Devolved Scotland. Journal of Applied Economics, 9(2), pp. 295-323. [ Links ]

Holmlund, B., 1993. Wage Setting in Private and Public Sectors in a Model with Endogenous Government Behaviour. European Journal of Political Economy, 9(2), pp. 149-162. [ Links ]

Hospido, L., and Moral-Benito, E., 2014. The Public Sector Wage Premium in Spain: Evidence from longitudinal administrative data [Documentos de Trabajo no. 1422]. Banco de España, Madrid, España. [ Links ]

INE (Instituto Nacional de Estadística), 2012. Wage Structure Survey (WSS). Methodology. Madrid: Instituto Nacional de Estadística. [ Links ]

Koenker, R., 2005. Quantile Regression. Cambridge: Cambridge University Press. [ Links ]

Lassibille, G, 1998. Wage gaps between the public and private sectors in Spain. Economics of Education Review, 17(1), pp. 83-92. [ Links ]

López, A., 2007. La protección social de los funcionarios públicos. Granada: Universidad de Granada. [ Links ]

Lucifora, C, and Meurs, D, 2006. The Public Sector Gap in France, Great Britain and Italy", Review of Income and Wealth, 52(1), pp. 43-59. [ Links ]

Machado, J.A.F, and Mata, J., 2005. Counterfactual Decomposition of Changes in Wage Distributions using Quantile Regression. Journal of Applied Econometrics, 20(4), pp. 445-465. [ Links ]

McKenzie, D, Stillman, S., and Gibson, J., 2010. How Important is selection? Experimental vs. non-experimental measures of the income gains from migration. Journal of the European Economic Association, 8(4), pp. 913-945. [ Links ]

Melly, B., 2005a. Public-private Sector Wage Differentials in Germany: Evidence from quantile regression. Empirical Economics, 30(2), pp. 505-520. [ Links ]

Melly, B., 2005b. Decomposition of Differences in Distribution using Quantile Regression. Labour Economics, 12(4), pp. 577-590. [ Links ]

Melly, B., and Puhani, PA., 2013. Do Public Ownership and Lack of Competition Matter for Wages and Employment? Evidence from personnel records of a privatized firm. Journal of the European Economic Assodation, 11(4), pp. 918-944. [ Links ]

Mizala, A., Romaguera, P., and Gallegos, S., 2011. Public-private Wage Gap in Latin America (1992-2007): A matching approach. Labour Economics, 18(Supplement 1), pp. 115-131. [ Links ]

Mueller, R.E., 2000. Public- and Private-sector Wage Differentials in Canada Revisited. Industrial Relations, 39(3), pp. 375-400. [ Links ]

Muñoz de Bustillo, R., and Antón, J.-L, 2012. Those were the days my friend. The public sector and the economic crisis in Spain. Paper presented at the meeting of the International Labour Organisation-European Commission project "Adjustments in the Public Sector in Europe: Scope, effects and policy issues", ILO Headquarters, Geneva, Switzerland, 13th-14th March. [ Links ]

Muñoz de Bustillo, R., and Antón, J.-L, 2013. Those were the Days, my Friend. The public sector and the economic crisis in Spain. In: D. Vaughan-Whitehead (ed.). Public Sector Shock: The impact of policy retrenchment in Europe (pp. 511-542). Cheltenham: Edward Elgar. [ Links ]

Muñoz de Bustillo, R., and Antón, J.-L, 2015. Turning Back before Arriving: The weakening of the Spanish welfare state. In: D. Vaughan-Whitehead (ed.). The European Social Model in Crisis: Is Europe Losing Its Soul? (pp. 451-506). Cheltenham: Edward Elgar. [ Links ]

Ñopo, H, 2008. Matching as a Tool to Decompose Wage Gaps. Review of Economics and Statistics, 90(2), pp. 290-299. [ Links ]

Oaxaca, R.L., 1973. Male-female Wage Differentials in Urban Labor Markets. International Economic Review, 14(3), pp. 673-709. [ Links ]

Oaxaca, R.L., and Ransom, M.R., 1994. On Discrimination and the Decomposition of Wage Differentials. Journal of Econometrics, 61(1), pp. 5-21. [ Links ]

OECD (Organization for the Co-operation and Economic Development), 2013. The 2012 Labour Market Reform in Spain: A preliminary assessment. Paris: OECD. [ Links ]

Pons, E., and Blanco, J.M., 2000. El papel de la educación en la determinación salarial: diferencias por sexo y sector [Documento de Trabajo no. 00-01]. Universitat de Valencia, Valencia, Spain. [ Links ]

Postel-Quinay F, and Turón, H, 2007. The Public Pay Gap in Britain: Small differences that (don't?) matter. Economic Journal, 117(523), pp. 1460-1503. [ Links ]

Segovia, C, 2012. Sueldos privilegiados en las CCAA rescatadas. El Mundo, 29th October, p. 34.

Staiger, D, and Stock, J.H., 1997. Instrumental Variables Regression with Weak Instruments. Econometrica, 65(3), pp. 557-586. [ Links ]

Tepe, M., Kittel, B., and Gottschall, K., 2015. The Competing State: Transformation of the public/private sector earnings gap in four countries. In: S. Schneider and H. Rothgang (eds.). State Transformations in OECD Countries. Dimensions, Driving Forces, and Trajectories (pp. 41-66). Houndsmills: Palgrave Macmillan. [ Links ]

Ugidos, A., 1997. Diferencias salariales entre hombres y mujeres en el sector público y en el sector privado. Información Comercial Española. Revista de Economía, 760, pp. 61-75. [ Links ]

Ullibarri, M., 2003. Diferencias salariales entre los sectores público y privado por género, escolaridad y edad. El caso de España. El Trimestre Económico, 70(278), pp. 233-252. [ Links ]

Van der Gaag, J., and Vijverberg, W, 1988. A Switching Regression Model for Wage Determinants in the Public and Private Sectors of a Developing Country. Review of Economics and Statistics, 70(2), pp. 244-252. [ Links ]

Visser, J., 2006. Union Membership Statistics in 24 Countries. Monthly Eabor Review, 129(1), pp. 38-49. [ Links ]

Antón and Muñoz de Bustillo gratefully acknowledges financial support from the Spanish Ministry of Science and Innovation (research projects CSO2010-16413, CSO2013-41828-R and CSO2013-47667-P and CSO2013-41828-R, respectively). A previous version of the article was presented at the 34th Annual Conference of the International Working Party on Labour Market Segmentation (IWPLMS 2013), Dublin, 12th-14th September 2013. The authors thank Albert Recio, Rafael Bonete, Damián Grimshaw, Virginia Hemanz and two anonymous reviewers for helpful comments on a previous draft.

1 For instance, in some developed countries (like Norway or Switzerland) there is an earnings penalty on public sector employees and the same applies in many cases to some types of jobs —particulady those requiring high skills— in a relevant number of countries. See, among other, Gregory and Bodand (1999).

2 In this respect, we can quote, among many others, the works of van der Gaag and Vijverberg (1988) for Ivory Coast or Hartog and Oosterbeek (1993) for the Netherlands.

3 For instance, other techniques quite similar to the one proposed by Machado and Mata (2005) that allows decomposing the gaps across the distribution are the ones suggested by Firpo, Fortín and Lemieux (2007) and Chernozhukov et al. (2013). See Fortín, Lemieux and Firpo (2011) for a survey of econometric decompositions.

4 In the results summarized by the table, when several sorts of results are presented in the reviewed studies, we try to select those results that take the private sector as the reference group when calculating the unexplained differential. In the same fashion, when dealing with the gender gap, we present the results that take males as the reference. We discuss this issue in more detail in the methodology section. See, among others, Oaxaca and Ransom (1994) for a discussion about this issue.

5 See, for example, Muñoz de Bustillo and Antón (2013) for a summary of how the decentralization process has affected the distribution of public labour force by type of public administration.

6 Nevertheless, in the case of Spain, the available studies on the impact of immigration on wages in Spain suggest the absence of significant negative effects of migration on labour market outcomes of natives (Carrasco, Jimeno and Ortega, 2008; Gonzalez and Ortega, 2011).

7 The analysis of public-private wage gaps at the level of the regions García-Pérez and Jimeno (2007) shows, unsurprisingly, a weak inverse relation between the wage gap and the per capita income of the regions, as poorer regions tend to have lower wages in the private sector as well as a higher public employment rates. This simple correlation is interpreted as a signal of negative impact of public employment on productivity. From our perspective, we should also take into account the existence of national wide criteria for service provision (and more or less similar wages) regardless of the situation of local labor markets in terms of wages and unemployment, and regardless of the level of development of the regions. This could also explain such relationship. Therefore, the alleged causal relationship between regional public-private wage gaps and productivity is far from being clearly grounded.

8 In fact, the classifications of occupations has been changed twice for other purposes (for instance, in the LFS) following successive updates of the International Standard Classification of Occupation.

9 As monthly wages reported in the WSS correspond to October 2010, in principle, this database should be including the 5% average cut decided in May 2010 and applicable since June 2010.

10 Standard public sector employees are affiliated to the general Social Security. Nevertheless, some civil and military servants join another scheme with different retirement conditions. The exceptions among civil servants refer to some jobs injustice, Diplomacy and Public Administration, among others. They are usually jobs that do not have a private counterpart. See, for instance, López (2007) for details. Furthermore, apart from not affecting standard employees, it is not clear at all that the special conditions governing their scheme are beneficial for them. In this respect, it is not very likely that there might be a correlation between belonging this regime and unobservable characteristics linked to personal skills, particulady after implementing extensive controls for observable characteristics.

11 According to the Spanish LFS of the 3td quarter of 2010 (a quarter selected because the reference month for the WSS 2010 is October), there was no worker employed by the public sector in the domestic personnel sector, the presence of this type of workers is negligible in Agriculture, livestock and fishing activities and neither public nor private sector employee in extraterritorial bodies. According to the LFS, the percentage of public sector workers in the relevant sectors (leaving aside Agriculture, livestock and fishing activities and Activities of households as employers but including the partially covered Public Administration, Defence and Compulsory Social Security) is 22.2% of total employees, while the WSS 2010 gives a figure of 18.2%. Excluding the partially covered sector, coverage is complete.

12 In this respect, it is advisable to keep in mind that bad instruments —either weakly correlated with the endogenous right-hand side variable or dubiously exogenous to it— can make more harm than good (Bound, Jaeger and Baker, 1995; Staiger and Stock, 1997; Angrist and Pischke, 2009; McKenzie, Stillman and Gibson, 2010). For instance, if instruments are weak (weakly correlated with the potentially endogenous variables), the precision of estimates can dramatically diminish). Indeed, these sorts of issues might be behind the large variability of results for previous estimates of the gaps for Spain.

13 For instance, García, Hernández y López (1997) chooses marital status and whether the person is a household head as exclusion restrictions; Ugidos (1997), father's education; Albert and Moreno (1998), marital status; Lassibille (1998), marital status, family income and the demographic and economic structure of the household as instrumental variables; Pons and Blanco (2000), marital status, whether the father works or worked in the public sector; whether the mother works or worked and parents' schooling level; Ullibarri (2003), parents' education and sector of employment (public or private sector); finally, García-Pérez and Jimeno (2007) selects spouse's education and sector of affiliation, capital income and savings rate. In all these cases, there are good reasons for being sceptical about the exogeneity of the mentioned variables with respect to earnings.

14 This is the most common choice in the literature. Other alternatives yield similar qualitative results. For a detailed discussion on the selection of the reference group, see Oaxaca and Ransom (1994).

15 Other ways of analyzing unexplained wage gaps across the whole distribution have been proposed by DiNardo, Fortín and Lemieux (1996), based on semiparametric estimation methods, and Gardeazábal and Ugidos (2005) and Melly (2005b) using quantile regression.

16 Standard errors of this expression can be computed using the asymptotic expression for the covariance matrix suggested by Albrecht, van Vuuren and Vroman (2008). We compute them but they are not showed in the figures in order to favour the clarity of the presentation. They are available from the authors upon request. It is also worth mentioning that other recent decompositions, as the one proposed by Chernozhukov et al. (2013), build on the approach of Machado and Mata (2005).

17 The name of Human health and social work, although not very appealing, is the denomination used in the National Classification of Economic Activities (particularly, it corresponds to group Q). No further disaggregation is possible. This group includes human health activities, residential care activities and social work activities without accommodation.

18 The weight of public employment in total salaried employment according to the Spanish LFS in 2010 (2nd quarter) is slighdy different: the public sector employed 20% of salaried workers and Education and Human health and social work activities amounted to 67 and 52% of employees, respectively. The weight of both sectors of activity in total public employment was roughly 47%. The discrepancies between both sources can be related to anonymization procedures used by the National Statistics Institutes when delivering the sample of the WSS 2010 and with the fact that teachers in private education funded by the State has their wage direcdy paid by public authorities, which might make them report that they are public employees in the LFS (EACEA, 2012, p. 42).

19 Specifically, we estimate a first model including only age, education, nationality and region, a second model comprising also tenure, part-time condition, type of contract, supervisory role and firm size; a third model adds occupation and sector of activity and a the last incorporates type of collective agreement and firm's target market. As mentioned in the main text, the results obtained under the different models are relatively similar.

20 For instance, apart from the problems affecting some variables like occupational and educational level, Muñoz de Bustillo and Antón (2012) does not control for tenure and Hospido and Moral-Benito (2014) do not include education and tenure in their analyses.

21 In this respect, it is important to mention that most of the private schools —73%— are financed to a large extent by public funds. More than 80% of pupils attending private pre-university education attend to this type of education centre. These educational centres apply similar wage rates than public schools (although they are not civil servants they have a national collective agreement regulating wages and other working conditions) and, therefore, during the crisis have been usually subject to the same pay policy than public schools. Even teachers are paid directly by public authorities (EACEA, 2012, p. 42).

12 For instance, as mentioned in a previous footnote, teachers in such centres are covered by a unique collective agreement (with the exception of the Basque Country) establishing similar working conditions as those enjoyed by their public counterparts and the bulk of funds allocated to such schools goes direcdy to fund personnel costs. Such circumstances do not apply to publicly-funded private health care, where public authorities usually pay per each service produced by private providers (like medical tests and surgical interventions at private clinics) or purchase collective private insurances for some groups of civil servants.

23 On the role of labour regulation reforms in the management of economic crisis in Spain see, among others, Garcia Serrano (2011). The impact of the labour reforms and fiscal consolidation policies on Spanish public employment and the Welfare State is studied in Muñoz de Bustillo and Antón (2013 and 2015). Different aspects of the crisis of the Spanish economy are explored in detail in the special numbers 124 and 135 of Papeles de Economía Española, in the number 246 of the journal Cuadernos de Información Económica and in García and Ruesga (2014).

24 As mentioned above, in principle, the first pay reduction should be captured by our database. Regarding the second cutback, some workers with very low wages were waived, but they represented a tiny fraction of public sector labour force.