Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.71 no.280 Ciudad de México abr./jun. 2012

The Rise and Fall of Export-led Growth

El ascenso y caída del modelo de crecimiento orientado por las exportaciones

Thomas I. Palley*

* New America Foundation. Correo electrónico: <mail@thomaspalley.com>.

Received November 2011

Accepted March 2012

Abstract

This paper traces the rise of export-led growth as a development paradigm and argues it is exhausted owing to changed conditions in emerging market (EM) and developed economies. The global economy needs a recalibration that facilitates a new paradigm of domestic demand-led growth. Globalization has so diversified global economic activity that no country or region can act as the lone locomotive of global growth. Political reasoning suggests EM countries are unlikely to abandon export-led growth, and nor will the international community implement the international arrangements needed for successful domestic demand-led growth. Consequently, the global economy likely confronts asymmetric stagnation.

Keywords: export-led growth, domestic demand-led growth, economic development, stagnation.

JEL Classification:* F00, F01, F02, F10, F20, F50, O11, O19, O24 ............................ 141

Resumen

Este artículo traza el ascenso del modelo de crecimiento orientado por las exportaciones como un paradigma de desarrollo y se argumenta que éste ya está agotado debido a cambios en las condiciones de las economías de mercado emergentes (EM) y de las desarrolladas. La economía global necesita una re-calibración que facilite un nuevo paradigma de crecimiento orientado por la demanda interna. La globalización ha diversificado tanto la actividad económica global que ningún país o región puede actuar como la única locomotora del crecimiento global. El razonamiento político sugiere que es improbable que los países EM abandonen el modelo de crecimiento orientado por las exportaciones, y que la comunidad internacional no implementará los arreglos internacionales necesarios para un exitoso crecimiento orientado por la demanda interna. En consecuencia, es probable que la economía global confronte estancamiento asimétrico.

Palabras clave: crecimiento orientado por las exportaciones, crecimiento orientado por la demanda interna, desarrollo económico, estancamiento.

INTRODUCTION

For the past thirty years development policy has been dominated by the paradigm of export-led growth. That paradigm is part of a consensus among economists about the benefits of economic openness which has been used to promote and justify globalization.

The Great Recession has surfaced contradictions that were always inherent in export-led growth and globalization and the global economy now confronts a troubling outlook of significant demand shortage. In developed economies the shortage is explicit in high rates of unemployment and large output gaps. In emerging market (EM) economies it is implicit in their reliance on export markets.

This paper argues the case for trade openness and export-led growth was always over-simplified and over-sold. As a result of the widespread turn to openness and export-led growth the global economy confronts an extended period of asymmetric stagnation marked by slower growth in EM economies, stagnation in developed economies, and increased economic tensions between EM and developed economies.

THE RISE OF EXPORT-LED GROWTH

The export-led growth paradigm rose to prominence in the late 1970s when it replaced the import-substitution paradigm that had dominated development policy thinking (especially in Latin America) in the thirty years after World War II. Export-led growth is a development strategy aimed at growing productive capacity by focusing on foreign markets. It is part of a new consensus among economists about the benefits of economic openness that took hold in the 1970s.

This new consensus rests on a fusion of three strains of argument that is illustrated in Figure 1. The first strain, based on Heckscher-Ohlin-Samuelson comparative advantage theory, is about the gains from trade between economies with different capital –labor ratios (Ohlin, 1933; Samuelson, 1948; Dornbusch, Fischer and Samuelson, 1980). The second strain concerns the benefits of openness for controlling rent seeking, a problem that import-substitution development was strongly criticized for (Krueger, 1974). The third strain, which developed later, is the benefits of openness for growth. The claim is trade encourages technology diffusion and knowledge spillovers that contribute to faster productivity growth (Grossman and Helpman, 1991).

Export-led growth represents a subsidiary branch within this new consensus that applies to developing countries. The argument is self-conscious policy focused on external markets helps capture the economic benefits of openness for developing countries by encouraging best practice adoption; promoting product development; and exposing firms to competition. The success of the four East Asian Tiger economies (South Korea, Hong Kong, Singapore, and Taiwan) appeared to provide empirical support for these claims.

According to economists export-led growth generates a win –win outcome for developing and industrialized economies. All benefit from the global application of the principle of comparative advantage, while developing countries gain extra benefit from an external focus. Moreover, industrialized economies supposedly benefit even if developing countries subsidize their exports so as to win additional exports. That is because countries which subsidize their exports are giving a gift to countries receiving those exports. However, that latter claim rests on two highly questionable assumptions. First, there is no long-term dynamic cost to industries displaced by such subsidies. Second, there is scarcity of resources and full employment (i.e. no Keynesian unemployment) which makes the subsidies a gift.

These arguments about the benefits of trade and economic openness played an important role in propelling the new agenda of international economic integration. That is because they dovetailed with the economic interests of large corporations who were looking to establish a new global economic structure that has since become known as globalization. Corporations therefore embraced economists' ideas as they helped power their global economic agenda. That created a corporate –elite opinion alliance which bonded trade theory with corporate globalization, and that alliance drove expansion of the General Agreement on Tariffs and Trade (GATT) and the subsequent establishment of the World Trade Organization (WTO) in 1996.

With regard to developing countries, the International Monetary Fund (IMF) and World Bank played a special role spreading the new agenda. That is because developing countries needed financial assistance after the 1970s oil shocks and the IMF and World Bank made access to assistance conditional on governments embracing the openness agenda.

CRITIQUES OF THE NEW OPENNESS AGENDA

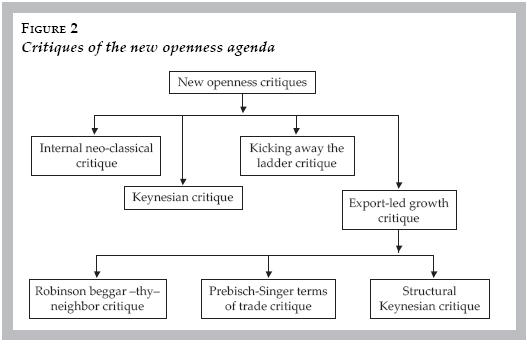

Though the new "openness" agenda swept academic economics, it was also always opposed and the insights and arguments of this opposition have become increasingly prescient. Figure 2 identifies four strains of critique of the openness paradigm. The first strain is the comparative advantage critique. There has always been a small internal neoclassical critique that focuses on potential pathologies of trade liberalization. These pathologies included Johnson's (1954, 1955) terms of trade deterioration critique; Bhagwati's (1958) immiserizing growth critique that extended Johnson's critique to a dynamic context; the Stolper and Samuelson (1941) critique about trade and income distribution; and Lipsey and Lancaster (1956-57) based critiques about unintended negative effects of trade liberalization in a world of market imperfections (see for example Brewer, 1985). However, this internal critique is a collection of rare pathologies and in many regards it is a confusing distraction to more systemic critiques. That is because it accepts the fundamental logic of neoclassical trade theory rather than challenging it.1

The second strain is labeled the Keynesian critique and it has its roots in macroeconomics and Keynes rejection of comparative advantage (Prasch, 1996; Milberg, 2002). In a Keynesian world of demand shortage trade can reduce domestic demand, leading to reduced output, employment, and national welfare. An implicit corollary proposition is that in a Keynesian world export subsidies are not a gift but may instead poach demand and employment.

The Keynesian aggregate demand shortage critique also makes exchange rates a trade issue because undervalued exchange rates impact demand by altering the relative price of imports and exports. Classical open economy macroeconomics, which is the twin of neo-classical trade theory, asserts any employment effects of under-valued exchange rates are at worst temporary. That is because monetary factors are supposedly neutral. Either the real exchange rate adjusts to offset the effects of money, or the money supply adjusts via the specie-flow mechanism in response to trade deficits. However, this logic falls apart if there are hysteresis effects related to patterns of demand and the organization of production (Palley, 2003a). In that case exchange rates are non-neutral in both the short- and long-run, and these non-neutralities make the benefits of trade contingent on appropriate exchange rate arrangements. Absent such arrangements trade may reduce welfare.

The Keynesian demand shortage argument also carries over to situations with economies of scale. In the presence of economies of scale, measures that increase demand (including protection) can increase exports by lowering the average costs of producers. That can provide another reason to limit free trade (Krugman, 1984).

The third strain of critique is labeled "kicking away the ladder" after the book of that title by Chang (2002). This critique traces back directly to the post-World War II import-substitution school of thought and argues trade protection, industrial policy, and the ability to conduct macroeconomic policy are necessary for successful development. Chang (2002) argues no country has successfully industrialized without such policies. Whereas the Keynesian critique of openness is generic and holds for both developed and emerging market economies, the kicking away the ladder critique applies only to emerging market and developing economies.

The fourth strand of critique is specifically about export-led growth and it consists of three separate elements. The first element is labeled the Robinson beggar-thy-neighbor critique after Joan Robinson's (1947 [1937]) observations about macroeconomic mercantilism. This argument is Keynesian and stems from the competitive devaluation experience of the 1930s. The logic is countries that try to export their way out of demand shortage implicitly harm their neighbors by poaching demand and employment. Applied to export-led development, the Robinson critique suggests there may be a fallacy of composition and developing countries may crowd out each-others exports (Blecker, 2000; Palley, 2003b; Blecker and Razmi, 2010).

The second element is labeled the Prebisch (1950) and Singer (1950) critique. It focuses on supply and price effects of export-led growth in contrast to the Robinson critique which focuses on demand and quantity effects. Sixty years ago Raul Prebisch (1950) and Hans Singer (1950) identified a problem of declining terms of trade for commodity exporting countries. Today, the problem has shifted from commodities to manufactured goods and countries that engage in export-led growth may exacerbate the problem by increasing the global supply of such goods (Sarkar and Singer, 1991; Kaplinsky, 1993; Sapsford and Singer,1998).

The third element is labeled the structural Keynesian critique (Palley, 2002, 2004). The argument here is export-led growth promotes economic structures that deliver low quality growth and prevent the development of deep prosperity. Within countries, development has shallow roots because it is externally focused –a phenomenon exemplified by export processing zones and Mexico's maquiladora zone–. Internationally, export-led growth promotes a race to the bottom as countries try to gain competitive advantage by any means. That results in wage suppression, disregard for labor and environmental standards, disregard of workplace conditions, and weak regulation aimed at pleasing capital.

The development of wages in Mexico (see Salas and Zepeda, 2003) exemplifies the wage suppression that comes with the adoption of an export-led growth strategy. Severe wage moderation aimed at increasing international competitiveness also afflicts Germany and has contributed to Germany's macroeconomic stagnation (see Hein and Truger, 2005, 2010). Moreover, because of Germany's economic standing and power it has also pressured wage developments throughout Europe, which illustrates the negative externalities that adoption of export-led growth can impose on global aggregate demand.

A BRIEF HISTORY OF EXPORT-LED GROWTH

The last thirty years have seen tremendous spread of the export-led growth paradigm. The strategy was pioneered by Germany and Japan in 1950s and 1960s. In the 1970s and 1980s it was adopted by the four East Asian Tigers –South Korea, Taiwan, Hong Kong, and Singapore–. In the 1980s and 1990s it spread further, being adopted in South East Asia by Thailand, Malaysia, and Indonesia. In Latin America it was adopted by Mexico. In the 2000s China has exemplified the paradigm.

The model has not been constant, but has instead evolved to fit changing global circumstances and to fit individual country conditions. This evolution can be thought of as involving four stages.

Stage I was kicked off by Germany and Japan and can be thought of as running from 1945-1970. Both countries had their own indigenous industrial base and export growth was driven by an under-valued exchange rate. Growth also benefitted from U.S. aid made available after World War II as part of reconstruction and the Cold War.

Stage II captures the experience of the four East Asian tigers - South Korea, Taiwan, Hong Kong and Singapore –and runs from 1970-1985–. Once again countries relied on an under-valued exchange rate but now there was need for more foreign technology acquisition. This was done via strategic planning and benefitted from the fact that technology was becoming more mobile.

Stage III is epitomized by Mexico's engagement with export-led growth. The major change from stage II is that countries now started turning themselves into export production platforms for foreign multi-nationals rather than developing their own indigenous industrial capacity. This changed strategy was feasible because of increased mobility of technology and capital. The key elements of the new strategy were a) integration into the global economy; b) an undervalued exchange rate; c) suppression of wages and social standards. The goal was to enhance international competitiveness so as to become attractive to multi-national corporations (MNCs) as a site for foreign direct investment (FDI) that was export-oriented. However, the benefits have also proved much more elusive.

The new strategy is exemplified by Mexico's experience which began with the trade liberalization of 1986. That set the path to North American Free Trade Agreement (NAFTA) and the creation of a North American free trade area in 1994. The inauguration of NAFTA in January 1994 was marked by a peso crisis that resulted in massive devaluation of the peso vis-à-vis the US dollar, providing Mexico with an under-valued currency.

This third stage of export-led growth represents the beginning of the modern era of corporate globalization, and a critical feature is that export-led growth is no longer a purely national strategy. Instead, it is a partnership between developing countries, multi-national corporations, and developed countries. Governments and multi-nationals promoted the new system using the traditional language of free trade and claimed the goal was creation of a global market place. However, the real goal was not to promote traditional trade, but rather to create a global production zone in which corporations could establish export production platforms that would export back to developed country markets.

NAFTA is the template for the new model and it is massively significant from a historical standpoint. By unifying the United States (U.S.), Canada, and Mexico into a single free trade zone NAFTA created for the first time a free trade production zone that unified developed and developing economies. This template was then extended globally via the establishment of the WTO in 1996 and the admission of China into the WTO in 2001.

There are three important features of the NAFTA –corporate globalization model–. First, it promotes trade but not the classical trade of balanced exports and imports. Second, it promotes a new type of export-led growth based on relocating existing production and diverting new investment. That benefits emerging market economies by creating jobs, transferring technology, and relieving balance of payments constraints on growth. However, these economies do not own the industrialization process as was the case in stages I and II. Third, it does considerable damage to developed economies via deindustrialization, creation of international financial imbalances, and undermining the wage –productivity growth link which in turn undermines the coherence of the domestic income and demand generation process.

Stage IV is an extension and augmentation of the stage III model and is exemplified by China. China's model makes three major adjustments to Mexico's NAFTA model. First, it is characterized by asymmetric global engagement with China maintaining greater tariffs on imports. Second, there is managed under-valuation of the exchange rate that is maintained with capital controls. Third, there is a strategy for building an indigenous national technological base via forced technology sharing, joint-ventures in which MNCs may be minority shareholders, and technology theft. China's policies toward banking and automobile production are prime examples of this.

MNCs have also changed their strategy. Thus, they are now willing to engage in joint-ventures and also license and source from foreign producers rather than own facilities. In the case of China that is the price of entry, with corporations hoping they will be paid back by future profits from China's large market. Licensing and joint-ventures also benefit corporations by reducing their capital investment.

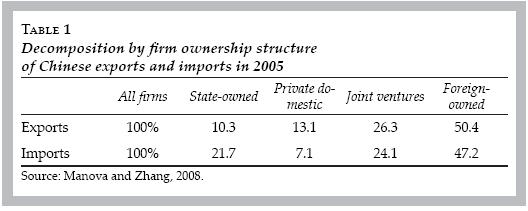

However, the basic structure of dependence on multinationals for exports remains intact so that stage IV Chinese export-led growth remains distinct from the earlier stage I and II experiences of Germany, Japan, and the East Asian Tigers. This dependence is illustrated in Table 1 which provides a decomposition of Chinese exports and imports by ownership structure. Foreign-owned firms account for 50.4% of Chinese exports, and that rises to 76.7% if joint ventures are included.

THE FALL OF EXPORT-LED GROWTH

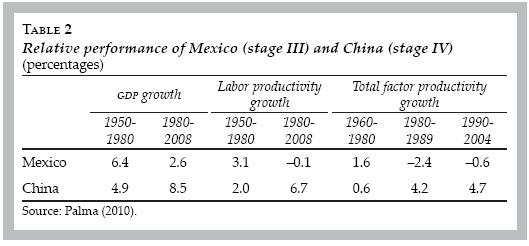

So far the analysis has been backward looking. This section peers into the future. For past several decades export-led growth has been a relatively successful development strategy, but there have also been clear signs of fraying. Though China has done well, stage III participants (like Mexico) have been less successful. This is illustrated in Table 2 which shows China has had rapid Gross Domestic Product (GDP) growth, rapid labor productivity growth due to rapid capital accumulation, and rapid total factor productivity (TFP) growth reflecting a dynamic economy characterized by technical advance. In contrast, Mexico has not recovered its strong performance of 1960-1980. Since 1980 GDP growth has been sluggish, labor productivity has been unchanged, and TFP growth has been negative.

Looking into the future, there are reasons to believe the export-led growth strategy is exhausted for all. The reason is changed conditions in both the developing economies and the developed economies.

The financial crash of 2008 and the accompanying Great Recession represent a watershed moment and have created an over-arching structural condition of global demand shortage. The U.S. economy is debt saturated. Europe is constrained by fiscal austerity and is itself wedded to export-led growth via Germany. Japan continues to suffer from and weak internal demand, has an aging population, and it is also still hooked on export-oriented growth. This combination augurs for stagnation in the industrialized economies.

Emerging market economies have continued growing on the back of their export-led growth strategies but the positive factors are likely to prove temporary. EM economies benefitted significantly from recovery of trade after the trade collapse of 2009. They are also benefitting from high commodity prices that have bounced back with trade, and commodity prices have further strengthened because commodities are viewed as a speculative hedge against inflation. Lastly, EM countries are benefitting from interest rate compression produced by the crisis. This rate compression will likely be a permanent benefit, but the trade bounce is a one-off benefit and realization of the prospect of stagnation will likely take the inflation premium out of commodities. At that stage, EM economies as a group will face structural impediments that make export-led growth collectively impossible.

The export-led growth model is now afflicted with several structural problems. Problem number one is the debt saturation of U.S. consumers. The model relied on robust consumer markets in developed economies (particularly the U.S.) to buy the exports and justify FDI. For twenty-five years those markets were artificially strong, fuelled by rising debt and asset price inflation. That pattern was unsustainable and it is now over, leaving a hole in the logic of the export-led model.

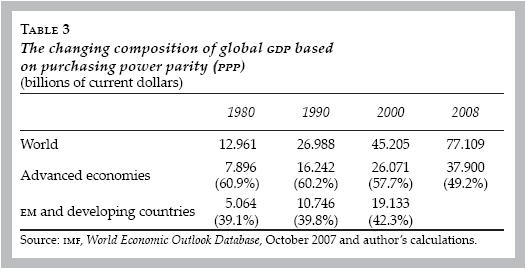

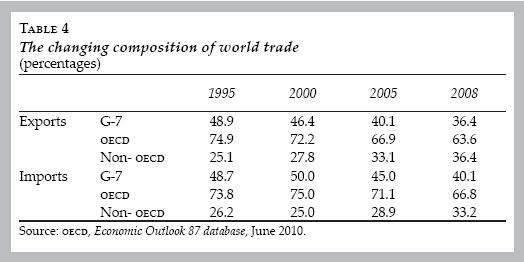

Problem number two is the relative size of the EM economies. They have become such a large share of the global economy that their exports are now driving a hole in the industrialized economies and sabotaging the recovery of those economies. This is illustrated in Tables 3 and 4. Table 3 shows the evolution of developed economy and emerging market plus developing economy shares of global GDP. The latter's share has risen from 30.1 percent in 1980 to 50.8 percent in 2008. Their share of global economic activity therefore makes it difficult for the group to rely on export-led growth.

Table 4 shows the changing composition of world trade. Non-Organization for Economic Co-operation and Development (OECD) country exports have risen from 25.1% of total in 1995 to 36.4 percent in 2008. Their share of world imports has risen more slowly from 26.2 to 33.2 percent. As a bloc these countries are running trade surpluses and they are still significantly dependent on exports for growth despite their larger size.2

In effect, the NAFTA globalization model has created a divided world where the consumers are in the North and producers are in the South. In the era of globalization expanding productive capacity is now relatively easy owing to technological innovations that have increased the mobility of capital and managerial expertise. The more difficult challenge is the structural Keynesian challenge of creating an income and demand generation process that supports productive capacity (Palley, 2006).

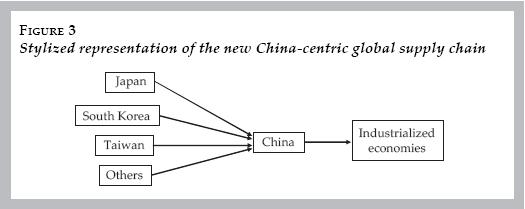

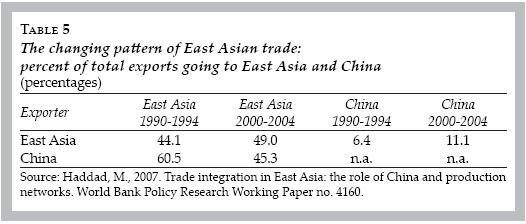

Nor is China likely to become the engine of growth because its growth model is still that of an assembler focused on supplying industrialized country consumers. This is illustrated in Figure 3 which provides a stylized representation of the new China-centric global supply chain. East Asian country exports go to China and China's exports then go to the industrialized economies.

This pattern of trade is supported by evidence in Table 5 which analyzes the changing composition of East Asian exports. The share of East Asian exports going to China has been rising, reflecting China's assembly role. However, the share of Chinese exports going to East Asia has been falling, reflecting China's reliance on consumers in industrialized economies.

Problem number three is the declining relative price of manufactured goods. With the export-led growth strategy being so widely adopted, this is contributing to a new Prebisch (1950) and Singer (1950) declining terms of trade problem similar to the one that afflicted commodity producing developing countries in the first half of the 20th century. During that period the relative price of primary commodities fell as supply increased. Now the problem is increased supply of low technology manufactured goods (Sarkar and Singer, 1991).

Problem number four is what globalization critics term the "global race to the bottom". Because it is so easy for MNCs to shift production between countries, that has created a "race to the bottom" dynamic in which developing countries undermine each other. Each country is trying to get competitive advantage through a combination of wage suppression; suppression of labor, environmental and social standards; suppression of business regulation; shifting of tax burdens onto labor income away from capital income; creation of extra-judicial export processing zones; and competitive devaluations that create financial instability. Since all do it, none gains significant competitive advantage. Instead, this destructive competitive dynamic undermines the development of standards, institutions, income equality and wage growth that are needed for deeply rooted development. The only beneficiaries are MNCs whose profit margins are increased.

Finally, problem number five is the adoption of export-led growth by China. Because China's labor force is so large and its wages so low, and because the prospect of producing for China's large domestic market is so commercially attractive, China is siphoning FDI and demand away from other emerging market economies. That is undermining their industrialization and development. China's emergence poses two problems for other developing and EM economies. First, its size blocks access to the traditional ladder of development for newcomers. Second, its entrance on the global stage has introduced South-South competition to go along with North- South competition. That explains why the benefits of export-led growth have been so limited for stage III countries like Mexico.

One benefit from China for developing economies is that China's relentless urbanization is likely to create persistent upward pressure on commodity prices. The urbanization process will require energy resources for power and transportation, and iron ore, copper, and lumber for construction. However, even that is a mixed blessing. First, it will only benefit EM and developing economies with these resources. Second, it stands to create "Dutch disease" in these economies by appreciating their exchange rates, something that is already clearly visible in Brazil and Chile. That will actually undermine these countries' industrialization and development and recreate an international division of labor paralleling that created in the 19th century by British industrialization.

In sum, for a developing country beginning the process of industrialization thirty years ago, export-led growth offered a reasonable bet. Its endowment and resources would have been significantly different from developed economies, and the U.S. economy was about to embark on a thirty year consumption spree. Now, a newcomer must compete with many EM countries that are already on the ladder of industrialization and have similar resource endowments. Above all, it must compete with China. Moreover, that competition must take place in an environment where developed economies are debt-saturated in both the private and public sector.

THE CASE FOR DOMESTIC DEMAND-LED GROWTH

The implication of these arguments is the export-led growth paradigm is exhausted for developing countries. It also risks serious harm to the global economy. That means there is need to shift from export-led growth to a domestic demand-led growth model. This does not mean the abandonment of exporting. Countries will always need exports to pay for needed imported inputs and final goods they do not produce. However, it does mean building up the domestic demand side of the economy and reducing reliance on strategies aimed at attracting export-oriented FDI.

The outline elements of a domestic demand-led strategy are clear (Palley, 2002):

a) Build social safety nets that diminish need for precautionary saving.

b) Raise wages and link wages to productivity growth by implementing a minimum wage, improving labor protections, and increasing collective bargaining via unions.

c) Increase public infrastructure investment and fill the backlog of public investment opportunities resulting from twenty-five years of neglect imposed by the neoliberal Washington Consensus development model.

d) Increase the provision of public goods –like healthcare and education.

e) Rebalance tax structures by increasing taxes on higher income groups and lowering them on lower income groups.

In the international economy there is need to:

a) End under-valued exchange rates and adopt a system of managed exchange rates aimed at avoiding global imbalances in trade.

b) End policies of international labor competition via implementation of global labor standards.

c) Implement global environmental and social standards that block international competition on these margins.

d) Limit incentives to attract export-oriented FDI.

However, though it is clear what is needed, there are tremendous political obstacles preventing change. First, EM economies are unwilling to give up a strategy that has worked so well and has not yet been proven to fail. If a policy is successful, political calculus suggests it is unlikely to be abandoned until it fails. That is because abandonment means costs now for the sake of avoiding hypothetical future larger costs, which is not politically compelling.

Second, there is also resentment that EM economies are being asked to change when they still have far lower income per capita income. Third, no individual country has an incentive to abandon export-led growth and adopt these types of policy measures for fear of being the only country to do so. Indeed, each individual country has an incentive to cheat on such measures and pursue an export-led growth strategy by itself. In effect, there is a collective action problem. The only way to get a global shift to a new growth model is to establish and enforce multilateral rules on exchange rates, and standards on acceptable labor, tax and environmental competition. However, getting agreement on such rules and standards is unlikely.

In addition to these political obstacles to change, there are also structural obstacles. Once countries embark on the path of export-led growth it seems to be very difficult to change strategies. For example, Germany and Japan are still focused on exporting, continuously running large trade surpluses fifty years after having adopted the export-led model and long after they have become top tier high income countries. One possible explanation is that once export-oriented industries acquire dominance they gain political control, while the institutions and political interests that would promote domestic demand-led growth remain weak.

CONCLUSIONS AND PREDICTIONS

The above analysis suggests four conclusions and three predictions. Conclusion number one is the export-led growth paradigm is exhausted because of changed conditions in both EM and developed economies.

Conclusion number two is EM economies are mistaken in their belief that they can collectively continue to grow on the basis of export-led growth. It will not deliver success for them and it will further impede the task of economic recovery in the developed countries.

Conclusion number three is there is need for a major recalibration of the global economy that abandons export-led growth and replaces it with a new paradigm of domestic demand-led growth.

Conclusion number four is globalization has so diversified global economic activity that no country or region can act as the lone locomotive of global growth. A diversified global economy requires that all regions pull together.

These conclusions support the following three predictions. Prediction number one is for political reasons, it is highly unlikely that EM countries will shift away from export-led growth, and nor will the international community agree on the international arrangements needed to make a domestic demand-led growth paradigm work. The fact is once a country has adopted export-led growth it appears near impossible to abandon it.

Prediction number two is failure to recalibrate the global economy is likely to produce a political backlash in the industrialized countries, particularly in the U.S. where the public has lost political patience because adjustment by China has been delayed too long.

Prediction number three is the global economy is likely to experience asymmetric stagnation marked by slower growth in EM economies, stagnation in developed economies, and increased economic tensions between EM and industrialized economies.

REFERENCES

Bhagwati, J., 1958. Immizerizing growth: a geometrical note. Review of Economic Studies, 58, pp. 201-5. [ Links ]

Blecker, R.A., 2000. The diminishing returns to export-led growth. Paper prepared for the Project on Development, Trade, and International Finance the Council of Foreign Relations Working Group on Development. New York: Council on Foreign Relations. [ Links ]

Blecker, R.A. and Razmi, A., 2010. Export-led growth, real exchange rates and the fallacy of composition. In: Setterfield, M., ed. Handbook of Alternative Theories of Economic Growth, Cheltenham: Edward Elgar. [ Links ]

Brewer, A., 1985. Trade with fixed real wages and mobile capital. Journal of International Economics, 18, pp. 177-86. [ Links ]

Chang, H.-J., 2002. Kicking Away the Ladder: Development Strategy in Historical Perspective. London: Anthem Press. [ Links ]

Dornbusch, R., Fischer, S. and Samuelson, P.A., 1980. "Heckscher-Ohlin Trade Theory with a continuum of goods. Quarterly Journal of Economics, 95, pp. 203-24. [ Links ]

Grossman, G.M. and Helpman, E., 1991. Trade, knowledge spillovers and growth. European Economic Review, 35 (May), pp. 517-26. [ Links ]

Hein, E. and Truger, A., 2005. A different view of germany's stagnation. Challenge, 48, pp. 64-94. [ Links ]

Hein, E., and Truger, A., 2010. Finance-dominated capitalism in crisis: the case for a Keynesian New Deal at the European and the global level. Berlin School of Economics and Law Working Paper no. 6. Berlin: Berlin School of Economics and Law. [ Links ]

Johnson, H., 1954. Increasing productivity, income-price trends and trade balance. Economic Journal, 64, pp. 462-85. [ Links ]

Johnson, H., 1955. Economic expansion and international trade. Manchester School of Economic and Social Studies, 23, pp. 95-112. [ Links ]

Kaplinsky, R., 1993. Export processing zones in the dominican republic: transforming manufactures into commodities. World Development, 21, pp. 1851-65. [ Links ]

Krueger, A. O., 1974. "The political economy of rent-seeking society. American Economic Review, 64, pp. 291-303. [ Links ]

Krugman, P., 1984. "Import protection as export promotion: international competition in the presence of oligopoly and economies of scale. In Kierzkowski, H., ed. Monopolistic Competition in International Trade. Oxford: Oxford University Press, pp. 180-93. [ Links ]

Lipsey, R.G. and Lancaster, K., 1956-57. The General Theory of the Second Best. Review of Economic Studies, 24, pp. 11-32. [ Links ]

Manova, K., and Zhang, Z., 2008. "China's exporters and importers: firms, products, and trade partners. [unpublished manuscript]. June 2008. Stanford, CA: Department of Economics, Stanford University. [ Links ]

Milberg, W., 2002. Say's Law in the open economy: Keynes' rejection of the Theory of Comparative Advantage. In: Dow S. and Hillard, J. eds. Beyond Keynes, Aldershot: Edward Elgar. [ Links ]

Ohlin, B., 1933. Interregional and International Trade. Cambridge, Massachusetts: Harvard University Press. [ Links ]

Palley, T.I., 2002. Domestic demand-led growth: a new paradigm for development. In: Weaver J. and Baker, J. eds. New Rules for Global Finance. Washington, DC: New Rules for Global Finance. (Also published as: A new development paradigm: domestic demand-led growth [online]. September 2002. Foreign Policy in Focus (FPIF) Discussion Paper. Washington, DC: FPIF. Available in: <http://www.fpif.org/> [ Links ]).

Palley, T.I., 2003a. International trade, macroeconomics, and exchange rates: reexamining the foundations of trade policy. Paper presented at a Conference on Globalization and the Myths of Free Trade held at the New School for Social Research, April 18. New York: New School for Social Research. [ Links ]

Palley, T.I., 2003b. Export-led growth: evidence of developing country crowding-out? In: Arestis, P., Baddeley, M. y McCombie, J. eds. Globalization, Regionalism, and Economic Activity. Cheltenham: Edward Elgar. [ Links ]

Palley, T.I., 2004. The economic case for International Labor Standards. Cambridge Journal of Economics, 28 (January), pp. 21-36. [ Links ]

Palley, T.I., 2006. Capital accumulation is not enough: developing the domestic market. Challenge, November-December, pp. 20-34. [ Links ]

Palma, G., 2010. "Why has productivity growth stagnated in most Latin American countries since Neoliberal reforms? Cambridge Working Papers in Economics no. 1030. Cambridge: Department of Applied Economics, Cambridge University. [ Links ]

Prasch, R.E., 1996. Reassessing the Theory of Comparative Advantage. Review of Political Economy, 8(1), pp. 37-54. [ Links ]

Prebisch, R., 1950. The Economic Development of Latin America and its Principle Problem. Santiago: United Nations Economic Commission for Latin America (UNECLA). [ Links ]

Robinson, J., 1947 [1937]. Essays in the Theory of Employment, 2nd edition, Oxford: Basil Blackwell. [ Links ]

Salas, C. and Zepeda, E., 2003. Employment and wages in contemporary Mexico. In: Salas, C. and de la Garza, E. coords. State of Working Mexico, 2003. Washington, DC: Solidarity Center. [ Links ]

Samuelson, P.A., 1948. International trade and equalisation of factor prices. Economic Journal, 58, p. 163-84. [ Links ]

Sapsford, D. and Singer, H., 1998. The IMF, the World Bank, and commodity prices: a case of Shifting Sands?" World Development, 26, pp. 1653-60. [ Links ]

Sarkar, P. and Singer, H., 1991. Manufactured exports of developing countries and their terms of trade since 1965. World Development, 19, pp. 333-40. [ Links ]

Singer, H., 1950. The distribution of gains between investing and borrowing countries. American Economic Review (Papers and Proceedings), 40, pp. 473-85. [ Links ]

Stolper, W.F., and P.A. Samuelson, 1941. Protection and real wages. Review of Economic Studies, 9, pp. 58-73. [ Links ]

* JEL: Journal of Economic Literature-Econlit.

This paper was presented at a conference on the Mexican Economy organized by the Economics Department of the University of Puebla, Puebla, Mexico, November 17-19, 2010 and at a conference on Brazil-China-United States. Relations held at the Federal University of Rio de Janeiro, Rio de Janeiro, Brazil on June 10, 2011. I thank participants and two anonymous referees of Investigación Económica for helpful comments. All errors and opinions are those of the author.

1 Progressive activists sometimes appeal to arguments such as the Stolper and Samuelson (1941) theorem to criticize free trade. This is a dangerous tactic as it implicitly accepts the logic of neoclassical trade theory with its claims about the benefits of trade arising from application of the principle of comparative advantage.

2 In Table 4 non-OECD proxies for EM and developing economies. However, Mexico, South Korea and Turkey are members of the OECD. If their exports and imports were subtracted from the OECD and added to the non-OECD, the trade share of EM and developing economies would increase further.