Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.70 no.277 Ciudad de México jul./sep. 2011

Fiscal policy contradiction: a perspective on Brazil and Mexico

Contradicción en la política fiscal: una perspectiva sobre Brasil y México

Elton Eustaquio Casagrande1 and Renato Vaz García2*

1 Department of Economics, University of São Paulo State (UNESP), <elton@fclar.unesp.br>

2 University of Sorocaba (UNISO), <renato2405@yahoo.com.br>.

Received April 2010

Accepted April 2011.

Abstract

The aim of this paper is to discuss the quality of fiscal policy in Brazil and Mexico and investigate whether fiscal policy influence is favorable to reduce the unemployment rate. Public spending, which has a positive effect on the level of employment when results in additional aggregate demand, may cause a negative effect on employment, if its financing depends in persistent high interest rates. Brazil and Mexico have engaged in a long effort to control public spending and to reduce the public deficit to zero. Does this policy bring a positive result to the economic activity no matter how actual public deficit has been financed? We select variables related to public budget as public sector borrowing requirements, taxes, public debt and others to form a data base. The fiscal institutional arrangement and de data allow us to evaluate the fiscal policy as a whole and to discuss the importance of credibility and reputation of the government.

Key words: fiscal policy, public debt, public expenditure, employment.

Clasificación JEL: ** E62, H63

Resumen

El objetivo de este artículo es analizar la calidad de la política fiscal en Brasil y México, y examinar si al influencia de la política fiscal es favorable para reducir la tasa de desempleo. El gasto público, que tiene un efecto positivo en el nivel de empleo cuando resulta en demanda agregada adicional, puede causar un efecto negativo en el empleo, si su financiamiento depende de tasas de interés persistentemente elevadas. Brasil y México han realizado un gran esfuerzo para controlar el gasto público y reducir el déficit público a cero ¿Esta política ocasiona resultados positivos en la actividad económica independientemente de cómo se financia el déficit público? Hemos seleccionado variables relacionadas con el presupuesto público como los requerimientos financieros del sector público, ingresos, deuda pública y otras bases de datos. El arreglo institucional fiscal y los datos nos permiten evaluar la política fiscal en su conjunto y discutir la importancia de la credibilidad y de la reputación del gobierno.

Palabras clave: política fiscal, deuda pública, gasto público, empleo.

INTRODUCTION

The aim of the paper is to discuss the quality of fiscal policy in Brazil and Mexico at the present decade. Brazil and Mexico are the most important countries of Latin America in terms of Gross Domestic Product (GDP). The macroeconomic performance of both countries is crucial to economic and social equilibrium in the region.

Public spending, which has a positive effect on the level of employment when results in additional aggregate demand, may cause a negative effect on the economy, if its financing depends on persistent high interest rates. Brazil and Mexico have engaged in a long effort to control public spending and to reduce public deficit.

How both countries have managed their fiscal policy in the last years and how this evidence help us evaluate better the fiscal scenario in the short and long run?

To answer this we detail the institutional structure responsible for managing public finance in both countries after 1999. In Brazil, the National Treasury Secretariat is responsible for the control and administration of the federal public debt, thus centralizing responsibility for the management of all federal government financial commitments within a single government unit. Since all payments are included within the General Federal Government Budget approved annually by the National Congress, the result of this process is enhanced budget and financial transparency. Besides, based on the Budget Directive Law (BDL) and on the Fiscal Responsibility Law (FRL), approved in 2000, the government in Brazil aims to promote a balanced management of budget.

Mexico presents a high degree of transparency in terms of its fiscal policy and control of public spending. After crossing serious financial crises over the 90's, Mexico has adopted a process of modification on its public debt structure, which contributes for a reduction of its financing costs, and started to give priorityto contractionary fiscal policy rather than other national productive issues. The National Program for Financing Development (PRONAFIDE) 2002-2006 contains the government medium-term economic, financing and fiscal strategies. We select variables related to taxes, public spending and debt to form a data base.

The economic outlook in both countries indicated that in the second half of the 90's GDP expanded little in Brazil, approximately 1% in average per year, and from 2001 to 2006 GDP raised 2.5% in average. In Mexico, from 1996 to 2000 the GDP grew 5.5% in average. After 2000 Mexico faced a deep recession and GDP recovery began in 2003. The monetary authorities introduced the goal of lower inflation and the interest rate has been used to aim price stability in both countries. Appreciated exchange rate, capital inflows, low inflation and high interest rate, in sum, are the basic policy structure in both countries. After 2000 inflation has been maintained lower than 5.5% per year in both countries. In Brazil interest rate has fallen from 31% in 1998 to 18.24% in 2005. In Mexico nominal interest rate was near 23% in 1998 and fell to 9% in 2005.

The real interest rate is the main element of the stabilization policy despite the high cost it causes to private sector in terms of opportunity costs and, in particular, to public sector. It provides an attractive profitability into domestic bond markets and assures a high foreign exchange reserves level. Foreign reserves are essential to exchange rate stability. To maintain this policy, the government needs to demonstrate its capability of payment. This capability is proportional to the capability to obtain revenues by personal taxes, contributions for social insurance, indirect business taxes, and corporate taxes. Fiscal cutbacks and privatization of public firms are also common to both countries.

The macroeconomic effect of the stabilization policy, their relation to fiscal policy and the consequences on economic activity is not trivial. The deficit concept is defined as: nominal deficit = outlay – tax revenue, and a second deficit concept, named the primary government budget deficit excludes net interest from government outlays: primary deficit = outlay – net interest – tax revenue.

The primary deficit/surplus becomes a key variable of the macroeconomic performance. It represents an indicator of the public sector capability to collect taxes and, for this reason, to assure the credibility of the fiscal policy.

To investigate the process of financing public deficit, we organize the paper as follows. In the first and second sections we present an institutional perspective on fiscal policy employing data from 1999 to 2008 to discuss the consequences for Brazil and Mexico. The fiscal institutional arrangement and the data allow us to evaluate the fiscal policy as a whole and to evaluate the quality of fiscal policy in both countries. In the last section we propose a real target to be incorporated to fiscal policy, as a focus to financial market besides the primary surplus.

INSTITUTIONAL FRAMEWORK AND PUBLIC BUDGET PERFORMANCE

Brazil

The Integrated System of Federal Government Financial Administration (SIAFI hereafter) is the primary tool used by The National Treasury Secretariat (STN hereafter), which is responsible for administration of federal financial resources. The system provides support to central, sectoral and executive public management entities, among which are included all of those units belonging to the direct administration, semiautonomous agencies and foundations, state-owned companies, joint capital companies and entities pertaining to the legislative and judicial branches.

The STN uses SIAFI as the fundamental instrument in its task of monitoring and controlling federal government budget. In light of its legally defined responsibilities, the STN –as the SIAFI managing entity– is responsible for defining the rules and procedures covering utilization of the system and, consequently, for guidance in its use to public managers.

The essential characteristic of the system is its capillarity which allows all Management Units scattered throughout the country to access systematic records of documents (payment documents, bank orders, and others) which are promptly and automatically translated into a set of accounting entries.

SIAFI has not only consolidated its position as an essential instrument of public spending control and transparency but also gained international recognition and served to transmit to the market the fiscal targets.

After 1999 the government started to adopt limits and targets for primary result and for Public Sector Borrowing Requirement (PSBR). The explicit fiscal targets in Brazil involve the Fiscal Responsibility Law (FRL) approved in 2000, which not only complemented the Budget Directive Law but also promoted much more controls and responsibilities to policy makers. The FRL, in particular, was conceived together with inflation targeting to guarantee the fiscal discipline and transparency in all government units. The main issues of this law are: the adoption of fiscal targets to all government spheres; limits to employee expenditures and level of indebted; punishment to public administrators that do not follow rules and the prohibition for the Central Bank of issuing primary public bonds. The level of indebted, debt to revenues, to all government spheres cannot be greater than two. In 2016, Federal, States and Municipalities must reach this level of indebtedness. Periodically, all government spheres must publish reports analyzing the fiscal targets of the previous period and indicate adjustments to the next period.

The fiscal targets set limits to all government spheres, even current or capital expenditures as figure 1 illustrates. The current expenditure is much more rigid when compared to the capital one because of the public labor contract. Employees in public sector cannot be fired unless an administrative procedure has been installed. Facing an unbalance in the PSBR government promotes adjustments by cutting the capital expenditures. In figure 1 Federal Adjustment in 2009 came from a primary surplus of 1.65% of GDP and a cut of 0.5% of the total public investment.

Therefore, the BDL and FRL define the fiscal targets. The item we want to emphasize is the definition of primary surplus. The Central, State, Local governments and Public Productive Enterprises have to reach a primary surplus as a percentage of GDP. Besides, the BDL and FRL create a new regulation forcing a definition of targets to revenues, expenditures, nominal and primary results, limits to public debt to current year and to biennial. The FRL requires an evaluation of the recent past fiscal results of all government spheres. This process must follow a specific methodology based on financial and accounting procedures.

Consequences of this institutional arrangement arise. First, fiscal policy can affect economic activity by influencing the total amount of spending in the economy, or aggregate demand. Second, cutting capital spending causes political problems to the government agenda in National Congress. The solution has been reached with both, a tax increase and capital expenditure cutting which affect negatively governor's popularity and aggregate demand, but not financial market agents.

The actual capital expenditure has been less than 20% of GDP. This indicates a forced reduction in the amount of capital formation, which brings consequences to the whole economy in the long run.

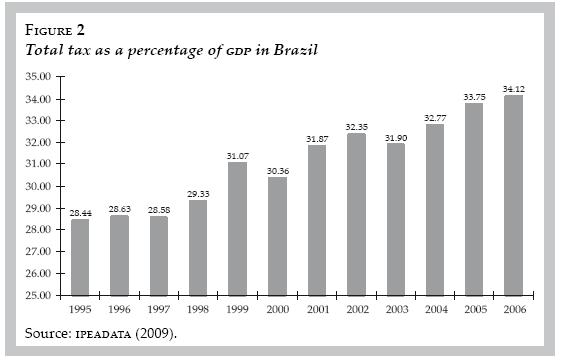

In terms of total taxes, figure 2 illustrates how much all government spheres have collected in taxes since 1995. In 2008 the percentage reached 34%. As Bresser-Pereira (2007) shows the total tax as a percentage of GDP in Brazil is approximately similar to that of countries like Germany, United Kingdom, Canada, and Spain. If the comparison goes to countries with similar per capita income, Brazil's is twice higher.

Sicsú (2007) explains that the taxes have been raised in order to reduce the nominal deficit, which in turn has grown because of the increase in the interest rate. Then, tax is adjustable to finance the interest rate expense.

Policies which aim to increase the spending with social policies and public investments cannot justify the rise in taxes. Mandatory spending grew only 6% from 2000 to 2006. As such, the gross fixed capital formation, responsible for enhancing private investment, has decreased from 18.32% as percentage of GDP in 1995 to 16.81% in 2006. Then, besides high taxes level affect negatively public investment, depleting the capital stock of the economy.

On the other hand, the expenses with nominal interest on public debt have increased along the last years, which, in spite of the high primary surplus defined by the fiscal targets, generates a nominal deficit.

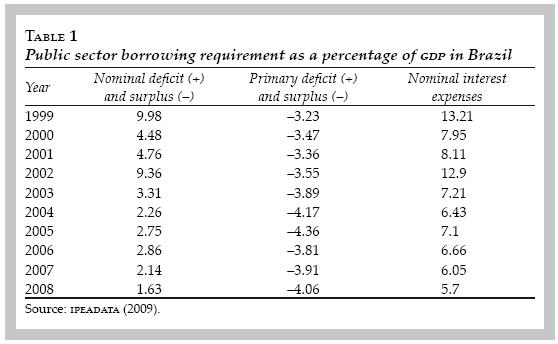

Following table 1, it is possible to verify that despite the government effort to reach the level of primary surplus, as defined by the fiscal targets, nominal deficit has remained around 2% of GDP. In relation to the nominal interest expenses, a great part of the public debt is formed by securities linked to floating interest rate (SELIC). In 2000 securities linked to floating interest rate were around R$ 270 billion, equivalent to 60% of the total debt. In 2007 the participation was reduced to 36% (figure 3). However, keeping a high interest rate (figure 4) Central Bank continues to cause a meaningful impact on the cost of indebtedness of the public.

According to Oreiro et al. (2003) the actual level of interest rates also increase the price of the credit and affect negatively the private expectation. Bresser-Pereira (2007) adds that the high interest rate in Brazil is incompatible with the investment level to promote development. According to the author, private investment only sustains itself by government subsidies, like long term interest rates and by the agricultural credit. According to Oreiro and Paula (2004) the real interest in Brazil would be above its long term level. Then it would be possible for the government to reduce it with no risk of provoking inflation.

To justify the high interest rate in Brazil is not an ordinary task. Bresser-Pereira and Nakano (2002) explain that the financial system and the monetary authorities associate more than one target to this instrument. It is used for: i) regulating the aggregated demand; ii) avoiding exchange rate devaluation and inflation; iii) bringing foreign savings to finance the balance of payment and public debt. According to the authors, one or more than these targets will be pushing the interest rate.

The financial instrument that covers those targets is a security named Treasury's Financial Bills (LFT). With them, National Treasury offers a hedge for investors because of its basic interest rate indexation, interest yield, liquidity and short term maturity. The share of LFT in the total debt produces negative effects on the economy as Moura (2006) emphasized. Protecting investors against unpredictable shocks, transfers a negative impact for the non-financing economy which suffers recession effects when LFT yield arises. The LFT share in public debt composition reflects an uncertainty degree despite price stability, high level of foreign exchange reserves, and primary surplus.

The fiscal adjustment that has been made in Brazil does not match with financing policy of the National Treasury. In this sense, if fiscal policy is practiced when the economy faces an economic fluctuation, characteristic public bonds, in particular LFT, produces a huge pressure on the public budget when interest rates increase or the LFT average maturity decreases. Fiscal policy has been weakened by the public debt policy due to the interplay between monetary policy and public debt.

Oreiro et al. (2007) discuss the relation between the interest rate (SELIC) and the cost of capital to the private sector. The LFT, indexed by SELIC, offers a hedge to the investors, but with consequences to the weighted average cost of capital.

Barbosa (2005) investigates the relation between monetary policy and public debt management policy, named the contagion effect. To him, the inflationary history in Brazil forced Central Bank to issue not only money, but notes, bills and bonds. These money funds worked, before 2000, as indexed money since their yield followed very closely the rate of inflation. Thus, in that environment government securities did not have to pay a risk premium, owing to the fact that they provided a full hedge against inflation.

After 2002, in the context of the Fiscal Responsibility Law, the Brazilian Central Bank was prohibited from issuing primary bills, notes or bonds. The hard task, at present, is how to disentangle the Central Bank reserves market from the government securities market. The first best solution is to have a fiscal regime in which government securities become risk free, which means, the rate of interest on Central Bank reserves would be free of government securities risk.1

However, securities market demands a risk premium on government securities, based on fragility of fiscal system in Brazil. Barbosa (2005) exemplifies this fiscal fragility based on the primary fiscal surplus policy. According to him, "the primary fiscal surplus implemented since 1999, and followed through President Cardoso's second term and President Lula's tenure, is not based on institutions but on the personal commitment of both Presidents" (Barbosa 2005:4)

Despite the scenario above, the National Treasury achieved progress in 2006. The net public debt/GDP ratio had a downward trajectory. The total fixed rate and inflation-linked debt was greater than the Selic-indexed debt (figure 5). To increase the average maturity of bonds, the Federal Government started, in 2006, to offer fiscal benefits to foreign investors exempting them from income taxes. This policy tries to broaden the investor base in order to face the internal financial system power which resists accepting average maturity bonds superior to 12 months.

On the contrary, the gross public debt/GDP ratio had an upward trajectory from 2002 to 2008 which caused a considerable public concern. The gross public debt rose because of the accumulation of foreign exchange reserves. The accumulation of reserves is a "buy" dollars (and debt) at a higher cost than that obtained when it is invested in the financial market. The direct fiscal cost of the operation as much as Treasury loans to public banks, impacts the government's gross debt without affecting the net public debt. In the short run financial markets concerns that gross public debt increases.

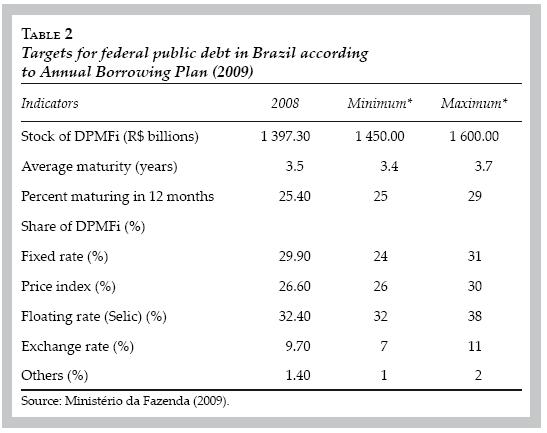

Yearly, the Federal Government presents the public borrowing plan which contains its strategy on public finances and public debt according to Fiscal Responsibility Law (table 2). In 2007 the Federal Government focused its strategy on the following items:

i) issuance of fixed rate bonds (ltn and NTN-F) in volumes and maturities that will make it possible to increase the participation of these securities in the overall public debt, while gradually lengthening average maturities at issue; ii) emphasis on issuances of NTN-B, a security referenced to the Broad National Consumer Price Index (IPCA), while no issuances of NTN-C, referenced to the General Market Price Index (IGP-M), are projected; iii) net redemptions of SELIC-indexed securities (LFT) and maintenance of average issuance maturities at levels similar to those in effect in 2006 (approximately 44 months); and iv) continuation of the policy in effect since 2003 of not issuing exchange rate-indexed NTN-D. (Ministério da Fazenda 2007:9).

The government commitment to substitute part of the debt with LFT securities by fixed rate or inflation-linked securities and increase the debt average maturity is supported by the high interest rate level, which maintains pressure on the public budget for the future.

Mexico

Mexico has a fiscal structure very similar to Brazil with Federal, State, Local governments plus a number of public productive firms. In terms of the Political Constitution of the United Mexican States and the General Law of Public Debt (Ley General de Deuda Pública), the Federal Government, through the Ministry of Finance and Public Credit (SHCP), is responsible for the Public Sector's financial program under which public debt is handled. The legal framework entitles the SHCP for hiring the Federal Government indebtedness, as well as for determining its legal and financial conditions.

The Public Credit Unit (PCU) is the Undersecretaries' administrative branch authorized to negotiate, contract, subscribe titles and authorize indebtedness of the entities of the Federal Public Administration –including the development banks– and to guarantee the financing of such public spheres. The base for hiring credits for financing the public budget is the debt ceiling approved by Congress. This structure is also similar to the Brazilian National Treasury Secretariat and its commitments.

In addition the PCU pursues the mission of drafting, propose, implement, and evaluate policies, guidelines and programs to obtain resources in the money and capital market; as well as to manage the financing of international private sources and international institutions. Also, the PCU impels and executes actions in order to optimize the profile, structures and cost of public debt.

After the exchange rate crisis of 1994, Mexico started a new Fiscal Regime based on targets for primary surplus. In 1995, the primary surplus reached 4.7% of GDP. However in the following years the primary surplus has been reduced and the nominal deficit was raised up until 2002. Interest expenses and social expenditures were responsible for the nominal deficits until 2002. After that, Mexico made adjustments in order to obtain a budget balance.2

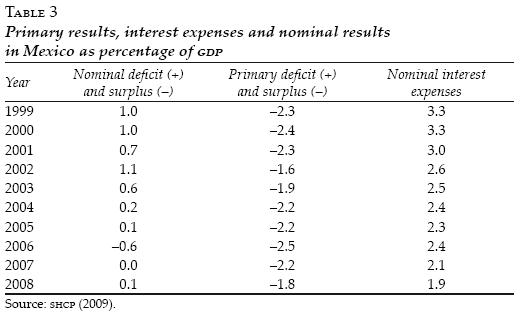

According to Cysne and Sobreira (2007), the Mexican Fiscal Responsibility Law, approved in 2006, instituted Fiscal Targets as limits for indebtedness and deficits. Interest expenses represented 4.5% as a percentage of GDP in 1995 and decreased to 2.5% in 2005 favored by the declining of the interest rate (table 3). Before this law, PRONAFIDE worked as a legal structure for fiscal targets.

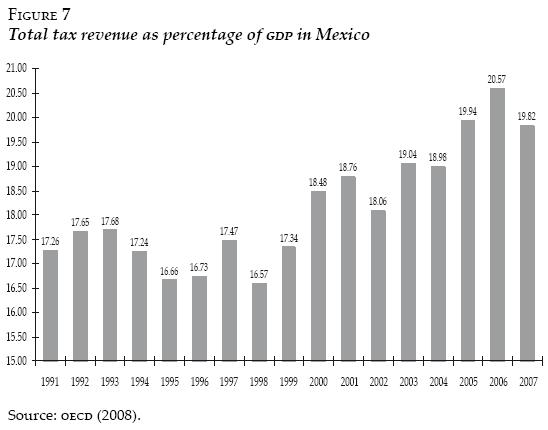

The primary surplus combined with the reducing interest expenses on public debt created all conditions for the public finance balance. It is also true that Mexico collects and spends little, when compared to Brazil and other countries from Organisation for Economic Co-operation and Development (OECD). Total tax as percentage of GDP in Mexico reached 19% in 2007 (figure 7). The dependency on oil-related taxes in government budgets has provoked changes in public expenditures with consequences for economic growth. Fiscal targets to be achieved when oil sources decreased have implied public expenditures cutting. An interesting consequence is the pro-cyclical character of the Fiscal Policy adjustment which contributes to overall macroeconomic volatility (Dalsgaard 2000).

Historically, Mexico is characterized by difficulties associated to external debt and its high fiscal costs (Dornbusch 1988). Since 2000 Mexican Federal Government instituted a complex of reforms to develop a domestic financial bond market and shift the pattern of public sector financing. After the Tequila crisis, the weakness of debt structure became evident to Mexican authorities.

The government strategy to develop a domestic bond market was supported by a shift to domestic financing of fiscal deficit with medium and long term average maturity bonds. The development of a liquid domestic yield curve, a move to greater predictability and transparency of debt issuance, and, finally a structural initiative aimed at strengthening the market for government debt (Jeanneau and Verdia 2005).

Since 1990 external and internal debt have an inverse trend. While external debt was renegotiated (in 1988) and reduced as a percentage of GDP progressively, the internal debt grew and became greater than the external one (figure 8).

The Mexican public debt includes the internal and external debt of the federal government, public enterprises and National Bank for Development. Internal debt, in responsibility of the Federal Government, is responsible for the larger item of the debt.

According to Garcia and Salomão (2006), and Sidaoui (2002) the main bonds issued by the Mexican Government are:

a) Federation Treasury Certificates (CETES): fixed rate securities, issued in 1978 with maturity up to 12 months.

b) Federal Government Development Bonds (BONDES): securities linked to floating rates, with 3 years minimum maturity up to 5 years.

c) Federal Government Development Bonds (BONOS): fixed rate securities, with maturities of 3, 5 and 10 years.

d) Federal Government Development Bonds denominated in Investment Units (UDIBONOS): inflation linked securities with maturities of 5 and 10 years.

e) Treasury Bonds (TESOBONOS): short-term exchange rate linked securities which emission was extinct in 1996.

In 2000 the Bank of Mexico started to issue Bonos de Regulación Monetaria del Banco de México (BREMS) in order to allow the sterilized intervention of monetary policy. That was a necessary step to develop a domestic bond market, linking monetary policy, money supply and foreign exchange reserves.

Figure 9 shows that the domestic government bond market has grown; in particular, the BONOS have been preferred by investors. Consequently, the predominance of the fixed rate securities and higher average maturity (figure 10) provide stability to finance public deficit.

Comparing the years 1994 and 2000 it is possible to identify two opposite scenarios. In the former, under financial crises and high instability, the issuance of short-term exchange rate linked securities (TESOBONOS) became notable. After 2000, under high stability, it became viable for Mexico to issue CETES, UNIBONOS and BONOS. Moreover, in this period, the domestic bond market experienced a significant change through the domestic debt held by external investors. The domestic Federal Government debt held by external investors in 2002 was less than 2%, and in 2006 it went up to 10% of total holders.

Much of the domestic bonds market depends on the legal context to allow government to establish governance requested by financial markets. Anti-inflationary policy in Mexico, as well as a policy for increasing savings, have been used for managing aggregate demand. Currency appreciation was a result which has put pressures on wages in order to keep the productive level of the Mexican economy.

If in 1995 Mexico depended much on external savings, ten years later the domestic bonds market has financed the public sector. This change was established by a new behavioral pattern for the economy with internal and coactive controls over public sector, once guarantees were to be offered for investors.

The range of reforms analyzed by Ortiz (2004) produced all conditions to develop a domestic financial market. It has required low inflation and null fiscal deficit. The stability of this adjustment process depends on a steady state process. To avoid risks over this process fiscal policy has to sustain the indebtedness safe level. Also it has to provide adjustment in current and capital expenditures to create conditions to prompt payments of interest expenses.

THE FISCAL RESPONSIBILITY LAW, THE PRONAFIDE AND ECONOMIC PERFORMANCE

To guarantee the well functioning of the stabilization process in Mexico and in Brazil, to boost domestic bond markets for government securities and to allow a safe circuit for investors in the financial system, primary surplus has constituted the crucial fiscal target. In this sense, a surplus compatible with public debt/GDP works as an indicator for country risk.

The development of the domestic bond market has required a major support in terms of guarantee. In Mexico, the PRONAFIDE 2002-2006, provided the directives for fiscal policy. The document proposed three main policies. First, maintain the total debt as a percentage of GDP within safe level. Second, broaden the share of foreign investors in the domestic bond market, and third gives the financial support to states and municipalities to commit their obligation. The document also highlights the importance of reducing the informal sector to amplify the tax revenue and actions to reduce tax avoidance. The results analyzed before indicated a hierarchy between productive and fiscal/financial issues, much more favorable for the second issue.

In Brazil, the Fiscal Responsibility Law approved in 2000 constituted a key element of the new consensus in Fiscal Policy, because it establishes legal instruments to assure fiscal credibility to all government spheres, targets for expenditures as a percentage of the revenues, limits for indebtedness as a percentage of the revenues, parameter for social securities and procedures for realigning the public budget.

With this apparatus the Brazilian government sustains the credibility of domestic debt required by investors creating more tax if necessary or cutting capital expenditures. Compared to Mexico, Brazil has worse debt composition and lower average bond maturity. This imposes a flexible conduct in collecting more taxes but also rigidity in fiscal spending to smooth adverse shocks effects.

The Fiscal Responsibility Law in Brazil has determined that the year 2016 is the deadline to all government spheres to reach the target of consolidated public debt equal to twice the total public revenues. In order to achieve this target and, at present avoid losing control of the actual fiscal targets, it would be necessary, for Brazil, to reduce and to extinct the floating rate securities as Mexico did. Otherwise, rising tax revenues and cutting much more capital expenditures, will be an ordinary policy to maintain the financial solvency of the public sector.

The network to collect tax in Brazil is quite developed, but still does not charge many economic activities. The progressive investment of public sector in identifying tax avoidance has permitted all government spheres to reach a record of tax revenues. In Mexico, from 2002 to 2006 the government worked to reduce tax avoidance.

The debt composition and the bonds average maturity have a superior quality in Mexico when compared to Brazil's. However, there was a lack of stimulus for productive issues after 2000. Federal government concentrated the action over the macroeconomic stability. In Brazil, after the privatization process, public investment has been below of depreciation rate.

The domestic bond market in Brazil reveals a high dependence of the government primary surplus. With a great proportion of debt financed by floating rates securities with maturity up to 12 months, the market establishes a permanent pressure on public finance.

The Fiscal Responsibility Law works as a guarantee for the government raising taxes when the debt/revenue ratio rises. The Law forces controls over expenditures and all government spheres have worked to increase revenues to keep that relation below the limits. The PRONAFIDE did not fixed targets as the Fiscal Responsibility Law did in Brazil. However, productive as well as developing issues were not implemented.

Brazil, although collecting and spending, have a fragile relation over economic fluctuations, as bonds average maturity is low and inferior than Mexico's. If Brazil may be a parameter for illustrating how much taxes revenue will grow in Mexico, it is uncertain that Mexico illustrates how the average maturity of domestic debt will be in Brazil in the future. With the New Macroeconomic Consensus,3 both countries will continue to expect high interest rate.

The effort in collecting taxes and establishing a macroeconomic stability inwhichhighinterestrates,currency appreciation,capitalinflows, fluctuation in current accounts, rigid controls of inflation predominate, impose limits for discretionary policies. The Fiscal arrangements have a proposal to assure a safe rate for indebtedness of public sector leaving as a residual public investment policy.

FINAL REMARKS

The fiscal policy treated as a mechanism of transferring credibility for domestic bond market is incomplete since it must collect and spend for providing public goods. The adversity that the government itself faces, in Brazil, to improve the quality of debt also arises from the accumulation of international exchange reserves by the central bank. The high fiscal cost of this accumulation to the Treasury, in particular from 2002 to 2008, may cause a negative effect on investors' expectation. The net debt/GDP ratio may be displaced as the fundamental indicator of government capacity of payment since gross public debt grows.

In Brazil, the trade-off between the risk of government securities and that of the central bank funds must be faced by the society to eliminate this distortion, as suggested by Barbosa (2005). Compared to Mexico, Brazil's fiscal policy causes much more uncertainty.

On the contrary, fiscal policy in Mexico is more objective. The PRONAFIDE proposes to maintain the total debt as a percentage of GDP within safe level. There is a real possibility in reducing the informal sector to amplify the tax revenue and actions to reduce tax avoidance. Finally, a better composition of public debt and larger maturity of public bonds in Mexico compared to Brazil creates optimistic expectation in financial markets.

To assure growth, raises in productivity, decreases in inequality, PRONAFIDE in Mexico and the Fiscal Responsibility Law in Brazil should include a real target for a minimum public investment. The target should define a minimum for investment to cover the depreciation rate of the estimated public fixed capital stock. Additional estimations would be necessary to define a growing rate of public investment according to population growth, above the depreciation rate. If this target becomes part of PRONAFIDE, Federal government could achieve its proposal in terms of public spending. Also, it would provide economic fundamentals to widen the tax system.

On the contrary, in Brazil, following the Fiscal Responsibility Law, the real target proposal would be possible only if government raises taxes or cuts interest rate and reduces the cost of capital. That would be an important task for the government to change the fiscal policy in the next years.

More than financial indicators, which drove the public sector conduct in this decade in both countries, real targets, as mentioned above, would help to boost the economy's productivity. This target would make feasible the introduction of new technologies to a wider range of sector than defined in PRONAFIDE (2002-2006), which selected the telecommunication sector only.

The real target also would reduce the impact of gross public debt on market expectation in short run. Public investment can boost aggregate demand and the fiscal condition in the medium run.

For both countries, the governance structure which has been developed since 2000 inside National Treasury Secretariat in Brazil and the Ministry of Finance and Public Credit in Mexico should provide a real indicator of the economy linked to real targets which, in theoretical terms, would translate the real potential of the economy and its condition of indebtedness.

The decision of electing an indicator of public finance based on primary surplus sets both economies in a fragile path, because this policy increases public debt once the government must sterilize capital inflow. It establishes also a trap, because the larger public debt the larger must be primary surplus.

When facing economic fluctuation, income is drained for tributes payment and the high interest rate level as well as currency appreciation in vigor makes a recession worst because of low competitiveness induced by this policy.

Government and the domestic bond market are linked by a kind of opportunism in fiscal policy. From one side, the domestic bond market is profitable and has the taxes as a hedge for investor (creditors). From the other side, the government sector has increased its share as a proportion of the GDP because of tax increases, which provide more political power to all government spheres. And both societies may be suffering from a kind of misunderstanding.

REFERENCES

Aresthis, P. and M. Sawer, Re-examining Monetary and Fiscal Policy for the 21st Century, Cheltenham, Edward Elgar, 2004. [ Links ]

Barbosa, F. H. "The contagion effect of public debt on monetary policy: the Brazilian experience". Ensaios Econômicos daEPGE, no. 591, 2005. [ Links ]

Bresser-Pereira, L.C., Macroeconomia da estagnação: crítica da ortodoxia convencional no Brasil pós-1994, São Paulo, Ed. 34, 2007. [ Links ]

Bresser-Pereira, L.C. and Y. Nakano, "Uma estratégia de desenvolvimento com estabilidade", Revista de Economia Política, vol. 22(3), 2002, pp. 146-180. [ Links ]

Cysne, R.P. and R. Sobreira (coords.), Ajustes Fiscais: experiências recentes de países selecionados, Rio de Janeiro, Fundação Getulio Vargas (FGV), 2007. [ Links ]

Dalsgaard, T., "The tax system in Mexico: a need for strengthening the revenue-raising capacity", Organisation for Economic Co-operation and Development (OECD) Economics Department, Working Papers no. 233, 2000. [ Links ]

Dornbusch, R., "Mexico: stabilization, debt and growth", Economic Policy, vol. 3(7), 1988, pp. 233-283. [ Links ]

Garcia, M.G.P. and J. Salomão, "Alongamento dos títulos de renda fixa no Brasil", in: E.L. Bacha and L.C. Oliveira Filho (orgs.), Mercado de Capitais e Dívida Pública: tributação, indexação, alongamento, Rio de Janeiro, Contra Capa Livraria, 2006. [ Links ]

Jeanneau, S. and C.P. Verdia, "Reducing financial vulnerability: the development of the domestic government bond market in Mexico", BISQuarterly Review, 2005, pp 61-71. [ Links ]

Ministério da Fazenda, Dívida pública federal: plano anual de financiamento, Brasília, Secretaria do Tesouro Nacional, 2007. [ Links ]

––––––––––, Dívida pública federal: plano anual de financiamento, Brasília, Secretaria do Tesouro Nacional, 2009. [ Links ]

Moura, A.R., "Letras financeiras do tesouro: quousque tandem?", in: E.L. Bacha and L.C. Oliveira Filho (orgs.), Mercado de Capitais e Dívida Pública: tributação, indexação, alongamento, Rio de Janeiro, Contra Capa Livraria, 2006. [ Links ]

Oreiro, J.L. and L.F. Paula, "Crescimento econômico e superávit primário", Jornal Valor Econômico, May 24, 2004, pp. A14. [ Links ]

Oreiro, J.L.; J. Sicsú and L.F. Paula, "Controle da dívida pública e política fiscal: uma alternativa para um crescimento auto-sustentado da economia brasileira", in: J.L. Oreiro; J. Sicsú and L.F. Paula (orgs.), Agenda Brasil:políticas econômicas para o crescimento com estabilidade de preços, Barueri, Ed. Manole, 2003. [ Links ]

Oreiro, J.L.; L.F. Paula; G. Jonas and R. Quevedo, "Por que o Custo do Capital no Brasil é Tão Alto?", Papers and Proceedings of XXXV Meeting of Brazilian Economic Association, Recife, 2007. [ Links ]

Ortiz, E., "Stability conditions for a small open economy", in: L.R. Wray Wray and M. Forstater, Contemporary Post Keynesian Analysis, Cheltenham, Edward Elgar, 2004. [ Links ]

Sicsú, J. "PAC: quatro anos depois o governo tenta mudar o rumo", in: J. Sicsú (org.), Arrecadação (de onde vem?) e Gastos Públicos (para onde vão?), São Paulo, Boitempo, 2007. [ Links ]

Sidaoui, J.J., "The role of the Central Bank in developing debt markets in México", BIS Papers no. 11, 2002. [ Links ]

WEB SITES

Banco Central do Brasil, Boletins Anuais: <http://www.bc.gov.br/>. Access: July 20, 2009. [ Links ]

Banco de México: <http://www.banxico.org.br/>. Access: September 25, 2009. [ Links ]

IPEADATA: <http://www.ipeadata.gov.br/>. Access: July 20, 2009. [ Links ]

Secretaría de Hacienda y Crédito Público (SHCP): <http://www.shcp.gob.mx>. Access: July 20, 2009. [ Links ]

Organisation for Economic Co-operation and Development (OECD): <http://www.oecd.org/>. Access: December 15, 2008. [ Links ]

Secretaria do Tesouro Nacional, RelatórioMensal da Dívida Pública Federal: <http://www.tesouro.fazenda.gov.br>. Access: January 20, 2009. [ Links ]

* The authors thank the referees for comments and suggestions on this essay.

** JEL: Journal of Economic Literature–Econlit.

1 Oreiro et al. (2007) discuss the negative effect of LFT on the cost of capital in Brazil.

2 The Mexican nominal deficit in the traditional concept doesn't incorporate some extra budget operations. Only after 2001, when the country started to publish the Public Sector Borrowing Requirements (PSBR) in accordance to International Monetary Fund (IMF), these operations were included. The deficit based on the PSBR shows a higher deterioration on the public budget when compared to the traditional nominal deficit. However, the difference between them has been falling in the last years. In 2005, for example, traditional nominal deficit was 0.1% of GDP, and the nominal deficit according to the PSBR was 1.4%. See details in Cysne and Sobreira (2007).

3 The New Macroeconomic Consensus sustains that fiscal policy is not a powerful macroeconomic instrument and monetary policy is taken as the main instrument of macroeconomic policy. See details in Arestis and Sawyer (2004).