Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.69 no.273 Ciudad de México jul./sep. 2010

The role of over–reaction and the disposition effect in explaining momentum in Latin American emerging markets

El papel de la sobrerreacción y el efecto disposición en la explicación del efecto momentum en los mercados emergentes latinoamericanos

Isabel Abinzano*, Luis Muga** and Rafael Santamaría***

* Universidad Pública de Navarra. E–mail: isabel.abinzano@unavarra.es.

** Universidad Pública de Navarra. E–mail: luis.muga@unavarra.es.

*** Universidad Pública de Navarra. E–mail: rafael@unavarra.es.

Received April 2009.

Accepted March 2009.

Abstract

This paper analyzes the momentum effect in the four main Latin American stock markets. In the behavioural finance framework, the results obtained suggest that over–reaction and the disposition effect play a key role in explaining momentum. The interaction of these two factors, which depend on the market state and the performance of winner and loser momentum portfolios in relation to the reference price, provide the key to explaining the intensity of the momentum and the likelihood of its long term reversal. The impact of over–reaction and the disposition effect is also shown to vary across stock markets, making it difficult to obtain simple findings of general validity.

Key words: over–reaction, disposition effect, momentum, emerging markets.

JEL Classification:**** G12, G14, G19

Resumen

Este artículo analiza el efecto momentum en los cuatro mercados financieros latinoamericanos más importantes. En un contexto de finanzas del comportamiento, los resultados obtenidos sugieren que la sobrerreacción y el efecto disposición juegan un papel esencial en la explicación del efecto momentum. La interacción de estos factores, que dependen del estado del mercado y de la evolución con respecto al punto de referencia de las carteras ganadora y perdedora de la estrategia de momentum, ofrecen la clave para explicar la intensidad del momentum y la probabilidad de reversión a largo plazo. El impacto de la sobrerreacción y el efecto disposición varía en los distintos mercados, dificultando la extracción de conclusiones sencillas generalizables.

Palabras clave: sobrerreacción, efecto disposición, momentum, mercados emergentes.

INTRODUCTION

Medium–term continuation in stock returns, also known as 'the momentum effect', is an empirical pattern found almost universally across both the United States (US) market1 and others (see Rouwenhorst 1998, for various European markets; Chui et al. 2000, or Hameed and Kusnadi 2002, for some Asian Basin markets; Hon and Tonks 2003, for the United Kingdom; Glaser and Weber 2003, for the German market; Muga and Santamaria 2007a, for some Latin–American markets).

Although a portion of momentum strategy returns might be due to compensation for risk factors, some studies, such as those of Jegadeesh and Titman (2002), Fong et al. (2005) and Muga and Santamaria (2007b), show that it is difficult to reconcile the momentum effect with these explanations, suggesting the need to incorporate behavioural finance concepts.

Cooper et al. (2004) take a behavioural finance approach to test overreaction theories (see Daniel et al. 1998; Hong and Stein 1999), using market state as indirect validating evidence.2 These authors claim that overreaction is stronger in the wake of up–market periods. Thus, if this is what causes momentum, the effect should manifest itself more strongly after stock market upturns. As a consequence, according to predictions based on overreaction theories, the momentum will reverse in the long–run as the market eventually corrects the mis–pricings. Their results for the US stock market support their predictions.

Other theories, however, show that the presence of disposition investors, who characteristically hold on to loser stocks longer than winner stocks, will, in the presence of an imperfectly elastic demand function, generate a price under–reaction to public information, which results in return continuation (Grinblatt and Han 2005) that should not result in long–term reversal.

Muga and Santamaria (2009a) assert that, when attempting to explain the momentum effect using a behavioural model framework, it is necessary to consider the disposition effect jointly with overreaction theories. These factors, most probably in conjunction with others, such as investor mix, are found to interact and vary in intensity across different market states. As a consequence, momentum may occur in up–markets, down markets, or both. Its strength will depend on circumstances such as the investor mix and the magnitude of unrealised gains and losses. In fact, these authors find momentum in both up–markets and down–markets and show that, while overreaction–driven momentum reverts in the long term, disposition–driven momentum does not. Nevertheless, these findings may be influenced by the fact that they were obtained for a specific period in a specific market (the Spanish stock market).

Du (2008), in contrast, explores the 52–week high and momentum strategies, finding long–term reversal to be associated with both strategies, which, in his view, means that since "it is unlikely that investors only under–react to information, but do not overreact", he can conclude that momentum always reverts. This author, however, analyzes investment in international stock indexes, without assessing either their performance in relation to the state of the market or the evolution of the winner and loser portfolios in relation to the reference price, thus ignoring a potentially key factor in determining the impact of the disposition effect on asset pricing.

Taking a behavioural finance perspective, this study aims to contribute to this ongoing debate with an analysis of the four main stock markets in Latin America (Argentina, Brazil, Chile and Mexico). This extension is of particular interest, first because it focuses on several different markets,3 and second because they are markets in which the consequences of the momentum effect vary substantially. In two of them, for instance, it does not reach global significance (see Muga and Santamaria 2007a). This permits a richer and more generalizable analysis. The study also considers the role of reference price models in the Latin American markets, an aspect of the issue on which there is no prior empirical evidence. It also analyzes individual assets instead of using international index portfolios as in Du (2008). Finally, since the focus is on emerging markets, there is an opportunity to examine the impact of the choice of market state proxy on the results, and thereby assess the role attributed to overreaction and the disposition effect.

The remainder of the paper is organized as follows. Section 2 presents the theoretical framework and the hypotheses that are to be tested. Section 3 presents the database. Section 4 gives the overall results for each of the markets considered. Section 5 analyzes these results when market state is included as a determining variable. Section 6 discusses the results from the behavioural finance perspective. Finally, section 7 presents the main conclusions to be drawn.

THEORETICAL FRAMEWORK AND WORKING HYPOTHESES

Literature Review

The causes of the momentum effect have been a subject of debate in the finance literature ever since the phenomenon was first reported in the seminal study by Jegadeesh and Titman (1993), and particularly since Fama and French (1996) themselves showed that their three–factor model is unable to explain the abnormal returns yielded by strategies designed to exploit the momentum pattern.

One of the issues that have received most attention is the relationship between momentum strategy returns at different points of time. Chordia and Shivakumar (2002) find a relationship between the momentum effect and variables used to capture macro– economic risk. However, working within a framework based on behavioural finance, Cooper et al. (2004) find market state to be a more reliable predictor of momentum strategy returns than the macro–economic variables proposed by Chordia and Shivakumar (2002).

The behavioural finance framework provides two main arguments to explain the momentum effect, one of which attributes it to overreaction. Among the existing research on these lines we might cite the pioneer studies by Barberis et al. (1998), who propose that the momentum effect appears as a result of conservatism and the representativeness heuristic in the decisions of some investors, and Daniel et al. (1998), who suggest overconfidence and self–attribution biases among agents as a possible source of abnormal returns to momentum strategies. Hong and Stein (1999), meanwhile, develop a model that shows momentum to be due to the slow diffusion of information and the presence of momentum traders, trading under the assumption of continuation in stock returns. The common theory in all this research is that various types of behavioural bias lead to an overreaction in stock prices that should revert in the long term.

Cooper et al. (2004) take these arguments as their main basis and develop an ingenious method to test the explanatory capacity of this hypothesis by relating momentum to the market state. These authors test models such as those of Daniel et al. (1998) and Hong and Stein (1999),4 in which delayed overreaction is followed by reversal, by extending their predictions to different market states. Thus, the Daniel et al. (1998) model is consistent with greater momentum in up–markets, due to the fact that a higher general level of overconfidence will produce stronger overreaction leading to higher medium–term momentum, whereas the Hong and Stein (1999) model suggests that an increase in momentum during up–markets is due to variation in the risk aversion of momentum traders. In particular, the decline in risk aversion that comes with wealth increases further prolongs the delayed overreaction and thus leads to greater momentum. Cooper et al. (2004) reason that the momentum effect will be stronger in up–market conditions and that, as a consequence of its being due to overreaction, the momentum profits will reverse in the long–run, as the market eventually corrects the mis–pricings; hence the link between momentum effects and long–run reversal. Their results for the US stock market support their predictions. Huang (2006) also found evidence to support this hypothesis based on index returns from the Morgan Stanley Capital Investment (MSCI) for 17 countries.

The other argument provided by behavioural finance to explain the momentum effect is put forward by Grimblatt and Han (2005), who demonstrate the explanatory capacity of the Prospect Theory and Mental Accounting (PT/MA) in price setting and return continuation in particular. Disposition–prone agents exhibit an S–shaped value function, concave (risk averse) in the domain of gains and convex (risk–loving) in the domain of losses, both measured relative to a reference point. As Grinblatt and Han (2005) assert, if demand for a stock by rational investors is not perfectly elastic, then the demand shock induced by PT/MA tends to generate price under–reaction to public information. Thus, in equilibrium, past winners tend to be undervalued, while past losers tend to be overvalued. If we assume that information will prevail in the future, we might see a momentum effect attributable to unrealised gains (losses).

In this case, the continuation may or may not persist in the long term, but it will not be followed by reversal. This motivates US to disassociate two phenomena that have been so frequently related in the literature: momentum returns and their subsequent reversal. Despite sometimes playing a key role in explaining momentum returns, the disposition effect is not a question of overreaction and will therefore not lead to subsequent return reversal.

George and Hwang (2004) test the explanatory capacity of the 52–week high strategy in return continuation. This strategy is based on the anchoring and adjustment bias described by Kahneman et al. (1982). The common idea in all reference models is that investors have a reference point against which they assess the potential impact of news. In the Grinblatt and Han (2005) model, where there is a disposition–prone investor segment, the reference price is the purchase price. To test for the price impact of the disposition effect, they use a proxy for the reference price taken by this type of agent (Capital Gains Overhang). This proxy yields very similar results to those obtained using the 52–week high, another of the reference variables used in the literature (George and Hwang 2004), although, as noted in Grinblatt and Han (2005), both of these are imperfect proxies for the type of information to be measured.5

Finally, Muga and Santamaria (2009a) show that the effect of the market state on reference price strategies is not direct, but depends instead on the evolution of the winner and loser portfolios with respect to that reference price.6 Their study suggests that the momentum effect can only be explained in terms of the potential concurrence of both types of investor bias. Findings reported in Odean (1999) on this issue suggest that individual investors overestimate either the quality of their private information or their ability to interpret it and Shefrin and Statman (1985) and Odean (1988) also document the observation of the disposition effect in individual investors. Shapira and Venezia (2001), Frazzini (2006) and Scherbina and Li (2005) observe a disposition bias even among relatively more sophisticated institutional investors, although it is weaker than in individual investors. As a consequence, both biases are widely documented in behavioural finance literature.

WORKING HYPOTHESIS

The various findings reported in the studies by Cooper et al. (2004), George and Hwang (2004), Grinblatt and Han (2005) and Muga and Santamaria (2009a) appear to show that the relationship between stock return continuation and long–term reversal is not direct, but rather depends on the underlying cause of the momentum. If momentum over a given period is basically due to overreaction, it should revert in the long term, whereas, if the greater role is played by the disposition effect, it should not.

One way to test whether the momentum effect is related to overreaction or to the disposition effect is to isolate returns to strategies based on the state of the market in order to examine the potential impact of overreaction and the specific performance of the winner and loser portfolios in given market states. It is in this respect that the testing procedure used by Cooper et al. (2004) has some appeal, but it requires some degree of adjustment when the analysis involves financial markets in emerging economies. Cooper et al. (2004) use the market index cumulative return as a proxy for the state of the market. Thus, an up–market state is assumed if the cumulative return for a given period (12, 24 or 36 months) is positive, and a down–market state is assumed otherwise. The tremendous variability of emerging markets, however, makes the adoption of either assumption difficult to decide. This issue will be analysed further in section 5.

As already stated, the hypothesis we propose to test is that both overreaction and disposition bias are latent among investors and have a major effect on prices when prevailing circumstances allow. Thus, when prices show a continuation of the trend (especially in up–market conditions) investors are very likely to overreact to information, thus triggering a momentum effect with long–term reversal. On the other hand, when the winner portfolio rises above the reference price and the loser portfolio falls below it, or at least one of the two is not far from its reference price, this creates the necessary conditions for the disposition effect to have the maximum impact on prices and, as a consequence, for reference price strategies to capture return continuation that should not revert in the long term.

To find empirical evidence of the presence of the disposition effect, it will be necessary to detect significant returns to reference price strategies, such as the 52–week high. If none are found, it must be assumed that the disposition effect has no explanatory capacity in the market and period in question, in which case any momentum must be attributed to overreaction and expected to revert in the long term. Even when there is significant evidence of disposition bias, if winner and loser momentum portfolios follow a parallel trend (both rise or both fall), the disposition effect is the same on both portfolios, thus the impact on the overall strategy (winners minus losers) is neutralised. In such a case, the disposition effect will have little capacity to explain the momentum effect and the momentum should revert in the long–term. If, on the other hand, the portfolio performance is seen to maximize the impact of the disposition effect, the latter will play a large part in explaining the momentum effect and long–term return reversal should not occur.

With the aim of testing this reasoning we propose the following hypotheses:

H1: If the reference price strategies are not significant, any momentum effect should revert in the long–term because it will be due to investor overreaction.

H2: If the reference price strategies are significant and the winner and loser portfolios move in a parallel fashion, the momentum effect will be mainly due to overreaction and momentum returns should revert in the long–term.

H3: If the reference price strategies are significant and the winner portfolio rises above the reference price and the loser portfolio falls below it, the disposition effect is playing a key role, and long–term reversal should not occur.

H4: Momentum effect and long–term reversal are distinct phenomena that are not bi–univocally related.

Hypothesis H3 acknowledges that the important role played by the disposition effect does not rule out the possible co–presence of overreaction. The point is that, despite some price reversal due to the disposition effect, this is not enough to correct the continuation of the momentum effect.

Hypothesis H4, meanwhile, is very closely related with the results found for the previous hypotheses H1, H2 and H3, in which, as already mentioned, the basic underlying argument is that price reversal only occurs if the return continuation is fundamentally due to investor overreaction. Otherwise, it is possible to have momentum without long–term reversal.

Fulfilment of all four of the above hypotheses would corroborate the theories of Cooper et al. (2004), while showing those of George and Hwang (2004) and Grimblatt and Han (2005) to be partial theories, since it would take a combination of both factors to obtain a joint explanation for all four hypotheses.

Database

The data used for this analysis are monthly returns of all the stocks traded in the main four Latin American stock exchanges: Bolsa de Comercio de Buenos Aires (Buenos Aires SE, Argentina), Bolsa de Valores de São Paulo (Sao Paulo SE, Brazil), Bolsa de Comercio de Santiago (Santiago SE, Chile) and Bolsa Mexicana de Valores (Mexican Exchange, Mexico) for the estimation period January 1990 to December 2007, supplied by Thomson Financial.

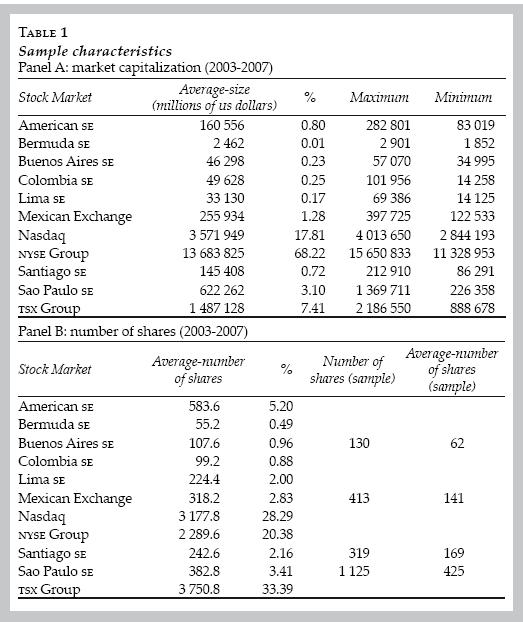

Table 1 shows some of the data characteristics. The general data for the period 2003–2007 was supplied by the World Federation of Exchanges (panel A and panel B). Also shown are the sample characteristics of the database, with returns adjusted for thin trading (panel B). Specifically, some stocks on the various markets showed the same adjusted price for long periods of time. This meant that they were in fact showing no trading activity during those periods. Their inclusion among the sample could have artificially generated return continuation, which might, at certain points of time, have pervaded the winner or loser portfolios underlying the trading strategies. The returns on these stocks were therefore replaced with the average returns for the month in question during those periods, such that they are never included in the construction of either the winner or the loser portfolio. The moment they register a price change they are once again treated in the same way as the rest of the stocks. As already noted, the database includes all the stocks listed on the four main Latin American stock exchanges. Panel A in table 1 shows that three of them are clearly larger than any other Latin American or Caribbean stock exchanges (Sao Paulo SE, Santiago SE and the Mexican Exchange) but the Colombia SE has drawn very close to the Buenos Aires SE in terms of average capitalization in US dollars over the last five years. This, however, is due exclusively to the spectacular growth experienced by the Colombia SE in recent years. The joint weight of the four markets considered is very small in relation to the Americas as a whole (little more than 5%). 3.10% of that is due to the Brazil SE, which, since its merger in 2008, has grown considerably.7 Although the shares listed on these markets make up only 9.36% of the total sample,8 the actual number is much greater, since there is a large number of new listings and also de–listings for various reasons.

Panel B in table 1 gives the average number of shares that the World Federation of Exchanges reports as admitted for trading between 2003 and 2007, and the percentage they represent of the total number of shares traded in the American markets. Also shown are the sample characteristics. The first shown are the total number of shares listed on each of these stock markets over the sample period, according to the Thomson Financial database. As already noted, several firms exhibited identical adjusted prices over consecutive monthly periods. In such cases, the price was allowed to remain invariant for up to four months. When the same price persisted for a fifth month it was replaced with a code to substitute that month's return with the average stock return for that month. The last column in panel B gives the average number of stocks. As the table shows, there is a large number of stocks on these markets for which trading is quite thin. For this reason it was decided to restrict the analysis of the performance of the trading strategies to the period January 1992 to December 2007 for the Chilean, Argentine and Mexican ses and January 1996 to December 2007 for the Brazil SE, since the latter had been heavily affected by thin trading up until that time.

Finally, it is worth noting, despite the large number of different firms (1 125) that were quoted on the Sao Paulo SE, the maximum number of firms showing active trading is actually no more than 551, with an average of 425. It is also very important to note the number of delisted stocks (495 firms over the whole of the sample period). Furthermore, shares in the same firm but with different rights are traded on this stock exchange.9 This could potentially contaminate our results since it involves related assets. Moreover, the adjusted prices follow parallel trends, creating serious problems for portfolio construction based on nearness to the last 52 week high. The choice of solution to this problem has in fact important implications for the results, since, although we have an appealing solution for the returns (which is to assign them the average return for the sample period), it is not clear what should be done with the reference price. If it is maintained, we obtain a larger amount of data and better coverage of the reference price quintiles; but, when there are stocks showing no return, the portfolio has to be built on a smaller amount of data. The elimination of such stocks considerably reduces the amount of data and for a large part of the sample there are only two or three non–empty quintiles, making it difficult to assign the stocks correctly. In our case, we have opted for the first solution, since in our view there is less bias in portfolios with fewer data than there is in portfolios with fewer quintiles (this means that in some months the 5th quintile portfolio is constructed from that of the 4th or 3rd quintile).

One of the potentially important issues in this research, irrespective of the theoretical perspective, is the economic and financial crises that have repeatedly affected these economies. It should be noted that the sample period saw three main crises. One took place in 1994, when, as a result of the devaluation of the peso, the Mexican economy was thrown into frenzy. The situation, which was dubbed the "tequila crisis", spread to the whole of Latin America and its effects continued to be felt until 1996. The second was the currency crisis that hit Brazil between 1998 and 1999. Internal issues aside, the South East Asian financial crisis of 1997 and, especially, Russia's 1998 default on its debt may clearly have triggered the Brazilian financial crisis.10 The last was the Argentine financial crisis, which started towards the end of 2001, when extreme measures, including the notorious "corralito", introduced by the Minister of Economy, Domingo Carvallo, and vehemently protested by the public, triggered a major economic crisis.11 This also spread to other Latin American countries in what was termed a "tango" effect, the strongest repercussions being felt in Brazil, Paraguay and Uruguay (which, together with the Argentina, make up Mercado Común del Sur, MERCOSUR). It had less international impact than the Mexican crisis, however.

MOMENTUM AND REFERENCE PRICE STRATEGIES

Methodology

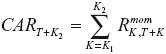

In line with the recent literature, this paper uses a method similar to that described by Jegadeesh and Titman (1993) in their seminal article on the momentum effect. The approach used by these authors is based on the analysis of a set of momentum strategies over the holding period. It involves pooling returns to obtain the momentum portfolio return at a certain point. The specific procedure is as follows: At a certain point in the sample period, the stocks are ranked by their cumulative returns over the previous J months (formation period)12 and classified by quintiles, where the stocks in the top–performing quintile are assigned to the winner portfolio and those in the bottom quintile to the loser portfolio. The momentum strategy consists of taking a long position on the winner portfolio and going short on the losers. These portfolios are held on for a horizon of K months following their formation (the holding period). Thus, different momentum strategies can be constructed from different combinations of formation and holding periods. The methodology employed throughout this study basically follows that of Cooper et al. (2004), where momentum profits in each formation period are calculated in event time, irrespective of what strategies might be implemented in successive periods. This departs from the calendar–time method proposed by Jegadeesh and Titman (1993) and presents a problem of high correlation in momentum portfolio returns, making adjustments to the t–statistic necessary in order to assess the level of significance.13 This drawback is nevertheless balanced by the advantage it provides in enabling observation of the long–run return performance, which is not possible when using Jegadeesh and Titman's (1993) overlapping portfolio method. Specifically, in each of the markets considered in the study, stocks are sorted in a given month according to their past formation period14 returns, whereupon a buying position is taken on the stocks in the highest–performing quintile in the formation period, which are used to construct the winner portfolio, and a selling position is taken on the lowest–performing quintile during the same period, from which the loser portfolio is constructed. The momentum profits are then calculated by constructing time series return data for each consecutive month, from 1 to 60 months after the formation period, skipping a month between formation and holding periods. The raw returns15 are cumulated to form the event–time returns to the momentum strategy:

where  is the raw profit for each momentum strategy, and the (K1,K2) pairs correspond to the periods to be analyzed, which, in our case, are (1,3); (1,6); (1,12); (13,36) or (13,60). The first three holding periods allow US to evaluate the impact of the momentum effect in these markets and the last two enable US to determine the long term performance.

is the raw profit for each momentum strategy, and the (K1,K2) pairs correspond to the periods to be analyzed, which, in our case, are (1,3); (1,6); (1,12); (13,36) or (13,60). The first three holding periods allow US to evaluate the impact of the momentum effect in these markets and the last two enable US to determine the long term performance.

Reference price models are based on the assumption that investors use reference points against which they evaluate the potential impact of news. George and Hwang (2004) claim that the momentum effect is an under–reaction induced by some kind of "anchoring" bias, in line with the reasoning used by Grinblatt and Han (2005) which is grounded in prospect theory and mental accounting. Following George and Hwang (2004), in this paper we use the 52–week–high as the reference for investors. This type of strategy is constructed along the same lines as shown in the event time methodology, except that in this case the stocks are sorted at portfolio formation according to the following measure: Pi,t /Maxi,t, where Pi,t is the price of asset i at the end of period t, while Maxi,t, the reference price, is the maximum price of asset i over the year ending at the end of month t. Thus, at the end of each period, the stocks will be sorted by quintiles, and a long position will be taken on the quintile nearest to the reference price, when measured by the ratio described above, and a short position on the quintile furthest from it. The strategy will be tested for holding periods of three, six, and 12 months.

Results

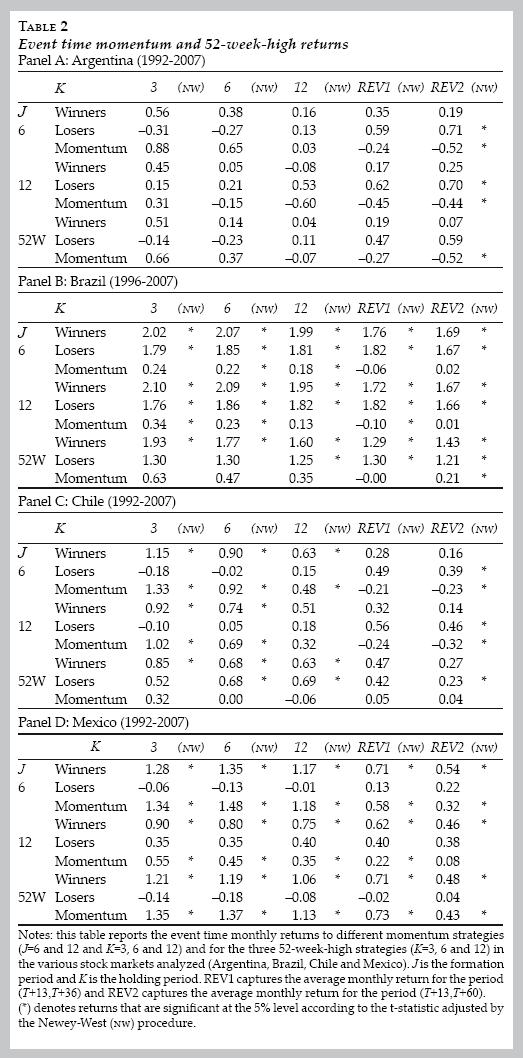

Clear differences emerge in the results of the past return (momentum) portfolio, the price reference portfolio, and the long–run performance of the two across the various stock markets over the sample period (see table 2). This, as noted earlier, depends to a large extent on the role played in each market by the different factors postulated as the source of returns to strategies of this type.

Thus, panel A in this table gives the results obtained for the Argentine stock market over the period running from January 1992 to December 2007. The data shows that none of the strategies based on past returns constructed from different combinations of formation and holding periods, yields returns that are significantly different from 0 according to the Newey–West corrected t–statistic. Even for long formation and holding periods, the returns to the strategies proved negative, albeit non–significant. This lack of momentum is also accompanied by non–significant returns to the reference price strategies, and negative, though non–significant, returns to the twelvemonth holding period strategy. In other words, an overall analysis of the results suggests that neither the disposition effect nor anchoring bias appears to play a significant role in driving momentum in the Argentine stock market.

The results shown for the Brazil stock market, given the aforementioned initial thin trading, correspond to the period running from January 1996 to December 2007 (see panel B, table 2). Most of the formation and holding period combinations show a momentum effect that, despite being weak, is significant according to the Newey–West corrected t–statistic. This momentum is seen to be followed in holding periods of up to the 36 months by reversal that is significant in the 12–month formation period strategies, but fades towards the 60–month holding period. Nevertheless, the returns to the reference price strategies show less significance over the sample period as a whole, despite some signs of significance (a 12–month holding period yields a monthly return of 0.35% with a corrected t–statistic that is significant at the 10%). These results are consistent with a certain degree of overreaction and disposition bias, and would need to be differentiated by market states in order to identify which of these effects prevails over the other.16

The results for Chile, the third of the markets considered (panel C, table 2), suggest the presence of a momentum effect, with the returns to the different strategies ranging between 1.33% per month for the combination of a six–month formation period and a three–month holding period (6/3 strategy), and 0.32% per month for the 12/12 strategy, and significant in all cases.17 In contrast to the clarity with which the momentum effect can be observed in the Chilean stock market, the returns to the reference price strategies are much more modest. Thus, the strategy based on the three–month holding period yields a monthly return of 0.32%,18 which has faded by the six–month holding period. From an analysis of the results across the whole sample period, it is possible to confirm the presence of a momentum effect in the Chilean stock market, but neither anchoring bias nor disposition bias appears to be the main cause. Furthermore, given the long–term reversal of the momentum returns (a monthly average of —0.23% for holding periods between 13 and 60 months for the 6–month formation strategy), the explanation appears to be more consistent with overreaction theories.

Finally, panel D, table 2 gives the results for the Mexican stock market, which shows evidence of a momentum effect, in that all the past return strategies yield significantly positive returns ranging between an average of 1.48% a month for the 6/6 strategy and 0.35% per month for the 12/12 strategy. In contrast to findings for the Chilean stock market, moreover, the reference price strategies yield significantly positive returns ranging between an average of 1.35 and 1.13 per cent per month for the 3–month and 12–month holding periods, respectively. A joint analysis of the returns to both strategies suggests the presence of a momentum effect in the Mexican stock market, probably due to anchoring bias or disposition bias, given the lack of long–term return reversal in either strategy, as postulated above.

MOMENTUM, 52 WEEK–HIGH AND MARKET STATES

The evidence presented in the previous section recommends separating the momentum returns into up–market and down–market states in order to identify possible sources of return continuation in markets such as these. This was done following the method proposed in Cooper et al. (2004).

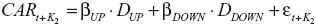

This involves running the following regression:

Which allows US to test various hypotheses. Specifically, we check to see if momentum strategies yield zero mean returns in any market state and whether mean returns to momentum strategies are invariant between up–markets and down–markets.

Nevertheless, one of the issues raised by the cited authors, and one that probably needs to be considered in emerging markets, is the choice of dummy variable used to capture an up–market or down–market period, as noted already. In their study, Cooper et al. (2004) define an up–market period as one in which the market return over the previous 36 months is positive (Dup= 1) and a down–market period as one in which it is negative or 0 (Dup= 0). They also use the cumulative return for the previous 24 and 12 months as a robustness test, arguing that, when constructing their dummy, longer time horizons should capture greater variation in the market state, while shorter ones provide a larger number of observations in down–markets, thus making the tests more powerful. Nevertheless, as argued in Muga and Santamaria (2008), emerging markets may present a different set of problems, since, given the already–mentioned frequency of the crises and the higher volatility of this type of market, longer horizons may result in the dummy variable failing to properly capture the state of the market. As noted by Cooper et al (2004), the dummy variable based on longer time horizons ought to capture more of the variation in market states, but the frequency of crises in this type of markets may justify the use of shorter time horizons to capture market state, despite some loss of capacity to capture factors such as the overconfidence and self attribution biases described in the model developed by Daniel et al (1998). Specifically, the use of a 36 month horizon for Latin American markets results in observations of down–markets in which both the winner and loser portfolios show positive returns, and upmarket periods, in which returns are positive to the winners and negative to the losers. Muga and Santamaria (2008), specifically, show that it is more coherent to talk of up–markets and down–markets when using proxies for shorter horizons. They recommend the use of market–specific horizons of no more than 12 months.

In line with the above, we begin our analysis with a dummy variable based solely on the market's past 12 month cumulative returns. To determine whether this dummy properly captures market state, the cumulative returns of the winner and loser momentum portfolios for the 6–month formation period are given in figure 1. Panel A in figure 1 illustrates portfolio performance for the Argentine stock market. A positive return in up–markets can be observed for both the winner and loser portfolios, and, in parallel with this, negative returns can be observed for both winner and loser portfolios in down–markets, allowing US to assert that the 12–month market dummy properly captures market state, the data showing 115 up–market periods (60 % of the total) and 77 down–market periods (40% of the total).

The Brazil stock market (panel B, figure 1), shows positive returns to both the winner and loser portfolios during what the dummy defines as upmarket periods. In down–market periods, however, positive returns are also observed from the second month of the holding period (positive slope), which might suggest that the chosen variable is failing to properly capture different market states.

The results found for the Chilean (panel C) and Mexican (panel D) markets are similar to those obtained for the Brazil stock market, in that the chosen dummy variable appears to be efficient at capturing up–markets but not down–markets, where both past winners and past losers show positive returns.

In light of these considerations, it was decided to proxy the state of the market for these three countries using the cumulative return to the corresponding indices for the six months prior to portfolio construction and re–evaluate the performance of the momentum winner and loser portfolios. Figure 2 shows the results for the Brazilian, Chilean and Mexican markets, in which the past 12–month cumulative return dummy does not perform as well as expected in distinguishing between up–markets and down–markets.

Panel A shows the results for the Brazilian stock market, where, in up–markets, both the winner and loser portfolios show positive returns, while, in down–markets, they can be seen to perform in a similar way as to that observed with the 12–month dummy. Nevertheless, the final cumulative return in down–markets under this new consideration is somewhat lower than under the previous conditions, leading US to conclude that this dummy is more efficient at capturing down–market states than that shown in figure 1 (panel B), although neither can be considered a down–market in the true sense.

Panel B gives the results for the Chilean stock market, where both winners and losers again show positive returns in up–markets, while the loser portfolio shows negative returns in down–markets as it did for much of the holding period.

Finally, panel C in figure 2 shows portfolio performance for the Mexican stock market, where in up–markets, a positive return is once again observed for both the winner and loser portfolio, although the latter's was close to zero. In down–markets, the return shown by the losers is negative and that shown by the winners is positive, suggesting that this dummy is a more reliable proxy for the down–market state than the past 12–months' cumulative return (panel D figure 1).

In conclusion, therefore, when dealing with emerging markets, the choice of dummy variable to explore the performance of the momentum effect is very important, since, given the frequent crises and volatility that characterise these markets, the use of a very long time horizon carries the risk of failing to properly capture the effect one is aiming to measure. Consequently, following the preliminary analysis, it was decided to use the past 12 months' cumulative index returns as proxies for market state in the Argentine market (panel A figure 1) which showed 115 up–market and 77 (40%) down–market periods. The past six months' cumulative returns were used for the remaining markets (figure 2). There were 100 up–market periods and 44 (31%) down–market periods in the Brazilian stock market; 128 up–market periods and 64 (33%) down–market periods in the Chilean stock market; and 139 up–market periods and 53 (28%) down–market periods in the Mexican stock market.

Having determined which dummy variable to use in each of these markets, the possible sources of momentum were analysed in each one, differentiating by market states.

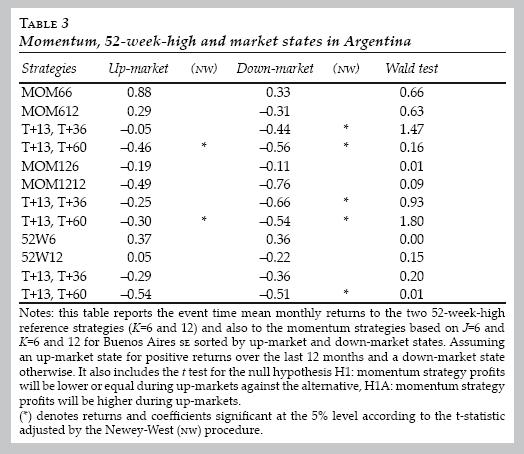

The results for the Argentine market, displayed in table 3, coincide with those obtained before differentiating by market state. In this case, no momentum effect is found in either up– or down–market states. Furthermore, the returns to strategies based on long formation and holding periods are negative, albeit non–significant. From the perspective of the behavioural finance theory, the lack of any momentum effect may be due to the minimal impact of disposition prone investors (the returns shown by the reference price portfolios are non–significant and there is no instance in which the disposition effect has maximum impact, panel A, figure 1), and to the lack of up–market period, when, according to Cooper et al (2004), self attribution and overconfidence bias are more likely. 40% of the periods in the Argentine market were considered down–market periods, versus 27% in the case of the US market (Cooper et al 2004), 31% in the Brazilian, 29% in the Chilean, or 23% in the Mexican stock market.19

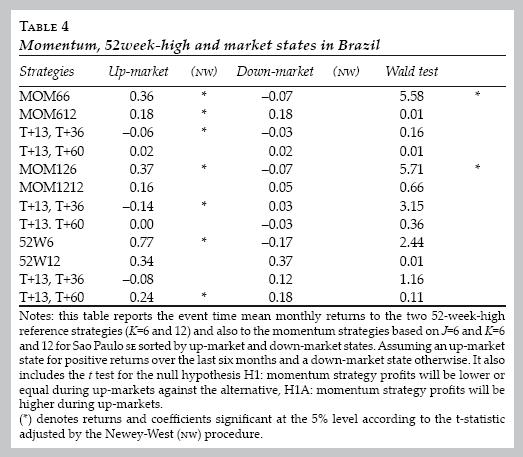

Table 4 gives the results for the Brazil stock market differentiated by market state. The data show a significantly positive momentum effect during up–markets for strategies with both 6– and 12–month formation periods, this momentum showing significant reversal over the 36–month horizon. This is consistent with the presence of overreaction in up–markets. The reference price strategies also show significantly positive returns during these market states without long–term reversal. Nevertheless, the fact that both the winner and loser momentum portfolios are well above the reference price (panel A, figure 2) makes it unlikely for disposition bias to affect the performance of the past return portfolios, which is why the reversal effect can be observed up to the 36th month. This is consistent with hypothesis H2.

In contrast to this positive effect in up–market periods, no effect is found in the down–market periods, providing additional evidence of the presence of a momentum effect in the Brazilian stock market, explicable by one of the theories in which overreaction is postulated as the source.

The results for the Chilean market differentiated by market state proxied by the past 6 months' cumulative market return dummy (table 5) confirm what was suggested by the results for the market as a whole. A significantly positive momentum effect is observed in up–market periods, for both 6– and 12–month formation periods. This momentum effect, moreover, reverts in the long–term, which, as already noted, is consistent with theories claiming that momentum is generated by some form of overreaction. The disposition effect during these market periods is non–significant, however, and both the winner and loser portfolios show a clearly positive performance (panel B, figure 2), confirming the hypotheses in which the momentum effect is attributed to overreaction. Again, this result supports hypothesis H1 (it is also partially consistent with hypothesis H2, although the lack of statistical significance of the reference price strategy is more consistent with hypothesis H1).

Nevertheless, down–markets exhibit a much weakened momentum effect, and only reach statistical significance for the 6–month formation period and 6–month holding period strategy. This is a rapidly–fading momentum effect that never reverts, which is consistent with an explanation based on anchoring bias or the disposition effect.20 Finally, the performance of the winner and loser portfolios during down–markets (panel B, figure 2), with one loser portfolio below the reference price and a winner portfolio very close to or above it, are more indicative of anchoring bias and the disposition effect having a stronger impact during such periods. This result is consistent with the predictions of hypothesis H3.

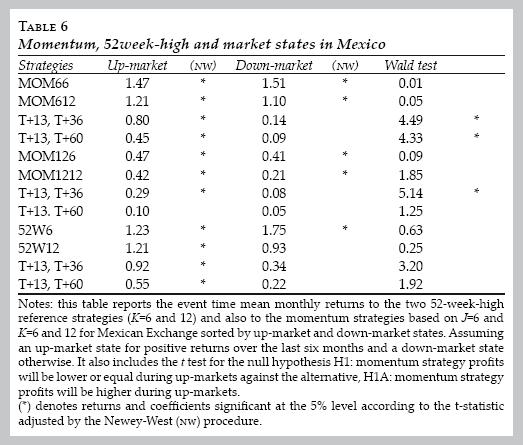

Finally, the results for the Mexican stock market differentiated by market state (table 6) also show consistency with what was suggested by the portfolio returns for the market as a whole. A significantly positive momentum effect with no reversal can be observed for all strategies and all market states. The reference price strategies also present significantly positive returns and the performance of the winner and loser portfolios in relation to the reference price (panel C, figure 2) is consistent with strong anchoring biases or a disposition effect among investors. This enables US to conclude that the most plausible explanation for the momentum effect in the Mexican stock market lies in the presence of agents exhibiting a disposition effect or anchoring biases. The results for both market states are fully consistent with the predictions of hypothesis H3.

DISCUSSION OF THE RESULTS FROM THE BEHAVIOURAL FINANCE PERSPECTIVE

As already mentioned in the previous section, the choice of market state proxy is very complex and may have a crucial influence on the results. In fact, in the sample used by Cooper et al. (2004) there was a total of 674 up–market months (84%) versus 124 down–market months (16%) for the market state dummy, i.e. the past 36 month cumulative index returns. However, when 6– and 12–month proxies are used in order to adapt to the markets under consideration, the proportion of up–market periods varies between 60 and 72 per cent. Logically, this results in a marked difference in the duration of market states. Specifically, while Cooper et al (2004) observe periods of over 10 years without a down–market month in the US market, the longest up–markets in the Latin American setting last from 21 months to 56 months based on the market state proxies used in the present study. Despite this restriction on data interpretation, stemming from the incomparability of the proxies across developed and emerging markets, we believe that the conclusions of this study still remain completely valid.

To sum up, the results presented above and the empirical support for hypotheses H1, H2 and H3 (especially the first and the third) clearly allow US to accept hypothesis H4.

The lack of reversal in the reference price strategy is consistent with the predictions made by Muga and Santamaria (2009a) and also with the findings of Cooper et al. (2004); George and Hwang (2004) and Grinblatt and Han (2005), although it was not reported in any of these. It nevertheless contrasts with the claim made by Du (2008) relating to the presence of long–term reversal in strategies based on the disposition effect. One possible explanation for this is that the results obtained by Du fall within the postulations of hypothesis H2, that is, both the classic momentum strategies and the reference price strategies are significant, but, if the winner and loser portfolios follow parallel trends, this will neutralize the impact on the overall strategy (winner minus loser) thus assigning a greater explanatory capacity to possible overreaction as the underlying cause of the observed momentum effect, than to the disposition effect, the former being what leads to the observed reversal.

It should be noted that the results reveal the partiality of the arguments of Cooper et al. (2004), on the one hand, and George and Hwang (2004) and Grimblatt and Han (2005) on the other, since an overall explanation of the results would require the concurrence of both types of bias, as shown in Muga and Santamaria (2009a). Further observation shows that when the prevailing impact is from overreaction, subsequent long–term reversal is found, while if the main influence is from the disposition effect no subsequent reversal of any kind is observed.

It is also worth noting that, although the observed cause for the momentum effect in the markets considered is consistent with the joint influence of overreaction and disposition bias, various issues remain unanswered, suggesting a promising avenue for future research. The first is the analysis of the role played by stock characteristics. From the behavioural finance perspective, the characteristics of emerging markets mean that overconfidence and self–attribution bias have less impact on momentum returns than in developed markets. This may be one of the reasons for the lower momentum returns traditionally observed in emerging markets. Nevertheless, specific stock characteristics (liquidity, size, asymmetric information, level of analyst coverage), shown by several studies to play a prominent role (see Hong and Stein 1999, for example), might suggest the contrary, that is, a stronger effect in these markets than in more developed markets, where liquidity is higher. This finding, despite losing some of its force due to the limited number of markets analysed, thus preventing US from drawing more generalizable conclusions, suggests that investor behaviour plays a key role in explaining the phenomenon. That is not to say that stock characteristics are irrelevant, it just means that they are not strictly determinant. The likelihood is that a combination of stock characteristics and investor behaviour, associated with market microstructure issues, would provide a fuller explanation of the phenomenon.

Finally, some mention must be made of the macroeconomic issues. Although Cooper et al. (2004) explanation for the momentum effect as a consequence of market state is robust to macroeconomic considerations, it is reasonable to suppose that market state will, directly or indirectly, influence investor behaviour. This raises the complex question of what direction the influence of economic environment on investor behaviour takes and whether it remains the same irrespective of economic conditions at a given point in time.

CONCLUSIONS

As anticipated, notable differences are found across the four markets considered. Three of them show significant momentum, albeit with varying degrees of intensity and different long–term trends. The exception is the Argentine market, where no significant momentum can be observed in either market state. The 52–week high strategy also fails to show significance in this market. The Mexican market, in contrast, shows momentum in both market states. Here, the explanatory capacity of the reference price strategies is confirmed. The performance of the winner and loser portfolios in relation to the reference price results in the disposition effect driving price formation, hence the lack of long–term reversal. The Brazilian and Chilean markets both show significant momentum in up–market periods. In both cases, the performance of the reference price portfolios shows the lack of any notable disposition effect and suggests that the explanation lies mainly in overreaction with subsequent long–term reversal. In the Chilean stock market, some momentum is also found in down–market periods. In this case, the disposition effect plays a greater role, hence the lack of long–term reversal.

This distinct pattern of results and their long–term evolution are not readily explicable either by overreaction or the disposition effect alone; otherwise the relationship between momentum and long–term performance would always be the same.

In a behavioural finance framework, the results obtained are consistent with an explanation based on the fact that the momentum effect requires the concurrence of investor overreaction and the disposition effect. The interaction of these two factors, dependent on the market state and the performance of the winner and loser portfolios in relation to the reference price, is crucial in explaining the intensity of the momentum effect and its potential long–term reversal in the various markets considered. It has been shown that these two phenomena are not directly related, since momentum can be present with or without long–term reversal, contrary to assertions made in Du (2008). It has also been shown that the impact of overreaction and the disposition effect is not uniform across the markets considered, making simple and generalizable results impossible to obtain. Probably, stock type, the speed of information diffusion, its visibility,21 the degree of market stability and market trends, liquidity and transaction costs are all among the explanatory variables accounting for the phenomenon.

Research into ways of modelling the aggregate effect of behavioural biases and their interaction, in conjunction with the above variables, shows itself to be a very promising approach towards the collection of more solid empirical evidence by more highly specified direct testing of this and other so–called stock price anomalies.

REFERENCES

Barberis, N.; A. Shleifer and R. Vishny, "A model of investor sentiment", Journal of Financial Economics, no. 49, 1998, pp. 307–343. [ Links ]

Beckmann D.; L. Menkhoff and M. Suto, "Does culture influence asset managers' views and behaviour?", Journal of Economic Behavior and Organization, no. 67, 2008, pp.624–643. [ Links ]

Chordia, T. and L. Shivakumar, "Momentum, business cycle and time varying expected returns", Journal of Finance, no. 57, 2002, pp. 985–1019. [ Links ]

Chui, A.C.W; S. Titman and K.C.J. Wei, "Momentum, legal systems and ownership structure: an analysis of Asian stock markets", University of Texas at Austin, Working paper, 2000. [ Links ]

Cooper, M.J.; R.C. Gutiérrez and A. Hameed, "Market states and momentum", Journal of Finance, vol. 59, no. 3, 2004, pp. 1345–1365. [ Links ]

Daniel, K.; D. Hirshleifer and A. Subrahmanyam, "Investor psychology and security market under and overreactions", Journal of Finance, no. 53, 1998, pp. 1839–1885. [ Links ]

Damill, M.; R. Frenkel and L. Juvenal, "Las cuentas públicas y la crisis de la convertibilidad en la Argentina", Desarrollo Económico, no. 43, 2003, pp. 203–230. [ Links ]

Du, D., "The 52–week high and momentum investing in international stock indexes", The Quarterly Review of Economics and Finance, no. 48, 2008, pp. 61–77. [ Links ]

Estrada, J. and A.P. Serra, "Risk and return in emerging markets: family matters", Journal of Multinational Financial Management, no. 5, 2005, pp. 257–272. [ Links ]

Fama, E. and K. French, "Multifactor explanation of asset pricing anomalies", Journal of Finance, no. 51, 1996, pp 3–56. [ Links ]

Fong W.M.; W.K. Wong and H.H. Lean, "International momentum strategies: a stochastic dominance approach", Journal of Financial Markets, no. 8, 2005, pp. 89–109. [ Links ]

Frazzini A., "The disposition effect and under–reaction to news", Journal of Finance, vol. 61(4), 2006, pp. 2017–2046. [ Links ]

George T.J. and Ch–Y. Hwang, "The 52–week high and momentum investing", Journal of Finance, vol. 59, no. 5, 2004, pp. 2145–2176. [ Links ]

Glaser, M. and M. Weber, "Momentum and turnover: evidence from the German stock market" Schmalenbach Business Review, no. 55, 2003, pp. 108–135. [ Links ]

Grabel, I., "Averting crisis? Assessing measures to manage financial integration in emerging economies", Cambridge Journal of Economics, no. 27, 2003, pp. 317–336. [ Links ]

Grimblatt; M. and B. Han, "Prospect theory, mental accounting, and momentum", Journal of Financial Economics, no. 78, 2005, pp. 311–339. [ Links ]

Hameed, A. and Y. Kusnadi, "Momentum strategies: evidence from pacific basin stock markets", Journal of Financial Research, no. 25, 2002, pp 383–397. [ Links ]

Hon, M.T. and I. Tonks, "Momentum in the United Kingdom stock market", Journal of Multinational Financial Management, no. 13, 2003, pp. 43–70. [ Links ]

Hong, H. and J.C. Stein, "An unified theory of underreaction, momentum trading and overreaction in asset markets", Journal of Finance, no. 54, 1999, pp. 2143–2184. [ Links ]

Huang, D., "Market states and international momentum strategies", The Quarterly Review of Economics and Finance, no. 46, 2006, pp. 437–446. [ Links ]

Jegadeesh, N. and S. Titman, "Returns to buying winners and selling losers: Implications for stock market efficiency", Journal of Finance, no. 48, 1993, pp. 65–91. [ Links ]

––––––––––, "Profitability of momentum strategies: an evaluation of alternative explanations", Journal of Finance, no. 56, 2001, pp. 699–720. [ Links ]

––––––––––, "Cross–sectional and time–series determinants of momentum returns", Review of Financial Studies, no. 15, 2002, pp. 143–157. [ Links ]

Kahneman, D.; P. Slovic and A. Tversky, Judgment under Uncertainty: Heuristics and Biases, Cambridge, Cambridge University Press, 1982. [ Links ]

Kaminsky, G.; C. Reinhart and C. Végh, "The unholy Trinity of financial contagion", Journal of Economic Perspectives, vol. 17, no. 4, 2003, pp. 51–74. [ Links ]

Kehoe, T.J., "What can we learn from the current crisis in Argentina?", Scottish Journal of Political Economy, vol. 50, no. 5, 2003, pp. 609–633. [ Links ]

Krueger, A.O., "Crisis prevention and resolution: lessons from Argentina", International Monetary Fund, Conference on "The Argentina Crisis", Cambridge, July 17, 2002. [ Links ]

Muga, L. and R. Santamaria, "The momentum effect in Latin American emerging markets", Emerging Markets Finance and Trade, vol. 43, no. 4, 2007a, pp. 25–46. [ Links ]

––––––––––, "The momentum effect: omitted risk factors or investor behaviour? Some evidence from the Spanish stock market?", Quantitative Finance, vol. 7, no. 6, 2007b, pp. 637–650. [ Links ]

––––––––––, "'New Economy' Firms and Momentum", Journal of Behavioral Finance, no. 8, 2007c, pp. 109–120. [ Links ]

––––––––––, "Momentum and market states in Latin American emerging markets", en L. Beridze (ed.), Economics of Emerging Markets, New York, Nova Science Publishers Inc., 2008. [ Links ]

––––––––––, "Momentum, market states and investor behaviour", Empirical Economics, no. 37, 2009a, pp. 105–130. [ Links ]

––––––––––, "El efecto momentum en la Bolsa Mexicana de Valores", El Trimestre Económico, no. 302, 2009b, pp. 109–120. [ Links ]

Odean, T., "Are investors reluctant to realize their losses?", Journal of Finance, no. 53, 1998, pp. 1775–1798. [ Links ]

––––––––––,"Do investors trade too much?", American Economic Review, no. 89, 1999, pp. 1279–1298. [ Links ]

Paula, L.F.R. and A.J. Alves, Jr., "External financial fragility and the 1998–1999 Brazilian currency crisis", Journal of Post Keynesian Economics, vol. 22, no. 4, 2000, pp. 589–617. [ Links ]

Rouwenhorst, K.G., "International momentum strategies", Journal of Finance, no. 53, 1998, pp. 267–284. [ Links ]

Shapira, Z. and I. Venezia, "Patterns of behaviour of professionally managed and independent investors", Journal of Banking and Finance, no. 25, 2001, pp. 1573–1587. [ Links ]

Shefrin, H. and M. Statman, "The disposition to sell winners too early and ride losers too long", Journal of Finance, no. 40, 1985, pp. 777–790. [ Links ]

Scherbina, AD. and J. Li, "Change is good or the disposition effect among mutual fund managers", February 25, 2005 (American Finance Association (AFA), Boston Meetings Paper, 2006). Available at: <http://ssrn.com/abstract=687401> [ Links ].

Thaler, R.V and E. Johnson, "Gambling with the house money and trying to break even: the effects of prior outcomes in risky choice", Management Science, no. 36, 1990, pp. 643–660. [ Links ]

Weber, M. and C.F. Camerer, "The disposition effect in securities trading: an experimental analysis", Journal of Economic Behavior and Organization, no. 33, 1998, pp. 167–184. [ Links ]

The authors thank the Spanish Ministry of Education and Science (ECO2008–03058 and ECO2009–12819), European Regional Development Fund (ERDF) and the Junta de Andalucía (P08–SEJ–03917) for their financial support. The authors also thank the editor and two anonymous referees of Investigación Económica for helpful comments.

**** JEL: Journal of Economic Literature–Econlit.

1 Jegadeesh and Titman (2001) obtain that, far from fading during the nineties, momentum returns actually strengthened.

2 Although they focus particularly on the Daniel et al. (1998) model, the references of these authors do, in fact, fit any of the various delayed over–reaction models.

3 It is important to emphasize that culture can influence asset managers' views and behaviour (see Beckmann et al. 2008). These differences lead to differences in herding, active asset management style or information research effort, which clearly impact on investment behaviour.

4 Cooper et al. (2004) decline to test the Barberis et al. (1998) model, which, while fairly consistent with these findings, is seriously lacking when it comes to establishing a relationship with market state.

5 Weber and Camerer (1998) show a disposition effect in securities trading by means of experimental analysis. They find disposition effects for two different assumptions about reference points, the initial purchase price and the previous stock price. Nevertheless, they consider that more research is needed to determine how reference points adapt over time and how multiple reference points are balanced.

6 Some authors claim that investors are more reluctant to sell after sustaining previous losses. The function may therefore not be invariant with market conditions, (Thaler and Johnson 1990).

7 BM&FBOVESPA S.A. —The stocks, commodities and Futures market was created in 2008 through a merger between the commodities and Futures (BM&F) market and the São Paulo stock market (BOVESPA). This new market is third in the World in terms of market capitalization and second in the American continent.

8 These figures show that the average size of the firms listed on these markets is smaller.

9 For example, the Petrobras firm has two different types of shares admitted for quotation. Furthermore, on the IBOVESPA index (the São Paulo SE index), 7.926% are Petrobras blue chips (PETR4) (second place) 2.052% are ordinary shares (PETR3) (15th place in the shares listed). Far from being an isolated example, this is very frequent.

10 For a more detailed analysis of the Brazilian crisis, see Paula and Alves (2000) and Grabel (2003).

11 In 1991 the Argentine government adopted the currency–board–like Convertibility Plan into an attempt to break Argentina's inflationary psychology once and for all. As can be seen in Kehoe (2003), many commentators argue that, by pegging the Argentine peso to the US dollar, however, this plan resulted in an overvaluation of the peso, making the Convertibility Plan unsustainable; and its inevitable collapse triggering the resulting crisis. The desperate measures taken during 2001 to keep the Convertibility Plan in place, especially the "corralito", which restricted depositors' access to bank accounts, imposed tremendous costs on the economy. Yet these measures did not save the Convertibility Plan. Rather, the costs associated with these measures, particularly those incurred by the domestic financial system, made the crisis far worse when the Convertibility Plan failed. For further information, see Krueger (2002), Damill et al. (2003) and Kaminsky et al. (2003) among others.

12 In their paper, both the formation period, J, and the holding period, K, take values of: 3,6,9 and 12, making a possible total of 16 different momentum strategies

13 The t–statistic is adjusted using the Newey and West (1987) procedure.

14 The formation periods are the six and 12 month periods typically used in the literature.

15 Cooper et al. (2004) also use Capital Asset Pricing Model (CAPM) and Fama–French adjusted returns, but, since there is sufficient evidence to show that these evaluation models are unable to explain the momentum effect and are also difficult to apply to emerging markets, they are not used in the present study (see Estrada and Serra 2005).

16 Despite our comments regarding the results obtained for the Brazil stock market, they should be interpreted with extreme caution, given the limitations of the data described in the database.

17 The J=12 K=12 strategy is significant at 10% for the Chilean market.

18 The 0.32% return to the 52–week high strategy for the three–month holding period is significant at the 10% level according to the Newey–West t–statistic.

19 In order to have a single reference point for comparison, these percentages were obtained using the past 12 months' cumulative index returns as a proxy for market state.

20 Examination of the market as a whole reveals some evidence of the disposition effect in the Chilean stock market (panel C, table 1), while the reference price strategy presents average monthly returns of 0.43% (significant at the 10% level) for the 3–month holding period during down–market states.

21 Muga and Santamaria (2007c) show that stock characteristics affect the proportion of momentum traders, through whose activity the momentum effect is triggered or strengthened and Muga and Santamaria (2009b) underline the role of visibility in the magnitude of the momentum effect in the Mexican Exchange, which is the reason why momentum is only significant when the sample contains less visible stock (those not listed in the selective Indice de Precios y Cotizaciones, IPC). This visibility is associated with speedier diffusion of information, due to more widespread stock tracking by experienced investors.