1. Introduction

Researchers and development agencies1 have flashed warning signs about the potentially devastating effects that the Covid-19 crisis might have on developing countries via international trade channels. Among the reasons for this concern are that many developing countries do not have the same economic resources to support their citizens and rescue their economies as developed countries do. In other cases, economic growth in developing countries might be highly dependent on trade, thus a decline in economic activity in their main trading partners will lead to a sharp decline in their exports (hence aggregate demand).

Such dependence is especially important in countries that have relied on the export-led development strategy to achieve economic growth, as is the case of Mexico. Figure 1 below shows how the value of exports as a share of GDP has been rising since the 1960s. According to Ocampo and Ros (2011) the state-led industrialization strategy was criticized from the 1960s and there was a transitional change towards the export-led growth strategy. On the other hand, Kristjanpoller and Olson (2014) find evidence that the export-led growth strategy was implemented in Mexico since the 1970s. They argue that Latin America was characterized by political and economic transformations from 1970 to 1990 that consolidated the export-led strategy.

Mexico's export expansion is also unique in its high dependence on the US economy. For example, in 2018, 76.4% of all Mexican exports were directed to the US (the major market for Mexican exports). On the other hand, Mexico imports primarily from the US, in 2018, 46.5% of all imports came from this country (WITS, 2019). According to the US Census Bureau (USCB), in 2020, Mexico was the second United States' trading partner, after China, with US$488.8 billion in total trade (imports plus exports). Mexico ranked second, after Canada, for US exports and second after China for US imports (USCB, 2020).

The trade interdependence among countries was also evident in the last financial crisis in 2009, also known as the great trade collapse, because the global output fell by 2.2% while global trade fell by 12.2% (WB, 2010; WTO, 2010; Baldwin, 2009). During the Covid-19 crisis, global trade fell even more, by 13.4% during the first half of the year, which is why is also called the greater trade collapse. It is still fortunate that the actual data fell within the "optimistic" end of the estimate whereas the "pessimistic" end is about 30% (WB, 2020; WTO, 2020). However, there exist large variations across countries and sectors. According to Figure 2, amongst all emerging economies, countries from Latin America experienced the steepest fall in monthly export volume by May 2020, whereas exports from China did not even collapse below its January level. If one looks beyond May 2020, the recovery has been even more uneven.

Source: created by the authors with data from CPB World Trade Monitor.

Figure 2 Monthly export volume (2020m01=1)

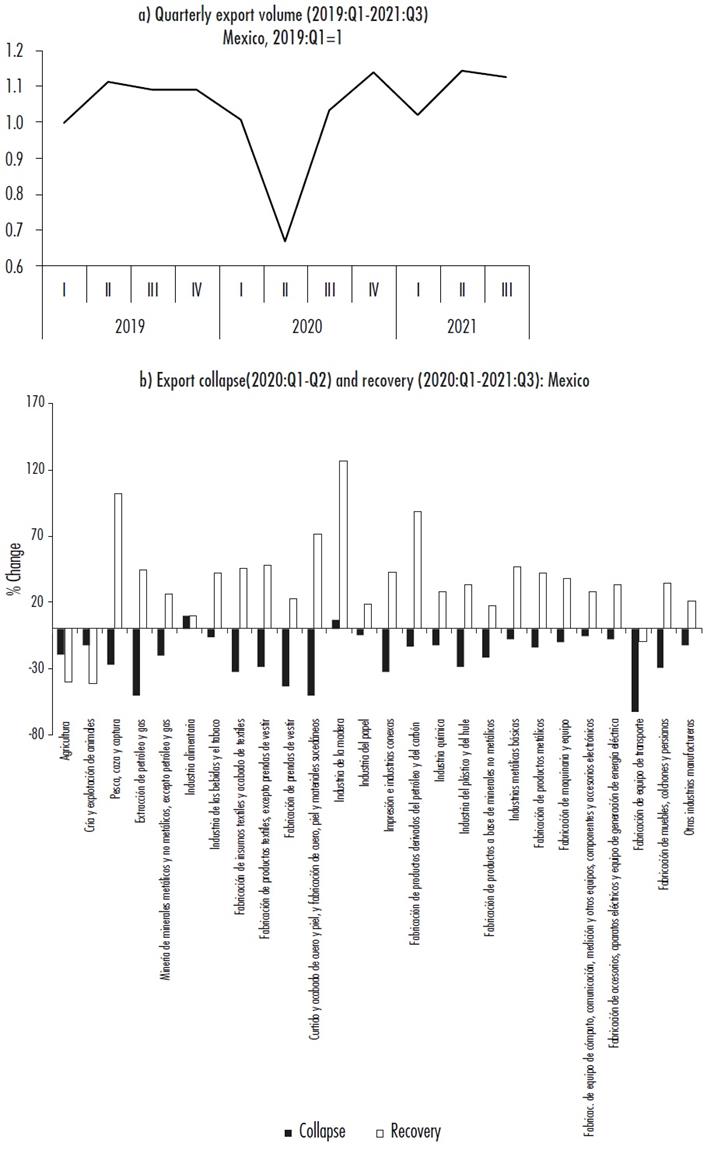

Let us now turn to Mexico more specifically. Figure 3 shows its overall trade performance before and after the Covid-19 crisis. Figure 3a shows the export collapse (32%) between the first and second quarter of 2020 and the subsequent recovery. Figure 3b provides a sectorial breakdown of the trade collapse and recovery. This figure shows: a) that not all sectors recovered equally from the loss and b) that the export collapse and recovery tend to concentrate in a few specific sectors: e.g., oil and gas extraction, fabrication of transport equipment, leather and leather products, wearing apparel, fabrication of textile products. These happen to be sectors that export mostly to the USA (UNTS, 2020). Hence, the percentage changes in Figure 3b corresponds to the fact that there is a high dependence of Mexico's exports on the US economy.

Source: Instituto Nacional de Estadística, Geografía e Informática (INEGI, 2021).

Figure 3 Quarterly change in Mexican exports (aggregate and sectorial)

The export collapse was also reflected in the growth performance of the Mexican economy. In the second quarter of 2020, GDP dropped by 18.5%, the biggest fall (in a quarter) in the history according to data of the INEGI (2021). The same source has reported that in the third quarter of 2020 the Mexican economy grew 12.1% with respect to the previous quarter, mostly pushed by the high growth in the manufacturing exports (which expanded by 31.5%). This recovery is observed in Figure 3a which shows that by the third quarter of 2020 exports were back to pre-Covid levels. Given Mexico's heavy reliance on its trade with the USA, understanding and assessing the employment effects of the collapse and recovery of exports to the USA due to the Covid-19 crisis would be worthwhile for both economists and policymakers.

The INEGI has estimated that at the height of the Covid-19 shock (between April and June of 2020), Mexico lost around 12.5 million jobs (2.1 in the formal sector and 10.4 in the informal sector), the most affected groups being the youth (population between 16 and 30 years old) and women. Furthermore, in the first quarter of 2021, the INEGI reported that one year after the pandemic 2.1 million jobs are still missing, mostly in the service sector, and 7 out of 10 individuals without jobs are women (INEGI, 2020).2

While these findings provide a profound understanding of the bigger context in which the employment effects of the Covid-led trade collapse took place, the present paper assesses the employment effects exclusively due to the collapse and recovery of exports to the USA at a detailed sectoral level. We do so by using Input-Output (I-O) analysis and detailed bilateral trade data. We first estimate the number of jobs lost in Mexico due to export collapse to the US between January and May 2020, which is the period when Covid-19 hit the world trade the hardest and Mexico experienced the biggest export collapse in 34 years. We then estimate the jobs recovered when exports returned to pre-Covid levels. The I-O demand-driven framework is a widely used technique to systematically assess the macroeconomic effects of changes in various demand components. Its transparency in terms of assumptions and causal mechanisms, as well as its ability to obtain detailed sectoral results, has earned this method a high and positive reputation for its policy relevance (Gibson, 2011).

The rest of the paper is organized as follows: section two presents the literature review on the relationship between trade and employment, with a strong emphasis on the application of the I-O technique. Section three presents the method used to estimate the employment effects of Mexico's US export collapse and recovery during the Covid-19 crisis. Section four studies the gender and skill breakdown of the employment effect. Finally, section five concludes the paper with policy implications.

2. Trade and employment: a brief review of the literature

In his survey of methods to study the effect of trade on employment, Gibson (2011) discusses the different channels through which changes in trade would affect sectorial activities and employment. Since total employment is the product of aggregate demand and labor coefficients (inverse of labor productivity), then the rate of change in total employment will be equal to the sum of the rate of changes of the labor coefficients and output. The I-O framework, used in this paper, assumes that a fixed amount of each input is required to produce one unit of output (i.e. a Leontief production function). This means that our estimations, which is based on this framework, will not consider changes in technology, tastes, policy and micro behavior. Labor productivity is assumed to be exogenously given and fixed over time. Hence, the change in employment is solely caused by the change in output as the result of change in both final and intermediate inputs demanded, and export demand is part of the final demand. In other words, the employment effects will result from the change of exports via the so-called multiplier effect.3

The two assumptions mentioned above are not too problematic for the present study since our period of analysis is short (Jan 2020 to May 2020 for the collapse in exports and May 2020 to December 2021 for the recovery). Given the length of the periods, we believe that it is reasonable to expect that Mexico's technology, tastes, policy, micro behavior, and productivity do remain constant.

The employment effects of trade shocks in developing countries have been studied by several authors. For example, Kucera and Jiang (2018) studied how falling exports to the US and the EU affected China's employment during the so-called great trade collapse of 2008-9. A substantial negative effect (in full-time equivalent of between 3.3 and 5.4%) was found in industries where women were overrepresented. The study found that a large share of the effects of trade collapse on employment came from the income-induced effects as opposed to the direct and indirect effects. Kucera et al. (2012) studied the impact of the great trade collapse on employment in India and South Africa. The study found a 1.1% decline in jobs in India and 4.4% in South Africa (in full time equivalent). Sectors in which male workers were overrepresented were harder hit in South Africa, while no gender bias was found for India. For the case of Mexico, Murillo-Villanueva et al. (2018) studied manufacturing exports by technological content and its corresponding changes in employment between 2008 and 2012. The authors found that the manufacturing subsectors of medium and high technological content generated the least number of jobs per unit of export. Although they found that exports had a positive net effect on employment, no gender breakdown was presented in this study. In the next section, we present our methods to study the employment effects of the collapse and recovery of Mexican exports to the USA during the Covid-19 crisis.

3. Trade and employment: an I-O analysis

This section presents the I-O framework used in this study and provides an aggregate and a sectorial picture of the employment effects of trade. Following Kucera and Milberg (2003), Jiang (2013) and Kucera and Jiang (2018), the employment effect due to a trade change is estimated based on equation (1). In this equation A is the technical coefficient matrix, each element a i,j in this matrix is the share of sector j´s total output that is used to purchase sector i's output as its required intermediate input. I is the identity matrix and (I - A) -1 is the Leontief inverse matrix, which contains the multipliers of final demand to total output. Each element l i,յ of the Leontief inverse matrix shows the input requirement by sector i if there were a unit increase in final demand in sector j. In other words, it indicates how an increase in final demand stimulates the production of outputs across all sectors through backward linkages (the production of additional units of output required to satisfy one unit of final demand in each sector of the economy).

Ê is the diagonal labor coefficient matrix, which shows the employment required per unit of output produced for each sector. ∆L is the employment (as full-time equivalent) change as the result of a change in trade ∆T. For the case of the export collapse, ∆T is the annualized change of exports from Mexico to the USA from January to May 2020, which is the period when Mexico's exports to the USA fell the steepest, and from May 2020 to December 2021 for the period of recovery. Therefore, in equation (1) below, (I - A) -1 ∆T is a vector of annualized by-sector output changes due to the trade collapse or recovery during the two aforementioned periods, and pre-multiplying by the Ê matrix would result the annualized change in employment in each sector due to the change of exports from Mexico to USA.

The data used in this paper comes from several sources; the I-O table (base year 2014) comes from the Global Trade Analysis Project (GTAP) data version 10. The I-O table is compiled at producer prices of the corresponding year and valued in millions of 2014 US dollars. The I-O table contains the transaction (flows) table from which the matrix A (the technical coefficients matrix) is obtained. The I-O table has 65 activities, 25 of these activities comprise the primary sector, 20 the manufacturing sector AND 20 the service sector.4 Data on the employment by skill and occupation is compiled by ImpactEcon and it is consistent with the GTAP sectors (Walmsley and Carrico, 2013), and by sector gender employment shares are obtained from the International Labor Organization (ILO) ILOSTAT database. Bilateral trade data between Mexico and the USA comes from the USITC Dataweb.

To construct the vector of changes in exports, we first use the monthly import data at SITC 5-digit level of the USITC for January and May 2020 for the period of collapse and May 2020 to December 2021 for the period of recovery. Notice that the bilateral imports from Mexico from the US perspective is exactly the exports from Mexico to the USA from Mexico's perspective, this is called the "mirror data". To match the trade data to GTAP sectors, we first rearranged the SITC trade data in Harmonized System (revision 3) according to the concordance table published by the EUROSTAT (2020), then the trade data in HS3 is matched with the GTAP sectors according to another concordance table published by the World Bank (WITS, 2020). Once the trade vectors are constructed based on GTAP sectors, the difference between May and January 2020 were calculated and then annualized to capture of change of Mexico's exports to the US between these periods. Finally, the vector of changes of export value is deflated to 2014 level so it is consistent with the valuation of labor coefficients.

The left-hand-side of Table 1 shows that 4.2 million jobs were lost in Mexico because of the export collapse to the USA between January and May of 2020. These 4.2 million jobs represent 33.6% of all the jobs lost in Mexico at the height of the Covid-19 pandemic (12.5 million jobs). It also reveals that 65% of the net job losses occurred in the manufacturing sector followed by the service sector with 47%. Interestingly, the Agriculture, food and minerals sector gained five hundred thousand jobs (-12% of the total net job losses due to the trade collapse) which might seem counter intuitive. However, this can be explained by: a) the fact that the agricultural sector was considered by both the Mexican and USA governments as "essential" and never stopped working during the pandemic and b) the fact that the demand for food and other agricultural products in the US have behaved relatively stable during the pandemic.5 Turning to the recovery period (May 2020 to December 2021) as shown on the right-hand side of Table 1, the total job creation surpasses the collapse period by 589 365 jobs. However, the manufacturing and service sectors have not regained all the jobs lost during the export collapse, in fact 443 448 jobs are still missing after a 19 months of recovery period.

Table 1 Aggregated employment effects of the export collapse and recovery

| Sector | Collapse | Recovery | Difference | ||

| Jobs | % | Jobs | % | ||

| Agriculture, food and minerals | 500 000 | -12 | 600 332 | 12 | 100 332 |

| Manufacturing | -2 767 606 | 65 | 2 324 121 | 48 | -443 485 |

| Services | -1 978 945 | 47 | 1 911 464 | 40 | -67 481 |

| Net job lost and recovered | -4 246 552 | 100 | 4 835 917 | 100 | 589 365 |

Source: created by the authors using data from GTAP version 10 and ILO stat.

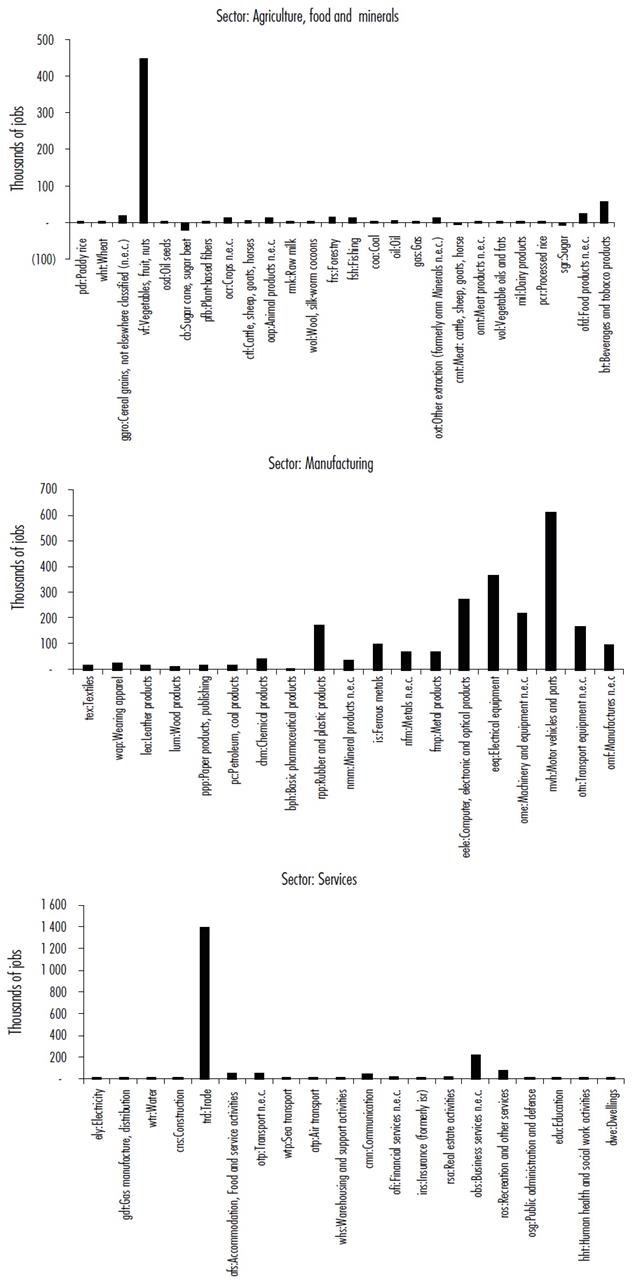

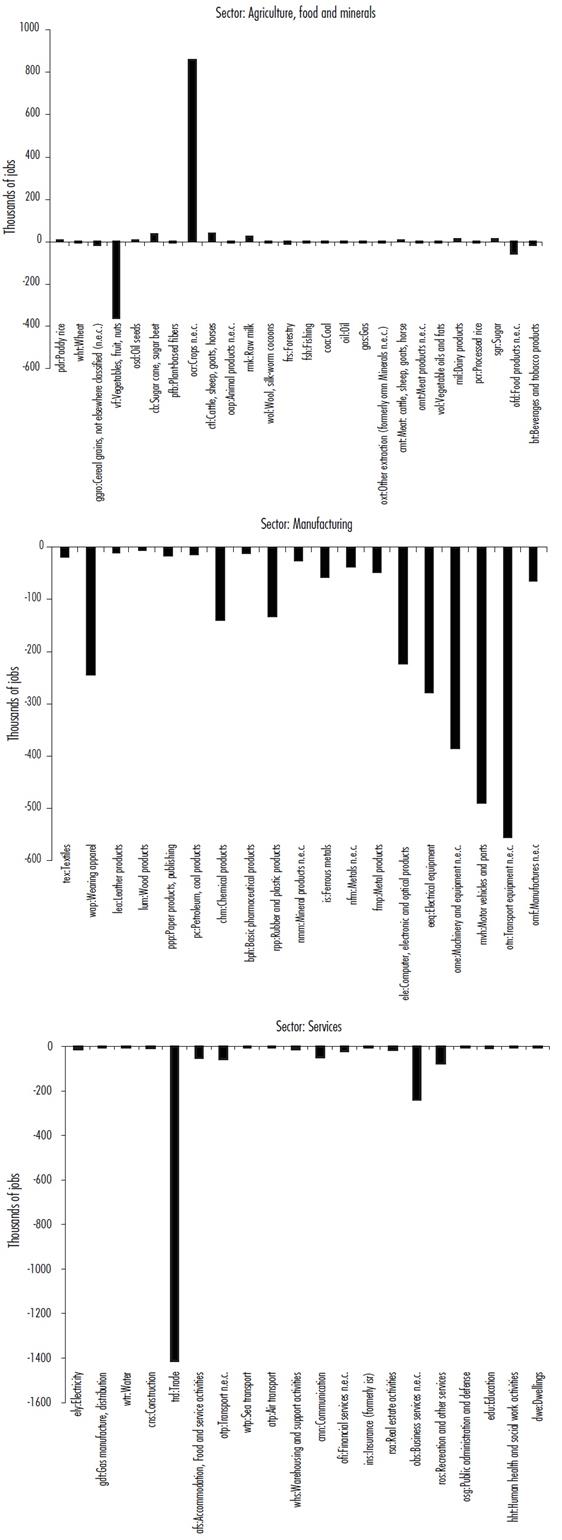

Since the I-O technique allows detailed sectoral analysis, Figure 4 shows the disaggregation of the three sectors in Table 1, and the immediate observation is that the employment effects of the export collapse are concentrated in few activities. For the category of Agricultural, food and minerals sectors, the two activities that standout are Vegetables, fruit and nuts, and Crops n.e.c. The former experienced some job losses whereas the later a considerable amount of job gain. As mentioned earlier, overall, we observe slight employment gains for this category. For the service activities, most jobs losses were concentrated in the retail trade activity. Finally, for the Manufacturing industries, most of the job losses took place in (from high to low): Transport equipment n.e.c., Motor vehicles and parts, Machinery and equipment n.e.c., Electrical equipment, Wearing apparel, Computer electronic and optical products, Chemical products, Rubber and plastic products. The result is concerning because the activities with highest employment loss happen to be activities with medium to high productivity,6 those are sectors that are important for the development and structural transformation of the economy.

Source: created by the authors using data from GTAP version 10 and ILO stat.

Figure 4 Disaggregated employment effects of the export collapse on the Mexican economy

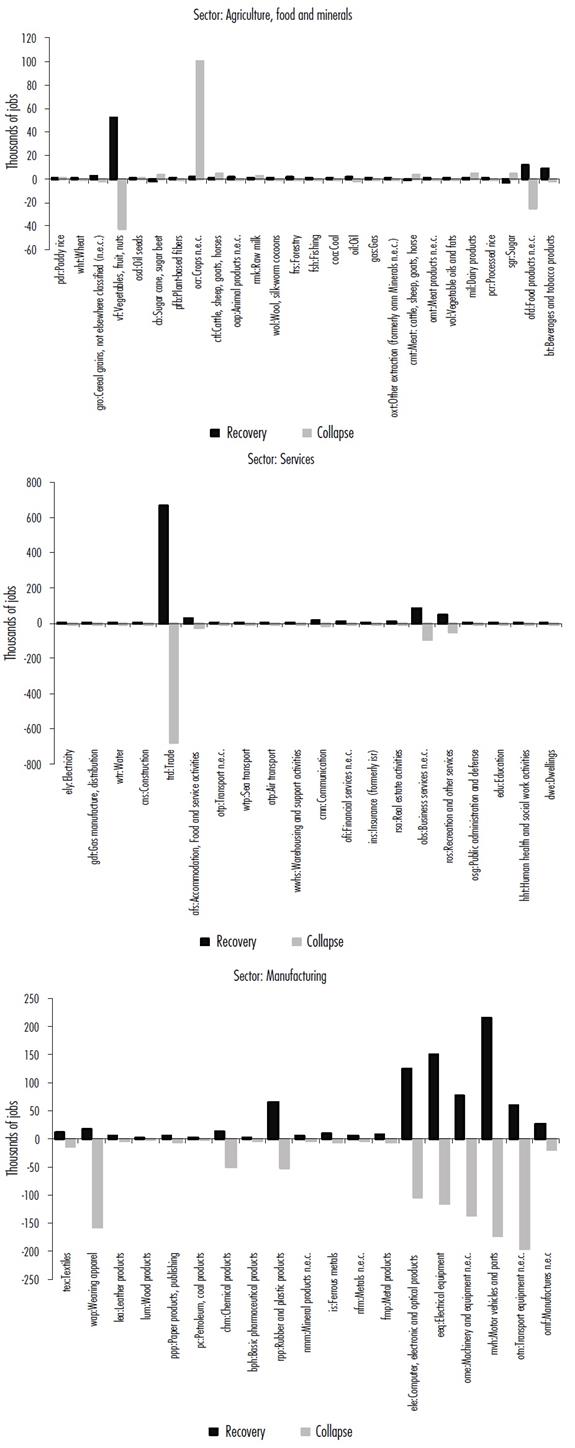

If we compare the results in Figure 4 with what happened during the recovery phase (see Figure A1 in Appendix), we observe that activities such as vegetables, fruit in the agricultural sector and retail trade in the service sector recovered almost all jobs lost during the collapse. However, this was not the case in the manufacturing sector. For example, the transport equipment activity recovered less jobs than what it lost. Perhaps the most dramatic case is the wearing apparel activity which lost 243 552 jobs and recovered only 25 704 jobs. These observations confirm the uneven recovery found at the aggregated level in Table 1.

If we consider that by January 2020 the number of individuals employed in the manufacturing sector represented 25% of total employment, while the agricultural and service sectors employed 12 and 63%, respectively (INEGI, 2020), it can be suggested that although the service is the largest sector (in terms of employed individuals) the collapse of Mexico's export to the US due to the Covid-19 shock mainly affected the country's manufacturing sector's employment.

What explains that most jobs losses and gains took place in the manufacturing sector? Certainly, the composition of the Mexican export basket, highly concentrated in manufacturers, is an important contributor. A closer look at the collapse and recovery would reveal that a bias against the manufacturing sector is indeed a characteristic of the crisis. This is so because when the manufacturing employment share in job loss (65%) is compared with the baseline national share of employment in the manufacturing sector (25% in 2020), we find that a higher percentage (40%) of manufacturing workers lost their jobs than their share in national employment. On the other hand, during the export recovery, most jobs created were in the manufacturing sector (48%). When this manufacturing employment share in job creation is compared with the baseline national share of employment in the manufacturing sector (25%), we also find that a higher percentage of manufacturing workers gained jobs than the baseline share in 2020. Thus, even by considering the recovery, the Covid led export collapse still results a 23% bias against the manufacturing jobs. In other words, looking at both periods (the collapse and the recovery) together, the manufacturing sector is especially negatively affected; hence we can say that the Covid-led export collapse is particularly hostile towards manufacturing employment. But looking at the period of collapse alone, the amount of manufacturing employment loss was sudden and severe.

To develop further insights from our findings, it is useful to follow Esquivel (2020) in his description of how Covid-19 hit the Mexican economy in three waves. The first running from January to March, affecting tourism mostly due to the collapse of travels and the negative news coming from the rest of the world about the spread of the virus. The second wave was characterized by the lockdown and strict social distancing measures, these measures affected mostly the manufacturing and service sectors (this took place between April and May, in some sectors, it was extended until June). The third phase covers July to December, characterized by gradual re-opening of the economy. Hence, what our results (for the export collapse) captured is exactly an important aspect of the second wave where the manufacturing and services sectors were the most affected by the collapse of exports to the US. In the next section we turn our attention to the employment effects of the trade collapse and recovery by skills and gender.

4. skills and gender breakdown of the employment effects

The I-O framework used in the previous section can be expanded to study the skill composition of employment. To do this we use data on employment by occupation compiled by ImpactEcon, which is consistent with GTAP sectors (Walmsley and Carrico, 2013). The database contains five labor occupations: technicians, clerks, service/shop workers, officials and managers and agricultural. Technicians and officials and mangers are classified as skilled workers while clerks, service/shop workers, and agricultural are classified as unskilled.

With this information we construct an occupation by industry matrix P with five occupational categories and 65 sectors. Each element P

i,j

in this matrix is the proportion of sector z's employment that belongs to the the jth occupation category. Assuming that the proportion of the occupation breakdown in this matrix does not change over time, we obtain the employment change across sectors and occupations by multiplying P *

Table 2 summarizes our results and shows that 16% of the total job losses were of skilled occupations and 84% of unskilled ones. Unskilled workers are the ones losing more jobs across the three aggregated sectors. However, when the total job losses by skills are compared with the baseline national share of employment by skills in 2019 this result reveals a 3% bias against unskilled workers. According to the INEGI (2020), 19% of national employment in 2019 was held by skilled workers and 81% by unskilled workers. Since 84% of unskilled workers is slightly higher that the national share in 2019 before the crisis, the difference (81 compared with 84%) indicates that there is a 3% bias against unskilled workers. This bias against unskilled workers was 6% during the recovery. Hence, relative to the collapse, the recovery is slightly more unskilled. This result is also consistent with studies on Mexico suggest ing that the Covid-19 crisis is inflicting the most pain on those who are already most vulnerable, such as the youth, low-skilled workers, and women (ILO, 2020, Hoehn-Velasco et al., 2021, and Monroy-Gómez-Franco, 2021a).

Table 2 Aggregated employment by skills

| Sector | Jobs | Skilled | Unskilled | % Skilled | % Unskilled |

| Collapse | |||||

| Agriculture, food and minerals | 500 000 | 166 | 499 833 | 0 | 100 |

| Manufacturing | -2 767 606 | -301 200 | -2 466 406 | 11 | 89 |

| Services | -1 978 945 | -369 827 | -1 609 118 | 19 | 81 |

| Net job lost and recovered | -4 246 552 | -670 861 | -3 575 691 | 16 | 84 |

| Recovery | |||||

| Agriculture, food and minerals | 600 332 | 1 8 373 | 581 959 | 3 | 97 |

| Manufacturing | 2 324 121 | 253 113 | 2 071 008 | 11 | 89 |

| Services | 1 911 464 | 346 969 | 1 564 495 | 18 | 82 |

| Net job lost and recovered | 4 835 917 | 618 455 | 4 217 462 | 13 | 87 |

Source: created by the authors using data from ImpactEcon.

In the final section, we discuss the policy implications of our findings.

We further extend the analysis to assess the gender aspect of the employment effect of trade collapse in Mexico. Sectoral gender data is obtained from the ILOSTAT for 2019. Using the isic-Rev.4 classification, we constructed a concordance table to map the isic-Rev.4 ILO data to the GTAP database used in section III. Once the GTAP-sector gender composition data were compiled, we obtain the number of female (or male) workers affected by the employment change by multiplying ∆L * Ĝ . Where Ĝ diagonal matrix of sectoral female (or male) to total employment ratios and ΔL is the change in employment due to the trade collapse obtained in section III. To obtain the gender ratio in the employment loss, we do the following calculation: (ΔL * Ĝ * i)/(∆L * i), where i is the summation vector (a column vector of ones). Then we compare this value with the baseline total gender ratio from the ILOSTAT database. This comparison reveals whether the employment effects of the trade collapse are biased toward women or men. Similar to the skill analysis above, a key assumption behind this calculation is that the gender composition at a sectoral level is fixed over time, which is again a reasonable assumption in the face of sudden and rapid shock like the Covid-19 crisis.

Table 3 shows that out of the 4.2 million jobs lost due to the trade collapse, 45% were held by female workers and 55% by male workers. In all the three aggregated sectors male workers are the ones that lost most jobs compared with female workers. However, when the share of female in employment lost due to the trade collapse is compared against the baseline female employment share at national level in 2019 this result reveals a 5% bias against female workers. This is so because according to the INEGI (2020), 40% of the national employment in 2019 was held by women and 60% by men. Since a higher percentage of female workers have lost their jobs due to the Covid-19 export collapse (40% compared with 45% of all jobs lost due to trade collapse), this indicates that there is a 5% bias against them. However, during the recovery most of the jobs created (63%) are male (a 3% bias in favor of male workers, since 60% of national employment in 2019 was male employment). Hence, our study provides clear evidence that the export collapse negatively affected female employment. Moreover, the recovery is shown to be biased in favor of male employment and against female employment.

Table 3 Aggregated employment effects of the export collapse and recovery by gender

| Sector | Jobs | % | Female | % | Male | % |

| Collapse | ||||||

| Agriculture, food and minerals | 500 000 | -12 | 47 305 | 9 | 452 695 | 91 |

| Manufacturing | -2 767 606 | 65 | -1 047 400 | 38 | -1 720 206 | 62 |

| Services | -1 978 945 | 47 | -907 733 | 46 | -1 071 212 | 54 |

| Net job lost and recovered | -4 246 552 | 100 | -1 907 828 | 45 | -2 338 724 | 55 |

| Recovery | ||||||

| Agriculture, food and minerals | 600 332 | 12 | 80 078 | 13 | 520 254 | 87 |

| Manufacturing | 2 324 121 | 48 | 809 560 | 35 | 1 514 561 | 65 |

| Services | 1 911 464 | 40 | 878 334 | 46 | 1 033130 | 54 |

| Net job lost and recovered | 4 835 917 | 100 | 1 767 972 | 37 | 3 067 945 | 63 |

Source: created by the authors construction using data from GTAP version 10 and ILO stat.

Our findings corroborate several recent studies showing that Covid-19 has disproportionately affected women in Mexico. For example, ECLAC (2021a) and Hoehn-Velasco et al. (2021) document how once schools closed (due to the pandemic) women have been sharing the burden of childcare at home more than men. This has reduced the time available for women to join or developing professional skills to re-enter the labor market. The study also shows that an increase in household chores also increased the risk that women quit their paid jobs. As a result, two out of three jobs lost due to the Covid-19 pandemic in Mexico were held by women. The gender bias revealed by our analysis is not as severe because our analysis focuses exclusively on the effects of Mexico to US export collapse, thus the gender result is, to a large extent, driven by the composition of commodities lost due to the export collapse as well as the gender intensity embodied in each commodity. There are many channels through which the Covid-19 crisis can affect employment; export is only one of them. However, from our study it is evident that the female jobs lost during the collapse of exports to the US were barely recovered, thus contributing to increase the existing gender bias against female workers as found in other studies e.g.ILO (2020), ECLAC (2021a) and Hoehn-Velasco et al. (2021).

A disaggregated view of our results (summarized in Table 4) reveals the few manufacturing and service activities where most female employment loss and recovery took place. These manufacturing and service activities were also identified by the ILO (2020) as sectors of high risk of losing female jobs during the Covid-19 pandemic due to the high concentration of female workers and the export dependence of these activities. Considering that most manufacturing jobs cannot be performed remotely from the workplace, as suggested by Monroy-Gómez-Franco (2021b) and Leyva and Mora (2021).7 Thus, female workers faced not only the challenge of not being able to work remotely during the pandemic but also that the export dependence of these activities has made them more vulnerable in the face of Covid-19 crisis.

Table 4 Main activities affected by the trade collapse and recovery (female employment)

| Agriculture | Manufacturing | Services |

| Vegetables, fruit and nuts | Transport equipment n.e.c., | |

| Motor vehicles and parts, | Retail trade | |

| Crops n.e.c. | Machinery and equipment n.e.c., | |

| Electrical equipment, | ||

| Wearing apparel, | ||

| Computer, electronic and optical products, | ||

| Chemical products, | ||

| Rubber and plastic products. |

Source: created by the authors based on results from Figure A2 in Appendix.

5. Concluding remarks and policy implications

The heavy reliance of Mexican exports on the performance of the US economy had potential devastating employment effects in the context of the Covid-19 crisis. Our results show that out of the 12.5 million jobs that the Mexican economy lost at the peak of the Covid-19 shock, 4.2 million (or 33.6%) where lost exclusively due to the collapse of Mexican exports to the USA between January and May 2020. This result indicates that trade interdependence is an important channel through which the negative effects of crises can spread.

Our analysis of the collapse and recovery phase also provides evidence of an uneven recovery at a sectorial level. We found that activities such as vegetables, fruit in the agricultural sector and retail trade in the service sector recovered almost all jobs lost during the collapse. However, this was not the case in the manufacturing sector where 443 448 jobs were still missing by December 2021. The bias against manufacturing employment is even more evident when the share of manufacturing employment lost during the trade collapse period and gained during the recovery period is compared against the manufacturing employment share at baseline level. During the collapse, the employment loss contains higher share for manufacturing employment relative to the baseline level, whereas during the recovery, employment gain contains lower share of manufacturing employment relative to the baseline level.

Furthermore, using disaggregated data of employment by skill, this paper found that 84% of the jobs lost due to the export collapse were unskilled workers and 16% were skilled workers. This represents a 3% bias against unskilled workers, when compared with the nation's share of unskilled workers in 2019. At the same time, our employment data disaggregated by gender reveals that there is a 5% bias against female workers since their job loss is more than their share of national employment in 2019. These findings imply that the employment costs of the trade collapse can potentially worsen previously existing gaps in the Mexican labor market, as identified by the ILO (2020), Hoehn-Velasco et al. (2021) and Monroy-Gómez-Franco (2021a).

Moreover, we found that the jobs lost in the Mexican economy due to the export collapse tend to concentrate in specific activities of the manufacturing and service sectors. Several of these activities are identified by the ILO (2020) as sectors of high risk of losing female jobs during the Covid-19 pandemic due to the high concentration of female workers and the export dependence of these activities. Hence, our findings also provide supporting evidence that trade interdependence can exacerbate gender and skill gaps in the labor market and overall inequality by inflicting the most pain on those who are already most vulnerable (i.e., low skilled and female workers). This claim becomes clear when our findings for the recovery period are incorporated. That is, during the collapse the jobs losses were biased against female labor (5% bias since 40% of the national employment in 2019 was female employment), but during the recovery most of the jobs created (63%) are male (a 3% bias in favor of male workers, since 60% of national employment in 2019 was male employment). Hence the trade collapse had more bias against female employment and the recovery had bias favoring male employment.

Thus, the results of this study can help policy makers to develop targeted interventions towards hard-hit sectors and vulnerable segments of the population to promote a more inclusive recovery. For example, policies that promote upgrading the skills of workers and increase the labor force participation of woman in the manufacturing activities identified in this study can be effective ways of mitigating the negative effects of current and future trade shocks on Mexican employment.8 It is worth noticing that our proposed policies coincide with studies that encourage the use of skill development and gender inclusion to promote long term economic growth in Mexico (OECD, 2017 and Monroy-Gómez-Franco, 2021a).

To the best of our knowledge, the policy responses from the Mexican government have focused only on limited aspects of job protection with no especial attention to trade related policies. For example, the government promoted measures to protect workers' health at workplace and the promotion of remote working. In the case of people who lost their jobs to the Covid-19 crisis the government offered legal advice and economic support. Around 672 thousand loans were given to informal workers and 300 thousand loans to formal workers. The government's response also included loans and microcredits for employers in both the formal and informal sector (e.g. 3 million credits of MX$25 thousand (around US$1 250) each were given to formal and informal employers).9

Despite of the various policy responses to the pandemic, they may still be insufficient considering that Mexico is among the Latin American countries that spend the least government funds to deal with the pandemic, 0.7% of GDP vs. the 8% of GDP, for Latin America as a region according to ECLAC (2021b). The insufficiency also partly comes from the fact that the Covid-19 relief funds were not clearly targeted to vulnerable population and none of the policy interventions were trade related.

From a long-term development perspective, the results of this study raise the question of whether the export-led Mexican development strategy can become less vulnerable. We believe that the heavy reliance of Mexican exports on the performance of the US economy suggests that export diversification strategies might be in the interest of the country to better manage external trade shocks. However, the collapse of global demand for manufacturing goods and the disruption of global value chains might be an opportunity for the Mexican economy to rethink its current development strategy and rebalance its economy by depending less on the external sector and strengthening the internal demand. This strategy would require active government policies to raise the incomes of the domestic consumers for example by rising minimum wages and education levels and eliminating poverty.

Given the uncertainty that the Covid-19 crisis has brought to the world economy, it is worth asking how can Mexico prepare for the next trade shock. Our findings suggest that a good starting point is the design of a trade policy that has the goal of diversifying exports while protecting unskilled and female workers from losing their jobs. In this regard, policies that focus on increasing the domestic value added of exports by upgrading the skills of Mexican workers can be part of such trade policy. The increase of current public investment in health care to protect the most vulnerable as well as strengthening social safety nets; expanding access to quality education, clean water, and sanitation; and investing in climate-smart infrastructure can also help minimize the risks and impacts of future trade shocks. In other words, a more resilient post-pandemic economy will depend on how the Mexican society supports its more vulnerable members.

nueva página del texto (beta)

nueva página del texto (beta)