1. Introduction

Nicaragua is the second poorest country in Latin America and the Caribbean, with a GDP per capita of $1,221.69 US dollars in 2011. On average, the economy grew 2.6% between 1960 and 2011, well below the average growth rate of Low & Middle income countries and developed countries; evidence suggests that the country is falling behind other countries, widening income differentials.

In spite of this economic expansion, its progress has been barely visible to its people; GDP per capita increased from $1,186.48 US dollars in 1960 to $1,221.49 US dollars in 2011, which is equivalent to a 3% increase in 51 years (0.06% annual growth rate). Socially, poverty is high; in 2009 42.5% of the population was poor and 14.2% of the inhabitants were living below extreme poverty. Notwithstanding this growth, the impact on poverty has been very low, considering that from 1993 to 2009 both, poverty and extreme poverty, declined slightly 7.8% and 5.2% respectively.

Our investigation attempts to identify and better understand the constraining elements of the Nicaraguan economic growth, and in order to do so we utilize the Growth Diagnostic Framework (GDF).

The analytical tool also tries to identify the elements that limit the country's sustained growth; it suggests policy reforms to eliminate them accelerating its future economic progress.

Some empirical literature of authors such as Center for Global Development, (2009), Ianchovichina & Gooptu, (2007) and Agosin, Fernando-Arias, & Jaramillo, (2009) talks about the present distortion in economies that generate the low growth rate. Recent studies such as World Bank, (2004) and Agosin, Bolaños, & Delgado, Nicaragua: Remembrance of Growth Past, (2009) used this instrument in order to search constraints to growth in Nicaragua.

This paper is structured as follows. Section 2 reviews the Nicaraguan economic context, describing a brief evolution of the economic growth and other key macroeconomic variables. Section 3 provides the analytical understanding of the growth diagnostic framework and highlights how it can help boost growth.

Section 4 unveils potential elements that impede economic growth in the Nicaraguan economy during the period 1990 to 2011. In section 5, in the light of the empirical expositions, we present our conclusions.

Finally in section 6, we develop specific policy measures to hasten growth and eliminate key structural constraints to economic progress.

2.1. Growth

Economic growth is fundamental for the prosperity of a nation; therefore, we try to understand past sustained growth. We can distinguish three distinct phases in the Nicaraguan economic development over the last four decades. We briefly discuss these three phases below while emphasizing that our main interest is the development since the mid-1990s. Figure 1 gives the big picture of the Nicaraguan growth performance.

Source: World Bank, (2013).

Figure 1 Nicaragua: GDP (Constant 2000 US$) and GDP per Capita 1960 to 2011 - World Bank Classification Atlas Method

2.1.1. Phase 1 1960 to 1977 High Growth

The GDP per capita shows a significant development from $1,186.5 US dollars in 1960 to $1,993.4 US dollars in 1977, which is a rise of 68% in eighteen years. During this period the economy grew at an average of 6.34% annual growth rate and the average GDP per capita growth rate was 3.17%. The earthquake in 1972 that destroyed the capital city and the increase in political instability to overthrow the Somoza dictatorship affected growth during this period. A period characterized by the development of the industry sector and diversifications of export base.

The success of these policies was part of the government's stimulus to apply the import substitutions policies. Over this phase, Nicaragua invested heavily in public infrastructure and social services.

2.1.2. Phase 2 1978 to 1993 Growth Decline

This phase includes in fact three periods: 1978-1979, 1980-1989 and 1990-1993. In general, after 16 years the GDP per capita fell 54%, from $1,782.9 US dollars in 1978 to $824.4 US dollars in 1993. The bad growth performance in the period 1978-1993 is visible by the average GDP contraction of -2.6% per year and the GDP per capita fell 5.04% per year. A period characterized by a situation of economic imbalances that had long term consequences for the economy.

In the first part, the end of the 70s, two factors played an important role in the Nicaraguan growth performance. First, the Somoza dictator was overthrown in 1979 by the Sandinista revolution, which allowed putting an end to a forty-year-old control of the government by the Somoza family. Second, the national income fell due to an international commodity crisis and high petroleum prices increased the windfall revenues of exports. The economic contraction was of 17.2 % of GDP and the GDP per capita fell 17.6%.

However, during the second part, we observe five events that marked the 1980s: i) the civil war lasting from 1983 to 1989; ii) the US economic sanctions; iii) the commodity price crash; iv) a state dominated the economy andv) hyperinflation. Nicaragua was subsequently crippled and lost many resources that led to macroeconomic imbalances. These factors led to the collapse in investment, revenues, large current account deficits, high inflation rate and fiscal deficits; they also revealed the unsustainability of its external indebtedness. We observe an average GDP contraction of 0.77% and an average GDP per capita reduction of - 3.2% per year.

The third part, the downward trend of growth and the macroeconomic imbalances, forced the government to implement a series of structural reforms. Nicaragua opened the economy to the private sector in the 1990s and the external imbalances partially persisted during the following three years. Thus, this lead to a continued economic contraction; the GDP fell an average of 0.07% GDP and the GDP per capita decreased an average of -2.4%.

2.1.3. Phase 3 1994 to 2011 Low Growth

The GDP per capita growth, which had shown poor performance during previous years, suddenly changed pattern during this period. In the 17 years since 1994. The GDP has grown by 42%, from $862 USdollars in 1994 to $1,221.5 USdollars in 2011. A period characterized by economic volatility and low growth even though the positive impact of democratization, macroeconomic stability and trade liberalization. Since the 1990s the economy moved towards greater integration with the global economy. During this period there was a rapid growth in tourism revenues, external resources from foreign direct investment and workers' remittances from abroad.

The economy has grown steadily from 1994 to 2011 (except in 2009 due to the international crisis); the average annual growth rate of the GDP has been 3.8% and the annual growth rate of the GDP per capita has been 2.2%. Even though economy grew and the GDP per capita increased, it is still beneath the 1977 peak of $1,993 USdollars.

3. What is The Growth Diagnostic Framework?

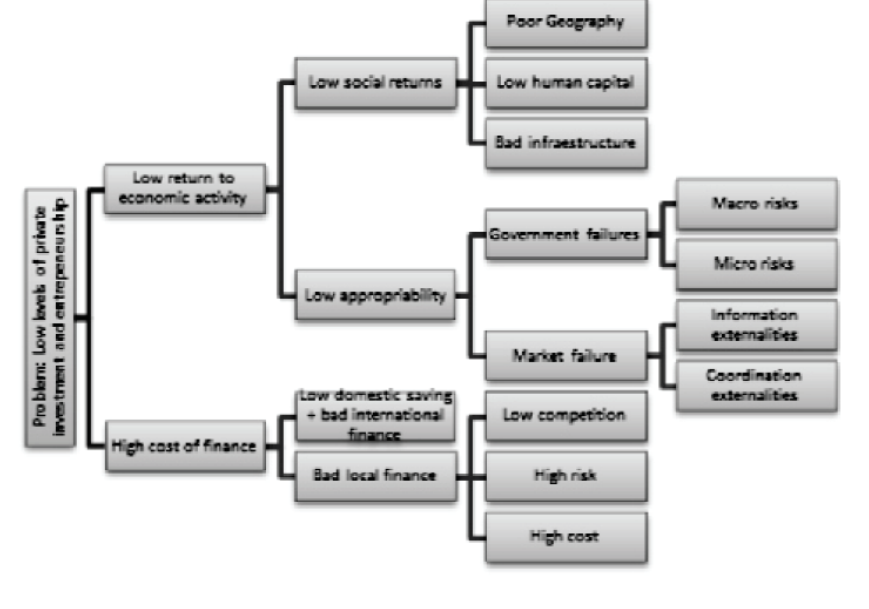

The Methodology elaborated by Haumasn, Rodik and Velazcos “Growth Diagnostic” is a method that helps target reform on the most binding constraints that impede growth. The methodology suggests that the low level of growth is due to the level of private investment and entrepreneurship; this framework aims to identify if the constraints are related to the return on the investment or to financial supply itself that impedes from achieving higher investment and growth rates Rodrik, (2011).

We use the growth diagnostic tool developed by Haussman, Rodrik, & Velasco, (2005) that identifies it as a product of the level of private investment and entrepreneurship in the country concerned, and these in turn are determined by the performance of the economic activity and high finance cost. The analysis tries to explain the observed growth rate of the economy distinguishing the distinctive set of symptoms that stop an economy from growing.

We proceed to use the methodology developed by Hausmann, Kliger, & Wagner, (2008) on how to perform a growth diagnosis for a country, which is summarized in a decision tree. This tool takes into account the specific national context of the country concerned to take action on this issue. We expose the elements that affect each of these factors that apply to the case of Nicaragua. The logical structure of the analysis can be represented in the form of a decision tree, as shown in Figure 2.

Source: Haussman, Rodrik, & Velasco, (2005, p. 27).

Figure 2 Growth Diagnostic Framework Decision Tree Analysis

4. An Application of the Growth Diagnostic Framework Applied to Nicaragua

For the inquiry, this framework uses a simple model that decomposes growth in the following way:

4.1.1. Low social returns

Health is part of a human being and it is also a factor to improve citizens' incomes. Among the theoretical and empirical papers that validate the health pillar of development, we use Bloom & Cannig, (2008), López-Casasnovas, Rivera, & Currais, (2005).

4.1.1.1. Poor Geography

Nicaragua's geographical position is not a constraint due to its strategic advantages. It is the largest country situated in Central America and has the largest freshwater body in the region, bordering both, the Pacific Ocean and the Caribbean Sea between Honduras and Costa Rica. The country has a land area of 120,340km2 and more than 10,000 of fresh water. In the northern region, Nicaraguais neighbor with Honduras and in the southern region it has boundaries with Costa Rica; it also has access to the Pacific Ocean in the western region and the Caribbean ocean in the eastern region. It is a resource-abundant country; it accounts that it possess around 5% of the world's biodiversity, and around 36.5% of the diversity of central American region4 MARENA, The Nature Conservancy, (2010, p. 10).

4.1.1.2. Low Human Capital

Nicaragua has a low quality of human resources; this is due to the low enrollment rates and the quality of education. The youth literacy rate is 87% (85% male and 89% female) and the average term of the population's school years is 6.25%.

Public investment in education has grown in Nicaragua; the problem is that this growth from a lower point that leaves the country behind other developing countries in the environment. Nicaragua has allocated an approximate average of 5.4% of GDP to education over the past eight years, a flow of resources insufficient to meet educational standards that change the equity of access and jumps in competition with more skilled human resources. The education budget is intended primarily to current expenditures, 92.7%, while 7.3% is classified as capital expenditure, which is mainly composed by the infrastructure costs and basic equipment.

Increase in number of children to primary education and dropout mitigated, in 2010, 92.5% of children entered elementary school and 56% of those who entered primary end achievement. The Secondary school enrollment rate is 49% for girls and 43% for boys. Data shows that more than 50% of adolescents are not enrolled in secondary school.

Identifying the workforce: i) 1.7 million people have primary education; ii) 1.5 million have secondary education and iii) 500,000 have college education. The education budget is intended primarily to current expenditures, 92.7%; while 7.3% is classified as capital expenditure, which is mainly composed of the infrastructure costs and basic equipment.

According to World Bank surveys conducted for companies, 24% considered that one of the limitations to the growth is a poorly qualified workforce. Investment in education should influence human capital for competitiveness of Nicaraguan products.

4.1.1.3. Bad Infrastructure

Infrastructure enables economic activity and reduces production costs, allowing higher levels of competitiveness. This also enables achieving higher economic growth by facilitating trade and provides inputs for production. The work of Calderon & Serven, Estache & Fray, (2007) and Gómez-Ibáñez, (2007) confirms the benefits of infrastructure investment and economic growth.

For example, the roads make trade more efficient and reduce their costs and electricity networks; water and internet provide vital services for productive activity and enhance the attraction of businesses and citizens. Poor access to gain access to basic services

Nicaragua's poor infrastructure is an important constraint to higher growth in Nicaragua. There is little and poor infrastructure quality; ports, airports, telecommunications and roads have a negative impact on competitiveness and value creation. Nicaragua does not have a railway system. This problem is more acute in rural areas that lack transportation, water, a sewerage system and market infrastructures. Nationwide it takes 70 days to obtain access to electricity services; taking into account we expect that smaller enterprises and business in rural areas to face more difficulties.

To view the statistics for 2009, 72% of the population has access to electricity, 11.62% of total roads were paved nationwide, 85% of the population has access to potable water and 52% have sewer service. This data reflects a bleak outlook deteriorating further if we consider that in 20 years progress was made in 1.12% as a percentage of paved roads, 11% increase in water coverage and 9% in sewer service improvements.

Another important element to consider is the quality of the services provided, which also affects costs, production time and company earnings. The Enterprise Survey of 2010 reveals that Nicaragua has an elevated number of outages in a typical month are of water (16.1) and electricity (6.8), well above Latin American average these services The World Bank, (2010, p. 14) . According to international infrastructure comparisons, the nation is among the worst; in quality of overall infrastructure, Nicaragua ranked 106 out of 144 countries evaluated World Economic Forum, (2013, p. 277).

Nicaragua has increased its electricity production from 1,457 GWh to 3,659 GWh, of which 37% is from renewable sources. The country is falling behind its neighbors in terms of annual production growth (2%), renewable sources, excluding hydroelectric (37% of total) and the highest electric power transmission and distribution losses (24% of output). This scenario leads to high electricity rates and disincentive to invest in the sector.

According to World Bank surveys conducted for companies, a 39% considered that the main problem is in the power supply and a 23.6% identified poor transportation network as the main problem to operate in Nicaragua. Companies quantify the electrical network problem leaks around 6% of its sales. There is no data on the impact of inadequate road infrastructure network, but in theory this has a negative impact on operating expenditure growth companies.

4.1.2. Low Appropriability

Macroeconomic and Microeconomic conditions can affect the appropriability of private investment. High inflation, exchange volatility or macroeconomic instability can generate distortions that may shrink investment and may even generate losses. There are also microeconomic elements that can generate losses to investors and business not taken account in the production function such as corruption, market failures, and expropriation and tax rates, causing low appropriability.

4.1.2.1.1. Macro risks

Debt Crisis and dependence of foreign resources

Nicaragua incurred in high external debt levels and had to restructure its debt. After various restructuring attempts, the country received debt relief from the international community though the Heavily Indebted Poor Countries Initiative (HIPC) and Multilateral Debt Relief Initiative (MDRI). This permitted to decrease the debt to GDP ratio from 940% to 58% in 2011.

It identifies a chronic deficit from the 1990s to the present and macroeconomic risk is external. The apparent imbalance of a current account deficit and a surplus in the capital and financial account arean association that has a direct impact on the deficit in the balance of payments and changes in the levels of gross external assets. What would be meaningless if it is not because nutrition is through the official development aid, remittances, exports and foreign direct investment, which allow the country to live and consume more than it produces, maintaining a harmful relationship dependency.

The country has close economic dependence on the external sector, which largely explains the deficit in the current account for more than three decades, a situation that is related to the following variables was marked mainly by the evolution of four exogenous variables: foreign financing, exports, remittances and foreign direct investment (FDI).

The financing behavior is associated with deficits in the balance of payments and changes in the level of gross foreign assets; it rests on official development assistance, remittances, exports and foreign direct investment, allowing the country to live and consume beyond what occurs in a dependent relationship.

Economic Policy

The economic policy has been subject to the execution of financial programs with the International Monetary Fund (IMF) and The World Bank (WB) since 1990 to the present. Nicaragua has implemented adjustment programs for almost two decades (1986-2004), which meant confronting economic policy objectives, the payment of debt service and the reconstruction of the country, generating political and social instability. With the Sandinista government from 2007, funds from Venezuela have meant more leeway, but the economic and social policy is being overseen and agreed by the IMF.

The Petrocaribe agreement establishes favorable conditions and funding mechanisms. In the short term ranges from 30-90 days and a deferred payment when the price exceeds $ 40 per barrel, the payment period is extended to 25 years, including two years of grace and an interest of 1%. Deferred payment can mean a 5% to a 50% of the oil bill depending on oil prices. ALBA Summit III, (2005).

The Financial Sector Crisis in the early 2000s

In 2000 and 2002, the crisis forced the closure of three banks, creating a sector that attracted great uncertainty. The loss to the state - that had to bear the costs of closing Interbank and Bancafé (2000), Nicaraguan Bank of Industry and Commerce (Banic) and Bamer (2001) - were enormous. Domestic debt was issued to save the financial sector, whose service during the period 2001 to 2004 was over 50% of GDP. It should be noted that part of the bank failures were the result of weaknesses in control and industry standards Ansorena, (2007).

In the audit report issued by the Comptroller General of the Republic it established fraudulent actions in the liquidation of assets of the failed banks, generating rejection of the legality of some internal bonds issued by the Nicaraguan State. Comptroller General of the Republic of Nicaragua, (2005).

4.1.2.1.2. Micro Risks

Corruption

We mention that as a result of allegations of fraud in the municipal elections of November 2008, and other governance problems, it is estimated that Nicaragua lost about $ 400 million on account of both, international cooperation and foreign investment. At the same time, implemented the final withdrawal of the Millennium Challenge Account (MCA), about U.S. $ 64 million were without running for a total of $ 175 million.

In addition, the Budget Support Group froze $ 100 million to the budget, which amounted to $ 64 million U.S. dollars in the CRM. The withdrawal of aid from Sweden, consisting of U.S. $ 30 million annually. For 2010, Sweden allocated only $ 5 million and even finalized the projects already initiated. 285 The IMF forecasted a decline in ODA in 2010 Vargas (2010, p. 89).

The new fraud allegations in the presidential elections of 2011 sharpened bilateral issues and the country was left virtually with funds from friendly countries (Venezuela, Russia, Iran, etc.) and multilateral agencies such as the IDB, WB and IMF.

In 2011 Nicaragua obtained a 2.5 in Institutional Assessment Index and Country Policy (CPIA) of the World Bank, where 1 is low and 6 is high; there was a decrease in the levels of transparency, accountability, and corruption in the public sector since 2005. According to World Bank surveys conducted in 2010 in businesses, a 52% considered that one of the limitations to growth was the high rate of corruption and a 38% of complainies in the judicial system to enforce judgments nonconforming right.

Product Innovation and Export Diversity

Trade-to-GDP ratios have increased worldwide; for Nicaragua, the ratio rose from 49.8% to 101% from 1960 to 2011. This ratio reflects an increase of the integration into the world economy. Nicaragua's trade policy has been liberalization of trade, membership in the Central American Common Market (CACM) established in the 60s and its free trade agreement with its main trading partner, the United States. In general, the country has five free trade agreements with the United States, Mexico, the Dominican Republic, Panama, and Chinese Taipei in vigor, and two, Chile and the European Union, are still in process of approval.

Nicaraguan trade increased at high rates from 1990 to 2011; exports and imports increased an average of 20% and 17%. The total value of imports exceeded that of exports, leaving a chronic current account deficit.

From an overall perspective of the production structure, the Nicaraguan agriculture of 2011 represents 21% of total gross value added in GDP and uses 30% of employment. The industry constituted 30% of gross value added and occupied 20% of employment. The sector heavier jurisdiction over services, 49% of total gross value added and employment to 50% of the workforce.

Nicaragua primarily exports raw materials; its production structure has been characterized as export-oriented, which is itself a sector strongly dissociated from the rest of the economy. In 2010 it exported a total of 1,851 million goods, of which 88% was food and 7% was manufacturing; while in commercial service concept, $ 430 million dollars was exported, of which 72% were service travel. Exports of goods and services in 2010 increased to 41% of GDP.

The export sector is concentrated in a few products of total exports; the top ten products represent the 81%, which implies susceptibility to international price changes and external sector demand. In addition, 55.3% of total exports is concentrated in the United States (30.6%), Venezuela (13.4%) and El Salvador (11.1%).

The diversification index is close to one, indicating that the country's export base has a bigger difference from the structure of product of the world average. It has expanded its export base from 128 products in 1995 to 239 products in 2011. The concentration index, also named Herfindal-Hirschmann index, shows a relative less concentration in absolute terms. Despite this improvement in export concentration index in 2011 Nicaragua with 0.23 has one of the highests in the Americas, well above regional level of 0.14, meanwhile it is closer to the Low Income countries average of 0.24.

On the other hand, if we look at the leading exporter's proportion of market share we can see that 1% of the largest exporters accounted for 47% of total exports in 2011. By expanding the selection of exporting more than 25% of the size, they reach 98% of total exports in 2011.

4.2. Is the reason the high cost of Finance

One of the limitations to private investment is access, supply and finance costs to business activities. The funds destined to the economic activity can be either from domestic resources or foreign resources.

4.2.1. Bad international finance + Low domestic savings

Nicaragua has no access to international finance in market terms, which is due to its agreement with the international commitments with international financial institutions such as the International Monetary Fund, the World Bank and Paris Club, as Nicaragua received debt relief.

Nicaragua receives more generous loans than in market terms, either by lower interest rate, or higher grace periods or a combination of these. Nicaragua has a low gross domestic savings to GDP; in 2011 it had 8.46%and a high current account deficit at -14% of GDP. Moodys investors' service gives Nicaragua a B3 rating, one of the lowest within the countries analyzed by the company. This rating elevates the cost of capital borrowed by enterprises from international capital markets.

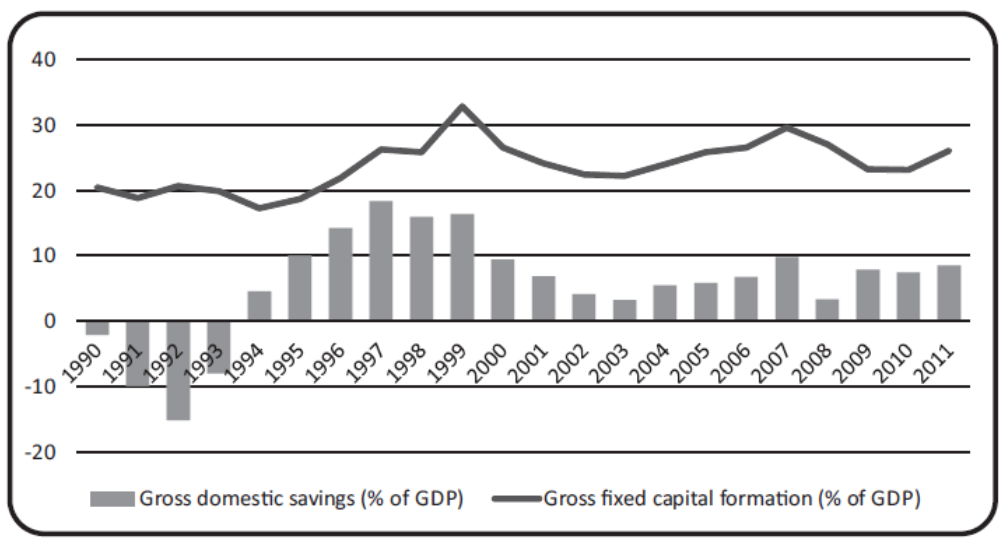

National savings suffered a major setback during the 80's until 1994, when it began showing positive signs. During the period 1994-2011, national savings to GDP has averaged 8% and this has is among the lowest in the region. A large part of the gross fixed capital formation is financed by foreign aid and private flows (foreign direct investment, foreign remittances). See Figure 3.

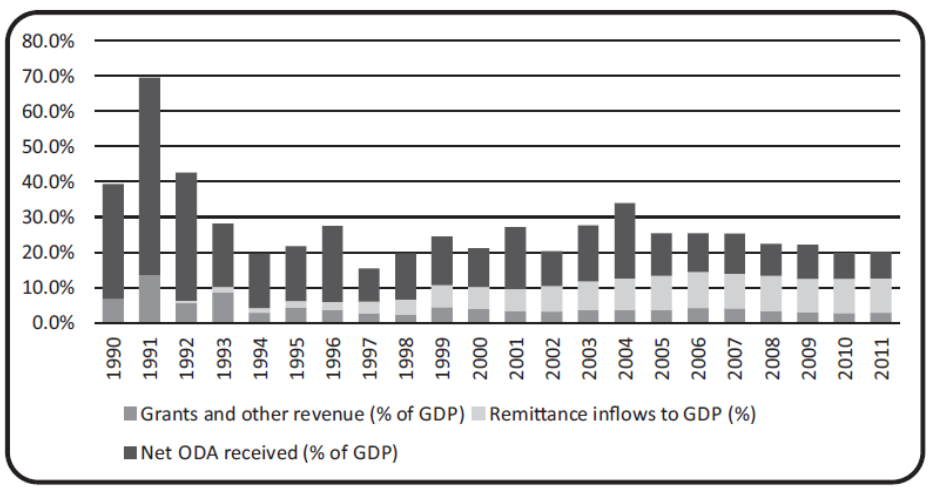

Domestic savings are low in Nicaragua; however, if we compare them to those of Central American Countries, Nicaraguan savings are relatively high, but well below low and middle income countries (26% in 2011). Nicaragua receives large amounts of financial flows from abroad; official development aid represented 7.5% of GDP in 2011; remittances represented 9.8% of GDP in 2011 and Grants 2.8% of GDP. See Figure 4.

Source: World Bank, (2013).

Figure 4 Remittances Inflows and Grants and Official Development Aid (ODA)

The (International Monetary Fund, 2012) and Moodys suggest that Nicaragua has a persistent high current account deficit and a reliance upon foreign international flows (remittances and foreignaid) with a 35% minimum of concessionality.

The external financing at low levels has positive effects on growth; however, high levels of indebtedness adversely affect growth, reffered to as “debt overhang” Krugman, (1988). External debt was a factor that limited the economic and social development in Nicaragua during the late 80s and 90s; the levels reached high debt ratios / GDP above 940% in 1989, which gradually reduced product of debt relief initiatives as HIPC and MDRI. In 2011, the country had a debt ratio to GDP of 55.8%.

Studies examining the negative impact on growth that include Nicaragua in the same meet Patillo, Poirson, & Ricci, (2004) argue that this phenomenon is generated when the debt-to- GDP ratio is above 30%. Bannister and Barrot's 2011 study, which used a different methodology, also corroborates this idea by identifying that specific case in Nicaragua, in which that negative impact is generated from 28%.

4.2.2. Bad Local Finance

In this section we want to determine if finance is a biding constraint; the reasoning is to find evidence of the quantity of finance supplied in Nicaragua is due to low because of scare supply, high price and high risk.

The financial sector has grown; if we take variables commonly used to measure the degree of development (Lynch, 1996), M3/GDP we observe that the private sector credit increased continuously after the banking crisis in the early 2000s. Domestic credit to private sector as a share of GDP is also relative low at a 25.25%, slightly below other Central American countries and well below low and middle income (average of 74.5%) countries.

This low ratio of credit to GDP suggests an issue with access to finance. This can be part of the high degree of informal employment in Nicaragua and the lack of guarantees of little of middle business to obtain credit. In 2010, 22% of firms used banks to finance investment and 33% of total small firms with line of credit to total small firms. Although we cannot deny that it can reflect a situation of lack of request or that the financial system does not encounter other needs of the private sector.

If we consider neighboring countries, Nicaragua has one of the lowest interest rates and second highest interest rate throughout the Central American region. The interest rate applied to loans in 2010 was 10%, the product of a gradual decline since 2000, ranging around 20%. So even with the existence of a fixed exchange rate - crawling peg against the dollar - for 2 decades, the difference between the interest rate addressed to loans and deposits (spread) has increased steadily since 2008, as it went from 6.6% in the year 2008 to 10.32% in 2010.

The real interest rate has fluctuated over the past decades. To copy this oscillation, it was at 9.6% in 2009 and at 0.2% in 2011. For one credit has become more expensive and the other applied to savings performance has fallen discouraged savings.

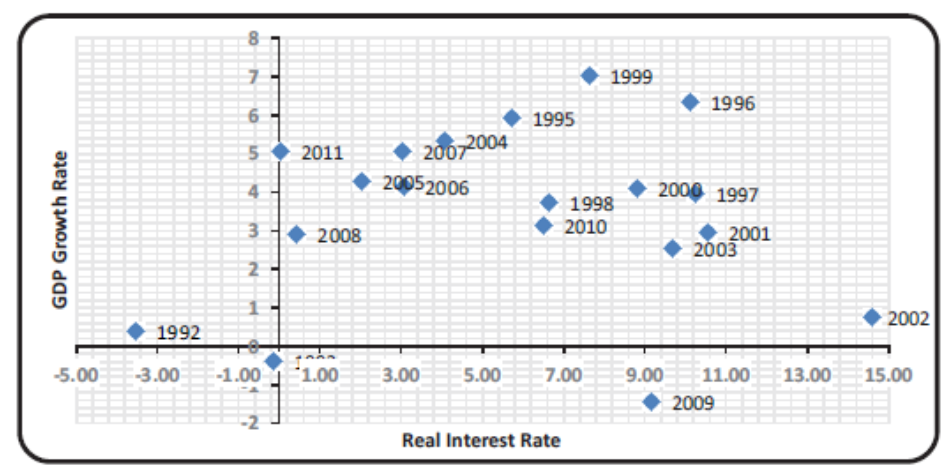

Once identified the key problems, we proceed to provide estimates on the appropriate response in terms of policy. Figure 5 Real Interest Rate and GDP Growth Rate shows that there is no correlation between both variables in Nicaragua. During the time analyzed, the growth rate in Nicaragua has been mostly positive ranging from -1.5 to 6.4%; while within the period real interest rate haven been declining ranging from -48 to 15%. Figure 5 exposes that the growth rate has not responded to changes in interest rates.

We find that the financial system is vulnerable, which negatively affects the intermediary function of banks. If we analyze bank credit to bank deposits we find that Nicaragua is among the lowest and has a high dollarization of its deposits (73.5% bank deposits in foreign currency in June 2011). This suggests that banks may be having difficulties in channeling deposit funds towards credit. Another indicator of the banks efficiency is the Bank non-performing loans to gross loans and the country has a 3%.

5. Conclusions

By applying the growth diagnostic methodology on Nicaragua, we found that low return to economic activity is the principal binding constraint to growth.

●Poor Geography

Its geographical position is not a constraint due to its strategic advantages. Nicaragua is a resource-abundant country, as it contains 5% of the world's biodiversity and has the biggest forest area in the Central American Region (25% of the land is forest).

●Low Human Capital

Nicaragua has a lack of human resources because of the low level of education of the labor force.

●Bad Infrastructure

There is a low provision of public goods, like transport infrastructure, access to electricity, water and sanitation system. The electricity sector is inefficient. The high transmission and distribution losses generate high tariff rate and price fluctuations due to the high dependence on petrol price.

●Government Failures

Nicaragua has a fragile fiscal situation, vulnerable to sudden stops of foreign financial flows. The chronic fiscal deficit and a growing external debt after the debt crisis suffered in the 80s. Nicaragua receives high quantities of grants, remittances, foreign aid and concessional loans. Another government failure is the weak institutions and corruption that eliminate credibility of government policies and attraction of investment.

●Market Failure

A constraint to Nicaragua's growth is due to market failure; the export structure has little diversification with food and raw material exports account more that 90% of exports in 2011. There are externalities that prevent business from broadening its horizons for new products and for new sectors with more value added sectors.

●High Finance Costs

High finance costs are not a binding constraint because Nicaragua receives large quantities of foreign resources and loan terms are below market terms.

6. Recommendations

Improve Human Capital

The actions that can be undertaken to raise human capital are:

I. establishing transfer programs and conducting a national development strategy for science, technology and innovation

II. focusing investment on school attendance and health checks to reduce the likelihood of falling into poverty

By conditioning transfers assets to promoting and developing human capital by families, the PTC intervention would enable more efficient, effective and equitable, since they advance on the double dimension of material assistance in the short term and creating conditions for overcoming poverty in the long term.

●National Plan for Science, Technology and Innovation

First you should conduct an audit of operations and results of the National Plan for Science, Technology and Innovation for the 2010-2013 period as well as sectorial strategies. Secondly, improve the quality of education at all levels and adapt the curriculum to the needs of domestic business.

Improve Infrastructure

Policies that can be taken to improve infrastructure for economic activity can get a boost by attracting private investment through public-private partnerships as well as ante and post evaluation of spending on public services.

● Public-Private

Partnerships Through public private partnership, incorporate private capital to build infrastructure such as roads and ports.

●Improve the effectiveness of public services spending

Collect statistical information to measure the effectiveness of spending on education, health and infrastructure. Apply and evaluate the programs carried out for the use of resources based on results as well as increase the amount invested.

Improve Government Management (Macro and Micro Risks)

Three. Correction of government failures are obtained through institutional improvements and implementation of macroeconomic policies aimed at correcting the imbalance in chronic external sector. A legislative change in respect of the civil government can induce favorable changes to reduce government failure in relation to corruption and politicization of the administration and judiciary. On the other hand, a policy of export diversification and policy.

Some measures to increase domestic savings can be routed in two ways; firstly establish disincentives to capital flight and repatriation of capital that left the country during the decade of the 1980s and nineties. On the other hand, changes in fiscal policy to make it more progressive and implement policies to combat tax evasion.

The Nicaraguan economy depends on the production and export of a few agricultural products and the terms of trade were volatile with downward trend before the current economic crisis. These features reflect a vulnerability to exogenous shocks and are the transmission mechanism of the propagation of cyclical fluctuations in the prices of commodities to the real economy, making the impact procyclical tax revenues.

The problem of weak macroeconomic policies and the need to make the country more resilient to exogenous negative impacts has a human face. A sharp drop of the factors directly affects the well-being of citizens and the satisfaction of their basic needs. A development strategy has to take into count the vast number of poor citizens, the levels of education, health and infrastructure.

Some institutional problems such as corruption, political instability, inefficient government bureaucracy and inadequate education of the workforce and infrastructure have a negative impact on economic growth.

nueva página del texto (beta)

nueva página del texto (beta)