Introduction

Pension systems worldwide face increased pressure from aging populations in most countries, which along with labor conditions that have brought along the growth of the informal sector of the economy, imply a significant challenge when it comes to savings. According to the Organisation for Economic Co-operation and Development (OECD) (2019a), it is estimated that by 2060 almost six out of every ten working age individuals in member countries will be 65 years or older. Additionally, the working-age population (measured using fixed age thresholds) is expected to decrease by more than one third during the same period. Moreover, non-standard workers are a particular concern, as new forms of labor might weaken income prospects of the future retiree generation.

The Life Cycle Hypothesis (LCH hereafter) is a theoretical framework developed by Modigliani and Brumberg in 1954 that inspired the rationale of savings behavior and the corresponding design of pension systems worldwide. Simply put, said framework stipulates that economics agent calculate how much they consume at each age, limited only by the resources available over their lives, to create retirement provisions. This model, like other classical theories, assumes that agents have defined preferences, in addition to perfect and rationally formed expectations. Certain studies point out that these assumptions are not necessarily fulfilled; hence, agents may have difficulties solving intertemporal consumption problems (Loewestein and Thaler, 1989; Graham and Isaac, 2002; Pistaferri, 2009; Carbone and Duffy, 2014). Others have shown that agents generally fail to optimize lifetime utility (Hey and Dardanoni, 1988; Ballinger et al., 2003, 2011; Carbone and Hey, 2004; Brown et al., 2009), where elements such as learning and cognitive abilities are sought to improve intertemporal planning, as they can act as counterweight for the short-sightedness of agents relative to their planning horizon.

In response to the shortcomings of the LCH, Shefrin and Thaler (1988) adapted the theoretical model to include behavioral characteristics related to saving decisions. Their Behavioral Life Cycle Theory (BLC) proposed three main modifications: the inclusion of a bequest motive, effects of capital market imperfections, and the possibility for the utility function to change over time. Likewise, the theory considers three crucial behavioral features, such as the temptation to spend their present income (self-control), the interpretation of saved money as a non-fungible asset (mental accounting), and agent’s actions depending on how relevant information is framed in their decisions (framing).

Regarding self-control, there is extensive empirical evidence, typically conducted from a psychological standpoint, about the difference between intentions and actual behaviors. According to Baumeister and Vohs (2004, p.3), the term self-control refers to "any efforts by the human self to alter any of its inner states or responses". Elster (1977) was a pioneer in studying different techniques that compensate for weak self-control. In relation to savings, the main issue is that saving at early stages is commonly avoided, and otherwise implies a rarely observed pre-commitment. To this extent, Shefrin and Thaler (1988), developed a utility function where the effort of decreasing consumption was considered. Like the one carried out by Faber and Vohs (2004), most studies regarding this behavioral aspect are related to buying impulses from the agents but the planning aspects of the decision are not quite developed.

On the other hand, mental accounting was first proposed by Kahneman and Tversky (1984) as the reflection of consumers' financial needs in a series of mental accounts. Shefrin and Thaler took this concept and built it into the BLC, identifying three crucial types: current income account, assets account, and future-income account. In this regard, the model proposed by Xiao and Olson (1993) suggests that over a given period of time, consumers spend most of their current income but hardly consume from the future-income account. However, as they warned, in countries where financial culture is hardly practiced, similar traces of mental accounting are not so easily identifiable.

Lastly, according to Modigliani (1986), savings are essential means for smoothing consumption because they act as a buffer against income shocks and facilitate long-term planning. Narrow framing is an issue studied by the BLC as individuals are subject to bounded rationality. Notable developments in these behavioral aspects are seen in Gottlieb and Mitchell (2019), who proved that narrow framers, unlike broad framers, make different decisions regarding if and how much to increase their contributions to their retirement savings plan. Likewise, Shin, Kim, and Heath (2019) provided empirical evidence on how narrow framing bias affects retirement saving decisions.

From individual to collective decisions

Saving has long been studied as an individual process. Two of its notable precursors were Kahneman and Tversky (1979), with the development of the prospect theory, according to which individuals make decisions in uncertain environments that deviate from the basic probabilistic principles. Such phenomenon, which arises from the individual decision process, can be rather easily extrapolated into a collective rationale. The authors highlight the three basic components by which saving, or dissaving, is formed as a collective attitude: in first place, there’s an affective component, associated with the emotions that an individual and/or group faces in a situation where expenses might not be covered in the retirement period. The second is the cognitive component, which is closely related to the agent's knowledge about the consequences that a shortage of monetary resources can have during the retirement period. Finally, there’s the behavioral component, which refers to the active reaction of the agents to the two previous elements.

To this end, collective mental accounting -particularly the balance between present and future-income accounts- and framing behavioral features can be constructed for specific demographic groups. In countries like Mexico, characterized by a highly informal labor market, it is of particular interest to make a distinction between collective attitudes towards saving depending on the conditions under which agents work. The objective of the present study is to elaborate on the narrow/broad frame debate, considering asymmetric collective attitudes towards savings, depending on the formal or informal condition of agents in the labor market. Time series analysis techniques are used to study the relationship between two types of savings -voluntary and mandatory-. Time series analysis, particularly the Vector Autoregressive Model (VAR), is a useful method as it aims to identify collective patterns and explore multivariate predictability in the short run as well.

There are different theoretical reasons to believe that both formality and informality help predict different savings choices, as they share collective characteristics. At the same time, it is somehow intuitive to expect asymmetric attitudes towards certain schemes. The uncertainty of having an occupation and, hence, an income, is the main factor involved. In theory, when individuals cannot foresee the amount of income, or predict it will be insufficient to cover daily expenses, they postpone voluntary savings (Shefrin and Thaler, 1988). Likewise, mandatory savings should be positively related to a formal occupation whilst, depending on the size and depth of the informal sector, a negative of neutral relationship could be expected with informality. Moreover, for agents belonging to the informal labor market, the future-income account is usually related to debt coverage or short-term expenditures rather than prevision.

From this perspective, and considering the Mexican labor market context, we establish two hypotheses: i) As the informal sector is typically related to a narrower framing -with a focus on current income- it will predict a negative collective behavior towards both types of savings. In other words, an increase of the informal sector size will be a useful predictor of a reduction in mandatory and voluntary savings in the near future. ii) As the formal sector is typically characterized by a broader framing -along with a focus on current income- a positive predictability of mandatory savings is expected, but no relation with voluntary ones.

The remainder of the document is organized as follows: section 1 presents a brief recollection of the characteristics of the Mexican pension system in relation to the LCH. Section 2 describes the data and methods used, while Section 3 presents the results of the analysis. Finally, closing remarks are made.

I. Mexican pension system

The Mexican pension system can be conceptualized in four pillars: Non-Contributive, Mandatory Governmental Employees, Mandatory Private Employees, and Voluntary. The Non-Contributive pillar was recently reformed in March 2021, and it seeks a minimum universal pension for adults in their retirement age. The second and third pillars consist of contributions from public and private institutions, respectively, to the employee. Finally, the voluntary pillar describes contributions made by the employee to an individual account throughout his or her lifetime. At the age of retirement, an individual will receive a pension according to the pillar or pillars he or she belonged to, and their specific characteristics (Villareal and Macías, 2020).

Regarding the mandatory pillars, there are two main social security programs with pension provisions for formal workers: the one administered by the Mexican Institute of Social Security (IMSS, for its acronym in Spanish) and the one managed by the Institute of Social Security and Services for State Workers (ISSSTE, for its acronym in Spanish). These programs presented a distribution scheme with tripartite contributions to the pension account made by employees, employers, and the State. However, neither the financial sustainability nor the contribution schemes were guaranteed. A reform to the pension system sought to change the previous conditions to a structure of defined contributions and individual accounts.

The reform in Mexico started with the creation of the Retirement Savings System (SAR, for its acronym in Spanish) in 1992, a complementary program to those already in existence, which involved a contribution of resources that were registered individually and accumulated in the Central Bank. However, the reform to the IMSS program in 1995, which covers workers in the formal private sector, came into effect on July 1st, 1997. This reform meant the replacement of the pay-as-you-go system and a defined benefit scheme with a fully funded scheme based on individual accounts. Modifications were further made in relation with retirement age and contribution requirements; however, no proper structural reform has yet responded to the current and future challenges of the system (Villagómez, 2016).

When the 1997 bill was implemented, the prospect was that most of the working-age population would be covered by any of the three systems in the medium term. As described by De la Torre and Rudolph (2018), “the expectation was that well-defined contribution systems would lead to higher enrollment by encouraging individuals to take ownership of their retirement accounts”. Pension coverage levels today are not even near the ideal. Moreover, most of the labor force is without any relevant aging-related protection. According to research conducted by Alonso et. al., (2014), although the number of contributors in the IMSS and ISSSTE systems has grown by 17% over the last decade, the effective coverage (contributors as a percentage of the economically active population) is still below 37%. The same holds true for coverage of the population over the age of 65, which has prevailed at around 20%.

This pension scheme relates to the LCH, for individualized pension accounts favor the active involvement of the agent, since the amount of money received will mainly depend on the amount of the contributions, the evolution of the worker’s salary, the commissions involved in the operation and the returns of the chosen financial instruments. Even though individualized accounts make a distinction between mandatory and voluntary savings, the latter are rarely increased in a systematic fashion. The Mexican pension system has a recurrent and increasingly concerning issue: individuals do not have sufficient savings to satisfy their retirement requirements, particularly with the increase in life expectancy and the prevalence of chronic diseases, which are costly.

Empirical research has proved that the current levels of savings turn out to be insufficient and analyzes the reasons why. They are mostly associated with socioeconomic variables such as income levels, age, conditions, and financial education. In Mexico, particularly after the pandemic, the job market is increasingly informal, which generates uncertainty within population about future income, life expectancy, and health. This sector represents 56% of the economically active population (EAP). Moreover, people over-consume in early stages of their lives, which prevents them from starting to save early enough, or even worse, they accumulate to consume in the short term.

Given the increasing lack of a contract and social security -defining elements of a formal job-, along with subemployment levels, and the hyperbolic preferences that distinguish the Mexican society, in March of 2021 the government proposed to gradually increase the amount of the monthly pension for the elderly, a program known as Pensión de Bienestar de Adultos Mayores (PBAM, for its acronym in Spanish). There are inherent risks in its execution, along with high fiscal costs that hinder the effectiveness of the program (Perez, 2021). For this reason, focus has shifted to the fourth pension pillar: voluntary contributions. This approach has been recommended by the World Bank and can be based on voluntary savings related to consumption rather than income (Villagómez, 2016).

The pertinence and relevance of studies, such as the present one, becomes clear. In light of the proposed reform to the pension system, and the ones almost surely happening in the near future, the current labor market characteristics may lead to a reduction of the amount of savings in the pension system. This could ultimately endanger its financial sustainability. If the new strategy is to concentrate in increasing voluntary savings, the examination of collective attitudes towards them by labor market participants is a critical starting point.

II. Data and Methods

Four time series are used to study the relationship between savings and the conditions under which individuals participate in the labor market, four time series are employed: formal occupation, informal occupation, voluntary savings, and mandatory savings. The databases include monthly observations between September 2009 and March 2020. Data related to the evolution of voluntary savings and mandatory savings was obtained from the National Commission of the Retirement Saving System (CONSAR, for its acronym in Spanish). These observations account for monetary resources allocated in pension accounts and measured in millions of Mexican pesos. Mandatory savings consider the monetary resources from workers listed in either the IMSS or the ISSSTE social security systems, also measured in millions of Mexican pesos. Due to the challenging nature of measuring the number of labor market participants -particularly the ones in the informal sector- we rely on the definition and the monthly counts collected from the National Survey of Occupation and Employment (ENOE, for its acronym in Spanish) published by the National Institute of Statistic and Geography (INEGI, for its acronym in Spanish).

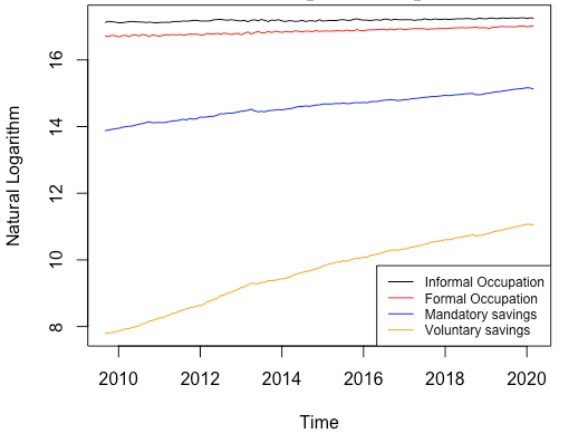

Figure 1 presents the evolution of the natural logarithm of each time series. Both mandatory and voluntary savings present noteworthy positive trends while informal and formal occupations are somewhat stable throughout the analyzed period. The evolution of the series may suggest some sort of common behavior between them, which can be related to a short-term or long-term nature. Before exploring the existence of either relation, both, or none of them, a description of the individual behavior of each series is in place.

Source: Own elaboration with information from INEGI (2020) and CONSAR (2020)

Figure 1 Evolution of the time series for the period: September 2009 - March 2020

Table 1 describes the main statistical characteristics of the constructed series. The first four columns refer to the series in their original units. The Shapiro-Wilk normality test is rejected for the formal occupation, voluntary savings, and mandatory savings series. This suggests that they follow a not normal distribution. Moreover, according to the skewness and excess of kurtosis, these series present platykurtosis -given that the excess of kurtosis is negative- and asymmetry, as they appear to be skewed to the right -given that the skewness is positive-. In other words, the probability of having extreme/atypical cases is smaller when compared to the normal distribution, and observations seem to be concentrated in the lower part of the distribution. Interestingly, the series of informal occupation seems to follow a normal distribution as the normality hypothesis is not rejected at the 5% significance level.

Table 1 Descriptive Statistics for the period: September 2009 - March 2020

| Informal Occupation | Formal Occupation | Mandatory Savings | Voluntary Savings | D(IO) | D(FO) | D(MS) | D(VS) | |||

|---|---|---|---|---|---|---|---|---|---|---|

| Obs. | 127 | 126 | ||||||||

| Units | Thousand Workers | Millions MXN | Natural Logarithm | Natural Logarithm | ||||||

| Min | 26,988 | 17,739 | 1,061,379 | 2,427 | -0.040 | -0.061 | -0.049 | -0.036 | ||

| Max | 31,458 | 24,709 | 3,856,552 | 64,274 | 0.045 | 0.047 | 0.046 | 0.080 | ||

| Mean | 29,265 | 21,086 | 2,303,442 | 22,662 | 0.001 | 0.002 | 0.010 | 0.026 | ||

| Std.Dev | 1,128 | 1,911 | 758,587 | 18,068 | 0.018 | 0.022 | 0.015 | 0.019 | ||

| Skewness | -0.026 | 0.057 | 0.207 | 0.707 | 0.158 | -0.037 | -0.897 | -0.030 | ||

| Kurtosis | -0.807 | -1.190 | -1.005 | -0.690 | -0.141 | -0.356 | 1.942 | 0.497 | ||

| SW test | 0.980 | 0.957 | 0.964 | 0.897 | 0.993 | 0.989 | 0.950 | 0.992 | ||

| P-value | 0.061 | 0.001 | 0.002 | 0.000 | 0.749 | 0.430 | 0.000 | 0.693 | ||

Source: Own elaboration with information from INEGI (2020) and CONSAR (2020)

To standardize the different units of measure, each variable is transformed monotonously using its natural logarithm. Additionally, as the implementation of the empirical strategy requires the series to be stationary, the Augmented Dickey-Fuller (ADF), and the Phillips-Perron (PP) tests were performed. Results are presented in Table 2. It can be observed that the mandatory savings series is consistently identified as I(1) -that is, non-stationary in levels, but stationary in first differences- for the four versions of the performed tests. On the other hand, it can be seen that the voluntary savings series behaves like I(0) -stationary in levels- for versions of the tests where only a constant is considered, but like I(1) for the versions where both a constant and a trend are considered.

Table 2 Results for Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests

| ADF | PP | |||

|---|---|---|---|---|

| Drift | Trend | Drift | Trend | |

| Informal Occupation D(Informal Occupation) | -1.62 | -4.60 * | -2.11 | -6.39 * |

| D(Informal Occupation) | -13.93 * | -13.88 * | -19.45 * | -19.38 * |

| Formal Occupation D(Formal Occupation) | -0.75 | -8.87 * | -0.46 | -11.64 * |

| D(Formal Occupation) | -21.98 * | -21.90 * | -27.07 * | -26.95 * |

| Mandatory Savings | -2.15 | -2.84 | -2.37 | -2.87 |

| D(Mandatory Savings) | -7.83 * | -8.10 * | -10.76 * | -11.02 * |

| Voluntary Savings | -4.12 * | 0.19 | -3.47 ** | 0.05 |

| D(Voluntary Savings) | -5.34 * | -6.53 * | -12.38 * | -13.53 |

Note: Reported values are the corresponding test statistics.

* Denotes rejection of the null hypothesis of unit root at 1% significance level and ** at 5%.

Source: Own elaboration

This inconsistency in the determination of the voluntary savings series’ integration order turns out to be an obstacle to explore a possible cointegration condition with it as an object of analysis. Possible tests of long-term relation (cointegration) detection such as Engle-Granger and Johansen are only appropriate if all the series are integrated is some order different to zero, meaning they are not stationary in levels. Because of this, the mandatory savings series could be used to carry out a cointegration analysis under both approaches, but voluntary savings could only be used for cointegration tests that consider a common trend.

Nevertheless, because an inconsistency in the integration order of the informal and formal occupation series can also be observed, I(1) in versions with a constant but I(0) with a constant and a trend, analysis of cointegration with the latter technique would not be appropriate either. Thus, the only cointegration analysis that would be appropriate for this work’s approach would involve both types of labor occupation with mandatory savings considered a constant. ADF unit root tests are performed, the Elliot-Rothenberg-Stock Unit Root Test for the difference between each type of labor occupation and mandatory savings, as well as the Johansen cointegration test. Results of this analysis are presented in Table 3.

Table 3 Results for the Augmented Dickey-Fuller (ADF), Elliot-Rothenberg-Stock unit root test for the difference of the series, and the Johansen cointegration test

| ADF | ERS | Johansen | |

|---|---|---|---|

| Informal Occupation | -2.02 | 1.75 | 14.33 |

| Mandatory Savings | (-2.88) | (-1.94) | (17.95) |

| Formal Occupation | -1.85 | 1.74 | 12.44 |

| Mandatory Savings | (-2.88) | (-1.94) | (17.95) |

Note: Reported values are the corresponding test statistics with the 5% critical values (in parenthesis)

Source: Own elaboration

Because the non-stationarity null hypothesis of the ADF and ERS tests for the difference between informal occupation and mandatory savings, as well as formal occupation and mandatory savings, are not rejected, a conclusion can be drawn that the linear combination of the non-stationary series results non-stationary as well. Therefore, a cointegration relation is absent. This same conclusion can be reached in the Johansen cointegration test, in which the null hypothesis that states that the constructed matrix’s rank equals zero (r = 0) cannot be rejected.

In view of the lack of evidence that suggests a long-term relationship between the variables, the present works focuses on finding the existence (or absence) of a short-term relationship between types of occupation and savings. Hence, the first difference of the natural logarithm of the series is used, and we proceed to the analysis of correlation and causality in Granger sense. The second set of four columns in Table 1 present the descriptive statistics of the differenced series. In this case, only the difference in the log of the mandatory savings follows a not normal distribution with a negative skew and a leptokurtic shape.

Table 4 presents the results obtained from the Pearson's product-moment correlation test: it can be seen that the linear association between the four series is rather high. Moreover, when the correlation analysis is performed with the first difference of the natural logarithm of the series only three correlations appear to be statistically different than zero: Formal occupation with informal occupation, formal occupation with mandatory savings, and voluntary savings with mandatory savings. Interestingly, the first two of them are negative while the third one positive. However, the estimation of dependence measures -such as the Pearson’s correlation- does not provide evidence of causality, at least in the sense that is commonly known as Granger causality, which relates to the predictability capacity, in the short run, from one series to another.

Table 4 Pearson’s Correlation Test

| Formal Occupation | Informal Occupation | Mandatory Savings | |

|---|---|---|---|

| Informal Occupation | 0.857 * | ||

| Mandatory Savings | 0.977 * | 0.881 * | |

| Voluntary Savings | 0.979 * | 0.876 * | 0.997 * |

| D(FO) | D(IO) | D(MS) | |

| D(IO) | -0.344 * | ||

| D(MS) | -0.189 ** | 0.005 | |

| D(VS) | -0.041 | 0.046 | 0.614 * |

* Denotes rejection of the null hypothesis of unit root at 1% significance level and ** at 5%.

Source: Own elaboration.

It is crucial to point out that causality can be unidirectional, go both ways, or be non-existent. This test was introduced by Granger (1969) and modified by Sims (1972). Granger causality implies that if a variable X Granger-causes Y, then x is said to contain useful information that can explain Y’s future behavior that is not present in the lagged values of y itself. To explore this predictability capacity, the conventional test is performed to the first differences of the natural logarithm of the series. Following the recommendations of the Hannan Quinn Criterion (HQ), Schwartz Bayesian Criterion (SBC), Akaike Information Criterion (AIC), and the Final Prediction Error Criterion (FPE), the optimal lag length range to perform the Granger causality analysis was between 2 and 4 lags.

The significant Granger causal relations, i.e., the ones in which the null hypothesis of no causal relation is rejected, are summarized in Table 5. From this table, an unsurprising robust bidirectional causal relation between formal and informal occupation can be seen. This implies that percentage changes in informal occupation Granger-causes (helps predicting percentage changes) formal occupation, and vice versa. For the lag order 2, both percentage changes in formal and informal occupation have predictability over percentage changes in mandatory savings, while percentage changes in informal occupation only Granger-cause percentage changes in voluntary savings. For the lag order 3 the only causal relationship found significant, apart from the formal-informal occupation one, is the one running from informal occupation to mandatory savings, while for lag order 4 only the one running from mandatory to voluntary savings is significant.

Table 5 Granger Causality Test

| Independent | Dependent | Order 2 | Order 3 | Order 4 |

|---|---|---|---|---|

| Formal Occupation | Informal Occupation | 4.918 * | 6.282 * | 4.637 * |

| Informal Occupation | Formal Occupation | 3.105 ** | 4.131 * | 2.595 ** |

| Formal Occupation | Mandatory Savings | 3.042 *** | 1.311 | 0.997 |

| Mandatory Savings | Formal Occupation | 1.843 | 1.143 | 1.073 |

| Formal Occupation | Voluntary Savings | 0.491 | 1.108 | 0.842 |

| Voluntary Savings | Formal Occupation | 2.113 | 1.391 | 1.118 |

| Informal Occupation | Mandatory Savings | 4.996 * | 3.078 ** | 1.631 |

| Mandatory Savings | Informal Occupation | 1.976 | 1.158 | 0.746 |

| Informal Occupation | Voluntary Savings | 2.869 *** | 1.877 | 1.985 |

| Voluntary Savings | Informal Occupation | 0.100 | 1.289 | 0.689 |

| Mandatory Savings | Voluntary Savings | 2.069 | 1.848 | 5.033 * |

| Voluntary Savings | Mandatory Savings | 0.271 | 1.210 | 1.338 |

Note: Reported values are the corresponding test statistics.

* Denotes rejection of the null hypothesis of no Granger causality at 1%, while ** and *** relate to rejection at significance levels of 5% and 10% respectively.

Source: Own elaboration

To explore the dynamic relationship of the variations of occupation with savings levels, a Vector Autoregression model (VAR) is proposed. Instead of estimating individual equations for each variable that may omit the endogenous relation between them, the VAR considers every variable as potentially endogenous in the constructed time series system. Sims (1980) initially proposed the VAR model to analyze the short-time relationship between time series. It has significant advantages since it captures dynamic relations between different variables. However, its interpretation may be difficult, and the success of estimation will depend strongly on the model’s lag length. The general form of a VAR model is the following:

Where the VAR is a

Explicitly, after substituting each variable, VAR models are:

Formal Occupation VAR:

Informal Occupation VAR:

Where each VAR is a

III. Results

From the six estimated VAR models -VAR(2), VAR(3), and VAR(4) with each type of occupation- the ones providing a better fit according to the Bayesian Information criterion were, for both cases, the VAR(2) models (-16.59 for the model considering formal occupation as exogenous variable and -16.58 for the one using informal occupation). Estimation results are presented in Table 6.

Table 6 VAR estimation results

| Formal Occupation (FO) | Informal Occupation (IO) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Mandatory Savings (MS) |

Voluntary Savings (VS) |

Mandatory Savings (MS) |

Voluntary Savings (VS) |

||||||

| Constant | 0.009 | *** | 0.018 | *** | Constant | 0.010 | *** | 0.018 | *** |

| (0.003) | (0.004) | (0.003) | (0.004) | ||||||

| Lag 1 MS | 0.068 | 0.238 | * | Lag 1 MS | 0.037 | 0.215 | * | ||

| (0.117) | (0.135) | (0.115) | (0.130) | ||||||

| Lag 1 VS | -0.055 | -0.174 | Lag 1 VS | -0.027 | -0.153 | ||||

| (0.091) | (0.106) | (0.092) | (0.104) | ||||||

| Lag 2 MS | -0.043 | -0.129 | Lag 2 MS | -0.070 | -0.121 | ||||

| (0.115) | (0.133) | (0.117) | (0.133) | ||||||

| Lag 2 VS | 0.053 | 0.438 | *** | Lag 2 VS | 0.054 | 0.435 | ** | ||

| (0.091) | (0.106) | (0.093) | (0.105) | ||||||

| FO | -0.075 | -0.031 | IO | -0.091 | -0.052 | ||||

| (0.072) | (0.084) | (0.085) | (0.097) | ||||||

| Lag 1 FO | 0.121 | * | 0.064 | Lag 1 IO | -0.204 | ** | -0.195 | ** | |

| (0.071) | (0.082) | (0.083) | (0.094) | ||||||

Notes: Reported values are estimated coefficients and their corresponding standard errors (in parenthesis)

*** Denotes significance at 1%, while ** and * relate to significance levels 5% and 10% respectively.

Source: Own elaboration

Remarkably, both models suggest a unidirectional predictability capability running from mandatory savings to voluntary savings. In other words, current changes in voluntary savings are predicted by changes in the mandatory savings from the previous month. Additionally, it is found that current changes in voluntary savings can be predicted from their changes presented two months before. Altogether, the results of this unidirectional relationship are somewhat intuitive and expected, in the sense that a predictability capacity running from voluntary to mandatory savings is expected to be neutral, as the latter contributions have to be done regardless of the collective attitude towards savings.

Regarding the type of labor force participation, no contemporaneous relationship exists between formal or informal occupation with neither type of savings. That is, current changes in the labor force are not useful to predict current changes in either type of savings. For the first VAR model, when considering the first lag, there is a positive predictability capacity running from the changes in formal occupation of the past month to changes in current mandatory savings. Simply put, changes in the current formal labor force can be used to predict changes in mandatory savings for next month. However, it is noteworthy that this predictability capacity does not appear to be valid for the case of current changes on voluntary savings.

On the other hand, for the second VAR model, a negative relationship between the first lag of informal occupation and both types of savings are found. In this sense, it appears that changes in the levels of participation in the informal labor market of a previous month, in fact, seem to be associated with negative changes in both types of savings. We reckon this might be explained by the predominance of this type of occupation in the Mexican labor force market.

Concluding remarks

A high savings rate is crucial for economic development. However, the Mexican economy faces the pressure of one of the most significantly informal labor markets in the world. Jobs without a contract or social security mean that individuals will have uncertainty about their income and, therefore, will postpone voluntary savings. By employing time-series techniques, this paper found there is a short-run asymmetric relationship between informal and formal occupation regarding the decision of modifying voluntary and mandatory savings. Particularly, changes in both types of occupations in a previous period appear to have a predictability capacity for current changes in mandatory savings, but current changes in voluntary savings might be predicted from previous changes in the informal market labor force.

Results seem to be in line with both of our research hypotheses. Building on the LCH, the explanation of these results may be done, at least initially, through collective behavioral patterns. Members of the formal sector are expected to display a broad framing towards savings decisions. This would imply that changes in the formal labor force could serve as a predictor for an increase in both mandatory -due to its compulsory nature- and voluntary, as they will rationally calculate their retirement requirements and increase their current savings accordingly. On the other hand, since members of the informal sector don’t have direct access to mandatory savings, a positive predictability relationship with this type of savings is highly unlikely. However, the LCH would expect that those individuals would focus on voluntary savings as the main source of coverage of their retirement needs. This is not the case for the Mexican pension system. Our results suggest the opposite: when changes in informal occupation are observed in a certain period, future changes in voluntary savings are expected in the opposite direction.

Together, the neutral predictability relationship -from formal occupation- and the negative predictability relationship -from informal occupation- seem to suggest a collective adverse attitude towards voluntary savings. This has clear and timely policy implications, as recent reform initiatives consider strategies to stimulate voluntary savings mainly through formal occupation. As the collective attitude towards voluntary savings seems to be adverse, this policy appears to be an inconsistent solution for the sustainability of the Mexican pension system. At least from this initial -and broad- analysis, suggestions can be made in order to improve mechanisms for a better transition from the informal to the formal sector. Clearly, we acknowledge this is easier said than done, as informality is a multidimensional problem that requires transformations both from the supply and demand sides of the labor market, as well as incentives designed by the government for a shift that provides certainty and decision-making tools to future retirees.

These results do not come without limitations. We suggest further discussion regarding three main concerns: (1) Even though INEGI’s methodology to estimate figures involving informality is sound, due to the difficulty of its calculation, data still represents an approximation to the gross dynamic of the labor market. (2) Individual factors related to the complex decision process of postponing consumption cannot be identified by using time series. Even though we elaborate on the reasons why collective attitudes towards savings might be identified by time series patterns, the observed trajectories may over-generalize other underlying effects present in said decision. To this end, complementary analyses based on behavioral economics principles and tools may lead to a better interpretation of the factors leading to a particular attitude towards savings.

Finally, (3) limited representation and coverage. Theoretically speaking, if a pension system is representative of its population, it should have a generalized coverage rate, that is, a high percentage of the labor force that is classified as an active member of a mandatory pension system (OECD, 2019b). Some countries in Latin America have included the universal pension in order to contribute to coverage levels; however, these amounts are usually low and do not mitigate the lack of a formal pension system (Martínez & St. Clair, 2021). If the pension system is as universal as it intends, increases in the formal sector should represent significant (and positive) changes in savings. Yet this does not seem to be the case for the Mexican pension system, since the coverage rate is relatively low due to the labor composition of the country, which limits the generalization of our results. In this sense, further discussion should be posed regarding the ways in which the Mexican pension system needs to incorporate alternative mechanisms to increase coverage and representation.

nueva página del texto (beta)

nueva página del texto (beta)