Introduction

The global scenario of natural rubber (Hevea brasiliensis Muell. Arg.) production presents features that are particularly regional. Asian countries represent the largest production of latex with 93 % of the total global production; however, they have grave problems in incrementing volume due to the ageing of the plantations and price fluctuations. On the other hand, Latin America, even though its production is not equivalent to Asia's, presents a higher dynamism in production growth, even though it only participates with 3 % in the international market for natural rubber (Food and Agriculture Organization of the United Nations [FAO], 2004). The production of natural rubber in Mexico has medium growth dynamism due to the same problems that Asia bears; it comprises only 10 % in Latin America, with the states of Veracruz and Oaxaca being the most dynamic regions.

In Mexico, the drive to develop forestry plantations has two main orientations. The first relates to the reforestation and protection of areas with several degradation levels; the second is linked to forestry plantations with commercial purposes. In regards to the latter, it is important to highlight that in 2011 between 5 and 10 % of the planted area had not received any type of support on behalf of the Comisión Nacional Forestal (CONAFOR, 2011), making it clear that neither the sustainability of the natural resources nor the interests of the communities that own the forests, jungles and territories are considered a priority, such is the case in southern Veracruz (Paré, 1996). Through CONAFOR, the federal government has formulated macro-instruments that instruct the manner in which forestry actions should be oriented. The main instrument is the PROARBOL program, whose main purposes are to broaden Mexico's participation in forestry matters in the global market, to improve the management of plantations and to make more profitable use of forestry resources. The foregoing is done through federal financial incentives that are granted through the Commercial Forestry Plantations Program, a financial aid instrument promoted by the CONAFOR (2013).

Southeastern Mexico has excellent natural conditions for the development of natural rubber plantations, which is aided by its optimal natural and economic conditions, since its relative proximity with the largest global consumption center, comprised by the United States of America and Canada, represents a commercial advantage (Rojo, Martínez, & Jasso, 2011). Similarly, the activity allows for the development of a sustainable productive strategy (Musálem-Santiago, 2003), more specifically in the areas that show evident disruption signs in their ecosystems due to anthropogenic action which has been on the rise due to the changes in soil use, from forestry to agricultural to farming, unregulated logging and forest fires, among other factors (Salazar, Zavala, Castillo, & Cámara, 2004). Despite having production and commercial potentials of regional importance, it is difficult to obtain the accounting data that allows for the promotion of production capacity or sustainability of the cultivations. This could stimulate the tendency of the producers to incorporate technological innovations that directly impact the profitability of the plantation and, indirectly, their income. In that regard, the precise location of production costs that are comprised in the cultivation of natural rubber is an effective efficiency parameter to compare the performance of a venture among other similar ones and against the market price, which, in these times of intense commercial dynamism, is determined by commercial intermediaries and producers in other parts of the world. Therefore, different methodologies which are easy to implement in the agricultural sector have emerged in order to correctly determine production costs (Molina & Contreras, 2010).

The objective of this investigation is to analyze the profitability of the cultivation of natural rubber in the production of latex in the state of Oaxaca, in order to improve decision-making and to identify the economic performance of this activity. The working hypothesis stipulates that, despite the importance of the cultivation in the income of the producers, there are other factors that affect the profitability and competitiveness of the producer, such as the type of management, the technological level and the small scale in which it is produced.

Materials and methods

The region of the study has an area of 625.15 km2 and is located in the northern region of the state of Oaxaca (18° 19' LN-17° 48' LS; 95° 51' LE and 96° 19' LO) in the Papaloapan Basin, located among the rivers that empty into the Gulf of Mexico with a mean altitude of 20 m. The weather is warm-humid with an annual temperature of 25 °C and an average precipitation of 2,307.7 mm (Instituto Nacional de Estadística y Geografía [INEGI], 2009).

The theoretical bases and the method used for the estimation of cost and yield were adjusted to the standards recommended by the working group of the United States Department of Agriculture-Natural Resources Conservation Service [USDA-NRSCS], 2000). In this manner, an alternative method was used to estimate income, cash outflow and profitability of the agricultural production.

The estimation of production costs was done in the municipality of Tuxtepec, Oaxaca, with those producers who received technical assistance service during the production cycle of 2012, with the help of the Agencias de Gestión de la Innovación para el Desarrollo de Proveedores (AGI-DP) model, through the Humid Tropic Strategic Project. This project belongs to the Program of Actions with the Federal Entities in regards to Investment, Sustainability and Capacity Development of the Secretaría de Agricultura, Ganadería Desarrollo Rural, Pesca y Alimentación (SAGARPA, 2013). The producers were chosen through a non-probabilistic sampling with expert selection, a technique used to select representative or typical units or portions, in accordance to expert criteria (Pimienta, 2000). Expert selection is used when it is not possible to do a randomized procedure due to lack of information or high costs (Mandujano, 1998). In this research, a model of producers was used with the characteristics of their production units, and the sampling was based on the review of technical reports and key informants, in this case, researchers from the region and members of the AGI-DP.

A previous research phase was developed in order to identify the possible production representative units (PRU) and to adjust the data collection tools. This comprised an exhaustive review of the production systems, price analyses for the supplies of the region and an exhaustive exploration of the producers' inventory supplies by the AGI-DP.

In the field phase, the collection of data and the validation of results were done through a method of panel actors. This research technique is developed through a group of people or experts on a subject, who reunite to issue a collective and consensual judgment about a certain matter (European Commission, 2006). For the purposes of this work, the panels were used to define the income and cash outflow in the production of natural rubber and to analyze its profitability. Five producers in the PRU OXHL2.5 and OXHL16, and six in the OXHL5, participated in the panels, a total of 16 panelists. The characteristics considered for the selection of experts were: extensive experience of the producer regarding the cultivation of natural rubber and homogenous characteristics in the production units in relation to their size and technological level. The producers were summoned by a facilitator, member of the AGI-DP, a renowned expert with extensive knowledge on the activity of the region and with convening power among the producers. In each panel, based on the construction of the consensus, a dialogue with the participants was established; this dialogue comprised their activities as natural rubber producers, as well as their technical parameters and their commercialization systems. Detailed information was collected regarding the technical production parameters, the prices of products and supplies, production levels and determination of income, costs and transfers of the PRU. Subsequently, the information was systematized and processed in order to generate the profitability indicators and, lastly, panel sessions were done a second time in order to present the results to the producers and to validate them (Salas, Sagarnaga, Gómez, Leos, & Peña, 2013; Sagarnaga et al., 2000; Zavala et al., 2012). The validation was done in a process similar to that of the consensus of the panels, in which the participants of the original panel were summoned once again. In this phase, the results were presented to the panelists in order to verify that the information was complete and correct; furthermore, it was verified that the technical and economic situation of the PRU was accurately reflected. The information obtained was systematized and processed in Excel® spreadsheets to quantify the costs and carry out the necessary operations for the analysis of the profitability indicators. The indicators were calculated using the following formulas:

Total income (TI):

Ti = MI + TRI + OI

where:

IM = Market income

TRI = Transfer income

OI = Other income

Variable costs (VC):

where:

aij = Supply j used in the production of product i

Pj = Cost of supply j.

Fixed Costs (FC):

where:

aik = Supply k used in the production of product i

Pk = Cost of supply k.

Total costs (TC):

TC= VC +FC

Benefit/cost relation (B/C):

In the case of this research, economic costs were considered as the total costs (cash and other) for the operation of the plantation. Moreover, the variable and fixed costs in cash were included (except the payment of interests), the substitution of capital and the costs of the land, the labor that was not remunerated and the invested capital in the production of supplies and machinery (United States Department of Agriculture-Economic Research Service [USDA-ER], 2012). The interpretation of the economic cost concept was based on the "opportunity cost". In this specific case study, the financial cost is defined as the total amount of charges attributed to all the resources, with the exception of personal funds and those of the operator, as well as labor of the family and the management (USDA-ERS, 2012). On the other hand, cash flow was also determined, which is the sum of real money that a company receives or pays for operation expenses during a specific period (Besley & Brigham, 2008); the expenses in cash, including capital and interests on long-term debts and personal withdrawals were considered in the calculation; amortizations and interests on capital were excluded (USDA-ERS, 2012). Lastly, profitability was considered as the measure of the productivity of the resources invested in a business (García, 1999), as well as the necessary investments to achieve its development; that is to say, it indicated the yield that the investments in an organization or activity generated, depending on the case. Profitability is an index, a relation; for example, the relation between a benefit and an incurred cost to obtain it, or between a utility and an expense.

The integration of an analysis of this kind is especially appropriate for the rural sector, since the value of agricultural production is not always based on money. Several of the supplies (native seeds, fertilizers, water, etc.) and labor (family) are not bought or sold; furthermore, family consumption of the crops is a part of the auto-supply that the family unit (rural) generates as a personal benefit. In addition, this method allows the estimation of the value of the goods and services that are not commercialized.

Results and discussion

Production of natural rubber in tropical regions is principally located in the municipalities with lower real income per capita on a national level; several of them present indexes of high marginality. Despite this, the economic benefits that the cultivation of natural rubber enables are the creation of jobs and a steady job during more than three decades of productive life of plantations, which has created a tighter bond between the farmer and his regions (Rojo-Martínez, Jasso-Mata, Vargas-Hernández, Palma-López, & Velásquez-Martínez, 2005).

Presently, the country has unsurpassable conditions (edaphic and climatic) for the commercial production of natural rubber (Rojo et al., 2011), and its expansion is of great importance as the substantial increase of commercial plantations of natural rubber would reduce the outflow of currency from the country, which is more than 100 million dollars per annum. This situation is generated due to the fact that the country imports around 70,000 t·year-1, mainly from Thailand, Indonesia and Malaysia (Rojo-Martínez et al., 2005); 90 % of the national requirements of natural rubber are imported (Fundación Produce Oaxaca, 2007). Natural rubber is considered one of the main imported products by Mexico from Southeast Asia (Villezca, 2013). The Consejo Mexicano del Hule (2002) indicates that the potential surface for the establishment of natural rubber goes from 500,000 up to 1,000,000 hectares, a convenient amount to reach self-reliance. Presently, it is estimated at a surface area of 33,375 ha (Instituto Nacional de Investigaciones Forestales, Agrícolas y Pecuarias [INIFAP], 2014). In Mexico, production is located in Veracruz (53 %), Oaxaca (33 %), Chiapas (8 %) and Tabasco (6 %) (Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación-Sistema de Información Agroalimentaria y Pesquera [SAGARPA-SIAP], 2013). In the case of Oaxaca, the region of Tuxtepec is the most important, with an average production surface of 3 ha (Fundación Produce Oaxaca, 2007) and constitutes one of the main sources of employment and income for more than 1,500 producers in the region.

The PRU proposals for the study comply with what is established in Sagarnaga and Salas (2010), who define them as the production units that, without representing a particular producer, typify the activities and decisions of the producers that participate in the panel in a virtual manner. The PRU also represent one production unit typical of a scale and of a particular production system from a region of the country (Orona et al., 2013). Three PRU were identified with the following profiles: OXHL2.5, OXHL5 and OXHL16, where OX refers to the state of Oaxaca, HL to natural rubber and the number represents the amount of hectares.

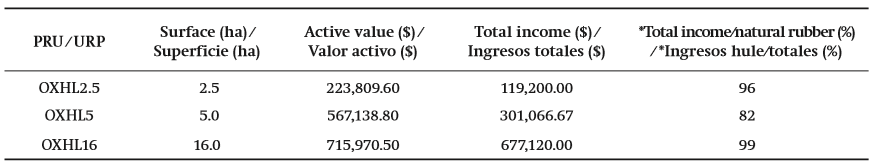

The analyzed PRU are of low, medium and large scale, with medium technological levels, characterized by the use of chemical fertilization, implementation of agrochemicals and annual mowing on a small production scale. According to Table 1, the OXHL2.5, OXHL5 and OXHL16 PRU contribute, respectively, with 96, 82 and 99 % of the producer's income. The sales market is regional and is done for the Beneficiadora y Comercializadora de Hule de Oaxaca S. A. de C. V. (BYCHOSA).

Table 1. Characteristics of the production representative units (PRU) of natural rubber in the state of Oaxaca.

Source: Elaboration from the field data, 2013.

*Income obtained from the production of natural rubber with relation to the total income.

The management done in the plantations of the study region is homogenous, due to the technical support given by AGI-DP; however, the OXHL16 PRU differentiate from the others due to the use of the stimulant Ethrel® to increase the production of latex. The technical parameters presented are within the regional average, with the exception of OXHL16, the oldest plantation (33 years old) and their tree densities are lower in comparison to the younger natural rubber plantations; therefore, latex yields of the OXHL16 are lower (Table 2). The foregoing is valid considering maximum latex yields are obtained from the 17 and 23 years old plantations.

Table 2. Technical parameters of the production representative units (PRU) of natural rubber in the state of Oaxaca.

Source: Elaboration from the field data, 2013.

*Spike is a cut made in a spiral shape on the bark of trees for the extraction of latex.

Table 3 shows the sale prices required based on different objectives. The required sale price for all PRU to gain a profit, including risk return, should be higher than $13.66; while the sale price required to cover variable costs is $9.40 per kilogram of natural rubber.

Table 3. Sale price (objective) required to obtain a profit in the production representative units analyzed in the state of Oaxaca.

Source: Elaboration from the field data.

Table 4 shows the balance prices of the analyzed PRU. In the OXHL2.5 PRU, the economic cost goes up to $13.66, while in OXHL5 the cost decreases to $10.95 and in OXHL16 it is $11.60 per kilogram of natural rubber. It can thus be deduced that the smaller the unit of production, economic costs tend to increase; despite the fact that in OXHL16 PRU this cost was not lower as the size and age of the plantations in this group are greater, therefore, the amount of resources employed is greater than that of the other units and the yield is lower. Regarding financial costs, in OXHL2.5 it goes up to $7.52 and in OCHL5 it is $6.98, while in OXHL16 it increases to $9.60 per kilogram of natural rubber. The procurement of a low financial cost is attributed to the fact that this is a production system with medium technological levels and rustic facilities. The cash flow in OXHL2.5 is up to $18.94 and in OXHL5 it is $13.02, while in OXHL16 it is $11.99 per kilogram of natural rubber. The procurement of such a high cash flow is due to withdrawals from the income of the production unit done by the producer. The OXHL5 PRU shows the lowest costs in comparison to the other two PRU, being the optimal size for a family dedicated to the production of natural rubber to maintain an efficient lifestyle. This is the case for families in Xishuangbanna, Yunnan, China and northeastern Thailand, where the production of natural rubber of small production farmers is a viable and efficient proposal to overcome poverty (Fox & Castella, 2013).

Table 4. Balance prices of the production representative units (PRU) analyzed in the state of Oaxaca.

Source: Elaboration from the field data, 2013.

The low equipment and infrastructure levels act in a positive manner regarding financial costs, reflecting low depreciation costs. In contrast, when the cash flow is greater than the economic cost, it can be inferred that the producers receive additional income from complementary activities, coinciding with what Aguilar, Galmiche, and Domínguez (2012) indicate; this situation also alludes to the existence of subsidiary monetary transfers.

With the results obtained, it can be proven that some PRU do not make economic profits from the plantation, as it is only able to cover its production costs. The foregoing can be demonstrated with the benefit/ cost relation; in the case of OXHL2.5, its benefit/cost relation is 0.80, in OXHL5 it is 1.01 and in OXH16 it is 0.94. Therefore, it can be said that there is a high probability that the activity becomes less profitable with time and becomes non-viable economically for the natural rubber producers of that region, which would imply their exit from the market, coinciding with the assumptions of Rodrigo (2007) and Aguilar et al. (2012).

According to Miragem et al. (1982), the sensitivity analysis supposes that the yields are the most important variable along with the price for the procurement of scenarios. For this case, the panelists speculated three scenarios in the production of latex: the positive, the most probable and the negative (Table 5). In this regard, a great similarity can be observed in the OXHL2.5 and OXHL5 PRU when it comes to the behavior of decreases and increases of yield, while in OXHL16, the expected yields are lower; these results coincide with those obtained by Izquierdo-Bautista, Domínguez-Domínguez, Martínez-Zurimendi, Velázquez-Martínez, and Córdova-Ávalos (2011) and Aguilar et al. (2012). Table 6 shows the sensitivity analysis for the economic cost. In the negative scenario, the cost is elevated in an amount close to $2.00 per kilogram of natural rubber in the case of all PRU. In the positive production scenario, the cost diminishes, approximately $1.00 per kilogram in all cases. When going by the negative scenario, the productive activity shows a great sensitivity to the decrease of yields, directly affecting the level of profitability of the activity.

Table 5. Yield obtained under different scenarios in the production representative units (PRU) analyzed in the state of Oaxaca.

Source: Elaboration from the field data, 2013.

Table 6. Sensitivity analysis of financial costs in the production representative units (PRU) analyzed in the state of Oaxaca

Source: Elaboration from the field data, 2013.

The results obtained reveal that the majority of PRU do not obtain any visible economic profits, product of the direct activity done on the plantation, and it can be inferred that the PRU cover a portion of their costs through additional income from other activities such as farming, the production of sugar cane or as agricultural farmers (Aguilar et al., 2012).

It is important to improve the productive processes that allow cost reductions in order to achieve economic and financial viability, coinciding with the suppositions of Izquierdo-Bautista et al. (2011) and Schroth, Moraes, and Da Mota (2004); otherwise, the economic and financial sustainability of the plantation would be at risk. Other aspects to take care of would be innovation of the management processes of the plantations, including improvement of the control of weeds, plagues, diseases, and the collection and processing of latex; as well as to improve the density of the plantations and introduce new clones to improve yields.

The absence of economic profit that allows the producers to maintain a standard of living in regards to their needs and expectations will lead them to perform complementary activities in a higher degree; otherwise, the producer may decide to abandon the activity or sell their plantation so that it can be used for the production of wood. This situation becomes more common in the region, due to the increase in the demand of wood and to the high wood productivity of the natural rubber tree (Monroy, Aguirre, & Jiménez, 2006; Garay, Moreno, Durán, Valero, & Trejo, 2004).

Conclusions

The indicators calculated show that the OXHL2.5 and OXHL16 PRU are only profitable in financial terms, so they are not able to improve their productive capacity and obtain utilities. On the other hand, the OXHL5 PRU is profitable in economic terms and this allows it to expand its productive capacity in the future and develop innovations in its productive processes. In the OXHL2.5 and OXHL16 PRU, the relation observed between the scale and the balance price is inverse in economic costs and cash flow; a small decrease in these costs can be observed on a higher scale. In financial terms the contrary happens, mainly due to the increase of the cost caused by depreciation. The OXHL5 PRU turned out to be more profitable, as the sale price for the analysis year allows them to cover the fixed costs, variable costs and the risk return on the inversion of the activity. In order to improve economic viability, all PRU should optimize their productive processes, reprogram their decision-making to incorporate technological innovations that allow for cost reductions, the increase of yield, improvement of product quality and in some cases renewal of the plantations.

texto en

texto en