Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Revista mexicana de ciencias forestales

versión impresa ISSN 2007-1132

Rev. mex. de cienc. forestales vol.14 no.78 México jul./ago. 2023 Epub 14-Jul-2023

https://doi.org/10.29298/rmcf.v14i78.1389

Scientific article

Rural supply chains to produce wooden furniture in Misantla, Veracruz

1Laboratorio de Logística y Sustentabilidad en Economías Emergentes, Tecnológico Nacional de México/ITS de Misantla. México.

2Universidad Popular Autónoma del Estado de Puebla. México.

3División de Estudios de Posgrados e Investigación, Tecnológico Nacional de México/IT de Puebla. México.

Wooden furniture manufacturing in Misantla uses long, technically unstructured artisan processes, high generation of wood waste and high turnover among its handicraftsmen. This paper describes the organization and operation of their carpentry shops and workshops. The relationships between their economic agents, the supplier-organization-final customers, including the internal and external processes as well as their productive factors that make up their supply chain were studied. This research, accomplished in 2021, was a mixed, exploratory and transactional study. 86 carpentry shops and 101 workshops were interviewed and a semi-structured survey was applied. Findings state a family wood furniture industry, with a technology designed by the carpenters, no access to technology supported by computers or the marketing strategies for a local and regional scope that favors delayed deliveries and client complaints. This family industry context requires formal administrative organization structures, training programs, and industrial integration schemes that allow access to technology and financing. It is important to organize as a single handicraft sector, a plan for reforestation and sustainable extraction management, an improvement in the supply of raw materials and materials, as well as defining marketing strategies, proposing automated processes for assembly and vertical integration to form clusters of value chain. Future research could use random sampling, enlarge the sample size, reduce the length of the survey, and include furniture stores from other regions.

Key words Handicraftsmen; family enterprises; wood industry; informality; small enterprises; tradition

La manufactura del mueble de madera en Misantla utiliza procesos artesanales largos, técnicamente no estructurados, con alta generación de desperdicio de madera y gran rotación entre sus artesanos. Esta investigación describe la forma de organización y operación de las carpinterías y talleres de ese sector. Se estudiaron las interrelaciones de los actores económicos proveedor-organización-cliente, incluidos los procesos internos y externos, así como los factores productivos que caracterizan su cadena de suministro. El estudio, realizado en 2021, tuvo un enfoque mixto, alcance exploratorio y diseño transversal. Se contactaron a dueños o encargados de 86 carpinterías y 101 talleres de muebles de madera a los que se les realizó una encuesta semiestructurada. Los hallazgos describen una industria familiar con tecnología adaptada y construida por el mismo carpintero, nulo acceso a tecnologías asistidas por computadora, y esquemas de comercialización para una economía local y regional que propicia entregas tardías e incumplimiento al cliente. Este contexto de industria familiar exige estructuras de organización administrativa formal, programas de capacitación, y esquemas de integración industrial que permitan acceder a tecnología y financiamiento. Resulta importante la organización como un solo sector de artesanos, un plan de reforestación y manejo sustentable de extracción, mejoramiento del suministro de materias primas y materiales, así como definir estrategias de comercialización, y plantear procesos automatizados para ensamble e integración vertical para conformar clústeres de cadena de valor. Futuras investigaciones podrían utilizar un muestreo aleatorio, ampliar el tamaño de muestra, reducir la longitud de la encuesta e incluir a mueblerías de otras regiones.

Palabras clave Artesanos; empresas familiares; industria maderera; informalidad; pequeñas empresas; tradición

Introduction

The appearance of businesses in emerging countries is not always the result of planning. Some are born as business initiatives, others as a need for family income, and often informally. In either case, the family business grows, develops and adjusts to its social, economic and political environment "in order not to disappear" immersed in dynamics such as competition, sustainability, cooperation and adaptation (Barros et al., 2016). The study of family businesses has been the subject of research due to their common elements of survival, coexistence, cooperation and growth (Basco and Pérez, 2009), in addition to being fundamentally an engine for the economy of their regions (Angulo, 2016).

In Mexico, studies of union mechanisms of family businesses are scarce, especially those linked to craftsmen in rural areas with cultural roots tied to family identity and heritage from its three dimensions: cultural, social and economic (González, 2015), in which their products include elements of unique shapes that give the crafts the identity of their territory. These cultural and social components have had an impact on the rural family economy (Pomar and Martínez, 2015).

Although the organizational structures are diverse and complex, artisan companies manage to adjust to large external competitors (Ayala-Carrillo et al., 2020), and to promote their cohesion and cooperation before mass producers with substitute products (García et al., 2020). The level of cohesion and cooperation of these economic units translates into the establishment of regional producers, and thus, they have managed to form their own local supply chains (SC).

However, current studies do not help to understand the factors that make these groups of companies with a history of family management and craft vocation coexist. Particularly, the wooden furniture industry (WFI) in Mexico in rural environments has transcended family generations without understanding the subsistence of this economic model, especially with cultural-rural roots. In this sense, the questions of this research were: What factors have allowed the coexistence of this industry? And how does its internal organization and processes influence its competitiveness?

To answer these questions, this article describes -including internal and external processes- the form of organization and collective and individual operation in the SC of the carpentry shops and workshops of the Misantla WFI in Veracruz, Mexico. In this sense, this article highlights the relationships of economic agents, logistics flows and the way to add value to a product to conceive how the different agents are interconnected to form a single system, without neglecting the processes oriented to business competitiveness. The results of this research contribute to the study of artisan sectors related to the forest industry, especially to know the subsistence of these economic models to the preservation of their predominantly informal culture with family identity in rural economies.

Materials and Methods

The study was carried out in the city of Misantla in the state of Veracruz. Of the 645 economic units (carpentry shops and workshops) referred by Balderas et al. (2019), 187 carpentry managers (n=86) and workshops (n=101) were contacted. The carpentry shop is the economic unit that performs all the operations for the assembly and final finish of a wooden piece of furniture; the workshop is the economic unit that provides a service to the carpentry shop. The carpenter is the central resource in the process of making handmade wooden furniture, which is associated with both the carpentry shop and the workshop. This term designates those involved in such production, except for the case of activities with specific knowledge. For example, someone who is only dedicated to carving wood is called "carver" instead of carpenter, and uses the word carpenter as a synonym for someone who is dedicated to sanding or assembling furniture.

Work consisted on an exploratory, descriptive and cross-sectional investigation. The primary information was collected through a semi-structured survey of 165 items on a 5-option Likert scale (Pimentel, 2019). The survey included the following variables: tradition, technology, access to credit, individual and collective forms of cooperation, the supply processes of raw materials and materials, the manufacturing process of the furniture, technological needs, and the commercialization process. In addition, sociodemographic variables such as education, income, seniority of the company, number of employees, were added among others. The surveys were conducted face-to-face for convenience using the level-2 exponential snowball technique (Pérez, 2005). The results were synthesized through a participatory and collaborative process with the economic actors of the artisanal family businesses of the IMM in the study region. In this way, the data of internal actors of these economic units were collected and processed, as well as that of indirect and direct actors to them who influence internal processes, including internal logistics and operations in the areas of packaging, distribution, delivery and monitoring of the product to the customer (GTZ, 2007).

The Value Chain of this sector was organized based on the internal and external processes proposed by Michael Porter (García, 2010). Finally, based on van der Heyden and Camacho (2006), the economic actors, the productive structure, competitiveness, and the factors that stimulate and restrict production were identified. Secondary information from repositories and work from Residence Reports of the Instituto Tecnológico Superior de Misantla (2010-2022) was also incorporated.

Results

Collaboration relations in the SC of the handcraft WFI

The collaboration relationship of the Misantla WFI is given by the carpentry shop-client and supplier-carpentry shop. The first is based on a system of production to order, the volume of production, and informal contracts that include the "advance" as a form of financing to execute the manufacturing operations of wooden furniture. While the second strengthens the link between the different actors in the WFI product chain to increase and strengthen their competitiveness.

The direct actors identified in the SC of the WFI are: suppliers, carpentry shops and customers. Suppliers of materials, raw materials and manufacturing services influence the manufacture of wooden furniture. The carpentry shops are responsible for manufacturing the wooden furniture and executing the internal logistics of the assembly, packaging, distribution, delivery and monitoring operations of the product to the customer. Customers initiate the make-to-order system and determine the production volume. The indirect actors identified in the WFI are: the academy, the municipal government, private transport providers and local wholesale providers, who provide advice regarding the form and application of the materials used in the manufacture of wooden furniture.

The influence of the environment that impacts the stability and competitiveness of the SC of the Misantla WFI includes economic, technological, and political-legal aspects. However, the collaborative relationship between these economic units is strengthened to a greater degree with the arrival of a new piece of furniture in the local market, which causes carpenters to unite to compete against said product.

Other factors that affect the competitiveness of the Misantla WFI have been the new production systems supported by techniques to improve their processes, government policies related to tax laws in which carpentry shops limit their contractual relationships with suppliers and customers and labor related to the high turnover of their staff due to the lack of social benefits. However, the Misantla WFI being a predominantly informal sector, the impact of these factors leads to a proportion of this industry not being able to adapt and respond to changes in its market, which causes the temporary or permanent closure of the carpentry shops and/or workshops.

Performance at the Misantla WFI

The handicraft WFI of Misantla at the date of this investigation is made up of 645 carpentry shops, of which 62.0 % are informal with sporadic opening and closing, and support of about 600 families. For 86.6 % of the carpentry shops, this economic activity is the only source of income. In this sector, 88.2 % of them have at least five employees, 7.4 % from six to ten employees and 4.4 % less than five employees. In general, the Misantla WFI is organized with an approach based on internal and support processes. While the internal processes are focused on ensuring the supply of materials, the design and development of the product, and the manufacture of the furniture, support processes are oriented towards marketing and meeting the needs of customers.

The Misantla WFI is characterized by eight direct agents for the manufacture of furniture: (1) Wood destruction workshops, (2) Carpentry shops; carpentry support workshops: (3) Sanding, (4) Turning, (5) Craft (carving), and (6) Cutting and reinforcement; and final treatment workshops: (7) Varnishing, and (8) Upholstery. The daily life of these economic units is that they are installed in residential buildings or in spaces with a tin roof. In this industrial context, transversal economic agents have been identified, which represent the supply level. In this sense, the carpentry subcontracts operations to various workshops, in which the administration of the carpentry shops or workshops falls to a single administrator or person in charge of the business since its foundation, which highlights its family nature.

Although the Misantla WFI joins for convenience when there is a need to confront mass production companies, 60.3 % of the carpentry shops fight for the local market. The remaining 39.7 % compete for the regional market. However, in general, the main administrative and technological needs are concentrated in the process, reforestation, preparation of business plans and technical assistance.

The findings of this research show that, although the largest economic contribution is made by carpentry, the largest daily cash flow is made by workshops that assist with the manufacture of furniture parts or furniture pre-finishing services, which represent 33.9 % of this local industry. This way of working is the result of 68.6 % of the collaboration agreements between carpentry shops and workshops in the handicraft furniture sector.

Internal processes of the Misantla WFI

The carpentry shops and workshops together manufacture wooden furniture predominantly in the Provençal (85 %), Colonial (10 %) and some type of Baroque (5 %) styles. In the horizontal structure of the SC, five key internal processes have been identified within the handcraft family businesses belonging to the WFI: (1) The initial link is the supply of raw materials, (2) Followed by the design and development of products, (3) Furniture manufacturing, (4) Distribution, and as a final link, (5) Marketing and services.

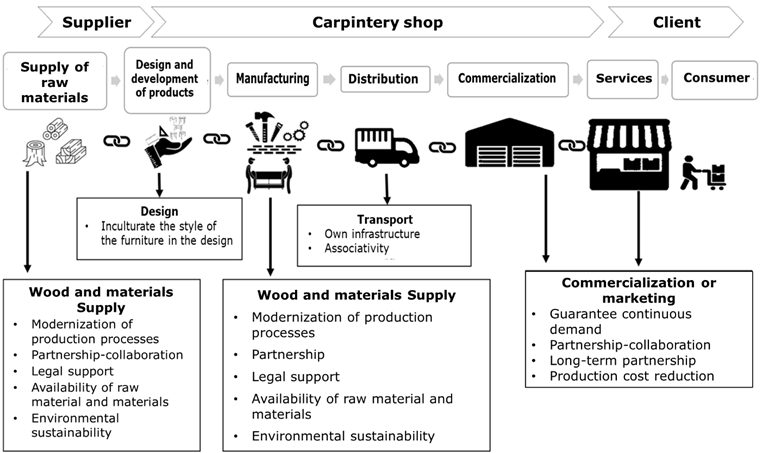

The elements of the SC of the Misantla WFI described in its logistics processes were identified from the contribution and collaboration of the key actors of the WFI-suppliers-carpentry shops-clients. In this way, the logistic processes allow describing and characterizing its SC (Figure 1).

Industrial organization

Internal processes use operations in which process management and responsibilities are shared, which may not be programmed to meet extraordinary customer requests, which causes the need for unscheduled inputs and supply of materials whose result has impacted the increase of material inventories. The members that participate in the production-to-order system are: suppliers, carpenters, and customers through two relationships: customers-carpentry shop (customer-carpenter) and carpentry shop-suppliers (carpenter-supplier).

The first client-carpenter relationship begins with the client's order with which the elaboration of the furniture is determined. The informal face-to-face contract is the mechanism to establish the price, the purchase guarantee and the delivery compliance by the carpenter. The price of the furniture is determined by the carpenter as he considers, among other criteria, the style and design of the furniture, the wood, the size of the piece, the final treatment, the time for delivery and the means of transport for the reception of the good by the customer. The purchase and manufacturing guarantee begins with the equivalent of 50 % of the furniture price as a form of capitalization for the acquisition of raw materials and materials in order to start the elaboration of the furniture. The difference in the payment of the final product is made when the furniture is delivered within the terms agreed between the parties (informal contract).

The second supplier-carpenter relationship is based on shared cooperation to maintain the supply of raw materials and materials in the first step of the SC of the industry. This carpenter-supplier relationship ensures the availability of the necessary inputs.

The relationships described have in common the carpenter, who is the channel through which the flow of materials, money and information between suppliers, the manufacturer and customers is carried out. However, when the demand exceeds the carpenter's production capacity, he can subcontract one or more of the operations with other carpentry shops or workshops -associative integration- to fulfill the orders. Although this subcontracting scheme benefits production capacity, the lack of working capital can impact the manufacture and finishing of the furniture, from the purchase of low-quality wood, the variation in the sale price of the furniture from carpenter to carpenter and, as a result, the increase in the price of furniture, which translates into a competitive disadvantage for the SC in this sector.

Raw material supply

Depending on the type of furniture to be manufactured, the supply of wood is not limited to the purchase of virgin wood or chipboard, but also includes the acquisition of fixing elements, adhesives, sandpaper, varnishes, dyes, among other structural materials for the manufacture of furniture or wooden accessories. The purchase of wood is carried out through four mechanisms: (1) Direct purchase from the owner of the trees, (2) Purchase of dry wood from the owners of cut trees, (3) Purchase from intermediaries, and (4) Purchase from small dedicated businesses to wood processing. On other occasions, the purchase can also be made between workshops and carpentry shops when there is pressure to obtain the wood.

On the other hand, the purchase of materials that add value to the wooden furniture, is customary to be carried out in generic and specialized hardware stores in the town; efforts have been made to guarantee supply through the selection of suppliers to minimize shortages of tropical wood such as cedar (Cedrela odorata L.) and mahogany (Swietenia macrophylla King), which are used in the Misantla WFI. The drying process is carried out by direct exposure to the sun.

Design and development of products

The WFI in Mexico is based on the family tradition, and its origin goes back to the European continent. Adapting the design is a necessary step due to the changing market conditions, for example, of the WFI of the states of Jalisco, Veracruz, Durango, Chiapas and the central states (Puebla, State of Mexico and Querétaro), today its designs in other communities of the country. This identity of cultural expression is not alien to the Misantla WFI, with a long family tradition of up to five generations, which has gone from adopting designs to adapting cultural projects, generating identity. Thus, the Misantla WFI outstands by the manufacture of Provençal (85 %), Colonial (10 %) and other styles of the Colony such as Baroque (5 %), furniture made of cedar wood (95 %), mahogany (4 %) and precious tropical woods such as palo amarillo (Tecoma stans (L.) Juss. ex Kunth), rosadillo (Astronium graveolens Jacq.), and melina (Gmelina arborea Roxb. ex Sm.) (1 %), of local origin.

The specialization of the Misantla WFI has required the development of the skills of the carpenter-handicraftsman to the degree of designing, manufacturing and using their own tools in manufacturing their furniture, and thereby highlighting the identity of the wooden furniture as a distinctive sign. However, this highly handicraft sector restricts its participation into mass production markets, from the little or inexistent flexibility to adjust its processes to new market trends. In general, with its current level of integration -based on individual and not collective efforts-, as well as small or no ability for self-management, the level of competitiveness of the Misantla WFI is limited compared to low-cost markets. In particular, because this WFI has not developed capacities related to the design of wooden furniture with cultural identity.

Manufacturing: Furniture assembly

In the Misantla WFI, 72 % adapt their operations to the type of furniture requested by the client under the scheme by orders and, based on these, production, supply of raw materials and materials are planned. This manufacturing system is highly dependent on handicraft labor, due to the fact that the machinery used is improvised or of obsolete technology, in which 90 % of the workshops adapt and adopt technologies for their operation. As a result, the manufacturing process is supported with hand tools and production is focused on the local and regional market. This manufacturing context highlights the need for technological adoption to improve productivity, be it by product focus or customer service.

In the manufacturing process of the Misantla WFI, four basic processes are identified, and three sub-processes that can be carried out inside and outside the carpentry, such as turning, carving and upholstering of furniture. In the SC, the following are identified for this industry: suppliers (forest industry, blacksmithing, dyes), subassemblies (carpentry shops workshops), and assembly workshops (carpentry shops). Among suppliers, the wood industry stands out, in which the raw materials are precious woods, agglomerates, laminates, boards, plywood, fittings, varnishes, solvents, paints, sealants and adhesives, as well as hardware stores, wood warehouses, which are part of the productive structure of the supply of raw materials and materials that make this industry operational.

The manufacturing processes of the Misantla WFI depend on the skill of the carpenter with long processes, high generation of raw material waste and materials during the manufacture of the pieces. The low collaboration between carpentry shops-workshops is related to the low technological level in the manufacture of furniture. The technology for manufacturing is limited and in the carpentry shop machinery or tools are improvised for the elaboration of the furniture, which shows technically unstructured and unbalanced processes, to which must be added the high turnover among its artisans. The common denominator of "low access to technology" impacts the productivity of this industry, due to the informality in which it works. All these factors place the Misantla WFI at a competitive disadvantage compared to similar or substitute products.

Distribution: Furniture transport company-client

At the Misantla WFI, the furniture distribution process distinguishes three types of transportation service: with the furniture manufacturer's own fleet, transportation by a third party -carried out by private transport, courier or parcel companies-, and the transport carried out by the client himself.

Transportation with its own fleet is expensive for the Misantla WFI due to the improvisation of its own fleet, either because it has excess or insufficient capacity, which causes a double haulage, or because it generally carries out this activity exclusively for the client, with absence of a distribution program and route planning.

The transport with third parties is used for the shipment of handicrafts and decorative furniture, as it is contracted by the producer or charged to the client. The outsourcing of transport is an alternative for the transport of the Misantla WFI, although the characteristics such as solid furniture, assembled in a single piece and a large volume of space in the container, make the shipment more expensive.

The third form of furniture distribution is a distribution scheme generally carried out as a result of negotiation between the producer and the client, with delivery of the furniture in the carpentry shop itself.

Commercialization

The commercialization or marketing of the Misantla WFI, as for the handicrafts segment, is carried out mainly among carpentry shop-intermediary-client, through direct and indirect channels. In direct channels, the final consumer purchases the furniture directly from the carpentry, while, in the indirect channel, there are intermediary agents between production and consumption.

In the artisan IMM in Mexico, 43 % of this sector sells its furniture with the benefit of greater participation in income and assumes the negotiation problems with the client (Camargo, 2017; Bailón et al., 2019). While, in the Misantla WFI, 57 % of the carpentry shops sell their products directly to the final consumer upon request. The lack of a marketing strategy encourages many carpentry shops to sell their products at a price to intermediaries and assume the cost-benefit of this commercial relationship, as a strategy for growth and positioning in the market.

Another of the strategies in this sense that is used in the WFI of Misantla is the direct exhibition of the product in the workplace, exhibition in an established commercial premises or in a furniture store, and in a minimum proportion, in electronic media or platforms digital, as well as local, regional, and eventually out-of-region furniture exhibitions; in them, only a proportion of less than 1 % of artisans from the entire industry participate with their own economic resources.

Currently, the sale process of wooden furniture in the Misantla furniture sector focuses mainly on local, state and in certain cases, national clients. In a strict sense, the sales process is carried out by each carpentry with the means and resources at their disposal, and they are reduced to the relationships they have developed over time, and word-of-mouth advertising among their clients.

After sales service

The after-sales service associated with the WFI handicraft in Misantla includes the installation, maintenance and repair of the wooden furniture. After-sales service is provided for one year for manufacturing defects or damage to accessories during delivery-transportation of the product or due to improper customer handling of both home and office furniture; it consists of the specialized support of cupboards, doors, sheets, inking, varnishing, repair and placement.

After the year of sale, the WFI after-sales service is offered 365 days a year at the customer's expense, and is the means to prolong the useful life of the wooden furniture, where 90 % of the time, the service is performed at the customer's home. In the case of furniture repair, the craftsman or the client moves the furniture from the client's home to the workshop where the service will be performed.

Competitive factors and advantages

Even though the WFI carpentry shops and workshops in Mexico show trends that incorporate specialization and modernization throughout the SC (Palos et al., 2008; Quintero and Martínez, 2015), the truth is that the WFI settled in rural communities are limited to maintaining relationships of association for convenience, which limits their competitive position beyond their local sphere of influence. Despite the competitive disadvantages of this handicraft sector, the strategies identified in the SC of the Misantla WFI show that the sector carries out activities to improve the efficiency of its production processes, as well as collaboration and customer service.

Figure 2 describes the strategies considered by the SC handicraft for the Misantla WFI. These strategies are aimed at strengthening the operations involved in the links that make up both the productive system and the SC agents from the individual to the collective, based on the addition of value throughout the links of the SC.

Discussion

As in countries such as Indonesia, India and Peru (Forest Trends, 2015; Norman and Canby, 2020; Rodríguez, 2020), the Misantla handicraft WFI stands out in the manufacture of furniture due to the use of virgin tropical wood of local-regional origin. However, the exploitation and extraction of these resources does not have a sustainable order, caused by the clandestinity of the use of wood. This phenomenon of clandestinity is similar to what was commented by Quintero and Martínez (2015) and by Andrade et al. (2021), which is caused, partly, by the non-compliance with the regulations of each government, and on the other hand, it brings with it the increase in costs and the use of wood that is not suitable for the artisanal manufacturing process; finally, this impacts the quality and shelf life of the product.

The study by Balderas et al. (2019) related to Misantla WFI coincides with the studies by Madrigal et al. (2015), Quintero and Martínez (2015), Camargo (2017), and Bailón et al. (2019), who described the WFI of the Mexican West (Michoacán, Jalisco, Durango), as production systems at the customer's request, with a high artisanal vocation, low technological level, intensive use of labor, batch production, low mass production and low level of innovation and technological development. This context translates into a disjointed SC among its economic agents with an impact on the client, given the lack of internal administrative organization, and planning of its processes, which causes unbalanced operations due to the lack of spaces in their work areas, as Balderas et al. (2019) pointed out; the results are late deliveries and desagreements between carpenter and client.

In this sense, in developed countries techniques such as Lean Manufacturing and Six Sigma are implemented to improve the continuous processes of the WFI (Abu et al., 2019). They include techniques such as failure mode effect analysis (FMEA) and geometrical variation mode effect analysis (GCMEA) in manufacturing processes, to address aesthetic and assembly aspects of wooden furniture (Wärmefjord et al., 2020).

In contrast, in emerging economies such as Malaysia and Mexico, these trends progress slowly due to obstacles such as lack of adoption of the technique, high employee turnover, and resistance to change (Guerrero et al., 2017). The WFI in Mexico manufactures robust furniture to order, with handmade assembly, with generally small parts, long assembly times and a high dependence on the skill of the carpenter-handicraftsman to achieve the assembly (Quintero and Martínez, 2015). Even though it is true that these characteristics present in the elaboration of wooden furniture give it its own identity, it places the handicraft WFI at a disadvantage position compared to competitors with technical production systems (Larsen, 2018).

Hernández and Pastrana (2017) report that some furniture companies, through innovation strategies, opt for modularity instead of manufacturing solid furniture that requires more storage and transport space.

Therefore, one of the challenges both in the Mexican WFI and in the international WFI (especially in emerging countries) is the integration of this sector. The promotion of reforestation programs, harvesting and commercialization of tropical wood, training strategies and creation of labor competencies that promote the development of intellectual capital and labor, as well as the use of wood waste generated by this sector, as highlighted by Medrano-Guerrero et al. (2022) that a certain part of the WFI sector in Mexico uses and recovers its wood waste with a circular economy approach.

This situation is not excluve for Mexico, as it is common to Latin America. The carpentry shops manage a subsistence economy and do not have elements to prioritize optimization options in environmental, productive and administrative aspects (Escobar et al., 2019). In general, the generation of wood waste horizontally affects all the actors in the product chain, not only from the natural resources lost, but also due to the inability of management by economic actors and users from an environmental and current legislation (Solano-Benavides et al., 2022).

The wood harvesting and furniture manufacturing industry generate residues of such material that are not reused, or underutilized with or without economic benefit, since more than 80 % of the carpentry shops give away or abandon these materials (Orellana, 2022). In this regard, in Misantla 72 % of the carpentry shops work by order, and use between 10 000-50 000 inches of wood per month, depending on the demand for furniture. On average, volumes of biomass between 75-85 kg of sawdust, 32-40 kg of shavings and 33-36 kg of scrap are generated by carpentry. These amounts do not include what the support workshops for carpentry produce; 66 % of them correspond to sawdust, 15 % to shavings and 19 % to wood. The destination of this waste is distributed with a 19 % proportion that is thrown away, 40 % is given away, 12 % is used for fertilizer, 21 % is incinerated and 9 % is sold (Palacio-Flórez, 2023).

On the other hand, and as a way of guaranteeing the quality of wooden furniture, in countries such as Brazil (Purnomo et al., 2014), Malaysia (Ng and Thiruchelvam, 2012) and China (Ali et al., 2019), the bet is on specialization and the development of intellectual capital and skills.

In contrast, in the Misantla WFI, the lack of interest of entrepreneurs-owners of workshops and carpentry shops for the development of personnel training programs, the form of organization and planning, as well as training in the use of techniques and tools of the furniture industry (Andrade et al., 2021). However, in the absence of training and specialization programs, as reported by Palos et al. (2008), Madrigal et al. (2015), and Durán et al. (2018), the Misantla WFI is committed to the training of workers on a day-to-day basis supported by the experience and tangible ability of its artisans with a furniture career, which has become a form of specialization for new artisans in the manufacture of wooden furniture, as well as in other operations related to furniture finishing as reported by Balderas et al. (2019).

Although the after-sales service is part of the accompaniment of the manufacture of furniture, it has not been consolidated in this community of the Misantla WFI, since the after-sales service allows organizations to develop operations as a competitive advantage by offering greater value for the client, as Aburto (2017) and Bailón et al. (2019) record it at an international level. Finally, with the aim of improving their competitive advantage, the studies by Andrade et al. (2021) highlight the need to redesign processes, and the adoption of technologies for the operation of handicraft family businesses.

Conclusions

In this work the Misantla WFI has been studied and a horizontal structure with four first level economic agents has been identified: sawmills, material suppliers, sub-assembly-assembly and final customers. On the second level are the suppliers of agglomerates, laminates, boards, plywood, fittings, varnishes, solvents, paints, sealants and adhesives, and service providers. It has been identified that the factors that have allowed the coexistence of this industry are related to its inheritance and long family tradition, which explains its paternalistic administration with an organizational structure in which the responsibility and operation of the business is centered on the owner.

However, even when an informal business is maintained, this industry is sustained by the skill of its artisans, and the relationships of trust between the economic actors (supplier, carpentry and customers), with the ability to adapt their production processes to meet the needs furniture requested by customers.

The competitive weaknesses of the Misantla WFI suggest the management of new forms of administration and organization of the economic actors throughout the SC as a strategy to integrate the WFI that ensures and improves the quality of the timber raw material and that of its primary components. In any case, it is transcendental that the artisan WFI transition to computer technology, especially in repetitive operations with the aim of generating greater value in its basic operations and reducing raw material waste. Future research should propose automated auxiliary processes of furniture parts for assembly and implement vertical integration for the formation of clusters of the value chain of this industrial sector of local economies with a global focus.

Acknowledgements

The authors appreciate the collaboration of the study subjects from the wood furniture industry of Misantla, Veracruz.

REFERENCES

Abu, F., H. Gholami, M. Z. M. Saman, N. Zakuan and D. Streimikiene. 2019. The implementation of lean manufacturing in the furniture industry: A review and analysis on the motives, barriers, challenges, and the applications. Journal of Cleaner Production (234):660-680. Doi: 10.1016/j.jclepro.2019.06.279. [ Links ]

Aburto D. la L., P. 2017. Efectos de la implementación de las estrategias orientación al mercado y orientación emprendedora en el comportamiento del consumidor: Caso de la industria de muebles de madera en México. Tesis de Maestría en Negocios y Mercados Internacionales. Universidad Panamericana. Benito Juárez, Ciudad de México, México. 110p. https://scripta.up.edu.mx/bitstream/handle/20.500.12552/2313/157791.pdf?sequence=1&isAllowed=y . (22 de abril de 2023). [ Links ]

Ali, Z., B. Gongbing and A. Mehreen. 2019. Supply chain network and information sharing effects of SMEs’ credit quality on firm performance. Do strong tie and bridge tie matter? Journal of Enterprise Information Management 32(5):714-734. Doi: 10.1108/JEIM-07-2018-0169. [ Links ]

Andrade H., E., G. Fernández-Lambert, D. Lara A., Y. M. Moreno and L. Geneste. 2021. Problem solving and risk management methodology: Feedback from Experiences with the use of taxonomies. In: Perez-Uribe, R., D. Ocampo-Guzman, N. A. Moreno-Monsalve and W. S. Fajardo-Moreno (Edits.). Handbook of research on management techniques and sustainability strategies for handling disruptive situations in corporate settings. IGI Global. Pennsylvania, PA, United States of America. pp. 378-395. [ Links ]

Angulo R., K. C. 2016. La empresa familiar una temática en desarrollo. Revisión literaria. Oikos Polis, Revista latinoamericana de Ciencias Económicas y Sociales 1(1):175-198. http://www.scielo.org.bo/scielo.php?script=sci_arttext&pid=S2415-22502016000100006. (15 de enero de 2023). [ Links ]

Ayala-Carrillo, M. del R., M. do M. Pérez-Fra y E. Zapata-Martelo. 2020. Conciliación entre el trabajo de cuidados-doméstico y artesanal-familiar en México. La Manzana de la Discordia 15(1):32-62. Doi: 10.25100/lamanzanadeladiscordia.v15i1.8687. [ Links ]

Bailón A., A., M. F. Díaz A., A. I. Luna H., D. B. Mendoza M., I. E. Rubio V. y C. M. Subia A. 2019. Caracterización de empresas muebleras pertenecientes a la Asociación de Fabricantes Muebleros de Durango, Dgo. Revista Ciencia Administrativa 2(1):159-178. https://www.uv.mx/iiesca/files/2019/10/volumen-2ligas.pdf . (25 de abril 2023). [ Links ]

Balderas P., J. J., L. C. Sandoval H., G. E. Nani G., E. D. Portela y F. Sánchez G. 2019. Competitividad y sustentabilidad con un enfoque de calidad en el sector productor de muebles de la región de Misantla, Ver. In: García S., L. E. (Edit.). Congreso Interdisciplinario de Ingenierías. Instituto Tecnológico Superior de Misantla. Misantla, Ver., México. pp. 214-222. https://pmii.itsm.edu.mx/productividad/CII/memoriacii_2019.pdf . (27 de abril de 2023). [ Links ]

Barros, I., J. Hernangómez and N. Martín-Cruz. 2016. A theoretical model of strategic management of family firms. A dynamic capabilities approach. Journal of Family Business Strategy 7(3):149-159. Doi: 10.1016/j.jfbs.2016.06.002. [ Links ]

Basco, R. and M. J. Pérez R. 2009. Studying the family enterprise holistically. Evidence for integrated family and business systems. Family Business Review 22(1):82-95. Doi: 10.1177/0894486508327824. [ Links ]

Camargo P., F. 2017. Dinámica de la producción regional en México. Paradigma Económico 9(2):127-166. https://paradigmaeconomico.uaemex.mx/article/view/9388 . (16 de octubre de 2022). [ Links ]

Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ). 2007. ValueLinks manual. The Methodology of value chain promotion. GTZ. Rome, RM, Italy. 221 p. https://www.fao.org/sustainable-food-value-chains/library/details/en/c/265293/ . (12 de abril de 2023). [ Links ]

Durán H., A., M. R. Gándara y J. M. Cornejo M. 2018. Factores estratégicos del CRM en las Pymes de la ZMG que mejoren su posición competitiva en la industria mueblera. In: Red Internacional de Investigadores en Competitividad (Riico). Red Internacional de Investigadores en Competitividad Memoria del VI Congreso. Riico. Puerto Vallarta, Jal., México. pp. 345-361. https://riico.net/index.php/riico/article/view/428 . (13 de diciembre de 2022). [ Links ]

Escobar C., J. D., J. E. Cañón B., Y. E. Aguilar L., D. B. Asprilla M. y J. C. Maturana G. 2019. Análisis del aprovechamiento sustentable de los residuos de la transformación de madera en dos municipios del Chocó (Colombia). Ingeniería y Desarrollo 37(2):192-211. Doi: 10.14482/inde.37.2.1271. [ Links ]

Forest Trends . 2015. Indonesia’s legal timber supply gap and implications for expansion of milling capacity: a review of the road map for the revitalization of the forest industry, phase 1. Forest Trends. Washington, Washington DC, United States of America. 36 p. https://www.forest-trends.org/publications/indonesias-legal-timber-supply-gap-and-implications-for-expansion-of-milling-capacity/ . (06 de enero de 2023). [ Links ]

García P., S. L., C. S. Juárez L. y T. I. Contreras T. 2020. La administración financiera en las microempresas mexicanas y el autoempleo: caso zona metropolitana Valle de México. Revista de Gestión Empresarial y Sustentabilidad 6(1):33-52. https://rges.umich.mx/index.php/rges/article/view/60 . (23 de enero de 2023). [ Links ]

García V., E. 2010. Fases para el diseño y análisis de la cadena de valor en las organizaciones. Journal of Business, Universidad del Pacífico 2(1):44-71. Doi: 10.21678/jb.2010.28. [ Links ]

González F., A. 2015. La nanoempresa, como forma de organización económica, su reconocimiento para México. Revista Venezolana de Análisis de Coyuntura 21(1):175-186. https://www.redalyc.org/pdf/364/36442240009.pdf . (10 de septiembre de 2022). [ Links ]

Guerrero, J. E., S. Leavengood, H. Gutiérrez-Pulido, F. J. Fuentes-Talavera and J. A. Silva-Guzmán. 2017. Applying lean six sigma in the wood furniture industry: A case study in a small company. Quality Management Journal 24(3):6-19. Doi: 10.1080/10686967.2017.11918515. [ Links ]

Hernández A., M. y A. Pastrana P. 2017. La modularidad como estrategia de innovación: Industria del mueble en México. In: Asociación Latino-Iberoamericana de Gestión Tecnológica (Altec). XII Congreso Latino-Iberoamericano de Gestión Tecnológica. Altec. Coyoacán, Ciudad de México, México. pp. 1-14. http://3.143.189.23/bitstream/handle/20.500.13048/1665/La%20modularidad%20como%20estrategia%20de%20innovaci%c3%b3n%20industria%20del%20mueble%20en%20M%c3%a9xico.pdf?sequence=1&isAllowed=y . (27 de febrero de 2023). [ Links ]

Larsen, F. 2018. Born global firms in the furniture industry. A multiple case study of Scandinavian furniture brands withing the premium segment. Master degree Project. International Business & Trade, University of Gothenburg. Gothenburg, O, Sweden. 110 p. https://gupea.ub.gu.se/bitstream/handle/2077/62158/gupea_2077_62158_1.pdf?sequence=1&isAllowed=y . (8 de marzo de 2023). [ Links ]

Madrigal T., B. E., R. Arechavala V., K. Lozano U. y R. Madrigal T. 2015. Liderazgo y capital social, ejes para consolidar un clúster: CS muebles en Jalisco, México. Revista Global de Negocios 3(1):109-120. http://www.theibfr2.com/RePEc/ibf/rgnego/rgn-v3n1-2015/RGN-V3N1-2015-9.pdf . (13 de abril de 2023). [ Links ]

Medrano-Guerrero, J. E., P. Meza-López, F. J. Hernández y J. A. Nájera-Luna. 2022. Cuantificación y caracterización de los residuos del proceso de aserrío en una fábrica de tarimas en El Salto, Durango, México. Investigación y Ciencia de la Universidad Autónoma de Aguascalientes 30(86):e3599. Doi: 10.33064/iycuaa2022863599. [ Links ]

Ng, B. K. and K. Thiruchelvam. 2012. The dynamics of innovation in Malaysia’s wooden furniture industry: Innovation actors and linkages. Forest Policy and Economics 14:107-118. Doi: 10.1016/j.forpol.2011.08.011. [ Links ]

Norman, M. and K. Canby. 2020. India´s wooden furniture and wooden handicrafts: risk of trade in illegally harvest wood. Forest Trends. Washington, Washington DC, United States of America. 68 p. https://www.forest-trends.org/wp-content/uploads/2020/09/India_Report_FINAL.pdf . (06 de enero de 2023). [ Links ]

Orellana B., D. V. 2022. Factores de gestión empresarial que impulsan la competitividad de las MIPYMES, sector muebles de madera en el sur del Ecuador. Tesis de Doctorado. Facultad de Contaduría Pública y Administración, Universidad Autónoma de Nuevo León. Monterrey, N. L., México. 152 p. [ Links ]

Palacio-Flórez, A., A. Cáceres-Martelo, E. Melamed-Varela, F. Fontalvo-Torres, … y X. Vargas-Ramírez. 2023. Eco muebles, una estrategia para el aprovechamiento de residuos sólidos. Ediciones Universidad Simón Bolivar. Barranquilla, ATL, Colombia. 113 p. [ Links ]

Palos D., H., V. Hernández P. y S. Pineda C. 2008. Propuesta de un modelo de estrategias de diferenciación para la industria maderera. Caso: Empresa ubicada en Zapopan, Jalisco. In: Red Internacional de Investigadores en Competitividad (Riico). II Congreso de la Red Internacional de Investigadores en Competitividad. Riico. Zapopan, Jal., México. pp. 1-19. https://www.riico.net/index.php/riico/article/view/1008/369 . (13 de septiembre de 2022). [ Links ]

Pérez L., C. 2005. Muestreo estadístico. Conceptos y problemas resueltos. Pearson Prentice Hall. Madrid, MD, España. 385 p. [ Links ]

Pimentel, J. L. 2019. Some biases in likert scaling usage and its correction. International Journal of Science: Basic and Applied Research (IJSBAR) 45(1):183-191. https://core.ac.uk/download/pdf/249336645.pdf . (11 de enero de 2023). [ Links ]

Pomar F., S. and G. Martínez V. 2015. Entretejiendo saberes y tradiciones. El caso de dos talleres textiles familiares en la Zona de Valles Oaxaca. Przedsiębiorczość I Zarządzanie 7(1):503-521. http://piz.san.edu.pl/docs/e-XVI-7-1.pdf . (12 de enero de 2023). [ Links ]

Purnomo, H., R. Achdiawan, Melati, R. H. Irawati, … and A. Wardell. 2014. Value-chain dynamics: strengthening the institution of small-scale furniture producers to improve their value addition. Forests, Trees and Livelihoods 23(1-2):87-101. Doi: 10.1080/14728028.2013.875279. [ Links ]

Quintero H., L. H. and D. Martínez G. 2015. Diagnosis to the value chain of the furniture industry of Jalisco, México. In: Asociación Española de Dirección e Ingeniería de Proyectos (Aeipro) (Edit.). 19th International Congress on Project Management and Engineering. Universidad de Granada. Granada, GR, España. pp. 415-426. http://dspace.aeipro.com/xmlui/handle/123456789/587 . (20 de agosto de 2022). [ Links ]

Rodríguez Z., A. 2020. Peruvian timber industry in the time of covid-19: effects and recovery efforts. Forest Trends. https://www.forest-trends.org/blog/peruvian-timber-industry-in-the-time-of-covid-19-effects-and-recovery-efforts/ . (06 de enero de 2023). [ Links ]

Solano-Benavides, E., N. Alandete-Brochero y H. Estrada-López. 2022. Residuos de madera: impacto social, económico y ambiental. Ediciones Universidad Simón Bolivar. Barranquilla, ATL, Colombia. 131 p. [ Links ]

van der Heyden, D. y P. Camacho. 2004. Guía metodológica para el análisis de cadenas productivas. Editorial Línea Andina. Lima, LMA, Perú. 91 p. https://www.avsf.org/public/posts/554/gui-a-metodologica-para-el-analisis-de-cadenas-productivas.pdf . (10 de enero de 2023). [ Links ]

Wärmefjord, K., R. Söderberg, A. Dagman and L. Lindkvist. 2020. Geometrical variation mode effect analysis (GVMEA) for split lines. Procedia CIRP (92):94-99. Doi: 10.1016/j.procir.2020.05.165. [ Links ]

Received: April 26, 2023; Accepted: June 29, 2023

texto en

texto en