Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Revista mexicana de ciencias agrícolas

versão impressa ISSN 2007-0934

Rev. Mex. Cienc. Agríc vol.8 no.1 Texcoco Jan./Fev. 2017

https://doi.org/10.29312/remexca.v8i1.81

Investigation note

Agricultural credit in Mexico

1Colegio de Postgraduados. Carretera México-Texcoco km 36.5. Montecillo, Texcoco, Estado de México, México. CP. 56230. edyg10@hotmail.com.

The present study analyzed the role of credit (granted by commercial banks and development banks) in the agricultural sector, through demand functions of inputs estimated with cost-translog technology. The data are annual from 1970 to 2010 of the variables agricultural gross domestic product (GDP), labor, tractors, threshing machines, phosphate fertilizers, nitrogenous and potassic, the estimation method was apparently unrelated regressions (SUR). The results show that an increase of 0.0035% of credit balances granted by the development bank promotes a 1% increase in agricultural GDP; Also, a 0.011% increase in credit balances granted by commercial banks, result in a 1% increase in agricultural GDP. This implies that a policy that encourages access to credit by development banks or commercial banks may have positive effects on the economic growth of the sector.

Keywords: agricultural GDP; FIRA; FND; SUR; translog cost

La presente investigación analizó el papel que desempeña del crédito (otorgado por la banca comercial y banca de desarrollo) en el sector agrícola, a través de funciones de demanda de insumos estimadas con tecnología de costo translog. Los datos son anuales de 1970 a 2010 de las variables producto interno bruto (PIB) agropecuario, mano de obra, tractores, trilladoras, fertilizantes fosfatados, nitrogenados y potásicos, el método de estimación fue regresiones aparentemente no relacionadas (SUR). Los resultados muestran que un aumento del 0.0035% de los saldos del crédito otorgado por la banca de desarrollo promueven un aumentó 1% en el PIB agropecuario; también, un aumento de 0.011% en los saldos del crédito otorgado por la banca comercial, resultan en un aumento de 1% en el PIB agropecuario. Esto implica que una política que incentive el acceso al crédito de la banca de desarrollo o de la comercial podrá tener efectos positivos en el crecimiento económico de dicho sector.

Palabras clave: costo translog; FIRA; FND; PIB agropecuario; SUR

Introduction

The credit originated by the agricultural sector is commercial banking and development banking. For commercial banks, this sector represents a greater risk compared to other sectors of the economy, so the Mexican State must participate directly and through public policies that encourage access to credit for a greater number of producers.

The institutions that provide credit to the Mexican agricultural sector are the National Finance Agricultural Development, Rural, Forestry and Fisheries (FND), Financial Intermediaries Banking (IFB) and not Bank, the Instituted Trusts in Relation to Agriculture (FIRA), and to a lesser extent the National Bank of Foreign Trade, SNC (Bancomext), Nacional Financiera, SNC (NAFIN), Sociedad Hipotecaria Federal, SNC (SHF), National Savings and Financial Services Bank (BANSEFI), and National Bank of Works and Services Public, SNC (BANOBRAS).

The Inter-American Development Bank (BID) (1999) recognizes that the lack of services and deep financial markets hinders the formation of new enterprises and the expansion and modernization of existing ones, and contributes to income inequality. Terrones and Sánchez (2010) estimated labor demand functions, tractors, threshing machines, commercial and development bank credit, nitrogen fertilizers, phosphates and potasics, of which the credit demand function of development banks and commercial banking turned out to be inelastic, and had a direct relationship with production, this study does not suppose separability of the factors, and concludes that both banks are substitutes.

In order to boost the development of the agricultural sector, credit has always been considered as one of the main factors. The ratio of credit to agricultural GDP has been increasing from 1970 (5% of GDP) to 2013 (28.5%). However, it is not inclusive for all producers in the sector; and attempts to measure the impact of credit in the agricultural sector are few and with unclear results. However, the bank offers resources at a price; the producers require liquidity services and are willing to pay an interest, this situation justifies the present investigation with the purpose of providing a further result in the measurement of the impact of credit in the agricultural sector, contributing some characteristics of this market i.e. if the demand for credit in the agricultural sector is elastic or inelastic.

The objective of this research is to analyze the role of credit in this sector, according to the source of funding (commercial banking or development banking) relating it through 8 functions of input demands derived from a cost function Translog -which is a second order logarithmic approach to any arbitrary cost function (Berndt and Christensen, 1973)-, with agricultural GDP, labor, tractors, threshing machines, phosphate fertilizers, nitrogen fertilizers and potassic fertilizers. It was hypothesized that credit granted to the agricultural sector is directly related to GDP; the demand functions of credit provided by commercial banks and development banks are inelastic at their own price; and behave in a complementary way in the demand for credit from the agricultural sector.

The annual data series from 1970 to 2010 were used, for the variables: agricultural GDP, price and quantity of credit balances of development banks and commercial banks (FAO, FIRA, FND and Banxico), the economically active population (INEGI), of tractors, of threshing machines; and phosphate, nitrogen and potassium fertilizers (FAO). To carry the series at constant prices was used the National Index of Consumer Prices (INPC) base 2010, and to convert to pesos the data in dollars was used the exchange rate (Banxico). The quantity and the amount of tractor imports (FAO) were used to calculate the tractor price.

In order to obtain the input demand functions, we started with a cost function translog expressed as:

Where: i, j= 1, ..., N= N different inputs considered with γij= γji; C= total cost; Y= production; Pi’s= input prices; ln= logarithm.

We assume homogeneity of degree one in prices, which implies that only N-1 of the participation equations are linearly independent, and consequently the following restrictions apply:

Varían (2014); by Shephard’s lemma, the derived demand functions for each input are obtained by partially differentiating the cost function from the prices of each input ∂C(∙)/(∂Pi )=Zi. In its logarithmic form, it is expressed as:

where:

si

then

The restrictions of homogeneity of degree one in prices are imposed under the restriction of ∑ i Si= 1.

Once the demand functions were estimated, Allen’s partial substitution elasticities were calculated between two inputs i and j Uzawa (1962), which measure the percentage change in input ratios due to a one percent change in their prices (σij> 0) and complementarity (σij< 0) among the inputs of the production. For the translogarithmic model, this implies (Salgado and Bernal, 2007):

Where: σij= is the elasticity Allen-Uzawa (1962).

In addition, price and cross-price elasticities of input demand were calculated, which measure the change in input demand i with respect to changes in price or changes in the price of input j; if (|ƞii|> 1) then the input i is elastic and if |ƞii|< 1 then the input i is inelastic; if (ƞij< 0)then the input i and j are complementary and if (ƞij> 0 ) then the input i and j are substitutes. The calculation was made as follows (Salgado and Bernal, 2007).

It is assumed, functional separability, which plays an important role in aggregate heterogeneous products and inputs. If production functions can be separated into subfunctions, then the relative intensities in the use of these factors can be optimized (and analyzed) separately from the rest of the productive factors (Berndt and Christensen, 1973). To estimate the input demand functions, the statistical analysis system (SAS) was used, using the seemingly unrelated regressions procedure (Syslin Sur) (Greene, 2012).

To validate each of the estimated parameters of the input demand functions the statistical test of t was used (Greene, 2012).

In the credit granted by the public sector in 2014, FIRA participated with 48% of the total granted to the agricultural sector. In second place the FND participates with 19%, and another 2% among them Bancomext, Nafin, SHF, Bansefi and Banobras.

The input demand functions that were estimated are: development bank credit Sd, credit from commercial banks Sc, labor (Sw), tractors (St), threshing machines (Sr), phosphate fertilizers (Sf), nitrogen fertilizers (Sn), and Potassium (Sp).

In the case of credit granted by development banks and commercial banks, the estimators are statistically significant individually with 95% confidence, and indicate that the 0.0035% increase in credit balances granted by the banking development may lead to a 1% increase in the GDP of the agricultural sector. Likewise, a 0.011% increase in credit balances granted by commercial banks may encourage a 1% increase in the GDP of the agricultural sector.

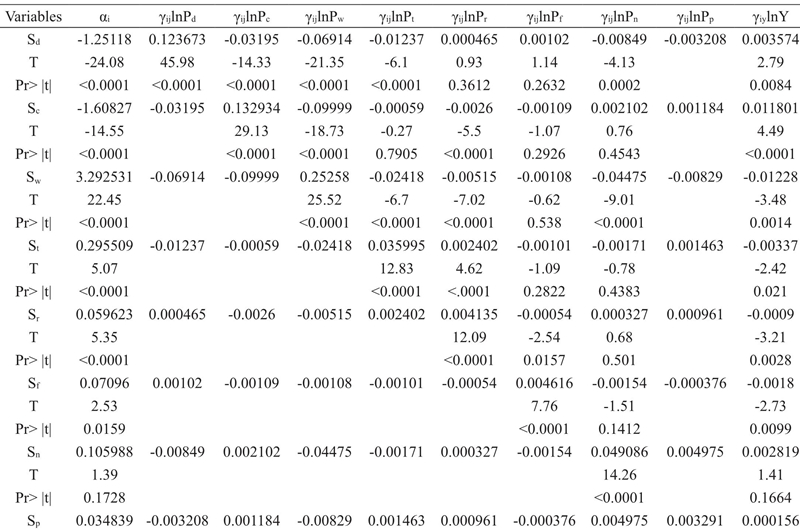

Considering α= 0.05, n-k= 41-7= 34 degrees of freedom, we have t 0.025= 2.0322, situation under which in 30 estimators the value of |tc |> tα/2, so we reject Ho and we conclude that they are statistically significant at 95% reliability; and three more estimators are at 80% reliability (Table 1).

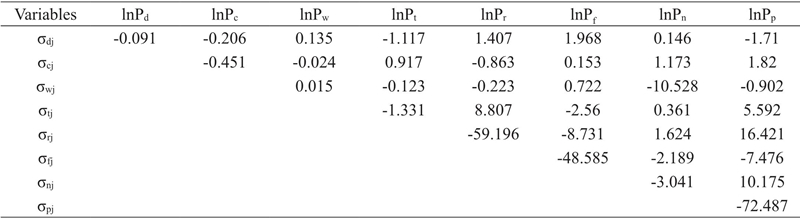

The Allen-Uzawa elasticities

For the credit demand of development banks, the results show that they are substitutes from lower to higher grade (from 0.135 to 1.96) with labor, nitrogen fertilizers, threshing machines and phosphate fertilizers; And complementary from lower to higher grade (from -0.206 to -1.71) with credit from commercial banks, tractors, and potash fertilizers. These results, in comparison to those of Terrones and Sánchez (2010), who estimated their own and Allen Uzawa’s elasticities, coincide, except for the phosphate and threshing fertilizer inputs, which for them were complementary, and with the bank credit input commercial where it turned out to be a substitute.

For commercial bank credit demand, the results show that they are substitutes from lower to higher grade (from 0.153 to 1.82) with phosphate fertilizers, tractors, and nitrogen and potassium fertilizers; And complementary from lower to higher grade (from -0.24 to -0.223) with labor, credit from the development bank and threshing machines.

These results, in comparison with those of Terrones and Sánchez (2010), coincide, except in the labor inputs and credit of the development bank, which for them turned out to be substitutes.

For labor demand, they are substitutes from lower to higher grade (from 0.135 to 0.722) with credit from development banks and phosphate fertilizers; and complementary from lower to higher grade (from -10.52 to -0.024) with credit from commercial banks, with tractors, threshing machines, and potassium and nitrogen fertilizers. These results, in comparison with those of Terrones and Sánchez (2010), coincide, except in the input phosphate fertilizers which for them turned out to be complementary, and with the input of commercial bank credit and potassic fertilizers, where for them be a substitute (Table 2).

For the demand of tractors, they show that they are substitutes from lower to higher grade (from 0.361 to 8.8) with nitrogen fertilizers, credit from commercial banks, potash fertilizers and threshing machines; and complementary from lower to higher grade (from -2.56 to -0.123) with labor, credit from development banks, and phosphate fertilizers. These results, in comparison with those of Terrones and Sanchez (2010), are coincident, except for the input of commercial banking credit where for them it turned out to be complementary.

Price elasticity and demand elasticity

In the case of development bank credit granted to the agricultural sector, it indicates that it is inelastic to its price (-0.013), and substitute from lowest to highest grade (from 0.01 to 0.073) with nitrogen fertilizers, threshing machines, phosphate fertilizers and labor; and complementary from lower to higher grade (from -0.037 to -0.014) with potassium fertilizers, tractors and credit from commercial banks. These results, in comparison with Terrones and Sánchez (2010), coincide, except in the phosphorus fertilizer input which for them turned out to be complementary, and with commercial bank credit and with potassium fertilizers where they turned out to be substitutes.

For the commercial bank credit granted to the agricultural sector, they imply that it is inelastic to its price (-0.081), and substitute from lowest to highest grade (from 0.015 to 0.079) with phosphate and potassium fertilizers, tractors, and fertilizers nitrogenous; And complementary from lower to higher grade (from -0.037 to -0.007) with threshing machines, labor and development bank credit. These results, in comparison with those of Terrones and Sánchez (2010), coincide, except in the credit of the development bank which for them turned out to be a substitute.

For labor, they show that it is inelastic at its price (0.008), substitute from lowest to highest grade (from 0.005 to 0.073) with phosphate fertilizers, and credit from development banks; is complementary from lowest to highest grade (from -0.711 to -0.002) with threshing machines, tractors, potassium fertilizers, commercial bank credit, and nitrogen fertilizers. These results, in comparison with Terrones and Sánchez (2010), coincide, except in the phosphorus fertilizer input which for them turned out to be complementary, and with commercial bank credit and with potassium fertilizers where they turned out to be substitutes.

For tractors, they say that it is inelastic at its price (-0.053), and substitute from lowest to highest grade (from 0.024 to 0.068) with nitrogen fertilizers, commercial bank credit, potash fertilizers and threshing machines; and complementary from lower to higher grade (from -0.044 to -0.005) with labor, phosphate fertilizers and credit from development banks. These results compared with Terrones and Sánchez (2010), coincide, except for the sign of the elasticity of the tractors with respect to their own price, for them turned out to be positive (Figure 3).

The results support the hypothesis raised that indicates the existence of a positive relationship between credit and agricultural GDP, it was also observed that the demand functions of credit inputs granted by commercial banks and private banks are inelastic at their own price and that the financing granted by these banks is complementary to each other.

Conclusions

The credit granted to the agricultural sector directly affects the agricultural GDP, which implies that the higher the credit, the higher the GDP growth in the sector. This means that a public policy that encourages greater credit balances for the agricultural sector will allow better rates of growth in agricultural GDP.

The demand for credit inputs from development banks and commercial banks are inelastic at their own price. This implies that a public policy of lower rates encourages access to credit, but is not sufficient to generate significant impacts on the growth of credit balances.

Given that the loans granted by commercial banks and development banks behave as complementary inputs, a well-directed public policy that encourages the granting of credit to the agricultural sector must involve the private sector and the public sector. However, the results obtained show that a policy that encourages credit through commercial banking is more efficient than directly incentivising it through development banks.

Literatura citada

Berndt, E. and Christensen, L. 1973. The translog function and the substitution of equipment, structures and labour in U.S. manufacturing 1929-1968. J. Econ. 1:81-114. [ Links ]

Greene, H. W. 2012. Econometric analysis econométrico. 7ma edición.Pretince Hall, S. A. Boston, MA, USA. 1951 p. [ Links ]

Ortiz, E.; Cabello, A. y de Jesús, R. 2009. Banca de desarrollo-microfinanzas-, banca social y mercados incompletos. Análisis Económico Azcapotzalco, México. 24(56):99-128. [ Links ]

Salgado, B. H. y Bernal, V.L.E. (2007). Funciones de costos translogarítmicas: una aplicación para el sector manufacturero mexicano. Documentos de investigación Banco de México.2007-08:1-33. [ Links ]

Terrones, C. A. y Sánchez, T. 2011. Demandas de insumos de la producción agrícola en México 1975-2011. Universidad y Ciencia Trópico Húmedo. 26:81-91. [ Links ]

Varian, H. R. 2014. Intermediate microeconomics: a modern approach.9a (Ed.). W. W. Norton and Company, USA. 832 p. [ Links ]

Uzawa, H. 1962. Production functions with constant elasticities of substitution. Review of Economic Studies. 29:291-299. [ Links ]

Received: February 2017; Accepted: April 2017

texto em

texto em