Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Revista mexicana de ciencias agrícolas

versión impresa ISSN 2007-0934

Rev. Mex. Cienc. Agríc vol.7 spe 15 Texcoco jun./ago. 2016

Articles

Factors that explain the permanence of rice production in Mexico

1Centro de Investigaciones Económicas, Sociales y Tecnológicas de la Agroindustria y la Agricultura Mundial (CIESTAAM)- Universidad Autónoma Chapingo (UACH). Carretera México-Texcoco, km 38.5, Chapingo, Estado de México. C. P. 56230. (arely8710@hotmail.com; jreyesa@ciestaam.edu.mx; icovag@gmail.com; manrrubio2050@gmail.com.mx).

2Instituto Nacional de Investigaciones Forestales, Agrícolas y Pecuarias (INIFAP)-Campo Experimental Valle de México. Carretera los Reyes-Texcoco, km 13.5, Coatlinchán, Texcoco, Estado de México, C. P. 56250. (ayala.alma@inifap.gob.mx)

In Mexico, during 2000- 2012 rice it has experienced decreased production and increased surface and imports. Yet there are states where the surface has been increased. The aim of this study is to analyze the network of value rice in Campeche, Morelos and Michoacan explaining its structure, level of coopetition and power among actors to identify factors that explain the production trends in these states. The 43 interviews were conducted during 2012 and 2013 the main players, obtaining information from state rice and each network environment. It was found that the Company Food Corporation in the Field in Campeche and Michoacan, taking roles as a customer, supplier and competitor. As a supplier of contract farming producer establishes and provides improved seed technology package and credit, the company CAC is reviving and redesigning rice production. Morelos began to generate a market niche as an ingredient in gourmet national cuisine.

Keywords: Oryza sativa L.; competition; gourmet ingredient; reactivation of production; value network

En México, durante 2000- 2012 el arroz ha experimentado disminución en superficie y producción e incrementó en importaciones. Aun así existen estados donde se ha aumentado la superficie. El objetivo de éste estudio es analizar la red de valor arroz en Campeche, Michoacán y Morelos explicando su estructura, nivel de coopetencia y poder entre actores para identificar los factores que explican las tendencias de la producción en estos estados. Se realizaron 43 entrevistas durante 2012 y 2013 a los principales actores, obteniendo información del entorno estatal arrocero y de cada red. Se encontró que la empresa Corporación Alimentaria del Campo en Campeche y Michoacán, toma roles como cliente, proveedor y competidor. Como proveedor del productor establece agricultura por contrato y aporta semilla mejorada, paquete tecnológico y crédito, así la empresa CAC está reactivando y rediseñando la producción arrocera. Morelos comenzó a generar un nicho de mercado como ingrediente gourmet en la cocina nacional.

Palabras clave: Oryza sativa L.; competencia; ingrediente gourmet; reactivación de la producción; red de valor

Introduction

According to the Commercial Information System via the Internet of the Ministry of Economy (SIAVI-SE, 2014) between the period 2000- 2012, there has been an increase in imports of paddy rice and husked. However, in a context of decreasing surface and therefore rice production, there are states where is increasing. Such behavior calls attention to what arises analyze it, trying to find the factors that causes the surface to increase production and stay in these places. This research is performed in outstanding rice production states such as Michoacan, Morelos and Campeche as a whole have contributed during 2010- 2012 to 41% in harvested area and production (SIACON-SAGARPA, 2013). Thus the aim of this study is to analyze the network of value rice in Campeche, Morelos and Michoacan explaining its structure, the level of coopetition and power among actors to identify factors that explain the production trends in these states.

A study by the National Institute of Forestry, Agriculture and Livestock (INIFAP, 2012), focused on identifying areas with high agro-ecological potential and a half in Mexico for several crops, including rice. In the case of cereals, 3 135 978 hectares fell within the range of high productive potential, located in 16 states and protruding Veracruz, Nayarit, Guerrero, Campeche, Yucatan, Tabasco and Michoacan. Other studies analyzed rice crop competitiveness, Iretas-Paredes et al. (2011) in the southern state of Morelos region through the chains approach, dialogue and action (CADIAC) and showed the inability to compete most rice producers with imported rice and helped to identify the alternative strategy of product differentiation for its culinary quality through an appellation of origin. In 2014 (Tolentino) also investigated the production of rice in the state of Morelos through the approach of localized agri food systems (SIAL), concluding that rice production contribute directly to local development and territorial anchoring based on the particularities productive land and know-how of its producers.

Materials and methods

The value network is a form of organization specialized in an activity in common production system, characterized by non-economic territorial concentration of its economic actors and other institutions in developing ties of economic nature and contribute to the creation of wealth, both its members and its territory. Consider the importance of territory, interaction and cooperation between the actors in the network, and companies and sectors are seen as part of a system or network that determines its mode of operation and results (Nalebuff and Brandenburguer, 2005; Muñoz and Santoyo, 2011). The value network is made up of the tractor company that goes to the center of the network and who has the power to set the dynamics of the value network. It is surrounded by the links of customers and suppliers in more competitors and completer on the horizontal axis vertical axis, and interdependencies between each other (Figure 1). A player within the network can play multiple roles within it.

In Mexico the value network instrument has been used in some studies to understand the problem of agricultural products. Is the one by Flores and Muñoz in 2005 generating a proposal for local development of the food chain rice in Campeche. There is also the Lopez et al. (2010) in which the strategies to be adopted by the meat industry are analyzed. Similar approach is used by Macías in 2009, meshes global value is used in the production of vegetables, which also identifies not only economic relations and stressed the importance of the intermediary in this.

Another similar study in the world is Demont (2013), which analyzed a set of strategies taken in african countries from the effects of the food crisis in 2008. Concluding that is necessary to promote physical and internal market infrastructure, adding value rice to make it more competitive than imported rice, not only in terms of prices but intrinsic characteristics and extrinsic quality attributes cereal. As part of analyzing the dynamics of international and domestic rice production were calculated, the effects of surface and production performance according to methodology FAO (1994). It was done with the main producers, exporters and including Mexico as outstanding importing countries. The effects Michoacan, Campeche and Morelos, which are the states of study were also calculated. The surface performance and the combined effect of surface and performance effects were obtained through expression for each TMAC.

The surface effect is obtained for the year n (year of study) to maintain constant yields and prices and only varies the surface:

In effect performance remains constant both the surface and varies only prices and performance:

Where: ES= effect surface; ER= effect performance; If (j)= area of study year; Ri(0)= Performance base year; Pi(0)= price of the base year; if (0)= surface of the base year; Ri(0)= Performance year under review; and n = number of years of study.

The combined effect results from the interaction of performance and effect surface effect:

EC= ES *ER.

The sum of the three effects TMAC explains the variation in production, so it fulfills

ES + ER + EC= TMAC of variation in production.

The information states study was obtained through two types of semi-structured interviews targeting the key players in the network of value rice. The visited the processor, credit providers such as Trust Funds to Agriculture (FIRA), input suppliers and commercial houses of agrochemicals, research institutions such as the National Institute of Forestry, Agriculture and Livestock (INIFAP) industry, PRODUCE foundations, and rice producers. The information was obtained from the first interview was the rice state environment, as the start of operations, its characteristics, the importance of their activity. A total of 25 interviews were conducted during May 2012 in Campeche, Michoacan june 2012 and december 2012 and january 2013 in Morelos. The second interview, allowed to obtain data on the value network, to identify the problems perceived in the state environment rice, its causes and possible solutions. The gathering of information began in 2012 and was completed in august 2013, getting eighteen interviews.

Results

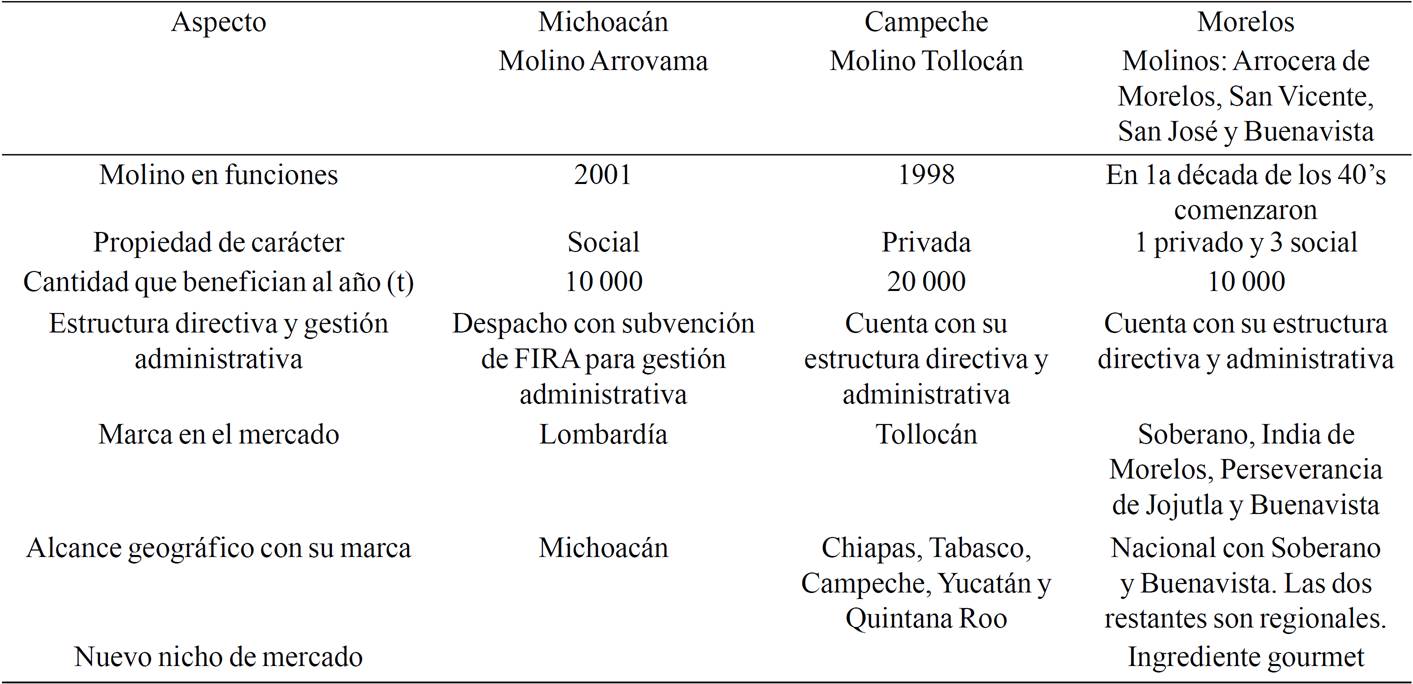

The field Information was designed Table 1, in which the characteristics of the production of the three stages of study are shown. In which it highlights the differential hectares dedicated to the cultivation of cereal producer in each state, land availability, production scales and different technological needs of each place. In Campeche and Michoacan is an intensive land use as a second crop is obtained is called soca that regrowth of new stems and leaves that arise after the rice harvest. It was found that the technology packages proposed by INIFAP, are modified by the producers attending their economic, knowledge of the culture or attacking a problem of pests and diseases. In Morelos some producers who also grow cane, apply the "cane" abundance fertilizer to rice, seeking to reduce production costs.

In Michoacan and Campeche rice farmers through the National Council of Rice Producers of Mexico, A.C. in coordination with the Latin American Fund for Irrigated Rice (FLAR) they met and adopted the agronomic management accurately rice cultivation with irrigation, based in six key points. These are the planting date according to the selection of varieties, planting density, treatment of seeds with fungicides, weed control in the early stage, fertilization at the right time and water management by establishing a sheet constant water. For information michoacanos producers have had good results, as they have reached up to 10 t ha-1.

The variety mainly planted in Campeche and Michoacan is Filipino Milagro, was introduced in Mexico in 1967. It is grown intensively and extensively, with seed obtained without a selection process which has caused it has degenerated mixtures and you cross mainly with red rice. INIFAP has generated two more varieties from Filipino Miracle: Miracle Hearty and Silverio (García et al., 2011). The state of Morelos has specific varieties (Table 1) and the use of appropriate technology package contributes to high yields obtained (10 t ha-1).

Field of information and building networks value Table 2 showing the differences and similarities of these are designed. For mills Campeche and Michoacan is a common competitor is the company Campo Food Corporation (CAC) and buying the paddy rice producers in the region and invades the regional market with its rice brands. In the case of Morelos, its competitors are all benefiting coarse rice mills as they compete for the market.

In Michoacan they include providers of producers who are parafinancial AFM AGRO S.A. of C.V. and Agromich S.A. of C.V. supporting the seed and inputs, in addition to advice technically because they have research centers where constantly analyze the control of pests, diseases and applying fertilizers.

Although there is a link with academic institutions in the three states of study, excels in Michoacan generation research with Universidad Michoacana de San Nicolás de Hidalgo and INIFAP serving mainly technical and market problems. While in Morelos as well as public academic institutions, stands the relationship with the private academic institution like the Universidad del Valle de México Campus Cuernavaca and Universidad La Salle Cuernavaca, supporters looking them ways to boost the market niche as an ingredient gourmet rice Morelos state. They have also participated in research related to rice, Universidad Autónoma Chapingo, the Colegio de Postgraduados, the Universidad Autónoma del Estado de Mexico, the Instituto Politécnico Nacional and the Universidad del Valle de Mexico.

When analyzing the tractor company (Table 3), stands the recent activity benefited from the mills of Michoacan and Campeche, otherwise they are mills in the state of Morelos where the great tradition is observed through the years to the benefit of rice. However, each of the mills has its recognized brand of rice in the regional or national market, which pays off economically while still selling them in bulk polished rice.

Having a mill belonging to the management structure and administrative management shows strengthened their organizational capacities and this allows them to identify what actions should be implemented to continue to market. Ruiz (2002) defines organizational capabilities as the forces that allow you to compete and give it a competitive advantage, provided they are difficult to imitate, also mentions that the strategic possibilities increase in direct relation to strengthening organizational capacities.

The rice of Morelos state has earned the designation of origin which is the name of a geographical region of the country which serves to designate a product originating therein, the quality or characteristics are due exclusively to the geographical environment, comprising therein factors natural and human (Ministry of Economy, Industrial Property Law Article 156). One of the advantages of owning an appellation of origin is that the product has an added value that is reflected in the price, and the strengthening of a brand is placed in niches exclusive markets (collective marks and appellations of origin, 2010). Morelos is working on creating a new niche market, taking advantage of their culinary qualities, it is presenting the state of Morelos rice as an ingredient in gourmet cooking. In Temixco, Morelos the First Forum of the Designation of Origin "Morelos State Rice" was held during the 28 and 29 november 2012, which in formally start generation niche as gourmet ingredient.

The creation of this new market space is called a blue ocean by Chan and Mauborgne (2005) and is defined as an untapped market space and creating demand and opportunities for highly profitable growth. Since all known areas of the market are a red ocean and the borders of these industries are defined and accepted and the rules of the game are known. As the market space for competition between existing companies is saturated, prospects for profitability and growth are reduced. The products become generic competition to death and blood stained the water red ocean.

According to fieldwork, mills benefit the rice grain according to the characteristics that customers demand them, as this may be integral or polished and with different percentages of integers. A key aspect is the consumer, whose demand is based on their tastes and preferences. In reviewing the results of the National Survey of Household Spending (ENGASTO) by INEGI in 2012, in which the expense is done in homes it is collected. The data showed that rice remains important in the food consumed in Mexican homes, as represented 0.77% slightly higher than the pasta was 0.61% of a total for food products 971 906 871 pesos. In another recent study (Retes et al., 2014) found that rice is a substitute omelet for the middle class in Mexico.

The providers rice mills are the producers of each entity. For information on the Mexican Rice Council A. C. it is estimated that in the state of Michoacan there are approximately 280 producers of rice, 160 producers in Campeche and 120 in Morelos. In the case of mill stands Tollocan its relationship with Kronos Rancho S. A. of C. V., who solves technical problems crop, marketing and boost rice production. When missing palay rice to meet all of its customers, uses import from the United States of America (Direct Information Field, 2012). In Michoacan, the mill has partners that will deliver the harvested rice, similar situation occurs in Morelos.

The credit provider is very important because when given in a timely manner contributes to the smooth development of the activities of the crop. Rice producers have been subject credit FIRA with a key sector risk (CRS) B3, a situation that was damaged with the collapse of the trading of rice Covadonga in 2011 (Barranco, 2011) leaving hundreds of rice farmers without power settle their debts with the institution. Currently the rice activity CRS B3 has a meaning that is an appropriate industry because even shows some weaknesses in growth and financial indicators, such weaknesses can be corrected in the short term (FIRA, 2014). For states study, both Michoacan and Morelos reached CRS B-3, not the state of Campeche who earned a CRS C-1 which means that it is an inadequate industry and showing some significant weaknesses in growth and financial indicators, although the deterioration of the industry is considered temporary (FIRA, 2013-2014). The mills are turning to commercial banks as Bank of Bajio and Bancomer addition to the Multiple Purpose Financial Companies (SOFOM) to obtain credit and disperse after their producers.

For information obtained in the field of Michoacan and Campeche, the company is known CAC, plays an important role in rice states where contract farming states. Providing not only certainty in buying the product, but also provides them with a technical in the culture, they indicated a technological package, seed and credit. Upon receiving the seed and a technology package, the integrated farmer is likely to improve product quality as this directly affects the quality of the product (Perez et al., 2004). CAC also looks after the harvest is done in the optimal stage of cereal, assuring that the quality of paddy rice and therefore better performance conditions in whole mill. With the value network it shows that the production of thick and thin rice in Mexico is being revived and redesigned in states with rice CAC potential for the company.

In Mexico, within the completer for rice production we have INIFAP, who has played an important role in the states of Campeche, Morelos and Michoacan to generate varieties and be closely with the producer to make the process of technology transfer. Staff in Michoacan Uruapan Experimental attends meetings System Product Rice month after month are performed in the municipality of Gabriel Zamora. In the case of Morelos the Experimental Zacatepec, it has been present in the generation of suitable varieties for the state, in the process of obtaining the designation of origin, now in the Regulatory Board and the Official Standard for Rice state of Morelos. There are also the Ministries of Agriculture of each state, since their activities support and boost rice production.

Competitors rice rice mills, is any rice that can access the area of influence of the mill. Competitors in the world are all rice exporting countries either as rice or polished. For information SIAVI-SE, imports of rice and polished rice is known to Mexico come mainly from the United States of America, Uruguay, Italy and Colombia.

By observing the behavior that has rice production through the impact area and yield, with the proposal of the FAO (1994) for the periods 2000-2002 and 2010-2012 (Table 4).

Table 4. Participation of factors in the behavior of rice production of major producers and exporters of rice, as well as suppliers of Mexico for the periods 2000-2002 to 2010-2012.

The effect is obtained that a whole surface explains the growth of cereal production, which is observed in the production of Uruguay, Thailand, India and Colombia. In addition to increasing the surface, the eastern countries such as Thailand, Indonesia and China have been busy introducing improved seed with technological packages for rice growing regions (Research Institute of Thailand Development 2013, 8 steps to reduce production costs, 2556; bill to strengthen agricultural research and extension 2013). In the case of Mexico its performance effect is positive, and is a response to the existence of suitable technology packages for rice-growing areas generated by INIFAP, and producers apply best according to their economic circumstances.

In calculating the effects of the factors of production (FAO, 1994), reviewing Table 5, stands the most influential factor in rice production was increased performance, highlighting Michoacán.

Table 5. Participation of factors in the behavior of rice production of Campeche, Michoacán, Morelos and nationally for the periods 2000-2002 to 2010- 2012.

Meaning that rice farming is done intensively, with improved seed, pest and diseases and weeds; which has allowed increasing yields and production will be maintained. While the surface in the country in general has declined, the study by INIFAP in 2012 identifying potential areas for rice production, supports the importance of the permanence of their culture. The state of Campeche has availability of water for irrigation from the Usumacinta necessary condition for growing river. Allowing leverage the potential of land located outside or near the river, provided there is the necessary for planting existing land water infrastructure.

Among the links found on the net value, stands the relationship with the company producer CAC. Creating an atmosphere of full communication and trust with the rice producer, plus the certainty that it will be a positive relationship for both. Since it makes an appearance since the contact begins to establish contract farming and throughout the production process and rice harvest, ending with the payment of the yield of paddy rice. By understanding a system of values achieved, we have an important condition for improving the sustainability of collaborative networks, it is the shared understanding between the different actors network (Camarinha-Matos and Macedo, 2010).

The network of value rice Morelos excels with coopetition, and cooperating to solve their problems and to the market competing for him, flaunting terroir and presentations of gourmet rice. Studies Minten et al. (2012) and Demont (2013) found that the rice to be competitive price plus value should be added through intrinsic characteristics and extrinsic quality attributes.Aspects that are present in Morelos and have contributed to strengthen the network of value rice to go under coopetition identifying the best solutions to the problems of production, markets and marketing.

Conclusions

The integration of the different components of the value network strengthens the permanence in production, to promote communication and thus meet the market trend, if the state of Morelos.

In the state of Morelos it is observed that rice has the option to continue to prosper, since all the actors together are driving the creation of a new market niche as a gourmet ingredient, or through the protected geographical indication strengthened with the designation of origin rice Morelos state.

The work done by food corporation del campo, demonstrates the need for an approach of agro-producer rice, as well a paddy rice that satisfies the mills for their performances in whole and producer is benefited by delivering a better rice is obtained palay and with better payment for their crop.

Key to the success of the rice agro-industries and producers in the country, is the constant updating of technology packages in each region and its implementation. Bringing decrease in production costs, better postharvest handling and therefore higher yield of whole mill.

Literatura citada

Barranco, A. 2011. Covadonga: fraude del siglo. http://www.eluniversal.com.mx/columnas/88894.html. [ Links ]

Camarinha-Matos, L. M. y Macedo, P. 2010. A conceptual model of value systems in collaborative networks. J. Intell. Manuf. 21:287-299. [ Links ]

Chan, K. W. and Mauborgne, R. 2005. La estrategia del océano azul. Cómo desarrollar un nuevo mercado donde la competencia no tiene ninguna importancia. Grupo Editorial Norma. Bogotá, Colombia. 334 p. [ Links ]

Demont, M. 2013. Reversing urban bias in Africa rice markets: a review of 19 national rice development strategies. Global Food Security. 2(3):172-181. [ Links ]

FAO. 1994. La política agrícola en el nuevo estilo de desarrollo latinoamericano. Santiago de Chile, Chile. 675 p. [ Links ]

FAO. 2014. Estadísticas- FAOSTAT: trade and production. http://faostat.fao.org/. [ Links ]

FIRA. Calificación de riesgo sectorial. Edición 2013-2014. http://www.fira.gob.mx/InfEspDtoXML/TemasUsuario.jsp. [ Links ]

Flores, V. J. J. y Muñoz, R. M. 2005. Propuesta para el desarrollo local de la cadena alimentaria de arroz en Campeche: red de innovación tecnológica e integración de productores a la agroindustria. Centro de Investigaciones Económicas Sociales y Tecnológicas de la Agroindustria y la Agricultura Mundial (CIESTAAM). Universidad Autónoma Chapingo (UACH). 52 p. [ Links ]

García, A. J. L.; Hernández, A. L. y Tavitas, F. L. 2011. El Silverio: nueva variedad de arroz para el trópico mexicano. Rev. Mex. Cienc. Agríc. 2(4):607-612. [ Links ]

TD RIA. 2013. Resumen del proyecto estratégico Arroz Investigación y desarrollo de arroz de Tailandia. http://thaipublica.org/2013/10/tdri-thailands-rice-strategy/. [ Links ]

INEGI. 2013. ENGASTO. Encuesta Nacional de Gastos de los Hogares 2012. http://eee3.inegi.org.mx/sistemas/tabuladosbasicos/tabdirecto.aspx?s=est&c=33627. [ Links ]

INIFAP. 2012. Potencial productivo de especies agrícolas de importancia socioeconómica en México. Publicación Especial Número 8. Primera edición. Xalapa, Veracruz, México. 140 p. [ Links ]

Ireta-Paredes, A. R.; Garza-Bueno, L. E.; Mora-Flores, J. S. y Peña- Olvera, B. V. 2011. Análisis de la competitividad de la cadena del arroz (Oriza sativa) con enfoque CADIAC, en el sur de Morelos, México. Agrociencia. 45: 259-265. [ Links ]

López, P. M. G.; Muñoz, R. M.; Leos, R. J. A. y Cervantes, E. F. 2010. Innovación en valor en la industria cárnica bovina mexicana: estrategias que adoptan los líderes de mercado. Rev. Mex. Cienc. Pec. 1(4):417-432. [ Links ]

Macías, M. A. 2009. Mallas de valor global en la agricultura de hortalizas en México. El caso de Sayula, Jalisco. Reg. Soc. 21(46):113-144. [ Links ]

Minten, B.; Murshid, K. A. S. and Reardon, T. 2012. Food quality changes and implications: evidence from the rice value chain of Bangladesh. World Development. 42:100-113. [ Links ]

Muñoz, R. M. y Santoyo, C. V. H. 2011. La red de valor: herramienta de análisis para la toma de decisiones de política pública y estrategia agroempresarial. Centro de Investigaciones Económicas Sociales y Tecnológicas de la Agroindustria y la Agricultura Mundial (CIESTAAM). Universidad Autónoma Chapingo (UACH). Texcoco, Estado de México. 16 p. [ Links ]

Nalebuff, B. J. y Brandenburger, A. M. 2005. Coo-petencia. Grupo Editorial Norma. Bogotá, Colombia. 432 p. [ Links ]

Pérez, G. A. M.; Oreja, R. J. R. y Dávila, G. E. 2004. La calidad en la cadena de valor del producto agroalimentario. Diferencias percibidas entre el agricultor individual y el asociado. Investigaciones Europeas de Dirección y Economía de la Empresa. 10(1):69-91. [ Links ]

Propuesta de ley sobre el fortalecimiento de la investigación y extensión agrícola. 2013. http://www.mj.org.cn/mjzt/2012nzt/2012lh/2012lhtafy/201203/t20120301_135329.htm. [ Links ]

Retes, M. R. F.; Torres, S. G. y Garrido, R. S. 2014. Un modelo econométrico de la demanda de tortilla de maíz en México, 1996-2008. Estudios Sociales. 22(43): 37-59 [ Links ]

Ruíz, G. C. 2002. Capacidades organizacionales ¿Dónde y cómo se genera valor en las empresas? http://issuu.com/siperws/docs/258#. [ Links ]

Secretaría de Economía (SE). 2010. Las marcas colectivas y las denominaciones de origen .wipo_geo_lim_11_6-2_do se café y vainilla 2010.pdf (consultado octubre, 2014). [ Links ]

SE. 2013. Instituto Mexicano de la Propiedad Industrial- Ley de la Propiedad Industrial. http://www.impi.gob.mx/temasinteres/paginas/ley_de_la_propiedad_industrial_2.aspx. [ Links ]

SE-SIAV. 2014. SIAVI 4. http://www.economia-snci.gob.mx (consultado junio, 2014). [ Links ]

SAGARPA-SIACON. 2013. Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación. Sistema de Información Agroalimentaria de Consulta. Información en línea. [ Links ]

Tolentino, M. J. M. 2014. La producción de arroz del estado de Morelos: una aproximación desde el enfoque SIAL. Estudios Sociales. 44:37-61. [ Links ]

Received: January 2016; Accepted: March 2016

texto en

texto en