Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Revista mexicana de ciencias agrícolas

Print version ISSN 2007-0934

Rev. Mex. Cienc. Agríc vol.7 n.6 Texcoco Aug./Sep. 2016

Articles

Economic feasibility of bioethanol production with three species of Agave spp. in producing areas from Mexico

1Campo Experimental Valles Centrales de Oaxaca-INIFAP. Calle Melchor Ocampo No. 7, 68200, Santo Domingo Barrio Bajo, Etla, Oaxaca, México.

2Campo Experimental Iguala-INIFAP. Carretera Iguala-Tuxpan km 2.5, Col. Centro, 40000, Tuxpan, Iguala de la Independencia, Guerrero, México. (barrios.aristeo@inifap.gob.mx; ariza.rafael@inifap.gob.mx).

3Campo Experimental Centro Altos de Jalisco-INIFAP. Carretera Libre Tepatitlán-Lagos de Moreno km 8, 47600, Tepatitlán de Morelos, Jalisco, México. (flores.hugo@inifap.gob.mx).

The increasing use of fossil fuels has caused global warming by CO2 emissions to the atmosphere, which has determined the need to develop technologies to produce non conventional fuels. Some countries have shown technological advances in the production and use of biofuels; however, they have been using crops for human consumption, so it is necessary to explore new species that allow to generate fuels with low environmental and economic costs. The genus Agave is an alternative to produce bioethanol for its high sugar content in pineapple and leaves. The objective of this research was to determine the economic feasibility to produce bioethanol from Agave tequilana Weber., Agave angustifolia Haw. and Agave cupreata Trel. Economic indicators were generated from a holistic view of the value chain as the private cost ratio (RCP), internal rate of return (TIR), current net value (VAN) and breakeven point (PE). The results indicated that bioethanol production is economically feasible for the primary and industrial sectors in Matatlán, Oaxaca and Amatitán, Jalisco, while in Tepatitlán, Jalisco was profitable for the primary sector but not for the industrial sector, in Chilapa, Guerrero was not profitable for the primary sector but for the industrial sector it was. Profitability is influenced by the price of raw material and bioethanol making necessary a process of price negotiation between sectors.

Keywords: Agave tequilana Weber; Agave angustifolia Haw. and Agave cupreata Trel.; bioethanol profitability

El uso creciente de combustibles fósiles ha provocado el calentamiento global por las emisiones de CO2 a la atmosfera, lo que ha determinado la necesidad de generar tecnologías para producir combustibles no convencionales. Algunos países han mostrado adelantos tecnológicos para la producción y uso de biocombustibles; sin embargo, se han utilizado cultivos necesarios para la alimentación humana, por lo que se requiere explorar nuevas especies que permitan generar combustibles de bajos costos ambientales y económicos. El género Agave es una alternativa para producir bioetanol por sus altos contenidos de azúcares en la piña y las hojas. El objetivo de esta investigación fue determinar la factibilidad económica de producir bioetanol con Agave tequilana Weber., Agave angustifolia Haw. y Agave cupreata Trel. Se generaron indicadores económicos desde un punto de vista integral de la cadena de valor como la relación de costo privado (RCP), tasa interna de retorno (TIR), valor actual neto (VAN) y punto de equilibrio (PE). Los resultados indicaron que la producción de bioetanol es factible económicamente para los sectores primario e industrial en Matatlán, Oaxaca y Amatitán, Jalisco, mientras que en Tepatitlán, Jalisco resultó rentable para el sector primario no así para el sector industrial, en Chilapa Guerrero resultó no rentable para el sector primario pero sí para el sector industrial. La rentabilidad está influenciada por el precio de la materia prima y el precio del bioetanol lo que hace necesario un proceso de negociación de precios entre sectores.

Palabras clave: Agave tequilana Weber.; Agave angustifolia Haw. y Agave cupreata Trel.; bioetanol; rentabilidad

Introduction

Population growth and industrial development have led to an increase in the consumption of fuels from oil, passing from 84 million barrels in 2005 (Page, 2013) to 91 million in 2014 (Rudich, 2015). The increasing use of this type of energy has caused a serious problem of environmental pollution by high CO2 emissions to the atmosphere known as global warming (IPCC, 2007 cited in Pardo, 2007). In this situation, it has sought to expand and diversify energy sources capable of reducing the dependence on oil (Castro et al., 2012) and reduce gas emissions into the atmosphere.

Bioenergy, involves the production and use of non-conventional energy, representing an alternative to this problem, as it allows to cut down the environmental and economic costs of fossil fuels, it became important after 1997 when developed countries committed through the Kyoto protocol to find a balance between environmental protection, economic growth and social protection (Gijón, 2005). Currently there is a second commitment period covering from 2013 to 2020, where specific goals are envisaged in reducing emissions.

In 2008 Mexico enacted a Law on Promotion and Development of Bioenergy, which aims to promote and support energy diversification and sustainable development (DOF, 2008); favoring the stablishment of energy crops to produce biodiesel and bioethanol as a way to induce positive impacts on agriculture and rural areas from Mexico. According to Zamarripa (2011), the production of energy crops implies obtaining higher revenues from the sale of raw material for biofuel production, job creation in field and industry; this can also induce the permanence of farmers in their place of origin and reduce migration. On their behalf, Castro and Guerrero (2013) indicate that Mexico has high potential for bioenergy development due to its biodiversity, climatic and geographical conditions.

Bioethanol is a product of alcoholic fermentation of various organic materials through the action of microorganisms (Hernández, 2008) it has been used as fuel or gasoline enhancer in countries like Brazil and the United States of America, is completely renewable, since, when burned, released carbon dioxide is recycled naturally (Chandel and Singh, 2011 cited by Castro et al., 2012).

The use of raw materials intended for human consumption like sugar cane and corn kernels (Howard et al., 2003 quoted in Castro et al., 2012), has led to conflicts of opinion by having to prioritize between human consumption or biofuels, so the use of non-polluting alternative sources from biomass represent an excellent opportunity for species such as Maguey (Agave spp.) having high biomass productivity even under stringent conditions of humidity, temperature and soil (Méndez et al., 2011). It represents an important part of the historical and cultural heritage of Mexico and currently translates into an important source of employment and income generation. It is found from 34° north latitude to 60° south latitude (García et al., 2010), so it can be found in sites with altitudes of 300 masl, to locations over 3 000 masl (Gentry, 1982 quoted in García et al., 2010). According to SIAP (2014), during the period 2010-2013 were cultured annually 89 063 ha of Agave tequilana W., 12 188 ha of Agave angustifolia H. and 730 ha of Agave cupreata T., whose production is destined to tequila and mezcal industry.

Derived from the production process of tequila and mezcal generate annually thousands of tons of stalks, waste leave, short fiber and bagasse, which are left in maguey or are deposited around shredders and tequileras becoming a source of contamination (González et al., 2005; Coronado et al., 2011).

Ethanol production from maguey leaf has been explored since the beginning of last century, but its industrial boom is still incipient (Magdub and Barahona, 2006 cited in Méndez et al., 2011). González et al. (2005) and Murillo et al. (2014) concluded that Agave tequilana bagasse is a viable material as substrate in fermentation processes to produce bioethanol; so the aim of this study was to determine the economic feasibility of the use of agave or mezcal species to produce bioethanol through the competitiveness and profitability from an integrated perspective of the value chain, agricultural and industrial sectors, thus explore the sensitivity of economic indicators to changes in market prices.

Material and methods

The study was conducted in representative growing areas of agaves cultivated in Mexico. Agave tequilana Weber was studied in Amatitán and Tepatitlán, in the state of Jalisco, the first is a municipality located in the region los Valles, important for the production of tequila, the second is located in the highlands of Jalisco which counts with the best conditions for the production of agave (Luna, 2003). Agave cupreata was evaluated in Chilapa de Alvárez municipality located in the center-east side of the state of Guerrero; and Agave angustifolia Haw was studied in Santiago Matatlán, town located in the Valles Centrales de Oaxaca. Figure 1 shows the states where the economic study was performed.

50 interviews were conducted to representative producers to quantify production technology through technical coefficients (quantities of inputs, labor and services per unit area) and on Excell was developed the matrix of technical coefficients. Later local market prices of inputs, labor and services that production requires and on the same Excel sheet private prices matrix was elaborated. The two matrices multiplied and generated a third of private budget with the basic economic indicators such as total income, total cost, net profit and private cost ratio (RCP) as an indicator of competitiveness. Industrial phase was characterized through the flow of processes and technical coefficients were determined (inputs to transform raw agave into bioethanol), this information was obtained through visits to tequila and mezcal companies from producing regions and reviewed previous studies at laboratory level in theExperimental field Iguala from INIFAP.

Ethanol production was economically analyzed from the perspective of value chain (primary phase and industrial phase) and a sensitivity analysis of profitability to possible changes of prices of raw materials and bioethanol was performed. The method used to determine the competitiveness of agave crop was raised by Monke and Pearson (1989), retaken for studies in Mexico by Padilla (1992); Puente (1995); Salcedo (2007); Rodriguez et al. (2013), consist in an accounting system of revenue and cost of the agricultural system to obtain competitiveness, profitability and policy effects indicators (Figure 2).

The preliminary financial indicators were:

Total Revenue (IT), known as value of production, was the result of multiplying yield obtained at plot level (Xi) by producer selling price (Pi).

IT= PiXi

The total cost (CT), which was the result of the sum of costs of inputs and internal factors, given by the price of the input (Pj) multiplied by the amount of input (Yj).

Net income (GN), was the result of the arithmetic difference between total revenue and total cost (Naylor and Gotsch, 2005).

GN= IT - CT

Cost benefit ratio (RBC) is the result of dividing total income over total cost, their interpretation is that for every peso invested in the activity how many pesos are are obtained.

RBC= IT/CT

According to Morris (1990) and Padilla (1992), value added (VA) is the difference between the price of a product unit minus the value of traded inputs required to produce that product unit, or said otherwise, it is the difference between production value and costs of tradable inputs, and is given by the following expression:

Where: VA= value added; Xi= quantity produced in tons per hectare; Yk= amount of tradable inputs applied per hectare; Pi= selling price of the product by the producer; Pk= price of tradable inputs acquired by the producer.

To define RCP, first it was necessary to define the cost of internal factors (CFI), this indicator expresses the part of the costs relating to the payment of the factors that do not have a defined external market or that can not be exported or imported as easily as labor and land, among others. CFI is given by the following expression:

Where: CFI= cost of internal factors; Zr= amount of internal factors applied per hectare; Pr= price of internal factors used by the producer.

RCP measures how competitive is a crop or production system regarding the use of available resources. Producers prefer to make profits in excess, which can be obtained if CFI is lower than VA to private prices; indicates the proportion from VA that is intended to cover CFI. Therefore, it is advisable for an agricultural system to remain compeititive is to try to minimize RCP, keeping low the costs of tradable inputs and internal factors and obtain a VA as high as possible (Puente, 1995). RCP is given by the following expression:

Where: RCP= private cost ratio; FI= cost of internal factors; VA= value added.

For an integral analysis of the chain including agricultural and industrial phases, the software for Windows, biodiesel / FAO system (Da Silva et al., 2009) was used, which was adapted to bioethanol projects as a contribution of this study (Figure 3), this software allows through mathematical calculations to obtain social and financial indicators from both agricultural and industrial production.

From the information obtained in field, yield per hectare of solid biomass was estimated considering that 65% of the total weight corresponds to leaves and 35% to pineapples. Importantly, the leaves have a value for its total reducing sugars content ranging from 3.3 to 16.1% on fresh weight (Montañez et al., 2011) that are usually left lying on the ground after harvesting the pineapples. A processing coefficient of 9.3 kg of solid biomass of agave was used to obtain one liter of bioethanol, obtained in experimental test from laboratory. The selling price of the raw material as solid biomass (whole plant) were determined based on the current price of pineapple for tequila, assigning a proportion of that price to the leaves, therefore, the price set for biomass was less than pineapple price only. To feed the evaluation system considered various production data, which are specified in Table 1.

Table 1. General data used in the elaboration of bioethanol projects.

| Municipio/estado | Precio de materia prima ($ kg-1) | Rendimiento de biomasa (kg ha-1) | Ciclo de producción (años) | |

| Solo piñas | Piñas y hojas | |||

| Amatitán, Jalisco | 5.2 | 1.8 | 342 857 | 7 |

| Tepatitlán, Jalisco | 6.2 | 2.17 | 457 142 | 6 |

| Santiago Matatlán, Oaxaca | 4 | 1.39 | 277 875 | 9 |

| Chilapa de Álvarez, Guerrero | 1.13 | 0.39 | 100 000 | 9 |

Economic indicators were:

Internal rate of return (TIR): mathematically defined as the interest rate that cause in the flofw of funds from one project than revenues in equivalent values in time are equal to expenditures also in equivalent terms in time. It is also defined as the discount rate reducing to zero the current value of the sum of a series of income and expenses (FIRA, 1993). Therefore, for an investment proposal, TIR is the interest rate i* that satisfies the following equation:

Where: VPN (i)= current net value at an interest rate i; Bt= total benefits in year t; Ct= total costs in year t; t= time in years, takes values ranging from t= 0 to t= n (number of periods of economic life from the project).

Current net value (VPN): is the current value of net cash flows of a proposal, defined as net cash flows, the difference between current value of cash receipts of a project and the current value of the outputs (FIRA, 1993; Ruíz, 2010). Through VPN it is possible to determine whether the project is an acceptable investment or not. It was calculated by the following expression:

Where: Bt= total benefits in year t; Ct= total costs in year t; t= time in years, takes values ranging from t= 0 to t= n (number of periods of economic life of the project); i= discount rate that represents the minimum rate of return required;

Breakeven point (PE): is the level of production in percentage or production units that exist when costs and revenues are equivalent; at this point the company does not experience losses nor profits (Martínez et al., 2015).

Results

Economic indicators of policy analysis matrix

The highest net profit of the producer was obtained in Tepatitlán, Jalisco, with $ 160 060.00 ha on average per year with an average RBC of 6.47. The least profitable situation occurred with A. cupreata in Guerrero since only reported an average net profit of $ 2 275.56 / ha, with an RBC of 2.07. Regarding the RCP, the current production of agave, was competitive for the studied species as the indicator was less than one, highlighting A. tequilana in Tepatitlán, Jalisco whose indicator was 0.08. The lowest competitiveness was with A. cupreata in Guerrero with 0.37 (Table 2).

Table 2. Summary of economic indicators from primary production of agave in Jalisco, Oaxaca and Guerrero (annual average values).

| Indicador | A. tequilana Amatitán, Jal. | A.tequilana Tepatitlán, Jal. | A.angustifolia Oaxaca | A. cupreata Guerrero |

| Ingreso Total ($ ha) | 95 571.00 | 189 333.00 | 44 444.00 | 4 394.44 |

| Costo Total ($ ha) | 30 060.00 | 29 273.00 | 3 341.00 | 2 118.89 |

| Ganancia Neta ($ ha) | 65 511.00 | 160 060.00 | 41 103.00 | 2 275.56 |

| RBC | 3.18 | 6.47 | 13.30 | 2.07 |

| RCP | 0.19 | 0.08 | 0.03 | 0.37 |

Characterization and technical coefficients for the industrial phase

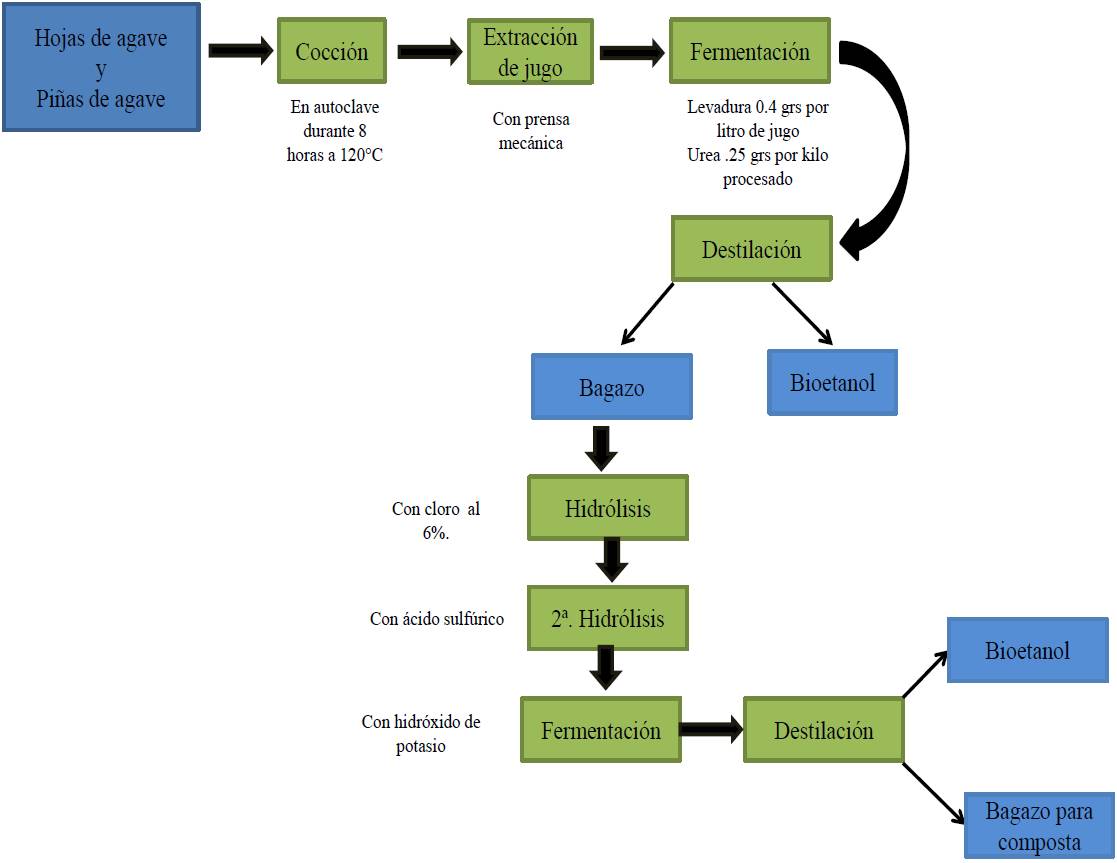

The process of ethanol production is illustrated in Figure 4. Previous activity to the process consist in mechanical pretreatment of the material, such as cleaning and grinding, that is, reduction of particle size to favor cell destruction or make it more sensitive to chemical processes (Sosa et al., 2011). Subsequently the first stage consist of cooking the material, for this procedure required an equipment called autoclave allowing to control temperature and pressure required to cook agave. Followed by mechanical juicing using a mechanical press in "V" which presses the pieces of raw material and extract the juice. As a third phase the fermentation is carried through the incorporation of yeast Saccharomyces cerevisiae and finally distillation. In the case of bagasse it proceeded to conduct a first hydrolysis with bleach and a second with sulfuric acid, to subsequently carry out a fermentation with potassium hydroxide and finally distillation.

Table 3 shows the technical coefficients of inputs required to produce one liter of ethanol.

Comprehensive analysis of profitability

From a comprehensive perspective evaluation of both production of raw material as for its transformation into bioethanol, the results were generally satisfactory in terms of profitability for the agricultural phase, since TIR was 91.28% for Tepatitlán, Jalisco as the highest, due to greater productivity in this area added to a shorter pineapple production, high profitability is also due to higher prices paid to producers by tequila companies since the tequila market continues to expand. The lowest profitability of primary production was for Chilapa de Alvárez, Guerrero with a TIR of 7.85% which is due to the low productivity of the production system and the low technological level. To implement a bioethanol production Project is necessary a negotiating process of agave price to make it more attractive to producers. For Amatitán, Jalisco and Santiago Matatlán, Oaxaca the TIR obtained was quite adequate, since producers earned income and positive earnings. The breakeven point was low in the first three cases, about 2% due to high profitability, not being like that in Guerrero that requires of a forth stage of production to achieve breakeven point, while the highest VPN was obtained in Tepatitlán, Jalisco and the lowest in Guerrero Chilapa (Table 4).

Table 4. Financial indicators of the agricultural phase in a comprehensive bioethanol project for four regions of Mexico*.

| Indicador | Amatitán, Jalisco | Tepatitlán, Jalisco | Santiago Matatlán, Oaxaca | Chilapa de Álvarez, Guerrero |

| Punto de equilibrio | 1.84 | 1.01 | 3.38 | 24.81 |

| TIR | 38.03 | 91.28 | 34.57 | 7.85 |

| VPN (miles de $) | 31 751.49 | 63 232.08 | 24 754.49 | -1 145.91 |

| Superficie destinada (ha) | 163 | 122 | 201 | 558 |

Regarding the industrial stage, it was found that the production cost of bioethanol is affected by input costs especially from chemicals, which amount represented more than 50% of the total cost per liter. On the other hand, the profitability of the industrial process was favored by byproducts also called co-products such as inulin and xylitol mainly, which have many uses in both medicine and food (Vargas, 2009), accounting for up to 70% of total revenues, while bioethanol represents 25% of income and bagasse can be used as compost represented only 5% of the revenue.

The best outlook for bioethanol production in the industrial phase was found in Guerrero with a TIR of 34.06% this for the low cost of the raw material that was recorded in this area; the lower financial profitability was given for Tepatitlán, Jalisco with a negative TIR due to the high cost of raw materials registered in this area; however, in this case it would be the possibility of negotiating the price of the raw material as it presents high profitability for the agricultural sector for the considered price, otherwise it is more profitable to allocate agave for tequila production than bioethanol. For Amatitán and Matatlán, the TIR was acceptable meaning profits for the two sectors. The breakeven point presented from the lowest in Guerrero with 0.31% to the highest in Tepatitlán, Jalisco with 14.15%. The highest VPN was obtained with A. cupreata in Guerrero (Table 5).

Table 5. Financial indicators of the industrial phase in a comprehensive bioethanol project for four regions of Mexico*.

| Indicador | Amatitán, Jalisco | Tepatitlán, Jalisco | Santiago Matatlán, Oaxaca | Chilapa de Álvarez, Guerrero |

| Punto de equilibrio | 1.37 | 14.15 | 0.67 | 0.31 |

| TIR | 12.64 | -48.36 | 19.08 | 34.06 |

| VPN (miles de $) | 634.45 | -4 461.9 | 4 015.55 | 16 468.6 |

Sensitivity analysis of TIR

A direct relationship between TIR from the agricultural sector and selling price of agave was observed; that is, if sale prices of agave increase, agricultural TIR also increases and vice versa, thus to agave producers suits them that the selling price of agave increases as they increase their profits and profitability. Instead, the TIR of the industrial sector showed inverse relationship; ie to price increases of agave, TIR decreases and vice versa, this means that industrialists that transform raw materials from agave into bioethanol suits them low prices of agave. Therefore, there are conflicting interests between farmers and industrialists, while the former want higher prices for their agave, the latter want the opposite.

In the particular case of Tepatitlán, Jalisco, the base situation considered a price of $ 2.17/kg of agave, the agricultural sector recorded a TIR of 91.28% and the industry of -48.40%, the project is profitable for the agricultural sector, but it is unviable for industrial, due to the high cost of raw materials. Agriculture appropiate earnings and industry incurred losses. There is room for price negotiation to favor more the industry without affecting considerably the gains from the agricultural sector, to this point is appropriate to review the extent to which producers can yield to lower their price from $ 2.17/kg to $ 1.63/kg for the industry obtain a TIR of 30% and agriculture of 80%; however due to the tequila industry offers the price of $ 2.17/kg, this situation would be very difficult to become real as farmers hardly would be willing to give up profits and certainly prefer to sell their agave to tequila industry. The bioethanol industry could not compete with tequila industry for the price of agave, unless a subsidy scheme to the industry via raw material price or selling price of bioethanol is implemented.

In the particular case of Amatitán, Jalisco, the base situation considered a price of $ 1.8 / kg of agave, the agricultural sector recorded a TIR of 38.06% and the industry of 12.60%, the project is profitable for both but agriculture appropriates the biggest gains. There is room for price negotiation to favor industry, here it is appropriate to review the extent to which producers can yield to lower its price. The breakeven point where both sectors would have a TIR of 30% is with an agave price of $ 1.40/ kg aproximately.

In the particular case of Santiago Matatlán, Oaxaca, the base situation considered a price of $ 1.37/ kg of agave, the agricultural sector recorded a TIR of 34.57% and the industry of 19.01%, the project is profitable for both, but agriculture appropriates higher profits. There is room for price negotiation to favor industry, here it is appropriate to review the extent to which producers are willing to lower their price. The breakeven point where both sectors would have a TIR between 25 and 30% is with an agave price of $ 1 kg aproximately.

In the particular case of Chilapa, Guerrero, where the base situation considered a price $ 0.40 kg of agave, the agricultural sector recorded a TIR of 7.85% and industry of 34.10%, the project is clearly profitable for the industry but for the agriculture is not because TIR is very low; in this case is the industry that participates in the highest gains. There is room for price negotiation to favor agriculture, to this point is appropriate to review the extent to which industry can yield increasing the purchase price of raw material; if mezcal industry offers the price of $ 0.40 kg, this situation would be very likely since to farmers suits best higher prices. Bioethanol industry competes with mezcal industry. The breakeven point where both sectors would have an equal TIR is with an agave price above $ 0.50 kg aproximately.

Regarding the effects of possible changes in sale prices of bioethanol in the profitability of projects, in Figure 5 can be seen a direct relationship between the two variables; that is, at higher sale price of bioethanol, the higher the TIR for the industrial sector. The base price that was used for the study was $ 9.00 / l, if this price decreases TIS is affected in varying proportions according to the particular case, being the case of Chilapa de Alvárez, Guerrero highlighting for its higher strength to withstand low prices of the biofuel (a decrease of 25% reports a TIR of 31.3%). The least desirable case is Tepatitlán, Jalisco as it requires an increase of bioethanol price above $ 11.3 / l for the industry to achieve more attractive returns.

Conclusions

Agave production under a monoculture system was profitable and competitive as it reports positive net income, being Tepatitlán, Jalisco with Agave tequilana the most efficient and profitable, while Chilapa, Guerrero with Agave cupreata was the least profitable. Bioethanol production under current conditions of solid biomass productivity (pineapple and leaves) and under the conditions of the industrial flow process still not developed commercially, is feasible in Santiago Matatlán, Oaxaca and Amatitán, Jalisco with positive TIR for the agricultural and industrial sectors. Bioethanol production in Tepatitlán was not feasible for the industrial sector due to high cost of raw materials, so it is necessary that the selling price of ethanol increases or to lower the price of raw material lower than the currently registered, situation placing the bioethanol industry as non competitive to tequila industry.

The production of bioethanol in the area of Chilapa, Guerrero with Agave cupreata was not feasible from the point of view of agriculture, but feasible for the industrial sector, situation demanding a negotiation in price of raw materials to favor farmers. The agricultural and industrial sectors showed conflicting interests, because while farmers are favored with high prices of agave as raw material for bioethanol, industrial are not favored by high prices, this makes necessary a process of price negotiating for raw materials. There is a direct relationship between the selling price of agave and agricultural TIR, which means that at higher selling price of agave, the higher will be TIR; while this relationship is inverse for the industrial sector, at higher prices of agave the profitability is lower. There is a direct relationship between selling price from bioethanol and industrial TIR; ie to higher selling prices of biofuel, the greater the TIR.

Literatura citada

Castro, C.; Beltrán, L. y Ortiz, J. 2012. Producción de biodiesel y bioetanol: ¿Una alternativa sustentable a la crisis energética? Rev. Soc. Cult. Des. Ximhai. 8(3):93-110. [ Links ]

Castro A., Guerrero. J. 2013. El agave y sus productos. Temas selectos de ingeniería en alimentos. Departamento de Ingeniería Química, Alimentos y Ambiental. Universidad de las Américas Puebla. 53-61 pp. [ Links ]

Coronado, V. C.; Quintana, H. P.; Tiscareño, L. F.; Jiménez, G. A. y Escamilla, S. E. 2011. 3er reporte del proyecto: desarrollo y puesta en marcha de tecnología de producción de etanol a partir del aprovechamiento integral del jugo y biomasa sólida de Agave Tequilero y mezcalero. 80 p. [ Links ]

Da Silva, J. A.; Pérez, R.; Chávez, B. M.; Carvalho, E. J. y Schuetz, G. 2009. Sistema biodiesel/FAO. Manual de ayuda. Software para Windows. Universidad Federal de Viscosa, Brasil y Coordinación FAO- Oficina Regional de Chile. 129 p. [ Links ]

DOF. 2008. Ley de Promoción y Desarrollo de los Bioenergéticos (DOF-01-02-2008). Cámara de Diputados del H. Congreso de la Unión, México. 12 p. [ Links ]

FIRA. 1993. Criterios actuales en el análisis financiero. Boletín informativo. 249(25):35. [ Links ]

García, J.; Méndez, S. y Talavera, D. 2010. El género Agave spp. en México: principales usos de importancia socioeconómica y agroecológica. In: VIII Simposium-Taller Nacional y 1er. Internacional Producción y aprovechamiento del nopal. Revista de Salud pública y nutrición. 5:109-129. [ Links ]

Gijón, R. 2005. Efectos del protocolo de Kyoto y de la directiva de comercio emisiones sobre el sector productivo Español. Rev. Inf. Com. Española. 822:79-89. [ Links ]

González, G.; González, R. y Nungaray, A. 2005. Potencial del bagazo del agave tequilero para la producción de biopolímeros y carbohidrasas por bacterias celulolíticas y para la obtención de compuestos fenólicos. E-gnosis on line. (3):14-19. [ Links ]

González, H. J.; Álvarez, N. M.; Ornelas, H. L. y Zamudio, J. M. 2011. Producción y aplicaciones biotecnológicas del Xilitol. Biotecnología. 15(2):26. [ Links ]

Hernández, M. 2008. Tendencias actuales en la producción de bioetanol. Facultad de Ingeniería. Universidad Rafael Landívar. Boletín electrónico. 8:17. [ Links ]

Luna, R. P. 2003. Explotación actual y potencial del cultivo de Agave Tequilana Weber Azul en el estado de Guanajuato. Universidad Autónoma Agraria Antonio Narro (UAAN) México, D. F., 25 p. [ Links ]

Martínez, M. I.; Val, A. D.; Tzintzun, R. R.; Conejo, N. J. y Tena, M. M. 2015. Competitividad privada, costos de producción y análisis del punto de equilibrio de unidades representativas de producción porcina. Rev. Mex. Cienc. Pec. 6(2):193-205. [ Links ]

Méndez, S.; Amante, A.; Talavera, D.; García, J. y Velez, A. 2011. Biocombustibles a base de nopal y maguey. In: IX Simposium-Taller Nacional y II Internacional de producción del nopal y maguey. Ed. Esp. Núm. 5. 12 p. [ Links ]

Montañez, L. J.; Victoria, C. J.; Flores, R. y Vivar, A. M. 2011. Fermentación de los fructanos del Agave tequilana Weber Azul por Zymomonas mobilis y Saccharomyces cerevisiae en la producción de bioetanol. Información tecnológica. 22(6):3-14. [ Links ]

Morris, M. L. 1990. Determinación de la ventaja comparativa mediante el análisis del CRI, pautas a partir de la experiencia del CIMMYT. Monografías en Economía. CIMMYT. México. 25 p. [ Links ]

Monke, E. A. and Pearson, S. R. 1989. The policy analysis matrix for agricultural development. Baltimore: Johns Hopkings University Press. 50 p. [ Links ]

Murillo, A. P.; Santibañez, A. J.; Ponce, O. J.; Castro, M. A.; Serna, G. M. and Hakwagu, M. M. 2014. Optimization of the supply chain associated to the production of bioethanol from residues of agave from the Tequila process in Mexico. Industrial and Engineering Chemistry Research. Am. Chem. Soc. 5524-5538 pp. [ Links ]

Naylor, R. y Gotsch, C. 2005. Matriz de análisis de política (MAP), ejercicios de cómputo MS-Excel. Organización de las Naciones Unidas para la Agricultura y la Alimentación (FAO)- SEPSA. Costa Rica. 66 p. [ Links ]

Padilla, B. L. E. 1992. Evaluación de los efectos de la política económica y análisis de las ventajas comparativas del sector agrícola en Sinaloa. Tesis de maestría en ciencias, Centro de Economía, Colegio de Postgraduados, Montecillo, Estados de México. 56-86 pp. [ Links ]

Page, D. 2013. Un mundo con sed de petróleo: el consumo se triplica en 50 años. Expansión.com. Madrid. [ Links ]

Pardo, M. 2007. El impacto social del cambio climático. Universidad Carlos III de Madrid. Departamento de Ciencia Política y Sociología. 15 p. [ Links ]

Puente, G. A. 1995. Indicadores económicos de la producción de trigo en México. Publicación especial Núm. 7. Instituto Nacional de Investigaciones Forestales, Agrícolas y Pecuarias (INIFAP). México D. F. 39 p. [ Links ]

Rodríguez, H. R.; Cadena, I. P.; Morales, G. M.; Jácome, M. S.; Góngora, G. S.; Bravo, M. E. y Contreras, H. R. 2013. Competitividad de las unidades de producción rural en Santo Domingo Teojomulco y San Jacinto Tlacotepec, Sierra Sur, Oaxaca, México. Rev. Agric. Soc. Des. 10(01):111-126. [ Links ]

Rudich, W. 2015. La OPEP prevé consumo récord de crudo en 2016, impulsando por precios bajos. Agencia EFE. España. 14 p. [ Links ]

Ruiz, R. 2010. Planeación y evaluación financiera. Biblioteca del Instituto Tecnológico de Sonora. http://biblioteca.itson.mx/oa/contaduria_finanzas/oal/planeacion_evaliacion_financiera/index.htm. [ Links ]

SIAP. 2014. Agricultura-producción-anual, 2010-1013: http://www.siap.gob.mx/agricultura-produccion-anual/. [ Links ]

Salcedo, B. S. 2007. Competitividad de la agricultura en América Latina, matriz de análisis de política. Organización de las Naciones Unidas para la Agricultura y la Alimentación (FAO). Oficina Regional de la FAO para América Latina y el Caribe. Santiago, Chile. 98 p. [ Links ]

Sosa, N. E.; Saucedo, L. J.; Salcedo, E. L. y Castro, M. A. 2011. Proceso de producción del bioetanol: Simulación en Aspen Plus. 24 p. [ Links ]

Vargas, V. C. 2009. Obtención de insumos de interés industrial a partir de las fructanas del agave mezcalero potosino (Agave salmiana). Tesis de Maestría. Centro Interdisciplinario de Investigación para el Desarrollo Integral Regional. CIIDIR-IPN-Michoacán. 123 p. [ Links ]

Zamarripa, A. 2011. Estado del arte y novedades de la bioenergía en México. Oficina Regional para América Latina y el Caribe - RLC. Organización de las Naciones Unidas para la alimentación y la Agricultura (FAO). 39 p. [ Links ]

Received: February 2016; Accepted: May 2016

text in

text in