Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

EconoQuantum

versión On-line ISSN 2007-9869versión impresa ISSN 1870-6622

EconoQuantum vol.9 no.2 Zapopan jul./dic. 2012

Artículos

Political contributions, subsidy and mergers

M. Ozgur Kayalica,1 Rafael Salvador Espinosa Ramírez2

1 Department of Management Engineering, and Technology and Economic Development Research Center (TEDRC), Istanbul Technical University, Macka, Istanbul, Turkey. (kayalica@itu.edu.tr)

2 Departamento de Economía, Universidad de Guadalajara, México. E-mail: rafaelsa@cucea.udg.mx

Recepción: 05/06/2012

Aceptación: 21/08/2012

Abstract

We examine, in a oligopolistic partial equilibrium model, the effects of mergers and internal lobbies in shaping national subsidy policies. Domestic and foreign firms compete in the market for a homogeneous good in a host country, then the optimal output of the firms can be affected ambiguously by the government subsidy policy in the host country. Domestic firms offer political contributions to the government, that are tied to the government's policy decision. The government sets the optimal policy maximizing a weighted sum of total contributions and aggregate social welfare taking into account merger of domestic firms as a competitive response.

Keywords: Foreign Direct Investment, Mergers, Lobby.

JEL Classification: F12, F13.

Resumen

A partir de un modelo oligopolistico de equilibrio parcial, modelamos los efectos de las fusiones y el cabildeo político doméstico para definir políticas nacionales de subsidio. Empresas locales y foráneas compiten en un mercado de bienes homogéneos en un pais huesped de inversión. La producción optima de las empresas va a depender de la politica de subsidio. Las empresas locales ofrecen cabildear con contribuciones económicas al gobierno para afectar la decisión de política. El gobierno establece la política óptima maximizando el peso entre las contribuciones políticas y el bienestar social agregado, tomando en cuenta las fusiones que hacen las empresas locales como respuesta a la competencia foránea.

Introduction

The emerging of Foreign Direct Investment (FDI) as a crucial source of development for many developing countries has produced many challenges inside these countries because this investment is not only an opportunity, but also the origin of disturbances into the domestic market.3 The significant increase in foreign investment since the 90's in developing countries has been accompanied with a strong tendency to open economies and the natural reduction and elimination of trade barriers.

The flow of investment into these developing countries has taken the form of new investment, acquisition, and cross-border merger.4 Especially acquisitions and cross-border merger have been considered as the best and faster way in which foreign direct investment is promoted to get into the developing economies.5 However, the lack of solid regulations in terms of competition policy, the weakness of an institutional environment and the fast openness of trade have produced some monopolistic distortions. A clear example is the acquisition and cross-border merger in the bank system in Latin America and especially in Argentina and Mexico where, after a very unclear and irregular government intervention and regulation, many banks were sold to foreign bankers. In response to this situation, in several countries, the argument has become prominent that governments should allow large-scale mergers between domestic firms (often called "national champions"). Even though such mergers may reduce even more competition and harm domestic consumers, the hope is that the newly created champion will play a significant role on world markets competition.6

In this sense, the firms located in developing economies urged of foreign investment, and in a cloudy institutional environment, react competitively against foreign competition by pressing the government in favor of their interest (lobby) and by merging in order to get some competitive advantage. Clear examples are the national owned banks and the supermarket chains, all in Mexico, facing foreign competition. After the main cross-border acquisitions and mergers during 1995-2005, the remaining national bankers and the national supermarket chains pressed to Mexican government and merger in order to gain competitive advantage over the foreign competition.

The government designs their policies not only according to welfare concerns, but also in response to the interests of organized lobby groups7. Therefore, the political processes generating economic policy is likely to be affected by pressure groups as far as foreign investment is concerned.8

In this work, we develop a partial equilibrium model of an oligopolistic industry in which a number of domestic and foreign firms compete in the market for a homogeneous good in a host country. It is assumed that the optimal output and competition strategies of foreign firms can be affected by government policy in the host country. The host country government uses two types of per unit subsidies to impact the optimal output of foreign firms. This distinguishes our model from the bulk of the literature, since we allow the government to use subsidies instead of direct trade policies like tariff and quota. Moreover, we allow uniform policies to see how the behavior of lobby group changes when receiving the same benefit as the foreign ones. On the other hand, our model consider merger as competitive strategy used by domestic firms and the reaction of local government policy to this strategy. In this case, we follow closely the paper of Collie (2003), who developed a significant paper on mergers of local and foreign firms and trade policy under oligopoly.9

Collie (2003) analyzes the reaction of the government (through trade policy) facing both foreign and domestic merger. As Collie (2003), we analyze the reaction of the government as domestic firms merge through the subsidy (tax) schedule. Even when most of the literature consider the need for regulating and preventing merge and acquisitions (M&A), the use of subsidy in our model is rooted in the existence of an open economy and a cloudy institutional environment.10 Closed examples are the supermarket chain and banks in Mexico, where the government pursues some lax tax policies in the case of supermarkets chain o even some kind of fiscal support in the case of the bank system.11

As seen before, domestic firms merge for several reasons, for instance, in order to obtain competitive advantage against foreign rivals. Mergers of domestic firms appear to be a surviving strategy. Our model extends the model developed by Collie (2003) in two ways: first, allowing domestic subsidy policies instead of trade policies considering an open economy; and second, introducing lobbying in a cloudy institutional setting to determine the optimal subsidy policy. Both features are relevant to characterizing a developing economy with a weak institutional environment and these are the key contributions of this paper.

Lobbying is modeled following the political contributions approach. Domestic firms offer political contributions to the government, that are tied to the government's policy choices. Then, the government sets the policy to maximise a weighted sum of total contributions and aggregate social welfare. Lobbying in our model has the structure of the common agency problem explored by Bernheim and Whinston (1986), which is later used by Grossman and Helpman (1994a) to characterize the political equilibrium under trade protection and finally generalized by Dixit, Grossman and Helpman (1997) for wider economic applications. A clear example that fit with our model is given by the alleged political contribution offered by a domestic supermarket chain in favor of a political candidate running for the presidency in Mexico.

Under the above specification, we examine aspects of the political relationship between the government and the domestic firms under different degrees of corruption. In other words, the optimal policies in the absence of lobbying are also analyzed to see how policies change by pressure from the interest group. The basic structure is given in the next section where we use a lobbying framework that follows Grossman and Helpman (1994a) and Dixit et al. (1997). In the third section we analyze the comparative static of discriminatory and uniform subsidy. The optimal discriminatory subsidy and merger in domestic firms is analyzed in the fourth section. In this sense, in the fifth section we consider merger and uniform subsidy. We conclude in the last section.

The Basic Framework: Lobbying

We consider an economy in which there are m identical domestic firms and n identical foreign firms located in a host country which may offer a per unit subsidy, si (where i = d,f), to each type of firms. The marginal costs of the domestic and foreign firms are cd and cf respectively. These marginal costs are assumed to be constant, and thus they also represent average variable costs.

On the other hand, the domestic firms form a lobby group whose political contribution schedule is defined by C(s), where s is the per unit subsidy granted by the host government to domestic firms, which we examine later in detail.12 Each domestic firm has the following utility,

where πd is the profit of a domestic firm. Consumers have identical quasi-linear preferences and are given some exogenous level of income,  . The preferences of the consumers are represented by u(y,D) = y + f(D) where y is the consumption of a numeraire good produced under competitive conditions with a price equal to 1. There is also just one factor of production whose price is determined in the competitive sector. We denote the consumption of the non-numeraire good by D, while function f is increasing and strictly concave in D. Hence, with income

. The preferences of the consumers are represented by u(y,D) = y + f(D) where y is the consumption of a numeraire good produced under competitive conditions with a price equal to 1. There is also just one factor of production whose price is determined in the competitive sector. We denote the consumption of the non-numeraire good by D, while function f is increasing and strictly concave in D. Hence, with income  each individual consumes D = g(p) of the non-numeraire good and y=

each individual consumes D = g(p) of the non-numeraire good and y= pg(p) of a numeraire good (where p is the price of non-numeraire good). We can then derive the consumers' indirect utility.

pg(p) of a numeraire good (where p is the price of non-numeraire good). We can then derive the consumers' indirect utility.

where CS is the consumer surplus (CS = f(g(p)) - pg(p)). The government collects the subsidy cost from consumers by taxing. We denote the total cost of the subsidy by TR. The government's objective can be written as

where ρ > 1 is a constant parameter we call corruption level, so the first term in (3) is the political contribution impact of the m firms on government objective function.13 Even when in some countries the political contribution is part of the political campaign, there are another countries where it is not allowed at all (it is part of the public budget), or there exists at least a limit to this contribution. We consider the latter case in which p becomes a corruption parameter. The second term in (3) is the total social welfare.14

The political equilibrium can be determined as the result of a two-stage game in which the lobby (representing domestic firms) chooses its contribution schedule in the first stage and the government sets the level of subsidy in the second. Then, the political equilibrium consists of a political contribution schedule C (s), that maximizes the profits of all the domestic firms given the anticipated political optimization by the government, and a subsidy level, s*, that maximizes the government's objective given by (3), taking the contribution schedule as given.

As discussed in Dixit et al. (1997), the model can have multiple sub-game equilibria, some of which may be inefficient. Dixit et al. (1997) develop a refinement that selects truthful equilibria that result in Pareto-efficient outcome.15 Stated formally, let (C0 (s0, Vd0),s0) be a truthful equilibrium in which V0 is the equilibrium utility level of each domestic firm. Then, (C0 (s0, Vd0),s0,Vd0) is characterized by

and

where Vc is defined in (2) and

Equation (4) characterizes the truthful contribution schedule chosen by the lobby, where A can be interpreted as the compensation variation. Hence, equation (4) (together with (7)) states that the truthful contribution function C(s, Vd0) relative to the constant Vd0 is set to the level of compensating variations. In other words, under truthful contribution schedules, the payment to the government is exactly equal to the change in domestic firms' profits that is caused by a change in policy s (see Dixit et al. (1997, p.760)). Equation (5) states that the government sets the subsidy level to maximize its objective, given the contribution schedule offered by the domestic firms.

Equation (6) implies that in equilibrium, the contribution of the lobby has to provide the government at least the same level of utility that the government could get if it did not accept any contributions. The lobby pays the lowest possible contribution to induce the government to set s0 defined by (5). Then, the government will be indifferent between implementing the policy (s1), by accepting no contributions and implementing the equilibrium policy (s0) and accepting contributions. In the first case, contribution would be zero and the government would maximize its objective function as if the domestic firms were politically unorganized. Using (1) to (3), it can be seen that the government does not accept any contribution at all when ρ = 1. Totally differentiating (3) we get

where, differentiating (4) (and (7)), and assuming A > 0 we have A(.) = C(.) we get

When ρ = 1 equation (9) serves for the case in which the government refuses the firms' contributions, and simply maximizes the social welfare. That is, when ρ = 1 we obtain s1 defined by (8). Equation (9) helps us to examine the public policy outcome of political relationship between the government and the lobby. After analyzing the equilibrium subsidy level, we focus on the effects of mergers and the optimal respond of the government facing a decrease in welfare.

It is a well known fact that

Having described the political equilibrium, we shall now introduce the rest of the model. We consider an oligopolistic industry with m identical domestic firms and n identical foreign firms. The domestic and foreign firms compete in the domestic market of a homogeneous good. The inverse demand function is derived from one specific case of the preferences mentioned in the beginning of this section such that u(y,D) = y + αD β-D2/2 for this commodity gives us the following expression

where D is the sum of outputs by domestic and foreign firms, i.e.,

where xd and xf are the output of a domestic and a foreign firm. We examine optimal subsidy levels when the government imposes discriminatory and uniform subsidy policies. Profits of a domestic and a foreign firm are respectively given by

where sd and sf are respectively the per unit subsidies imposed on the domestic and foreign firms, with negative values of s representing taxes.

It is assumed that the domestic and foreign firms behave in a Cournot-Nash fashion. Each firm makes its output decision by taking as given output levels set by other firms, the number of firms, and the subsidy level set by the government. The equilibrium is defined by a three-stage model: first, the government chooses the subsidy level taking everything else as given; in the second stage, the number of foreign firms is determined given the level of subsidy and output levels; finally, output levels are determined.

Using (14) and (15) we find the first order profit maximization conditions as

Using (12) to (17) we find the following closed form solutions

Where Δ = m + n + 1 > 0. Now we have the backbone of our analysis. We shall proceed to analyze the effect of subsidies on government objective function.

Comparative Static

After setting the model, we are going to consider the effect of subsidies on domestic profits (and therefore on political contribution), consumer surplus and the subsidy cost. In this section, we discuss the case of comparative static of discriminatory and uniform (sd = sf = sU) subsidies.

Discriminatory subsidy to domestic firms is not our interest given the strategy feature of domestic merger. In other words, if merger is a competitive strategy of domestic firms, there is no sense to talk about a merger in response to a domestic firm subsidy. We are considering that the domestic firms will merger only if there is a perception that any government policy may affect their competitive position facing foreign firms. In this sense, the analysis of discriminatory domestic subsidy is not relevant since there are not incentives to domestic merger once they benefit from a subsidy. We shall now totally differentiate (14) and using the closed form solutions (16-21) to get.16

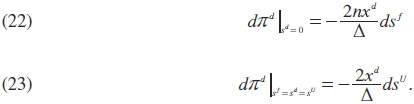

Equation (22) states that when only foreign firms are subsidized, the profits of the domestic firms go down. This is because subsidizing foreign firms give them a competitive advantage over the domestic firms due to a cost reduction. On the other hand, equation (23) states that a uniform subsidy will increase the domestic profits.

Next, the effect on consumer surplus can be found using (11), (12) and the closed form solutions (16-21) as

Subsidizing the foreign firms reduce the cost of foreign firms and increase the cost of domestic firms. However, the cost reduction in foreign firms is larger than the cost increase in the domestic firms and it will increase the total output consumed and therefore the market price is reduced. A discriminatory subsidy to foreign firms will increase the consumer surplus. On the other hand, a uniform subsidy will reduce cost in both foreign and domestic firms increasing the output and reducing the price, increasing the consumer surplus.

Finally, the total cost of financing per unit subsidy is defined as

From total differentiation of (26) and using again (16-21) we get the following general expression

Needless to say, subsidizing foreign and domestic firms (in a discriminatory or uniform way) increases the total cost of subsidy. So far, it is clear that subsidizing the firms has opposing effects on the various components of government's objective function or welfare, as we will mention in the following sections.

Discriminatory subsidy and mergers

Having described the general framework above, in this section we shall begin our analysis with the case when the government uses a discriminatory policy, namely subsidizing the foreign firms but not the domestic ones.

A relevant question for this section is why foreign firms could be subsidized (taxing) different to domestic firms? Basically, it is expected that domestic firms rents shift away with a subsidy to foreign firms, and these domestic firms may expect to lobby in favor of taxing foreign firms. However, there is plenty of evidence where governments subsidy foreign firms in order to get some benefit derived from foreign investment and competitiveness. There is discriminatory subsidy in favor of foreign firms when the government tries to pursue an aggressive policy to attract foreign investment in many developing economies.17 On the other hand, the government may offer subsidy to new or existing foreign firms to create or stimulate the competitiveness in some strategic or unexplored sectors where there already exist domestic competitors. Such policy is quite useful to promote some productive sectors where technological advances are limited18.

Substituting (22), (24), (27) in (9) we find

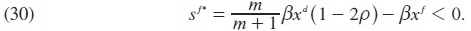

As discussed above, subsidizing the foreign firms has opposing effects on welfare through its various components. The above equation reflects this ambiguity. Clearly, a subsidy to foreign firm will reduce the benefit of the domestic firms and therefore the contribution made by them. It can be seen in the first term inside the square brackets in (29). On the other hand, a foreign subsidy will increase the consumer surplus according to the second term in (29). Finally, the last two terms tell us that financing the subsidy to foreign firms produces a negative impact on welfare. Assuming G to be concave in sf, we get the optimal subsidy equalizing (29) to zero as

From (30) it is clear that the cost of subsidizing foreign firms plus the loss in political contribution is larger than the benefit in consumer surplus. In this case, the optimal subsidy will be unequivocally negative and taxing foreign firms will be the optimal policy. Stating the above results formally,

Proposition 1. In the absence of any policy towards the domestic firms, the optimal subsidy to the foreign firms is negative.

Intuitively speaking from the domestic firms' point of view, a discriminatory subsidy seems to be an unfair policy for them. Even they may not know about the optimal policy chosen by the government, the perception is that they must do something in order to compensate the political advantage given to foreign firms. Or even if they know the optimal setting of the political policy, the domestic firms may react strategically in order to get some competitive advantage. One of the competitive strategies used to gain some advantage over the competitors is merging.

Generally, the domestic firms merger in order to get some economies of scale looking for some monopolistic advantages over the foreign competition. They may be unable to compete against foreign firms since the level of technology or the ways in which foreign firms have more financial opportunities give them a considerably advantage against domestic competitors. Actually, the merger of domestic firms may be the result of a merger or some predatory acquisition of foreign firms. An interesting example in Latin America and Asia is the banking acquisitions and mergers made by foreign banks after hard periods of financial crises between 1998 and 2009, where most of the governments rescued the bank and sell them in preferential conditions (equivalent to a shadow subsidy) to international investors (Goddard et al., 2012). The common response of the surviving domestic banks was to merger in order to face a foreign competition and obtain economies of scale that guarantee some competition level.

Of course, the foreign firms may have some cross-border merger as mentioned before, or some predatory acquisitions; however, we are just interested in this paper to focus on the domestic reaction rather than model a more general stylized fact, since a more sophisticated model is far from the aim of this paper. On the other hand, due to the nature of this model, it is expected to have a consumer surplus reduction with a merger in foreign firms reducing unequivocally the welfare. At the end, the merger in domestic firms will produce more interesting results on welfare given by their policy relation with the government. This could be a good extension, but we suspect the results may produce similar results in terms of the objective of this paper.

We shall now analyze the effect of local merger when the optimal policy has been set. It will be useful to review the effect of merger on welfare when the domestic government pursues an optimal per unit subsidy policy.19 Following Salant, Switzer and Reynolds (1983), the horizontal merger is modeled as an exogenous reduction in the number of domestic firms.20 We will analyze the effect of a change in the number of firms m on welfare. This change is given by the differentiation of (9) with respect to m as

The first and second term in the right hand of (31) show the change in the political contribution given by the merger (the change in the domestic profit and the contributing number of firms). The third and fourth terms are the changes in the consumer surplus and the cost of subsidizing firms respectively. From (11)-(21) and (26) we get the effect of merger in each component as

The effect of domestic firms' merger on domestic firms' profits is positive as mergers increase the market share for domestic firms. A reduction in the number of domestic firms will reduce the consumer surplus due to a reduction in the amount of output available to consume and therefore the price increases. Less domestic firms mean more subsidy to be paid by the government because of the increase in the market share, so a merger will increase the expense in subsidy made by government.21 Substituting (32) in (31) and using (30) we get

Once the optimal policy has been set, there are opposite effects of merger on welfare. First of all, the political contribution presents an ambiguous result in the presence of domestic merger. From the two first terms in (31) and using (32) we have

In this case, a merger will reduce the number of contributing firms but increases the proportion each remaining firm contributes to the political lobby. The net effect will depend on the number of competing domestic and foreign firms in the market. When the number of remaining domestic firms respect to foreign firms is larger, the contribution offered by the remaining domestic firms is larger than the loss in contribution given by a reduction in m. In opposition to this, a larger number of foreign firms over domestic firms will reduce the share of contribution that each domestic firm offers to the government and the merger will reduce the political contribution.

On the other hand, as mentioned before, a merger will reduce the consumer surplus because the amount of firms producing the consumed output is reduced and so the total production, increasing the price and reducing the consumer surplus. In the same sense, a merger means a reduction in competing firms so, in this case, the amount of output produced by foreign firms increases and, given that the optimal policy is a per unit subsidy, the amount of tax revenue increases.

After this explanation, from (33) we can see that the net effect of merger on welfare is going to depend on the number of domestic firms. In an extreme case, if the merger leads us into a monopoly (m = l), the monopolist would be unable to offer a larger contribution than that offered by two or more firms. In this case, a merger will reduce the benefit in welfare and this result is independently of the level of corruption.22

Only with a sufficiently large amount of domestic firms over foreign firms, the merger will increase the political contribution according to (34). In this case, the benefit in political contribution and tax revenue is larger than the loss in consumer surplus. A merger will increase the welfare. Formally, we can say

Proposition 2. When the government applies discriminatory subsidy to foreign firms, a merger of domestic firms will increase the welfare when m >> n . On the other hand, it will be reduced when m = 1.

Finally, to finish this section, we follow the analysis made by Collie (2003). When a local merger reduces the welfare, the government tries to correct this negative externality using the policy instrument. It is clear that subsidy (tax) is not the only policy to correct the negative externality of a merger, there are many options indeed. In fact, many developed countries have some anti merger regulations to avoid this disturbing strategy. However, in many developing countries it is not the case as weak enforcement policy and corruption are just some examples of limited merger policy. We focus on subsidy (taxing) as the main instruments, due to the general knowledge and practice about using fiscal policy to overcome a competition problem. However, many policies could be available to face the merger disturbance on welfare and a good extension of this paper can be made with many policy options.

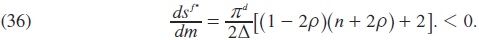

In this case, when the government pursues an optimal subsidy to foreign firms, how should the domestic country government respond to a local merger? In order to solve this question, we obtain the comparative static of a reduction in the number of local firms on the optimal subsidy policy such that

Taking into account that the government is going to respond politically to any local merger as long as it affects negatively the welfare, the conditions, under which this situation happens, are when merger lead us into a domestic monopoly in the country (m = 1 ).23 Assuming these values on (35), we can rewrite it as

This result is unequivocally negative and, since the optimal subsidy is negative (a tax), the optimal response is a tax reduction over the foreign firms. Formally, we can say

Proposition 3. When the government applies discriminatory subsidy to foreign firms, the optimal response of the domestic country to a local merger is to decrease the tax levied to foreign firms.

The intuition behind is quite straightforward. Once the optimal policy has been set by the government, evaluating not only the impact on consumer surplus and the total profits of domestic firms, but also the benefit on tax revenue, the domestic firms react and merge in order to get better profits by obtaining monopolistic advantages. Then the government is willing to reduce the tax levied to foreign firms in order to stimulate the competition and increase the consumer surplus by reducing prices. The consumer surplus is the most important consideration since the contribution has a negative impact on welfare given by the monopoly condition.

Uniform Subsidies and Mergers

Having described the case in which we have a discriminatory subsidy addressed to foreign firms, we shall follow our analysis with the case when the government uses a uniform subsidy. As we mentioned before, we are not going to analyze the case of discriminatory domestic subsidy as the local merger is a competing strategy that does not fit with a domestic subsidy.

A uniform subsidy is a fair policy to both kinds of firms. Different to the discriminatory subsidy, where the lobbying made by domestic firms determine the political contribution in clear opposition to a discriminatory subsidy in favor of foreign firms, in the case of uniform subsidy, the lobby effort is made in order to receive more subsidy even it is uniformly equal between foreign and domestic firms. More subsidy means more contribution offered by domestic firms, despite the foreign firms benefit. Substituting (23), (25), (28) in (9) (with (10)) we find

As mentioned previously, subsidizing uniformly to both kinds of firms has opposing effects on G through its various components. The above equation reflects this ambiguity. Clearly, a uniform subsidy will increase the benefit of the domestic firm and therefore the contribution made by them. It can be seen in the first term inside the square brackets in (37). On the other hand, a uniform subsidy will increase the consumer surplus according to the second term in (37). Finally, the last two terms in (37) tell us that financing the subsidy to both firms produces a negative impact on government objective function. Assuming G to be concave in sU, we get the optimal uniform subsidy equalizing (37) to zero as

From (38) we have an ambiguous vale of the optimal uniform subsidy. It is clear that the cost of subsidizing firms is contrary to the benefit in political contribution and consumer surplus. We can see that a larger corruption level will produce a larger positive perception about political contribution by the government. If this is the case, the benefit given by political contribution and consumer surplus will be larger than the loss given by financing subsidy and the optimal policy will be a subsidy.

However, if the corruption level is small enough and so the political contribution, the optimal uniforms subsidy will depend on the efficiency of domestic and foreign firms. When the domestic firms are sufficiently more efficient than the foreign firms, the government will adopt a subsidy since the benefit of the domestic profits and consumer surplus is larger than the cost for subsidizing uniformly both kinds of firms. On the other hand, when the foreign firms are sufficiently more efficient than the domestic ones, the domestic profits are small and, despite the benefit in consumer surplus, the cost for subsidizing firms uniformly is larger than the benefit in consumer surplus and domestic profits. In this case the optimal subsidy will be negative and taxing uniformly will be the optimal policy. Stating the above results formally,

Proposition 4. In the presence of a uniform subsidy to domestic and foreign firms, the optimal subsidy will be

if ρ>> 1, then sU*> 0,

if ρ;1 and cd << cf (cd >> cf), then sU*> 0(sU*< 0).

Even when a uniform subsidy is a fair policy, the domestic firms may take advantage of their local position and set a strategic behavior against the foreign competitors. As the last section, we consider merging as the competitive strategy implemented by domestic firms once the optimal policy has been set. All the explanation and intuition used in the last section respect to consumer surplus and political contribution effects of merger apply in this case. The only difference comes from the effect of merger on the cost of subsidizing. The cost of a uniform subsidy can be seen as

TR = DsU.

Differentiation of this expression with respect to m we gets the effect of merger on the cost of subsidizing as

From (39) we can see that a merger will reduce the cost of subsidy both firms as soon as the optimal policy is positive. Otherwise, a merger will increase the tax revenue. Substituting (38) in (39) and together with (32) (where apply) in (31) we get

The effect of a merger on the government objective function is ambiguous and it is going to depend on the level of corruption and the number of domestic and foreign firms. If merger leads us into a situation in which the number of foreign firms is larger or equal than the number of domestic firms (n ≥ m), then a merger will reduce the welfare.24 On the other hand, a merger can increase welfare if the number of domestic firms is larger than the number of foreign firms and the corruption level is sufficiently large. Formally, we can say.

Proposition 5. When the government applies uniform subsidies to foreign and domestic firms, a merger of domestic firms will reduce the government objective function when n ≥ m. On the other hand, the government objective function will increase when ρ>> 1 and/or n < m.

Intuitively speaking, with a merger, the consumer surplus will be reduced unequivocally. However, in the first case (n ≥ m) and according to (34), the policy contribution is reduced by merger because the amount of contributing firms is reduced.

The reduction in consumer surplus and policy contribution is larger than the reduction in the cost of subsidizing firms. In this case, with a merger in domestic firms, the welfare will be reduced.

On the other hand, when m > n and ρ>> 1, a merger of domestic firms will reduce consumer surplus as the previous case, but the political contribution will increase given the larger market share enjoyed by the large number of domestic firms despite the reduction in contributors according to (34). In brief, in the second case, a merger will promote a reduction in consumer surplus in smaller proportion than the increase in the benefit obtained by political contribution and the reduction in the cost of subsidy. With a merger in domestic firms, the welfare will increase.

As in the previous section, we wonder how the government is going to respond in terms of the political policy as a result of welfare's decreasing local merger. Again, we will differentiate the optimal policy function ( ) with respect to m, and we get

Considering only the condition under which the government objective function is reduced by merger (n ≥ m), it is clear that (41) is positive. In this sense, the optimal government's responses to a domestic merger is to decrease the optimal uniform subsidy. Formally we can say.

Proposition 6. When the government applies uniform subsidy to foreign and domestic firms, the optimal response of the domestic country to a local merger is to decrease the uniform subsidy.

Intuitively speaking, the fall in consumer surplus and political contribution will be compensated by a reduction in subsidy cost. Even when a reduction in subsidy may affect negatively the output produced by both firms through an increasing production cost, affecting negatively the consumer surplus and the amount of contribution (already decreased by the merger of domestic firms), the government is willing to reduce the cost of subsidy reducing the optimal uniform subsidy. This result is quite interesting as we may suppose that the optimal respond would be to increase the subsidy in order to benefit from consumer surplus and political contribution. However, it seems that the benefit produced by the reduction in the cost for subsidizing overcomes the possible benefit of increasing consumer surplus and political contribution independently of the political corruption level.

Conclusions

In this work, we develop a partial equilibrium model where the foreign and domestic firms compete under oligopolistic conditions. The government is endowed with per unit profit subsidies (taxes) to impose on both groups of firms (discriminatory and uniformly), while facing political pressure from a special interest group representing the domestic firms. Under this structure, the government maximizes a weighted sum of the total political contributions from interest groups and aggregate social welfare.

Using the above framework, we determine optimal policies in the presence of lobbying. We found that in the case of discriminatory subsidy for foreign firms, the optimal policy is to tax foreign competitors when the government receives political contributions from the domestic firms. In the case of uniform subsidies, when the government is highly corrupted, we show that the optimal subsidy is unequivocally positive and a subsidy will be given to both types of firms. However, when the level of corruption is sufficiently small, there is practically an absence of lobbying. The government is only concerned with maximizing the aggregate social welfare. In this case, the optimal uniforms subsidy is going to depend on the relative efficiency of both groups of firms. In particular, we found that the optimal uniform subsidy is positive (negative) if the foreign firms are less (more) efficient than the domestic ones.

We also analyze how the mergers of domestic firms change the equilibrium levels of subsidies and contribution payments. Our results show that, in the presence of lobbying, a merger of domestic firms is going to have different results according to the subsidy structure. In the case of a discriminatory subsidy, if merger leads us into a monopoly in domestic firms, then the welfare would be reduced given by a reduction in contribution and consumer surplus. This result is identical in the absence of corruption given clearly by the null effect of contribution in the government objective function. On the other hand, when the number of domestic firms is larger enough with respect to foreign firms, then the welfare will increase by a merger due mainly to an increase in contribution and the low level of monopolistic distortions.

In the presence of a uniform subsidy, the effect of a merger on welfare will depend again on the number of foreign and domestic firms as well as the corruption level. A merger will reduce welfare as soon as the number of foreign firms is equal or larger than the number of domestic firms. Different to the discriminatory case, it is not required to have a domestic monopoly to have a welfare reduction; it is enough if the foreign firms are at least the number of domestic firms. The explanation is the same than in the discriminatory case. On the other hand, a merger will increase welfare if the number of domestic firms is larger than the number of foreign firms, as in the discriminatory case, and the level of corruption should be large enough. It makes the political contribution significant in the policy decision.

Finally, we consider the optimal policy response of the government facing welfare's decreasing situation due to a merger in domestic firms. The result is quite interesting as we have contrary responses in both cases. At the discriminatory case, a merger in domestic firms will be answered decreasing the tax levied to foreign firms (as the negative subsidy means a tax to foreign firms). The interest to reduce the monopolistic distortion seems to be the key consideration in the political decision. On the other hand, in the case of uniform subsidy, the optimal response will be to reduce the uniform subsidy to both types of firms. It seems that the cost of financing is larger than the loss in consumer surplus and political contribution.

References

Benchekroun, H. and Chaudhuri, A. R. (2006). "Trade Liberalization and the Profitability of Mergers: a Global Analysis", Review of International Economics, Vol. 14(5); 941-957. [ Links ]

Bernheim, B. and Whinston, M. (1986). "Menu auctions, resource allocation, and economic influence", Quarterly Journal of Economics, Vol. 101; 1-31. [ Links ]

Bhagwati, J. N. (1993). "Fair trade, reciprocity and harmonization: the novel challenge to the theory and policy of free trade", in: D. Salvatore, ed. 1993. Protectionism and world welfare. Cambridge: Cambridge University Press. Ch.2. [ Links ]

Bhattacharjea, A. (2002). "Foreign Entry and Domestic Welfare: Lessons for Developing Countries", The Journal of International Trade and Economic Development, Vol.11(2); 143-162. [ Links ]

Brander, J. A. and Spencer, B. J. (1985). "Export subsidies and international market share rivalry", Journal of International Economics, Vol. 18; 83-100. [ Links ]

Brander, J. A. and Spencer, B. J. (1987). "Foreign direct investment with unemployment and endogenous taxes and tariffs", Journal of International Economics, Vol. 22; 257-279. [ Links ]

Collie, D. R. (2003). "Mergers and trade policy under oligopoly", Review of International Economics, Vol. 11; 55-71. [ Links ]

Dixit, A., Grossman, G. M. and Helpman, E. (1997). "Common Agency and Coordination: General Theory and Application to Government Policy Making" Journal of Political Economy, Vol. 105; 752-769. [ Links ]

Espinosa, R. and Kayalica, M. O. (2007). "Environmental policies and mergers' externalities", Economia Mexicana: Nueva Epoca, Vol. XVI(1); 47-74. [ Links ]

Ethier, W. J. (1986). "The multinational firm", Quarterly Journal of Economics, Vol. 101; 805-833. [ Links ]

Findlay, R. and Wellisz, S. (1982). "Endogenous tariffs, the political economy of trade restrictions, and welfare", in: J.N. Bhagwati, ed. 1982. Import competition and response. Chicago: University of Chicago Press. Ch. 8. [ Links ]

Gatsios, K. and Seabright, P. (1990). "Regulation in the European Community", Oxford Review of Economic Policy, Vol. 5(2); 37-60. [ Links ]

Goddard, J., Molyneux, P. and Zhou, T. (2012). "Bank mergers and acquisitions in emerging markets: evidence from Asia and Latin America", The European Journal of Finance, Vol. 18, Iss. 5; 419-438. [ Links ]

Grossman, G. and Helpman, E. (1994). "Protection for sale", American Economic Review, Vol. 84; 833-850. [ Links ]

Haufler, A. and Wooton, I. (1999). "Country size and tax competition for foreign direct investment", Journal of Public Economics, Vol. 71; 121-139. [ Links ]

Helpman, E. (1984). "A simple theory of trade with multinational corporations", Journal of Political Economy, Vol. 92; 451-471. [ Links ]

Hillman, A. L. (1989). The political economy of protection. Chur: Harwood Academic Publishers. [ Links ]

Hillman, A. L. and Ursprung, H. (1993). "Multinational firms, political competition, and international trade policy", International Economic Review, Vol. 34; 347-363. [ Links ]

Hortsman, I. and Markusen, J. (1987). "Strategic investments and the development of multinationals", International Economic Review, Vol. 28; 109-121. [ Links ]

Hortsman, I. and Markusen, J. (1992). "Endogenous market structures in international trade (natura facit saltum)", Journal of International Economics, Vol. 32; 109-129. [ Links ]

Itagaki, T. (1979). "Theory of the multinational firm: An analysis of effects of government policies", International Economic Review, Vol. 20(2); 437-448. [ Links ]

Janeba, E. (1995). "Corporate income tax competition, double taxation, and foreign direct investment", Journal of Public Economics, Vol. 56; 311-325. [ Links ]

Kayalica, M. O. and Lahiri, S. (2007). "Domestic Lobbying and Foreign Direct Investment. The role of policy instruments", Journal of International Trade & Economic Development, Vol. 16(3); 299-323. [ Links ]

Lahiri, S. and Ono, Y. (1998a). "Foreign direct investment, local content requirement, and profit taxation", The Economic Journal, Vol. 108; 444-457. [ Links ]

Lahiri, S. and Ono, Y. (1998b). "Tax policy on foreign direct investment in the presence of cross-hauling", Weltwirtschaftliches Archiv, Vol. 134; 263-279. [ Links ]

Long, N. V. and Vousden, N. (1995). "The effects of trade liberalization on cost-reducing horizontal mergers", Review of International Economics, Vol. 3; 141-55. [ Links ]

Magee, S. P., Brock, W. A. and Young, L. (1989). Black hole tariffs and endogenous policy theory. Cambridge: Cambridge University Press. [ Links ]

Markusen, J. R. (1984). "Multinationals, multi-plant economics, and the gains from trade", Journal of International Economics, Vol. 16; 205-226. [ Links ]

Markusen, J. R. and Venables, A. J. (1998). "Multinational firms and the new trade theory", Journal of International Economics, Vol. 46; 183-203. [ Links ]

Mayer, W. (1984). "Endogenous tariff formation", American Economic Rewiev, Vol. 74; 970-985. [ Links ]

Motta, M. (1992). "Multinational firms and the tariff jumping argument: a game theoretic analysis with some unconventional conclusions", European Economic Review, Vol. 36; 1557-1571. [ Links ]

Neven, D. (1992). "Regulatory reform in the European Community", American Economic Review, 82; 98-103. [ Links ]

Rodrik, D. (1995). "Political economy of trade policy", in: G. Grossman and K. Rogoff, eds. 1995. Handbook of International Economics, 3. Amsterdam: North-Holland Publishing House. Ch. 28. [ Links ]

Ross, T.W. (1988). "On the price effects of mergers with free trade", International Journal of Industrial Organisation, Vol. 6; 233-46. [ Links ]

Salant, S. W., Switzer, S., and Reynolds, R. J. (1983). "Losses due to merger: the effects of exogenous change in industry structure on Cournot-Nash equilibrium", Quarterly Journal of Economics, Vol. 98(2); 185-200. [ Links ]

Smith, A. (1987). "Strategic investment, multinational corporations and trade policy", European Economic Review, Vol. 31; 89-96. [ Links ]

UNCTAD (2000). World investment report 2000: Cross-border Mergers and Acquisitions and Development, Geneva: United Nations Publications. [ Links ]

3 As an important element of global economic activity, FDI has received enormous attention from scholars w orldwide. See, for example, Brander and Spencer (1987), Ethier (1986), Haufler and Wooton (1999), Helpman (1984), Horstmann and Markusen (1987) and (1992), Itagaki (1979), Janeba (1995), Lahiri and Ono (1998a) and (1998b), Markusen (1984), Markusen and Venables (1998), Motta (1992), and Smith (1987).

4 During the period between 1990-2000, most of the growth in international production has been via cross-border Mergers and Acquisitions (M & As) rather than greenfield investment. The total number of all M&As worldwide (cross-border and domestic) has grown at 42 percent annually between 1980 and 1999. The value of all M & As (cross-border and domestic) as a share of world GDP has risen from 0.3 percent in 1980 to 8 percent in 1999 UNCTAD (2000).

5 This urgency for FDI comes from the needs for growth and employment looked for developing economies.

6 One example of such a policy has been the acquisition of the German energy and gas provider RUHRGAS by its competitor EON in 2002. German competition authorities originally blocked that merger, on the grounds that it would lead to a dominant position on the domestic energy market. However, this decision was overruled by the federal government, which argued that the creation of a Germany-based global player is still in the interest of society, despite the detrimental domestic effects.

7 For instance, almost all countries have well-organized local producers (such as the automobile industry) who lobby the government for higher levels of protection against imported goods or against the goods of the foreign-owned plants producing in the country.

8 There are many models in the international trade literature that use political process. These include the tariff-formation function approach of Findlay and Wellisz (1982), the political support function approach of Hill-man (1989), the median-voter approach of Mayer (1984), the campaign contributions approach of Magee et al (1989), and the political contributions approach of Grossman and Helpman (1994). The literature has been surveyed in several works, including Magee, Brock and Young (1989), and Rodrik (1995).

9 Ross (1988) shows that a domestic merger driven by fixed cost savings leads to lower price increases in the face of unilateral tariff reduction than otherwise. In a two country oligopolistic model, Long and Vousden (1995) show that bilateral tariff reductions increase the profitability of a domestic merger when the asymmetry between the merging firms is large enough. Benchekroun and Chaudhuri (2006) show that trade liberalization always increases the profitability of a domestic merger (regardless of the cost-savings involved). Espinosa and Kayalica (2007) analyse the interface between environmental policies and domestic mergers externalities. Despite these works, domestic mergers have been an issue not explored enough by the economic literature.

10 Governments' policy measures regulating M&A activities affect the welfare of billions of consumers, as discussed in Benchekroun and Chaudhuri (2006), as well as the welfare of other economic agents such as employees and employers. For example, Bhattacharjea (2002) claims that if foreign mergers and export cartels can be treated as a reduction in the effective number of foreign firms, this can actually reduce home welfare below the autarky level, as the free-rider benefits that greater concentration bestows on domestic firms who are not party to the merger are insufficient to compensate for the loss inflicted on domestic consumers. This is a very serious regulatory issue in the world economy. The countries should pursue local and international policies in order to regulate possible unfair competitive strategies in case of mergers. This question has been addressed by Bhagwati (1993), Gatsios and Seabright (1990) and Neven (1992).

11 Multiple tax deduction is a normal practice for supermarket chain, and the government intervention in assuming some debts in Banks was the consequence of bank crisis from 1994 to 1996.

12 The model is adapted from Kayalica and Lahiri (2007), which developed a similar framework. Besides, we are considering only the lobby by the domestic firms but not by foreign firms. If we consider two lobby groups, the net effect will depend on who is paying more. The result may change certainly, but our assumption is based on the fact that domestic firms have the political closeness to the political structure given that they may be part of it directly. It is a common case in many developing economies where the domestics firms are part of the domestic establishment. On the other hand, in many countries, it is absolutely prohibited the foreign political contribution to the party in the power for any political campaign.

13 Using equations (1) and (2), government's objective function can also be written as G = ρCm + (πdm - Cm + CS +  - TR)Reorganizing the equation, we get G = ρ(-1)Cm + (πdm +

- TR)Reorganizing the equation, we get G = ρ(-1)Cm + (πdm + + CS - TR)form . Hence, government attaches a positive weight to contributions provided that ρ > 1. In other words, there is no political relationship between the government and the domestic firms when ρ = 1. The weight that the government attaches to social welfare is normalized to one.

+ CS - TR)form . Hence, government attaches a positive weight to contributions provided that ρ > 1. In other words, there is no political relationship between the government and the domestic firms when ρ = 1. The weight that the government attaches to social welfare is normalized to one.

14 We are assuming that foreign firms repatriate their profits.

15 Bernheim and Whinston (1986) develop a refinement in their menu-auction problem. Following this, first Grossman and Helpman (1994) and later Dixit et al. (1997) develop a refinement (as in Bernheim and Whinston (1986)) for the political contribution approach that selects Pareto-efficient actions.

16 These results were first established in the work of Brander and Spencer (1985) on strategic trade policy.

17 A clear example is the subsidy offered by the Mexican government to foreign firms in the automotive industry in order to get some future investment.

18 The Colombian government offers subsidies in order to develop the renewable energy sector.

19 In terms of value, about 70 percent of cross-border Mergers and Acquisitions are horizontal (see UNCTAD (2000, p.XIX.).

20 Although the number of domestic and foreign firms take an integer value, it will be treated as a continuous variable.

21 In our case, with a negative optimal subsidy, a merger means more tax revenue.

22 This result can be also reached when the corruption is sufficiently small (ρ≈1), and the political contribution is negligible making the loss in consumer surplus larger than the benefit in tax revenue. However, we do not consider this case here as we assume ρ > 1 since the beginning.

23 As mentioned before, when government objective function increases with a merger of local firms, the government does not have incentives to change the optimal policy and, therefore, we ignore the analysis.

24 Although the same result can be obtained with no corruption level (ft = 1), we just consider that p > 1 because for any level of corruption the condition n ≥ m holds.