Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

EconoQuantum

On-line version ISSN 2007-9869Print version ISSN 1870-6622

EconoQuantum vol.8 n.1-2 Zapopan Jul./Dec. 2011

Artículos

Convexity and marginal contributions in bankruptcy games

Leobardo Plata-Pérez1,2 Joss Sánchez-Pérez3

1 L. Plata-Pérez acknowledges support from CONACYT research grant 82610. E-mail: lplata@uaslp.mx.

2 Corresponding author. Facultad de Economía, UASLP; Av. Pintores s/n, Col. B. del Estado 78213, San Luis Potosí, México.

3 J. Sánchez-Pérez acknowledges support from CONACYT research grant 130515. E-mail: joss.sanchez@uaslp.mx.

Recepción: 23/03/2011

Aceptación: 05/09/2011

Abstract

In this paper we analyze two natural convexity definitions for cooperative bankruptcy games, one of them was introduced by Aumann and Maschler (1985). In particular, we show that convexity in the sense of increasing marginal contributions is not satisfied by the game introduced by these authors. Furthermore, we propose an alternative game that captures the situation of bankruptcy problems and characterize the anticore of such game; and using duality theory of cooperative games, we show that the core, anticore and its Shapley value coincide with the one studied by Aumann and Maschler (1985).

Keywords: Bankruptcy problems, cooperative games, convexity, marginal contributions.

Classification JEL: A120, C710, C020.

Resumen

En este trabajo analizamos dos definiciones naturales de convexidad para los juegos de bancarrota, una de ellas fue introducida por Aumann y Maschler (1985). En particular, mostramos que la convexidad, entendida como contribuciones marginales crecientes, no se satisface en el juego presentado por estos autores. Además proponemos un juego alternativo para capturar situaciones de bancarrota y caracterizamos el antinúcleo de este juego; usando la teoría de la dualidad para juegos cooperativos probamos que el núcleo, el antinúcleo y el valor de Shapley coinciden con el del juego estudiado por Aumann and Maschler (1985).

Introduction

A bankruptcy problem occurs when a company goes bankrupt owing money to some investors, but the company has only an amount E to cover debts. Investors demand quantities d1,d2,....,dn so that the sum of these claims exceeds the amount E to be distributed. The problem can also motivate a tax problem, the di represents income from taxpayers and E represents what the government needs to raise. See Herrero and Villar (2001), Thomson (2003), and Aumann and Maschler (1985) and more recently Aumann (2010), for further discussion on the bankruptcy problem and its solutions. One approach is to solve the problem through the solutions of cooperative games; this requires a cooperative game associated with each bankruptcy problem. O'Neill (1982) and Aumann and Maschler (1985) proposed a way to define a bankruptcy game as follows. They suggested to take the worth of a coalition S to be what it can get without going to court; i.e., by accepting either nothing, or what is left of the estate E after each member of the complementary coalition is conceded to get his complete claim. This game is convex in the sense of the standard definition described below.

When we apply cooperative game solutions to bankruptcy problems, we must begin to construct a cooperative game associated with each bankruptcy problem. Cooperative games are formal representations of situations in which all groups, or coalitions (and not just the group of the whole), can achieve something.

An important solution for cooperative games is the core: it represents the vector of efficient and stable distribution payoffs. Efficiency is linked to the idea of not wasting or debt, and stability refers to the absence of incentives to leave the cooperative agreement. A condition to ensure its emptiness is the convexity of the game. In addition, the solution Shapley value, possibly the most important solution concept, is always in the core. In fact, this value is the center of gravity of the vertices that form the core (See Shapley (1971)). The standard meaning of convexity is that the contribution of a player to any coalition is at least as large as his contribution to any subcoalition of it. This notion of convexity is not the only natural and possible one. If we review the concept of convex function of real analysis or convexity assumptions used in traditional microeconomics, we can generate alternatives. In microeconomics, the convexity of functions appears to represent cost functions associated with technologies that represent decreasing returns (classic case of perfect competition and general equilibrium), the functions of production associated with technologies of increasing returns, functions of increasing marginal productivity, in monetary profits risk-loving agents in decisions under uncertainty, among other uses. When these functions are represented by continuous, convex increasing functions, and defined on the non-negative reals, we have at least two ways to identify them. The first way is to note that the derivatives of the high points are higher than those derivatives of low points. A second way is to note that the derivatives are increasing. Both ways are equivalent in the case of real functions of real variable with the requirements listed above. When we turn to the world of players' marginal contributions to coalitions in cooperative games, the identity of the meaning of convexity disappears. The standard version used in O'Neill (1982) and Aumann and Maschler (1985) is identified with the first version. The idea of increasing derivatives is linked to marginal contributions, of the same agent, to bigger coalitions than its sub-coalitions. The idea of increasing successive derivatives is just the case of increasing marginal contributions that we exploit here. We proved that the game of Aumann and Maschler meets the standard definition of convexity but not the version of increasing marginal returns.

In this paper we make another contribution to the analysis of bankruptcy issues through cooperative games. We propose and study another way to associate a game with a general bankruptcy problem, different from the standard bankruptcy game presented in Aumann and Maschler (1985): the idea is to take the worth of a coalition to be what it can get by going to court; i.e., the total amount of debts its members are actually claiming, on the understanding that any amount of debt that goes beyond the estate is considered to be irrelevant. We show that those games are dual in a formal sense and exploit this duality relation to prove that their core, anticore and Shapley values coincide.

The paper is organized as follows. We first provide the framework of bankruptcy problems, as well as cooperative games in characteristic function form. The study of convexity in a game that appropriately summarizes the situation of bankruptcy problems is discussed in the third section. Finally, we studied an alternative bankruptcy game, which is defined in a way that members of a coalition receive their demands as far as possible, and leave the rest to the remaining players. We provide a simple characterization for the anticore for such game and we show that its Shapley value coincides with the one for the game studied in the third section.

Preliminaries

In this section we give a brief subsection of some concepts and notation related to bankruptcy problem, as well as preliminaries related to n-person cooperative games in characteristic function form, since it is a key subject in subsequent developments.

Bankruptcy problems

Think about the following situation. A small company goes bankrupt owing money to three creditors. The company owes creditor A $10,000, creditor B $20,000, and creditor C $30,000. If the company has only $36,000 to cover these debts, how should the money be divided among the creditors?

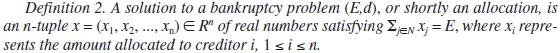

We suppose a problem with n creditors and we interpret di as the amount that the ith creditor demands, whereas E is the total amount that may be repaid.

A possible allocation for the situation described above is to proceed in a proportional way. So, a pro rata split of the money would lead to the allocation of $6,000 for creditor A, $12,000 for creditor B and $18,000 for creditor C.

Cooperative games

By an n-person cooperative game in characteristic function form (or a TU cooperative game), in what follows just a game, we mean a pair (N, v), where N = {1, ..., n} is a finite set of players and v is a function v: 2N → R with the property that v: (Φ) = 0 (2N denotes the set of subsets of N). We usually refer to subsets S of N as coalitions and to the number v (S) as the worth of S.

Since we consider a fixed set of players, by a game (N, v), we will mean just a characteristic function v. A game v is superadditive if v (S ∪ T) ≥ (S) + v (T) for all S, T ⊆ N, and it is subadditive if the inequality holds in the other direction. There are several interpretations for (N, v), it depends on what people want to model. For instance, if the game is superadditive, v (S) means the maximal amount the players in S can get if they decide to play together. While the game is subadditive, v (S) usually means the joint cost that players in S have to pay to get a service if they hired the service together. Additionally, we will denote the cardinality of a set by its corresponding lower-case letter, for instance  , and so on.

, and so on.

We denote by GN the set of all games with a fixed set of players N, i.e., GN = {v: 2N → R / v (Φ) = 0}. A solution φ: GN → Rn in GN is a rule to divide the common gain or cost among the players in N. Let ΓN be the set of solutions in GN.

The core is a widely accepted and frequently applied solution for cooperative transferable utility games. Each element of the core of a coalitional game is stable in the sense that no coalition can improve upon this element. Since the worth of a coalition is interpreted as the maximal profit or minimal cost for the players in their own coalition, the definition of the core depends on the interpretation of the game.

That is, the core is the set of efficient payoffs vectors such that each coalition receives at least its worth.

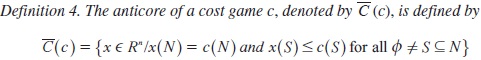

There is the counterpart for the core of cost games; here the feasible payoff vectors in such core are efficient and such that every coalition gets at most its worth. In this case, we refer to it as the "anticore":

Given v, w ∈ GN and λ∈ R , we define the sum and the product v + ω and λν in GN in the usual form, i.e.,

respectively.

In a similar manner, for φ, ψ ∈ ΓN and λ ∈ R , we define the sum and the product φ+ψ and λ φ in GN by

It is easy to verify that GN and iN are vector spaces with these operations.

Shapley L. (1953) characterized a unique solution on GN (denoted by Sh) for cooperative games:

For a brief revision of the concepts of solutions for cooperative games that are mentioned here, such as the Shapley value, see Driessen T. (1988) and Peleg B. and Sudhölter P. (2007).

Convexity and marginal contributions

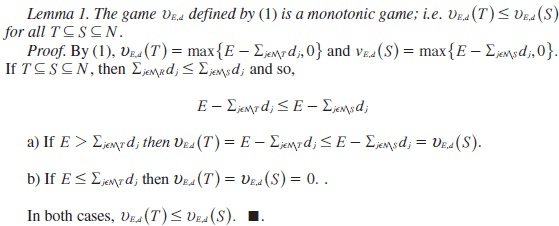

Aumann and Maschler (1985) define a natural way to associate a game with a bankruptcy problem (E, d), taking the worth of a coalition S to be what it can get without going to court; i.e., by accepting either nothing, or what is left of the estate E after each member of the complementary coalition N\S is paid his complete claim. Thus, they define the (bankruptcy) game vE,d corresponding to the bankruptcy problem (E, d) by:

Example 1. Let , (E, d) be a bankruptcy problem, for 4 creditors with E = 10 and d = (2,4,5,9). The game associated to (E, d), vE,d is defined as

And the Shapley value for this game is

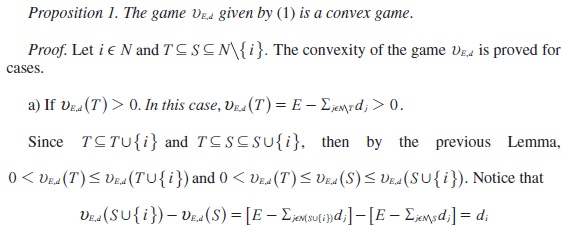

Introduced in Shapley (1971), convex cooperative games capture the intuitive property of "snowballing". Specifically, a game is convex if its characteristic function y satisfies:

There is an equivalent characterization of convex games. It can be shown (see, e.g., Section V.1 of (Driessen 1988)) that a game is convex if and only for all i ∈ N ,

Thus, the game v is convex if and only if the marginal contribution of a player to a coalition is monotone nondecreasing with respect to set-theoretic inclusion. This explains the term convex.

and

This concludes the proof.

Remark 1. It is well known that the core, the set of efficient payoff vectors such that each coalition receives at least its worth, of a convex game is non-empty. Therefore C(vE,d )‡ φ for every bankruptcy problem (E, d).

Example 2. Let (E, d) be a bankruptcy problem given in Example 1. Consider the following embedded coalitions:

By Lemma 1, vE,d ({4})≤ vE,d ({1,4})≤ vE,d ({1,2,4})≤ vE,d ({1,2,3,4}). The worths are 0 ≤ 1 ≤ 5 ≤ 10 and the corresponding marginal contributions satisfy 1 ≥ 4 ≥ 5, which are increasing.

Next, we will show that, in general, marginal contributions are not increasing for bankruptcy games. But first, we illustrate the idea with an example.

We note that marginal contributions are not increasing in the case where creditors with greater demands are first incorporated in the coalition formation process. We can generalize this idea.

Proposition 2. Let (E, d) be a bankruptcy problem with at least three creditors and let , a game associated to it, given by (1). Then marginal contributions are not in creasing for the game vE,d.

Proof. Let (E, d) be a bankruptcy problem and let vE,d, a game associated to it. Without loss of generality, suppose d1 ≤ d2≤ ...≤ dn. Let k be the greatest index such that

Take the embedded coalitions T ⊆ R ⊆ S defined by T ={1, 2,...,k}, R = T∪ =1 {k} = {1, 2,...,k} and S = R∪ ,{1+k} = {1, 2,...,k + 1} By Lemma 1, vE,d (T)≤ v, vE,d (R) ≤ vE,d (S) and it is easy to check that, vE,d (T∪{k}-vE,d (T) = dk and vE,d (T∪{k, k +1}) -vE,d (T∪{k}) =dk-1. Since dk-1d < dk, we can conclude that marginal contributions are not increasing for the game vE,d.

An alternative bankruptcy game

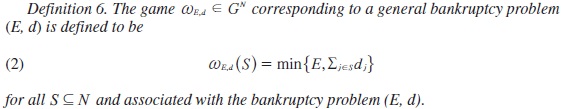

Since cooperative games are formal representations of situations in which all groups or coalitions (and not just the group of the whole) can achieve something, in this section we study another way to associate a game with a general bankruptcy problem. The idea is to take the worth of a coalition to be what it can get by going to court; i.e., the total amount of debts its members are actually claiming, on the understanding that any amount of debt that goes beyond the estate is considered to be irrelevant.

Note that the previous definition is in agreement with the standard manner in which cooperative games are constructed to represent conflicts, namely by defining the worth of a coalition as a guaranteed amount. If the worth of a coalition is interpreted instead as the amount the coalition can expect to receive, the definition is somewhat optimistic. However, the bias being systematic across coalitions, we might still feel that the resulting game appropriately summarizes the situation.

Since the core (anticore) has one of the most appealing solution concepts for cooperative games, e.g., various papers deal with the existence of the core (anticore) for specified types of games, whereas other papers address to the characterization of it (for instance, see Peleg (1985)); we provide a simple characterization of the anticore of the game. In this case, the anticore of ωE,d, is the set

Proof. First, we suppose 0 ≤ xi ≤ di, ∀i ∈ N . For every coalition S, such that, Φ ‡ S ⊆ N we have x(S) ≤ x(N)= E. On the other hand, x(S) ≤  and so, x(S)≤

and so, x(S)≤ = wE,d (S) for all Φ ‡ S ⊆ N. Hence, we conclude

= wE,d (S) for all Φ ‡ S ⊆ N. Hence, we conclude  .

.

Now, we suppose  . For the inequalities in the definition of

. For the inequalities in the definition of  with coalitions of cardinality 1, it follows immediately that for i ∈ N ,

with coalitions of cardinality 1, it follows immediately that for i ∈ N ,

While with coalitions of cardinality n−1, notice that

Therefore

And so, we conclude

Remark 2. From this simplest characterization of the anticore mentioned in the previous Theorem, it is clear that the anticore of the bankruptcy game ωE,d is always non empty; e.g., allocate to each successive creditor his claim as long as the sum of their claims does not exceed the amount E, and allocate to the other creditors, except one, nothing. And also, we can notice that elements in the anticore are feasible solutions in the sense that no creditor receives more than he demands.

Remark 3. C (ωE,d) = Φ for every bankruptcy problem, except for a problem where a creditor i claims an amount greater than E, and the remaining creditors N\{i} claims an amount of 0. In this case, C (ωE,d)= {(0,..., 0, E, 0,..., 0)}, where creditor i receives the amount E.

Example 4. Let (E, d) be a bankruptcy problem given in Example 1. The alternative game associated to (E, d), ωE,d, is defined as

And the Shapley value for this new game is

Which coincides with Sh(ωE,d).

For a general game v ∈GN , the interpretation of v(S) changes accordingly to what people want to model. For example, v(S) could be the joint benefit that the coalition S could generate if they decide to play together; in this case, we would say that y is a benefit game. In a second interpretation, we could assume that the players in N want to hire a service, then v(S) could be thought of as the joint cost (for the players in S) if they act together. In the latter case, we say that is a cost game. In both cases, v(S) is the "worth" assigned to the coalition S when it is formed, i.e., when the players in S decide to play together.

The duality operator, as defined next, allows us to move from one of these interpretations to the other. Thus it is a natural concept to study. For a brief revision of the dual operator, see for instance Funaki (1994), where this author investigates the relationship between axiomatizations of solutions of cooperative games due to their dual axiomatizations. The duality operator *:GN → GN is defined by

In other words, the value of a coalition in the dual of a given game equals the difference between the value of the grand coalition and the value of the complement of the coalition in the given game. It is considered as an optimistic valuation of the game situation if the original game is considered as a pessimistic valuation like maximum standard. The dual game is also considered as a cost game when we regard the original game as a saving game.

Note* (*v) = v that and it is easily shown that  .

.

Remark 4. If vE,d, and ωE,d, are games given by (1) and (2), respectively; then it holds that

and

for every S ⊆ N; i.e., the game vE,d is the dual game of ωE,d and conversely. So, it also holds that

Remark 5. The property of the Shapley value pointed out in the previous Example is satisfied for every game and its dual.

Let v ∈ GN and (*v) its dual, then

Now, if T = N\S, then

In the cooperative game theory framework, this means that the Shapley value is a self-dual solution.

Conclusion

This paper has contributed to the study of solutions for of bankruptcy problems through the use of cooperative games and their solutions. We have seen equivalent ways of defining convex real functions of real variable, they cannot be generalized in a natural and unique way, to generate a notion of convexity in cooperative games defined in the set of coalitions of players. The standard notion of convexity of a cooperative game is not equivalent to the notion that we introduce for increasing marginal contributions. We have explained the economic sense of duality in the case of cooperative games related to bankruptcy issues. We have obtained a characterization of stable solutions of the dual game of bankruptcy problems proposed in section 4. The high content of distributive justice of the Shapley value has been tested again. Two games built with apparently conflicting ideas of the behavior of coalitions have generated the same solution as the distribution of justice that the Shapley value. For future research, we may consider alternative ways to build cooperative games to solve bankruptcy problems; the imposition of desirable properties of any solution of bankruptcy can help to characterize solutions without going through the cooperative games.

References

Aumann, R. J. (2010). "Some non-superadditive games, and their Shapley values, in the Talmud", International Journal of Game Theory, 39, 3 - 10. [ Links ]

Aumann, R. J., Maschler, M. (1985). "Game theoretic analysis of a bankruptcy problem from the Talmud", Journal of Economic Theory, 36, 195 -213. [ Links ]

Driessen, T. (1988). Cooperative games, solutions and applications. Theory and Decision Library, Springer. [ Links ]

Funaki, Y. (1994). "Dual axiomatizations of solutions of cooperative games", Working paper 13, Faculty of Economics, Tokyo University. [ Links ]

Herrero, C., Villar, A. (2001). "The three musketeers: four classical solutions to bankruptcy problems", Mathematical Social Sciences 42, 307-328. [ Links ]

O'Neill, B. (1982). "A problem of rights arbitration from the Talmud", Mathematical Social Sciences, 2, 345 - 371. [ Links ]

Peleg, B. and Sudhölter, P. (2007). "Introduction to the theory of cooperative games", Springer, 2nd edition. [ Links ]

Peleg, B. (1985). "An axiomatization of the core of cooperative games without side payments", Journal of Mathematical Economics, 14, 203 - 214. [ Links ]

Shapley, Ll. (1953). "A value of a n-person games", Contributions to the Theory of Games, Annals of Math.Studies, Princeton, 28, 307 - 317. [ Links ]

Shapley, Ll. (1971). "Cores of convex games", International Journal of Game Theory, 1(1), 11 - 26. [ Links ]

Thomson, W. (2003). "Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: a survey", Mathematical Social Sciences, 45, págs. 249-297. [ Links ]

Nota

We would like to thank the anonymous referee for helpful comments on an earlier draft. All remaining errors, however, are solely ours.