Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

EconoQuantum

On-line version ISSN 2007-9869Print version ISSN 1870-6622

EconoQuantum vol.6 n.1 Zapopan Jan. 2009

Suplemento especial: Primer Seminario Internacional en Teoría Económica Contemporánea

Mesa 2: Finanzas y desarrollo

The impact of financial market imperfections on trade and capital flows

Spiros Bougheas, Rod Falvey1

1 GEP and School of Economics, University of Nottingham.

Abstract

We introduce financial frictions in a two sector model of international trade with heterogeneous agents. The level of specialization in the economy (economic development) depends on the quality of financial institutions. Underdeveloped financial markets prohibit an economy to specialize in sectors where finance is important. Capital flows and international trade are complements when countries differ in the degree of development of their financial sectors. Capital flows to countries with more robust financial institutions which in turn allow their economies to develop sectors that are financially dependent.

Keywords: trade flows, capital flows, financial frictions.

JEL Classification: F21, G15.

Introduction

Over the last 30 years, international capital flows have risen dramatically. These flows include both portfolio (equity and bonds) and foreign direct investment. Over the same period, international trade flows have also increased although not at the same rapid pace.2 The regional or global spread of recent financial and currency crises –Mexican 1994 and East Asian 1997 twin–crises, Brazilian and Russian 1998 currency crises, and the current global banking crisis– has been, in part, attributed to the increased world wide flows of capital (especially portfolio). Beside their stark welfare effects, these types of events also have distributional effects. In financial markets without frictions, these types of events cannot take place. When investors and borrowers have complete information about project returns and financial contracts are costless to enforce the allocation of capital will be efficient. However, in markets with frictions there will be financially constrained agents who although they own profitable projects they are unable to finance them. At the economy level, the implications of these constraints can be too important to be ignored. Potentially, they can influence comparative advantage and therefore the patterns of trade. But they also can influence the volume and direction of capital flows. Traditionally, capital mobility in economies with financial frictions has been examined within one–sector macro dynamic models. In contrast, till very recently, traditional trade models only considered the case of perfect capital mobility or none.

Our aim in this paper is to provide a unified framework that will allow us to analyze the impact of financial market frictions on international trade and capital flows. Additionally, we would like to assess the distributional effects of these types of changes. Our aim is to focus on developing economies, and thus we assume that our economy is a price taker in world markets. For similar reasons, we assume that trade is motivated by comparative advantage. In recent international trade models, trade is motivated by the desire of agents to consume an ever wider variety of goods.3 This type of model is more appropriate for industrialized countries where a big part of trade flows are within the same industries than developing economies where technological differences between them and their trading partners are more important in explaining their patterns of trade. With this in mind, we introduce financial frictions in a two–sector Ricardian model with heterogeneous agents.4 There is a primary sector producing a commodity with a CRS technology and labor as the only input. There is also a manufacturing sector producing a product with a risky technology that uses the labor of an entrepreneur and physical capital. Financial frictions limit the ability of entrepreneurs to raise funds in a competitive financial market. Agents are free to choose their sector of employment, a decision that ultimately depends on their initial endowments of physical assets which is the only source of heterogeneity in our model.

In modelling financial frictions, we follow the variable investment model of Holmstrom and Tirole (1997). The ability of agents to choose their level of effort, which is unobservable by investors, limits the amount of income that the former can pledge to the latter and thus the amount of external funds that they can obtain. Wealthy agents can raise more funds but even they are financially constrained, since in the absent of the moral hazard problem they would have been able to obtain bigger loans and thus run bigger projects. Poor agents find that it is better for them to find employment in the primary sector and invest their endowments in the capital market.

We begin by solving for the closed economy equilibrium. We find that changes in agency costs affect both the relative price between the two goods and the interest rate. Given that comparative advantage and optimal investment, choices depend on the differences between these prices and the corresponding world prices, changes in the efficiency of financial markets affect not only the volume of trade and capital flows, but also a country's patterns of trade and international indebtedness. Then we examine separately the cases of trade liberalization and financial openness before we allow free movement across international borders of both goods and capital. Here we find that trade and capital flows are complementary. Better financial markets, i.e. markets with lower agency costs, attract more foreign capital thus encouraging the production and export of manufactures. However, we also find that after liberalization, inequality increases in economies with more efficient financial systems while decreases in economies whose markets malfunction because of their high degree of agency costs.

Our paper is closely related to Antras and Caballero (2009), to our knowledge, the only other attempt to explain the impact of financial market frictions on both trade and capital flows.5 One important difference between the two papers is that we allow for heterogeneity and endogenous participation. In contrast, they are able to analyze a dynamic version of their model that allows them to make the important distinction between physical and financial capital.

We organize our paper as follows. In Section 2 we develop our model and in Section 3 we solve for the closed economy equilibrium. Sections 4and 5 are devoted to the analysis of trade and financial liberalization respectively. In Section 6 we allow both capital and goods to move freely across international borders and in Section 7 we provide some final comments.

The Model

There is a continuum of agents of unit measure. Agents differ in their endowments of physical assets A which are distributed on the interval  according to the distribution function f (A) with corresponding density function f (A). Every agent is also endowed with one unit of labor. The economy produces two final goods; a primary commodity (Y) and a manufacturing product (X). Preferences are described by the Cobb–Douglas function X α Y 1–α.

according to the distribution function f (A) with corresponding density function f (A). Every agent is also endowed with one unit of labor. The economy produces two final goods; a primary commodity (Y) and a manufacturing product (X). Preferences are described by the Cobb–Douglas function X α Y 1–α.

Next, we describe the production technologies of the two final goods. A CRS technology is used for the production of the primary commodity where one unit of labor yields one unit of the primary commodity. The technology for producing the manufacturing product is a stochastic technology. It requires to be managed by an entrepreneur who invests her endowments of labor and physical assets. An investment in assets of I units yields RI units of the manufacturing good when the investment succeeds and 0 when it fails. Following the variable investment version of the model in Holmström and Tirole (1997), we assume that the probability of success depends on the behavior of the entrepreneur.6 When the entrepreneur exerts effort, the probability of success is equal to pH while when she shirks the probability of success is equal to pL (< pH ), however, in the latter case she derives an additional benefit BI. Let Δp ≡ pH – pL. We assume that when the entrepreneur exerts effort the per unit of investment operating profit is positive, i.e. pH R > 1, and negative otherwise, i.e. pLR + B <1. Put differently, projects are socially efficient only in the case where the entrepreneur exerts effort.

The Financial Contract

Under the assumption that borrowers are protected by limited liability, the financial contract specifies that the two parties receive nothing when the project fails. Let Ri denote the payment to the lender when the project succeeds, which implies that the entrepreneur keeps RI – Ri ≡ Rb. Consider an entrepreneur with wealth A. The lender's zero–profit condition, under the assumption that the borrower has an incentive to exert effort, is given by

where r denotes the equilibrium interest rate. The left–hand side is equal to the expected return of the lender and the right–hand side is equal to the opportunity cost of the loan. The entrepreneur will exert effort if the incentive compatibility constraint shown below is satisfied

The constraint sets a minimum on the entrepreneur's return, which is proportional to the measure of agency costs  . For a given contract, the entrepreneur has a higher incentive to exert effort the higher the gap between the two probabilities of success is. In contrast, a higher benefit offers stronger incentives for shirking. The constraint also implies that the maximum amount that the entrepreneur can pledge to the lender is equal to

. For a given contract, the entrepreneur has a higher incentive to exert effort the higher the gap between the two probabilities of success is. In contrast, a higher benefit offers stronger incentives for shirking. The constraint also implies that the maximum amount that the entrepreneur can pledge to the lender is equal to  . It is exactly the inability of entrepreneurs to pledge a higher amount that limits their ability to raise more external funds. We impose the following constraint that ensures that the optimal investment is finite.

. It is exactly the inability of entrepreneurs to pledge a higher amount that limits their ability to raise more external funds. We impose the following constraint that ensures that the optimal investment is finite.

Substituting the incentive compatibility constraint into the zero–profit condition we get.

The inequality implies that the maximum amount of external finance available to an entrepreneur with wealth A is equal to.

Given that lenders make zero profits, the entrepreneur's payoff is increasing in the level of investment and thus at the equilibrium both the incentive compatibility constraint and (2) are satisfied as equalities.

Equilibrium under Autarky

Without any loss of generality, we use the manufacturing product as the numeraire and we use P to denote the price of the primary commodity. In order to derive the equilibrium under autarky, we need to know how agents make their occupational choice decisions. Consider an agent with an endowment of physical assets A. If the agent decides to become an entrepreneur her income will be equal to  given that her incentive constraint will be satisfied as an equality. In contrast, should she decide to work in the primary sector, her income will be equal to P + Ar. Using (2) to substitute for I, setting the above two income levels equal and solving for A we obtain a threshold level of endowments A* such that all agents with endowments below that level work in the primary sector and all other agents become entrepreneurs.

given that her incentive constraint will be satisfied as an equality. In contrast, should she decide to work in the primary sector, her income will be equal to P + Ar. Using (2) to substitute for I, setting the above two income levels equal and solving for A we obtain a threshold level of endowments A* such that all agents with endowments below that level work in the primary sector and all other agents become entrepreneurs.

Notice that (1) ensures that A* > 0. Notice that the threshold is increasing in the level of agency costs. Put differently, there is more credit rationing as financial markets become more inefficient.

Financial Market Equilibrium

Equilibrium in the financial market requires that

Where the left–hand side is equal to the supply of funds by those employed in the primary sector and the right–hand side is equal to the demand for funds by entrepreneurs. Using (2) we can rewrite the above condition as

where  is equal to aggregate endowments of physical assets. Here the right–hand side is equal to gross investment.

Goods Market Equilibrium

The specification of preferences implies that each agent allocates a fraction α of her income on the manufacturing product and the remaining income on the primary commodity. Without any loss of generality, we focus on the market for the primary commodity. An agent producing the primary commodity consumes an amount equal to  and therefore offers for sale an amount equal to

and therefore offers for sale an amount equal to  . Every entrepreneur demands an amount equal to

. Every entrepreneur demands an amount equal to  . Then, the goods market clearing condition is given by

. Then, the goods market clearing condition is given by

Using (2) to substitute for I we get

General Equilibrium

Definition 1: An equilibrium under autarky is a triplet {A*, r, P} that solves the system of equations comprising of the optimal occupational condition (3), the financial market clearing condition (4) and the goods market clearing condition (5).

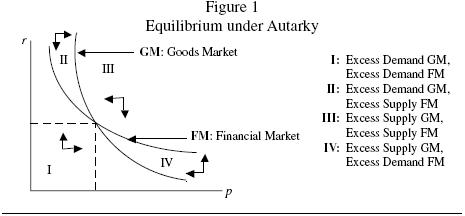

By substituting (3) in (4) and (5), we can reduce the equilibrium system into two market equilibrium condition in the two unknown prices P and r. As we show in the Appendix, using the two market–equilibrium conditions we can derive two loci that show combinations of the two prices that keep each market in equilibrium. The financial market locus has definitely a negative slope. Other things equal, an increase in the interest rate tightens the financial constraints and some agents move from the manufacturing sector to the primary sector, thus creating an excess supply in the financial market. A decline in the price of the primary commodity by discouraging employment in the primary sector brings the financial market back in equilibrium. The slope of the goods market locus can be either negative or positive. If it is negative, a sufficient, but by no means necessary, condition for stability is that, for those workers employed in the primary sector, wage income effects dominate financial income ones. Figure 1 shows the equilibrium under autarky under the assumption that both loci are negative.

Consider now the impact of a decline in agency costs on the two prices. The improved financial conditions offer incentives to agents to become entrepreneurs. The switch in the employment sector creates both an excess demand for external finance and an excess demand in the primary commodity market. In financial markets with lower agency costs there are more agents who have access to external finance and for a given net worth they can also obtain more funds. Thus, notice that financial development alleviates both types of credit rationing. The changes also imply that manufacturing output is higher in economies with better financial development. In terms of Figure 1, both loci move to the right after the decline in agency costs that suggests that at least one price and maybe both (if the direct effects dominate the indirect ones) will rise. The reason that one of the prices might decline, despite of the initial excess demand in both markets, is that an increase in any of the two prices encourages employment in the primary sector and thus relieving, at least partially, the pressure of the initial impact.

Trade Liberalization

We assume that the economy is a price–taker in the world markets and we denote by P* the world price of the primary commodity. In this section, we still assume that capital is not allowed to move across borders. It is clear that if the autarky price is below the world price (P < P*), then the economy will have a comparative advantage in, and thus export, the primary commodity. In contrast, if the world price is below the autarky price (P > P*), then manufacturing will be the exporting sector.

Financial Development and Trade Patterns

An immediate consequence of the analysis of the model under autarky is that financial development can affect the patterns of trade. Under autarky, other things equal, in economies with more developed financial systems the price of the primary commodity is higher. This means that economies with better financial systems are more likely to export manufacturing products and import primary commodities. Put differently, financial development favors financially dependent sectors, an observation also made by Antras and Caballero (2009), Beck (2002), Chaney (2005), Egger and Keuschnigg (2009), Ju and Wei (2008), Kletzer and Bardhan (1987), Manova (2008b), Matsuyama (2005) and Wynne (2005).

Trade Liberalization Equilibrium

Definition 2: A small economy equilibrium with free trade in goods and capital immobility is a pair {A* r} that solves the system of equations comprising of the optimal occupational condition (3), the financial market clearing condition (4) and the restriction that P = P*.

The following proposition describes the main results of this section.

Proposition 1: Under free trade, a decline in either agency costs or in the world price will increase the interest rate.

Proof: This follows by setting P = P* in (A3).

Both changes encourage entrepreneurship which, in turn, strengthens the demand for external finance. It is worth noticing that an improvement in the efficiency of financial markets has exactly the same consequences for the patterns of trade as an increase in the world price of the primary commodity. It is more likely that a country will export the manufacturing good after such changes than before. Also notice that in the case of autarky, the effect of a change in agency costs on the interest rate was ambiguous because of the potential counterbalancing effect of a price adjustment. In contrast, under free trade the latter effect is absent.

The following result will be useful below when we allow for both free trade and international capital mobility.

Corollary 1: Suppose that two economies differ only in the degree of development of their financial markets and that under autarky a decline in agency costs pushes both prices up (i.e. the indirect effects are dominated). Then the gap between the two interest rates will be wider under free trade.

Under autarky, the increase in the price of the primary commodity counterbalances some of the incentives that agents have to move to the manufacturing sector. In contrast, under free trade, the price is fixed and thus agents have stronger incentives to move to the manufacturing sector and therefore the interest rate is higher relative to autarky.

Capital Market Liberalization

When capital is allowed to move freely across borders, our small economy assumption implies that the domestic interest rate will be equal to the world interest rate, r = r*. In this section, we assume that goods are not traded internationally. From Proposition 1 we know that countries with more efficient financial systems have higher interest rates. This implies that, other things equal, capital will flow from countries with poor financial development to countries with more efficient financial markets. More efficient financial systems allocate capital more effectively and thus encourage the development of sectors that are more capital dependent, which in our case is the manufacturing sector.

Definition 3: A small economy equilibrium with free capital mobility but without international trade in goods is a pair {A * P} that solves the system of equations comprising of the optimal occupational condition (3), the goods market clearing condition (5) and the restriction that r = r*.

The following proposition describes the main results of this section.

Proposition 2: Under free capital mobility, a decline in either agency costs or in the world interest rate will increase the price of the primary commodity.

Proof: This follows by setting r = r* in (A4).

A decline in agency costs relaxes financial constraints and encourages agents to become entrepreneurs. Without the counterbalancing effect of an increase in the interest rate, as it happens in autarky, the price increases responding to both the increase in the supply of the manufacturing product and the decline in the supply of the primary commodity. Similarly, a decline in the world interest rate has a negative effect on saving and thus on the incentives on agents to find employment in the primary sector.

Once more, the following corollary will be useful below when we allow for both free trade and international capital mobility.

Corollary 2: Suppose that two economies differ only in the degree of development of their financial markets and that under autarky a decline in agency costs pushes both prices up (i.e. the indirect effects are dominated). Then the gap between the two prices rates will be wider under free capital mobility.

The intuition behind this result is exactly the same as the one we offered for Corollary 1.

Globalization Equilibrium

Now suppose that both capital and goods are allowed to be traded across international borders. This implies that the small economy is a price taker in both markets.

Definition 4: A small economy equilibrium with free trade and free capital mobility a real number A* that solves the optimal occupational condition (3) and the restrictions that r = r* and P = P*.

It is well known that, in traditional trade models, when comparative advantage arises because of differences in endowments, trade flows and capital flows are substitutes. The intuition is that a country that is, for example, well endowed in labor but poorly endowed in capital, can increase its consumption of capital intensive goods by either importing them or by producing them after importing capital. Put differently, there are two distinct ways to import capital. One way is to do it directly and another indirectly by importing goods that need relatively a lot of capital for their production. In contrast, when comparative advantage arises because of differences in technologies, trade flows and capital flows are complements. When two countries have the same endowments in labor and capital, the one that has a better technology for producing the capital intensive good will import capital and export that good.

The Complementarity between Trade and Capital Flows

From Corollaries 1 and 2 we obtain the following important result that has also been proved by Antras and Caballero (2009).

Proposition 3: In a globalized equilibrium, where the only difference between countries is the level of agency costs in their financial markets, trade flows and capital flows are complements.

From Corollary 1 we know that the interest rate gap is larger under free trade than under autarky that implies that capital flows are higher in a globalized equilibrium than one without trade in goods. Similarly, from Corollary 2 we know that the price gap is larger under free capital mobility than under autarky that implies that capital flows are higher in a globalized equilibrium than one without free capital mobility. Both together, the two corollaries, ensure the complementarity of the two flows in a globalized environment.

It is not surprising that differences in the quality of the financial systems are equivalent to differences in technology. In our model, financial frictions reduce the amount of funds that entrepreneurs can pledge to lenders. Pledgeable income per unit of investment is equal to  and thus either an improvement in technology (increase in R) or a decline in agency costs (decrease in

and thus either an improvement in technology (increase in R) or a decline in agency costs (decrease in  ) has exactly the same effect on the ability of the entrepreneur to raise external funds.

) has exactly the same effect on the ability of the entrepreneur to raise external funds.

Financial Frictions and Globalization

Given our small economy supposition, in a globalized equilibrium a change in agency costs only affects the allocation of agents between the two sectors.

Proposition 4: Under both free trade and free capital mobility, a decline in agency costs or a decline in the world price of the primary commodity or a decline in the world interest rate will decrease employment in the primary sector and increase employment in the manufacturing sector.

Proof: The proposition follows from a total differentiation of (3) after setting r = r* and P = P*.

It immediately follows that, other things equal, countries with better financial systems will export the manufacturing good and receive an inflow of foreign capital. More generally, better financial systems encourage the production and export of goods produced by financially dependent sectors. This is consistent with empirical evidence. There are many papers that have empirically established a correlation between financial development and trade patterns.7 But as Do and Levchenko (2007) and Huang and Temple (2007) have argued, the causality might also run the other way. Countries that export products produced by financially dependent sectors have a greater incentive to develop their financial markets. Manova (2008a) examines the export behaviour of 91 countries in the 1980–90 period and, after controlling for causality, finds that liberalization increases exports disproportionately more in sectors that are financially vulnerable. Similarly, Manova (2008b) finds that financially developed countries export a wider variety of products in financially vulnerable sectors.

Globalization and Inequality

The price adjustments that follow after markets are liberalized have strong income distributional effects. Now we know that, other things equal, autarkic economies with healthier financial systems are more likely to have higher interest rates and higher primary commodity prices. This implies that, when international trade in goods is liberalized, these countries will experience a drop in these prices and will export manufacturing products. As a result of these changes, agents employed in the primary sectors experience a loss in real income while those employed in the manufacturing sectors experience a gain.8 A similar pattern emerges after capital market liberalization. The same countries will experience a drop in the interest rate and a capital inflow. The decline in the interest rate depresses the real incomes of those agents employed in the primary sectors while boosts real incomes of those agents employed in the manufacturing sectors. Overall, these changes imply an increase in inequality.

Our model predicts exactly the opposite for countries with undeveloped financial systems. The price increases after the liberalization of the two markets boosts the real incomes of those agents with low endowments and who are employed in the primary sectors while those agents employed in the manufacturing sectors are worse off. Thus inequality declines. Of course, this presupposes that all other markets are friction–less and that the institutional structure is robust. If this is not the case, then there is no assurance that poor agents will receive either a fair price for their primary commodities or a fair return on their savings.9

Concluding Comments

We have introduced financial frictions in a small open economy model with free trade of goods and capital mobility across international borders. We have demonstrated that the quality of the financial system, as measured by the ability of the system to overcome a moral hazard problem that limits the amount of income which borrowers can pledge to lenders, can influence a country's trade patterns and capital flows. Furthermore, we have shown that differences in the quality of the financial system have similar effects as technological differences. The implication of the last observation is that trade flows and capital flows are complementary. Recently, there have been a few empirical attempts to explore the relationship between the two types of flows. As Aizenman and Noy (2007) emphasize, it is paramount to distinguish between de–jure and de–facto measures of trade and financial openness. The former include, for example, government changes in trade policy and financial market regulations while the latter refer to direct measures of flows. In their work they use de–facto measures, which are better suitable for predictions of models such as the one we have developed in this paper. They find that trade openness leads to financial openness but also that the relationship is also affected by political factors such as the degree of democratization and the level of corruption.10 Our model suggests that the degree of development in financial markets might be another potentially important factor. Well functioning financial markets allocate resources more efficiently and thus boost the returns to capital. Higher capital returns attract more foreign capital thus enhancing the comparative advantage of capital dependent sectors.

In our model, all borrowing and lending takes place in capital markets.11 This is not very realistic, especially for developing economies, as a great part of financial transactions are intermediated. The introduction of financial intermediaries would allow us to examine the behaviour of the spread between borrowing and lending rates which itself is a measure of financial development. The idea here is that a more efficient banking system offers higher returns on lending and lower borrowing costs.12

Using our model we have seen how variations in the quality of financial institutions and their impact on trade and capital flows can have profound effects on income inequality. This is true for both within country and global inequality. As Aghion and Bolton (1997) have suggested, there might be another link between financial development and inequality, but this time the causality runs the opposite way. They have shown that, for poor countries, an initial degree of inequality might be necessary precondition for economic development. It is also clear from our model that agents with higher endowments have more access to external funds. In a poor country with a low degree of income inequality, the majority of people would not be able to access external funds. An increase in inequality would push some agents above the financial threshold encouraging thus entrepreneurship and economic growth. Then, as long as trade and financial openness have an effect on inequality also have an effect on financial development.

Acknowledgements

Paper presented at the 1st International Conference on Contemporary Economic Theory: Topics on Development Economics at the University of Guadalajara.

References

Aghion, P. and P. Bolton (1997). A theory of trickle–down growth and development, Review of Economic Studies 64, 151–172. [ Links ]

Aizenman, J. (2006). On the hidden links between financial and trade opening, Journal of International Money and Finance (forthcoming). [ Links ]

Aizenman, J. and I. Noy (2007). Endogenous financial and trade openness, Review of International Economics (forthcoming). [ Links ]

Antras, P. and R. Caballero (2009). Trade and capital flows: A financial frictions perspective, Journal of Political Economy (forthcoming). [ Links ]

Beck, T. (2002). Financial development and international trade: Is there a link? Journal of International Economics 57, 107–131. [ Links ]

Beck, T. (2003). Financial dependence and international trade, Review of International Economics 11, 296–316. [ Links ]

Bougheas, S. and R. Riezman (2007). Trade and the distribution of human capital, Journal of International Economics 73, 421–433. [ Links ]

Chaney, T. (2005). Liquidity constrained exporters, University of Chicago, mimeo. [ Links ]

Davidson, C. and S. Matusz (2006). Trade liberalization and compensation, International Economic Review 47, 723–747. [ Links ]

Davidson, C; S. Matusz and D. Nelson (2006). Can compensation save free trade, Journal of International Economics 71, 167–186. [ Links ]

Do, Q.–T. and T. Levchenko (2007). Comparative advantage, demand for external finance, and financial development, Journal of Financial Economics 86, 796–834. [ Links ]

Egger, P. and C. Keuschnigg (2009). Corporate finance and comparative advantage, University of Munich, mimeo. [ Links ]

Evans, M. and V. Hnatkovska (2005). International capital flows, returns and world financial integration, Georgetown University, mimeo. [ Links ]

Holmström, B. and J. Tirole (1997). Financial intermediation, loanable funds, and the real sector, Quarterly Journal of Economics 112, 663–692. [ Links ]

Huang, Y. and J. Temple (2005). Does external trade promote financial development? University of Bristol WP 05/575. [ Links ]

Hur, J. M. Raj. and Y. Riyanto (2006). The impact of financial development and asset tangibility on export, World Development 34, 1728–1741. [ Links ]

Ju, J. and S.–J. Wei (2008). When is quality of financial system a source of comparative advantage? NBER WP 13984. [ Links ]

Kletzer, K. and P. Bardhan (1987). Credit markets and patterns of international trade, Journal of Development Economics 27, 57–70. [ Links ]

Manova, K. (2008a). Credit constraints, equity market liberalizations and international trade, Journal of International Economics 76, 33–47. [ Links ]

Manova, K. (2008b). Credit constraints, heterogeneous firms, and international trade, Stanford University, mimeo. [ Links ]

Melitz, M. (2003). The impact of trade on intra–industry reallocations and aggregate industry productivity, Econometrica 71, 1695–1725. [ Links ]

Matsuyama, K. (2005). Credit market imperfections and patterns of international trade and capital flows, Journal of the European Economic Association 3, 714–723. [ Links ]

Milanovic, B. (2005). Global income inequality: What it is and why it matters, United Nations, DESA WP 26. [ Links ]

Rajan, R. and L. Zingales (2003). The great reversals: The politics of financial development in the 20th century, Journal of Financial Economics 69, 5–50. [ Links ]

Slaveryd, H. and J. Vlachos (2005). Financial markets, the pattern of industrial specialization and comparative advantage: Evidence from OECD countries, European Economic Review 49, 113–144. [ Links ]

Tirole, J. (2006). The Theory of Corporate Finance, Princeton University Press, Princeton. [ Links ]

Wynne, J. (2005). Wealth as a determinant of comparative advantage, American Economic Review 95, 226–254. [ Links ]

2 Evans and Hnatkovska (2005) report that during the 1990s, capital flows have increases by 300 percent with much of this increase attributable to portfolio equity flows and foreign direct investment (600 per cent) while bond flows grew by 130 per cent. In contrast, international trade flows over the same period increased by 63 per cent and real GDP by the more modest pace of 26 per cent.

3 The seminal paper in that literature is Melitz (2003).

4 The same type of model has been used by Bougheas and Riezman (2007) to examine the effects of changes in the distribution of endowments on the patterns of trade and by Davidson and Matusz (2006) and Davidson, Matusz and Nelson (2006) to examine compensation policies for those who loose with the introduction of trade liberalization.

5 There is a related extensive literature that examines the impact of financial constraints on trade patterns; see for example Beck (2002), Chaney (2005), Egger and Keuschnigg (2009), Ju and Wei (2008), Kletzer and Bardhan (1987), Manova (2008b), Matsuyama (2005) and Wynne (2005). But none of these papers consider the case of capital mobility.

6 This is how Tirole (2006) interprets B: "The entrepreneur can "behave" ("work", "exert effort", "take no private benefit") or "misbehave" ("shirk", "take a private benefit"); or equivalently, the entrepreneur chooses between a project with a high probability of success and another project which ceteris paribus she prefers (is easier to implement, is more fun, has greater spinoffs in the future for the entrepreneur, benefits a friend, delivers perks, is more "glamorous," etc.) but has a lower probability of success." The proportionality assumption captures the idea that bigger investments offer more opportunities for misuse of funds. It happens to have a practical use since without it and given the linearity of the technology wealthy frms would be able to borrow an infinite amount of funds.

7 See for example, Beck (2003), Hur, Raj and Riyanto (2006) and Slaveryd and Vlachos (2006).

8 Strictly speaking, this is definitely true for those agents who do not change sector of employment. It is straightforward to show that, for those agents who move from the primary sector to the manufacturing sector, there is cut–off level of initial endowments such as those with initial endowment below that level are worse off and the other are better off.

9 Milanovic (2005) has argued that globalization had mixed effects on income inequality.

10 See Rajan and Zingales (2003) for a theoretical approach to the link between political factors and the two types of flows.

11 Our contractual structure is too simple to allow for a distinction between equity and bond markets. As Tirole (2006) shows, by allowing the technology return to be positive when the project fails, the optimal financial instrument becomes the standard debt contract.

12 In a related empirical study, Aizenman (2006) finds that when financial repression is used as a means of taxation, greater trade openness leads to financial reforms that lead to financial openness.