Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

EconoQuantum

versión On-line ISSN 2007-9869versión impresa ISSN 1870-6622

EconoQuantum vol.6 no.1 Zapopan ene. 2009

Suplemento especial: Primer Seminario Internacional en Teoría Económica Contemporánea

Mesa 1: Economía internacional y desarrollo

Multiple reserve requirements, exchange rates, sudden stops and equilibrium dynamics in a small open economy1

Paula Hernández–Verme,2 Wen–Yao Wang3

2 Departamento de Economía y Finanzas,Universidad de Guanajuato. Corresponding author. E–mail: paulaherver@gmail.com

3 Texas A & M University at Galveston.

Keywords: Sudden stops; Bank runs; Exchange rate regimes; Multiple reserve requirements; Dynamic Stochastic General Equilibrium; Open Economy Macroeconomics; International Financial crises.

JEL Classification: E31, E44, F41.

In this paper, we study the interaction between monetary policies and alternative exchange rate regimes to ascertain the probability of a crisis, building from the characteristics of the Asian–crisis countries in 1997. Our broader goal is to reinforce and fill in the link between the over–expansion of the financial system, banking crises, and exchange rate regimes/monetary policy that we find lacking in the literature. With this in mind, we build a Dynamic Stochastic General Equilibrium Model (DSGE) –from micro–foundations– replicating a small, open economy (SOE) with a nontrivial banking system, such as one of the 1997 East Asian countries. Two words of caution to the reader: First, this paper does not aim, from a historical point of view, to show the success of a particular monetary policy in place either in defending the national currency or in managing contagion at the time of the crisis. Our goal, instead, takes the form of a theoretical treatise on a "what if:" what if a typical Asian–crisis–country were to implement a policy of multiple reserve requirements with backing of the domestic money supply, and how would it work under alternative exchange rate arrangements? Thus, we look forward and aim to suggest policy options that may help these countries maintain stability in case a similar crisis was to hit again. Second, at this time, we do not consider economic activity explicitly other than in the financial sector.

Our model captures all five stylized facts of the East Asian countries at the time of the crisis. It is general knowledge that Indonesia, South Korea, and Thailand were the countries most affected by the East Asian 1997/98 crisis, followed by Malaysia, Laos and the Philippines. There are five stylized facts shared by these countries at the time of the crisis that we want to emphasize. 1) Increased risky–lending behavior by banks led to a boom in private borrowing financed by non–performing loans. 2) The lack of sound financial structure worsened with the ill–oriented process of financial and capital liberalization. 3) Banks' financial assets constituted the majority of their total assets –instead, for instance, of financing in capital markets. 4) Borrowing from foreign banks was a significant portion of domestic banks' loans. 5) The majority of these countries had intermediate pegs in place. According to the standard chronology of the crisis, the floating of the baht in July 1997 in Thailand triggered the crisis. A subsequent change in expectations led to the depreciation of most currencies in the region, bank runs, rapid withdrawals of foreign capital –a sudden stop– and a dramatic economic downturn followed. Unlike previous crises originated from fiscal imbalances and/or trade deficits, the Asian crises shed light on the increased risky behavior and the overexpansion of the banking system.

To build the framework that we just described, we used three building blocks that took us closer to our goal systematically. In the first block, we model explicitly the behavior of individuals and obtain the micro–foundations for our general equilibrium model. In the second block, we introduce alternative exchange rate regimes with their associated monetary policy rules. It is a well–established fact that for economies open to international capital flows, the choice of exchange rate regime is central to explain the vulnerability and fragility of financial markets, as well as domestic price stability and long–run viability. Table 1 summarizes the exchange rate arrangements in the Asian countries. During most of the 1980s and the first part of the 1990s, Indonesia, South Korea, Thailand and Malaysia had managed floating arrangements –an intermediate peg–, while Philippines had free floating. However, there were some important differences after the 1997 crises: Philippines continued with free floating, Indonesia, Korea and Thailand moved from intermediate pegs to free floating as well, but Malaysia turned to a very hard peg. These facts make our comparison of the relative merits of the two sets of policy rules relevant in the presence of binding multiple reserve requirements.

The third building block may allow one to infer behavior from a particular set of circumstances: we may be able to separate and identify causes and consequences by studying separately and jointly the main stylized facts of sudden stops and bank–runs in similar economies.4

We consider two potential causes of crises: a crisis comes to our model either in the form of a sudden stop of foreign credit (intrinsic uncertainty) or in the form of a panic among national depositors (extrinsic uncertainty). We put most of our effort on the distinguishing characteristic of the former but do not neglect the fact that a self–fulfilling panic and run may implicitly aggravate a crisis.

We believe that we improve on Chang and Velasco (2000a, 2000b and 2001) (C–V) in at least three dimensions. First, C–V attached intrinsic value to currencies they intended to be fat.5 We instead take multiple fat currencies –domestic and foreign– a bit more seriously, and introduce non–trivial demands for them. In particular, banks must hold a fraction of their deposits as unremunerated currency reserves: a fraction to be held in the form of domestic currency and another fraction in the form of foreign currency. Then, fat money instead enters our model by the regulation that governs the multiple reserve requirements in this economy,6 the implications being that: 1) There is a meaningful nominal exchange rate in our model, and 2) this nominal exchange rate will be determined according to the exchange rate regime and the monetary policy in place. In second place, we use a DSGE model in an economy with an infinite horizon, as is the Overlapping Generations (OG.) Thus, we are able to discuss the interesting equilibrium dynamics defining each exchange rate arrangement, as opposed to both Diamond and Dybvig (1983) (D–D) and C–V. In third place, we improve the way in which we introduce and treat potential crises. The potential for strategic complementarities and the realization of self–fulfilling prophecies is ever present in alternative versions of the OG model with outside assets in general, and models with one or more fat currencies in particular and, of course, in our model. In such a context, the presence of informational and institutional frictions can exacerbate situations that are already problematic, such as credit rationing, financial repression and endogenously arising volatility, thus complicating the standard analysis of separating and pooling equilibria. Thus, the appropriate utilization of the information and action sets available to agents at all points in time is critical. In this respect, we reformulate the sequential checking algorithm (see Figure 1) used by depositors and devise a re–optimization problem by banks after a sudden stop. In particular, one argument of the C–V framework was that when the probability of a crisis is public information, each agent in this economy must use this information when contemplating optimal plans of action at the beginning of every period and, as result, the optimal behavior of households is invariant with respect to whether the crisis was realized or not. Alternatively, we introduce the potential for uncertainty of the crisis by using a sunspot variable: a random variable unconnected to the fundamentals of the economy and that expresses the extrinsic uncertainty as a shock to the depositors' beliefs.

Our results show the existence of a continuum of equilibria that are indeterminate in two ways: 1) An allocation may be consistent with a continuum of relative price vectors, and 2) a vector of relative prices may be consistent with several different allocations. There is a strong association between the scope for existence and indeterminacy of equilibria, the properties along dynamic paths and the underlying policy regime.

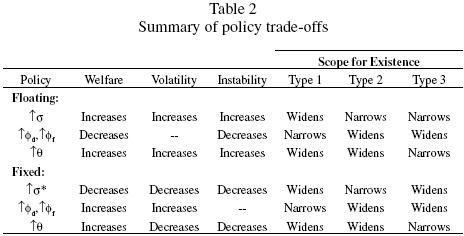

We present the summary of our results in Table 2. The reader may notice that each policy seems to produce mixed results in terms of welfare, unstable fluctuations and the scope for non panic and panic equilibria.

In situations where no crises are present, we observe that the monetary rule in place determines to an important extent the existence and properties of equilibria. Typically, there is a continuum of stationary equilibria, and local uniqueness and determinacy are lacking. Three cases may arise that correspond to different debt–structure vectors. With respect to dynamic equilibria under floating exchange rates, there is a nontrivial scope for complex eigenvalues that contributes to both cyclical and non–cyclical fluctuations; in some cases, the fluctuations can be significantly large and explosive. The scope for stability –and indeterminacy– is typically small, and the scope for determinacy typically dominates, but fluctuations are observed on the stable manifold. Moreover, unstable and oscillating divergence is observed in general. The reserve requirements play the role of stabilizing, at least partially, the dynamic equilibria in this model economy, while backing the domestic supply plays the opposite role. Thus, these results provide us with policy recommendations: to implement high and binding reserve requirements, but keeping the backing of the money supply to a minimum. In the extreme case of θ = 0, the order of the dynamic system is reduced, which one can interpret as the ultimate stabilization of dynamic equilibria.

With respect to the properties of dynamic paths under a hard peg, we must point out the following. In the first place, all dynamic systems under a hard peg have first order difference equations, eliminating the possibility of cyclical fluctuations in the debt–structure vector that are typically associated with complex eigenvalues. Second, regarding the core, the full spectrum dynamics can be observed under fixed, while floating allowed only for monotonic dynamics; the latter implies that a fixed exchange rate regime promotes endogenously–arising volatility around the stationary core, while floating does not. There is a trade–off, however, vis–à–vis the foreign–debt structure and state–contingent consumption: floating promotes higher order and very complicated dynamics that allow for nontrivial regions with complex eigenvalues in which cyclical and non–cyclical fluctuations are intertwined. In some cases, fluctuations can be significantly large and explosive, and the volatility may arise from a very large and unstable real part together with explosively–large and diverging amplitude of the cyclical component. A hard peg, instead, prevents the latter from occurring, and there is only a very small range for first order, simpler oscillating dynamics. Finally, the policy recommendations regarding dynamic properties vary drastically across regimes: i) High and binding reserve requirements promote and extend the stability of dynamic equilibria under floating, while they only preserve stability and prevent monotonic divergence under fixed; ii) the backing of the money supply is a destabilizing policy parameter under floating, but it promotes stability under fixed; iii) the policy recommendations are exact opposites; floating requires very high reserve requirements and a very low backing of the money supply but an economy with fixed exchange regime is better–off with a combination of very low reserve requirements and a very high backing of the money supply.

Next, we evaluated welfare under each exchange rate regime. We found that a policy of floating exchange rate regimes clearly and unambiguously dominates a hard peg in terms of steady–state expected utility in all cases and under all combinations of monetary policy, provided that σ = σ* for comparability. This is then a clear and very important advantage of floating versus fixed.

Last, we examined the potential for crises in the case of a sudden stop in a small, open economy that is a net borrower from the rest of the world. We show the existence of multiple equilibria of four types that we may rank based on the presence of binding information constraints and on social welfare. In particular, Type 1 equilibria are allocations where banks have liquid and solvent positions that are also incentive compatible, there are no panics and they yield the highest social welfare. Type 2 equilibria display no panics and banks have illiquid but solvent positions that are incentive compatible. Type 3 equilibria display panics since the banks positions are illiquid and solvent but not incentive compatible. The good news is that panic equilibria with illiquid and insolvent banks –Type 4 equilibria, which yield the lowest welfare– are not present in either of our model economies. Not surprisingly, we also find that the magnitude of bail out foreign credit (f1) determines the type of equilibria present. Economies with a high bail–out credit are more prone to display panic equilibria, since they will be more sensitive to a sudden stop. In this respect, the goal of the monetary authority would be to maximize the likelihood of Type 1 equilibria and to minimize the odds of Type 3 equilibria. Under floating, the policy combinations consistent with this goal display a high rate of domestic money growth, low but nonzero reserve requirements and a high backing of the domestic money supply. However, under a hard peg this goal is accomplished by low reserve requirements and low backing of the domestic money supply.

There is a clear trade–off in policy implementation when one regards the goals of high welfare, decreased scope for unstable fluctuations and the potential for crises together under both exchange rate regimes. Under floating, a high rate of domestic money growth and a high backing of the domestic money supply would increase welfare and would reduce the scope of panic equilibria. But there is a limit to this effect, since further increases of these two instruments may exacerbate unstable endogenously arising volatility. Under a hard peg, however, a high backing of the domestic money supply promotes high welfare, reduced unstable fluctuations, large scope for non panic equilibria and a small scope for panic equilibria. The only common point under both policies is the need for low but nonzero reserve requirements.

Overall, a policy of floating exchange rates generates higher steady–state expected utility but there is a high order dynamic system that promotes increased endogenously arising volatility that is not present under fixed exchange rates. Thus, floating promotes better steady–state properties while fixed displays better properties along equilibrium dynamic paths where equilibrium sequences do not vanish.

References

Bencivenga, V. R. and D. B. Smith (2002). "What to Stabilize in the Open Economy," International Economic Review, Vol. 43, No. 4: 1289–1307. [ Links ]

Chang, R. and A. Velasco (2000a). "Banks, Debt Maturity and Financial Crises," Journal of International Economics, Vol. 50, No. 1:169–94. [ Links ]

Chang, R. and A. Velasco (2000b). "Financial Fragility and the Exchange Rate Regime," Journal of Economic Theory, Vol. 92, No. 1:1–34. [ Links ]

Chang, R. and A. Velasco (2001). "A Model of Financial Crises in Emerging Markets," The Quarterly Journal of Economics, Vol. 116, No. 2:489–517. [ Links ]

Cole, H. L. and T. J. Kehoe (1996). "A Self–Fulfilling Model of Mexico's 1994–1995 Debt Crisis," Journal of International Economics, Vol. 41, 309–330. [ Links ]

Diamond, D. W. and P. H. Dybvig (1983). "Bank Runs, Deposit Insurance, and Liquidity," The Journal of Political Economy, Vol. 91, No. 3:401–419. [ Links ]

Frankel, J. A., S. L. Schmukler, and L. Serven (2002). "Global Transmission of Interest Rates: Monetary Independence and Currency Regime," NBER Working Paper 8828. [ Links ]

Hernandez–Verme, P. L. (2004). "Inflation, Growth and Exchange Rate Regimes in Small Open Economies," Economic Theory, Vol. 24, No. 4:839–856. [ Links ]

Hernandez–Verme, P. L. (2009). "Credit Chains and Mortgage Crises," Working Paper. [ Links ]

Kaminsky, G. L. (2003). "Varieties of Currency Crises," NBER Working Paper, 10193. [ Links ]

Kishi, M. and H. Okuda (2001). "Prudential Regulation and Supervision of the Financial System in East Asia," Institute for international monetary affairs. Available at http://www.mof.go.jp/jouhou/kokkin/tyousa/tyou041g.pdf [ Links ]

Lindgren, C–J., Baliño, T. J. T., Enoch, C, Gulde, A–M., Quintyn, M. and L. Teo (1999). "Financial Sector Crisis and Restructuring. Lessons from Asia. International Monetary Fund, Occasional Paper, 188. [ Links ]

1 We owe special thanks to Leonardo Auernheimer, David Bessler, Li Gan, Xu Hu and Dennis Jansen for helpful comments and suggestions to previous versions of this paper. We thank Teri Tenalio for her technical assistance. We would also like to thank the participants of the 2007 Midwest Macroeconomic Meetings, the 2007 Southwestern Association Meetings, the 2009 Midwest Economics Association Meetings and the Primer Seminario Internacional de Teoría Económica Contemporánea (2009) organized by the CUCEA, Universidad de Guadalajara for helpful suggestions.

4 See Kaminsky (2003) for details.

5 In their model, people held domestic currency because they derived utility from it, attaching intrinsic value to the currency.

6 See Hernandez–Verme (2004) for the original discussion.