Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

EconoQuantum

versión On-line ISSN 2007-9869versión impresa ISSN 1870-6622

EconoQuantum vol.6 no.1 Zapopan ene. 2009

Suplemento especial: Primer Seminario Internacional en Teoría Económica Contemporánea

Mesa 1: Economía internacional y desarrollo

Tariff De–escalation with successive oligopoly: Implications for developing country market access

Ian M. Sheldon*, Steve McCorriston** 1

* Andersons Professor of International Trade, Department of Agricultural, Environmental and Development Economics, Ohio State University, USA. E–mail: sheldon.1@osu.edu

** Professor, Department of Economics, School of Business and Economics, University of Exeter, UK. E–mail: S.McCorriston@exeter.ac.uk

Introduction

In this paper, we focus on the idea that firms are concerned about their relative profitability in a vertically–related market. This draws upon the literature on cascading protection, whereby increases in upstream tariffs may have a spillover effect on downstream firms' profits, thereby increasing the chance of tariffs downstream, e.g., Sleuwagen et al. (1998). The key result we present here is that simultaneous and equal reduction of upstream and downstream tariffs has non–equivalent effects on upstream and downstream firms' profits. This result is due to the within stage and between stage impact of tariff cuts, where the latter is comprised of pass–through and pass–back effects. This outcome provides a potential source of opposition to any tariff reductions, generating a strong argument for tariff de–escalation, and thereby rationalizing formula approaches to tariff reductions in trade negotiations (Francois and Martin, 2003). This also has important implications for market access, tariff escalation being highlighted as a key issue affecting developing country exports (World Bank, 2003).

The Model

The type of vertical market structure we model is very similar to that used by inter alia, Spencer and Jones (1991), and which is illustrated in Figure 1. Both the upstream (intermediate good) and downstream (final good) stages are duopolistic; at the downstream stage, a domestic firm producing x1; competes with imports of the final good x2 that are subject to a tariff td; while at the upstream stage, a domestic firm producing xu1 competes with imports xu2, where the intermediate good is homogeneous and sold at a common price such that the domestic downstream firm is indifferent between alternative sources for the intermediate good. Imports of the intermediate goods are also subject to a tariff tu; and with tariff escalation, tu < td. The technology linking domestic downstream production and the upstream intermediate good is one of fixed proportions. Formally, x1 = øxu, where xu = (xu1 + xu2) represents output of the upstream stage respectively, and ø is the constant coefficient of production, set equal to one to ease exposition.

Given this vertical structure, the model consists of a three–part game. First, the domestic government sets tariffs on both downstream and upstream imports, while the second and third parts consist of Nash equilibria at the upstream and downstream stages. The timing of firm's strategy choice goes from upstream to downstream. Specifically, given costs and the derived demand curve facing the upstream stage, upstream firms simultaneously choose output to maximize profits, which generates Nash equilibrium at the upstream stage. The price of the intermediate good is taken as given by the domestic downstream firm which, simultaneously with its foreign competitor, chooses output to maximize profits, thus giving Nash equilibrium at the downstream stage. In terms of solving the model, equilibrium at the downstream stage is derived first and then the upstream stage.

Assuming downward–sloping demands and substitute goods, the profit functions of downstream firms are given as:

where Ri (xi;, xj), i=1,2, i ≠ j, is the revenue of downstream firms, c1 and c2 are the domestic and foreign downstream firms' respective costs, and td is as defined above. Downstream firms' costs relate to the purchase of an intermediate input and excluding any other costs, the costs for the domestic downstream firm are equal to the price of the intermediate input, pu1.

The first–order conditions for profit maximization are given as:

Equilibrium at the downstream stage is derived by totally differentiating the first–order conditions (3) and (4):

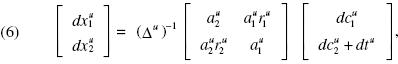

where ai = Ri, ii , i= 1,2, and ri = dxi / dxj , =–(Ri, ij / Ri, ii), i=1,2 i ≠ j. If Ri, ii< 0, then ri < 0 ó ( Ri, ii > 0, then ri > 0), we have strategic substitutes (complements) (Bulow et al., 1985). Also, for stability of the duopoly equilibrium, the diagonal of the matrix has to be negative, i.e., ai < 0, and the determinant positive, Δ–1 = a1a2 (1–r1 r2) > 0. Similarly, given upstream inverse derived demands, equilibrium at the upstream stage is derived as:

where aui < 0 and (Δu)–1 > 0 for stability, and also |aui| > |ai|, i.e., perceived marginal revenue upstream is steeper than downstream. From (5) and (6), comparative statics for upstream and downstream tariff changes can be conducted.

Tariff Reductions and Market Access

We want to consider the net change in market access for each stage following a simultaneous and identical reduction in tariffs downstream and upstream. For the upstream stage, the net change is given by:

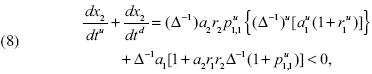

and for the downstream stage, the net change is given by:

i.e., imports of both the intermediate and final goods increase.

The key question is which stage is affected most by changes in market access due to tariff reductions? Comparing (7) with (8):

which shows that final good imports are likely to increase by less than increases in imports of the intermediate good. This result rationalizes why some firms in a vertically–related market will take a different stance on trade liberalization, reinforcing the need for formula tariff reductions.

Tariff Changes and Profits

To focus directly on the issue of tariff de–escalation, we take the effects on profits due to a simultaneous change in upstream and downstream tariffs, and pose the following question: by how much would the downstream tariff have to change given a unit reduction in the upstream tariff, in order to keep the change in domestic firms' profits equal between the two stages? This rule is implicit in the literature on cascading protection in vertically–related markets. Formally, this tariff rule is to find  such that:

such that:

To explore this further, we evaluate (10) numerically.2 The results show that the adjustment to the downstream tariff, given a unit change in the upstream tariff is: for strategic substitutes,  = 6.06 and, for strategic complements,

= 6.06 and, for strategic complements, = 4.43. Hence, the appropriate change in the downstream tariff should be greater than the change in the upstream tariff if the aim is to avoid a change in profits for the domestic firm at one stage of the vertically–related market being greater than the change in profits for the domestic firm at the other stage. In other words, there should be tariff de–escalation.

= 4.43. Hence, the appropriate change in the downstream tariff should be greater than the change in the upstream tariff if the aim is to avoid a change in profits for the domestic firm at one stage of the vertically–related market being greater than the change in profits for the domestic firm at the other stage. In other words, there should be tariff de–escalation.

Conclusions

In this paper, we have focused on the issue of simultaneous changes in tariffs in a vertically–related market where each stage can be imperfectly competitive. We show that identical and simultaneous change in tariffs at each stage is likely to have a differential effect on market access and profits for domestic firms at each stage; specifically, the domestic upstream firm will see its profits changing by more than the domestic downstream firm. This has potential insights for trade reform that have been largely unexplored. Though tariff reduction formulae have been widely employed as part of the trade negotiating process, their advocacy has often been on an ad hoc basis relating to the reduction in tariff peaks that typically arise in more processed goods, and which have significant effects on developing country market access. In this context, the mechanisms explored in this paper show that tariff de–escalation is a necessary part of ensuring that the burden of adjustment to trade liberalization is not unequally felt by a domestic firm at one stage compared to another. As such, rules that promote tariff de–escalation ensure (a greater extent of) parity in terms of the changes in profits between domestic upstream and downstream firms in vertically–related markets. In addition, tariff de–escalation will secure greater market access for developing country exporters.

References

Bulow, Jeremy I., John D. Geanakopolos, and Paul D. Klemperer (1985). "Multi–Market Oligopoly: Strategic Substitutes and Complements", Journal of Political Economy 93 (3), 488–511. [ Links ]

Francois, Joseph and Will Martin (2003). "Formula Approaches for Market Access Negotiations", World Economy 26 (), 1–28. [ Links ]

McCorriston, Steve and Ian Sheldon (2009). "Tariff De–escalation with Successive Oligopoly", unpublished working paper. [ Links ]

Sleuwaegen, Leo, René Belderbos, and Clive Jie–A–Joen (1998). "Cascading Contingent Protection and Vertical Market Structure", International Journal of Industrial Organization, 16 (6), 697–718. [ Links ]

Spencer, Barbara J. and Ronald W. Jones (1991). "Vertical Foreclosure and International Trade Policy", Review of Economic Studies 58 (4), 153–170. [ Links ]

World Bank (2003). Global Economic Prospects: Realizing the Development Promise of the Doha Agenda, Washington, DC: World Bank. [ Links ]

1 This is a summary of the paper presented at the "Primer Seminario Internacional en Teoría Económica Contemporánea: La Agenda del Desarrollo Económico", Universidad de Gaudalajara, CUCEA, México, September 10–11, 2009. It draws on an extended paper by McCorriston and Sheldon (2009).

2 Full details and discussion of the numerical evaluation can be found in McCorriston and Sheldon (2009).