1. Introduction

Recently, an economic agent that has become interesting for analyzing is a Family Business (FB), particularly its economic performance. Around the globe but mainly in Europe and North America FB are contributing in production, employment and welfare around the regions they are settled in a very significant way, see (Ward, 2007). This type of companies are present within industries more often that is usually expected, in fact Colli (2003) consider them as the most common organization inside economic environments.

How to identify a FB? What are their main characteristics? There are several different approaches regarding a definition of a FB. Gallo (1995) pointed out three main features for a FB. First ownership and control over the company must belong to a family. Second, high hierarchical positions like CEO, CFO, General Manager, etc. must be performed by a family member. And third, there should be a clear intention to transfer ownership, control and operation to future generations. In this same way Soto Maciel (2013) states that a FB is a company with family members in most positions in the board of directors, even the founder, so family values and believes transcend within the company with the objective to maintain family unity throughout heritage.

These two definitions have in common the strong intervention of a family in the entire company; therefore it is easy to infer that at least three subsystems interact in a FB: ownership, family and company. If there is a strong relation between these three aspects, then there is no doubt that a company can be classified as FB, according to Gersick et al. (1997) in addition with Tagiuri and Davis (1996). Of course variation in the subsystems have appeared when defining a FB, for instance Bañeguil, Barroso and Tato (2011) argued that there is only the need for company and family subsystems to be present for a FB to exist. Particularly, company and family are two superimposed, interdependent and conflict generating subsystems.

Ramírez and Fonseca (2010) considered a FB as an organization where several family members across generations have high control of all divisions of a company. A simplest definition relies on the family being part of a company in which they share values, believes and behavioral norms with each other and with other employees, see Leach (2009). Consequently, for a company to be defined as a FB at least the family subsystem need to be present. This idea has turned very controversial since some researchers argue that the control/ownership subsystem is also relevant. Despite the lack of consensus that might be around the definition of a FB, we think that control/ownership and family subsystems are the basis of it.

Once main characteristics of a FB are identified, the need for establishing the relevance of the economic efficiency is important. A company where owners and executives match in family bounds or share believes and values can be more efficient since property allows convergence of interest, leading the company to better economic performances (Castrillo and San Martín, 2007). In other words, the concern for the family to increase its welfare permits any family member to be aware of decision making process within the company so its value market can be increased. Usually a FB consider a family member with a high priority for being consider as a natural employee in the firm, therefore skills, professional education or experience are not relevant for the position. According to Poza (2005) when a FB put before the natural right for a family member to be hired, economic and financial decisions are taken very carefully. Risk perceptions are more frequent, and then the company’s performance tends to be better.

Family Business can either be private or public. Due to privacy on information it is easiest to analyze a public FB. There are numerous studies that show public FB having better economic and financial performances than non FB public companies: Allouche, et al. (2008), Anderson and Reeb (2003), Carney, et al. (2013), Corbetta (1995), Gueye and Simon (2010), Le Breton-Miller and Miller (2006), Martin-Reyna and Duran-Encalada (2012), Martínez, Stöhr and Quiroga (2007). Despite the availability for private information Sharma, Chrisman, and Gersick (2012) as well as Stewart and Hitt (2012) proved that private FB have shown better financial performances than non FB private companies.

Nevertheless, if family members have priority regardless skills, professional education and experience, then there is a normal exposure of the company to various risks like Operational Risk (OR) for example. When people are involved with information technologies, technical processes, data analysis or digital activities, operational risks are always present. Lately there’s been a progressive increase of OR within financial companies mainly due to a highest number of technical processes incorporated, so failure events are more often, see Dávila, et al (2016). Inoperability of a company is normally produced by human errors on processes or systems. When they occur is difficult to solve them if there is no evaluation about their cost.

Operational Risk analysis started due to economic losses of companies because the ignorance on causes, consequences and means for solve potential events. Consequently, to define, manage and value OR has become pertinent. OR has been defined as the potential loss due to: failures or deficiencies on internal controls, processing operation errors, storaged information losses, judicial or administrative resolutions, frauds and even legal and technological risks (CUB, 2005). Basel II (2006) defined OR as the loss for inadequate or failed internal processes, human and system errors or external events. Knowing OR is important since is possible to determinate capital requirements for solve eventual losses events, see Kolesnik (2018), Karwanskik and Grzybowska (2018), Condamin et al. (2018), Targino et al. (2017), Riso and Castellini (2019), Far and Bailey (2018).

The objective of the present research is to measure Operational Risk based on Family Business elements. These elements are considered as having impacts on processes, systems and operations within companies, particularly if they are handled by employees. Elements taken into account are: Property, Family Values, Board of Directors, Organizational Culture and Structure, Succession, Professionalization and Financing. Employees and their professional performance can be affected in a negative or positive way because of these elements and the environment around them.

This set of aspects are highly disseminated by the family (or not) due to the type and structure of the company base on the size. Consequently, this analyze considers operational risk and its causes for micro or small companies and medium as well. Each type of company is modeled by a different Bayesian Network.

Main results are: 1) There are family business theoretical elements that impact on Operational risk, 2) The higher the presence of family elements within companies the lower the Operational Risk is, 3) There is an specific organizational structure depending on a company size that is in accordance with an specific Bayesian Network for measuring Operational Risk when Family Business elements are considered.

The document is organized as follows: in Section 2 the Bayesian network is defined for both sets of companies (medium and micro/small), where operational risk is measured for several different scenarios according to all elements experts agreed on. Even more a scenario analysis is performed in order to characterize most important elements, conclusions are detailed in Section 3.

2. Bayesian Network

In last section was established that OR appears due to human errors. Turns out human errors are hard to measure and even more difficult to foreseen, therefore operational risk as well. One way to measure OR can be found in the use of Bayesian Networks (BN), especially if there is not enough information about failure events. As stated by Uusitalo (2007) analyzing insufficient, incomplete or inexistent data through a BN is a powerful tool since it is possible to model causality relations among a set of variables, even though under uncertainty, for predicting failure events. Hence BN are useful to solve problems from both descriptive and predictive perspectives. From the descriptive perspective BN analyze the interdependency between phenomena while from the predictive point of view BN classify information.

This type of analysis is possible because the use of statistical and engineering modeling (Cowell, Verrall & Yoon, 2007). As said by Beltran, Muñoz and Muñoz (2014) the probabilistic framework from what a BN is defined allow valid inferences for events that are unknown. A Bayesian Network is a mathematical structure where cause and effect relations are analyzed by assigning probabilities and ponderations to every variable characterized in the network. This idea is in line with Madsen and Kjaerulff (2013) and Chan et al. (2018). The use of BN to evaluate OR is not uncommon, see Alexander (2002), Reimer and Neu (2003), Leippold (2003), Neil, Marquez and Fenton (2004).

The design of a BN involves recognizing the main variables that interact with each other, causes and consequences of this interaction, the hierarchical level for all variables and the final outcome. Therefore a group of experts from different types of companies regarding their size was consulted. After several meetings, objectives, variables, channels of impacts and elements that they pondered affect operational risk were defined. Along with experts that own a FB, the following variables were selected as key factors to measure operational risk:

| ·Property | ·Financing |

| ·Family Values | ·Board of directors |

| ·Succession | ·Organizational structure |

| ·Organizational culture | ·Professionalization |

Experts agree on Property and Family Values being the core for a correct performance of a company, but separately having impacts on the organization and the decision making. Therefore organizational structure, succession and financing depend on how property and family values are. Consequently exogenous impulses will come from both into the network. In order to understand the interactions between variables, a description of them is provided.

Property in FB relies on family members being involved in ownership and control of a company. Two possibilities are established: 1) ownership and control depend on the entire family, or it could only be a single owner, or it can be a transition process through generations. 2) Ownership is with the family but no family members operate the company, therefore the entire control is share for family and no family employees.

Family Values are attitudes and rules of behavior associated to a believe system instilled from parents through sons. Esquivel and Aguilar (2002) argument that family values are the fundament for organizations; several conflicts come from distances between family and company’s values. Family values can become an objective for employees being identified and committed to them (Kets de Vries, 1993). When family values were settled by the founder, the organizational culture will endure from generation to generation positioning the company by its ethics and corporate identity as Fernández et al (2003) stated.

Succession is a process that ends with the transmission of ownership and control of a FB to the next generation. Only few companies are capable of survive this process, a high control remains in the founder but control could fade throughout generations if company’s values and vision are not strong: Manzano and Ayala (2002), Neubauer and Lank (1998), Kuratko et al (1994).

Organizational culture represents a set of values or customs and behavioral models that are shared in the company with the objective of generate competitiveness, build market relationships, increase profitability and to inculcate competitive vision, see Narver and Slater (1990). Regarding financing most FB possess a stable capital structure since investment is made with family resources mostly, thus reduces financial leverage below the rest of organizations that leads to a strong financial stability. Reasons for not getting regular financing on markets are to avoid non-family investors in and ensure investment projects.

A great board of directors is the key for economic development. Having most family members, if not all, in the board of directors could enhance the long-term vision and mission of the FB. Therefore rules, strategies, communication channels, regulations, achievements and most decision making will spread among members and so into the FB, (IFC, 2011).

Under these conditions the continuity of the company across generations will endure. When the long-term vision and mission of the company is settled, then the organizational structure tends to be better. It is easier to define responsibilities and therefore to identify operational failures. Masulis, Kien and Zein (2011) sustain that only few directors of FB acknowledge not having a well-defined organizational structure.

Professionalization is a consequence for a well-defined organizational structure since decision making at all levels in the company is the result of planning, control and applying strategic methods performed by family and non-family directors and employees. Thus also improves economic and financial performance of the company.

On the other hand, experts agreed that the size of a company directly provides the relation between factors that might affect in OR. For instance, medium companies usually tend to have more elements to control processes and systems, like the board of directors, the organizational culture and structure, etc. Meanwhile, small and micro companies require less of those elements so board of directors or organizational culture is not present within this kind of companies. Based on those ideas a couple of BN were designed in order to measure OR on both types of companies: medium and small companies.

The Bayesian network for medium companies considers Property as the starting point while the corresponding for small and micro companies considers Family Values. Probabilities for every event along the network were settled by experts according to the experience, informal information and data (if exists) they possess.

3. Medium companies

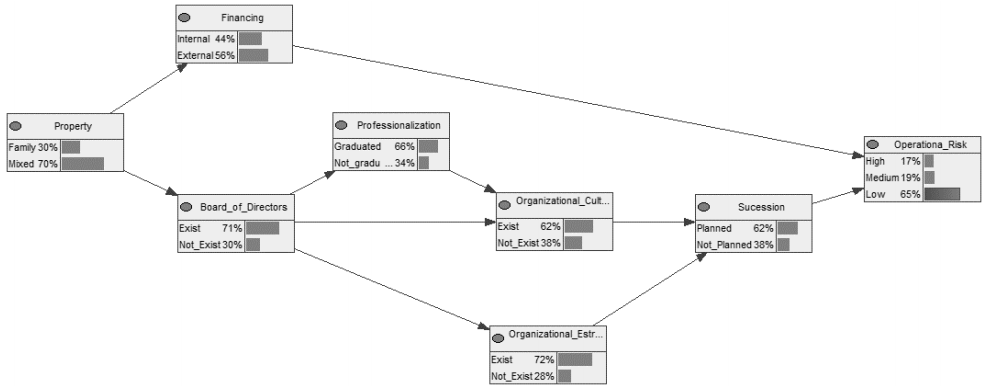

Operational risk in a medium company can be affected straight by Financing on one side, and by the administrative structure on the other. Figure 1 provides the base scenario for measuring OR by a BN. This BN take into account all elements experts agreed on that can be affecting directly or indirectly the operation in the company. This base scenario shows that there is a 65% of probabilities for a low operational risk if all elements in the network remain without absolute values in probabilities (either 1 or 0), which means all aspects are being considering at the same time as having impacts for OR.

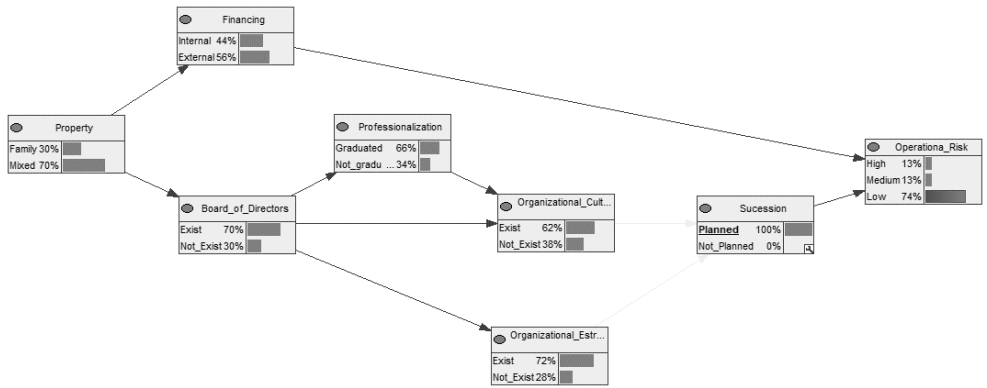

Next step is to analyze how operational risk behaves when probabilities increase up to 1 for every single element in the network, for example succession element is considered to be planned, the probability for a low operational risk is 74% as Figure 2 shows. Nevertheless, if succession is non-planned then the low operational risk probability is 49%, see Figure 3.

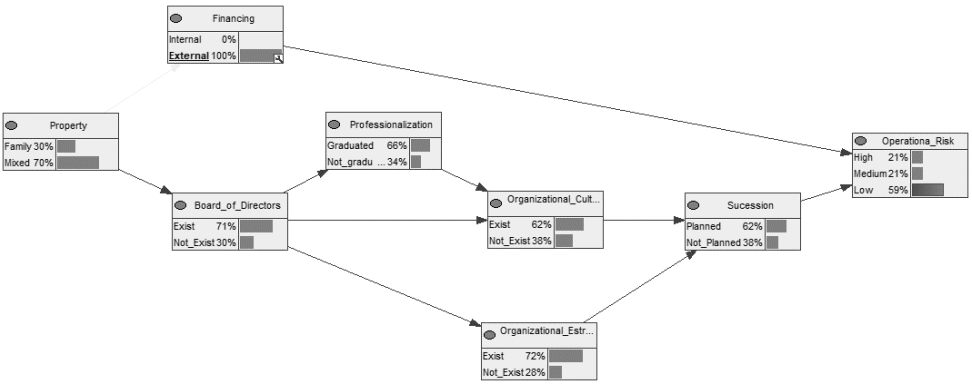

Another important element for operational risk is financing. If the company is financed by internal resources, then a low value for operational risk is 72% probable; but if is external then a low operational risk has 59% probabilities to occur. See Figures 4 and 5.

There are more aspects to contemplate, for instance type of property, if a company does or does not hold a board of directors, if hiring is based on professionalization and family members have no natural right for an specific position within the company, finally if organizational culture and structure is present or not. So in order to highlight the most relevant scenarios, the BN’s for financing and succession elements are presented. Results for medium and large companies are summarized in Table 1.

Table 1 Operational risk based on different elements for medium companies

| Element | Input probability value | Operational risk probabilities | ||

|---|---|---|---|---|

| Property | family | 100% | 15% | low |

| 18% | medium | |||

| 66% | high | |||

| mixed | 100% | 17% | low | |

| 19% | medium | |||

| 64% | high | |||

| Board of directors | exist | 100% | 15% | low |

| 16% | medium | |||

| 68% | high | |||

| not exist | 100% | 20% | low | |

| 24% | medium | |||

| 56% | high | |||

| Professionalization | graduated | 100% | 16% | low |

| 18% | medium | |||

| 66% | high | |||

| non-graduated | 100% | 18% | low | |

| 20% | medium | |||

| 62% | high | |||

| Organizational culture | exist | 100% | 15% | low |

| 16% | medium | |||

| 69% | high | |||

| not exist | 100% | 20% | low | |

| 23% | medium | |||

| 57% | high | |||

| Organizational structure | exist | 100% | 16% | low |

| 17% | medium | |||

| 67% | high | |||

| not exist | 100% | 20% | low | |

| 23% | medium | |||

| 58% | high | |||

Source: own elaboration.

For instance, the probability for a low value of operational risk increases in 1% from the base scenario if property of the company relies on the family, ceteris paribus the rest of the elements. It is natural to expect that high probabilities for operational risk decreases when a family possesses all the company. This comparison can be performed for all elements. It is important to highlight that impacts analyzed in the following table are not as significant as the previous when reducing OR.

Not having a board of directors or organizational culture and structure at all, has an impact between 7% and 9% of probability for OR to increase. Therefore it could be a negative effect on the company’s economic performance. Nevertheless to allocate resources for either element to exist does not have a significant impact on diminishing high or medium Operational Risk.

4. Small and micro companies

Experts consider small and micro companies to have a simplest administrative structure, therefore operational risk depends on most elements except organizational culture and board of directors. At the same time they consider family values to have more importance than property since values can in-fluence in a stronger way because the size of the company. The following figure provides the base scenario for OR for small and micro companies.

The probability for a low operational risk is 51% when all elements considered in the BN are affecting simultaneously on OR. Experts consider family values to affect with highest probability within a small or micro company since this type of business has very few employees. In this sense, it is easier to plan a succession that also is reflected on organizational structure. Subsequently, financing and professionalization depends directly from family and structure within the company and also affecting OR, which is more probable to happen due to less control on elements in the BN. Most elements are affecting the same way but organizational structure and financing.

When financing is completely internal low operational risk is 58% probable. On the other hand, if financing is external then there are a 33% of probabilities for a low operational risk, see Figures 8 and 9. Regarding organizational structure, a low operational risk is 57% probable when this structure exists within this type of companies and 31% probable if it doesn’t exist as Figures 10 and 11 show. The rest of the results for small and micro companies are summarized in Table 2.

Table 2 Operational risk based on different elements for micro and small companies

| Element | Input probability value | Operational risk probabilities | |

|---|---|---|---|

| family values | exist | 100% | 20% low |

| 29% medium | |||

| 51% high | |||

| not exist | 100% | 21% low | |

| 29% medium | |||

| 50% high | |||

| succession | planned | 100% | 18% low |

| 29% medium | |||

| 52% high | |||

| non-Pplanned | 100% | 22% low | |

| 29% medium | |||

| 49% high | |||

| professionalization | graduated | 100% | 15% low |

| 30% medium | |||

| 55% high | |||

| non-graduated | 100% | 33% low | |

| 26% medium | |||

| 41% high | |||

Source: own elaboration.

Other aspects such as the existence or not of family values, or whether owners have planned a succession or not and if professionalization is important within the company, are also relevant. Nonetheless changes in low operational risk are not as relevant.

To improve or not most elements could have a low impact on operational risk, but there is one element that can have serious consequences since hiring employees with academic degrees can enhance low operational risk around 10%. Recommendation for this kind of companies is not to allow all employees do not possess academic degrees but also not to allocate too many resources in order to hire professionals.

3. Conclusions

By using Bayesian Networks for micro, small and medium companies, operational risk was measured when family business elements were considered as affecting a company. Since statistical information could not be available within companies, the Bayesian Network was designed based on a group of experts that defined for each type of company a set of elements for family business outlines. Then a specific network was designed for different companies when size was considered. A set of micro, small and medium Mexican companies was analyzed under this methodology.

The network provided several results. First, it is possible to measure operational risk when family business theoretical elements are considered. Second, operational risk can be measured in low, medium and high probability for each type of company. Third, when considering the specific type of a company and therefore its Bayesian Network, a base scenario is defined. For instance medium companies possess a 65% probability of a low operational risk, a 19% probability for medium operational risk and a 17% probability of high operational risk in the base scenario. When small and micro companies are considered, there is a 51% probability of a low operational risk, 29% for a medium risk and 20% for a high risk in the base scenario.

For all types of companies analyzed, results show that Family Business elements affect operational risk. This methodology allows for these elements to be measured at the same time that defines causality relations between these elements and a company internal structure delimitated by a family as owner.

nueva página del texto (beta)

nueva página del texto (beta)