1.Introduction

Empirical evidence shows that the vast majority of central governments in modern economies use inter-governmental transfers (monetary transfers from the central government to subnational governments) to finance goods and services provided by subnational governments. Intergovernmental transfers are used in modern economies for different reasons: first, local public goods provided by subnational governments might show positive regional externalities. In the absence of intergovernmental transfers, local governments might not recognize the external benefits of local public goods and the provision of local public goods is not Pareto efficient. The central government can design a system of transfers to create incentives for local governments to provide Pareto efficient levels of local public goods (see Boadway 2007).

Second, intergovernmental transfers can be used to redistribute resources and reduce the inequality in the distribution of access to critical government services for individuals living in different regions of a country. Subnational governments might have different abilities to provide goods and services to their residents. This might lead to a problem of horizontal inequality in the access of residents of different localities to goods and services provided by sub-national governments such as public education, public security and health services (see Martinez and Sepulveda 2011). Therefore, a program of intergovernmental transfers can redistribute resources from high income to low income localities to improve the quality and access of critical services from the government in all regions of the country. Third, intergovernmental transfers can be explained as a mechanism to share revenue across different subnational governments (see Rao 2007) and to reduce failures of coordination that could lead to vertical and horizontal tax externalities (see Ponce and Medina 2018).

In Mexico, the provision of goods and services of sub-national governments is highly dependent of resources transferred by the central government to state governments. The evidence shows that, in 2014, the proportion of intergovernmental transfers in relation of total state public revenues is 84% (similar estimates are found for other years). According to a report of World Bank (2019), the total amount of intergovernmental transfers in Mexico is approximately 8.1 percent of GDP in 2017. In practice, Mexico uses intergovernmental transfers for different purposes: for instance, the fund of “participaciones” is a revenue sharing program financed by federal taxes aiming to reduce significant vertical imbalances (see the report by World Bank 2019).3 Intergovernmental transfers also include conditional transfers (through the fund of aportaciones) that financespecific projects in the areas of health, public security, etc., and discretionary transfers though specific agreements or convenios to finance the perceived priorities of policy makers in the central and state governments (see the report by World Bank 2019).

Given the importance of intergovernmental transfers in Mexico, it is relevant to ask: what should be the optimal distribution of inter-governmental transfers to state governments in Mexico? The objective of this paper is to develop a theoretical model to answer this question. We also develop a simulation analysis of the implied results of the theory to compare with the observed allocation of intergovernmental transfers in Mexico. Our analysis shows that the current system of allocation of intergovernmental transfers are poorly related with the regional inequality in the distribution of income and the regional heterogeneity of preferences of individuals for local public spending. However, most analysis on fiscal federalism, consider both, the regional distribution of income and the distribution of preferences, as important determinants of intergovernmental transfers. Hence, our analysis provides insights about advantages and shortcomings of the way intergovernmental transfers are currently allocated in Mexico. To see this, note that the first insight of our analysis shows that our model that considers a social welfare function in which all individuals of all regions receive the same weight in the social welfare function, provides a surprisingly good fit for the observed shares of transfers from the central government to states with our simulated results having a correlation of 0.9 with the observed shares of intergovernmental transfers received by states in Mexico.

Second, if the central government is concerned with the regional inequality of income then the implied shares of transfers to state governments are significantly different to the observed allocation of state transfers in Mexico. Altogether these findings suggest that the observed shares of intergovernmental transfers in Mexico are not fully incorporating the regional inequality of income. However, our estimates indeed consider the regional inequality of income in Mexico, and therefore, our estimates provide a complete set of estimates for transfers to states that could lead to a policy reform that improves the regional equity of public spending of state governments.

Third, we provide estimates of shares of intergovernmental transfers to state governments for the case in which policy is concerned about matching the provision of local public goods with the heterogeneity of preferences of individuals across regions in Mexico. For this case, we also provide exact estimates of the shares of resources that each state should receive and our analysis reveals opportunities for Pareto efficient improvements in the allocation of intergovernmental transfers to state governments in Mexico. In summary, our model identifies prescriptions of policy that could reform the way intergovernmental transfers are allocated in Mexico. Our policy prescriptions could lead to improvements of welfare in the Mexican economy related with a more effective subnational public spending.

The rest of the paper is structured as follows: section 2 provides a literature review. Section 3 introduces our theoretical model. Section 4 considers that the design of intergovernmental transfers seek to maximize a social welfare function that satisfies the properties of unanimity and symmetry in the allocation of social weights (all states receive the same social weight in the social welfare function). Section 5 estimates intergovernmental transfers for the case in which policymakers seek to reduce the regional inequality in the distribution of income. Section 6 considers social weights associated with the intensity of preferences for local public goods. Section 7 includes the description of the data and the simulation analysis that provides estimatesof optimal shares of intergovernmental transfers to state governments. Section 8 presents the results of our simulations. Section 9 concludes.

2. Literature Review

The literature on public economics on intergovernmental transfers can be classified by normative theories (that seek to study how policies should be designed and implemented) and positive theories (that study how polices are designed and implemented). Oneinfluential contribution on public finance is the median voter theory which postulates that government spending and taxation are determined by politicians that seek to win elections see Meltzer and Richard (1981). In this case, a central and sub-nationalgovernments design the ideal policy of the median voter on government spending and taxation because that is the policy that maximizes votes in the election. More recently, Hettich and Winer (2005) criticize the median voter model by pointing out that this model can not explain the complexity of modern tax systems and the multi-dimensional aspects of government spending. They propose a probabilistic voting model that predicts that policy makers deign tax and spending policies to please different groups in the society. Hence, governments select the ideal policy of the average voter or a weighted average voter in the electorate. Some applications to the theory of fiscal federalism from models with electoral concerns include the analysis of Besley and Coate(2003) who study the role of local and national legislatures in determining taxing and spending decisions of central and subnational governments and Lockwood (2008) who studies the role of lobbying in explaining the structure of governments in a federalist economy (for a survey of the political economy of fiscal federalism see Lockwood 2015). Recent empirical analysis, see Ponce, et al (2018) and Hankla, Martinez-Vazquez and Ponce-Rodriguez (2019) show worldwide robust evidence that elections and political institutions are important determinants of government spending in federations.

On the normative theory of fiscal public finance, the landmark theories of optimal taxation and optimal public spending consider that policy makers should design public policies to maximize a social welfare function which represents the collective welfareof society. While designing policy, policy makers, might assign weights to the welfare of individuals in the social welfare function. These social weights might represent well deserving objectives that policy makers want to achieve such as an equitable allocation of resources or concerns about the efficiency in the allocation of resources (see Atkinson and Stiglitz 1972, 1976 and more recently Saez and Stantcheva 2016). The normative analysis has emphasized that intergovernmental transfers should also be used to redistribute resources and reduce the inequality in the distribution of access to critical government services for individuals living in different regions of a country (see Boadway 2007). Subnational governments might have different abilities toprovide goods and services to their residents. This might lead to a problem of horizontal inequality in the access of residents of different localities to goods and services provided by sub-national governments such as public education, public security and health services (see Martinez and Sepulveda 2011). Others have pointed out that intergovernmental transfers should be assigned to achieve an efficient allocation of resources, see Boadway and Shah (2007). Intergovernmental transfers can also be explained as a mechanism to share revenue across different subnational governments (see Rao 2007) and to reduce failures of coordination that could lead to vertical and horizontal tax externalities (see Ponce-Rodriguez and Medina 2018).

Our analysis is a normative theory that allows to identify prescriptions of policy design by identifying optimal allocations for intergovernmental transfers. Our paper is different from the literature because we study the role of social weights in the social welfare function as a determinant of spending and tax policy design. The determination of weights takes into consideration the objectives of policy design of policy makers. Hence, the inter-regional allocation of weights might reflect priorities related with anti-poverty programs, concerns with the regional distribution of income and the efficiency in the allocation of resources. Hence, our theory contributes to the literature by considering specific Paretian regional distribution functions of social weights in the social welfare function and characterizing the optimal amount of intergovernmental transfers to states when policy makers are concerned about the regional inequality of income and the regional distribution of heterogeneity of preferences ofindividuals for local public spending.4

In addition, in this paper we develop a simulation analysis of the implied results our theory to compare with the observed allocation of intergovernmental transfers in Mexico. This comparison provides insights about advantages and shortcomings of the way intergovernmental transfers are currently allocated in Mexico. In particular, our analysis shows that the current system of allocation of intergovernmental transfers are poorly related with the regional inequality in the distribution of income and the regional heterogeneity of preferences of individuals for local public spending. However, most analysis on fiscal federalism, consider both, the regional distribution of income and the distribution of preferences, as important determinants of intergovernmental transfers. Hence, our analysis provides insights about advantages and shortcomings of the way intergovernmental transfers are currently allocated in Mexico.

3. The Model

The preferences and budget constraint of a resident living in locality

We consider an economy fiscally centralized in which there is a central government

and I local governments. Spending and taxing decisions are determined by the central

government while local governments are simple administrators of the provision of the

public good on their localities. The central government collects tax revenue from

all regions of the country by imposing a uniform proportional income tax

The central government selects

On the other hand, the government collects tax revenue and redistributes resources in the economy through intergovernmental transfers that finance local public goods in the economy. This is the social marginal benefit. At equilibrium, the optimal level ofintergovernmental transfers in locality i is where the social marginal benefit of increasing local public spending in locality i is equal to the social marginal costs of taxation. The other trade-off for policy design is that the central government allocates resources through intergovernmental transfers taking into account that 1$ allocated in locality i has an opportunity cost equivalent to the marginal benefits of local public goods in neighbour localities.

Hence the problem of tax and intergovernmental transfer policy design is given by:

Equation (1) is the nationwide social

welfare which is the sum of the weighted social welfare functions of each localities

In what follows, we characterize the equilibrium level of inter-governmental

transfers of the central government to subnational governments

Proposition 1. The optimal allocation of inter-governmental transfers to subnational government in locality i is given by

Proof.

See appendix 1.

Proposition 1 says that the optimal allocation of inter-governmental transfers that

finances local public spending in locality i depends positively on the country’s

aggregate income,

4. Social Weights and the Regional Allocation of Inter-Governmental Transfers

In this section, we analyse how the allocation of social weights determine the regional distribution of inter-governmental transfers and local public spending. The allocation of social weights in the social welfare function might be explained by preferences (or concerns) of policy makers over regional inequality, the distribution of regional preferences of citizens over local public goods, the regional distribution of population, etc. Even other incentives such as electoral concerns and political ideologymight affect the allocation of social weights, the regional distribution of intergovernmental transfers and the regional distribution of public spending.

In what follows, proposition 2 characterizes our benchmark outcome in which all

households of all localities receive the same weight in the social welfare function

of the central government. That is,

Proposition 2.

If

Proof.

Result follows trivially from proposition 1.

Proposition 2 says that if the central government assigns the same weight to the

welfare of all individuals in the economy in the social welfare function from then

the optimal allocation of inter-governmental transfers that finances local public

spending in all localities depend only on the regional distribution of social

marginal benefits of local spending in each locality,

5. Inter-Regional Income Inequality, Social Weights with Equity Concerns and Government Spending

The policy maker might be concerned about the inter-regional inequality of income. This might be an issue of main concern for policy design because different regions might have different incomes and therefore different capacities to provide local public goods such as public infrastructure, education, health services and other important tasks in which the government is involved. Hence, wealthy regions might be able to afford essential public spending that affects positively the welfare of their residents while poor regions would be constrained to have access to local resources to finance public spending. This, in turn, will lead to an unequal distribution of local public spending and welfare of residents in the economy. For this reason, a policy maker might assign priorities on the regional allocation of inter-governmental transfers to design an equalization transfer policy in which wealthy regions redistribute income to poor regions.

More relevant for our analysis, is that the policy maker in the central government could have a taste for the regional inequality of income. This “taste” corresponds to the personal view of the policy maker of the central government over the issue of the regional inequality of income in the economy. For instance, the policy maker in the central government might believe that one of the objectives of designing intergovernmental transfers is to maximize the redistribution of welfare of individuals livingin different regions. Such a personal view of the policy maker in the central government would imply a very particular set of social weights in the social welfare function in which localities with low income receive a high social weight in the social welfare function. In this case, the regional equitable distribution of income would be a clear objective in the allocation of intergovernmental transfers.

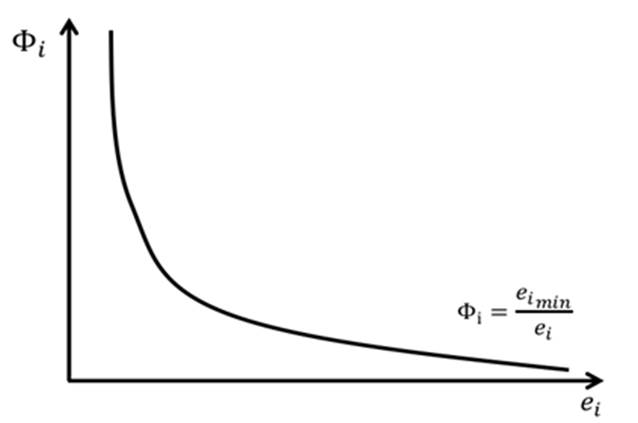

One way to do so, is to assign specific weights to the regional distribution of

marginal benefits of public spending. To do so, a policy maker could assign weights

according to a Paretian distribution of income in which localities with low income

might beassigned a high social weight in the social welfare function (see figure 1). In particular, the policy maker might

assign weights that are inversely related to income in the locality. To characterize

such possibility, we define

In condition (7), the policy maker

assigns weights that are inversely related to income in the locality. Those

localities with lower than average income have a social marginal utility (a social

weight

Proposition 3. If the allocation of social weights is determined by equity concerns about the inter-regional distribution of income such that

Then the optimal allocation of inter-governmental transfers is denoted

by

Where

Proof.

See the appendix.

If the policy maker is concerned with the interregional inequality of income then the

allocation of transfers for locality i depend on the aggregate intensity of

preferences in locality

Proposition 4 makes a comparative analysis of the distribution of transfers to

locality i for the case in which the social weights reflect that the policy maker

assigns the same social weight to all households, that is

Proposition 4. If the allocation of social weights is determined by an Inter-Rional Paretian distribution of income given by

And if a locality i satisfies

Proof.

This outcome follows trivially from propositions one and three.

Proposition 4 shows that if the allocation of social weights in policy design is not

trivial. In particular, proposition 4 shows that if the policy maker is concerned

about the inter-regional inequality of welfare of citizens then those localities

with incomes that are lower to the socially weighted income

6. Social Weights According to the Inter-Regional Distribution of Preferences and Intergovernmental Transfers

Policy makers might have preferences (or might be concerned) about the inter-regional

heterogeneity of preferences. This might be an issue of main concern for policy

makers because different regions might have different intensities of preferences for

local public goods. Optimal inter-governmental transfers are required to recognize

the regional intensity of preferences for local public spending. To see this, note

that localities with residents with higher than average marginal utilities from

public spending (in our model, localities with higher than average values of

As we mentioned before, also relevant for our analysis is that the policy maker in the central government could have a taste for the heterogeneity of preferences of individuals for subnational spending. This “taste” corresponds to the personal view ofthe policy maker of the central government over the issue of the heterogeneity of preferences for subnational public spending in the economy. For instance, the policy maker in the central government might believe that the provision of public goods shouldbe uniform across localities. Such a personal view of the policy maker in the central government would imply a very particular set of social weights in the social welfare function, however, such prescription of policy might not be socially optimal for the general case of the problem of the allocation of intergovernmental transfers.

Another possibility is that the policy maker wants to make the most efficient decisions in designing policy in the central government. Therefore, localities with high social marginal benefits from public spending could receive a high social weigh in the social welfare function. In this case, maximizing the regional net fiscal incidence of public goods (the net gains from government intervention) would be a clear objective in the allocation of intergovernmental transfers. The net fiscal incidence reflects the society’s surplus from government intervention and recognizes the next economic tradeoff: on the one hand, a marginal increase in the income tax implemented by the central government reduces private consumption of all residents in the economy. This constitutes a social marginal cost. On the other hand, the government collects tax revenue and redistributes resources in the economy through intergovernmental transfers that finances local public goods in the economy. This is the social marginal benefit.

Hence, the net fiscal incidence is the net benefit-cost analysis from government intervention and represents the society’s economic surplus (the sum of the consumer’s and producer’s surplus). By assigning social weights to the social welfare function, the policy maker is assigning weights to the net fiscal incidence of localities. Therefore, different weights to the net fiscal incidence of government intervention in each locality will lead to different levels of nationwide social welfare. For instance, if the policy maker assigns a high weight to localities with high net fiscal incidence then the nationwide welfare would be higher relative the alternative in which the policy maker assigns a high weight to localities with low net fiscal incidence.

Taking into account the regional distribution of net fiscal incidence of government

intervention, policy makers can assign weights that are positively related with the

intensity of preferences in each locality, that is to say, localities with high net

fiscal incidence from local public goods should be assigned a high social weight in

the social welfare function (see equation

10). To characterize such possibility, we define the locality with the

highest parameter of intensity of preferences for public spending by

We also define,

In what follows, proposition 5 characterizes the size of inter-governmental transfers

Proposition 5. If the allocation of social weights is determined by an inter-regional Paretian distribution of preferences given by

Then the optimal allocation of inter-governmental transfers is denoted

by

Where

Proof.

See the appendix.

Proposition 5, says that for the case in which the inter-regional heterogeneity of

preferences for local public goods determines the allocation of social weights

Proposition 6 compares

Proposition 6. If the allocation of social weights is determined by an Inter-regional Paretian distribution of preferences given by

And if a locality i satisfies

Proof.

This outcome follows by comparing

Proposition 6 shows that if the policy maker is concerned about the inter-regional

heterogeneity of preferences for local public spending then those localities with

values of

7. Simulations and Estimates of Optimal Shares of Inter-Governmental Transfers

Our theory makes predictions over the size and regional distribution of

intergovernmental transfers. In particular, table

1 shows predictions of our theory for the optimal allocation of

inter-governmental transfers (see column B of table

1) and its implied shares of intergovernmental transfers in relation to

the total amount of resources devoted from the central government to state

governments (see column C of table 1). The

shares of intergovernmental transfers are defined as follows, consider

Based on our theoretical model, we provide estimates for the size and regional distribution of shares of intergovernmental transfers to state governments for the cases in which the central government is concerned about the regional inequality in the distribution of income and the regional heterogeneity of preferences for local public goods. We also provide estimates for the case in which the social welfare function satisfies the properties of unanimity and symmetry (all social weights are the same).

For the analysis of simulation, we use data for intergovernmental transfers,

Table 1 Optimal Inter-Governmental Transfers and Optimal Shares of Inter-Governmental Transfers.

| Principles of Policy Design | Social Weights (A) | Optimal Transfers and Government Spending,

|

Shares of Inter-Governmental Transfers,

|

|---|---|---|---|

| Unanimity and Symmetry (equal weights) |

|

|

|

| Regional Inequality of Income |

|

|

|

| Regional Heterogeneity of Preferences |

|

|

|

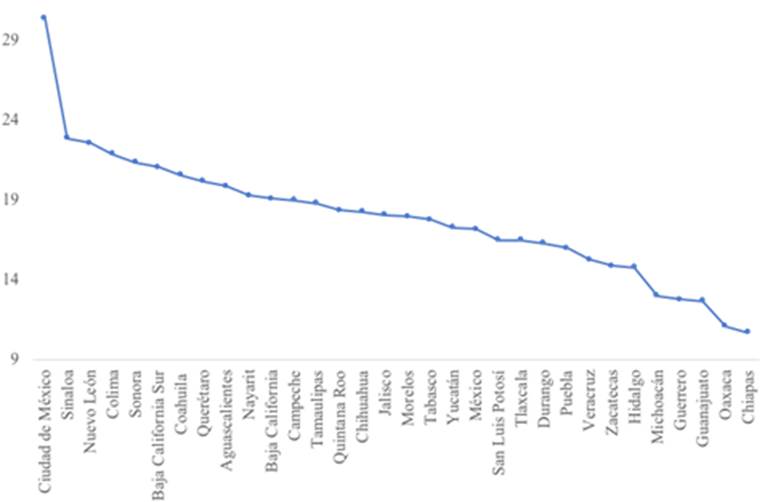

In what follows, figure two shows the distributional allocation of state gross domestic product for Mexico for year 2014, figure three the state distributions of regional heterogeneity of preferences for year 2014, and figure four the state population foryear 2014.

8. Results

In this section, we present the results of our estimations based on our theoretical

model. In the appendix we show a summary of

all of our simulations (see table 5). Figure 5 and 6 show the observed share of inter-governmental transfers and the

estimated shares of intergovernmental transfers for the case in which policy makers

use social weights given by

Figure 5 Real and Estimated Shares of Inter-Governmental Transfers by State When Social Weights Reflect Principles of Unanimity and Symmetry

Table 2 shows the main winners and losers from a change in the allocation of intergovernmental transfers from the current system towards using social weights in the social welfare function satisfying the unanimity and symmetry properties in which all households have the same marginal social utility are Ciudad de Mexico, Estado de Mexico, Jalisco, and Nuevo Leon with gains in percentage points of 5.87 1.63, 1.20, and 1.11 of the total amount of resources devoted to intergovernmental transfers (see table 2).7 Clearly, the gains would be concentrated in Ciudad de Mexico and these gains would come to the expense of several states that would receive less intergovernmental transfers. In particular, the states that would lose intergovernmental transfers would be Chiapas (with a loss of 2.45 percentage points), Oaxaca (with a loss of 1.98 percentage points), Guerrero (with a loss of 1.58 percentage points) and Michoacan (with a loss of 0.99 percentage points), Guanajuanto (with a loss of 0.92 percentage points) and Tabasco (with a loss of 0.78 percentage points).

Table 2 Winners and Loser from the Current System Towards a Change of Social Weights Satisfying Unanimity and Symmetry Treatment from the Central Government

| State | Social Weights with Unanimity and Symmetry | Real Share of Intergov Transfers | Gain | State | Social Weights with Unanimity and Symmetry | Real Share of Intergov Transfers | Loss |

|---|---|---|---|---|---|---|---|

| Ciudad de México | 12.61 | 6.74 | 5.87 | Chiapas | 2.60 | 5.05 | -2.45 |

| Estado de México | 13.41 | 11.73 | 1.68 | Oaxaca | 2.07 | 3.98 | -1.91 |

| Jalisco | 6.65 | 5.45 | 1.20 | Guerrero | 2.13 | 3.70 | -1.58 |

| Nuevo León | 5.31 | 4.21 | 1.11 | Michoacán | 2.78 | 3.77 | -0.99 |

| Baja California | 3.08 | 2.29 | 0.79 | Guanajuato | 3.43 | 4.35 | -0.92 |

| Coahuila | 2.82 | 2.34 | 0.48 | Tabasco | 1.97 | 2.74 | -0.78 |

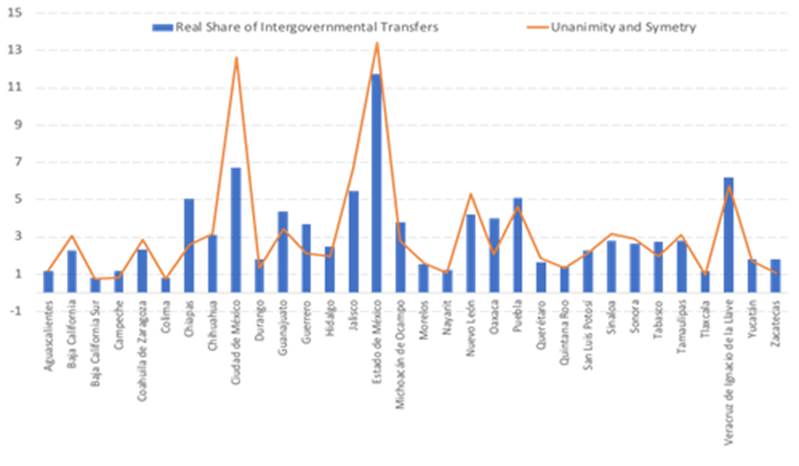

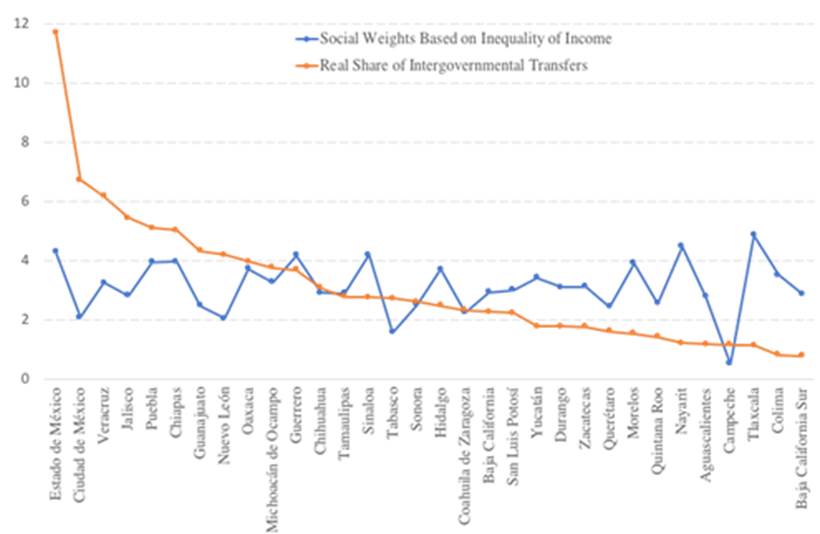

Figure 7 shows the observed shares of

inter-governmental transfers and the estimated shares of intergovernmental transfers

for the case in which policy makers are concerned with the regional inequality in

the distribution of state income. In this case, our estimates of the shares of

inter-governmental transfers are given by

The difference in the variance between the observed and estimated shares means that a change towards using social weights determined according to a concern of policy makers with the regional inequality of income leads to a more equitable allocation of intergovernmental transfers across regions. Second, the correlation between the real shares and the estimates assuming weights of the social welfare reflect concerns about the regional inequality in the distribution of income is 0.24.

What this means, is that policy makers in Mexico does not seem to incorporate (in a significant way) the regional inequality in the distribution of state income in the allocation of inter-governmental transfers to state governments. If policy makers were to consider the regional inequality of income the observed transfers would have less variability over localities.

Figure 6 Real and Estimated Shares of Inter-Governmental Transfers by State When Social Weights Reflect Concerns About the Regional Inequality of Income

Table 3 shows the main winners and losers from a change in the allocation of intergovernmental transfers from the current system towards using social weights in the social welfare function according to a concern of policy makers with the regional inequality of income. The states with the gains in the allocation of intergovernmental transfers are Tlaxcala, Nayarit, Colima, Morelos, Baja California Sur and Yucatan with gains in percentage points, respectively, of 3.72, 3.28, 2.70, 2.39, 2.09 and 1.63 of thetotal amount of resources for intergovernmental transfers.

Table 3 Winners and Losers from a Change from the Current System Towards Social Weights Considering the Regional Inequality of Income

| State | Social Weights Based on Inequality of Income | Real Share of Intergov Transfers | Gain | State | Social Weights Based on Inequality of Income | Real Share of Intergov Transfers | Loss |

|---|---|---|---|---|---|---|---|

| Tlaxcala | 4.87 | 1.15 | 3.72 | Estado de México | 4.31 | 11.73 | -7.42 |

| Nayarit | 4.50 | 1.22 | 3.28 | Ciudad de México | 2.09 | 6.74 | -4.65 |

| Colima | 3.52 | 0.83 | 2.70 | Veracruz | 3.27 | 6.19 | -2.92 |

| Morelos | 3.93 | 1.54 | 2.39 | Jalisco | 2.83 | 5.45 | -2.62 |

| Baja California Sur | 2.89 | 0.80 | 2.09 | Nuevo León | 2.07 | 4.21 | -2.14 |

| Yucatán | 3.43 | 1.80 | 1.63 | Guanajuato | 2.50 | 4.35 | -1.85 |

The states that would lose from a change towards using social weights in a social welfare function according to a concern of policy makers with the regional inequality of income are Estado de Mexico (with a loss of 7.42 percentage points), Ciudad de Mexico (with a loss of 4.65 percentage points), Veracruz (with a loss of 3.27 percentage points), Jalisco (with a loss of 2.67 percentage points), Nuevo León (with a loss of 2.14 percentage points), and Guanajuato (with a loss of 1.85 percentage points).

Figure 8 shows the observed shares of inter-governmental transfers and the estimated shares of intergovernmental transfers for the case in which policy makers are concerned with the regional heterogeneity of preferences. That is to say, policy makers could assign weights that are positively related to localities with high marginal social benefits from local public goods and low marginal social costs from taxation.

Figure 7 Real and Estimated Shares of Inter-Governmental Transfers by State When Social Weights Reflect Concerns About the Regional Heterogeneity of Preferences

In this case, our estimates of the shares of inter-governmental transfers are given

by

Table 4 Winners and Loser from the Current System Towards a Change of Social Weights Considering Regional Heterogeneity

| State | Shares of Inter-Gov Transfers Under Heterogeneity of Preferences | Real Share of Intergov Transfers | Gain | State | Shares of Inter-Gov Transfers Under Heterogeneity of Preferences | Real Share of Intergov Transfers | Loss |

|---|---|---|---|---|---|---|---|

| Ciudad de México | 20.12 | 6.74 | 13.38 | Chiapas | 1.46 | 5.05 | -3.59 |

| Nuevo León | 6.30 | 4.21 | 2.10 | Oaxaca | 1.21 | 3.98 | -2.78 |

| Sinaloa | 3.82 | 2.78 | 1.04 | Guerrero | 1.43 | 3.70 | -2.28 |

| Jalisco | 6.32 | 5.45 | 0.87 | Guanajuato | 2.29 | 4.35 | -2.06 |

| Baja California | 3.08 | 2.29 | 0.79 | Michoacán | 1.90 | 3.77 | -1.87 |

| Coahuila | 3.05 | 2.34 | 0.71 | Veracruz | 4.59 | 6.19 | -1.60 |

9. Conclusion

Modern economies use intergovernmental transfers to help finance important goods and services provided by subnational governments such as education, health services, infrastructure and anti-poverty programs. The normative literature of public economics has emphasized that intergovernmental transfers should be designed to alleviate problems of regional inequality and inefficiency in the allocation of resources. The literature on optimal taxation and spending has also pointed out that resources should be allocated to the highest economic returns and therefore the regional heterogeneity of preferences of individuals for local public spending should also be a principle of policy design in intergovernmental transfers.

In this paper we develop an optimal theory of intergovernmental transfers which provides specific rules for shares of resources of intergovernmental transfers to be assigned to state governments in Mexico. Based on this theory, we develop a simulation analysis that provides estimates about the optimal shares of resources to be allocated to state governments assuming that policy makers might have objectives such as minimizing the regional inequality of income and maximizing social welfare by matching localpublic spending with the heterogeneous regional preferences of individuals.

Our analysis provides interesting insights about the regional distribution of intergovernmental transfers in Mexico: the best fit of our model to observed data suggests that policy makers could use a social welfare function that satisfies the properties of anonymity and symmetry (all states receive the same social weight in the social welfare function). Our estimates also suggest that the best predictor of the share of intergovernmental transfers is the density of population in Mexico. This has the important implication that policy makers in Mexico do not fully incorporate the heterogeneity of preferences for goods and services provided by subnational governments and the regional inequality of income in the design of intergovernmental transfers.

However, our model suggests that incorporating these objectives of policy would lead to a different allocation of intergovernmental transfers that would represent a Pareto improvement in the allocation of public resources in the Mexican economy. In this paper, we provide estimates of optimal shares of intergovernmental transfers for state governments that take into account the heterogeneity of preferences for goods and services and the regional inequality of income in the design of intergovernmental transfers.

Our analysis also represents a proposal for policy reform in the allocation of intergovernmental transfers. In this paper we have assumed that policy makers want to maximize a social welfare function and therefore this paper contributes in pointing out feasible policy reforms that could lead to Pareto improvements. However, politicians and bureaucrats (who are in charge of the design and implementation of policy) might not seek to design policy to maximize the society’s welfare but to benefit groups of interest or to maximize votes in elections. In that sense, the policy prescriptions described in this paper might not be aligned with political realities and electoral incentives. An interesting avenue for future research is to extend this analysis considering a modern political economy view that could also point out towards political feasibility in policy design.

nova página do texto(beta)

nova página do texto(beta)