1. Introduction

The advent of the so call technology era has brought diverse developments in an enormous range of areas. One of those is the development of a new digital object that does not entirely fit in the conventional definitions. This entity has been studied undermany considerations, leading to the critical question of what are virtual assets? As in all areas of knowledge, you cannot comprehend certain subject without first understanding the central concepts that contextualize the main theme. For this reason, thedefinitions of the phenomenon about cryptocurrencies, the blockchain, and digital currency are essential. Therefore, digital currency is understood as a means of payment that is only available in a digital manner; however, it has the classic fundamental characteristics of fiat money that bases its value on the trust of an entity and has no endorsement of any physical good. Yao (2018) mentioned that “by the nature”, digital currency “is still central bank’s liability against the public with its value supported by sovereign credit, which gives it two unconquerable advantages over private digital currencies.” Primary, he stated that it could perform successfully all the fundamentals of money and second, it allows the creation of credit and plays abig role in the impact of the economy.

On the other hand, cryptocurrencies are an asset or means of payment that its creation is constituted through “an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” (Nakamoto, 2009). While, by definition, cryptocurrencies are not supported by a central bank or other authority, Zimmer (2017) alludes that the development of cryptocurrencies have been the result of the merger of two elements within a globalized economy: the computational unit and money itself, where the element that gives value to this high tech is scarcity. So, we are living changes in the technological field which is creating economic competition and obviously, decentralization in the markets and giving power to individuals. So, from the words of Mikolajewicz-Woźniak, A., & Scheibe, A. (2015) using the work of Kotler, P., Kartajaya, H., & Setiawa, I. (2010) we are “forthcoming new era is called the cooperation era - where people not only receive the message but also co-create it.”

Likewise, blockchain is defined as an open technology and distributed ledger that has the ability to perform efficient transactions between two agents with the following characteristics: verifiable and permanent. But, despite the expectation of growth on this type of technology, we believe it should be taken as an opportunity to found new bases for the social and economic system, and not only, to perceive it as a disruptive technology that completely changes the world. In other words, the potential of theblockchain is imminent in any field, nevertheless, a gradual adoption will be needed like any other technological change. McPhee & Ljutic (2017) present “blockchain adds a totally new dimension: the exchange of value between potential strangers in theabsence of trusted relationships. Replacing the dependency on trust with cryptography means that most verification, identification, authentication, and similar forms of assurance, accreditation, certification, and legalization of identity, origin, competence, or authority of persons or assets can now be guaranteed by mathematics. And once trust is replaced by reliable cryptography, there can be disintermediation of all the layers of middlemen.”

Having considered the ambiguous and abstract definition of those terms, it is necessary to state the problems to categorize it under common asset classifications. Bitcoin is properly defined as a cryptocurrency; nevertheless, this concept may be understood as a variety of characteristics, some shared by currencies, commodities, speculative assets, trade mechanisms, etc. In particular, this paper treats the presence of financial bubbles in cryptocurrencies at this day2 due to the effects of high volatility and their speculative behavior.

The lack of close and absolute criteria to categorize the digital object may be considered as a reason to theorize about the existence of bubbles. Angel & McCabe (2015) present the possibility that cryptocurrencies may be used as a substitute for credit and debit payment system; however, a payment system relies on the trust in an institution to cover the debt. In this case, Bitcoin is not backed by anything. In this sense, even when it can be used as a transaction facilitator, the barter problem may arise if the counterpart does not recognize it as worthy. On this behalf, Fry & Cheah (2016) refer to the condition of the cryptocurrencies depending on the realizations of the self-fulfilling expectations.

In the legal aspect, Bitcoin and all the virtual money are considered as a commodity by the Commodity Futures Trading Commission (CFTC) (Kawa, 2015). In this sense the so call mining of cryptocurrencies is seen as the productions cost equivalent to the obtaining of precious metals or the extraction of crude oil. However, the Cornell Law School under the U.S. Code, General Provisions, Chapter 1, § 1ª - Definitions (9), state that commodities are material goods as well as services, rights, and interests. Under this definition, cryptocurrencies may be considered as a right; nevertheless, as stated earlier, there is no institution backing or regulating the payment made using this mean.

On the economic view, cryptocurrencies share some qualities related to currencies. As exposed by Frisby (2014), Bitcoin presents relatively low transactions costs, as well as convertibility to diverse currencies all around the world. Following the immateriality that characterizes the virtual money, the fiduciary money does not depend on commodities to determine their value; instead, they rely on the consumers’ trust to use it as an exchange mechanism. This property is followed by the use of offer and demand laws to explain the movements in price relative to other assets. Although Bitcoin may cover these points, it lacks the control and regulations relative to Central Banks or any other financial institution. The problem with this also expands to the transaction efficiency as the price of goods and services in the real economy are not measured in any cryptocurrencies; so, in the last instance, it may be considered as a mere asset convertible to currencies.

To consider this, Yermack, D. (2015) studies the behavior of Bitcoin with respect to U.S. Dollar. Making it to the conclusion that the cryptocurrencies lack the store value required to fit the property of a currency. Also, because of the high volatility, he mentions this virtual object to act as a speculative asset. Taking this in consideration Cheah & Fry (2015) develop the hypothesis on the possibility of bubbles in the Bitcoin markets as the price is linked with sentiments, as well as peaks in price related to news. Thus, a quantitative and empirical analysis on the possible existence of financial bubbles will be applied using the generalized sup augmented Dickey-Fuller test method to four cryptocurrencies selected by their market capitalization. We excluded the analysis of Bitcoin because Li et al. (2018) previously have done this work. In this way, we are selecting for our analysis another 30.59% of the market share of these assets. The structure of this work is as follows. Section 2 shows a brief theoretical framework. Section 3 contains the methodology and data description. Section 4 displays the results and Section 5 exposes the conclusions.

2. Theoretical framework

The theory of bubbles has been greatly studied in recent years since the 2008 economic and financial crisis. Properly defined as a deviation of the price from its fundamental value (Campbell, Lo & MacKinlay, 1997), bubbles have the potential to extend todifferent markets and even affect economic activities. Because of this, detection of these disturbances becomes crucial for regulatory authorities as well as investors. The problem for this is stated by Greenspan A. (2002) who mentions that bubbles are only detected once they have collapsed since there is no way to determine if the rise in price is due to a fundamental reason or is mere speculation. The reasons behind bubbles are many and may present in different forms; in particular, Brunnermeier & Oehmke (2012) mention that a technological change in form of an innovation can lead to the creation of imbalances ultimately making the conditions for bubbles. On the other side, Caginalp, Porter & Smith (2001) state that access to information, data analysis and media have done nothing to prevent them from happening.

Relative to Bitcoin, it was during the last financial crisis of 2008 that Nakamoto proposed this virtual currency as an alternative to conventional ones. According to Bouri, Gupta, Tiwari & Roubaud (2017), it was because of the loss of trust on financialinstitutions that cryptocurrencies were sought as an alternative to conventional assets; a perspective that followed during the next years. Although the prices of Bitcoin have been increasing since then, high volatility has been a main characteristic of the asset. To compare this, Kubát (2015) compares the deviation of different financial assets, including currencies, indexes, and commodities; his results provide evidence of the turbulent behavior of the virtual currency. To study this phenomenon deeply, Bouoiyour & Selmi (2015) propose a GARCH analysis on the price of Bitcoin relative to U.S. Dollar, their results conclude the excessive volatility of it, as well as a larger impact of bad news in comparison to positive shocks. In this case, it is possible to identify some of the properties concerning of bubbles with the cryptocurrencies.

Harvey et al. (2016) pointed out that the methodology implemented by Phillips et al. (2011) may contain spurious results on explosive behavior when there are permanent changes in volatility in the innovation processes of the right-tailed recursive Dickey-Fuller-type unit root test. Given this circumstance, they propose the incorporation of the bootstrap test when a non-stationary volatility is present. In their studies, they use Nasdaq stock price index during the decade of 1990. In their results, it is possible to determine the existence of an explosive behavior in 1995; characteristic held by financial bubbles.

In subsequent works, Phillips et al. (2015) improve the methodology of the Dickey-Fuller mechanism to the augmented one in order to identify multiple bubbles. For this purpose, they use a sample of the S&P 500 in a so-called long period of time from 1871to 2010. In this new development, the historical bubbles are properly detected during the recognized periods.

The literature of virtual assets is a topic that has grown due to its applications as a means of payment and as an investment asset. Thum (2018) points out that the unusual behavior of growth and the immediate drop in the price of Bitcoin generates a great uncertainty and dispute over whether this behavior could be due to speculative bubbles in the cryptocurrencies.

Gringerg, R. (2011) exposes a parallel between trust and its relationship with irrational bubbles in cryptocurrencies. In it, he treats how unexpected changes such as a definitive prohibition by the government, an increase in the competition of alternative currencies, a deflationary spiral, problems with privacy, and loss of money or theft could affect the aforementioned relationship and, therefore, become determining facts for the cryptocurrency demand.

In the present, the search for possession of cryptocurrencies encompasses the search for expected profits in the future. But, to some extent, the existence of speculation is not exclusive of cryptocurrencies, in the Foreign Exchange market there is this performance and it is not necessarily related to an expectation of gain. Added to this point, Godsiff (2015) compares the volatility of the Bitcoin price with the speculative euphoria of the tulip crisis where the futures market was affected causing a rapid increase in prices followed by an immediate collapse. In the same way, he mentions that there is evidence of the volatility of the price of this cryptocurrency and searches in google. Also, he points out that the bubbles in the Bitcoin have been socially created and that the levels of activity in this economic phenomenon can develop markets and even increase public awareness.

On the other hand, Cheah & Fry (2015) reveal the empirical existence of a financial bubble in Bitcoin through a complex method originated in physics and determine that in this cryptocurrency there is a speculative element and that in addition, the fundamental value is zero.

Li et al. (2018) used for the Bitcoin prices with respect to the USD and the renminbi (RMB) the generalized sup augmented Dickey-Fuller test method set forth by Phillips et al. (2015). They mentioned that the prices of China and the United States of America are different, and therefore, it is important to take into account this discrepancy. These authors find out for the Bitcoin/RMB six bubbles, while for Bitcoin/USD only five. Additionally, they pointed out that Bitcoin is susceptible to exogenous shocks. This means that this cryptocurrency is affected to a greater extent by international economic events causing long-term bubbles, and by local economic decisions causing bubbles in the short term.

3. Methodology and data description

This methodology is based on the work of Phillips et al. (2011, 2015) and we applied the observations made to these articles by Harvey et al. (2016). Phillips and Yu (2011) expose the supreme of recursively determined ADF t-statistics with the aim of improving the known unit root tests. Therefore, the sup ADF test (SADF) uses a sample sequence in a forward expansion that considers the repetitive ADF estimate as the main basis. The result of this test comes from the sup value of the ADF statistical sequence. This model is consistent with the detection of a single bubble for the period analyzed. However, for the case of two or more bubbles observable under the previous model. An approximation with the GSADF test is recommended, which has a better accuracy under the previous scenario because it considers a greater number of subsamples, and a greater flexibility in the windows used to the range of the samples of the model. The program executed for this investigation is an EViews add-in called Rtadf (right-tail augmented Dickey-Fuller) developed by Itamar Caspi (2017).

The cryptocurrency information was obtained from coinmarketcap3 on April 22nd, 2018 with a total market capitalization of $400,337,634,5854 USD. With respect to this total, 30.59% of the market share of this measure will be taken in consideration, which involves the second, third, fourth and fifth cryptocurrencies5. As we mentioned before, Bitcoin was excluded in this analysis. But if we consider the study of Li et al. (2018) plus our analysis of the remaining five primal. We will be contemplating and applying this methodology to the 68.47% of the market cap of all cryptocurrencies to the date of the study. The price that was implemented is the daily closing of the sample described below6: Ethereum from 07/08/2015 to 22/04/2018; Ripple from 04/08/2013 to 22/04/2018; BitcoinCash from 23/07/2017 to 22/04/2018; and EOS from 01/07/2017 to 22/04/20187.

4. Results

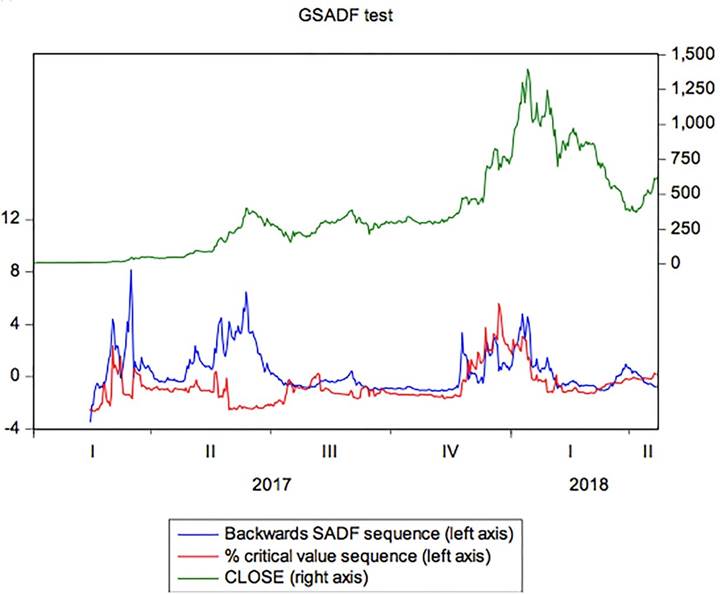

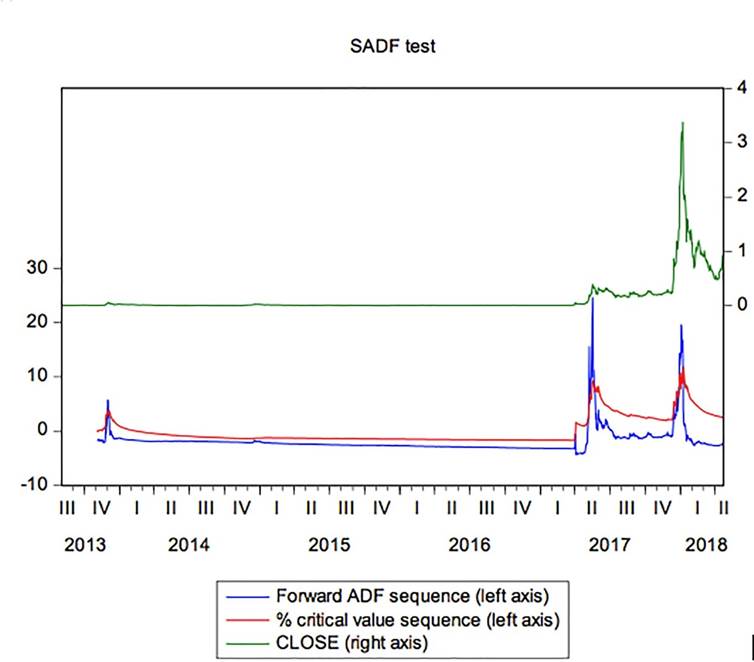

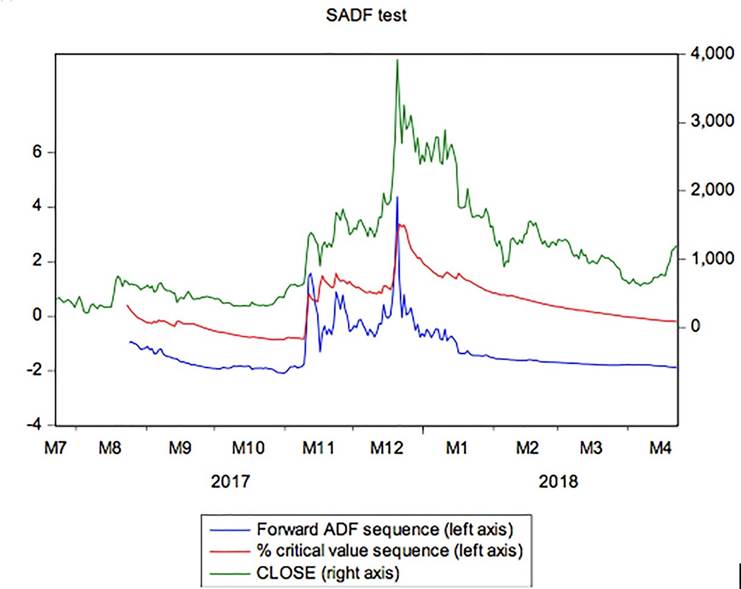

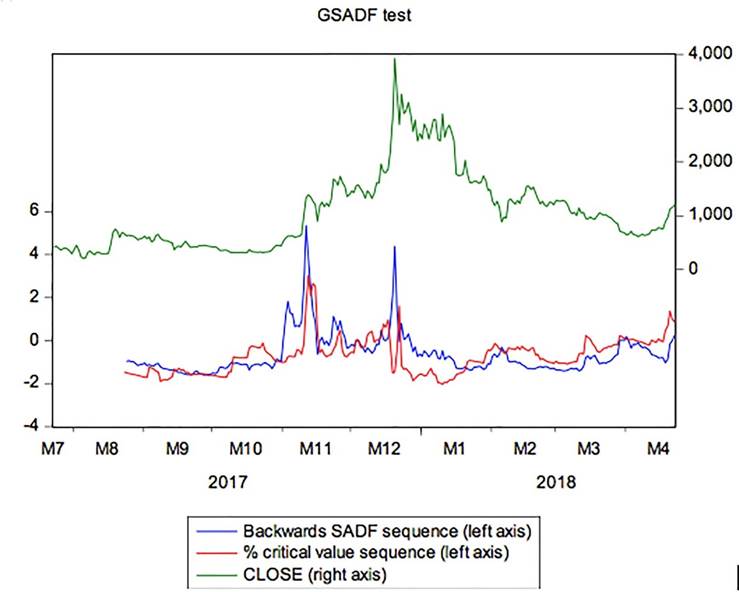

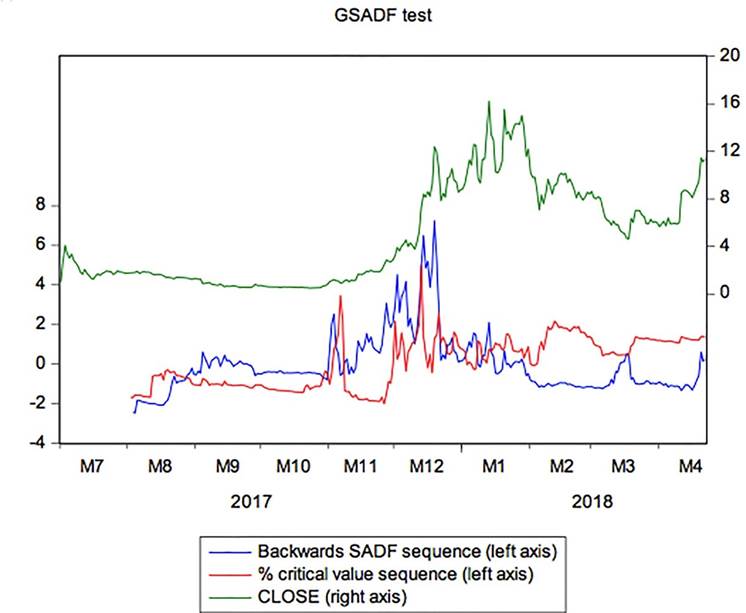

We applied the SADF and GSADF methodology with 10,000 and 2,000 replications, respectively. The results obtained are shown in Table 2, 3, 4 and 5. With this information, we can derive the presence of explosive behavior in these four cryptocurrencies. In all cases, we applied the SADF methodology (Figure 1, 3, 5 and 7) in order to have evidence of at least one exuberant behavior in these financial series where the null hypothesis was rejected. Therefore, for the first asset we have evidence of at least one explosive behavior in Ethereum with a level of significance of 1%; for the Ripple with a level of significance of 1%; for the Bitcoin Cash with a level of significance of 10%, and for the EOS with a level of significance of 5%.

With the previous results and in order to figure out the periods of multiple bubbles where they began an explosive growth in their price and also, they came to be used not only by a specific guild of experts in technology and finance. We selected a subsample (for Ethereum and Ripple) and the original sample (for Bitcoin Cash and EOS) of the series starting in 2017 and implemented the methodology of multiple bubbles GSADF (Figure 2,4,6and8). For the four assets studied, the null hypothesis wasrejected with a level of significance of 1%. Consequently, we can perceive the presence of multiple bubbles or that these assets contain explosive behaviors in their price in this subperiod (2017 - 2018).

Graphically, we can examine these results from Figure 1 to Figure 8 where we can identify the presence of bubbles when the Forward ADF sequence (blue line) is above the percentage of the critical value sequence (red line) with 95% confidence intervals. The completion or the collapse of the bubble is constituted when the Forward ADF sequence (blue line) is below the percentage of the critical value sequence (red line) with 95% confidence intervals.

Thereupon, as the GSADF (Figure 2,4,6and8) outperforms the SADF (Figure 1,3,5and7) we detect in Table 1. the bubbles resulted from the first test. For Ethereum we found 10 exuberant explosions, where the bubbles identified with the numbers 3 and 6 last more than two months. For Ripple we located 7 bubbles, where the third and seventh explosion last more than one month. Then, for Bitcoin Cash we found six bubbles, in which the third and sixth are the biggest in length. Finally, for EOS we have seven bubbles where the first and third explosion last more than one month. The previous longest periods stated are presented in Table 1. with a shading over them.

As mentioned above, the purpose of analyzing the period 2017 - 2018 was to observe a more recent period where cryptocurrencies began a boom in terms of their knowledge in the general public. The presence of bubbles in the four cryptocurrencies analyzed (Ethereum, Ripple, Bitcoin Cash and EOS) coincides with the results reported by Li et al. (2018) for the quarters of 2017 studied in the Bitcoin. Hence, we can infer that the existence of bubbles is not found in a single asset like Bitcoin, but rather couldbe present in the entire cryptocurrency sector.

Table 1 Number of bubbles in cryptocurrencies implementing GSADF test

| GSADF test | ||||

|---|---|---|---|---|

| Number of Bubbles | Dates | |||

| Ethereum | Ripple | Bitcoin Cash | EOS | |

| 1 | 14/02/17 - 08/03/17 | 17/02/17 - 04/03/17 | 23/09/17 - 27/09/17 | 28/08/17 - 29/10/17 |

| 2 | 10/03/17 - 18/03/17 | 18/03/17 - 14/04/17 | 29/09/17 - 10/10/17 | 31/10/17 - 04/11/17 |

| 3 | 19/03/17 - 14/07/17 | 28/04/17 - 06/07/17 | 29/10/17 - 13/11/17 | 08/11/17 - 10/12/17 |

| 4 | 17/07/17 - 30/07/17 | 10/07/17 - 02/08/17 | 17/11/17 - 03/12/17 | 13/12/17 - 22/12/17 |

| 5 | 08/08/17 - 12/09/17 | 09/08/17 - 21/08/17 | 18/12/17 - 22/12/17 | 25/12/17 - 28/12/17 |

| 6 | 17/09/17 - 28/11/17 | 06/10/17 - 16/10/17 | 23/12/17 - 21/01/18 | 03/01/18 - 08/01/18 |

| 7 | 05/01/18 - 11/01/18 | 27/11/17 - 08/01/18 | 11/01/18 - 15/01/18 | |

| 8 | 12/01/18 - 04/02/18 | |||

| 9 | 08/02/18 - 08/03/18 | |||

| 10 | 18/03/18 - 05/04/18 | |||

Table 2 The SADF and GSADF tests result in Ethereum

| Ethereum Price | SADF | GSADF |

| 14.49784*** | 8.163710*** | |

| Critical values | ||

| 99% level | 13.13328 | 5.571988 |

| 95% level | 10.47793 | 5.571988 |

| 90% level | 9.170676 | 5.571988 |

*** Significance at the 1% level.

** Significance at the 5% level.

*Significance at the 10% level.

Table 3 The SADF and GSADF tests result in Ripple

| Ripple Price | SADF | GSADF |

| 24.62992*** | 9.459127*** | |

| Critical values | ||

| 99% level | 21.68289 | 3.504366 |

| 95% level | 17.35930 | 3.504366 |

| 90% level | 15.07182 | 3.504366 |

*** Significance at the 1% level.

** Significance at the 5% level.

* Significance at the 10% level.

Table 4 The SADF and GSADF tests result in Bitcoin Cash

| Bitcoin Cash Price | SADF | GSADF |

| 4.379902* | 5.345659*** | |

| Critical values | ||

| 99% level | 7.104894 | 3.025993 |

| 95% level | 4.886610 | 3.025993 |

| 90% level | 3.835460 | 3.025993 |

*** Significance at the 1% level.

** Significance at the 5% level.

* Significance at the 10% level.

5. Conclusion

In conclusion, the presence of multiple bubbles was examined in the four cryptocurrencies, subsequent to Bitcoin, with the largest market capitalization. The results show from the GSADF test that Ethereum presents ten bubbles from January 1st, 2017 to April 22nd, 2018; Ripple, seven bubbles from January 1st, 2017 to April 22nd, 2018; Bitcoin Cash, six bubbles from July 23rd, 2017 to April 22nd, 2018; and EOS, seven bubbles from July 1st, 2017 to April 22nd, 2018. This could mean that a technological change in the financial markets and their spontaneous knowledge in the general public could be causing purchases and sales in a speculative way in these virtual assets and not based in the fundamental value of them. So, the presence of exuberant behavior couldbe in the entire cryptocurrency sector and not exclusively in one. It is worth mentioning that the market capitalization of these assets is still too small to represent a financial risk, however the regulatory authorities should be alert to these explosions and collapses as the investments in these virtual assets increase.

In the Conclusions is missing a wider discussion regarding that Mexico’s stagnation is due to its inefficient financial system and its lack of contract enforcement

In the last paragraph of the Conclusions the authors can still say more about easing credit constraints and its possible impact on poverty and inequality burdens.

nueva página del texto (beta)

nueva página del texto (beta)