1. Introduction

The unbiased forward exchange rate hypothesis (UFRH) states that the forward discount is an unbiased predictor of the future spot exchange rate if we assume risk neutrality and a covariance stationary risk premium. Acceptance of the UFRH should also imply that the foreign exchange market is efficient. If the foreign exchange market is efficient, the spot (forward) exchange rate should incorporate all available information, and it should not be possible to forecast one spot (forward) exchange rate as a function of another.

Depending on the time period, selection of exchange rates and type of methodology, researchers have reached different conclusions about the efficient market hypothesis. Rapp and Sharma, (1999), for instance, find mixed evidence of market efficiency among spot and forward rate for each of the G-7 countries. They argue that market efficiency is supported by the finding of co-movement between the forward and the corresponding spot rate. Nevertheless, the rate of depreciation and the forward premium were not found to exhibit co-movements as the efficiency hypothesis would imply. Barkoulas, et al. (2003) also find that the UFRH is accepted for a group of six major developed economies provide that the risk neutral assumption is dropped.

The evidence in favor of UFRH for emerging economies seems to be less clear. Varetsalo (2014), in a study for 10 emerging economies, rejects the unbiased forward hypothesis.3 He finds that in the majority of cases, extending the time horizon the regression produces increasing biased estimates of the future exchange rate. By the same token, Kumar and Azouzi (2011) find the same result in their analysis of the Tunisian and Indian foreign exchange markets, namely that the UFRH does not hold for both markets. Their analysis also concludes that the Indian market is less biased than the Tunisian. Frankel and Poonawala (2010), on the other hand, compare the behavior of the forward bias between developed and emerging economies and find that contrary to general beliefs, emerging economies present a smaller forward discount bias than advanced economies. According to Frankel and Poonawala, the existence of such a bias in emerging economies can be attributed in large part to expected depreciations rather than to the existence of time varying exchange risk premium.

For the Mexican economy, Verschoor and Wolff (2001) evaluate the relationship between the forward discount and the future change in the exchange rate. They reject the null hypothesis that the forward discount is an unbiased predictor of future change of the exchange rate. Moreover, when decomposing the forward discount bias into its two main components, -namely, the irrational behavior of investors and the existence of time varying risk premia-, they find that survey expectations were off by large and significant constant. They also find that there is a large average risk premium as well as a time-varying risk premium.

It should be pointed out that the conclusions reached by these studies are based on econometric techniques that assume lineal relationships between the forward premium and the change of the future exchange rate. However, given that Mexico's monetary and exchange rate policies have not remained constant over the last two decades or so but rather have been evolving, one would expect that the relationship between the forward premium and the change of future spot rate is non lineal.

Benavides (2016), for example, finds a positive relationship between the risk premium and depreciation expectations during periods of high exchange rate volatility. That is an explanation of the apparently stable trend of the premium in recent years, relative to values before 2010, despite the relatively constant Mexican peso depreciation increasing trend. The author shows that during periods when it is observed an above-normal depreciation in the currency, such as during the Financial Crisis of 2008-2009 and around the Greek Financial Crisis (2011), the forward risk was high.

One of the implications of Benavides (2016) results is that the UFRH does not hold. However, we would argue that since the early 2000s there have been several types of policy interventions in both the money and foreign exchange markets which have altered the relationship between the forward and the spot exchange rates, so that the unbiased forward exchange hypothesis may be accepted for certain periods of time.

Our main purpose is therefore to test the UFRH in Mexico´s foreign exchange market. To test the hypothesis we use weekly data on the 30 and 90 day forward rates and spot rate. Furthermore, we use two models to test the unbiased hypothesis: a lineal and a non-lineal one. The non-lineal model is a two-regime Markov Switching model.

Our two main results are. First, the two-state Markov Switching model is preferred to the single state model for both the forward and the spot rates. Second, we found evidence in favor of the UFRH for the 30 day forward rate. In this case, state 1 is the efficient state, whereas state 2 is the inefficient state. Even though this approach to test the unbiased exchange rate hypothesis is not new, to the best of our knowledge, our work is the first one that tests the hypothesis in a nonlinear framework for the Mexican case. We believe that this paper serves useful in several ways. First of all, the findings of this empirical analysis provide guidance to understand better the Mexican foreign exchange market operation. Second, this paper contributes to increase the limited literature by testing the foreign exchange market efficiency hypothesis in a nonlinear framework. Moreover, the results shed light on the course of time-varying parameters and smoothed probabilities that identifies periods where the hypothesis holds and where it is rejected.

The remaining of the paper is divided into three additional sections. In section two we briefly discuss foreign exchange market efficiency and describe the econometric models used to test the hypothesis. Section three presents the empirical results and the main implications. Section four offers some concluding remarks.

2. Literature Review

For the last two decades, exchange rates have become increasingly unpredictable and the activities of businesses have become highly international. As a result, many business decisions depend on future exchange rates. Therefore, accurate knowledge of exchange rates is very important for currency traders who are engaged in hedging and arbitrage in the foreign exchange markets.

Exchange rate market efficiency is a key for investors to take good decisions. If the market is inefficient, investor can obtain above average profits by taking advantage of this inefficiency, but if the market is efficient, then the investor will not be able to obtain above average profits. It has been noted that market inefficiencies tend to disappear along time; thus when they exist it is preferable to take advantage of it. Fama (1984) argued that no market is ever perfectly efficient; that is, no market is perfectly competitive and frictionless, so that there will always be a way to get an edge.

The unbiased forward exchange rate hypothesis was first proposed by Fama (1984). He sustained that the forward exchange rate that is observed in the market for a future period is the certainty equivalent determined by the market for the spot exchange rate in that future period. That is, the forward exchange rate is an unbiased predictor of future spot exchange rates. This hypothesis also implies that forward exchange rate is efficient in the sense that it fully reflects any available information that is relevant for the spot exchange rate, i.e. the forward rate incorporates all the expectations that economic agents have formed about the future exchange rates (Chiang, 1988). The main conclusion of the assumed exchange market efficiency is that the expected rate of return by trading in the forward exchange rate market will be zero (Geweke and Feige, 1979; Hansen and Hodrick, 1980).

According to Fama (1970), markets could be efficient in a weak-form, semi-strong form or strong-form. The classification depends on the speed at which information is reflected in the prices. The weak-form asserts that prices fully reflect the information implicit in historical prices and new information is unrelated to previous information. The semi-strong form states that prices reflect all relevant information that is publicly available, while the strong-form claims that all the information, available or not to any participant, is accurately reflected in market prices.

Early studies found strong empirical support for the unbiased forward exchange rate hypothesis. See for instance, Kohlhagen, (1979), Giddy and Dufey, (1975), and Fama, (1976) among others. However, later studies have found evidence that is contrary to these early findings. Among the latter are Levich (1985), Boothe and Longworth (1986), Frankel and Rose (1995) and Engel (1996). These mixed empirical results question the hypothesis that the forward exchange rate is an efficient predictor of the spot rates and have given rise to a puzzle among finance scholars.

Several explanations about the existence of the puzzle have been put forth. Amongst them we find the following three. First, it represents the premium (discount) to speculative agents characterized by risk aversion (Ott and Veugelers, 1986). Second, it results from irrational expectations and speculative bubbles (Frankel and Rose, 1995). Third, it arises as a consequence of international market inefficiency from various frictions (Frankel and Froot, 1987). Some studies argue that the nonlinear behavior of the forward discount can help explain the empirical puzzle (Sarno et al, 2006).

The conclusions drawn about the unbiased forward exchange rate hypothesis have changed partly because researchers have modified their empirical models in the light of new developments in measurement, financial theory and econometric techniques. We believe that the lack of conclusive evidence about the hypothesis is due to the fact that the forward exchange rate hypothesis may change over time and that the links between the forward and the spot exchanges rates are very sensitive to the sample period considered for the analysis.

Unless researchers have strong a priori indications of when and why the forward and spot exchange rates change is linked, accounting for such changes in a linear framework may be difficult. To overcome those difficulties, some researchers such as, Clarida et al (2003), Spagnolo et al (2005) and Chen (2010) argue that the results obtained from a Markov switching model are better than the ones obtained from a lineal model.

Turning to the studies done for testing the unbiased forward exchange rate hypothesis in the Mexico´s foreign exchange market, they are scarce and in the linear framework, and provide mixed evidence. For instance Garduño (1996) and Galindo et al. (2004) tested the semi-strong version of the efficient market hypothesis and did not find evidence in favor of the hypothesis. Garduño (1996) included data from 1991 to 1994, while Galindo et al (2004) from 1980:1 to 2002:12. Cabrero et al. (2013), through a bootstrap technique, failed to reject the hypothesis of efficiency. Their period of analysis was 1997-2011.

2.1 Foreign Exchange Market Efficiency and the Econometric Models.

In a relatively simplistic version of competitive exchange markets with no transaction costs, assuming that economic agents are risk neutral and that the information is used rationally, the foreign exchange market efficient hypothesis implies that the forward exchange rate is an unbiased and efficient predictor of future spot exchange rates. Therefore, the forward rate forecast error is random and unrelated to the information set available to market participants at the time expectations are formed.

However, empirical studies have concluded that the forward rate is often a biased predictor of future spot rates. A number of models have attributed this bias to the risk premium; that is, currency traders will demand a high return for holding the currency. Hence, market participants may not be risk neutral but risk averse. They will exploit a profit opportunity resulting from a difference between their expected future spot rate and the current forward rate only if the expected return is sufficiently large.

In what follows we sketch the basic ideas behind the unbiased forward exchange rate hypothesis. Let

Recall that is the expected excess return from forward exchange speculation, where

Thus, the traditional approach to test the foreign exchange market efficiency is based on equations (1) and (2),

where

Previous to the surge of co-integration modeling framework, concerns that non-stationary spot and forward rate would lead to the wrong inference in OLS regressions let some researchers to induce stationarity by differencing them; see for instance Bilson (1981), Longworth (1981), Hansen and Hodrick (1983), Fama (1984) and Huang (1984). The stationary version of the unbiased hypothesis states that the k-period forward exchange premium

Given the assumption of risk neutral agents and perfectly competitive markets, the foreign exchange market efficient hypothesis implies the following joint hypothesis for both equations (3) and (4):

According to Fama’s market efficiency’s forms, if

We now recall to the model we shall use to test the efficient market hypothesis. In an efficient market, historic forward rate forecast errors

where the forecast error is made a function of past forecast errors. No significant values of

2.2 Empirical models.

In this section, we briefly describe the econometric models used in the empirical analysis. First, we consider Hansen and Hodrick’s (1980) model and label it “Model A”

where

The null hypothesis for testing the efficient market hypothesis in Model A is therefore,

As noted previously, Clarida et al (2003), Spagnola et al (2005) and Chen (2010), favor the use of a nonlinear Markov switching model because it is better fit to test the market efficiency hypothesis when the market has faced several disturbing shocks which may induce time varying coefficients.

Markov-Switching has become one of the most popular nonlinear time series modeling technique. Roughly speaking, it involves multiple structures that characterize the time series behavior during different regimes. By allowing the model to switch between these structures, this representation is able to capture relatively complex dynamic patterns. An important feature of this kind of model is that the switching mechanism is controlled by an unobservable state variable that follows a first-order Markov chain structure. The Markovian property regulates the process in such a way that the current value of the state variable depends on its immediate past value. As such, a given structure may prevail for a random period of time, and it is replaced by another structure when switching takes place.

Hence, “Model B” is a two-state Markov switching model that differentiates between the state in which the unbiased forward exchange rate hypothesis is fulfilled and the state in which it is not. To complete the description of the Markov-Switching model we point out that the unobservable realization of the regime

where

The model is useful to make probabilistic inferences about the unobserved state

where

For the model specification test, where

If we cannot reject

For testing the hypothesis of market efficiency in the two-state Markov switching model, the hypothesis for state 1 and that for state 2 are:

The Wald statistics for testing

where R is a 3x3 restriction matrix;

3. Data end empirical results

3.1 Data description

The data set used in our empirical analysis consists of weekly data on the natural logarithm for the Mexican/US foreign exchange spot rate and forward rate, namely those for the 30 and 90 days forward rates. Following the covered interest rate parity, forward rates for the 30 and 90 days were valued the Thursday of each week. For the domestic risk free instruments we use the 28 and 90 days secondary market interest rates of Mexican certificates of deposit (CETES); while for the foreign risk free instruments, the four weeks Treasury Bills and the three month Treasury Bills were used. The spot rate and CETES are from the Mexican Central Bank statistics (http://www.banxico.org.mx) and Treasury Bills are from the US-Federal Reserve Bank of ST. Louis statistics (https://fred.stlouisfed.org). Sample periods were determined on the availability of data. Therefore, data for the 90-day forward rate run from March 28, 2002 to January 5, 2017; while data for the 30-days forward rate run from January 31, 2002 to January 5, 2017.

3.2 Empirical results.

In table 1 we present the estimated regressions of the forecast error on a constant and two lagged forecast errors. We also present hypothesis tests for model selection; model generating process originated by a single state versus two states and market efficiency in the two-state Markov switching model. All numerical computations were carried out with WinRATS version 9.1 (www.estima.com)

As we can observe from table 1, the Likelihood Ratio (LR) test for model selection indicates that the two-state Markov switching model is preferable to the one state linear regression model, for both, the 30 and 90 day forward rate. As Krolzing (1997) argues, there is no general test to compare two models with different number of regimes. The issue is that the asymptotic theory cannot be used here because there are unidentified nuisance parameters as well as violation of the non-singularity conditions. However, most researchers still use the LR to obtain useful supporting evidences. Throughout this paper, the LR tests are considered in this way

Moreover, the test results for

Next, we test the efficient market hypothesis (

Finally, as shown in Table 1, for the 90-day forward rate, the

Table 1 Estimated results from models A and B.

Numbers in parenthesis are standard errors for parameter estimates, while p-values for testing hypothesis. * denotes significance at the 5% level

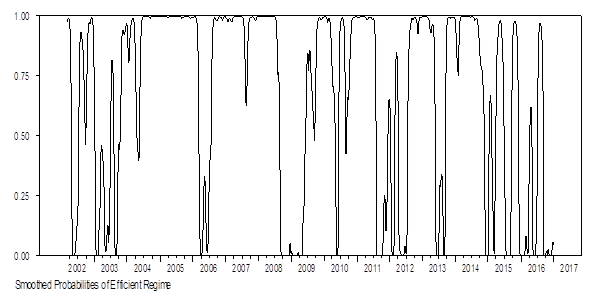

Smoothed Probabilities

As noted in Hamilton (1989, 1990), the Markov switching model allows us to form a probabilistic inference about the unobserved state

Table 1 also shows that according to the estimates from model B, the efficient and inefficient regime for the 30-days forward rate may have sustained periods. This high persistence of both regimes is represented by the large regime-staying probabilities,

The corresponding efficient dates, identified by Model B, are presented in Table 2. The March-April 2002 period, the first efficient period identified by the model, can be partially explained by the following event: By the end of August 1996, Mexico's Foreign Exchange Commission, considered that foreign exchange's reserves could be increased without disturbing the foreign exchange market. The scheme adopted allowed commercial banks to buy US dollars through put options; holders of these rights could sell US dollars to Mexico's central bank at the interbank exchange rate published for the previous business day if the exchange rate was not higher than the average exchange rate for the 20 business days previous to the date on which these rights were exercised. The objective was to encourage purchase US dollars when there was an excess supply of foreign currency, and discourage those purchases when there was an excess demand.

On the other hand, in order to minimize the asymmetric impact of the option scheme on the foreign exchange market, a contingent dollar sales scheme was introduced in February 1997. Under this scheme, Mexico's central bank auctioned everyday US$ 200 million. This scheme was not intended to defend specific levels for the exchange market, but only to moderate exchange rate volatility by providing liquidity during days of high uncertainty, thus discouraging some participants from engaging in speculative strategies.

Between August 1996 and March 2001, the Mexico's central bank purchased more than US$ 38 billion under the above mentioned policy of international reserve accumulation. However, as pointed out by Sidaoui (2005), after a preliminary evaluation of pros and cons, the Mexican Exchange Market Commission canceled both the put option and the sale of US$ scheme, effective June and July 2001, respectively, thereby leaving the exchange rate essentially free to float, and from that point on, the exchange rate began to appreciate until April 2002. That is, from March 7, 2002 to April 18, 2002, the exchange rate was determined by market powers and, hence, the market during that period was more likely to be efficient.

Figure 2 presents Mexican Central Bank interventions and exchange rate from May 5, 2003 to January 7, 2017. As we can observe, the foreign exchange rate interventions has been associated with market currency depreciation. This behavior may reflect the central bank´s preferences to adopt, during trendless periods of the spot exchange rate, a policy where market forces decide the movement of the rates without any intervention. It may also reflect the central bank´s preference to adopt a slowdown policy during appreciation periods, by which it intervenes and goes to deter the trend of appreciation.

Source: Own estimation on the basis of BANXICO data.

Intervention measure as a percentage of the average annual GDP between 2003 and 2016. Positive values of interventions refer to purchases, whereas negative values refer to sales.

Upward movements of the exchange rate correspond to depreciation.

Figure 2 Intervention and Exchange Rate.

Another period that deserves special mention run from September 4, 2008 to July 11, 2009; the period that encloses the global financial crisis. During this period the Mexico's Central Bank intervened in order to influence the exchange rate through foreign currency auctions, known in Mexico as extraordinary auctions. As it can be observed in figure 2, the exchange rate depreciation during the period of analysis occurred on March 2, 2009 where the US dollar-Mex peso parity reached a level of 15.6.

According to Benavides (2011), the nearly 55% depreciation of the Mexican currency during the period from August 5, 2008 to March 2, 2009 motivated the Mexico's Central Bank to intervene in the foreign exchange market. The reason for this intervention was to provide liquidity to the market.

Given the high volatility on the exchange rate market during October 2008 the Central Bank conducted direct non-coordinated interventions5. The days of these direct interventions were the 8, 9, 10, 16 and 23rd of October 2008. Benavides (2011) sustains that during this period of high instability, Central Bank's interventions were the only relevant macroeconomic shocks. We argue that because of these interventions the foreign exchange market became inefficient (at least, during this period). In other words, the policy adopted by Mexico's Central Bank, likely affected the efficiency of the market as observed in Figures 1 and 2.

Finally, although the appraisal of the effects of political events on the exchange rate is not the aim of this paper, it is well known that economic agents not only incorporate economic information but also political one into their expectation about the government´s engagement to the level of the foreign exchange rate. For instance, the government´s ideological bias is considered by economic agents as a signal that gives them information about government´s monetary policy objectives. Extensive literature on political ideology assumes that right parties prioritize inflation´s control mechanisms while left parties gives more emphasis on employment and wealth redistribution policies (see, for instance, Alesina and Sach, 1988). Then, economic agents could be more speculative on the decision of populist governments about the monetary policy and its effects on the exchange rate. Hence, the forward exchange rate will reflect this information.

During electoral campaigns, economic agents receive information from competing parties promoting their policy objectives and programs. Weeks previous to the Election Day are filled with a great deal of uncertainty as to who will win the election, and therefore, these periods are often associated with policy modifications that may affect the government´s engagement to the exchange rate. The uncertainty in expectations associated with political events during election periods will contribute to a risk premium in the forward exchange rate market. Therefore, according to this argument, we expect the forward rate to be a biased predictor of future spot rates more often during periods of potential political changes than during periods when government´s tenure in office is secure.

The results shown in Table 2, at first sight suggest that the periods related to federal electoral campaigns do not correspond to efficient regime. With regards to the 2006 and 2012 Mexican presidential elections, where a leftist party had high chances of winning the presidential elections, it is worth noting that, prior and post-election days - from March 16 to July 27, 2006 for the first case and from April 12 to July 19, 2012 for the second case -the forward exchange rate was a biased predictor of future spot rate.

One final comment about political events and exchange rate uncertainty, Mexico is arguably the major world economy most dependent on the U.S. economy. The trade between Mexico and the U.S. has grown fivefold since NAFTA took effect in 1994, making Mexico the largest U.S. trade partner after China and Canada, according to data from the International Monetary Fund. While Mexico has also strengthened its trade ties with other nations and has a free-trade agreement with the EU, it still sent 73 percent of exports to the U.S. in 2015. In this context, NAFTA currencies have been under pressure during U.S. election year given Trump's campaign promises to renegotiate the trade deal between the North American countries. The Mexican peso had an inverse correlation to the fortune of the Trump campaign: the higher Trump was ahead of the election the further the peso depreciated. There were a lot of unknowns about how the Trump presidency would unfold and how his trade and tariff agenda would impact the NAFTA. Definitely, the uncertainty during this period of political potential change contributed to the existence of a risk premium in the exchange rate market. This was because traders demanded a higher return for taking a forward position in the exchange rate market, the more unexpected the arrival of news the more unexpected trading volumes reflecting the spread in the rates. As a result, the forward rate was a less accurate predictor of the future spot rate movements during almost all 2016.

Table 2 Efficient periods as identified by model

| Period | |

| 2002:03:07-2002:04:18 | 2010:09:16-2011:08:04 |

| 2002:07:18-2002:09:19 | 2011:12:22-2012:01:12 |

| 2002:10:03-2003:01:02 | 2012:03:01-2012:04:05 |

| 2003:07:10-2003:08:07 | 2012:07:26-2013:05:23 |

| 2003:10:23-2004:04:15 | 2013:09:19-2014:11:20 |

| 2004:05:20-2006:03:09 | 2015:01:22-2015:02:12 |

| 2006:08:03-2008:08:28 | 2015:04:02-2015:06:25 |

| 2008:06:18-2009:09:10 | 2015:09:24-2015:12:03 |

| 2009:09:24-2010:05:06 | 2016:04:14-2016:05:05 |

| 2010:06:17-2010:08:26 | 2016:07:07-2016:09:08 |

Note: The dates at which we conclude that the process had switched between regimes are based on the cutoff point

4. Conclusions

In this paper, we have considered the problem of testing the unbiased forward exchange rate hypothesis to the Mexican´s foreign exchange market. Instead of the linear regression base model, our empirical analysis has been based on a nonlinear Markov switching model. The use of a two-state Markov switching model allows us to differentiate between efficient and inefficient states. Our empirical results show that the hypothesis of market efficiency is rejected for the 30 and 90 day forward rates in the case of the linear model, while for the two-state Markov switching model, results suggest that for the 30 day forward rate we cannot reject the null hypothesis of efficiency in state 1, but we reject the hypothesis in state 2; identifying state 1 as the efficient state and state 2 as the inefficient one. For the 90 day forward rate we cannot identify the efficient and inefficient states. Our results also shown that the nonlinear two-state Markov switching model is far superior to the traditional single state linear regression model to test the unbiased forward exchange rate hypothesis to the Mexican´s foreign exchange market.

nueva página del texto (beta)

nueva página del texto (beta)