Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Economía mexicana. Nueva época

versão impressa ISSN 1665-2045

Econ. mex. Nueva época vol.22 no.2 Ciudad de México Jan. 2013

Artículos

Environmental Policies, Mergers and Welfare

Políticas ambientalistas, fusiones y bienestar

Mahelet Getachew Fikru

Assistant Professor, Department of Economics, Missouri University of Science and Technology, Rolla, MO'. USA. fikruma@mst.edu,

Fecha de recepción: 11 de agosto de 2010;

Fecha de aceptación: 7 de noviembre de 2011.

Abstract

Unlike previous theoretical studies, we examine the welfare effects of a merger when participating firms are in a pollution-intensive sector. With passive environmental policy we show that profitable mergers reduce welfare; and this is because the reduction in consumer surplus and tax revenue dominates any rise in profit and utility. On the contrary, with active policies we show that profitable mergers are welfare enhancing due to lower gross pollution, higher consumer surplus, lower tax costs and efficiency gains. The results imply that though environmental policies are adopted for the primary purpose of reducing pollution, such policies may have a negative effect on social welfare if they do not take into account the market structure and competitiveness of sectors.

Keywords: end-of-the-pipe type abatement, environmental policy, merger, pollution intensity, welfare.

Resumen

A diferencia de estudios teóricos previos, examinamos los efectos de una fusión en el bienestar cuando las firmas participantes operan en un sector de contaminación intensa. Mostramos que con una política ambiental pasiva las fusiones rentables reducen el bienestar, y esto se debe a que la disminución en el excedente de consumo y en los ingresos impositivos sobrepasa cualquier aumento en la ganancia y la utilidad. Por el contrario, con políticas activas las fusiones rentables incrementan el bienestar debido a una contaminación general más baja, un excedente de consumo más alto, menores costos impositivos y ganancias en eficiencia. Los resultados implican que aun cuando las políticas ambientalistas se adoptan con el propósito principal de reducir la contaminación tales políticas pueden tener un efecto negativo sobre el bienestar social si no toman en cuenta la estructura de mercado y la competitividad de los sectores.

Palabras clave: abatimiento del tipo al final del ducto, política ambiental, fusión, intensidad de contaminación, bienestar.

JEL classification: L1, L4, Q5, H2.

Introduction

During the past two decades, about half of the merger cases in the European manufacturing industry involved one or more firms in a highly toxic sector. Similarly, in the US in the year 2009, among the top industries which had the highest merger deal volume, merger among firms in a polluting sector accounted for over 55 per cent of the total value of deals. Moreover, during 1996-2006 cross-border deals in the primary and secondary sectors were dominated by pollution-intensive firms with an average value of sale of $129 billion, compared to $90 billion in less-polluting sectors.1 These figures suggest that polluting firms have a significant share in the total value and volume of mergers. This paper studies how a merger among polluting firms affects social welfare, and examines the conditions under which such a merger increases welfare.

Firms in a pollution-intensive sector are often required to pay an emission tax for each unit of pollution they fail to abate. In fact, the use of environmental taxes in environmental policies gained importance in most advanced economies in the mid 1990s, and since then the tax base has been significantly broadening (European Environmental Agency, 2006). A typical emission tax would raise the optimal price of the good thereby reducing demand for the taxed output. Recent studies argue that environmental taxes reduce pollution and resource use (Lahiri and Ono, 2007; Lahiri and Symeonidis, 2007; Sterner and Kohlin, 2003) and encourage the adoption of abatement technologies (Requate and Unold, 2003; Frondel et al., 2004; De Vries, 2007; Perino, 2010 ). Other studies show that environmental policies affect firms' investment decisions (Leiter et al., 2010) and stimulate innovation and competitiveness (Porter, 1991). The contribution of this paper is to examine the role of environmental policies in the welfare effect of a merger among polluting firms.

Mergers and Acquisitions (M&As) appear to be a strategy for gaining market power. In 1997/98 alone there were over 10,000 M&A deals all over the world, where about half of them were among firms in the same industry (Gugler et al., 2003). Salant et al. (1983) showed that in an oligopolist market, homogenous goods, linear demand and constant marginal cost, a merger among identical firms to gain market power is not profitable. Later on, several authors relaxed Salant et al.'s (1983) 'identical firm' assumption by introducing asymmetries among firms to show that synergy and efficiency gains make mergers profitable (Farrell and Shapiro, 1990; Levin, 1990; Barros, 1998; Long and Vousden, 1995; Collie, 2003; Qiu and Zhou, 2007).

A typical merger would reduce competition by reducing output and raising price; thus, a merger formed for the primary purpose of gaining market power reduces social welfare (Fridolfsson and Stennek, 2005; Qiu and Zhou, 2006; Mcelroy, 1993). Levin (1990) and McAfee and Williams (1992) also argued that a merger reduces welfare if the participating firms constitute a higher proportion of the market relative to outsiders. Similarly, Lommerud and Sorgard (1997) showed that a merger results in a welfare loss due to a reduction in product variety. Espinosa-Ramirez and Kayalica (2007) introduced environmental externalities in an open economy to show that a merger among foreign owned firms reduces welfare. On the contrary, Farrell and Shapiro (1990) showed that welfare might increase following a merger if there are cost savings from shifting production from high cost firms to low cost firms. In addition, Qiu and Zhou (2006) argued that consumer surplus is higher when firms merge for sharing private information. Canton et al. (2008) find that a merger among environmental service providers reduces the quality of the environment and this may reduce social welfare. Unlike Canton et al. (2008), we consider firms primarily engaged in the production of a pollution-intensive good. In a closed economy we show that if environmental policies are passive, a merger among polluting firms leads to a welfare loss. However, if environmental policies are active and adjust to changes in the market structure, any profitable merger would be welfare enhancing. We show that with active policies the increase in welfare comes from higher consumer surplus and lower tax costs, in addition to the low gross pollution and efficiency gains. In this way, the closed economy model can be used to explain mergers in the European Union.

In the first section we present a model of profit maximizing firms in a Cournot Oligopoly market. Firms are asymmetric with respect to their pollution intensity and abatement technology. In section II we examine the welfare effect of a merger among polluting firms when environmental policies are passive and active. Finally, section III summarizes major results and concludes the discussion.

I. The Model

Consider a pollution-intensive sector with n firms engaged in the production of a homogenous good and competing in a Cournot Oligopoly market. Assume the economy is closed and demand for the good is linear, as follows:

where p is the consumer price, α is the market size, X is the market demand and X'is are outputs of firms.

As in Salant et al. (1983), the firms have identical and constant marginal costs of production, c. All firms use an end-of-the-pipe-type abatement technology following Lahiri and Symeonidis (2007), where production initially takes place causing gross pollution, out of which the firm abates a certain amount while the rest is emitted (Field and Field, 2002). Gross pollution is assumed to be proportional to total output by a ratio equal to the pollution per unit of output, or pollution intensity.

where θ(Xi) is gross pollution, Ai is the abatement level, Zi is pollution intensity and ei is the emission level of firm i.

Each firm pays a per unit emission tax, t, for each unit of pollution it fails to abate. In addition, firms incur a cost of abating pollution, where the abatement cost function is assumed to be quadratic, as in Barrett (1994):

where g (Ai) is the abatement cost function of firm i, and ri is the slope of the marginal abatement cost and is used to represent the efficiency of the abatement technology.

Previous studies assume that asymmetries arise from differences in the marginal cost of production, and results show that as long as firms have a sufficient gap in their marginal cost, mergers can be profitable due to the rationalization of production. The merged entity can always shift production from the high-cost plant to the low-cost plant without changing total output (Farrell and Shapiro, 1990, Qiu and Zhou, 2007). The asymmetries introduced in this study are not in terms of different marginal costs of production; they rather consider firms which differ in their pollution intensity, Zi and their abatement technology, ri. The effective marginal cost of each firm i can be represented as Ci = c + tZi.

Each firm i maximizes profit with respect to output and emission levels as follows:

The first order conditions yield:

where  , and * indicates a value at equilibrium.

, and * indicates a value at equilibrium.

Any k number of firms (n > k) can decide to merge, but merging to form a monopoly is prohibited, as outlined by the US Merger Guidelines provided by the Federal Trade Commission and the Department of Justice. We use a subscript j to identify the k firms participating in the merger, where j = 2,..., k. Assume that the kth firm has the most efficient abatement technology and the lowest pollution intensity. Maksimovic et al. (2008) showed that about 19 per cent and 25 per cent of firms engaged in an acquisition will shut down target plants within 3 and 5 years of acquisition respectively. Similarly, about 27 per cent of acquired plants are sold to other operators within 3 years from the acquisition. In a similar study, Li (2010) found that target plants are most likely to be aggressively shut down, especially those that are inefficient. Following these findings, we assume that the merged entity reallocates all production to the most efficient plant, which is the kth plant. Thus, similar to Levin (1990), Fauli-Oller (2002) and Qiu and Zhou (2007) a merger is viewed as an acquisition of a high-cost plant by a low cost plant. One can check the optimal profit of the merged entity to be:

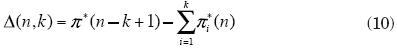

where Hk is the sum of the pollution intensity of the n - k + 1 firms in the post-merger market. A merger results in an increase in the equilibrium price, where the post-merger price becomes pm = (α + nc + tHk) / n - k + 2, where pm > p. Similar to Salant et al. (1983) the profitability of such a merger is defined as:

Inserting the optimal values we find that A(n, k) > 0, as long as two conditions are satisfied;2

where pm is the post-merger price, p is the pre-merger price, H is the pre-merger sum of pollution intensities, and Hk is the post-merger sum of pollution intensities. Given positive output, the second condition implies that the price increase following the merger is sufficiently high. The first condition implies that the gap between the pre- and post-merger pollution intensity of the sector is high; in other words, the sum of the pollution intensity of the post-merger closed plants is high relative to the pollution intensity of the merged entity. Similar to previous studies, the incentive to merger comes from re-allocating production from high cost plants to low cost plants. In our case, besides efficiency gains, this re-allocation results in shifting production to a less-polluting plant, which may have some positive environmental externalities.

In the following section we examine the conditions under which a merger among polluting firms increases social welfare.

II. Welfare Analysis

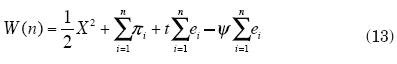

As long as there is full employment in the economy, social welfare is defined as the sum of consumer surplus, profits and tax revenue. In addition, the production of a pollution-intensive good results in the release of pollutants harmful to human health and the environment. This creates disutility from emission, which should be subtracted from the welfare function. The welfare function is defined as

where ψ is the marginal disutility of emission, and is assumed to be constant and positive. The effect of a merger on welfare is represented by the effect of an exogenous decrease in n on social welfare (Espinosa-Ramirez and Kayalica, 2007; Collie, 2003). Hence, we calculate

where H =  Zi and dW (n) / dn > 0 for all positive output. With a passive environmental policy, that is, given t, a merger among polluting firms is followed by a decline in social welfare. The merger leads to a higher price and hence reduces consumer surplus and increases industry profits. The merger also results in a lower industrial emission, and consequently tax revenue collected from emission tax declines. The decline in consumer surplus and tax revenue dominates the increase in profit and in utility. Thus, welfare declines following a merger.

Zi and dW (n) / dn > 0 for all positive output. With a passive environmental policy, that is, given t, a merger among polluting firms is followed by a decline in social welfare. The merger leads to a higher price and hence reduces consumer surplus and increases industry profits. The merger also results in a lower industrial emission, and consequently tax revenue collected from emission tax declines. The decline in consumer surplus and tax revenue dominates the increase in profit and in utility. Thus, welfare declines following a merger.

On the contrary, if environmental policy makers are active and adjust environmental policies when the market structure changes, then such flexibility might reverse the negative welfare effects.

Proposition: If environmental policies are active and adjust when the market structure changes, then a merger among polluting firms increases social welfare.

Proof: The optimal emission tax is obtained by maximizing the welfare function with respect to emission tax. If optimal policies are flexible and adjust to changes in the number of firms, then dt/dn is non-zero for all positive output. First, we obtain the optimal policy as

where  Second, the effect of a merger on the optimal tax is calculated as follows:

Second, the effect of a merger on the optimal tax is calculated as follows:

For all positive output dt*/dn is strictly positive. An exogenous merger induces the optimal emission tax to decline. Using this flexibility, the total effect of an exogenous change in n on social welfare can be expressed as the sum of the direct effect of n on W (n) and indirect effect through t* as follows:

where α11 = HX / (n + 1) -  θi + (t - ψ)(H2 / (n + 1) -

θi + (t - ψ)(H2 / (n + 1) -  Z2i- 1 / R), and α12 = (α - c + tH)[- X- Ht + Hψ] / (n + 1)2. For all positive output α11 < 0 and α12 < 0, which implies that dW (n) / dn < 0.

Z2i- 1 / R), and α12 = (α - c + tH)[- X- Ht + Hψ] / (n + 1)2. For all positive output α11 < 0 and α12 < 0, which implies that dW (n) / dn < 0.

Welfare increases when the number of firms declines as a result of a merger. The gain in welfare comes from lower emission as a result of fewer firms operating in the market, efficiency gains and lower tax costs. In addition, the post-merger lower emission tax works against the increase in price when markets become less competitive. This reduces the price increasing effect of a merger, and offsets the decline in consumer surplus in the passive-policy case. This brings out the importance of flexible optimal environmental policies in enhancing social welfare when a merger takes place among polluting firms. The results imply that though environmental policies are adopted for the primary purpose of reducing pollution, such policies may have a negative effect on social welfare if they do not take into account the market structure and the competitiveness of sectors.

These results are robust even with unemployment. With unemployment in the economy, the income paid to all resources used in production and abatement are included in the welfare function. The welfare function with unemployment is

With passive policy, a change in the market structure due to a merger results in a decline in social welfare for all positive output. That is,

Similarly, for unemployment it is easy to check that

III. Conclusion

This paper examines the welfare effect of a merger among polluting firms when firms are asymmetric in terms of their abatement technology and pollution intensity. The result shows that a profitable merger among polluting firms is followed by a welfare loss if the environmental policy is fixed. In the passive policy case we showed that the reduction in industrial emissions and efficiency gains is not sufficient to overcome the reduction in consumer surplus and in tax revenue. On the contrary, if environmental policies are flexible to changes in the market structure, then the optimal response of the policy maker would be to reduce the emission tax when a merger occurs. With this adjustment in the optimal policy it is possible to achieve a welfare gain through reduced emissions, lower tax costs, higher consumer surplus and efficiency gains.

References

Barrett, S. (1994), "Self-Enforcing International Environmental Agreements", Oxford Economics Papers, 46, pp. 878-894. [ Links ]

Barros, P.P. (1998), "Endogenous Mergers and Size Asymmetry of Merger Participants", Economics Letters, 60 (1), pp. 113-119. [ Links ]

Canton, J., M. David and B. Sinclair-Desgagne (2008), "Environmental Regulation and Horizontal Mergers in the Eco-industry", FEEM Working Paper No. 46. [ Links ]

Collie, D. R. (2003), "Mergers and Trade Policy under Oligopoly", Review of International Economics, 11 (1), pp. 55-71. [ Links ]

De Vries F. P. (2007), "Market Structure and Technology Diffusion Incentives under Emission Taxes and Emission Reduction Subsidies", Journal of Institutional and Theoretical Economics, 163 (2), pp. 256-268. [ Links ]

Espinosa-Ramírez, R. S. and M. O. Kayalica (2007), "Environmental Policies and Mergers' Externalities", Economía Mexicana, Nueva Época, XVI (1), pp. 47-74. [ Links ]

European Environmental Agency (2006), "Using the Market for Cost-Effective Environmental Policy: Market Based Instruments in Europe", EEA Report No. 1. [ Links ]

Eurostat Database (2010), retrieved March 20, 2010, from http://ec.europa.eu/eurostat. [ Links ]

FactSet Mergerstat (2010), "Global Mergers and Acquisitions Information", retrieved January 2, 2010, from https://www.mergerstat.com/newsite/. [ Links ]

Farrell, J. and C. Shapiro (1990), "Horizontal Mergers: An Equilibrium Analysis", The American Economic Review, 80 (1), pp. 107-126. [ Links ]

Fauli-Oller, R. (2002), "Mergers between Asymmetric Firms: Profitability and Welfare", The Manchester School, 70 (1), pp. 77-87. [ Links ]

Field, B. and M. Field (2002), Environmental Economics, New York, McGraw-Hill. [ Links ]

Fridolfsson, S. O. and J. Stennek (2005), "Why Mergers Reduce Profits and Raise Share Prices-A Theory of Preemptive Mergers", Journal of the European Economic Association, 3 (5), pp. 1083-1104. [ Links ]

Frondel, M., J. Horbach and K. Rennings (2004), "End-of-Pipe or Cleaner Technology Production? An Empirical Comparison of Environmental Innovation Decisions across OECD countries", ZEW Discussion Papers No. 04-82. [ Links ]

Gugler, K., D. C. Muller, B. B. Yurtoglu and C. Zulehner (2003), "The Effects of Mergers: an International Comparison", International Journal of Industrial Organization, 21 (5), 625-653. [ Links ]

Hettige, H., P. Martin, M. Singh and D. Wheeler (1995), "The Industrial Pollution Projection System", Policy Research Working Paper, World Bank. [ Links ]

Horizontal Merger Guidelines, retrieved January 2, 2010, from http://www.justice.gov/atr/public/guidelines/horiz_book/hmg1.html. [ Links ]

Lahiri, S. and G. Symeonidis (2007), "Piecemeal Multilateral Environmental Policy Reforms under Asymmetric Oligopoly", Journal of Public Economic Theory, 9 (5), pp. 885-899. [ Links ]

Lahiri, S. and Y. Ono (2007), "Relative Emission Standard versus Tax under Oligopoly: The Role of Free Entry", Journal of Economics, 91 (2), pp. 107-128. [ Links ]

Leiter, A. M., A. Parolini and H. Winner (2010), "Environmental Regulation and Investment: Evidence from European Country-Industry Data", Working Papers in Management and Economics. [ Links ]

Levin, D. (1990), "Horizontal Mergers: The 50-Percent Benchmark", The American Economic Review, 80 (5), pp. 1238-1245. [ Links ]

Li, X. (2010), Productivity, Restructuring, and the Gains from Takeovers, University of Michigan. [ Links ]

Lommerud, K. E. L. Sorgard (1997), "Merger and Product Range Rivalry", International Journal of Industrial Organization, 16 (1), pp. 21-42. [ Links ]

Long, N. V. and N. Vousden (1995), "The Effects of Trade Liberalization on Cost-Reducing Horizontal Mergers", Review of International Economics, 3 (2), pp. 141-155. [ Links ]

Maksimovic, V., G. Phillips and N. R. Prabhala (2008), "Post-merger Restructuring and the Boundaries of the Firm", Working Paper, University of Maryland. [ Links ]

McAfee, R. P. & M. A. Williams (1992), "Horizontal Mergers and Antitrust Policy", The Journal of Industrial Economics, 40 (2), pp. 181-187. [ Links ]

Mcelroy, F. (1993), "The Effects of Mergers in Markets for Differentiated Products", Review of Industrial Organization, 8 (1), pp. 69-81. [ Links ]

Perino G. (2010), "Technology Diffusion with Market Power in the Upstream Industry", Environmental and Resource Economics, 46 (4), pp. 403-428. [ Links ]

Porter, M. E. (1991), "America's Green Strategy", Scientific American, 264 (4), pp. 33-35. [ Links ]

Qiu, L. D. and W. Zhou (2006), "International Mergers: Incentives and Welfare", Journal of International Economics, 68 (1), pp. 38-58. [ Links ]

---------- (2007), "Merger Waves: A Model of Endogenous Mergers", RAND Journal of Economics, 38 (1), pp. 214-226. [ Links ]

Requate T. and W. Unold (2003), "Environmental Policy Incentives to Adopt Advanced Abatement Technology: Will the True Ranking Please Stand up?", European Economic Review, 47 (1), pp. 125-146. [ Links ]

Salant, S. W., S. Switzer and R. J. Reynolds (1983), "Losses from Horizontal Merger: The Effect of an Exogenous Change in Industry Structure on Cournot-Nash Equilibrium", The Quarterly Journal of Economics, 98 (2), pp. 185-199. [ Links ]

Sterner, T. and G. Kohlin (2003), "Environmental Taxes in Europe", Public Finance and Management, 3 (1), pp. 117-142. [ Links ]

UNCTAD Foreign Direct Investment database (2010), retrieved January 2, 2010, from http://www.unctad.org/Templates/Page.asp?intItemID=1923. [ Links ]

1 The calculations are based on UNCTAD data, FactSet Mergerstat and European Commission Eurostat database. The top 20 pollution-intensive sectors of Hettige et al. (1995) are included in the calculation.

2 See the appendix for proof.