Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Economía mexicana. Nueva época

versión impresa ISSN 1665-2045

Econ. mex. Nueva época vol.22 no.2 Ciudad de México ene. 2013

Artículos

Fiscal Decentralization in Specific Areas of Government. A Technical Note

Descentralización fiscal en áreas específicas de la gestión pública: Una nota técnica

Leonardo Letelier S. and José Luis Sáez Lozano*

Senior lecturer, Institute of Public Affairs, University of Chile. Santiago de Chile. lletelie@iap.uchile.cl

Aassociate professor, Department of International and Spain's Economics (tenured), University of Granada. Granada, Spain. josaez@ugr.es

Fecha de recepción: 23 de marzo de 2011;

fecha de aceptación: 7 de noviembre de 2011.

Abstract

This study makes a contribution in two basic areas. First, it sets up a model which combines efficiency as well as political economy aspects in explaining the degree of fiscal decentralization. It innovates in making explicit the benefits from better informed politicians and policy makers (Von Hayek effect) and the potential cost push effect on public services and public goods (Scale Effect) resulting from decentralization. It takes advantage of previous literature in recognizing the extent of the ideological distance between the local and the national median voter as a third factor worth considering in the social cost benefit analysis of decentralization. Second, the aforementioned effects are put into the context of specific functional areas of government, each of them having a particular set of characteristics which lead to a different degree of decentralization. The net outcome will be the result of combining the rent seeking orientation of the central government with the particular median voter demand for each different public good.

Keywords: political economy, median voter, fiscal federalism, decentralization.

Resumen

Este trabajo hace una contribución en dos áreas básicas. Primero, presenta un modelo que combina el concepto de eficiencia con elementos de economía política a fin de explicar el grado de descentralización fiscal. La innovación en este caso consiste en hacer explícito el efecto del mejoramiento en información (efecto Von Hayek) y el impacto sobre el costo de producir bienes públicos (efecto Escala) emanados de la descentralización. En el marco de aportes previos sobre el tema, se reconoce también el impacto de la descentralización sobre la distancia ideológica entre el votante mediano nacional y el votante mediano local como un tercer factor digno de ser considerado en el costo social de la descentralización. Segundo, los efectos antes mencionados se ponen en el contexto de áreas funcionales específicas del gobierno; cada una de las cuales tiene un conjunto particular de características que condicionan su grado de descentralización. El efecto neto será el resultado de combinar el interés del gobierno central de generar rentas a partir de su control del gasto público, con la demanda específica del votante mediano respecto de cada uno de los distintos bienes públicos.

Palabras clave: economía política, votante mediano, federalismo fiscal, descentralización.

JEL classification: D720, H110, H710, H770.

Introduction

Fiscal decentralization (FD) has turned into a topic of major academic and political interest over the last two decades. Its theoretical modelling as well as the empirical research upon its potential effects has moved from the traditional normative public finance framework (Oates, 1972), to the more recent political economy approach (Lockwood, 2006). This latter impulse has been popularized as the second generation of fiscal federalism (Oates, 2008), and is the one that inspires our contribution.

While the existing empirical evidence about the potential effects of FD is rather ample and usually favourable to the hypothesis that it positively contributes to people's welfare (Letelier, 2012; Voigt and Blume, 2012), there is still an active controversy about the case of specific public goods. For example, despite the fact that FD appears to have positive effects on both the level of expenditure in education and the country's educational performance (Lindaman and Thurmaier, 2002; Barankay and Lockhood, 2007; Faguet and Sánchez, 2007; Letelier, 2010), some evidence shows that it also tends to make this performance more heterogeneous across the national territory (Zhao, 2009). Similar evidence may be found in health, in which positive effects of FD on the service quality (Enikolopov and Zhuravskaya, 2007; Uchimura and Jütting, 2009) are potentially compensated by a negative effect on this function's logistics (Bossert et al., 2007). A recent empirical research about the relationship between FD and "government's quality" based on a sample of OECD countries (Kyriacou and Roca-Sagalès, 2011) concludes that decentralization affects this quality in a positive way, albeit such effect diminishes when FD is combined with multiple overlapping politically autonomous sub-national governments. A similar controversy exists regarding the so called "governance" (Neyapti, 2006; Hankla, 2009), the territorial equity (Bonet, 2006; Rodríguez-Pose and Ezcurra, 2009), the danger of elite capture (Bardhan and Mookherjee, 2006), the fiscal balance (Ebel and Yilmaz, 2002; Thornton, 2007) and the economic growth (Martínez-Vázquez and McNab, 2003; Qiao et al., 2008). Along the same lines, the international comparative experience suggests that FD encompasses a broad and generic concept, which admits multiple specific nuances in the cases of particular State's functions (Osterkamp and Eller, 2003; Hooghe and Marks, 2009). At the one end, garbage collection is usually considered a local government's duty. At the other, national defence exhibits almost no exceptions in this function being a national responsibility. In between those extremes we are likely to find a wide variety of functions for which the existing degree of FD originates in a combination of historical, political and public sector's efficiency factors.

Diverse hypotheses have been put forward to explain the behaviour of FD over time as well as its variation across countries. If we were to highlight some usually considered explanatory variables, these include income per head (Wheare, 1964; Pryor, 1967; Pommerehne, 1977; Marlow, 1988; Wallis and Oates, 1988), population density (Litvack and Oates, 1971) and the degree of population heterogeneity (Tiebout, 1956), among others. Evidence in favour of such hypotheses is also ample and robust (Panizza, 1999; Letelier, 2005; Arzaghi and Henderson, 2005). More recently, related theoretical modelling has used political economy models, thereby a trade off is usually presented between the benefits of centralization for the central government and the costs of it for the country as a whole. In this spirit we find the contribution by Panizza (1999), in which an "agenda setter" central government determines the degree of FD and the model proposed by Arzaghi and Henderson (2005), thereby each nation's region decides about staying as members of a unitary country versus the option of becoming autonomous in a federation. Nevertheless, there still exists a vacuum regarding the reason why some specific State's functions exhibit different degrees of FD. The wide variety of publicly provided services requires a case specific approach that takes due account of the benefits, costs and production function at stake in every case.

In such a context, the present paper is intended to explain FD by type of public good. Our contribution builds upon Panizza (1999), albeit it deviates from it when focusing on the specific nature of particular services. It is stated that the socially optimum degree of FD hinges upon a public good specific trade-off between a pro-decentralization target, thereby a deeper specific knowledge of jurisdiction's demands is achieved by delegating powers onto lower tiers of government ("Von Hayek Effect": VHE), versus the centralizing target that takes proper advantage from scale economies in delivering efficiently produced public goods ("Scale Effect": SCE). Since former effects are likely to be different across State's functions, it follows that FD will also differ across types of public goods.

The remaining of this paper is organized as follows. Section I addresses the theoretical context; section II describes the problem faced by the median voter (MV); section III presents the government's problem, and section IV examines the effect of exogenous factors in the model. Conclusions are presented in section V.

I. The Theoretical Context

Our contribution to the existing theoretical debate is twofold. First, it is explicitly acknowledged that decentralization entails a potential positive effect on the quality of public goods, which results from the information advantage being held by sub-national governments in their effort to identify real needs and demands of their local constituency (Hayek, 1945). Second, we also recognize that decentralization may take us away from the optimal scale level in delivering specific public goods. Excess decentralization may result in too small jurisdictions being forced to funding and/or producing scale sensitive services, leading to a high price-quality ratio. As stated above, these two opposing effects will be called VHE and SCE respectively. Along the same lines, the so called Median Voter's ideological distance, which is assumed to be a unique general public good variable in Panizza (1999), may now be assigned a specific dimension for each type of public good.

It will be assumed that the general government (central plus decentralized levels) spends G, which is a combination of n different public goods. The effect of consuming public good xh by individual "i" will be inversely related to the distance between i's preferences and the median voters', which is defined by Panizza (1999) as α[θlim + (1 - θ)lij]. Parameter α represents the degree of diversity in the spectrum of preferences among voters, θ is the degree of centralization, lim is the distance of individual i from the national median, and lij is the distance between individual i and the local MV. This assumes that the degree of decentralization is the same regardless of the particular public good we are dealing with. Correspondingly, we can define the extent of proximity between voters' i and the median as Khi = 1 - αh[θhlim + (1 - θh)lij]. Coefficient Khi will only be one in case voter i coincides with the local as well as with the national MV.

As far as relative prices are concerned, the private good will be defined as a numerare (pn+1 = 1). Voters are assumed to assign a specific price to each public good which relates to the level of taxes they pay. Public good prices will depend on the so called Scale Effect (SCE) parameter. This captures the cost saving effect of centralization. Since this effect differs across public goods, we can state that ∂ ph/∂ θh ≤ 0 ∀ ph > 0. It follows that the price being paid for the public good xh will be an inverse function of the degree of centralization and the corresponding scale economies attached to the provision of that particular good. It will be assumed that all jurisdictions have the same number of tax payers, so that no reference is made to the effect of population itself in the unit price of public good h.

Given that the marginal utility from xh depends on the quantity as much as on the quality of it (Faguet, 2001), a coefficient called πh will be introduced to capture the probability that xh posses exactly those characteristics being demanded by individual "i", so that πh = πh [θh] and π'h< 0. A maximum quality will be achieved when πh = 1. In the opposite case, a very low quality leads to nh = 0. It will be assumed that the specific knowledge on the MV's needs being held by the current government is inversely related to the degree of centralization. Assuming that n different public goods and a single private good exist, every voter will express his demand on n + 1 options, of which n are public goods and the remaining one is a private good (it will be called "xn+1").

Formally, this amounts to saying that every voter should express his preferences on every available option, such as that, x1 ≥ 0, ..., xh ≥ 0,..., xn ≥0, xn+1 ≥ 0, where x1,... , xn represent the demands for every public good, and xn+1 is the demand for the private good. Prices are represented by p1 > 0,... , ph > 0,...,pn > 0 for the n public goods, and pn+1 = 1 for the single private good. As opposed to Panizza (1999), individuals maximize a utility function "u", which entails an n + 1 dimensional solution (equation 1):

The solution for the generic public good xh and the private good xn+1 for voter "i" is the following:

II. The Median Voter

Providing that all individuals settled down in particular jurisdictions chose their location on the basis of their preferences (Tiebout, 1956), and that space localization may be represented as a continuum of symmetrically distributed jurisdictions around the median voter, Panizza (1999) shows that the MV will choose a national level of xh≠n+1 = xm, such that xm = μym / (μ + β) and μ = 1 - α [θ(S/4) + (1 - θ) (S/4J)], where 1 -μ may be interpreted as the ideological distance relative to the center, S is the country's territory and J is the number of jurisdictions.

In the context of a perfectly representative democracy, the national government decides on the level of decentralization by setting up an agenda, thereby it will try to centralize its power over the budget in order to maximize rents being produced from staying in power. As the political system becomes less representative, the ruling national government's power rises and so does its capacity to keep budget control by avoiding fiscal devolution to sub-national governments. Such a behavior confronts the wills of the national MV, whose problem may be presented as follows:

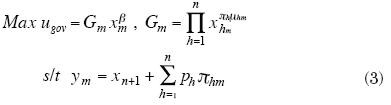

The solution to (3) will be:

where  Sub index "m" stands for the MV. Note that results from (3) differ from (1) in the term μhm, which corresponds to the expression khi for the generic voter "i".

Sub index "m" stands for the MV. Note that results from (3) differ from (1) in the term μhm, which corresponds to the expression khi for the generic voter "i".

III. The Government's Problem

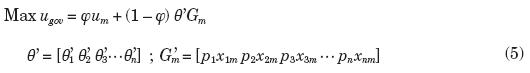

Under the assumptions that 1) MV's reasoning is known for government, and 2) every different public good has a particular production function and a case specific information advantage from decentralization, the ruling national government will choose the degree of decentralization for each public good (θh ∀j = 1, ..n) by solving the following problem:

Sub-index m will be omitted from now on. By substituting 4a and 4b into 5, and assuming that n = 2, it can be shown that government's optimum θh for h = 1 hinges upon the following first order condition (equation 6), which assumes that MV's utility function is homogenous of degree one on the whole set of consumption options (see the appendix for details).

While the "non opportunistic'' component of government's behavior in equation 6 is being timed by φ, the opportunistic part is being timed by (1 - φ). Formally, it can be stated that three endogenous effects and a set of exogenous factors (ε) will determine government's optimum degree of centralization on x1. Formally, this implies that θ*1 = θ*1 [μ'1,π'1,p'1, ε], where θ*1 stands for government's optimum. First, a more centralized delivery of public good h = 1 will rise the average ideological distance between individual voters and the median, turning this public good less representative of local preferences. Term μ'1 accounts for this effect in equation 6. It will be called the Ideological Effect of centralization (IE). Second, regardless of the extent to which the specific characteristics of public good h = 1 fit voters' preferences, a more centralized delivery of x1 worsens its quality (VHE), this being captured by π'1. The effect on government's welfare depends on the strength of democracy (φ) and the degree to which a lower (higher) θ1 expands (reduces) government's expenditures. Third, a lower (higher) θ1 raises (reduces) the price of xh, which further reduces (rises) demand for x1 (SCE).

The term (γ0) captures the opportunistic impact on ugov caused by a θ1 induced change on x1 expenditure. Coefficient γ1 (VHE) depends on the MV's welfare loss from more centralization on x1 (φUmp1) and the effect on government's welfare from the potential for increased decentralized expenditure resulting from α rise in θ1 (ρ2). A similar interpretation should be given to g1, although in this case the effect of a change in θ1 is being channeled through π1. Finally, γ2 stands for the shift in demand for x1 as a response to a decline on p1 resulting from more centralization (SCE). Exogenous factors are accounted for in set ε. The following proposition is in order:

Proposition 1. In trying to set up the optimum degree of centralization, the central government will assign different degrees of centralization to different public goods. Government's optimum will differ across public goods, all of them being (potentially) different from each other regarding the median voter distance between the national median and the jurisdiction median for each particular public good, their quality sensitivity to decentralization (VHE), and the cost push effect of decentralization (SCE).

IV. Exogenous Factors

Variations in the model's exogenous variables will affect centralization as long as they change central government's marginal utility with respect to each public good's centralization level. Formally, this implies that first order condition (equation 6) should be differentiated with respect to the set of exogenous variables (ε). It follows that the central government will centralize more in case any derivative from equations 7a to 7c (bellow) is positive.

In a non democratic world (φ = 0) with a single public good "G", with neither VHE nor SCE (p'1 , π'1= 0), and identical preferences between the national and the local MV (μ'1 = 0), a rise in MV's income will also rise the expenditure on this generic public good, which directly improves government's welfare (equation 7a)':

In a democratic context (φ > 0) the MV prevents these rents from being too high by reducing his demand for G, leading to a lower central government's marginal utility from centralization. Strictly speaking, this might be reversed if the opportunistic part in (7a) is larger in absolute terms than the non-opportunistic one, and 1-p1 η1y > 0. The reason being that a low h and/or |p'1| are likely to induce very little changes in central government's rents as a response to variations in the median income. Nevertheless, if we assume that p'h< 0, π'h< 0 and accept that n > 1, the impact of income on decentralization becomes less clear since a high income elasticity of this public good ηhy> 1 may produce a substantial cost reducing effect, turning more centralization into a welfare winning option for the median as his income rises. We can state the following propositions:

Proposition 2: If π'1 = 0, p'1 = 0 and 1 - p1 η1y≤ 0, an increase in the median voter's income unambiguously lowers government's marginal utility from centralization and leads to more decentralization. This result might be reversed if 1 -p1 η1y> 0 and the opportunistic component in equation 7a is larger —in absolute terms— than the non opportunistic one. Since this is likely to be different across public goods, a rise in income will have different implications on every different public good.

Proposition 3: If π'1≤ 0, p1' < 0 and 1 - p1 η1y≤ 0, proposition 2 still holds as long as 1 - η1y≤ 0. In case 1 - η1y> 0, the sign in 7a depends on how strong the SCE of centralization is.

As in Panizza (1999), S (surface) has an "ideological" impact on the median voter's welfare. A larger territory lowers μh (see the Appendix) and therefore raises 1 - μh, which is formally defined as the ideological distance relative to the center. In our analytical frame nevertheless, this is conditioned upon the specific nature of each different public good. For example, welfare implications resulting from public goods which mostly benefit a particular jurisdiction (as is the case of school and hospital infrastructure) are more likely to differ significantly between the local and the national MV. As expected, such a divergence diminishes as the national benefit becomes larger with respect to the local one. If public good-specificness were ruled out, a larger territory would lead to a rise in 1 -μh, which stands for the ideological distance from the center. Since this affects x1 as well as x2 it is not clear that MV's marginal utility —and also his demand— for x1 will be reduced. On the one hand, the non opportunistic part in equation 7b will tend to be positive as long as the demand for x1 rises along with S. This will be further strengthened if the scale effect (p'1) is significant. On the other hand, the opportunistic component will also get larger as S raises the demand for x1. The net effect on government's marginal utility from a change in S depends on the sign as much as on the magnitude of the opportunistic and non opportunistic components all together. Given that αis also common to all public goods, the above argument is equally valid as far as variations on population heterogeneity are concerned.

Proposition 4: Different degrees of population homogeneity (α) as well as different country sizes (S) have an ambiguous effect of θh. The net effect depends on whether changes on α and/or S rise or reduce the demand for xh.

V. Conclusions

The present paper builds on previous literature by presenting a model in which the central government runs the agenda; thereby the degree of FD is defined. It innovates in making an explicit acknowledgement that functional areas of governments should be given a specific treatment regarding the quality and the cost implications of decentralization. As opposed to the general government definition of FD, the degree of FD on specific public goods can be said to depend on three separate factors. They are the potential for information and public goods quality benefit from decentralization (VHE), the ideological affinity between the local median and the central median voter (IE), and the cost increasing effect of having a smaller scale of operation (SCE). Since these effects are likely to differ across public goods, the model predicts that government's optimal FD is public good specific.

In the context of the model, a rise in the MV's income does not necessarily lead to more decentralization, as in the one public good case. On the one hand, more centralization benefits central government as public goods expenditure rises. On the other, given that public goods have different income elasticities, the cost reducing effect of centralization may further strengthen centralization for the median voter in some cases, making the net effect on FD ambiguous. Functional areas of government in which the cost benefit of centralization is very important are likely to be less centralized. Conversely, public goods in which the quality benefit of decentralization and/or the ideological sensitivity of widening the gap between the local and central MV is high, are likely to be more decentralized.

Both the country's territory and the degree of population diversity have ambiguous effects on the degree of FD chosen by the central government. Since these two variables affect all public goods, the net impact on FD depends on how strong the cost reducing effect is in one public good relative to all others. On the one hand, the non opportunistic part of government's behavior will push government to decentralize more as long as the demand for a specific public good rises as a response to a larger S and/ or α. This will be further strengthened if the scale effect (p'1 ) is significant. On the other hand, the opportunistic component will also get larger as changes in S and/or α rises the demand for x1.

References

Arzaghi, M. and V. Henderson (2005) "Why Countries are Fiscally Decentralizing", Journal of Public Economics, 89 (7), pp. 1157-1189. [ Links ]

Barankay, I. and B. Lockwood (2007), "Decentralization and the Productive Efficiency of Government: Evidence from the Swiss Cantons", Journal of Public Economics, 91 (5-6), pp. 1197-1218. [ Links ]

Bardhan, P. and D. Mookherjee (2006), "Pro-Poor Targeting and Accountability of Local Governments in West Bengal", Journal of Development Economics, 79 (2), pp. 303-327. [ Links ]

Bonet, J. (2006), "Fiscal Decentralization and Regional Income Disparities: Evidence from Colombian Experience", Annals of Regional Science, 40 (3), 661-676. [ Links ]

Bossert, T., D. Bowser and J. Amenyah (2007), "Is Decentralization Good for Logistic Systems? Evidence on Essential Medicine Logistics in Ghana and Guatemala", Health Policy and Planning, 22 (2), pp. 73-82. [ Links ]

Ebel, D. and S. Yilmaz (2002), "On the Measurement and Impact of Fiscal Decentralisation", World Bank Policy Research Working Paper 2809, World Bank, Washington D. C. [ Links ]

Enikolopov, R. and E. Zhuravskaya (2007), "Decentralization and Political Institutions", Journal of Public Economics, 91 (11-12), pp. 2261-2290. [ Links ]

Faguet, J. P. and F. Sánchez (2007), "Decentralization's Effects on Educational Outcomes in Bolivia and Colombia", World Development, 36 (7), pp. 1294-1316. [ Links ]

---------- (2001), "Does Decentralization Increase Responsiveness to Local Needs? Evidence from Bolivia", Policy Research Working Paper 2561, World Bank. [ Links ]

Hankla, C. R. (2009) "When is Fiscal Decentralization Good for Governance?", Publius, 39 (4), pp. 632-650. [ Links ]

Hayek, V. F. (1945), "The Use of Knowledge in Society", American Economic Review, 35 (4), pp. 519-530. [ Links ]

Hooghe, L. and G. Marks (2009), "Does Efficiency Shape the Territorial Structure of Government?", Annual Review of Political Science, 12, pp. 225-241. [ Links ]

Kyriacou, A. P. and O. Roca-Sagalés (2011), "Fiscal Decentralization and Government Quality in the OECD", Economics Letters, 111 (3), pp. 191-193. [ Links ]

Letelier, S. L. (2005), "Explaining Fiscal Decentralization", Public Finance Review, 33 (2), pp. 155-183. [ Links ]

---------- (2010), "Efecto de la descentralización fiscal sobre la eficiencia técnica en la gestión de la educación y la salud", Documentos y Aportes en Administración Pública y Gestión Estatal, 14, pp. 7-24, Universidad Nacional del Litoral, República Argentina. [ Links ]

---------- (2012) "Teoría y práctica de la descentralización fiscal", Ediciones U. C., Pontificia Universidad Católica de Chile. [ Links ]

Lindaman, K. and K. Thurmaier (2002), "Beyond Efficiency and Economy: An Examination of Basic Needs and Fiscal Decentralization", Economic Development and Cultural Change, 50 (4), pp. 915-934. [ Links ]

Litvack, J. and W. Oates (1971), "Group Size and the Output of Public Goods: Theory and Application to State-Local Finance in the United States", Public Finance, 25 (2), pp. 42-58. [ Links ]

Lockwood, B. (2006), "The Political Economy of Decentralization", in E. Ahmad and G. Brosio (eds.), Handbook of Fiscal Federalism, Northampton, MA, Edward Elgar Publishing, pp. 33-60. [ Links ]

Marlow, M. (1988), "Fiscal Decentralization and Government Size", Public Choice, 56 (3), pp. 259-269. [ Links ]

Martinez-Vazquez, J. and R. McNab (2003), "Fiscal Decentralization and Economic Growth", World Development, 31(9), pp. 1597-1616. [ Links ]

Neyapti, B. (2006), "Revenue Decentralization and Income Distribution", Economics Letters, 92 (3), pp. 409-416. [ Links ]

Oates, W. (1972), Fiscal Federalism, New York, Harcourt, Brace, Jovanovich. [ Links ]

---------- (2008) "On the Evolution of Fiscal Federalism: Theory and Institutions", National Tax Journal, 61 (2), pp. 313-334. [ Links ]

Osterkamp, R. and M. Eller (2003), "Functional Fiscal Decentralization", Journal of Institutional Comparisons, 1 (3), Autumn, pp. 15-20. [ Links ]

Panizza, U. (1999), "On the Determinants of Fiscal Centralization: Theory and Evidence", Journal of Public Economics, 74 (1), pp. 97-134. [ Links ]

Pommerehne, W. (1977), "Quantitative Aspects of Federalism: A Study of Six Countries", in W. Oates (ed.), The Political Economy of Fiscal Federalism, New York, Lexington. [ Links ]

Pryor, F. (1967), "Elements of a Positive Theory of Public Expenditures", Finanzarchiv, 26 (3), pp. 405-430. [ Links ]

Qiao, B., J. Martinez-Vazquez and Y. Xu (2008), "The Tradeoff between Growth and Equity in Decentralization Policy: China's Experience", Journal of Development Economics, 86 (1), pp. 112-128. [ Links ]

Rodríguez-Pose, A. and R. Ezcurra (2009), "Does Decentralization Matter for Regional Disparities? A Cross Country Analysis", Journal of Economic Geography, 10 (5), September, pp. 1-26. [ Links ]

Thornton, J. (2007), "Fiscal Decentralization and Economic Growth Reconsidered", Journal of Urban Economics, 61 (1), pp. 64-70. [ Links ]

Tiebout, C.M. (1956), "A Pure Theory of Local Expenditures", Journal of Political Economy, 64, October, pp. 416-424. [ Links ]

Uchimura, H. and J. P. Jütting (2009), "Fiscal Decentralization, Chinese Style: Good for Health Outcomes?", World Development, 37 (12), pp. 1926-1934. [ Links ]

Voigt, S. and L. Blume (2012), "The Economic Effects of Federalism and Decentralization; A Cross-country Assessment", Public Choice, 151 (1-2), pp. 229-254. [ Links ]

Wallis, J. and W. Oates (1988), "Decentralization in the Public Sector: An Empirical Study of State and Local Government", in H. Rosen (ed.), Fiscal Federalism: Quantitative Studies, Chicago, University of Chicago Press. [ Links ]

Wheare, K. C. (1964), Federal Government, London, Oxford University Press. [ Links ]

Zhao L. (2009), "Between Local Community and Central State: Financing Basic Education in China", International Journal of Educational Development, 29 (4), pp. 366-373. [ Links ]

*The authors acknowledge the support from the Interministerial Commission on Science and Technology (CICYT: CSO2011-29346).