Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Economía mexicana. Nueva época

versión impresa ISSN 1665-2045

Econ. mex. Nueva época vol.20 no.2 Ciudad de México ene. 2011

Artículos

Latin American Private Pension Funds' Vulnerabilities

Vulnerabilidades de los fondos privados de pensiones en América Latina

Jorge Guillén*

* Assistant Professor of Economics and Finance, Universidad ESAN. Lima, Perú. jguillen@esan.edu.pe

Fecha de recepción: 22 de octubre de 2009.

Fecha de aceptación: 25 de mayo de 2010.

Abstract

In the last years, we have been witnesses of significant large rates of return in most Latin-American private pension fund institutions (PPF). This outstanding performance of funds can be explained by an economic boom in the region. However, these funds have lately been hampered in some countries, something that contrasts with the successful performance of private pension funds' returns. We measure management performance with the Data Envelopment Analysis (DEA) technique, and test a sample of eight countries in Latin America to determine if there is any vulnerability in the private pension funds. The results are relevant for policy makers and regulators of pension funds.

Keywords: DEA , private pension funds, return of portfolio.

Resumen

Desde hace algunos años hemos sido testigos de un incremento significativo en el rendimiento del portafolio de las administradoras de fondos para el retiro (AFORE). Este notable desempeño de las AFORE se explicaría por un boom económico en la región. Sin embargo, la coyuntura actual ha provocado que los fondos de pensiones se deterioren, lo que contrasta con periodos de auge. En una muestra de ocho países de Latinoamérica utilizamos una medida de eficiencia gerencial, mediante la técnica de Data Envelopment Analysis (DEA) para verificar si existe o no vulnerabilidad en los fondos de pensiones. Los resultados son relevantes para los diseñadores de política y los reguladores de las AFORE .

Palabras clave: DEA , AFORE , rendimiento de portafolio.

JEL Clasification: G23; G28; O54.

Introduction

The Latin American region has been booming and hitting outstanding economic growth, which has averaged over 6 per cent per year since 2004.1 This latter booming had not been seen for a long time there. The high prices of gas, corn, and soy have not hampered inflation. On the contrary, this has mainly been low. This good macroeconomic situation has positively affected foreign private investment, which has achieved a two-digit growth (see IMF, 2008).

Most of the forecast by multinational organisms claims that Latin America's economies are expected to grow 5 per cent in average during 2010 (Latintrade, 2010). Therefore, Latin America could be able to catch up on developing economies because it is growing at a faster rate than the United States and the European Union, but at a lower rate than Africa, Asia and the Middle East.

Positive external shocks may explain part of the successful performance in the Latin American economies. Basically, China is pumping the region due to its increasing demand for some commodities,2 which raises prices and helps Latin American exports (Deutsche Bank, 2006; Waggoner, 2006).

The good macroeconomic performance has led Fitch, a credit-rating agency, to grant Peru, Colombia, Brazil, Chile and Mexico with sovereign bonds to investment grade. The upgrade rates the sovereign debt with bbb, which reflects the continued improvement within the latter Latin America's fiscal and external solvency ratios, and demonstrate a sufficient counterbalance to the countries' key credit weaknesses, including a concentrated export base as well as political and social risks. This positive economic rating allows this latter sample of Latin American countries an easy access to financial funding with competitive interest rates. Therefore, investment will keep to flow towards the region (A coming test of virtue, 2008; Mishkin, 2007).

In addition, the good environment in the Latin American region has permitted to achieve an outstanding performance in the portfolio's rate of return of private pension funds (PPFs),3 averaging 7.88 per cent, 9.91 per cent, and 3.09 per cent in 2005, 2006 and 2007, respectively. In 2007 some countries achieved rates of return in their PPFs' portfolios of37.99 per cent.

The international financial crisis may have produce recession in some developing economies, and the growth in Latin America has coupled the latter situation with a slowing down of the economy. However, if the international prices of commodities continue to keep their level, the path of growth for Latin American countries seems to be guaranteed (The credit crunch, 2008).

The expansionary monetary policy in the United States elicits a number of investors to recompose their portfolios towards higher yielding Latin American bonds. Latin American stock markets have been holding up relatively well. However, the international credit crunch and liquidity problems associated with the Sub Prime mortgage have dampened Latin American PPFs' portfolio rate of return.

The purpose of this paper is twofold: to verify whether the boom in the PPFs' performance is linked to the management of these institutions, and to find out vulnerabilities of the private pension funds. The analysis of management quality is crucial, because there is not a unique measure that tests for this variable. The assessment of management requires a non objective judgment and the fulfillment of long run and short run policies, procedures, strategic plans and decisions.

Efficiency has been calculated using Data Envelopment Analysis (DEA). DEA is a particular frontier that permits to rank PPFs within a country or region. This is the standard technique that permits to obtain scores of managerial efficiency for each PPF. The frontier analysis is able to process PPFs' multiple input-outputs in an efficient manner (see applications of Hansweck, 1977; Martin, 1977; Pantalone and Platt, 1987).

The hypothesis of this paper is that management of PPFs is not related to return in their portfolio, which produces vulnerabilities in the private pension funds.

The paper is organized as follows: section I describes the PPFs system regulation and explains how the financial crisis environment affects them. Section II presents the data, and section III the methodology performed. Section IV shows the results, and the final section concludes.

I. The financial crisis and private pension funds (PPFs) in Latin America

The creation of Latin America's private pension funds had an important effect on these economies (Barrientos, 2001). Domestic savings have been influenced because the role of these institutions is mainly4 to collect workers' contributions before retirement into a large individual fund. The retirement should reflect the workers effort during their years of activity; so, it will depend on how well these funds can be managed. Basically, it is like the 401k plan; the private pension funds provide the best retirement to their affiliates with a wide array of financial assets (risky or risk free). In addition, the PPFs arrange disability and survivor insurance for active contributors, wife or children of family head.

Latin America's pension funds were sought by their reformers of pensions to be set up in a competitive framework (Barrientos, 2001). However, according to Stiglitz and Orszag (1999), there is a myth about how a competitive framework leads to low administrative costs in a decentralized pension fund.5 The administrative costs of these funds are relatively high because of advertising expenses, loss of economies of scale and several other costs.

For Barrientos (2001), the competition among PPFs has been constrained to commission fees, services, and rates of return. However, in our study, we discuss if this environment holds for the contributors.

PPFs, like banks, can be regulated by the government. Regulation may cover product, commission, investment portfolios, rates of return and probity. In 1980, Chile took the unprecedented step of switching from a pay-as-you-go pension system to a substitutive pension system. Then it was followed by reforms in Peru (1993), Colombia (1993), Argentina (1994), Uruguay (1996), Bolivia and Mexico (1997), El Salvador (1998), and Costa Rica (2001). In this new framework of pension funds, the possibility of contributing a fraction of a salary was allowed. Independent workers were permitted to contribute as well. The PPFs are mainly regulated and monitored by Superintendencia de Administradoras de Pensiones (SPPF), except in Uruguay, where the Central Bank assumes this role.

The new system coexists with the old one in some countries, as the case is in Chile, Peru, Colombia, Costa Rica, El Salvador and Uruguay. According to the Asociación Internacional de Organismos de Supervisión de Fondos de Pensiones (AIOS), the new system may coexist with the old one, which is the case of Chile, Peru, Colombia, Costa Rica, El Salvador and Uruguay.6 In Bolivia the new system completely replaced the old one, and Argentina was working under the latter framework until the government took the fund.

The regulation of PPFs differs across countries. For example, one of the contrasting policies is the possibility of investment abroad, which is allowed in certain degrees in all the countries, except El Salvador. The constrained possibility of investing outside may reduce portfolio of diversification and affect the management of these funds. However, giving PPFs the possibility of withdrawing all the local funds for investment options abroad may cause an increase in the exchange rate (Rajan and Parulkar, 2008). Investment abroad may be used to finance government purchases.

Another contrasting issue of regulation of PPFs by countries is the minimum profitability, which permits contributors to achieve a certain level of return in their portfolio. Minimum profitability helps to protect investors during periods of high volatility in the return of portfolio. This is a characteristic present in emerging financial markets, like those in the Latin American region. The minimum requirement of profitability varies from country to country. Some countries do not have explicit rules for minimum profitability. Minimum profitability permits a PPF to hold a certain level of return, and to compose its portfolios in certain risk free assets.

During the second half of 2008, the international financial crisis had some negative effects in the region, which produced some exposure in the Latin American private pension funds.7 Authors like Titelman, Perez-Caldente and Pineda (2009) studied the effects of the financial crisis in the region.8 After the second half of 2008 there was a notorious slowdown in the Latin American countries. Anti-cyclical policies to recover from the slowdown have been possible to implement due to the previous favorable macroeconomic conditions in the region. The effect of this crisis can be compared to older international crises, like the Asian crisis (1997) and the Russian crisis (1999), but the final impact is still an open question here. The next section describes the data and compares two periods: 2005-07 and 2008-09, purposely set before and after the financial crisis, to find out any structural changes in the PPFs.

II. Data

We use AIOS as a source of quarterly data from March 2005 to December 2007, the period of booming, and also from March 2007 through December 2009, the period with financial turmoil. The sample includes ten countries: Argentina, Bolivia, Chile, Colombia, Costa Rica, El Salvador, Mexico, Peru, Dominican Republic and Uruguay. At the end, we did not calculate scores of efficiency for Bolivia and El Salvador duo to lack of information for these countries.

The most common applications of DEA have been done for banks (see, for example, Barr et al., 1999; Berger and DeYoung, 1997; Berger and Mester, 2003). Some papers in the literature apply these DEA indicators of efficiency to analyze the links between efficiency and non-performing loans (Berger and De Young, 1997). DEA is also very popular for camel9 models and therefore for predicting the failure of a bank (Hansweck, 1977).

Tables 1a and 1b summarize some statistics regarding PPFs. They show an average of the variables for each country for the period 2005-2007 and 2008-2009. We have split the periods to compare episodes before and after the international financial crisis. In other words, we check a period during the booming of pension funds and the time after that. Our hypothesis that the management of PPFs is not linked to portfolio return and therefore vulnerabilities arise can be seen by looking at the statistics.10

Entry barriers may block the free entry of certain PPFs in some countries, because we can see that the number of PPFs is small in some countries and large in others. Some market concentration may be shown, which can be supported by the figure below. So, we can claim that there is a range from moderate to high concentration, according to the countries' Herfindhal Index, shown below.11

The countries with a high degree of concentration are Bolivia, Chile, Colombia, Costa Rica, El Salvador, Peru, Dominican Republic and Uruguay. In the case of Mexico, it seems to be the least concentrated in the region, with 21 PPFs, but three of them share more than fifty per cent of the market, in average.12 This sheds light on the fact that the competitive framework of PPFs does not hold, as was sought with the creation of the Latin American pension funds.

We can verify this last claim by looking at the market share variable, which is measured as the percentage of contributors attained by the largest PPF within a country. For example, for the period 2005-2007, the number is low in Chile (0.19) and Argentina (0.19) but very high in El Salvador (0.51) and Uruguay (0.45). This suggests a higher competition in the first two countries, and some degree of economy of scale in the management of funds for the other two countries with a high rate of concentration.

The number of contributors and affiliates does not go along with the size of the respective country. Mexico has the highest number of contributors and affiliates (14.2 and 37.5 million people). Uruguay has the lowest number of contributors and affiliates. It is interesting to notice that during the second period of analysis this ratio drops in all countries due to a substitution effect of private by public pension plans. As we explained in section II, the financial crisis deteriorated the image of private pension funds, and Argentina even expropriated private funds due to exposure of its private retirement plans (Kay, 2009).

The transfer of funds13 as a ratio of affiliates is very high in Mexico (13.29) and Costa Rica (13.97), which implies a high competition within these countries. There is not much in the literature about determinants of transfers, but Abuhadba (1994) found that rates of return, sales, and commission variables were relevant for Chile during 1992-1993. He found that rates of return and commission have a small impact on transfer behavior, but that sales by promotion personnel are very important in the transfer of funds. For the second period of assessment, which includes the years of financial turbulence, the number of transfers dropped for all countries. This reflects the lack of competition, due to the exposure of private pension funds.

During 2005-2007, the booming period in Latin American countries, the annual rate of return varies from 21.17 for Peru to 2.97 for Bolivia. These results are supported by the evolution in the stock market for each country. Authors like Li and Hu (1998) explain the link between macro-economic environment and the stock market, so the good macroeconomic performance and stability may explain the differences in the return of portfolio. Some countries in the region have a better impact on their local stock market, which allows them a better return of portfolio. Most PPFs invest in the local stock market and are the main source of investment.

It is interesting to point out how the rate of return has dramatically dropped for the period of financial turmoil, which reflects the impediment of PPFs to avoid the situation by using alternative financial tools. In some cases the real rate of return hit negative numbers, which is an indicator of an unreliable private pension plan in the region.

Finally, the variable expenses as percentage of contributors, which can be taken as proxy for management efficiency, shows for both periods high ratios in Colombia and Chile but lower ratios in the Dominican Republic and Uruguay. This proxy of efficiency does not consider multiple input-output. Next section will explain our estimation of efficiency management.

III. Methodology

In this section, we will explain how efficiency scores are constructed. In addition, we describe the data sources and justify the use of certain variables to elaborate the efficiency scores.

The efficiency indicator has been calculated using the Data Envelopment Analysis (DEA) technique. In the past, average productivity of labor was used to measure efficiency, but this indicator failed to use all the information of inputs and outputs available (Farell, 1957). Cooper et al. (2004) provided the following definition of "relative efficiency" that solves the problem of the efficiency indicator used in the past:

A DMU is to be rated fully efficient on the basis of available evidence if and only if the performances of other DMUs do not show that some of its inputs or outputs can be improved without worsening some of its other inputs or outputs.

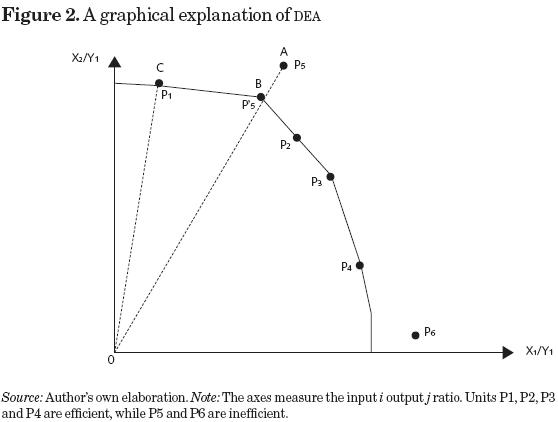

Farrel (1957) introduced the basic idea of measuring relative efficiency using Euclidean distances from a given observation to an optimal "relative frontier". The word "relative" is used because it is constructed based on sample information. A DMU (PPF in our case) allocated on the frontier receives a score of one, while PPFs allocated above the frontier receive scores higher than one. The idea can be visualized by looking at figure 2.

This figure represents the case of two inputs as a ratio of one output and six decision-making units (PPFs): P1, P2, P3, P4, P5, P6.14 PPF P1 is efficient, and, according to Farrel's (1957) distance method, it receives a score of one. This score is calculated by dividing two rays: the Euclidean distance from the origin to the optimal frontier (OC) divided by the Euclidean distance of the PPF P1 to the origin (OC). PPF P5 obtains an efficiency score lower than one because the Euclidean distance from the origin to the frontier is lower than the Euclidean distance of PPF P5 to the origin (i.e., OB/OA<1).

In the case of multiple inputs, outputs, and PPFs, efficiency scores are calculated using linear programming techniques. This methodology receives the name of DEA. Charnes et al. (1978) set up this linear programming that was not completely solved in the paper of Farrel (1957).

The linear program employed by Charnes et al. (1978) calculates the efficiency scores given by

Where xij is the amount of ith input at PPF j, yrj stands for the amount of rth output from PPF j, and finally jo is the PPF to assess. S+i, S-r are the slack variables.15

The linear program is called the input-oriented model16 with variable returns to scale (VRS).17 The first restriction says that a PPF j0 cannot use more resources than any other PPF or a linear combination of PPFs. The second restriction means that no other PPF or combination of PPFs has at least the same amount of output as PPF j0. At the minimum φ = 1 and S+i = S-r = 0 for all i and r. If at the minimum, the slack variables are non zero and the solution is weakly efficient. Our estimation resulted fully efficient,18 which means that the slack variables (S+i, S-r) are zero at the minimum.

We use as PPF outputs total revenue and number of contributors, and as PPF inputs administrative cost and sale cost. This input/output selection has been used previously in empirical analyses by Barrientos (2001) and Barros et al. (2008). The availability of data for all PPFs in the region permits us to discriminate inputs and outputs in this way. It makes sense to say that according to the selection of these multiple inputs and outputs, PPFs will have a management decision to incorporate the necessary input allocation and product mix decisions needed to attract contributors and make favorable investments.

There are other ways of calculating measures of efficiency. Berger and De Young (1997) and Cheng et al. (2001) calculated the efficiency of banks in the US system by introducing stochastic elements (cost efficiency analysis). Authors like Berger and Mester (2003) used profit efficiency instead of cost efficiency because mergers of US banks and technological changes negatively affected the results. Later, we show how our DEA scores are reliable and consistent, which guarantees that they are suitable in the study.

IV. Results

Efficiency estimation results

The results give a wide variety of DEA scores for each PPF in a particular country. The variability in the efficiency scores can be explained by outliers. However, we have run a test of difference in quartiles in order to avoid the latter problem.19 We verify that there is a significant difference between quartiles of efficiency, so outliers cannot interfere with the ranking of PPFs. This guarantees reliability of our DEA scores because the efficiency scores show a consistent measure over time. In addition, we have run a Bootstrap20 for the first 100 PPFs, and the results make our estimations of efficiency robust. We may say that our efficient indicators can respond to sampling variations of the estimated frontier.

Figure 3 shows two types of efficiency: absolute and relative. Absolute efficiency runs the model explained in the preceding section for the complete set of PPFs in the region (seventy three).21 In contrast, relative efficiency comes after measuring efficiency of PPFs within a particular country. In the relative efficiency estimation, the frontier will be bounded to each country's PPFs over time. It is interesting to notice that the latter indicator reflects the power of a PPF relative to the local market.22

This figure shows that there are countries that cannot maintain absolute comparable to relative efficiency. In some cases, relative efficiency gets lower. It means that for certain countries the local power of market cannot reflect leadership in the region.

This paper analyzes the vulnerabilities of PPFs. So, the latter result helps us to interpret how local power market is not relevant to avoid exposure of PPFs.

Tables 3a and 3b show the regression results. The endogenous variable, annual real rate of return for a portfolio of a particular PPF, is of interest to prove our hypotheses of PPFs' vulnerabilities. In order to make a robust estimation in the panel, we controlled for fixed, country and time effects. There are four models under different combination of effects and specifications. We worked with eight countries for the first sample (20072008) and with seven countries for the second sample (2008-2009). During the latter period Argentina's PPFs disappear due to government rules.

Some countries may have up to 21 PPFs. The sample has lost some observations due to the mergence of PPFs over time, and then we ended up with 592 observations in the first split of the sample, and with 231 observations in the second split.

For the first three models the estimation has been made with OLS but controlling for some variables, while for the last one the technique was fixed effects. The signs of the coefficients for all the given specifications are consistent with economic intuition.

For the ratio transfers/funds, the expected sign must be negative because an increase in this ratio will reduce the liquidity of funds in the PPF. Another variable, regulation, considers the case where outside investment is forbidden, but the possibility exists to a certain degree. We may expect the sign of regulation to be negative because the prohibition against investing abroad blocks the diversification of the portfolio. There is a lot of issues and lobbying here, and according to Barr (2002), Kay (2009) and Thomson (2008) pension systems face political risks because all pension schemes depend upon effective governments, which face a task due to lobbying by interest groups.

The case of relative and absolute efficiency is very important and crucial to our analysis. According to our hypothesis, management of a PPF does not necessarily matches the PPF's portfolio return. Absolute efficiency, which measures management within the selected sample of PPFs, should have a significant positive sign. We may expect different results for the variable relative efficiency, which is a measure of local management performance.

In the cases of Fixed Commission, Commission on Flow, Commission on Balance and Commission on Return we may expect a positive sign, because the higher the commission or fee the higher the incentive to perform better.

External variables have been added to find out the determinants of PPFs' portfolio return. We have included macroeconomic variables that are expected to be positive for GDP growth and negative for variations in the exchange rate. In the first case, GDP is a good sign of positive expectations about a country's economy, and this should increase the rate of return. However, if the dollar is expected to devalue, it may represent negative expectations23 about the economy, and in a developing region it can cause inflation, which is bad for a PPF's real rate of return.24

Tables 3a and 3b show the result for each formulation described above. The first table considers the period before the financial crisis (March 2005-December 2007) and the second one includes an assessment for March 2007-December 2009. The transfers/funds ratio was not significant for the two periods under consideration. Therefore, competition is not affecting portfolio return.

It is interesting to notice the contrast by periods of the regulation variable. It gave the negative and expected sign in the first period, but a significant opposite sign in the second one. The first period belongs to the boom in the region, and releasing the restriction to transfer funds abroad may affect negatively the PPFs' portfolio return. However, in the period of financial crisis, which is from March 2007 through December 2009, regulation may help the PPFs' portfolio because the internal stock market is underperforming. There are a lot of issues outside our scope. For instance, Thomson (2008) points out lobbying by interest groups that made pension reforms difficult to achieve.

The variables Fixed Commission, Commission on Flow and Commission on Balance were not significant in all periods and models, but Commission on Return gave different and significant signs in the two periods under analysis. For the period before crisis (2005-2007) it gave an unexpected negative sign. This result can be explained because the latter booming period makes funds over performed, and a higher commission on return may discourage the PPFs' return of portfolio. In the second period of assessment, which is the time of financial turbulence and underperfor-mance of the stock market, a higher commission on return may encourage PPFs' investors to improve their return of portfolio.

For all the models over different periods of time, the sign of the coefficient for variation in the exchange rate and in gdp growth resulted negative and positive respectively. In addition, we should mention that our analysis is not homogeneous across countries due to the different composition of portfolios. The percentage of investment is shown in figure 4.

Management gave the expected sign for both periods of analysis. This fact shows that the exposure of PPFs' portfolio return does not depend on local management (relative efficiency), but instead on absolute efficiency, which measures a PPF management within the whole set of private pension institutions in the region. This is relevant, to avoid pension funds deterioration. The latter result is relevant for policy makers because local market power does not guarantee a good performance of PPFs' portfolio.

V. Conclusions

This study shed light on private pension funds' vulnerabilities in Latin America. Our results support the critique of Kotlikoff (2008) where private pension funds are subject to stick market fluctuations of risky assets.

Besides heterogeneity of portfolios, PPFs do not link management performance. Local market power is not enough to create a good portfolio for PPFs.

The recent international crisis and any other future negative external shocks may hamper the performance of stock markets in the region, and so of PPFs' portfolio return. Policy makers should improve the efficiency of PPFs by making them more competitive without sacrificing stability in the system.

It is not in the scope of this research to give any recommendation, but it should be interesting to make a comparative analysis of PPFs' regulation among countries in the region. The fact that some countries have lower and different types of commissions and a minimum return calls the attention on interest group effects that may be analyzed shortly.

Also, another future research may extend this analysis by exploring in more detail the implicit mechanisms between relative and absolute efficiency with real rates of return.

References

A coming test of virtue (2008), The Economist, 10 April, available at: www.economist.com/displayStory.cfm?story_id=11016383. [ Links ]

Abuhadba, M. (1994), Aspectos organizacionales y competencia en el sistema previsional, working paper, Santiago. [ Links ]

Aggarwal, R., C. Inclán and R. Leal (1999), "Volatility in Emerging Stock Markets", Journal of Financial and Quantitative Analysis, 34 (1), pp. 33-55. [ Links ]

AIOS, Several publications, available at: http://www.aiosfp.org/estudios_publicaciones/analisis_comparativo/comparacion_conceptual_sistemas.pdf. [ Links ]

Araujo, E. (2009), "Macroeconomic Shocks and the Co-movement of Stock Returns in Latin America", Emerging Markets Review, available online in August. [ Links ]

Barr, N. (2002), "Reforming Pensions: Myths, Truths and Policy Choices", International Social Security Review, 55 (2), pp. 3-36. [ Links ]

Barr, R., K. Killgo, T. Siems and S. Zimmel (1999), "Evaluating the Productive Efficiency and Performance of U.S. Commercial Banks", working paper, Federal Reserve Bank of Dallas. [ Links ]

Barrientos, A. (2001), The Efficiency of Pension Fund Managers in Latin America, working paper, University of Manchester. [ Links ]

Barros, C. P., G. Ferro and C. Romero (2008), Technical Efficiency and Heterogeneity of Argentina Pension Funds, working paper 29, University of Lisbon. [ Links ]

Berger, A. and L. J. Mester (2003), "Explaining the Dramatic Changes in Performance of US Banks: Technological Change, Deregulation and Dynamic Changes in Competition", Journal of Financial Intermediation, 12 (1), pp. 57-95. [ Links ]

Berger, A. and R. De Young (1997), "Problem Loans and Cost Efficiency in Commercial Banks", Journal of Banking and Finance, 21 (6), pp. 849-870(22). [ Links ]

Charnes, A., W. W. Cooper and E. Rhodes (1978), "Measuring the Efficiency of Decision Making Units", European Journal of Operations Research, 2 (6), pp. 429-444. [ Links ]

Cheng, S. T., V. Mason and J. Higgins (2001), Does Bank Efficiency Change with the Business Cycle? The Relationship between Monetary Policy, Economic Growth and Bank Condition, working paper, Emporia University. [ Links ]

Cooper, W. W., L. M. Seiford and J. Zhu (2004), "Data Envelopment Analysis: History, Models and Interpretations", in W. W. Cooper, L. M. Seiford and J. Zhu (eds.), Handbook on Data Envelopment Analysis, Kluwer Academic Publishers, Boston, pp. 1-39. [ Links ]

Deutsche Bank (2006), China's Commodity Hunger: Implications for Africa and Latin America, 13 June, available at: www.dbresearch.com/PROD/DBR_INTERNET_EN-ROD/PROD0000000000199956.pdf. [ Links ]

Farrel, M. J. (1957), "The Measurement of Productive Efficiency", Journal of the Royal Statistical Society, 120 (3), pp. 253-290. [ Links ]

Federación Internacional de Administradoras de Pensiones (FIAP), several publications, available at: http://www.fiap.cl/prontus_fiap/site/edic/base/port/inicio.html. [ Links ]

Hamilton, J. and L. Gang (2001), "Stock Market Volatility and the Business Cycle", Journal of Applied Econometrics, 11 (5), pp. 573-693. [ Links ]

Hansweck, G. A. (1977), "Predicting Bank Failure", research paper in Banking and Financial Economics, Financial Studies Section, Division of Research and Statistics, Board of Governors of the Federal Reserve System. [ Links ]

International Monetary Fund (2008). International Financial Statistics, May. [ Links ]

Kay, J. (2009), "Political Risk and Pension Privatization: The Case of Argentina", International Social Security Review, 62 (3), July-September, pp. 1-21. [ Links ]

Kotlikoff, L. (2008), "Pension Reform as the Triumph of Form over Substance", Berkeley Electronic Press, January. [ Links ]

Latintrade (2010), "Consensus Forecast", available at: www.latintrade.com. [ Links ]

Li, L. and Z. Hu (1998), Responses of the Stock Market to Macroeconomic Announcements across Economic States, working paper 98/79, International Monetary Fund. [ Links ]

Martin, D. (1977), "Early Warning of Bank Failure: A Logit Regression Approach", Journal of Banking and Finance, 1 (3), pp. 249-276. [ Links ]

Mishkin, F. (2007), "Financial Instability and Monetary Policy", Speech at the Risk USA Conference, November, New York. [ Links ]

Pantalone, C. C. and M. B. Platt (1987), "Predicting Commercial Bank Failure since Deregulation", New England Economic Review, July-August, pp. 37-47. [ Links ]

Poterba, J. and L. Summers (1984), The Persistence of Volatility and Stock Market Fluctuations, working paper 1462, National Bureau of Economic Research. [ Links ]

Rajan, R. S. and M. Parulkar (2008), "Real Sector Shocks and Monetary Policy Responses in a Financially Vulnerable Emerging Economy", Emerging Markets Finance & Trade, 44 (3), pp. 21-33. [ Links ]

Stiglitz, J. and P. Orszag (1999), "Rethinking Pension Reform: Ten Myths about Social Security Systems", paper presented at the Conference on "New Ideas About Old Age Security", 14-15 September, The World Bank, Washington, D. C. [ Links ]

The Credit Crunch: Mark it and Weep (2008), The Economist, 6 March, available at www.economist.com/opinion/displaystory.cfm?story_id=10808525. [ Links ]

Thomson, L. (2008) "Pension Reform, Political Pressure and Public Choice the Case of France", Economic Affairs, 28 (4), pp. 68-71. [ Links ]

Titelman Daniel, Esteban Pérez-Caldente and Ramón Pineda (2009), "¿Cómo algo tan pequeño terminó siendo algo tan grande? Crisis financiera, mecanismos de contagio y efectos en América Latina", Revista CEPAL 98, pp. 7-34. [ Links ]

Waggoner, J. (2006), "Booming China Helps Commodity Prices Boom", USA Today, 2 February, available at: www.usatoday.com/money/markets/2006-02-02-commodities-2_x.htm. [ Links ]

Wilson, P. W. (2007), "fear: A Package for Frontier Efficiency Analysis with R", Socio-Economic Planning Sciences, forthcoming. [ Links ]

1 It is 5 per cent for the International Monetary Fund (IMF), 2008.

2 China is industrializing but requires some commodities that the region; fortunately, it is able to supply.

3 This goes along the approach of Araujo (2009) who claims that "Therefore, macroeconomic shocks (supply and demand) cannot be neglected in accounting for the dynamics of real stocks."

4 In some countries, like Mexico, there are two institutions managing pension funds: AFORE (Administradora de Fondos para el Retiro) and SIEFORE (Sociedad de Inversión Especializada en Fondos para el Retiro). The former collects the money from workers and the latter invests it. For statistical analysis the AFORE will work out as PPFs.

5 In Latin America, a centralized pension fund may work when the government manages the funds with the private sector.

6 We do not have information for the Dominican Republic; even though, it has seven PPFs: bbva Crecer, Caribalico, León, Popular, Reservas, Romana and Siembra.

7 Argentina expropriated its private pension funds because of political and social issues. After 2008, there is not data on PPFs in Argentina. See Kay (2009) for a detailed explanation of this issue.

8 They explain that, compared to previous international crises, the effect of the recent financial turmoil can be a credit crunch and the drop in exports.

9 CAMEL stands for Capital, Asset Adequacy, Management, Earning and Liquidity. DEA is the proxy for management assessment.

10 The calculation of the rate of return is not homogeneous across countries, but it is an indicator of the performance of funds, which is available at AIOS. To attempt a homogeneous rate of return we consider the real variables, which means that the inflation effect has been removed in the sample of countries.

11 An HHI between 1 000 to 1 800 indicates moderate concentration, while an HHI above 1 800 indicates high concentration. It considers the whole data set period.

12 It considers a share average for all the periods in the country.

13 By transfer of funds we mean the right of a contributor to switch among PPFs within a country. There may be some limitations that vary from one country to another.

14 In our case the DMUs are PPFs, but there are several studies that use DEA for banks, hospitals, colleges, departments, etc.

15 See Charnes et al. (1978) for a more comprehensive explanation of this problem.

16 Besides the input-oriented model, there is another approach called the output-oriented model. Output maximization is the dual of the linear program introduced by Charnes et al. (1978).

17 Some models include constant returns to scale (CRS) instead of VRS. VRS means that in a production process, operations will follow increasing or decreasing returns to scale. Note also that firms which have not been efficient in the models so far may become efficient if we allow an assumption of variable returns to scale (relaxing the crs assumption).

18 See these definitions in Cooper et al. (2004).

19 It can be provided upon request.

20 Bootstrapping is based on the idea of repeatedly simulating the data generating process (DGP) by re-sampling and plugging the original estimator to each simulated sample, so that the resulting estimates mimic the sampling distribution of the original estimator. We follow the Bootstrap commands posted by Wilson (2007). We find that there is no difference between the simulated and the original scores of efficiency. Then, outliers can be dismissed.

21 We considered seventy three PPFs in our estimation of efficiency, but we had to withdraw Bolivia and El Salvador due to lack of information.

22 During 2008-2009 some PPFs entered the market. This is the case of Chile and Mexico; the latter situation is considered in the analysis.

23 Along these lines, Aggarwal et al. (1999) identified high volatility of stock markets during the Mexican peso crisis, as well as during high periods of hyperinflation. In addition, Poterba and Summers (1984) demonstrated that shows in the stock market do not persist. The period of time analyzed in our sample is short.

24 Hamilton and Gang (2001) found that economic recessions are the primary factor driving fluctuations in the volatility of stock returns.