Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Economía mexicana. Nueva época

versión impresa ISSN 1665-2045

Econ. mex. Nueva época vol.19 no.2 Ciudad de México ene. 2010

Artículos

Merger Policy and Efficiency Gains

Política de fusiones y ganancias en eficiencia

Marcos Ávalos Bracho*

* Full-time professor-researcher, Centro de Alta Dirección en Economía y Negocios (CADEN), Facultad de Economía y Negocios, Universidad Anáhuac-México Norte, Mexico City. mbracho@anahuac.mx

Fecha de recepción: 7 de noviembre de 2008;

Fecha de aceptación: 17 de diciembre de 2009.

Abstract

This paper provides a discussion on mergers and the role played by efficiency gains. By introducing a capacity-constrained Cournot model, we show that one way to extract useful information from merging firms is to design a scheme (requiring that the firms divest some of their assets) that leads to self-selection of the more socially worthwhile mergers.

Keywords: efficiency gains, merger policy, structural remedies.

Resumen

El presente artículo ofrece una discusión sobre el papel de las ganancias en eficiencia en la evaluación de las fusiones. Mediante la introducción de un modelo de Cournot de capacidad restringida, se demuestra que una forma de extraer información útil de las empresas a fusionarse es mediante el diseño de un esquema (bajo la condición de que las firmas se desprendan de algunos de sus activos) que induzca la autoselección de aquellas fusiones que incrementen el bienestar.

Palabras clave: ganancias en eficiencia, política de fusiones, desincorporación de activos.

JEL classification: L51, D43, C35.

Introduction

One crucial aspect of the application of competition policy for mergers is the efficiency gains consideration.1 This is not a minor point, since many competition authorities around the world are using efficiency gains considerations when discussing merger activity.2

The aim of this paper is to provide a discussion on mergers and the role played by efficiency gains. We hold that divestment remedies can indeed induce socially desirable self-selection in mergers. Such remedies often emerge as a result of negotiations between the merging firms and the antitrust authority.3

In practice, the task of antitrust authorities is complicated by the fact that most mergers claim to achieve some kind of efficiency gains (i.e. some form of cost reduction or quality improvement), particularly in negotiation with the antitrust authorities. By exploiting cost synergies, the merged firms might be able to experience production costs below those of either firm before the merger. Therefore, merger policy involves the delicate balancing of anticompetitive effects against possible efficiency gains.4 In assessing this trade-off, the competition authority often relies on very imperfect information. Not only is the evaluation of market power inherently imprecise, but the merging parties typically have better information about potential efficiency gains than regulators.5 Of course, the merger review process is designed to extract as much information as possible from the parties, but it is reasonable to assume that some asymmetry remains.

This paper aims to study the consecuences of this asymmetric information on formulating merger policy in the light of "policy remedies". The idea is quite simple; by requiring some form of divestment, the antitrust authority makes the merger less attractive to the merger firms. This means that marginally profitable mergers will be called off. In the absence of any asymmetric information on market power, marginally profitable mergers will tend to exhibit weak synergies, i.e. those that would be less likely to yield net welfare gains. One can therefore hope that an appropriately chosen disvestment remedy would help select mergers that are socially beneficial.

Modelling this simple insight is surprisingly difficult for two main reasons. Firstly, since the effectiveness of the divestment remedy relies on self-selection, the decision to merge can no longer be completely exogenous. While one can still consider an arbitrary merger between two firms, the decision whether or not to proceed with the merger, given the divestment requirement, must now be modelled. It is well known that the traditional analysis framework on horizontal mergers, in the light of private incentives to mergers and merger process, heavily base on quantity-setting (Cournot Oligopoly) models.6 From the point of view of policy-making and enforcement aspects of competition policy, some economists believe that this model of competition with anticompetitive effects of merger has been the dominant approach in the internal analysis of antitrust authorities during the last decade (see for example Baker, 1999; Hay and Werden, 1993).

One difficulty with this, is that in Cournot competition at least, mergers tend to be unprofitable for the merging parties, but profitable for their rivals.7 We deal with the merger paradox by introducing favorable cost effects. These gains will be specified as reductions in (constant) unit costs.8

The second difficulty is that in the traditional specification of mergers, the concept of 'divestment' is meaningless: the two merging firms just become a single firm, with nothing to show that they ever were separate entities. We deal with this issue by introducing capacity constraints. We start from an initial situation where all firms are capacity-constrained, and capacity expansion is prohibitively expensive. In this context, the merged firm actually differs from its rivals in that it has access to double the capacity.9 In other words, mergers involve not only a coordination of (pricing) decisions, but also the "adding up" of tangible assets.10

In this paper, we build a model upon the existing literature, particularly Williamson (1968), Farrell and Shapiro (1990), perry and porter (1985) and Besanko and Spulber (1993), to investigate how some of the policy tools at the antitrust authority's disposal might help alleviate the problem of asymmetric information on potential synergies.11 perry and porter (1985) investigated the circumstances under which an incentive to merge exists even though the product is homogenous, but they failed to analyze (or account for) issues related to welfare on merger policy. Although Farrell and Shapiro (1990) give sufficient general conditions under which all privately profitable mergers increase welfare and, presumably, all proposed mergers should be approved, they do not consider the problem of asymmetric information.

The main information needed in the Farrell and Shapiro's externality condition12 is split into two separable parts. First, to see whether a merger would indeed reduce output requires information only on the participants' (pre-merger) marginal cost functions and on those of the merged entity. Second, to evaluate the external effect, whether it benefits or harms rival firms and consumers jointly, and only requires information on market shares and the output responsiveness parameters of non-merging firms (Farrell and Shapiro, 1990, p. 122). There is a problem in the first part, when firms choose to understate the true level of synergies, for example, by reporting a different value and hiding evidence showing greater efficiency gains. In this situation, the government will infer that merger is socially desirable, when in fact it is not; the merger would be approved under Farrell and Shapiro's externality condition.13

Our model is more closely related to the work by Besanko and Spulber (1993) on the effects of asymmetric information in designing merger policy. In their model, they assume that the post-merger level of synergies (as a reduction of marginal costs) is private information only concerning the merging firms. Besanko and Spulber (1993) show that, under asymmetric information, expected social welfare is maximised when the antitrust authority makes the decision to challenge using a standard that is tougher than the social welfare criterion. In this setting, the antitrust policy and enforcement process has two stages. In the first stage, a welfare standard that will be employed in the evaluation of horizontal merger cases is chosen. This standard is chosen to maximize expected social welfare. In the second stage, given the welfare standard, firms decide whether or not to merge. If a merger occurs, the antitrust authority decides whether to challenge the merger by applying the welfare standard chosen in the first stage.14 Nevertheless, as in the case of Besanko and Spulber (1993), we assume that the merging firms have better information about cost savings than the antitrust authority.

This paper limits itself to showing that divestment remedies can indeed induce socially desirable self-selection in mergers. By introducing a capacity-constrained Cournot model, we show that one way to extract useful information from the merging firms is to design a scheme (requiring that the firms divest some of their assets) that leads to self-selection of the more socially worthwhile mergers. In particular, we show that some of the mergers that firms would pursue are undesirable because of their effect on welfare, so that approval is only warranted if synergies are large enough. In the presence of asymmetric information on the level of efficiency gains, the antitrust authority must trade-off the benefits from approving mergers that are desirable against the cost of approving mergers that would decrease welfare. In this case, there might be a role for divestment policy. Since the current model is quite specific, however, we have not yet been able to determine with any generality how the extent of the required divestment should vary as a function of initial industry concentration. The rest of the paper is organized as follows.

The model is clarified in detail in the following section (I). The pre-merger and post-merger equilibria are analyzed in section II. Also, we determine when mergers are profitable. In section III we introduce a divestment policy instrument and analyze its effect on equilibrium. Further, we derive the locus of binding regulation by the antitrust authority and undertake the welfare analysis for the constrained case. In section IV we discuss the merger policy of the model and determine the conditions under which the divestment policy can induce socially desirable self-selection in mergers. Finally, some concluding remarks are made in section V.

I. The Model

Let N be the Cournot identical firms competing in a homogeneous product market. Each firm i has an initial exogenous capacity constraint Ki= K ∀i.15

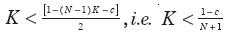

We assume a linear inverse demand functionP(Q) = 1 - bQ and that marginal costs are constant ci = c ∀i and common among all firms, while fixed costs are zero. We assume that firms are capacity-constrained, so that Ki< (c), where

(c), where  stands for the equilibrium value of a unconstrained firm's output. While the level of capacity is set exogenously, we want to ensure that each firm would not have any incentive to expand its own capacity through "greenfield" investment. Bearing this in mind, we therefore assume that Ki>

stands for the equilibrium value of a unconstrained firm's output. While the level of capacity is set exogenously, we want to ensure that each firm would not have any incentive to expand its own capacity through "greenfield" investment. Bearing this in mind, we therefore assume that Ki> (cK), where cK indicates the marginal cost of increasing the capacity, and cK> c. If firm i wishes to produce greater output, it must acquire additional capacity by merging, so we can expect that this constant unit cost of capacity expansion should be greater than the constant marginal cost.16

(cK), where cK indicates the marginal cost of increasing the capacity, and cK> c. If firm i wishes to produce greater output, it must acquire additional capacity by merging, so we can expect that this constant unit cost of capacity expansion should be greater than the constant marginal cost.16

We specify the merger process as follows: if firms 1 and 2 merge, they combine their capacities and the result is one firm with capacity 2K. Additionally, we assume that formation of a merger results in synergies which reduce the marginal cost of production for the merged firm. Let the marginal cost of the new entity be cF = aci,where where α  [0, 1]; this measures the degree of synergy (or efficiency) with which a smaller a represents more synergies.17 Clearly, if α = 1, then the merger experiences no synergies at all, and a < 1 implies that the merger creates synergies. When such a merger occurs, the industry reduces to N - firms Cournot oligopoly, with the merged firm's marginal cost being ac and each of the outside merged firm's cost c. Also notice that since cF is expressed as a proportion of c, the scope for synergies is greater when c is larger. The asymmetry of the model occurs because the antitrust authority cannot observe with any accuracy the real level of these synergies generated by the merger. Otherwise, if the antitrust authority has full information (i.e. knows the level of synergies a), merger policy would be easy: approve any merger that increases the net effect on social welfare, and reject any other. This completes the model specification, and we turn to its analysis in the next sections.

[0, 1]; this measures the degree of synergy (or efficiency) with which a smaller a represents more synergies.17 Clearly, if α = 1, then the merger experiences no synergies at all, and a < 1 implies that the merger creates synergies. When such a merger occurs, the industry reduces to N - firms Cournot oligopoly, with the merged firm's marginal cost being ac and each of the outside merged firm's cost c. Also notice that since cF is expressed as a proportion of c, the scope for synergies is greater when c is larger. The asymmetry of the model occurs because the antitrust authority cannot observe with any accuracy the real level of these synergies generated by the merger. Otherwise, if the antitrust authority has full information (i.e. knows the level of synergies a), merger policy would be easy: approve any merger that increases the net effect on social welfare, and reject any other. This completes the model specification, and we turn to its analysis in the next sections.

II. Pre-merger and post-merger equilibria

II. 1. Pre-merger equilibrium

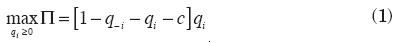

In the Cournot equilibrium, firm i simultaneously and independently sets output to maximize its profits, setting qi to solve:18

If optimal production by firm i is positive, for all i (with c < 1) the first order-condition for profit maximization is given by:

In a symmetric Nash equilibrium, the output of each firm in the industry will be identical, so that Q = Nq, where q is the output per firm. Therefore we obtain:

We will assume that, before the merger, all firms are capacity constrained, so that  = K

= K  i. For this condition to hold, the unconstrained output

i. For this condition to hold, the unconstrained output  must be larger than K, so that:

must be larger than K, so that:

To ensure that q* = K is in equilibrium, we must also check that no firm has an incentive to deviate. The corresponding maximization problem is:

So that

For firm i to be capacity constraint we need  , which is the same condition as in (4). In this capacity-constrained equilibrium each firm would set q = K; thus, the market price is

, which is the same condition as in (4). In this capacity-constrained equilibrium each firm would set q = K; thus, the market price is

and the total industry profit is

Consumer surplus is given by

Finally, we can write the welfare function as the sum of consumer surplus and producer surplus, which then yields:

II. 1.1 post-merger equilibrium

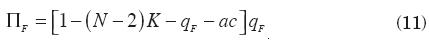

Remember that the merger process between two firms combining their capacities can result in some synergy on marginal costs. Thus, in the Cournot equilibrium, the new firm with marginal cost cF = αc simultaneously and independently sets output to maximize its profits:

It is straightforward to calculate the optimal output choice of the new firm:

By comparing the solution with the initial level of capacity constraint K, we identify two cases.

Case 1. The merged companies are still capacity-constrained. This occurs when the new firm's optimal production level is greater than its level of capacity, i.e. qF> 2K. Substituting equation (12) and making an arrangement yields the following condition:  .

.

The welfare analysis of this case is straightforward. Since total output remains unchanged and costs decrease (∀ α < 1), such mergers unambiguously improve welfare.

Case 2. The merged companies are not capacity constrained. Assume that  .

.

This implies that the new firm's optimal product is lower than its level of capacity, i.e. qF < 2K. Then, we still need that  the initial level of capacity constraint is lower than the optimal product in pre-merger equilibrium, while it is greater than the optimal product in post-merger equilibrium,

the initial level of capacity constraint is lower than the optimal product in pre-merger equilibrium, while it is greater than the optimal product in post-merger equilibrium,  This requires the following (necessary) condition:

This requires the following (necessary) condition:

Intuitively, the post-merger synergies must be small enough that, given an initially binding capacity, the merged firm does not find it profitable to use all its own capacity. This results in the traditional trade-off between market power and efficiency gains: the merger decreases total output but also decreases costs. The desirability of mergers is therefore ambiguous.

In the post-merger equilibrium, the price:

Thus, total quantity is given by:

The total optimal quantity is the sum of the optimal choice product from the firms that have not entered into a merger [i.e. (N - 2)] plus the optimal choice product from the new firm created by the merger.

Consumer surplus is equal to:

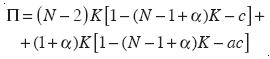

The total profit is given by the (N - 2) firms' profit, plus the new firm's profit (due to the merger):

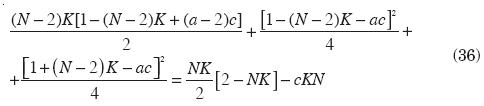

Finally, welfare is made up of total profits plus consumer surplus. Thus, we can write the welfare function as follows:

II.1.2. profitable Mergers, no Regulation

By comparing the new firm's profit in the post-merger equilibrium in equation (12) with its profit in the pre-merger equilibrium, it is possible to determine the level of synergies that makes the merger privately profitable. A merger will be profitable if the following equation holds:

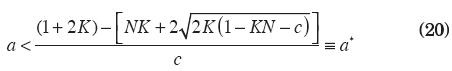

We can re-write equation (19) as follows:

Thus, if synergies are large enough (i.e. α < α*) a merger is profitable. Therefore, profitable mergers are only possible if α* > 0, i.e. if  . For this condition to be compatible with case 2, we need a small number of firms N, and a small initial level of capacity.19

. For this condition to be compatible with case 2, we need a small number of firms N, and a small initial level of capacity.19

III. Policy-Making and Welfare Analysis

Competition policy takes the form of requiring the divestment of some of the two firms' joint capacity, as a condition for approving the merger. The new firm's capacity is then given by the following equation:

Where α  [0, 1]. If α = 0, the new firm would have to divest the whole capacity of one of the merging entities. By contrast, for α= 1 the merger would be approved without any precondition.20 For the sake of simplicity, we will assume that the divested capacity just vanishes. In particular, it is not sold to another participating industry.21

[0, 1]. If α = 0, the new firm would have to divest the whole capacity of one of the merging entities. By contrast, for α= 1 the merger would be approved without any precondition.20 For the sake of simplicity, we will assume that the divested capacity just vanishes. In particular, it is not sold to another participating industry.21

Of course, divestment can only be effective if restriction on the remaining capacity is binding. Using equation (12), we can re-write (21) as follows:

Solving for a yields the locus of binding divestment; this is:

If α < αr (α), then the level of competition policy instrument binds. If α > αr(α), the level of policy instrument does not bind. Figure 1 illustrates the locus of binding divestment. This locus of binding divestment is downward sloping.

Starting on the curve, a decrease in a makes the resulting output of the merged firm higher, so that the constraint now binds strictly. To go back to the curve, one must relax the constraint, i.e. increase α. For α= 0 the level of synergy on the locus is  , and for α= 0 the level of policy instrument will be

, and for α= 0 the level of policy instrument will be

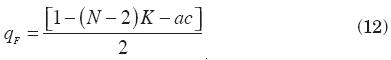

III.1. Profitable Mergers with Regulation

Figure 2 shows the zones when mergers are still profitable after divestment. For a above the level of α* mergers would not be profitable, since they would not profit in the absence of any divestment.22 For α < α*, we must compare pre-merger profits to the profits of the merged firm. To the right of αr (α), the required divestment is not binding, so that mergers are profitable (ΔΠ> 0). To the left of αr (α), the divestment requirement is binding. We must therefore compare the profits of the firms before merging to the constrained profits of the merged entity.

After merging we have:

Thus, the new firm's profit is given by:

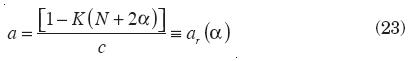

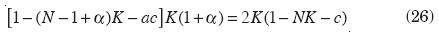

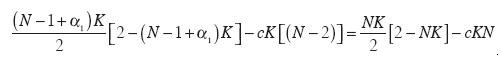

We can equalise this equation to the profit from pre-merger equilibrium as follows:

Re-writing this equation yields:

Solving for a yields:

For any a the merger is profitable if α < αp (α), i.e. we are below the αp line drawn in figure 2. It is straightforward that αp (α= 0)  0 and αp (α= l) > 0.23 Moreover, αp (α) is upward sloping. Intuitively, an increase in the level of synergies (or lower a) would increase the profits of the merged firm. Therefore, to get back to the αp (α) locus one must further constrain the firms by reducing α.24

0 and αp (α= l) > 0.23 Moreover, αp (α) is upward sloping. Intuitively, an increase in the level of synergies (or lower a) would increase the profits of the merged firm. Therefore, to get back to the αp (α) locus one must further constrain the firms by reducing α.24

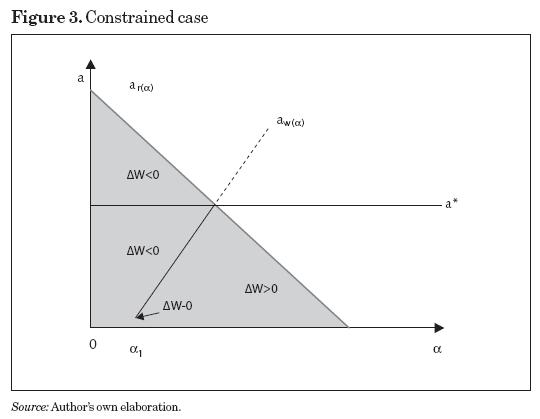

III.2. Welfare Analysis

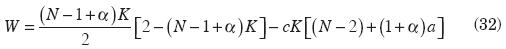

Having analyzed a divestment policy mechanism and its effect on equilibrium, in this section we turn our attention to the welfare analysis for the constrained case. First, let us focus on the constrained case, i.e. the region to the left of αr (α) (see Figure 2). We computed the total output, consumer surplus, total profit and welfare for the non constrained case in the post-merger equilibrium section.25

In the constrained case, the total equilibrium output is given by:

where the term (N - 2 )K denotes the amount produced by the firms that have not entered into a merger, and the term (1 + α)K indicates the amount produced by the new firm (firms that have gone into a merger). The consumer surplus is given by:

The total profit is:

The first term stands for the profits from N - 2 firms, while the second term represents the new firm's profits due to the merger. Simplifying this expression yields the following equation:

Hence, the welfare function is given by:

Now, we can compare this welfare function with the welfare function in the case of pre-merger equilibrium, i.e.:

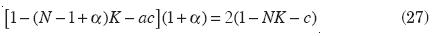

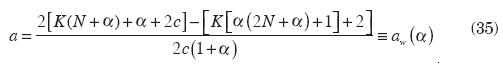

If we consider W = W0 [equalising (32) and (33)], we can write that:

Solving for α yields:

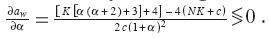

For any α the merger is desirable if α < αw (α), i.e. we are below the αw line drawn on figure 3. Notice that  , then αw (α= 0)

, then αw (α= 0)  0. Alternatively, notice that αw (α= 1) = 4 > 0 , so that αw (α= 1) > 0. Intuitively, an increase in the level of synergies (or lower a) would increase welfare. To get back to the αw (α) locus one must therefore further reduce welfare by reducing α. Formally, the effect of a change in α on αw (α) is

0. Alternatively, notice that αw (α= 1) = 4 > 0 , so that αw (α= 1) > 0. Intuitively, an increase in the level of synergies (or lower a) would increase welfare. To get back to the αw (α) locus one must therefore further reduce welfare by reducing α. Formally, the effect of a change in α on αw (α) is  . Figure 3 illustrates the region (shadow area) for the constrained case, i.e. the region to the left of the locus of binding regulation. For values to the left of αw it decreases welfare while for values to the right of αw it increases welfare.

. Figure 3 illustrates the region (shadow area) for the constrained case, i.e. the region to the left of the locus of binding regulation. For values to the left of αw it decreases welfare while for values to the right of αw it increases welfare.

Remember that αw was derived under the assumption that the firm's behavior was constrained by the divestment policy. This mean that αw would only apply to the left of the locus of binding regulation αr (α). We must derive another aw line that would apply to the right of αr. In other words, we must also consider the welfare effect of mergers when the divestment policy is not binding. To deal with this, we need to equalize equation (33) to the expression for post-merger welfare when the firms' output in not constrained by the divestment policy [i.e. equation (18)]. Doing so yields:

Solving for α and taking the positive value yields:

where  = [4 K2 (1-N)+ 16 K–k (3N2K + 16c)]. Using simulation one could show that this line is upward sloping. For values to left of α'w the merger would decrease welfare but for values to right of α'w the merger would increase welfare.

= [4 K2 (1-N)+ 16 K–k (3N2K + 16c)]. Using simulation one could show that this line is upward sloping. For values to left of α'w the merger would decrease welfare but for values to right of α'w the merger would increase welfare.

IV. Discussion on Merger Policy

Finally, now that we understand the effects of mergers on welfare and profits, we shall analyze these effects together in order to determine the region where a merger would be proposed and approved by the antitrust authority. We assume that the antitrust authority could reject or approve a merger without restriction, or could approve the merger with restrictions. The aim of this section is to try to find the conditions under which imposing a divestment requirement might be optimal.

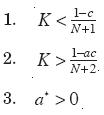

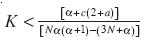

To this end, we must take care of two sets of conditions: the first one is the set of parameters that jointly satisfy the various assumptions we have made. This set of parameters is provided by the following three conditions that need to be satisfied simultaneously:

The second set involves conditions (which are not essential) that help determine what the graph will look like. These conditions are:

The first four conditions involve only 3 parameters, N, K and c. Using the Maple program, by simulating values for K and N, given c = 0.1, we can depict the following curves for  = K,

= K,  , αr = α* and α*= 0, in order to show the combinations of these 3 parameters (N, K and c) for which the four conditions hold. Figure 4 shows these curves. The thick curve describes α* = 0, while the solid black curve illustrates when αr = α*; the cross curve depicts K =

, αr = α* and α*= 0, in order to show the combinations of these 3 parameters (N, K and c) for which the four conditions hold. Figure 4 shows these curves. The thick curve describes α* = 0, while the solid black curve illustrates when αr = α*; the cross curve depicts K =  , and finally, the diamond curve describes

, and finally, the diamond curve describes  .

.

The cross curve takes care of Condition 1, i.e. we must restrict our attention to the area below this curve. The diamond curve takes care of Condition 2, so that we confine our attention to the area above this curve. The thick grey curve takes care of Condition 3, and we saw that by simulating values for equation (20) it can be shown that α* > 0, which is fulfilled below this curve. Hence, the region that satisfies these three conditions is given by the area below the cross curve and above the diamond curve.

Using simulation, it could be shown that for values that increased the marginal cost the thick curve (α* = 0) will be clearly affected. Such curve could be below all the other curves, meaning that these conditions cannot jointly be satisfied.

When the diamond curve is over the cross line, our necessary condition in equation (13) would not hold. Intuitively, the post-merger synergies are not small enough that, given an initially binding capacity, the merged firm finds it profitable to use its own capacity, i.e.  . Further, any merger in this region would not be profitable, since above the thick line (curve α* = 0) condition 3 is not satisfying. Moreover, the diamond curve could be above the cross and the thick curves. Hence, if the marginal cost were large enough, our model's conditions would not be satisfied simultaneously.

. Further, any merger in this region would not be profitable, since above the thick line (curve α* = 0) condition 3 is not satisfying. Moreover, the diamond curve could be above the cross and the thick curves. Hence, if the marginal cost were large enough, our model's conditions would not be satisfied simultaneously.

On the other hand, we mentioned that the solid black curve illustrates when αr = α*. This solid black curve takes care of Condition 4, but, when is this condition satisfied? By comparing the locus binding regulation in equation (23) and the level when a merger is profitable in equation (20), it can be shown that:

By simulating values for equation (38) it could be shown that condition 4 (αr > α*) is fulfilled below the solid black curve.

Let us now turn our attention to conditions 5 and 6. Parameter α2 is the level of divestment policy of the locus αp (α), i.e. for all α < α2 divestment requirement reduces the merged firm's profits, while for any α >α2 divestment requirement increases profits (see figure 2). Parameter α1 is the level of divestment policy of the locus αw (α), i.e. for all α < α1divestment requirements welfare decreases, but for allα >α1 divestment requirements welfare increases (see figure 3).

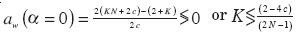

The divestment policy α2is given by equation (27) when a is set equal to 0; so, we can write that:

Thus, solving for α2and taking the positive value yields:

Instead, the divestment policy α1 should be obtained by setting (32) equal to (33) and obtaining the value of α when α = 0, so that we can write as follows:

Thus, solving for α1 and taking the positive value yields:

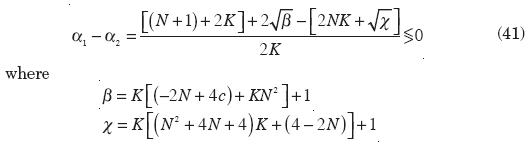

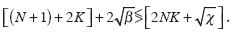

Comparing α1 and α2 yields:

Thus,  If

If  equation (41) will be positive, i.e. α1 > α2. For instance, consider that c = 0.2, N= 10 and K= .04; equation (41) becomes positive, so that α1 > α2. Using simulation it can be shown that by increasing the number of firms, i.e. N, the divestment policy level α1 has a tendency to be larger than the divestment policy level α2. On the contrary, simulation can also show that by increasing the level of capacity K the divestment policy level α2 tends to be larger than the divestment policy level α1. Consequently, if the initial exogenous level of capacity constraint K is large enough, the divestment policy level α2 would be greater than the divestment policy level α1.26

equation (41) will be positive, i.e. α1 > α2. For instance, consider that c = 0.2, N= 10 and K= .04; equation (41) becomes positive, so that α1 > α2. Using simulation it can be shown that by increasing the number of firms, i.e. N, the divestment policy level α1 has a tendency to be larger than the divestment policy level α2. On the contrary, simulation can also show that by increasing the level of capacity K the divestment policy level α2 tends to be larger than the divestment policy level α1. Consequently, if the initial exogenous level of capacity constraint K is large enough, the divestment policy level α2 would be greater than the divestment policy level α1.26

Finally, we can compare αw in (35) against αp in (28). It can be shown that:

If  equation (42) will be negative; then, we have that αw < αp.

equation (42) will be negative; then, we have that αw < αp.

Having derived the conditions, we shall discuss the role that the antitrust authority can play in order to determine the region where mergers are approved or rejected. Of course, it is possible to derive many cases, which will depend on the simulating of the parameters in each of the conditions established above. However, we shall concentrate on three of them in order to illustrate that imposing a divestment policy instrument might be optimal, while guaranteeing that mergers are likely to occur can be beneficial for social welfare.

Case 1. The Antitrust Authority has full information

If the antitrust authority had full information, i.e. knew N, c, K and α, merger policy would be easy: approve any merger in the region that implies ΔW > 0 and reject any other. Approving mergers on the condition of divestment would never be optimal, since setting α < 1 only reduces the total level of output and therefore they would reduce welfare.

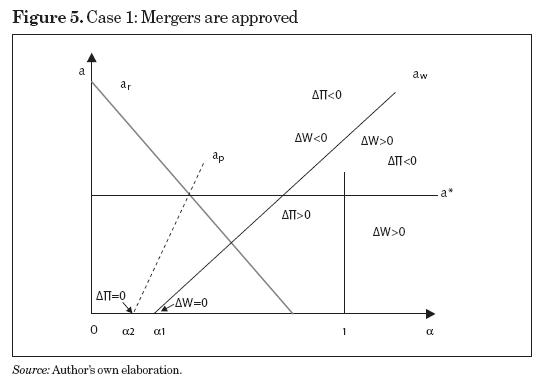

The problem is that the level of synergies α is unlikely to be accurately observed by the antitrust authority. Hence, without divestment policy the relevant decision is based on a cross-section of values of α and the corresponding welfare/profit effect at α= 1. Suppose for instance, that the graph looks like figure 5. As can be seen, all occurring mergers would be socially desirable. Hence, all mergers should be approved.27

Case 2. The Antitrust Authority must trade-off the benefits of approving mergers On the other hand, assume that the graph looks like figure 6.28 For example, at the situation where α= 1 there is a dilemma; some of the mergers that firms would pursue are undesirable because of their effect on welfare, so that approval is only warranted if synergies are large enough, i.e. if α  [αw, α*]. Without knowledge of a, the antitrust authority must trade-off the benefits of approving mergers that are desirable against the cost of approving mergers that would decrease welfare. In this case, there might be a role for divestment policy.

[αw, α*]. Without knowledge of a, the antitrust authority must trade-off the benefits of approving mergers that are desirable against the cost of approving mergers that would decrease welfare. In this case, there might be a role for divestment policy.

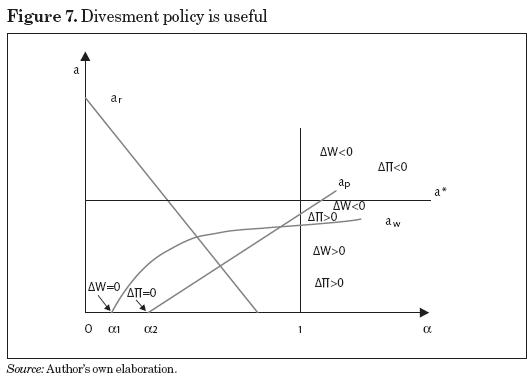

Divestment policy is potentially useful because it induces self-selection: only mergers still profitable after the required divestment will be pursued. For divestment policy to be useful, this self-selection must go in the right direction, i.e. it must increase the probability that mergers are of the socially desirable type. Clearly, this is not the case in figure 6, where decreasing α actually increases the proportion of the socially undesirable mergers. For instance, suppose that the graph looks like figure 7. We can clearly see that reducing α decreases the probability that mergers are of the socially undesirable type.29

Case 3. Divestment policy is optimal

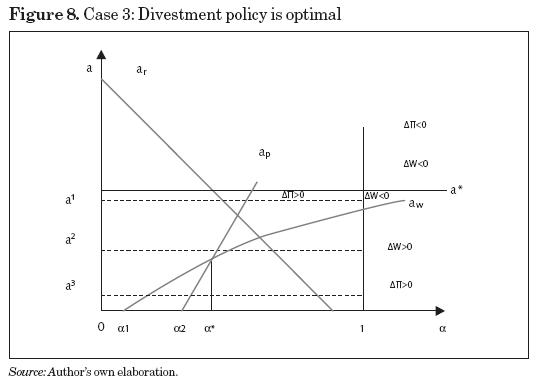

Figure 8 30 describes a situation where imposing some divestment induces the right type of self-selection. Reducing α from α = 1 decreases the proportion of socially undesirable mergers. In fact, by setting α = α* one would be able to ensure that all mergers which are profitable are also socially desirable. Therefore, there might be ground for using divestment requirements.

However, there is still a trade-off in this situation. Let us consider three cases. First, suppose that the real (observable) level of synergies generated by the merger is at α1. For α = α1 an unconstrained merger would occur, but would not be socially desirable. By setting α low enough (say at α*), this type of merger is avoided. This is the social benefit of using a divestment requirement.

Let us now assume that α = α2. Without restriction, the merger would occur and be socially desirable. However, if α = α*this socially desirable merger would no longer take place. Finally, consider the case where α = α3. The merger takes place both without restriction and with α = α*. The merger is also socially desirable in both cases. However, the level of welfare will be higher with α = 1 than with α = α*, because the divestment restriction decreases the merged firm's output.

In the situation shown in figure 8, then, approving mergers subject to divestment would most likely be optimal if the ex ante distribution of α puts a lot of weight on the "α1" and "α3" cases, and little weight on the "α2" case.

IV. 1. Efficiency Gains in Practice

In this subsection we briefly review the evaluation of efficiency gains in some jurisdictions, namely the United States, Canada, United Kingdom and Mexico. This review indicates what the difficulties are in order for efficiency gains to be considered by competition policy agencies, and what administrative routines are used to mitigate these problems.

Our review shows that the different countries differ in their objectives. In all cases, consumers' welfare is argued to be important. In some countries also the firms' profits are considered as part of the objectives. That is usually referred to as the Williamsonian welfare standard.

IV. 1.1. United States

The United States merger policy is mainly carried out by the Federal Trade Commission (FTC) and the Department of Justice (DOJ). A merger cannot be consummated until one of the agencies has evaluated its likely effects on competition. If a problem is found, the merging parties can withdraw the proposal, negotiate a method of alleviating the agencies concern (for example some divestiture) or litigate the acquisition's legality.

The Antitrust Division of the DOJ and the FTC jointly issue Horizontal Merger Guidelines. The purpose of the Guidelines is to give merging parties and the general public guidance on how the agencies analyse mergers, and how they decide whether or not to challenge a proposed transaction. The first releases of the Guidelines in 1968 and 1982 opposed efficiency considerations, unless there were exceptional circumstances. The later releases of the Guidelines in 1984 and 1992 (still in use today) reveal a more sympathetic treatment of efficiency claims. Coate and McChesney (1992) statistically analyse 70 merger investigations (including all important horizontal mergers) at the FTC from 1982 to 1987. They find that efficiency considerations during that period did not affect the agency's decisions on whether or not to challenge mergers.

Today, however, the picture may be different. According to Chairman pitovsky (1998), claims of efficiencies do influence the FTC prosecutorial discretion, for example in some hospital mergers and in the case of Chrysler-Daimler Benz. The efficiency section was the main subject in the revision of the 1992 Guidelines, which appeared in 1997. The purpose of the revision was to clarify rather than to change the standards. The new version discusses types of efficiency, merger specificity, verifiability, pass-on, and net effects.

IV.1.2. Canada

On application by the Director of Investigation and Research (the federal government official responsible for the enforcement of the Competition Act), the Competition Tribunal may issue a prohibition or divestiture order with respect to a merger which it deems likely to prevent or lessen competition substantially. The Act lists a number of factors that may be considered in determining whether competition will be affected.31

In the event that the Tribunal finds that a merger is likely to prevent or lessen competition substantially, Section 96 of the Act provides an efficiency defence. Section 96 directs the Tribunal not to issue an order:

"if it finds that the merger is likely to bring about gains in efficiency that will be greater than, and will offset, the effects of any prevention or lessening of competition and that the gains in efficiency would not likely be attained if the order were made".

In 1991 the Director of Investigation and Research at the Competition Bureau issued guidelines as to how he intended to interpret the merger provisions of the Act.

Standard: The Guidelines interpret the Act (section 96) as creating a "trade-off framework" within which likely efficiency can be balanced against likely anti-competitive effects. The anti-competitive effects are defined quite precisely in the Guidelines as the dead-weight loss from increased prices to the Canadian economy as a whole. This interpretation is, in fact, a Williamsonian approach in trading-off efficiencies with anticompetitive effects. However, anti-competitive effects include price increases but also reduction in service, quality, variety, innovation and other non-price dimensions of competition.

Merger specificity: Claimed efficiency gains cannot be considered if the efficiencies would likely be obtained also if the order (that would be required to remedy the anticompetitive effects of the merger) were made. This assessment involves an evaluation of whether any of the likely efficiency gains would also likely be attained through less anti-competitive means if the order in question were made. Examples of alternatives are: internal growth; a merger with an identified third party; a joint venture; a specialization agreement; or a licensing, lease or other contractual arrangement. Efficiencies are not excluded from consideration on the basis that they theoretically could be attained through other means.

Types of efficiencies: The Guidelines use two broad classes of efficiency gains: production efficiencies and dynamic efficiencies. production efficiencies are generally the focus of the evaluation, because they can be quantifiably measured, objectively ascertained, and supported by engineering, accounting or other data. The Guidelines distinguish between product-level, plant-level and multi-plant-level efficiencies. Concrete examples of savings are: mechanisation, specialisation, the elimination of duplication, reduced downtime, a smaller base of spare parts, smaller inventory requirements, the avoidance of capital expenditures that would otherwise have been required, and plant specialization.

Khemani and Shapiro (1993) found that the Canadian antitrust authority has applied the merger guidelines, particularly the efficiency gains criterion in a consistent manner.

IV.1.3. United Kingdom

The 1973 Fair Trading Act (FTA) contains provisions for control of mergers. The system is predisposed in favour of mergers. The Secretary of State may refer a merger to the Monopolies and Mergers Commission (MMC), where he thinks it fits. The Secretary of State is advised by the Director General of Fair Trading (DGFT). A merger may be prohibited if at least a two-third majority of the MMC considers it might operate against the public interest. Even at that stage, the Secretary of State has the discretion not to prohibit the merger.

On many occasions the MMC has considered the impact that a merger would have upon the economic efficiency of the companies concerned. The case law suggests that in order for efficiency gains to be decisive, they must be sufficiently large (Mid Kent Holdings/General Utilities/SAUR), merger-specific (Capital/Virgin Holdings), and passed on to consumers (P & O/Stena). Interestingly, there are cases where efficiency gains have been considered to outweigh loss of (potential) competition (Stagecoach/ Chesterfield Transport).32

Several empirical studies have endeavored to identify the determinants of the antitrust enforcement of MMC's decisions. For instance, Weir (1992; 1993) uses a probit model to evaluate the relationship between the resolutions reached by the Commission and the criteria set out in the statutory "public interest" test, such as prices and quality, cost reduction, new entry, and foreign trade, among others. Weir shows that very few of the issues, which are part of the "public interest," appear to influence the Commission's decision. For example, the author found that mergers are more likely to be allowed if they do not affect either competition or prices. However, potential benefits, such as greater employment or efficiency gains, do not consistently help the would-be merged firm. Davies, Driffield and Clarke (1999) applied the same binary approach to 73 monopoly cases handled by the MMC, finding that the Commission's decision is greatly explained by market shares of the participating firms.

IV.1.4. Mexico

In December 1992 the Mexican Congress promulgated the Federal Law of Economic Competition (FLEC), which created the Federal Competition Commission (CFC) to promote competition in the marketplace and reduce the scope and mode of government intervention in the Mexican economy.33The CFC is the agency in charge of the implementation of competition policy, which includes the investigation of monopolistic practices and the control of vertical and horizontal mergers.

The Law states that any factor that the Commission deems appropriate, given the nature of the relevant market -e.g., sales indicators, number of customers, productive capacity, and so on-, will be used as the input while constructing the concentration indexes. Furthermore, the FLEC sets out a list of factors that, in addition to concentration indices, should be used to determine whether competition has been lessened substantially. Among these factors, the FLEC considers the evaluation of possible efficiency gains by the merged firm. Such efficiency gains include economies of scale and scope, significant reduction of administrative costs, transfer of production technology, and lowering of production costs derived from the expansion of an infrastructure or distribution network.

Avalos and De Hoyos (2008) show that, contrary to the Commission's objective, the presence of efficiency gains increases the probability of a case being challenged. They suggest that there are two ways in which the apparent anomaly behind this result can be explained. First, a proposed merging entity that is aware of potential increases in market concentration as a result of the merger, may be inclined to make larger efficiency claims to try to offset its effect on concentration. Second, the authorities may account for the counteracting effect just explained, and hence be particularly sceptical about ambitious claims of efficiency gains. This result might reflect that Mexican merger policy involves the delicate balancing of anticompetitive effects against possible efficiency gains.

V. Conclusions

We argued that antitrust authorities typically have poorer information than the merging parties about the potential efficiency gains which are supposed to be enjoyed by the new entity. Introducing a capacity-constrained setting model, we showed that by requiring firms to divest some of their assets we can actually achieve self-selection of the more socially worthwhile mergers. The antitrust authority must trade-off the benefits of approving mergers that are desirable against the cost of approving mergers that would decrease welfare, so that approval is only warranted if synergies are large enough.

There is still much work to be done on this topic. First, we were unable to determine general (sufficient) conditions under which our analysis remains valid. We were unable to obtain results describing the conditions under which mandatory divestment is likely to be especially effective. For example, should the divestment increase or decrease with the degree of concentration of the industry? Also, how does the effectiveness of the remedy depend on the specification of demand and on the type of competition assumed? Our model applies to mergers in markets for goods such as steel, oil, and cement, where there is little product differentiation and capacity matters.

Other merger cases occur in industries where firms produce differentiated products. In such cases, divestment often takes the form of shedding one or more product lines or brands. This could be modeled in the price-setting framework of Deneckere and Davidson (1985). The basic conclusion would remain the same: by imposing divestment of product lines, the antitrust authority would block mergers that do not create significant synergies.

Alternatively, one could analyze price competition and capacity divestment in a model in the spirit of Kreps and Scheinkman's (1983), where firms choose capacity before competing in prices. However, such an analysis would be rather complex and might not yield additional insights. After all, Kreps and Scheinkman (1983) have shown that capacity-setting followed by price-setting tends to yield a Cournot equilibrium.

A further weakness of our analysis is that we assume that divested capacity simply vanishes. In practice, such capacity is likely to be sold to another industry participant (or a new entrant). One should add that, sometimes, selling the capacity to another firm is not without problems. One particular problem is the continuing relationship between the merged firm and the buyer of the divested assets after divestiture, such as the supply arrangement or technical assistance requirement, which may increase the buyer's vulnerability to the seller's behavior. Also, buyers often have serious information problems. They may not fully know what assets they need to succeed in the business, or if the assets offered by the respondents are up to the task. Divestitures that include technology transfers pose serious problems: the merged firm's incentives to limit the asset package, the buyer's performance reliance on the respondent for technical assistance and transfer of know-how, and the merged firm's incentives to engage in strategic behavior.34

Finally, since the source of policy inefficiency is asymmetric information between the antitrust authority and the firm, it might be worth analyzing what the (second) best revelation mechanism might look like. However, under the realistic assumption that any incentive scheme cannot be made conditional on post merger performance,35 it is not a priori obvious that it would be very different from the divestment remedy examined here.

References

Avalos, M. and R. De Hoyos (2008), "An Empirical Analysis of Mexican Merger policy", Review of Industrial Organization, 32, pp. 113-130. [ Links ]

Baker, J. B. (1999), "Developments in Antitrust Economics", Journal of Economic Perspectives, 1, 181-194. [ Links ]

Baron, D. (1988), "Regulatory and Legislative Choice", Rand Journal of Economics, 19 (3), pp. 467-77. [ Links ]

Besanko, D. and D. Spulber (1993), "Contested Mergers and Equilibrium Antitrust policy", Journal of Law, Economics & Organization, 9 (1), pp. 1-29. [ Links ]

Bridgeman, J. (1999), "Merger Efficiency - Fact or Fiction?", speech given at Keele University, 3 February (http://www.oft.gov.uk/html/rsearch/sp-arch/spe5-99.htm). [ Links ]

Cabral, L. (2003), "Horizontal Mergers with Free-Entry; Costs Efficiencies May Be a Weak Defense and Asset Sales a poor Remedy", International Journal of Industrial Organization, 21, pp. 607-623. [ Links ]

Cheung, F. (1992), "Two Remarks on the Equilibrium Analysis of Horizontal Mergers", Economics Letters, 40, pp. 119-123. [ Links ]

Coate, M. and F. McChesney (1992), "Empirical Evidence on FTC Enforcement of the Merger Guidelines", Economic Inquiry XXX, pp. 277-293. [ Links ]

Davies, S. W., N. L. Driffield and R. Clarke (1999), Monopoly in the UK: What Determines Whether the MMC Finds Against the Investigated Firms? The Journal of Industrial Economics XLVII, pp. 263-283. [ Links ]

Deneckere, R. and C. Davidson (1985), "Incentives to Form Coalitions with Bertrand Competition", RAND Journal of Economics, 16(4), pp. 473-486. [ Links ]

Dixit, A. (1980), "The Role of Investment in Entry-Deterrence", Economic Journal, Royal Economic Society, 90(357), pp.95-106. 95-106. [ Links ]

Farrell, J. and C. Shapiro (1990), "Horizontal Mergers: An Equilibrium Analysis", American Economic Review, 80, pp.107-126. [ Links ]

Fisher, F.M. (1987), "Horizontal Mergers: Triage and Treatment", Journal of Economic Perspectives, 1, pp.23-40. [ Links ]

Gowrisankaran, G. (1999), "A Dynamic Model of Endogenous Horizontal Mergers", RAND Journal of Economics, 30(1), pp.56-83. [ Links ]

Hay, G. and G. Werden (1993), "Horizontal Mergers: Law, policy, and Economics", American Economic Review, 83, pp.173-177. [ Links ]

Head, K. and J. Ries (1997), "International Mergers and Welfare under Decentralized Competition policy", Canadian Journal of Economics 30, pp.1104-1123. [ Links ]

Khemani, R. and D. Shapiro (1993), "An empirical Analysis of Canadian Merger policy", The Journal of Industrial Economics, 41, pp.161-177. [ Links ]

Kreps, D. and J. Scheinkman (1983), "Quantity precommitment and Bertrand Competition Yield Cournot Outcomes", Bell Journal of Economics, 14, pp.326-338. [ Links ]

Levin, D. (1990), "Horizontal Mergers: The 50-percent Benchmark", The American Economic Review, 80(5), pp.1238-1245. [ Links ]

McAfee, R.P. and M. Williams (1992), "Horizontal Mergers and Antitrust Policy", The Journal of Industrial Economics, 40(2), pp. 181-187. [ Links ]

Motta, M., P. Michel and H. Vasconcelos (2003), "Merger Remedies in the European Union: An Overview", in Francois Leveque y Howard Shelanski (eds.), Merger Remedies in American and European Union Competition Law, Edward Elgar publishers. [ Links ]

Parker, R. and D. Balto (2000), "The Evolving Approach to Merger Remedies", Antitrust Report, FTC, also available at www.ftc.gov. [ Links ]

Perry, M. and R. Porter (1985), "Oligopoly and the Incentive for Horizontal Merger", American Economic Review, 75, pp.219-227. [ Links ]

Pitovsky, R. (1998), "Efficiencies in Defence of Mergers: 18 Months After", Remarks given at George Mason Law Review Antritrust Symposium: The Changing Face of Efficiency, October 16, (http://www.ftc.gov/speeches/pitovsky/pitofeff.htm). [ Links ]

Rogoff, K. (1985), "The Optimal Degree of Commitment to an Intermediate Monetary Target," Quarterly Journal of Economics, 100, pp. 1169-1189. [ Links ]

Röller, L.H., J. Stennek and F. Verboven (2000), "Efficiency Gains from Mergers", papers 543, Industrial Institute for Economic and Social Research. [ Links ]

––––––––––(2006), "Efficiency Gains From Merger", in F. Ilzkovitz and R. Meiklejohn (eds.), European Merger Control: Do We Need an Efficiency Defence?, Edward Elgar Publishing. [ Links ]

Salant, S., S. Switzer and R. J. Reynolds (1983), "Losses from Horizontal Merger: The Effects of an Exogenous Change in Industry Structure on Cournot-Nash Equilibrium", Quarterly Journal of Economics, 98 (2), pp. 185-199. [ Links ]

Spulber, D. and D. Besanko (1992), "Delegation, Commitement, and the Regulatory Mandate", Journal of Law, Economics, & Organization, 8, pp. 126-154. [ Links ]

Weir, C. (1992), "Monopolies and Mergers Commission, Merger Reports and the Public Interest: A Probit Analysis", Applied Economics, 24, pp. 27-34. [ Links ]

Weir, C. (1993), "Merger policy and Competition: Analysis of the Monopolies and Mergers Commission's Decisions", Applied Economics, 24, pp. 57-66. [ Links ]

White, L. J. (1987), "Antitrust and Merger policy: A Review and Critique", Journal of Economic Perspectives, 1, pp. 13-22. [ Links ]

Williamson, O. E. (1968), "Economies as an Antitrust Defense: The Welfare Tradeoffs" , American Economic Review, 58, pp. 18-36. [ Links ]

1 The literature distinguishes between five categories (based on the concept of the production function) of cost savings that may be generated by a merger. These categories can be taken into account in an efficiency defense: i) rationalization of production; ii) economies of scale; iii) technological progress, iv) purchasing economies; and v) reduction of slack (managerial and X-efficiency). For a more detailed discussion, see Röller, Stennek and Verboven (2000).

2 Efficiency gains from horizontal mergers are an important competition policy issue today. Röller, Stennek and Verboven (2006) discuss this issue extensively, and point out that there is a recent debate in many antitrust authorities (particularly in the U.S. and EU antitrust agencies) to include a more precise treatment of efficiency defense in their merger regulations.

3 The assets targeted by the remedy often involve production capacity, long-term contracts or intellectual property.

4 This case was first studied in a seminal paper by Williamson (1968). perhaps it is the most influential contribution, which supports the total welfare approach in merger analysis. Williamson proposed to compare the dead-weight losses due to price increases after the merger with the internal efficiencies generated. Williamson concluded that cost saving might well be very important in a merger's overall welfare effect. High-cost production is replaced by low-cost production because of the merger. This represents an increase in average production efficiency, which accounts for the increase in total surplus.

5 White (1987) and Fisher (1987) argue that efficiency gains are typically easy to claim, but hard to prove. Fisher (1987) argues in favour of a very high standard for proving actual efficiencies, based on several examples where efficiencies were claimed but presumably not materialized, or could have been materialized in another way.

6 Most of the existing merger models do not deal with the dynamics of the merger process, as they simply compare a pre-merger situation with a post-merger situation, without taking into account that a merger might trigger other mergers. A more recent strand of the literature studies the pattern of mergers that can be expected to occur through some endogenous process. For instance, Gowrisankaran (1999) develops a complex dynamic model where merger, exit, investment and entry decisions are endogenous variables rationally chosen by the firm. Despite the fact that this dynamic setting is a promising approach for future research, it is far beyond the scope of this paper. On the other hand, the Cournot model applied in this paper does not capture the trade-off between the proportionality and the efficiency of the structural remedies, and not either the possible adverse welfare effects that might result from the execution of these remedies. These topics are interesting items within the merger debate, which could be explored in further studies.

7 In the Industrial Organization literature, the situation where mergers are typically not profitable for insiders, but are profitable for non-merging firms (outsiders), has become known as the "merger paradox".

8 As in the case of Farrell and Shapiro (1990) and perry and porter (1985), the new firm resulting from the merger will be larger than the non-merging firms. In the Salant, Switzer and Reynolds (1983) framework, the merged firm does not differ from the non-merging firms; it continues to have access to the same technology.

9 We follow perry and porter (1985) in that the new firm has access to the combined productive capacity of both merger partners. The productive capacity in perry and porter's framework takes shape as a tangible asset that the merged firm acquires from its two partners, which increases the output it can produce at a given average cost.

10 However, structural remedies (divestment capacity) have potential problems. Motta, Michel and Vasconcelos (2003) state that use of structural remedies, especially when the divested assets are used to strengthen an existing competitor, might increase the risk of collusion in the industry due to two problems: symmetric and multimarket contacts. One well-known case of a merger involving asset transfers amongst rivals is the Nestlé / Perrier case, in the French mineral water industry. The food product manufacturer Nestlé made a bid for perrier S.A. Nestlé anticipated that the European Commission (EC) would reject the proposed merger because of such increase in concentration, and proposed that, together with the merger, it would transfer Volvic (one of the Nestlé / Perrier water sources) to rival BSN. Nevertheless, such presumption is far from obvious, since the argument can be made that collusion between Nestlé and Perrier is easier when they hold symmetric market shares than when they are very different in size.

11 There is some literature focusing on studies about the policy inefficient asymmetric information between the regulatory agencies and the firms. Examples are Rogoff (1985) on monetary policy, Baron (1988) on regulatory mechanism design, and Spulber and Bensanko (1992) on administrative law. We cannot follow this treatment of the asymmetric information problem. The reason is that in the antitrust merger enforcement process the incentive scheme cannot be made conditional, as proposed by these models.

12 The Farrell and Shapiro's externality condition states that a proposed merger is welfare improving if the external effect of a merger -defined as the change of the total surplus of all consumers and non-merging- is positive.

13 For instance, Cheung (1992) considers a three-firm Cournot oligopoly with linear demand and different marginal cost for each firm, to show how the merging firms have an incentive to mislead government about the true level of synergies generated by the merger. Cheung shows that when firms overstate the true value of synergies, the merger is approved under the Farrell and Shapiro's externality condition.

14 Besanko and Spulber (1993) show that the equilibrium in the merger enforcement process will depend on the welfare standard employed by the antitrust authority. For instance, when the antitrust authority lends sufficiently large weight to producers' surplus, firms will anticipate that the antitrust authority will not challenge a merger; meaning that firms will decide to merge.

15 The assumption that capacity is fixed, is made for simplicity. Otherwise, the model should consider not only external growth (i.e. growth by mergers) but also internal growth (i.e. growth by capital accumulation), which would greatly expand the set of strategies available to firms, considerably complicating the analysis. Still, there are several industries characterized by fixed capacity and difficult (or impossible) entry. Take for instance the cement industry (availability of raw materials and environmental regulations make new production sites unlikey) and the mineral water industry. Other industries that might fit the assumption of fixed capacity are those where entry is regulated by law and subject to licenses or authorization. Think for example of radio, television and telecommunication services, which make use of the wave spectrum. Yet another example of fixed capacity is given by the landing and take-off slots at any airport. The number of slots is fixed, and so an airline can increase its slots if it merges with rivals.

16 For more detail and discussion of this assumption of production costs see Dixit (1980).

17 The antitrust literature identifies various cost savings that may be generated by a merger. Levin (1990) assumes constant returns and heterogeneous marginal costs. A merged firm produces at the minimum of the marginal costs of the merging firms. perry and porter (1985) and McAfee and Williams (1992) assume heterogeneous quadratic cost functions. As a result, production continues to take place at each of the firms involved in the merger, but there will be a real-location of production. Farrell and Shapiro (1990) adopt a general formulation in which mergers may lower costs through rationalization, capital shifting, learning, or economies of scale. Head and Ries (1997) assume that the cost-savings generated by a merger can fully be described by a single parameter. Larger values of such parameter generate greater gains from merging.

18 For the sake of simplicity, we will henceforth assume that b = 1 for the demand function.

19 For instance, when N = 3,c = 0.2 and K = 0.2 equation (20) would be α*= 0.23431, so that α*> 0.23431, so that α* > 0.

20 Although other more complicated modelling specifications may be possible, the divest capacity mechanism α is a straightforward and tractable way to model the rigidity of merger policy.

21 This is a crucial assumption and it is a very sensible weakness. In practice, the capacity to divest is probable to sell to another competitor. Such re-sale would have two opposing effects on the effectiveness of the remedy. On the one hand, by ensuring that all pre-merger capacity is still used in equilibrium, re-sale would reduce the undesirable output-decreasing effect of the remedy. On the other hand, re-sale would also reduce revenues, limiting the impact of divestment on the profitability of mergers, possibly blunting the self-selection mechanism. Another notorious weakness is stated by Cabral (2003). He shows that by requiring the divest capacity mechanism and selling to their rival, merging firms effectively "buy off" the potential entrant; that is, dissuade it from opening new stores, a detrimental effect for consumers.

22 We assume that αr (α = 0)> α*. Later on, we shall determine whether the conditions in α (α)> α* hold.

23 Note that αp (α = 0)= (2c-1) + K(N + 1) O or

O or  , then αp (α = 0)

, then αp (α = 0)  0. In addition, note that αp (α= 1) = 2c >0,then αp(α=1)>0.

0. In addition, note that αp (α= 1) = 2c >0,then αp(α=1)>0.

24 Formally, the effect of a change in α on αp (α) is

25 See equations (15), (16), (17) and (18) respectively.

26 Using simulation, it could be shown that α1 > α2 is fulfilled below the solid black curve, while α1 < α2 is satisfied above the curve.

27 For K = 0.0235, N = 3 and c = 0.03 the model's conditions are satisfied. Moreover, these values yield, as positive, the difference between the divestment policy instruments α1 and α2, i.e. α1 - α2 = 3.6773, so that α1 > α2. Also, the difference between the locus of binding regulation αrand α* is positive, i.e. αr - α*= 7.861; then αr > α*.

28 As in case 1, using simulation it could be shown that for K= 0.0335, N= 3, and c = 0.02 the model's conditions are satisfied. Likewise, these values show that the difference between the divestment policy instruments α1 and α2 is positive, i.e. α1 - α2= 4.673; then α1 > α2. Also here, the difference between the locus of binding regulation αrand α* is positive, i.e. αr- α*= 14.323; then αr > α*.

29 In the next case, we shall see how reducing a decreases the proportion of socially undesirable mergers in greater detail.

30 As in the previous cases, using simulation it could be shown that for K = 0.24759, N = 3, and c = 0.001 the model's conditions are satisfied. Further, these values show that the difference between the divestment policy instruments α1 and α2 is negative, i.e. α1 - α2= - 1.931; then α1 < α2. Once again, the difference between the locus of binding regulation αrand α* is positive, i.e. ar - α* = 217.18; then αr > α*.

31 Two provisions distinguish the Canadian competition law from the laws of many other countries. First, the Tribunal may not reach a conclusion that a merger is likely to prevent or lessen competition substantially solely on the basis of market share or concentration evidence. Second, the Tribunal is obliged to consider the extent of foreign competition, whether any of the parties is likely to fail, the availability of acceptable substitutes, barriers to entry, the extent of remaining competition, whether the merger eliminates a particularly vigorous competitor, and the extent of change and innovation in the market.

32 Some additional cases are discussed by Bridgeman (1999).

33 FLEC Mexico. See Official paper of the Federation (DOF, in Spanish) (December 24, 1992).

34 An illustrative example of this problematic situation was the merger of Schnucks Markets and St. Louis, Missouri Company in 1995. The USA Federal Trade Commission required the divestiture of twenty-four stores by Schnucks. However, Schnucks failed to maintain them properly, producing an unattractive set of assets (see parker and Balto, 2000). Another, more recent example is the World Com/MCI merger. As a condition for approval, the parties were required to divest MCI's internet operations. These were acquired by Cable and Wireless. However, two years after the divestment Cable and Wireless' market share had fallen to less than half of MCI's former share.

35 Antitrust authorities are notoriously reluctant to turn themselves into regulatory agencies monitoring conduct on a continuous basis.