Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Economía, sociedad y territorio

versión On-line ISSN 2448-6183versión impresa ISSN 1405-8421

Econ. soc. territ vol.15 no.49 Toluca sep./dic. 2015

Artículos de investigación

Bureaucratic discretion and legislative oversight on the budget process in Mexico 2001-2012

Discrecionalidad burocrática y supervisión legislativa del proceso presupuestario en México 2001-2012

Rodrigo Velázquez-López Velarde*

* Centro de Investigación y Docencia Económicas (CIDE). e-mail: rodrigo.velazquez@cide.edu

Recibido: 9 de octubre de 2013.

Reenviado: 4 de junio de 2014.

Aceptado: 7 de julio de 2014.

Abstract

The article analyzes the extent to which democratization increased the level of legislative control over the budget process during the first twelve years of democracy in Mexico. Two components of legislative oversight are examined in detail: Haciendas financial information available to legislators and the legislation regulating the government's capacity to allocate and reallocate federal funds. The article finds that while legislators have formal rights to control the bureaucracy, public officials have informal leverage over members of Congress, as well. By distributing resources that legislators can use for patronage purposes, bureaucrats obtain legislators' consent to implement programs at their convenience.

Keywords: budget process, legislative oversight, democratization, Mexico.

Resumen

El artículo analiza el grado en que la democratización incrementó el control legislativo sobre el proceso presupuestal en los primeros doce años de democracia en México. Dos componentes del control legislativo son examinados: la información financiera que Hacienda pone a disposición del Congreso y la legislación para asignar y reasignar fondos federales. Los hallazgos indican que mientras los legisladores cuentan con derechos formales para controlar a los funcionarios, éstos también tienen influencia sobre los congresistas. La burocracia obtiene consentimiento del legislativo para implementar programas a su conveniencia al distribuir recursos a los legisladores que pueden ser utilizados para fines clientelares.

Palabras clave: Proceso presupuestal, supervisión legislativa, democratización, México.

Introduction

Does democratization make bureaucrats accountable? The conventional wisdom of authoritarian regimes states that bureaucrats impose order and control over society at will. Under authoritarian rule public officials have unlimited autonomy and huge bureaucratic discretion to design and implement public policies. To what extent do these practices change under democracy? Do legislatures in new democracies constrain public officials' leeway?

The tension between democracy and bureaucracy has been examined profoundly in developed countries. In the us, for instance, while some scholars argue that officials act autonomously, others claim that legislators are able to rein in bureaucracies through the establishment of various institutional mechanisms (McCubbins et al., 1987, 1989; Carpenter, 2001; Wood 2010). In contrast, it is still unclear whether new democracies have imposed democratic principles and constraints on their bureaucratic structures. Because autonomous bureaucratic practices and actions may slowly undermine democracy, it is critical for the life of these new regimes that public servants are held accountable and responsive to legislators and ultimately to the citizenry. The purpose of this paper is thus to investigate the extent to which democratization produced an increase in legislative control over bureaucracy by examining the budget process during the first twelve years of democratic regime in Mexico (2001-2012).

During the PRI administrations, bureaucrats acted with hardly any constraints (Díaz-Cayeros and Magaloni, 1998; Weldon, 2002). Since the dominant party controlled all branches of government, Congress did not effectively check public programs. This huge bureaucratic discretion to design and implement policies provided ample room for officials to frequently abuse their office with corrupt acts (Ugalde, 2000). Consequently, it is imperative to know whether democratization has produced a change in legislative control over the bureaucracy.

Although in Mexico the legislature's formal control of the bureaucracy has increased in the wake of democracy, in actuality there has not been much of a change.1 Democratic conditions have allowed legislators to enact stricter legislation that in principle should limit bureaucrats' discretion to design and implement public programs. However, in practice, officials do not respect such laws and consequently, bureaucrats continue carrying out policies at their convenience. The reason why there has not been a shift in the legislature's actual influence is that bureaucrats control resources that legislators need.

I argue that in Mexico, the control of governmental resources encourages bureaucrats to influence legislators and not the other way around. Whereas the principal-agent theory stipulates that politicians exert unilateral control over public officials, in Mexico there is a bidirectional authority; one where legislators have formal rights to control bureaucrats, but officials have informal leverage over lawmakers, as well. Due to the absence of a Weberian state2 and extensive state intervention in economic and social spheres, public officials are able to control resources that legislators require in order to advance their careers. By distributing resources that politicians can use for patronage purposes, bureaucrats obtain legislators' consent to design and implement programs as they wish.

The paper proceeds in four sections. First, I address the institutionalist approach for political control of bureaucrats, which is the most influential framework used to analyze bureaucratic-legislative relations in contemporary social science. In this section I also specify how democracy is expected to affect bureaucratic-legislative relations. Section two analyzes the lack of legislative oversight in the budget process; and the third section explains why legislative control over bureaucracy remains at such a low level. The paper concludes that informal mechanisms limited the effectiveness of legislative oversight over the budget process during the first twelve years of Mexico's democracy.3

1. The institutional approach for political control of bureaucrats

Bureaucracies in developing nations remain scarcely studied, at least from a political science perspective. Although institutionalism has examined the executive branch by focusing on presidentialism (Shugart and Carey, 1992; Linz and Valenzuela, 1994; Mainwaring and Shugart, 1997), it has systematically neglected the role of the administrative apparatus that supports presidents. By only addressing presidential-legislative relations, political scientists have ignored the role of bureaucratic-legislative interactions in the political system (some exceptions are: Siavelis, 2000; Cheibub-Figueiredo, 2003; Eaton, 2003; Barreiro, 2006; Ferraro 2008; Velázquez, 2008; Melo et al., 2009; Velázquez 2012).

The few studies of bureaucratic-legislative relations in Mexico suggest that the main factor accounting for the lack of effective oversight is the prohibition of immediate reelection (Díaz-Cayeros and Magaloni, 1998; Ugalde, 2000). This rule weakens legislators' incentives to monitor government agencies and hinders legislative professionalization, which is required to carry out oversight actions. The argument also stresses that even in the case that legislators were experts in some subjects, they would not have enough time to systematically monitor an agency because the no-reelection rule forces them to leave Congress after one term.

While the no-reelection argument makes a contribution, it is not sufficient as an explanation for the continuing weakness of the legislative oversight of the bureaucracy for at least two reasons. First, if the no-reelection rule were the most important factor, there would be a difference between deputies and senators' control over the bureaucracy. This variation should exist because deputies and senators have different time horizons, three and six years respectively. Accordingly, senators should exert greater control given that their term is twice as long. However, senators' supervision of bureaucracy is as ineffective and superficial as the one exerted by deputies (Velázquez 2008; author interviews: May 4th, 8th, 11th, 18th, 23th, 31st; June 13th; July 3rd, 19th; November 10th; December 15th, 2006). Second, if there were consecutive reelection, legislators would also depend on bureaucrats for patronage and favors. Since bureaucrats control such resources, legislators would not reduce their dependency on officials. To secure their reelection, lawmakers would have to maintain the amount of benefits delivered to their districts or states. Hence, if there were reelection, it is very likely that legislators would continue allowing bureaucratic discretion in the design and implementation of public programs in exchange for governmental resources.

In contrast to developing nations, bureaucratic-legislative relations in the us and other industrialized countries have been profoundly explored.4 The most influential studies apply the principal-agent framework from economics to examine how formal rules limit bureaucratic behavior. These analyses build their explanations on the premise that there are informational problems, such as asymmetry of information and expertise, which favors appointed officials. In order to overcome informational problems and prevent undesirable policy outcomes, politicians (principals) create legislation and statutes to control officials (agents).

Legislation sets the limits of what bureaucrats can and cannot do in the design and implementation of public policies and programs. Proponents of the institutionalist approach also assume that bureaucrats implement policies either as legislators want or within clear boundaries stipulated in legislation (Velázquez, 2012). Therefore, the scholars who apply this approach presume that a change in formal rules (legislation) will lead to a change in bureaucratic behavior.

In this vein, Weingast (1984) argues that legislators shape bureaucratic policies through the committee system to satisfy their electoral goals. McCubbins and Schwartz (1984) state that lawmakers establish "fire alarms" instead of "police patrols" to save time and reduce the costs of oversight. The fire alarms system comprises rules, procedures and informal practices that allow citizens and interest groups to oversee bureaucrats' activities. McCubbins et al. (1989) assert that congress people use legislative statutes and procedures to control officials. According to these authors, procedural instructions are included in legislation to ensure that agencies will favor interest groups that support legislators. Similarly, Rosenbloom (2010) argues that in the case of the United States, legislators offset bureaucrat's informational advantage by forcing officials to declare policy changes in advance. This type of procedures helps legislators to prevent deals between bureaucrats and interests groups (Wood, 2010). In contrast, Moe (1989) argues that such procedures are not very useful for controlling officials and impede an effective functioning of the bureaucracy.

John D. Huber and Charles R. Shipan's 2002 book Deliberate Discretion? synthesizes previous analyses and advances a model that explains why some legislatures enact very detailed and specific bills (low-discretion legislation), while others pass ambiguous laws (high-discretion legislation) that provide enormous policymaking latitude to bureaucrats. In this vein, Huber and Shipan argue that the greater the level of policy conflict between lawmakers and bureaucrats, the higher the possibility that legislators will constrain bureaucrats through laws. Moreover, divided governments (where opposition parties control both chambers of Congress) tend to reduce bureaucratic discretion.

Similarly, the higher the level of Congress' legislative capacity, the greater the chance legislators will use such capacity to enact legislation that reduces bureaucratic leeway. In sum, public officials are more constrained by laws when policy conflict is high; the executive branch does not control any legislative chamber; Congress has technical capacity to write low-discretion legislation; and when courts or other institutions may also constrain bureaucratic discretion. In the next segment, I assess to what extent Huber and Shipan's argument, which synthesizes previous institutionalist theories, applies in Mexico.5

2. The expected effects of democratization on legislative oversight

Democratization in Mexico seems to have activated the factors that, according to the institutionalist approach, should increase the level of legislative oversight over public policies and programs. One of these variables is the existence of divided government. Studies analyzing executive-legislative relations frequently assert that when divided government exists —the political context where the legislature is controlled by one party and the executive branch by another— preferences and policy goals between executive agencies and members of Congress tend to differ to a greater extent than when just one party is in control of both branches (Huber and Shipan, 2002; similar in Cox and Kernell, 1991; Epstein and O'Halloran, 1999). Accordingly, it is expected that under divided government policy conflict between Congress and executive agencies will be higher that under unified government. Given that opposition political parties cannot implement their preferred policies by themselves, they will tend to oversee more closely the work of executive agencies and to reduce the level of bureaucratic discretion allowed in legislation.

As it is well known, divided governments in Mexico did not occur during the PRI hegemony (1929- 1997). Therefore, students of Mexican legislative politics as Casar (2002), Weldon (2004) and Béjar (2012) affirm that once the president introduced a bill in Congress it was very likely to be enacted. However, since the emergence of divided governments in 1997, the approval of the executive agenda has become more difficult (Espinoza, 1999). Congressional gridlock in key legislation such as the transformation of the oil industry for years indicates that the level of policy conflict between the president and Congress has significantly increased in the democratic era.

The number of institutions that approve legislation also has an effect on the level of control exerted over the bureaucracy (Clarke, 1998). When divided governments occur in bicameral systems, "conflict is likely to be greater with a divided legislature (i.e. when each chamber of the legislature is controlled by a different party) than with a unified legislature (when one party controls both chambers)" (Huber and Shipan, 2002: 151). Hence, when the legislature is divided it is harder to constrain bureaucrats' discretion than under a unified legislature because, in the case of the former, the president's party —which is in control of one chamber— may hinder the other chamber's effort to reduce bureaucratic leeway.

As previously mentioned, divided governments have been the norm in Mexico since 1997. Nevertheless, up until now the legislature has been divided only during one legislative term (1997-2000). During this period, President Zedillo used his PRI majority in the Senate to block important initiatives such as the opposition efforts to decrease the rate of the value-added tax (Weldon, 2004). In contrast, since 2000 the president's party has not had control of either chamber of Congress. This political context has allowed opposition parties to enact laws that, in principle, limit the policies of the president and his agencies. Accordingly, divided governments with unified legislatures have increased the level of policy conflict between Congress and the president.

In terms of legislative capacity, the legislative branch never developed a high level of expertise during the PRI era because Congress had a limited role in proposing and passing bills. Nevertheless, when PRI started to lose its majority in Congress, legislators subsequently created ten research centers within Congress that offer technical support to lawmakers. The amount of money allocated to these research centers and to legislative assistance in general has significantly increased during the first twelve years of democratic regime in Mexico. For instance, while in 2006, legislators spent 136 million pesos to pay for personal advisors and legislative staff, in 2012, members of the Mexican Congress allotted 256 million for legislative assistance (shop, 2012). The adoption of the civil service system in the Chamber of Deputies in 2000 and the Senate in 2005 has also strengthened legislators' technical capacity.

In sum, democratization has allowed for the emergence of divided government, which intensified the level of policy conflict between Congress and the president. Moreover, divided governments with unified legislatures have allowed legislators to enact laws that seem to give them greater control over the bureaucracy. In the same way, democratic competitive elections have produced a plural party composition of Congress that has positively affected legislative capacity. According to institutional theories, public officials in Mexico should be significantly more constrained under democracy than in the PRI era. In the next section, I assess whether the expected effects of democratization on bureaucratic behavior have occurred in Mexico by analyzing some aspects of the budget process.

3. The budget process

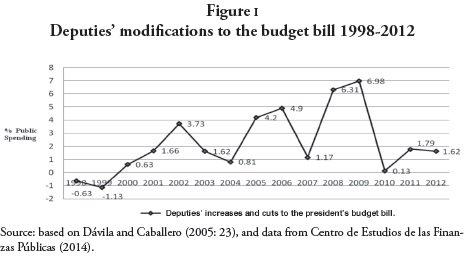

During the PRI era the federal budget was approved with few legislative changes. Once the president introduced the budget bill to the Chamber of Deputies, there was little debate and deputies' amendments were minor (Díaz-Cayeros and Magaloni, 1998; Ugalde, 2000; Weldon, 2002). Substantial modifications to the budget started when PRI did not reach a majority in the lower chamber in 1997. Ever since, deputies have made important changes to the president's budgets (figure 1).6 Lawmakers have significantly redistributed the federal resources channeled to public programs and agencies (Ugalde, 2000). Similarly, deputies have strongly fought for additional resources to benefit their districts, states, population sectors and certain interest groups. A noteworthy dispute between the executive and legislative branches occurred in 2005 when President Fox submitted a constitutional challenge to the Supreme Court arguing that the executive branch had authority to veto certain items of the 2005 budget that were included by deputies.

The antagonism between the executive and legislative branches grew in May 2005 when the Supreme Court ruled that the president could veto the budget.7 Although deputies' influence on the budget process since 1997 is considered by some scholars to be an example of effective legislative control over the executive branch (Casar, 2001; Weldon, 2002), empirical research does not support this conclusion. In practice, public officials have ample discretion to implement public programs and reallocate funds even when legislators have modified the budget bill and other formal rules to constrain executive agencies.

To document that the level of legislative control over the bureaucracy remained low, I first analyze how the principal rules governing fiscal legislation have changed since the nineties, and then assess the divergence between those rules and the extent to which these laws truly constrain bureaucratic behavior in practice. Specifically, I examine two components of legislative control: the Secretaría de Hacienda y Crédito Público's [Secretariat of Finance] (Hacienda hereafter) financial information available to legislators; and the legislation regulating the government's capacity to allocate and reallocate federal funds.8

3.1. Financial information

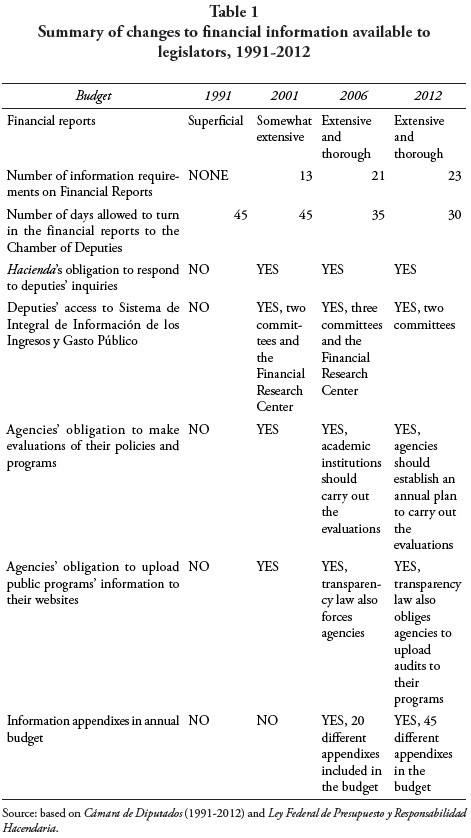

Before 1995, the federal budget did not include any stipulation regulating the content of the financial information provided by Hacienda to Congress. Since then, annual budgets have instructed that information reports should assess the implementation of public programs according to the objectives and goals previously approved. Furthermore, it was stipulated that Haciendas reports must be turned in to the Chamber of Deputies 45 days, at most, after the quarter.

Although these reports were designed as a mechanism to oversee the implementation of public policies, they did not represent a significant constraint to bureaucrats since budgets did not stipulate what type of information officials should send to legislators. Therefore, even though Hacienda bureaucrats had to deliver the financial reports, the information contained in them was very general and superficial. It was not until pan's 2000 victory in the presidential election that legislators significantly increased the number of information requirements that Hacienda should provide in each quarterly report. Accordingly, article 79 of the 2000 budget detailed, for the first time, nine types of information that Hacienda bureaucrats must include in their reports. The number of data requested increased every year until reaching 23 in 2012. More important, as of 2006, the information requirements and other financial dispositions regarding the annual budget were established in a new federal budget law (Ley Federal de Presupuesto y Responsabilidad Hacendaria). This law provides guidelines, limits, and rules that officials should include and specify in each annual budget. Hence, every annual budget has to be elaborated following the budget law instructions. Financial analysts have stated that this law significantly reduced public officials' discretion to design and implement public policies and programs (Author interview: November 24th, 2008).

Besides these requirements, Hacienda has to detail in its reports the difference between the amounts actually approved and expended for every single budget item. In addition, each executive agency should send quarterly reports to their respective legislative committees about the execution and results of their main public programs. In the same vein, deputies established that Hacienda must send an additional report regarding the reallocations of funds channeled to states and municipalities.

Since 2000, another important stipulation regarding the financial information of annual budgets establishes that Hacienda bureaucrats are obliged to respond to deputies' inquiries regarding the execution of public spending within 30 days of the request's submission. Furthermore, deputies established in the 2001 budget that the Hacienda and Budget committees, as well as the Chamber of Deputies' Financial Research Center, should have open, complete and permanent access to Sistema Integral de Información de los Ingresos y Gasto Público (Integral Information System of Incomes and Government Expenditure), which is an information system that compiles all of the country's economic information.9 In 2002, legislators also reduced the time in which Hacienda should send its quarterly reports from 45 to 35 days after the end of the three-month period. Since the enactment of the new budget law in 2007, Hacienda only has 30 days to deliver the financial information to the Chamber of Deputies.

Moreover, the 2005 budget required that the Auditoría Superior de la Federación10 (ASF) analyze Hacienda's Informe de Avance de la Gestión Financiera (a financial report about government spending) during the first semester of the fiscal year. ASF reports to the Chamber of Deputies about the results of the evaluation of such documents. In 2009, this stipulation was permanently established in a new federal audit and accountability law (Ley de Fiscalización y Rendición de Cuentas de la Federación). Article 7 of this new law specifies the information requirements that this report should include and instructs ASF to analyze this report and turn in its conclusions about it to the Chamber of Deputies 30 days later. Another important modification was that each agency must contract external academic institutions to evaluate the efficiency of their programs. Such evaluations have to be sent to both ASF and the Chamber of Deputies and uploaded to the agencies' websites.

Legislators must then consider these studies when developing the next year's budget. Similarly, the 2001 budget instructed all executive agencies to upload to their websites all information regarding their main programs including external evaluations. In the same vein, an amendment to the Transparency Law (Ley Federal de Transparencia y Acceso la Información Gubernamental) in 2012 obliged the executive agencies to upload the results of the audits carried out to their public programs. Additionally, as from 2002 bureaucrats have included appendixes in the budget that contain detailed financial information regarding the amount of federal funds that executive agencies, states and municipalities receive; the public programs implemented by agencies; among other information. The number of appendixes increased from two, in the 2002 budget, to 45 in 2012. Last but not less important, in order to analyze the execution of federal funds throughout the fiscal year, since 2001, the budget instructs Hacienda to apply the same accounting methodology in all its quarterly reports.

The amount of economic data requested in the economic reports, as well as the legislative controls of bureaucratic behavior, has increased as the process of democratization has advanced (see table 1 for a summary). Therefore, some analysts maintain that bureaucrats' obligation to send economic reports to the lower chamber has produced greater legislative control over the way in which officials carry out public policies (Ugalde 2000; Author's interviews: August 16th; November 23rd, 2006; November 24th, 2008).

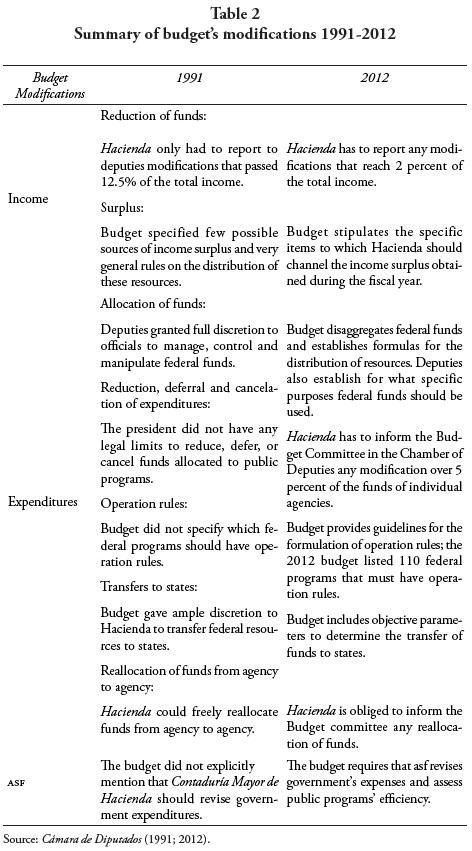

3.2. Congressional control over government's income and spending

The process of democratization also had an effect on the legislative control over government income and spending. During the PRI era, Hacienda did not have to report any reductions or changes to the federal revenue caused by unexpected contingencies. By 1995, however, budget requirements established that Hacienda's bureaucrats had to report to deputies, within 15 days, any modification to the revenue above 15, 000 million pesos, regardless of the percent of total income approved by Congress. Moreover, if the modification exceeds that amount, budget stipulations instructed Hacienda to prepare a plan that specifies the reductions and cuts to be made by the program and agencies. The plan had to be approved by deputies within 15 days of its submission. Additionally, since 2007 Hacienda has to follow specific procedures established in a new budget law —Ley Federal de Presupuesto, Contabilidad y Gasto Público Federal— in case of reductions of the federal revenue.

For instance, article 17 obliges Hacienda to inform deputies of any modification that exceeds two percent of the approved federal revenue. Similarly, article 21 of the budget law stipulates that in case of reductions of the revenue, executive agencies should proceed to make adjustments to the spending in the communications and press offices and other administrative tasks. Moreover, the budget law prohibits officials to make cuts to federal public programs.

In the heydays of PRI, bureaucrats could make use of budget surpluses with hardly any legislative control, as budgets did not impose effective constraints on Hacienda and other agencies in the allocation of additional resources. The 1991 budget, for instance, only stipulated four vaguely described sources of income surplus, and there were no clear rules given regarding how this additional income should be used. By contrast, the 2006 budget establishes 14 possible sources of income surplus and the exact funds and programs to which Hacienda should allocate such surplus. More restrictions were imposed to the management of budget surpluses in the 2006 new budget law. For instance, article 19 of this law regulates in detail different types of budget surpluses and establishes the specific distribution where the additional resources should be allotted.

A similar process occurred in the case of government expenditures, as the president's power to modify or cancel the amount of funds allocated to agencies and programs has been significantly constrained during the process of democratization. The first restrictions were imposed in 1997. Fiscal rules established that Hacienda had to send a report to the Budget Committee when the modifications exceed 10 percent of the amount authorized by deputies. In the 2005 budget, deputies established a stipulation that instructed Hacienda to report any changes to the programs or agencies' that surpassed 15,000 million pesos. Modifications below this amount have to be reported in the financial quarterly reports. Moreover, starting in 2007, Hacienda has to inform the Budget Committee in the Chamber of Deputies any modification over 5 percent of the funds of individual agencies. In addition, Hacienda should report the advances and setbacks of all public programs approved in the budget by June 30th of each fiscal year.

Regarding the allocations of funds during the non-democratic era, budgets were very vague in terms of the amount of money allotted to different sectors. Thus, deputies granted full discretion to officials to manage, control, and manipulate important funds such as those channeled to social expenditures. While the 1991 budget, for example, allocated 51,000 million pesos to social expenditures, it did not establish any rules regarding how this fund should be distributed. With great frequency, bureaucrats used this discretion for clientelistic purposes, granting strategic favors, for example, that would influence votes and tip the balance towards PRI candidates (Magaloni et al., 2007). The bureaucrats' huge discretion to manage federal funds became constrained in 1996 when the funds began to be disaggregated in the budget.

Following the previous example, in 1996 deputies specified that the social expenditures fund should be subdivided into three areas. Additionally, legislators introduced a formula —based on poverty indexes and population, among other parameters— to be used to calculate the distribution of one of these funds. Subsequent budgets were even more detailed and explicitly established for what specific purposes federal funds should be used. For instance, the 2012 annual budget included a specific article to regulate the social expenditures of Oportunidades Program. Among other requirements, the Secretariat of Social Development should turn in the Chamber of Deputies the complete register of the beneficiaries of the program. Similar constraints have gradually been imposed on other budget items such as public health, education, security, and poverty alleviation.

Other important controls and limits to the management of the federal budget have been established during recent years. For instance, since 2006, budgets have included specific stipulations of how the state-owned companies such as Petróleos Mexicanos and Comisión Federal de Electricidad should invest and manage their resources. These agencies are now forced to send financial reports to the Chamber of Deputies. Furthermore, as of 2012, legislators have explicitly prohibited making cuts to public programs focused on women, indigenous people and the development of science and technology.

Another action that, in principle, reduced bureaucrats' discretion to allocate federal funds was the establishment of operation rules (reglas de operación) for federal programs in budgets. Since 2000, budgets have included an entire chapter that provides general guidelines on how operation rules should be formulated. These rules establish the precise objectives, instructions, procedures and formulas that executive agencies have to follow in the execution of programs. These guidelines and directives were formally established in the 2006 budget law. Accordingly, since 2007 agencies must include the reglas de operación of public programs in every annual budget. Although public officials are in charge of formulating the operation rules, the new budget law stipulates that legislative committees may recommend changes to these rules. In the same vein, agencies have to consult with legislative committees before implementing such rules.

While in the past, Hacienda had ample leeway to transfer federal resources to the states; budgets after democratization and the Ley de Coordinación Fiscal (Law on Fiscal Coordination) have established —based on objective parameters— the amount of federal resources distributed among the states.11 Ley de Coordinación Fiscal has been modified several times over the last years. Many of the amendments have constrained Hacienda's discretion to transfer the federal resources to the states by establishing new formulas for the allocation of resources. In addition, legislators have established controls and procedures on how states must utilize federal resources. For instance, modifications to the Ley de Coordinación in 2007 forced states to carry out evaluations of the public programs implemented with federal funds. Hacienda should include such evaluations in the financial quarterly reports sent to the Chamber of Deputies.

PRI administrations used to allow bureaucrats to freely reallocate funds from one agency to another. Since 2000, however, Hacienda officials have defined clear limits on the amount of money that can be transferred from one agency to another. The 2006 budget, for instance, required Hacienda to notify the Budget Committee of the Chamber of Deputies if the transfer either exceeds 10 percent of a budget item or overpasses 1 percent of the programmable expenditures. By 2012, Hacienda was obliged to inform the Budget committee of any reallocation of funds.

Regarding oversight of government expenditures during the PRI era, annual budgets stipulated that Hacienda was the institution in charge of overseeing the execution of the budget. Since 2003, however, annual budgets explicitly order ASF to supervise government spending approved in the budget and verify the accomplishment of goals and objectives. Another important change came in 1999 when the Constitution was amended in order to create ASF, which replaced Contaduría Mayor de Hacienda. This constitutional reform, along with the enactment of Ley de Fiscalización Superior de la Federación in 2000, granted more authority to ASF to supervise —ex post— public spending, as well as to audit federal transfers to states and municipalities (Ugalde, 2000). As previously mentioned, this law was substituted with a new federal audit and accountability law (Ley de Fiscalización y Rendición de Cuentas de la Federación) in 2009, which strengthened the powers of ASF.

As this section described, the process of democratization brought important changes to the budget laws (see summary of changes in table 2). Legislators have transformed formal rules to force Hacienda and other agencies to consistently report detailed information about the way government resources are being spent, as well as the effectiveness of the public policies and programs they fund. Regarding bureaucrats' discretion to assign, reallocate and manage the budget, members of Congress have established many constraints that, in principle, reduce the officials' discretion to manage federal funds for their own purposes. All these changes seem to indicate that the institutional theories apply very well in Mexico. But does this theory hold when the analysis goes beyond formal rules? What happens in real budgetary politics?

4. Politics in practice

Despite the fact that democratization has allowed legislators to enact stricter budgets, in practice, not much has changed. The main reason for this is that there is a breach between the formal rules and what really happens with their implementation in the budget process. In this section, I illustrate why the financial information Hacienda is required to submit is not an effective mechanism to exert control over bureaucrats. I also present evidence of how, in practice, the legislative constraints on government income and expenses do not effectively reduce bureaucratic leeway.

4.1. Financial information

As previously mentioned, legislators have included a provision in budgets that forces Hacienda to send quarterly financial reports to Congress. Although this requirement may look like an effective tool for exerting legislative control over Hacienda bureaucracy, in practice their effects on controlling the bureaucracy are very limited. Interviews with legislators and legislative staff reveal that lawmakers neither analyze the Hacienda nor ASF reports. Two former secretarios técnicos12 (technical secretaries) of the Budget and Hacienda committees in both legislative chambers stated that there is no systematic review of these documents, and that committee members neither read the reports nor asked legislative staff to examine them (Author interviews: August 30th; November 10th, 2006).

Among the main reasons why legislators do not analyze these reports are the limited time to carry out their duties and because they do not clearly see a political profit performing this activity.13 Hence, financial reports are usually received and promptly stacked in congressional archives. Fourteen members of the Hacienda and Budget committees (including five chairs between 1982 and 2006) confirmed the secretarios técnicos' statements14 (Author interviews: May 4th, 18th, 19th, 23rd; August 2nd, 16th, 23rd, 30th; September 5th, 2006).

Moreover, although the main purpose of the Hacienda reports is to give an account of its actions, they do not completely fulfill this objective. The quality of the information contained in the reports and the cuenta pública15 (Public account) is very poor. The information is not well synthesized, raw economic data is included, and the amount of information is excessive. Information from interviews suggests that the lack of legislators' interest in these reports unintendedly caused a greater decline in the quality of information provided. According to a top Hacienda official in charge of elaborating the economic reports, the quality of the reports worsen once officials noticed that members of Congress did not pay attention to them (Author interview: October 31st, 2006). Fifteen more legislative staff" and Hacienda officials interviewed made similar statements about the quality of the government's financial information available to legislators.

ASF, which is the congressional office that carries out ex post oversight actions over the government financial management, has continuously denounced the low quality of the Hacienda information and the agency's infringements on both the budgets' provisions and other fiscal legislation regarding financial information.16 Even when opposition legislators reached a majority in the Chamber of Deputies in 1997, thereby allowing them to demand greater adherence to the budget's stipulations, Hacienda continued to depart from the information requirements established in annual budgets.

The 1998, 1999 and 2000 Decretos, for instance, decried that Hacienda continued to not provide disaggregated taxpayer information. Without this information, legislators affirmed, it is impossible to evaluate the government's taxation policy. In 2001, ASF found that Hacienda failed to report in Cuenta Pública that 0.26 percent of the total budget was not used during the fiscal year (ASF, 2001, Tomo Ejecutivo: 68). In 2002 and 2003, ASF detected that Hacienda had either not registered or reported inaccurately 159,000 and 235,000 million pesos, respectively. This amount represented 10.89 and 15.46 percent of the total budgets exerted in those fiscal years (ASF, 2002, Resumen Ejecutivo: 29-30; 2003, RE: 38).

In 2004, the ASF's final report noted that Hacienda changed its own performance indicators in Cuenta Pública to assess the efficiency of the government's expenditures. Similarly, in 2005 ASF found significant differences between the information presented in Hacienda's quarterly reports and Cuenta Pública. (ASF, 2005 III (1): 56-62). In 2006, ASF reported that the Tax Administration System, an Hacienda agency, violated several articles of the reglamento (regulations) of the current budget law by not reporting in Cuenta Pública the complete revenue information obtained through customs' taxes (ASF, 2006, RE: 16-17; III (5): 434-446). In 2007, 2008 and 2009 deputies either pointed out that Hacienda provided incomplete information regarding certain federal funds or criticized the quality of the information. In 2008 and 2009, legislators denounced lack of transparency of the financial information provided by Hacienda. Specifically, members of the Chamber of Deputies stated that the aggregated financial data allowed the continuation of officials' discretion in the management of public resources (Cámara de Diputados, 2012a: 4; 2012b: 6).

4.2. Real congressional control over government's income and public spending

As described earlier, the process of democratization allowed legislators to establish stricter budgetary laws. Yet, in practice, bureaucrats deliberately ignore the limits established in annual budgets regarding the government's income and the distribution of federal funds. Despite the opposition's triumph in the 1997 midterm congressional election, legislators were not able to exert effective control over the bureaucracy, and Hacienda's violations of budgetary regulations persisted. In terms of public financing, officials from diverse agencies continued to either overspend or underspend budget funds allocated to public policies and programs. In 2002 and 2003, for instance, Hacienda did not adhere to article 24 of the annual budget since the agency allowed the overspending of diverse decentralized agencies. The total unauthorized amount was 3,172 and 1, 270 million pesos in 2002 and 2003, respectively (ASF, 2000-2012, Tomo Ejecutivo: 133-134; 2003, TE: 146-147).

Mexico City's newspaper Reforma detected that, in 2006, certain government agencies spent more money than the amount approved in the annual budget. According to Reforma, the agencies whose spending exceeded the amount authorized by the Chamber of Deputies in 2006 were: Secretaría de Energía (Secretariat of Energy): 194 percent; Hacienda: 38 percent; Gobernación (Interior): 33.6 percent; Relaciones Exteriores (Foreign Affairs): 20.9 percent; and the Office of the President: 17.6 percent (Almanza, 2007). In terms of underspending, diverse federal agencies have not utilized all the resources approved in the annual budget during the democratic era. In 2008, agencies such as Secretaría de Salud (Secretariat of Health), Educación (Education) and Desarrollo Social (Social Development) did not spent 30, 000 million pesos in public programs. This amount was equivalent to 75 percent of the federal fund for the strengthening of municipalities that year (Loeza, 2009). The agencies' underspending continued during all President Calderon's administration. In his last year, the underspending of the entire federal administration reached almost 84,000 million pesos (Garduño and Méndez, 2012).

Moreover, Hacienda bureaucrats repeatedly failed to respect budget stipulations regarding the allocation of funds. For instance, deputies denounced the fact that, in every fiscal year between 1996 and 2000, Hacienda used funds from annual budgets to pay previous fiscal debts. The funds for these payments were neither considered in annual budgets nor authorized by deputies (Cámara de Diputados, 1998-2000). Interviews with Hacienda officials confirmed the persistence of high bureaucratic discretion in the democratic era. A former top-level Hacienda official asserted that the agency makes over 1000 modifications to the budget every year without the consent of Congress (Author interview: August 2nd, 2006). Hacienda chooses not to disclose all the important financial information to legislators so that bureaucrats can make modifications to the budget without the approval of Congress (Author interview: October 31st, 2006).

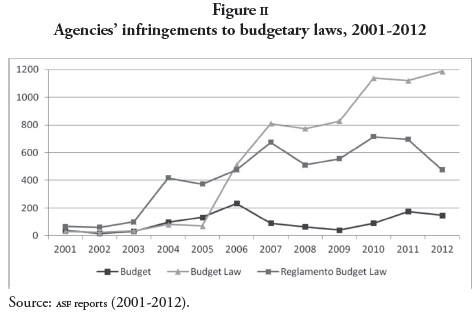

The change of regime that came with the pan's victory in the 2000 presidential election did not significantly increase the level of legislative control over Hacienda and other bureaucratic agencies. Since 2001, the ASF's reports have revealed the agencies' continued lack of adherence to budget laws. Figure 2 shows the number of federal agencies' infringements to the main budgetary laws between 2001 and 2012. As it is observed, far from having a decrease in the number of violations to budgetary laws, ASF has detected more infringements committed by federal agencies almost every year.

Regarding Haciendas management of federal funds, pan administrations committed suspicious actions in the democratic period. On the last day of the 2003 fiscal year, for example, Hacienda transferred 2,600 million pesos to the Infrastructure Investment Fund. This amount surpassed the original resources authorized for this fund by 290.7 percent (ASF, 2003 III [1]: 537-551). In 2005, ASF found diverse irregularities in another Hacienda agency, Tesorería de la Federación (Federal Treasury). This agency infringed the budget law and other fiscal and accounting manuals. Among the most important wrongdoings found were that Tesorería made inappropriate transfers into their accounts and incorrectly registered 2,187 million pesos (ASF, 2005 III [1]: 568-609). Similarly, in 2009 Hacienda improperly transferred 1,717 million pesos to Tesorería. Hacienda argued that the resources were the remnant from a special government fund to support federal public programs. However, ASF detected that Hacienda did not fully justified the source of these resources (ASF, 2009, Tomo Ejecutivo: 59).

Despite the enactment of stricter rules regarding the implementation of the budget, in practice, public officials still have great discretion to operate given that they either ignore the new legislation or modify the programs' operation rules at their convenience in order to continue managing public funds at their will. Hacienda, for instance, systematically ignored budget stipulations regarding the distribution of oil surplus revenues. Between 2003 and 2004, Hacienda took 29 000 million pesos from the oil surplus revenue to pay debts from diverse public enterprises. This action was not stipulated in the 2003 and 2004 budget laws; and deputies did not subsequently approve this change (ASF, 2005 III (2): 62-63).

In 2005, Hacienda did not present enough evidence to prove the transfer of 4,877 million pesos from the oil surplus to the natural disasters fund (ASF, 2005 III [2]: 62; 72-80). In 2006, Hacienda infringed article 25 of the budget by not providing evidence that 9.45 percent of the resources to cover the federal taxes of other government agencies17 (ASF, 2006 III [2]: 290-321). Hacienda continued breaking budgetary laws during all president Calderon's administration. One of the frequent wrongdoings was that Hacienda reallocated millions of pesos without justification. In 2008, for instance, Hacienda took 500 million pesos from one federal fund and reallocated to others without the approval of the Chamber of Deputies (ASF 2008, Tomo Ejecutivo: 95).

The 2009 ASF report pointed out that Hacienda increased 73 percent of the resources allotted to some agencies including the Secretariat of Foreign Affairs and the Office of the President without congressional approval (ASF 200, Tomo Ejecutivo: 50). In 2010, Hacienda did not explain the reallocation of 900 million pesos to the natural disaster fund (ASF 2010, Tomo Ejecutivo: 56). Finally, in 2012, ASF revealed that Hacienda reallocated 74, 844 million pesos to diverse agencies without providing a legal explanation (ASF 2012, Tomo Ejecutivo: 96).

Due to the fact that lawmakers did not publicly denounce Hacienda's wrongdoings, it seems that they had scarce interest in exercising their oversight functions. A parliamentary survey applied to deputies in 2003 revealed that only 1.6 percent considered "controlling government activities" as their main legislative function (Universidad de Salamanca and cesop, 2006: 95). Therefore, it makes sense that there was no systematic effort to ascertain whether bureaucrats, in fact, implemented the federal budget exactly as it was approved by deputies. In the best scenario, legislators either asked public officials to appear before committees or proposed puntos de acuerdo (non-binding resolutions) in order to solve programs' failures. However, in both actions legislative control is inefficient and very superficial. According to 95 percent of the legislators and bureaucrats interviewed, comparecencias (officials' appearances before congressional committees) and puntos de acuerdo, are not efficient mechanisms to solve problems or correct agencies' mistakes.

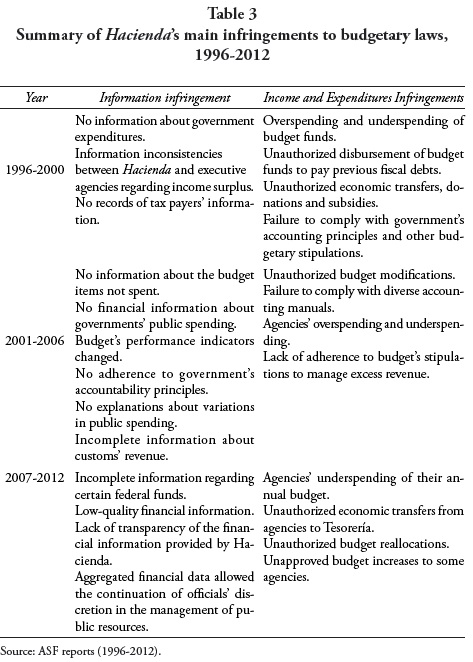

In sum, the rule of law in Mexico, in terms of the budget process, is deficient (see table 3 for a summary). Whereas Hacienda bureaucrats did not respect the procedures established by legislators, deputies did not effectively use their oversight powers. What explains the lack of effective legislative control over the budget process in democratic Mexico?

5. The applicability of the principal-agent theory in developing countries

To answer the previous questions it is necessary to first assess the applicability of principal-agent theory in developing countries. There are two main differences between legislators and bureaucrats in developed and developing countries: First, due to the strength of informal patterns of behavior, the principal cannot have effective control over the agent through legislation. The assumptions of the institutionalist approach presuppose there is an effective rule of law and that relationships between officials and legislators are largely regulated by formal rules. This does not seem to be the case in many underdeveloped countries, where bureaucrats do not follow clear rules in their day-to-day behavior (Grindle, 1977; Helmke and Levitsky, 2004). Even if legislators enact low-discretion legislation there is no guarantee that bureaucrats will act as lawmakers want. The weak rule of law, along with the absence of a Weberian state, makes it exceedingly difficult to constrain bureaucratic behavior through laws and statutes.

Second, in developing countries there is not only an asymmetry of information between bureaucrats and legislators but also a disadvantage in terms of the control of governmental resources. Under these conditions bureaucrats have informal but significant leverage over their principals who, in theory, have the right and responsibility to allocate the resources of the state. Consequently, the institutionalist framework may not work well in political systems where the executive branch still intervenes deeply in diverse societal and economic spheres. Given this kind of intervention, bureaucrats have control over multiple resources that are allotted in a discretionary way. Bureaucrats in these settings often become involved in patronage-client relationships (PCRS) in which officials offer benefits to legislators in exchange for allowing bureaucratic discretion in the design and implementation of policies.

The benefits might range from resources, goods and special favors for legislators' constituency or interest groups, to getting a position within the agency. By allowing bureaucrats to have huge leeway legislators secure resources to distribute among their constituents and other interest groups that politically support them. The legislative-bureaucratic relationship would deteriorate if policymakers started investigations or accused bureaucrats of policy failures.

Information from interviews indicates that PCRS between legislators and bureaucrats persist in Mexico. Executive agencies have diverse methods to influence legislators. In the two-step method, for instance, Hacienda first offers diverse goods, such as food, pieces of clothing or money, to legislators so they can distribute them among their constituents. Lawmakers return the favor either by maintaining the status quo or by passing diverse provisions that Hacienda wants to have included in fiscal laws. If there are some legislators that refuse to accept Hacienda's requests, in a second step, bureaucrats threaten them with audits to their personal finances or companies, if any.

Ultimately, "legislators end up doing what Hacienda wants" (Author interviews: July 19th; August 23rd, 2006). Another bureaucratic method to manipulate lawmakers' behavior is to grant special fiscal treatment to interest groups or companies that support politicians' careers. Legislators, then, frequently meet bureaucrats to ask for favors for themselves or their constituents. Upon legislators' request, Hacienda postpones or calls off audits to those local companies that infringed fiscal laws (Author interviews: July 19th, October 31st, 2006).

The previous statements are consistent with the fiscal privileges that Hacienda grants to some private companies. During the PRI era, Hacienda established a fiscal system that included tax exemptions and privileges for companies and entrepreneurs that supported the regime. Although PRI lost the presidency in 2000, the fiscal privilege system continued. According to a 2005 ASF audit, fiscal laws exempted some companies from paying taxes. In the same vein, ASF noted that billions of pesos were disbursed in tax refunds. Furthermore, tax refunds were highly concentrated. Between 2000 and 2005, 679, 000 million pesos were refunded to taxpayers. Just in 2005, Hacienda refunded 149, 000 million pesos. This figure is equivalent to 15 percent of the total taxes collected during the fiscal year. Furthermore, 76.5 percent of that amount was refunded only to 398 taxpayers. It is noteworthy that 100 taxpayers, who had an annual income of at least 50 million pesos, ended paying to Hacienda less than 70 pesos after tax refunds (ASF, 2005 TE: 103-104; ASF, 2005 III [1]: 364-392).

There is also an especial treatment to some individuals and companies that have fiscal debts with Hacienda. In 2005, for instance, Hacienda registered 495, 000 million pesos in fiscal debts. This amount represents 98.5 percent of the central public administration's programmable spending. ASF detected that 0.04 percent of the debtors owed 48.3 percent of the total fiscal debt. Moreover, ASF also found that Hacienda only recovered 1.7% of the debt by the end of the fiscal year. ASF concluded that the low recovery rates were due to the fiscal privileges and preferential systems established in laws and urged Congress to enact stricter legislation in this subject (ASF, 2005 TE: 144-145; ASF, 2005 III [5]: 172-210). The tax exemptions and privileges continued during the second pan administration. In fact, ASF estimated that between 2002 and 2012, the federal government did not collect 6.09 billion pesos because of the tax exemptions and privileges. This amount was equivalent to the 53 percent of the taxes collected during this period (ASF 2012, Tomo Ejecutivo: 85).

The previous information shows that agents in developing countries have the means to influence their principals. Bureaucratic leverage over legislators is not taken into consideration in the principal-agent theory. As previously mentioned, this framework assumes unidirectional authority from principal to agents. As shown in the previous examples, in developing countries there is a bidirectional authority where principals have formal rights to control the agents, but agents have informal leverage over principals as well. These informal mechanisms of influence neutralize the formal control powers that legislators have over bureaucrats. The extent to which officials can influence lawmakers depends on the bureaucrats' degree of control over governmental resources. The higher it is, the greater their leverage over legislators and the lower the legislators' control over public programs.

Given extensive state intervention; the absence of a Weberian state; bureaucrats' power to control government resources; and the legislators' need for resources; is it possible to exert legislative control over public programs in Mexico? In principle it is possible to control bureaucrats. However, effective control over the bureaucracy emerges only if politicians hold the perception that a policy or agency is hurting their interests. This happens when an agency implements or modifies a policy in a way that systematically hurts political parties' privileges. Under this circumstance, lawmakers will carry out oversight actions that lead to either the transformation or the elimination of the policy. The failure to pursue oversight actions could imply long-term negative consequences for legislators.

Conclusion

Even though democratization in Mexico has set in motion the strengthening of certain functions of Congress, especially its proposing, amending and blocking powers, legislative control of the bureaucracy barely increased during the first years of the democratic era. The factors that, according to the institutionalist approach, decrease the level of bureaucratic discretion had only a limited effect on reducing officials' latitude. The analysis of the budget process suggests that divided governments with unified legislatures, coupled with a higher level of legislative capacity, only allowed legislators to enact stricter laws during the administrations of President Fox and President Calderón. However, the analysis of two components of the budget process also illustrates that the changes in formal rules did not significantly alter officials' behavior.

The findings suggest that Mexican public officials have the political power to influence their controllers. The source of this bureaucratic power is the capacity to control valuable resources on which legislators depend. Accordingly, bureaucrats and lawmakers enter into informal patron-client relationships where the former provide governmental resources or favors to the latter in exchange for their consent to carry out public policies in a discretionary way. Thus, legislators deliberately fail to use their control powers to rein in agencies. Effective oversight actions over certain public policies or programs will lead bureaucrats to cut the flow of resources that are distributed to legislators.

The case of Mexico suggests that the enforcement of formal rules is limited in countries without a Weberian state and extensive state intervention. In these settings, legislators may be able to reduce bureaucratic discretion in formal legislation, but in practice they still allow ample bureaucratic discretion to design and implement public policies. Although democratization has produced changes that gave more formal control powers to legislatures in developing countries, it has not eliminated the informal mechanisms used by bureaucrats to influence legislators. The lack of adherence to formal regulations indicates that democracy may facilitate the conditions for the existence of bureaucratic accountability, but it will not necessarily make it happen.

References

Almanza, Lucero (2007), "Exceden gasto sin ser vigilados", Reforma, March 6th, Consorcio Interamericano de Comunicación, México, <www.reforma.com>, April 12th 2013. [ Links ]

ASF (Auditoría Superior de la Federación) (2000-2012), Informes del resultado la revisión y fiscalización de las cuentas públicas, ASF-Cámara de Diputados, México, <www.asf.gob.mx>, June 2014. [ Links ]

Barreiro, Leany (2006) "¿Cómo controla el Congreso brasileño al Ejecutivo? El uso de pedido de informes, la convocatoria de autoridades y las propuestas de fiscalización y control", in Mariana Llanos and Ana María Mustapic (eds.), El control parlamentario en Alemania, Argentina y Brasil, GIGA-Konrad Adenauer Stiftung-Homo Sapiens Ediciones, Buenos Aires, pp. 95-124. [ Links ]

Béjar, Luisa (2012), "¿Quién legisla en México? Descentralización y proceso legislativo", Revista Mexicana de Sociología, 74 (4), UNAM, México, pp. 619-647. [ Links ]

Cámara de Diputados (1991-2012), "Presupuestos de Egresos de la Federación", Diario Oficial de la Federación, SEGOB, México. [ Links ]

Cámara de Diputados (1991-2009), "Decretos relativos a la revisiones de las Cuentas Públicas correspondientes a los Ejercicios Fiscales", Diario Oficial de la Federación, SEGOB, México. [ Links ]

Cámara de Diputados (2006), "Ley de Presupuesto y Responsabilidad Hacendaria", Diario Oficial de la Federación, March 30th, SEGOB, México, pp. 3-39. [ Links ]

Cámara de Diputados (2012a), "Decreto relativo a la revisión de la Cuenta Pública correspondiente al Ejercicio Fiscal 2008", Diario Oficial de la Federación, May 4th, SEGOB, México, pp. 2-4. [ Links ]

Cámara de Diputados (2012b), "Decreto relativo a la revisión de la Cuenta Pública correspondiente al Ejercicio Fiscal 2009", Diario Oficial de la Federación, May 4th, SEGOB, México, pp. 4-6. [ Links ]

Carpenter, Daniel (2001), The Forging of Bureaucratic Autonomy: Reputations, Networks, and Policy Innovations in Executive Agencies 1862-1928, Princeton University Press, New Jersey. [ Links ]

Casar, María Amparo (2001), "El proceso de negociación presupuestal, el primer gobierno sin mayoría: un estudio de caso", working paper núm. 137, CIDE, México. [ Links ]

Casar, María Amparo (2002), "Executive-Legislative Relations: The Case of Mexico 1946-1997", in Scott Morgenstern and Benito Nacif (eds.), Legislative Politics in Latin America, Cambridge University Press, Cambridge, pp. 114-146. [ Links ]

Centro de Estudios de las Finanzas Públicas (2014), Cámara de Diputados, México, <www.cefp.gob.mx>, June 2014. [ Links ]

Cheibub-Figueiredo, Argelina (2003), "The Role of Congress as an Agency of Horizontal Accountability: Lessons from the Brazilian Experience", in Scott Mainwaring and Christopher Welna (eds.), Democratic Accountability in Latin America, Oxford University Press, New York, pp. 170-197. [ Links ]

Clarke, Wes (1998), "Divided Government and Budgetary Conflict", Legislative Studies Quarterly, 23, The University of Iowa, Iowa, pp. 5-23. [ Links ]

Cox, Gary and Samuel Kernell (eds.) (1991), The Politics of Divided Government, Westview Press, Boulder. [ Links ]

Dávila, David and Lila Caballero (2005), El sistema de comisiones, el cabildeo legislativo y la participación ciudadana en el Congreso mexicano, Fundar Centro de Análisis e Investigación, México, pp. 1-55. [ Links ]

Díaz-Cayeros, Alberto and Beatriz Magaloni (1998) "Autoridad presupuestal del Poder Legislativo en México: una primera aproximación", Política y Gobierno, V (2), CIDE, México, pp. 503-528. [ Links ]

Eaton, Kent (2003), "Can Politicians Control Bureaucrats? Applying Theories of Political Control to Argentina's Democracy", Latin America Politics and Society, 45 (4), University of Miami, Miami, pp. 33-62. [ Links ]

Epstein, David and Sharyn O'Halloran (1999), Delegating Powers: A Transaction Cost Politics Approach to Policymaking Under Separated Powers, Cambridge University Press, New York. [ Links ]

Espinoza, Ricardo (1999), "La relación ejecutivo-legislativo en la LVII Legislatura", Diálogo y Debate, 9, Cámara de Diputados, México, pp. 174-188. [ Links ]

Evans, Peter and James Rausch (1999), "Bureaucracy and Growth: A Cross-National Analysis of the Effects of 'Weberian' State Structures on Economic Growth", American Sociological Review, 64 (5), Washington, pp. 748-765. [ Links ]

Ferraro, Agustín (2008), "Friends in High Places. Congressional Influences on the Bureaucracy in Chile", Latin American Politics and Society, 50 (2), University of Miami, Miami, pp. 101-130. [ Links ]

Garduño, Roberto and Enrique Méndez (2012), "Subejercicio presupuestal de casi 84 mil millones en áreas sustantivas: PRD", La Jornada, November 15th, UNAM, México, p. 14. [ Links ]

Grindle, Merilee (1977), Bureaucrats, politicians, and peasants in Mexico, University of California Press, Berkeley-Los Angeles. [ Links ]

Helmke, Gretchen and Steven Levitsky (2004), "Informal Institutions and Comparative Politics: A Research Agenda", Perspectives on Politics, 4, American Political Science Association, New York, pp. 725-740. [ Links ]

Hernández, Erica (2005), "Reasignan diputados el gasto congelado", Reforma, October 11th, Consorcio Interamericano de Comunicación, S. A. de C. V., México, <www.reforma.com>, June 10th 2014. [ Links ]

Huber, John and Charles Shipan (2002), Deliberate Discretion?, Cambridge University Press, Cambridge. [ Links ]

Huber, John and Nolan McCarty (2004), "Bureaucratic Capacity, Delegation, and Political Reform", American Political Science Review, 98 (3), American Political Science Association, Washington, pp. 481-494. [ Links ]

Linz, Juan and Arturo Valenzuela (eds.) (1994), The Failure of Presidential Regimes, The Johns Hopkins University Press, Baltimore. [ Links ]

Loeza, Carlos (2009), "El subejercicio en el 2009", El Economista, February 19th, Periódico El Economista, México, <www.eleconomista.com. mx>, June 30th 2014. [ Links ]

Magaloni, Beatriz, Alberto Díaz-Cayeros and Federico Estévez (2007), "Clientelism and Portfolio Diversification: A Model of Electoral Investment with Applications to Mexico", in Herbert Kitschelt and Steven I. Wilkinson (eds.), Patrons, clients, and policies, Cambridge University Press, New York, pp. 182-205. [ Links ]

Mainwaring, Scott and Matthew Soberg Shugart (eds.) (1997), Presidentialism and Democracy in Latin America, Cambridge University Press, Cambridge. [ Links ]

McCubbins, Mathew and Thomas Schwartz (1984), "Congressional Oversight Overlooked: Police Patrols versus fire Alarms", American Journal of Political Science, 8 (1), Midwest Political Science Association-Wiley, New Jersey, pp. 165-179. [ Links ]

McCubbins, Mathew, Roger Noll and Barry Weingast (1987), "Administrative Procedures as Instruments of Political Control", Journal of Law, Economics, and Organization, 3 (2), Oxford University Press, Oxford, 243-277. [ Links ]

McCubbins, Mathew, Roger Noll and Barry Weingast (1989), "A Theory of Political Control and Agency Discretion", American Journal of Political Science, 33 (3), Midwest Political Science Association-Wiley, New Jersey, pp. 568-611. [ Links ]

Melo, Marcus André, Carlos Pereira and Carlos Mauricio Figueiredo (2009), "Political and Institutional Checks on Corruption: Explaining the Performance of Brazilian Audit Institutions", Comparative Political Studies, 42 (9), Sage Publications, Thousand Oaks, pp. 1217-1244. [ Links ]

Moe, Terry (1989), "The Politics of Bureaucratic Structure", in John Chubb and Paul Peterson (eds.), Can the Government Govern?, The Brookings Institution, Washington, pp. 267-329. [ Links ]

Mullins, Daniel and John Mikesell (2010), "Innovations in Budgeting and Financial Management", in Robert Durant (ed.), The Oxford handbook of American bureaucracy, Oxford University Press, New York, pp. 738-766. [ Links ]

Reyes-Hernández, Marlen, Pablo Mejía-Reyes and Paolo Riguzzi (2013), "Ciclo político presupuestal y gobiernos con y sin mayoría en México, 1994-2006", Economía, Sociedad y Territorio, XII (41), El Colegio Mexiquense, Zinacantepec, pp. 79-119. [ Links ]

Rosenbloom, David (2010), "Reevaluating Executive-Centered Public Administrative Theory", in Robert Durant (ed.), The Oxford handbook of American bureaucracy, Oxford University Press, New York, pp. 101-127. [ Links ]

SHCP (Secretaría de Hacienda y Crédito Público) (2012), "Cuenta de la Hacienda Pública Federal, México", SHCP, <http://www.shcp.gob.mx/EGRESOS/contabilidad_gubernamental/Paginas/cuenta_publica.aspx>, June 17th 2014. [ Links ]

Shugart, Mathew and John Carey (1992), Presidents and Assemblies, Cambridge University Press, Cambridge. [ Links ]

Siavelis, Peter (2000), "Disconnected Fire Alarms and Ineffective Police Patrols: Legislative Oversight in Post-Authoritarian Chile", Journal of Interamerican Studies and World Affairs, 42 (1), University of Miami, Miami, pp. 71-98. [ Links ]

Sour, Laura, Irma Ortega and Sergio San Sebastián (2004), "Política presupuestaria durante la transición a la democracia en México: 1997-2003", Documento de trabajo núm. 142, CIDE, México. [ Links ]

Ugalde, Luis Carlos (2000), The Mexican Congress: Old Player, New Power, Center for Strategic and International Studies, Washington. [ Links ]

Universidad de Salamanca-CESOP (Centro de Estudios Sociales y de Opinión Pública) (2006), Actitudes, valores y opiniones de las élites parlamentarias de México, Instituto Interuniversitario de Iberoamérica-CESOP-Cámara de Diputados LIX Legislatura, México. [ Links ]

Velázquez, Rafael (2008), "La relación entre el Ejecutivo y el Congreso en materia de política exterior durante el sexenio de Vicente Fox: ¿cooperación o conflicto?", Política y Gobierno, XV (1), CIDE, México, pp. 113-157. [ Links ]

Velázquez, Rodrigo (2012), "Realidades mexicanas: el efecto de la democratización en las relaciones Congreso-burocracia", Foro Internacional, LII (1), El Colegio de México, A. C., México, pp. 5-37. [ Links ]

Weber, Max (1946), "Bureaucracy", in Hans Heinrich (ed.), Max Weber: essays in sociology, Oxford University Press, New York, pp. 196-228. [ Links ]

Weingast, Barry (1984), "The Congressional-Bureaucratic System: A Principal-Agent Perspective (With Applications to the SEC)", Public Choice, 44, Martinus Nijhoff Publishers, Netherlands, pp. 147-191. [ Links ]

Weldon, Jeffrey Allen (2002), "The Legal and Partisan Framework of the Legislative Delegation of the Budget in Mexico", in Scott Morgenstern and Benito Nacif (eds.), Legislative Politics in Latin America, Cambridge University Press, Cambridge, pp. 377-410. [ Links ]

Weldon, Jeffrey Allen (2004), "Changing Patterns of Executive-Legislative Relations in Mexico", in Kevin Middlebrook (ed.), Dilemmas of political change in Mexico, Institute of Latin American Studies, University of London-Center of US Mexican Studies, San Diego-London, pp. 133-167. [ Links ]

Wood, Dan (2010), "Agency Theory and the Bureaucracy", in Robert Durant (ed.), The Oxford Handbook of American Bureaucracy, Oxford University Press, New York, pp.181-206. [ Links ]

Wood, Dan and John Boathe (2004), "Political Transactions Costs and the Politics of Administrative Design", Journal of Politics, 66 (1), Southwestern Political Science Association, Georgia, pp. 176-202. [ Links ]

Wood, Dan and Miner Marchbanks (2008), "What Determines How Long Political Appointees serve?", Journal of Public Administration Research and Theory, 18 (3), Public Management Research Association, Kansas, pp. 375-396. [ Links ]

1 In this article the terms bureaucracy and bureaucrats are used to refer to those middle and top level public officials responsible for the designing and implementation of public programs.

2 The Weberian state is defined as a hierarchically integrated set of administrative organizations with the following characteristics: rule-governed decision making; offices with no overlapping jurisdictions ordered by formal rules (laws or administrative regulations); recruitment of officials through a meritocratic system, and predictable career ladders. For more characteristics see Weber (1946). Weber's ideal type has been the source of some empirical studies. For instance, Evans and Rausch (1999) created a "Weberian scale" to examine the effect of meritocratic systems and bureaucratic long term careers on economic growth in 35 developing countries.

3 Field research was carried out in Mexico City between March 2006 and July 2009. Seventy-two key informants were extensively interviewed: 41 percent of the interviewees were middle and top level officials; 51 percent were deputies, senators and legislative staff. The rest of the interviewees were members of non-governmental organizations. Almost all the interviewees asked for confidentiality, therefore they are not identified by name.

4 See Velázquez (2012) for a comprehensive overview of the theoretical frameworks to study bureaucratic-legislative relations and their applicability to the Mexican case. The next section draws on this study.

5 Huber and McCarty (2004) examine how much authority legislators delegate to public officials when bureaucratic capacity is low. Other authors have developed theoretical approaches underscoring the role of presidents in the bureaucratic-congressional relation. According to these studies, presidents are important actors that can control public officials through diverse mechanisms. See Wood and Boathe (2004), Wood and Marchbanks (2008), and Mullins and Mikesell (2010).

6 For detailed analyses of the effect of democracy and divided governments on the budget process see Sour et al. (2004) and Reyes-Hernández et al. (2013).

7 Specifically, deputies increased the amount allotted to diverse budget items such as the infrastructure fund. The total amount modified by deputies was 80 million pesos. At the end, deputies and Hacienda officials negotiated the allocation of these additional resources. For details see Erica Hernández (2005).

8 Both areas are important in the bureaucratic-legislative relation. While Hacienda provides information to Congress about the finances of the country, legislation establishes the extent of authority delegated to bureaucrats in the distribution of federal resources. In democracy, bureaucrats should provide legislators complete and transparent information about the financial state of the nation. Similarly, officials should respect the constraints established in legislation regarding the allocation of resources.

9 However, the 2006 Ley Federal de Presupuesto y ResponsabilidadHacendaria only allows access to the Sistema Integral de Información de los Ingresos y Gasto Público to the Hacienda and Budget committees.

10 This institution is the technical body that supports Congress in the oversight and review of government spending.

11 This law regulates and establishes the formulas used to determine the annual amount of money that each state will receive from diverse federal funds.

12 Secretarios técnicos are congressional officials in charge of providing nonpartisan technical support to committees.

13 This information is consistent with a survey given to deputies of the LVI Legislature (1994-1997). This study revealed that legislators considered the oversight and control of the executive branch as the least important motivation behind their actions (Ugalde, 2000: 132).

14 Secretarios técnicos from six other different committees also stated that there is no systematic assessment of governmental reports.

15 Cuenta pública is the official annual record of the government's financial operations and accounting records from the previous fiscal year (Ugalde, 2000).

16 Deputies analyze the ASF report on cuenta pública and elaborate a non-binding resolution where they make a statement about the management of the government's resources during a fiscal year. This legislative resolution is called Decreto relativo a la revisión de la cuenta pública (Decree related to the Revision of Public account). Every single Chamber of Deputies' Decreto about Cuenta Pública between 1991 and 2009 disclosed that the government information was incomplete or deficient. See Diario Oficial de la Federación: Decretos relativos a la revisión de la Cuentas de la Hacienda Pública Federal correspondientes a los ejercicios fiscales 1991-2009.

17 In 2006 the excess revenue obtained from oil sales reached 9,100 million pesos.

Información sobre el autor

Rodrigo Velázquez-López Velarde. Mexican political scientist. He received his Ph. D. from the University of Texas at Austin in 2010. Currently, is assistant professor at the Centro de Investigación y Docencia Económicas (CIDE) Región Centro. Professor Velázquez is a member of the National System of Researchers, candidate level. His research has been focused on bureaucratic-legislative relations, democratization and political accountability. Among his recent publications are: "Realidades mexicanas: El efecto de la democratización en las relaciones Congreso-burocracia", Foro Internacional, LII (1), El Colegio de México, México, pp. 5-37 (2012); "Aprendiendo a utilizar las evaluaciones como herramienta de cambio: el programa de becas de posgrado del CONACYT", in Guillermo Miguel Cejudo and Claudia Maldonado (eds.), De las recomendaciones a las acciones: la experiencia del Premio 2011 Programas Federales Comprometidos con el Proceso de Evaluación, SFP-CIDE-CLEAR, México, pp. 179-210 (2011).