Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Agrociencia

On-line version ISSN 2521-9766Print version ISSN 1405-3195

Agrociencia vol.46 n.2 Texcoco Feb./Mar. 2012

Socioeconomía

Inter-firm coordination in the mexican avocado (Persea americana) industry: the packer-buyer relationship

Coordinación entre empresas en la industria mexicana del aguacate (Persea americana): relación entre el empacador y comprador

Jose J. Arana-Coronado1,2*, Jos Bijman2, Onno Omta2, Alfons Oude-Lansink3

1 Colegio de Postgrados. Km. 36.5, Carretera México-Texcoco. 56230. Montecillo, Estado de México, México. *Autor responsable. (jarana@colpos.mx)

2 Wageningen University. Business Administration Group.

3 Business Economics Group. P. O. Box 8130, 6700 EW Wageningen, the Netherlands.

Recibido: febrero, 2011.

Aprobado: enero, 2012.

Abstract

Vertical coordination is an effective response to uncertainties in marketing environments. This article presents evidence relating the influence of transaction characteristics on inter-firm coordination to respond what conditions determine the level of inter-firm coordination between packers and buyers. Based on transaction cost analysis, we measured inter-firm coordination using two variables, information exchange and duration of the arrangement with the buyer. Data were gathered from 44 non-forwardly integrated packers participating in the Mexican avocado (Persea americana) industry. We showed that higher levels of inter-firm coordination not only require coordinated response, but also cooperative response. Although information exchange is contingent on the magnitude of asset specificity and presence of environmental uncertainty, duration of the arrangement between packer and buyers has been a main factor to explain reduction of opportunism associated to the fulfillment of the arrangement, as well as the presence of higher levels of information exchange when asset specificity is significant. As a result, packers with higher levels of inter-firm coordination have increased sales and reduced stock outs.

Key words: environmental uncertainty, inter-firm coordination, information exchange, duration.

Resumen

La coordinación vertical es una respuesta eficaz a las incertidumbres en entornos de mercados. En este artículo se presenta evidencia sobre la influencia de las características de transacción en la coordinación entre empresas para responder qué condiciones determinan el nivel de coordinación entre empresas empacadoras y comprador. Con base en el análisis de los costos de transacción, se midió la coordinación entre empresas con dos variables, intercambio de información y duración del acuerdo con el comprador. Los datos se obtuvieron de 44 empacadores no integrados anticipadamente que participan en la industria aguacatera de México. Se mostró que niveles mayores de coordinación entre empresas necesitan una respuesta coordinada y también una respuesta cooperativa. Aunque el intercambio de información depende de la magnitud de la especificidad del activo y la presencia de incertidumbre del entorno, la duración del acuerdo entre el empacador y los compradores es un factor principal para explicar la reducción del oportunismo asociado al cumplimiento del acuerdo, así como la presencia de niveles altos de intercambio de información, cuando la especificidad del activo es significativa. Como resultado, los empacadores con mayores niveles de coordinación entre empresas han aumentado las ventas y reducido el desabasto.

Palabras clave: incertidumbre del entorno, coordinación entre empresas, intercambio de información, duración.

INTRODUCTION

Since 1997 the Mexican avocado (Persea americana) industry has shown increasing exports and it is the leader in fresh avocado exports in the world (Sánchez, 2007). To comply with international quality standards and reliable supply, supply chain management practices such as product standardization, supplier partnership and enhanced exchange information have been introduced (Sánchez, 2007). Particularly, inter-firm coordination based on information exchange between packers and buyers has grown in relevance. Packers selling product in national and international markets face an environment of uncertainty in which prices are determined on a daily basis and customer demand is rather volatile in terms of promotions and preferences, and changes in order to satisfy procedures and volume requirements (Ramos, 2007; Sánchez, 2007). Responding to these uncertainties, differentiated levels of information exchange have been established between packers and buyers (Ramos, 2007). Whereas some packers have accessed information about retail demand and promotions, and precise information that facilitates joint planning activities related to product requirements, distribution, and transportation, other packers have supported their transactions based on information requirements such as product quantity and price. As a result, these latter packers require to manage more safety inventory and increase the delivery costs to fulfill orders or alternatively, because they do not commit to supply a specified quantity of product, face more stock outs (Sánchez, 2007). To that respect, Buvik and John (2000) emphasize the relevant role that transaction costs, such as asset specificity and environmental uncertainty, have in the inter-firm coordination, whereas Gulati et al. (2005) consider cooperative mechanisms (interaction between partners) to be of greater importance in order to have a more coordinated dyadic relationship.

Based on the previous arguments, the present research poses the following objectives: to determine the level of inter-firm coordination between packers and buyers and to find out how inter-firm coordination impacts on the packer's performance. According to these objectives we established the following seven hypotheses.

Transaction characteristics, duration, and inter-firm coordination

A positive association between asset specificity and information exchange exists under a seller-buyer relationship (Noordewier et al., 1990; Buvik and John, 2000). Substantial asset specificity creates interdependence that asks for safeguarding governance (Williamson, 1991; Rindfleisch and Heide, 1997; Geyskens et al., 2006) and the higher the interdependence among partners, the greater the amount of information exchange (Noordewier et al., 1990; Gulati and Singh, 1998; Andersen and Buvik, 2001). Thus, in a seller-buyer relationship, the seller firm adapts its skills, product design, production processes or logistics to the requirements of a specific buyer (Andersen and Buvik, 2001). The hypothesis is (Figure 1):

H1: The level of asset specificity of packer investments in operation methods and skilled knowledge tailored to the buyer is positively associated to the amount of information provided by that buyer.

Asset specificity plays an important role in enhancing productivity and producing rents which in turn sustain the relationship (Hwang, 2006; Hawkins et al., 2008). Greater investment in specialized assets not only creates more dependency and therefore vulnerability to exploitation, it also leads to higher profits, and as result, a sustained relationship (Buvik and Haugland, 2005). The following hypothesis is proposed (Figure 1):

H2: The level of asset specificity of packer investments in operation methods and skilled knowledge tailored to the buyer is positively associated to the duration of the contractual arrangement between the packer and the buyer.

A particular form of environmental uncertainty is demand uncertainty, which arises from forecasting errors, rapid changes in demand for specific product varieties, and irregular orders (Davis, 1993). Demand fluctuations cause instability throughout the supply chain. Firms operating under high demand uncertainty are likely to have a greater need for information exchange. Noordewier et al. (1990) point out that under conditions of high environmental uncertainty increasing information exchange led to a reduction in acquisition costs and delivery delays in marketing standard products (i.e., with low asset specificity). In our study, we also expect a positive relationship between environmental (demand) uncertainty and information exchange for transactions with low asset specificity (Figure 1). The hypothesis is:

H3: Under low levels of asset specificity, the association between environmental uncertainty and information exchange is positive.

Buvik and John (2000) and Baker et al. (2002) indicate that sellers that have made buyer-specific investments may be reluctant in situations of environmental uncertainty to use buyer-provided information to plan their own activities, as they are afraid that the information provided by the buyer is biased towards the buyer's interests. Thus, information exchange will not always increase in response to increasing environmental uncertainty, as it is contingent on the safeguarding problem. The hypothesis (Figure 1) is:

H4: Under high levels of asset specificity, the association between environmental uncertainty and information exchange is negative.

Duration of the arrangement concerns the extent to which the relationship or specific arrangement between the seller and buyer has been going on (Dwyer et al., 1987). Ongoing relationships between sellers and buyers provide opportunities for better aligning of interests and activities (Gulati et al., 2005; Mesquita and Brush, 2008). The presence of a long term relationship provides expectations about near future behavior by the transaction partner (Heide and John, 1992). Partners to an ongoing contractual arrangement expect that future transactions will continue to deliver benefits. An ongoing relationship is more likely to have a high level of information exchange than a short-term arrangement or a onetime transaction (Hawkins et al., 2008). Knowledge on the behavior and reputation of the transaction partner, obtained through repetitive interactions, encourages cooperation (aligning of interests) and coordination (aligning of activities). In summary, experiences of past interactions support the willingness of the exchange partners to continue and even increase information exchange. The hypothesis (Figure 1) is:

H5: Duration of the arrangement is positively related to information exchange.

Inter-firm coordination and performance

Information exchange is important because it assists in resolving disputes and aligning perceptions and expectations (Gulati et al., 2005), and also because it facilitates efficient planning and scheduling of sales (Noordewier et al., 1990). Sellers and buyers communicating and sharing information reduce response time and improve cost savings through greater operational efficiencies (Ogden et al., 2005). Noordewier et al. (1990) indicate that increased information exchange can also decrease the possession and acquisition costs for inventories. The hypothesis (Figure 1) is:

H6: Information exchange is positively related to operational performance, sales, price and packer performance, and negatively to stock outs.

Baker et al. (2002) indicate that repeated exchange deters the pursuit of short run gains that undermine the longevity of the relationship. According to Davis (1993), increased timing in the supply chain occurs when opportunistic behavior is reduced under duration of the arrangement. Besides, the prospects of future sales, volume commitments, or high profit margins can mitigate transactional risks and provide a risk premium for the seller (Buvik and Haugland, 2005). When the parties are willing to adapt to environmental changes by adjusting the terms of their contract, the time and effort the seller spends negotiating detailed upfront contracts that cover a wide range of contingencies is reduced. In addition, long relationships also imply parties to have time to learn one another's ways of doing business and develop multiple communication links or shared norms, values and beliefs (Gulati et al., 2005). The hypothesis (Figure 1) is:

H7: Duration of the arrangement is positively related to operational performance, sales, price and packer performance, and negatively to stock outs.

MATERIALS AND METHODS

Data

The study was based on data gathered from 44 non-forwardly integrated avocado packers commercializing their product in one of two markets, national or international. They were randomly selected from 346 (13 % of the total) non-forwardly integrated avocado packers in Michoacán (Sánchez, 2007), by using two criteria: location and size of packaging house (Table 1). To get the data, a face-to-face survey was applied to packers between February to April 2008. The packers were chosen from four municipalities: Peribán, Nuevo Parangaricutiro, Tancítaro and Uruapan. From the sample, 28 are small packers, 10 middle packers, and 6 large packers representing 9 %, 53 %, and 86 % of the total packers contained in the respective stratum.

Measurements

Measures used in the present model and included in the survey are asset specificity and environmental uncertainty for transaction characteristics; information exchange and duration of the arrangement for inter-firm coordination; and price, sales, stock outs, and packer performance as performance indicators. Asset specificity, environmental uncertainty and information exchange are created using multiple items (Table 2), whereas performance indicators are done using a single item. Items are measured using a seven-point Likert scale ranging from "not agree at all" to "totally agree" for transaction characteristics and information exchange, and "much lower" to "much higher" for performance indicators.

Asset specificity refers to the physical and human investments made by the packer and tailored to a specific buyer. Based on Ganesan (1994), three items were used to measure asset specificity. Environmental uncertainty refers to demand uncertainty faced by the packer in the packer-buyer relationship; based on Noordewier et al. (1990), two items were used to measure the level of environmental uncertainty. Information exchange is conceptualized as information provided by the buyer for organizing the flow of activities and resources in the packer-buyer relationship. Based on Noordewier et al. (1990), four items were used to measure information exchange. Duration of the arrangement is measured by means of the number of recurrent transactions. Duration has four choices: one order or transaction (D1), recurrent transactions during one season (D2), recurrent transactions during one year (D3), and recurrent transactions during several years (D4).

Four performance indicators were used: total sales, price, stock outs, and the relative performance. The last item is the performance of the packer compared to his main competitors. We use two categories of performance measures: actual performance such as sales, and perception performance such as price, stock outs, and relative performance. Each performance indicator was individually included in the analysis.

Method

Partial least squares (PLS)[4] is used to estimate the model (Figure 1). This statistical method allows us to assess the reliability and validity of the model (Ringle et al., 2005). In addition, using PLS exploratory factor analysis we determined the best items for variables transaction characteristics and information exchange. Although PLS[5] estimation has some shortcomings such as the bias and inconsistency of loadings and inner structural coefficients (Fornell and Cha, 1994), our decision to use PLS but not LISREL was motivated by several considerations. First, the small sample size does not satisfy the assumptions for maximum likelihood estimation (MLE). Anderson and Gerbing (1988: 415) indicate that the Lisrel program requires a sample size of 150 or more to obtain parameter estimates that have standard errors small enough to be of practical use. Second, some theoretical problems such as inadmissible solutions (i.e., negative error) and factor indeterminacy (i.e., nonconvergence) have been identified with LISREL's MLE (Fornell and Bookstein, 1982); however, PLS avoids these two theoretical problems. Third, PLS estimation requires only that the basic assumptions of least squares estimation are satisfied. Fourth, PLS uses jackknife or bootstrap (Efron and Gong, 1983) in combination with the traditional measure of goodness-of-fit (Bagozzi, 1981) to evaluate the model. Furthermore, in PLS models both formative and reflective indicators can be used simultaneously (Fornell and Bookstein, 1982). Bootstrapping with 500 resamplings was used to show the precision of the PLS estimates (Chin, 1998).

Validity and reliability of measures and constructs

Factor analysis was used to calculate the loadings for constructs asset specificity, environmental uncertainty and information exchange; the loadings indicate how much variance in each independent item is accounted for by the latent construct (Lattin et al., 2003). Thus, before interpreting the model coefficients, we first checked the reliability and validity of the measures. Following Fornell and Larcker (1981), we examined the individual item reliability (factor loading), internal consistency (composite reliability and Cronbach's alpha "α"), and discriminant validity (average variance extracted and interconstruct correlations) for each construct.

The acceptability of the measurement model was assessed by first looking at the reliability of the individual items. Individual item reliability was determined by examining the loadings of measures on their corresponding constructs; only individual factor loadings greater than 0.6 were retained, for all cases. All loadings were greater than or close to 0.7 for packer sample, indicating a high degree of individual item reliability (Table 2).

Internal consistency was assessed using two measures: composite reliability and Cronbach's alpha. Regarding composite reliability, an internal consistency of 0.7 or greater is reasonable for exploratory research. Composite reliability for all constructs exceeded 0.8, indicating a good internal consistency (Table 3). In terms of Cronbach's alpha, a minimum reliability of 0.7 is required. The constructs presented values "α" equal to or higher than 0.7 (Table 2) confirming that each construct has a good internal consistency.

The discriminant validity was carried out in two ways. First, the square root of the variance extracted (the numbers on the diagonal in Table 3) should be greater than all construct correlations (the numbers on the off-diagonal in Table 3), as is the case here. Second, the test involves assessing how each item is related to the latent constructs and the item loadings and cross-loadings on the constructs are shown in Table 4. No item loaded more highly on the other constructs than it did on its associated construct and both criteria indicate that the discriminant validity of the constructs used in the model is satisfied. Therefore, we can rely on the coefficients to interpret the relationships.

RESULTS AND DISCUSSION

Four out of the seven hypothesized relationships were significant at the 5 % level, while the relationship between inter-firm-coordination and performance (hypotheses 6 and 7) were only significant for some performance indicators (Figure 2).

The transaction characteristics (independent variables) used in the present model -i.e., asset specificity environmental uncertainty and the interaction term asset specificity-environmental uncertainty- explain on average 36 % of the total variance of inter-firm coordination, indicating good prediction accuracy. Asset specificity alone, i.e. absent environmental uncertainty, is not significantly associated to information exchange between seller and buyer (path coefficient = 0.084). Thus, hypothesis 1 is not supported. A higher investment of the packer in operation methods and skilled knowledge, specifically for the transaction with the main buyer, does not necessarily lead to more information provided by the buyer.

The results reveal that asset specificity shows a significant positive association with duration of the arrangement. Therefore, hypothesis 2 is supported (path coefficient = 0.581). A packer investing in operation methods and skilled knowledge specific for the transaction with the buyer wants to safeguard his investment, but also created more expectation of benefits based on a long-term relationship with his tailored buyer (Dyer, 1997; Buvik and Haugland, 2005).

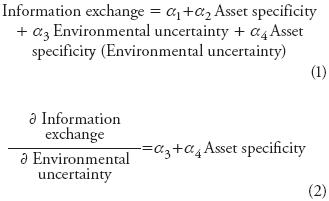

The relationship between environmental uncertainty and information exchange is contingent on the level of asset specificity, as is shown in the following expression: (equation 3)

Substituting coefficients for α3 and α4 , we have,

For a low level of asset specificity, environmental uncertainty presents a significant positive relationship with information exchange (path coefficient = 0.462 when AS = 0), thus supporting hypothesis 3. When uncertainty about demand and availability of alternative buyers increases, the seller will require more precise information about retail demand and promotions, in order to support coordinated planning activities related to product requirements, distribution, and transportation.

For a high level of asset specificity, the interaction term asset specificity-environmental uncertainty has a significant negative relationship with information exchange (path coefficient= —0.304). Therefore, hypothesis 4 is supported. When substantial levels of both asset specificity and environmental uncertainty are present, the seller will be cautious in using the information provided by the buyer because he fears that the buyer will use his information advantage to the disadvantage of the dependent seller.

Duration of the arrangement has a significant positive relation with information exchange (coefficient = 0.283), which supports hypothesis 5. Longer duration of the arrangement fosters information exchange.

Information exchange shows a significant positive association with the following performance indicators: seller's sales (path coefficient = 0.263) and seller's performance compared to his main competitors (path coefficient = 0.254). Therefore, hypothesis 6 is supported for these indicators. Information provided by buyers to the packers significantly improves efficiency and allows planning current and future product needs, thereby improving service offered by the packer to the buyer.

Duration of the arrangement shows a significant negative association with seller's stock outs (path coefficient = —0.419), which supports hypothesis 7 for this indicator. For the other performance indicators (sales, price, and relative performance) the effect of duration of the arrangement is not significant.

CONCLUSIONS

Inter-firm coordination plays an important role in aligning activities and interests when substantial environment uncertainty is present. Previous studies show that information exchange is contingent on the magnitude of asset specificity, but no more explanation was found about the role that some governance mechanisms can play in mitigating opportunism in a dyadic relationship.

In our study, the level of information exchange was contingent on the magnitude of asset specificity. Under a low level of asset specificity, environmental uncertainty resulted in a positive association with information exchange; however, under a high level of asset specificity, environmental uncertainty did not lead to more information exchange. In addition, a higher level of duration of the arrangement is associated with a higher level of information exchange.

Finally, the two inter-firm coordination mechanisms influenced different performance indicators. Whereas a higher level of information from buyer results in increased sales and better performance of the packer, a longer duration of the arrangement, i.e., more number of transactions, reduces the stock outs of the packer.

LITERATURE CITED

Andersen, O., and A. Buvik. 2001. Inter-firm co-ordination: international versus domestic buyer-seller relationships. The Int. J. Manage. Sci. 29: 207-219. [ Links ]

Anderson, J. C., and D. W. Gerbing, 1988. Structural equation modeling in practice: A review and recommended two-stage approach. Psychol. Bull. 103: 411-423. [ Links ]

Bagozzi, R. P. 1981. Evaluating structural equation models with unobservable variables and measurement error: A comment. J. Marketing Res. 18: 275-281. [ Links ]

Baker, G., R. Gibbons, and K. J. Murphy. 2002. Relational contracts and the theory of the firm. The Quart. J. Econ. February: 39-84. [ Links ]

Buvik, A., and S. A. Haugland. 2005. The allocation of specific assets, relationship duration, and contractual coordination in buyer–seller relationships. Scand. J. Manage. 21: 41-60. [ Links ]

Buvik, A., and G. John. 2000. When does vertical coordination improve industrial purchasing relationships. J. Marketing 64: 52-64. [ Links ]

Chin, W. W. 1998. The partial least square approach to structural equation modeling. In: Marcoulides, G. A. (ed). Modern Methods for Business Research. London: Erlbaum. pp: 295-336. [ Links ]

Chin, W. W. , and P. R. Newsted. 1999. Structural equation modeling analysis with small samples using partial least squares. In: Hoyle, R. H. (ed). Statistical Strategies for Small Samples Research. London: Sage. pp: 307-341. [ Links ]

Davis, T. 1993. Effective supply chain management. Sloan Manage. Rev. 34(4): 35-46. [ Links ]

Dwyer, F. R., P. H. Schurr, and S. Oh. (1987). Developing buyer-seller relationships. J. Marketing 51: 11-27. [ Links ]

Dyer, J. H. 1997. Effective inter-firm collaboration: how firms minimize transaction costs and maximize transaction value. Strategic Manage. J. 18(7): 535-556. [ Links ]

Efron, B., and G. Gong. 1983. A leisurely look at the bootstrap, then jackknife, and crossvalidation. The Am. Statistician 37: 36-48. [ Links ]

Fornell, C., and F. Bookstein. 1982. Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. J. Marketing Res. 19: 440-452. [ Links ]

Fornell, C., and J. Cha. 1994. Partial least squares. In: Bagozzi, R.P. (ed). Advanced Methods of Marketing Research. Oxford, England: Blackwell. pp: 52-78. [ Links ]

Fornell, C., and D. Larcker. 1981. Evaluating structural equation modeling with unobservable variables and measurement error. J. Marketing Res. 18: 39-50. [ Links ]

Ganesan, S. 1994. Determinants of long-term orientation in buyer–seller relationships. J. Marketing 58: 1-19. [ Links ]

Geyskens, I., J. B. E. M. Steenkamp, and N. Kumar. 2006. Make, buy, or ally: a transaction cost theory meta-analysis. Academy Manage. J. 49(3): 519-543. [ Links ]

Gulati, R., P. R. Lawrence, and P. Puranam. 2005. Adaptation in vertical relationships: beyond incentive conflict. Strategic Manage. J. 26: 415-440. [ Links ]

Gulati, R., and H. Singh. 1998. The architecture of cooperation: managing coordination costs and appropriation concerns in strategic alliances. Administrative Sci. Quart. 43: 781-794. [ Links ]

Hawkins, T. G., C. M. Wittmann, and M. M. Beyerlein. 2008. Antecedents and consequences of opportunism in buyer-supplier relations: Research synthesis and new frontiers. Industrial Marketing Manage. 37: 895-909. [ Links ]

Heide, J. B., and G. John. 1992. Do norms matter in marketing relationship? The J. Marketing 56(2): 32-44. [ Links ]

Hwang, P. 2006. Asset specificity and the fear of exploitation. J. Econ. Behavior and Organization 60: 423-438. [ Links ]

Lattin, J., J. D. Carroll, and P. E. Green. 2003. Analyzing Multivariate Data. Pacific Grove, CA: Thomson: Brooks/Cole. [ Links ]

Mesquita, L. F. , and T. H. Brush. 2008. Untangling safeguard and production coordination effects in long-term buyer-supplier relationships. Academic Manage. J. 51(4): 785-807. [ Links ]

Noordewier, T. , G. John, and J. R. Nevin. 1990. Performance outcomes of purchasing arrangements in industrial buyer-vendor relationships. J. Marketing. 54(4): 80-93. [ Links ]

Ogden, J. A., K. J. Petersen, J. R. Carter, and R. M. Monczka. 2005. Supply management strategies for the future: A Delphi study. The J. Supply Chain Manage. 41(3): 29-48. [ Links ]

Ramos, J. A. 2007. Perspectivas de la red aguacate para el 2007. Fideicomisos Instituidos en Relación con la Agricultura (FIRA), Banco de México. [ Links ]

Rindfleisch, A., and J. B. Heide. 1997. Transaction cost analysis: Past, present, and future applications. J. Mark. 61(4): 30-54. [ Links ]

Ringle, C. M., S. Wende, and A. Will. 2005. SmartPLS - Version 2.0. Universitat Hamburg, Hamburg. [ Links ]

Sánchez, G. 2007. El Cluster del Aguacate de Michoacán. Sistema de Inteligencia de Mercados. Fundación Produce Michoacán. 241 p. [ Links ]

Williamson, O. E. 1991. Comparative economic organization: The analysis of discrete structural alternatives. Administrative Sci. Quart. 36: 269-296. [ Links ]

4 Visual PLS is free software for partial least squares analysis, version 2.0 M3 released on October 2, 2006, and it is available at http://www.smartpls.de

5 For a detailed discussion about the PLS model, see Chin and Newsted (1999).