Introduction

Institutions have long been recognized as crucial to the process of capital accumulation and economic growth. According to Douglass North (1990, p. 118), “institutions provide the basic structure by which human beings throughout history have created order and attempted to reduce uncertainty in exchange. Together with the technology employed, they determine transaction and transformation costs and hence the profitability and feasibility of engaging in an economic activity”. A clear definition of property rights reduces the uncertainty on the outcomes from intertemporal decisions such as savings and investment. In an economy with clear property rights, individuals and firms thus have incentives to save and invest, so credit markets have higher potential for growth.

Capital markets may be sensitive to the definition of property rights. Some empirical studies show that a clear set of property rights contributes with financial development. North and Weingast (1989), for example, showed that the Glorious Revolution led to a clear commitment to certain rules, promoting the development of public, and private capital markets. Empirical studies for the 20th century have also proved a positive correlation between property rights and financial deepening. La Porta, Lopez-de-Silanes, Shleifer and Vishny (1997) explained that legal systems that protect creditors and enforce contracts encourage better functioning debt and equity markets; whereas Levine (1998) showed that legal rights of creditors and the efficiency with which legal systems enforce those rights explain much of the cross-sectional variation of financial development. Other studies, however, question the hypothesis that institutions influence credit markets. Findings in Epstein (2000), for example, contradict North and Weingast’s hypothesis that the Glorious Revolution influenced the return to capital; whereas Musacchio (2008) looked at the Brazilian case and argued that the adoption of legal system did not constrain financial development.

Political instability may have influenced the development of credit markets. In very unstable political contexts, property rights may not be clear or enforced. In some circumstances, the State itself may be the main violator of property rights through the confiscation of properties and arbitrary taxation. Proprietors may not fully enjoy their rights over their estates and other assets, and potential lenders may not be able to recover their funds in case of non-payment. Credit markets may then be stagnant and interest rates high. In a recent study, for example, Roe and Siegel (2011) reported strong evidence in favor of the hypothesis that political instability impeded financial development.

Several historical studies have analyzed the role of political institutions in the evolution of credit markets in Latin America. Those studies have emphasized the importance of restrictive bank laws, discretionary policies, capital requirements, and restrictions on note issue in explaining the slow development of capital markets in the region. Haber (1991), for example, argued that restrictive bank laws led to a highly concentrated banking sector in Mexico and Brazil and thus retarded industrialization. Similarly, Maurer (2002) argued that legal restrictions limited the creation of banks in Mexico and that the enactment of the banking law of 1897 reduced banking concentration. In another study, Hanley (2005) argued that restrictions to the chartering of corporations prior to 1889 were a primary reason for the small size of the banking sector in Brazil. More recently, Zegarra (2014) showed that restrictive bank laws hindered the provision of banking services in some Latin American economies. However, the impact of political instability and property rights insecurities on Latin American financial development has not received much attention from the literature, even though it has been widely recognized that most Latin American countries experienced much political instability in the first decades after independence in the 19th century.1

This article analyzes the effect of political instability and institutional insecurities on the development of mortgage credit in Lima, Peru, between 1835 and 1865. Peru is an interesting historical case of study to analyze the effect of political instability and institutional change on the evolution of credit markets. In the 1830s and early 1840s Peru was a very unstable country and property rights were not secured. From the late 1840s, however, political civil wars became more sporadic. Furthermore, in the early 1850s the government enacted important institutional changes that improved the definition of property rights of lenders and borrowers. The expropriation of private properties was restricted and the legal rights of creditors and borrowers were more clearly defined.

Based on more than 1 400 mortgage loans over 1835-1865, this article shows that the mortgage credit market remained stagnant and interest rates were high during the period of political instability and institutional uncertainties. On average, annual interest rates were above 21% per year in 1835-1845, a very high level for international standards; and more than 36% of loans specified an interest rate of more than 20%. As Peru became less politically unstable and property rights were more clearly defined, the credit market of Lima expanded rapidly and interest rates declined. The average interest rate decreased to 14.7% per year in 1855 and 12.8% in 1865, whereas the percentage of loans with interest rates of more than 20% declined from 38% in 1841-1845 to 8.4% in 1855 and 8.1% in 1865.

Some economists and economic historians have argued that the creation of commercial and mortgage banks in the 1860s led to the expansion of credit and the reduction in interest rates (Camprubí, 1957; Engelsen, 1978). It is certainly possible that the creation of banks contributed to the expansion of credit markets, especially from 1866, when the first mortgage bank was created. However, the results of this article suggest that in the 1850s, prior to the creation of banks, political stabilization and the establishment of a more secure system of property rights had already led to the expansion of credit markets and the reduction in interest rates.

This article constitutes a contribution to the study of early private credit markets in Latin America. Most studies have emphasized the role of banks, neglecting the importance of private credit markets, probably due to the lack of official information. Notarial records have been proven extremely useful for studying early credit markets in other countries. Hoffman, Postel-Vinay and Rosenthal (2000), for example, relied on notaries’ records for the study of Parisian credit markets in 1660-1870. Only recently, for Latin America some studies have relied on notarial records and other primary sources to show that private credit markets played an important role in channeling resources. Levy (2012) showed that private lenders loaned important sums of money in Yucatan prior to the creation of banks, facilitating the boom of henequen. For Peru, Zegarra (2016) analyzed the impact of political instability on the access to long-term credit in the 19th century; Suárez (2001) studied the evolution of credit markets in colonial times, whereas Engelsen (1978) examined the participation of private lenders and mortgage banks in channeling funds to the agricultural sector in the 19th century.

The sample of notarized loans

Notaries provide a very useful source of information of credit markets. Notaries registered several types of transactions, such as loans, sales, leasing contracts, inheritances, among others. The use of the notarial records can provide deep insights into the importance of credit markets in Lima.

This article relies on a sample of 1 457 new mortgage loans for the 1835-1865 period. In particular, the sample covers the period 1835-1845 as well as the years 1850, 1855, 1860 and 1865. Since there were many more loans in the 1850s and 1860s than in the 1830s and 1840s, I selected loans for all years in the entire period 1835-1845 and loans for only four years in 1850-1865 (in particular, 1850, 1855, 1860 and 1865) in order to have a balanced sample. I constructed the sample from notaries’ records, all of them taken from the National Archives of Peru (Archivo General del Perú, Sección Colonial, Protocolos Notariales) in the city of Lima.2

From all notaries operating in the city of Lima, I selected six notaries: José de Selaya (1835-1865), Felipe Orellana (1862-1865), Félix Sotomayor (1845-1865), Francisco Palacios (1865), Ignacio Ayllón-Salazar (1835-1837), and José Ayllón-Salazar (1835-1845). The notary of José de Selaya covers the entire period of analysis. His businesses actually started in 1831 and finished in 1877. Félix Sotomayor began to operate in 1840 and ended businesses in 1881. Ignacio Ayllón-Salazar was also an important notary, especially for the early 19th century: its businesses covered from the late 18th century to 1837. José Ayllón-Salazar, brother of Ignacio, was active between 1829 and 1852. Felipe Orellana was another important notary, with operations between 1850 and 1879; whereas Francisco Palacios operated from 1862. The selected notaries in the sample only worked in their offices in Lima. Occasionally, lenders or borrowers from other cities recurred to them. However, in most cases, loans were granted by limeños (individuals living in Lima) to limeños.

I collected all mortgage loans granted by the six notaries between January and December in the following years: 1835-1845, 1850, 1855, 1860 and 1865. The sample includes all new mortgage loans recorded by the six notaries.3 These loans were registered as obligaciones, mutuos and hipotecas. It is worth noticing the similarities and differences between obligaciones, mutuos, and hipotecas. Mutuos were loans. Obligaciones were obligations of one party to another. Most obligations were loans (equivalent to mutuos), and some were other types of obligations. Hipotecas refer to loans secured with real estate. Some of the hipotecas were new loans; others were contracts whose only purpose was to specify the real estate that would serve as collateral for a previously signed loan.4

The sample of 1 457 loans is of a relatively considerable size. In total, for the same period, the population of contracts under the titles obligaciones, mutuos and hipotecas (notarized by all notaries from Lima) was 6 602.5 So the sample accounts for 22% of the population of loans. On the other hand, considering that the sample covers fifteen years (eleven years in 1835-1845 and four years in 1850-1865), the average number of loans per year is almost 100, a relatively large number.6

The selection of notaries was not random. In fact, the six notaries from the sample were among the main notaries in Lima. It might be argued then that the sample is not representative of the population of loans, and that it is not possible to extend the conclusions from the sample to the entire population. To deal with this issue, I first look at all loans notarized in Lima (the population of loans) for 1845 and 1855. I noticed that there were not important differences in interest rates.7 However, there were some differences in loan sizes between the sample and the population; also, the proportion of loans in the sample with respect to the population is not the same in both years. The differences in loan sizes and proportion of loans are important for the analysis of the total value of credit. I then resorted to the population estimates of the value of credit by Zegarra (2016) to determine whether the evolution of credit in the population is consistent with the evolution in the sample. As I will explain in this article, the population figures do not contradict our estimates.

In addition to including the names of the lenders and debtors and the amount of the loan, most loans included the maturity of the loan, the interest rate, and the mortgaged asset. Sometimes contracts also included the actual date of payment and the purpose of the loan. Original figures on loan sizes up to 1860 are in pesos, and in 1865 in soles or pesos. The official currency in Peru to 1862 was the silver peso. However, it seems that the common currency was the feeble peso, minted in Bolivia, which had less specie than the Peruvian peso. In 1863, the government established a new currency: the silver sol. One silver peso was equivalent to 0.8 soles. I then converted all figures in the sample to silver soles using such equivalence.8

Notarial records provide information on the location of most borrowers and lenders. Some borrowers and lenders came from cities aside from Lima. Some came from the cities of Arequipa, Ica and Trujillo. Even so, most borrowers and lenders lived in the city of Lima.9 The evidence then suggests that transportation costs shaped 19th century’s Peruvian credit markets. By the mid-19th century, interregional credit transactions barely occurred. The regional characteristic of the credit market did not experie nce significant changes throughout this period. In the 1830s and in the 1860s limeños in need of funding transacted with liquid limeños. Scattered evidence from notaries in Ica, a city 100 miles South of Lima, is also consistent with the regional view of credit markets: lenders and borrowers tended to be inhabitants of Ica and the nearby towns.10

Information on gender indicates that most lenders and borrowers were men (Table 1). Nonetheless, women had an active participation in the credit market. In the sample, around 23% of loans corresponded to female lenders and 27% to female borrowers. Not only married women, but also single women and widows loaned and borrowed money.

Table 1. Distribution of loans according to different categories

| Number of observations | Percentage of the total number of loans | |

|---|---|---|

| Total | 1457 | 100 |

| Nominal interest rate | ||

| 0% | 50 | 3.4 |

| More than 0% and up to 6% | 45 | 3.1 |

| More than 6% and up to 10% | 97 | 6.7 |

| More than 10% and up to 15% | 525 | 36 |

| More than 15% and up to 20% | 188 | 12.9 |

| More than 20% | 247 | 17 |

| N. A. | 305 | 20.9 |

| Loan size | ||

| Up to 1 000 soles | 723 | 49.6 |

| More than 1 000 soles and up to 2 000 soles | 295 | 20.2 |

| More than 2 000 soles and up to 5 000 soles | 278 | 19.1 |

| More than 5 000 soles and up to 10 000 soles | 89 | 6.1 |

| More than 10 000 soles | 68 | 4.7 |

| . | 4 | 0.3 |

| Maturity | ||

| Up to 1 year | 770 | 52.8 |

| More than 1 year and up to 2 years | 291 | 20 |

| More than 2 years and up to 5 years | 142 | 9.7 |

| More than 5 years and up to 10 years | 31 | 2.1 |

| More than 10 years | 2 | 0.1 |

| N. A. | 221 | 15.2 |

| Gender of lender | ||

| Male | 1073 | 73.6 |

| Female | 333 | 22.9 |

| Companies | 51 | 3.5 |

| Gender of borrower | ||

| Male | 1035 | 71 |

| Female | 396 | 27.2 |

| Companies | 26 | 1.8 |

| Occupation of lender | ||

| Merchants | 471 | 32.3 |

| Hacendados and agriculturists | 41 | 2.8 |

| Military personnel | 50 | 3.4 |

| Public bureaucracy | 19 | 1.3 |

| Members of the Catholic Church | 18 | 1.2 |

| Renters | 91 | 6.2 |

| Professionals | 99 | 6.8 |

| Others | 14 | 1 |

| N. A. | 654 | 44.9 |

| Occupation of borrower | ||

| Merchants | 379 | 26 |

| Hacendados and agriculturists | 166 | 11.4 |

| Military personnel | 154 | 10.6 |

| Public bureaucracy | 34 | 2.3 |

| Members of the Catholic Church | 24 | 1.6 |

| Renters | 215 | 14.8 |

| Professionals | 76 | 5.2 |

| Others | 38 | 2.6 |

| N. A. | 371 | 25.5 |

| Collateral | ||

| Urban estates | 618 | 42.4 |

| Rural estates | 91 | 6.2 |

| Chattel mortgages | 214 | 14.7 |

| Wages | 53 | 3.6 |

| General mortgages 1/ | 408 | 28 |

| Others | 73 | 5 |

Notes: The table reports the distribution of loans according to different categories. For loans with more than one lender/borrower, I selected the gender and occupation of the first lender-borrower that appears in the contract. For contracts secured with more than one asset, I selected the first asset mentioned in the contract.N = Number of observations; % = percentage of the total number of loans; N. A. = Information is not available; 1/ The category includes loans secured with “all present and future goods” as well as loans where the collateral was not specified.

Source: Prepared by the author on the basis of the sample of loans (loans notarized by Ignacio Ayllón-Salazar, José Ayllón Salazar, José de Selaya, Felipe Orellana, Francisco Palacios and Félix Sotomayor). See text for a description of the data sources.

A large percentage of lenders and borrowers were merchants. In the sample, around 32% of lenders and 26% of borrowers were merchants. Merchants represented thus an important source of funds, but this was not limited to mortgage credit. Prior to the creation of commercial banks, commercial houses granted short-term credit. Commercial notes by the main merchants were so widely accepted that they circulated as a means of payment. Later on, since 1862 merchants expanded their businesses through the creation of banks of issue in Lima and other cities of Peru. In addition, from 1866 on, merchants participated in the formation of mortgage banks (Camprubí, 1957). Military personnel and public employees also had an important participation as borrowers. In addition, agriculturists (including owners of haciendas) represented 11% of borrowers.

Loans were secured with a wide variety of assets. It is important to mention that mortgage loans were loans secured with any collateral type, not only real estate. Depending on the guarantee, mortgages could be general or special. Practically every loan indicated that the borrower would secure the loan with all present and future assets. If a loan was only secured with “all present and future assets”, then the contract was called general mortgage.11 Other contracts, however, specified the asset that guaranteed the payment of the loan. These assets consisted of urban and rural real-estate, leasing contracts, machinery, merchandise, and even the borrower’s salary. If a loan was secured with a specific asset, the contract was called special mortgage.

An important number of loans were secured with urban estates. Urban loans accounted for 42% of the number of loans. Meanwhile, loans secured with rural estates represented only a small percentage of the sample. Rural loans accounted for around 6% of the total number of loans. Asignificant number of loans were chattel mortgages, secured with leasing contracts, merchandise and machinery. In the sample, these chattel mortgages accounted for nearly 15% of the number of loans. A large number of merchants, not owning a house or finca, secured their loans with the leasing contracts and merchandise in their stores. Salaries were also used as collateral for loans. In 1860, several state employees, especially members of the Army mortgaged their salaries. Overall, loans secured with wages accounted for nearly 4% of the contracts.12 Finally, general mortgages accounted for 28% of the contracts in the sample.13

Political instability and institutional uncertainties

During colonial times, usury laws and moral condemnation imposed upper limits on interest rates. These restrictions remained until the early 19th century. By 1805, for example, interest rates could not be above 6% per year (Macera, 1977, vol. iv, p. 130). In addition, some families and organizations were endowed with special rights over properties, such as that those properties could never be transferred (they were called vinculaciones). In spite of these restrictions, numerous lenders and bankers channeled funds to a variety of borrowers for consumption and investment in colonial times. Nevertheless, most lendings operated in the form of censos consignativos.14

Since the early 19th century, there were several changes to the traditional land and credit markets. Usury laws, for example, were abolished soon after independence. A law, passed in Congress in December of 1832, established that all laws forbidding or restricting usury or interests on money were abolished.15 In 1835, however, general Felipe Salaverry, di facto president of Peru, decreed that interest rates could not be higher than 1% per month. In 1837, the short-lived civil codes of the Confederation Peru-Bolivia raised the upper limit on interest rates, establishing that interest rates could not be higher than 2% per month and that the legal interest rate (for those loans which did not specify a rate) was 6% per year.16 Nevertheless, the civil codes (and so interest restrictions) were suspended in 1838. Since then and up to 1875 at least, the State did not impose any legal constraint on interest rates for private loans.

Furthermore, restrictions on the sale of lands were abolished from the early 19th century, prior to the independence of Peru. The first republican law of disentailment or desamortización was the law of 1829. This law made possible the partial redemption of lay estates, such as legal chaplaincies and other pious foundations with lay titles. The disentailment process continued in the 1840s. With the disentailment process, a significant number of estates were then incorporated into the land market.

As colonial usury laws were abolished and more land was legally available for transactions since the early 19th century, the mortgage market could have gained some dynamism. Private lenders and even the Catholic Church could have been provided credit to investors secured with urban and rural estates, as well as with other types of assets. However, political instability and the consequent institutional weaknesses probably constituted an obstacle to the growth of the credit market.

Soon after independence, Peru entered into a period of deep political and institutional instability. Uprisings and civil wars were frequent in Peru for almost three decades. Leading their own armies, local warlords or caudillos faced each other continuously in an attempt to conquer power. The presidency frequently changed in 1821-1845 (Zegarra, 2016). Political instability was critical soon after the destitution of Simón Bolivar in 1827: in the following three years, Peru had three presidents. Then, in 1834, president Luis José Orbegoso had to face several uprisings: two military caudillos attempted to take over the government, although they were finally defeated. Later during the period of the Confederation Peru-Bolivia, Peru had three main political figures: a protector, a president in the North, and a president in the South. The confederation, however, had to fight the armies of some Peruvian caudillos and the Chilean army, until the confederation was finally dissolved in 1839. Two years later, soon after president Agustín Gamarra passed away, several caudillos aimed at becoming presidents. Between 1841 and 1845, Peru had seven presidents or jefes de gobierno.

Several constitutions were enacted during this period. The first constitution of independent Peru was enacted in 1823. Nevertheless, three years later, Simón Bolivar enacted a new constitution. In 1828, Bolivar’s constitution was replaced by a new one. In 1834, the National Convention enacted a new constitution. But this constitution was then replaced by another one five years later. The fact that there were five constitutions in only 16 years reflects the deep political instability of Peru. It also suggests that in Peru a constitution itself did not represent a binding commitment to a certain set of rules.

This period of extreme political instability was accompanied by economic stagnation. Exports were stagnant in the 1820s, 1830s and early 1840s. According to Mitchell (1998), total exports were 5 900 000 soles in 1821, 5 100 000 soles in 1832, 5 300 000 soles in 1839 and 4 800 000 soles in 1845.17 Mining production went through a period of stagnation in post-independence years. Basadre (1983) stated that by the mid-1830s “Peru had lost in benefit of Chile its preponderancy in the Pacific […] Agriculture, the source of the Inca splendor, mining, the source of colonial splendor, seemed mired in decline” (Basadre, 1983, vol. ii, p. 55).

Political instability and economic stagnation generated a weak and disorganized fiscal apparatus and low fiscal revenues. Fiscal revenues reflected the economic stagnation. Fiscal revenues declined from 5 900 000 pesos per year in 1800-1809 to 3 900 000 per year in 1820-1829 and 3 300 000 per year in 1830-1831.18 Basadre (1983), for example, pointed out that in the 1830s the fiscal situation was very dramatic. In some cases, taxes were not collected; in other cases, taxes were collected by tax-officers but did not reach the respective government offices. In addition, state employees did not receive their salaries regularly, and the State permanently lived with debts that did not repay, and with loans that did not require. The fiscal apparatus was so weak and disorganized that no fiscal budget was prepared between 1832 and 1845.

Fiscal needs severely affected the system of property rights in the 1820s and 1830s. In the 1820s, the need for funding government spending led to the confiscation of properties. In the early 1820s a large number of properties were confiscated by the governments of José de San Martín and Simón Bolivar. Around 47 merchants with close connections to the Spaniards armies were forced to leave the country between 1821 and 1824, and so their haciendas were transferred to the State and then to military men, merchants and other patriots.19 Later in 1826, small convents were suppressed, and their properties passed to the State to finance education and the Beneficence of Lima.20 Then in January 1830, Agustín Gamarra established that the properties from the suppressed convents had to be managed by the Caja de Consolidación. In February of 1833, however, Gamarra himself passed a decree that established the transference of those properties to the state.21 Although this decree was not executed, it shows that the intention of confiscating properties to fund fiscal needs persisted in the 1830s (Armas, 2007). Due to the need to fund war expenses, the governments of Santa Cruz and Orbegoso confiscated and sold estates belonging to schools, to the beneficence, to hospitals, to religious communities and to Indians (in particular, to the Caja de Censos de Indios).

The need to finance the State also led to arbitrariness in the imposition of levies. During the anarchy of 1835 and during the wars of restoration in 1837 and 1838-1839 and the wars of 1841, compulsory levies under the name of “loans” took place.22 García-Calderón (1868) argued that the political instability brought desolation into the agricultural sector. In his own words: “During this time, attacks against movable and semi-movable property of the farmers, the desolation of the fields, and the forced loans called quotas that were imposed to the owners of estates, caused such abatement in agricultural wealth that nobody wanted to own land” (p. 11).

Other government measures further contributed to institutional uncertainty. During the governments of Orbegoso and Santa Cruz, state lands (estates belonging to the state) were sold to fund public expenses. Nevertheless, in July 1839, once the Confederation Peru-Bolivia was abolished, the government of Gamarra established that the sales of state lands during the government Santa Cruz were null, so the buyers had to return the estates to the original owners (Dancuart, 1903). A new law passed in November 1839 but it was only promulgated in 1846; it established that the buyers could remain as leasers for a number of years until the State made the total payment of the debt. Those who had received estates as payment for their services to the confederation had to return the estates (Basadre, 1983, vol. II, p. 260).

The confiscation of properties and the continuous changes in property rights were probably facilitated by the absence of a civil code or a general civil legislation that limited the discretionary power of authorities.23 As in other Latin American economies, in Peru authorities had a discretionary power to rule all aspects of economic life, so proprietors’ rights were not protected from abusive authorities. Officials and Authorities could gain from their discretionary political power.

These institutional deficiencies probably affected the credit market. Although creditors could make loans secured with real estate, they were probably uncertain about the possibility of repossessing mortgaged properties in case of non-payment. Debtors’ personal connections could well make it impossible to repossess and foreclosure the mortgaged property. The deficiencies of the system of property rights may then have had negative effects on land and credit markets. The confiscation of estates probably led to a high risk of expropriation and therefore to low incentives to purchase estates and grant real-estate mortgage loans.

Additionally, the mortgage legislation included some elements that restricted the growth of the credit market. Up until 1851, contracts and commercial transactions were still regulated by colonial practices, such as the Ordenanzas del Consulado de Bilbao, Las siete partidas, and the Nueva recopilación. One probable constraint to the development of credit markets was the lack of a system of public information about mortgages. Potential lenders had difficulties to learn about the mortgaged situation of a property. Lenders did not know whether a property had been used as collateral, and how many times it had been used. Then there was uncertainty about the property rights over the estate. A lack of definition of the order of preference also created problems. A lender did not know whether he had preference over others for the possession of collateral. In the case of non-payment, the lender had much uncertainty about the return to its investment: the process to repossess collateral was long and costly, reducing the returns to mortgage lending.

Therefore, for more than two decades after independence in 1821, the State did not provide a stable system of property rights. Property rights were not clearly defined and were subject to the possibility of government abuse. Even though usury laws were abolished in the early 1830s and the disentailment incorporated new estates into the land market, the system of unsecure property rights probably impacted the credit market.

The victory of Ramon Castilla in the Battle of El Carmen in 1844 and his rise to the presidency one year later largely contributed to the stabilization of the country. In the two decades that followed 1845, conspiracies, coups and civil wars were not as frequent as in the 1820s, 1830s and early 1840s. In the words of Javier Tantaleán, “governments no longer lasted days or a few months” (Tantaleán, 2011). Ramón Castilla, for example, ruled Peru 13 years in 1845-51 and 1855-62, and Rufino Echenique ruled between 1851 and 1854. Peru had two constitutions during this period. The constitution of 1856, enacted by the National Convention, replaced the constitution of 1839. In 1860, a new constitution was enacted, but this new constitution remained valid for 60 years until 1920.

Political stability in the 1850s and 1860s was accompanied by the expansion of the economy. Total exports increased from 4 800 000 soles in 1845 to 7 500 000 soles in 1851 and 37 000 000 soles in 1861. The index of the total volume of exports increased from 25.5 in 1840-1849 to 52.8 in 1850-1859 and 68.9 in 1860-1869.24 The rapid growth of exports was largely caused by the boom of guano. Guano exports increased from less than 25 000 tons in 1845 to 186 000 tons in 1850 and 461 000 tons in 1860. Although guano exports then declined to 368 000 tons per year in 1861-65, they were much larger than in the 1850s. Nitrate exports also increased during this period from 17 000 tons in 1845 to 24 000 tons in 1850 and 64 000 tons, in 1860 and 112 000 tons in 1865. The expansion of the commercial activity led to an increase in public revenues. According to Contreras (2012), fiscal revenues increased from 5 600 000 soles per year in 1846-49 to 13 700 000 soles in 1850-1859 and 28 200 000 soles in 1860-1869.

Political stability and economic growth were accompanied by the enactment of legislation that defined property rights more clearly. The enactment of the civil code of 1851, for example, represented a major institutional change.25 The 1851 civil code constituted a cohesive piece of legislation that aimed at establishing general regulations and property rights for the lives of Peruvians regarding people’s rights, property rights, and obligations and contracts. The civil code established general requirements for contracting and therefore reduced the discretionary power of the authorities. Now borrowers and lenders counted with a piece of legislation that protected their property rights. With the civil code, for example, arbitrary confiscation was illegal. According to the civil code, the expropriation of properties had to follow a formal procedure. The government had to declare certain property as having public utility. The government also had to prove that the property served the public interest. The value of the property would be established by an independent expert. If the owner agreed on the sale, the transfer could be done immediately through the Prefect of the province. If the owner disagreed on the sale, declaring that the property was not necessary for the state or that the price was too low, a judge would intervene and dictate a sentence. This sentence, however, was appealable. One cannot argue that the civil code itself eliminated the uncertainties over property rights, but it may have sent a signal that the State attempted to provide greater institutional securities.26

In addition, the civil code regulated all types of contracts, including loans. According to the code, lenders could make loans secured with any good. There were no capital requirements for private lenders, no restrictions on loan sizes, and no interest rate caps. Nevertheless, there were certainly some requirements for lending and borrowing. The individuals who could not directly lend or borrow were the non-emancipated minors (younger than 21 years old), married women without the authorization of their husbands, persons with mental problems, fatuous individuals, pródigos, and members of the church.27 With some exceptions, most mentally sane adults could lend or borrow.28

The code may have reduced information costs by requiring the registration of real-estate mortgages in public offices, and making the information available to the public. Mortgages could only be constituted by escritura pública, i.e. in a notary. To be valid, mortgages had to specify the amount of the loan and the mortgaged estate, and had to be registered in the local mortgage public offices or Oficina de Hipotecas.29 Information on mortgaged estates was supposed to be clear, thereby reducing informational deficiencies.303131 Also, mortgages had to be registered in a special public office called registro de hipotecas.31 These public offices were to be established in the capital cities of each province.32

Therefore, from 1845, Peru became politically more stable and formal property rights were better secured. The probability of confiscating properties may have declined and the legislation may have been clearer in the definition of the property rights of lenders and borrowers.33 As I will show in the following section, these political and institutional changes probably had an important effect on credit markets.

Private credit and interest rates

Credit markets have existed in Peru from colonial times. Numerous lenders and bankers channeled funds to a variety of borrowers for consumption and investment. Nevertheless, as colonial usury laws were abolished and more land was legally available for transactions from the early 19th century, the mortgage market could have gained some dynamism. Private lenders and even the Catholic Church could have provided credit to investors secured with urban and rural estates. However, political instability and the consequent institutional weaknesses probably constituted an obstacle to the growth of the credit market.

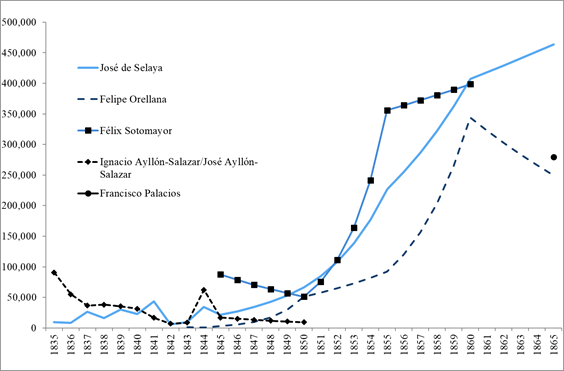

Institutional deficiencies and political instability in the 1830s and early 1840s probably reduced the incentives to save and invest. Notarial evidence suggests that the credit market did not experience much growth during the 1830s and early 1840s. Although limitations to the sale of properties and usury laws were eliminated in the early 19th century, the expansion of credit markets in Peru in the 1830s and 1840s was very slow. Recent estimates by Zegarra (2016) show that the total value of new mortgage loans in Lima remained below 500 000 soles in most of 1835-1845 and that it only expanded rapidly from the mid-1840s. Among the loans notarized by José de Selaya, for example, the number of loans slightly increased in the 1830s and 1840s. In particular, the average number of loans per year notarized by Selaya was 13.8 in 1835-1840 and 17.2 in 1841-1845. The value of new loans by this notary only increased from around 19 000 soles per year in 1835-1840 to 23 000 soles per year in 1841-1845 (Figure 1). Among loans notarized by the brothers Ignacio and José Ayllón-Salazar, the average number of loans per year actually decreased from 26 in 1835-1840 to 12.2 in 1841-1845, and the average value of new loans declined from nearly 48 000 soles per year in 1835-1840 to 22 000 soles in 1841-1845.

Source: Prepared by the author on the basis of the sample of loans (loans notarized by Ignacio Ayllón-Salazar, José Ayllón Salazar, José de Selaya, Felipe Orellana, Francisco Palacios and Félix Sotomayor). See text for a description of the data sources.

Figure 1 Value of New Loans, by notary, 1835-1865 (soles)

Importantly, the evidence indicates that interest rates reached very high levels in the 1830s and 1840s (Table 2). More than 36% of loans included nominal interest rates above 20% in 1835-1845, and the average nominal interest rate was 21% in 1835-1840 and 22% in 1841-1845. Among loans secured with urban estates, 48% of loans specified interest rates above 20% in 1835-1840 and 51% of loans did so in 1841-1845; meanwhile, the average interest rate was 22.4% in 1835-1840 and 24.7% in 1841-1845. Among loans secured with rural estates, the average interest rate was above 19% in 1835-1845, and the percentage of loans with interest rates above 20% was 33% for 1835-1840 and 20% in 1841-1845.34

Table 2. Private lenders: nominal interest rates, 1835-1865

| 1835-1840 | 1841-1845 | 1850 | 1855 | 1860 | 1865 | |

|---|---|---|---|---|---|---|

| All loans | ||||||

| Average interest rate (percentage) | 21.1 | 21.9 | 17.5 | 14.7 | 13.9 | 12.8 |

| Distribution of loans (percentage of the number of loans) | ||||||

| Interest equal to 0 | 3.8 | 3.8 | 3.5 | 1.6 | 2.5 | 5.5 |

| More than 0% and up to 6% | 3.8 | 1.0 | 0.9 | 4.7 | 1.4 | 6.6 |

| More than 6% and up to 10% | 2.5 | 2.4 | 6.2 | 13.2 | 6.7 | 9.2 |

| More than 10% and up to 15% | 16.7 | 15.8 | 24.8 | 45.3 | 46.7 | 49.8 |

| More than 15% and up to 20% | 10.5 | 21.1 | 20.4 | 15.8 | 9.5 | 9.2 |

| More than 20% | 36.0 | 37.8 | 17.7 | 8.4 | 5.5 | 8.1 |

| Missing | 26.8 | 18.2 | 26.5 | 11.1 | 27.7 | 11.7 |

| Number of observations | 239 | 209 | 113 | 190 | 433 | 273 |

| Loans secured with urban estates | ||||||

| Average interest rate (percentage) | 22.4 | 24.7 | 18.1 | 14.8 | 13.5 | 13.3 |

| Distribution of loans (percentage of the number of loans) | ||||||

| Interest equal to 0 | 6.7 | 0.0 | 0.0 | 0.0 | 1.0 | 2.1 |

| More than 0% and up to 6% | 1.7 | 0.0 | 0.0 | 7.2 | 2.6 | 6.3 |

| More than 6% and up to 10% | 0.0 | 2.8 | 9.8 | 14.4 | 8.2 | 9.0 |

| More than 10% and up to 15% | 21.7 | 15.5 | 29.4 | 48.5 | 64.1 | 59.0 |

| More than 15% and up to 20% | 8.3 | 14.1 | 29.4 | 16.5 | 12.8 | 10.4 |

| More than 20% | 48.3 | 50.7 | 19.6 | 10.3 | 5.6 | 8.3 |

| Missing | 13.3 | 16.9 | 11.8 | 3.1 | 5.6 | 4.9 |

| Number of observations | 60 | 71 | 51 | 97 | 195 | 144 |

| Loans secured with rural estates | ||||||

| Average interest rate (percentage) | 18.8 | 18.6 | 26.1 | 14.1 | 12.0 | 11.6 |

| Distribution of loans (percentage of the number of loans) | ||||||

| Interest equal to 0 | 0.0 | 6.7 | 0.0 | 0.0 | 8.7 | 0.0 |

| More than 0% and up to 6% | 16.7 | 0.0 | 0.0 | 0.0 | 4.3 | 0.0 |

| More than 6% and up to 10% | 0.0 | 0.0 | 0.0 | 20.0 | 4.3 | 19.2 |

| More than 10% and up to 15% | 8.3 | 6.7 | 0.0 | 40.0 | 52.2 | 65.4 |

| More than 15% and up to 20% | 8.3 | 26.7 | 40.0 | 30.0 | 21.7 | 3.8 |

| More than 20% | 33.3 | 20.0 | 20.0 | 0.0 | 0.0 | 0.0 |

| Missing | 33.3 | 40.0 | 40.0 | 10.0 | 8.7 | 11.5 |

| Number of observations | 12 | 15 | 5 | 10 | 23 | 26 |

Notes: The table reports average interest rates and the distribution of loans according to interest rates.

Source: Prepared by the author on the basis of the sample of loans (loans notarized by Ignacio Ayllón-Salazar, José Ayllón Salazar, José de Selaya, Felipe Orellana, Francisco Palacios and Félix Sotomayor). See text for a description of the data sources.

Interest rates were certainly higher for smaller loan sizes and shorter periods of maturity (Table 3). However, even for loans of great amount and long duration interest rates were high. Among loans of 5 000 to 10 000 soles, for example, the average interest rate was 15.4% in 1835-1840 and 16.8% in 1841-1845, whereas among loans of more than two years of maturity the average interest rate was above 14% in 1835-1840 and 18% in 1841-1845.

Table 3. Nominal Interest rates by Loan Size and Maturity

| 1835-1840 | 1841-1845 | 1850 | 1855 | 1860 | 1865 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IR | N | IR | N | IR | N | IR | N | IR | N | IR | N | |

| All loans | 21.1 | 175 | 22.2 | 171 | 17.5 | 83 | 14.7 | 169 | 13.9 | 313 | 12.8 | 241 |

| Interest rate by loan size | ||||||||||||

| Up to 1 000 soles | 24.1 | 98 | 25.4 | 112 | 20.8 | 50 | 19.3 | 63 | 15.5 | 98 | 14.8 | 102 |

| More than 1 000 soles and up to 2 000 soles | 18.9 | 42 | 18.1 | 23 | 10.7 | 16 | 12.7 | 41 | 14.3 | 78 | 12.3 | 42 |

| More than 2 000 soles and up to 5 000 soles | 15.1 | 29 | 15.2 | 27 | 13.3 | 11 | 11.8 | 38 | 14.0 | 83 | 11.0 | 55 |

| More than 5 000 soles and up to 10 000 soles | 15.4 | 5 | 16.8 | 5 | 15.4 | 5 | 10.7 | 16 | 11.1 | 35 | 11.6 | 19 |

| More than 10 000 soles | 16.1 | 1 | 11.3 | 4 | 12.7 | 1 | 10.7 | 11 | 9.3 | 19 | 10.6 | 23 |

| Interest rate by maturity | ||||||||||||

| Up to 1 year | 23.1 | 117 | 24.1 | 116 | 19.1 | 54 | 16.0 | 93 | 15.5 | 167 | 12.8 | 115 |

| More than 1 year and up to 2 years | 19.1 | 27 | 17.8 | 31 | 15.2 | 20 | 14.4 | 40 | 13.1 | 73 | 13.2 | 73 |

| More than 2 years and up to 5 years | 13.7 | 8 | 18.3 | 14 | 13.6 | 8 | 12.8 | 20 | 10.7 | 38 | 12.2 | 34 |

| More than 5 years and up to 10 years | 15.3 | 9 | a/ | 0 | a/ | 0 | 6.7 | 3 | 11.1 | 12 | 8.0 | 5 |

| More than 10 years | a/ | 0 | a/ | 0 | a/ | 0 | 9.0 | 1 | a/ | 0 | a/ | 0 |

Notes: The table reports average nominal interest rates by loan size and maturity.a/ No information for this range. IR = Interest rate (%). N = Number of observations.

Source: Prepared by the author on the basis of the sample of loans (loans notarized by Ignacio Ayllón-Salazar, José Ayllón Salazar, José de Selaya, Felipe Orellana, Francisco Palacios and Félix Sotomayor). See text for a description of the data sources.

Contemporary sources indicated that credit in Lima was scarce and interest rates were high in the 1830s and 1840s.35 In 1830, minister of Hacienda José María de Pando pointed out that there was scarcity of specie, as evidenced by the high interest rates. In his memoirs, Peruvian president José Echenique also indicated that credit in the 1840s was scarce and interest rates were very high. In particular, Echenique argued that without capitalists, and with only a few lenders that speculated charging usury rates of 2 and 3% per month, it was impossible to use credit to invest on and purchase rural estates or repair urban estates (Echenique, 1952, vol. ii, p. 195).36 As interest rates were very high, several investment projects were probably not profitable.37

As political uncertainties declined from the mid-1840s, the supply of funds may have increased more rapidly than the demand for funds. As risk declined, interest rates declined. Consistently, the evidence suggests that the credit market expanded substantially in the 1850s and 1860s. Among loans notarized by José de Selaya, the number of notarized loans increased from fifteen in 1845 to 61 in 1855, and 81 in 1865, and the value of new loans increased from less than 22 000 soles in 1845 to more than 220 000 soles in 1855, and 463 000 soles in 1865. Among loans notarized by Felipe Orellana, the number of loans increased from only eight in 1845 to 41 in 1855, and 81 in 1865, and the value of new loans increased from less than 4 000 soles in 1845 to more than 90 000 soles in 1855, and 250 000 soles in 1865. Among loans notarized by Félix Sotomayor, the value of new loans increased from around 87 000 soles in 1845 to more than 350 000 soles in 1855, and nearly 400 000 soles in 1860. Consistently, estimates for the entire population show an important expansion of credit after 1845. According to Zegarra (2016), the total value of new mortgage loans in Lima remained below 500 000 soles per year in most of the 1835-1845 period, and then increased from 334 000 soles in 1845 to 1 400 000 in 1855, 2 200 000 in 1860 and 1 900 000 in 1865.38

Some might argue that the expansion of credit may be explained by the growth of the economy, not by political stabilization and institutional change. Notwithstanding, the estimates favor the hypothesis that the expansion of credit is at least partly explained by political stabilization and institutional change. In particular, total mortgage credit grew by 220% in real terms between 1845 and 1865,39 at a far greater rate than real gdp: real gdp only grew by 65% in the same period.40 That the value of mortgage credit expanded at a faster rate than gdp suggests that the expansion of mortgage credit did not obey only to the expansion of the economy. Political stabilization may then have influenced the expansion of credit.

The changes in the value of credit were accompanied by changes in interest rates. The evidence shows that nominal interest rates decreased in the 1850s and 1860s. Average nominal interest rates declined from more than 21% in 1835-1845 to 17.5% in 1850, 14.7% in 1855 and 12.8% in 1865. In 1841-1845 around 23% of loans were associated with annual nominal interest rates of 15% or less; this percentage then increased to 65% in 1855 and 71% in 1865. Among loans secured with urban estates, average nominal interest rates declined from almost 25% in 1841-1845 to 18.1% in 1850, 14.8% in 1855 and less than 14% in 1860 and 1865. In these loans, the percentage of loans with interest rates of 15% or less increased from 18% in 1841-1845 to 70% in 1855 and 76% in 1865.41

Interest rates declined for most ranges of loan sizes and maturity. Among loans of 1 000 soles or less, for example, the average interest rate declined from 25% in 1841-1845 to 19% in 1855 and 14.8% in 1865; whereas in loans of 5 000 to 10 000 soles, the average interest rate declined from 16.8% in 1841-1845 to 10.7% in 1855 and 11.6% in 1865. Similarly, among loans of one year or less of maturity, the average interest rate declined from 24% in 1841-1845 to 16% in 1855 and 12.8% in 1865; whereas among loans with a duration between two and five years, the average interest rate decreased from 18.3% in 1841-1845 to 12.8% in 1855 and 12.2% in 1865.

Contemporary sources also indicated that interest rates went down in the 1850s and 1860s. By 1869, for example, Nicolás Rodrigo stated that annual interest rates declined from 24% in 1830 to around 12% in 1854-1870 as loanable funds became more available. In particular:

That Peru today has more money than in previous years is a tangible truth shown everywhere by the material progress of the country, and the easiness, with which many companies are formed, even those that can provide only distant profits ... So that by the years 30 [1830] and 32 [1832] as money was scarce and therefore food products were cheap, the interest came to 24 percent; while subsequently and as money was abundant, the interest has declined to 12, 9 and even 8 percent … From the year 1854 to today, the interest of money has generally remained around 12%. (Junta Municipal de Lima, 1870, p. 8.)

Other contemporary sources also reveal that annual interest rate in Lima in the 1850s and 1860s was lower than in the 1830s or early 1840s. Emilio Althaus pointed out that the annual interest rate in 1854-1870 was around 12% per year (Junta Municipal de Lima, 1870, p. 15). E. Ayulo stated that the interest rate in 1854-1870 was around 1% per month, except in some moments of abundance of capitals, when interest rates were lower (Junta Municipal de Lima, 1870, p. 14). Meanwhile, J. F. Lembecke indicated that the annual interest rate was 9%. According to Lembecke, at this rate “it was easy to find money” (Junta Municipal de Lima, 1870, p. 12); but in the following years interest rates increased. Similarly, in the early 1860s, José Arnaldo Márquez pointed out that the annual interest rate in Peru ranged between 9 and 12% (Márquez, 2003, p. 134). In his Estadística General de Lima, published in 1858, Manuel Fuentes declared that mortgage rates ranged between 1% and 2% per month (Fuentes, 1858, p. 328). These rates were above those reported by other sources; however, they are still below the rates declared for the 1830s and 1840s. Meanwhile, Francisco García-Calderón indicated that the interest rate in Lima in the late 1860s –just prior to the creation of the Banco de Crédito Hipotecario, the first mortgage bank of Peru– was 1% per month (García-Calderón, 1868, p. 65).

Banks appeared in the 1860s. The first commercial bank was the Banco de la Providencia, which started to operate in late 1862. Other banks of issue and discount were then created in the following years. By 1875 there were thirteen commercial banks in Peru; most operated in Lima, a few in other cities. The first mortgage bank was created in 1866; four years later the second mortgage bank was founded. Some historians point to the appearance of those banks as a key factor in the expansion of credit markets (Camprubí, 1957; Engelsen, 1978). It is possible that the creation of banks had an important effect on the development of private capital markets. However, the evidence suggests that prior to the foundation of commercial and mortgage banks, the stabilization of the political system and the establishment of a more secure system of property rights contributed to the expansion of credit markets and the reduction in interest rates.

Nominal interest rates in Lima in the 1830s and 1840s were not only higher than in the 1850s and 1860s. Nominal interest rates in the years of political instability and institutional insecurities were also very high for international standards. In the United States, for example, mortgage rates were usually below 11%. Eichengreen (1984), for example, estimated that mortgage rates ranged between 7.4 and 8.6% in 1869-1879, and between 6.2 and 7.4% in 1880-1890; whereas Homer and Sylla (2005) reported that mortgage rates in New York city were 7% in 1869, 5.9% in 1879 and below 6% in the 1880s. Interest rates in Western Europe were also below 11%. According to Homer and Sylla (2005), for example, mortgage rates in Paris were around 10% in the first half of the 19th century and 6% or less in Germany in 1820-1875. In Latin America, interest rates were usually higher than in the United States and Europe, but were still lower than those in Lima in the 1830s and early 1840s. According to Levy (2012), average interest rates in the state of Yucatan, Mexico, ranged between 10% and 16% in the 1870s, 1880s and 1890s.42 In 1880, for example, the average interest rate to all borrowers was 10.6%. Then average interest rates were 15.9% in 1885, 12.5% in 1890 and 11.4% in 1895. Meanwhile, mortgage rates in Bogota, Colombia, were around 12% per year;43 whereas in Medellin commercial houses charged rates between 8% and 12% and individuals charged up to 18% per year.44

Inflation is usually one important element in explaining nominal interest rates: in the presence of high inflation, creditors add a substantial premium to the real interest rate and thus nominal interest rates tend to be high. Inflation, however, cannot account for the evolution of nominal interest rates in Lima. In fact, in the 1830s and early 1840s the Peruvian economy did not go through an inflationary process: in the period of 1830-1845 there was inflation only in 1836, 1837 and 1844. In 1835, 1838-1843 and 1845, prices went down every year.45 Annual deflation was actually 1.8% in 1830-1835, 4.5% in 1835-1840 and 3.5% in 1840-1845. On the contrary, prices went up in the 1850s and 1860s: annual inflation was 0.1% in 1845-1850, 4.8% in 1850-1855, 22% in 1855-1860 and 3.1% in 1860-1865. Then nominal interest rates in the 1850s and 1860s were much lower than in the 1830s and 1840s in spite of the increase in inflation since 1850. As a result, real interest rates in the 1850s and 1860s were much lower than in the 1830s and early 1840s. The average real interest rate was 22.4% in 1835-1840 and 23.2% in 1841-1845.46 Then real interest rates declined to 3.6% in 1855 and to 2.6% in 1865.47

Conclusions

In recent years, notarial records have been more extensively employed for the study of private credit markets in the United States, Western Europe and Mexico. Notarial records have been used to study the participation of women in credit markets, the impact of revolutions, the role of notaries as financial intermediaries, among other subjects. Notarial records for Peru are also available and allow us to study the development of private credit markets.

The evidence of more than 1 400 mortgage loans for 1835-1865 suggests that political institutions had a key impact on the development of the private credit market of Lima. In particular, political instability and institutional uncertainties led to the stagnation of the private credit market of Lima and high interest rates in the 1830s and early 1840s; whereas the rise of Ramón Castilla, along with political stabilization and the enactment of civil and commercial codes, apparently fostered the growth of credit markets and reduced interest rates, by providing a more secured system of property rights. Even controlling inflation, nominal interest rates steadily declined as the country became more stable. This article has relied on a sample of mortgage loans. Nevertheless, it is plausible that other forms of credit (such as pawn, commercial and banking credit) followed a similar trend. In fact, the appearance of commercial and mortgage banks in the early 1860s may have been facilitated by the political stabilization of Peru and the decline in the lending risk.

I cannot argue that political stabilization was the only factor that explains the growth of mortgage credit in the 1850s and 1860s. The growth of the economy probably also impacted the private credit market. As the Peruvian economy benefited from the guano boom in the 1850s and 1860s, more funds may have flown into the economy and investors may have had more needs for credit. The supply of credit and the demand for it probably increased as the economy grew. However, the expansion of the value of credit at a faster rhythm than gdp and the decline in interest rates suggest that political stabilization influenced the risk of lending and the supply of funds.

The case of Peru confirms that political institutions had a deep impact on capital markets. Nonetheless, commitment to certain rules did not act similarly to other economies. North (1989), for example, consider the Glorious Revolution and the enactment of a constitution in 17th century England as an example of the positive effect of commitment on the development of capital markets. In Peru, however, although political institutions mattered, constitutions did not play the same role as in England. Peru in fact had seven constitutions between 1823 and 1860. The enactment of constitutions did not imply commitment to a certain set of rules.

In Peru, constitutions cannot be considered exogenous. Civil wars and continuous political unrest may have been more exogenous than the constitutions. There were constitutions throughout the 19th century. These rapid changes were probably not only a symptom of a lack of strong commitment to a set of rules, but also a message for the economic agents. If individuals realized that constitutions did not represent a binding commitment, then the enactment of a new constitution itself did not produce a major change in the securing of property rights. It was probably not the enactment of the Constitution of 1855 which reduced the risk of lending, but the political stability –together with the abundance of fiscal resources– which sent a signal to estate owners, lenders and borrowers that both the probability of confiscation and the risk of lending would decline. One could also argue that the enactment of the commercial and civil codes had a far minor effect than political stabilization.48 In this study, the sample does not let us determine whether political instability had a greater role than the lack of commercial and civil codes.

nueva página del texto (beta)

nueva página del texto (beta)