Introduction

In his classical study about the history of money in Brazil, Pandiá Calógeras (1960), referring to the period prior to the arrival of the royal family in Rio de Janeiro in 1808, asked, "What amounts had been coined? How much was in circulation? These problems cannot be solved given the current state of our knowledge" (p. 15). This paper seeks to provide an answer to these two questions, with the aim of contributing to the discussion of the Brazilian monetarization process in the eighteenth century. For this purpose, we estimate the stock of national currency in the colony by subtracting the total amount of coinages sent to Portugal from the total amount of national coins produced at the mints of Portuguese America between 1703 and 1807.

Based on the hypotheses that, in the eighteenth century, Brazil was not merely an economy that exported precious metals and that there was a relative expansion of the domestic market, the main research question is whether this market was, or was not, lubricated by the circulation of metallic money. Quantifying the currency stock that was available in Brazil might help to solve this question.1

The most recent historiography has reassessed the monetary aspects of relations between Brazil and Portugal (Carrara, 2010b; Costa, Rocha & Sousa, 2013), with one of its conclusions pointing to the existence of complementarity in the production of metallic money. This complementarity can be explained not only by the coinage of provincial and national gold coins in the Brazilian mints and in the Lisbon Mint but also by the recipients of the issues of gold coins. In Rio de Janeiro, Minas Gerais, and Bahia, the national gold coins that were produced were destined for private economic agents, who could then send them to Portugal in ships' holds. Meanwhile, in Lisbon, gold bullion and gold dust were mainly received by the State. Between 1720 and 1807, 557 tons (271 000 contos de réis) of gold arrived in the port of Lisbon, corresponding to 73% of the total gold production in the period between 1721 and 1799. Of these imports, 78% were destined for private economic agents, while 22% were net tax revenues collected by the State (Costa, Rocha & Sousa, 2013). While this conclusion highlights the gap between the production and the remittances of gold, the systematic calculation of all the gold coined at the Brazilian mints needs to be reassessed in order to understand whether, during the eighteenth century, all the coins minted in Brazil were, or were not, shipped to Lisbon. A comparison of these three variables -production of gold dust, coinages, and remittances- also enables us to find an explanation for the gap between coinages and remittances.

In turn, in Brazilian historiography, there is now greater consensus about the view that, in the eighteenth century, Brazil was not merely an export economy, but that it also expanded its domestic trade.2 Recently, the debate over the relationship between mining, currency, and the domestic market has extended the discussions that had previously taken place in relation to the former Spanish colonies such as Potosi, Cordoba, Paraguay and Buenos Aires,3 a debate that has tended to become polarized into a discussion about the nature of the areas that produced precious metals: were they natural economies or monetary economies? (Johnson, 1973; Carrara, 2010a).

The remainder of the paper is organized as follows. Section 2 presents a brief summary of the historiographical debate on the role of currency in the colonial period. The aim will be to demonstrate how the various approaches have tended to focus on contradictory theses: sometimes what is most noticeable is the absence of a demand for money and, at other times, its shortage. In section 3, the legal framework governing the monetary system is described, and new estimates are provided for the production of national gold coins at the mints of Rio de Janeiro, Bahia, and Minas Gerais. The continuing permanence of national gold coins in Brazil allows us to question their destination and, furthermore, serves to provide a first step in the regional analysis, establishing a difference between Rio de Janeiro and Bahia. This will be the purpose of section 4. The fifth, and final, section presents our estimate of the stock of national gold currency in Brazil, corroborating the information available from that time, according to which part of this national gold currency remained in Brazil in response to the growth of the economy.

Money in colonial Brazil: Absence of a demand for money, or a shortage?

The most common approach to monetary questions in the colonial period is based on the idea that there was almost no circulation of metallic money. Not even the great production of gold (and gold coins) in the eighteenth century would have changed this picture, because, in a slave-based economy, based on the plantation system, with self-sufficient economic units geared exclusively to the external market, the absence of currency would not interfere with its economic performance. Therefore, the development of trade from the mid-eighteenth century onwards, especially in the Rio de Janeiro region, would have led to a hierarchical system of credit. This line of reasoning leads us to conclude that inside the colony itself, there would have been no demand for metallic money for transaction purposes, as these could be carried out without the need for monetary resources.

A survey of some of the authors who have written and reflected on Brazilian economic history allows us to demonstrate these claims. Roberto Simonsen (1941), analyzing the monetary situation prevalent at the end of the colonial period, states that "in a land where industries, except for the production of raw cotton cloth, were prohibited, where the main activity was concentrated in agriculture, and where foreign trade was in the hands of Portugal, the money stock would have been limited, just as the needs for currency would also have been limited" (vol. 2, p. 261).

This makes it explicit that there would not have been any demand for money; therefore, it would not make sense to talk about a shortage of money.

Following the same line of thought, Celso Furtado (1959) considers that production was basically destined for export so that the monetary flow was established between the production unit and the external market. In the event of an external crisis, the adjustment was made automatically: by reducing income, the fall in exports also implied a reduction in imports not only of consumer goods but also of capital goods and labor, giving rise to a (frequently lengthy) process of economic decline. It should be added that there would be no demand for money for transactions inside the colony, for the only "multiplier effect" caused by the sugar industry would be related to cattle farming, which would absorb no more than 5% of the monetary income generated by sugar exports.

In turn, writing about the Brazilian export economy, Caio Prado Jr. (1942) assumed that "the general nature of Brazilian colonization [...] is that of a colony destined to provide European trade with some tropical commodities of great economic importance. It is for this purpose that it was created. [...] Anything more that exists therein [...] is subsidiary and destined solely to support the achievement of that essential aim. Also included here is the subsistence economy" (p. 41).

Caio Prado Jr. (1942) describes the various secondary activities at length, highlighting the "agricultural renaissance" that took place from the 1770s onwards, and mentioning the existence of coastal trade to supply the urban centers. Nevertheless, he reveals almost nothing about the forms (means) of payment.

Among those who have sought to analyze monetary questions more directly, D. T. Vieira (1985) explains, in a frequently quoted passage, why there was little actual need for cash in view of the economic and social characteristics of Brazil at that time:

[The] producer did not need cash because the payment of work was limited to the maintenance of the slave [...]. The stewards and skilled workers mainly received their payments in natura. [...] Existing in small quantities, money was only accumulated in the most important cities, and even there it was only in the hands of the wealthiest; the latter, in turn, had no need for a trading intermediary, given the scarcity of the population and the scantiness of their needs, and tended to hoard it rather than cause it to circulate (p. 350, our emphasis).

The problematics of the scarcity of currency was also considered by Noya Pinto (1979), who highlights the important influence of mining on the supply and demand for money. This author considers that, prior to the appearance of gold, the circulation of currency in Brazil was reduced in scale, being limited to the small amounts of coins minted in Lisbon and sent to the colonies. To overcome this shortage, the colonists resorted either to trading with the use of native products transformed into currency, such as tobacco and cotton or to trading with the Spanish colonies, especially Buenos Aires, where they acquired silver coins. This circumstance meant that a system of trade in natura remained dominant, stimulating a closed internal economy that supplied itself, and in which prices changed little due to the weak mechanism of supply and demand. In the eighteenth century, however, gold altered this situation. Firstly, gold in the form of dust, and then later in the form of coins produced at the various mints set up in Brazil, began to circulate in the Brazilian domestic market, leading to a rise in prices resulting from the huge demand and limited supply. Mining activity, which was accompanied by urban and demographic growth, created conditions for the formation -for the first time in the history of Brazil- of an internal market stimulated by the increased amount of currency in circulation and the greater purchasing power of the colony in general, and the mining regions in particular. Thus, for Noya Pinto, the greater supply of currency (metallic money and gold dust) contributed to the development of the internal market. The exception to this picture was the region of Bahia, where the demand for money existed, but the supply was insufficient to meet it, at least until the 1730s.

More recently, Jucá Sampaio (2002) reached a number of conclusions about the shortage of metallic currency in some regions of Brazil. Studies based on inventories serve him as an argument. He considered credit not as an option for postponing the settlement of payments in keeping with a mercantile logic, but as a consequence of that shortage. According to Jucá Sampaio, money traveled in just one direction, namely, from the mining areas to Rio de Janeiro, where the merchant elite controlled its flows, although in the daily life of Rio society, however, money would be scarce. Like Fragoso (1992) and Fragoso & Florentino (1993), Jucá Sampaio considers that the shortage of currency led to the establishment of hierarchical chains of credit (indebtedness).

Therefore, according to these authors, questions related both to the supply and demand for money would not have been important for analyzing the Brazilian economy in the colonial period. The most common conclusions point to the absence of currency in most regions, together with its geographical and social concentration. However, is it possible to continue to defend this picture of an economy poorly supplied by metallic money?

Production of National coins in Brazil

The scramble for metallic money

Throughout its colonial period, Portuguese America adopted a bimetallic monetary system. The unit of account was the real and, besides metallic money (gold, silver, and copper), the means of payment included such commodities as cotton, sugar and gold dust. In the first half of the eighteenth century, while cotton was a means of exchange in the State of Maranhão and Grão-Pará, gold dust circulated, above all, in the mining regions (Antonil, 2001). However, in the colony as a whole, the ratio between the settlement of exchanges in commodities or in cash had changed in comparison with the previous century: cash payments became more common, that is to say, metallic money became not only the means of payment but also the predominant means of exchange. In this sense, a lack of metallic money might have represented an obstacle to trade in general, including the business of the State. On the other hand, if metallic money is seen to have circulated in sufficient quantities to meet the demand for money for transaction purposes, then this would strengthen the thesis of the expansion of the internal market throughout the eighteenth century.

As far as metallic money is concerned, two types of coins were produced, both at the Lisbon Mint, and at the mints set up in Brazil: national gold coins, intended for circulation in Portugal, and provincial coins, made of gold, silver and copper, which were to be used exclusively as legal tender in the Portuguese American territory. Thus, in the case of colonial Brazil, not only was the system a bimetallic one, but it was also a system that had complementary coins in circulation (Fantacci, 2005). However, as it will be demonstrated in section 5, the so-called national gold coins also circulated in Brazil. Let us, then, assess their production at the mints operated by the Portuguese crown in Brazil.

Coinages in Brazil (1703-1807): New estimates

The large-scale mining of gold in Brazil from the late seventeenth century onwards brought profound changes to the coinage policy. It was decided to reopen the Rio de Janeiro Mint (CMRJ) in 1703, and later on, in 1714, the Bahia Mint, which remained in operation until 1832 (see Gonçalves, 1984). A third mint was established in Vila Rica between 1724 and 1734. The initial idea was to exclusively mint national coins, with the same intrinsic and extrinsic value as those produced at the Lisbon Mint (table 1, appendix). With this measure, the metropolitan authorities sought to prevent the smuggling of gold dust, for this diminished the crown's revenue.

Historians interested in calculating the quantity of gold transferred from Brazil to Europe have investigated the total amounts produced at the Brazilian mints. Soetbeer (1880) presents annual data regarding the marks of gold entering the Rio de Janeiro Mint in the period 1703-1810. Documents from the second half of the nineteenth century seem to confirm Soetbeer's data. For example, Candido de Azeredo Coutinho (1862), head of the CMRJ, stated that 867 contos de réis had been coined at that mint each year during the period when the Vila Rica Mint was in operation. This average annual value for the period 1725-1733 is the same as in Soetbeer's data. Furthermore, according to Azeredo Coutinho, 1755 was the year of greatest production, for the reason that production in 1780 having been 2 550 contos lower. Soetbeer's data show that the CMRJ produced 4 844 contos of national coins in 1755 (the highest value in his series), and 2 297 contos in 1780, that is to say, 2 547 contos less. Furthermore, the figures presented by Soetbeer are almost identical to the annual values presented by the Conde de Resende for the period 1768-1796.

Another historian, Michel Morineau (1985) presents a table showing the production of the CMRJ for five-year periods. This table is based on Soetbeer's data, even though the two sets of figures do not always coincide with one another.

The coinage of the Vila Rica Mint was originally presented by Charles Boxer (1962). As in the case of Soetbeer, his data show the amount of marks that entered that mint each year.

Costa, Rocha & Sousa (2013) produced a synthesis of the information provided by Morineau (1985) and Boxer (1962) by aggregating the values for some years of the 1760s at the Bahia Mint. In the case of the Vila Rica Mint, in order to convert marks (weight) into contos de réis (unit of account) the value in marks was divided by ten and multiplied by 1 024.

To the data that have been mentioned above we can now add the value of the gold coins produced by the Bahia Mint,4 which allows us to present the consolidated data for the production of national gold coins over five-year periods by the three mints operating in Brazil in the eighteenth century.

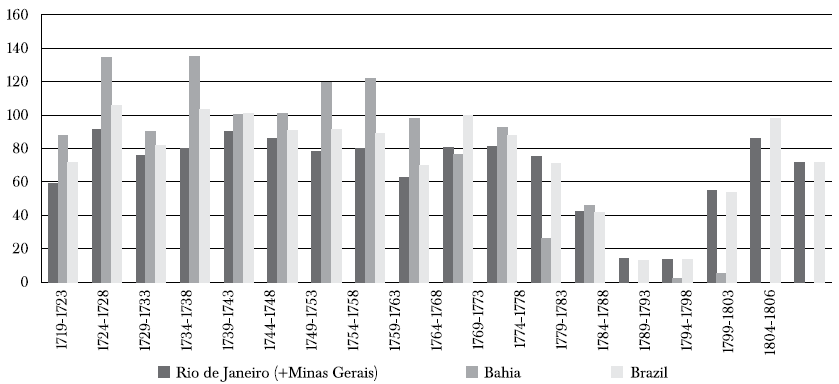

The levels of coinage were high between 1724 and 1763 and remained significant in size until the late 1780s (see figure 1). The production of coins only began to become concentrated at the CMRJ from the 1750s onwards for, up until then, the output of the Bahia Mint amounted to roughly one-third of that of the CMRJ. It can also be concluded that, during the ten years in which it was in operation, the Vila Rica Mint minted more than half of the total amount of coins produced in the colony, and that the beginning of its activity in 1724 greatly reduced the activities of both the Rio de Janeiro and the Bahia mints. Between 1703 and 1807, the CMRJ was responsible for 74.1% of the total of national coins minted in Brazil.

Sources: Rio de Janeiro, periods 1703-1767 and 1797-1807, Soetbeer (1880). For the period 1768-1796, Meio circulante, 1883; for Minas Gerais, Boxer (1962); for Bahia, AHU_CU_Bahia_CA, doc. 19715.

Figure 1 Production of National gold coins (1703-1807) (in contos)

What explains the differences between coinages and remittances of National gold coins?

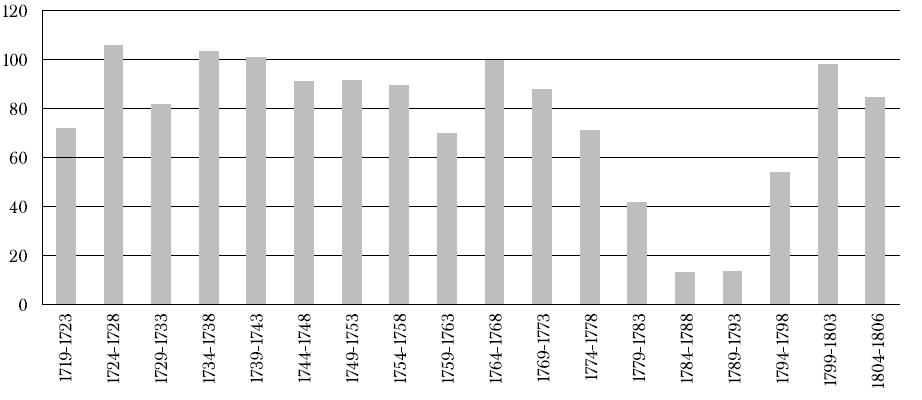

While the national gold coins were destined for circulation in Portugal, not all of them made the trip. The difference between the coinages of national gold coins produced at the Brazilian mints and their subsequent remittances was one of the conclusions already highlighted in Costa, Rocha & Sousa (2013). However, the new data shown in figure 1 and table 2 provide us with the means to reassess this difference. Figure 2 and table 3 (see the appendix) organize the data regarding the coinages of national gold coins in comparison with their actual remittances on board ships crossing the Atlantic in the period between 1720 and 1807.

Sources: Coinage, Rio de Janeiro, periods 1703-1767 and 1797-1807, Soetbeer (1880). For the period 1768-1796, Meio circulante, 1883; for Minas Gerais, Boxer (1962); for Bahia, AHU_CU_Bahia_CA, doc. 19715; remittances, Costa, Rocha & Sousa (2013, pp. 67-68).

Figure 2 Ratio of remittances to coinage of National gold coins (1719-1806) (percentage)

Table 1 Stock of National gold coins (nominal values)

| Total stock of gold (contos) | Stock of gold per capita (réis) | |

|---|---|---|

| Brazil (1806) | 35 539-45 604 | 9 074-11 693 |

| Portugal (1806) | 72 927 | 22 790 |

Sources: Mortara (1941, p. 43) for the population of Brazil. For the value of the stock of gold in Portugal, see http://aquila4.iseg.ulisboa.pt/aquila/investigacao/ghes/investigacao/base-de-dados

Table 2 Stock of gold currency (nominal values)

| Total stock (pounds) | Stock per capita (pounds) | |

|---|---|---|

| Brazil (1806) | 9 830 555 - 12 667 777 | 2.5-3.2 |

| Nova Granada (1800) | 691 778 | 0.74 |

| England (1800) | 51 000 000 | 5.5 |

Note: Conversions - £1=0.0036 contos; 1 peso=38 pence=£0.158 (McCusker, 1992).

Sources: For Nova Granada, see Moreno (2013). For England, see Lindert (1985).

We conclude that remittances were higher than coinages in three five-year periods, notwithstanding the proportion of remittances was lower in most of the period. For the period 1719-1806 as a whole, there was a difference of roughly 20%. Secondly, there were certain conjunctures that affected the ratio between the two variables. There was a fall in remittances by the early 1740s, followed by a slight rise between 1764 and 1773, and then a sharp fall from the late 1770s onwards. Remittances rose once again at the end of the century, and at the beginning of the following one.

The behavior of the two variables raises at least two questions. First, what justifies the differences between coinages and remittances? And, on the other hand, what is the meaning of the conjunctures detected?

As has already been demonstrated in previous research, 91% of the coins shipped were sent to private agents, and only 9% were destined for the State (Costa, Rocha & Sousa, 2013, pp. 72-82). Of these shipments, 80% were related to commercial activities, while the remainder was equivalent to what today is referred to as unilateral transfers and the remuneration of services.

Considering the proportions that have been calculated, it can, therefore, be said that the 20% difference between the production and remittances of national gold coins can be explained by the fact that the shipments of these national gold coins minted in Brazil were not sent to Portugal, at least not in an official manner. The questions are: did this mean that 20% of coins minted in Brazil were illegally shipped in such a way as to avoid payment of the 1% import duty levied at the Lisbon Mint, which was the destination for these shipments? Or, on the contrary, did this mean that these national gold coins remained in Brazilian territory? The information provided by the governors of Rio de Janeiro, Bahia and Maranhão point to their circulation in domestic transactions (see section 5). In this sense, some explanatory hypotheses may be needed to account for the fall in legal remittances of gold coins from the 1740s onward.

Smuggling was, as ever, the prime suspect, but this activity would be more profitable in the case of gold dust. Simple fraud was, certainly, part of the problem, but the fact that gold dust had a lower nominal value than that of the (international) market was more important, as stressed by some contemporaries. In commenting on the different values officially attributed to gold dust, Eschewege (1944) summarizes the argument as follows:

By virtue of this arbitrary process [...], the mistake was made of never attributing to it the real exchange value, which resulted in a loss of many millions for the Crown. In fact, as gold had a much greater commercial value than the one attributed to it by the government, it was natural that smuggling should appear as such an attractive proposition, for not only were the 20% of the one-fifth tax saved, but, furthermore a high premium was gained" (vol. 2, pp. 247-248).

The second reason that can be suggested is the trade with Portugal. Brazilian exports increased, in particular, with the "agricultural renaissance" in the early 1770s (Ferlini, 2003, pp. 128-133), and imports fell (Costa, Rocha & Sousa, 2013, pp. 83-84). The effects of foreign trade on remittances depended both on trade balances and also the way in which payments were made. Remittances reflected all the imports paid in cash, as well as the "unilateral transfers", while those paid with other merchandise (bartering) helped to reduce remittances; in turn, exports paid in cash did not reduce remittances, rather, in the short term, they may even have increased them, if the money was used to pay off debts.

Another possible explanation would be a greater use of bills of exchange. However, as pointed out by Markus Denzel (2006), "the bill of exchange did not [...] develop into a means of payment in Latin America. [...], and until the end of the colonial era, payments from the Spanish colonies as well as from Brazil to Europe were made by transferring precious metals. Moreover, the native's European suppliers requested immediate payment for their delivered goods" (p. 23).

Arbitration operations in the River Plate and Colonia do Sacramento region could also explain the fall in remittances, as silver was highly valued at the time (Lima, 2013; Menz, 2009), but this would, of course, be a silent effect, because, unlike gold, there are no records of its imports into Lisbon (Sousa, 2012).

Another hypothesis is related to the probable increase in hoarding (or liquidity preference). Gold coins completely fulfilled the function of offering reserves of universal value, all the more so, because, at the time, the absence of a banking system or a capital market did not allow for alternative forms of financial investment.

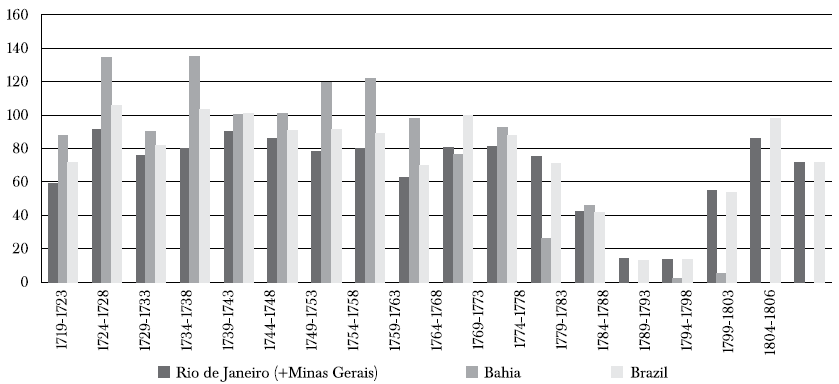

Finally, and perhaps the most important reason for not sending gold coins to the metropolis, was the gradual increase in the demand for money because of the growth in the population and in income, the diversification of production, and the expansion of intraregional and interregional trade, which occurred particularly during the last quarter of the eighteenth century.5 The rise in the transactions' demand for money was partly reflected in the frequent appeals made by the local authorities to the king, requesting silver and copper provincial coins to be sent from Lisbon. However, the national gold coins were also used as means of payment, both in private transactions and in payments to and by the State. Many kinds of payments were necessarily made in cash (military expenditure, civil and naval construction, etc.). Furthermore, there were also individual and institutional cash loans, urban and rural property investments, rental charges, etc., which were all paid for in money. When the amounts were high, gold coins were used, as they had a greater extrinsic value.6 The aggregate data may conceal regional differences in the shipments. Thus, figure 3 and table 4 may clarify these differences, by separating Rio de Janeiro and Bahia.

Sources: Rio de Janeiro, periods 1703-1767 and 1797-1807, Soetbeer (1880), for the period 1768-1796, Meio circulante, 1883. For Minas Gerais, Boxer (1962). For Bahia, AHU_CU_Bahia_CA, doc. 19715.

Figure 3 Ratio of remittances to coinage of National gold coins by geographical mints (1719-1807) (percentage)

Comparing Rio de Janeiro and Bahia, it can be seen that the latter port shipped proportionally more coins up until the 1760s. From the five-year period of 1764-1768 onwards, Rio increased, and Bahia drastically reduced their remittances. Bahia's links to the remittances of private agents may explain the decrease in the importance of its mint, as, from 1750 onwards, there was a reduction in the remittances sent by these agents to Lisbon (Costa, Rocha & Sousa, 2013). We continue to put forward the research hypothesis that these remittances were more linked to agents located in the north of Portugal, above all in Porto. The possibility of alternative areas of trade, namely with the east of Europe, may have led some of these agents to operate in other geographical regions.

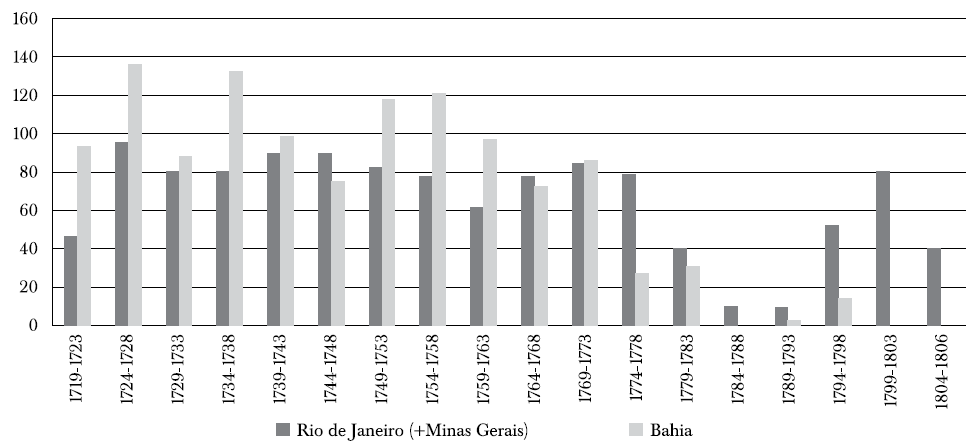

Figure 4 and table 5 (see the appendix) show the relationship between private remittances and the income of the mints, with this latter variable having been calculated from the total coinage minus the seigniorage paid (6.25% for gold).

Sources: Coinage, Rio de Janeiro, periods 1703-1767 and 1797-1807, Soetbeer (1880). For the period 1768-1796, Meio circulante, 1883; for Minas Gerais, Boxer (1962); for Bahia, AHU_CU_Bahia_CA, doc. 19715; remittances, Costa, Rocha & Sousa (2013, pp. 67-68).

Figure 4 Proportion of coinage shipped by private agents (percentage)

This strengthens the conclusion that private agents did not send all the national gold coins that they received to Lisbon, especially those produced at the CMRJ. In Bahia, it was from the five-year period of 1774-1778 onwards that this difference between coinage and remittances became particularly significant, for, up until then, shipments had included almost all the coins minted.

As not all the coins produced were sent to Lisbon, the difference could have meant that remittances were sent to the State. However, not only did the State absorb only 9% of the total coinage made in Brazil (Costa, Rocha & Sousa, 2013) but also the policy of shipments to Portugal changed during the course of the eighteenth century. In the first decades of this century, the tax revenue related to gold (the quinto tax, and the seigniorage) was supposed to be sent to the Court. In the case of the seigniorage, despite this recommendation, an ever-greater part of this was being used in Brazil, and, from 1767 onwards, the whole revenue from the CMRJ was, quite probably, sent to the Royal Treasury of the Captaincy. For example, between 1719 and 1738, the seigniorage amounted to 3 575 contos, and remittances to the State to 7 876 contos, thus pointing to the sending of the seigniorage revenue, together with the revenue from other taxes. However, this was not the case during the last few decades of the eighteenth century: between 1780 and 1807, the mints raised 2 723 contos from seigniorage, but only 2 344 contos were sent to the crown. The most probable explanation for this would be the increase in the State's financial requirements, mainly for the defense of the territory, which not only included soldiers' pay but also expenditure on fortifications. In the eighteenth century, outside the mining regions, such payments could only be made in cash, that is to say, with metallic money. The monetary cost of maintaining the colony was thus increasing.

Stock and circulation of National gold coins in Brazil

What has been said so far allows us to conclude that around 20% of the national gold coins produced at the Brazilian mints remained in the colony. Based on this premise, a first attempt can be made to calculate the money stock in Brazil, only taking into account legal operations. The stock is not the same as circulation, the difference between these two variables lying in the phenomenon of hoarding.

The calculation of the stock of national gold coins in Brazil can be made by adapting the formula proposed by Glassman & Redish (1985), as follows: Stock of national gold coins (in Brazil) = coinage at the mints of Rio de Janeiro, Bahia and Minas Gerais - remittances of national coins to Portugal in commercial transactions or unilateral transfers (State and private agents) + Brazilian exports received in national currency + transfers by private agents to Brazil - losses through wear.

The first two components of this formula (coinage and remittances) are known, and are undoubtedly the most determinant variables. The amount of illegal shipments, which include smuggling and arbitrage operations, is not known and this would naturally represent a reduction in the money stock. Also unknown are the "Brazilian exports received in national currency", and the "transfers by private agents to Brazil", both representing an increase in the stock of coins. These components may not be overlooked, for, in fact, both the data to be found in the Balances of Trade, as well as that in some documents from the period, show the existence of cash transfers from Lisbon to Brazil.

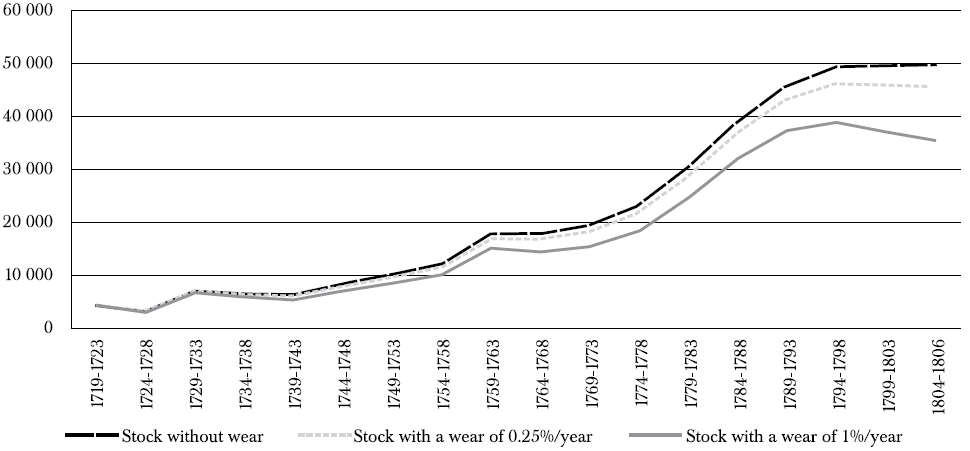

As far as the variable "losses through wear" is concerned, our estimates contemplate a rate of wear of both 0.25% per year and 1% per year used in previous studies by Glassman & Redish (1985). By considering these two percentages, it is possible to calculate a range of variation for the stock of national gold coins in Brazil, with a difference of roughly 10 000 contos (see table 6, appendix).

One question remains, what is the initial value to be taken into account? The most exact calculation is only possible from 1719 onward, as the value of the remittances sent on the fleets only started to be recorded as from 1720 (Costa, Rocha & Sousa, 2013). However, there are some data available about the gold imported to Lisbon as from 1713, before the beginning of a fleet system in 1720 (Lopes, 2001). According to these data, the value of gold arriving in Lisbon between 1713 and 1719 amounted to 2 627 contos. However, this amount corresponds to gold bullion, as there is almost no record of coins entering the country; in other words, roughly 16 700 contos worth of gold minted as national gold coins at the Rio de Janeiro and Bahia mints (see table 2, appendix) are not included in the data before 1720. In this sense, while this might represent a possible methodology for calculating the value of 1719, its calculation is not reliable, for the reasons that have been explained above. We, therefore, assume a base value of zero in 1719, as it is not possible to precisely assess the amounts that remained in Brazilian territory.

The accumulated data give a picture of the balance of the monetary base, serving as a basis from which other forms of means of exchange and payments might be created (bills of exchange, paper money, bank deposits, etc). In this case, the ratio between coinage and remittances is just a first approximation for calculating the money stock, with the oscillations taking place in this ratio being more relevant than the absolute values (table 6 and figure 5).

Sources: Coinage, see table 2, appendix; remittances, see Costa, Rocha & Sousa (2013, pp. 67-68).

Figure 5 Stock of National coins in Brazil (in contos)

However, the absolute values reveal that the availability of metallic money in the colony would not have been an obstac/le to the development of a "domestic market", at least in the second half of the eighteenth century, when the demand for money increased greatly, thus contradicting the notion that there was a shortage of currency. In 1806, there were between 36 000 and 46 000 contos of gold metallic money left in Brazil, which may point to the thesis put forward by Angela Redish (1984) that, at the beginning of the nineteenth century, in some colonial areas, the currency problem was a qualitative one, rather than a quantitative one.

The only calculation made so far of the value of the currency in Brazil at the beginning of the nineteenth century was originally presented by Cândido José de Araújo Viana, in 1833, which since then has been quoted by all authors. Viana estimated the total amount of metallic currency in circulation as being 10 000 contos, including gold, silver, and copper coins, two-thirds of which were gold. Therefore, his estimate is much lower than ours is, all the more so if one considers that some of the gold currency included in Viana's calculations consisted of provincial coins. However, his estimates cannot be strictly compared with our own, insofar as they refer to the money in circulation, whereas our calculations refer to the money stock.

Some official statements from the time seem to strengthen our estimates. An official letter sent in 1799 to dom Rodrigo de Sousa Coutinho by the head of the Bahia Mint proposing the issue of paper money, makes the following conjecture, "Supposing that at this Captaincy at least five million cruzados of metallic money -both national and provincial- are in circulation, the sum of 500 thousand cruzados in paper is one-tenth of this amount".7 Thus, he estimated the amount of metallic currency in the captaincy of Bahia alone to amount to 2 000 contos.

Considering that the values showed in table 6 (see the appendix) would, therefore, be very close to the total currency stock in Brazil, we can begin to assess its significance by comparing it first with Portugal.

It should be noted that the data for Portugal include not only the coinages made at the Brazilian mints but also the coinages made in Lisbon, both for private agents and for the State, as well as the exports arising from the negative trade balances with foreign nations. Comparing the two stocks, it can be concluded that between 30% and 40% of the national gold coins produced in Brazil and Portugal would have been in Brazil at the beginning of the nineteenth century. In terms of the money supply per capita, the degree of monetarization of the Brazilian economy was roughly half that of the Portuguese economy. The different demographic and economic structures would account for such differences. Therefore, this relatively high degree of monetarization of the Brazilian economy calls into question those theses that point to the absence of currency in slave-based economies.

Next, we shall compare the value obtained for Brazil with that obtained for Nova Granada, a mining economy, and with England, an economy that was at the beginning of its industrialization process.

As shown in table 2, the Brazilian economy was much more heavily monetarized than the former Spanish colony (roughly three times as much), and it had a degree of monetarization closer to that of England (roughly one half). It should be stressed that this degree of monetarization tells us nothing either about the pattern of its distribution nor about the velocity of circulation of money. We are comparing economies with different levels of economic and financial development, with the degree of monetarization in England also being explained by the existence of banking institutions that increased the potential use of gold coins as the monetary base.

As we have already stressed, calculating the currency stock does not mean this currency was actually in circulation. However, some information provided by governors allows us to observe the presence of national gold coins in Brazil, alongside provincial coins. This very fact can be concluded from the information sent by the governor of Bahia to Rodrigo de Sousa Coutinho in 1797: "For regular daily transactions, there are in circulation the provincial coins of this captaincy [...] besides the half doubloons of six thousand and four hundred réis, which very frequently circulate so well in trade." These doubloons of 6$400 réis were included in the national currency. The governor also provided details about all the different types of coins in circulation:

There are in this captaincy gold, silver and copper provincial coins... Gold coins of 4$000, 2$000 and 1$000. Silver coins: 2 patacas are worth 640 réis; 1 pataca is worth 320; 1/2 pataca is worth 160... Also in circulation are silver coins of 800, 600, 300, 150 and 75 réis... Copper coins: of 20 réis, which have the same size as the Portuguese coin of 10 réis; of 10 réis, which have the same size as the Portuguese coin of five réis; and of 5 réis, which have the same size as the Portuguese coin of three réis.

The governor of Bahia could not, however, provide any information about the total amount of coins in circulation, "because as these are generally in circulation across the whole of America, with the exception of Minas Gerais, where silver coins are also in circulation, it is difficult to make such a calculation, on account of the trade taking place between the different captaincies".

Regionally, there were no differences in circulation. Also in 1797, the viceroy, Conde de Resende, sent the minister for Overseas Affairs information about the coins that were in circulation in the captaincy of Rio de Janeiro. His report was similar to the one presented by the governor of Bahia: there were "national gold coins circulating throughout the realm" (doubloons of 24$000, coins of 6$400, 4$800 and 800 réis, among others), as well as "provincial gold currency that is only in circulation in Brazil" (coins of 4$000, 2$000 and 1$000 réis). In the captaincy of Rio de Janeiro, there were also silver coins in circulation, all of which were provincial coins, of different values between 640 réis and 40 réis, as well as copper coins, also provincial, of 40, 20, ten and five réis. Just like Fernando of Portugal, the viceroy stated that it was not possible to calculate the total amount of provincial coins in circulation "because, as these are in circulation throughout the whole of Brazil, and are not produced only at this city's mint, it is neither easy to calculate the currency that has been transported nor that which is still kept at the limits of the captaincy".8

The governor of Maranhão also submitted a report about the currency in circulation in the captaincy, stating that "there are in circulation [...] provincial coins with the following values: those of copper are worth five, ten, twenty and forty réis; those of silver are worth 80, 160, 300, 320, 600 and 640 réis, and those of gold are worth 1 000, 2 000 and 4 000 réis; and there are also in circulation those national coins that have a value of 6 400 réis or more".9

The information delivered by governors can be confirmed by other documents. In 1777, in the village of Cubatão, near São Paulo, about 21% of the 5 143 contos de réis found in three coffers were national coins.10

Therefore, we can conclude that in four different regions of Brazil, the currency in circulation was composed not only of provincial coins but also of national coins. In none of these reports submitted by the governors were there any complaints, which are so often made on other occasions by local authorities, regarding the shortage of currency, or any demands for the dispatch of more provincial coins. Unfortunately, however, this information does not allow us to estimate the proportion of the different types of coins in circulation at the end of the eighteenth century.

Conclusions

This research set out to assess the production, supply, and circulation of national gold coins in Brazil in the eighteenth century.

The calculation of the coinage made possible to recalculate the values for the different mints and to demonstrate a relative continuity up until the end of the century. The last quarter of the century still presented levels of coinage that were comparable with those from the beginning of the century.

Comparing the values of the coinage with remittances to Lisbon, the first half of the eighteenth century reveals a more stable conjuncture than that found in the second half. This latter period shows fluctuations, which were expressed in the faster growth of the supply, despite the fall that took place in the production-coinage of gold.

These conclusions question the historiographical theses regarding the shortage of currency in Brazil throughout the eighteenth century. The growth of the economy from the last quarter of the century onwards implied an increase in the demand for money, which may explain the increase in the supply of national gold coins.

nueva página del texto (beta)

nueva página del texto (beta)