1. Introduction

Entrepreneurship is an important feature of the Mexican society comprised of individuals performing independent activities for a non-salary income, either as self-employed, or employer. According to the National Institute of Statistics and Geography (INEGI, by its acronym in Spanish), this labor condition has represented an average employment share of 26.7% per year over the last 15 years, accounting for 11.8 million in 2005 and 14.7 million in 2019. The figures also indicate a significant variability and divergence of the relative intensities in which these entrepreneurs proliferate, as well as their employment shares and growth rates over time and across the states. Besides, Mexico has been characterized by a long-run, adverse economic context, such as the slow, prolonged recovery following the 2003 e-businesses crisis and the 2008-2010 downturn which hit it severely; the long-run labor hardships resulting in declining wages; the increasing disparities in the rates of economic growth and development across states; and recently, the economic recession which started in 2019, and that has been aggravated by the unprecedented Covid-19 pan demic, detonating a severe global economic and sanitary crisis.

Given this background, this paper aims at analyzing the role of the economic context in determining entrepreneurship trends in Mexico, in order to assess the effects derived from economic downturns and their implications for state-level employment. In accordance with a significant amount of literature, the research contends that the economic and development context affects entrepreneurship differentially depending on the type of venture. This proposal is assessed by estimating a model representing the different types of entrepreneur stock by applying panel data analysis tracking the different entrepreneurial outcomes at state level during the 2005-2019 period. The econometric outputs are used to estimate the entrepreneurial effects -over the quantity of entrepreneurs and employment- on the total number of employees associated to these entrepreneurs. These are obtained in accordance with a model describing those effects as dependent upon the entrepreneurial structures. The states' employment shares per type of venture, the ventures' responsiveness to the changes in the levels of economic activity, and the average venture size. The resulting evidence supports the aforementioned contention, providing insights on the regional distribution of the entrepreneurial and employment effects derived from economic downturns. In estimating these effects, the research provides hints on the relative magnitudes and impacts from the entrepreneurship structures across the states, bringing policy implications and, potentially, proposing entrepreneurs' segmentations for policy purposes and further research.

The research is organized as follows: section 2 introduces the literature review, the next one examines the economic performance and the entrepreneurial landscape in Mexico during 2005-2019. Section 4 describes the data and methodological approach, followed by the empirical results along with the relevant discussions in section 5. Finally, section 6 integrates the concluding remarks, including the policy implications derived from the research.

2. Key determinants of entrepreneurship and the role of the economic context

Entrepreneurship may be defined as opportunity recognition and enterprise formation (Parker, 2018). It may be either nascent, which involves pre-startup activities -the market assessment, the evaluation of the required investments, the legal arrangements- and the actual startup or the business establishment (Marvel et al., 2016). Nascent entrepreneurship may be dependent upon specific entrepreneurship education (Bergmann et al., 2016). The businesses establishment's decision, on the other hand, is determined by pecuniary aspects such as the relative earning differential between entrepreneurship and salaried work or the expected increase of the individual's income; by non-pecuniary aspects such as the desire for independence and improving working conditions, the personal satisfaction, family commitments, among others; also by individual's characteristics such as education, experience, age, family background, and the possession of financial and other forms of capital e.g. social capital (Parker, 2009 and 2018). There is literature that has assessed the contribution of entrepreneur's education in encouraging startups and business success: education improves the entrepreneur's judgment by providing analytical skills, information about business opportunities, the understanding of markets and the entrepreneurial process (Casson, 2005). It is also related to the individual's choosing entrepreneurship, rather than salaried work (Masakure, 2015). On the other hand, Sluis Van der et al. (2008) suggest that education is it not related to the probability of choosing entrepreneurship as an occupation, but to the likelihood of better performance as an entrepreneur; Kangasharju and Pekkala (2002) link it with a greater survival probability, and Jiménez et al. (2015) relate education with higher odds of formal entrepre-neurship and lower informal entrepreneurship.

The research efforts analyzing entrepreneurship's dependency upon the macroeconomic and institutional context can be found in Sutton (1991), who suggests that the market expansion increases the number of firms in homogenous goods industries, which in turn reduces industry concentration, and allows more entrepreneurs to operate in markets. In addition, Lucas (1978) indicates the number of entrepreneurs to be indirectly related to the capital-labor ratio in the economy: developed economies exhibiting a high ratio would have relatively fewer and larger firms as compared to the less developed countries.

Other views consider entrepreneurship as a pro-cyclical phenomenon. Aghion and Bolton (1997), for example, suggest that entrepreneurship increases as a result of a wealth effect, which induces effort and reduces moral hazard, enabling individuals to borrow for venturing. Rampini (2004), finds that favorable shocks to the economy -which causes productivity and wealth- increases entrepreneurship by making agents more willing to bear risk and become entrepreneurs. A different perspective suggests that the number entrepreneurs may be counter-cyclical; for instance, Ghatak et al. (2007) suggest that, as wages fall in recessions, low-ability marginal types of entrepreneurs emerge reducing the average quality of entrepreneurs. Furthermore, the un employment and labor market conditions may affect entrepreneurship in two opposite ways: the "recession-push" and "prosperity-pull" effects. According to the "recession-push" hypothesis, unemployment reduces job opportunities, pushing people towards entrepreneurship out of necessity. This perspective explains entrepreneurship as a response to the difficult circumstances that prevail in the economy and in the labor markets (Georgellis et al., 2005); also it is more frequent in people with low wages as employees, who change jobs frequently, or have experienced frequent and persistent unemployment (Evans and Leighton, 1990). Schuetze (2000) adds that unemployment and the resulting reduction of wages, lower the opportunity cost of starting a business and increases the propensity of an individual to become an entrepreneur, therefore boosting the number of entrepreneurs. The "prosperity-pull" hypothesis contends that low unemployment increases the market demand for the entrepreneurs which increases their income and capital availability while reducing the risk of bankruptcy. In contrast to the "recession-push" hypothesis, these factors imply a negative relationship between entrepreneurship and unemployment (Parker, 2009). The "recession-push" hypothesis is consistent with the opportunity-led entrepreneurship idea, in which the dynamic markets generate opportunities for innovative ventures, implying an interplay between the inherent abilities of the individuals -the entrepreneurial talent- and the favorable economic conditions to start new firms (Van Stel et al., 2007). This view is supported by the concept of entry for innovation opposed to the standard entry for profit concept- wherein entrepreneurship is motivated by individuals endowed with human capital searching for gains derived from the innovative activity (Audretsch, 2001), which would also depend on the accumulation of knowledge, the innovation capacity and the characteristic economic activities of the regions (Audretsch et al., 2008).

The overall environment and the interdependencies between economic development and institutions also affect the entrepreneurial outcomes. Wennekers et al. (2005) and Acs et al. (2008) find a U-shape relationship between the country's rate of entrepreneurial dynamics and the stages of economic development. The institutional context has been examined in Bruton et al. (2010) who find a relation to the individual's intentionality of engaging in innovative entrepreneurship. Alvarez and Urbano (2011) link formal and informal institutions to the encouragement -or hindering- of the decision towards the creation of knowledge-based business. Baumol and Strom (2007), argue that the heterogeneity in institutions causes economic growth and performance variations through shaping differing incentives for entrepreneurs. More recent empirical studies are Liñán and Fernandez-Serrano (2014), suggesting that the persistent differences in entrepreneurial activity are related to the role of institutions and national cultures which influence behavior and attitudes about entrepreneurship; furthermore Aparicio et al. (2016) propose the simultaneous effect between institutional factors, opportunity entrepreneur-ship and its subsequent impact on economic growth. Additional results are provided in Dvoulety (2018) on the impact of the macroeconomic, institutional and economic environment on established and early-stage enterprises. Brás and Soukiazis (2018) find a direct relationship between entrepreneurial activity and investment freedom, financial market development and the per capita product. Mexican evidence regarding the impact of the economic context on entrepreneurship is reported in Ramírez-Urquidy et al. (2013), who find a development-entrepreneurial structures link; González et al. (2018), points out that recession push factors stimulating necessity entrepreneurship, and Texis et al. (2019), find pull effects associated to past unemployment and push effects with current unemployment.

Finally, an expanding amount of literature emphasizes the groundbreaking concept of entrepreneurial ecosystems (EE) in determining the entrepreneurial outcomes (Malecki, 2018). In this regard, Spigel (2017) defines EE as the union of localized cultural outlooks, social networks, investment capital, universities, and active economic policies that create supportive, innovation based venture environments. Theodoraki and Messeghem (2017) describe the EE as a generic context aiming to foster entrepreneurship within a given territory, including formal and informal networks, physical infrastructure, culture, and involving organizations supporting entrepreneurs.

3. Economic performance and the entrepreneurial landscape in Mexico 2005-2019

The Mexican economy has experienced a moderate growth since 2005: Gross Domestic Product (GDP) annual average growth rate during 2015-2020 was 1.45% whereas per capita GDP reached 1.05% during 2005-2019 (see Table 1). The 2008 U.S. financial crash was particularly difficult as output decreased 5.28% and per capita GDP fell 6.5% in 2009. The crisis hit the labor markets strongly: wages (w) -measured by the per hour average labor income- experienced successive reductions since 2008 of 5.85, 2.57 and 3.10%. In general, labor market's performance has been precarious, with an average fall of -0.45% during the period of analysis. Recent figures reveal that Mexico is currently in the middle of a drastic economic decline which started in 2019 with a negative annual GDP growth of 0.14% and continued with a decline of 8.6% in 2020 spurred by the unprecedented Covid-19 pandemic (see Table 1).

Table 1 Mexico: macroeconomic variables 2005-2020 (state average growth rates)

| GDP* | w* | GDPp* | |

| 2005 | 2.31 | 0.87 | |

| 2006 | 4.50 | 3.67 | 3.13 |

| 2007 | 2.29 | -0.10 | 0.99 |

| 2008 | 1.14 | -5.84 | -0.36 |

| 2009 | -5.29 | -2.57 | -6.50 |

| 2010 | 5.12 | -3.10 | 3.87 |

| 2011 | 3.66 | -0.68 | 2.41 |

| 2012 | 3.64 | 1.40 | 2.53 |

| 2013 | 1.35 | -3.49 | 0.24 |

| 2014 | 2.80 | -4.48 | 1.55 |

| 2015 | 3.29 | 4.23 | 2.09 |

| 2016 | 2.91 | 0.30 | 1.67 |

| 2017 | 2.12 | -2.42 | 1.03 |

| 2018 | 2.14 | 1.81 | 1.14 |

| 2019 | -0.14 | 4.93 | NA |

| 2020 | -8.60 | NA | NA |

| Average | 1.45 | -0.45 | 1.05 |

Notes: Preliminar data (p). Not available (NA); *Annual growth (%). Source: INEGI (2021).

The regional disparities in economic dynamics are evident. Despite the state average GDP and GDPp growth, the wage levels have decreased -except for 2019- and tended to converge among the states (see Table 2). Moreover, the leading state economies in terms of GDPp have also led in-growth rates (see Table 3) failing to catch up. Campeche and Tabasco are outliers, given the income bias derived from the oil industry mostly embedded there.

Table 2 Macroeconomic context variables 2005-2019

| GDP* | Growth % | w** | Growth % | GDPp*** | Growth % | |

| 2005 | 396 270.3 | 44.7 | 112 433.6 | |||

| 433 286.2 | 8.9 | 45 852.8 | ||||

| 2006 | 415 726.5 | 4.44 | 46.3 | 3.66 | 116 122.6 | 2.96 |

| 456 680.2 | 2.30 | 9.9 | 5.99 | 48 507.3 | 2.15 | |

| 2007 | 428 427.0 | 3.60 | 46.3 | 0.06 | 118 830.7 | 2.03 |

| 465 674.4 | 3.00 | 9.9 | 4.06 | 50 485.7 | 2.5 | |

| 2008 | 435 344.1 | 2.28 | 43.6 | -5.72 | 119 293.6 | 0.65 |

| 471 984.0 | 2.20 | 9.2 | 4.51 | 50 236.6 | 2.16 | |

| 2009 | 412 394.8 | -4.65 | 42.4 | -2.15 | 111 310.2 | -6.12 |

| 451 936.3 | 3.67 | 8.3 | 5.21 | 46 047.3 | 3.77 | |

| 2010 | 435 780.7 | 5.67 | 41.1 | -2.83 | 115 964.8 | 4.20 |

| 472 800.1 | 2.91 | 7.7 | 4.43 | 48 072.1 | 2.97 | |

| 2011 | 453 318.1 | 3.74 | 40.9 | -0.70 | 118 997.8 | 2.31 |

| 490 931.6 | 2.45 | 8.3 | 4.58 | 50 428.8 | 2.37 | |

| 2012 | 471 740.1 | 3.71 | 41.4 | 1.56 | 121 916.3 | 2.32 |

| 511 489.4 | 1.64 | 8.1 | 4.97 | 52 277.3 | 1.80 | |

| 2013 | 478 930.2 | 1.46 | 40.0 | -3.18 | 122 078.2 | 0.15 |

| 519 224.9 | 1.98 | 7.0 | 5.23 | 52 404.9 | 2.09 | |

| 2014 | 493 684.5 | 3.51 | 38.2 | -4.57 | 124 678.4 | 2.21 |

| 531 141.1 | 2.33 | 7.3 | 4.54 | 53 518.9 | 2.42 | |

| 2015 | 512 448.7 | 3.97 | 39.8 | 4.29 | 128 385.1 | 2.70 |

| 551 062.6 | 2.76 | 7.8 | 6.00 | 56 018.6 | 2.48 | |

| 2016 | 529 725.9 | 3.33 | 39.9 | 0.24 | 131 503.3 | 2.1 |

| 572 884.6 | 2.47 | 8.5 | 5.76 | 58 431.5 | 2.34 | |

| 2017 | 544 255.5 | 2.47 | 39.0 | -1.93 | 133 81 9.0 | 1.29 |

| 590 853.5 | 2.93 | 7.3 | 5.32 | 60 906.9 | 2.66 | |

| 2018 | 558 226.9 | 2.70 | 39.7 | 1.83 | 136 333.3 | 1.56 |

| 606 969.4 | 3.18 | 7.5 | 4.52 | 63 355.3 | 2.85 | |

| 2019 | NA | NA | 41.62 | 3.41 | NA | NA |

| NA | NA | 8.41 | 5.37 | NA | NA |

Notes: *State average in millions pesos (2013=100); ** State average income per worker per hour in pesos; *** State average in pesos. Second row shows standard deviation. Not available (NA).

Source: INEGI (2021).

Table 3 Average GDPp and growth rates of the states 2005-2019

| GDPp* | GDPp Growth** | |

| Aguascalientes | 140 174.00 | 3.11 |

| Guanajuato | 101 461.80 | 2.83 |

| Colima | 128 160.00 | 2.74 |

| Queretaro | 166 669.70 | 2.53 |

| Baja California Sur | 170 674.10 | 2.28 |

| San Luis Potosí | 111 503.10 | 2.25 |

| Zacatecas | 91 152.53 | 2.22 |

| Morelos | 97 525.17 | 1.86 |

| Coahuila de Zaragoza | 185 804.90 | 1.84 |

| Chihuahua | 129 906.80 | 1.69 |

| Jalisco | 131 659.70 | 1.64 |

| Nuevo Leon | 225 422.20 | 1.62 |

| Puebla | 84 008.62 | 1.62 |

| Yucatan | 104 122.30 | 1.62 |

| Sinaloa | 114 882.00 | 1.57 |

| Hidalgo | 81 591.88 | 1.48 |

| Quintana Roo | 151 965.80 | 1.32 |

| Sonora | 172 999.80 | 1.30 |

| Chiapas | 54 049.95 | 1.27 |

| Michoacan | 79 962.88 | 1.24 |

| Guerrero | 62 442.22 | 1.02 |

| Veracruz | 95 297.25 | 0.98 |

| Oaxaca | 60 616.94 | 0.93 |

| Durango | 105 310.10 | 0.88 |

| Baja California | 142 632.60 | 0.36 |

| Tlaxcala | 72 102.54 | 0.35 |

| Nayarit | 90 103.29 | 0.29 |

| Mexico | 81 813.44 | 0.00 |

| Tamaulipas | 137 951.20 | -0.22 |

| Mexico City | 295 891.10 | -0.25 |

| Tabasco | 220 333.30 | -0.28 |

| Campeche | 888 220.20 | -6.25 |

Notes: *Average GDPp per year in 2013 pesos ** Average per year GDPp growth Source: INEGI (2021).

The self-employees and employers -along with their corresponding employment shares and the annual growth rates- are also displayed in Table 4. The figures suggest a continuous -yet irregular- increase in the stock of entrepreneurs, varying employment shares and irregular rates of growth over time. The entrepreneurs increased from 11.8 million in 2005 to 14.7 million in 2019, experiencing an annual average growth rate of 2.01% over the period. The stock of self-employed individuals exhibits a declining employment share from 23.7% in 2005 to 21.7% in 2019, except for 2009 which reached 23.3%. The entrepreneurs recorded an annual average growth of 1.86% from 9.83 million to 12.2 million during the period. The employers' stock exhibits more volatility with an average annual growth rate of 2.99%, increasing from 1.97 million in 2005 to 2.87 million in 2019. The sharpest volatility in the entrepreneurs stock -either total, self-employed or employer- occurred during the 2009 recession, and the subsequent years of recovery.

Table 4 Entrepreneurship structure and dynamics 2005-2019

| Entrepreneurs* | Share **(%) | Growth*** | Self-employed* | Share** (%) | Growth*** | Employers* | Share** (%) | Growth*** | |

| 2005 | 11 798.63 | 28.4 | 9 829.3 | 23.7 | 1 969.3 | 5.0 | |||

| 2006 | 11 921.66 | 27.8 | 1.04 | 9 811.0 | 22.7 | -0.19 | 2 110.7 | 5.1 | 7.18 |

| 2007 | 12 057.33 | 27.7 | 1.14 | 9 834.5 | 22.3 | 0.24 | 2 222.8 | 5.3 | 5.31 |

| 2008 | 11 129.01 | 25.8 | -7.70 | 9 362.2 | 21.3 | -4.80 | 1 766.8 | 4.3 | -20.52 |

| 2009 | 12 659.14 | 28.1 | 13.75 | 10 630.9 | 23.2 | 13.55 | 2 028.2 | 4.9 | 14.80 |

| 2010 | 10 776.44 | 24.2 | -14.87 | 9 058.1 | 20.3 | -14.80 | 1 718.4 | 4.1 | -15.28 |

| 2011 | 12 888.91 | 27.2 | 19.60 | 10 626.1 | 22.3 | 17.31 | 2 262.8 | 4.9 | 31.68 |

| 2012 | 11 552.11 | 24.5 | -10.37 | 9 703.3 | 20.4 | -8.68 | 1 848.8 | 4.1 | -18.30 |

| 2013 | 13 050.00 | 26.9 | 12.97 | 10 823.4 | 22.2 | 11.54 | 2 226.6 | 4.8 | 20.44 |

| 2014 | 12 902.84 | 26.4 | -1.13 | 10 895.1 | 21.9 | 0.66 | 2 007.7 | 4.4 | -9.83 |

| 2015 | 13 346.93 | 26.5 | 3.44 | 11 144.0 | 21.9 | 2.28 | 2 202.9 | 4.6 | 9.72 |

| 2016 | 13 532.94 | 26.4 | 1.39 | 11 274.1 | 21.7 | 1.17 | 2 258.9 | 4.7 | 2.54 |

| 2017 | 13 730.92 | 26.5 | 1.46 | 11 374.4 | 21.6 | 0.89 | 2 356.5 | 4.9 | 4.32 |

| 2018 | 14 317.83 | 26.7 | 4.27 | 11 719.9 | 21.6 | 3.04 | 2 598.0 | 5.1 | 10.25 |

| 2019 | 14 757.75 | 26.9 | 3.07 | 12 171.6 | 21.7 | 3.85 | 2 586.1 | 5.2 | -0.45 |

| Average | 26.7 | 2.01 | 21.9 | 1.86 | 4.8 | 2.99 |

Notes: *Thousands; ** Employment share; *** % Annual growth.

Source: INEGI (2021).

The entrepreneurship rates -measured as the entrepreneurs' share, either self-employed or employer in employment- vary with the level of development; measured by the state annual average GDPp during 2005-2019 (see Table 5). Dropping the outliers Campeche and Tabasco, those states with a higher-than-average level of development, except for Mexico City, exhibit lower rates of both entrepreneurship and self-employment. Oaxaca and Guerrero, as two of the least developed states, lead this group with corresponding shares of 43.40 and 39.43 of entrepreneurs; and 36.47 and 39.80% of self-employees.

Table 5 Level of development and the entrepreneurship-employment shares

| Average GDPp* | Entrepreneurs** (%) | Self-employed** (%) | Employers** (%) | |

| Campeche | 888 220.20 | 37.10 | 26.00 | 4.65 |

| Mexico City | 295 891.10 | 40.53 | 35.33 | 5.15 |

| Nuevo Leon | 225 422.20 | 19.47 | 15.60 | 3.70 |

| Tabasco | 220 333.30 | 25.35 | 20.19 | 5.05 |

| Coahuila | 1 85 804.90 | 21.67 | 17.27 | 4.38 |

| Sonora | 1 72 999.80 | 21.67 | 16.47 | 5.16 |

| Baja California Sur | 1 70 674.10 | 21.87 | 15.67 | 6.27 |

| Queretaro | 1 66 669.70 | 22.93 | 18.47 | 4.53 |

| Quintana Roo | 151 965.80 | 22.07 | 16.87 | 5.14 |

| Baja California | 142 632.60 | 20.67 | 15.53 | 4.97 |

| Aguascalientes | 140 1 74.00 | 19.40 | 14.60 | 4.79 |

| Tamaulipas | 1 37 951.20 | 23.33 | 19.13 | 4.22 |

| Jalisco | 131 659.70 | 24.13 | 18.27 | 5.91 |

| Chihuahua | 1 29 906.80 | 22.13 | 16.13 | 6.08 |

| Colima | 1 28 1 60.00 | 23.33 | 18.93 | 4.34 |

| Sinaloa | 1 14 882.00 | 25.40 | 18.93 | 6.55 |

| San Luis Potosi | 1 1 1 503.10 | 28.33 | 23.87 | 4.42 |

| Durango | 105 310.10 | 26.13 | 21.20 | 4.99 |

| Yucatan | 104 1 22.30 | 29.87 | 25.13 | 4.81 |

| Guanajuato | 101 461.80 | 24.53 | 19.93 | 4.54 |

| Morelos | 97 525.17 | 31.13 | 24.80 | 6.41 |

| Veracruz | 95 297.25 | 31.07 | 26.67 | 4.47 |

| Zacatecas | 91 152.53 | 27.93 | 22.87 | 5.13 |

| Nayarit | 90 103.29 | 31.40 | 25.47 | 5.98 |

| Puebla | 84 008.62 | 29.80 | 25.27 | 4.47 |

| Mexico | 81 813.44 | 27.53 | 23.53 | 4.15 |

| Hidalgo | 81 591.88 | 30.27 | 26.07 | 4.33 |

| Michoacan | 79 962.88 | 23.80 | 20.67 | 3.20 |

| Tlaxcala | 72 102.54 | 26.40 | 22.47 | 3.77 |

| Guerrero | 62 442.22 | 39.53 | 36.47 | 3.11 |

| Oaxaca | 60 616.94 | 43.40 | 39.80 | 3.41 |

| Chiapas | 54 049.95 | 20.40 | 16.13 | 4.27 |

| Average *** | 1 22 261.93 | 26.67 | 21.92 | 4.75 |

| SD *** | 52 329.54 | 6.13 | 6.37 | 0.92 |

Notes: * Average GDPp per year in 2013 pesos; **Average employment share per year; *** The stat Excludes Campeche and Tabasco.

Source: INEGI (2021).

The employment share provided by the employers seems to be more homogenously distributed around the average (4.75%) across the states in both the higher and the lower developed groups. An atypical case in the former group is Nuevo Leon with a share of 3.70%, lower among the higher income group. Baja California Sur, Jalisco and Chihuahua, which belong to the higher income group; and Sinaloa, Morelos and Nayarit of the lower income group, stand out in terms of the employers' employment share with 6% or even higher. The states with the lowest employers-employment shares are Michoacan, Tlaxcala, Guerrero and Oaxaca ranging 3.2-3.7%, which belong not only to the lower income group but to the worst long run performers.

The output growth and variability may also be relevant to entrepreneur-ship. Table 6 illustrates the unstable nature of the economic performance and entrepreneurship inherent to the states. However, it is possible to draw a positive relation between the average GDPp growth and its variability, as measured by the ratio Mean/sD; meaning that the lower growing states not only grow slowly, but unstably and the higher growing states grow faster and steadier.

Table 6 Per capita GDP and entrepreneurs dynamics

| GDPp* | Entrepreneurs* | Self-employed* | Employers* | |||||||||

| Mean (%) | SD (%) | Mean/SD | Mean (%) | SD (%) | Mean/SD | Mean (%) | SD (%) | Mean/SD | Mean (%) | SD (%) | Mean/SD | |

| Aguascalientes | 3.10 | 4.08 | 0.76 | 2.57 | 12.20 | 0.21 | 2.35 | 10.41 | 0.23 | 0.87 | 6.65 | 0.13 |

| Guanajuato | 2.83 | 2.96 | 0.96 | 1.34 | 8.35 | 0.16 | 1.51 | 9.35 | 0.16 | 0.13 | 4.00 | 0.03 |

| Mexico City | 2.74 | 2.20 | 1.24 | 1.47 | 11.98 | 0.12 | 1.90 | 11.26 | 0.17 | -0.12 | 4.40 | -0.03 |

| Queretaro | 2.53 | 3.07 | 0.82 | 3.39 | 18.37 | 0.18 | 2.64 | 17.45 | 0.15 | 1.54 | 6.27 | 0.25 |

| Baja California Sur | 2.27 | 6.10 | 0.37 | 3.92 | 11.04 | 0.35 | 3.46 | 14.04 | 0.25 | 2.18 | 6.70 | 0.33 |

| San Luis Potosi | 2.24 | 2.85 | 0.79 | 1.26 | 7.08 | 0.18 | 1.25 | 6.06 | 0.21 | 0.19 | 3.30 | 0.06 |

| Zacatecas | 2.20 | 3.92 | 0.56 | 0.87 | 7.77 | 0.11 | 0.35 | 6.92 | 0.05 | 0.66 | 4.58 | 0.14 |

| Michoacan | 1.89 | 2.82 | 0.67 | 1.75 | 11.74 | 0.15 | 0.97 | 10.82 | 0.09 | 1.16 | 5.10 | 0.23 |

| Chihuahua | 1.83 | 4.15 | 0.44 | 0.11 | 10.31 | 0.01 | 0.01 | 10.19 | 0.00 | 0.18 | 6.13 | 0.03 |

| Colima | 1.71 | 3.05 | 0.56 | 2.37 | 6.38 | 0.37 | 2.27 | 5.90 | 0.38 | 0.97 | 5.04 | 0.19 |

| Jalisco | 1.63 | 2.92 | 0.56 | 1.27 | 12.27 | 0.10 | 0.67 | 12.27 | 0.05 | 1.00 | 4.95 | 0.20 |

| Puebla | 1.63 | 4.08 | 0.40 | 2.86 | 9.49 | 0.30 | 2.24 | 8.78 | 0.26 | 1.13 | 3.21 | 0.35 |

| Nuevo Leon | 1.63 | 3.52 | 0.46 | 1.80 | 8.08 | 0.22 | 2.18 | 8.29 | 0.26 | 0.03 | 3.55 | 0.01 |

| Yucatan | 1.63 | 2.05 | 0.79 | 1.78 | 6.99 | 0.25 | 1.46 | 6.61 | 0.22 | 0.61 | 3.45 | 0.18 |

| Sinaloa | 1.57 | 2.53 | 0.62 | 1.32 | 8.91 | 0.15 | 0.87 | 9.76 | 0.09 | 0.96 | 4.46 | 0.21 |

| Hidalgo | 1.49 | 3.09 | 0.48 | 1.70 | 11.65 | 0.15 | 1.06 | 11.07 | 0.10 | 0.89 | 3.99 | 0.22 |

| Quintana Roo | 1.32 | 4.19 | 0.32 | 3.75 | 7.56 | 0.50 | 4.05 | 7.25 | 0.56 | 0.75 | 5.33 | 0.14 |

| Sonora | 1.30 | 3.71 | 0.35 | 2.97 | 20.04 | 0.15 | 3.17 | 20.79 | 0.15 | 0.64 | 7.40 | 0.09 |

| Coahuila | 1.28 | 6.95 | 0.18 | 1.61 | 11.54 | 0.14 | 2.05 | 11.28 | 0.18 | -0.06 | 4.96 | -0.01 |

| Mexico | 1.23 | 2.86 | 0.43 | 3.75 | 13.18 | 0.28 | 3.87 | 12.39 | 0.31 | 0.38 | 3.96 | 0.09 |

| Guerrero | 1.00 | 2.21 | 0.45 | 2.11 | 8.18 | 0.26 | 1.79 | 6.57 | 0.27 | 0.43 | 2.68 | 0.16 |

| Veracruz | 0.98 | 2.35 | 0.42 | 2.43 | 11.68 | 0.21 | 2.57 | 10.76 | 0.24 | 0.15 | 4.44 | 0.03 |

| Oaxaca | 0.93 | 2.10 | 0.44 | 1.57 | 5.73 | 0.27 | 1.23 | 5.57 | 0.22 | 0.47 | 2.30 | 0.20 |

| Durango | 0.90 | 1.91 | 0.47 | 2.38 | 9.97 | 0.24 | 1.82 | 8.34 | 0.22 | 1.01 | 4.61 | 0.22 |

| Baja California | 0.37 | 4.39 | 0.08 | 2.35 | 11.12 | 0.21 | 2.66 | 11.72 | 0.23 | 0.31 | 4.77 | 0.07 |

| Tlaxcala | 0.35 | 3.74 | 0.09 | 3.02 | 12.77 | 0.24 | 2.61 | 10.45 | 0.25 | 0.74 | 4.47 | 0.17 |

| Nayarit | 0.29 | 3.33 | 0.09 | 1.68 | 4.48 | 0.37 | 1.04 | 5.11 | 0.20 | 1.01 | 2.78 | 0.36 |

| Morelos | -0.02 | 2.11 | -0.01 | 1.71 | 10.12 | 0.17 | 1.99 | 9.81 | 0.20 | -0.04 | 3.44 | -0.01 |

| Tamaulipas | -0.21 | 3.21 | -0.07 | 1.79 | 12.60 | 0.14 | 1.84 | 14.66 | 0.13 | 0.42 | 3.42 | 0.12 |

| Chiapas | -0.25 | 2.62 | -0.10 | 2.73 | 9.48 | 0.29 | 2.38 | 7.69 | 0.31 | 0.63 | 3.80 | 0.17 |

| Tabasco | -0.28 | 4.45 | -0.06 | 4.37 | 15.67 | 0.28 | 4.72 | 17.95 | 0.26 | 0.88 | 4.66 | 0.19 |

| Campeche | -6.52 | 3.42 | -1.91 | 1.95 | 8.26 | 0.24 | 1.81 | 8.10 | 0.22 | 0.46 | 3.06 | 0.15 |

| Average | 1.41 | 3.30 | 0.45 | 2.12 | 10.37 | 0.22 | 1.94 | 10.05 | 0.20 | 0.64 | 4.47 | 0.14 |

Notes: * Mean: Per year average growth; SD: Period Standard Deviation. Average excludes Campeche and Tabasco.

Source: INEGI (2021).

Besides, it is also possible to draw a rough negative relation between the degree of instability in the rate of growth, and that of the entrepreneurs share in employment. Applying either for the total and the self-employed individuals: those states with a high growth variability -most of them low performers- seem to experience less variability in entrepreneurs share in employment. It seems that the robust and less unstable growth in some states provide opportunities for people to switch from entrepreneurship to salaried work and vice versa; where people try entrepreneurship and take advantage of the labor opportunities. These opportunities may not be available in other states characterized by a lower and more unstable performance where, in turn, individuals remain as self-employed, translating into a stagnating entrepreneurial stability.

4. research methodology

Hypothesis and empirical methods

The model in equation 1 is proposed to explain the stock of entrepreneurs and underlies some hypothesis on the grounds of the theoretical and empirical research presented.

Where N is the number of entrepreneurs; Y is a measure of economic activity and w is wage, both related to the macroeconomic context. Variable y is a measure of economic development representing some variables associated to the states' context conditions

Assuming a Cobb-Douglass function, equation 1 turns to 2

Where β is the neutral component of the function not dependent upon the right-hand side variables Y, w, or y. The parameters β Y , β w, and β y are the corresponding parameters of the argument. It is expected β y to be positive and the size of the parameter depending on the type of venture. On the one hand, entrepreneurship may be pro-cyclical: expansions generate opportunities, make individuals more willing to bear risk and make credit more likely. This will increase the number of entrepreneurs of higher ability who foresee opportunities. However, expansions may also induce lower ability entrepreneurs to search for jobs given improved labor opportunities. In addition, ß w is expected to be negative: given that w represents the opportunity costs of entrepreneurship, high level of wages ceteris paribus will induce individuals to search for jobs rather than venturing; but if wages are low, lower-ability marginal type will enter entrepreneurship expecting better gains as compared to salaried employment. Finally, the parameter ß y is expected to affect the number of entrepreneurs differentially depending on the entrepreneur type. Development entails certain economical and institutional context which may induce or hinder entrepreneurs to undertake investments and create jobs. These may include the working of financial markets, the level of efficiency of the rule of law and contract enforcement, the quality of the government performance, policy support and regulations, the level of conduciveness of the knowledge context, among other factors. These factors may be related, although partially, to the concept of EE, which involves, in addition, more entrepreneurship-specific contextual factors, interactions and policies. In general, higher development would be consistent with relatively larger and more sophisticated ventures, whereas lower development induces self-employment and more rudimentary ventures.

An unbalanced panel data is estimated tracking 30 of the 32 states during the period 2005-2019. Campeche and Tabasco were dropped given the GDPp bias from the oil industry. The empirical work is based on the log-transformation of equation 2.

Where

The type of entrepreneurs (n) considered in the study are the total number of entrepreneurs (Inentr), the self-employed individuals (Inse) and the employers (Inemp). Data on the stock of entrepreneurs were obtained from the National Survey of Occupation and Employment (ENOE, by its acronym in Spanish) elaborated by INEGI, which surveys individuals aged 15 or more and tracks the independent workers divided into self-employees and employers by state on a quarterly basis. INEGI defines an independent worker as an individual who runs his own enterprise or business and does not have a boss or superior to whom he is accountable for his performance or outcomes. A self-employee is an individual who works alone or with the support of family members at his own house or somebody else's without any commitment to pay them for their services. An employer is an independent worker who uses the services of one or more workers in exchange for an economic remuneration in monetary or kind.

A relevant characterization of the types of enterprises and entrepreneurs, which may be implicit in INEGI data, is provided in Acs et al. (2017), who propose the necessity, opportunity and innovation driven entrepreneurship types. The former includes those individuals who have no other option to make money in the labor market and undertake self-employment activities to survive; the second group includes those entrepreneurs who see opportunities to bring a good or service to the market, have serious expectations of job creation and growth, and whose returns will be higher than engaging in salaried work. The third group is the innovation-driven entrepreneurship which, like opportunity entrepreneurship, have serious expectations of job creation and growth from bringing an innovation to the market. Likewise, the authors also make a distinction between the small business owner who replicates what others do, and the entrepreneur who innovates. The former includes many forms of self-employment and small businesses in the streets, corners or shopping centers whose owners manage, operate or run routine business activities as they exhibit a known production function and operate in a well and clearly defined way. The later includes high-impact ventures, which conduct the necessary activities to create an innovative, high-growth company where not all markets are well established or clearly defined. The former involves activities that generate employment and income for their families; the second ensures that innovation facilitates increased productivity and contributes to economic growth. The relative presence of these types of entrepreneurs in INEGI data is unknown, but certainly it biases to the former case.

The proxies used to represent Y

it

and w

it

are the GDP per state in real terms at 2013-prices and the workers' average income by working hour obtained from the Economic Information System (BIE, by its acronym in Spanish) and the ENOE, both elaborated by INEGI. The level of development is included as dummy variables controlling for the lower developed states (y

l

) and the higher developed states (y

h

) with the associated parameters

The dummy variable y

l

takes the value of 1 if the states have an average GDPp during the 2005-2019 period lower than the mean minus 0.5 standard deviation and 0 otherwise and includes Chiapas, Guerrero, Hidalgo, Mexico, Nayarit, Oaxaca, Puebla, Tlaxcala, Veracruz, and Zacatecas. The variable y

h

equals 1 if the state has an average GDPp greater than the states mean plus 0.5 standard deviation and 0 otherwise and includes Aguascalientes, Baja California, Baja California Sur, Chihuahua, Ciudad de Mexico, Coahuila, Colima, Jalisco, Nuevo Leon, Queretaro, Quintana Roo and Sonora. The rest of the states are considered as average developed. The variables IS

P

, IS

S

and lS

T

are the natural logs of the shares of the primary, secondary and tertiary sectors of the economy computed as the proportion of the value added of the sector in the total value added and

The error term is given by

Estimation of the effects on local entrepreneurship and employment

The estimates derived from equation 3 will be used to obtain the impact on the entrepreneurial outcomes by type and state derived from the changes in the macroeconomic context and their employment implications, assuming the level of development and the sector structure invariant. Consequently, the change of the number of entrepreneurs of any type

This change will be dependent on the production and wage elasticities of the entrepreneurial outcomes

Where

Where

Where

The relative employment effects across the states will not only depend on

The relative entrepreneurial and employment effects of equations 5 and 8, and the absolute entrepreneurial and employment effects of equation 6 are estimated by type of venture and state. The factor θ

i

applies to the number of employers and to a fraction of the total entrepreneurs given by the ratio employers-total entrepreneurs. The self-employed individuals are assumed not to have salaried workers so they are not affected by θ

i

. In addition, it will be assumed ∆GDP

i

=1% w¡ = 0, as they seem more neutral and do not divert from the focus of this research. Besides, this implies that ∆GDP

i

and ∆w

i

will be the same for all states so the impact on the state employment derived from entrepreneurship will depend mostly on

5. Empirical results

The correlation analysis in Appendix 1 supports the model proposed in equation 3. It suggests discarding any specification issues due to highly correlated independent variables. The independent variables Iy t and ly t-1 turned out to be highly correlated with lw ergo the inclusion of dummy variables y h and h l as proposed in equation 3. The instruments used to deal with endogeneity when necessary are the lagged variables IYt-1 and lwt-1, which are correlated with themselves but uncorrelated with the rest of the right-hand side variables. The Levin-Lin-Chu unit-root test in Appendix 2 suggests that some log variables accept the null hypothesis (Ho) that panels contain unit roots; nevertheless, the Kao tests for cointegration in Appendix 3 bias to the rejection of the Ho that the variables are not cointegrated.

Econometric outcomes

The econometric results of equation 3 are reported for the three entrepreneurial outcomes (n) in Table 7. The models are estimated using 413 observations as Mexico City missed seven observations; except for three, which include 383 observations given the inclusion of lGDPt-1 and lwt-1 as instruments. The regressions' statistics suggest the global significance of the econometric estimations and that most of their variance are due to differences across states (rho). The explanation capacity of the models is acceptable. Estimations also bias to the acceptance of RE model according to the Hausman test in regression 1 and 2. This implies that individual states characteristics are not correlated with the time-varying characteristics of the independent variables, evading the endogeneity issues. Regression 3 rejects the RE model indicating an endogeneity problem, which is solved partly by the FE estimation. However, the possible simultaneity involving the entrepreneurship outcome, GDP and w required comparing the FE and FE IV using lY t-1 and lw t-1 as instruments, which turned out to be a preferable model according to the Hausman test exhibited in Table 7. This result indicates that employers, as opposed to the total number of entrepreneurs and the self-employees, are simultaneously determined with output and wages, which suggest the effects of employers on performance, stressing the more opportunity-driven nature of these ventures. This may be explained by the fact that employers are larger and possible more sophisticated ventures as compared to the other two measures of entrepreneurs. Although not necessarily innovative, these ventures may be run by more educated entrepreneurs possessing general training and some specific skills, allowing them to deal with larger ventures.

Table 7 Econometric results: entrepreneurs, self-employees and employers

| (1) | (2) | (3) | ||||

| lnentr | lnse | lnemp | ||||

| Coef. | p | Coef. | p | Coef. | p | |

| lY | 0.42 | * | 0.32 | * | 0.90 | * |

| lw | 0.00 | -0.19 | * | 0.79 | * | |

| yl | 0.05 | * | 0.04 | * | 0.10 | * |

| yh | -0.03 | ** | -0.04 | * | -0.02 | |

| lsp | -0.06 | -0.10 | * | 0.10 | ||

| lss | -0.09 | -0.13 | 0.16 | |||

| lst | 0.33 | 0.24 | 0.91 | |||

| tc=08 | -0.08 | * | -0.07 | * | -0.16 | * |

| tc=09 | 0.05 | * | 0.05 | * | 0.03 | |

| tc=10 | -0.13 | * | -0.12 | * | -0.18 | * |

| c | 7.20 | 8.77 | * | -2.50 | ** | |

| Within R-sq | 0.55 | 0.50 | 0.41 | |||

| F-test/Wald Chi2 | 465.43 | 387.18 | 2.54E+08 | |||

| Prob | 0.00 | 0.00 | 0.00 | |||

| rho | 0.99 | 0.98 | 0.97 | |||

| Hasuman Chi2 | 13.80 | 13.36 | 0.01 | |||

| Hausman prob | 0.09 | 0.10 | 0.99 | |||

| Model | RE | RE | FE IV |

Notes: *p<0.05;**p<0.10; Instruments in regression 3: lYt-1, lwt-1.

Source: own elaboration.

The variable Y it , representing the level of economic activity, turned out to be significant at 5% with a positive effect over the entrepreneurial outcomes lnempr, lnese, lnemp but different in size. These results concur with the previous research arguing the importance of the level of economic activity as a determinant of the number of entrepreneurs and the pro-cyclical nature of entrepreneurship (Lucas, 1978; Aghion and Bolton, 1997; Sutton, 1991; Rampini, 2004). The parameter estimates ß Y yield 0.42, 0.32 and 0.90 correspondingly, suggesting that 1% change in GDP brings a 0.42% change in the overall entrepreneurship, 0.32% change in the number of self-employed individuals and 0.90% in the number of employers. This implies that the employers would receive a larger impact from economic downturns, than the self-employment ones, given that the corresponding elasticities ê Y turns out to be higher. In sum, the responsiveness of the entrepreneurial outcomes to changes in economic activity diverge between the types of ventures, possibly reflecting their differential characteristics in terms of the type of good/service, market segments targeted, business models, education, among other; which determine their responsiveness to market variations and the exploitation of opportunities. On the one hand, the self-employed individuals produce traditional income-inelastic goods and services oriented to low-income markets or to satisfy basic consumption, which are consistent with necessity entre-preneurship. The employers, on the other, produce goods which are more income-elastic oriented to higher income markets, and possible more opportunity driven.

The effects of the labor markets dynamics, as measured by the wage level (w), over the entrepreneurial outcomes reveal also important divergences: Wages do not seem to affect entrepreneurship in general- wages are statistically insignificant as shown in regressions 1. However, they turn out to be significant at 5% though contrary in signs for the group of self-employees and employers of the regressions 2 and 3 correspondingly. On the one hand, the elasticities ê w associated to the self-employed individuals Inse turn out to be -0.19 and for the employers lnemp 0.79; this means that 1% change in wages generates a negative 0.19% impact in the former and a positive 0.79% impact in the later. These results may reflect the necessity-opportunity dichotomy of entrepreneurship by which the hardships of the labor markets characterized by depressing wages and the lack of labor opportunities, encourage self-employment and discourage the employers to venture, due to the lack of market opportunities associated to the deficient demand. These processes are consistent with the "recession-push" and "prosperity-pull" hypothesis emphasized in Georgellis et al. (2005), Parker (2009), Schuetze (2000), Ghatak et al. (2007), González et al. (2018) and Texis et al. (2019).

The binary variables y

i

and y

h

and their associated parameters

The sector structure of the states as measured by ISp, ISs and IS

T

and the associated elasticities

Besides, the dummy variables t

c

= 08, t

c

= 09 and t

c

= 10 and the associated parameters

The effects of economic downturns over entrepreneurship and employment in the Mexican states

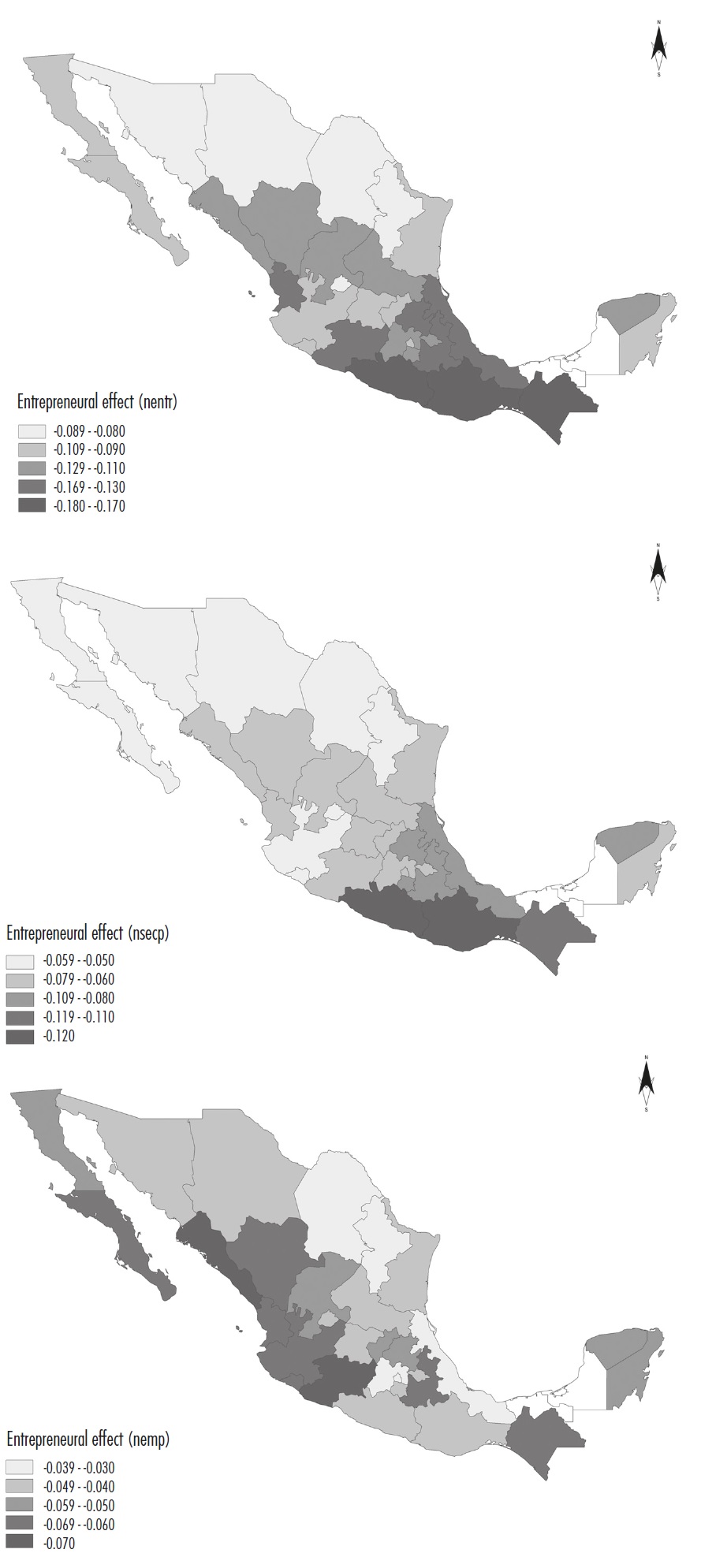

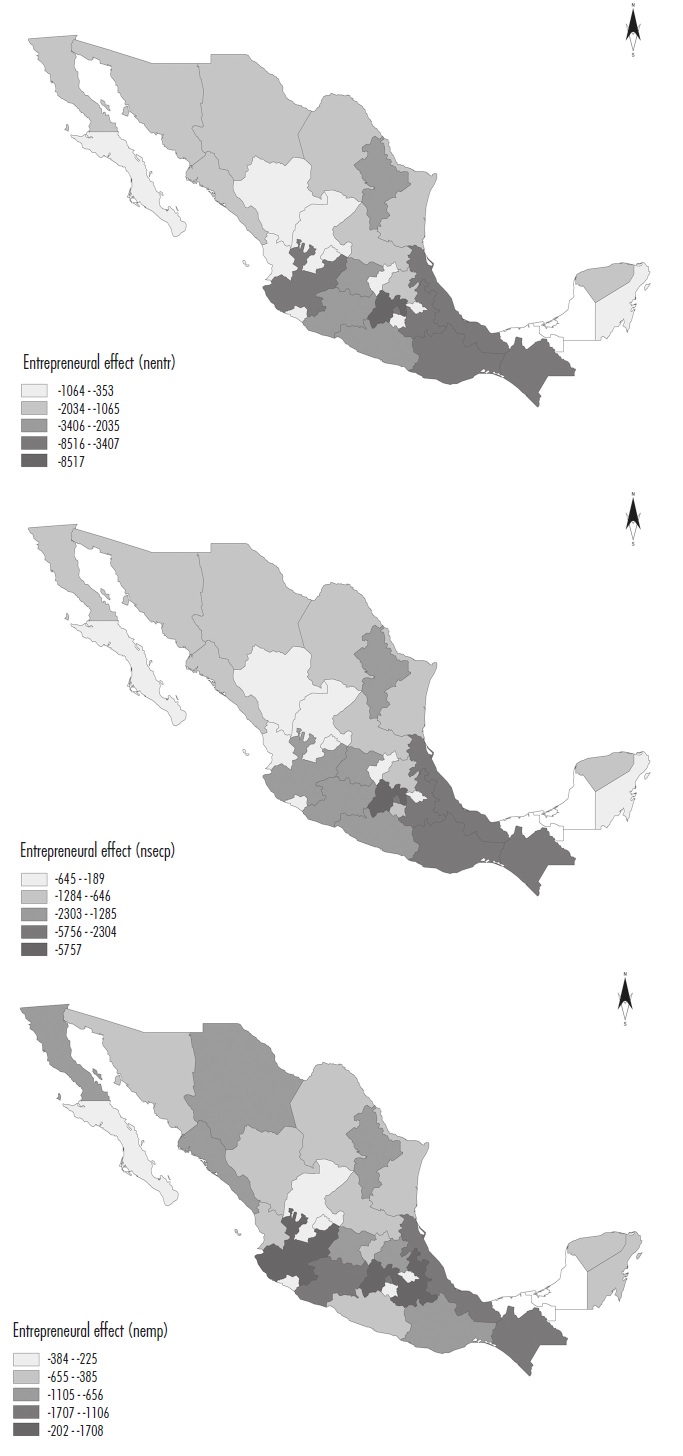

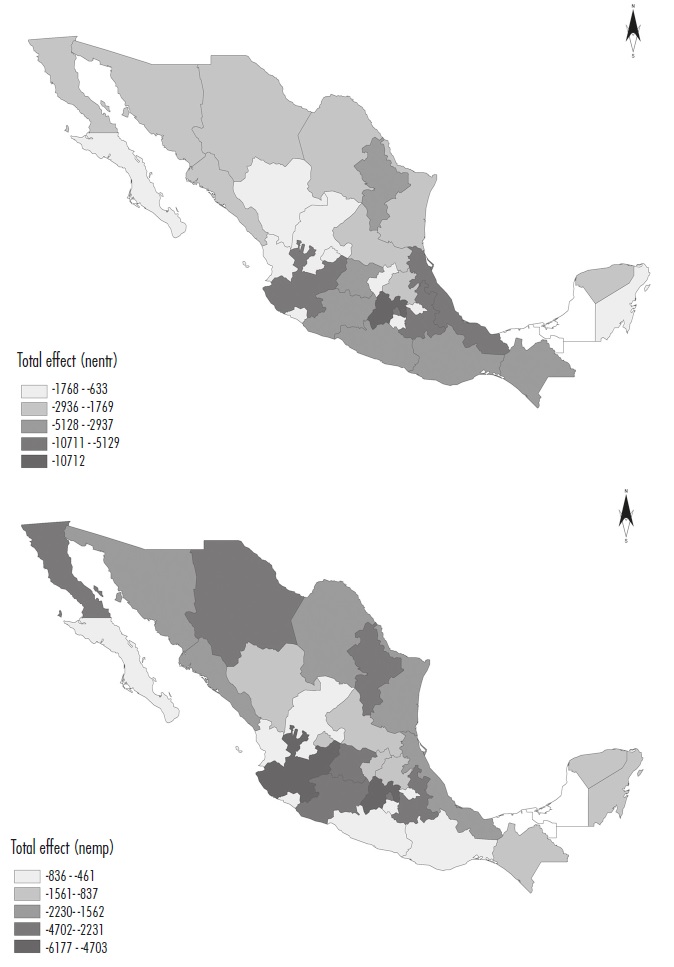

The estimation of the relative (% of employment) and absolute (Total quantity) entrepreneurial and employment effects derived from equations 5, 8, and 6 are reported in Appendix 4 and 5 for the three types of entrepreneurial outcomes under the premises displayed in Table 8. The distribution of these effects is exhibited in the Figures 1 through 4, where the darkest color depicts those states displaying the highest negative impact and the lightest the lowest negative impact.

Table 8 The estimation parameters

| ∆GDP i | ∆w i | 𝜃 i |

|

|

|

|

| Aguascalientes | -0.01 | 0.00 | 3.27 | 0.19 | 0.15 | 0.049 |

| Baja Californio | -0.01 | 0.00 | 3.07 | 0.21 | 0.16 | 0.051 |

| Baja California Sur | -0.01 | 0.00 | 2.65 | 0.22 | 0.16 | 0.067 |

| Coahuila | -0.01 | 0.00 | 3.61 | 0.19 | 0.15 | 0.039 |

| Colima | -0.01 | 0.00 | 2.66 | 0.22 | 0.15 | 0.065 |

| Chiapas | -0.01 | 0.00 | 0.89 | 0.41 | 0.35 | 0.051 |

| Chihuahua | -0.01 | 0.00 | 3.40 | 0.20 | 0.15 | 0.042 |

| Mexico City | -0.01 | 0.00 | 2.18 | 0.25 | 0.21 | 0.038 |

| Durango | -0.01 | 0.00 | 2.12 | 0.27 | 0.20 | 0.063 |

| Guanajuato | -0.01 | 0.00 | 2.67 | 0.24 | 0.20 | 0.040 |

| Guerrero | -0.01 | 0.00 | 0.82 | 0.43 | 0.39 | 0.041 |

| Hidalgo | -0.01 | 0.00 | 1.79 | 0.30 | 0.24 | 0.059 |

| Jalisco | -0.01 | 0.00 | 2.80 | 0.23 | 0.16 | 0.065 |

| Mexico | -0.01 | 0.00 | 2.28 | 0.26 | 0.23 | 0.029 |

| Michoacan | -0.01 | 0.00 | 1.69 | 0.31 | 0.23 | 0.076 |

| Morelos | -0.01 | 0.00 | 1.96 | 0.28 | 0.24 | 0.041 |

| Nayarit | -0.01 | 0.00 | 1.56 | 0.30 | 0.23 | 0.071 |

| Nuevo Leon | -0.01 | 0.00 | 3.48 | 0.19 | 0.16 | 0.033 |

| Oaxaca | -0.01 | 0.00 | 0.72 | 0.44 | 0.39 | 0.049 |

| Puebla | -0.01 | 0.00 | 1.47 | 0.33 | 0.26 | 0.066 |

| Queretaro | -0.01 | 0.00 | 2.51 | 0.25 | 0.19 | 0.056 |

| Quintana Roo | -0.01 | 0.00 | 2.49 | 0.24 | 0.19 | 0.050 |

| San Luis Potosi | -0.01 | 0.00 | 2.07 | 0.28 | 0.23 | 0.043 |

| Sinaloa | -0.01 | 0.00 | 2.22 | 0.26 | 0.18 | 0.076 |

| Sonora | -0.01 | 0.00 | 3.24 | 0.20 | 0.15 | 0.047 |

| Tamaulipas | -0.01 | 0.00 | 2.64 | 0.22 | 0.19 | 0.039 |

| Tlaxcala | -0.01 | 0.00 | 1.99 | 0.27 | 0.23 | 0.044 |

| Veracruz | -0.01 | 0.00 | 1.50 | 0.33 | 0.30 | 0.037 |

| Yucatan | -0.01 | 0.00 | 1.89 | 0.29 | 0.24 | 0.051 |

| Zacatecas | -0.01 | 0.00 | 1.84 | 0.27 | 0.21 | 0.059 |

| Total | -0.01 | 0.00 | 2.25 | 0.27 | 0.22 | 0.051 |

Notes: the parameter θ i , is obtained using INEGI data.

Source: own elaboration.

The big picture suggests that the per-state relative, entrepreneurial impact derived from a 1% decline in GDP i cetiris paribus averages -0.113% for the total number of entrepreneurs, -0.069% for the self-employees and 0.047% for the employers; the estimated per state employment effects average -0.161, -0.069 and -0.102% correspondingly (see Appendix 4). In general, the relative entrepreneurial impacts (see Figure 1) are largest in some southeastern states such as Oaxaca, Guerrero, Chiapas, which are shaded darkest in the figure, followed by Veracruz, Puebla, Michoacan, Nayarit, Hidalgo and Yucatan. Separating by type of venture, the relative effect in self-employment is largest in Oaxaca, Guerrero and Chiapas followed by Puebla, Veracruz and Mexico. It is apparent that the strongest entrepreneurs relative impact hit the southern states, particularly the self-employees, given their relatively large population and occupation trends biased toward this type of ventures.

The employers' entrepreneurial relative effects turn out to be largest in Sinaloa, Guerrero, Chiapas, Puebla, Jalisco, Nayarit, Durango and Colima, which may be explained by the interaction of a relatively higher share of the employers in employment and the higher GDP i elasticity of such ventures, as compared to the total entrepreneurs and the self-employees. The effects in the northeastern states are rather more modest (except for Baja California), which is explained possibly by the relatively stronger labor markets and job opportunities associated to the location of large manufacturing industries, discouraging selecting entrepreneurship as an occupation.

The relative total employment effects (see Figure 2) are felt strongest in some southeastern and pacific states such as Guerrero, Oaxaca and Chiapas, followed by Puebla, Michoacan, Jalisco, Hidalgo, Sinaloa, Durango and Baja California Sur. The relative entrepreneurial and employment effects converge in the self-employment case so these are not included in the Figure 2. As for the relative employment effects associated to the employers, they tend to affect the northern and northwestern states more, and some central and pacific states. These effects are largest in Baja California Sur, Sinaloa, and Jalisco, followed by Baja California, Sonora, Chihuahua, Coahuila, and Durango. Despite the modest relative, total-employment effects in the northern states, when considering the employers' relative employment effects separately, they become among the most affected states due the interaction of the relatively higher GDP i elasticity of such ventures and the average venture size in those states.

The entrepreneurial and employment per state absolute effects are exhibited in Appendix 5. In gross terms, 1% decline in GDP i is expected to produce an overall reduction in the number of entrepreneurs by venture type and the related employees distributed heterogeneously across the different states.

The impact in the number of entrepreneurs is largest in Mexico, followed by Puebla, Oaxaca, Jalisco, Veracruz and Mexico City. Discomposing into types of ventures, the self-employees' absolute effects are highest in Mexico, Oaxaca, Puebla, Jalisco, Guerrero and Chiapas, whereas the strongest effects derived from the decline in the number of employers are located in Jalisco, Puebla, Mexico, Mexico City, Veracruz and Chiapas (see Figure 3). The size of these effects is related to the population size of these states, which correlates with the number of entrepreneurs, along with the GDP i elasticity of the ventures.

As for the absolute impact in the employment (see Figure 4) produced by the entrepreneurs' decline, the strongest effects turned out to be in some central and eastern states, such as Mexico and Mexico City, and also in Veracruz and Puebla; followed by the southern and eastern states Michoacan, Guerrero, Oaxaca, Chiapas, Guanajuato; and the northern state of Nuevo Leon. These states are the most populated in the country which is reflected certainly in the absolute values. As before, the absolute entrepreneurial and employment effects converge in the self-employment case, so they are not included in the Figure 4. The employment absolute impact related to the employers is strongest in Jalisco and Mexico, followed by the neighboring states Michoacan, Guanajuato, and Puebla, and the northern states of Baja California, Chihuahua and Nuevo Leon (see figure 4). Some less populated states in the north facing also a significant absolute effect are Sonora, Coahuila and Tamaulipas. Despite the importance of the size of the states' population to determine the dimension of these effects, the results also exhibit the role played by the interplay between the higher GDP i elasticity of the employers, and the average venture size characteristic of the northern states.

6. Final remarks and policy implications

This research found that the states' economic and development context affect entrepreneurship differentially depending on the type of venture. Based on this finding, the research also estimated the entrepreneurial and employment effects of economic downturns across the states as dependent upon their entrepreneurial structures in terms of venture types, the ventures' sensibility to the changes of economic activity and the states' average venture size. Thus, the research provides insights on the regional distribution of such effects and the relative magnitudes and impacts of economic downturns.

The research results are relevant not only under the current recessive context but also under different economic scenarios and policy courses. Particu larly, the results provide valuable clues to direct government policies, support programs and regulations on entrepreneurship regionally sound for Mexico and useful for the central and the local governments. Although the effective ness of some policies regarding entrepreneurship, which involves economic stimulus, subsidies, transfers or fiscal incentives have been highly questioned, their implementation has been a common practice among the countries and regions in order to stimulate entrepreneurship for innovation or employment, avoid bankruptcy, or deal with the contracting effects of downturns, sometimes with positive outcomes. Given these trends, the paper results may offer some criteria for these policies to be more efficient.

Policy design and implementation requires differentiating between self-employment and employers, and account for the relative regional weights of entrepreneur types and venture sizes; besides, differentiation should also apply to the type and size of the support and policy instruments matching with the types of entrepreneurs. In Mexico, in accordance with its entrepreneurial structure, support may be either direct, which includes money transfers and soft loans, or indirect, including fiscal incentives, tax payments deferrals, credit availability, demand stimulus among other. Direct, massive and relatively smaller support may serve well for the self-employed individuals and the smaller employers, whereas mostly indirect, specific and relatively larger support may be appropriate for the larger employers.

According with the paper results, some tensions arise in any federal policy resources to entrepreneurs: first, allocating resources to the employers may be easier and more cost-efficient to administer and may generate an equivalent impact on employment, rather than focusing on the self-employees, which in turn may result in under provision of support to these individuals along with the resulting inequality and the possible harm on the future entrepreneurial potential. Another tension is allocating policy resources according with the relative impacts by state. This option may be subject to higher transaction cost and less cost efficiency from the central government standpoint instead of allocating according to the absolute impacts concentrating in few states, which in turn, may be easier, more cost-efficient and generate equivalent impacts on employment. This implies potential tensions among the central and some local governments since the former may have incentive to allocate resources as to maximize the absolute impact at the lowest cost and effort, whereas the later would claim allocating resources according to the relative impacts. In any case, effective policy requires selectivity, distinguishing those entrepreneurs guaranteeing the higher policy impact in both groups of ventures, coordination and complementarity between federal and local governments. This research offers insights for entrepreneurs' segmentations for policy purposes at regional level, which may be subject to further research.

This research faced some limitations. The lack of data availability constrained the entrepreneurial variables to the stock of entrepreneurs, rather than using other measures of entrepreneurial activity, such as enterprise formation or net creation as proposed in literature. Besides, the research estimated the effects assuming ∆GDP =1% across the states cetiris paribus, given the lack of forecasts of the dependent variables at state level, which implied ignoring the effects of ∆w on the entrepreneurial outcomes and the resulting effects. These limitations, however, do not divert from the research aim nor compromise its insights. Further research would also include the assessment of the divergent policy responses of governments to mitigate the harm from economic downturns comparatively in terms of instruments, economic sizes and the derived entrepreneurial and employment effects.

nueva página del texto (beta)

nueva página del texto (beta)