Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Problemas del desarrollo

versión impresa ISSN 0301-7036

Prob. Des vol.51 no.200 Ciudad de México ene./mar. 2020 Epub 09-Sep-2020

https://doi.org/10.22201/iiec.20078951e.2020.200.68317

Articles

Fragmentation of production and economic integration in North America: centrifugal and centripetal forces

a University of Santiago de Compostela, Spain. Email address: oscar.rodil@usc.es.

b Autonomous University of Chiapas, Mexico. Email address: jalachis@hotmail.com.

International fragmentation of production and economic integration are two structural motors of change that have characterized the global economy for decades. However, an interest in analyzing these two processes together has recently intensified due to the neo-protectionist turn in trade and economic policy in the United States. This paper examines trade and productive relations between Mexico, the United States and Canada, demonstrating how the global value chains (GVCS) in which they participate obscure global tendencies (centrifugal forces) and regional counter-tendencies (centripetal forces) that provoke changes in the geography and composition of productive linkages. These processes have the result of restructuring, and to a certain extent disintegrating, the regional bloc.

Key Words: productive fragmentation; economic integration; global value chains; foreign trade; CUSMA

La fragmentación productiva internacional y la integración económica son dos motores del cambio estructural que caracterizan a la economía mundial desde hace décadas. Sin embargo, el interés por analizar ambos procesos en conjunto se ha visto reforzado recientemente por el giro neoproteccionista de la política comercial y económica de Estados Unidos. Este trabajo aborda las relaciones comerciales y productivas de México, Estados Unidos y Canadá, mostrando cómo las cadenas globales de valor (CGV) en las que participan ocultan tendencias globales (fuerzas centrífugas) y contratendencias regionales (fuerzas centrípetas) que provocan cambios en la geografía y en la composición de los encadenamientos productivos, con un resultado reestructurador y en cierta medida desintegrador del bloque regional.

Palabras clave: fragmentación productiva; integración económica; cadenas globales de valor; comercio exterior; T-MEC

Clasificación JEL: F14; F15; F55; F62

1. INTRODUCTION

Two of the most striking phenomena that form part of structural changes to the global economy are the fragmentation of productive processes on a global scale, and the proliferation of integration agreements. Although each has its own characteristics and factors, it is of interest to analyze them together within a scenario such as the arena of integrated trade between the countries of North America, formerly known as the North American Free Trade Agreement (NAFTA) and whose renegotiation gave way to the 2018 signing of the Canada-United States-Mexico Agreement (CUSMA). Such an interest is reinforced by the intense political and economic debate provoked by the neo-protectionist turn in United States politics following Donald Trump’s arrival to the American government.

Within this context, the present work performs a study of commercial and productive relations between the countries that make up the sphere of North American integration, based on information regarding value-added trade contained in the TiVA database (OECD, 2016 and 2018). Ultimately, this work intends to explicate the consequences of the centrifugal (globalizing) and contrasting centripetal (regionalizing) tendencies which are associated with international productive fragmentation, as understood within the framework of the aforementioned integration processes.

The content of the text is divided into six sections, in addition to this introduction. Section 2 presents an overview of the North American regional integration process, as understood within the context of the reconfiguration of the world economy, and paying particular attention to the United States’ protectionist turn. In section 3, a theoretical and conceptual approach to the object of study is presented. Section 4 addresses methodological concerns related to the study of international productive fragmentation from the perspective of value-added trade. Following this, section 5 discusses the joint insertion of the three North American countries into global value chains (GVCs). Section 6 analyzes changes that have occurred in the productive chains within the regional bloc. Finally, section 7 presents the article’s conclusions.

2. THE INTEGRATION OF NORTH AMERICA IN THE CONTEXT OF THE GLOBAL ECONOMY’S RECONFIGURATION AND THE NEO-PROTECTIONIST TURN IN THE UNITED STATES

The center/periphery definition under the current terms

As a way to better analyze the implications of North America’s integration process, it is useful to start from the definition proposed by Raúl Prebisch. Prebisch conceptualized the global economic structure as asymmetrical and composed of two zones-one developed and the other underdeveloped-which are articulated as center and periphery, respectively (Prebisch, 1948, cited by Martínez, 2011). However, the current International Division of Labor (IDL) does not serve to explain the center/periphery economic relations of recent decades, which are characterized by globalization and the incessant growth of manufacturing exports in newly industrialized countries, reflected in both economic (in terms of per capita GDP) and institutional (incorporation into the OECD of Latin American and Asian economies) spheres. The "periphery" has ceased to be an inclusive category; otherwise, how could countries such as South Korea, India, Argentina, Morocco, Burkina Faso, and Mexico or Central American countries be put in the same bag-just to name a few that do not coincide in typological groups defined by exports, income or institutions? The center/periphery conception is therefore unusable under the current context of globalization and the new IDL (Martínez, 2011).

Vidal (2002) suggests that the strongest matrix in the center/periphery framework is that of Samir Amin, since it offers the possibility of articulating historical, economic-structural and institutional-phenomenal levels of development, using the well-known characterization of the center’s capitalist development as autonomous (historical dimension), self-centered (structural dimension) and modernizing (institutions and material well-being). It is important to note, then, that the commercial definition of centers as exporting manufactures and peripheries as exporting primary products has been surpassed. Extraversion can also occur in the export of manufactures, and self-centered economies can undoubtedly have primary exports-even dominating international primary product markets through their export volume, as does in fact happen. This is because the center/periphery dichotomy no longer rests on what is produced, but on how it is produced (Martínez, 2011).

In any case, scholars that subscribe to the regulationist view consider the existence of what Marxist theorists called Department I of industrial production, i.e. the means of production (capital goods, raw materials and intermediates), in addition, of course, to Department II (consumer goods), to remain decisive elements in classifying a country as developed or not (Boyer, 1986; Boyer and Saillard, 2002; cited by Domingues, 2012).

Although the neoliberal counterrevolution of the 1980s rejected this theoretical vision, the reconfiguration of the global economy through globalization once again highlights the reality of the center/periphery structure, and therefore reinforces the usefulness and relevance of such a conceptualization to explain unequal development under global capitalism (Martínez, 2011). It is therefore appropriate to refer to a reconceptualization of the global economic structure with the form center/semi-periphery/periphery.

The advent of global capitalism has changed the roles of regions and countries, leading to the emergence of a semi-peripheral region of the world (including Argentina, Brazil, Chile and Mexico in Latin America; China, India, Indonesia, South Korea, Malaysia, Singapore, Thailand and Turkey, in Asia; the Russian Federation and South Africa) (Martínez, 2011). In the specific case of Mexico, its inclusion in NAFTA led to the country’s incorporation into processes of globalization; it is considered part of the global economy’s semi-periphery, characterized by inwardly reproducing the semi-periphery/periphery structure, and in some rare cases, that of the center.

It is necessary to reiterate that this definition is not based on a market-oriented view of what is produced but rather on how it is produced, given that globalization involves a new IDL. In Mexico, there are regions that due to their semi-peripheral character, function as embedded within the global capitalist system, while others only fulfill the role of labor reserve and do not participate in production or global consumption-or if so, only marginally. Within the framework of the center/semi-periphery/periphery trinomial, central economies can retain the benefits of technical progress and manage their production capacity, which is derived from increases in productivity across all sectors and in consumption. This is done by way of a sufficient remuneration of factors, which indicates the endogenous absorption of value-added. However, peripheral economies cannot retain productivity gains, since these are lost through trade with centers (unequal exchange, low value-added), and by permanent financial adjustment (foreign debt). In addition, production capacity is determined by the needs of external markets, and as such it cannot be linked to consumption capacity.

Peripheral economies continue with traditional trade prior to globalization; that is, they are exporters of primary products and importers of manufactures, but in general they hardly participate in either global production or consumption, and they are characterized by their structural heterogeneity. Meanwhile, semi-peripheral economies such as Mexico are joined to the global factory mechanism and participate in production, though not in the same way with global consumption, since there is a divergence between their ability to consume and to produce that locates them in an intermediate position between center and periphery (Martínez, 2011).

Integration and neo-protectionism in North America

The main structural transformation that Mexico experienced in relation to the opening process-due to changes to its economic model in 1982, its incorporation into the GATT in 1986, and the signing of NAFTA in 1994-occurred in the structure of its exports. In this sense, Mexico went from being an oil-exporting country to essentially being an exporter of manufactured goods, in line with its participation in the new IDL, although this production focus was also fostered by a particular industrial policy.

Specifically, the origins of Mexico's manufacturing activities date back to the establishment in May 1965 of the Promotion of Maquiladora Export Industry policy in the north of the country. In 1990, the Temporary Import for Export Program (TIEP) was established, which favored the importation of duty-free components, provided that at least 30% of their sales were exported (Contreras and Munguía, 2007). In any case, NAFTA definitively changed the structure of Mexico's exports, which until 1982 were mostly oil.

The change of economic model, along with NAFTA, inserted Mexico into the global economy as the primary Latin American country producing manufactures and, in addition, as a major recipient of foreign direct investment (FDI). However, economic growth has been mediocre, as it would require exports to incorporate greater value-added internally, and to be linked to a greater extent with internal production chains that manage to drive the economy as a whole.

The renegotiation of NAFTA, and its subsequent signature in November of 2018 in the form of a new agreement (CUSMA), was marked by a redefinition of trade policy showing a strongly protectionist and interventionist turn, following the irruption of Donald Trump into American politics. Not surprisingly, Trump’s electoral campaign emphasized from the beginning an explicitly critical discourse against NAFTA, stating that it was the main culprit of the United States’ trade deficit with Mexico (López, 2018). In the whirlwind of this neo-protectionist discourse, the initial intention was-as confirmed later on-the practical liquidation of said trade agreement. This possibility was already foreseen in NAFTA’s constitutive text, which provided that any partner wishing to exit the agreement was only required to announce it six months in advance.

In any case, the signature of CUSMA indicates that a breakdown in the integration process is unlikely, as additionally bolstered by the interests of American multinational companies; these companies show the greatest outsourcing of production worldwide, and in particular, to their two business partners: Mexico and Canada. Furthermore, most of the trade between Mexico and the United States is intra-firm and intra-industrial, exhibiting a large proportion of intermediate goods (Rodil and López, 2011).

A practical consequence of international productive fragmentation is, for example, that Mexico has become the sixth largest exporter of automobiles, though there is no car brand of Mexican origin. All cars or automobile parts produced in Mexico are part of the automotive industry’s GVC, which is mostly led by American companies. Something similar happens in other industries, such as the electric-electronic, information and communication technology, or textile industries. In this sense, NAFTA contributed to the destruction of a large portion of the productive chains that formed part of the Mexican economy; those that still remain are fundamentally linked to international productive fragmentation and are oriented towards the United States.

Consequently, Mexico has become one of the primary trading partners of the United States, competing with China and Canada for leadership in this position. However, a good part of this trade takes place via GVCs, which carry multiple shares of value from different countries, and involve many trades crossing the same border several times. In fact, there is evidence that the apparent trade deficit between the United States and Mexico is reduced when this trade is measured only by net value-added exchanges (Rodil, 2018).

3. PRODUCTIVE FRAGMENTATION AND ECONOMIC INTEGRATION: TOWARDS AN INTEGRATIVE EXPLANATORY FRAMEWORK

Among the various dimensions that characterize the globalization process, there are two which are increasingly interrelated: the expansion of international trade, and growing international productive fragmentation. As regards the commercial side, it is a proven fact that global trade has expanded in recent decades-far exceeding the growth of the global GDP (OMC, 2013, 2014). However, much of this trade expansion is accompanied by the formation of regional integration blocs. Meanwhile, international productive fragmentation has experienced a progressive increase (Baldwin, 2012; Gandoy, 2014), showing a sustained growth in the trade of intermediate goods (Sturgeon and Memedovic, 2010; Johnson and Noguera, 2012).

The concept of GVC refers to the combined phases of value generation that characterize any production process which ends in the elaboration of a final product, with some of these phases being located in different countries. Studies of GVCs have expanded exponentially in recent years, a development which is not free of inaccuracies and interpretive discrepancies. Among the various features of GVCs, there are several that have been emphasized more frequently in the literature. For example, Palazuelos and Fernández (2015) highlight that: 1) these chains have served as an engine of trade expansion in recent decades, according to new features of production; 2) multinational companies govern the principal segments of GVCs in various ways, although such chains also present new organizational forms that do not require formal hierarchical relationships; and 3) GVCs have been extended by successive waves of FDI, which have shaped the new architecture of international production.

Among the primary explanatory factors of the progress of GVCs are the discovery and dissemination of technological innovations in transportation and communication. They have also contributed to the proliferation of institutional frameworks characterized by the rise of multilateralism and processes of trade liberalization and integration. Likewise, the essence of GVCs seems to indicate that in recent decades, the geographical boundaries of regional blocs have been surpassed, gradually leading to “genuinely global” productive fragmentation processes (Los et al., 2015).

This article aims to shed light on this analytical confluence through the study of international productive fragmentation in the context of economic integration, as seen with Mexico, the United States and Canada, and which has been developing for several decades. This analytical interest is also fueled by the incorporation of China and other Asian countries into the global market, causing the acceleration of trade and investment flows, and surpassing the limits of trade agreements such as NAFTA, where China has broken in to become a leading commercial actor (López et al., 2014).

Figure 1 intends to gather, under the same explanatory framework, the set of relationships that underlie such a goal, where ideas from different theoretical lines of thinking (of eclectic character) converge. This is based on different regional and global trends that may result in the practical confluence of international productive fragmentation and regional integration processes. For analytical purposes, these trends are classified here as centrifugal and centripetal forces: the former refers to factors which deepen global elements of the productive fragmentation process, giving rise to “extra-regional” value chains; the latter refers to factors which deepen the regional orientation of said process, leading to the formation of “intra-regional” value chains.

From the perspective of integration, centrifugal forces lead to an “outward” (extra-regional) orientation of participation in GVCs, while centripetal forces lead to an "inward" (intra-regional) orientation of such participation. The existing literature refers broadly to the existence of centripetal and centrifugal forces derived from integration that affect the distribution of activity within the integrated space (Riveiro, 2005). However, in this case the centrifugal/centripetal characterization is applied to the possible effects of regional integration on the way these countries would be inserted into the international productive fragmentation process, by way of changes that would affect both their internal and external relationships.

Among the centrifugal forces are factors such as production needs (production input requirements), access to markets or external suppliers, as well as the possible creation of external trade and the promotion of foreign relations (depending on changes in the degree of external protection of each regional bloc), as a result of possible strategic alliances with third countries outside the regional bloc (external partners). The joint action of these factors may lead to an increasingly open (extra-regional) productive integration for the regional bloc as a whole.

On the contrary, the theory of integration (Viner, 1950; Meade, 1955; Lipsey, 1960) demonstrates that the effects of economic integration include the internal generation of trade-promoting efficiency and internal competitiveness among partner countries-as well as the possible existence of trade diversion (the substitution of imports originating in third countries with imports from partner countries). At the empirical level, Rodil and López (2011) point out the existence of such effects in the specific case of NAFTA, which promotes greater intra-regional commercial and productive integration (a centripetal effect), as compared to relations with the rest of the world. Likewise, processes of Myrdal cumulative circular causation can be triggered, especially when the participation of regions at different levels of development is envisioned, leading to production concentration processes in the central territories, drawn by the coexistence of economies of scale and agglomeration economies.

It should be noted that this explanatory framework does not establish which forces are predominant, since these will depend on the individual case and particular circumstances, and may even vary from one period to another, due-for example-to shifts of trade policy in different countries and regions. However, it offers a foothold for a better understanding of the various factors that influence the ways in which countries are inserted into the process of international productive fragmentation. In any case, it is reasonable to assume that existing GVCs are a mixed and dynamic result of such trends and counter-trends.

This article therefore proposes to establish the resulting vector in the case of the North American countries, based on a study of their trade in value-added and their participation in GVCs.

4. MEASURING PRODUCTIVE FRAGMENTATION THROUGH VALUE-ADDED TRADE

At a methodological level, the complexity of trade associated with the existence of GVCs makes a more accurate measurement of it necessary. To do this, various techniques were developed (trade in intermediate goods, trade in parts and components, input-output analysis, etc.), aimed at quantifying degrees of participation in such productive chains.

The method used in this study to measure participation in GVCs corresponds to the measurement of trade in value-added, based on the TiVA database (OECD, 2016 and 2018), which presents data for more than 60 countries-including the major economies of the world-for the periods of 1995-2011 (December 2016 version) and 2005-2015 (December 2018 version). It should be noted that the changes in methodology applied to TiVA as of December 2018 has meant alterations at the level of indicators, among other consequences, though these have not affected the observed trends. Therefore, it is appropriate to differentiate the series corresponding to each methodology in the graphs.

This technique makes it possible to overcome the main problem that affects measurements based on raw trade, a problem which consists of double-counting when calculating exports without previously discounting the value of inputs imported for manufacturing. A consideration of the net value-added flows that pass from one country to another makes it possible to avoid this overvaluation inherent to raw trade flows.

Figure 2 illustrates the map of primary trade flows (gross exports) and value-added that North American countries are leaders of among themselves (intra-regional flows), as well as with their main partner regions in Europe and Asia (extra-regional flows). In terms of gross intra-regional export flows, these reached a total of US $ 1.07878 trillion in 2015, concentrating 43% in the United States, followed by Canada and Mexico with 29 and 27%, respectively. This volume of trade accounts for only one third of the trade flows that the North American bloc maintains with Europe and (East-Southeast) Asia, although 85% of this extra-regional trade is channeled through the United States.

When considering domestic value-added flows that are incorporated into the final demand of the destination country, a contraction is observed in both the total intra-regional quantity, which amounts to US $730.85 billion (68% of the value of gross exports), and of the extra-regional total including Europe and East Asia, which becomes US $2.72383 trillion (88% of the value of gross exports). These differences suggest the approximate overvaluation that follows from the gross export figures, which incorporates value-added from different sources.

Graph 1 shows the differences observed when comparing bilateral trade balances of the North American regional bloc partners, considering two types of calculations: by raw trade and by value-added. In this sense, it can be seen that all gross trade balances overvalue value-added balances, the former being affected by the problem of double-counting. This comparison introduces important nuances and relativizes the foundations of the neo-protectionist political discourse promoted by the Trump administration, which is based on an overvalued trade deficit.

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 1 Bilateral balance of raw and value-added trade. North America, 2015

Among the indicators available to calculate participation in GVCs, those suggested by Koopman et al. (2010, 2014) have been highly regarded. Specifically, to measure the total participation of an economy in a GVC, the following indicator is used:

Where FVA is the foreign value-added that a country incorporates into its exports. For its part, IVA refers to the value-added generated by a country that is incorporated into exports from other countries. As the participation rate in a GVC is defined, both FVA and IVA are divided by the country's gross exports (X), such that this indicator can be expressed as the percentage of a country's gross exports which is linked to international productive fragmentation.

It should be added that the first sum (FVA/X) is usually called the backward participation rate, referring to the productive chains that flow into the reference country from other value-generating countries in the previous stages of the production chain. The second sum (IVA/X) is often referred to as the forward participation rate, referring to the productive chains of the reference country that flow towards other countries where subsequent stages of the value chain are located.

The fact that a country has a greater participation forwards than backwards is usually associated with greater specialization in the initial stages of the production process; if its participation is mostly backwards, the opposite occurs, associated with specialization during stages closer to final consumption. It follows that the participation rate in a GVC can reach similar values in countries with different patterns of insertion. Therefore, an index is proposed which measures the dominant position of a country in terms of its insertion in GVCs (Koopman et al., 2010, 2014), and which is calculated using the following expression:

This expression, including logarithms, is useful for comparing a wider number of economies with more marked differences than those analyzed in this paper. Accordingly, there is a similar index, but which is simpler and more intuitive in its interpretation, which is calculated according to the following expression:

A positive sign position index expresses a prevalence of forward productive chains in GVCs, while a negative sign reflects a predominance of backward chains. As with participation rates, this index is also expressed as a percentage of gross exports. Although forward participation is usually associated with specialization in the initial stages of the production cycle, and backward participation with specialization in its final stages, it should not necessarily be assumed that this is always the case, as there may be inputs with quite different technical content and value-added associated with their production.

It should be noted that such indicators, which are related to value-added trade flows-in addition to helping quantify the degree and mode of a country’s insertion in GVCs-are useful for the study of the productive fragmentation phenomenon from a geographical perspective, which is in line with the objectives of the present work.

5. NORTH AMERICA’S INSERTION INTO INTERNATIONAL PRODUCTIVE FRAGMENTATION

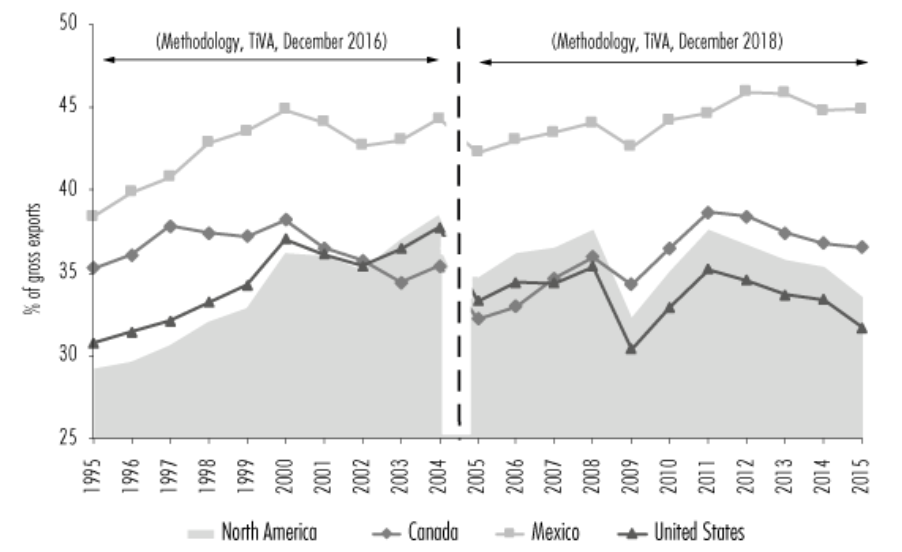

The study of value-added trade conducted by the economies participating in the North American integration process confirms their progress towards insertion into GVCs, as understood within the framework of international productive fragmentation. This general result emerges both when the commercial bloc’s foreign trade is analyzed in the global context, and when the analysis is carried out for each of the countries separately (see graph 2). Thus, it can be observed that since the beginning of NAFTA, in terms of the commercial bloc’s relationship with the rest of the world, value-added trade flows linked to GVCs experienced an increase between 1995 and 2015, rising from 29.2% of the value of their gross exports to 33.5%, although this showed a declining trend as of 2011.

Similar results are obtained when analyzing each of the three partners separately, including in this case not only trade with the rest of the world (extra-regional), but also trade with their commercial partners (intra-regional). The data show that throughout this joint integration experience, the three economies share the same tendency to increase their insertion in GVCs, although with different degrees of intensification (Graph 2).

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 2 Total participation in global value chains by North American countries (foreign or domestic value-added linked to global value chains as a percentage of gross exports)

Mexico stands out as the partner with the greatest participation in international productive fragmentation, affecting almost 45% of its gross exports in 2015. This is followed by Canada, with 36.5% of its gross exports led by value-added flows linked to GVCs. The United States, on the other hand, reached a 31.7% participation at the end of the period, being the partner with the lowest degree of inclusion in GVCs in the region. In line with Martínez’s (2011) argument, Mexico’s high level of participation in GVCs corresponds to its semi-periphery role, with its economy tied to the global factory mechanism, and not having a corresponding high consumption capacity.

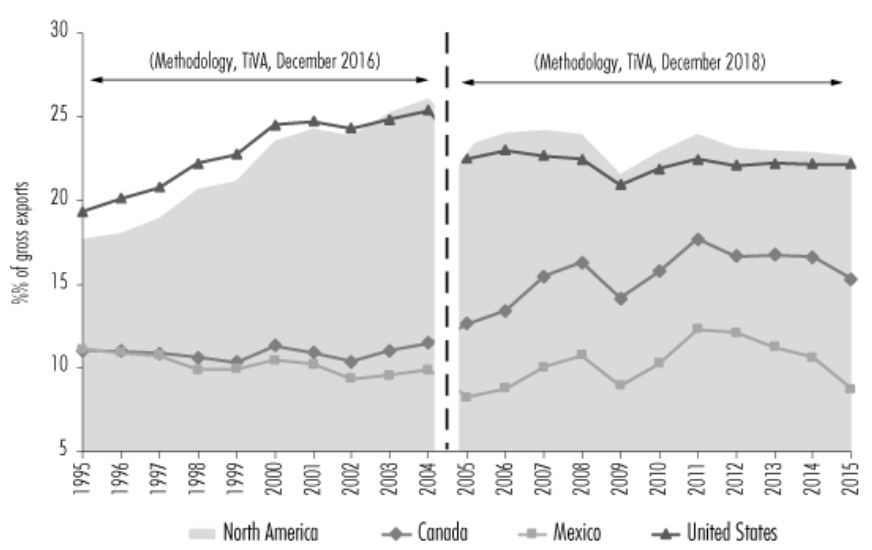

The study of value-added trade of foreign origin that is incorporated in the gross exports of Mexico, the United States and Canada shows their degree of backwards participation within the framework of GVCs (see Graph 3). A first finding of interest, then, is that as a whole, there is an increase of this type of participation in the external insertion of the commercial bloc until 2011, followed by a declining trend. This shows that the weight of the added-value of foreign origin that these countries jointly export to the rest of the world (extra-regional) went from representing 11.6% of total exports in 1995, to 10.9% 20 years later, then reaching its maximum of 13.6% in 2011. It should be highlighted that a striking similarity can be observed, both in terms of degree and changes in behavior, in the backward participation of the commercial bloc as a whole and of the United States, which is explained by the latter’s preeminent role as the primary exporting power, making up more than 85% of North American exports to the rest of the world.

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 3 North American countries’ backward participation in global value chains (foreign value-added as a percentage of gross exports)

The comparative analysis of each of the three partners’ backward participation separately reproduces features similar to those observed in the total participation. This is the case in terms of ordering the countries according to the relative weight of backward chains; Mexico is highlighted, with the increasing importance of foreign value-added which has been incorporated into its gross exports during the first years of integration, with a weight of 36.1% in 2015. This is followed by Canada, with 21.2% of its gross exports. For its part, the United States shows a significantly lower weight of backward productive chains than that of its two trading partners, reaching only 9.5% of its gross exports in 2015, although this follows a growing trend starting at the beginning of the new millennium.

The fact that Mexico is consolidated as the country in the region with the greatest presence of backward chains in its gross exports should not be neglected. In fact, this is a particular feature of semi-peripheral economies, which are linked to the international economy by being manufacturing powers, but whose defining characteristic is their specialization in phases of production close to final consumption and which contribute little value-added to the set of exports (maquiladora industry).

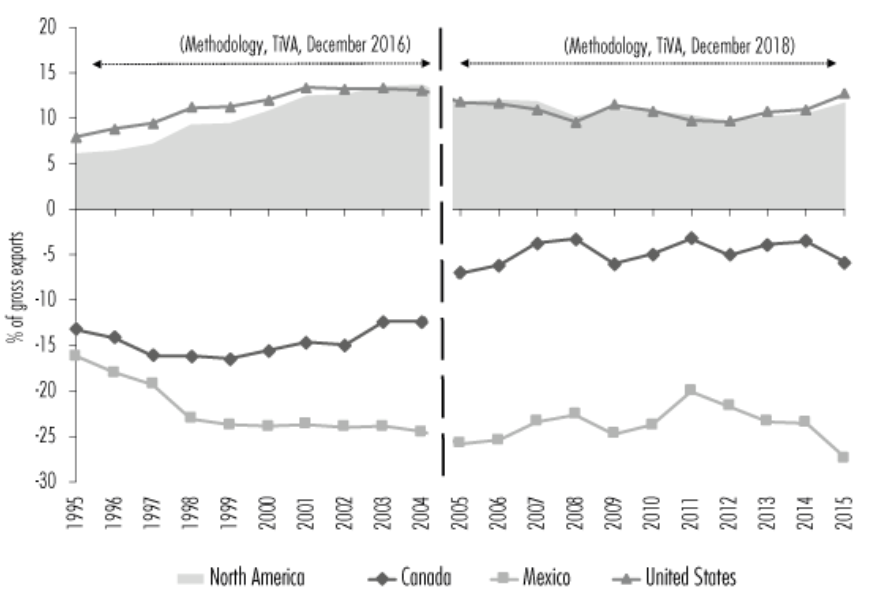

A very different image as compared to what is presented above is provided by an analysis of forward participation, where North America shows a significant and growing insertion throughout the whole period, which reached 22.6% of its exports to the rest of the world in 2015, this being 5% more than in 1995 (see Graph 4). This behavior is particularly strong in the United States, a country of greater relevance as an exporter, and which shows the largest weight of forward linkages, reaching 22.2% of its gross exports in 2015. It should be noted that this is forward participation in GVCs on the part of an economy with a high level of development, suggesting a different justification than that which characterizes other economies with a similar profile in terms of insertion in GVCs, but which have a lower level of development, since they come from sectors with medium and high technological intensity.

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 4 North American countries’ forward participation in global value chains (domestic value-added incorporated in foreign exports as a percentage of gross exports)

In a comparative perspective, forward participation demonstrates a scenario symmetrical to that observed with backward participation, where Mexico is the partner with the lowest weight of forward chains (8.8% of its gross exports in 2015), far behind Canada (15.3%)-although it should be noted that both countries started at the same level at the beginning of the period analyzed (11.1% in 1995). This finding corresponds again to the idea that Mexico acts as a semi-periphery country within the framework of the international productive fragmentation process, specializing in manufacturing activities close to final consumption and mostly oriented towards the United States, which acts as the central axis.

Based on the above, a net position in the predominant forward GVC in the case of the whole regional bloc (extra-regional trade), and for the United States in particular (see Graph 5), can be observed. The opposite is found in the case of the two other business partners, Canada and Mexico, which show a prevalence of backward chains, with a tendency to soften in the case of Canada and to accentuate in the case of Mexico. In fact, the contrast with the United States has been reduced gradually in the case of Canada, which approached a neutral position towards the end of the period, while Mexico has accentuated its mode of insertion with the prominence of backward chains.

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 5 North American countries’ position in global value chains (percentage of gross exports)

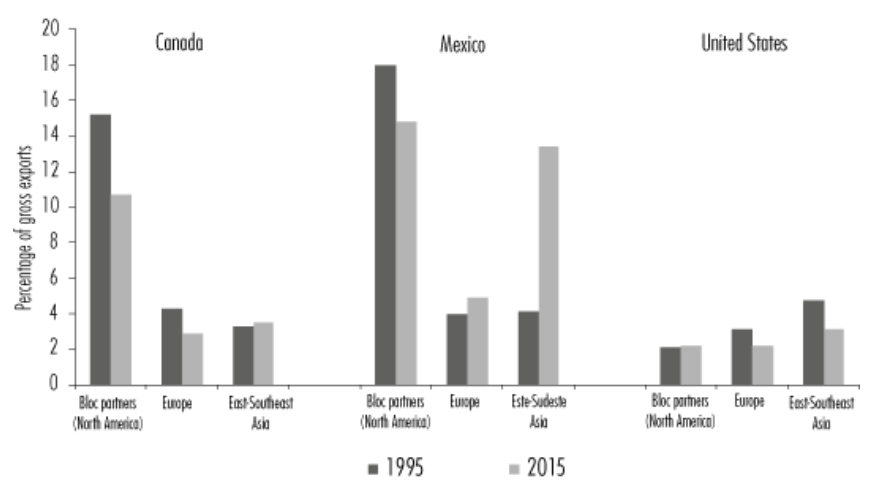

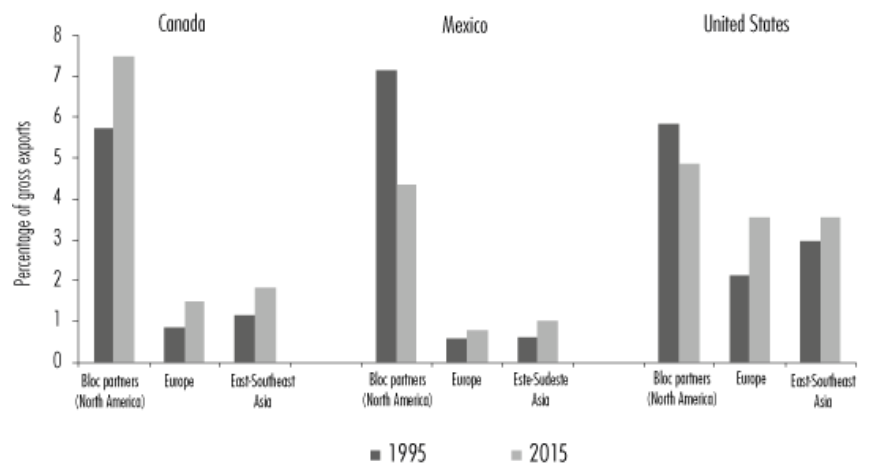

An additional step in studying the insertion of Mexico, the United States and Canada in the international productive fragmentation process is brought up by their joint participation in GVCs. This means verifying the extent to which economic integration accompanies a greater affiliation in their participation in GVCs, or if, on the contrary, they have decreased their joint insertion in favor of growing affiliations with other economies. The answer to this question suggests a comparative analysis which makes a comprehensive view of the changes in question possible. Therefore, the backward and forward participation rates in Mexico, United States and Canada, as associated with three different geographical areas, are presented sequentially: North America, Europe and East-Southeast Asia. The selection of these three geographical areas is justified by their relevance within the context of their commercial and productive interrelations.

With regard to backward linkages (see Graph 6), it is worth noting the high number of exports from Mexico, and to a lesser extent from Canada, that are carriers of foreign value originating from their other two partners in the regional bloc, in particular from the United States. However, in both cases there is a notable decrease in the rate of joint participation between 1995 and 2015, accompanied by an increase in backward participation linked to added value of Asian and European origin. This is especially evident in the case of Mexico, where the increase in backwards participation with the countries of East and Southeast Asia is much greater than the decrease in its participation linked to its two partners in North America. This result proves the increasing entry of external value-added to the region via Mexico, and to a lesser extent Canada, and the reduction of intra-regional value-added, as part of the changes in the machinery of GVCs.

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 6 North American countries’ backward participation by geographic area (foreign value-added as a percentage of gross exports)

As a counterpoint, a certain symmetry can be observed in the behavior of the United States, which exhibits a very low backward participation rate linked to its two partners, although this has seen a slight increase between 1995 and 2015. This trend goes contrary to what is observed with the value-added share from countries in Asia and Europe. This fact reaffirms the new architecture in which the insertion of Mexico, the United States and Canada in GVCs is based, which shows a growing participation of third countries, mostly in East and Southeast Asia, and which has Mexico as the principal productive link to the regional bloc.

Of particular note is the change in geographical pattern that Mexico shows in its backward production chains, with a striking increase in value-added from East and Southeast Asia-to the detriment of value-added from its regional partners. This result can be interpreted in terms of the predominance of centrifugal forces, which lead to a change in the geographical articulation of GVCs and deepens their extra-regional character; however, this happens without altering the type of productive specialization seen in Mexico, which continues to serve as a kind of semi-periphery specialized in the final stages of manufacturing, and which is characterized by scarce generation of value-added.

The forward participation rate (see Graph 7) demonstrates a scenario with certain similarities, though also notable differences, in comparison to the previous one. Among the similarities, the strong presence of intra-regional productive chains stands out. However, a notable difference with respect to backward participation is that a deepening in this type of intra-regional forward linkages is observed only in Canada. This is contrary to what happens with Mexico and the United States, which despite showing relatively high rates of joint participation, have seen them decrease between 1995 and 2015, especially in the case of Mexico. On the other hand, it is worth noting the progress that is generally observed in forward chains with other economies external to the integration process, such as Asian and European countries.

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

Graph 7 North American countries’ forward participation by geographic area (domestic value-added exported by other countries as a percentage of gross exports)

All of these tendencies and contrasts that are observed in the context of the North American insertion in GVCs continue to be different scenes from the same script, which demonstrate multiple aspects of one complex process. On one hand, they show the existence of increasing productive linkages with third countries, which is a clear example of how GVCs cross the borders of regional blocs, giving rise to a phenomenon with a growing extra-regional character. On the other hand, they reveal the existence of GVC restructuring processes that entail changes in the geography associated with the productive chains that take place within the North American bloc itself.

These changes, however, operate under a somewhat symmetrical logic between the United States and its two partners, Mexico and Canada. This manifests itself in the greater weight of intra-regional chains in the cases of Mexico and Canada (although with a general tendency towards reduction), compared to the lesser weight of said chains in the case of the United States. Ultimately, these results reveal the predominance of centrifugal forces associated with extra-regional productive fragmentation (extra-regional GVCs) over centripetal forces associated with productive fragmentation at the regional scale (intra-regional GVCs).

6. CHANGES IN INTRA-REGIONAL PRODUCTIVE LINKAGES

The changes experienced in the joint participation of Mexico, the United States and Canada show variations in the sectoral composition of their productive chains, which can be observed when analyzing value-added from their regional partners in five selected sectors.

In the case of Canada (see Table 1), there are two sectors which have significantly increased their importance in terms of exported value-added originating in the United States and Mexico. These are the chemical and non-metallic mineral sector as well as the basic metal and processed metal sector. Both sectors represent 28% of the value-added exported by Canada from the United States in 2015 (16% in 1995), and 20% from Mexico (11% in 1995). However, in 2015, transportation equipment-the main export sector of foreign value-added, which in 1995 concentrated 50% of the value-added exported by Canada from the United States and 65% from Mexico-has a relative weight lower than that of 1995 at 23 and 19%, respectively.

Table 1 Primary export sectors of value-added of foreign origin. Canada, 1995-2015 (percentage of value-added exported originating in the partner country)

| Value-added country of origin | ||||||

| United States | Mexico | |||||

| Export sectors | 1995 | 2005 | 2015 | 1995 | 2005 | 2015 |

| Chemical and non-metallic mineral products | 9 | 13 | 14 | 6 | 6 | |

| Basic and processed metals | 7 | 14 | 14 | 5 | 10 | 14 |

| Machinery and equipment, n.e.c | 4 | 4 | 4 | 3 | 4 | 5 |

| Electric and optical equipment | 4 | 3 | 2 | 4 | 8 | 4 |

| Transportation equipment | 50 | 32 | 27 | 65 | 38 | 46 |

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

In Mexico’s case (see Table 2), two sectors stand out in terms of the importance of value-added originating from their regional partners, although they show opposite trends. The transportation equipment sector increased its importance, reaching around 40% of the value-added exported by Mexico originating in the United States and Canada. On the contrary, electronic products saw their importance reduced by almost half between 1995 and 2015, in line with the increasing rise of Asian countries as suppliers.

Table 2 Primary export sectors of value-added of foreign origin. Mexico, 1995-2015 (percentage of value-added exported originating in the partner country)

| Value-added country of origin | ||||||

| United States | Canada | |||||

| Export sectors | 1995 | 2005 | 2015 | 1995 | 2005 | 2015 |

| Chemical and non-metallic mineral products | 4 | 9 | 9 | 5 | 10 | 9 |

| Basic and processed metals | 5 | 6 | 8 | 7 | 10 | 8 |

| Machinery and equipment, n.e.c | 5 | 4 | 5 | 6 | 5 | 5 |

| Electric and optical equipment | 47 | 33 | 22 | 38 | 23 | 18 |

| Transportation equipment | 24 | 29 | 41 | 26 | 34 | 40 |

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

For its part, the United States (see Table 3) exhibits contradictory trends. In particular, the importance of the chemical and non-metallic mineral product sector originating in its two partners (Mexico and Canada), and of transportation equipment originating in Mexico, is highlighted. However, there is an opposite trend for electrical equipment, which has seen a reduction to less than a third of its previous importance.

All of these changes observed in the composition of exported foreign value-added from an intra-regional origin point to a reconfiguration of North America’s productive chains. In particular, they emphasize the decreasing importance of intra-regional flows associated with electrical equipment, in line with growing participation in GVCs with third countries, mainly of East and Southeast Asia-regions which are positioning themselves as important links in the supply of such products. This fact evidences the irruption of centrifugal forces that affect the supply of technology-intensive products, such as electrical and electronic products, thus increasing extra-regional participation.

Table 3 Primary export sectors of value-added of foreign origin. United States, 1995-2015 (percentage of value-added exported originating in the partner country)

| Value-added country of origin | ||||||

| Mexico | Canada | |||||

| Export sectors | 1995 | 2005 | 2015 | 1995 | 2005 | 2015 |

| Chemical and non-metallic mineral products | 12 | 21 | 17 | 12 | 24 | 44 |

| Basic and processed metals | 6 | 6 | 8 | 7 | 8 | 7 |

| Machinery and equipment, n.e.c | 11 | 11 | 11 | 11 | 10 | 5 |

| Electric and optical equipment | 25 | 11 | 7 | 14 | 8 | 2 |

| Transportation equipment | 18 | 23 | 28 | 22 | 19 | 13 |

Source: prepared by the authors based on the TiVA database (OCDE, 2016 and 2018).

7. CONCLUSIONS

The overlap of two distinct, though interrelated, phenomena like international productive fragmentation (GVCs) and economic integration (regional blocs), necessitates establishing an explanatory framework which integrates both dimensions, as well as the examination of consequent impacts on commercial and productive insertion of the participating countries. The explanatory framework proposed here departs from a combination of various theoretical and conceptual contributions, in addition to their adaptation to the current context. On the one hand, a conceptualization of the global economic structure as composed of center/semi-periphery/periphery is restored, highlighting in particular the role that Mexico and the United States play as semi-periphery and center, respectively.

This characterization of Mexico as a semi-periphery country is reflected in the participation of its economy within the global factory mechanism without this being accompanied by other development indicators, such as a high consumption capacity. As has been shown, the insertion of Mexico in GVCs is mainly oriented towards specialization in the stages of production close to final consumption, which provide little value-added to exports as a whole; this contrasts with what happens with the United States, which sees an insertion linked to activities and tasks that generate considerable value-added. In light of this interpretative framework, the center/semi-periphery/periphery conceptualization remains valid.

The explanatory framework is completed with the consideration of centrifugal (production requirements, access to external markets, establishing external trade) and centripetal (establishing internal trade, trade diversion, cumulative circular causation) forces that influence the extra-regional or intra-regional orientation of the productive fragmentation process, and therefore of the resulting value chains. One goal of this work was to present the vector resulting from the confluence of these forces during the period of 1995-2015. To do this, the analysis of joint participation in GVCs was crucial, demonstrating that the North American integration framework operates as a scenario of intra-regional productive fragmentation. However, there are certain changes (centrifugal forces) that point to the reconstitution of existing productive chains in the region. This happens, for example, with the decreasing importance of intra-regional flows associated with electrical and electronic products, in accordance with the region's growing commercial and productive links with third countries-especially those in East and Southeast Asia-leading to a deepening of extra-regional value chains.

REFERENCES

Baldwin, R. (2012), "Global supply chains: why they emerged, why they matter, and where they are going", Discussion Papers, núm. 9103, Londres, Center for Economic Policy Research, Discussion Papers . Recuperado de <https://cepr.org/active/publications/discussion_papers/dp.php?dpno=9103> [ Links ]

Boyer, R. (1986), La Théorie de la regulación: une analyse critique, Paris, La Découverte. [ Links ]

Boyer, R. y Saillard, Y. (2002), Théorie de la regulación: l'état des savoirs, Paris, La Découverte . [ Links ]

Contreras, O. y Munguía, L. (2007), "Evolución de las maquiladoras en México. Política industrial y aprendizaje tecnológico", Región y Sociedad, XIX, Número especial, México, El Colegio de Sonora. [ Links ]

Domingues, J. M. (2012), Desarrollo, periferia y semiperiferia en la tercera fase de la modernidad global, 1a edición, Ciudad Autónoma de Buenos Aires, CLACSO. [ Links ]

Gandoy, R. (2014), "La implicación española en cadenas globales de producción", en J. A. Alonso y R. Myro, Ensayos sobre economía española. Homenaje al profesor José Luis García Delgado, Pamplona, Thomson Reuters. [ Links ]

Johnson, R. y Noguera, G. (2012), "Accounting for intermediates: production sharing and trade in value added", Journal of International Economics, vol. 86, núm. 2, DOI <https://doi.org/10.1016/j.jinteco.2011.10.003> [ Links ]

Koopman, R., Powers, W, Wang, Z. y Wei, S.-J. (2010), "Give credit where credit is due: tracing value added in global production chains", Working Paper 16426, National Bureau of Economic Research, DOI <https://doi. org/10.3386/w16426> [ Links ]

______, Wang, Z. y Wei, S.-J. (2014), "Tracing value-added and double counting in gross exports", American Economic Review, vol. 104, núm. 2, DOI <https://doi.org/10.1257/aer.104.2.459> [ Links ]

Lipsey, R. G. (1960), "The theory ofcustoms unions: a general survey", The Economic Journal, vol. 70, núm. 279, DOI <https://doi.org/10.2307/2228805> [ Links ]

López, J. Α. (2018), "El Tratado de Libre Comercio de América del Norte en tiempos de Donald Trump", Japan Society of Social Science on Latin America, núm. 51, Tokio, Japan Society of Social Science on Latin America . [ Links ]

López, J. Α., Rodil, Ó. y Valdez, S. (2014), "The impact of China's incursion into the North American Free Trade Agreement (NAFTA) on intra-industry trade", CEPAL Review, 114, Santiago de Chile, CEPAL. [ Links ]

Los, B., Timmer, M. P. y de Vries, G. J. (2015), "How global are global value chains? Α new approach to measure international fragmentation", Journal of Regional Science, vol. 55, núm. 1, DOI <https://doi.org/10.1111/ jors.12121> [ Links ]

Martínez, J. (2011), "La estructura teórica centro/periferia y el análisis del Sistema Económico Global: ¿obsoleta o necesaria?", Revista de Economía Mundial, núm. 29, EU, Gale. [ Links ]

Meade, J. (1955), The theory ofcustoms union, Amsterdam, North-Holland. [ Links ]

Organización Mundial del Comercio (OMC) (2013), Informe sobre el comercio mundial 2013. Factores que determinan el futuro del comercio, Ginebra, Secretaría de la OMC. [ Links ]

______(2014), Informe sobre el comercio mundial 2014. Comercio y Desarrollo: tendencias recientes y función de la OMC, Ginebra, Secretaría OMC. [ Links ]

Organización para la Cooperación y el Desarrollo Económicos (OCDE) (2016), Trade in Value Added (TiVA), December 2016. Recuperado de <https://stats.oecd.org/Index.aspx?DataSetCode=TIVA_2016_C1 > [ Links ]

______(2018), Trade in Value Added (TiVA), December 2018. Recuperado de <https://stats.oecd.org/Index.aspx?datasetcode=TIVA_2018_C1> [ Links ]

Palazuelos, E. y Fernández, R. (2015), "Producción internacional: inversión directa y cadenas de valor", en E. Palazuelos, R. Fernández, C. García, B. Medialdea y M. J. Vara, Economía Política Mundial, Madrid, Akal. [ Links ]

Prebisch, R. (1948), El desarrollo económico de la América Latina y algunos de sus principales problemas, Santiago de Chile, CEPAL . [ Links ]

Riveiro, D. (2005), "Efectos potenciales de un proceso de integración económica. La experiencia de América Latina", Revista Galega de Economía, 14 (1-2), Santiago de Compostela, Universidade de Santiago de Compostela: Facultad de Ciencias Económicas y Empresariales. [ Links ]

Rodil, O. (2018), "La cara oculta del comercio de México con Estados Unidos. Las cadenas de valor al descubierto", Comercio Exterior, 13, Ciudad de México, Bancomext. [ Links ]

Rodil, O. y López, J.A. (2011), "Efectos del Tratado de Libre Comercio de América del Norte sobre el comercio de México: creación de comercio y especialización intraindustrial", Revista de Economía Mundial , vol. 27, Huelva, Universidad de Huelva. [ Links ]

Sturgeon, T. J. y Memedovic, O. (2010), "Mapping global value chains: intermediate goods trade and structural change in the world economy", Working Paper 5/2010, United Nations Industrial Development Organization. [ Links ]

Vidal, J.M. (2002), "Centro-Periferia", en D. Guerrero (coord.), Lecturas de Economía Política, Madrid, Síntesis. [ Links ]

Viner, J. (1950), The customs union issue, Carnegie Endowment for Internacional, New York, Peace. [ Links ]

This research was undertaken with the support of the “European strategy for transition to a circular economy: a prospective judicial analysis and changes in global value chains” project, financed by the Spanish State Research Agency (ECO2017-87142-C2-1-R), of the Competitive Reference ICEDE Research Group (ED-431C 2018/23) and the CRETUS Strategic Group (ED431E 2018/01); co-financed by FEDER (EU).

Received: February 06, 2019; Accepted: August 12, 2019

texto en

texto en