Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Problemas del desarrollo

Print version ISSN 0301-7036

Prob. Des vol.50 n.197 Ciudad de México Apr./Jun. 2019 Epub Oct 18, 2019

https://doi.org/10.22201/iiec.20078951e.2019.197.64625

Articles

Renewable Energy in Argentina as an Energy and Industrial Policy Strategy

a Centro de Estudios Urbanos y Regionales, Consejo Nacional de Investigaciones Científicas y Técnicas (Center for Regional and Urban Studies, National Council for Scientific and Technical Research) (CEUR-CONICET), Argentina. E-mail: eugeniacastelao@conicet.gov.ar

With the enactment of a new regime regarding the promotion of electrical energy from renewable sources in 2015, Argentina took up the transition towards a more sustainable and diversified energy matrix. Since then, national energy policy has driven the creation of a competitive domestic market for Energy from Renewable Sources (ERS). Meanwhile, industrial policy has focused on promoting the transfer of technology and local industry. This paper analyzes the orientation of these policies, the coherence of their objectives, and the immediate results. Energy policy and industrial policies designed for ERS develop at different speeds and with little coordination, making it necessary for national industry to participate in its value chains.

Key Words: renewable energy; electrical energy; energy policy; renewable sources; industrial policy; technology

Con la promulgación de un nuevo régimen sobre fomento a la energía eléctrica de fuentes renovables (2015), Argentina retomó la transición hacia una matriz energética más sustentable y diversificada. Desde entonces, la política energética nacional ha impulsado la creación de un mercado doméstico de Energía de Fuentes Renovables (EFR) competitivo, mientras que la política industrial se ha concentrado en promover la transferencia de tecnología y la industria local. El presente trabajo analiza la orientación de estas políticas, la coherencia de sus objetivos y los resultados inmediatos. La política energética y la política industrial destinada a la EFR se desarrollan a diferentes velocidades, con escasa coordinación, condicionando la participación de la industria nacional en sus cadenas de valor.

Palabras clave: energía renovable; energía eléctrica; política energética; fuentes renovables; política industrial; tecnología

Clasificación JEL: O13; P28; Q42; Q43; Q48

1. INTRODUCTION

In the early 1990s, various countries committed to fighting climate change via a transition to more sustainable energy systems (Lund, 2009). Faced with the volatility of the fossil fuel market, some countries proposed improving the security and flexibility of their electrical systems by incorporating Energy from Renewable Sources (ERS). Latin America and the Caribbean (LAC) face the challenge of integrating ERS technologies to decrease the energy matrix’s dependency on petroleum (45.5%), natural gas (21.3%) and hydroelectric energy (23.2%) (see Table 1) and thereby mitigate their susceptibility to the instability of fossil fuel prices and the impact of climate change on water reserves (Jacobs et al., 2013). Likewise, the region must increase its energy production in order to respond to the growing demand which, in the case of electricity, is estimated at an annual rate of 1.6-1.9% between 2014 and 2030, and 0.8-1.1% from 2030 to 2060 (World Energy Council, 2017).

Table 1 Primary Energy Matrix: Distribution of Consumption by Energy Source and Country or Region in Percent (2017).

| Country/ Region | Petroleum | Natural Gas | Coal | Nuclear Energy | Hydroelectric | Renewable |

| Canada | 31.1 | 28.5 | 5.3 | 6.3 | 25.8 | 3.0 |

| USA | 40.9 | 28.4 | 14.9 | 8.6 | 3.0 | 4.2 |

| USA and Canada | 39.6 | 28.5 | 13.6 | 8.3 | 6.1 | 4.1 |

| Argentina | 36.8 | 48.5 | 1.2 | 1.7 | 11.0 | 0.8 |

| Brazil | 46.1 | 11.2 | 5.6 | 1.2 | 28.4 | 7.5 |

| Chile | 47.9 | 13.5 | 17.5 | 0.0 | 13.2 | 7.9 |

| Mexico | 45.8 | 39.8 | 6.9 | 1.3 | 3.8 | 2.3 |

| Latin America and the Caribbean | 45.5 | 21.3 | 4.7 | 0.7 | 23.2 | 4.7 |

| Germany | 35.8 | 23.1 | 21.3 | 5.1 | 1.3 | 13.4 |

| Spain | 46.7 | 19.8 | 9.7 | 9.5 | 3.0 | 11.3 |

| Italy | 38.8 | 39.7 | 6.3 | 0.0 | 5.3 | 9.9 |

| Netherlands | 47.4 | 36.0 | 10.6 | 1.4 | 0.0 | 4.6 |

| UK | 39.9 | 35.4 | 4.7 | 8.3 | 0.7 | 11.0 |

| Europe | 37.1 | 23.2 | 15.1 | 9.8 | 6.6 | 8.2 |

| Commonwealth of Independent States | 20.8 | 50.5 | 16.1 | 6.7 | 5.8 | 0.1 |

| Middle East | 46.8 | 51.4 | 0.9 | 0.2 | 0.5 | 0.2 |

| Africa | 43.7 | 27.1 | 20.7 | 0.8 | 6.5 | 1.2 |

| Asia Pacific | 28.6 | 11.5 | 48.4 | 1.9 | 6.5 | 3.0 |

Source: BP (2018).

Over many years the institutional and technological conditions which accompanied the development of energy markets gave way to 1lock-in mechanisms which inhibit the development and spreading of technologies related to ERS (Unruh, 2000; Frantzeskaki and Loorbach, 2010). The effects of learning, economies of scale and scope, the network effects, technological interrelations, and socio-technical configurations bestow advantages on traditional energy technologies in spite of their negative environmental impact (Cecere et al., 2014).

In the last decade, policies promoting the growth of ERS have managed to break the inertia of energy markets, boosting the creation of ERS domestic markets and promoting the competitive-ness and reach of these technologies (IRENA, 2017a). This process reflects a growing share of these technologies in the energy matrix of Germany (13.4%), Spain (11.3%), the United Kingdom (11%), Chile (7.9%) and Brazil (7.5%) (see Table 1). Propelled by these countries, Europe heads the energy transition with an ERS average share of 8%. Meanwhile in LAC this percentage is 4.7%, similar to the median of the USA and Canada but above that of other regions. The data clearly demonstrates the opportunity for growth that ERS has at a global level, but it also shows that there is a strong asymmetry among countries in the same regions.

In an age of profound international economic imbalance, the promotion of ERS became a strategy to encourage growth in local industry and job creation. While energy policies focus on creating and consolidating domestic ERS markets (Zhang et al., 2013), industrial policies establish strategies to support the ability of local companies related to the field to compete and their ability to create job openings, increase exports and supplant the import of goods and services (Lund, 2009; Lewis and Wiser, 2007).

There are differences in academic literature regarding ERS’ contribution to a local industry’s growth. The studies carried out in countries in the European Union generally present evidence of policies promoting ERS as having a positive impact on the performance of the domestic industry, for both exports and the creation of jobs (López-Polo et al., 2006; Weiss et al., 2003). These works highlight the role that the State plays in creating a wide ERS domestic market which is sustainable and stable over time. This favors the strengthening of local businesses in preparation for their eventual entry into international markets, even when starting from a weak industrial base (Kranzl et al., 2006; Lewis and Wiser, 2007; Arentsen et al., 2007; Lund, 2009; Zhang et al., 2013). Furthermore, they point out the role of industrial policies directly supporting the domestic industry as an effective strategy to drive diversification towards ERS and opening up new export possibilities (Lewis and Wiser, 2007; Lund, 2009; Zhang et al., 2013).

Nevertheless, other authors point out that there is no univocal relationship between policies promoting ERS, their multiple goals -energetic, economic and social-, and the creation of jobs (Frondel et al., 2010; Pahle et al., 2016), as this depends on the regulatory frame-work, the makeup of the energy matrix, and the initial production structure (Lambert and Pereira Silva, 2012).

In the case of Argentina, the State has been making policies promoting ERS since the 1970s, with few significant results in the local industry and energy market. As such, ERS’ present share of the energy matrix is less than 2% of the current capacity (720MW in 2017)2 . However, the changes to the Régimen de Fomento Nacional para el uso de Fuentes Renovables de Energía destinada a la Producción de Energía Eléctrica (System for Increasing at a National Level the Use of Renewable Energy Sources Earmarked for Electrical Energy Production) (Law 27.191) in September 2015, along with a change in leadership of the national government in December of that same year, marked a new age for ERS in the country.

This article analyzes the energy policy and industrial policy adopted by the national government of Argentina since late 2015 with regards to ERS in order to answer the following questions: 1) What goals does the current energy policy have in relation to ERS? 2) What role does it play in the development of national industry play in formulating this policy? 3) How is the goal of developing the national industry expressed in the design and formulation of the energy policy and the industrial policies which accompany it? 4) What results can be perceived and how are these evaluated by the public sector and the private sector?

In order to address these questions, in section 2 we will describe how the regulatory framework for ERS has evolved since the 1970s in Argentina. In section 3, we will analyze the coherency of the objectives and the formulation of industrial and energy policies at a national level which are associated with ERS and which have been in effect since late 2015. In section 4 we can then use the immediate results which the RenovAr program has had to evaluate what challenges face these policies and what they have gotten right. Finally, we will present the conclusions of the work by addressing the questions posed.

2. THE EVOLUTION OF POLICIES PROMOTING ERS

As in the rest of Latin America, the interest in promoting the generation of ERS in Argentina dates back to the 1970s, when the oil crisis showed the vulnerability of countries which lacked their own energy resources. Even though back then Argentina had an adequate energy balance (Silva Colomer et al., 2014), the national government proposed developing a policy which actively promot-ed ERS, placing special emphasis on hydroelectric reserves in order to lessen the petroleum’s relative share of the energy matrix (Barrera, 2011). That streak was broken by the coup d’état in 1976; even so, in the 1980s the domestic public sector made specific, albeit intermittent, plans to gather information on the renewable energy resources available in the country.

In the 1990s, the electrical sector adopted a new institutional and business makeup which implied the privatization of public companies in the sector and the vertical disintegration of three activities 1) generation, 2) transport, and 3) distribution. The generation of electricity was defined as an economic activity open to admitting multiple players in competition. Nevertheless, the lack of specific incentives for ERS generation and the relatively low prices of oil and natural gas limited the installation of projects for generating ERS in this market.

With the signing of the Kyoto protocol (1997), Argentina committed to reducing its green-house gas emissions, which gave it access to new international sources of financing for sustainable environmental projects. This led to the approval in 1998 of the first law specifically targeting the advancement of ERS, called the Régimen Nacional de la Energía Eólica y Solar (National System of Wind and Solar Energy) (Law 25.019). Said law established tax breaks for projects generating electrical power from renewable resources and a reward, or feed in tariff, of $10 US/MWh. That same decade, investments manifested themselves in an installed capacity of 28.88 MW of wind energy but the majority of these plants were not formally part of the Argentine Interconnected Electrical System (SA-DI), rather the energy generated was destined for local distribution networks (Recalde et al., 2015).

The weak tax break system and the reward system afforded by Law 25.019 disappeared with the crisis that hit the country in 2001 and the steep devaluation of their currency. The costs of operating and maintaining these plants, which were for the most part equipped with imported technology, increased and their income was adversely affected by the government regulated electrical tariffs which were not updated despite the passage of time (Jacinto et al., 2014)

In 2006, the national government formulated the Régimen de Fomento Nacional para el Uso de Fuentes Renovables de Energía Destinada a la Producción de Energía Eléctrica (System for Increasing at a National Level the Use of Renewable Energy Resources Earmarked for Electrical Energy Production) (Law 26.190). For the first time, this law established goals for ERS consumption equivalent to 8% of the demand presented by the Wholesale Electricity Market (MEM)3 in 2016; it granted tax breaks and economic benefits to ERS generation projects, in addition to those afforded by Law 25.019, prioritizing projects using national funds. Furthermore, the Renewable Energy Trust Fund (Fondo Fiduciario de Energías Renovables) was founded, made up from a surcharge applied to MEM users in order to reward the use of renewable resources for generating electrical energy.

In October of 2009, within the parameters of Law 26.190, the Ministry of Energy established the program GENREN in which bidding took place on contracts to supply ERS with a capacity of 1000MW for a period of 15 years with prices in US dollars. The selection of projects was carried out using as the criteria the bid prices, investment timelines and the percentage of domestic parts making up the project’s investment. The opening round received 51 bids from 22 companies for a total of 1,436.5MW, 32 projects had a capacity of 895MW and were awarded in the following manner: 84% wind energy, 12% thermal energy using biofuels, and the rest from Small Scale Hydroelectric sources (PAH)4 and solar Photovoltaic sources (PV).

This bidding proved the existence of projects in the country with the environmental and technological conditions appropriate for ERS generation, as well as the entrepreneurial and technological ability for its development. Nevertheless, the conditions of the Argentinian energy political land-scape -little political willingness, weak regulatory frameworks, economic instability and financial restrictions- limited the effectiveness of political tools earmarked for boosting ERS and, as a result, the installation of the selected projects.5

With the aim of increasing the electricity generated and to meet the allotment of 8% for ERS in the energy matrix, the federal government developed a new method for contracting ERS. The Federal Ministry of Energy (Resolución SE 108/2011) regulated the signing of contracts between the Administrative Company for the Wholesale Electric Market (CAMMESA)6 , on behalf of MEM, and projects generating electrical energy from renewable sources for a period of 15 years and remuneration in dollars, defined as a function of the fixed and variable costs of each plant. Little by little, the electric energy matrix began to diversify itself by connecting new wind and solar energy farms to the network, and in 2015, two biogas companies.

3. INDUSTRIAL AND ENERGY POLICIES WITH REGARDS TO ERS

Law 27.191 established the foundation for designing a regulatory framework to encourage the shaping of an ERS market and strengthening the development of a domestic technological industry for producing ERS. Nevertheless, the regulations and programs drawn up based on this law pursue industrial and energy policies which are difficult to consolidate in the short term and determine the dynamics for local industry’s entry into global value chains.

Next, we will analyze the maze of regulations and programs designed around Law 27.191 and the limits of their implementations.

A New Regulatory Framework for Electrical Energy from Renewable Sources

The System for Increasing at a National Level the Use of Renewable Energy Resources Earmarked for Electrical Energy Production (Law 26.190 from 2006 and modified by Law 27.191) established in 2015 a timeline for ERS’ share of energy consumption and three key tools in boosting its generation and changing the makeup of the national market. The tools include a public trust fund earmarked for giving warranties and financing for projects; tax, customs, and regulatory breaks; and a renewable and private energy sources futures market.

On the one hand, the goal postponed until 2017 of 8% of electrical energy consumed at a national level being covered by ERS as established by Law 26.190 and a timeline was defined for the mandatory consumption to reach 20% in 2025. Contrary to previous policies and other proposals at an international level, the timeline presented specific, mandatory and measurable goals, which along with a commitment from the national government, grant a clear vision of the path for the growing demand for ERS (Irena, 2017a). Compliance will mean incorporating into the energy matrix an additional capacity of 1000MW from renewable sources each year for the next 10 years.

In spite of the challenge for Argentina that this timeline presents, other countries in the region and around the world have committed themselves to even more demanding proposals regarding the participation of ERS in the energy matrix. For example: 35% by 2024 in Mexico (SENER, 2017); 86% by 2024 in Brazil (including large scale Hydroelectric installations) (Ministério de Minas e Energía, 2015); and 80% by 2050 in Germany (Arranz, 2016). These goals are nevertheless the result of strong pre-existing drives to boost ERS and which currently propose to consolidate and further the sector’s growth.

On the other hand, with regards to tools used to invigorate the offering, the new law broadens the tax, customs, and regulatory breaks which Law 26.190 offered to projects generating electric energy using renewable resources. In order to accelerate their installation, the law establishes that these incentives must decrease with time until they are done away with completely in 2025. Among the most relevant benefits with regards to the goals of this study are the fact that the State bestows upon the projects a fiscal certificate good for paying federal taxes equivalent to 20% of the value that the electromechanical installations have at a national level7 . Additionally, it exempts these projects from the payment of import fees on capital assets not produced in the country (until 2022, inclusive, according to Decreto 814/2017). While some point out that this last benefit hinders the growth of the domestic industry, others believe that the list of goods which are exempt is restrictive and could cause bottlenecking when the first projects are at the construction stage (Siboldi, 2016).

Then we have the law that proposes the creation of the Fund for the Development of Renewable Energies (FODER)8 in order to broaden financing for the projects. The trust fund is earmarked for financing the construction of ERS projects and providing guarantees and payment obligations assumed by CAMMESA. The projects which spent the highest percentage of their investments on domes-tic products have preference when it comes to access to this fund. Nevertheless, FODER has so far not acted as a fund for financing but for guarantees, leaving it in the hands of the private sector to seek and negotiate financing.

To boost investors’ faith, the Federal Ministry of Energy and Mining (MINEM) signed ac-cords with the World Bank so that if interested projects so choose, it will back FODER’s role as a guarantor for CAMMESA. The new public policies find themselves constrained by the previous policies (Rogge et al., 2017). This combination of guarantees is an effective strategy to reduce the level of uncertainty associated with CAMMESA’s ability to pay and the functioning of the electric sector.

Finally, the law defines the framework for creating a futures market for electric energy from renewable energy for private companies upon establishing that the biggest users of the MEM (those whose needs exceed a capacity of 300Kw) must meet the ERS consumption goals, effectively and on their own, as set forth by the law. The users which fall into this category, almost 7,500 and 90% of whom consume less than 1MW according to the Asociación de Grandes Usuarios de Energía Eléctrica de la República Argentina (Argentine Republic’s Association of Large Scale Electric Energy Users), will be able to sign individual contracts for electric energy, self-generate it or do so in collaboration, or participate in the joint purchasing process carried out by CAMMESA. However, this last option includes charges for the management and commercialization costs which are subject to the needs of each user and the current ERS capacity.

According to some in the private sector, only companies with a demand for more than 10MW (around 53 companies) will opt for not participating in CAMMESA’s joint purchases in the short term. But as time passes and tariffs increase, the majority of companies will opt for contracts in the futures market. This market provides an opportunity for renewable energy producers, for even though it does not provide the guarantee and certainty of public bids, it allows spreading the risk among different clients, many with an international reach, and opens a tiered path which allows for growth as demand increases. For large scale users, it represents an opportunity to reduce costs, especially with wind and solar energy, and guarantee its supply.

The Objectives of Policy and its Creation

In 2016, MINEM established as main objectives in energy management improving the efficiency of supply and demand, increasing the security of the system, and developing a more competitive market. In order to reach these goals, the institution proposed three lines of attack: 1) increase the domes-tic production of oil and natural gas, which had recently been in decline (Ceppi, 2018), 2) improve the efficiency of consumption, and 3) improve electrical energy production and distribution (MINEM, 2016). Support for ERS production, with stable operating costs which are relatively independent of international markets, was included as part of these guidelines as the incorporation of ERS into the national grid helps to fulfill various proposed objectives such as increasing available capacity, displacing the import of electrical energy and fossil fuels, and diminishing external vulnerabilities of the system.

In line with these objectives, the Subsecretaría de Energías Renovables (Subsecretariat of Renewable Resources), created in 2016, is in charge of defining the speed, the direction, and means for incorporating ERS into the energy matrix as it considers its technological diversity and geographical distribution (Subsecretaría de Energías Renovables, 2016). The objectives of MINEM and the Subsecretariat are an answer to the goals presented by Law 27.191 -a competitive energy system, growth in markets related to ERS, diversity in technology and geographical distribution- but the law also mentions the need to develop industries associated with these technologies. Fostering domestic supplies however does not form part of the Subsecretariat’s main objectives. Even so, various public figures from this and other areas of MINEM publicly highlighted the role of ERS projects as a method to channel new foreign direct investments into the country and promote local production and employment.

One of the principal strategies employed by MINEM to increase capacity and share of ERS in the electric matrix is the implementation of the program RenovAr, which provides a framework for the purchase of energy from renewable sources via an open call. In May 2016, the federal government launched round 1 of this program and round two in October 2017. In round one it opened bid-ding on contracts to supply electric energy for 1000 MW capacity from ERS, establishing an allocation quota for each kind of technology. The second round opened bids on contracts for 1200 MW capacity with an allocation quota for each technology and in the case of wind and solar energy, by region. In the first round 123 projects offering a total of 6,346 MW were presented, of which 105 (5,209 MW) passed formal, technical, economic, and legal evaluations and 59 were selected (2,434.7 MW). In the next round, 228 projects were presented with a total capacity of 9,403 MW, 194 passed the evaluation and 88 were awarded (1942.3 MW).

The projects were selected based on adjusted bid price,9 which had to be less than the maximum selection price as set forth for each technology by MINEM. Only in the case when two projects were technologically equal was priority given to the project with a higher declared domestic parts rating (CND).10 In practice this made the role of CND a marginal one in the selection of the projects, contrary to what happened with public bids in other countries where the socio-economic goals of energy policies with regarding ERS are reflected in the design of said policies. In South Africa for example, the bidding process evaluates projects by giving a weight of 70% to price and 30% to the fulfilment of social economic goals such as the creation of jobs, use of domestic parts, and ownership structure (Pahle et al., 2016).

The transition to an environmentally and socially sustainable economic model, based on technological ability, as well as on local innovation demands an active industrial policy focused on the coordination problems which limit the diversification and spreading of technology (Bárcena, 2017). In the beginning, Argentina’s industrial policy for the ERS sector depended on the Ministry of Production’s (MP) supplier development program (PRODEPRO). This selective program offers financing at a subsidized rate, non-refundable contributions, and technical support for industries considered strategic, like those associated with generating ERS. It thus seeks to facilitate the acquisition of physical capital; the development, standardization, and certification of products; production reforms; and training human resources.

Activities which make intense use of natural resources -such as generating ERS- demand to a lesser or greater degree adaptive innovations and processes which continually seek solutions to increase productivity, which is generally limited by physical constraints, and meet increasing demands (Pérez et al., 2014). As such, the Acuerdo por la Producción y el Empleo: Principales lin-eamientos para el sector de Energías Renovables (Agreement for Production and Employment: Principal Guidelines for the Renewable Energy Sector), signed by representatives from the public11 and private sector - unions, businesses, and trade associations - 12 , seeks to promote innovation and competitiveness of the sector’s domestic businesses.13 The document presents a vision for the medium term (2018 - 2023) and a combination of functional policy actions, horizontal and vertical, geared towards the development and transference of technology (Lall and Teubal, 1998).

On the one hand, in line with the objectives of MINEM, the agreement proposes increasing ERS generation, prioritizing competition in the projects’ pricing. At the same time, it seeks to increase the use of local parts in the projects and to transfer technology to domestic businesses with the goal of promoting their entry into global value chains. This represents a challenge for industrial policy which has seen its field of influence limited by the economy being opened to international competition.

On the other hand, the actions proposed by the agreement (see Table 2) are geared toward promoting the creation of a stable renewable sources electrical energy market and the growth of two sectors considered critical, due to their abilities and proximity to ERS technologies: the metallurgical industry and suppliers of electrical parts and equipment. Specifically, the agreement seeks to strengthen wind turbine and solar panel production chains and for the domestic components to reach 50% and 30% respectively in said chains by 2023.

Table 2 Nature of the Agreement´s Industrial Policy Actions (2017)

| Program/ Stage | Instrument | Goal |

| RenovAr | Public bids on contacts for supplying electrial energy from renewable sources. | Developing the renewable sources electrical energy market. |

| Law 27.191 | Financial incentives for ERS projects. | Developing the renewable sources electrical energy market. |

| Law 27.191 | Fiscal Certificates for using domestic parts. | Cultivating local suppliers. |

| Law 27.191 | Import tariff scheme. | Reach competitive prices along the entire supply chain. |

| ReProEr | Registry of suppliers and manufacturers for ERS. | Cultivating local suppliers. |

| In progress | Financing for ERS generation projects. | National participation in ERS projects. |

| PRODEPRO | Financing for suppliers. | Promoting the integration of local suppliers in global vale chains. |

| In progress | Technical assistance for suppliers. Strengthening the "National Innovation System." Agreements for cooperation with foreign technologists. |

Promote the transfer and development of new technologies. |

Source: Created by author base on material from the Ministry of Production (2017).

Industrial policy needs to promote the production of goods and services, as well as the adoption of processes which generate new experiential and tacit knowledge and skills. Many of these skills are expressed in engineering, design, and management routines which are developed and replicated by means of experience and which workers, technicians and businessmen execute in a more or less automatic fashion. As a result, the learning and building of new skills is an incremental process in relation to the technological space in which these companies move, and depends on a technological path which they have already tread (Porcile and Martins, 2017). These conditions are necessary for the companies to create their own high-tech designs and brands (Lee, 2013). Otherwise the innovation process is carried out by importing capital assets, acquiring patents or licenses and/or specializing in low-tech parts assembly in global production chains (Yoguel et al., 2017).

4. SOME RESULTS FROM INDUSTRIAL AND ENERGY POLICIES

Even though some of the projects awarded by the RenovAr program find themselves in the construction stage (round 1) or in the stages before signing a contract (round 2), analyzing them allows one to understand the aim and reach of the MINEM’s energy policies, as well as the challenges that face industrial policy in order to empower the development of these technologies in the country. Next, we will analyze the results of the program with regards to the diversification of technology, the price of electric energy and the share held by domestic parts in the electromechanical installations of these projects.

Technological diversification

The energy transition from an electric matrix highly dependent on natural gas to one which is more diversified and sustainable requires a policy to lead this process, ensuring a continual balance between available renewable resources and the sustainability of the system. The technological makeup of the electric matrix, which defines the relationship between base energy and intermittent energy,14 the location of the projects in relation to the availability of renewable resources and transportation nodes, and the impact of both on the efficiency of the projects and the price of electric energy, determine the speed and direction of the energy transition.

In response to these determinants, the RenovAr program established an allocation quota for each type of ERS, which is reflected in a growing technological diversification of the capacity awarded in relation to previous bids. Even so the capacity awarded by RenovAr mostly corresponds to wind energy (54%) and PV energy (39.8%), while the share of PAH (0.7%) and bioenergy plants, both biomass and biogas, (5.4%) are straggling (see table 3).

Table 3 Capacity of the Winning Bid Projects for ERS Generation by Technology Type (in MW)

| Technology | Genren | Renovar 1 | Renovar 2 |

| Wind | 754.0 | 1 472.9 | 893.4 |

| PV solar | 20.0 | 927.2 | 816.3 |

| PAH <30/50 MW | 11.0 | 11.4 | 20.1 |

| Thermal biofuel | 110.4 | NL | NL |

| Biogas | NA | 8.6 | 69.3 |

| Biomass | NA | 14.5 | 143.2 |

| Total | 895.4 | 2 434.7 | 1 942.3 |

Note: NA Technology not awarded; NB Technology not bid upon.

Source: created by the author based on bid data from MINEM (2017).

Small hydroelectric plants are an energy source spread throughout the country. In 2011 there were already 380 MW installed and today there are 488 MW, fostered in previous decades along with large hydroelectric plants. Although there is much room to increase the capacity of small hydroelectric plants in the whole country, these projects are generally to be found in isolated regions which increases the cost of each MWh delivered to the MEM. Bioenergy, on the other hand, is a technology which is mature at an international level but incipient in the country; it has great potential thanks to the availability of agro-industry and farming resources, and with a value chain complex in its organization and costs. Furthermore, both technologies are categorized by an average capacity relatively low in comparison to that of wind and solar energy.

The number of projects selected also increased between round 1 and round 2 of RenovAr, growing from 59 to 88, and the share of biomass and biogas projects in particular increased (from 2 to 16, and 6 to 34 respectively). The reduction in the minimum capacity required for these technologies (1MW in round 1 and 0.5 MW in round 2) and the application of price incentives to lower scale projects in round two drove an increase in the number of projects with low capacities, which allows for a more efficient use of the installed transportation network and a good use of residual biomass.

Prices

In round 1 of RenovAr bids, the bid prices turned out to be lower than the maximum set price for selection, which was not known until the moment the envelopes were opened, and less than the expectations of the private sector and large-scale users (who have ERS consumption obligations according to Law 27.191) who had as a reference the bid prices from GENREN (see Table 4). In addition, 70% of the projects were selected with prices which did not exceed the national electric system’s average monomic cost15 in that year ($71.3 US/MWh in 2016).16

Table 4 Average Price for Projects Whose Bids Were Collected, by Technology. In $US/MWh*

| Technology | Genren | Renovar 1 | Renovar 2 |

| Wind | 127.0 | 56.2 | 40.9 |

| PV solar | 570.0 | 57.0 | 42.8 |

| PAH <30/50 MW | 162.0 | 105.0 | 98.9 |

| Thermal biofuel | 287.0 | NL | NL |

| Biogas | NA | 154.0 | 154.7 |

| Biomass | NA | 110.0 | 117.2 |

Note: *The prices correspond to the contemplated average of the adjusted bid Price; NA Technology not selected/ NB Technology not bid upon.

Source: created by the author based on bid data from MINEM (2017).

These results are defined in part by a tendency to lower the prices of wind and solar energy at an international level, driven by a reduced cost of these technologies.17 In Argentina, on the other hand, the changes in the economic and political environment, the competition created by the bidding system, signing conditions, and guarantees bestowed by RenovAr lower the cost of financing and broadened their availability at an international level. The lower economic and financial uncertainty was reflected in a drop in the percent of projects selected which requested a guarantee from the World Bank, from 54% in round 1 to 31.8% in round 2. These conditions allow the adjusted bid price to reach levels comparable to those markets with a greater history in the field (see Figure 1).

Source: created by the author based on data from IRENA (2017b).

Figure 1 Selected Bid Prices According to Technology and Country. In $US/MWh (2016).

Furthermore, by prioritizing the product prices, the selection criteria of efficiency was further emphasized, that is the meeting between technology and quality of the renewable resource available, relegating to second place factors such as the use of domestic parts, geographical location (especially in the second round), or the proximity to consumption centers.

The price level of wind and solar energy in the country, despite being good for the competitiveness of the energy system, represents a challenge for the market’s growth. According to sources from the private sector, if this trend of lowering prices becomes more pronounced, only large-scale projects which have more accurate costs and which are more developed -with a lower risk of contingencies and a greater understanding of the available renewable resource’s traits- will be successfully selected for new bids.

Declared Domestic Parts (CND)

Investing in ERS projects provides much room to promote job creation through local industries’ participation in the different stages of development, installation, and operation and maintenance of these projects. The technological development stage is characterized by the creation of stable and highly specialized jobs; likewise, the installation stage has an intense need for temporary but specialized manual labor; and the operation and maintenance stage requires stable and moderately specialized local employment (OIT, 2011; Lambert and Pereira Silva, 2012). Nevertheless, the actual impact on employment by ERS generation projects depends on inserting local industry into the early stages of the chain, as the last stages have a more intense service but have less weight when it comes to the global added value (Sica, 2016).

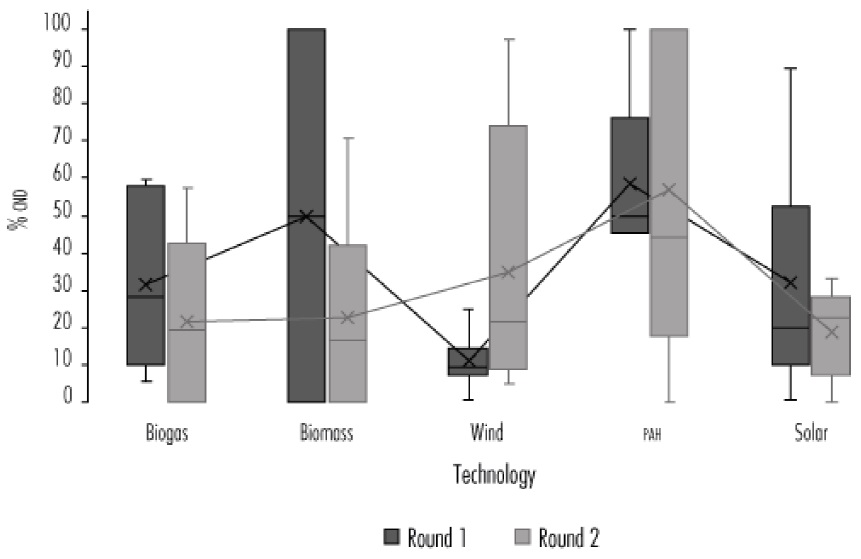

Integration of domestic goods in projects selected by the RenovAr, calculated by the pro-jects as the CND for the purpose of getting tax breaks, showed a wide variety in rounds 1 and 2 and disparate trends in both (see Figure 2). In fact, the incorporation of CND in each technology type is not related to the bid price nor is there an apparent relationship to rounds or the scale of the projects.

Source: Created by the author based on data from MINEM (2017).

Figure 2 Percent of CND in Bids by Technology (2016-2017).

Only wind projects increased the average percent of CND (from 11% to 35%) and its distribution. Projects with a CND share close to 100% are few and for the most part correspond to pro-jects which propose to increase their already installed capacity.

The drop in average CND use, even if it is in the short term, puts into question the idea that it is possible to increase the incorporation of domestic parts in ERS projects without employing criteria in the bid selection process which takes its incorporation into account, and/or financing or support policies which “reward” those who choose to become involved in developing integral value chains or in technology transference processes. Various sources in companies dedicated to designing and installing projects in the country state that, in general, there are no local providers which offer specific products for these technologies.

For example, the government of Brazil implemented policies which promote local content in wind energy projects as is the case with the Incentive Program for Alternative Electric Energy Sources18 (PROINFA) which provides financing from the National Social and Economic Development Bank19 if at least 60% of the windfarm contains local parts (Freier, 2016). These experiences show that it is possible to set goals for domestic components in a gradual and staged manner in energy markets with sufficient capacity (Lewis and Wiser, 2007). In bids carried out in this country, wind energy has a significant share, as do the associated industries (Puerto Rico and Sauer, 2015).

Public figures and sources from the private sector agree on fostering the emergence and development of a national industry connected to the ERS market. Nevertheless, they reject the possibility of imposing a minimum requirement for domestic parts for projects in the market’s structuring phase, arguing that it would increase adjusted bid prices and that market growth will be what promotes a dynamic of innovation in the domestic industry. However, other sources in the private sector question the possibility of the domestic industry’s penetrating the ERS sector under current conditions. The presence of large international players in the field of wind and photovoltaic solar energy increases competition on the one hand but, on the other hand, imposes high quality standards for goods produced locally which could be integrated into the value chain. In other words, the current setting demands a level of competitiveness which the local industry has yet to develop in the field of ERS and which it will only be able to reach if it manages to reduce the cognitive and technological distance between international players and local companies.

CONCLUSIONS

This study set forth to analyze the current regulatory framework for ERS in Argentina, covering its objectives, its creation, and implementation, and the scope of the results. Likewise, it analyzed the role that policies geared towards ERS bestow upon the promotion of the domestic industry and their inter-action with the accompanying industrial policies.

This is how we can affirm that public policies geared towards promoting ERS in the country line up with the objectives of national energy policy, especially with improving energy security and the competitiveness of the electric system in the middle term. Law 27.191 provides regulatory conditions to promote an increase in the installed electric capacity via ERS generation plants which have, in many cases, operating costs lower than those of other electric energy generation technologies. The rules and regulations for finances, taxes, and customs created by the government based on this law drew a large number of renewable source electric energy generation projects to the public bids, with bid prices below the maximum price established by RenovAr and those expected by the private sector.

The sale price of electric energy has been the primary criteria for selecting these projects, which coincides with the drop in average prices offered for ERS, fostering the competitiveness of the national electric system, but negatively limiting the participation of the domestic industry in these projects. The MINEM´s decision to use FODER to reduce uncertainty in investors and not to finance those projects with a greater percentage of domestic parts, reinforces the current trend of energy policy to the detriment of the objectives of industrial policy.

The importance given to the domestic industry in the objectives of MINEM contrasts with the role which politicians and functionaries unofficially give to ERS projects as a method for promoting local production and employment. This process appears to depend most of all on regional policies which the MP creates to promote the transference of skills, product technology and innovation in the field of ERS, with a special focus on the electrical and metallurgical industry and on the value chains of wind and photovoltaic solar energy. The immediate results show a complex landscape for domestic suppliers with domestic parts holding a low and highly variable share of ERS projects. Its effectiveness in the medium-term will depend on the reach of these policies and the ability of the industry to generate experiential and tacit knowledge which fosters innovation processes at a national level.

REFERENCES

Arentsen, M., Bechberger, M., Di Nucci, M., Midttun, A., Casale, C. y Kl-menc, A. (2007), "Renewable Energy and Liberalisation in Selected Electricity Markets-Forum Final Report", CSTM Studies and Reports, núm. 318. [ Links ]

Arranz, I. (2016), La transición energética en Alemania. Energiewende, Berlín, ICEX. [ Links ]

Bárcena, A. (2017), "Prólogo", en M. Cimoli (ed.), Políticas industriales y tecnológicas en América Latina, Santiago, CEPAL-BUZ/GIZ. [ Links ]

Barrera, M. (2011), "La diversificación de la matriz energética", Voces en el Fénix: Ultimátum a la tierra, vol. 2, núm. 10, Facultad de Ciencias Económicas, Universidad de Buenos Aires. [ Links ]

Brian Arthur, W. (1989), "Competing Technologies, Increasing Returns, and Lock-in by Historical Events", The Economic Journal, vol. 99, núm. 394, Royal Economic Society, May. [ Links ]

BP (2018), Base de datos Statistical Review of World Energy, June. Disponible en <http://www.bp.com/statisticalreview> [ Links ]

Cecere, G., Corrocher, N., Gossart, C. y Ozman, M. (2014), "Lock-in and Path Dependence: an Evolutionary Approach to Eco-innovations", Journal of Evolutionary Economics, 24. DOI <https://doi.org/10.1007/s00191-014-0381-5> [ Links ]

Ceppi, N. (2018), "Política energética argentina: un balance del periodo 2003-2015", Problemas del Desarrollo. Revista Latinoamericana de Economía, vol. 49, núm. 192, México, IIEC-UNAM. Disponible en <https://www.probdes.iiec.unam.mx/numeroenpdf/192_v49/02artCeppi.pdf> [ Links ]

Decreto 814/2017, Derecho de Importación Extrazona. Alícuotas. Boletín Oficial de la República Argentina, Buenos Aires (10 de octubre de 2017). [ Links ]

Frantzeskaki, N. y Loorbach, D. (2010), "Towards governing Infrasystem Transitions: reinforcing Lock-in or facilitating Change?", Technological Forecasting and Social Change, 77(8). DOI <https://doi.org/10.1016/j.te-chfore.2010.05.004> [ Links ]

Freier, A. (2016), "La situación de la cooperación energética entre Argentina y Brasil en el área de la energía renovable: ¿Integración, difusión o fragmentación?", Relaciones Internacionales, núm. 51. Disponible en <https://revistas.unlp.edu.ar/RRII-IRI/article/view/2951/2678> [ Links ]

Frondel, M., Ritter, N., Schmidt, C. y Vance, C. (2010), "Economic Impacts from the Promotion of Renewable Energy Technologies: The German Experience", Energy Policy, 38(8). DOI <https://doi.org/10.1016/j.enpol.2010.03.029> [ Links ]

Irena (2017a), Rethinking Energy 2017: Accelerating the Global Energy Transformation, International Renewable Energy Agency, Abu Dhabi. [ Links ]

______(2017b), FeaturedDashbord- Policy. IRENA. Disponible en <resourceirena.irena.org/gateway/dashboard/?topic=1021ysubTopic=1062> [ Links ]

______ (2017c), Featured Dashbor-Costs. IRENA. Disponible en <http://resourceirena.irena.org/gateway/dashboard/?topic=3ysubTopic=1057> [ Links ]

Jacinto, G., Clementi, L., Carrizo, S. y Nogar, L. (2014), "Vientos para el cambio. Territorios, energía eólica y cooperativas de electricidad en el sur bonaerense", Revista Transporte y Territorio, núm. 11. Disponible en <http://revistascientificas.filo.uba.ar/index.php/rtt/article/view/656/635> [ Links ]

Jacobs, D., Marzolf, N., Paredes, J.R., Rickerson, W., Flynn, H., Becker-Birck, C. y Solano-Peralta, M. (2013), "Analysis of Renewable Energy Incentives in the Latin America and Caribbean Region: The Feed-in Tariff Case", Energy Policy , 60(C). doi <https://doi.org/10.1016/j.enpol.2012.09.024> [ Links ]

Kranzl, L., Stadler, M., Huber, C., Haas, R., Ragwitz, M., Brakhage, A., Gula, A. y Figorski, A. (2006), "Deriving Efficient Policy Portfolios promoting Sustainable Energy Systems: Case Studies applying Invert Simulation Tool", Renewable Energy, 31. DOI <https://doi.org/10.1016/j.renene.2005.11.005> [ Links ]

Lall, S. y Teubal, M. (1998), "Market-Stimulating Technology Policies in Developing Countries: A Framework with Examples from East Asia", World Development, vol. 26, núm. 8. [ Links ]

Lambert, R.J. y Pereira Silva, P. (2012), "The Challenges of determining the Employment Effects of Renewable Energy ", Renewable and Sustainable Energy Reviews, 16. DOI <https://doi.org/10.1016/j.rser.2012.03.072> [ Links ]

Lee, K. (2013), Schumpeterian Analysis of Economic Catch-up: Knowledge, Path-creation, and the Middle-income Trap, Cambridge, MA, Cambridge University Press. [ Links ]

Lewis, J. y Wiser, R. (2007), "Fostering a Renewable Energy Technology Industry: An International Comparison of Wind Industry Policy Support Mechanisms", Energy Policy , 35. DOI <https://doi.org/10.1016/j.enpol.2006.06.005> [ Links ]

Ley N° 25.019, Declárase de interés nacional la generación de energía eléctrica de origen eólico y solar en todo el territorio nacional. Boletín Oficial de la República Argentina , Buenos Aires (26 de octubre de 1998). [ Links ]

Ley N° 27.191. Modificaciones a la Ley 26190. Régimen de Fomento Nacional para el uso de Fuentes Renovables de Energía destinada a la Producción de Energía Eléctrica. Modificación. Boletín Oficial de la República Argentina , Buenos Aires (21 de octubre de 2015). [ Links ]

Ley N° 26.190, Régimen de Fomento Nacional para el uso de fuentes renovables de energía destinada a la producción de energía eléctrica. Boletín Oficial de la República Argentina , Buenos Aires (2 de enero de 2007). [ Links ]

López-Polo, A., Suna, D. y Haas, R. (2006), "An International Comparison of Market Drivers for Grid connected PV Systems", Proc. 21st European Photovoltaic Solar Energy Conference, Dresden, Germany. [ Links ]

Lund, P.D. (2009), "Effects of Energy Policies on Industry Expansion in Renewable Energy", Renewable Energy , 34(1). DOI <https://doi.org/10.1016/j.renene.2008.03.018> [ Links ]

Ministerio de Energía y Minería (MINEM) (2016), Argentina-Energy for Growth. For the Institute of the Americas, La Jolla, May 26. Recuperado de <www.energia.gob.ar/contenidos/archivos/Reorganizacion/planeamiento/publicaciones/IOA-La%20Jolla-May2016.pdf> [ Links ]

______ (2017), Proyectos adjudicados del Programa RenovAr. Rondas 1 y 1.5. MINEM. Recuperado de www.minem.gob.ar/www/833/25897/proyectos-adjudicados-del-programa-renovar [ Links ]

Ministério de Minas e Energia (2015), Plano Decenal de Expansão de Energia 2024. Ministério de Minas e Energia-Empresa de Pesquisa Energética, Brasília, MME/EPE. [ Links ]

Ministerio de Producción (2017), Acuerdo por la Producción y el Empleo Principales lineamientos para el sector de Energías Renovables. Plan de consolidación e integración. Recuperado de <http://www.uia.org.ar/download.do?id=6707> [ Links ]

Organización Internacional del Trabajo (OIT) (2011), Skills and Occupational Needs in Renewable Energy . Ginebra, OIT. Disponible en <www.ilo.org/wcmsp5/groups/public/---ed_emp/---ifp_skills/documents/publication/wcms_166823.pdf> [ Links ]

Pahle, M., Pachauri, S. y Steinbacher, K. (2016), "Can the Green Economy Deliver it All? Experiences of Renewable Energy Policies with Socio-economic Objectives", Applied Energy, 179. DOI <https://doi.org/10.1016/j.apenergy.2016.06.073> [ Links ]

Pérez, C., Marín, A. y Navas-Aleman, L. (2014), "The Possible Dynamic Role of Natural Resource-based Networks in Latin American Development Strategies", en G. Dutrénit y J. Sutz (eds.), Innovation Systems for Inclusive Development: The Latin American Experience, Cheltenham, Edward Elgar. [ Links ]

Porcile, G. y Martins, A. (2017), "Cambio estructural, crecimiento y política industrial", en M. Cimoli (ed.), Políticas industriales y tecnológicas en América Latina , Santiago, CEPAL-BUZ /GIZ. [ Links ]

Puerto Rico, J. y Sauer, I.L. (2015), "Política energética en Brasil: implementación del componente renovable", Energética, 45. Disponible en <https://revistas.unal.edu.co/index.php/energetica/article/download/47366/pdf>. [ Links ]

Recalde, M., Bouille, D. y Girardin, L. (2015), "Limitaciones para el desarrollo de energías renovables en Argentina", Problemas del Desarrollo. Revista Latinoamericana de Economía , vol. 46, núm. 183, México, IIEC-UNAM . Disponible en <http://www.scielo.org.mx/scielo.php?pid=S030170362015000400089&script=sci_arttext&tlng=pt> [ Links ]

Resolución SE 108/2011, Habilitase la realización de Contratos de Abastecimiento entre el Mercado Eléctrico Mayorista y las ofertas de disponibilidad de generación y energía asociada. Boletín Oficial de la República Argentina , Buenos Aires (13 de abril de 2011). [ Links ]

Rogge, K.S., Kern, F. y Howlett, M. (2017), "Conceptual and Empirical Advances in Analysing Policy Mixes for Energy Transitions", Energy Research y Social Science, 33. DOI <https://doi.org/10.1016/j.erss.2017.09.025> [ Links ]

Secretaría de Energía (SENER) (2017), Reporte de Avance de Energías Limpias 2017, México. [ Links ]

Siboldi, A. (2016), "Aspectos institucionales, legales, regulatorios. Marco normativo de las energías renovables. Agencia de ERNC y ahorro de energía", en L.M. Rotaeche y G.A. Rabinovich (eds.), Energías renovables no convencionales: Argentina frente al desafío de un futuro sostenible, Buenos Aires, Instituto Argentino de la Energía "General Mosconi". [ Links ]

Sica, D. (2016), "El desarrollo de la industria y la integración de las energías renovables", en L.M. Rotaeche y G.A. Rabinovich (eds.), Energías renovables no convencionales: Argentina frente al desafío de un futuro sostenible , Buenos Aires, Instituto Argentino de la Energía "General Mosconi" . [ Links ]

Silva Colomer, J., Blanco Silva, F., Maroto, C., Donato, L. y López Díaz, A. (2014), "Análisis de las energías renovables en producción eléctrica: Estudio comparativo entre España y Argentina", Revista Peruana de Energía, núm. 4. Disponible en <http://www.santivanez.com.pe/wp-content/uploads/2015/05/2-Analisis-Energias-Renovables.pdf> [ Links ]

Subsecretaría de Energías Renovables (2016), Energías Renovables en Argentina. Oportunidades, Desafíos, Acciones, Buenos Aires, Subsecretaría de Energías Renovables. Disponible en <www.energiaestrategica.com/wp-content/ uploads/2017/08/20170809_Viento-y-Energia_UBA_SKind.pdf> [ Links ]

Unruh, G. (2000), "Understanding Carbon Lock-in", Energy Policy , 28(12). DOI <https://doi.org/10.1016/S0301-4215(00)00070-7> [ Links ]

______ (2002), "Escaping Carbon Lock-in", Energy Policy, 30(4). DOI <https://doi.org/10.1016/S0301-4215(01)00098-2> [ Links ]

Weiss, I., Sprau, P. y Helm, P. (2003), "The German PV Solar Power financing Schemes reflected on the German PV Market", Proc. 3rd World Conference on Photovoltaic Energy Conversion, Osaka. [ Links ]

World Energy Council (2017), Escenarios energéticos mundiales, Londres, World Energy Council. [ Links ]

Yoguel, G., Barletta, F. y Pereira, M. (2017), "Los aportes de tres corrientes evolucionistas neoschumpterianas a la discusión sobre políticas de innovación", Revista Brasileira de Inovação, 16(2). DOI <https://doi.org/10.20396/ rbi.v16i2.8650116> [ Links ]

Zhang, S., Andrews-Speed, P., Zhao, X. y He, Y. (2013), "Interactions between Renewable Energy Policy and Renewable Energy Industrial Policy: A Critical Analysis of China's Policy Approach to Renewable Energies", Energy Policy , 62. DOI <https://doi.org/10.1016/j.enpol.2013.07.063> [ Links ]

1This refers to mechanisms which favor the adoption of one technology and bestows advantages over other alternative technologies even when the latter are potentially superior substitutes. In general, they produce increasingly higher yields as the technology spreads help them become dominant and define the path of innovation (Brain Arthur, 1989). These mechanisms are the result of the co-evolutionary process between technological infrastructure, organizations, society and governmental institutions which facilitate the continuity of a specific technology (Unruh, 2002).

2Unlike other countries, Argentinean National Law 27.191 does not consider as ERS that which comes from hydroelectric installations with a capacity greater than 50MW, but only that generated by small hydroelectric facilities (with a maximum 50MW).

5Currently the projects selected in GENREN are connected to the MEM: 3 wind energy projects with a capacity of 127.4MW, 4 solar energy projects with 8.2MW capacity, and 2 landfill biogas projects with a 16.6MW capacity.

7This fiscal certificate is given when at least 60% of the components used are produced domestically or, if it is lower, when it is effectively proven that their domestic production is inexistent. In no case can the percentage be lower than 30%.

8From the Spanish “Fondo para el Desarrollo de Energías Renovables.” The fund is made up of charges specific to the demand of electric energy, resources coming from the National Treasury -equivalent to no less than 50% of the effective savings in fossil fuels due to the incorporation of RES in the previous year- and other national and international resources.

9This is calculated based on the bid price, associated loss factors at the point of interconnection and the time for commercialization.

10From the Spanish “Componente Nacional Declarado”. CND refers to the amount of domestic parts used in the electromechanical installations for these projects, not including manual labour, as set forth by Law 27.191.

11MINEM, MP, Ministerio de Trabajo (Ministry of Labour), Empleo y Seguridad Social (Employment and Health Insurance), Administración Federal de Ingresos Públicos (Federal Administration of Public Income), Agencia Argentina de Inversiones y Comercio Internacional (Argentine Agency for Foreign Investments and Trade), and Dirección General de Aduanas (General Customs Administration).

12Asociación de Industriales Metalúrgicos de la República Argentina (Industrial Metallurgical Association of the Argentine Republic), Cámara de Industriales de Proyectos e Ingeniería de Bienes de Capital (Chamber of Industrialists for Engineering Projects and Capital Goods), Cámara Eólica Argentina (Argentinean Chamber of Wind), Unión Obrera Metalúrgica (Metallurgical Workers’ Union), Sindicato de Luz y Fuerza (Electricity and Power Union), Unión Obrera de la Construcción de la República Argentina (Construction Workers’ Unioni for the Argentine Republic).

13the state estimates that there are 4000 workers employed in activities connected to ERS, 110 suppliers in the chains of wind and photovoltaic solar energy, five manufacturers for biomass landfills and around 50 local suppliers of electrical equipment which can use across all technologies associated with ERS.

14the base energy is that which is reducing the continuous manner with acceptable economic costs for the market which is why it covers the base of the demand curve. Dissolutions between demand above the base are covered by the energy produced by technologies with a greater level of intermittency according to their availability and cost. The intermittency of this energy is owed to the fact that certain powerplants are only able to function when the resource, be it sun, wind, or tide, is available.

15The Average Monomic Cost is the sum of representative production costs (fixed and variable) of electric energy in the MEM, divided by the total demand met, in a control period.

16These prices do not take into account the adjustments for the incentive factor Index which awards projects early on in their operation and decreases with the passage of time. Neither does it take into account the annual adjustment factor which raises the price by 1.5 to 2 points annually. In total, it is estimated that the average price is around 20% higher, which would imply that 49% of the projects do not exceed the aforementioned monomic price for that date.

17According to IRENA (2017c) the average normalized price of electricity at an international level decreased by 60% for photovoltaic solar energy and 21% for solar energy between 2010 and 2016.

Received: April 23, 2018; Accepted: October 22, 2018

text in

text in