Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Problemas del desarrollo

versão impressa ISSN 0301-7036

Prob. Des vol.50 no.196 Ciudad de México Jan./Mar. 2019

https://doi.org/10.22201/iiec.20078951e.2019.196.64823

Articles

A Case Study in Mining and Unsustainable Development: San Juan, Argentina

aNational Scientific and Technical Research Council (CONICET) - National University of San Juan, Argentina. *E-mail: margarita.moscheni@gmail.com

“Mining is the main engine of development”, is one of the most commonly used arguments in support of the activity. This paper is the product of comprehensive interpretive research, which aims to test this hypothesis, using extractive mining in San Juan, a province in the center-west of Argentina, as a case study. One of the key findings of this study is that high foreign investment in mining is not synonymous with development. To the contrary, mining creates growth which is concentrated, exclusive and unsustainable, and which undermines external commercial apparatus, displaces traditional modes of production and triggers a process of socio-environmental conflicts, causing irreversible ecological damage.

Key Words: Mining; San Juan province; foreign investment; exports; environmental pollution; ecological damage

“La minería es el motor principal del desarrollo”, reza uno de los principales argumentos a favor de esta actividad. Este trabajo es producto de una investigación de tipo interpretativo y comprensivo, que aspira a verificar el slogan mencionado, tomando como caso la minería extractiva en San Juan, provincia ubicada en el centro-oeste de Argentina. Entre los principales resultados obtenidos está que la alta inversión extranjera en minería no es sinónimo de desarrollo, sino por el contrario, genera un crecimiento concentrado, excluyente e insostenible, vulnerando el aparato comercial externo, desplazando las producciones tradicionales y generando un proceso de conflictos socioambientales y de daños ecológicos irreversibles.

Palabras clave: minería; provincia de San Juan; inversión extranjera; exportaciones; contaminación ambiental; daños ecológicos

Clasificación JEL: L71; L72; R11; Q51; Q56

INTRODUCTION

The objective of this work is to describe the characteristics of development imposed by the activity of extractive mining, providing evidence that said activity is far from being the “main engine of development” as the big players’ main slogans propose. The study covers the period 2003-2017 as 2003 was the year when construction first began on the most important mining camps.

First, we shall present some categories for analysis, such as what is understood by sustainable development, as well as the contributions made by weak and strong sustainability. Second, we shall describe the most important extractivist projects operating in the province of San Juan. Then we shall look at the impact of mining with regards to the environment as well as some productive variables. Finally, we shall present our conclusions.

2. SOME CONCEPTUAL ASPECTS

Sustainable Development

The theoretical approaches to sustainable development are not homogenized. There is no one agreed upon definition and, given the different transdisciplinary contributions and epistemological stances, its conceptualization is constantly undergoing modification. In this work, to be considered as “sustainable development” the following minimum requirements must be met:

Economic growth must preserve the environmental, social, cultural, and historical dimensions of a specific location.

Intergenerational equity is paramount. It is not possible to cater to mankind’s present well-being to the detriment of future generations. Nor can we forget to honor and respect what we have inherited from previous generations.

The state should play an important role, with the power to intervene to guarantee points 1 and 2 and to control the exploitations.

Economic wealth is insufficient for humans’ well-being. There are vital basic resources more important than money such as water and air.

At local level, sustainable development must result in a structural transformation of the territory in a way that improves the immaterial and material conditions of the local people and their habitat.

At global level, the definitions and practices surrounding sustainable development must be the same. This must be true both for developed countries and for those which are not.

Depending on the development and transformation impinged on the territory, sustainability can take on one of two forms: weak or strong.

Weak Sustainability

Under the current technocratic predominance there is a prevailing positivist outlook: technology as a key factor capable of replacing any limited or destroyed capital. This theory effectively understands that what matters is not capital itself, be it natural or man-made, but rather preserving the global stock of said capital (Solow, 1991). As such, any destruction of exhaustible natural resources can be compensated for with technological innovations which come as the product of new investments.

This theoretical approach is framed by theories of economic growth and market economics. The basis of preserving natural resources will always be of the utmost importance, even if in the process of development their loss becomes necessary. Mass-Colell (p. 207 qtd. in Pañeda 1994, p. 206), lauding this growth, said in a conference that “it is through our wealth, not our poverty, that we will save nature.” He stated that: “as long as technology evolves, there can be an unlimited substitution of resources” (Más-Colell, 1994, qtd. by López Pardo, 2012, p. 39).

Faith in replacing one resource (natural) with another (man-made through technology) is common among many authors who believe in this approach. Basically, this is possible because of the supposition that the money obtained from production (which destroys the ecosystem), would come back to preserve the ecosystem in the form of investments which in turn raise the stock of technological capital. As such, the substitution of the capital destroyed sees a proposed weak sustainability’s actions intervening in the consequences rather than the causes. Otherwise it would focus on creating technology for the production process that generates growth and would also serve to preserve the environment.

Kappot (2001), qtd. in López Pardo (2012, p. 204), lists some of the more important variables covered by environmental management policies designed within the framework of weak sustainability:

Exclude the social environment (only cover the natural), leaving the people at risk by excluding them from the decision process which affects their habitat.

Prioritize economic growth and the privatization of natural resources.

The topic of the environment is depoliticized (qtd. in López Pardo, 2012, p. 204).

O’Riordan (1996), qtd. in López Pardo (2012, p. 275), complements this with the following:

Little intention to integrate policies.

Little social awareness.

Little media coverage (qtd. in López Pardo, p. 275).

Investment decisions which advocate economic growth, the source of mankind’s well-being (neoclassical approach), replace social participation facilitated by the governing processes. At the level of public policy, evaluations are carried out to determine the adjusted cost base (ACB) in order to determine which alternative implies the lowest cost with the highest benefit.

Falconí sets the proposals of Lewis Gray from 1913-1914 and Harold Hotelling (1999), qtd. in Falconí (2002, p. 37), as theoretical precursors to weak sustainability. They state that:

The optimal choice depends on comparing the net gain (market price minus the marginal cost of extraction) obtained by selling the natural resource and investing it at the market’s interest rate, and the gain obtained by keeping the resource underground to sell it in the future.

On the other hand, its origin can be found in the neoclassical economic growth models of the 1970s, based on exhaustible resources (Falconí, 2002, p. 38). Solow, Stiglitz, and Hartwick are among the outstanding thinkers of this period.

In the first place, Solow (1974) aspires to identify an economy’s conditions for economic growth within the context of non-renewable natural resources, understanding that previous generations could turn to a group of finite resources when contributing to reproducible capital:

One of the objectives of Solow (1974) was to look at the conditions that would allow an economy to grow forever under the presence of limited natural resources. According to his model, considering that some resource could be available only in limited amount did not necessarily change the possibility for output to grow indefinitely. Furthermore, he stated that the earlier generations could always draw on the finite pool of resources as long as they added to the stock of reproducible capital

Second, Stiglitz (qtd. in Cabeza Gutés, 1996, p. 149) focuses on the role of technology as a key element in substituting natural capital with man-made. Like Solow, he bases his work on Cobb-Douglas’ function of production, according to which the value of man-made capital is greater than the share held by natural capital.

The capacity for substitution received structural criticism on the restrictions which technology presents when replacing certain natural processes. Leal asserts this when he quotes Daly:

The principle of substitution is insufficient and only serves as a distraction when facing global environmental problems like pollution, global warming and the hole in the ozone layer. In spite of technological advances and investments made, we have been unable to replace nature’s ability to recycle and its self-filtration system; we have been unable to stop global warming, nor have we stopped the filtration of UV radiation (2008, p. 7).

Third, Cabeza Gutés highlights another interesting contribution, Hartwick’s savings-investment rule “to have a stream of constant level of consumption per capita to infinity, society should invest all the current returns obtained from the utilization of the stock of exhaustible resources” (qtd. in Cabeza Gutés, 1996, p. 149).

Strong Sustainability

This approach implies a critical opinion of weak sustainability given that socioeconomic development and environmental conservation are contradictory in nature. Both are dependent on the other, having an inverse relationship: the growth of the former implies the destruction of the latter. Except if the exploitation aspect can be assimilated by the ecosystem. Within this approach one can find one of the most important exponents on the topic, Right Livelihood Laureate Herman Daly, for whom sustainable development is not analogous with economic growth. He states what he believes its feasibility depends on:

Human’s capacity for exploitation should be equal to its capacity for maintaining the environment, in other words that the area being supported be proportionate to the area supporting it. In order to achieve this, the quantity of inhabitants and their capacity for consumption must be limited. The speed at which the environment is exploited must be equal to the regenerative speed of natural resources, the quantity of emissions must correspond to the environment’s capacity to assimilate them and the exploitation of natural resources must correspond to the extraction rate of renewable resources. In short, the environment’s resilience must be taken into account (Leal, 2008, p. 4).

This approach does not have an absolute faith in technology and the quantification of resources and their substitutability, as there are certain natural capitals which are “sensitive”, difficult to replace: “natural capital has general characteristics, like being vulnerable, and capital can be sensitive because of its importance to the workings not of the economy, but society in all its aspects” (Neumayer, 1999, p. 97, qtd. in López Pardo, 2012, p. 33).

The differences between weak and strong sustainability are summarized in the following table:

Table 1 Comparison of Weak and Strong Sustainability's Key Characteristics

| Weak Sustainability | Strong Sustainability |

| More anthropocentric (technocentric) than ecocentric. | More ecocentric than anthropocentric. |

| Mechanistic. | Systemic. |

| Sustainability is synonymus with the socioeconomic system's viability. | Sustainability as a viable relationship between the socioeconomic sytem and the ecosystem. |

| Sustainability compatible with economic growth. | Sustainability incompatible with economic growth. |

| Natural capital can be substituted with human capital. Constancy of total capital. | Natural capital is complementary to and cannot be substituted by human capital. Constancy of natural capital |

| Sustainability demands monetizing the natural environment. | Many natural resources, processes and services are priceless. |

| Belief in sustainable development which is in reality sustained. | Diverse sustainable evolutions which historically have existed. |

| Local environment. | Global and systemic environment. |

Source: Luffiego and Rabadán (2000), qtd. in Leal (2008, p. 8).

The Territory: Mining in San Juan

Historically San Juan was an agro-industrial province with a strong wine-making profile. But within the institutional framework designed in the 1990s, with changes in demand and international prices, foreign investments changed the province’s profile towards metal mining in the first decade of the 2000s.

Given the competitive and comparative advantages provided by the setting, the province became an important area for mining production, export and investment. This is especially true when it comes to gold, which accounts for 50% of domestic production.

In a province which, compared to the national standard, theretofore had had relatively little industrial development, the first big mining project started in 2003 with the construction of the Veladero project. This mine had 12.8 million ounces of reserves, accounted for 75% of the province’s production and its level of production held steady at an average of 600 thousand ounces per year. It is operated by the Canadian company Barrick Gold which in 2010 controlled 10% of gold production, becoming one of the largest players in the global market (Abcb, 2012). Veladero is expected to have a lifespan of 19 years, meaning that it would close up in 2024. “The investment made for the construction of Veladero, estimated to be $600 million USD, represents no less than 36% of the Foreign Direct Investments in Argentina in 2003 ($1.659 million USD)” (Barrick Gold, 2009).

Construction on the Gualcamayo mine, located 2,000m above sea level in Jáchal and measuring 25,000 ha, began in 2007 with an investment of $180 million USD (Diario Las Noticias, 2009). Originally it was operated by Viceroy but was bought by Yamana Gold in 2006 and, at the time of writing, is operated by the subsidiary Minas Argentinas S.A. (MASA). Gualcamayo produces copper, silver and gold and expects an effective lifetime of 10 years and a reserve of 1.2 million ounces of gold.

Construction on Casposo began two years later. This mine lies 180km from the capital of San Juan at an altitude of 2,400m, which affords it greater accessibility and the ability to have normal operating conditions year-round, advantages which the other projects lack. This mine started off with a reserve of 489 thousand ounces and an annual production of about 65 thousand ounces of gold. It is characterized by the production of silver ingots with 99% purity and a lifespan of 10 years. The mine is the only one with an open pit mine. It has another mine underground and has a silver processing plant which represents a much smaller investment when compared to a gold refinery. Furthermore, with an approximated investment of $45 million USD (Mining Press, 2007), it is the first metal mine in the country currently managed by Argentinian investors in the form of Austral (Argentina).

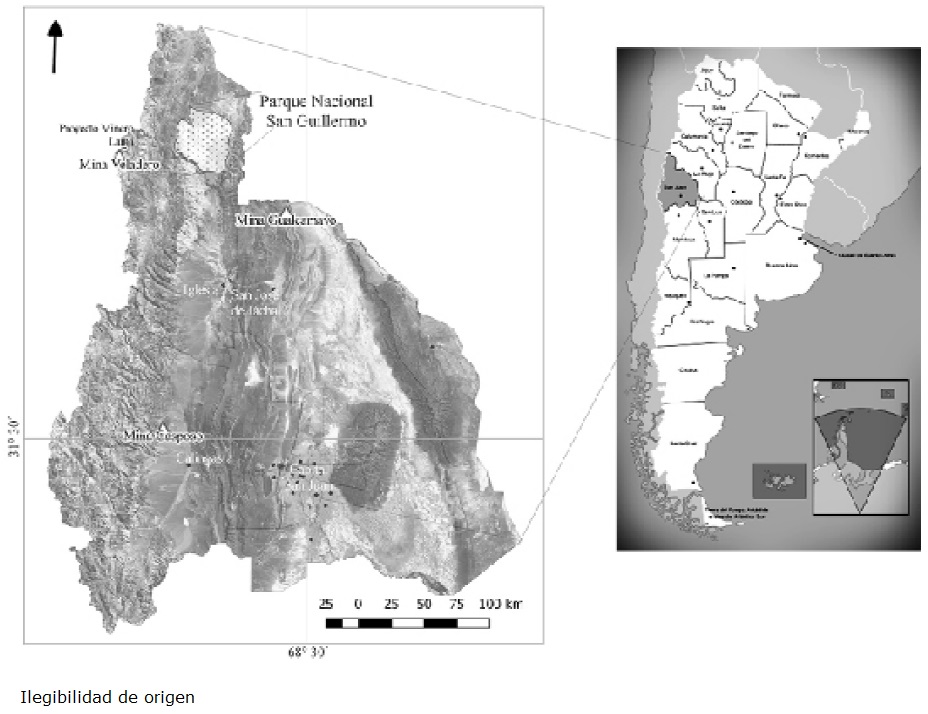

The Casposo and Gualcamayo projects are the smallest in relative terms, with only 20% of the gold reserves that Veladero has. Figure 1 shows the locations of the different projects.

Source: Made by Huellas -Cartografía, SIG y Diseños en 3D- (Huellas -Cartography, SIG, and 3D Designs-)

Figure 1 Location of Mining Projects. San Juan, 2018.

In 2009 construction began on the Argentinian-Chilean binational project Lima-Pascua, one of the ten largest in the world, with an estimated investment of about $1.5 bn USD (Mining Press, 2006). Nevertheless, its operation was suspended in 2013.1

According to Editorial RN (RN Publishing group) (2014), “in the period between 2003-2014, the total amount of investments destined for the Veladero, Gualcamayo, Casposo and Lama projects together reached the total of $58,123,595,575 ARS”.

3. DEVELOPMENT

Mining and the Use of Non-Renewable Natural Resources

Mining activity is the type of production with an extensive consumption of non-renewable resources. According to the Ministerio de Minería de San Juan (San Juan’s Department of Mining), Veladero has a water concession of 110 thousand L/s, Gualcamayo 116.65L and Casposo 12.5L 2 . In other words, Veladero itself is capable of consuming 9.504 million liters a day. It also burns 4 million liters of gas oil a month, generating and consuming between 18 to 20 MW.

On the other hand, mining’s type of extraction implies changing the landscape of the region in which it operates, even to the point of destroying it. Examples of elements affected are the mountains and local flora and fauna. Colectivo Voces de Alerta (Warning Voices Collective) says so in the following summary:

Through the use of explosives, parts of the mountains are blown up in order to facilitate removing large volumes of rock. “Steps” are thereby formed, making way for an “open pit”. This results in moving tons of rocks which are increasingly greater than those actually used, emphasizing the deterioration inflicted on the environment. This type of extractive technology means that just one undertaking can span up to a thousand hectares just for the area of the mine -which will be completely destroyed-, removing up to 300,000 tons of rock per day while using up to 100 tons of explosives, over 100,000L of fuel, dozens of tons of highly toxic chemicals (cyanide, sulphuric acid, xanthate, mercury, etc.), and an extremely high amount of energy and water. As one can surmise, the process generates large quantities of effluents and waste (in most cases, over 95% of extracted rock becomes waste: up to 4 tons of rubble for every gram of gold) which remain in perpetuity in the exploited region as “environmental liabilities.” Among them it is important to point out the “open pit” mine - which can be over 1,500m in diameter and 1,000m deep, the rubble and dump sites for waste rock can cover hundreds of hectares, and the tailing dams” (Moran, 2001; Oblasser and Chaparro Ávila, 2008, qtd. in Machado et al., 2011, p. 8).

In 2009, Barrick Gold was served with a suit for “collective environmental damage” caused by the Pascua Lama and Veladero projects, both belonging to Barrick and located in the San Guillermo Biosphere Reserve (SGBR), an area protected at an international level.3 The suit states that “in just the exploitation stage they made 720 perforations averaging 100 meters deep” resulting in “the removal of large quantities of the ground, directly impacting the landscape and cultural heritage, thereby altering the environment” and that it “alters the topography and the landscape in the region” by being “a great producer of domestic, pathogenic, harmful and harmless industrial waste” (Dictamen Vargas, Ricardo Marcelo C/San Juan, Provincia de y Otros, 2009, p. 3).

The damage is corroborated by a document drawn up by the National Parks Administration4 (APN), who was originally charged with creating a Plan de Manejo de la Reserva (Management Plan for the Reserve). The APN issued a negative result on the mining development in the region, warning of the potential danger to the environment posed by mining activity in the reserve.5

The APN’s evaluation notes that even if mining was not carried out in the SGBR region directly, it would still be affected indirectly as it borders the rivers Blanco and La Palca (whose main tributaries came from the river Las Taguas, which is used by Veladero and Lama). These rivers provide drinking water for the animals in the region (APN, 2013).

In addition to the destruction and consumption of finite resources, experience shows us that there are multiple cases where resources have been contaminated and for which technology has yet to find any artificial substitute, as is the case with water. In this case study, Barrick Gold contaminated the waters of the rivers and operates in glacial regions, thereby destroying a vital source of water for the local people.

First of all, according to a report by the División Operaciones del Departamento de Delitos Ambientales de la Policia Federal Argentina (Argentina Federal Police’s Department of Environmental Crimes - Operational Division), Barrick Gold had three cyanide solution spills in San Juan, contaminating the rivers Potrerillos, Jáchal, Las Taguas, Palca and Blanco (TN, 2016). The first was on September 12th, 2015, in the river Potrerillos.6 Evidence of this spill was given by an analysis carried out by a researcher from the National University of Cuyo (UNCUYO) from the province of Mendoza, Argentina. She detected the presence of heavy metals (aluminum and manganese) in the river at levels much higher than those which the law allows7 (clear evidence that the waters had been contaminated) (Fernández Rojas, 2015).

The government later tasked the United Nations Office for Project Services (UNOPS) with an impact analysis. The technical report carried out by the United Nations Environment Programme (UNEP) confirmed the contamination of zone 0, which is the area closest to the spill (UNOPS, 2016, p. 8).

The spills made it evident that the mining company was operating without the mandatory environmental insurance as established by article 22 of the Ley General de Ambiente (General Environmental Law) #25.675. The company owned up to the infraction, claiming that they did not have said insurance as there was no provider in the Argentinian market.8

In April 2018, an analysis carried out on the Jachal river’s tributary presented numbers which demonstrated the presence of heavy metals higher than permitted by law.9 This allows one to suppose that Barrick had covered up two other spills.10

Second, on the topic of glaciers, the mining in San Juan (and in Chile) was set up on top of permafrost, frozen ground, glaciers and periglacial processes. Glaciers Toro 1, Toro 2 and Esperanza were within the Pascua Lama Project’s boundaries. Veladero’s heap leaching pads for example, are located on periglacial landforms. This is according to the Environmental Impact Report (2002) carried out by the consulting firm Knight Piésold S.A. for Minera Gold S.A., a subsidiary of Barrick Gold. In the section “Descripción de cuerpos de aguas superficiales” (“Descriptions of Surface Bodies of Water”) they confirm the presence of “glaciers at the heads of the basins of the rivers Canito, Turbio and Los Amarillos” (p. 45); and of rock glaciers (p. 16).

In Chile, the Department of Water, a section within Chile’s Ministry of Public Works showed that the exploitation of glaciers Toro 1, Toro 2 and Esperanza reduced their volume between 56% and 70% in the period of 2005-2013.

Mining and Weak Economic Growth

This section will cover three productive variables with the aim of analyzing the impact of mining in the area.

Gold and Gross Regional Domestic Product11

The sectors that showed the most activity in the period between 2003 (when construction on Veladero began) and 2015, were construction and mines and quarries (calcium carbide, lime and ferrosilicon in particular), with a growth rate of 12.70% and 11.79% respectively (see Table 2). Both sectors are directly linked to extractive mining as goods and services providers in the mining value chain.

Table 2 Growth Rate in GRDP by Economic Sector, San Juan 2003-2015

| San Juan GRDP | 8.05 |

| Agriculture and Livestock | 2.29 |

| Industrial Minerals | 11.79 |

| Manufacturing Industries | 7.12 |

| Gas, Water and Electricity | 7.88 |

| Construction | 12.79 |

| Hotels, Restaurants and Commerce | 9.21 |

| Transportation and Communications | 7.09 |

| Financial Insitutions, Real Estate, B2B Services | 5.90 |

| Social, Community and Personal Services. | 10.53 |

Source: Created by the authors based on Instituto de Investigación Económicas y Estadísticas (Economic and Statistics Research Institute or IIEE), San Juan, 2015.

One can see in the province’s macroeconomic accounts that in the whole sector of construction, construction in the mining sector went from accounting for 7.5% in 2003 to 47.5% in 2015.

The mines and quarries sector registered the second-highest growth rate (11.7%) between 2003-2015,12 even though the sector does not contribute greatly to the GRDP as it only accounted for 0.48% in 2015.

In summary, the greatest productive contribution linked, albeit indirectly, to mining is a boost in some economic activities. Even so these activities do not represent great contributions to the GRDP - non-metallic minerals and construction only make up 7.67% of the GRDP in 2015.

On the other hand, gold production falls in the sector of Manufacturing Industry (under the category of Basic Metals and the subcategory of Non-Ferrous Metals), which until 2004 had registered as null for the GRDP. Nevertheless, San Juan’s GRDP registered a growth from $2,070.9 ARS in 2005 to $364,331.9 ARS in 2015. This trend begins in 2005 when Veladero began production and increased with the contributions of Gualcamayo (2007) and Casposo (2009). It kept rising until 2013 when a drop in gold prices and increasing costs saw Pascua Lama’s activities suspended.

In spite of the drop, in 2015 it accounted for 38% of the manufacturing industries’13 contribution and 5.5% of the province’s production total.

As we can see in Table 3, in the ten years from 2005-2015, gold saw a growth rate of 60% and made up on average 4.1% of San Juan’s GRDP and 31.7% of the manufacturing industries sector.

Table 3 Contributions of basic metals to the total of the GRDP. San Juan, 2005-2015. In thousands of constant 1993 pesos

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Cup of 2005-2015 growth | |

| Basic metals | 158 193.00 | 628 779.00 | 557 166.00 | 801 537.00 | 1 053 058.00 | 2 065 312.00 | 2 692 622.00 | 2 578 105.00 | 2 167 035.00 | 3 475 511.00 | 2 953 609.00 | 30.48 |

| Ferroalloys | 131 725.00 | 149 282.00 | 152 022.00 | 234 534.00 | 161 014.00 | 200 415.00 | 326 067.00 | 209 360.00 | 231 846.00 | 355 862.00 | 254 816.00 | 6.18 |

| Metals (gold) | 2 070.90 | 96 118.86 | 106 306.99 | 123 635.03 | 214 422.62 | 448 269.48 | 517 139.98 | 440 653.25 | 355 515.12 | 429 876.78 | 364 331.91 | 60.10 |

| Total GRDP | 3 055 597.00 | 3 399 912.00 | 3 835 502.00 | 4 155 495.00 | 4 439 015.00 | 5 221 497.00 | 6 023 487.00 | 6 327 276.00 | 6 627 518.00 | 6 665 901.00 | 6 587 077.00 | -22.00 |

| Gold / Manufacturing industry % | 0.46 | 16.00 | 17.00 | 19.70 | 34.00 | 50.00 | 51.00 | 44.00 | 37.70 | 41.00 | 38.00 | 31.00'% (average) |

| Gold/ GRDP | 0.06 | 2.80 | 2.70 | 2.90 | 4.80 | 8.50 | 8.50 | 6.90 | 5.30 | 6.40 | 5.50 | 4.10% |

Source: Own elaboration based on IIEE, San Juan, 2015.

Foreign investments in mining did not modify the production framework in the region. Indeed, before mega mining, San Juan had a core strongly linked to services and federal spending and, not only has this not changed in recent years, it has been strengthened. The numbers show that in 2015 the economy of San Juan is not based on productive activities, but rather on public spending, financial services and real estate. More than half of that produced by the provincial economy is spent on the financial and public sector (primarily on health and education).

Clearly, in accordance with Harvey’s way of thinking (2003), the way to reproduce extractive capital is linked more with accumulation by dispossession than the self-expansion of capital.

San Juan’s Metal Exports

San Juan’s exports grew from 2003 to 2011. But starting in 2012 there was a drop as can be seen in Table 4. In 2014, the exportable framework was focused on Industrial Manufacturing (IM) (accounting for 84%), mostly in the metallic mining sector (88%). The rest was spread out among goods from farming (12%) and raw materials (4%). In Industrial Manufacturing, 84% of the shipments were gold, accounting for 70% of San Juan’s total exports. These processes mirror the views of the Economic Commission for Latin America and the Caribbean (CEPAL), which characterize heterogeneous and specialized outlying economies,14 in which modern sectors exist with little to no drag effect on the rest of domestic activities and with a demand filled primarily with imports. This is especially true in a province whose manufacturing development is minimal.

Table 4 Mining exports of San Juan 2003-2014, in thousands of USD FOB

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014* | |

| Gold | 0 | 0 | 0 | 331 576 | 339 359 | 466 700 | 724 859 | 160 486 | 1 850 258 | 1 701 940 | 1 300 368 | 1 206 760 |

| Silver in the rough | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 53 240 |

| Non-metalliferous minerals** | 23 809 | 6 095 | 40 998 | 48 119 | 49 728 | 70 374 | 47 643 | 54 770 | 77 138 | 61 272 | 60 244 | 63 573 |

| Other industrial manufactures | 33 089 | 50 992 | 49 488 | 63 344 | 71 401 | 88 793 | 821 933 | 102 135 | 114 466 | 127 114 | 124 232 | 109 007 |

| Total MOI | 56 899 | 73 408 | 90 486 | 443 039 | 46 048 | 625 867 | 854 696 | 1 761 772 | 2 041 861 | 1 890 325 | 1 484 844 | 1 432 579 |

| Total exports | 150 210 | 210 527 | 284 315 | 675 001 | 742 113 | 983 308 | 1 133 970 | 2 103 771 | 2 470 274 | 2 289 773 | 1 860 286 | 1 704 411 |

Notes: * Last data available; ** Non-metalliferous minerals include lime, calcium carbide, calcium carbonate and ferroalloys. Other manufacturing includes fuel and energy. Source: IIEE based on data processed by INDEC.

In 2016, San Juan exported a total of $1.263 million dollars, 2.2% of the national total. Seventy-three percent of local sales to the international market are gold, with their primary destination, also at 73%, being Canada. This happens to be the home country of Barrick Gold, the largest gold producer in San Juan. The fluctuations are strongly tied to how the price of gold behaves: a higher international price means greater activity in local exports and vice versa.15

These characteristics expose the province’s exportable framework to commercial vulnerability as it depends on the fluctuations of one single product (gold) in the international market and the conduct of just one company (Barrick Gold). It demonstrates a very delicate export model which allowed rapid economic growth (and can put the province’s economy in check in the case of a crisis), and a fragile medium-term development process for the region.

The metal value chain allowed for a better positioning of San Juan, which had historically had a minimal participation in the national total of exports at just 0.6% in 2000, characterized by an exports framework fundamentally linked to its farming framework. In 2000, 58% of its external sales were made up of wine, olive oil and horticultural products. In 2005, the first gold exports started and the province improved its participation at national level and changed its exports profile towards mining goods. As a result, in 2016 it placed 7th in provincial export rankings.

In the 20th century, regions with little development participated in the global economy via the exportation of raw materials with little to no industrial processing, such as gold bullion. The classic division of labor is currently manifest, presenting little evolution with regard to times past and is not necessarily indicative of development. Growth is only evident in activities linked to exportation with the rest of the industrial fields and economic activities in the province have a relatively low level of development (e.g. wine-making).

Far from strengthening a commercial export framework which revitalizes local and national industry, mega mining investments impose commercial vulnerabilities on the exports basket. The concentration of exports in just one product results in a certain fragility (in San Juan gold accounts for 70% external sales) as it is dependent on market fluctuations of just one product (gold) and the conduct of a single company (Barrick Gold). It presents a delicate exports model which allowed rapid economic growth (capable of putting the province’s economy in check in the case of a crisis), a development process with weak sustainability and which weakens the territory.

Employment in metal mining

In 2015 the nation’s metal value chain employed 10,956 workers (Ministerio de Hacienda y Finanzas Públicas, 2016), of which 25.5% were native to San Juan. The creation of jobs at national level had a rising trend when compared to the 1990s: in 1996, there were 2,420 workers employed in the field while in 2006 it was 4,788.

However, the provincial total makes up a small part of the workforce. All the companies linked to the field of quarries and mines (including non-metallic ones) occupy 3,302 of San Juan natives. This was only 3.8% in terms of local employment in the first trimester of 2016 and less than 2% of the province’s economically active population (EAP).16 This is a small number for an economic activity which presented itself as a great generator of jobs.

The construction phase, from preparing the mine for extracting the minerals to the installation of the different processes, is the one which calls for the greatest amount of labor. The construction of just Veladero, which began in 2003, required 3,800 jobs whilst the Pascua Lama project (the largest project which began in 2009) needed ten thousand jobs, all of which disappeared when the project was suspended in 2013. The workforce is made up of workers from different fields and this can be clearly seen in the field of construction where in 2003 1,694 workers were employed, a number which rose to 17,791 in 2013. In 2014, it dropped to 12,857.

In spite of the poor number of workers employed directly, advocates of the activity posit that the greatest drag is to be found in the generation of indirect jobs: “for every job generated inside a mining company, two jobs must be generated with contractors and suppliers” (Abcb, 2012, p. 55). In other words, in 2016 in San Juan the number of indirect jobs that the sector demanded oscillated at around 6,600.

Mining projects of great magnitude require the use of great capital, thanks in part to the expansive agricultural needs that the labor implies. So, while agriculture accounts for 10% of the jobs in the province, all of mining, including the non-metallic type, accounted for only 4% (Observatorio de Empleo and Dinámica Empresarial).

To this we can add that in the field of commodities like gold the need for workers is linked to the international market and, when the price drops, it directly impacts employment. This can be seen in 2014 and 2016 when drops in international prices for metals resulted in 250 layoffs (including cases of “voluntary resignations”).

On the other hand, even when the need for workers is low, one of the more important legitimizing aspects of mining activity is the high remuneration. Indeed, mining has the highest salaries in San Juan. While an agricultural worker17 in 2016 made an average of $8,711 ARS per month, those in mining made an average of $57,354 ARS. In absolute terms, this is effectively 283% more than the average salary in the province. In a province with a low level of development, this pay gap which drives extractive activity improves the material conditions of reproduction.

As can be seen in Table 5, remuneration in mining rose much more than in other economic activities. However, in the long-term its growth rate is relatively less than other activities. Metal mining registers the lowest growth rate when compared to the other activities analyzed in a 14-year period.

Table 5 Changes in Salaried Workers in the Private by Field. Q1, 2002-Q1, 2016* -San Juan.

| Field | Q1 2002 |

Q1 2003 |

Q1 2006 |

Q1 2010 |

Q1 2013 |

Q1 2016 |

| Agriculture, Livestock, Hunting, Forestry | 9 344 | 9 424 | 11 943 | 11 070 | 11 226 | 8 486 |

| Mine and Quarry Exploitation | 669 | 763 | 1 919 | 3 016 | 3 874 | 3 302 |

| Industrial Manufacturing | 10 182 | 9 939 | 12 889 | 15 306 | 16 343 | 14 809 |

| Water, Gas and Electricity | 356 | 353 | 345 | 333 | 358 | 341 |

| Construction | 2 757 | 1 694 | 7 242 | 8 464 | 17 791 | 11 885 |

| Commerce (wholesale and retail) | 7 841 | 7 526 | 10 033 | 13 494 | 14 491 | 14 664 |

| Hotels and Restaurants | 791 | 775 | 1 331 | 2 251 | 3 878 | 2 951 |

| Transportation, Storage and Communication Services | 2 864 | 2 827 | 3 466 | 4 831 | 5 896 | 5 502 |

| Financial Intermediation and Other Financial Services | 1 321 | 1 091 | 1 121 | 1 255 | 1 609 | 1 558 |

| Real Estate Services, Corporate and Housing | 3 442 | 3 492 | 6 302 | 7 584 | 8 858 | 7 588 |

| Teaching | 1 420 | 1 768 | 2 702 | 4 179 | 5 701 | 6 577 |

| Health and Social Services | 2 094 | 2 074 | 2 202 | 3 063 | 3 591 | 3 564 |

| Community, Social and Personal Services (n.e.c.). | 2 586 | 2 553 | 2 631 | 3 043 | 4 411 | 4 399 |

| Total | 45 843 | 44 081 | 64 203 | 77 955 | 98 440 | 85 797 |

Notes: the years selected were chosen to see if the important changes in mining companies are reflected in employment statistics. In 2003 for example, construction began in Veladero. In 2005 activity began, including exports. This makes the assumption that the demand for labor is driven by mining activity. In 2009 construction began on Pascua Lama and was suspended in 2013. This also assumes a certain level of impact on the demand for workers native to San Juan. The period of study is the year prior to the dates given.

Source: Created by the authors based on Observatorio de Empleo y Dinámica Empresaria, MTESS.

Although metal mining was the recipient of big investments in the period 2000-2010, the average value of salaries in San Juan has remained below the national average. This means that while the national average salary in 2016 was $20,295 ARS, in San Juan it was $16,203 (SIPA, 2016). One can then deduce that mining does not provide a drag effect on remuneration of other economic activities in San Juan.

The impact that mining has on the departments where the projects are to be found is relatively low. In 2017 the governor of Iglesia (the department where Veladero finds itself) stated that of 5000 people who form part of the EAP, 3000, or 60%, were unemployed. In Calingasta (department where Casposo is located) unemployment reaches 35% while in Jáchal (Cualcamayo’s department) 20%.

Mining labor changed employment in the province: it paid high salaries which improved the quality of life; people learned new skills, the nature of work changed (especially when it came to workdays and schedules); all the while new workers faced higher risks in terms of health, safety, and socio-familial bonds. Work dynamics also changed and outsourcing grew. The search for employees is “delegated to consulting and outsourcing companies such as Manpower, Orico and BTZ Minera [BTZ Mining]. In Mines like Bajo La Alumbrera, Veladero and Gualcamayo there is a high level of outsourcing, which has resulted in a rise of probationary employment contracts and the mining companies being exempt from their responsibilities in the case of the layoffs” (Gómez Lende, 2016, p.158).

The ten years spanning from 2005 to 2015 show that indicators for employment, exportations, and royalties do not turn up positive numbers for the impact on the region. To the contrary, mining has given way to socio-environmental conflicts stemming from irreversible damages.

4. CONCLUSIONS: MINING AND UNSUSTAINABLE DEVELOPMENT

The analysis provided evidence of potential mining-generated growth which is unaccompanied by preservation of the region’s culture and environment. Rivers were contaminated and they contributed to the destruction of glaciers, thereby eliminating one of the crucial and vital resources for human life: water. This not only endangers the well-being of present generations but also future ones. Neither is there a government entity with an active role in socio-environmental control and preservation.

Revitalization and growth are not necessarily a direct consequence of mining. As can be seen throughout this piece, mining in San Juan is not an activity which revitalizes the provincial economy. Economic growth is an argument that is just used to legitimize the activity. Data on employment, exports and royalties show that mining is not enough to guarantee the well-being of the local population in the long-term.

San Juan mining only contributed 4% on average to the GRDP in the period between 2005 and 2015, provided few direct employment opportunities and endangers the exportation framework. It is clear that there is a contradiction between the disposition and appropriation of non-renewable natural resources which have great value at global level but little impact on the region, and do not guarantee a long-term development process with strong sustainability. The taxes paid by the mining companies, as well as the royalties18 , have not resulted in improvements to the departments where their mining projects find themselves (Iglesia, Calingasta and Jáchal). Fifteen years after construction began on the first large project it is still not possible to verify any structural reworking in the region which has resulted in improvements to the local population’s habitat.

There are no great public works which contribute to the quality or development of local spaces; there is no increase in the quantity nor the quality of hospitals with which to provide for one’s health; mining has not made a direct impact on education and neither local roads nor access routes have seen any improvement. Likewise, prior to all this there was no local public transportation system and one has not been established since, as such any tourists who make their way there have no options when it comes to local transportation. Furthermore, no gas system nor sewer system has been installed.

In terms of productivity, the number of jobs is not significant and the number of local suppliers is not important nor big enough to modify conditions of the development framework in these departments.

The governing system has seen no improvements: citizens live in a constant state of social conflict and uncertainty; they feel excluded from the plebiscite, the decision-making process for policies which directly affect them; and there is no method for accessing clear and truthful information.

The media, aside from the community’s, is for the most part guided by mining PR. The possibility of questioning any practice which affects the locale’s development is therefore quite low, as is the chance of any media coverage.

Mining activity is having an impact on rivers and glaciers, thereby destroying a source of water, for which there is no market value. Water, indigenous flora and fauna as well as the air are not replaceable as was posited by the theories from the 1970s. At least they are not yet replaceable, given that the technology or capital to replace them does not yet exist. There have been no technological innovations in mine exploitation which do not destroy the environment, and when the mineral has run dry and the project’s lifespan has run its course, global stock will not be the greater for it, but rather the lesser.

In Latin America and other peripheral regions, international thinking is different: investing in technology is unusual, rather it is imported. In Argentina in particular, the main investors reside in a sphere of privilege (Castellani, 2012), characterized by growth fostered by protection provided by the state rather than innovations from private investments. This thinking combines with an important institutional weakness which is characteristic of local regions which enter the world market with new productions.

Historically the departments in San Juan with mining projects do not have a tradition of metal mining and therefore lack trained technicians, nor do they have inhabitants who are trained or educated in the field. Neither are there governmental systems in place capable of demanding development or of controlling the destruction of natural resources. In some cases, it was professionals from the mining companies who proposed projects to the local governments, imposing development styles which are beneficial to the corporations. Moreover, a consequence of this institutional weakness is the transgression of any regulations designed to protect the environment, even the need for environmental insurance, as was seen in the case of Barrick Gold and their first spill.

In summary, one must ask, “Can we really put a price on the destruction of an element vital for native people? Supposing that natural resources are proportionate; how should one measure the destruction of the culture and history of a community forced to emigrate due to a lack of water? Under what ethical considerations can this happen?”

Beyond the debates and considerations within the walls of academia, sustainable development in a capitalist system (with its constant search for a surplus that implies the destruction of the environment, culture, history and society in local regions with important natural resources) is but a pipe-dream.

REFERENCES

Abcb (2012), Dimensionamiento del aporte económico de la minería en Argentina, Argentina, Cámara Argentina de Empresarios Mineros (CAEM). Recuperado de <http://www.miningpress.com/media/briefs/abeceb_15.pdf> [ Links ]

Administración de Parques Nacionales (APN) (2013), Plan de Manejo Parque Nacional San Guillermo y Propuesta de Manejo Integrado de la Reserva de Biosfera San Guillermo. Recuperado de <https://www.losquesevan.com/plan-de-manejo-del-parque-nacionalsan-guillermo.1617> [ Links ]

Barrick Gold (2009), Mina Veladero impulsa el crecimiento económico y social de San Juan, página web oficial. Recuperado de <https://barricklatam.com/mina-veladero-impulsa-el-crecimiento-economico-y-social-de-san-juan/barrick/2012-06-05/161602.html> [ Links ]

Cabeza Gutés, M. (1996), “The Concept of Weak Sustainability”, Ecological Economics 17. Recuperado de <https://campusvirtual.univalle.edu.co/moodle/pluginfile.php/682139/mod_label/intro/CABEZA-Weak-Sustainability.pdf> [ Links ]

Castellani, A. (2012), Recursos públicos, intereses privados. Ámbitos privilegiados de acumulación. Argentina 1966-2000, Argentina, UNSAM Edita. [ Links ]

Diario Las Noticias (2009), “La mina de oro Gualcamayo, en Jáchal, comienza a producir comercialmente”, nota periodística, 30 de julio. Recuperado de <http://www.diariolanoticias.com/mostrarnoticia1.php?id_noticia=3042> [ Links ]

Dictamen Vargas, Ricardo Marcelo C/ San Juan, Provincia de y Otros s/ daño ambiental (2009), Argentina. Recuperado de <http://www.mpf.gov.ar/dictamenes/2009/monti/agosto/6/v_175_l_xliii_vargas.pdf> [ Links ]

Editorial RN (2014), “La minería sigue siendo, el principal motor del desarrollo...”. Recuperado de <http://www.editorialrn.com.ar/index.php?option=com_content&view=article&id=1133:la-mineria-sigue-siendo-el-principal-motor-del-desarrollo&catid=14:nacional&Itemid=599> [ Links ]

Falconí, F. (2002), Economía y desarrollo sostenible. ¿Matrimonio feliz o divorcio anunciado? El caso de Ecuador, Ecuador, FLACSO. [ Links ]

Fernández Rojas, J. (2015), “El derrame de la Barrick envenenó el agua de Jáchal”, informe en el portal web Unidiversidad perteneciente a la Universidad Nacional de Cuyo, 3 de octubre. Recuperado de <http://www.unidiversidad.com.ar/el-derrame-de-la-barrick-enveneno-el-agua-de-jachal> [ Links ]

Gómez Lende, S. (2016), “Psicoesfera y minería metalífera en la Argentina: el mito de la creación de empleo en las provincias de Catamarca y San Juan”, Geografía, vol. 25, núm. 1, Brasil, Universidade Estadual de Londrina, enero-junio. Recuperado de <http://www.uel.br/revistas/uel/index.php/geografia/article/view/25362> [ Links ]

Harvey, D. (2003), El nuevo imperialismo, Madrid, Akal. [ Links ]

Informe de Impacto Ambiental Veladero (2002), Knight Piésold Consulting. Recuperado de <http://center-hre.org/wp-content/uploads/2013/05/veladero-informe-de-impacto-ambiental-exploracion.pdf> [ Links ]

Instituto de Investigación Económicas y Estadísticas (2015), Tasa de crecimiento en el PBG por sector económico, San Juan, 2003-2015. [ Links ]

Leal, G. (2008), Debate sobre la sostenibilidad. Desarrollo conceptual y metodológico de una propuesta de Desarrollo Urbano Sostenible, Pontificia Universidad Javeriana, Bogotá, Colombia. Recuperado de <http://www.javeriana.edu.co/Facultades/Arquidiseno/maeplan/publicaciones/documents/DebatesobrelaSostenibilidad_000.pdf> [ Links ]

López Pardo, I. (2012), Sostenibilidad “débil” y “fuerte” y democracia deliberativa -el caso de la Agenda 21 local de Madrid. (Tesis doctoral), Universidad Carlos III de Madrid. Recuperado de <https://e-archivo.uc3m.es/handle/10016/16270> [ Links ]

Machado, H., Svampa, M., Viale, E., Giraud, M., Wagner, L., Antonelli, M., Giarraca, N. y Teubal, M. (2011), 15 mitos y realidades de la minería transnacional en Argentina. Guía para desmontar el imaginario prominero, Argentina, Colectivo Voces de Alerta. Recuperado de <http://biblioteca.clacso.edu.ar/Argentina/iigg-uba/20161025033400/15mitos.pdf> [ Links ]

Mining Press (2007), “Casposo responderá a observaciones a su IIA antes del plazo”, nota periodística, 15 de agosto. Recuperado de <http://www.miningpress.com/nota/24305/casposo-respondera-a-observaciones-a-su-iia-antes-del-plazo> [ Links ]

__________ (2006), “Cómo será Pascua Lama”, nota periodística, 21 de febrero. Recuperado de <http://www.miningpress.com/nota/13886/como-sera-pascua-lama> [ Links ]

Ministerio de Hacienda y Finanzas Públicas (MHyFP) (2016), Informes de cadenas de valor: minería metalífera y rocas de aplicación, año 1, núm. 2, Argentina, mayo. Recuperado de <http://www.economia.gob.ar/peconomica/docs/SSPE_mineria_metalifera_rocas.pdf> [ Links ]

Observatorio de Empleo y Dinámica Empresarial. Ministerio de Producción y Trabajo, <www.trabajo.gob.ar> [ Links ]

Pañeda, C. (1994), “El mundo que viene”, Revista de Economía Aplicada, vol. 5, núm. II, Alianza, Madrid. Recuperado de <http://www.revecap.com/revista/numeros/05/pdf/paneda.pdf> [ Links ]

Petit Primera, J. (2013), “La teoría económica del desarrollo desde Keynes hasta el nuevo modelo neoclásico del crecimiento económico”, Revista Venezolana de Análisis de Coyuntura [en línea], XIX, enero-junio. Recuperado de <http://www.redalyc.org/articulo.oa?id=36428605012> [ Links ]

Sistema Integrado de Previsión Argentino (SIPA) (2016), Estudios y Estadísticas Laborales, Ministerio de Producción y Trabajo. Disponible en <http://www.trabajo.gob.ar/estadisticas/index.asp> [ Links ]

Solow, R. (1991), “Sustainability: An Economist‘s Perspective”, en R. Dorfman y N.S. Dorfman (eds.), Economics of the Environment, New York, WW Norton & Company. [ Links ]

__________ (1974), “La economía de los recursos o los recursos de la economía”,The American Economic Review, vol. 64, núm. 2, Documentos y Actas de la Ochenta y Sexta Reunión Anual de la Asociación Económica Americana. [ Links ]

TN (2016), “Confirman que Barrick Gold contaminó con cianuro 5 ríos en San Juan”, nota periodística, 23 de febrero. Recuperada de <https://tn.com.ar/sociedad/confirman-que-barrick-gold-contamino-con-cianuro-5-rios-en-san-juan_654592> [ Links ]

UNOPS (2016), “Estudio sobre la calidad de los cuerpos de agua en el área de influencia de mina Veladero posterior al incidente ambiental del 13/09/15” (Informe ECCA Veladero). Resumen Ejecutivo. Naciones Unidas. Recuperado de <http://auditoriaambiental.org/wp-content/uploads/2016/05/Resumen-ejecutivo-ECCA_08-04-2016.pdf> [ Links ]

1This project was stopped by a suit presented by the Diaguita communities in Chile due to Barrick’s environmental infractions which endanger the glaciers and pollute the water resources of the region.

2Department of Mining for the Province of San Juan <http://serviciosmineria.sanjuan.gov.ar/estadisticas/docs_pdf/pdf/consumo_de_aguas.pdf>

3The SGBR is characterized by having the highest concentration of guanacos and vicunas, as well as other species of flora and fauna native to the region. The area is also the subject of archeological study due to the importance of its historical heritage. Above all, its greatest asset is water as important water basins, glaciers and periglacial processes can be found.

7See the report compiled by UNCUYO, Fernández Rojas (2015) <http://www.unidiversidad.com.ar/el-derrame-de-la-barrick-enveneno-el-agua-de-jachal>

9Tiempoar <https://www.tiempoar.com.ar/articulo/view/76139/veladero-denuncian-dos-grandes-derrames-que-fueron-ocultados>

10One can assume that the decision to hide the spills is to avoid closing the mine as the Argentinian Mining Code states in Article 264, section E, that “in the case of THREE (3) serious infractions the establishment will proceed to be permanently shut down”.

11GRDP measures the value of goods and services produced at a certain place and time. It is used to measure the gross value added of the province’s productions, while the country’s total is measured by the GDP.

12This is the period of time analyzed as 2003 marks when construction on Veladero began, which required goods from mines and quarries, such as lime, calcium carbide and calcium carbonate. Meanwhile, 2015 provides the latest data available at the time of writing.

14“The specialization (or dismantling) possesses the following indicators: concentration of exports on just a few primary products: a lack of horizontal diversification in the industry, sectorial complementarity and vertical integration; the presence of modern sectors in the form of enclaves, with barely any internal effects of drag; the existence of an internal demand for manufactured products which is filled with imports” (Petit Primera, 2013, p. 218).

15“the pricing (spot or future) is set according to the stocks of metals (London, New York, Shanghai) based on the demand and available supply” (Ministerio de Hacienda y Finanzas Públicas, 2016, p. 10).

16The most important sectors are industry (17.2%), commerce (17%) and construction (13.8%). Together they account for 48% of jobs in the first quarter of 2016.

Received: February 09, 2018; Accepted: August 31, 2018

texto em

texto em